Abstract

This paper analyzes the conditional diversification benefits (CDBs) of commodity futures. We utilize three distinct classes of empirical models in order to explore the additional value of commodities in stock portfolios. Firstly, the dynamic equicorrelation model is conducted which allows us to compute the average conditional correlations for a large number of assets. Secondly, we employ the dynamic conditional correlation (DCC) technique to examine pairwise correlations between commodity futures and equity markets. Thirdly, using the time-varying correlations derived from the DCC model, we quantify the diversification benefits through time within the context of CDB measure. By constructing six hypothetical portfolios, our results point out that the portfolio consisting of the commodity futures and the emerging stock markets exhibits the lowest equicorrelation level. The cross-sectional differences in the bivariate correlations show that the energy and metal futures have the highest level of co-movements with the equities. Our findings also reveal that the inclusion of commodity futures into the emerging and developed market portfolios increases the diversification benefits although these benefits deteriorate negligibly in the episodes of financial turmoil. The futures that offer the highest diversification benefits are lean hogs, feeder cattle, natural gas, orange juice, and gold. Our empirical results provide significant insights for portfolio managers and global investors to assess the gains from investments in commodity futures.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction and the related literature

The turn of the twenty-first century has brought up a remarkable increase in the commodity-related asset investments.Footnote 1 The fact that commodities are accepted as diversifying assets, due to their low correlations with stocks and bonds, entails the appetite of the international investors. On the one hand, there are various studies underpinning the efficacy of commodity assets in enhancing risk reduction without cutting off returns in portfolios (Anson 1999; Jensen et al. 2000; Georgiev 2001; Idzorek 2007; You and Daigler 2013). Commodities also provide hedging against (un)expected inflation since commodity prices are determined by the demand and supply forces in the context of the general economic activity (Erb and Harvey 2006; Gorton and Rouwenhorst 2006; Adams et al. 2008; Anson et al. 2011).Footnote 2 On the other hand, low or even negative returns recently reduce the attractiveness of commodity futures. Some costs, such as rollover costs, further affect the performance of portfolios containing commodities, and hence the potential benefits from diversification may be outweighed by these costs.Footnote 3 Recent studies also document diminishing diversification benefits of commodities as a result of the increased financialization (Silvennoinen and Thorp 2013; Büyükşahin and Robe 2014; Daskalaki and Skiadopoulos 2011) Therefore, it is of particular importance to explore whether the commodity futures still offer benefits for global investors in constructing a well-optimized portfolio beyond traditional stocks. An accurate quantification of diversification benefits can enable portfolio rebalancing and improve risk-adjusted returns.

Gorton and Rouwenhorst (2006) discuss that commodity futures are different from traditional assets in the sense that they are derivative assets with short-term maturity claims on real assets, which have intrinsic values and seasonality in prices. They also argue that unlike bonds and stocks, which are used for raising external funds for the company, commodity futures allow companies to hedge for the fluctuations in the prices of the commodities that are either their inputs or outputs. Therefore, the commodity markets are seen as segmented markets that offer potential diversification benefits. The inherent benefits attract investors, which in turn hasten the financialization process of the commodity markets (Tang and Xiong 2012). As a consequence, the commodities become equity-like instruments; the shocks in the other financial markets spread instantaneously to commodity markets with the increased financialization (Cheng and Xiong 2013; Acharya et al. 2013). Although commodities constitute a heterogeneous group, mainly categorized as soft and hard commodities with different pricing dynamics, the financialization process prompts these assets to be taken as a single asset class, which increases the co-movement in their prices (Silvennoinen and Thorp 2013). Consequently, the investment growth in commodity index funds shallows the diversification benefits across stocks, bonds, and also within different commodity groups (Tang and Xiong 2010; Gruber and Vigfusson 2012; Basak and Pavlova 2016). For this reason, it is an unresolved issue whether commodity futures are still ideal candidates for investors and portfolio managers to achieve a successful asset allocation.

A strand of the existing literature provides a clear evidence of the risk reduction feature of the commodities in stock portfolios. Erb and Harvey (2006) enunciate very low correlations between commodities concluding that commodity markets consist of individual dissimilar assets. Belousova and Dorfleitner (2012) investigate the diversification benefits of both physical commodities and commodity futures in a portfolio of traditional assets and report the same results in both cases; energy and precious metals improve both the risk and return profiles, while the other commodity groups only enhance risk reduction.Footnote 4 Mensi et al. (2013) examine the correlation and volatility transmission between commodities and S&P 500 index and derive the result that adding commodities to stock portfolios improves the overall risk-adjusted return performance. Creti et al. (2013) elucidate evolving correlations between commodities and the S&P 500 index, recording the highest coefficients during the global crisis, and they also evince the safe haven quality of gold as well as the diversification potential of coffee and cocoa. In order to elaborate the commodity price and volatility dynamics in the post-financialization episode, Christoffersen et al. (2014a) annotate that financialization does not increase the volatility in the commodity marketsFootnote 5 and that the commodities still possess the diversifying benefit against stocks. In a recent study, Daskalaki et al. (2014) verify that commodity futures market is segmented from equity markets and that there is considerable heterogeneity among commodity futures by accounting for commodity specific factors. Zheng (2014) studies the bound between investor sentiment and commodity returns and indicates that commodity futures act as “safety and quality” assets.

Contrarily, some studies report the diminished benefits of commodity futures in portfolio allocation. Silvennoinen and Thorp (2013) examine the market co-movements between commodity futures and other financial assets in a study where they find increasing correlations between the commodities and the US stock market, particularly during high-equity market volatility episodes. Büyükşahin and Robe (2014) document that both before and after the Lehman Brothers bankruptcy, the correlation between commodities and equity markets has been positively related to the TED spread used as a proxy of financial stress and that the commodity–equity correlations peaked between the fall of 2008 and the spring of 2010. The findings of Daskalaki and Skiadopoulos (2011) reveal the deteriorated diversification benefits during a sample period of 20 years between 1989 and 2009 as a consequence of the increased financialization in the commodity futures market. Bessler and Wolff (2015) investigate the out-of-sample portfolio diversification benefits for different commodity groups and figure out energy, precious metals, and industrial metals in improving the Sharpe ratio of stock–bond portfolios, while livestock and agricultural groups display no benefits. The scholars also acknowledge the time-varying nature of the diversification, which almost vanished during the global financial crisis. In a more recent study, Barro and Misra (2016) analyze gold returns in the long run, from 1836 to 2011, and find that the average real rate of return for gold is only 1.1% per year, which is very close to the risk-free rate.

