Abstract

This paper develops a production-inventory model of a single product with imperfect production process in which inflation and time value of money are considered under shortages. Demand rate has been considered to be a function of quadratic decreasing and exponential decreasing of selling price. The selling price of a unit is determined by a mark-up over the production cost. Unit production cost is considered incorporating several features like energy and labour cost, raw material cost, replenishment rate and other factors of the manufacturing system. The defective items which is a certain fraction of the total production or a random number are either reworked or refunded if those reach to the customer. Two scenarios have been considered in which defective items are refunded from the customer with penalty in scenario (a) and the defective items are repaired and sold to the customer as good items in scenario (b). Based on these two scenarios, three models have been developed in which defective items are certain fraction of the produced quantity in Model-I, a random number in Model-II, and are dependent in reliability parameter and time in Model-III. Considering all these phenomena optimum production of the product has been evaluated to have maximum profit. Finally, numerical examples are given to illustrate the results along with graphical analysis. Sensitivity analysis has also been carried out for different values of the parameter.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In the manufacturing system, a production process is not always completely perfect and as a result of which some defective items may be produced from the very beginning of the production. In that case defective items are certain fraction of the total production. Again on the other hand, all the produced items may be non-defective at the beginning of the production process but as long as the production continues, the production process deteriorates with time. In that case, defective items are random number. These defective items are either repaired or refunded if they reach to the customer. Lee and Park [1], Urban [2], Lin [3], Rosenblatt and Lee [4], Lee and Rosenblatt [5] developed an EPL model of this type of production process. Sana et al. [6, 7] developed an EMQ model in an imperfect production system in which defective items are sold at a reduced price. Then several research works have been done on imperfect production process and defective items [8–11].

Recently, Mondal et al. [12] developed an inventory model for defective items with variable production cost. But in this paper shortages and time-value of money were not taken into account. So, in this paper we have developed an EPL model of defective items considering shortages, inflation and time-value of money (Table 1).

In this model demand has been considered as quadratic and exponential decreasing function of selling price. The selling price of a product is one of the important factors in the present competitive market situation. It has been seen in case of defective goods whose demand is mainly price dependent that higher selling price negates the demand whereas lower selling price has a reverse effect. Whitin [13] first considered the effect of price dependent demand in an inventory model. Then many researchers have worked in this area [14–17]. Recently, Maiti et al. [18] developed a production-inventory with stochastic lead-time where price dependent demand was considered. Different types of demand like stock dependent and time varying demand have also been considered in several research work [19–23].

Again many EOQ models do not take into account the effects of inflation and time-value of money. So the time-value of money which plays an important role, can not be ignored in the present economic situation. Buzacott [24] was the first who had included the idea of inflation in inventory literature. Misra [25], Van Hees and Monhemius [26], Bierman and Thomas [27], Sarkar and Pan [28] also have worked in this direction. Other notable paper in this direction are Hariga [29], Cheung [30], Chung, Liu and Tsai [31].

Again, in the present economic situation, shortage of the items takes an important role. Chandra and Bahner [32] established an inventory model for deteriorating items with shortages and linear time-dependent demand in which time-value of money was considered. Again several research work in the direction of probabilistic deterioration have been done by many researcher [33, 34]. Bose, Goswami and Chaudhuri [35], Dohi, Kaio and Osaki [36], Chen [37], Wee and Law [38] also developed the inventory model in which shortages were taken into consideration. Datta and Pal [39], Bose et al. [40] developed inventory model considering effect of inflation and shortages. Roy and Chaudhuri [41] analysed a finite time-horizon deterministic EOQ model with stock dependent demand and effect of inflation and allowing shortages in all cycles. Sarkar et al. [42] developed an inventory model with finite replenishment rate where price discount offer was considered. Some recent works in this area are given by [43–50] (Table 2).

Notations and Assumptions

This paper is developed with the following Notations and Assumptions.

-

Notations:

- p::

-

Selling price per unit item.

- D(p)::

-

Demand rate which is a function of selling price.

- P::

-

Production rate (a decision variable).

- f(P)::

-

Unit production cost.

- A::

-

Advertisement cost per unit item.

- \(c_{r}\)::

-

Raw material cost.

- L::

-

Labour charges.

- S::

-

Maximum stock level.

- \(S_{1}\)::

-

Maximum shortage.

- \(c_{h}\)::

-

Inventory carrying cost per unit quantity per unit time.

- \(c_{0}\)::

-

Set up cost which is known and constant.

