Abstract

This paper seeks to understand the long memory behaviour of global equity returns using novel methods from wavelet analysis. We implement the wavelet based multivariate long memory approach, which possibly is the first application of wavelet based multivariate long memory technique in finance and economics. In doing so, long-run correlation structures among global equity returns are captured within the framework of wavelet-multivariate long memory methods, enabling one to analyze the long-run correlation among several markets exhibiting both similar and dissimilar fractal structures.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Estimation and the analysis of long memory parameters have mainly focused on the analysis of long-range dependence in stock return volatility using traditional time and spectral domain estimators of long memory. The presence of long memory requires major revisions in the standard estimation procedures without which the estimated results can be seriously biased. In this paper on long memory among global equity markets, several wavelet-based estimators are applied to test for presence of long memory in global equity returns and also returns volatility. The presence of long memory in volatility of stock returns as well as some returns themselves is demonstrated from the empirical evidences. Furthermore, phases of efficiency and inefficiency of markets, as adjudicated by presence of both long memory and no-memory, is evidenced when the analysis is performed using rolling windows. Existence or absence of long memory in stock returns may be used to determine the stage of market development in terms of efficiency and inefficiency. According to the weak-form version of the Efficient Market Hypothesis (EMH), equity prices contain all available information about equity price, acquired from past trading. This suggests that prediction of prices, when the EMH hold, is not possible. On the other hand, presence of long-memory in equity returns and volatility implies that distant observations in the equity returns and volatility series are related to each other. This implication leads to rejection of efficient markets as presence of long-range dependence is incompatible with the basic tenets of efficient market hypothesis (EMH).

The analysis of long memory is further extended to estimate long-run correlation matrix of global equity returns using wavelet based multivariate long memory estimator. Long memory among several groups of equity markets can either be the result of some same underlying process generating the data or it could be a product of multiple mechanisms (Wendt et al. 2009). The long-run correlation matrix, also known as fractal connectivity matrix, generated from multivariate long-memory model helps in determining convergence of wavelet correlations of long-range dependent processes. The convergence to an asymptotic value over a range of low-frequency wavelet scales helps one in determining regimes of fractal connectivity (Achard et al. 2008; Achard and Gannaz 2016). In doing so, associations and similarities between the processes that generate equity market returns of various markets can be highlighted. Furthermore, a hierarchical clustering algorithm is implemented on the elements of the generated fractal connectivity matrix to group markets having similar long-run correlation behavior. Significant rise in long-run correlations is evidenced during the subprime crisis period. However, long-run correlations among all equity markets are very low.Footnote 1 Nonetheless, comparisons can be drawn with regard to the long-memory behavior of global equity markets during both normal and crisis-hit periods. In this paper, the issue of multifractality of equity returns is also highlighted via implementation of a rolling window long memory procedure. The resulting estimates of long memory parameters, with varying degrees of fractal structures, are found to be not always stable, and fluctuate between regimes of efficiency and inefficiency. This implies that markets are not always efficient in the weak sense and arbitrage opportunities exist. The pattern of evolution of long memory parameter, as verified from the time-series of Hurst exponents, is in agreement with the adaptive markets hypothesis (Lo 2004).

Literature Review

Since the groundbreaking work of Hurst (1951), where he investigated the flow of river Nile and found evidence of long-range dependence, there has been significant interest, spanning researchers across disciplines, in the phenomena of long memory (Mandelbrot and Ness 1968; Granger and Joyeux 1980; Hosking 1981). Since then, a plethora of time-series based models of long memory has been developed to analyze long-range dependence in stochastic processes. However, a majority of research articles that focuses on estimation of long memory parameters and detection of the same relies on the traditional approaches (Mandelbrot 1965; Lo 1991; Geweke and Porter-Hudak 1983). Numerous studies have been carried out to test the presence of long run dependence in stock returns and volatility (see for eg. Ding et al. 1993; Granger and Ding 1995; Lobato and Velasco 2000).