As can be seen from the previous literature, there are mixed and contradicting results on the portfolio diversification benefits of commodity futures. For this reason, it is eminent to conduct more comprehensive research on commodity markets utilizing contemporary and novel techniques. In this study, our aim is to contribute to the existing literature in three dimensions. First, we utilize the dynamic equicorrelation (DECO) model proposed by Engle and Kelly (2012) to estimate the large variance–covariance matrices as in our case. To this end, we construct six hypothetical portfolios from a set of 21 commodity futures, 13 emerging and 13 developed stock markets: the first portfolio consists only commodity futures, while the second and the third are composed of the emerging and the developed markets, respectively. The other portfolios are mixed: Portfolio 4 combines commodity futures and emerging stock markets, Portfolio 5 includes commodity futures and developed stock markets, and lastly, Portfolio 6 incorporates emerging and developed stock markets. Our motivation to use the DECO model is to quantify the equicorrelation levels of the portfolios as the correlation measure is a key input in portfolio optimization. The results from the DECO model substantiate the lowest level of correlations in Portfolio 4, which may imply that adding commodity futures in an emerging market portfolio provides the highest diversification benefits for global investors.

Additionally, in order to analyze the cross-sectional differences in asset correlations, we conduct the dynamic conditional correlation (DCC) model. The DCC analysis measures the bivariate time-varying correlations between individual commodity futures and stock markets, which allows the comparison of the correlation levels for individual asset pairs rather than portfolios. The overall results indicate that commodity futures form a heterogeneous asset group as evidenced by the bilateral correlations at varying magnitudes. Finally, we gauge the diversification benefits of commodity futures across both emerging and developed stock markets via the conditional diversification benefit (CDB) measure of Christoffersen et al. (2014b) based on the dynamic optimal portfolio weights and the correlations generated from the DCC model. The CDB results show the increased diversification benefits of portfolios when the commodity futures are included. However, since the commodities are segmented assets, the diversification benefits are varying across individual commodities. The best portfolio diversifiers are the lean hogs, the feeder cattle, the natural gas, the orange juice, and the gold, while the platinum and the silver futures have almost no portfolio allocations. Hence, our findings depict that commodity futures are still beneficial from the perspective of the CDB measure despite the growing financialization debate cited in the recent literature.

The rest of the paper is organized as follows: Part 2 explains the methodology used in the analyses, Part 3 describes the statistical properties of the data, Part 4 discusses the empirical findings, and finally Part 5 concludes.

2 Methodology

Estimating the covariance matrix is of great importance in portfolio optimization. Traditionally, researchers and practitioners use equally weighted historical returns to construct the covariance matrix which is constant over time. However, recent developments of more complex models in financial econometrics undermine the simplicity of this approach. Time-varying models, such as multivariate GARCH, assign greater weights to the more recent returns, and therefore they are more appropriate tools to generate variance–covariance matrices for portfolio optimization problem. In this study, we consider two types of multivariate GARCH-type methodology, namely dynamic conditional correlation (DCC) and dynamic equicorrelation (DECO) models. Our methodology requires estimating the variance–covariance matrices indirectly from the conditional correlation matrices provided by the DCC or the DECO model which has two-step algorithms. Firstly, the conditional variances of the assets are estimated through the univariate GARCH model. Then, the coefficients of conditional correlations are estimated by using the standardized error terms from the univariate models. The estimation framework is given in the following parts.

2.1 Univariate volatility modeling

In this part, we briefly summarize the empirical framework that is employed to capture the underlying volatility process of commodity and index returns. For this purpose, we consider an asymmetric extension of GARCH (1,1) model to capture the leverage effect. Recall that standard GARCH (p, q) model is given by Bollerslev (1986) as;

where εt is i.i.d. white noise, \( \omega > 0, \, \lambda_{\text{i}} \ge 0,\;\; \, \delta_{\text{j}} \ge 0 \), and \( \sum {_{i = 1}^{{\hbox{max} (p,{\text{ q)}}}} (\lambda_{i} + \delta_{i} ) < 1} \).

Glosten et al. (1993) extended the GARCH (p, q) model in order to demonstrate that good news and bad news have different effects on volatility by using \( \varepsilon_{t - 1} \) as a threshold. A GJR-GARCH (p, q) model can be generally expressed as:

where \( I(y_{t - i} ) = 1 \) if \( y_{t - i} < 0 \) and \( I(y_{t - i} ) = 0 \) if \( y_{t - i} \ge 0 \).

As with the standard GARCH model, the coefficients of the GJR-GARCH must be restricted to ensure the positiveness of the fitted variances. This task is difficult to describe for a complete GJR-GARCH(p,q) model, but it is straightforward for a GJR-GARCH(1,1). The formulation of a GJR-GARCH(1,1) model reads as:

and it must be the case that \( \omega > 0 \), \( \lambda \ge 0 \), \( \lambda + \gamma \ge 0 \), \( \delta \ge 0 \) and \( \lambda + \frac{\gamma }{2} + \delta < 1 \).

