Abstract

This paper examines the spillover effects and the causality between inflation, output growth and its uncertainties for India. Using monthly data for the period from April 1980 to April 2011, we estimated a bi-variate GARCH in mean with BEKK representations. This study differs from the earlier works where the parameters in the BEKK representations are estimated individually and the inferences are drawn on the basis of the individual lagged variance, covariance, and error terms from the respective equations. The empirical evidence suggests that inflation uncertainty seems to have significant negative impact on output growth and positive impact on output uncertainty and there is a positive influence of output uncertainty on the inflation. More importantly, there are spillovers and volatility transmission effects between the macroeconomic uncertainties where the volatility in output growth is significantly influenced by the shocks and volatility in inflation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In recent times, a substantial attention has been given on the effects of macroeconomic uncertainties on key variables like inflation and output growth. Investigating the effects of uncertainties on the real macroeconomic variables offers a significant knowledge of how uncertain macroeconomic situation slow down the economy.Footnote 1 Berument et al. (2009) pointed out that in an uncertain economic situation, economic agents are making decisions that are different from the ones they would make in the normal economic situation, considering their both future and past economic activities.

Economic theory postulates a different possible association between the macroeconomic variables with their uncertainties.Footnote 2 The idea of the negative impact of inflation uncertainty on output growth is originally attributed to Okun (1971) and Friedman (1977). In his Noble lecture, Friedman (1977) pointed out that the prevailing uncertainty about future inflation will impose higher risk on the returns from the capital invested which may consequently delay the future investments and cut down the growth rates. In a Barro–Gordon framework, Cukierman and Meltzer (1986) claimed that a surprise money shocks by monetary authorities will increases inflation uncertainty, which in turn affects the output growth. Pindyck (1991) also drawn a same conclusion by expounding that nominal uncertainty will increases the uncertainty associated with potential returns to investment and thus have an adverse effect on output growth.

In contrary to the popular belief of adverse real effects of inflation uncertainty, the idea of positive real effects are also hold well in the literature. In a model with symmetric adjustment costs of investment, Abel (1983) showed that the growth rates are positively influenced by inflation uncertainty through increase in investments. In the same fashion, Dotsey and Sarte (2000) demonstrates that higher inflation uncertainty leads to higher output growth as a result of higher precautionary savings which in turn leads to higher investment. Varvarigos (2008), using human capital accumulation channel model, supported the Abel’s insight of positive association between nominal uncertainties and output growth.

The positive effect of real uncertainty on inflation is advocated by Devereux (1989) in an extended Barro–Gordon model by introducing an endogenous wage indexation. He pointed out that though Fed dislikes inflation, volatility in real uncertainty reduces the optimal amount of wage indexation and induces the policymaker to create more inflation surprises in order to obtain favorable real effects. Cukierman and Gerlach (2003) also recognized the Devereux (1989) claim on the positive association between output uncertainty and rate of inflation. In contrast, output uncertainty may also lead to lower the inflation rate via the combined effect of Taylor (1979) with the Cukierman–Meltzer hypothesis channel.Footnote 3

Similar to the above discussed perceptions, the spillovers among the macroeconomic uncertainties are also received much attention. Logue and Sweeney (1981) claimed that the nominal uncertainty has a positive impact over the real uncertainty because during the period of higher relative price variability, producers are finding it more difficult to distinguish the real demand shifts from the nominal shifts. In this situation, the production and investment decision are very much uncertain which slows down all the economic activities and ends up with greater uncertainty in real growth rates. Cecchetti and Ehrmann (1999) supported this argument by finding out that the aggregate supply shocks create a positive trade-off between nominal and real variability. Clarida et al. (1999) also provides justification for this claim by deriving a short-run positive inflation–output variability tradeoff. However, Taylor (1979) provided a different argument on the possibility of negative effect of nominal uncertainty on the real uncertainty as a result of the tradeoff between inflation uncertainty and output growth uncertainty (the so-called Taylor curve).

Despite with the considerable volume of investigation, the existing empirical literature on this issue has supplied contradictory evidences. Neanidisa and Savvab (2010) tabulated the list of studies which gives different results for same countries when the method of uncertainty measure differs. Besides, the literature that exists are mainly pertaining to advanced industrialized economies, where the average inflation rates have been typically very low. There is a very little empirical evidence with respect to the experience of developing countries where the average inflation is relatively higher.

In this background, this paper is intended to analyze the relationship between macroeconomic uncertainties, inflation and output growth in India from a developing country perspective using the simultaneous approach and a two-step procedure method. The contribution of this paper is threefold. First a bivariate GARCH-M model with BEKKFootnote 4 variance representation is employed as a simultaneous estimation method, where the conditional variances are allowed to influence the conditional mean. Second, estimating a two-step procedure method, where the conditional variances of inflation and output growth are obtained from a bi-variate GARCH model and then causal relationships between these variables are tested using Granger causality tests. Finally, the spillovers and volatility transmissions between real and nominal uncertainties are verified from a bi-variate BEKK model. The rest of the paper is organized as follows: “Review of Literature” provides an overview of the existing empirical literature in this issue; “The Model” outlines the methodology adopted in this study; “Data and Empirical Results” discusses the data and presents the empirical results with interpretations; and the final section provides the concluding remarks.

