Abstract

In this paper we investigate the dynamic conditional correlations between the equity and commodity returns for G7 countries from January, 2000 to October, 2014. The commodity futures include Brent, crude, gold, silver, wheat, corn and soybean futures, BCOM and CRB which are two aggregate commodity price indices. The results illustrate the lowest dynamic conditional correlations belong to the portfolios that include gold, wheat and corn futures for all the Equity indices. In addition, the correlations between the gold/equity pairs are negative during the financial crisis. This fact indicates the benefit of hedging stock portfolios with gold futures whenever we have stress in the financial markets. The findings from hedging effectiveness suggest that there are diversification advantages for all the commodity/stock portfolios than only stock portfolios. Finally, including CRB, BCOM and gold future to stock portfolios provides the optimal hedging effectiveness ratios. These findings can be helpful in developing new commodity indices.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Over the last few decades there have been excess volatilities in the financial markets especially during different financial crises. This uncertainty in the markets cause investors to be more concerned about their decision-making process and to look for proper hedging instruments to overtake these undesired volatilities in their expected returns.

This research integrates different lines of studies that conduct the correlations in the financial markets. Previous studies have tried to find the spillover volatility between different financial markets. Additionally, new literature has analyzed the portfolio construction and hedging effectiveness.

Bekaert and Harvey (1997) examine the volatility in emerging stock markets from 1976 to 1992. They study the effect of local and world factors on emerging stock returns employing a volatility spillover model. Their findings suggest that the international factors impact on the volatility in emerging markets is very small. Ng (2000) analyzes the effect of international and regional factors in the Pacific-Basin region. The results indicate that both world and regional factors influence the Pacific-Basin stock markets although world factors have higher impact. Skintzi and Apostolos (2006) examine the volatility spillover in the US and the aggregate Euro area bond markets to twelve individual European bond markets. They find that there are significant volatility spillovers from the Euro zone bond market and the US bond market to the individual European markets. Mishra and Panda (2016) apply the daily returns of S&P CNX Nifty to analyze the robustness of implied volatility oppose to the backward looking volatility. The findings suggest that Conditional Volatility gives a preferable prediction of realized volatility than forward looking volatility and other backward looking volatility.

Levy and Lerman (1988) and Izadi and Hassan (2017) find a positive and significant relationship between the equity market and the bond yield spreads in different regions, indicating a strong relationship between fixed income and stock markets in developed countries. By analyzing the US and UK financial markets between January 1990 and June 2010, Ciner et al. (2013) find that on average the bond market plays a hedging role in the equity market.

Hillier et al. (2006), using the daily data from 1976 to 2004, study the diversifying benefits of including precious metals (gold, silver and platinum) to the portfolios of stocks. They find a low correlation between precious metals and stock index indicating that these metals may provide diversification in investments. They also find that these hedging abilities increase during crisis periods. Arouri et al. (2011) examine the volatility transmission between oil and sector stock markets in Europe and the United States using various GARCH-based models. They find that all the models (VAR-GARCH, BEKK-GARCH, DCC-GARCH and CCC-GARCH) similiarly indicate that including the oil commodity to well-diversified portfolios improves their risk-adjusted returns. Antonakakis and Badinger (2012) analyze the spillover between output growth and output growth volatility for G7 countries using the VAR-based spillover index approach. They employ the real industrial production index for measuring output. They find that spillovers increase after the mid-1980s and the US has the major effect in transmitting the volatilities to other G7 countries. The findings also indicate that volatility shocks grow in the long run and there is a negative cross-variable effect between volatility shocks and economic growth.

