Abstract

The correlation structure across assets and opposite tail movements are essential to the asset allocation problem, since they determine the level of risk in a position. Correlation alone is not informative on the distributional details of the assets. Recently introduced TEDAS—Tail Event Driven ASset allocation approach determines the dependence between assets at different tail measures. TEDAS uses adaptive Lasso-based quantile regression in order to determine an active set of negative coefficients. Based on these active risk factors, an adjustment for intertemporal correlation is made. In this research, authors aim to develop TEDAS, by introducing three TEDAS modifications differing in allocation weights’ determination: a Cornish–Fisher Value-at-Risk minimization, Markowitz diversification rule or naïve equal weighting. TEDAS strategies significantly outperform other widely used allocation approaches on two asset markets: German equity and Global mutual funds.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Asset allocation and security selection go hand in hand with risk management. They are not only important concepts in a quantitative finance and applied statistics, but also significant determinants for long-term portfolio construction for private and institutional investors. Absence of significant correlation among various asset classes is the essential motivation for traditional portfolio allocation. In reality, some strategies contradict this principle, such as the traditional 60 equity/40 bond portfolio approach: in recent years, the correlation between the bond market and the stock market was 0.98 (Geczy 2014). During the Global Financial Crisis, the Endowment Model underperformed due to increased correlation across assets, Swensen (2009). The risk parity strategy recommended a significant allocation to bonds amidst the implementation of quantitative easing and performed poorly because of interest rate volatility (Kazemi 2012; Nathan 2013).

A pillar in portfolio theory, mean-variance (MV) portfolio optimization by Markowitz (1952) proposed to study semi-variance even though the optimization was not straightforward given the low computation power at that time. As computing capacities increased, later models incorporated optimization involving higher and time-varying moments. The mean-variance and subsequent refined models did not perform well during volatile periods. In the case the number of assets (p) exceeds the number of observations (n) results of Markowitz portfolios are not stable: Bai et al. (2009) proved that the asset return estimate given by the Markowitz MV model was always larger than the theoretical return and the rate of the difference was related to p/n, the ratio of the dimension to the sample size. Jobson et al. (1979) and Jobson and Korkie (1980) showed that the Markowitz mean-variance efficient portfolios were highly sensitive to p/n. They suggested to shrink the number of estimators or assets. From this point of view, the Least Absolute Shrinkage and Selection Operator (LASSO) (Tibshirani 1996) provides a feasible solution and good out-of-sample results of mean-variance portfolios, see e.g. DeMiguel et al. (2009a), Fan et al. (2012), Yen and Yen (2014) and Fastrich et al. (2015).

Taking into consideration observed return co-movement spikes for strong negative-return times, modelling tail dependence can be viewed as more flexible approach to portfolio allocation. Härdle et al. (2014) introduced a new asset allocation strategy, Tail Event Driven Asset Allocation (TEDAS). TEDAS exploits negative co-movement of alternative assets in the tail with a core asset to hedge downside risk. The subset of alternative or satellite assets performs the role of downside protection. Successful protection of the portfolio by limiting the downside risk during volatile periods allows the portfolio returns to recover sooner. TEDAS, with smaller drawdowns, outperforms more traditional methods that suffer larger drawdowns during extreme events.

TEDAS can also be viewed as an application of the core-satellite model, given that a subset of satellite assets is chosen from a larger universe of assets. For big data, where the number of possible alternatives is larger than the number of observations, the adaptive LASSO quantile regression (ALQR) is used to pursue variable selection and measure relations between variables at tail quantiles simultaneously. In order to deal with changing volatility and correlation structure problem, Dynamic Conditional Correlation (DCC) is used. TEDAS applies Cornish–Fisher VaR (Value-at-Risk) measure for portfolio optimization, utilizing accordingly higher moments of distributions of asset returns, such as skewness and kurtosis. Here, we extend TEDAS by introducing three modifications, which we call “TEDAS gestalts”: TEDAS basic, TEDAS naïve, which places equal weights on every satellite asset, and TEDAS hybrid, which uses the most common Markowitz mean-variance rule to select the weights.

In this paper, we provide an extensive empirical analysis, and we compare the performance of the TEDAS strategies with a wide range of benchmark portfolio strategies, applied to global mutual fund and German stock market data. TEDAS portfolios yield robust and consistent results with various assets, time periods, parameter frequencies, and in big and small data. Differently from Härdle et al. (2014), in the analysis we introduce, portfolio rebalancing framework assumes incorporation of transaction costs.

The rest of the paper is organized as follows. In “TEDAS—Tail Event Driven ASset allocation strategy” section, we introduce the framework of TEDAS. In “The choice of satellite assets and data description” and “Empirical results” sections, we apply the methods to different markets and compare the performance between different models. In fifth presents the conclusion and discussion. All codes and datasets are available as  Quantlets on Quantnet (Borke and Härdle 2016).

Quantlets on Quantnet (Borke and Härdle 2016).