Review of Literature

Based on the methodology, empirical studies focused on this issue are categorized into simultaneous equation models and the two step procedure methods. In simultaneous equation models, the mean and uncertainties effects of all variables are estimated and tested simultaneously within the model itself. In the two step procedure methods, first the conditional variances are obtained from the model and proxied as an uncertainty measure and the used in Granger-causality tests verify the nexus between the variables. A very brief review of some of the pioneering works in this issue is discussed as follows.

Darrat and Lopez (1989) found that economic development in twelve Latin American countries was hampered by erratic inflationary environment and justifies Friedman hypothesis. Davis and Kanago (1996) are also hold the similar view, but argue that this effect is purely temporary whereas Jansen (1989) found no evidence to the claim. In contrary, Grier and Perry (1999) conclude that inflation uncertainty significantly lowers real output growth in US and no other possible relationships. Using constant correlation model (CCC) model, Fountas et al. (2002) established similar association for Japanese economy.

In a pioneering work, using a post war US data Grier and Perry (2000) and Grier et al. (2004) studied the effects of uncertainties in a multivariate asymmetric GARCH-M model and found that nominal uncertainty negatively affects the growth rate and there is a positive association between growth uncertainty and the output. Using the same methodology, Bredin and Fountas (2005) documented that macroeconomic uncertainty tends to influence macroeconomic performance in G7 economies. Karanasos and Kim (2005) examined this relationship in G3 countries and found some associations only in the sub samples. In the augmented multivariate GARCH-M system model, Grier and Grier (2006) support the validity of Friedman hypothesis in Mexican economy. In a bi-variate EGARCH-M model, Wilson (2006) provide evidence that the real uncertainty raises the average inflation and lowers the growth rate in Japan and no other possible relationships.

By employing a constant correlation model (CCC), Fountas et al. (2006) found that in G7 countries, inflation and its uncertainty do have real effects and real uncertainty is a positive determinant of the output growth. With same data set and methodology, Fountas and Karanasos (2007) detected a contradicting results that nominal uncertainty is not harmful to the output. In an extended CCC model with US data, Conrad et al. (2008) found a positive effect from nominal uncertainty from real uncertainty and a negative feedback from the other side. Bredin et al. (2009) found a contradictory results than the existing literature for five Asian countries that the real uncertainty negatively affects the growth rate and no evidence for Friedman hypothesis. Using annual historical data on developing and developed countries, Jha and Dang (2011) found that inflation uncertainty affects the growth rate only in the developing countries when inflation exceeds a certain threshold level. In a bivariate CCC model, Jiranyakul and Opiela (2011) found a positive association between inflation, inflation uncertainty and output growth in Thailand.

Some studies are investigating these association with different approaches than the standard methodologies. Chang and He (2010) applied a bivariate Markov switching model and observed that the nominal uncertainty will affect growth only in the low inflation regimes. In a bivariate Smooth Transition Garch approach, Neanidisa and Savvab (2010) found that inflation uncertainty lower growth rate in the high inflation periods and real uncertainty enhances output growth only in low growth regimes and the real and nominal uncertainties have mixed effects on average inflation for G7 countries.

The Model

Simultaneous Estimation Method

To investigate the dynamics between the macroeconomic uncertainties and their influence on output growth and inflation rate, following Grier et al. (2004) and Bredin et al. (2009), we estimate a bi-variate VAR-GARCH-M (Vector Autoregressive GARCH-in-Mean) model as follows:

in which,

where \(x_{t}\) is a \(2 \times 1\) column vector, that is (\(y_{t,} \pi _{t})\), symbolize the output growth and inflation rate respectively, \(\alpha \) is the \(2 \times 1\) vector of constants and \(\Gamma _{i,} \;i=1,\ldots ,p,\) is the \(2 \times 2\) matrix of parameters. The \(2 \times 1\) vector, \(\uppsi \) represents the uncertainties and \(e_{t}\) is the vector of residuals. The effects of macroeconomic uncertainties on macroeconomic performance are tested on the basis of the sign and statistical significance of the matrix element \((\uppsi )\) included Eq. (1). The matrix elements \(\uppsi _{11}\) and \(\uppsi _{21}\) measure the impact of real uncertainty on output growth and inflation rate respectively.

Two-Step Procedure Method

Further, as a two-step procedure method, we estimate a simple VAR-GARCH modelFootnote 5 with BEKK parameterizations for the following reason. Though the simultaneous estimation method in Eq. (1) explains the contemporary effects of uncertainty but fails to capture the lagged influence of uncertainties in the model. Generally, the effects of uncertainties on macro variable has lagged impact, the simultaneous equation model like GARCH in mean model cannot capture these lagged effects and in this situation two-step procedure method holds an edge over the GARCH in mean models. Thus, to verify lagged influence of uncertainties and to test the sign and direction of this relationship, a two-step procedure method with Granger causality test procedures are employed.