The presence of long memory in squared daily returns of S&P 500 index is evident in the works of Ding et al. (1993) and Lobato and Savin (1998). Ray and Tsay (2000) unearthed the presence of strong long-range dependence in the volatilities of selected companies of the S&P 500 index. Granger and Ding (1995) also detected presence of long memory in absolute value of stock returns. Furthermore, Lobato and Velasco (2000) using a frequency domain method unearthed presence of long memory in stock returns and volatility of returns. Similarly, presence of long memory in returns of emerging markets is documented in Assaf and Cavalcante (2002), Barkoulas et al. (2000), Panas (2001), and Henry (2002).

In their analysis of the EMH, Jagric et al. (2005) employ a wavelet method to test for long memory in returns of some select European markets. Similar analysis using wavelet-based methods to detect long memory in the returns of Dow Jones Industrial average (DJI) is employed by Elder and Serletis (2007) where no evidence of long memory is detected. However, presence of long memory in equity returns of some developed markets is documented in Ozdemir (2007). Similarly, there are many studies that either refute or confirm presence of long memory in both developed and emerging markets (Ozun and Cifter 2007; Bilal and Nadhem 2009; Mariani et. al 2010; Tolvi 2003).

The presence of heterogeneous investment horizons can be one of the most important factors that generate long memory behavior in equity markets. Investment horizons, which can be successfully disaggregated into several micro-units using wavelet methods to delineate price behaviors from varying time-horizons, contain varying returns and volatility structures (Nekhili et al. 2002; Gencay et al. 2005; In et al. 2011). Aggregation of all micro units, ranging from very short run to long run, is said to produce long memory properties in aggregate series (see Granger 1980; Davidson and Sibbertsen 2005). However, contemporaneous aggregation of microunits having both short-memory and long-memory may lead to spurious long-memory in the aggregate, thereby biasing the results in favour of long-range dependence. Granger and Ding (1996) attempt to theoretically explain this bias arising out of aggregation but however fail to empirically demonstrate that long memory in returns volatility of stock indices is due to aggregating volatility of individual stocks containing short-memory. Furthermore, Andersen and Bollerslev (1997) theoretically demonstrated volatility to be an assortment of various heterogeneous information structures in the short-run and concluded that the underlying volatility processes contain long memory. Nonetheless, in some major studies, estimates of long-memory are found to be uncontaminated by aggregation effects thereby supporting evidence in favour of fractality in equity returns (see Han 2005; Souza 2007; Kang et al. 2010), thereby rejecting any indication of spurious long memory.

Early studies examining long memory in financial time series, using wavelets, are relatively few. (See Jensen 1999; Jensen and Whitcher 2000; Xu and Gencay 2003; Vuorenmaa 2005; DiSario et al. 2008). Significant contribution to studies in wavelet based long memory and fractal properties of asset returns can be found in Gencay et al. (2001) and Xu and Gencay (2003). Recent studies demonstrating long memory in high frequency time series mainly focus on newer approaches built from wavelet building blocks (Power and Turvey 2010; Tan et al. 2012, 2014; Xue et al. 2014; Pascoal and Monteiro 2014).

This paper investigates long memory among global equity markets using estimators from the wavelet domain by implementing wavelet based approaches of Abry and Veitch (1998) and Abry et al. (2003) to examine the Hurst exponents, and its time-varying structures. Moreover, an analysis of multivariate long memory of global equity markets using the recent method of Achard and Gannaz (2016) is carried out, which possibly is the first application of wavelet domain multivariate long memory technique in finance and economics. The aforementioned multivariate method allows one to analyze the long-run correlation among several markets exhibiting fractal structures.

Data

The empirical data consists of closing prices of twenty-four major stock indices comprising both developed and emerging markets. The stock indices included are BSE 30 (India), Nasdaq (U.S.), S&P 500 (U.S.), DJIA (U.S.), FTSE 100 (Great Britain), CAC40 (France), DAX 30 (Germany), NIKKEI 225 (Japan), KOSPI (Korea), KLSE (Malaysia), JKSE (Indonesia), TAIEX (Taiwan), SSE (China), STI (Singapore), HSI (Hong Kong), BEL20 (Belgium), ATX (Austria), AEX (Netherlands), IBEX 35 (Spain), SMI (Switzerland), STOXX50 (Eurozone), ASX 200 (Australia), KSE100 (Pakistan), and IBOV (Brazil). The period of study ranges from 01-07-1997 to 20-01-2014 consisting of 4096 dyadic length observations making it suitable for various wavelet methods. Returns of all the stock indices are calculated by taking first order logarithmic differences. Furthermore, the data was formatted and aligned keeping in mind the closing dates of different stock exchanges.

