Abstract

Adopting green and sustainable production practices is crucial for addressing growing environmental challenges and achieving economic and social benefits in developing countries like India. However, such approaches often involve costs, necessitating a re-examination of the relationship between corporate environmental responsibility (CER) and corporate financial performance (CFP). The existing studies on CER in Indian firms and the associated environmental regulations lack establishing an empirical relationship between CER and CFP. Furthermore, the global literature similarly lacks a decisive consensus, often exhibiting indeterminate outcomes concerning the positive impact of CER on CFP. This study systematically reviews literature published from 2000 to 2024 to examine the influence of CER on the CFP of Indian firms, focusing on the following research questions: (i) What is the relationship between CER and CFP of Indian firms? (ii) Are Indian firms prioritizing CER likely to achieve better CFP? (iii) Which specific dimensions of CFP of Indian firms are influenced by CER? Three scholarly search engines were used to identify studies based on a well-formulated search string, with the SLR guided by PRISMA following document search, article screening, and data extraction processes. The results indicate a positive relationship between CER and CFP, with significant improvements in environmental outcomes. Returns on investment emerges as a common indicator of CFP, showing a significant positive impact from CER practices. While studies have used a wide range of CER indicators, the reduction and recycling of waste are found to play a prominent role in improving CFP. This finding has important policy implications for sustainable development and the environment, as the government of India encourages firms to adopt waste-to-wealth practices. Policymakers should particularly focus on small and medium-sized firms that are either reluctant to adopt environmental measures or fear reduced financial performance due to a lack of financial support.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The adoption of sustainable approaches by firms is crucial in addressing environmental challenges such as pollution, global warming, loss of biodiversity, and resource scarcity, as well as achieving economic and social benefits [1]. In this context, if environmental governance and supervision are implemented through environmental information disclosure, specifically through Corporate Environmental Responsibility (CER) disclosure policies, firms are more likely to act responsibly. They may reduce pollution to avoid strict environmental regulations, governance, and supervision [2]. Broadly, CER extends Corporate Social Responsibility (CSR) by integrating environmental concerns into production processes and responding to environmental regulatory failures [3]. CER operates on two levels: first, it focuses on policies that prevent environmental damage, and second, it emphasizes environment-friendly production processes [4]. Even without perfect competition, CER can significantly improve firm performance [5].

However, when the industrial sector of a developing country progresses towards economic development to become globally competitive, environmental responsibilities are often inadequately addressed due to a lack of awareness and a greater emphasis on economic gains [6]. Additionally, small and medium-sized enterprises (SMEs) are less inclined to engage in environmentally responsible activities due to limited management resources and reputational concerns [7, 8]. Despite this, in any phase of transition, emphasizing environmental responsibility is imperative. Government intervention is necessary to positively influence policymakers and address these issues effectively [9].

Although the industrial sector has a positive linear association with environmental values [10], manufacturing industries may hesitate to invest in environmental responsibility as it can impact their financial performance [11]. Factors such as externalities and public goods, imperfect competition (product differentiation, information asymmetry, market contestability), innovation, and resource availability underscore the need for Corporate Environmental Responsibility (CER) in developing countries like India [3]. Micro, Small, and Medium Enterprises (MSMEs) in India can gain a competitive advantage and achieve environmental improvements by adopting CER practices [12]. In the long run, adopting green practices can lead to better employment opportunities and increased profitability [13].

Implementing environmental criteria in the industrial sector of an emerging economy like India would enable the country to adopt sustainable practices, attract more foreign direct investment, and enhance exports [14]. According to [15], eco-efficiency matrices can help in establishing relationship between environmental practices and financial performance. Historical industrial disasters, such as the Bhopal Gas Tragedy of 1984, raised environmental consciousness among Indian industries. Consequently, environmental management plans were mandated in 1994 for setting up new businesses and expanding existing ones [16]. Following the Companies Act of 2013, the Government of India required firms to allocate 2 percent of their profits to CSR initiatives [17]. On May 1, 2018, the Ministry of Environment, Forest, and Climate Change (MoEFCC) issued an Office Memorandum (F. No. 22–65/2017-IA III dated October 20, 2020), suggesting a common principle for integrating CER with Greenfield (new start-ups in rural areas with no existing infrastructure, processes or systems) and Brownfield (redevelopment of existing start-ups in urban areas that focus on environmental issues) projects. This includes projects not governed by section 135 of the Companies Act (2013) or those without net profit.

According to the Office Memorandum, Corporate Environmental Responsibility (CER) depends on the amount of investment. Since CER is a subset of Corporate Social Responsibility (CSR), the funds allocated for CER are always less than or equal to the 2 percent of profits allocated for CSR, but should never fall below 0.125 percent. To ensure transparency and uniformity in implementing CER, the government has issued specific guidelines. The cost of CER should include expenses incurred for pollution control, environmental protection, conservation of natural resources and biodiversity, and the reduction, reuse, and recycling of wastes. Additionally, CER initiatives should be based on public hearings and social needs assessments in the affected industries, and a monitoring report must be submitted [18].

However, the existing studies on CER (e.g., [19,20,21]) in Indian firms and the associated environmental regulations lack establishing an empirical relationship between CER and CFP, which could be generalized to draw policy implications at a larger scale. Furthermore, the global literature similarly lacks a decisive consensus, often exhibiting indeterminate outcomes concerning the positive impact of CER on CFP. Studies indicate that the relations between CER and CFP can be positive ([22,23,24]), neutral [25], or negative [26].

Consequently, a necessity emerges to address the indistinctness and substantiate the connection between environmental responsibility and corporate performance [27]. Therefore, the present study aims to conduct a systematic literature review (SLR) on the impact of CER on Indian firms in the last two decades. The particular research questions addressed in this study are as follows:

-

RQ1: What is the overall relationship between CER and CFP of Indian firms?