TEDAS: Tail Event Driven ASset allocation strategy

The basic elements of TEDAS are presented in Härdle et al. (2014). The proposed tool set has important implications for portfolio risk management and asset allocation decisions. Along with the basic set-up, we propose two modifications: TEDAS naïve and TEDAS hybrid.

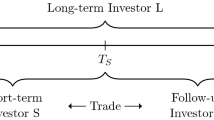

The TEDAS strategy is based on a simple idea widely used in practice—core-satellite approach. The core of portfolio (or core asset) consists of passive investments that track major market indices, e.g. the DAX30 or S&P500 (in practice the role of core can play exchange traded fund—ETF). Initially, the portfolio consists of the core asset only. The core portfolio is chosen by the fund manager, and the satellite assets are chosen by TEDAS to limit the downside risk of the core portfolio during extreme events.

At a high level, TEDAS consists of two related stages. The first stage is an asset selection. Portfolio constituents are selected using the tail event approach. The tail dependence of core and satellite assets is identified via an adaptive LASSO quantile regression (ALQR), Zheng et al. (2013). At the second stage, portfolio selection, portfolio weights for active assets are determined.

The fund manager performs following steps at the first stage to select portfolio constituents.

-

1.

Consider a data vector \(Y \in \mathbb {R}^T\) of core asset log-returns and a matrix \(X \in \mathbb {R}^{T \times p}\) of satellites’ log-returns, T is a number of all observations and number of assets in the initial set.

-

2.

For each period \(t = n,\ldots ,T\) obtain empirical \(\tau\)-quantiles \(\hat{q}_{\tau } \mathop{=}\limits ^{{\text {def}}}F_n^{-1}(\tau )\) from the core log-returns’ empirical distribution \(F_n\), where \(\tau _{j=1,\ldots ,5} = (0.05,0.15,0.25,0.35,0.50)\), where n is equal to the width of the moving window and \(p > n\).

-

3.

Determine core asset log-return \(r_{t}\), set \(\tau _{t} = \widehat{F}_n(r_t)\).

-

4.

Select \(\tau _{t}\) according to the right-hand side \(\hat{q}_{\tau _{j,t}}\) in: \(r_{t} \le \hat{q}_{{\tau _{1,t}}}\) or \(\hat{q}_{{\tau _{1,t}}} < r_{t} \le \hat{q}_{{\tau _{j,t}}}\).

-

5.

Obtain the ALQR estimator by Zheng et al. (2013) for \(\hat{\beta }_{\tau _{t}, \lambda _n}\) using the observations \(X_t \in \mathbb {R}^{t-n+1,\ldots ,t\times p}\), \(Y_t \in \mathbb {R}^{t-n+1,\ldots ,t\times 1}\)

$$\begin{aligned} \hat{ \beta }_{\tau _{t}, \lambda _n}^{\text {adapt}} = {\text {arg}}\,\underset{ \beta \in \mathbb {R}^p}{{\text {min}}} \sum _{i=1}^n \rho _{\tau } (Y_t - X_t^{\top } \beta ) + \lambda _n \Vert \hat{\omega }^{\top } \beta \Vert _{1} \end{aligned}$$(1)ALQR is applied to select relevant hedging assets for a new portfolio. This technique allows simultaneously to solve two challenges for portfolio managers. It shrinks the high-dimensional universe of satellite assets to potential candidates for portfolio’s constituents: the \(L_1\) penalty \(\lambda _n \Vert \hat{\omega }^{\top } \beta \Vert _{1}\) in (1) nullifies “excessive” coefficients. ALQR also provides information concerning the dependence between the core portfolio and satellites at different quantiles (for various \(\tau\)). Additional technical details are in “Adaptive LASSO Quantile regression (ALQR)” section.

-

6.

Choose \(X_t^{\mathcal {J}}\), where \(\mathcal {J}\) is the index set corresponding to negative coefficients \(\hat{\beta }_{\tau _{t}, \lambda _n}^{\text {adapt}}\). These assets with negative ALQR coefficients (formula 1), i.e. assets adversely moving with the core for chosen level of a tail event, are constituents of a new rebalanced portfolio.

At the second stage, portfolio selection, the manager determines portfolio weights vector \(\widehat{w}_t\) for assets selected during the first stage. TEDAS offers three alternative ways to solve this task, and we refer to them as TEDAS gestalts (Table 1). Depending on the volatility-modelling method and the portfolio weights’ optimization rule, three TEDAS gestalts can be applied. The TEDAS basic gestalt employs the dynamic conditional correlation model (DCC) to account for time-varying covariance structure and correlation shifts in returns’ covariance, see Engle (2002), Franke et al. (2015). The weights of satellites are defined based on the Cornish–Fischer Value-at-Risk (VaR) minimization rule, Favre and Galeano (2002) (“Cornish–Fisher VaR optimization section”).

The TEDAS naïve gestalt assigns to every satellite asset an equal portfolio weight.

The TEDAS hybrid gestalt employs the simplest approach to estimate the covariance structure of assets’ returns, the historical covariance matrix. Portfolio weights are calculated according to classical mean-variance optimization procedure with long-only constraint (Markowitz diversification rule), Markowitz (1952). Calculation details are in “Mean-variance optimization procedure (Markowitz diversification rule)” section.

