Abstract

Empirical studies have provided conflicting findings about the relationship between inflation and inflation uncertainty. Thus, the direction of the causality is still questionable. The present paper is aimed to extend the existing literature using non-linearity models and asymmetric causality tests. For this purpose, the data for 33 developed and developing countries during 1988Q4-2016Q3 is used. The results showed an asymmetry in the inflation behavior which is specified by smooth transition process, as well as separating positive and negative shocks observed in causality test. The asymmetric causality between inflation and inflation uncertainty is confirmed in most countries, although the empirical evidence in favor of Cukierman-Meltzer hypothesis is found to be weaker than Friedman-Ball hypothesis.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The relationship between inflation and inflation uncertainty has been attracted a lot of attention among economists due to its importance for policy analysis. Theoretically, two opposite hypotheses are suggested to explain the relationship between inflation and inflation uncertainty. Okun (1971), Friedman (1977) and Ball (1992) demonstrated that some policy-makers might not be interested in implementing anti-inflationary policies due to the fear of the recession. Thus, the public faces greater uncertainty about future money supply growth and accordingly about future inflation following the increased inflation. It is known as “Friedman-Ball Hypothesis”. Then, the opposite type of causation between inflation and its uncertainty has been shown in the theoretical macroeconomics literature. Cuikerman and Meltzer (1986) argued that policy-makers usually follow a discretionary policy instead of the policy rule and try to stimulate the economic growth by inflation surprises. Therefore, an increase in inflation uncertainty leads to a rise in the average inflation rate by increasing the incentive of the policy-maker to produce inflation surprises. It is called “Cukierman-Meltzer Hypothesis”.

In this regard, clear consensus on the relationship between inflation and its uncertainty has not yet observed in empirical studies. Numerous studies concluded that, there is a positive bidirectional causality relationship between inflation and inflation uncertainty, while many studies confirmed only one of the Friedman-Ball or Cukierman-Meltzer Hypothesis. In addition, in some countries, no evidence could support the above hypotheses. These conflicting findings can be usually attributed to the differences in indicators, countries and time periods.

However, a review on previous empirical studies showed that, most of the studies employed linear autoregressive model and symmetric causality test, and so they ignored non-linear relations that might occur. While some studies found evidences about asymmetric and non-linear dynamics of inflation (Fischer et al. 2002; Cogley and Sargent 2002; Amano 2007; Surico 2007; Doyle and Falk 2010; Zhang 2011; Tsong and Lee 2011; Meller and Nautz 2012; Chang 2012; Qin et al. 2013; Giannellis 2013; Komlan 2013; Falahi and Hajamini 2015; Chesang and Naraidoo 2016; and Falahi and Hajamini 2017). It is evident that when these non-linear dynamics are ignored, the uncertainty measure will be incorrect and resulting in an incorrect analysis of the inflation-uncertainty relationship. Thus, there is a strong motivation to employ regime switching models in order to better understand the relationship between inflation and its uncertainty.

Based on the above, the present paper is aimed to investigate the relationship between inflation and uncertainty among 33 developed and developing countries by addressing the misspecification problems. A two-step procedure was first employed. During the first step, the conditional variance of inflation is estimated by STAR-GARCH model for each country so that the process can confidently capture non-linear dynamic of inflation. In second step, the asymmetric causality test is performed between positive and negative shocks of generated conditional variance and inflation.

The present paper is different from the previous studies in two ways. First, while previous studies have focused on a limited number of countries, especially developed ones, this study used a large number of developed and emerging countries and therefore, it is expected that more reliable results would be provided. Second, STAR-GARCH model and asymmetric causality method are used in this study to estimate potential asymmetric behavior of inflation and its uncertainty. This may contribute to a better understanding with respect to the previous conflicting findings, or providing at least one further explanation for the differences in the results. Moreover, understanding this asymmetry will be helpful to determine the objective function of the central bank, and also to calculate the welfare costs caused by the inflation and uncertainty.

The present paper is organized as follows. “Literature Review” section gives a brief overview of previous studies. “Econometric Methodology” section introduces the econometric methodology. “Empirical Findings” section demonstrates the empirical findings, and the concluding remarks are elaborated in “Conclusion” section.

Literature Review

Economists believe that high inflation because of welfare cost of inflation rises as the rate of inflation increases is not acceptable. This welfare cost will be higher, regardless of how much inflation is, when the future inflation is unpredictable. In fact, since expected inflation is one of the factors involving in economic decision-making, uncertainty about future inflation will also negatively influence both business investment decisions and consumer saving decisions. This ex ante effect influences the economy through various channels.Footnote 1 In addition, there is an ex post effect that occurs when the decisions have been made and economic agent understands that the inflation differs from what had been expected (Golob 1994; Yellen 2017). Therefore, the inflation-uncertainty relationship is important for determining the welfare cost and monetary and fiscal policies.

However, explanation of inflation uncertainty related to the inflation is relatively difficult. At first, Okun (1971) argued that there is a positive relationship between inflation and its fluctuations. When monetary authorities accept high inflation to accommodate a shock, the public fears that inflation will rise again in case of another shock. Therefore, high inflation creates uncertainty about whether inflation will return to a low level, or whether inflation will rise further.