-

RQ2: Are Indian firms that prioritize CER more likely to achieve better CFP compared to those that do not?

-

RQ3: Which specific dimensions of CFP (such as profitability, return on investment, market share) are most influenced by CER in the context of Indian firms?

The importance of the study lies in identifying the most effective CER measures in enhancing CFP and reflecting the affected CFP indicator on prioritizing CER measures. Insights from the study would enable firms to design their CER strategies and for the policymakers and regulators to design industry-specific norms. This is crucial for balancing firms’ CER practices and financial performance to reap a competitive advantage in the global market, particularly for SMEs often constrained by limited resources, production technologies, managerial skills and market opportunities. Promoting firm-specific and/or industry-oriented CER measures is expected to be crucial for their financial performance. Thus, unlike the previous empirical studies, this paper examines CER-CFP linkages by capturing the publication trends over the years, productive authors, and publishing journals, which helps to understand the advancement in this domain.

The existing studies have not highlighted the empirical relationship between CER and CFP, leading to an indecisive consensus towards the financial and environmental outcomes. These have also failed to identify the most affected financial outcomes as a result of adopting CER measures. The results of this study could offer crucial Indian insights for policymakers to ensure that Indian firms adopt CER measures for better financial and environmental outcomes in the long run. The results also indicate the specific firms located in some specific Indian cities that are contributing towards sustainable development. In the contemporary world, this study can contribute towards encouraging the firms in adopting sustainable business practices for better financial performance.

The remaining paper is organized into the following sections: The second section describes the methodology adopted in the present study, including the process of SLR, document search, article screening, and development of a literature base for the review, data extraction, and categorization. The third section gives the results related to general information, CER-CFP linkages, the impact of CER on CFP, and the dimensions of CFP. The last two sections are based on discussions of the insights and the concluding remarks, respectively.

2 Methodology

2.1 Systematic literature review

This study focuses on Corporate Environmental Responsibility (CER) activities undertaken by Indian firms from January 1, 2000, to July 26, 2024, as CER is recognized as a subset of Corporate Social Responsibility (CSR) since the inception of global CSR initiatives in 2000. This timeframe is selected due to the growing attention on the relationship between CER and Corporate Financial Performance (CFP) over the past two decades. For this purpose, the present study has adopted a Systematic Literature Review (SLR) approach since it provides a structured approach to gathering and analysing existing literature, ensuring that all relevant studies are considered and reducing the risk of bias in the selection process [28]. Additionally, SLR provides transparency and reproducibility in the research process by following a predefined set of criteria [29]. Diverse search engines are used for appropriate data interpretation based on clearly defined and well-formulated research questions [30]. The SLR is guided by the PRISMA (Preferred Reporting Items for Systematic Reviews and Meta-Analyses) as suggested by [31, 32]. Since, all the studies included in the SLR are not empirical, some studies having primary data and some others having secondary data, statistical significant outcomes and meta-analysis cannot be conducted. Given the limited number of studies, all the studies do not provide the nature of impact between CER and CFP.

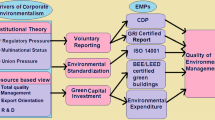

Figure 1 shows the conceptual framework used in the study. The bold arrows show the direct relationships, whereas the dotted arrows indicate the direct/indirect feedback effects from financial performance and environmental outcomes to factors that, in turn, influence the adoption of CER measures. Factors such as external pressure (Government Laws), financial leverage, and environmental hazards tend to influence the Indian manufacturing industries to adopt CER measures such as recyclable materials, waste reduction, safe chemicals, energy utilization, water use, recycling costs, electricity, and carbon propensity materials. The adoption of CER measures may lead to improvement in financial outcomes (Return on assets, return on equity, return on investment, sales, profitability, income, cost reduction, FDI, MBR, EPS, market share, productivity, revenue, inventory turnover) and environmental outcomes (Environment management system, pollution control, biodiversity, reduction in greenhouse gas emissions, designing of products for less environmental impact). Apart from these direct effects of the adoption of CER measures, external factors can also have indirect effects on financial performance and environmental outcomes.

External factors such as stringent government laws and financial leverage (ratio of debt to firm assets) can improve the return on assets and market share of the firms through the reduction of emissions and pollution by adopting safe chemicals and low carbon propensity materials [33]. In spite of cost reduction, firms can increase their revenue, earn better returns on assets, and subsequently increase their profit through the reduction of environmental hazards by incorporating sustainable or green practices such as using the 3R concept, lesser use of energy and water, etc. These can reduce the risk of the firms and contribute towards better environmental management [34].

2.1.1 Document search

To identify relevant studies focusing on the intersection of environmental responsibility and financial performance, a comprehensive search strategy was employed. This involved developing a set of search strings and searching studies using the Scopus and Web of Science databases. These databases were chosen for their extensive coverage across various disciplines [35]. The keywords were initially derived from existing literature [36] and were subsequently refined through modifications and consultation with experts to ensure their relevance and effectiveness. Two experts, having no conflict of interest and specializing in the background of industrial economics and environmental economics, respectively, were consulted through a discussion process to identify the most suitable keywords used in the article screening process. The finalized search strings, as outlined in Table 1, were designed to encompass all relevant aspects of the topic, including corporate environmental responsibility, financial performance, and environmental outcomes in Indian manufacturing industries. Asterisks were employed to denote interconnected keywords that are likely to yield the most pertinent information. In Addition, Google Scholar was also utilized as a database, and different combinations of keywords such as “Corporate sustainable performance and corporate performance”, “Corporate environmental responsibility and firm performance”, “Corporate environmental responsibility and financial performance”, “Sustainable corporate development and financial performance”, “Sustainable corporate development and firm performance” and “Corporate responsibility and business performance” have been used to identify the studies relevant to the topic. The keywords selected represent the alternative terms or synonyms used in the concept framing [37].