- q(t)::

-

Stock level at time t.

- Q::

-

Number of produced units(a decision variable).

- M(Q, P)::

-

Average profit per unit time for a cycle.

- \(P_{1}\)::

-

Total number of defective items.

- \(\mu \)::

-

Scaling parameter for defective items.

- \(\frac{1}{m}\)::

-

Mean of exponential distribution.

- \(t_{1}\)::

-

Time upto which the production is made i.e. after \(t=t_{1}\) the production is discontinued.

- \(t_{2}\)::

-

Time at which stock level falls to zero due to demand.

- \(t_{3}\)::

-

Time at which shortages reach to the level \(S_{1}\).

- T::

-

Time at which stock level is again zero i.e. one cycle time.

- \(\gamma \)::

-

r-i, r is the interest rate per unit currency and i is the inflation rate per unit currency.

- \(\psi \)::

-

Product reliability parameter.

-

Assumptions:

-

(a)

The demand rate D(p) is deterministic function of selling price p. It is either quadratic decreasing or exponential decreasing function of selling price p. \(D(p)=a-bp-cp^{2}\), where \(a,b,c>0\) and \(D(p)=d \times p^{-k}\), \(d,k>0\).

-

(b)

The unit production cost \(f(P)=c_{r}+A+\frac{L}{P^{\alpha }}+KP^{\beta }\), where K is a positive constant and \(\alpha ,\beta \) are chosen to provide the feasible solution of the model.

-

(c)

The defective items are fraction of the produced items in first and third model and a random number for the second model.

-

(d)

Selling price p is determined by a mark-up over the unit production cost f(P). i.e. \(p= {\uplambda }f(P)\), \({\uplambda }>1\) where \({\uplambda }\) is the mark-up.

-

(e)

Lead time is assumed to be zero.

Development of the Model and Analysis

The defective items are either reworked or refunded if those are sold to the customer. Under these circumstances, we investigate the following two scenarios:

Scenario (a): Q units are to be produced. All produced items including the defective items are sold to the customers at the rate of D units as good units and later \(P_{1}\) defective items are refunded from the customer with penalty at a cost of \(c_{v}\) per unit.

Scenario (b): Q units are produced and \(P_{1}\) defective items are spotted just after the production. Those are repaired against the cost of \(c_{\theta }\) per unit and sold as good items to the customer.

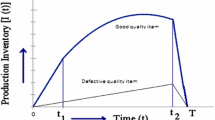

At \(t=0\), the stock level is zero and then the variable production starts to produce items at a rate P units per unit time. The production stops at \(t=t_{1}\). As the production rate is greater than demand rate, some units are accumulated during the interval \(0 \le t \le t_{1}\). At \(t=t_{1}\), the inventory level reaches to the maximum stock level S. After \(t=t_{1}\), the stock level decreases due to demand only and at \(t=t_{2}\) it falls to zero. Then shortages start and are accumulated to the level \(S_{1}\) at \(t=t_{3}\). After \(t=t_{3}\) the production starts again. Fresh production and supply to the consumers occur simultaneously during the interval \(t_{3} \le t \le t_{4}\). The whole backlog is cleared by the time \(t=t_{4}\) and the stock level is again zero at \(t=t_{4}\). The graphical representation of the model is given by Fig. 1.

Hence under the above assumptions, the differential equation satisfied by q(t) at time t can be represented as:

with initial and boundary condition

and

and

The present-value of total revenue is

The present-value of production cost is

The present-value of holding cost is

The present-value of set-up cost is

The present-value of shortage cost is

The present-value of refund cost is

The present-value of rework cost is

Model-I : Defective items are a certain fraction of the produced quantity:

Scenario (a): The total profit incorporating inflation and time-value of money is given by

Scenario (b): The total profit incorporating inflation and time-value of money is given by

Model-II : Number of defective items is random:

Let the time \(\tau \) at which in-control state changes to a out-control state is a random variable and follows exponential distribution with mean \(\frac{1}{m}\). So the number of defective items is a random variable and is given by

So the expected number of total defective item is given by

Scenario (a): The expected average profit M(Q, P) is given by

Scenario (b): The expected average profit M(Q, P) is given by

Model-III : Defective items are dependent on reliability parameter \(\psi \) and time t:

The amount of defective items produced at time t is \(\eta e^{\psi t }P\) where \(\eta e^{\psi t}<1\). Since the fraction \(\eta e^{\psi t}\) increases with time t and \(\psi \) simultaneously, so in this system the production of defective items increase with increase of time. It has been seen, after a certain time almost all manufacturing system undergoes unsatisfactory performance. So, in long production run process, the system shifts in-control state to a out-control state during malfunctioning. As a result percent of defective items increase with time t. Again, lower value of \(\psi \) decrease the percent of defective items. For that reason, the defective items at time t has been considered as \(\eta e^{\psi t}P\).