Methodology

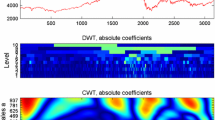

In this paper, wavelet-based measures of long memory parameters are applied to analyze long memory behavior of global equity returns. There are several classes of wavelet based long memory estimators that can measure long-term correlations present in a time series. The wavelet-based Hurst estimator of Abry and Veitch (1998) is used in a rolling window algorithm to analyze the time varying structure of the Hurst parameter and its evolution, and long range dependence over time.

Long-range dependence a phenomenon is associated with a slow power law decay of the autocorrelation function of a stationary process x. The covariance function \(\gamma_{x} (k)\) of the long memory process x takes the following form,

where \(c_{\gamma }\) is a positive constant and \(H \in (0,0.5)\). The Hurst parameter H is used to measure presence of long memory. The spectrum \(\mathop \Gamma \limits^{{}}_{x} (\nu )\) of a long memory process x is given by,

where \(\nu\) is the frequency, \(c_{f} = \pi^{ - 1} c_{\gamma } \Lambda (2H - 1)\sin (\pi - \pi H)\), and the Gamma function is given by \(\Lambda\). This mathematical structure of long memory processes is the reason for its inclusion in a class of stochastic processes which have the \(1/|\nu |^{\alpha }\) form. The property of long memory also finds some close association with the phenomenon of scale invariance, self-similarity and fractals. Hence, statistically self-similar processes like fractional Brownian motion (FBM) are closely related to long memory phenomenon.

Let \(\gamma_{0}\) be an arbitrary reference frequency selected by the choice of \(\psi_{0}\), the mother wavelet. The amount of energy in the signal during scaled time \(2^{j} k\) and scaled frequency \(2^{{ - j}} \nu _{0}\) is measured by the squared absolute value of the detail wavelet coefficient \(|d_{x} (j,k)|^{2}\). A wavelet based spectral estimator of Abry et al. (1998) is constructed by taking a time average of \(|d_{x} (j,k)|^{2}\) at a given scale, and is given by,

where nj is the “number of wavelet coefficients” at level j, and \(n_{j} = 2^{{ - j}} n\), where n is the data length. Therefore, \(\mathop \Gamma \limits^{ \wedge }_{x} (\nu )\) captures the amount of energy that lies within a given bandwidth and around some frequency \(\nu\). Hence, \(\mathop \Gamma \limits^{ \wedge }_{x} (\nu )\) can be regarded as an estimator for the spectrum \(\mathop \Gamma \limits^{{}}_{x} (\nu )\) of x. The wavelet based estimator of the Hurst exponent \(\mathop H\limits^{ \wedge }\) is designed by performing a simple linear regression of \(\log_{2} (\mathop \Gamma \limits^{ \wedge }_{x} (2^{ - j} \nu_{0} ))\) on j, i.e.,

where \(\mathop c\limits^{ \wedge }\) estimates \(\log_{2} (c_{f} \int {|\nu |^{(1 - 2H)} |\Psi_{0} (\nu )|^{2} } d\nu )\), where \(\Psi_{0}\) is the Fourier transform of the mother wavelet \(\psi_{0}\).). c ̂ is the estimator provided that the integral converges. The derivation of c ̂ as an estimator of the above is not detailed in this paper and interested readers may refer to Abry et al. (1998) and Abry et al. (1995). A weighted least square estimator is constructed by performing a WLS fit between the wavelet scales \(j_{1}\) and \(j_{2}\) which gives the estimator of the “Hurst exponent”, H.

where \(\eta_{j} = \log_{2} \left( {\frac{1}{{n_{j} }}\sum\limits_{k} {|d_{x} (j,k)|^{2} } } \right)\) and the weight \(S_{j} = (n\ln^{2} 2)/2^{j + 1}\) is the inverse of the theoretical asymptotic variance of \(\eta_{j}\). The scales \({j}_{1} and {j}_{2}\) are not adjacent scales and is determined by the length of the dataset. \({j}_{1}\) is the initial scale (finer scale) and \({j}_{2}\) is the maximum scale (coarser scale) that one can take based on length of the data. However, it should be noted that the scales selected are dyadic in nature (i.e. powers of 2). The estimator of multivariate long memory and the related “fractal connectivity matrix” based on the above univariate estimato,r is given in Achard et al. (2008) and Achard and Gannaz (2016). The term “fractal connectivity” is just another name for long-run correlation matrix estimated via multivariate wavelet estimator of Achard and Gannaz (2016).