2.1.2 Article screening and development of literature base for review

After developing the final search strings, 199 and 106 articles were obtained from Scopus and Web of Science, respectively (as shown in Fig. 2 and Table 2). After this, the duplicate studies were removed, and 258 articles were finalized for title screening. Several inclusion criteria were used for screening the articles (Fig. 2). Post the title screening phase, 35 articles were identified as suitable for abstract screening, and amongst these, 23 were found appropriate for full-text evaluation. The exclusion was done based on different criterion—articles published before 1st January 2000, non-English articles, articles based on other countries with paywall restrictions, and non-distinct articles that deal with related concepts such as social responsibility, environmental outcomes, economic accounting, supply chain, environmental accounting and non-financial indicators but are not required for this study. Following a thorough screening of articles from Web of Science and Scopus, 16 articles were initially identified. Subsequent searches on Google Scholar, along with references and citations, yielded an additional 8 studies deemed suitable for inclusion in the systematic literature review (SLR). Consequently, a total of 24 studies were ultimately selected for the review process.

2.1.3 Data extraction and categorization

The present study has used both qualitative and quantitative analysis (descriptive statistics) for data extraction and reporting. The qualitative method here includes thematic analysis (ThA), which has been used to analyze classifications and present patterns or themes that are useful for data interpretation [38]. The data extracted from different studies were combined and composed in a Microsoft Excel Spreadsheet to classify the obtained studies under different themes based on authors, year of publication, journal name, types and number of firms taken, regions or states considered, respondents of surveys, CER adopted and their impact on CFP, overall relationship between CER and CFP, prioritization of firms regarding CER and environmental outcomes, as available. Such data extraction is important to form the results section of the review, minimize errors, provide an overview of the decisions made about the data, and establish an updated dataset for subsequent analysis [39]. The authors aimed to analyze the impact of CER on the performance of Indian firms in the last two decades. Not all the articles selected for SLR could suffice the three research questions. Some articles could specify the relationship between CER and CFP; some could provide the impact of CER on CFP, whereas some other articles provided theoretical underpinnings on the issue.

3 Results

3.1 General information on the reviewed papers

Manufacturing firms, such as those in the foundry, dairy, and automobile industries, have predominantly been the focus of the studies considered for the systematic literature review (SLR). These studies are concentrated in the northwestern regions and metropolitan cities of the country, including Kolkata, Pune, Ahmedabad, Bangalore, Mumbai, Delhi, and Nashik. It has been found that financial performance indicators, such as returns on assets, return on investment, and productivity, have been significantly impacted (more than 70 percent on average) by implementing Corporate Environmental Responsibility (CER) measures, such as reducing and recycling industrial wastes, based on the 24 studies selected for the literature review. Figure 3 illustrates the trends of publications over the years across different journals. Notably, while the search included studies published between 2000 and 2024, the relevant studies are primarily concentrated between 2016 and 2024, with most being published in 2022.

The authors have categorized the published articles based on the time periods they cover. The period from 2000 to 2024 has been divided into three sub-periods, each reflecting key research trends in Corporate Environmental Responsibility (CER) over the years. In the first sub-period (2000–2010), no articles were published that highlighted the relationship between CER and Corporate Financial Performance (CFP) of Indian manufacturing firms. This sub-period marked the introduction and emergence of CER as a subset of Corporate Social Responsibility (CSR) in India. The next sub-period (2011–2019) saw an emphasis on CER and the implementation of policies making it mandatory for Indian firms to adopt CER. Five articles were published during this time. The final sub-period (2020–2024) focused on recent trends in CER in the post-pandemic context. Reflecting the growing interest of researchers, 19 articles were published during this period.

Studies related to corporate environmental responsibility and financial performance have been increasing over the years. Table 3 shows the number of firms analyzed in these studies and the number of respondents surveyed, respectively. The studies are non-overlapping, meaning they have either used firms or respondents, but not both, for their analyses. On average, each study using secondary datasets has considered 123 firms for analysis. In contrast, studies using primary data sources have surveyed an average of 305 respondents.

3.2 Adoption of CER and CFP performance

According to Fig. 4, among the reviewed papers (n = 24), 81 percent report a positive and significant relationship between CER and CFP. The remaining papers have reported either a negative relationship or a positive but not significant relationship between CER and CFP. This indicates that if Indian firms adopt CER practices, their CFP tends to increase in most cases. This suggests that CER, which focuses on environmental protection, can yield better financial performance and environmental outcomes in the long run. Table 3 portrays the reasons behind the impact on the nature of the relationship between CER and CFP. Enhanced environmental responsibility tends to correlate with improved financial performance. Firms that adopt CER measures typically enjoy favourable reputations compared to their counterparts. They often foster strong relationships with employees, attract and retain skilled personnel, and gain improved access to capital, all of which contribute to enhanced financial performance. Small firms may not gain in terms of financial performance as compared to their expenditure on CER measures, providing a negative relationship between CER and CFP. The size, type, location, selling efforts, import–export intensities, market share, and demand for the products of the firms also affect the type of relationship between CER and CFP [51] (as indicated in Table 4).

The studies demonstrating a positive linkage between CER and CFP have primarily focused on manufacturing firms across various sectors, including Chemicals, Dairy, Fertilizers, Oil & Gas, Pharmaceuticals, Pulp & Paper, Sugar, Textiles, Hotels, FMCG, Automobiles, Foundry, and Electronics. Conversely, the studies indicating a negative relationship between CER and CFP [26] have not specified the types of firms exhibiting such negative relationships. However, [25] specifically examined Indian Fast-Moving Consumer Goods (FMCG) firms and did not provide a conclusive result regarding the adoption of CER measures.