Friedman (1977) argues that inflation and its unpredictability are positively related to each other. High inflation causes political pressure to reduce it, but the monetary authority may or may not be reluctant to reduce the inflation. In fact, an increase in average rate of inflation may induce an erratic policy response and hence more nominal uncertainty creates about the future inflation. Friedman (1977) contends the effect of uncertainty on real economic performance. This hypothesis assumes that the uncertainty would distort the effectiveness of the price mechanism in allocation of resources. Furthermore, inflation uncertainty may influence the intertemporal allocation of resources through interest rates. Therefore, the inflation uncertainty creates economic inefficiency and a lower rate of economic growth.Footnote 2

Ball (1992) designed a repeated asymmetric information game indicating a formal derivation of Friedman’s first hypothesis, which more inflation will lead to a higher uncertainty. Ball’s game model includes monetary authority (liberal and conservative policy-makers) and public. Liberal policy-makers contrary to conservative policy-makers are willing to bear the economic costs of disinflation policies. When inflation is low, there is a consensus between both types of policy-makers. Thus, if the inflation remains low and stable, the uncertainty concerning future inflation will be also maintained at low level. But, when the inflation is high, the public does not know whether the monetary authority will follow a tight monetary policy to reduce inflation, or not. Also it is very complex for public to predict how much and how quickly prices will respond to monetary policy. Indeed the disinflation policy causes inflation uncertainty, even if the stance of monetary policy is known with certainty.

In addition, high inflation destabilizes the relation between the money stock and policy instruments of central bank, and hence magnifying monetary control errors. Also Dmitriev and Kersting (2016) indicated that there is a positive relationship between the steady state level of inflation and business cycle inflation volatility. Okun (1971), Friedman (1977), and Ball (1992) believe that monetary policy and its effectiveness becomes more unpredictable during the periods of high inflation. It means that high inflation causes uncertainty about future inflation which is known as “Friedman-Ball Hypothesis”.

Conversely, inflation uncertainty may produce higher average rate of inflation due to opportunistic behavior of monetary authority. Cuikerman and Meltzer (1986) and Cukierman (1992) proposed a theoretical model showing that monetary authority is willing to keep the inflation at low level, but also seeking to stimulate the real output by monetary shock. Therefore, the policy-makers face a trade-off between a desire to increase real output and a desire to keep the inflation at low level. Accordingly, uncertainty about money growth and inflation will lead to a higher average rate of inflation, since the incentive of monetary authority increases to create inflation surprises. Moreover, as Grier and Perry (1996) mentioned, when aggregate nominal shocks become more unpredictable, individual firms adjust less output in response to all shocks. Instead, prices will be more dispersed and hence inflation uncertainty will increase the relative price dispersion. This positive effect of uncertainty on inflation is called “Cukierman-Meltzer Hypothesis”.

A summary of empirical studies is presented in Table 1. The reviewed studies investigated the inflation-uncertainty relationship in limited number of countries, especially developed countries, nonetheless clear consensus has not yet been reached. While some studies showed a positive bidirectional causality relationship between inflation and inflation uncertainty, others confirmed only one of the Friedman-Ball Hypothesis or Cukierman-Meltzer Hypothesis. In addition, no evidence could support the above hypotheses in some countries.

Most of empirical studies showed the relationship between inflation and uncertainty based on the linear autoregressive and symmetric Granger-causality test. Since, the inflation is in a permanent interaction with decisions of economic agents (consumers, producers, and government), and so it is complicated to explain it by linear approach. There is evidence in favor of the non-linear and asymmetric dynamics of inflation. It was found that there are some relationships between inflation level, inflation persistence, and inflation variability. So, it is expectable that inflation behaves asymmetrically. In the following, these evidences are reviewed.

First, inflation persistence depends on the size and sign of shocks. Cogley and Sargent (2002), Amano (2007), Zhang (2011), and Falahi and Hajamini (2017) indicated that there is a strong and positive relationship between inflation variability and its persistence. Also Fischer et al. (2002) demonstrated that inflation persistence arises in high inflation regime, although it may gradually disappear in full-blown hyperinflations. Tsong and Lee (2011), showed that large negative shocks despite of large positive shocks may induce strong mean reversion. Giannellis (2013) contended that inflation is persistent and transitory when it is low and high, respectively.

Moreover, Zhang (2011) and Meller and Nautz (2012) described that inflation persistence is sensitive to changes in the monetary policy regime. They found that less persistency and less responsive to inflationary shocks are attributed mainly to a better monetary policy. Qin et al. (2013) also demonstrated that inflation persistence is positively related to the preferences of policy-makers. They argued that the monetary authority should gauge a relatively high degree of inflation persistence when designing and implementing monetary policy under uncertain model. This evidence implies that inflation persistence is influenced by inflation and its variability. Therefore, inflation process is naturally a non-linear autoregressive model and it should be modeled using the regime switching models.Footnote 3

Second, low and high inflations have different effects on the economic agent’s behavior, especially monetary and fiscal authorities, thus triggering different reactions. Surico (2007), Doyle and Falk (2010), Komlan (2013), and Chesang and Naraidoo (2016) argued that monetary authority may react asymmetrically to disinflation and inflation shocks, and accordingly inflation shocks have different effect on uncertainty. Chesang and Naraidoo (2016) found that asymmetric preferences have a significant role in explaining inflation movement. Generally, reaction of monetary authority to high inflation may be very intense and rapid, while moderate inflation usually faces no significant reaction and continues slowly.

Furthermore, Hasbrouck (1979) argued that increasing trend of inflation raises the fluctuations of inflation by increasing responsiveness of money demand to shocks. Ball (1992) indicated that high inflation reduces nominal rigidity and thus it steepens the short-run Phillips curve; a steeper Phillips curve implies that inflation varies more when the demand fluctuates. Civelli and Zaniboni (2014) and Chen and Hsu (2016) concluded that the responses of inflation to monetary shocks are hump-shaped. Ungar and Zilberfarb (1993) indicated that the relationship between inflation and uncertainty is significant only during the high inflation. In this regard, Chang (2012) and Falahi and Hajamini (2015) reported that inflation influences uncertainty in the presence of high-inflation variability, while the effect is insignificant in the presence of low-inflation variability.

As explained above, it is concluded that the relationship between inflation and uncertainty depends on the size and sign of shocks, thus the use of regime switching model and asymmetric causality test is preferred.