At the second stage, the fund manager performs following steps.

-

7.

Apply one of TEDAS Gestalts to \(X_t^{\mathcal {J}}\), selected on step 6, obtain vector of weights \(\hat{w}_t\) to invest in each security.

-

8.

Determine the realized portfolio wealth for \(t+1\)

$$\begin{aligned} W_{t+1} = W_t\times exp({\hat{w}_t^{\top }X_t^{\mathcal {J}}}) \end{aligned}$$(2)

For the construction of TEDAS portfolios, we use the following rebalancing rules. The initial portfolio wealth is \(W_0= \$1\). If one of inequalities in step 4 holds, the fund manager sells the core asset and buys satellite assets \(X^{\mathcal {J}}\) from step 6 in proportions, estimated on step 7. In case \(X^{\mathcal {J}}\) are not chosen, i.e. there are no adversely moving satellites, investor keeps the cash position and the value of the portfolio does not change in comparison with the previous period. When none of inequalities in step 4 holds, the manager fully invests into the core index. The rebalancing strategy assumes that 1%Footnote 1 of portfolio wealth is used to pay transaction fees.

The choice of satellite assets and data description

We apply TEDAS strategies for core assets from two large international stock markets: German DAX30 and American S&P 500. Small- and middle-size companies are recognized as more nimble, fast growing, and more able to adapt to changes to technology than their bloated, plodding large competitors. Due to these reasons, small- and mid-cap stocks are highly attractive for portfolio managers and investors. Academic literature counts vast number of papers documenting and analysing outperformance of small- and mid-cap stocks. Banz (1981) found smaller firms (small caps) have had higher risk-adjusted fs, on average, than larger firms. Reinganum (1981) observed portfolios based on firm size or earnings/price ratios experienced average returns systematically different from those predicted by the CAPM. For an extensive literature review concerning a size effect, we refer to, for example, Crain (2011). Over the last decade, global and German small and mid-caps have been relatively strong again and outperformed large caps (Fig. 1). The existence of size effect and the benefits of diversification (see e.g. Bender et al. 2015) justify utilization of small- and mid-cap stocks in portfolio construction strategies.

The empirical analysis of TEDAS application to equity market focuses on the German stock market. The universe of potential hedging assets consists of 123 constituents of indices SDAX, MDAX and TecDAX—small- and mid-cap stocks. The collected data cover 157 trading weeks from 1 January 2013 to 5 January 2016 (Source: Datastream). The performance of TEDAS strategy for German equity market was analysed on 77 eighty-week moving windows.

The role of mutual funds in world economy has increased in the 20 years. As of 2015, US$ 37.2 trillion was invested in regulated open-end fund assets worldwide and US$ 17.8 trillion in US mutual funds (Investment company institute 2016). In addition, mutual funds account for 88% of investment companies in total. The popularity of mutual funds is due to their perceived safety compared to alternatives, notably stocks. This perception has resulted in a situation where almost half specifically, 44.1% of US households have participated in such funds in the end of 2015. The number of mutual funds also grows up rapidly. The number of regulated worldwide open-ended funds amounted 52 746 in 1999 and reached 100 494 in the end of 2015. (European Fund and Asset Management Association 2016). All this underlines the sheer size and the importance of the US mutual find market which, therefore, should provide us with an important test case for the evaluation of the performance of TEDAS strategy and show whether TEDAS can handle cases of big data.

The potential of diversification, an important determinant for asset allocation, makes mutual funds attractive for institutional and retail investors. In the 2015 US market, 41% of all industry assets were held by domestic equity funds and an additional 15% by world equity funds, those that invest significantly in shares of non-US corporations. Moreover, Bond funds held 21% of US mutual fund, whereas money market funds, hybrid funds and other funds such as those that invest primarily in commodities held the remainder (23%). Finally, it has been observed that in the US there has been a tendency towards equity mutual funds regarding portfolio diversification, which means increased investment rates in foreign (non-US) markets (Investment company institute 2016).

For our mutual funds’ study, we use the data on monthly returns net of management commissions, which is provided by Lipper of Thomson Reuters. Our empirical analysis uses monthly returns on a sample of global equity mutual funds over the 25-year period from December 1990 to December 2015 (300 monthly log-returns). We require funds to have contiguous returns time series over the chosen testing time period. Thus, our final data sample for TEDAS strategies analysis include monthly returns of 739 actively managed equity mutual funds, covering 180 moving windows with length 120 months. Figure 2 illustrates a geographical focus assignment of the mutual funds in our testing sample, defined by the predominant country or region of the fund’s portfolio (mutual fund holds at least 50% of its assets in a specific country/region). The majority of mutual funds is concentrated on American and European markets, significantly fewer—on Asian markets.

To compare the performance of TEDAS strategies with the protective put hedging approach, we used information about prices of European-style put options of DAX 30 for period from 15 July 15 2014 to 18 December 2015 and S&P 500 for period from October 2002 to December 2015 (Source: Datastream).

