Abstract

The empirical research on the relationship between corporate environmental responsibility and environmental performance remains in the one-way positive impact and lacks the research on nonlinear relationship between them. Based on the stakeholder theory, this paper selects A-share chemical–listed companies in China from 2006 to 2017 as the research samples and uses generalized method of moments (GMM) model to investigate the impact mechanism between corporate environmental responsibility and environmental performance. The results showed that corporate environmental responsibility positively impacted on environmental performance; however, the impact was not significant. The corporate environmental performance positively and significantly impacted on environmental responsibility. Moreover, results reported that industry competition played a positive regulatory role in corporate environmental responsibility affecting environmental performance and has played a positive role in corporate environmental impact on environmental responsibility. A nonlinear relationship (inverted “U” shape) between environmental responsibility and environmental performance was found. The study results stress to establish a fair and perfect market competition mechanism to improve the environmental performance of chemical industries in China.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In the industrial countries, the conflict between economic development and environmental protection has become a worldwide problem (Ferreira et al. 2006). Environmental pollution restrains to achieve a goal of sustainable development (Nwokorie and Obiora 2018). Despite the introduction of efficient machinery, environmental pollution has been increased in the planet (Clay 2013; Elahi et al. 2019a, b). An increase in the global GDP without paying attention to environmental issues is not a sustainable policy (Van den Bergh 2011). Therefore, a correct understanding and investigation of this issue will help to enhance the company’s awareness and consciousness of environmental responsibility. It will enable the company to develop a positive interaction between actively assuming environmental responsibility and improving environmental performance, and build sustainable industrial development.

Previous studies found a positive relationship between corporate environmental performance and environmental responsibility. Particularly, Nairn-Birch et al. (2015) and Li et al. (2015) conducted an empirical research using greenhouse gas emission data and found that dynamic financial performance has a significant positive relationship with environmental responsibility. Alexopoulos et al. (2018) explored the relationship between environmental responsibility and environmental performance for the Greek national manufacturing companies and reported that there was a positive correlation between environmental performance and environmental responsibility. The reason for the inconsistency in the previous studies is that most of studies examined the relationship between environmental responsibility and environmental performance from a static and one-way perspective without investigating the inter-temporal impact and nonlinear relationship between the environmental responsibility and environmental performance (Filbeck and Gorman 2004; Elsayed and Paton 2005). In fact, the relationship between corporate environmental responsibility and environmental performance may not only have a one-way positive effect but also have a cross-period interaction and a nonlinear relationship between the environmental responsibility and environmental performance.

In previous studies, three research gaps have been found. Firstly, a proper relationship between corporate environmental responsibility and environmental performance was not found. Secondly, the empirical research on the relationship between corporate environmental responsibility and environmental performance in academic circles has remained in the one-way positive impact. There was a lack of inter-temporal interaction between corporate environmental responsibility and environmental performance. Thirdly, there is a lack of research on the nonlinear relationship between environmental responsibility and environmental performance. To cover up these gaps, we have used data from 2006 to 2017 of Chinese chemical companies as the research sample to investigate whether there is an inter-temporal relationship between corporate environmental responsibility and environmental performance. Moreover, the study discusses the moderating role of industry competition on environmental responsibility and environmental performance. Finally, the study investigates the nonlinear relationship between corporate environmental responsibility and environmental performance.

The study contributes to the existing literature in three aspects. Firstly, the existing literature mainly focused on the qualitative analysis of the corporate environment without considering the quantitative analysis. This study examines the inter-temporal interaction between environmental responsibility and environmental performance, as well as internal and external factors. Secondly, the existing literature focused on the linear relationship between environmental responsibility and environmental performance. The current study explores the nonlinear relationship between environmental responsibility and environmental performance. Thirdly, most of previous studies used multiple linear regression which has an endogenous problem. In order to solve this problem, the current study uses a dynamic generalized method of moments (DGMM) model to discuss the relationship between environmental responsibility and environmental performance.

Theoretical framework and research hypothesis

Theoretical framework

The legality theory of enterprises believes that “legitimacy” is an important strategic resource for enterprises. It helps enterprises to obtain the recognition and support of various stakeholders and enhance their competitive advantages (Zeitz 2002). According to this theory, corporate environmental responsibility is an important way for companies to obtain legitimacy. It helps to improve transaction efficiency and reduce transaction costs (Blackman 2012). When an enterprise fulfills its environmental responsibility, it improves the quality of environmental information disclosure, allows investors to learn more information, adopts investment behaviors more rationally, and increases corporate environmental performance (Giannarakis 2014). However, it should be pointed out that the positive impact of corporate environmental responsibility on environmental performance and environmental performance on environmental responsibility often has certain drawbacks in reality. In fact, the real market is not a perfect market; many irrational factors make difficulties for all stakeholders to get timely and complete information about the corporate responsibility for the environment. Regarding value creation, Melinda (2016) believed that the environmental measures taken by companies provide competitive advantage. For companies, improving efficiency is conducive to improving their market value. According to the principal-agent theory, the relationship between an enterprise and various stakeholders is a principal-agent relationship, and there is a problem of information asymmetry; the environmental responsibility of an enterprise can reflect the importance the enterprise attaches to environmental protection, and it is easy to win the trust and support of various stakeholders (Wang 2020). Therefore, this article focuses on inter-temporal interaction between corporate environmental responsibility and environmental performance.