Econometric Methodology

STAR Model

Bacon and Watts (1971) pioneered to introduce smooth transition autoregressive (STAR) models. Then, Chan and Tong (1986) added these models to the econometrics, and accordingly Granger and Teräsvirta (1993), Teräsvirta (1994, 1998), Eitrheim and Teräsvirta (1996), and Teräsvirta et al. (2005) expanded these models. A STAR model is written as a general form as follows:

where \( Y_{t} = \left( {y_{t - 1} , \ldots ,y_{t - p} } \right)^{\prime } \) and \( \varphi_{i} \) represents the coefficient vector, \( y_{t - d} \) indicates the transition variable in which \( d \) is known as delay parameter, \( c \) is regarded as a constant and \( \gamma \) describes the transition parameter which can be standardized by the standard deviation \( y_{t} \). An increase in \( y_{t - d} \) is leads to an increase in the transition function \( G\left( {y_{t - d} ;\gamma ,c} \right) \) which this function is increasing from zero to unit and accordingly displays a non-linear behavior.

The transition function can often be defined as \( 1/\left( {1 + exp\left( { - \gamma \left( {y_{t - d} - c} \right)} \right)} \right) \) or \( 1 - exp\left( { - \gamma \left( {y_{t - d} - c} \right)^{2} } \right) \), which are called logistic and exponential smooth transition autoregressive (LSTAR and ESTAR), respectively. According to Chan (1993), the transition parameter and the constant value are consistently calculated by minimizing the sum of squared residuals:

The coefficients vector is estimated by \( \hat{\varphi }\left( {\hat{\gamma },\hat{c}} \right) {=} \Big( \mathop \sum \nolimits_{t = 1}^{T} Y_{t} {\Big( \hat{\gamma },\hat{c} \Big)} Y^{\prime}_{t} \Big( {\hat{\gamma },\hat{c}} \Big) \Big)^{ - 1} \mathop \sum \nolimits_{t = 1}^{T} Y_{t} \left( {\hat{\gamma },\hat{c}} \right)y_{t} \). The STAR model varies according to the size of this parameter since the transition parameter can be any positive value. As the transition parameter in ESTAR model converges to zero or positive infinity, the value of the transition function approaches one and hence the model reduces to linear autoregressive (LAR) process. Similarly, the model degenerate to LAR if the transition parameter in LSTAR model approaches zero. Therefore, Luukkonen et al. (1988) suggest that the hypothesis \( H_{0}:\gamma = 0 \) is tested to choice STAR versus LAR.

However, the LSTAR model approximately degenerates into the self-exciting threshold autoregressive (SETAR) process if the transition parameter converges to positive infinity. SETAR model was first introduced by Tong (1978) and developed by Tsay (1989, 1998), Chan (1993), and Hansen (1996, 1997, 1999, 2000). This model is written as follows:

where \( I\left[ \cdot \right] \) represents an indicator function in which \( y_{t - d} \) and c are regarded as the threshold variable and threshold parameter, respectively. Based on the \( \varphi_{1} \) and \( \varphi_{2} \), the behavior is described in low and high regimes.

Further, Granger and Teräsvirta (1993) and Teräsvirta (1994) introduced a LM test for the choice between LSTAR and ESTAR. Based on the first-order Taylor approximation, auxiliary regression of LSTAR is written as follows:

The rejection of \( \psi_{3} = 0 \) implies that the LSTAR model should be selected. If \( \psi_{3} = 0 \)is not rejected and subsequently \( \psi_{2} = 0|\psi_{3} = 0 \) is not rejected, the ESTAR model is selected accordingly. Finally, not rejecting the second hypothesis and rejecting \( \psi_{1} = 0|\psi_{2} = \psi_{3} = 0 \) leads to an LSTAR model.

Uncertainty

Various criteria are available for measuring uncertainty. Kline (1977) suggested that the uncertainty can be measured by moving standard deviation. Ungar and Zilberfarb (1993) used the mean squared error of prediction. However, Baillie et al. (1996) and Berument and Dincer (2005) argued that the above criteria are biased, and they measured variability not uncertainty. Alternatively, Ball (1992) and Cuikerman and Meltzer (1986) emphasized that inflation uncertainty can be measured through the variance of the unpredictable component of an inflation forecast.

In fact, it is the conditional variance which can be used well to measure uncertainty. Assume that the series \( \varepsilon_{t} \) in Eq. (1) is conditionally heteroscedastic, it can be generally defined as \( \varepsilon_{t} \left( {\gamma ,c} \right) = \sqrt {h_{t} \left( {\gamma ,c} \right)} \epsilon_{t} \) where \( \epsilon \) is independent and identically distributed with zero mean and unit variance. According to Engle (1982) and Bollerslev (1986), generalized autoregressive conditionally heteroscedastic (GARCH) model is written as follows:

where \( {\text{E}}_{t} = \big( {1, \varepsilon_{t - 1}^{2} , \ldots ,\varepsilon_{t - q}^{2} } \big) \) is represents the vector of squared error terms and \( H_{t} = \left( {h_{t - 1} , \ldots ,h_{t - s} } \right) \) is regarded as the vector of conditional variances.

Asymmetric Causality

The conditional variance series can be used to determine whether there is an asymmetric causality between inflation and its uncertainty or not. Assume that the inflation (\( y_{t} \)) is a non-stationary process, and the positive and negative shocks are separated as the following \( \zeta_{t}^{y, + } = { \hbox{max} }\left( {\zeta_{t}^{y} ,0} \right) \) and \( \zeta_{t}^{y, - } = { \hbox{min} }\left( {\zeta_{t}^{y} ,0} \right) \). Hence, the random walk process \( y_{t} \) is written as follows:

Similarly, the conditional variance is as follows:

In this case, each positive and negative shock plays a permanent effect on the underlying variable. Thus, the positive and negative shock vectors are defined based on Hatemi-J (2012) in cumulative forms as \( W_{t}^{ + } = \left( {\mathop \sum \nolimits_{\tau = 1}^{t} \zeta_{\tau }^{y, + } ,\mathop \sum \nolimits_{\tau = 1}^{t} \zeta_{\tau }^{h, + } } \right) \) and \( W_{t}^{ - } = \left( {\mathop \sum \nolimits_{\tau = 1}^{t} \zeta_{\tau }^{y, - } ,\mathop \sum \nolimits_{\tau = 1}^{t} \zeta_{\tau }^{h, - } } \right) \), respectively.