Empirical Results

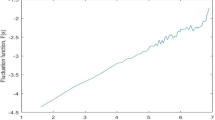

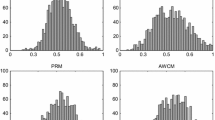

The empirical analysis first proceeds with visually analyzing the dynamic nature of long memory of select equity returns, as given by the time-series plot of long memory estimates, which are obtained by applying the wavelet based estimator of the Hurst exponent developed by Abry and Veitch (1998) and Abry et al. (2003) in a rolling windows framework.

Rolling Windows Hurst Analysis of Time Varying Market Efficiency

Long memory in equity returns can vary with due to changes in efficiency of equity markets over time. The advancement of equity markets, coupled with varying phases of market development, policy decisions, and financial turbulence, can significantly alter long memory structure of financial markets. Therefore, estimates of long memory parameters are not always stable for all markets. In view of the changing structures and efficiency of equity markets, an analysis of long memory behavior of equity returns constitutes an analysis of time-varying long memory behavior of equity returns. Consequently, the Hurst exponents of select equity returns are estimated in a rolling window framework. The length of window contains 260 observations which approximately equals one year. The window is moved forward by an increment of twenty-four days i.e. a one month increment. Finally, estimation of wavelet-based Hurst exponent in rolling window framework generates a time-series of Hurst exponent. The rolling window is selected based on the suggestions given by (Ranta 2013) The time periods before and after crisis events have 250 days. Shorter time windows fail to capture long term events whereas longer window does not capture short term events. The selection of window length of 250 was done to reduce sample bias with the sole motive of capturing both long term and short-term events. We have also carried out with window length 500 but found that it was inefficient in capturing short term events.

Plots of time-series of the Hurst exponents of select equity returns can be visually inspected to identify phases of efficiency and inefficiency, as measured by the drift in Hurst exponent from the threshold value of 0.5, given by the horizontal line around the Hurst value of 0.5 in Figs. 1, 2 which plot the generated Hurst series against time given in the horizontal axis in years. The vertical axis in Figs. 1, 2 shows the Hurst values.

The plots of Hurst series given in Figs. 1, 2 reveal the time-varying wavelet correlationFootnote 2 of Hurst exponents. The developed equity markets of Europe show relatively less degree of persistence in returns with Hurst exponent below 0.5 for most of the time period. However, equity returns of France (CAC 40) and Germany (DAX) exhibited long-range dependence during the first three quarters of 2004, thereby allowing some possibility for returns predictability during that period. Nevertheless, equity returns of France and Germany have been relatively unpredictable throughout the studied time period. The same holds good for the Eurozone (STOXX 50) equity returns. On the other hand, the emerging markets equity returns seem to exhibit varying phases of return predictability with high values of Hurst exponent during some time intervals. For example, some indication of persistence in the returns of the Indian equity market (BSE 30) can be observed during the one year period of January 1999-January 2000 which is then followed by a sharp drop in the Hurst exponent around February 2000, which may be attributed to market fluctuations arising out of the dot-com bubble. However, long-memory rises again after March 2000 extending up to January 2001 indicating some evidence of returns predictability during this period. Some evidence of returns predictability, as indicated by the presence of long-memory with Hurst value above 0.5, is also observed during February 2006-November 2006 and the last half of 2012. Moreover, the Asian markets of Hong Kong (HSI), China (SSE), Indonesia (KLSE) and Taiwan (TAIEX) exhibit evidence of returns predictability. Persistence in equity returns is evidenced for, i) HSI during mid 2011-mid 2012, ii) SSE during mid 2005- early 2006, mid 2008-January 2009 and late 2010-late 2011, iii) KLSE during mid 1999-February 2000 and 2001–2002 and, iv) TAIEX during January 1999-mid 2000.