Empirical results

Results for German equity market

The comparison of the three TEDAS gestalts with the core DAX30 index is given in Fig. 3. All three TEDAS strategies demonstrate almost equal results in terms of cumulative return. At the end of the analysed time span, these strategies yield 153–159% of cumulative return taking into account 1% of transaction fees (the cumulative returns reach even 208–216% without the transaction costs).

Weekly cumulative returns (upper panel) and log-returns (lower panel) of portfolio strategies with the following colour code: DAX30 index (black), TEDAS basic (red), TEDAS naïve (blue) and TEDAS hybrid (green) strategies applied to German stocks from 15 July 2013 to 5 January 2016. (Color figure online)

We provide a comparative analysis of TEDAS performance with three alternative widely used strategies: mean-variance strategy, 60/40 portfolio and risk parity portfolio. The rebalancing setting is equivalent for all benchmark and TEDAS portfolios. The mean-variance portfolio selection is a common benchmark for every newly introduced asset allocation strategy. The traditional Markowitz portfolio optimization approach as has been shown in the previous literature has some drawbacks especially for the case when p > n. The portfolio formed by using the classical mean-variance approach always results in extreme portfolio weights (Jorion 1985) that fluctuate substantially over time and perform poorly in the sample estimation (for example, Frankfurter et al. 1971; Simaan 1997; Kan and Zhou 2007) as well as in the out-of-sample forecasting.

Great number of studies provide various observations and suggestions concerning reasons driving MV optimization estimate so far away from its theoretic counterpart. Vast majority of authors believe that the reason behind this outcome is that the “optimal” return is formed by a combination of returns from an extremely large number of assets (see e.g. McNamara 1998). Efficiency of Markowitz optimization procedure depends on whether the expected return and the covariance matrix can be estimated accurately. In our comparative study, we used portfolio covariance matrix modelled by the basic orthogonal GARCH method to solve the dynamic Markowitz risk-return optimization problem. The orthogonal GARCH model (MV OGARCH) was first proposed in Alexander (2001), and is based on principal components analysis (PCA).

60/40 portfolio allocation strategy implies the investing of 60% of the portfolio value in stocks (often via a broad index such as S&P500) and 40% in government or other high-quality bonds, with regular rebalancing to keep proportions steady. German market’s 60/40 portfolio is constructed with DAX30 and eb.rexx Government Germany index, which contains the 25 most liquid German government bonds with residual maturities of between 1.5 and 10.5 years.

The risk parity portfolio strategy is based on allocation by risk, not by capital. In this case, the portfolio manager defines a set of risk budgets and then computes the weights of the portfolio such that the risk contributions match the risk budgets. We employ so-called equal risk contribution (ERC) portfolios. The idea of the ERC strategy is to find a risk-balanced portfolio with equal risk contributions for all assets (for details, see e.g. Maillard et al. 2010).

The comparison of cumulative returns achieved with TEDAS naïve and alternative strategies, demonstrated in Fig. 4, shows that TEDAS performs significantly better than other considered approaches (Table 2).

A rebalancing of the portfolio to hedge the core asset occurred 38 times (marked with black dots in Fig. 3) out of 77 moving-window estimation periods. Table 2 summarizes the performance of portfolio strategies in terms of cumulative returns as well as in terms of risk. All present indicators specify the TEDAS naïve portfolio strategy as the most attractive for investors: it reaches 257% of cumulative return providing at the same time the highest excess return, 0.46%, for the extra volatility. In general TEDAS strategies show better risk-adjusted returns than all other analysed benchmarks and have comparatively the same level of risk. Based on results of the Wilcoxon signed-rank test (Table 3), we find three TEDAS strategies do not significantly differ from each other, but the difference from other benchmarks is statistically significant. Hence, TEDAS strategies performance is mainly driven by the asset selection decision rather than the portfolio selection decision.

Figure 5 (upper panel) shows the distribution of the size of hedging subset \(X^{\mathcal {J}}\), equal the number of assets with negative ALQR \(\beta\)-coefficients for different quantiles. In most of cases, the number of selected satellites is less than five, which indicates the practical applicability of this strategy and the simplicity of portfolio rebalancing. Furthermore, we analyse how frequently certain stocks were selected as satellites. The results are presented in Fig. 5 (lower panel). More frequently small stocks (first 50 stocks in the graph) and stocks of high-tech companies (last 30 stocks) hedge the core. This conclusion is also confirmed by Table 4, which lists the most frequently used satellites from German stocks. The majority of them belongs to small capitalization companies.

Figure 6 shows the densities of the returns of stocks listed in Table 4, the core asset DAX30 and, for comparison, the normal distribution. Most of satellites has leptokurtic and left-skewed distributions. More frequently used satellites show stronger deviations from the Gaussian distribution. This result corresponds to previous findings, e.g. Lee et al. (2006) demonstrate that the inclusion of assets with skewed and leptokurtic returns enhances overall portfolio returns. These assets provide the opportunity of downside protection, especially during periods of high volatility. Detailed information on the characteristics of returns distribution is collected in Table 5, pointing out the heavy tailed properties of distributions. With aim to investigate the co-movement of satellites’ returns, we compare correlations of returns separately for weeks on which core asset moved up or down (Table 6). As it was expected, correlations were slightly stronger during the bear market periods. However, most small-cap stocks’ pairs exhibit low correlations.