In order to test causality relationship, Toda and Phillips (1993a) and Toda and Yamamoto (1995) suggested the maximal order of integration (\( d_{max} \)) and optimum lags (\( k \)) are specified. Then a \( \left( {k + d_{max} } \right)^{th} \) order VAR model for positive shocks is estimated as followsFootnote 4:

Similarly, we have the following equation for negative shocks:

According to Granger (1969), the null hypothesis of non-causality is defined as \( H_{0}^{{j{ \nrightarrow }i}}:\Phi_{1,ij} = \ldots = \Phi_{k,ij} = 0 \) where \( i,j = 1, 2 \) and \( i \ne j \). The significance of optimum lags coefficients is tested by Wald statistic including standard Chi square distribution with \( k \) degree of freedom. If the estimated statistics is larger than the critical value, the null hypothesis is rejected and it is concluded that there is a Granger causality from variable \( i \) to variable \( j \). However, as Hatemi-J (2012) demonstrates, the data do not usually follow a normal distribution and the existence of conditional heteroskedasticity effects is regarded as a rule rather than an exception. Thus distribution of Wald statistic is non-standard and it is better to compute critical values of Wald statistic by the bootstrapping simulation technique.

Of course, over-fit VAR leads to a decrease in the test robustness. Toda and Yamamoto (1995) emphasized that the inefficiency caused by additional lags is small when the number of variables is few and lag length is large. In addition, according to Hatemi-J (2012), the positive or negative shocks should be replaced by cumulative shocks if stationary variables are stationary. In this case, the VAR model is separately estimated based on the vectors \( Z_{t}^{ + } = \big( {\zeta_{t}^{y, + } ,\zeta_{t}^{h, + } } \big)^{\prime } \) and \( Z_{t}^{ - } = \big( {\zeta_{t}^{y, - } ,\zeta_{t}^{h, - } } \big)^{\prime } \), and \( k^{th} \)-order VAR model are similarly estimated (\( d_{max} = 0 \)) and accordingly the mentioned null hypotheses are tested.

Empirical Findings

In this study, the inflation rate was calculated using the quarterly collected data on Consumer Price Index (CPI) during 1988Q4-2016Q3 for 33 developed and developing countries.Footnote 5 First, the stationary of variables was checked by the method proposed by Hylleberg et al. (1990). The results showed that both the inflation rates and their uncertainty have one unit root at frequency annual in the most countries, therefore, they are considered as non-stationary processes. These variables are stationary at frequencies zero, \( \pi /2 \) and 1/2 in all the studied countries (Table 2).

Second, non-linear models were estimated for inflation process in each country. A summary of the results is shown in Table 3. The optimal lag order (\( p^{*} \)) was selected based on the minimization of the Akaike information criterion. In addition, the delay parameters (\( d \)) was determined based on the smallest p value of LM statistic suggested by Teräsvirta (1998).

Luukkonen et al. (1988), Granger and Teräsvirta (1993) and Teräsvirta (1994) represented the LM tests for the selection of the type of model. The results showed that the linearity hypotheses (\( H_{0} :\gamma = 0 \)) are not rejected in the eight countries including Canada, Finland, Italy, Japan, New Zealand, South Africa, Sweden, and Thailand while the inflation rate followed a smooth transition process for the 25 other countries.

Among these 25 courtiers with non-linear process, for the countries such as France, Indonesia, Saudi Arabia, and South Korea, the inflation rates were found to be well-modelled by the exponential STAR model, while for other countries, they were modelled by the logistic STAR model. The standardized transition parameters of STAR models are less than two (except Austria, Switzerland, Spain, and US), which display the slow speed of transition between inflationary regimes. In fact, the non-linear process of inflation for the 21 countries followed a monotonic smooth transition from one regime to another, which is against SETAR or Markov switching models where one sudden switch occurs between the regimes. In contrast, the US inflation rate process reduced to self-excited TAR (SETAR) model since transition parameter converged to positive infinity (\( \gamma \to + \infty \)).

In the following, GARCH model is estimated to generate the conditional variance series of inflation as a measure of its uncertainty. Based on the Akaike information criterion, the optimum lags of squared error terms (\( q^{*} \)) and conditional variances (\( s^{*} \)) are selected for GARCH models (Table 3).

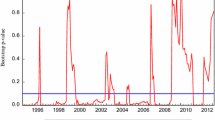

The inflation-uncertainty curves are reported in Fig. 1. This Figure demonstrates that, there is a strong and positive relationship between inflation and its uncertainty in most countries. However, two variables may be strongly correlated with each other, but there are no statistical causal relations, either one-way or bi-directional. In this regard, Hatemi-J (2012) test was employed to evaluate the asymmetric causality between inflation and inflation uncertainty shocks (Table 4). The optimum lag (\( k^{*} \)) was determined based on the Hatemi-J information criterion. According to Hatemi-J (2008), this information criterion is robust to conditional heteroskedasticity, and it performs well when the vector autoregressive model is used for prediction.

The inflation rates can be considered as a non-stationary process at the frequency annual. Thus, the causality relationship should be tested by cumulative shocks and an additional unrestricted lag based on the framework introduced by Hatemi-J (2012) and Toda and Yamamoto (1995). However, the inflation rates were found to be stationary processes at the frequencies zero, \( \pi /2 \) and 1/2, so the causality relationship was tested using shocks in the framework introduced by Hatemi-J (2012) and Granger (1969).