Interestingly, with the exception of equity returns of Pakistan (KSE 100) and China (SSE), returns markets from both developed and emerging economies exhibit anti-persistence (short-memory) during the financial crisis period of 2008, thereby eliminating any scope for returns predictability during this period. Moreover, barring periods of abrupt changes in Hurst parameter beyond and within the threshold range of 0.5, phases of market efficiency are more pronounced for the developed equity markets where Hurst exponents of these markets’ equity returns tend to lie below the threshold range of 0.5. However, efficiency of both developed and emerging equity markets is not stable throughout the studied time-period, allowing investors some arbitrage opportunities. Nonetheless, investors operating in emerging equity markets have more scope for arbitrage as these markets exhibit relatively more phases of long-range dependence.

Long-Range Correlation among Global Equity Returns

The long memory structure, of both developed and emerging markets, and its dynamic evolution can vary with stock returns of different markets and their underlying structure as evidenced from the previous section. However, there can be similarities in the fractal structure of the stock returns of some markets. Therefore, in this section, an attempt is made to investigate the long-range correlation among global equity returns using the newly developed multivariate long-memory estimators of Achard and Gannaz (2016) which offer an efficient way to estimate long-memory and analyze similarities in fractal structure among equity markets. The resulting long-run correlation matrix, estimated using the aforementioned method, aids in scrutinizing the correlation structure among equity returns operating at long-range frequencies. The long run correlation matrix, also known as the fractal connectivity matrix, furthermore assists in analyzing similarity of fractal structures among equity markets. The elements of long-range correlation matrix, of equity returns exhibiting LRD, is clustered using the hierarchical clustering algorithm to analyze the structure of equity returns correlations during both stable and turbulent financial phases, thereby assisting in identifying fractally similar market groups.

Figure 3 gives the long-run correlation matrix, displaying long-run correlation among seven equity markets of the U.S. (SP500), France (CAC40), Germany (DAX), Japan (NIKKEI), South Korea (KOSPI), Indonesia (JKSE) and India (BSE30). The upper panel of Fig. 3 shows the fractal connectivity matrix whereas the lower panel gives the clustered version, using hierarchical clustering algorithm, of the long-run matrix of correlations. The left panel shows the correlation matrix of equity returns during the pre-subprime crisis period whereas the right panel gives the matrix of equity returns during the crisis period. The color-coded legend, on the right side of fractal connectivity matrix and towards the bottom of the clustered matrix, helps in identifying the strength of long-range correlations. The strength of correlation rises as we move from red (low) to blue (high). The returns of seven aforementioned equity markets are labeled numerically from 1 to 7 in the upper panel and alphanumerically from C1 to C7 in the lower panel, where “C1, C2, C3, C4, C5, C6 and C7” correspond to SP500, CAC40, DAX, NIKKEI, KOSPI, JKSE and BSE30, respectively. It is evident from the long-run correlation matrix (upper panel) that long-range correlations significantly risen during the subprime crisis period, as indicated by larger number of elements in blue depicting positive correlations. The clustering of markets according to similar fractal structures is different during pre-crisis and crisis periods. Moreover, five markets (C1, C3, C4, C5 and C7) are clustered together during the subprime crisis period reflecting similar long memory behavior among these markets during crisis period. This is in line with the results from previous section where fractal structure of returns from SP500 (C1), DAX (C2), NIKKEI (C3), KOSPI (C4) and BSE30 (C7) behave similarly during the subprime period.

Figure 4 gives the long-run correlation matrix among seven Asian equity markets of South Korea (KOSPI), Malaysia (KLSE), Taiwan (TAIEX), China (SSE), Singapore (STI), Hong Kong (HSI) and India (BSE30).The fractal structure of Asian equity returns given in Fig. 4 evidences the rise in long-range correlation between South Korean and Taiwanese equity returns during the subprime crisis. The long-range correlation among other Asian markets are very low during both crisis and non-crisis periods indicating dissimilar fractal structures. This is also evidenced from clustering of equity returns from these markets where markets forming clusters are almost similar during both crisis and non-crisis periods. This is in contrast with the developed western markets where fractal structures, based on long-range correlation coefficients and clustering of the same, are not similar during crisis and non-crisis periods.