Vivian and Wohar (2012) using a GARCH model, analyze whether there are structural breaks in commodity spot returns volatility from 1985 to 2010. The empirical findings suggest supply or demand factors in the commodity markets could determine the volatility. They also find that many commodity returns experience high volatility even after structural breaks. Mensi et al. (2013), employing a VAR-GARCH model, examine the correlation and volatility spillover between equity and commodity markets. They study the daily returns of the commodity futures (Brent, WTI, Wheat, Gold), beverage spot prices and S&P 500 returns from 2000 to 2011. The findings illustrate significant correlation and volatility spillover across commodity and US stock market. They also calculate the greatest weights and hedge ratios for the commodity-stock portfolios. They conclude that including commodity to a well-diversified stock portfolio improve its overall return after adjusting for risk. Chang et al. (2013) examine the volatility spillovers between crude oil and stock indices returns applying several multivariate GARCH models like, CCC, DCC, VARMA-GARCH and VARMA-AGARCH. Their results indicate significant conditional correlation between crude oil and stock returns only based on DCC model. Lee et al. (2014) applies BEKK, CCC and DCC models to investigate the volatility spillover between stock price and oil price. Their empirical results show that the DCC model is preferred to the CCC model and the BEKK model.

Gao and Lu (2014) study the volatility and correlation of seven commodity futures and S&P 500 during 1979 to 2010 applying a bivariate model of switching autoregressive conditional heteroskedasticity (SWARCH). The results show that the return volatilities are not correlated and there is risk diversification between commodity futures and stocks.

Kumar (2014) studies the return and volatility spillover between gold and Indian industrial sectors employing the vector autoregressive asymmetric dynamic conditional heteroskedasticity (ADCC-BVGARCH) model from 1999 to 2012. The results show a significant return transmission from gold to Indian industrial sectors but not any significant evidence for volatility spillover. He also finds that negative values of conditional correlation mainly occur during the period of crisis illustrating the advantage of portfolio diversification during these durations. The findings from hedging effectiveness suggest that including gold in stock portfolios can manage the investment risk. Aydogan (2017) studies the effects of investor sentiment on volatility of nine stock markets from January, 2004 to June, 2015. The results indicate that portfolio performance can be improved by contemplating investor sentiment.

In this paper, we aim to analyze stocks portfolio execution after including commodities. The factors that determine commodity prices such as weather conditions, storage and transportation costs, etc. are particular to commodities. Therefore the behavior of commodity prices is different from that of stocks and bonds (see Symeonidis et al. 2012).

We are not able to find any comprehensive paper that investigates the role of several commodity futures in diversifying stock portfolios in the context of developed financial nations. The goal of this research is to examine the dynamic conditional returns, the hedge ratios, optimal portfolio weights and hedging effectiveness for several commodity/stock pairs in G7 countries. The stock indices of G7 countries include United States (SPX), Canada (SPTSX), France (CAC), Germany (DAX), Italy (FTSMIB), Japan (NKY) and the United Kingdom (UKX). The commodities include the index of Bloomberg commodity-contracts on 22 physical commodities (BCOM), Crude and Brent oil futures, gold and silver futures, wheat, corn and soybean futures and CRB Index (commodity research BUREA BLS/US spot all commodities). First, we apply the time-varying conditional correlation GARCH model. The conditional variance and covariance estimates from the DCC-GARCH model are utilized to project the greatest hedge ratios. Consequently, we compute the optimal portfolio weights and hedging effectiveness for the commodity/equity pairs in the context of portfolio management.

The remaining of this research is divided into three parts. Section 2 explains the data and research methodology. Section 3 reports the empirical findings, and finally Sect. 4 describes the overview of the main results and conclusion.

2 Data and research methodology

2.1 Data description

We employ daily data returns from the Bloomberg database for several commodities and stock indices of seven financially developed countriesFootnote 1 from January 3, 2000 to October 24, 2014. The commodity indices we analyze in this study include BCOM Index (Bloomberg commodity- contracts on 22 physical commodities), crude and Brent oil futures, gold and silver futures, wheat, corn and soybean futures and CRB Index (commodity research BUREA BLS/US spot all commodities).