The null hypothesis stating “positive inflation shock does not cause inflation uncertainty” was rejected for 11 studied countries including Canada, China, Germany, India, Iran, Japan, Mexico, Peru, Saudi Arabia, South Africa, Thailand, and Turkey. Thus, an increase in the inflation rate of these countries leads to higher inflation uncertainty. Furthermore, the results indicated that the negative inflation shock is related to lower uncertainty for 12 studied countries such as Austria, China, Finland, Germany, Mexico, Netherlands, New Zealand, Peru, Singapore, Switzerland, Turkey, and UK. Therefore, Friedman-Ball Hypothesis was confirmed for at least one of positive or negative shocks among 21 studied countries.

This result is complementary to the recent findings in the studies by Fountas (2010), Jiranyakul and Opiela (2010), Balcilar et al. (2011), Karahan (2012), Hartmann and Herwartz (2014), Daniela et al. (2014), Nasr et al. (2015), Falahi and Hajamini (2015), Su et al. (2017), Jiang (2016), Balaji et al. (2016), and Albulescu et al. (2019), where inflation was found to significantly raises inflation uncertainty in the most countries. However, it should be noted that this result is often confirmed only for one positive or negative shock. In addition, while this study found no significant causality, the result did not match the evidence from Italy, Sweden, US, Indonesia, Malaysia, and Philippines found in the studies by Fountas (2010), Jiranyakul and Opiela (2010), Balcilar et al. (2011), and Albulescu et al. (2019) showing supporting evidence in favor of Friedman-Ball Hypothesis.

According to Cukierman-Meltzer hypothesis, the inflation uncertainty influences inflation rate directly, because the central bank plays the incentive role for stimulating output by creating monetary policy surprises. Table 4 shows that the positive shocks of uncertainty result in increasing inflation for 8 countries including Australia, Brazil, China, Germany, Italy, Malaysia, Netherlands, and Philippines. Also the negative shocks of uncertainty lead to lower inflation for 7 countries such as Austria, India, Indonesia, Netherlands, Spain, Turkey, and UK. As a result, Cukierman-Meltzer hypothesis was confirmed only for 11 countries, and the empirical findings failed to support this hypothesis for most countries.

In general, the results are similar to those of the studies by Fountas (2010), Jiranyakul and Opiela (2010), Balcilar et al. (2011), Karahan (2012), Hartmann and Herwartz (2014), Daniela et al. (2014), Nasr et al. (2015), Falahi and Hajamini (2015), Chowdhury et al. (2018), and Albulescu et al. (2019), where inflation uncertainty leads to higher rate of inflation. However, the result did not match the evidence from Canada, France Singapore, Thailand, and US found in the studies by Jiranyakul and Opiela (2010), Bhar and Mallik (2010), Neanidis and Savva (2013), and Chowdhury et al. (2018), and Albulescu et al. (2019).

Briefly, the causality between inflation and its uncertainty was confirmed for 27 countries, while no causal relationship was observed for 6 countries including Belgium, France, Norway, South Korea, Sweden, and US. Furthermore, the causality between inflation and its uncertainty was found to be bi-directional for countries of China and Germany among the cases in which shocks were positive, while negative shocks occurred for Austria, Netherlands, Turkey, and UK. The empirical evidence in favor of Cukierman-Meltzer hypothesis was found to be weaker than Friedman-Ball hypothesis. This finding is consistent with those of the previous studies (Table 1), which they often showed strong support for the Friedman-ball hypothesis, but they found mixed results for the Cukierman–Meltzer hypothesis.

Conclusion

Economists have studied the relationship between inflation and inflation uncertainty for a long period of time, because it is regarded as an important factor in determining monetary policy for the central banks. Most of empirical studies investigated this relation using a linear model and symmetric causality test. However, there are evidences regarding the asymmetric and non-linear dynamics which provide a strong incentive to employ more sophisticated models for better understanding of the relationship between inflation and uncertainty.

In this regard, this study attempted to extend the existing literature by testing the non-linearity of inflation process and asymmetric causality between inflation and its uncertainty. For this purpose, the quarterly collected data sets related to 33 developed and developing countries during 1988Q4-2016Q3 were used. In general, the results confirmed that there is an asymmetry in the inflation behavior, which can be specified by the inflationary regimes of STAR models and separating positive and negative shocks in causality test.

According to the prediction of Friedman-Ball hypothesis, the evidences of asymmetric causality test showed that inflation significantly raises inflation uncertainty for at least one of the positive or negative shocks among 21 countries. Although the countries experience different monetary policies at the disposal of different central banking institutions, the findings have shown that inflation increases inflation uncertainty. When an inflationary shock occurs, public does not know whether the monetary authority will follow a tight monetary policy to reduce inflation or not. Also public cannot predict how much and how quickly prices will respond to monetary policy. Therefore, policy-making faces positive shocks with respect to stabilization of inflation especially in developing countries, where it should be more emphasized.

Conversely, uncertainty about future inflation has positive predictive power for inflation only for 11 countries, supporting the Cukierman-Meltzer hypothesis. This can be characterized as an opportunistic behavior of monetary authority in these countries. The opportunistic behavior may originate from the less independence and poor governance, so that it causes the monetary authority not to pursue anti-inflationary policies. In addition, the opportunistic response may be as a result of the presence of mixed types of policy-makers monetary and fiscal authorities. Indeed the high inflation may be originated from erratic government policies. The public is well anticipating that fiscal policy response influences both demand and supply shocks as well monetary policy and so may contribute to rising inflation in the economy. Therefore, monetary and fiscal policies need to be coordinated to reduce uncertainty about future inflation effectively and subsequently, so that the actual rate of inflation is determined.