The probability density functions of the distributions of weekly returns for the main 7 satellite German stocks with the following colour code: SRTX (red), CLS1X (orange), HAWX (amber), P1ZX (light green), GFKX (green), GLJX (light blue), KD8X (blue) and DAX30 (black). A normal distribution with the same mean and standard deviation as the returns on SRTX (red) is displayed as a histogram in the background. The observation period is from 1 January 2013 to 5 January 2016. (Color figure online)

All TEDAS gestalts, applied to the universe of German stocks, outperform both traditional benchmark strategies, such as Markowitz rule or 60/40 and more sophisticated ones, such as the ERC model. Our analysis leads us to believe that using the ALQR technique delivers good results in reducing the dimensionality of the asset universe for more effective portfolio allocation.

Results for global mutual funds

Since the number of satellites after filtering (\(p=739\)) is very large, the length moving window for mutual funds sample is adjusted to 120 months. We allocated 1 unit of money in December 2000 using each strategy and calculated the 180 monthly cumulative returns until December 2015.

As in the previous analysis, the outcomes of the three TEDAS strategies are compared. From the end of 2000 to the end of 2015, the TEDAS naïve yields the highest return, 1193%. TEDAS basic and TEDAS hybrid set-ups show similar returns of 1184 and 1175%, respectively (Fig. 7).

In order to check whether TEDAS is significantly better than current popular methods, we employed the same four benchmarks as in the case of German stocks. We constructed a 60/40 portfolio using S&P 500 and the Barclays US treasury index. By comparing the TEDAS hybrid and the benchmarks, we can tell that TEDAS demonstrates superior results. The 60/40 strategy and ERC portfolios have high correlation with the S&P 500, and these three gave less than 150% of cumulative return over 15 years of investment (Fig. 8). Signed-rank test p values (Table 7) are all smaller than 5%, that indicates significant difference of TEDAS strategies from benchmark portfolios, which lies in line with German stocks sample results. Table 8 documents an investigation of riskiness of strategies, proving that higher absolute performance of TEDAS approach is supplemented with better risk-adjusted performance metrics.

Figure 9 shows the frequency of the number of selected mutual funds for four quantiles (0.05, 0.15, 0.25 and 0.35). Unexpectedly, the number of selected satellites in most cases is less than five, which is similar with the German stocks data, which specifies a high efficiency of ALQR method as a dimension shrinkage technique. It must be noted that for different levels of tail events TEDAS portfolio constituents differ significantly (Fig. 9 in the lower panel), illustrating our assumption that linearly connected assets are not necessary dependent in tails along with varying dependence for different tail events. We analyse geographical focus of frequently used mutual funds in TEDAS portfolios in Table 9. Since our core asset is US based, a quite evident result is that all TEDAS constituents are mostly global or European market-orientated funds, indicating benefits of international diversification (see Driessen and Laeven 2007).

The investigation of distributional characteristics for separate satellites-mutual funds is provided in Fig. 10 supplemented with Table 10. Similar with German equity market, mutual funds have more weight around zero and negatively skewed. Kurtosis in most cases exceeds 150, increasing tail risk (see Table 10). Significant deviation from normal distribution can be explained by active management of mutual funds, which leads to a so-called alpha benefit, that is, providing an abnormal return adjusted by risk in the CAPM framework (see e.g. Lehmann and Modest 1987; Matallin-Saez 2007). An active management of mutual funds can be a potential explanation for a significantly stronger co-movement of returns than on German stock market, especially during the months with negative dynamics (Table 11).

The probability density functions of the distributions of weekly returns for the main 10 satellite mutual Funds with the following colour code: ORBOPEF (red), SWESVGB (orange), ESPASEV (amber), TSBEURI (light green), ODDIMMC (green), UPNGFAD (light blue), SYIEULVKL (blue), TSBITEI (dark blue), PAEQOPP LX (purple), PACFSTK (violet) and S&P500 (black). A normal distribution with the same mean and standard deviation as the returns on SWESVGB (orange) is displayed as a histogram in the background. The observation period is from December 1990 to December 2015. (Color figure online)

As an additional robustness test we compare TEDAS strategy with a well-known hedging strategy—protective put (PP). The basic idea of such strategy is that the holder of a security buys a put option to guard against the loss in case the price of the underlying asset drops. In our PP strategy setting, we assume that the investor receives back at least the investment into the core asset, which means the strike price for the option contract is equal to the spot price of the underlying asset—TEDAS core index—in the beginning of investment period. For German equity dataset, we used European-type put option on the core asset—DAX30 index with maturity date in the end of December 2015. In case with global mutual funds dataset, seven different consecutive European-style options hedge the core—S&P 500 index. Maturity varies from 1 year to 3 years, and the hedging put option was chosen based on appropriate strike price of the option contract available in the market. Cumulative returns of PP strategies include prices of option contracts. Figure 11 exhibits comparison results of PP approach with TEDAS naïve strategy for both samples: German stocks and mutual funds. It is clear that for our samples and chosen testing periods, protective put strategy underperforms in comparison with TEDAS portfolio as well as with other benchmark portfolios.