Therefore, the present-value of refund cost is

Therefore, the present-value of rework cost is

Scenario (a): The total profit M(Q, P) is given by

Scenario (b): The total profit M(Q, P) is given by

Numerical Examples

To illustrate the proposed model-1, model-2 and model-3 we consider the following examples given below.

Example-1 of model-1: Let us take \(D(p)= a-bp-cp^{2}\) and the parameter values in the inventory system are \(c_{0} = \$100\), \(c_{h}= \$3\), \(c_{s} = \$2\), \(c_{r}= \$50\), \(a =100\), \(b=\) 0.3 \(\alpha = 0.7\), \(\beta \,=\) 1.5, \(c_{v} \,=\) 200, \({\uplambda }\,=\,\) 1.2, \(A \,=\) $50, \(\mu \,=\) 0.08, \(\gamma \,=\) 0.02, \(L\,=\) $1500, \(K\,=\) 0.01, \(\delta \,=\) 0.8, \(c\,=\) 0.001, in appropriate units. The optimal solution is \(P^{*}\,=\) 159.811, \(Q^{*}\,=\, 80.2984\), and maximum expected average profit is \(M\,=\,1637.74\) (Fig. 2).

Example-2 of model-1: Let us take \(D(p)\,=\, d\times p^{-k}\) and the parameter values in the inventory system are \(c_{0} \,=\) $100, \(c_{h} \,=\) $3, \(c_{s} \,=\) $2, \(c_{r} \,=\) $50, \(d \,=\) 20000,\(k\,=\) 1.6 \(\alpha \,=\) 0.7, \(\beta \,=\) 1.5, \(c_{v} \,=\) 200, \({\uplambda }\,=\) 1.2, \(A \,=\) $50, \(\mu \,=\) 0.08, \(\gamma \,=\) 0.02, \(L\,=\) $1500, \(K\,=\) 0.01, \(\delta \,=\) 0.8, in appropriate units. The optimal solution is \(P^{*}\,=\) 478.359, \(Q^{*}\,=\, 88.9129\), and maximum expected average profit is \(M\,=\,2678.58\) (Fig. 3).

Example-1 of model-2: Let us take \(D(p)\,=\, a-bp-cp^{2}\) and the parameter values in the inventory system are \(c_{0} \,=\) $100, \(c_{h} \,=\) $3, \(c_{s} \,=\) $2, \(c_{r} \,=\) $50, \(a \,=\) 200,\(b\,=\) 0.7 \(\alpha \,=\) 0.7, \(m\,=\) 0.08, \(\alpha _{1} \,=\) 0.001, \(\beta \,=\) 1.5, \(c_{v} \,=\) 200, \({\uplambda }\,=\) 1.2, \(A \,=\) $50, \(\gamma \,=\) 0.01, \(L\,=\) $1500, \(K\,=\) 0.01, \(\delta \,=\) 0.8, \(c\,=\) 0.001, in appropriate units. The optimal solution is \(P^{*}\,=\) 154.575, \(Q^{*}\,=\) 1081.71, and maximum expected average profit is \(M\,=\,30469.9\) (Fig. 4).

Example-2 of model-2: Let us take \(D(p)= d\times p^{-k}\) and the parameter values in the inventory system are \(c_{0} = \$100\), \(c_{h} = \$3\), \(c_{s} = \$2\), \(c_{r} = \$50\), \(d = 20000,k= 1.6\), \(\alpha = 0.7\), \(m= 0.08\), \(\alpha _{1} = 0.001\), \(\beta = 1.5\), \(c_{v} = 200\), \({\uplambda }= 1.2\), \(A = \$50\), \(\gamma =0.01\), \(L=\$1500\), \(K=0.01\), in appropriate units. The optimal solution is \(P^{*}= 64.704\), \(Q^{*}= 156.406\), and maximum expected average profit is \(M= 4879.64\) (Fig. 5).