Research hypothesis

The impact of corporate environmental responsibility on environmental performance

According to the stakeholder theory (Friedman and Miles 2010), from the perspective of internal stakeholders, the owner of the company hopes that managers can faithfully fulfill their social responsibilities and disclose more information to the outside world, which can better maintain and guarantee own interests. Enterprises that disclose more environmental information will get a good impression of fulfilling environmental responsibilities. A good external image allows companies to raise various resources more preferentially, and the company’s environmental performance will be improved to a certain extent. From the perspective of external stakeholders, creditors provide financial support to the enterprise, creating a good financing channel for the enterprise (Allen et al. 2005). In addition, continuous and effective environmental protection investment is conducive to the establishment of the company’s own environmental protection culture internally, and externally to the establishment of the company’s green brand, thereby improving the competitiveness of the company and creating more performance for the company (Ben et al. 2020). Environmental responsibility is the social responsibility of an enterprise to protect environment. The relationship between the two can be measured from two dimensions. Firstly, corporate environmental responsibility is an important way to gain legitimacy and helps to improve the efficiency and quality of transactions. David et al. (2019) discussed the relationship between corporate environmental responsibility and financial performance based on sample data from 2008 to 2016. They have determined that corporate environmental responsibility and financial performance have a positive effect. Similarly, Zhang et al. (2020) conducted a study on heavily polluted companies in Shenzhen and Shanghai as the research samples and investigated that there was an inter-phase relationship between corporate environmental responsibility and financial performance. They have reported that corporate environmental responsibility was positive. Secondly, corporate environmental responsibility is an important way to achieve sustainable development and helps increase corporate value. Wu et al. (2020) explored the impact of corporate environmental responsibility on corporate innovation performance based on data of Shenzhen Stock Exchange from 2006 to 2015. They have determined that corporate environmental responsibility has a positive impact on innovation performance. Bacinello et al. (2020) believed that corporate environmental responsibility and sustainable innovation have a significant positive impact on corporate performance. Based on the previous literature, we have proposed the given hypothesis.

-

Hypothesis 1 Corporate environmental responsibility positively affects environmental performance.

Impact of corporate environmental performance on environmental responsibility

According to the capital supply theory and redundant resource theory (Preston and Obannon 1997; Campbell 2007), corporate environmental performance is the economic condition for companies to assume environmental responsibility. Enterprises need to pay a certain cost for environmental responsibility, and a certain amount of financial support. It is hard to imagine that a company will have the ability to assume environmental responsibility. An enterprise’s environmental performance may affect both current and future environmental responsibilities (Al-Tuwaijri et al. 2004). The company’s resources are cumulative and can affect the company’s future economic strength, which in turn affects the company’s future environmental investment (Burgelman 2020). While the corporate environmental responsibility is a rigid social responsibility that companies must undertake, and it is a prerequisite for companies to continue to operate. In addition, since the actual market is not a perfect market, many irrational factors make it difficult for all stakeholders to obtain timely and complete information about companies’ environmental responsibility (Kunieda and Nishimura 2019). If enterprises do not invest in environmental protection and assume environmental responsibility, they will be subject to strict supervision, which in turn will lead to rectification or closure of the business, which reflects the urgency of the current period (Berger-Walliser and Scott 2018). Good environmental performance requires a process of operation and continuous accumulation; in addition to the company’s investment in environmental management and environmental protection projects, it also requires a process that is internalized into corporate income; environmental performance may positively affect current and future environmental responsibility (José and Sansalvador 2020). Sudha (2020) believes that the environmental responsibilities undertaken by enterprises can help enterprises increase their competitive advantages, and ultimately increase their profits and market value. Based on the above analysis, this paper proposes the given research hypothesis.

-

Hypothesis 2 Current corporate environmental performance may positively affect current and future environmental responsibilities.

The moderating effect of industry competition on the environmental responsibility and environmental performance

The new institutional economics believes that the market is an institutionalized exchange, or an institutional arrangement, which can restrain enterprises as an “invisible hand” (Coase 2013). In order to win the recognition and support of various stakeholders, the company’s environmental responsibility can be transformed into environmental performance (Kassinis and Vafeas 2006). However, in the relationship between corporate environmental performance and environmental responsibility, in the case of fierce industry competition, companies may face the risk of survival and loss of shareholders’ interests (Howes et al. 2013). Environmental protection investment is more regarded as a long-term investment with a long return period and greater uncertainty. Companies will pay more attention to environmental protection investment, thereby promoting the conversion of corporate environmental performance into environmental responsibility (Walker and Wan 2012). According to the legality theory, under normal circumstances, based on the pressure of the market competition system, in order to obtain more legality, enterprises will pay more attention to fulfilling environmental responsibilities (Chen et al. 2020). Therefore, the key to the positive regulation of industry competition lies in the legality formation mechanism. Based on the above discussion, we propose the given research hypothesis.