3.3 Dimensions of CFP influenced by CER

Most of the studies included in the systematic literature review (SLR) have focused on the improved Corporate Financial Performance (CFP) resulting from the adoption of Corporate Environmental Responsibility (CER) measures. In addition to empirical studies, certain theoretical studies in the SLR have also indicated a positive relationship between CER and CFP ([19, 23]).

From the SLR, it becomes evident that Return on Assets (ROA) is a crucial CFP indicator, reflecting a firm's competitiveness in the global market through increased profit margins, product differentiation strategies, enhanced asset turnover, and cost leadership strategies. Most firms have regarded ROI as a significant indicator of CFP. Return on Investment (ROI) is linked to firms' international assignments and the associated risks or uncertainties [52]. Furthermore, some studies have suggested that Cost Reduction (CR) can facilitate the development of new and innovative products, potentially leading to increased customer satisfaction [53].

Figure 5 illustrates the distribution of studies based on the Corporate Environmental Responsibility (CER) measures adopted. With a broad spectrum of CER measures employed across various studies, it is notable that the reduction and recycling of waste materials emerge as pivotal factors in enhancing Corporate Financial Performance (CFP) [54]. Specifically, 42 percent of the studies have focused on reducing energy consumption and lowering the costs associated with hazardous waste disposal and recycling. In contrast, only 17 percent of the studies have addressed the utilization of recyclable materials and ecologically safe chemicals.

Figure 6 depicts the distribution of studies based on Corporate Financial Performance (CFP) indicators, highlighting Return on Assets (ROA), Return on Investment (ROI), and Cost Reduction (CR) as the most commonly utilized indicators. These three indicators have been selected for analysis due to their direct positive relationship with Corporate Environmental Responsibility (CER). Table 3 indicates that CER has the highest positive impact on ROI, reaching up to 96 percent. While ROA and CR have been prominent CFP indicators in many studies, other indicators such as sales, productivity, profitability, and inventory turnover are indirectly affected positively by approximately 90 percent due to the adoption of CER measures. Factors including market share, revenue, income, foreign direct investment, and return on equity (ROE) have also been influenced by the implementation of CER, whereas factors like market-to-book ratio and earnings per share show negligible effects.

Significant interactions have been noted in studies examining the relationship between Corporate Environmental Responsibility (CER) and Corporate Financial Performance (CFP). In many instances, studies implementing highly effective CER measures, such as waste reduction or energy utilization reduction, have observed improvements in at least one of the key CFP indicators, namely ROI, ROA, and CR. Consequently, the most impactful CER measures align with the most influenced CFP indicators. Further discussion on this topic is provided in the subsequent section.

4 Discussion

4.1 Positive relationship between CER and CFP

The systematic literature review conducted in this paper reveals a predominantly positive relationship between corporate environmental responsibility and firms’ financial performance across the majority of studies. Enhanced environmental responsibility tends to correlate with improved financial performance. While the extent of this positive relationship may vary depending on different Corporate Environmental Responsibility (CER) measures and Corporate Financial Performance (CFP) indicators, market mechanisms and government intervention can significantly influence the effectiveness of this process [54].

This trend has sparked growing research interest in comprehending the nature and direction of CER-CFP relationships within the Indian context. The findings of this study offer valuable insights for industrialists to identify the most effective CER measures to enhance their financial performance. Additionally, these findings facilitate comparisons of CFP between industries adopting CER and those that are not. By providing a comprehensive overview of the CER-CFP linkage in Indian firms, this study supports researchers and academicians in this field to understand the increasing attention academia is paying to this domain, thus contributing to better outcomes and informed decision-making.

4.2 Are Indian firms prioritizing environmental responsibility more likely to achieve better financial performance than those not?

Building on the positive relationship established between Corporate Environmental Responsibility (CER) and Corporate Financial Performance (CFP) in the preceding section, firms often adopt incentives to mitigate their environmental impact or inconsistencies [54]. By implementing waste reduction and recycling initiatives, firms can curb expenses associated with purchasing fresh materials, consequently bolstering CFP.

The firm's investment in waste reduction and recycling can also confer a competitive advantage [12]. This advantage stems from the concept of the 3Rs—Reduce, Reuse, and Recycle—which constitutes a circular, iterative process. Within this cycle, the utilization of recyclable materials, as evidenced in a limited number of studies, is contingent upon waste reduction (demonstrated in the majority of studies) through reuse. Thus, as more Indian firms focus on reducing waste disposal, emphasis on material reuse can increase, subsequently enhancing the recycling process [55].

Firms that adopt CER measures typically enjoy favourable reputations compared to their counterparts. They often foster strong relationships with employees, attract and retain skilled personnel, and gain improved access to capital, all of which contribute to enhanced financial performance [56]. Furthermore, investors are reassured that their investments contribute to sustainable development and are less prone to risk due to better environmental performance [57].

4.3 Changes in CFP indicators due to adoption of CER measures

Return on Assets (ROA), Return on Investment (ROI), and Cost Reduction (CR) are among the most influential Corporate Financial Performance (CFP) indicators, as they reflect aspects related to employee safety and health, waste management, and community development [43]. ROA signifies the ability of firms to generate profits from their business activities, indicating efficiency in production. Consequently, higher ROA typically corresponds to greater CFP.