Example-1 of model-3: Let us take \(D(p)= a-bp-cp^{2}\) and the parameter values in the inventory system are \(c_{0} = \$100\), \(c_{h} = \$3\), \(c_{s} = \$2\), \(c_{r} = \$50\), \(a = 200\),\(b= 0.7\), \(\alpha = 0.7\), \(\beta = 1.5\), \(c_{v} = 200\), \({\uplambda }= 1.2\), \(A = \$50\), \(\eta =0.09\), \(\psi =0.05\), \(\gamma =0.01\), \(L=\$1500\), \(K=0.01\), \(c=0.001\), in appropriate units. The optimal solution is \(P^{*}= 159.276\), \(Q^{*}= 57.6545\), and maximum expected average profit is \(M= 1608.07\) (Fig. 6).

Discussion

In scenario (a) and scenario (b) of model-1, the system with free from defective items (\(\mu =0\)) gives more profit than the system with defective items (\(\mu \ne 0\)). Again in defective production system, the amount of profit decreases as \(\delta \) changes from 0.8 to 1.0 (Table 3)

In case of model-2 with random defective items, for all scenarios, profit is less when mean of the exponential distribution is less i.e. profit with \(m=0.08\) is more than the profit with \(m=0.4\). But the change in profit with mean is very slow (Table 4).

In case of model-3 for all scenarios the profit decreases as the reliability parameter \(\eta \) changes from 0.05 to 0.08. Therefore lower value of \(\eta \) gives more profit (Table 5).

Sensitivity Analysis

The sensitivity of the maximum total profit is examined due to changes in production rate and price mark-up. To illustrate the result, it has been shown only for Model-1 (Example-1), scenario-(a).

Figure 7 shows that total profit increases with the production rate P and it attains maximum value $1637.74 at \(P=159.811\) when \(Q=80.3\).

From Fig. 8 it is observed that unit production cost is minimum i.e. Rs. $163.212 at production rate \(P= 159.337\). It is interesting to note that at \(P=159.811\) unit production cost is not minimum.

Figure 9 represents maximum total profit versus price mark-up \({\uplambda }\). Normally, profit increases with the increase of price mark-up. From Fig. 9, it is observed that the profit is maximum when the price mark-up is 1.17 and the profit decreases as price mark-up is more than 1.17 because demand decreases with increase of selling price. Again sensitivity to the different changes of parameters are observed in Table 6.

Conclusions

In this paper, we have extended Mondal et al. [7] EPL model for defective items considering shortages, inflation and time-value of money. Again, in this model different types of demand like quadratic decreasing and exponential decreasing function of selling price have been considered.

This model could be extended in fuzzy and fuzzy-stochastic environment taking demand, defective items and other inventory parameters to be imprecise.

References

Lee, J.S., Park, K.S.: Joint deterioration of production cycle and inspection intervals in a deteriorating production. J. Oper. Res. Soc. 42, 775–783 (1991)

Urban, T.L.: Deterministic inventory models incorporating marketing decisions. Comput. Ind. Eng. 22, 85–93 (1992)

Lin, C.S.: Integrated production inventory models with imperfect production processes and a limited capacity for raw materials. Math. Comput. Model. 29, 31–39 (1999)

Rosenblatt, J., Lee, H.L.: Economic production cycles with imperfect production process. IIE Trans. 18, 48–55 (1986)

Lee, H.L., Rosenblatt, J.: Simultaneous determination of production cycle and inspection intervals in a deteriorating production. Manag. Sci. 33, 1125–1136 (1987)

Sana, S., Goyal, S.K., Chaudhuri, K.S.: An imperfect production process in a volume flexible inventory model. Int. J. Prod. Econ. 105, 548–559 (2007)

Sana, S., Goyal, S.K., Chaudhuri, K.S.: On a volume flexible inventory model for items with an imperfect production system. Int. J. Oper. Res. 2(1), 64–80 (2007b)

Sarkar, B., Gupta, H., Chaudhuri, K.S., Goyal, S.K.: An integrated inventory model with variable lead time, defective units and delay in payments. Appl. Math. Comput. 237, 650–658 (2014)

Sarkar, B., Moon, I.: Improved quality, setup cost reduction, and variable backorder costs in an imperfect production process. Int. J. Prod. Econ. 155, 204–213 (2014)

Sarkar, B.: An inventory model with reliability in an imperfect production process. Appli. Math. Comput. 218(2012), 4881–4891 (2012)

Sarkar, B.: An EOQ model with delay in payments and stock dependent demand in the presence of imperfect production. Appl. Math. Comput. 218(2012), 8295–8308 (2012)