Conclusion

This paper investigated the phenomenon of long memory among global equity returns using methods from both univariate and multivariate class of wavelet based long memory estimators. Since dependence structure of equity returns over time can be time-varying, analysis of long memory is first carried out in a time varying framework. This helps in examining the evolution of long memory parameter over time, thereby allowing one to detect phases of market efficiency and inefficiency. Accordingly, analysis of the evolutionary nature of long memory is captured using rolling windows estimation method where long memory of equity returns from both emerging and developed markets are investigated. The results indicate that the developed equity markets of Europe and the U.S. show relatively less degree of persistence. However, phases of long-memory, though smaller, are detected for some developed markets. In contrast, markets from emerging economies are found to have relatively more phases of inefficiency, indicating presence of arbitrage opportunities. Moreover, emerging markets’ equity returns are found to move between phases of long memory and short memory. Furthermore, long memory is not evidenced during the subprime crisis period of 2008 for majority of markets which is in line with the wavelet-based study of Tan et al. (2014), where faster information disseminated among investors during financial crises is said to curtail speculative behavior, thereby affecting predictability of markets. Likewise, the time-varying nature of long memory and varying phases and stages of market efficiency is consistent with the conception of adaptive markets, where market efficiency should be viewed from an evolutionary framework.

The results obtained from time varying long memory analysis reinforce the notion that markets are not always efficient. On the other hand, markets tend to traverse through different dynamics and are subjected to evolutionary patterns, where stages of both efficiency and inefficiency come into play. Since, evidence of heterogeneity in market efficiency during both stable and turbulent periods is demonstrated via several measure of market fractality, investors should take cognizance of the dynamic and evolutionary nature of market efficiency; and tactically formulate investment strategies based on the fractal structures of equity markets which are evolutionary and time varying in nature. The structure of fractality in equity returns based on fractal connectivity matrix, which aids one in investigating long memory properties of equity markets in greater detail, is used to analyze similarities in long memory behavior among equity markets. The analysis reveals existence of similarities of fractal structures among returns from developed markets during periods of financial turbulence. Thus, multivariate wavelet estimator of long-range correlation and fractal similarities provide an efficient way of analyzing equity markets’ correlation structure. However, analyses of global equity returns using the aforementioned method demands a more thorough investigation as there are no studies in literature analyzing fractal connectivity of financial markets.

Notes

This is not to be confused with the regular wavelet correlation where correlations tend to be strong in the long-run. Correlations based on fractal connectivity are used to determine the similarity in mechanisms that generate the underlying long memory behaviour among markets.

Wavelet correlation and cross-correlations are like the usual cross-spectral meaures from spectral analysis. However, cross-spectral methods cannot capture the time component as it relies on Fourier decomposition of time signal wherein time information is completely lost, which is not the case with wavelet based decompositions where information from both time and frequencies are captured or localized simultaneously.

References

Abry et al. 1995. Wavelets, spectrum analysis and 1/f processes. In Lecture notes in statistics: Wavelets and statistics, eds. Antoniadis, A., and Oppenheim, G, vol. 103, pp. 15–29.

Abry, et al. 1998. Wavelet analysis of long range dependent traffic. IEEE Trans Inf Theory 44 (1): 2–15.

Abry, P., and D. Veitch. 1998. Wavelet analysis of long range dependent traffic. IEEE Transactions on Information Theory 44 (1): 2–15.

Abry, P., P. Flandrin, M. Taqqu, and D. Veitch. 2003. Self-similarity and long-range dependence through the wavelet lens. In Theory and Applications of Long Range Dependence, ed. P. Doukhan, G. Oppenheim, and M.S. Taqqu. Basel: Birkhauser.

Achard, S., and I. Gannaz. 2016. Multivariate wavelet Whittle estimation in long-range dependence. Journal of Time Series Analysis 37 (4): 476–512.

Achard, S., D.S. Bassett, A. Meyer-Lindenberg, and E.T. Bullmore. 2008. Fractal connectivity of long-memory networks. Physical Review E. https://doi.org/10.1103/PhysRevE.77.036104.