Improvements in ROI resulting from the adoption of CER measures imply that firms are willing to forego current consumption for the sake of better future consumption, leading to increased wealth accumulation. Enhanced ROI also enhances firms' market performance and attractiveness to potential investors, contributing to long-term benefits [58]. Moreover, Cost Reduction (CR) is typically reduced when firms adopt environmental practices, as they face fewer fines and penalties. This reduction in costs contributes positively to CFP by enhancing profitability and operational efficiency.

4.4 What are possible environmental outcomes due to the adoption of CER measures?

In addition to traditional Corporate Financial Performance (CFP) indicators, some studies have delved into monetizing environmental concepts, investment decisions, and motivations behind adopting Corporate Environmental Responsibility (CER) indicators. For example, the adoption of CER measures has led to an 85 percent reduction in greenhouse gas emissions [23, 59, 60]. This reduction stems from the use of low-carbon materials, safer chemicals, and minimized waste during production processes, mitigating the emissions contributing to global warming and climate change.

Further studies have demonstrated improvements in environmental scores resulting from CER implementation ([26, 61]). Initiatives such as environmental management systems, pollution control, and biodiversity conservation are bolstered by CER practices like incorporating recyclable materials and reducing hazardous waste, water consumption, electricity usage, and energy utilization [22].

Proper treatment and utilization of water, waste, and energy not only maintain the food web and chain in society but also contribute to ecosystem and biodiversity enhancement [62]. Reduced electricity usage translates to less pollution and a greater contribution to resource conservation and sustainable development. Mismanagement of waste, when disposed of into air and water bodies without treatment, results in pollution, adversely affecting the environment and living organisms' health.

Efficiency improvements in manufacturing processes through eco-design and utilizing discarded product parts for new products reinforce the reuse concept in the industrial sector [63]. Waste reduction can be achieved through minimizing industrial packaging. Though recycling waste may yield lower-quality products, it aids in reducing the consumption of extracted resources like carbon-intensive materials, fossil fuels, and minerals. Firms can enhance this process by collaborating with similar firms to explore co-product opportunities or utilizing other firms' waste as raw materials [64].

Moreover, innovative hybrid waste management systems combining individual and central sorting methods improve recycled product quality and increase reuse possibilities. The underlying hypothesis is that firms prioritize environmental activities to enhance their financial performance.

Understanding the environmental outcomes resulting from CER adoption is crucial for raising firm owners' awareness of green manufacturing and sustainable development. Improved environmental outcomes prompt firms to embrace more environmentally friendly practices, including reuse, reduction, and recycling, while stimulating innovative approaches to sustainability challenges. Analysing environmental outcomes effectively can inform policy adjustments and inspire ecologically sustainable initiatives among young firm owners [65].

Table 5 illustrates various CER approaches undertaken in different studies to elucidate differences in their impact on Corporate Financial Performance (CFP) and environmental outcomes. For example, [21] demonstrated a greater impact of CER measures on cost reduction compared to [66], despite both studies showing equal improvement in environmental performance (around 80 percent). Both studies implemented common CER measures such as reduced energy usage and increased utilization of low-carbon materials. However, [22] also emphasized reducing water and electricity usage, increasing the use of recyclable materials, and proper waste disposal, leading to significantly enhanced CFP compared to [67] (Table 6).

Similarly, [23] and [48] focused on reducing greenhouse gas emissions in manufacturing firms over time. However, [48] reported an 82 percent reduction in emissions, while [23] reported a 68 percent reduction. Additionally, [48] emphasized reduced water and electricity usage, which was not considered in [23]’s study.

The CER approaches adopted by firms to enhance their CFP encompass additional measures or pathways such as Organizational Culture, Innovation, Governmental Financial Support and Policies, Technological Advancements, Sustainable Manufacturing Practices, Improved Production Systems, Lean Operations, Efficient Utilization of Natural Resources, Proactive Environmental Strategy, and Eco-Innovation. Government initiatives enhance firms' competitiveness and incorporate environmental strategies into organizational culture, thereby enhancing both financial and environmental performance [68, 69]. In many instances, technology serves as a moderating factor between the undertaken CER approaches and firms' financial performance [70].

India's industrialization, characterized by its lack of planning, leads to SMEs neglecting CER measures, contributing to deteriorating air quality in industrial cities [71]. Despite being planned and environmentally responsible, the ten most populated Indian cities struggle with Industrial Hazardous Waste (IHW) due to waste disposal at dumpsites and prolonged waste retention without treatment [72]. Understanding the factors influencing the location of environmentally responsible firms in specific regions is crucial and can significantly impact the CER-CFP linkage (Table 7).

4.5 The major findings and implications of the study

Table 3 presents the key findings gleaned from the studies examined in the SLR. These findings encompass environmental and sustainability issues, major Corporate Environmental Responsibility (CER) indicators and their corresponding effects on Corporate Financial Performance (CFP), environmental management and emerging environmental concepts, managerial and environmental implications, as well as the diverse methodologies employed to ascertain the relationship between CER and CFP.

Sustaining environmental sustainability is paramount to addressing associated damages or environmental costs [73]. Implementing CER measures, particularly waste and energy reduction, without compromising efficient and cost-effective production processes, emerges as a critical factor in bolstering the financial performance of Indian firms. This not only sustains the economy but also reinforces a competitive position in the global market. Developing industry-specific strategies for effective recycling programs, adopting investment strategies in renewable energy generation, establishing carbon offset programs to curb industrial emissions, utilizing environmentally friendly materials in manufacturing and packaging, fostering partnerships with other industries, conducting regular environmental audits for assessment, incentivizing customers for reuse and recycling, integrating eco-friendly practices into supply chain management, and supporting research and development initiatives are potential future CER endeavors.