-

Hypothesis 3 Industry competition may play a positive regulatory role in the impact of corporate environmental responsibility on environmental performance. Similarly, it may have a positive regulatory role in corporate environmental performance affecting environmental responsibility.

Nonlinear relationship between environmental responsibility and corporate environmental performance

In addition to directly promoting the impact of environmental responsibility on corporate performance, there may also be a nonlinear relationship: inverted “U”-shaped curve relationship, that is, environmental responsibility first promotes corporate performance, and then turns into a negative effect after reaching a certain critical point. Sayedeh et al. (2015) discussed the relationship between corporate social responsibility and corporate performance; the study found that there may be a mediating effect between corporate social responsibility and environmental performance, and there is a certain nonlinear relationship between the two. Yavuz et al. (2016) believed that environmental development and corporate social responsibility have a positive impact on environmental performance, and there is a nonlinear relationship between environmental responsibility and environmental performance. Angela et al. (2017) found that corporate social responsibility is conducive to promote the improvement of corporate environmental performance, and that social responsibility has an inverted U-shaped curve relationship with environmental performance. Isabel-María (2020) estimated the data of 956 companies from 2006 to 2014 using Tobit and GMM and determined the impact of corporate social responsibility on environmental performance. They have found that social responsibility has a significant positive impact on environmental performance, and there was a nonlinear relationship between the two. Based on the above analysis, we have proposed the given hypothesis.

-

Hypothesis 4 Environmental responsibility does not directly promote corporate environmental performance, and there is a nonlinear relationship between the environmental responsibility and corporate environments. Based on the above theoretical analysis, the transmission mechanism model between environmental responsibility and environmental performance of chemical companies is shown in Fig. 1.

Martial and methods

Sample selection and data sources

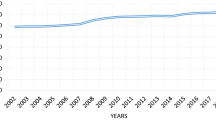

This paper collected data from 2006 to 2017 of Chinese chemical companies as the research sample. In order to avoid the impact of dual supervision of foreign stocks, H-share- and B-share-listed companies excluded mergers and acquisitions that occurred between 2006 and 2017. Companies that undergo restructuring or major management changes will eventually choose a listed company in the chemical industry with an A-share industry code that is C43. In addition, this study performs 1% Winsorize processing on the corresponding variables (Cox 2006).

Among them, the data of A-share chemical–listed companies mainly collected from the CSMAR database, Juchao Information website, China Corporate Social Responsibility website, and the official website of the China National Certification and Accreditation Administration Commission. The basic information and financial information of the sample companies are all from the CSMAR database. The pollutant discharge fee data of the sample enterprises was collected manually according to the website of the Data Center of the Ministry of Ecology and Environment. Environmental responsibility data was manually collected based on the corporate social responsibility website of China.

Variable selection

Environmental performance

Corporate environmental performance refers to the production and operation performance and benefits of a company in a certain period of time. It provides a comprehensive overview of the company’s production and operation activities. Griffin and Mahon (1997) studied a large amount of literature and found that there were 80 methods to measure corporate environmental performance. In the literature on measuring the relationship between environmental responsibility and corporate environmental performance, commonly used indicators to measure corporate environmental performance are divided into financial indicators such as return on investment, price-earnings ratio, and pollution discharge costs. Following Zhang et al. (2019a, b), Hu (2012), and Cornett et al. (2008) we have used operating income emission rates as a proxy variable to measure corporate environmental performance. Pollutant discharge fees refer to the punitive fees levied by the environmental protection administrative department for enterprises that discharge toxic and harmful pollutants above the local normal level or above the national standard. This represents the compensation made by enterprises for environmental damage. The state imposes pollution fees on enterprises to achieve environmental governance. The pollution discharge fee reflects the total amount of pollution discharged by the enterprise to a certain level, so the operating income pollution discharge rate can reflect the financial status of the enterprise to some extent. The smaller the operating income pollution discharge rate, the stronger the company’s environmental awareness and the prevention of pollution. The better the effect, the higher the environmental performance, and vice versa.