Conclusion

This study represents an extensive empirical analysis of the performance of asset allocation strategies based on the TEDAS approach applied to global mutual funds and German stocks. TEDAS focuses on the co-movement of the core and the universe of satellite assets during extreme events. The degree of extremeness is defined by empirical quantile of returns distribution. Reduction in the universe of satellite assets to a manageable subset and at the same time having the properties of negative correlation with the core during extreme event is an innovative approach in asset allocation.

The main contribution of this paper is to demonstrate the practical significance of the TEDAS tool set for both institutional and private investors in various settings. We conducted an empirical study on the performance of TEDAS strategy applied to multiple configurations of core and satellites. TEDAS incorporates “least absolute shrinkage and selection” which does variable selection and shrinks noise coefficients to zero and simultaneously discloses causal relationships between tail events of the benchmark asset and the covariate hedge funds returns in the high-dimensional framework. TEDAS selects portfolio weights through the minimization of the portfolio objective risk function modelled as the variance–covariance Value-at-Risk adjusted for higher portfolio return distribution moments such as skewness and kurtosis via the Cornish–Fisher expansion; the variance–covariance return structure is allowed to be time-varying and is modelled with the dynamic conditional correlation (DCC) approach to capture the effect of possible asymmetric volatility clustering.

The results of three modifications of TEDAS adopted in this study are robust. Nevertheless, there is clearly room for further additional research. Theory says that TEDAS basic and TEDAS hybrid should perform better than TEDAS naïve. However, we do not observe it in our empirical study. This finding lies in line with previous researches: e.g. DeMiguel et al. (2009b) demonstrated underperformance of fourteen MV models in comparison with 1/N rule. Possible solution to such issue could be, for instance, incorporation of time-varying modelling of higher portfolio moments as in Ghalanos et al. (2015).

The testing of TEDAS strategy for global mutual funds and German equity data leads to conclusion that TEDAS is meaningful for geographically different markets (global and Germany), using weekly and monthly returns as well as for different levels of dimensionality of the assets universe. This paper demonstrates the power of the TEDAS strategy for different asset markets, such as equity, mutual funds and hedge funds (Härdle et al. (2014)). Furthermore, compared with four conventional benchmark allocation approaches, TEDAS cumulative returns are significantly higher. Investigation of risk-adjusted TEDAS returns also demonstrates better results than other benchmark strategies.

Notes

To define the rate, we turn to Edelen et al. (2013), who report that, on average, the equity mutual funds in their sample incur 0.80% of fund value annually in trading costs per unit. Commission charges schedule, which was obtained from Barclays Stockbrokers, proves the feasibility of such rate as well.

References

Alexander, C. 2001. A Primer on the Orthogonal GARCH Model. Reading: ISMA Centre, University of Reading. Unpublished manuscript.

Bai, Z., H. Liu, and W.K. Wong. 2009. Enhancement of the Applicability of Markowitz’s Portfolio Optimization by Utilizing Random Matrix Theory. Mathematical Finance 19(4): 639–667.

Banz, R.W. 1981. The Relationship Between Return and Market Value of Common Stocks. Journal of Financial Economics 9(1): 3–18.

Bassett, G., and R. Koenker. 1978. Regression Quantiles. Econometrica 46: 33–50.

Belloni, A., and V. Chernozhukov. 2011. \(L_1\)-Penalized Quantile Regression in High-Dimensional Sparse Models. Annals of Statistics 39(1): 82–130.

Bender, J., Briand, R., Fachinotti, G., and S. Ramachandran. 2005. Small Caps? No Small Oversight: Institutional Investors and Global Small Cap Equities. MSCI Research Insight, March 2012. http://www.msci.com/www/research-paper/small-caps-no-small-oversight/014391548. Accessed Feb 2015.

Borke, L., and W.K. Härdle. 2016. Q3-D3-LSA, Berlin: Humboldt Universität zu Berlin. SFB 649 Discussion Paper 2016-049.

Brandimarte, P. 2006. Numerical Methods in Finance and Economics: A MATLAB-Based Introduction, 2nd ed. New York: Wiley.

Cornish, E.A., and R.A. Fisher. 1960. The Percentile Points of Distributions Having Known Cumulants. Technometrics 2(2): 209–225.

Crain, M. 2011. A Literature Review of the Size Effect. Working Paper, 29 October 2011. http://www.ssrn.com/abstract_id=1710076. Accessed Feb 2015.

DeMiguel, V., L. Garlappi, F.J. Nogales, and R. Uppal. 2009a. A Generalized Approach to Portfolio Optimization: Improving Performance by Constraining Portfolio Norms. Management Science 55(5): 798–812.

DeMiguel, V., L. Garlappi, F.J. Nogales, and R. Uppal. 2009b. Optimal Versus Naive Diversification: How Inefficient is the 1/N Portfolio Strategy? Revew of Financial Studies 22: 1915–1953.