For computing two-step procedure method, the following bi-variate GARCH model is estimated as

where all the elements and coefficients in this model holds same characteristics of the Eq. (1) and the only difference is the GARCH variance coefficient \((\uppsi )\) which measures the influence of variance in mean equation is excluded.

Variance–Covariance Method

To model the second moment (variance) of the series, there are several well-known multivariate-GARCH models with different parameterizations available in the literature. The common practice in to follow the diagonal-GARCH representations suggested by Bollerslev (1988) where the off-diagonal elements of the matrices in variance equations are restricted to zero. In this diagonal representation, the conditional variance of each series depends only on its past values and its own lagged squared residuals and the conditional covariance depends on past values of itself with the lagged cross product of residuals.

To overcome these limitations, Engle and Kroner (1995) proposed a new class of procedures known as BEKK representations. This specification ensures a positive definite for all values of \(e_{t}\), by imposing quadratic forms on the matrices coefficients and allow the conditional variance-covariance to interact with each other.Footnote 6 This model allows for non-diagonality in the covariance process and provides an appropriate framework to check the volatility linkage between the variables and also reduces the computational complexity of estimating a large number of parameters. Hence, to model the variance–covariance matrix \((H_{t})\) of Eqs. (1) and (2), a bivariate GARCH (1, 1)—BEKK representation proposed by Engle and Kroner (1995) is employed.

The BEKK parameterization for a bivariate VAR-GARCH (1, 1) model is as follows

where, C, A, B, are the \(2 \times 2\) parameter matrices of the variance equations in which \(C_{11}\) is restricted to be lower triangular matrix and A\(_{11}\) and B\(_{11}\) are the other two unrestricted matrices. The parameters of matrix A\(_{11}\) measure the degree of the effects of shocks or news on the conditional variance and measure the extent to which the conditional variances are associated with past squared errors. The elements of square matrix B\(_{11}\) indicate the persistence in conditional volatility between the variables and measure the influence of past conditional variances over the conditional variance of the present period.Footnote 7

The complete representation of the second moment of the bivariate VAR-GARCH with BEKK representation will take the expansion as followsFootnote 8:

The important difference between the present model and the earlier studies is that the present model, tests the possible non-diagonality in the covariance structure. In their pioneering work, Grier et al. (2004) indicated that the imposing of invalid diagonal restrictions in covariance structure may create severe specification errors in the model. Thus, we tested the diagonal restrictions in covariance structures of the BEKK model instead of simply assuming a priori diagonality.Footnote 9

To verify the volatility spillovers between the variables, it is necessary to expand the conditional variance of each equation by the matrix multiplication method, because the parameters in the BEKK representation cannot be inferred on individual basis. Kearney and Patton (2000) pointed out that the parameters in the BEKK representations are cannot be interpreted on an individual basis and the inference is based on the functions of the parameters form the intercept and the coefficients of the lagged variance, covariance, and error terms of the respective equations.Footnote 10 Hence the variance system \(H_{t}\) is further expanded as the following equations:

The above equations measure the spillovers and volatility transmissions across the variables over a period of time. The coefficients of the above Eqs. (5) and (6) are the non-linear function of the elements in the BEKK-GARCH equation (3). Finding out the standard errors for these coefficients is not straight forward. So, following Kearney and Patton (2000), to calculate the standard errors of this non-linear function, we apply the delta method using first-order Taylor approximation.Footnote 11

The simultaneous estimation method given in Eq. (1) avoids the problem of generated regressors, but including all possible lagged influence of uncertainties in the mean equation may result in loss of information. In addition, a deliberate restrictions on the lagged effects of uncertainties may fail to establish an exact association between variables, as the real and nominal effects of uncertainties may occur for an extended period of time. To circumvent this problem, the real and nominal uncertainties are obtained from the bivariate BEKK-GARCH model specified in Eq. (2) and standard Granger type causality test are used to verify the causal effects among the variables.

Data and Empirical Results

Data

The empirical investigation has been conducted using monthly data on output inflation, which is measured as a monthly percentage change in the seasonally adjusted index of industrial production (IIP) and wholesale price index (WPI) for the sample period from April 1980 to April 2011. All the data is obtained from various issues of the Handbook of Statistics on Indian Economy, various publications of Central Statistical Organization (CSO) and other publications of the Reserve Bank of India.

The summary statistics, unit root test results and the estimates of serial correlation tests are presented in Table 1. The reported descriptive statistics shows that both inflation and output growth are positively skewed with the significant amount of kurtosis. The Jarque–Bera (JB) normality test rejects the null hypothesis normality in both the series. The augmented Dickey–Fuller (ADF), Philip–Perron (PP) and KPSS unit root tests are used to test the time series properties of the series and the results are produced in panel (b) of Table 1.