Environmental responsibility

Environmental responsibility means that companies can no longer exchange economic benefits at the expense of the environment. When companies pursue economic benefits, they should consider environmental carrying capacity. If an enterprise consciously fulfills its environmental responsibilities, it can increase its market share to a certain extent, and, in the long run, it can bring more economic benefits to the enterprise. Environmental responsibility is the social responsibility of an enterprise in environmental protection. In order to be able to quantify the environmental responsibility of a company, the quality of social responsibility information disclosure is considered the standard of corporate environmental responsibility evaluation (Kuo et al. 2012). The corporate social responsibility evaluation score issued by Runling Global as a benchmark to determine the quality of corporate social responsibility information disclosure (Lambooy 2011). If the company’s social responsibility is fulfilled better, the score will be higher. However, the practicality of this method is too weak, and it is difficult to obtain all the data in the existing database. Therefore, this paper uses the environmental protection subsidy ratio proposed by Coase (2013) to measure the environmental responsibility of enterprises.

Moderator

Since the profit rate of the main business can reflect the degree of market monopoly, this study draws on the practice of Tomasz (2007) and uses the reciprocal of the standard deviation of the main business profit rate of the enterprise to measure the degree of industry competition. In the face of industry competition, in order to gain legitimacy and enhance competitive advantages, companies will assume environmental responsibilities to win the recognition and support of various stakeholders and transform corporate environmental responsibilities into environmental performance.

Control variable

When conducting empirical analysis, if the relevant variables are not well-controlled, the independent and other variables may act together on the dependent variable, which may confuse the relationship between the independent and dependent variables. Therefore, following Aravind and Christmann (2011), Clarkson et al. (2011), and Zhang et al. (2013), we have selected control variables to analyze the impact of environmental responsibility on environmental performance. The first is the debt-to-asset ratio, which is the ratio of total liabilities to total assets of the sample companies. The second is the return on total assets, the ratio of the net profit of the sample companies to the average total assets. The third is the scale of the company; the study conducted by Tang et al. (2006) found that the size of the company can affect the environmental responsibility of the company. In the current study, we used the natural logarithm of total assets to measure the scale of the company. The specific definitions of related variables are given in Table 1.

Model construction

Since there may be an endogenous problem in the model, the mixed least-squares method is not suitable (Henseler et al. 2009). If there is a dynamic panel bias, the estimators within the group are inconsistent, and the first-order difference estimator also has endogeneity (Elhorst 2010). Therefore, there is a need of a method to overcome the endogeneity of the model. Zhang et al. (2019a, b) believed that the dynamic panel model is a model that reflects the dynamic lag effect by introducing the explained variables of the lag period into the static panel model explanatory variables. Generalized difference moment estimation (GMM) eliminates fixed effects by first-order difference of the model and introduces instrumental variables under certain conditions to obtain the difference generalized moment estimator. It can solve the problem endogeneity of explanatory variable and residual heteroscedasticity and may obtain no biased and consistent estimator (Antia et al. 2010). The specific regression models can be written as follows:

In addition, there may be a nonlinear relationship between corporate environmental responsibility and environmental performance. Therefore, the square term EBR2 of the explanatory variable is introduced to analyze the nonlinear relationship between environmental responsibility and corporate environmental performance. Based on the sign of the relationship between the environmental responsibility and corporate environmental performance, the judgment is that the “U”-shaped curve is an inverted “U”-shaped curve. Therefore, the specific regression model can be written as follows:

where EPi, t represents the environmental performance value of company i in year t, EBRi, t represents the environmental responsibility value of company i in year t, ALRi, t represents the asset-liability ratio of company i in year t, PCi, t represents the return on total assets of company i in year t, ESi, t represents the enterprise scale value of enterprise i in year t, and εi is a random disturbance item.

Results and discussion

Descriptive statistics and correlation analysis

Table 2 presents the summary of the descriptive statistics used in the study. Results depict that the minimum, maximum, mean, and standard deviation of environmental performance (EP) were 0.1230, 0.9510, 0.5759, and 0.1901 respectively. It shows that the environmental performance of each sample enterprise was quite different, and the level was uneven. The minimum value of environmental responsibility (EBR) was 0; it shows that the company did not receive any environmental protection subsidies in that year. The maximum value was 0.4579, and the average value was 0.0887. This implies that, to a certain extent, chemical environmental protection subsidies were relatively small. The minimum and maximum values of industry competition (IC) were 0.0044 and 0.3030, respectively. It indicates that the degree of market competition between enterprises was quite different.

Table 3 presents the results of the correlation analysis between the variables. It can be seen that the correlation coefficient between environmental performance (EP) and environmental responsibility (EBR) was 0.329. This implies that there was a positive correlation between corporate environmental responsibility and environmental performance. In addition, the absolute value of the correlation coefficient between the variables was less than 0.5, which indicates that there was no serious multicollinearity problem between the variables (Xia et al. 2018).