This study was aimed to investigate only the inflation-uncertainty relationship; however, both the inflation and its uncertainty lead to uncertainty about other variables, retardation of economic growth, and also misallocation of resources in the economy. Therefore, the incentive for reducing the inflation is clear, and monetary and fiscal authorities should attempt to keep the inflation stable and at low level, and thus helping to boost investment, employment and growth.

The results showed important implications for macroeconomic modelling and policy-making. First, since the empirical evidence in favor of Friedman-Ball hypothesis was found to be stronger than Cukierman-Meltzer hypothesis, the monetary authorities must have a quick, effective and efficient policy in response to inflation. So that it helps to reduce the inflation and minimizing its marginal effect on inflation uncertainty. If all policy-makers prefer toward inflation stabilization and adjusting the money growth rate differently with respect to the level of inflation uncertainty, inflation uncertainty may have no predictive power for inflation. It will help to stabilize expectations of inflation and then helping to control inflationary shocks.

Second, when inflationary shocks occur, even if public knows that the monetary and fiscal authority will follow tight policies to reduce inflation, they cannot predict how much and how quickly prices will respond to these policies. In fact, uncertainty-inflation relation is observed because the timing and short-run effect of policy on inflation are uncertain. Therefore, in order to rationalize as well as anchoring the public’s inflation expectations, it is suggested to inform people regularly and adequately regarding the information on inflation shocks as well.

Third, although the true relationship between inflation and its uncertainty is yet unclear, and it is considered as a potential research question to be pursued, but non-linear and asymmetric models were found to be more successful for investigation of the inflation-uncertainty relationship. Therefore, it is suggested to conduct future studies on the type of inflation targeting, monetary policy rules and stabilization policies which can be consistent with these asymmetric behaviors. Furthermore, the inflation-uncertainty relationship was found to be significantly different for positive and negative shocks. These results provide new insights for estimation of the welfare costs of inflationary and deflationary policies. Also since inflation can be detrimental to economic growth through uncertainty about future inflation, it would be interesting to find whether positive and negative shocks may influence economic growth.

Notes

First, when inflation is more unpredictable, investors will require higher expected returns, subsequently interest rates will be expected to be higher. Therefore, businesses and consumers will invest less in equipment and durable goods, respectively. Second, one occurs when the uncertainty is transmitted to other economic variables influencing economic decisions of consumers and businesses. For example, uncertainty about interest rates, wages, tax rates, and profits may induce businesses to delay investment and production decisions. Third, one occurs when businesses spend resources to improve their forecast of inflation, and also try to hedge against unexpected inflation using derivative instruments. Thus resources are diverted from other more productive activates.

Thus, Friedman’s theory includes two hypotheses, which only the first one is studied in the present paper.

Toda and Phillips (1993a) argue that Granger causality test may not be reliable for non-stationary variables. Furthermore, regarding Johnson-type ECM model as alternative approach, some such as Rahbek and Mosconi (1999), Toda and Yamamoto (1995), Toda and Phillips (1993b), and Reimers (1992) indicated that the robustness of the hypothesis tests significantly decreases if the variables are not integrated in order one.

Quarterly adjusted data were used in this study, as the inflation rate displays some forms of seasonal variation.

References

Albulescu, C., A.K. Tiwari, S.M. Miller, and R. Gupta. 2019. Time-frequency relationship between inflation and inflation uncertainty for the US: evidence from historical data. Scottish Journal of Political Economy. https://doi.org/10.1111/sjpe.12207.

Amano, R. 2007. Inflation persistence and monetary policy: A simple result. Economics Letters 94: 26–31.

Bacon, D.W., and D.G. Watts. 1971. Estimating the transition between two intersecting straight lines. Biometrika 58: 525–534.

Baillie, R., C. Chung, and A. Tieslau. 1996. Analysing inflation by the fractionally integrated ARFIMA-GARCH model. Journal of Applied Econometrics 11: 23–40.

Balaji, B., S.R.S. Durai, and M. Ramachandran. 2016. The dynamics between inflation and inflation uncertainty: Evidence from india. Journal of Quantitative Economics 14 (1): 1–14.

Balcilar, M., Z.A. Ozdemir, and E. Cakan. 2011. On the nonlinear causality between inflation and inflation uncertainty in the G3 countries. Journal of Applied Economics. 14 (2): 269–296.

Ball, L. 1992. Why does high inflation raise inflation uncertainty? Journal of Monetary Economics 29: 371–388.

Berument, H., and N.N. Dincer. 2005. Inflation and inflation uncertainty in the G-7 countries. Physica A 348: 371–379.

Bhar, R., and M. Mallik. 2010. Inflation, inflation uncertainty and output growth in the USA. Physica A 389: 5503–5510.

Bollerslev, T. 1986. Generalized autoregressive conditional heteroscedasticity. Journal of Econometrics 31: 307–327.

Buth, B., M. Kakinaka, and H. Miyamoto. 2015. Inflation and inflation uncertainty: The case of Cambodia, Lao PDR, and Vietnam. Journal of Asian Economics 28: 31–43.

Chan, K.S. 1993. Consistency and limiting distribution of the least squares estimator of a threshold autoregressive model. The Annals of Statistics 21: 520–533.

Chan, K.S., and H. Tong. 1986. A note on certain integral equations associated with non-linear series analysis. Probability Theory and Related Fields 73: 153–158.

Chang, K.-L. 2012. The impacts of regime-switching structures and fat-tailed characteristics on the relationship between inflation and inflation uncertainty. Journal of Macroeconomics 34: 523–536.

Chen, S.-W., and C.-S. Hsu. 2016. Threshold, smooth transition and mean reversion in inflation: New evidence from European countries. Economic Modelling 53: 23–36.

Chesang, L.K., and R. Naraidoo. 2016. Parameter uncertainty and inflation dynamics in a model with asymmetric central bank preferences. Economic Modelling 56: 1–10.