The ADF and PP tests rejects the null hypothesis of unit root and the KPSS test accepts the null hypothesis of stationary for both inflation and output series which confirms that the variables are stationary at their levels. The Ljung–Box-Q statistic tests for serial correlation presented in panel (c) firmly rejects the null hypothesis of no autocorrelation and show a significant amount of serial dependence in both the series. Correspondingly, the presence of conditional heteroskedasticity in the squared errors of inflation and output growth are also confirmed. The reported ARCH-LM test statistic are also provides strong evidence for the presence of series ARCH effects in the residuals.

Empirical Results

The parameters estimated from the bivariate GARCH-M modelFootnote 12 are presented in Table 2. The estimated coefficients of the mean and variance equation are shown in panel (a) and panel (b) respectively. The residual diagnostic statistics are reported in panel (c) and the estimates of simple diagonal restriction model and the estimates of some nested models are reported in panel (d).

The negative and insignificant \(\uppsi _{11}\) coefficient indicates that there is no positive association between real uncertainty and output growth as advocated by Black (1987). The positive and significant value of the estimated coefficient of \(\uppsi _{21 }\) provides evidence for Devereux (1989) claim of ‘increased growth uncertainty raises average inflation’. On the other hand, the \(\uppsi _{12}\) coefficient, which measures the impact of nominal uncertainty on output growth, is negative and significant. This result is in consistence with Friedman and Okun argument of negative real effects of inflation uncertainty. Finally, the positive and statistically insignificant estimate of the \(\uppsi _{22}\) coefficient shows that the nominal uncertainty does not have any impact on the inflation rate. This result disproves the Cukierman–Meltzer claim of positive association and the Holland claim of negative influence of inflation uncertainty on inflation.

The values of Ljung–Box test statistics reported in panel (c) ensure the absence of serial correlation in the standardized and squared standardized residuals of both inflation and the output growth equations up to 10th lag period. The results produced in panel (d) shows strong evidence for the presence of heteroscedasticity in both the series. The homoscedasticity assumption requires that the matrices in the variance equation, (A\(_{11}\) and B\(_{11})\) to be jointly insignificant. But the reported results show that they are jointly significant at 1% level \((H_0 :\alpha _{ij} =\beta _{ij} =0)\) and individually significant at conventional level for most of the coefficients.

The estimates from the mean equation rejects the non-diagonal VAR (\(H_0 :\Gamma _{12}^i =\Gamma _{21}^i =0)\) and provide strong support for the presence of dynamic interactions between output growth and inflation rate. In addition, the joint significant of the coefficients of the matrix element \(\uppsi \) indicates the presence of GARCH-M effect and evident the presence of the influence of macroeconomic uncertainties over macroeconomic performances\((H_0 :\psi _{ij} =0)\). The diagonal covariance process between the conditional covariance requires the off-diagonal elements of the matrices A\(_{11}\) and B\(_{11 }\)to jointly insignificant. But, the estimates of the off-diagonal elements of these two matrices are jointly significant at 1% level of significance\((H_0 :\alpha _{12}^*=\alpha _{21}^*=\beta _{12}^*=\beta _{21}^*=0)\). This result indicates that the lagged conditional variances and lagged squared innovations in output growth (inflation) are influencing the conditional variance inflation (output growth).

As pointed out in the methodology mentioned in the methodology, the validity of the above discussed results is under concern for two reasons. First, the uncertainties may have a lagged impact over the macroeconomic performances and the GARCH-M models do not capture the lagged effects of uncertainties. Secondly, the estimated BEKK parameters (A and Bmatrices) cannot be interpreted on the individual basis, because these parameters involve nonlinear functions of the original parameters.Footnote 13 Thus, to test influence lagged uncertainty effects on macroeconomic performance, we estimate a two-step procedure method. In two-step procedure method, first the macro uncertainties are obtained from VAR-BEKK-GARCH model and secondly, for measure the lagged effects, the estimated uncertainties are used in a Granger causality tests.

The results of VAR-BEKK-GARCH model are given in Table 3 where the mean and variance coefficients are reported in panel (a) and panel (b). These results are simply describing the volatility transmissions between conditional variance and not the mean effects of the volatility. The exclusion of uncertainty coefficients from the mean equation departed its ability of explaining the effects of uncertainty on macroeconomic variables. The residual diagnostic statistics reported in panel (c) indicates that there is no autocorrelation problem in the standardized and squared standardized residuals of output growth and inflation equations up to 10th lag order. The results of simple diagonal restriction model and other nested models are given in panel (d). The estimates from both the mean equations are rejecting the null hypothesis of diagonal restrictions in the VAR model \((H_0 :\Gamma _{12}^i =\Gamma _{21}^i =0)\) and provide a strong support for the presence of dynamic interactions between output growth and inflation rate.