Driessen, J., and L. Laeven. 2007. International Portfolio Diversification Benefits: Cross-Country Evidence From a Local Perspective. Journal of Banking and Finance 31(6): 1693–1712.

Edelen, R., R. Evans, and G. Kadlec. 2013. Shedding Light on “Invisible” Costs: Trading Costs and Mutual Fund Performance. Financial Analysts Journal 69(1): 33–44.

European Fund and Asset Management Association. 2016. Worldwide Regulated Open-Ended Fund Assets and Flows. Trends in the Fourth Quarter of 2015. European Fund and Asset Management association (EFAMA), March 2016. https://www.efama.org. Accessed June 2016.

Engle, R. 2002. Dynamic Conditional Correlation: A Simple Class of Multivariate GARCH Models. Journal of Business and Economic Statistics 20(3): 339–350.

Fan, J., J. Zhang, and K. Yu. 2012. Vast Portfolio Selection with Gross-Exposure Constraints. Journal of the American Statistical Association 107(498): 592–606.

Fastrich, B., S. Paterlini, and P. Winker. 2015. Constructing Optimal Sparse Portfolios Using Regularization Methods. Computational Management Science 12(3): 417–434.

Favre, L., and J.-A. Galeano. 2002. Mean-Modified Value-at-Risk Optimization with Hedge Funds. The Journal of Alternative Investments 5(2): 21–25.

Franke, J., W.K. Härdle, and C.M. Hafner. 2015. Statistics of Financial Markets: An Introduction, 4th ed. Berlin: Springer.

Frankfurter, G.M., H.E. Phillips, and J.P. Seagle. 1971. Portfolio Selection: The Effects of Uncertain Means, Variances and Covariances. Journal of Financial and Quantitative Analysis 6: 1251–1262.

Ghalanos, A., E. Rossi, and G. Urga. 2015. Independent Factor Autoregressive Conditional Density Model. Econometric Reviews 34(5): 594–616.

Geczy, C. 2014. The New Diversification: Open Your Eyes to Alternatives. Journal of Portfolio Management. doi:10.3905/jpm.2014.40.5.146.

Härdle, W.K., Nasekin, S., Lee, D.K.C. and K.F. Phoon. 2014. TEDAS—Tail Event Driven Asset Allocation. Berlin: Humboldt Universität zu Berlin. SFB 649 Discussion Paper 2014-032.

Investment Company Institute. 2016. Investment Company Fact Book: 2016. Investment company institute (ICI), May 2016. https://www.icifactbook.org. Accessed June 2016.

Jobson, J.D., B. Korkie, and V. Ratti. 1979. Improved Estimation for Markowitz Portfolios Using James–Stein Type Estimators. Proceedings of the American Statistical Association, Business and Economics Statistics 41: 279–284.

Jobson, J.D., and B. Korkie. 1980. Estimation for Markowitz Efficient Portfolios. Journal of the American Statistical Association 75: 544–554.

Jorion, P. 1985. International Portfolio Diversification with Estimation Risk. Journal of Business 58(3): 259–278.

Kan, R., and G. Zhou. 2007. Optimal Portfolio Choice With Parameter Uncertainty. Journal of Financial and Quantitative Analysis 42(3): 621–656.

Kazemi, H. 2012. An Introduction to Risk Parity. Alternative Investment Analyst Review. Chartered Alternative Investment Analyst Association, April 2012. https://www.caia.org. Accessed Feb 2015.

Koenker, R., and K.F. Hallock. 2001. Quantile Regression. The Journal of Economic Perspectives 15(4): 143–156.

Lee, D.K.C., F.P. Kok, and Y.W. Choon. 2006. Moments Analysis in Risk and Performance Measurement. The Journal of Wealth Management 9(1): 54–65.

Lee, E.R., N. Hohsuk, and U.P. Byeong. 2014. Model Selection via Bayesian Information Criterion for Quantile Regression Models. Journal of the American Statistical Association 109(505): 216–229.

Lehmann, B.N., and D.M. Modest. 1987. Mutual Fund Performance Evaluation: A Comparison of Benchmarks and Benchmark Comparisons. The Journal of Finance 42(2): 233–265.

Maillard, S., T. Roncalli, and J. Teiletche. 2010. The Properties of Equally Weighted Risk Contribution Portfolios. Journal of Portfolio Management 36(4): 60–70.

Matallin-Saez, J. 2007. Portfolio Performance: Factors or Benchmarks? Applied Financial Economics 17: 1167–78.

Markowitz, H. 1952. Portfolio Selection. The Journal of Finance 7(1): 77–91.

McNamara, J.R. 1998. Portfolio Selection Using Stochastic Dominance Criteria. Decision Sciences 29(4): 785–801.

Nathan, A. (ed.) 2013. Bond Bubble Breakdown. Commodities and Strategy Research, 22 April. http://www.nber.org. Accessed Feb 2015.

Reinganum, M.R. 1981. A New Empirical Perspective on the CAPM. The Journal of Financial and Quantitative Analysis 16(4): 439–462.