2.2 Models of conditional correlations

2.2.1 Dynamic conditional correlation (DCC)

After specifying the appropriate univariate model for the volatility dynamics, we turn our attention to calculate the conditional correlations based on the decomposition of variance covariance matrix into conditional standard deviations and correlations. Let \( y_{t} = \left\{ {y_{1t,} y_{2t} , \ldots ,y_{nt} } \right\}^{'} \) represents the colon vector of returns in an n asset portfolio, and the returns are normally distributed with zero mean and conditional variance matrix \( \varSigma_{t} = E\left[ {y_{t} y_{t}^{\prime } |\varOmega_{t - 1} } \right] \) meaning that

with Ωt-1 denotes the information set up to time t-1, \( u_{t} = \left\{ {u_{1t} ,u_{2t} , \ldots ,u_{nt} } \right\}^{\prime } \sim N\left( {0,I_{t} } \right) \) and \( I_{t} \) is the identity matrix of order n. \( \sqrt {\varSigma_{t} } \) can be calculated through Cholesky decomposition of \( \varSigma_{t} \). The covariance matrix can be decomposed into:

where \( D_{t} \) is the diagonal matrix of the time-varying standard deviations \( \sigma_{i,t} \) from the GJR-GARCH model as:

and \( \varGamma_{t} \) has ones on the diagonal and conditional correlations of the error terms \( \varepsilon_{t} \) off the diagonal;

The correlation matrix \( \varGamma_{t} \) has to be positive definite in order to ensure the positive definiteness of \( \varSigma_{t} \). Moreover, all correlation coefficients must remain in the range from − 1 to 1. The correlation matrix of the error terms must be decomposed into the following form in order to ensure that these requirements are satisfied;

where \( S_{t} \) is a positive definite matrix that determines the structure of dynamics and \( S_{t}^{* - 1} \) normalizes the elements in \( S_{t} \);

Engle (2002) formulated the DCC model such that the dynamics of \( S_{t} \) is represented with the cross-products of the return shocks:

with \( \bar{S} \) representing the unconditional covariance matrix of the standardized error terms \( \bar{S} = E\left[ {\varepsilon_{t} \varepsilon^{\prime}_{t} } \right] \) and α and β are constant coefficients.

The estimation of the parameters of \( \varSigma_{t} \), namely \( \psi = \left( {\alpha ,\beta } \right) \), involves maximizing the following log-likelihood function:

2.2.2 Dynamic equicorrelation (DECO)

Despite its usefulness in the multivariate correlation modeling, the DCC model is still plagued with dimensionality problem. Estimating correlations between more than 50 time series is cumbersome and computationally expensive. Thus, we resort to simpler version of the DCC model, which is called dynamic equicorrelation (DECO) model. Engle and Kelly (2012) define the DECO model by assuming that all pairwise correlations in the DCC framework are equal which makes estimation process much easier. The definition of the equicorrelation matrix is given as;

with \( I_{n} \) denotes an nxn identity matrix and \( J_{n} \) is a matrix of one and of the corresponding dimensions. The only interesting number of the above equation is equicorrelation component \( \rho_{t} \). As stated by Engle and Kelly (2012) the usefulness of this equation is that it is easy to invert and calculate its determinant:

where \( P_{t}^{ - 1} \) exists if \( \rho_{t} \ne 1 \) and \( \rho_{t} \ne \frac{ - 1}{n - 1} \) and \( P_{t}^{ - 1} \) is positive definite if \( \rho_{t} \in \left[ {\frac{ - 1}{n - 1},1} \right] \). The estimation of the DECO model is achieved via decomposing the log-likelihood function into a volatility and correlation part as follows:

2.3 Conditional diversification benefits

Since we have time-varying correlations between assets, the diversification benefits should be dynamic as well. For this purpose, we follow the methodology proposed by Christoffersen et al. (2014b) to calculate the conditional diversification benefit (CDB) measurement. We also make use of the CDB to determine the optimal weights in portfolio optimization scheme. The methodology requires the following steps:

The variance of a portfolio combination of securities is equal to the weighted average covariance of the returns on its individual securities:

For simplicity, assume that volatility is time dependent and same across assets thus:

Let \( Var(r_{A,t} ) = Var(r_{i,t} ) = Var(r_{j,t} ) \) denotes “asset” volatility. So we have:

and,

The variance ratio given in Eq. (19) is minimized by using the dynamic weights \( w_{i,t}^{*} \) subject to a total of 1 and short-sale constraints. Subtracting the variance ratio from 1 defines the dynamic conditional correlation based diversification benefits (Christoffersen et al. 2014b):

If conditional correlations are calculated by the DECO model meaning that all pairwise correlations are the same, the CDB equation renders to:

CDB measure can also be used to define the optimal weights as:

The CDB measure provides a realistic approach in the sense that it quantifies a time-varying portfolio allocation. Given the changing atmosphere of the global economy and shifts in investors’ risk appetite, a model that captures both correlation dynamics and dynamic optimal weights would be very useful in practice.

3 Statistical properties of the data

The weekly data for the nearest-maturity commodity futuresFootnote 6 and the stock markets is used for the time period from January 10, 1992, to March 7, 2014.Footnote 7 The data are extracted from the Bloomberg database. The database gives the futures price data from different exchanges, including Chicago Board of Traders (CBOT), New York Mercantile Exchange (NYMEX), Intercontinental Exchange (ICE), Commodity Exchange Inc. (COMEX), and Chicago Mercantile Exchange (CME). We select the national stock exchange price indices for each country. The weekly returns are computed as Rt= ln (Pt/Pt−1)*100. We present the summary statistics for the commodity markets in Table 1. We categorize 21 commodities into five groups, namely energy, grains and oilseeds, livestock and meat, softs and food, and metals. Table 1 demonstrates that the statistics differ across commodity futures, which suggests that commodities are heterogeneous assets. The mean statistics in Table 1 depict that the highest average returns are observed for the commodities listed under the energy and the metals. The highest mean returns are found for Brent oil, soybean oil, feeder cattle, soybean meal, and palladium, while we obtain the lowest average returns for natural gas, wheat, live cattle, orange juice and copper within each group. As can be seen from the table, Brazil outpaces all the other stock markets’ returns and Finland yields the highest mean return among the developed markets. Japan is the only stock market with a negative average return during the sample period.

As pointed out by Kat and Oomen (2007), commodity futures are subject to higher volatility than the equity markets due to commodity specific shocks, for example, weather-related events, the level of inventories, or even epidemic. Comparing the standard deviations in Table 1, commodities and emerging markets possess similar risk profiles, with the highest standard deviation of 7.339% for natural gas and 6.080% for Turkey. We observe that the developed markets are segmented in terms of unconditional risk with the highest value of 3.493% for Finland. The standard deviations of only four commodities, such as soybean oil, feeder cattle, live cattle, and gold, are very close to those of the developed markets. Hence, most of the commodity futures are more risky than the developed stock markets, and they are similar to the emerging markets based on the values of unconditional risk, measured with standard deviations.