Mondal, B., Bhunia, A.K., Maiti, M.: Inventory models for defective items incorporating marketing decisions with variable production cost. Appl. Math. Model. 33, 2845–2852 (2009)

Whitin, T.M.: Inventory control and price theory. Manage. Sci. 2, 61–68 (1995)

Kunreuther, H., Richard, J.F.: Optimal pricing and inventory decisions for non-seasonal items. Econometrica 39, 173–175 (1977)

Lee, H.L., Rosenblatt, M.J.: The effects of varying marketing policies and conditions on the economic ordering quantity. Int. J. Prod. Res 24, 593–598 (1986)

Abad, P.L.: Optimal pricing and lot sizing under conditions of perishable and partial back ordering. Manag. Sci. 42, 1093–1104 (1996)

Mukherjee, S.P.: Optimum ordering interval for time-varying decay rate of inventory. Opsearch 24, 19–24 (1987)

Maiti, A.K., Maiti, M.K., Maiti, M.: Inventory model with stochastic lead-time and price dependent demand incorporating advance payment. Appl. Math. Model. 33, 2433–2443 (2009)

Sarkar, B., Mandal, P., Sarkar, S.: An EMQ model with price and time dependent demand under the effect of reliability and inflation. App. Math. Comput. 231(15), 414–421 (2014)

Khanra, S., Mandal, B., Sarkar, B.: An inventory model with time dependent demand and shortages under trade credit policy. Econ. Model. 35, 349–355 (2013)

Sett, B.K., Sarkar, B., Goswami, A.: A two-warehouse inventory model with increasing demand and time varying deterioration. Scientia Iranica Trans. E Indust. Eng. 19, 306–310 (2012)

Sarkar, B., Sana, S.S., Chaudhuri, K.S.: An imperfect production process for time varying demand with inflation and time value of money - An EMQ model. Expert Syst. Appl. 38, 13543–13548 (2011)

Sarkar, B., Sana, S.S., Chaudhuri, K.S.: A finite replenishment model with increasing demand under inflation. Int. J. Math. Oper. Res. 2(3), 347–385 (2010)

Buzacott, J.A.: Economic order quantities with inflation. Oper. Res. Q. 26, 553–558 (1975)

Misra, R.B.: A note on optimal inventory management under inflation. Nav. Logist. Q. 26, 161–165 (1979)

Van Hees, R.N., Monhemius, W.: Production and Inventory control: Theory and Practice, pp. 81–101. Barnes and Noble, Macmillan, New York (1972)

Bierman, H., Thomas, J.: Inventory decisions under inflationary conditions. Decis. Sci. 8, 151–155 (1977)

Sarkar, B.R., Pan, H.: Effects of inflation and the time value of money on order quantity and allowable shortage. Int. J. Prod. Econ. 34, 65–72 (1994)

Hariga, M.A.: Economic analysis of dynamic inventory models with non-stationary cost and demand. Int. J. Prod. Econ. 36, 255–266 (1994)

Cheung, K.I.: A continuous review inventory model with a time discount. IIE Trans. 30, 747–757 (1998)

Chung, K.J., Liu, J., Tsai, S.F.: Inventory systems for deteriorating items taking account of time value. Eng. Opt. 27, 303–320 (1997)

Chandra, M.J., Bahner, M.L.: The effects of inflation and the time value of money on some inventory systems. Int. J. Prod. Res. 23, 723–730 (1985)

Sarkar, B.: A production-inventory model with probabilistic deterioration in two-echelon supply chain management. Appl. Math. Model. 37, 3138–3151 (2013)

Sarkar, M., Sarkar, B.: An economic manufacturing quantity model with probabilistic deterioration in a production system. Econ. Model. 31, 245–252 (2013)

Bose, S., Goswami, A., Chaudhuri, K.S.: An EOQ model for deteriorating items with linear time-dependent demand rate and shortages under inflation and time discounting. J. Oper. Res. Soc. 31, 771–782 (1995)

Dohi, T., Kaio, N., Osaki, S.: A note on optimal inventory policies taking account of time-value. RAIRO 26, 1–14 (1992)

Chen, J.M.: An inventory model for deteriorating item with time proportional demand and shortages under inflation and time discounting. Int. J. Prod. Econ. 55, 21–30 (1998)

Wee, H.M., Law, S.T.: Replenishment and pricing policy for deteriorating items taking into account the time-value of money. Int. J. Prod. Econ. 71, 213–220 (2001)