Andersen, T.G., and T. Bollerslev. 1997. Heterogeneous information arrivals and return volatility dynamics: uncovering the long run in high frequency returns. Journal of Finance 52 (3): 975–1005.

Assaf, A., and J. Cavalcante 2002. Long-range dependence in the returns and volatility of the brazilian stock market. [Internet]. http://www.long-memory.com/volatility/CavalcanteAssaf2002.pdf. Accessed 15 Oct 2018.

Barkoulas, T.J., C.F. Baum, and N. Travlos. 2000. Long memory in the Greek stock market. Applied Financial Economics 10 (2): 177–184.

Bilal, T.M., and S. Nadhem. 2009. Long memory in stock returns: evidence of G7 stocks markets. Research Journal of International Studies 9: 36–46.

DiSario, R., H. Saraoglu, J. McCarthy, and H.C. Li. 2008. An investigation of long memory in various measures of stock market volatility, using wavelets and aggregate series. J Econ Finance 32: 136–147.

Davidson, J., and P. Silberstein. 2005. Generating schemes for long memory processes: regimes, aggregation, and linearity. Journal of Econometrics 128: 253–282.

Ding, Z., C.W.J. Granger, and R.F. Engle. 1993. A long memory property of stock returns and a new model. Journal of Empirical Finance 1 (1): 83–106.

Elser, J., and A. Serletis. 2007. On fractional integration dynamics in the US stock market. Chaos, Solitons and Fractals 34: 777–781.

Gencay, R., F. Selcuk, and B. Whitcher. 2001. An Introduction to Wavelets and Other Filtering Methods in Finance and Economics. San Diego: Academic Press.

Gencay, R., F. Selcuk, and B. Whitcher. 2005. Multiscale systematic risk. Journal of International Money and Finance 24: 55–70.

Geweke, J., and S. Porter-Hudak. 1983. The estimation and application of long memory time series models. Journal of Time Series Analysis 4 (4): 221–238.

Granger, C.W.J. 1980. Long memory relationships and the aggregation of dynamic models. Journal of Econometrics 14: 227–238.

Granger, C.W.J., and Z. Ding. 1995. Some properties of absolute value return an alternative measure of risk. Annales d’Economie et de Statistique 40: 67–91.

Granger, C.W.J., and Z. Ding. 1996. Varieties of long memory models. Journal of Econometrics 73: 61–77.

Granger, C.W.J., and R. Joyeux. 1980. An introduction to long-memory time series models and fractional differencing. Journal of Time Series Analysis 1 (1): 15–29.

Han, Y.W. 2005. Long memory volatility dependency, temporal aggregation and the Korean currency crisis: the role of a high frequency Korean won (KRW)-US dollar ($) exchange rate. Japan and the World Economy 17: 97–109.

Henry, O.T. 2002. Long memory in stock returns: some international evidence. Applied Financial Economics 12: 725–729.

Hosking, J.R.M. 1981. Fractional differencing. Biometrika 68 (1): 165–176.

Hurst, H. 1951. Long term storage capacity of reservoirs. Transaction of the American Society of Civil Engineer 116: 770–799.

In, F., S. Kim, and R. Gencay. 2011. Investment horizon effect on asset allocation between value and growth strategies. Economic Modelling 28: 1489–1497.

Jagric, T., B. Podobnik, and M. Kolanovic. 2005. Does the efficient market hypothesis hold? Evidence from six transition economies. Eastern European Economics 43 (4): 79–103.

Jensen, M. 1999. Using wavelets to obtain a consistent ordinary least Squares estimator of the fractional differencing parameter. Journal of Forecasting 18: 17–32.

Jensen, M. J., and B. Whitcher 2000. Time-varying long-memory in volatility: detection and estimation with wavelets. Working paper, Department of Economics, University of Missour.

Kang, S.H., C. Cheong, and S.M. Yoon. 2010. Contemporaneous aggregation and long-memory property of returns and volatility in the Korean stock market. Physica A 389: 4844–4854.

Lo, A.W. 1991. Long-term memory in stock market prices. Econometrica 59 (5): 1279–1313.

Lo, A.W. 2004. The adaptive markets hypothesis: market efficiency from an evolutionary perspective. Journal of Portfolio Management 30 (5): 15–29.