The measures of higher moments, skewness, and kurtosis suggest different risk profiles among commodities. The skewness values are mostly negative for commodity markets varying between − 0.036 and − 1.158, except for wheat, coffee, and orange juice. The skewness statistics range from − 0.005 (− 0.316) to − 0.860 (− 1.543) for emerging (developed) markets. Therefore, the probability of a large negative return is higher than a large positive return for most of the assets. Moreover, the kurtosis statistics are all greater than three for all of the assets, implying higher possibility of an extreme outcome in the return distributions. The results from skewness and kurtosis statistics suggest skewed fat tails and the leptokurtic patterns of the return distribution, which Jarque–Bera normality tests also confirm. In order to check the empirical relevance of the data for further volatility modeling, the Ljung–Box tests on raw and squared returns and the ARCH Lagrange multiplier tests up to 10 lags are also reported in Table 1. The associated statistics provide that there exists significant ARCH effects and also autocorrelations in the squared returns. Hence, the data are convenient for the use of conditional volatility models.

4 Empirical results

4.1 Univariate volatility model

The results from the univariate GJR-GARCH (1,1) models are reported in Table 2.Footnote 8 The shocks to volatility parameters (λ) are mostly significant at conventional levels. However, lean hogs, orange juice in the commodity group; and Austria, Belgium, Germany, Finland, Japan, the Philippines, Switzerland, the UK. and the USA among the stock markets, do not display ARCH effects in conditional volatility. The shock parameter (λ) is the highest for natural gas followed by the gold futures. The coefficients δ are all significant at the 1% level for both commodity futures and stock markets, which implies persistence in volatility. The highest volatility ARCH effects are observed for natural gas, corn, live cattle, soybean meal, and gold in each commodity futures group, while the highest persistence in volatility is documented for heating oil, soybean oil, live cattle, orange juice, and silver. Our empirical results also suggest that the asymmetric return–volatility phenomenon in commodity futures and emerging stock markets is not as widespread as it is in the developed equity markets.Footnote 9 Nine of 21 commodity futures, seven of 13 emerging markets and all the developed markets, except for Denmark, exhibit the asymmetric effect. However, the asymmetric news impact coefficients (γ) vary among the assets in terms of both sign and magnitude. The signs are mostly negative for commodity markets, except for the feeder cattle and positive for all the emerging and the developed markets. The positive sign in the asymmetry coefficient implies that negative return shocks drive volatility more than the positive shocks of the same magnitude. The statistically significant asymmetry parameters are from a minimum of 0.056 to a maximum of 0.201 in absolute terms for commodity futures and from 0.062 to 0.112 for emerging markets. The minimum and the maximum values range from 0.116 to 0.432 for the developed markets. Hence, our results imply that the commodity futures are not equity-like assets in the sense that most of them exhibit no leverage and the remaining displays positive leverage effect.Footnote 10

The findings related to the asymmetric effect support the results from Chevallier and Ielpo (2014). They link the inverted asymmetry to two reasons that were previously discussed by Giamouridis and Tamvakis (2001). The first one can be explained by the theory of storageFootnote 11 in the sense that low level of inventories cause abnormal positive returns and upsurge in volatility. As suggested by Carpantier and Dufays (2013) and Carpantier and Samkharadze (2013), this inventory effect may play a role in asymmetries; a shortage of the commodities raises the prices and volatility while high level of inventories leads to relatively lower prices and volatility. Secondly, commodity markets provide a limited downside risk given that there is a minimum price to operate the exploitation of a commodity with profits. These two reasons indicate a positive return–volatility correlation in commodity futures. Additionally, as discussed by Chiarella et al. (2015) the market-wide shock effects such as the fluctuations in interest rates, inflation rates, and exchange rates cause inverted asymmetry, because investors switch their investments to safer assets at times of increased market uncertainty. The overall results from the univariate volatility specification shed light on the possible diversification benefits of the commodities in a stock portfolio as the volatilities of commodity futures and the equity markets divergently react to the return shocks.

4.2 DECO model results

In Table 3, we present the results from the dynamic equicorrelation (DECO) model which at once estimates 21 assets in Portfolio 1 (commodity futures), 13 assets both in Portfolio 2 (emerging markets) and in Portfolio 3 (developed markets), 34 assets both in Portfolio 4 (emerging markets and commodity futures) and Portfolio 5 (developed markets and commodity futures) and 26 assets in Portfolio 6 (emerging and developed markets). The DECO model proposed by Engle and Kelly (2012) estimates the time-varying correlations with the assumption of equal correlations across assets at any given time and the higher dimensional systems with computational ease.

Table 3 shows that the sum of the parameters φ and ψ is close to unity for each of the asset combinations, indicating the dynamic equicorrelations are highly persistent and mean-reversion in correlations is quite slow. The average conditional correlation parameters (ρ) are also tabulated, which suggest that the developed markets (Portfolio 3) are much more interrelated with each other and the lowest correlations are computed for Portfolio 4. It is also clear that adding commodities into both emerging and developed market portfolios dramatically reduces the level of correlations, which indicates the potential diversifying benefits of commodities. Although our study aims to investigate the diversification benefits of the commodity futures, it is apparent from our results that emerging stock markets are also possible diversifiers for the developed markets. The potential of emerging stock markets as diversifying assets is highlighted by various studies (see among others, Divecha et al. 1992; Harvey 1995; De Santis 1997; Gilmore and McManus 2002; Bekaert et al. 2009; Switzer and Tahaoglu 2015)