Regression analysis of corporate environmental responsibility and environmental performance

Unit root test

In order to avoid spurious regression, the panel data needs to be tested for stationarity to ensure that the regression results are true and effective. This paper intends to use the unit root test of Levin-Lin-Chu, Im-Pesaran-Shin, ADF, and PP (Arellano and Manuel 2002). The results are given in Table 4. Results found that the p values of six variables have a significance level at 5%, which indicates that the data is not stable. After taking the 1st difference of the original data, the p values of all variables were less than the 5% significance level, which indicates that the data were stationary at 1st difference.

Interaction between corporate environmental responsibility and environmental performance

Table 5 shows the results of model 1 using OLS regression, fixed-effects model (FE), and dynamic GMM model to analyze the impact of environmental responsibility on environmental performance. Results found that the overall R2 in the OLS regression and fixed-effects model (FE) was small, and the goodness of fit was low. This may be due to the endogenous problem in the model which leads to the unsatisfactory overall fit of the model. Therefore, we used dynamic GMM regression, and the results found that the vector of environmental responsibility’s estimation of environmental performance was positive at p value 0.05. This implies that it is significant at the level of 5%, but this positive impact is only manifested in the current period and lags behind the performance of the first period. The lag in the positive impact of environmental responsibility of chemical companies on environmental performance is not obvious, which more reflects the urgency of environmental performance in the current period. The p value of Sargan statistic was greater than 0.05, which indicates that the instrumental variables added in the model were valid. In addition, from the test p value results of AR (1) and AR (2), it can be seen that there was no serial correlation in the first- and second-order autocorrelation tests, and the results of the model were valid. Thus, the better the fulfillment of environmental responsibilities, the better to promote the improvement of corporate environmental performance.

Furthermore, Table 5 shows the regression results of model 2. In the GMM model, the sign of the current environmental performance to environmental responsibility was positive, and the p value was less than 0.05, which indicates that it is significant at the 5% level. Moreover, the sign of the environmental performance for the lagging period was negative, and the p value is less than 0.05, which indicates that it is significant at the 5% level. It shows that this positive impact not only affects the current period but also affects the lagging period with obvious time lag and long-term nature. This satisfied the second research hypothesis.

The p value of Sargan statistic was greater than 0.05, which indicates that the instrumental variables added in the model were valid. The empirical results showed that as it continues to increase its supervision of environmental issues, environmental responsibility is a social responsibility that enterprises must bear and is a prerequisite for continued business operations. If the company does not bear environmental responsibility, it will be subject to strict supervision, which will lead to suspension of business for rectification or shutdown and transfer.

Adjustment effect of internal and external factors

In order to test the moderating effect of the internal and external factors of the enterprise, we have divided the industry competition according to the median and obtained the strong and weak groups. We used the systematic GMM estimation for each group. The specific regression results are shown in Tables 6 and 7. Table 6 shows the estimated results of the environmental responsibility and environmental performance of different chemical companies’ industry competition. The environmental responsibility of chemical companies with strong industry competition and chemical companies with weak industry competition has a significant role in promoting environmental performance. Furthermore, the impact coefficient of environmental responsibility of chemical companies with strong industry competition on environmental performance was 1.2076. The impact coefficient of environmental responsibility of chemical companies with weak industry competition on environmental performance was 0.7116. Obviously, the environmental responsibility of chemical companies with strong industry competition has a greater impact on environmental performance than that of chemical companies with weak industry competition. It shows that the industry competition can enhance the positive impact of corporate environmental responsibility on environmental performance to a certain extent.

Table 7 shows the estimated results of the environmental performance and environmental responsibility of different chemical companies’ competition. In general, the environmental performance of chemical companies with strong industry competition and chemical companies with weak industry competition has a significant role in promoting environmental responsibility. The impact of coefficient of the environmental performance of chemical companies with strong industry competition on environmental responsibility was 0.3847. The impact coefficient of environmental performance of chemical companies with weak industry competition on environmental responsibility was 0.1237. Obviously, the environmental performance of chemical companies with strong industry competition has greater impact on environmental responsibility than that of chemical companies with weak industry competition. It shows that industry competition can enhance the positive impact of corporate environmental performance on environmental responsibility to a certain extent, and play a positive regulatory role. The results satisfied the research hypothesis 3.

Nonlinear relationship between corporate environmental responsibility and environmental performance

In order to further clarify the nonlinear relationship between environmental responsibility and environmental performance, the quadratic term of environmental responsibility (EBR) is introduced to explore whether the nonlinear relationship between the two is “U”-shaped or inverted “U”-shaped curve. Table 8 shows the results of model 3 using OLS regression, fixed-effects model, and dynamic GMM model regression. It is found that the empirical results of the first two methods were not effective. Although R2 is improved compared with the research of models 1 and 2, the overall R2 is still low. The dynamic GMM regression results showed that whether it is the p value of the Sargan tests or the p value of the first- and second-order correlation test of the sequence, the p value is greater than 5%, and the test passes. In addition, it can be found that the estimated coefficient of the first term of environmental responsibility (EBR) is positive, and the estimated coefficient of the second term is negative, and the p value is less than 5%. The null hypothesis is rejected, indicating that the model is effective and significant as a whole, and the research hypothesis 4 is satisfied. In summary, the curve relationship between environmental responsibility and corporate environmental performance is an inverted “U” shape.