2.2 Dynamic conditional correlations model (DCC-GARCH (1.1))

Engle (2002) analyzes the veracity of the correlations estimated by different methods. He finds that the bivariate form of dynamic conditional correlation model compared to classic multivariate GARCH and different models is the most accurate one. Let rs,t and rc,t be two conditional returns that are normally distributed with zero mean and 2 × 2 conditional covariance matrix, Ht. The DCC-GARCH model is formulized as follows:

where Pt is the conditional correlation matrix and Dt = diag (h11 0.5, h22 0.5) is a diagonal matrix with time-varying standard deviations from the estimation of univariate GARCH(1,1) model:

and,

where Qt is a (2 \(\times\) 2) symmetric positive definite matrix, Qt = (q ijt ), and DCC(1,1) model is given as:

where Ǭ is a (2 × 2) matrix of the unconditional correlation of standardized residuals and Zt is the standardized retunes. θ1 and θ2 are equal or greater than zero scalars and it is assumed that θ1 + θ2 < 1. The dynamic conditional correlations are estimated as follow:

where qt is the conditional variance covariance of Zt.

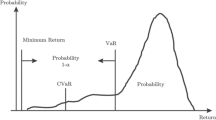

2.3 Hedge ratio

To hedge a portfolio, first we need to find how the returns of the assets are correlated within the portfolios. Since the volatilities and correlations are changing during the time, the hedge ratio should be modified for the latest data (See Engle 2002).

Following Baillie and Myers (1991), the return on a portfolio of two asset classes like commodity and stock can be indicated as:

where RH,t is return on hedge portfolio, Rs,t is return on stock, Rc,t is return on commodity and βt is the hedge ratio.

The conditional variance of the hedge portfolio, obtained from the GARCH-DCC model, is:

The optimal hedge ratio is the ht that minimizes the variance of the hedge portfolio returns (see Baillie and Myers 1991; Kroner and Sultan 1993; Kumar 2014). Therefore, by taking a partial derivatives respect to βt we can obtain the optimal hedge ratio.

If we show the conditional covariance between commodity and stock with h c,st and the conditional variance of the stock with h s,st and make the partial derivatives equal to zero, we have:

Therefore,

where h COM,STOCKt is the conditional covariance between commodity and stock at time t and h STOCK,STOCKt is the conditional variance of stock return series at time t. It means that a 1$ long position in a commodity can be hedged by a β COM,STOCK t dollars short position in the stock.

2.4 Optimal portfolio weights

For constructing a commodity/stock portfolio, we need to have the optimal weight of each asset in the portfolio that minimizes the risk. Pursuing Kroner and Ng (1998) and Kumar (2014), the greatest portfolio weights can be computed by minimizing the portfolio risk without influencing the expected return.

where W COM, STOCK t is the weight on the first asset in a portfolio of two assets (optimal weight of a commodity in our study) at time t. We also compute the weight on the second asset as 1 − W COM,STOCK t .

2.5 Hedging effectiveness

Ku et al. (2007), Guo et al. (2013) and Kumar (2014) suggest a formula for calculating the hedging effectiveness (HE) across the constructed portfolios. The higher HE of a proposed portfolio indicates that we decrease the risk of the portfolio by adding the second asset.

where Variancehedged indicates the variance of commodity/stock portfolio returns and Varianceunhedged indicates the variance of stock portfolio returns.

2.6 Descriptive statistics

Table 1 reports the descriptive statistics of all stock indices daily returns. We compute the returns utilizing the following logarithmic model:

where ri,t and Pi,t denote the daily return in percentage and the closing price of index i on day t, respectively.

The results of Table 1 Panel A show that the Toronto stock index, SPTSX, has the highest mean daily return among other G7 countries, however, Germany has the highest median daily return. Germany stock Index, DAX, seems to be more volatile than other indices. Except for the France stock index, CAC, all other returns are negatively skewed.

Table 1 Panel B presents descriptive statistics of nine commodity futures daily returns. Gold future index with 0.017% average daily returns has the highest mean. Brent, silver and crude future indices, by 0.015%, 0.014% and 0.013% respectively, have the next higher means. Brent future index with an average of 0.022% daily returns has the highest median and crude oil future index is the most volatile commodity in our sample. In addition, the Jarque–Bera statistic confirms the significant non-normality in all the return series.