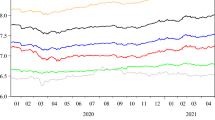

We provide the time evolution of the equicorrelations for each asset combination in Fig. 1. The graphs indicate that the equicorrelations are quite volatile over time and exhibit an upward trend. The fitted equicorrelations change from 0.03 to 0.34 for Portfolio 1 with the lowest variation, and from a minimum of 0.13 to a maximum of 0.88 with the highest variation for Portfolio 3. The graph (a) provides evidence of increased market integration in commodity markets as shown by the heightened equicorrelations, which supports the findings of Tang and Xiong (2010), Byrne et al. (2011), Creti et al. (2013) and Sensoy et al. (2015). Starting from 2004 onward, the commodity futures exhibit increased co-movements related to the surmounted global trading activity in derivatives and concurrent financial crisis, shifting the prices of commodities from their fundamental values determined by the demand and supply side factors.Footnote 12 The highest correlations in commodity futures coincide with the global financial meltdown of 2008, which is in line with the findings of Creti et al. (2013). The crisis period induces a significant risk aversion among investors and reduction in real economic activities, decreasing the physical demand for commodities. For Portfolios 2, 3m and 6, graphs (b), (c) and (f) demonstrate that the equicorrelations among the global equity markets considerably increase as a result of financial integration and burst to high levels with the contagion effects of the 2008 crisis. Moreover, graphs (d) and (e) demonstrate that the equicorrelations strengthen over time. The correlations are high particularly during the crisis period of 2008. It is also evident from graphs (d) and (e) that the level of DECO correlations for Portfolio 4 and 5 is low compared to those of Portfolio 2, 3, and 6, suggesting that adding commodity futures into a portfolio of either emerging or developed stock markets might be beneficial to reap the potential benefits from diversification. However, the equicorrelations, as can be seen in graphs (d) and (e), are also upward trending and subject to day-to-day variations, calling for the need of dynamic optimization in portfolio rebalancing, which we is discussed in Sect. 4.4 in detail.

4.3 DCC model results

Despite modeling the commodities as one group in the DECO models, the commodity futures are too distinct to be considered as a single asset class since the underlying factors affecting their prices are variant. The geopolitical risk, the biofuel production, the technological advancements, and the natural events are all among the critical factors. For example, seasonal weather conditions significantly influence oil and food prices. For the metal commodities, strikes, wars, or recessions cause a downward supply pressure and hence price variations. Given the fact that commodities are distinct assets, we need to investigate the bivariate conditional correlations between each commodity futures and stock markets, using the DCC-GJR-GARCH (1,1) models. The DCC model enables to compute the cross-sectional differences in correlations.Footnote 13 The average conditional correlations of commodity futures across emerging and developed stock markets are presented in Table 4.Footnote 14

The results from Table 4 provide evidence that commodity futures are more correlated with the developed markets than the emerging markets, except for natural gas, cocoa, and gold futures. This indicates that commodity futures are better diversifiers for portfolios heavily composed of emerging markets. The energy and metal groups are found to display the highest correlations with both the emerging and the developed markets, which reflects the further financialization of these two groups. The commodity futures that exhibit the highest level of co-movements with the stock markets are copper, palladium, platinum, silver and oil (Brent and WTI). This result is parallel with the findings of Sensoy et al. (2015) who report that the energy and metal commodities have become more linked with the financialization of the commodity markets as a result of the growing investor activity and derivatives trading, which in the end leads to a higher liquidity. As stated by Belousova and Dorfleitner (2012), the increase in liquidity enhances pricing efficiency at the cost of decreasing diversification benefits. In addition, the energy and metal commodities are closely tied to the general economic conditions as they are the main inputs in the production process. For this reason, the energy and metal prices are more correlated with the global business cycle than the prices of other commodities.Footnote 15 We report lower correlations with the equity markets for the other commodity groups (grains and oil seeds, livestock and meat, softs and food). Therefore, these commodities can be treated as alternative assets to traditional equity investments for investors who seek profits from diversification.

4.4 The results from the conditional diversification benefits (CDB) measure

In this section, we present and discuss the results from the CDB quantification. The graphs in Fig. 2 represent the time evolution of the conditional diversification benefits (CDB) measured with the optimal portfolio weights. It is evident that the conditional diversification benefits exhibit a decreasing trend, which is consistent with the upward pattern in the DECO correlations. The CDB substantially declines in the episodes of stock market turbulence; the reduction in the benefits is much apparent during the Global Financial Crisis of 2008, which may cast doubt on the perception of commodities as refugee assets during the volatile periods. However, the decline in the benefits of portfolios including commodity futures is much lower than that of emerging and developed markets. Moreover, the portfolios with higher benefits are Portfolio 1 (only commodity futures) and Portfolio 4 (commodity futures and emerging markets). It is clear from all the figures that the inclusion of commodity futures in a long-only stock market portfolio considerably increases the benefits from diversification. As can be observed in graph b, the benefits mostly fluctuate between 60 and 75% for Portfolio 2 (only emerging markets), while the graph (c) shows much lower diversification benefits for the developed markets with an average value of 45%. Adding commodity futures in a portfolio of both emerging and developed stock markets significantly enhances the diversification as can be seen from the graphs (d) and (e).

In Table 5, we present the key statistics from the distribution of optimal weights for each portfolio. The top of the table reports average, minimum, and maximum optimal weights during time as well as the fraction of weeks in which each asset has no allocation. For Portfolio 1 (only commodity futures), the results suggest that nine of the 21 commodities have zero allocation in at least 1 week during the sample. The top five commodities having the maximum allocation are lean hogs, feeder cattle, orange juice, natural gas and cotton. The results for Portfolio 2 (only emerging markets) show that six out of 13 emerging markets have a zero allocation in at least 1 week over the sample period. The stock market with the highest allocation is South Korea, followed by Turkey and India. The findings for Portfolio 3 (only developed markets) substantiate that all the developed equity markets, except for Austria, Denmark, and Japan, have no allocation in some part of the sample. The highest maximum portfolio weight is found for Japan, which supports the findings of Christoffersen et al. (2014b).