The elements in A\(_{11}\) and B\(_{11}\) matrix confirm the presence of strong conditional heteroskedasticity in output and inflation series, where the null hypothesis of no GARCH effect \((H_0 :\alpha _{ij} =\beta _{ij} =0)\) is rejected jointly at 1% and individually at the conventional level of significance. The joint significance of off-diagonal elements of both the two matrices strongly rejects the null of diagonal covariance process \((H_0 :\alpha _{12}^*=\alpha _{21}^*=\beta _{12}^*=\beta _{21}^*=0)\) which implies that the lagged squared innovations in real activity (inflation rate) significantly influence the conditional variance of inflation rate (output growth).

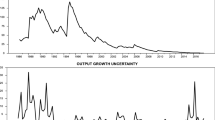

The conditional variances and covariance of output growth and inflation are plotted in Figs. 1, 2 and 3. The visual inspection of this plots show that both output growth and inflation volatility is high in the period from 1990 to 1993. In this period, Indian economy experienced biggest economic turbulence followed by new economic reform process. Also both growth and inflation volatility is showing consistency in ups and downs up to 2007 and recoded a higher variance thereafter which is due to the global financial crisis. The conditional variance and covariance do not remain constant over time and showed a clear cluster

Table 4 reports the results of pair wise F statistics of Granger-causality analysis between uncertainties and macroeconomic performance derived from the two-step procedure method described above in “Two-Step Procedure Method” and “Variance–Covariance Method”. Since the inference is highly sensitive to the number of lags used, we used standard lag length criterions for choosing an optimal lag length.Footnote 14 These specifications are nothing but the expanded parameters of the matrices (\(C_{11}\), A\(_{11}\) and B\(_{11})\) in the BEKK representation. The notations (\(y_{t}\) and \(\pi _{t})\) given in second row of Table 4 represents the output growth and inflation and the notations (\(h_{yt }\) and \(h_{\pi t})\) symbolize the real and nominal uncertainties. The symbol  indicates the null hypothesis of x does not Granger cause y. To understand the direction of influence of the variable that causes the other variable, the sign of the sum of the lagged coefficients are taken into account. The sign appear as a superscript of the Fstatistic shows the direction of the relationship. In Table 4, the results between output and nominal uncertainty, inflation and real uncertainty and real and nominal uncertainty are reported in Panel A, B and C respectively.

indicates the null hypothesis of x does not Granger cause y. To understand the direction of influence of the variable that causes the other variable, the sign of the sum of the lagged coefficients are taken into account. The sign appear as a superscript of the Fstatistic shows the direction of the relationship. In Table 4, the results between output and nominal uncertainty, inflation and real uncertainty and real and nominal uncertainty are reported in Panel A, B and C respectively.

The reported F statistics provide evidence that the null hypothesis of inflation uncertainty does not Granger-cause output growth can be rejected at 10% level of significance and the null hypothesis of output growth does not Granger-cause nominal uncertainty cannot be rejected at any conventional level of significance. The negative sum of the lagged inflation uncertainty coefficients in the output equations indicate the adverse impact of the inflation uncertainty on the output growth. These findings provide concrete evidence to Friedman (1977) and Pindyck (1991) claim on the negative real effects of inflation uncertainty. In contrast, there is no evidence for reverse causality from output growth to nominal uncertainty.

The null hypothesis of no causality between real uncertainty and inflation is rejected at 1 % significant level and the sum of the lagged output uncertainty coefficients in the inflation equation is positive. This evidence provides strong empirical support to Devereux (1989) and Cukierman and Gerlach (2003) claim of positive influence of output uncertainty on the inflation rate. In addition, the null hypothesis of no causality between inflation and real uncertainty are also rejected at 1% level of significance. Theoretically, there is a no any direct mechanism are available to explain the effect of inflation on output uncertainty and the sign of the effect. The interaction of Friedman (1977) hypothesis and Logue and Sweeney (1981) effects or Ungar and Zilberfarb (1993) and Taylor (1979) effect may channel this association.

The reported F statistic rejects the claim that inflation uncertainty does not influence output uncertainty at 1% level of significance. The sign given in the superscript indicates that the sum of the lagged nominal uncertainty coefficients in the real uncertainty equation is positive which showed that the inflation uncertainty has positive and significant impact on real uncertainty. This evidence supports the positive real uncertainty effects of nominal uncertainty advocated by Logue and Sweeney (1981). However, the null hypothesis of real uncertainty does not causes nominal uncertainty cannot be rejected and there is no evidence for Devereux (1989) argument of positive association between real uncertainty and nominal uncertainty.