2.7 Unit root test and ARCH-LM test

We perform the Augment Dickey–Fuller (ADF) and PP unit root tests for examining the stationary process of the return series. The results of these tests are shown in Table 2. Panel A indicates the results of the Unit root test. The null hypothesis of having unit root test is rejected, indicating that all the return series are stationary at 1% level. We also adopt ARCH-LM test by Engle (1982) for analyzing the significance of the time-varying conditional variance. Panel B indicates the evidence in support of the presence of conditional heteroskedasticity in the return series and therefore estimation of a GARCH model is appropriate.

Table 3 describes the correlation coefficients between commodity and stock markets daily return series. The returns of SPTSX and BCOM price indices show the highest correlation (0.396) among other pairs. Table 3 shows a negative correlation between S&P 500 and DAX with gold future returns indicating the advantage of diversification in the short term. Japan stock index daily return, NKY, has almost the lowest correlation with the commodity return series among G7 countries.

3 Empirical results and analysis

This section describes the maximum likelihood estimates of the DCC-GARCH models to estimate the time varying volatility and correlation in commodity/stock pairs. We also use the variance and covariance estimates to find the hedge ratios and the optimal portfolio weights for each commodity/stock pairs. At the end, we report the hedging effectiveness of all constructed portfolios.

3.1 Time varying conditional correlation (DCC-GARCH (1.1))

Tables 4, 5, 6, 7, 8, 9, and 10 illustrate the summary statistics for dynamic conditional correlation measures between the equity index and commodity futures for the seven developed countries. Panel A in each table provides the statistics over the full sample period (Jan. 2000 to Oct. 2014).

For indicating the behavior of commodity/stock correlation during the recessions, we include the U.S. business cycles reference dates to our models. These data are collected from the National Bureau of Economic Research. Therefore, we present the results of DCC coefficients during the first U.S. recession (March 2001–Nov. 2001) in Panel B. The summary statistics during the recent recession (Dec. 2007–June 2009) are indicated in Panel C.

Table 4 Panel A shows that gold futures have the lowest conditional correlation with SPX following by wheat, corn and silver futures during the full sample period. Panel B indicates that DCC coefficients between commodities and SPX decline during the recession period in 2001. We observe a negative DCC between gold futures and SPX (− 0.04). Panel C shows those DCC coefficients between SPX and a few commodity futures (gold, silver, corn and soybean) decrease during the crisis periods compared to the full sample period. The DCC coefficient between SPX and gold still shows a negative sign.

Table 5 Panel A shows smaller DCC coefficients between SPTSX with wheat, corn, soybean and gold futures. The statistics presented in panel B indicate that the average DCC coefficients drop in sub-period B compared to the full sample period. The gold futures show a negative correlation with SPTSX during the recession period showing its diversification potential. During the recent recession, gold futures have the lowest dynamic conditional correlation with SPTSX.

The results of Panel A in Table 6 illustrate smaller DCC coefficients between CAC with gold, wheat and corn futures. During sub-period B the DCC coefficient between CAC with gold and CRB is negative. In addition, during the recent recession gold has a negative conditional correlation with CAC.

Table 7 indicates that gold and wheat futures have the smallest DCC coefficient with DAX in the entire sample period. During sub-period B the conditional correlations between DAX with most of the commodities decrease. The gold futures correlate to DAX with a negative sign in both recession periods. Panel C of Table 7 shows that gold and silver futures have the lowest correlations with DAX during the recent recession period.

Table 8 Panel A indicates the lower DCC coefficients between FTSMIB with gold, wheat and corn futures from January, 2000 to October, 2014. During the sub-period B the correlations between FTSMIB and most of the commodities show a smaller number. Among all the commodities gold and silver futures have the lowest correlations with the equity index and the coefficient for the former is negative, meaning that gold futures are the best instrument for diversification objective in Italy stock market during the recession periods.

Table 9 Panel A shows corn, wheat and gold futures have the lowest correlation coefficients with NKY. The means and standard deviations of the DCC coefficients between NKY and commodity futures are smaller compared to other countries. Panel B and C indicate that the conditional correlations between NKY with the precious metals and agricultural futures are smaller during the recession periods.