Datta, T.K., Pal, A.K.: Effects of inflation and time-value of money on an inventory model with linear time dependent demand rate and shortages. Eur. J. Oper. Res. 52, 1–8 (1991)

Bose, S., Goswami, A., Chaudhuri, K.S.: An EOQ model for deteriorating items with linear time-dependent demand rate and shortages under inflation and time discounting. J. Oper. Res. Soc. 46, 771–782 (1995)

Roy, T., Chaudhuri, K.S.: A finite time-horizon deterministic EOQ model with stock level-dependent demand, effect of inflation and time value of money with shortage in all cycles. Yugoslov J. Oper. Res. 17(2), 195–207 (2007)

Sarkar, B., Sana, S.S., Chaudhuri, K.S.: Inventory model with finite replenishment rate, trade credit policy and price-discount offer. J. Ind. Eng. 2013, 1–18 (2013)

Barzoki, M.R., Jahanbazi, M., Bijari, M.: Effects of imperfect products on lot sizing with work in process inventory. Appl. Math. Comput. 217, 8328–8336 (2011)

Pal, B., sana, S.S., Chaudhuri, K.S.: Three-layer supply chain: a production-inventory model for reworkable items. Appl. Math. Comput. 219, 530–543 (2012)

Sarkar, B., Gupta, H., Chaudhuri, K.S., Goyal, S.K.: An integrated inventory model with variable lead time. Appl. Math. Comput. 237, 650–658 (2014)

Pal, B., Sana, S.S., Chaudhuri, K.S.: A mathematical model on EPQ for stochastic demand in an imperfect production system. J. Manuf. Syst. 32, 260–270 (2013)

Pal, B., Sana, S.S., Chaudhuri, K.S.: Joint pricing and ordering policy for two echelon imperfect production inventory model with two cycles. Int. J. Prod. Econ. 155, 229–238 (2014)

Das Roy, M., Sana, S.S., Chaudhuri, K.S.: An optimal shipment strategy for imperfect items in a stock-out situation. Math. Comput. Model. 54, 2528–2543 (2011)

Sarkar, B., Sana, S.S., Chaudhuri, K.S.: An imperfect production process for time varying demand with inflation and time value of money - An EMQ model. Expert Syst. Appl. 38, 13543–13548 (2011)

Crdenas-Barrn, L.E., Sarkar, B., Trevio-Garza, G.: Easy and improved algorithms to joint determination of the replenishment lot size and number of shipments for an EPQ model with rework. Math. Comput. Appl. 18, 3138–3151 (2013)

Acknowledgments

The authors wish to thank the anonymous referees for their helpful comments and suggestions which greatly improved the content of the article.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Theorem: The profit function M(Q, P) possess a maximum solution.

Proof:

We first obtain second order derivative of M(Q, P) and using (36) we have

provided \(X=(\frac{D}{\gamma Q}-\frac{D}{\gamma Q}e^{-\gamma T}-e^{-\gamma T})>0\) and \(Y=(2c_{h}+\frac{\gamma c_{h}Q}{D}e^{-\gamma t_{2}}-c_{s}(2+e^{-\gamma t_{2}})-\frac{\gamma c_{s}Q}{D}e^{-\gamma (T-t_{2})}-\frac{2c_{0}D}{Q^{2}(1-\frac{D}{P})})>0\)

provided \(B= \frac{\alpha (\alpha +1)L}{P^{\alpha -1}}-2c_{h}Q(1-e^{-\gamma t_{2}})>0\)

provided \(C=c_{h}(1-e^{-\gamma t_{2}})-c_{s}(1-e^{-\gamma (T-t_{2})})>0\)

Hence M(Q, P) has a maximum with respect to Q and P if \(\frac{\partial ^{2} M(Q, P)}{\partial Q^{2}}<0\) and \(\frac{\partial ^{2} M(Q, P)}{\partial Q^{2}}\frac{\partial ^{2} M(Q, P)}{\partial P^{2}}-\frac{\partial ^{2} M(Q, P)}{\partial Q \partial P}>0\)

For our numerical data the above conditions are satisfied and therefore the profit function has a maximum solution.

Rights and permissions

About this article

Cite this article

Chakrabarty, R., Roy, T. & Chaudhuri, K.S. A Production: Inventory Model for Defective Items with Shortages Incorporating Inflation and Time Value of Money. Int. J. Appl. Comput. Math 3, 195–212 (2017). https://doi.org/10.1007/s40819-015-0099-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40819-015-0099-6