Further, using the specification denoted in Eqs. (5) and (6)Footnote 15; the volatility spillovers between real and nominal uncertainties are investigated and the results are presented in Table 5. Two different types of transmission mechanism are discussed in the above table. The first mechanism is conditional volatility channel which includes direct and indirect volatility transmission mechanism. The direct transmission mechanism measure the response of the conditional variance \((h_{{11},t+1})\) to its own volatility \((h_{11,t} )\) and/or to the volatility of the other variable \((h_{22,t} )\) whereas the indirect volatility transmission channel compute the response to conditional covariance \((h_{12,t} )\) of both the series. Secondly, in the news/shocks transmission channel, the direct transmission measures the response of the conditional variance \((h_{{11},t+1})\) to its own shocks/news \((\varepsilon _{1,t}^2)\) and/or to the shocks/news from the other variable \((\varepsilon _{2,t}^2)\) and the indirect transmission measures the response to the cross values of the error terms \((\varepsilon _{1,t} \varepsilon _{2,t} )\).

The symbols \(h_{11,t}\hbox { and }h_{12,t} \) use to describe the conditional variance for the output growth and inflation respectively and the symbol \(h_{22,t} \) represents the conditional covariance between output growth and inflation. The squared error terms \(\varepsilon _{1,t}^2 \) and \(\varepsilon _{2,t}^2 \) represents the effect of ‘news’ (i.e., an unexpected/unanticipated shocks or change) in output growth or inflation. The cross values of error terms \(\varepsilon _{1,t} \varepsilon _{2,t} \) represents the ‘news’ in the output growth and inflation in time period ‘t’.

The first column of Table 5 presents the estimated coefficients of the output uncertainty model whereas the coefficients obtained from inflation uncertainty model is given in the second column. The reported results reveal that the output growth volatility \((h_{{11},t+1})\) is directly affected by its own past volatility \((h_{11,t} )\) and by its own news \((\varepsilon _{1,t}^2 )\) and also by the past inflation volatility \((h_{12,t} )\) as evident by the statistical significance of the respective coefficients. In addition, as shown by the significant \(\varepsilon _{1,t} \varepsilon _{2,t}\) and \(h_{12,t}\) coefficients, the output growth volatility is also indirectly affected by the shocks and volatility in inflation. This finding is consistent with the earlier results that the unexpected shocks in inflation uncertainty are associated with a rise in output uncertainty.

In terms of inflation volatility model, the estimated results shows that inflation volatility \((h_{22,t+1} )\) is directly and significantly affected by its own news \((\varepsilon _{2,t}^2)\) and past volatility \((h_{22,t})\) and also by the news \((\varepsilon _{1,t}^2)\) and past volatility \((h_{11,t})\) of the output growth. Additionally, as indicated by the statistical significance of the estimated coefficients it is understood that inflation volatility is also indirectly affected by the shocks \((\varepsilon _{1,t}\varepsilon _{2,t})\) and volatility from the output growth \((h_{12,t} )\). The negative and significant estimates of the coefficient \((\varepsilon _{1,t}\varepsilon _{2,t})\) which measures the news/shocks from the output growth to inflation volatility indicates that a positive shock in output growth is associated with a decline in inflation volatility. From the results, we note that there is a significant volatility transmission between output growth and inflation.

Concluding Remarks

This paper examines the impact of macroeconomic uncertainties on macro performance and the volatility spillovers between macroeconomic uncertainties in India using monthly data on output and inflation for the period from April 1980 to April 2011. Two methods are employed to understand the relationship between real and nominal uncertainty. A bi-variate VAR-GARCH in mean model and a two-step procedure, in which a simple bi-variate VAR-GARCH model is estimated to derive the conditional variances of output and inflation and then Granger causality test, is used. The volatility transmissions and spillover effects between real and nominal uncertainty is also examined using a bi-variate BEKK model. The empirical results from bi-variate VAR-GARCH in mean model and a two-step procedure method, shows that the Friedman (1977) claim of negative influence of nominal uncertainty on output growth is valid supporting the view of nominal uncertainty has real effects. Further, the estimated results strongly supports the Devereux (1989) and Cukierman and Gerlach (2003) arguments of positive inflationary effects of real uncertainty. The results from Granger causality test provides evidence for the Logue and Sweeney (1981) claim of positive effects of real uncertainty on inflation uncertainty. The results from the bi-variate BEKK model provide evidence that the volatility and the shocks in inflation significantly influence the volatility of real uncertainty.

Notes

The term macroeconomic uncertainties are used to designate nominal (inflation volatility) and real uncertainty (output growth volatility). Although volatility (fluctuations in a variable) and uncertainty (unpredictability of fluctuations) are two different concepts, it is common practice to use them interchangeably.

Twelve relationships are possible among the four variables—nominal uncertainty, real uncertainty, inflation and output growth. However, there is hardly any empirical support for most of these hypotheses.

The Taylor effect claimed a negative association between output volatility and inflation volatility and the Cukierman–Meltzer suggest a positive effect of inflation uncertainty on inflation. The combination of these two channels causes a negative impact of output growth uncertainty on the average rate of inflation.

The acronym BEKK is used to refer Baba, Engle, Kraft and Kroner as mentioned in Engle and Kroner (1995).