The study offers lucid insights into the relationship between CER and CFP, revealing a predominantly positive correlation in most Indian manufacturing firms. This suggests that adopting CER measures can lead to improved CFP. Firms in sectors such as Chemicals, Dairy, Fertilizers, Oil & Gas, Pharmaceuticals, Pulp & Paper, Sugar, Textiles, Hotels, FMCG, Automobiles, Foundry, and Electronics, located in Kolkata, Pune, Ahmedabad, Bangalore, Mumbai, Delhi, and Nashik, prioritize CER adoption and have demonstrated success in enhancing their CFP compared to non-adopting firms.

5 Concluding remarks

This paper establishes a positive correlation between corporate environmental responsibility and firms' financial performance across a majority of the studies. Consequently, there is a burgeoning interest in exploring the nature and direction of CER-CFP relationships within the Indian context. It's reasonable to hypothesize that firms are incentivized to prioritize environmental activities to enhance their financial performance. Common measures adopted by manufacturing firms include waste reduction and recycling, with a focus on improving returns on assets, returns on investment, productivity, among others. Following the methodology outlined by [74], this SLR consolidates previously fragmented knowledge on the topic, facilitating a comprehensive analysis of the CER-CFP relationship within the Indian landscape.

However, the findings of this paper raise several critical avenues for further research. For instance, there is a need to design industry-specific strategies for effective recycling programs, invest in renewable energy generation, develop carbon offset initiatives to mitigate industrial emissions, promote the use of environmentally friendly materials in manufacturing and packaging, foster inter-industry partnerships, conduct regular environmental audits, incentivize customer engagement in reuse and recycling, integrate eco-friendly practices into supply chain management, and support research and development efforts towards future CER initiatives. Especially, governmental and policy interventions should target sustainable manufacturing pathways for small and medium-sized firms, addressing reluctance or fears regarding adverse financial impacts. Additionally, understanding the training needs of employees for effective CER implementation is crucial. Future studies should delve deeper into various CER indicators and their dynamics concerning firms' financial performance.

Firms should invest in and adopt more sustainable practices, with government support through financial incentives, tax breaks, and stringent regulations for non-compliance. Increased research and development efforts can foster greater environmental awareness and commitment among firms. Identifying novel energy management practices to enhance environmental performance is also paramount. Instances can be observed from the electronics manufacturer, NEC (based in Japan, Ireland and Australia) who came up with Eco-Action 21 Plan back in 2000 [75].

Despite its advantages, SLR has inherent limitations. The exclusion of non-English articles may overlook valuable insights, while reliance on keyword identification might omit some pertinent studies. Moreover, many reviewed papers lack specific details regarding firm locations, product types, and CER implementation processes. Sometimes, the introduction of green bonds introduced by the firms prove to be beneficial. However, these also lead to the mechanism of “Greenwashing” which means that the firms show that they follow green initiatives but actually they neglect such initiatives. Greenwashing is highly deceptive as it attracts consumers to purchase products based on false and misleading information on sustainable issues. This “whitewashing” can be restricted through the determination of a product’s lifecycle and look for transparency and accountability. Therefore, while SLR offers valuable insights, overcoming these limitations and drawing robust conclusions necessitates context-specific analyses and suitable methodological frameworks.

Data availability

The dataset will be shared on request.

References

Jaiswal J, Bihari S. Role of connectedness to nature and perceived environmental responsibility on green purchase behaviour. Asian J Busin Res. 2020;10(3):65–84.

Wang M, Liao G, Li Y. The relationship between environmental regulation, pollution and corporate environmental responsibility. Int J Environ Res Public Health. 2021;18(15):8018.

Crifo P, Sinclair-Desgagn B. The economics of corporate environmental responsibility. Int Rev Environ Resour Econ. 2014;7(3–4):279–97.

Sandhu S, Smallman C, Ozanne LK, Cullen R. Corporate environmental responsiveness in India: lessons from a developing country. J Clean Prod. 2012;35:203–13.

Peng B, Chen S, Elahi E, Wan A. Can corporate environmental responsibility improve environmental performance? An inter-temporal analysis of Chinese chemical companies. Environ Sci Pollut Res. 2021;28(10):12190–201.

Shih YC, Wang Y, Zhong R, Ma YM. Corporate environmental responsibility and default risk: evidence from China. Pac Basin Financ J. 2021;68: 101596.

Battisti M, Perry M. Walking the talk? Environmental responsibility from the perspective of small-business owners. Corp Soc Responsib Environ Manag. 2011;18(3):172–85.

Blundel R, Monaghan A, Thomas C. SMEs and environmental responsibility: a policy perspective. Business Ethics A Eur Rev. 2013;22(3):246–62.

Zeng C, Zhang L, Li J. The impact of top management’s environmental responsibility audit on corporate environmental investment: evidence from China. Sustain Account Manage Policy J. 2020;11(7):1271–91.

Slavoljub J, Zivkovic L, Sladjana A, Dragica G, Zorica PS. To the environmental responsibility among students through developing their environmental values. Procedia Soc Behav Sci. 2015;171:317–22.

Kim Y, Statman M. Do corporations invest enough in environmental responsibility? J Bus Ethics. 2012;105:115–29.

Simpson M, Taylor N, Barker K. Environmental responsibility in SMEs: does it deliver competitive advantage? Bus Strateg Environ. 2004;13(3):156–71.

Lee JW, Kim YM, Kim YE. Antecedents of adopting corporate environmental responsibility and green practices. J Bus Ethics. 2018;148:397–409.

Bhattacharyya A, Cummings L. Attitudes towards environmental responsibility within Australia and India: a comparative study. J Environ Planning Manage. 2014;57(5):769–91.

Sudha S. Corporate environmental performance–financial performance relationship in India using eco-efficiency metrics. Manage Environ Quality An Inter J. 2020;31(6):1497–514.