Since our main objective is to examine whether adding commodity futures in a portfolio outweighed toward stocks provide diversification, we need to keep a close eye on the mixed portfolios, namely Portfolios 4, 5, and 6. Starting with Portfolio 4 of (commodity futures and emerging markets), the statistics indicate that Brazil, Hungary, and Indonesia from the emerging markets group and platinum, silver, and soybean oil from the commodity group have nearly no allocation during the study period. The highest average allocations are documented for South Korea (0.101), lean hogs (0.091), feeder cattle (0.0817), natural gas (0.074), and orange juice (0.069). It is remarkable that the commodity futures have more allocation than the emerging markets in Portfolio 4 as shown by the mean and the maximum allocation statistics. As for Portfolio 5 (developed markets and commodity futures), our results show the outperformance of commodity futures. The largest average statistics are found for the commodity futures; lean hogs (0.106), natural gas (0.084), feeder cattle (0.083), orange juice (0.081), and gold (0.061), respectively. For portfolios 4 and 5, we also notice that platinum and silver futures are not good investment choices with regard to a CDB diversification as they virtually have no allocation during the sample. As for portfolio 6 (emerging and developed markets), we document that the portfolio should be tilted toward the emerging markets as indicated that the best diversifiers are South Korea, Turkey, and India with the highest average allocations of 0.256, 0.102, and 0.086, respectively.

Overall, our results suggest that some of the commodity futures still offer diversification benefits even though market integration and their financialization have been increasing over time. The best portfolio diversifiers from the perspective of the CDB measures are mainly the lean hogs, feeder cattle, natural gas, orange juice, and gold. We empirically demonstrate that the inclusion of commodity futures in a stock portfolio improves diversification which is also documented by Jensen et al. (2000), Belousova and Dorfleitner (2012), Erb and Harvey (2006), Christoffersen et al. (2014a) and Bessler and Wolff (2015). Our findings contradict the results from Büyükşahin and Robe (2014), Cheung and Miu (2010), Tang and Xiong (2010) Daskalaki and Skiadopoulos (2011) and Silvennoinen and Thorp (2013) who challenge the perception that commodities are portfolio diversifiers. Our findings do not either support the main argument of Cheung and Miu (2010)’s paper which postulates that the diversification benefits of commodities disappear when needed most.

Based on the empirical results of the CDB measures, we can clearly state that the commodity futures are heterogeneous assets in terms of diversification benefits at varying magnitudes. This can be attributed to the fact that each commodity has its own unique characteristics due to storability and renewability. For example, storable commodities, such as gold, silver, and copper, can be purchased at the spot price and stored till the expiration of the futures contract, while non-storable commodities, such as livestock, can be profitable in the course of a particular stage of its life cycle. For the renewable commodities, such as grains, the harvest time and seasonal weather conditions play a key role in their pricing dynamics, whereas, for the nonrenewable commodities, such as oil, their supply and prices heavily depend on the exploration activities and the future prime costs. All of these factors together may account for distinct price dynamics of commodity futures, which reflects diversification potential of commodity futures in stock portfolios.

As discussed above, investors can enjoy the benefits of adding commodity futures to a stock portfolio, which also supports our findings of low correlations between commodity futures and stock returns in the previous sections. The conditional correlations are major inputs in the CDB optimization. The low correlations and diversification benefits can be partially explained by the different factors that drive price dynamics of commodities and stock returns. Theoretically, stock prices are determined on the basis of future cash flows of companies; a company that has the potential of long-term earnings generally shows an increase in its stock price. Au contraire, commodities cannot be valued based on the future cash flows; instead, their prices are largely affected by physical demand and supply. Additionally, as stated in Dusak (1973), Bodie and Rosansky (1980), Jagannathan (1985) and Shang (2011) traditional asset pricing models of equities do not apply to commodities. In other words, commodity returns are mostly unrelated to the equity market-wide factors, such as stock beta or consumption risk, and the risk premiaFootnote 16 is the only factor that affects expected commodity future returns (Szymanowska et al. 2014). Lastly, the value of a stock significantly hinges upon local news, firm performance, and the country’s economic outlook, while the commodity prices are impacted by the global demand and supply imbalances (Anson 2008).

5 Conclusion

In this paper, we provide a detailed analysis of diversification benefits attained by the commodity futures. To this end, six hypothetical portfolios are constructed to analyze the level of correlations and conditional benefits from diversification. Using the weekly data from January 3, 1992, to March 7, 2014, we employ the empirical models and elaborate the following findings.

First, the DECO model, which enables us to handle large portfolios by modeling high dimensional matrices with ease, is utilized to measure the level of equicorrelations for the hypothetical portfolios. Hence, in the context of the DECO model, we treat the commodities as an asset group rather than distinct assets. The findings suggest that the inclusion of commodity futures into both developed and emerging market portfolios considerably lessens the equicorrelation levels. This empirical finding indicates that the commodity futures as an asset group may be potential risk diversifiers for stock portfolios.

Second, we analyze the bivariate cross-sectional correlations of commodity futures with the stock markets, using the DCC model. The results reveal that the futures in energy and metal groups display the highest level of correlations with the emerging and developed markets, which can be related to the further financialization of these two groups. The commodity future that exhibits the highest correlation is copper followed by palladium. It is also worth noting that the futures tend to co-move more with the developed markets rather than the emerging ones, which implies that the commodities are better diversifiers for emerging markets portfolio.

Third, we conduct a recent and novel technique of conditional diversification benefits (CDB) measure proposed by Christoffersen et al. (2014b). This method enables us to compute a time-varying quantification of diversification benefits based on dynamic optimal portfolio weights and the dynamic correlations. The results from the CDB measure show that adding commodity futures in portfolio of both emerging and developed stock markets significantly increases the benefits from diversification. The benefits tend to decline in the crises episodes, such as in the 2007–2009 global crisis; however, the decline in diversification benefits is much lesser in the portfolios, which contain commodities than that of the stock-only portfolios. Moreover, the key statistics from the distribution of portfolio weights for each portfolio demonstrate that lean hogs, feeder cattle, natural gas, orange juice and gold futures are best portfolio diversifiers from the perspective of the CDB measure.

Even though the commodity futures are segmented assets in terms of the underlying dynamics that affect their prices, the financialization process has put the commodities into more interconnection with the equity markets. Creti et al. (2013) explain financialization as a process where the commodity prices are determined by financial factors and investors’ behavior in derivative markets. The financialization phenomenon can also be traced from the plots as the equicorrelations for the commodity futures follow the same trends with the equicorrelations of the emerging and developed equity markets.