Schwarz, G.E. 1978. Estimating the Dimension of a Model. Annals of Statistics 6(2): 461–464.

Simaan, Y. 1997. Estimation Risk in Portfolio Selection: The Mean Variance Model Versus the Mean Absolute Deviation Model. Management Science 43(10): 1437–1446.

Swensen, D.F. 2009. Pioneering Portfolio Management: An Unconventional Approach to Institutional Investment, Fully Revised and Updated. New York: Free Press.

Tibshirani, R. 1996. Regression Shrinkage and Selection via the Lasso. Journal of Royal Statistical Society 58(1): 267–288.

Yen, Y., and T. Yen. 2014. Solving Norm Constrained Portfolio Optimization via Coordinate-Wise Descent Algorithms. Computational Statistics and Data Analysis 76: 737–759.

Zheng, Qi, C. Gallagher, and K.B. Kulasekera. 2013. Adaptive Penalized Quantile Regression for High-Dimensional Data. Journal of Statistical Planning and Inference 143(6): 1029–1038.

Zou, H. 2006. The Adaptive Lasso and Its Oracle Properties. Journal of Statistical Planning and Inference 101(476): 1418–1429.

Author information

Authors and Affiliations

Corresponding author

Technical Appendix

Technical Appendix

Adaptive LASSO Quantile regression (ALQR)

Introduced in Bassett and Koenker (1978) quantile regression (QR) estimates conditional quantile functions–models in which quantiles of the conditional distribution of the response variable are expressed as functions of observed covariates (see Koenker and Hallock 2001).

\(L_1\)-penalty is considered to nullify “excessive” coefficients (Belloni and Chernozhukov 2011). Simple lasso-penalized QR optimization problem is:

The adaptive Lasso in Zou (2006) yields a sparser solution and is less biased. Using this result, Zheng et al. (2013) replaced \(L_1\)-penalty by a re-weighted version:

here \(\tau \in \mathbb (0,1)\) is a quantile level, \(\rho _{\tau }(u) = u\{\tau - {\mathbf {I}}(u < 0)\}\) piecewise loss function, \(\lambda _n\) regularization parameter. Weights \(\hat{\omega } = 1/|\hat{ \beta }^{{\text {init}}}|\), \(\hat{\beta }^{{\text {init}}}\) is obtained from (3). In TEDAS set-up, \(Y \in \mathbb {R}^n\) represents core log-returns (DAX or S&P500 indices) and \(X \in \mathbb {R}^{n \times p}\)—satellites’ log-returns (German stocks or mutual funds), \(p > n\). The choice of the regularization parameter is critical. In the quantile regression literature, two criteria are used the Bayes information criterion (BIC) (Schwarz 1978; Lee et al. 2014) and the cross-validation criterion (e.g. Belloni and Chernozhukov 2011; Zou 2006). In TEDAS application, BIC is applied to choose \(\lambda _n\) parameter.

Cornish–Fisher VaR optimization

A modification of VaR via the Cornish–Fisher (CF) expansion (Cornish and Fisher 1960) improves its precision adjusting estimated quantiles for non-normality. To obtain asset allocation weights, the following VaR-minimization problem is solved (for details, see Favre and Galeano 2002; Härdle et al. 2014):

here \(W_t \mathop {=}\limits ^{{\text {def}}} W_0 \cdot \prod _{j=1}^{t-1} w_{t-j}^{\top }(1+r_{t-j})\), \(\tilde{w}\), \(W_0\) initial wealth, \(\sigma ^2_p(w) \mathop {=}\limits ^{{\text {def}}} w_t^{\top } \Sigma _t w_t\),

here \(S_p(w_t)\) is skewness of the portfolio, \(K_p(w_t)\) excess kurtosis of the portfolio, \(z_{\alpha }\) \({\text {N}}(0,1)\) \(\alpha\)-quantile. If \(S_p(w_t)\), \(K_p(w_t)\) are zero, then the problem reduces to the Markowitz case.

Mean-variance optimization procedure (Markowitz diversification rule)

Mean-variance optimization procedure is based on four inputs: the weights of total funds invested in each security \(w_i, i = 1,\ldots ,d\), the expected returns \(\mu\) approximated as averages \(\overline{r}\), volatilities (standard deviations) \(\sigma _i\) associated with each security and covariances \(\sigma _{ij}, j = 1,\ldots ,d; i \ne j\) between returns. Portfolio weights \(w_i\) are obtained from the quadratic optimization problem, see Brandimarte (2006, p. 74)

where \(\Sigma \in \mathbb {R}^{d \times d}\) is the covariance matrix for d portfolio asset returns and \(r_{T}\) is the “target” return for the portfolio assigned by the investor.

Rights and permissions

About this article

Cite this article

Härdle, W.K., Lee, D.K.C., Nasekin, S. et al. Tail Event Driven ASset allocation: evidence from equity and mutual funds’ markets. J Asset Manag 19, 49–63 (2018). https://doi.org/10.1057/s41260-017-0060-9

Revised:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41260-017-0060-9