In Fig. 2, it is found that the turning point of environmental responsibility (EBR) on environmental performance (EP) is 0.2726. If the average value of environmental responsibility (EBR) exceeds 0.2726, it indicates that environmental responsibility (EBR) will have a negative effect on the environmental performance (EP) of a company. In fact, according to the results of descriptive statistical analysis, the mean value of environmental responsibility (EBR) is 0.0887, which is less than the turning point of 0.2726, which indicates that the current corporate environmental responsibility of the Chinese chemical industry still has a positive effect on corporate environmental performance.

In summary, this paper concludes that the current environmental responsibility of chemical companies has a significant positive impact on environmental performance, and the current environmental performance has a significant positive impact on environmental responsibility. The results are consistent with the research results of Zhang et al. (2020). However, the study found that the environmental performance of a period of lag has a significant positive impact on environmental responsibility. This implies that the environmental performance of chemical companies has a certain lag in the impact of environmental responsibility. The study examines the moderating effect of industry competition between environmental responsibility and environmental performance. The results obtained are consistent with the research results of Coase (2013), which indicates that industry competition can enhance the positive impact of environmental responsibility and environmental performance to a certain extent.

In addition, the nonlinear relationship between environmental responsibility and environmental performance was examined, and the inverted U-shaped curve relationship between the two was found.

This means that environmental responsibility first had a positive effect on corporate environmental performance and then turned into a negative effect. When an enterprise develops to a certain period of time, enterprise managers participate in excessive environmental protection investment in order to enhance their own recognition or obtain more private benefits. It is easy to increase the cost of the enterprise and damage the profit and performance of the enterprise.

Conclusion and policy implications

The study uses the data of Chinese chemical industries to analyze a relationship between corporate environmental responsibility and environmental performance. The results found a complex relationship between the corporate environmental responsibility and environmental performance. There was a lagging relationship between the corporate environmental responsibility and environmental performance, and the regulatory effect caused by industry competition. An interactive inter-temporal positive impact between the company’s environmental responsibility and environmental performance was found. Specifically, corporate environmental responsibility positively impacted on environmental performance, but this impact does not lag behind. The environmental performance of a company positively impacted on its environmental responsibility. Regarding the regulatory variables, it is found that industry competition played a positive regulatory role in estimation the impact of corporate environmental responsibility on environmental performance. There was an inverted U-shaped nonlinear relationship that was found between corporate environmental responsibility and environmental performance.

The study proposed few implications based on the findings. Firstly, the company should adopt a forward-looking environmental strategy and proactively carry out environmental protection activities in order to improve the company’s environmental performance. It will directly improve the company’s environmental performance. Secondly, it is necessary to take countermeasures against enterprises that cause environmental pollution in light of the actual situation of enterprises. For example, if the enterprise causes environmental pollution due to poor management and lacks environmental investment capacity, it should take measures to shut down. In addition, as an enterprise itself should be aware of the importance of environmental protection and take the initiative to assume the social responsibility of protecting the environment, it should implement environmental protection concepts into actions and fully disclose environmental management information in the company’s annual report. Thirdly, it is necessary to establish a fair and complete market competition mechanism to improve the environmental performance of chemical companies. Unlikely to developed countries, in China, due to the weak legal awareness, the costs of companies that actively perform environmental responsibilities cannot be converted into value through consumers. This ultimately leads to the lack of the most fundamental motivation for companies to perform environmental responsibilities and promotes the development of low-cost vicious competition. Therefore, promoting fairness and perfecting the establishment of market competition mechanisms is important to improve the level of environmental responsibility of Chinese enterprises. Finally, it is required to establish a sound chemical enterprise environmental management, environmental responsibility, and environmental performance linkage mechanism. There is a need to advocate enterprises to introduce advanced environmental protection technology and to regularly organize enterprises to learn environmental management experience for the resource conservation, energy reduction, and pollution reduction.

Data availability

All data is available.

References

Alexopoulos I, Kounetas K, Tzelepis D (2018) Environmental and financial performance. Is there a win-win or a win-loss situation? Evidence from the Greek manufacturing. J Clean Prod 197:1275–1283

Allen F, Qian J, Qian M (2005) Law, finance, and economic growth in China. J Financ Econ 77(1):57–116

Al-Tuwaijri SA, Christensen TE, Hughes LK (2004) The relations among environmental disclosure, environmental performance, and economic performance: a simultaneous equations approach. Acc Org Soc 29(5–6):447–471

Angela MR, Keizer K, Steg L (2017) The relationship between corporate environmental responsibility, employees’ biospheric values and pro-environmental behavior at work. J Environ Psychol 54:65–78