To check the presence of asymmetry in BEKK GARCH, the sign and size bias test proposed by Engle and Ng (1993) was used. The test result does not provide any evidence for asymmetry in the output series. Thus a symmetric VAR-BEKK GARCH model is estimated.

In this diagonal representation, the conditional variances are functions of their own lagged values and own lagged returns shocks, while the conditional covariances are functions of the lagged covariances and lagged cross-products of the corresponding shocks.

The covariance in the BEKK model is stationary only if all the Eigen values of \(A\otimes A+B\otimes B\) (where \(\otimes \) stands for Kroner product) are less than one in modulus (Engle and Kroner 1995).

For simplicity, the individual elements of the matrices, C, A and B are taken as

$$\begin{aligned} C_{11} =\left( {{\begin{array}{ll} {c_{11} }&{}\quad {c_{12} } \\ 0&{}\quad {c_{22} } \\ \end{array} }} \right) ,\quad A_{11} =\left( {{\begin{array}{ll} {a_{11} }&{}\quad {a_{12} } \\ {a_{21} }&{}\quad {a_{22} } \\ \end{array} }} \right) ,\quad B_{11} =\left( {{\begin{array}{ll} {b_{11} }&{}\quad {b_{12} } \\ {b_{21} }&{}\quad {b_{22} } \\ \end{array} }} \right) \end{aligned}$$The delta method to derive the standard errors of the parameters in the Eqs. (5) and (6) has following steps: (i) The variance–covariance matrix (V) of the estimates was derived from Eq. (3); (ii) For every parameter in Eqs. (5) and (6), a gradient vector (G) of the partial derivatives with respect to the estimated parameters of Eq. (3) was derived (iii) The square root of the scalar G’VG is the standard error of the particular parameter in Eqs. (5) and (6). For a detailed discussion of this method refer to Papke and Wooldridge (2005), Wooldridge (2002, Section 3.5.2).

To check the presence of asymmetry, the sign and size bias test proposed by Engle and Ng (1993) was used. The test result does not provide any evidence for asymmetry and thus a symmetric model is estimated. Based on AIC, SBC and HQ lag length criterions, three lags are chosen as an optimal lag length.

Standard lag length criterions suggests three lags as an optimal lag length for the Model 1 and two lags for the Model 2 and Model 3.

These specifications are nothing but the expanded parameters of the matrices (\(C_{11}\), A\(_{11}\) and B\(_{11})\) in the BEKK representation.

References

Abel, A. 1983. Optimal investment under uncertainty. American Economic Review 73: 228–233.

Berument, H., Y. Yalcin, and Y. Yildirim. 2009. The effect of inflation uncertainty on inflation: Stochastic volatility in mean model within a dynamic framework. Economic Modeling 26 (6): 1201–1207.

Black, F. 1987. Business Cycles and Equilibrium. New York: Basil Blackwell.

Bollerslev, T. 1988. A Multivariate Generalized ARCH Model with Constant Conditional Correlations for a Set of Exchange Rates. Northwestern University, Manuscript.

Bredin, D., and S. Fountas. 2005. Macroeconomic uncertainty and macroeconomic performance: Are they related? The Manchester School 73: 58–76.

Bredin, D., J. Elder, and S. Fountas. 2009. Macroeconomic uncertainty and performance in Asian countries. Review of Development Economics 13: 215–229.

Cecchetti, S., and Ehrmann M. 1999. Does inflation targeting increase output volatility? An international comparison of policymaker’s preference and outcomes. NBER Working Paper No. 7426.

Chang, K.L., and C. He. 2010. Does the magnitude of the effect of inflation uncertainty on output growth depend on the level of inflation? The Manchester School 78 (2): 126–148.

Clarida, R., J. Gali, and M. Gertler. 1999. The science of monetary policy: A new Keynesian perspective. Journal of Economic Literature XXXVII: 1661–1707.

Conrad, C., M. Karanasos, and N. Zeng. 2008. The link between macroeconomic performance and variability in the UK. Economics Letters 106: 154–157.

Cukierman, A., and A. Meltzer. 1986. A theory of ambiguity, credibility, and inflation under discretion and asymmetric information. Econometrica 54: 1099–1128.

Cukierman, A., and S. Gerlach. 2003. The inflation bias revisited: Theory and some international evidence. The Manchester School 71: 541–565.

Darrat, A.F., and F.A. Lopez. 1989. Has inflation uncertainty hampered economic growth in Latin America? International Economic Journal 3: 1–14.

Davis, G., and B. Kanago. 1996. On measuring the effect of inflation uncertainty on real GNP growth. Oxford Economic Papers 48: 163–175.

Devereux, M. 1989. A positive theory of inflation and inflation variance. Economic Inquiry 27: 1–10.

Dotsey, M., and P.D. Sarte. 2000. Inflation uncertainty and growth in a cash-in-advance economy. Journal of Monetary Economics 45: 631–655.