Table 10 Panel A shows the lowest DCC coefficient between UKX and gold futures. According to the results presented in panel B, the conditional correlations between UKX with all the commodities decrease during the recession period. The DCC coefficient between UKX and gold futures are negative during both recession periods.

In conclusion, the results of Table 6, 7, 8, 9, and 10 indicate that during the full sample period gold, wheat and corn futures have the smallest dynamic conditional correlations with all equity indices. During the sub-period B, all stock indices except NKY (Japan) have negative conditional correlations with gold futures. The DCC coefficients between gold futures and SPX, CAC, DAX, FTSMIB and UKX show a negative sign during the recent financial recession period. The negative conditional correlation between gold/equity pairs during the financial crisis, indicate the benefit of hedging stock portfolios with gold futures while we have stress in the financial markets.

3.2 Does the market volatility determine the dynamic conditional correlation between commodity and equity?

Silvennoinen and Thorp (2013) find that increases in the VIX index are linked to higher commodity-stock correlations. Accordingly, we analyze the impact of log of VIX on commodity/stock dynamic conditional correlation coefficients.

Table 11 provides the results of the ordinary least squares (OLS) regression for each dynamic conditional correlation between commodity and stock pair over the log of implied volatility index (VIX). Our results indicate that the relationship between gold/equity conditional correlations and log of VIX are negative and significant for all the countries. We also observe negative and significant relationships between silver/equity conditional correlations and log of VIX Index in the United States, Canada, Germany and Japan. These negative coefficients indicate that in high volatile market conditions, the correlations between precious metals and G7 stock returns decrease. This fact shows a good opportunity for hedging and reducing the investment risk by including those precious metals to stock portfolios especially during uncertain conditions.

For other commodity/stock pairs, the positive coefficients illustrate that the conditional correlations between those commodity/stock pairs change in the same direction as market volatility does.

3.3 Hedge ratio

We use the estimates of conditional covariance and conditional variance from the DCC-GARCH (1,1) model to project the optimal hedge ratios (See Kroner and Sultan 1993) for all possible commodity/stock pairs using Eq. (9).

Table 12 reports the information of the average hedge ratios for commodity/stock pairs. The optimal hedge ratio indicates that a $1 long position in a commodity can be hedged with the value of the hedge ratio short position in the stock. The results show that the cheapest hedge ratio (the lowest value of the hedge ratio) is long $1 corn and short 3.1 cents NKY. The most expensive hedge ratio (the highest value of the hedge ratio) is long $1 crude and short 54.7 cents SPTSX.

Following Basher and Sadorsky (2016), we analyze out of sample performance of hedge ratios for robustness. The out of sample hedge ratios of the derived portfolios indicates lower coefficients for all the countries except Canada and Italy. For SPTSX and FTSMIB we observe slightly higher hedge ratios for most commodities.

3.4 Optimal portfolio weights

In this section, we compute the average optimal portfolio weights based on the conditional variance and covariance estimates of the DCC-GARCH (1, 1) model using Eqs. (10) and (11) (see Kroner and Ng (1998)). Table 13 presents the statistics of the optimal portfolio weights of the commodities in each commodity/stock portfolio. Among all the results, the highest average weight belongs to CRB/stock pairs which vary between 0.773 for CRB/SPTSX portfolio and 0.889 for CRB/NKY portfolio. These findings indicate that for a $1 commodity/equity portfolio how much should be invested in commodity futures. Following CRB, two other commodities (BCOM and gold futures) have the highest average weights in all the commodity/stock portfolios. The optimal weight for BCOM in a BCOM/stock portfolio varies from 0.341 in a BCOME/SPX portfolio to 0.614 in a CRB/NKY portfolio. The optimal weight of gold futures in a $1 gold/stock portfolio changes from 0.348 in the gold/SPTSX portfolio to 0.587 in the gold/NKY portfolio. In average, the crude/stock and Brent/stock portfolios show the lowest optimal weights for the commodities.