Antia M, Pantzalis C, Park JC (2010) CEO decision horizon and firm performance: an empirical investigation. J Corp Finan 16(3):288–301

Aravind D, Christmann P (2011) Decoupling of standard implementation from certification: does quality of ISO 14001 implementation affect facilities’ environmental performance. Bus Ethics Q 21(1):73–102

Arellano Manuel (2002) Sargan’s instrumental variables estimation and the generalized method of moments. J Bus Econ Stat 20(4):450–459

Bacinello E, Gérson T, Alberton A (2020) Influence of maturity on corporate social responsibility and sustainable innovation in business performance. Corp Soc Responsib Environ Manage 27(2):749–759

Ben L, Béchir, Bruna MG, Ben ZY (2020) The curvilinear relationship between environmental performance and financial performance: an investigation of listed French firms using panel smooth transition model. Financ Res Lett 35(2):137–143

Berger-Walliser G, Scott I (2018) Redefining corporate social responsibility in an era of globalization and regulatory hardening. Am Bus Law J 55(1):167–218

Blackman A (2012) Does eco-certification boost regulatory compliance in developing countries? ISO 14001 in Mexico. J Regul Econ 42(3):242–263

Burgelman RA (2020) Strategy is destiny: how strategy-making shapes a company’s future. Free Press, New York

Campbell JL (2007) Why would corporations behave in socially responsible ways? An institutional theory of corporate social responsibility. Acad Manage Rev 32(3):946–967

Chen S, Desai DA, Heyns SP, Pietra F (2020) A bibliometric analysis of the research on shot peening. Afr J Sci Technol Innov Dev 12(1):69–77

Clarkson PM, Li Y, Richardson GD, Vasvari FP (2011) Does it really pay to be green? Determinants and consequences of proactive environmental strategies. J Acc Publ Pol 30(2):122–144

Clay JW (2013) World agriculture and the environment: a commodity-by-commodity guide to impacts and practices. Island Press, USA

Coase RH (2013) The problem of social cost. J Law Econ 56(4):837–877

Cornett MM, Marcus AJ, Tehranian H (2008) Corporate governance and pay-for-performance: the impact of earnings management. J Financ Econ 87(2):357–373

Cox NJ (2006) Winsor: Stata module to winsorize a variable. Stat Soft Compon 8:36–37

David CB, Roman M, Martin M, Nickolaos GT (2019) Does corporate social responsibility impact firms’ innovation capacity? The indirect link between environmental & social governance implementation and innovation performance. J Bus Res 84(11):5371–5376

Elahi E, Weijun C, Jha SK, Zhang H (2019a) Estimation of realistic renewable and non-renewable energy use targets for livestock production systems utilising an artificial neural network method: A step towards livestock sustainability. Energy 183:191–204

Elahi E, Weijun C, Zhang H, Nazeer M (2019b) Agricultural intensification and damages to human health in relation to agrochemicals: application of artificial intelligence. Land Use Pol 83:461–474

Elhorst JP (2010) Dynamic panels with endogenous interaction effects when T is small. Reg Sci Urban Econ 40(5):272–282

Elsayed K, Paton D (2005) The impact of environmental performance on firm performance: static and dynamic panel data evidence. Struct Chang Econ Dyn 16(3):0–412, 395

Ferreira AJD, Lopes MAR, Morais JPF (2006) Environmental management and audit schemes implementation as an educational tool for sustainability. J Clean Prod 14(9–11):973–982

Filbeck G, Gorman RF (2004) The relationship between the environmental and financial performance of public utilities. Environ Resour Econ 29(2):137–157

Friedman AL, Miles S (2010) Developing stakeholder theory. J Manag Stud 39(1):1–21

Giannarakis G (2014) Corporate governance and financial characteristic effects on the extent of corporate social responsibility disclosure. Soc Respon J 10(4):569–590

Griffin JJ, Mahon JF (1997) The corporate social performance and corporate financial performance debate: twenty-five years of incomparable research. Bus Soc 36(1):5–31

Henseler J, Ringle CM, Sinkovics RR (2009) The use of partial least squares path modeling in international marketing. Adv Int Mark 20:277–319

Howes R, Skea J, Whelan B (2013) Clean and competitive: motivating environmental performance in industry. Routledge, London

Hu QY (2012) Research on the correlation between environmental performance and financial performance of listed companies. China’s Popul Resour Environ 22(6):23–32

Isabel-María GS (2020) The moderating role of board monitoring power in the relationship between environmental conditions and corporate social responsibility. Bus Ethics Eur Rev 29(1):114–129

José MB, Sansalvador ME (2020) The relation between corporate social responsibility certification and financial performance: an empirical study in Spain. Corp Soc Respon Env Manage 27(2):96–107

Kassinis G, Vafeas N (2006) Stakeholder pressures and environmental performance. Acad Manage J 49(1):145–159