Engle, R., and K. Kroner. 1995. Multivariate simultaneous generalized ARCH. Econometric Theory 11: 122–150.

Engle, R., and V. Ng. 1993. Measuring and testing the impact of news on volatility. Journal of Finance 48: 1749–1778.

Fountas, S., and M. Karanasos. 2007. Inflation, output growth, and nominal and real uncertainty: Empirical evidence for the G7. Journal of International Money and Finance 26: 229–250.

Fountas, S., M. Karanasos, and J. Kim. 2002. Inflation and output growth uncertainty and their relationship with inflation and output growth. Economics Letters 75: 293–301.

Fountas, S., M. Karanasos, and J. Kim. 2006. Inflation uncertainty, output growth uncertainty and macroeconomic performance. Oxford Bulletin of Economics and Statistics 68: 319–343.

Friedman, M. 1977. Nobel lecture: Inflation and unemployment. Journal of Political Economy 85: 451–472.

Grier, R., and K.B. Grier. 2006. On the real effects of inflation and inflation uncertainty in Mexico. Journal of Development Economics 80: 478–500.

Grier, K.B., and M.J. Perry. 1999. The effects of uncertainty on macroeconomic performance: Bivariate GARCH evidence. Journal of Applied Econometrics 15: 45–98.

Grier, K.B., and M.J. Perry. 2000. The effects of real and nominal uncertainty on inflation and output growth: Some GARCH-M evidence. Journal of Applied Econometrics 15: 45–58.

Grier, K.B., Ó.T. Henry, N. Olekalns, and K. Shields. 2004. The asymmetric effects of uncertainty on inflation and output growth. Journal of Applied Econometrics 19: 551–565.

Hassan, S.A., and F. Malik. 2007. Multivariate GARCH modeling of sector volatility transmission. The Quarterly Review of Economics and Finance 47: 470–480.

Jansen, D.W. 1989. Does inflation uncertainty affect output growth? Further Evidence. Federal Reserve Bank of St. Louis Economic Review, July/August, 43–54.

Jha, R., and Dang, Tu. 2011. Inflation variability and the relationship between inflation and growth. CAMA Working Papers 2011-08, Centre for Applied Macroeconomic Analysis, Crawford School of Public Policy, The Australian National University.

Jiranyakul, K., and P.T. Opiela. 2011. The impact of inflation uncertainty on output growth and inflation in Thailand. Asian Economic Journal 25: 291–301.

Karanasos, M., and J. Kim. 2005. The inflation–output variability relationship in the G3: A bivariate GARCH (BEKK) approach. Risk Letters 1: 17–22.

Kearney, C., and A.J. Patton. 2000. Multivariate GARCH modeling of exchange rate volatility transmission in the European monetary system. The Financial Review 41: 29–48.

Logue, D., and R. Sweeney. 1981. Inflation and real growth: Some empirical results. Journal of Money, Credit and Banking 13: 497–501.

Malik, F., and T.B. Ewing. 2009. Volatility transmission between oil prices and equity sector returns. International Review of Financial Analysis 18: 95–100.

Neanidisa, K.C., and Savvab, C.S. 2010. Macroeconomic uncertainty, inflation and growth regime-dependent effects in the G7. Centre for Growth and Business Cycle Research, Economic Studies, No. 145, University of Manchester, Manchester.

Oehlert, G.W. 1992. A note on the delta method. American Statistician 46: 27–29.

Okun, A. 1971. The mirage of steady inflation. Brookings Papers on Economic Activity 2: 485–498.

Papke, Jeffrey M., and J.M. Wooldridge. 2005. A computational trick for delta-method standard errors. Economics Letters 86: 413–417.

Pindyck, R. 1991. Irreversibility, uncertainty, and investment. Journal of Economic Literature 29: 1110–1148.

Shields, K., N. Olekalns, Ó.T. Henry, and C. Brooks. 2005. Measuring the response of macroeconomic uncertainty to shocks. Review of Economics and Statistics 87 (2): 362–370.

Taylor, J. 1979. Estimation and control of a macroeconomic model with rational expectations. Econometrica 47: 1267–1286.

Ungar, M., and B.Z. Zilberfarb. 1993. Inflation and its unpredictability: Theory and empirical evidence. Journal of Money, Credit and Banking 25: 709.

Varvarigos, D. 2008. Inflation, variability, and the evolution of human capital in a model with transactions costs. Economics Letters 98: 320–326.

Wilson, B.K. 2006. The link between inflation, inflation uncertainty and output: New time series evidence from Japan. Journal of Macroeconomics 28: 609–620.

Wooldridge, J.M. 2002. Econometric Analysis of Cross Section and Panel Data. Cambridge: MIT Press.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Balaji, B., Durai, S.R.S. & Ramachandran, M. Spillover Effects of Real and Nominal Uncertainties in India. J. Quant. Econ. 16 (Suppl 1), 143–162 (2018). https://doi.org/10.1007/s40953-017-0108-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40953-017-0108-1