The results from this paper have potential implications for global investors, portfolio managers and policy makers. Firstly, an accurate measure of time-varying correlations is extremely important for strategic and tactical asset allocations as the correlation measure is the key input in portfolio optimization. Secondly, given the severe economic crises during the last two decades, international investors increasingly seek for safer assets to protect themselves from adverse risks. The results from this study suggest that the commodity futures can be treated as diversifiers since the diversification benefits of commodity futures are still much higher than those provided by stock-only portfolios in the periods of global uncertainty, such as during the crisis of 2008. We also believe that our results are of paramount importance for policy makers and authorities. Understanding the role of financial players in the futures market as well as the dynamic linkages between commodity futures and stock markets can help the authorities in designing and implementing optimal policies on commodity trade and derivative markets.

For a further study, copula-based models would be beneficial to compute the time-varying diversification benefits. The copula-based quantification can provide valuable information for market participants on tail dependency. Moreover, wavelet variance and covariance could also be utilized to measure the benefits of diversification for different investment horizons as the investors have heterogeneous time preferences for their investing strategies.

Notes

Tang and Xiong (2010) mention that commodity investments surge from 15 billion US$ in 2003 to somewhat 200 billion US$ in 2008. According to G20 study group report on commodities, in the first quarter of 2011 the commodity investments reach to 410 billion US$. For the report please visit the website http://unctad.org/en/Docs/webgds2011_g20d05_en.pdf.

It is worth noting that we did not test the dimension of diversification benefits against inflation.

We are grateful to the reviewer for highlighting this important point.

They study the diversification benefits from the perspective of a European investor.

Namely, the bubble view put forth by Masters (2008), arguing that the speculation in commodity markets spiked the oil prices in 2007 and 2008.

Chiarella et al. (2015) claim that futures prices are set more transparently than spot commodity prices, and thus they may convey a better explanation of the return and volatility dynamics in commodity markets. Additionally, previous work makes use of the futures contracts as proxies for the asset class. Physical commodities are costly to store and harder to trade and therefore may not be suitable as an investment asset. We follow this practice in this paper.

We use weekly data to deal with the non-synchronous trading (different trading hours of the markets) problem.

The parameter estimations are obtained through the quasi-maximum likelihood (QML) estimation, which enables us to have robust standard errors in the case of departure from normality. For further details and asymptotic properties, see Bollerslev and Wooldridge (1992).

Positive leverage is the occurrence of higher volatility after a price increase, and vice versa negative leverage is the increase in volatility after a negative price shock.

See Ng and Pirrong (1994) for a detailed discussion on the theory of storage.

As discussed by Baker (2014), the dynamics of commodity futures markets are affected by both the commodity producers and speculative dealers. Although the dealers have no use for commodities, they trade commodities for an expected return, which shifts the prices from their fundamental values. Basak and Pavlova (2016) also model demand shocks and disentangle the impacts of institutional funds from the effects of fundamentals. Their results suggest that financialization explains commodity prices and the existence of institutional investors amplify the influence of rising demand. For other related studies, see Irwin and Sanders (2011), Büyükşahin et al. (2008) and Ederer et al.(2013).

Out of these 546 asset pairs, we find constant conditional correlations for 37 pairs.

We do not provide model estimates and the graphs of the bilateral correlations to conserve space. All the results are available to interested readers upon their requests.

The risk premia of commodity futures stem from differences in the contract maturities as well as the factors inherent to each commodity group. For further details, see Szymanowska et al. (2014).

References

Acharya VV, Lochstoer LA, Ramadorai T (2013) Limits to arbitrage and hedging: evidence from commodity markets. J Financ Econ 109(2):441–465

Adams Z, Füss R, Kaiser DG (2008) Macroeconomic determinants of commodity futures returns. In: Fabozzi FJ, Füss R, Kaiser DG (eds) The handbook of commodity investing. Wiley, Hoboken, pp 87–113

Anson M (1999) Maximizing utility with commodity futures diversification. J Portf Manag 25:86–94

Anson MJ (2008) The pricing and economics of commodity futures. Handbook of Finance, Wiley, Hoboken

Anson MJP, Fabozzi FJ, Jones FJ (2011) The handbook of traditional and alternative investment vehicles. Wiley, Hoboken

Baker SD (2014) The financialization of storable commodities. Working paper, University of Virginia

Barro RJ, Misra S (2016) Gold returns. Econ J 126(594):1293–1317

Basak S, Pavlova A (2016) A model of financialization of commodities. J Finance 71(4):1511–1556

Bekaert G, Hodrick RJ, Zhang X (2009) International stock return comovements. J Finance 64(6):2591–2626

Belousova J, Dorfleitner G (2012) On the diversification benefits of commodities from the perspective of euro investors. J Bank Finance 36(9):2455–2472

Bessler W, Wolff D (2015) Do commodities add value in multi-asset portfolios? An out-of-sample analysis for different investment strategies. J Bank Finance 60:1–20

Black B (1976) Studies of stock price volatility changes. In: Proceedings of the 1976 meetings of the American Statistical Association, Business and Economic Statistics, pp 177–181

Bodie Z, Rosansky VI (1980) Risk and return in commodity futures. Financ Anal J 36(3):27–39

Bollerslev T (1986) Generalized autoregressive conditional heteroskedasticity. J Econom 31(3):307–327

Bollerslev T, Wooldridge JM (1992) Quasi-maximum likelihood estimation and inference in dynamic models with time-varying covariances. Econom Rev 11(2):143–172

Büyükşahin B, Robe MA (2014) Speculators, commodities and cross-market linkages. J Int Money Finance 42:38–70

Büyükşahin B, Haigh M, Harris J, Overdahl J, Robe M (2008) Fundamentals, trader activity and derivative pricing. EFA 2009 Bergen meetings paper

Byrne JP, Fazio G, Fiess NM (2011) Primary commodity prices: co-movements, common factors and fundamentals. World Bank policy research working paper series

Carpantier JF, Dufays A (2013) Commodities inventory effect. Working paper

Carpantier JF, Samkharadze B (2013) The asymmetric commodity inventory effect on the optimal hedge ratio. J Futures Markets 33(9):868–888

Chiarella C, Kang B, Nikitopoulos CS, Tô TD (2015) The Return–volatility relation in commodity futures markets. J Futures Mark 36:127–152