Mishra S, Suar D. Salience and corporate responsibility towards natural environment and financial performance of Indian manufacturing firms. J Global Respons. 2013;4:44–61.

Vinod S, Sivakumar N. Corporate environmental responsibility of Indian companies comprising the NIFTY index: analysis and categorization. Biznes I Zarzadzanie a Bezpieczenstwo W Polsce I Na Świecie. 2018: 275–289.

Hu J, Wu H, Ying SX. Environmental regulation, market forces, and corporate environmental responsibility: Evidence from the implementation of cleaner production standards in China. J Bus Res. 2022;150:606–22.

Kumar N, Mathiyazhagan K, Mathivathanan D. Modelling the interrelationship between factors for adoption of sustainable lean manufacturing: a business case from the Indian automobile industry. Int J Sustain Eng. 2020;13(2):93–107.

Kumar S, Dua P. Environmental management practices and financial performance: evidence from large listed Indian enterprises. J Environ Planning Manage. 2022;65(1):37–61.

Verma R, Sharma D, Priyanka. Relationship among environmental performance, R&D expenditure and financial performance: evidence from indian manufacturing firms. Glob Bus Rev. 2022;23(6):1316–35.

Moslehpour M, Chau KY, Tu YT, Nguyen KL, Barry M, Reddy KD. Impact of corporate sustainable practices, government initiative, technology usage, and organizational culture on automobile industry sustainable performance. Environ Sci Pollut Res. 2022;29(55):83907–20.

Malek J, Desai TN. Investigating the role of sustainable manufacturing adoption in improving the organizational performance. Technol Soc. 2022;68: 101940.

Pachar N, Darbari JD, Govindan K, Jha PC. Sustainable performance measurement of Indian retail chain using two-stage network DEA. Ann Oper Res. 2022;315(2):1477–515.

Javed MY, Hasan M, Azam MK. Relationship between sustainable practices and firm performance: a study of the FMCG sector in India. In proceedings of third international conference on sustainable computing: SUSCOM 2021 (pp. 107–114). Singapore: Springer Nature Singapore. 2022.

Gupta A, Pardo P, Cooper M. The contribution of sustainable practices to financial performance and firm value in companies in developing countries: the case of India. 2022.

Testa M, D’Amato A. Corporate environmental responsibility and financial performance: does bidirectional causality work? Empirical evidence from the manufacturing industry. Soc Respons J. 2017;13(2):221–34.

Nightingale A. A guide to systematic literature reviews. Surg Infect. 2009;27(9):381–4.

Boell SK, Cecez-Kecmanovic D. On being ‘systematic’in literature reviews. Formulat Res Methods Informat Syst. 2015;2:48–78.

Pae CU. Why systematic review rather than narrative review? Psychiatry Investig. 2015;12(3):417.

Moher D, Liberati A, Tetzlaff J, Altman DG. PRISMA Group*, T Preferred reporting items for systematic reviews and meta-analyses: the PRISMA statement. Annals Int Med. 2009;151(4):264–9.

Sarkis-Onofre R, Catalá-López F, Aromataris E, Lockwood C. How to properly use the PRISMA statement. Syst Rev. 2021;10(1):1–3.

King AA, Lenox MJ. Does it really pay to be green? An empirical study of firm environmental and financial performance: An empirical study of firm environmental and financial performance. J Ind Ecol. 2001;5(1):105–16.

Gangi F, Daniele LM, Varrone N. How do corporate environmental policy and corporate reputation affect risk-adjusted financial performance? Bus Strateg Environ. 2020;29(5):1975–91.

Chadegani AA, Salehi H, Yunus MM, Farhadi H, Fooladi M, Farhadi M, Ebrahim NA. A comparison between two main academic literature collections: web of science and scopus databases. arXiv preprint arXiv:1305.0377. 2013.

Ameer F, Khan NR. Green entrepreneurial orientation and corporate environmental performance:a systematic literature review. Eur Manag J. 2023;41(5):755–78.

Aromataris E, Riitano D. Constructing a search strategy and searching for evidence. Am J Nurs. 2014;114(5):49–56.

Alhojailan MI. Thematic analysis: a critical review of its process and evaluation. In WEI international European academic conference proceedings, Zagreb, Croatia. 2012.

Munn Z, Tufanaru C, Aromataris E. JBI’s systematic reviews: data extraction and synthesis. AJN Am J Nurs. 2014;114(7):49–54.

Fatima T, Elbanna S. Drivers and outcomes of corporate sustainability in the Indian hospitality industry. Manag Decis. 2023;61(6):1677–96.

Prasad S, Khanduja D, Sharma SK. An empirical study on applicability of lean and green practices in the foundry industry. J Manuf Technol Manag. 2016;27(3):408–26.

Patel JD, Shah R, Trivedi RH. Effects of energy management practices on environmental performance of Indian small-and medium-sized enterprises. J Clean Prod. 2022;333: 130170.

Ghose B, Makan LT, Kabra KC. Impact of carbon productivity on firm performance: moderating role of industry type and firm size. Manag Financ. 2023;49(5):866–83.

Samar Ali S, Kaur R, Ersöz F, Lotero L, Weber GW. Evaluation of the effectiveness of green practices in manufacturing sector using CHAID analysis. J Remanufact. 2019;9:3–27.

Ratna VV. Integrating sustainability with corporate strategy to enhance organizational performance. PURUSHARTHA-A J Manage Ethics Spirituality. 2018;11(1):1–10.

Laskar N, Chakraborty TK, Maji SG. Corporate sustainability performance and financial performance: empirical evidence from Japan and India. Managem Labour Stud. 2017;42(2):88–106.