The findings in this section indicate that in constructing commodity/stock portfolios, BCOM, CRB and gold futures have the highest optimal weights. Since BCOM and CRB are two aggregate commodity indices the results suggest including a diversified commodity index to a stock portfolio is the optimal way of diversification.

In addition, according to the Bloomberg website, gold remains the highest weighted commodity in BCOM index and its composition weight for 2015 is 11.9%. This fact again persists on the diversification benefit of including gold to the stock portfolios.

3.5 Hedging effectiveness

Table 14 reports the hedging effectiveness ratios based on Eq. (12). The results indicate that including commodities to a stock portfolio decline the portfolio risk. According to the findings the variance reduction due to adding commodities in an optimal portfolio changes from 0.040 for crude/SPTSX portfolio to 9.8 for CRB/NKY portfolio. In average, the highest hedging effectiveness ratios belong to the portfolios including CRB, BCOM and gold future.

4 Conclusion

We analyze the time varying conditional correlation between commodity futures and equity returns for G7 countries from January, 2000 to October, 2014 by using a DCC-GARCH model. The commodities include BCOM Index (commodity returns of futures and spot price of 22 commodities), Brent and crude oil futures, gold and silver futures, wheat, corn and soybean futures and CRB Index. We also explore the most favorable portfolio weights, hedge ratios and hedging effectiveness for all the proposed commodity/stock portfolios.

Our findings indicate that gold, wheat and corn futures show the lowest time-varying conditional correlations with all equity indices. In addition, the negative conditional correlation between gold/equity pairs during the financial crisis illustrates the advantage of including gold futures to stock portfolios whenever there is stress in financial markets.

Furthermore, our results indicate that in high volatile market conditions the correlation between precious metals and G7 stock returns decreases. This fact shows a good opportunity for hedging and reducing the risk of stock portfolios by including precious metals especially during uncertain conditions.

The results of hedge ratios and greatest portfolio weights suggest that the investment risk in stock portfolios can be reduced by including commodities. In constructing commodity/stock portfolios, BCOM, CRB and gold futures have the highest optimal weights. We also compute the hedging effectiveness indices which suggest that all the commodity/stock portfolios provide better diversification benefits than only equity portfolios. Finally, including CRB, BCOM and gold futures to stock portfolios have the highest hedging effectiveness indices and the ability to adjust risk.

Our empirical findings can be applied for making trading strategies, introducing new commodity indices, designing optimal portfolios and improving asset allocation decisions by portfolio managers, institutional investors such as investment companies and individual investors.

Notes

The United States, Canada, France, Germany, Italy, Japan and the United Kingdom.

References

Antonakakis, N., & Badinger, H. (2012). International spillovers of output growth and output growth volatility: Evidence from the G7 countries. International Economic Journal, 26(4), 635–653.

Arouri, M., Lahiani, A., & Nguyen, D. K. (2011). Return and volatility transmission between world oil prices and stock markets of the GCC countries. Economic Modelling, 28, 1815–1825.

Aydogan, B. (2017). Sentiment dynamics and volatility of international stock markets. Eurasian Business Review, 7(3), 407–419.

Baillie, R. T., & Myers, R. J. (1991). Bivariate GARCH estimation of the optimal commodity futures hedge. Journal of Applied Econometrics, 6(2), 109–124.

Basher, S. A., & Sadorsky, P. (2016). Hedging emerging market stock prices with oil, gold, VIX, and bonds: A comparison between DCC, ADCC and GO-GARCH. Energy Economics, 54(C), 235–247.

Bekaert, G., & Harvey, C. R. (1997). Emerging equity market volatility. Journal of Financial Economics, 43(1), 29–77.

Chang, C.-L., McAleer, M., & Tansuchat, R. (2013). Conditional correlations and volatility spillovers between crude oil and stock index returns. The North American Journal of Economics and Finance, 25, 116–138.

Ciner, C., Gurdgiev, C., & Lucey, B. (2013). Hedges and safe havens: An examination of stocks, bonds, gold, oil and exchange rates. International Review of Financial Analysis, 29, 202–211.