Lobato, I.N., and N.E. Savin. 1998. Real and spurious long-memory properties of stock-market data. Journal of Business Economic Statistics 16: 261–268.

Lobato, I.N., and C. Velasco. 2000. Long memory in stock market trading volume. The Journal of Business and Economic Statistics 18: 410–426.

Mandelbrot, B. 1965. Self-similar error clusters in communication systems and the concept of conditional stationarity. IEEE Trans Commun Technol 13 (1): 71–90.

Mandelbrot, B., and J.W. Van Ness. 1968. Fractional Brownian motions, fractional noises and applications. SIAM Review 10: 422–437.

Mariani, M.C., I. Florescub, M. Beccar Varelaa, and E. Ncheuguim. 2010. Study of memory effects in international market indices. Physica A 389 (8): 1653–1664.

Nekhili, R., A. Altay-Salih, and R. Genncay. 2002. Exploring exchange rate returns at different time horizons. Physica A 313: 671–682.

Ozdemir, Z.A. 2007. Linkages between international stock markets: a multivariate long memory approach. Physica A 388 (12): 2461–2468.

Ozun, A., and Cifter, A. 2007. Modeling long-term memory effect in stock prices: A comparative analysis with GPH test and daubechies wavelets. MPRA Paper 2481, University Library of Munich, Germany.

Panas, E. 2001. Estimating fractal dimension using stable distributions and exploring long memory through ARFIMA models in Athens Stock Exchange. Applied Financial Economics 11: 395–402.

Pascoal, R., and A.M. Monteiro. 2014. Market efficiency, roughness and long memory in PSI20 index returns: wavelet and entropy analysis. Entropy 16: 2768–2788.

Power, G.J., and C.G. Turvey. 2010. Long-range dependence in the volatility of commodity futures prices: wavelet-based evidence. Physica A 389: 79–90.

Ranta, M. 2013. Contagion among major world markets: A wavelet approach. Int J Manag Finance 9: 133–150.

Ray, B., and R. Tsay. 2000. Long-range dependence in daily stock volatilities. Journal of Business and Economic Statistics 18: 254–262.

Souza, L.R. 2007. Temporal aggregation and bandwidth selection in estimating long memory. Journal of Time Series Analysis 28 (2007): 701–722.

Tan, P.P., D.U.A. Galagedera, and E.A. Maharaj. 2012. A wavelet based investigation of long memory in stock returns. Physica A 391: 2330–2341.

Tan, P.P., C.W. Chin, and D.U.A. Galagedera. 2014. A wavelet-based evaluation of time-varying long memory of equity markets: a paradigm in crisis. Physica A 410: 345–358.

Tolvi, J. 2003. Long memory and outliers in stock market returns. Applied Financial Economics 13 (7): 495–502.

Vuorenmaa, T. 2005. A wavelet analysis of scaling laws and long-memory in stock market volatility, Bank of Finland Research Discussion Paper.

Wendt, H., A. Scherrer, P. Abry, and S. Achard. 2009. Testing fractal connectivity in multivariate long memory processes. 34th Proceedings of IEEE ICASSP, Taipei, Taiwan, pp. 2913–2916.

Xu, Z., and R. Gencay. 2003. Scaling, self-similarity and multifractality in FX markets. Physica A 323: 578–590.

Xue, Y., R. Gençay, and S. Fagan. 2014. Jump detection with wavelets for high frequency financial time series. Quantitative Finance 14 (8): 1427–1444.

Acknowledgement

Computations are done in both MATLAB and R Programming language. The authors would like to thank Prof. Darryl Veitch for providing the MATLAB program which can be accessed from https://crin.eng.uts.edu.au/~darryl/secondorder_code.html. The R codes written by the authors are based on multiwave and fArma packages in R. The dataset used along with the codes, which can replicate results of this paper, shall be provided by the corresponding author on request.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations

Rights and permissions

About this article

Cite this article

Bhandari, A., Kamaiah, B. Long Memory and Fractality Among Global Equity Markets: a Multivariate Wavelet Approach. J. Quant. Econ. 19, 23–37 (2021). https://doi.org/10.1007/s40953-020-00220-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40953-020-00220-0