Chowdhury, K.B., S. Kundu, and N. Sarkar. 2018. Regime-dependent effects of uncertainty on inflation and output growth: Evidence from the United Kingdom and the United States. Scottish Journal of Political Economy. 65: 390–413.

Civelli, A., and N. Zaniboni. 2014. Supply side inflation persistence. Economics Letters 125: 191–194.

Cogley, T., and T.J. Sargent. 2002. Evolving post-World War II U.S. inflation dynamics. NBER Macroeconomics Annual. 16: 331–388.

Conrad, C., and M. Karanasos. 2005a. On the inflation-uncertainty hypothesis in the USA, Japan and the UK: A dual long-memory approach. Japan and the World Economy 17: 327–343.

Conrad, C., and M. Karanasos. 2005b. Dual long memory in inflation dynamics across countries of the Euro area and the link between inflation uncertainty and macroeconomic performance. Studies in Nonlinear Dynamics and Econometrics. 9 (4): 5.

Cuikerman, A., and A. Meltzer. 1986. A theory of ambiguity, credibility and inflation under discretion and asymmetric information. Econometrica 54: 1099–1128.

Cukierman, A. 1992. Central bank strategy, credibility, and independence. Cambridge, MA: MIT Press.

Daal, E., A. Naka, and B. Sanchez. 2005. Re-examining inflation and inflation uncertainty in developed and emerging countries. Economics Letters 89: 180–186.

Daniela, Z., C. Mihail-Ioana, and P. Sorina. 2014. Inflation uncertainty and inflation in the case of Romania, Czech Republic, Hungary, Poland and Turkey. Procedia Economics and Finance 15: 1225–1234.

Dmitriev, M., and E.K. Kersting. 2016. Inflation level and inflation volatility: A seigniorage argument. Economics Letters 147: 112–115.

Doyle, M., and B. Falk. 2010. Do asymmetric central bank preferences help explain observed inflation outcomes? Journal of Macroeconomics 32: 527–540.

Eitrheim, Ø., and T. Teräsvirta. 1996. Testing the adequacy of smooth transition autoregressive models. Journal of Econometrics 74: 59–75.

Engle, R.F. 1982. Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica 50: 987–1007.

Evans, M. 1991. Discovering the link between inflation rates and inflation uncertainty. Journal of Money, Credit, and Banking 23: 169–184.

Falahi, M.A., and M. Hajamini. 2015. Relationship between inflation and inflation uncertainty in Iran: An application of SETAR-GARCH model. Journal of Money and Economy 10 (2): 69–90.

Falahi, M.A., and M. Hajamini. 2017. Asymmetric behavior of inflation in Iran: New evidence on inflation persistence using a smooth transition model. Iranian Economic Review 21 (1): 101–120.

Fischer, S., R. Sahay, and C.A. Végh. 2002. Modern hyper- and high inflations. Journal of Economic Literature 40: 837–880.

Fountas, S. 2010. Inflation, inflation uncertainty and growth: Are they related. Economic Modeling 27: 869–899.

Fountas, S., and M. Karanasos. 2007. Inflation, output growth, and nominal and real uncertainty: Empirical evidence for the G7. Journal of International Money and Finance 26: 229–250.

Friedman, M. 1977. Nobel lecture: Inflation and unemployment. Journal of Political Economy 85: 451–472.

Giannellis, N. 2013. Asymmetric behavior of inflation differentials in the euro area: Evidence from a threshold unit root test. Research in Economics 67: 133–144.

Golob, J.E. 1994. Does inflation uncertainty increase with inflation? Economic Review-Federal Reserve Bank of Kansas City 79: 27.

Granger, C.W.J. 1969. Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37 (3): 424–438.

Granger, C.W.J., and T. Teräsvirta. 1993. Modelling nonlinear economic relationships. Oxford: Oxford University Press.

Grier, K.B., and M.J. Perry. 1996. Inflation, inflation uncertainty and relative price dispersion: evidence from bivariate GARCH-M models. Journal of Monetary Economics 38: 391–405.

Grier, K.B., and M.J. Perry. 1998. On inflation and inflation uncertainty in the G7 countries. Journal of International Money and Finance 17: 671–689.

Grier, K.B., and M.J. Perry. 2000. The effects of real and nominal uncertainty on inflation and output growth: Some GARCH-M evidence. Journal of Applied Econometrics 15: 45–58.

Hansen, B.E. 1996. Inference when a nuisance parameter is not identified under the null hypothesis. Econometrica 64: 413–430.

Hansen, B.E. 1997. Inference in TAR models. Studies in Nonlinear Dynamics and Econometrics 2: 1–14.

Hansen, B.E. 1999. Testing for linearity. Journal of Economic Surveys 13: 551–576.

Hansen, B.E. 2000. Sample splitting and threshold estimation. Econometrica 68: 575–603.

Hasbrouck, J. 1979. Price variability and lagged adjustment in money demand (Mimeograph). Philadelphia, PA: University of Pennsylvania.

Hartmann, M., and H. Herwartz. 2014. Causal relations between inflation and inflation uncertainty-Cross sectional evidence in favor of the Friedman-Ball hypothesis. Economics Letters 115: 144–147.

Hatemi-J, A. 2008. Forecasting properties of a new method to choose optimal lag order in stable and unstable VAR models. Applied Economics Letters 15 (4): 239–243.

Hatemi-J, A. 2012. Asymmetric causality tests with an application. Empirical Economics 43: 447–456.

Hylleberg, S., R.F. Engle, C.W.J. Granger, and B.S. Yoo. 1990. Seasonal integration and cointegration. Journal of Econometrics 44: 215–238.

Jiang, D. 2016. Inflation and inflation uncertainty in China. Applied Economics 48 (41): 1–9.