Adebanjo D, Teh PL, Ahmed PK. The impact of external pressure and sustainable management practices on manufacturing performance and environmental outcomes. Int J Oper Prod Manag. 2016;36(9):995–1013.

Makan LT, Kabra KC. Carbon emission reduction and financial performance in an emerging market: empirical study of Indian firms. Indonesian J Sustain Account Manage. 2021;5(1):23–32.

Haile Y, Min H. Success factors for renewable energy businesses in emerging economies. Manag Res Rev. 2023;46(8):1091–111.

Posti L, Bhamoriya V, Kumar R, Khare R. How productive is liquid waste management practices in Indian informal micro, small and medium enterprises? Manage Environ Quality An Int J. 2024;35(2):314–40.

Mishra P, Chandra T. Mergers, acquisitions and firms performance: experience of Indian pharmaceutical industry. Eurasian J Busin Econ. 2010;3(5):111–26.

McNulty Y, De Cieri H, Hutchings K. Do global firms measure expatriate return on investment? An empirical examination of measures, barriers and variables influencing global staffing practices. Int J Human Resour Manage. 2009;20(6):1309–26.

Saini M, Aggarwal V, Dhingra B, Kumar P, Yadav M. ESG and financial variables: a systematic review. Int J Law Manage. 2023;65(6):663–82.

Iwata H, Okada K. How does environmental performance affect financial performance? Evidence from Japanese manufacturing firms. Ecol Econ. 2011;70(9):1691–700.

Mostafa MK, Peters RW. Applying the three R’s: reduce, reuse, and recycle in the chemical industry. J Air Waste Manag Assoc. 2017;67(3):322–9.

Aggarwal P. Relationship between environmental responsibility and financial performance of firm: a literature review. IOSR J Bus Manag. 2013;13(1):13–22.

James P. Business environmental performance measurement. Bus Strateg Environ. 1994;3(2):59–67.

Ngwakwe CC. Environmental responsibility and firm performance: evidence from Nigeria. Int J Human Soc Sci. 2009;3(2):97–103.

Kamwaro EK. The impact of investment portfolio choice on financial performance of investment companies in Kenya (Doctoral dissertation, University of Nairobi). 2013.

Gupta AK, Gupta N. Effect of corporate environmental sustainability on dimensions of firm performance–towards sustainable development: evidence from India. J Clean Prod. 2020;253: 119948.

Gupta AK, Gupta N. Environment practices mediating the environmental compliance and firm performance: an institutional theory perspective from emerging economies. Glob J Flex Syst Manag. 2021;22(3):157–78.

Bodhanwala S, Bodhanwala R. Does corporate sustainability impact firm profitability? Evid India Manage Decis. 2018;56(8):1734–47.

Velenturf AP, Purnell P. Principles for a sustainable circular economy. Sustain Product Consumpt. 2021;27:1437–57.

Korhonen J, Honkasalo A, Seppälä J. Circular economy: the concept and its limitations. Ecol Econ. 2018;143:37–46.

Geissdoerfer M, Savaget P, Bocken NM, Hultink EJ. The Circular economy–a new sustainability paradigm? J Clean Prod. 2017;143:757–68.

Press D. Industry, environmental policy, and environmental outcomes. Annu Rev Environ Resour. 2007;32:317–44.

Das C. Analysing the effect of low carbon product design on firm performance. Int J Product Perform Manag. 2023;72(1):180–99.

Anwar M, Li S. Spurring competitiveness, financial and environmental performance of SMEs through government financial and non-financial support. Environ Dev Sustain. 2021;23(5):7860–82.

Bakhsh Magsi H, Ong TS, Ho JA, Sheikh Hassan AF. Organizational culture and environmental performance. Sustainability. 2018;10(8):2690.

Bendig D, Schulz C, Theis L, Raff S. Digital orientation and environmental performance in times of technological change. Technol Forecast Soc Chang. 2023;188: 122272.

Singh S, Sharma P, Garg N, Bala R. Groping environmental sensitivity as an antecedent of environmental behavioural intentions through perceived environmental responsibility. J Enterpris Commun People Places Global Econ. 2022;16(2):299–319.

Dutta A, Jinsart W. Waste generation and management status in the fast-expanding Indian cities: a review. J Air Waste Manag Assoc. 2020;70(5):491–503.

Labuschagne C, Brent AC, Van Erck RP. Assessing the sustainability performances of industries. J Clean Prod. 2005;13(4):373–85.

Xiao Y, Watson M. Guidance on conducting a systematic literature review. J Plan Educ Res. 2019;39(1):93–112.

Kubokawa S, Saito I. Manufacturing management strategies for environmental protection: toward the environmental upgrading of management and manufacturing systems to cope with environmental laws. Product Plann Control. 2000;11(2):107–12.

Acknowledgements

We are thankful to the editor and reviewers of the journal for their constructive comments, which have helped immensely to improve the manuscript.

Funding

Not available.

Author information

Authors and Affiliations

Contributions

TM: Conceptualization, Data curation, Formal analysis, Writing–original draft, Visualization, Review Editing; PD: Conceptualization, Writing–review & editing, Supervision; BB: Conceptualization, Writing–review & editing, Supervision.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

All the authors agree to publish the article in the journal Discover Sustainability.

Competing interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License, which permits any non-commercial use, sharing, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if you modified the licensed material. You do not have permission under this licence to share adapted material derived from this article or parts of it. The images or other third party material in this article are included in the article’s Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article’s Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by-nc-nd/4.0/.

About this article

Cite this article

Mishra, T., Datta, P. & Behera, B. Corporate environmental responsibility, financial performance and environmental outcomes in India: a review. Discov Sustain 5, 213 (2024). https://doi.org/10.1007/s43621-024-00421-0

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s43621-024-00421-0