Cheng IH, Xiong W (2013) The financialization of commodity markets (no. w19642). National Bureau of Economic Research

Cheung CS, Miu P (2010) Diversification benefits of commodity futures. J Int Financ Markets Inst Money 20(5):451–474

Chevallier J, Ielpo F (2014) Investigating the leverage effect in commodity markets with a recursive estimation approach. Res Int Bus Finance 39:763–778

Christoffersen P, Lunde A, Olesen KV (2014a) Factor structure in commodity futures return and volatility. Rotman School of Management working paper (2495779)

Christoffersen P, Errunza V, Jacobs K, Jin X (2014b) Correlation dynamics and international diversification benefits. Int J Forecast 30(3):807–824

Creti A, Joëts M, Mignon V (2013) On the links between stock and commodity markets’ volatility. Energy Econ 37:16–28

Daskalaki C, Skiadopoulos G (2011) Should investors include commodities in their portfolios after all? New evidence. J Bank Finance 35(10):2606–2626

Daskalaki C, Kostakis A, Skiadopoulos G (2014) Are there common factors in individual commodity futures returns? J Bank Finance 40:346–363

De Santis G (1997) Stock returns and volatility in emerging financial markets. J Int Money Finance 16(4):561–579

Divecha AB, Drach J, Stefek D (1992) Emerging markets: a quantitative perspective. J Portf Manag 19(1):41–50

Dusak K (1973) Futures trading and investor returns: An investigation of commodity market risk premiums. J Polit Econ 81:1387–1406

Ederer S, Heumesser C, Staritz C (2013) The role of fundamentals and financialisation in recent commodity price developments: an empirical analysis for wheat, coffee, cotton, and oil (no. 42). Working paper, Austrian Foundation for Development Research (ÖFSE)

Engle R (2002) Dynamic conditional correlation: a simple class of multivariate generalized autoregressive conditional heteroskedasticity models. J Bus Econ Stat 20(3):339–350

Engle R, Kelly B (2012) Dynamic equicorrelation. J Bus Econ Stat 30(2):212–228

Erb CB, Harvey CR (2006) The strategic and tactical value of commodity futures. Financ Anal J 62(2):69–97

Fama EF, French KR (1988) Business cycles and the behavior of metals prices. J Finance 43(5):1075–1093

French KR, Schwert GW, Stambaugh RF (1987) Expected stock returns and volatility. J Financ Econ 19(1):3–29

Georgiev G (2001) Benefits of commodity investment. J Altern Invest 4:40–48

Giamouridis DG, Tamvakis MN (2001) The relation between return and volatility in the commodity markets. J Altern Invest 4(1):54–62

Gilmore CG, McManus GM (2002) International portfolio diversification: US and Central European equity markets. Emerg Mark Rev 3(1):69–83

Glosten LR, Jagannathan R, Runkle DE (1993) On the relation between the expected value and the volatility of the nominal excess return on stocks. J Finance 48(5):1779–1801

Gorton G, Rouwenhorst KG (2006) Facts and fantasies about commodity futures. Financ Anal J 62(2):47–68

Gruber J, Vigfusson R (2012). Interest rates and the volatility and correlation of commodity prices. Working paper, Federal Reserve Board

Harvey CR (1995) Predictable risk and returns in emerging markets. Rev Financ Stud 8(3):773–816

Idzorek TM (2007) Commodities and strategic asset allocation. In: Till H, Eagleeye J (eds) Intelligent commodity investing: new strategies and practical insights for informed decision making. Risk Books, London, pp 113–177

Irwin SH, Sanders DR (2011) Index funds, financialization, and commodity futures markets. Appl Econ Perspect Policy 33(1):1–31

Jagannathan R (1985) An investigation of commodity futures prices using the consumption-based intertemporal capital asset pricing model. J Finance 40(1):175–191

Jensen GR, Johnson RR, Mercer JM (2000) Efficient use of commodity futures in diversified portfolios. J Futures Mark 20:489–506

Kat HM, Oomen RC (2007) What every investor should know about commodities Part I: univariate return analysis. CFA digest

Kucher O, Kurov A (2014) Business cycle, storage, and energy prices. Rev Financ Econ 23(4):217–226

Masters MW (2008) Testimony before the committee on homeland security and governmental affairs. US Senate, Washington, May 20

Mensi W, Beljid M, Boubaker A, Managi S (2013) Correlations and volatility spillovers across commodity and stock markets: linking energies, food, and gold. Econ Model 32:15–22

Ng VK, Pirrong SC (1994) Fundamentals and volatility: storage, spreads, and the dynamics of metals prices. J Bus 67(2):203–230

Sensoy A, Hacihasanoglu E, Nguyen DK (2015) Dynamic convergence of commodity futures: not all types of commodities are alike. Resour Policy 44:150–160

Shang HH (2011) Macroeconomic factors and the cross (section of commodity returns). Working paper. Concordia University

Silvennoinen A, Thorp S (2013) Financialization, crisis and commodity correlation dynamics. J Int Financ Mark Inst Money 24:42–65

Switzer LN, Tahaoglu C (2015) The benefits of international diversification: market development, corporate governance, market cap, and structural change effects. Int Rev Financ Anal 42:76–97

Szymanowska M, Roon F, Nijman T, Goorbergh R (2014) An anatomy of commodity futures risk premia. J Finance 69(1):453–482

Tang K, Xiong W (2010) Index investment and financialization of commodities. Working paper. Princeton University, Renmin University of China

Tang K, Xiong W (2012) Index investment and the financialization of commodities. Financ Anal J 68(5):54–74

You L, Daigler RT (2013) A Markowitz optimization of commodity futures portfolios. J Futures Mark 33(4):343–368

Zheng Y (2014) The linkage between aggregate stock market investor sentiment and commodity futures returns. Appl Financ Econ 24(23):1491–1513

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Demiralay, S., Bayraci, S. & Gaye Gencer, H. Time-varying diversification benefits of commodity futures. Empir Econ 56, 1823–1853 (2019). https://doi.org/10.1007/s00181-018-1450-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-018-1450-7