Kuo L, Yeh CC, Yu HC (2012) Disclosure of corporate social responsibility and environmental management: evidence from China. Corp Soc Respon Env Manage 19(5):273–287

Kunieda T, Nishimura K (2019) Endogenous business cycles in a perpetual youth model with financial market imperfections. Int J Econ Theory 15(3):231–248

Lambooy T (2011) Corporate social responsibility: sustainable water use. J Clean Prod 19(8):852–866

Li DY, Sun Y, Yang G (2015) Research on the relationship between enterprise environmental benefit, energy efficiency and economic performance. Manage Rev 27(5):29–37

Melinda LN (2016) The value relevance of environmental emissions. J Econ 19(1):93

Nairn-Birch N, Delmas MA, Lim J (2015) Dynamics of environmental and financial performance: the case of greenhouse gas emissions. Org Env 28(4):374–393

Nwokorie EC, Obiora JN (2018) Sustainable development practices for the hotel industry in Nigeria: implications for the ilaro area of ogun state. Res Hosp Manage 8(2):125–131

Preston LE, Obannon DP (1997) The corporate social-financial performance relationship a typology and analysis. Bus Soc 36(4):419–429

Sayedeh PS, Sofian S, Saeidi P, Saeidi SP, Saaeidi SA (2015) How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. J Bus Res 68(2):341–350

Sudha S (2020) Corporate environmental performance–financial performance relationship in India using eco-efficiency metrics. Manage Env Qual Int J 13(4):137–148

Tang YL, Chen ZL, Liu X, Li WH (2006) An empirical study on the environmental information disclosure status and influencing factors of listed companies in my country. Manage World 1:158–159

Tomasz B (2007) Is competition good for corporate performance? An analysis on German and Italian firms. J Env Psychol 8:1–63

Van den Bergh JC (2011) Environment versus growth—a criticism of “degrowth” and a plea for “a-growth”. Ecol Econ 70(5):881–890

Walker K, Wan F (2012) The harm of symbolic actions and green-washing: corporate actions and communications on environmental performance and their financial implications. J Bus Ethics 109(2):227–242

Wang S (2020) Competitive position of enterprises, corporate growth and audit fees: based on empirical evidence from Chinese A-share listed companies. Mod Econ 11(2):453–474

Wu W, Liang Z, Zhang Q (2020) Effects of corporate environmental responsibility strength and concern on innovation performance: the moderating role of firm visibility. Corp Soc Respon Env Manage 27(3):1487–1497

Xia C, Yang YF, Zheng JM (2018) Media coverage, media credibility and debt cost. Manage Rev 30(4):180–193

Yavuz A, Kuzey C, Acar MF, Açıkgöz A (2016) The relationships between corporate social responsibility, environmental supplier development, and firm performance. J Clean Prod 112:1872–1881

Zeitz ZGJ (2002) Beyond survival: achieving new venture growth by building legitimacy. Acad Manage Rev 27(3):414–431

Zhang C, Zhang ZG, Bao LL (2020) Research on the intertemporal impact of corporate environmental responsibility and financial performance and its mechanism. Manage Rev 32(2):76–89

Zhang XJ, Chen HZ, Jiang L (2019a) Parameter estimation of stochastic volatility model based on generalized moment method. J Eng Math 36(6):611–626

Zhang ZG, Jing XC, Li GQ (2013) An empirical study on the intertemporal impact of the interaction between corporate social responsibility and financial performance. Acc Res 8:32–39+96

Zhang ZG, Zhang C, Cao DT (2019b) Is the corporate environmental management system certification valid. Nankai Manage Rev 22(4):123–134

Acknowledgments

The authors are grateful to the case company for permitting and supporting this research.

Funding

This work was financially supported by the Humanities and Social Sciences Research Project of the Ministry of Education (20YJAZH096), the National Science Foundation of China (71850410541), and the Key Project of National Social and Scientific Fund Program (18ZDA052).

Author information

Authors and Affiliations

Contributions

Conceptualization, BP and Sh Chen; data curation, Sh Chen; formal analysis, Sh Chen; methodology, BP; project administration, BP and E Elahi; software, BP and Sh Chen; supervision, E Elah; writing - original draft, BP and Sh Chen; writing - review and editing, BP and E Elahi.

Corresponding authors

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Consent to participate

All authors agree to participate

Consent to publish

All the authors agreed to publish the paper.

Additional information

Responsible Editor: Nicholas Apergis

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Shuilin Chen is also the parallel first author.

Supplementary Information

ESM 1

(XLSX 39 kb)

Rights and permissions

About this article

Cite this article

Peng, B., Chen, S., Elahi, E. et al. Can corporate environmental responsibility improve environmental performance? An inter-temporal analysis of Chinese chemical companies. Environ Sci Pollut Res 28, 12190–12201 (2021). https://doi.org/10.1007/s11356-020-11636-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-020-11636-9