Engle, R. F. (1982). Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Journal of the Econometric Society, 50(4), 987–1007.

Engle, R. F. (2002). Dynamic conditional correlation: A simple class of multivariate generalized autoregressive conditional heteroskedasticity models. Journal of Business & Economic Statistics, 20, 339–350.

Gao, L., & Lu, L. (2014). The volatility behavior and dependence structure of commodity futures and stocks. Journal of Futures Markets, 34(1), 93–101.

Guo, Zh., White, B., & Mugera, A. (2013). Hedge effectiveness for Western Australia Crops. In 57th AARES Annual Conference, Sydney, New South Wales, 5–8 February, 2013. Retrieved September 12, 2014 from http://ageconsearch.umn.edu/record/152154.

Hillier, D., Draper, P., & Faff, R. (2006). Do precious metals shine? An investment perspective. Financial Analysts Journal, 62(2), 98–106.

Izadi, S. (2015). Two essays in finance and economics: “Investment Opportunities in Commodity and Stock Markets for G7 Countries” and “Global and Local Factors Affecting Sovereign Yield Spreads”. University of New Orleans Theses and Dissertations. https://scholarworks.uno.edu/td/2087.

Izadi, S., & Hassan, M. K. (2017). Impact of International and Local Conditions on Sovereign bond spreads: International Evidence. Borsa Istanbul Review. https://doi.org/10.1016/j.bir.2017.08.002.

Kroner, K. F., & Ng, V. K. (1998). Modeling asymmetric movements of asset prices. Review of Financial Studies, 11, 844–871.

Kroner, K. F., & Sultan, J. (1993). Time-varying distributions and dynamic hedging with foreign currency futures. Journal of Financial and Quantitative Analysis, 28, 535–551.

Ku, Y. H. H., Chen, H. C., & Chen, K. H. (2007). On the application of the dynamic conditional correlation model in estimating optimal time-varying hedge ratios. Applied Economics Letters, 14(7), 503–509.

Kumar, D. (2014). Return and volatility transmission between gold and stock sectors: Application of portfolio management and hedging effectiveness. IIMB Management Review, 26(1), 5–16.

Lee, Y. H., Huang, Y. L., & Wu, C. Y. (2014). Dynamic correlations and volatility spillovers between crude oil and stock index returns: the implications for optimal portfolio construction. International Journal of Energy Economics and Policy, 4, 327–336.

Levy, H., & Lerman, Z. (1988). The benefits of international diversification in bonds. Financial Analysts Journal, 44(5), 56–64.

Mensi, W., Makram, B., Boubaker, A., & Managi, S. (2013). Correlations and volatility spillovers across commodity and stock markets: Linking energies, food, and gold. Economic Modelling, 32, 15–22.

Mishra, A. K., & Panda, S. P. (2016). Looking into the relationship between implied and realized volatility: A study on S&P CNX Nifty index option. Eurasian Economic Review, 6(1), 67–96.

Ng, A. (2000). Volatility spillover effects from Japan and the US to the Pacific-Basin. Journal of international money and finance, 19(2), 207–233.

Silvennoinen, A., & Thorp, S. (2013). Financialization, crisis and commodity correlation dynamics. Journal of International Financial Markets, Institutions and Money, 24, 42–65.

Skintzi, V. D., & Apostolos, N. R. (2006). Volatility spillovers and dynamic correlation in European bond markets. Journal of International Financial Markets, Institutions and Money, 16(1), 23–40.

Symeonidis, L., Prokopczuk, M., Brooks, C., & Lazar, E. (2012). Futures basis, inventory and commodity price volatility: An empirical analysis. Economic Modelling, 29(6), 2651–2663.

Vivian, A. J., & Wohar, M. E. (2012). Commodity volatility breaks. Journal of International Financial Markets, Institutions and Money, 22(2), 395–422.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Izadi, S., Hassan, M.K. Portfolio and hedging effectiveness of financial assets of the G7 countries. Eurasian Econ Rev 8, 183–213 (2018). https://doi.org/10.1007/s40822-017-0090-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-017-0090-0