Jiranyakul, K., and T.P. Opiela. 2010. Inflation and inflation uncertainty in the ASEAN-5 economies. Journal of Asian Economics 21: 105–112.

Karahan, Ö. 2012. The Relationship between Inflation and Inflation Uncertainty: Evidence from the Turkish Economy. Procedia Economics and Finance 1: 219–228.

Kline, B. 1977. The demand for quality-adjusted cash balance: Price uncertainty in the U.S. demand for money function. Journal of Political Economy 85: 691–715.

Komlan, F. 2013. The asymmetric reaction of monetary policy to inflation and the output gap: Evidence from Canada. Economic Modelling 30: 911–923.

Kontonikas, A. 2004. Inflation and inflation uncertainty in the United Kingdom, evidence from GARCH modeling. Economic Modelling 21: 525–543.

Luukkonen, R., P. Saikkonen, and T. Teräsvirta. 1988. Testing linearity against smooth transition autoregressive models. Biometrika 75: 491–499.

Meller, B., and D. Nautz. 2012. Inflation persistence in the Euro area before and after the European Monetary Union. Economic Modelling 29: 1170–1176.

Nasr, A.B., M. Balcilar, A.N. Ajmi, G.C. Aye, R. Gupta, and R.V. Eyden. 2015. Causality between inflation and inflation uncertainty in South Africa: Evidence from a Markov-switching vector autoregressive model. Emerging Markets Review 24: 46–68.

Neanidis, K.C., and C.S. Savva. 2013. Macroeconomic uncertainty, inflation and growth: Regime-dependent effects in the G7. Journal of Macroeconomics 35: 81–92.

Nonejad, N. 2018. Has the 2008 financial crisis and its aftermath changed the impact of inflation on inflation uncertainty in member states of the European Monetary Union? Scottish Journal of Political Economy 66 (2): 1–31.

Okun, A. 1971. The Mirage of steady inflation. Brooking Papers on Economic Activity 2: 485–498.

Özdemir, A.Z., and M. Fisunoğlu. 2008. On the inflation-uncertainty hypothesis in Jordan, Philippines and Turkey: A long memory approach. International Review of Economics & Finance 17: 1–12.

Qin, L., M. Sidiropoulos, and E. Spyromitros. 2013. Robust monetary policy under model uncertainty and inflation persistence. Economic Modelling 30: 721–728.

Rahbek, A., and R. Mosconi. 1999. Cointegration rank inference with stationary regressors in VAR models. Econometrics Journal 2: 76–91.

Reimers, H.-E. 1992. Comparisons of tests for multivariate cointegration. Statistical Papers 33 (1): 335–359.

Su, C.W., H. Yu, H.L. Chang, and X.L. Li. 2017. How does inflation determine inflation uncertainty? A Chinese perspective. Quality & Quantity 51 (3): 1417–1434.

Surico, P. 2007. The Fed’s monetary policy rule and U.S. inflation: The case of asymmetric preferences. Journal of Economic Dynamics & Control 31: 305–324.

Teräsvirta, T. 1994. Specification, estimation, and evaluation of smooth transition autoregressive models. Journal of the American Statistical Association 89: 208–218.

Teräsvirta, T. 1998. Modelling economic relationships with smooth transition regressions. In Handbook of applied economic statistics, ed. A. Ullah and D.E.A. Giles, 507–552. New York: Marcel Dekker.

Teräsvirta, T., D. Dijk, and M.C. Medeiros. 2005. Linear models, smooth transition autoregressions, and neural networks for forecasting macroeconomic time series: A re-examination. International Journal of Forecasting 214: 755–774.

Thorton, J. 2007. The relationship between inflation and inflation uncertainty in emerging market economies. Southern Economic Journal 73: 858–870.

Toda, H.Y., and T. Yamamoto. 1995. Statistical inference in vector autoregressions with possibly integrated processes. Journal of Econometrics 66: 225–250.

Toda, H.Y., and P.C.B. Phillips. 1993a. The spurious effect of unit roots on vector autoregressions: An analytical study. Journal of Econometrics 59 (3): 229–255.

Toda, H.Y., and P.C.B. Phillips. 1993b. Vector autoregressions and causality. Econometrica 61 (6): 1367–1393.

Tong, H. 1978. On a threshold model. In Pattern recognition and signal processing, ed. C.H. Chen. Amsterdam: Sijthoff and Noordhoff.

Tsay, R.S. 1989. Testing and modeling threshold autoregressive processes. Journal of the American Statistical Association 84: 231–240.

Tsay, R.S. 1998. Testing and modeling multivariate threshold models. Journal of the American Statistical Association 93: 1188–1202.

Tsong, C.-C., and C.-F. Lee. 2011. Asymmetric inflation dynamics: Evidence from quantile regression analysis. Journal of Macroeconomics 33: 668–680.

Ungar, M., and B.-Z. Zilberfarb. 1993. Inflation and its unpredictability-theory and empirical evidence. Journal of Money, Credit and Banking 25 (4): 709–720.

Varlik, S., V. Ulke, and H. Berument. 2017. The time-varying effect of inflation uncertainty on inflation for Turkey. Applied Economics Letters 24 (13): 961–967.

Wilson, B.K. 2006. The links between inflation, inflation uncertainty and output growth: New time series evidence from Japan. Journal of Macroeconomics 28: 609–620.

Yellen, J.L. 2017. Inflation, uncertainty, and monetary policy. Business Economics 52 (4): 194–207.

Zhang, C. 2011. Inflation persistence, inflation expectations, and monetary policy in China. Economic Modelling 28: 622–629.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Hajamini, M. Asymmetric Causality Between Inflation and Uncertainty: Evidences from 33 Developed and Developing Countries. J. Quant. Econ. 17, 287–309 (2019). https://doi.org/10.1007/s40953-019-00165-z

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40953-019-00165-z