Abstract

As pro-environmental behaviors in business are advocated, recycling process has become a hot topic in the supply chain management. Besides the traditional wholesales and retail for new products, manufacturers would like to recycle and reprocess used products with consideration of production costs and pressure from environment protection. This paper considers the recycling process implemented by manufacturers themselves or entrusted to retailers to implement. A two-period model is established to discuss the optimal recycling and pricing strategies for manufacturers and retailers under both active return and passive return. The results show that the manufacturers and retailers are always better off in active return than that in passive return. The decision that manufacturers participate to the recycling by themselves or entrust it to retailers depends on the return rate and the collection cost. Numerical simulations and sensitivity analysis are implemented to demonstrate our results and illustrate the effect of each parameter on the optimal strategies.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Manufacturers would like to promote the recycling of used products, partly because recycled products can be decomposed into useful raw materials and then reduce production costs (Guide and Van 2001). Moreover, consumers involved in the recycling process may continue to buy new products. The recycling policy may stimulate potential demand in the market. To encourage the willingness of consumers to return used products, for instance, Xerox Corporation provided prepaid mailboxes so that customers can return their used print cartridges easily without incurring extra costs. Lexmark offered a discount to customers who agreed to return the used product. Huawei encouraged the recycling of old mobile phones through trade-in activities (Xu and Liu 2017). The recycling of used products can effectively reduce environmental pollution (Zhao et al. 2019). Leal Filho et al. (2019); Shah et al. (2020) introduced that recycled products can be decomposed into raw materials and used to produce new products. Wang et al. (2019a; b) pointed out that product recycling can prevent waste and harmful substances from entering the ecological environment by reusing waste materials and key components. A closed-loop supply chain (CLSC) should combine forward and reverse activities into a unified system to improve economic and environmental performance (Krikke et al. 2004).

The researches on the CLSC can be divided into two categories: coordination mechanisms and return functions (De Giovanni and Zaccour 2019b). In CLSC, manufacturers can recycle the products by themselves or entrust the recycling activities to retailers. Some literatures argue that manufacturer recycling yield more profits. And manufacturers may prefer collecting by themselves when gains from the collection process are high (De Giovanni and Zaccour 2013). But some literatures attain opposite opinions that retailers or the third parties have advantages for recycling products. A CLSC performs better when retailers recycle the products (Savaskan et al. 2004). Bhattacharya et al. (2006) modeled a three-player game where remanufacturers as the third party are always responsible for recycling. Atasu et al. (2013) found that retailer-managed collection is preferred by manufacturers. So the decision that either manufacturer recycling or retailer recycling depends on many factors. The manufacturer should outsource the product collection when outsourcing performs environmentally and operationally better (De Giovanni and Zaccour 2014). Miao et al. (2017) built a decision model of CLSC for retailer recycling and manufacturer recycling. The conclusion showed that retailer recycling is optimal for retailers, and manufacturer recycling is optimal for manufacturers and systems. Li et al. (2017) considered mixed recycling channels as the research object and found that mixed recycling channels are more effective.

The return function is often modeled as an exogenous parameter, a function of some decision variables or a dynamic process. The coordination mechanisms are used to balance respective objectives and improve the payoff of all parties involved in the CLSC. This paper mainly focuses on the return function, which is modeled as a function of some decision variables. In the early literatures, the return rate is always a given function or a constant. Minner and Kleber (2001) considered the return rate as a constant percentage of sales. And some literatures considered a constant return rate that \(0 < {\upalpha } < 1\) (Ferrer and Swaminathan 2006; Xiong et al. 2013; Ma et al. 2013; De Giovanni and Ramani. 2017). It means the proportion of recycled products is fixed and independent with other factors. Besides, the return rate can be assumed as a function of decision variables of firms, e.g., collection efforts, acquisition price. Savaskan et al. (2004), Govindan and Popiuc (2014) considered that the return rate is a function of the square root of collection efforts. Savaskan and Van Wassenhove (2006) proposed that manufacturers may set an expected return rate of production recycling. Yoo and Kim (2016), Saha et al. (2016) retained a return rate that depends on acquisition price. Recently, the return function becomes more complex and is influenced by more than one factor. Huang et al. (2013) considered that retailers and the third party compete for collecting used products, so the return rate reasonably depends on the investments of both competing sides. In this paper, the return function is modeled as a linear function of the improvement of product quality and subsidies. The linear function implies a simple positive correlation that the return rate increases with the improvement of product quality and subsidies. Manufacturers can encourage consumers to return used products by improving the product quality or setting a higher subsidy level. This paper explores recycling strategies and pricing strategies in active and passive return to figure out which recovery scenario is more beneficial for CLSC members.

The attitudes of consumers for recycling can be divided into two types: active return and passive return (De Giovanni and Zaccour 2019a). Passive return means that the proportion of consumers who are willing to return used products is fixed and independent of the recycling policies of manufacturers. On the contrary, active return means that the proportion of consumers who are willing to participate the recycling varies with the product quality improved by manufacturers or other subsidy policies. In this case, the recycling behaviors of consumers may be encouraged by the incentives of manufacturers. For example, when new mobile phones with higher quality are launched, consumers maybe can not wait to swap old phones for new ones. Here the improvement of product quality affects the willingness of consumers to return used ones significantly. Discussions on active return and passive return have been involved in many papers. Bakal and Akcali (2006) (order of reference) defined the return function as \(S(f) = \alpha + \beta f\), where \(\alpha\) represents the effect of passive return, and \(\beta f\) represents the effect of the active return. Many literatures follow the definition of the return function above (Kaya 2010; Huang and Wang 2017). But few of them explained that how active and passive return affects the pricing and recycling strategies implemented by manufacturers differently.

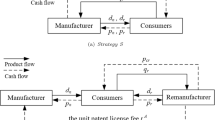

This paper considers a binary supply chain consisting of manufacturers and retailers. A two-period CLSC is built to simulate the real trading and recycling process. In the first period, manufacturers determine the wholesale price and sells products to retailers. Then, retailers set the retail price based on the wholesale price and distribute products to common consumers. Part of the products sold in the first period may be recycled and enter into the second period. Manufacturers could choose to participate the recycling process by themselves (called manufacturer recycling) or entrust it to retailers with additional fees (called retailer recycling). Both active and passive return are considered in the model. In the second period, manufacturers need to decide the amount of investment on the quality improvement for new products. Then, they determine the wholesale price of new products, on which retailers sets the retail price.

This paper compares the optimal strategies of manufacturers and retailers in different scenarios and wishes to answer the following questions:

-

1.

What are the optimal pricing strategies for manufacturers and retailers in each scenario, i.e., manufacturer/retailer recycling with active/passive return?

-

2.

For manufacturer recycling, either active return or passive return is better for manufacturers and retailers?

-

3.

For retailer recycling, either active return or passive return is better for manufacturers and retailers?

-

4.

Should manufacturers participate the recycling process by themselves or entrust it to retailers?

The paper is organized as follows: Section 2 describes a two-period supply chain model and the optimal strategies under different scenarios are solved. Section 3 presents numerical simulations and sensitivity analysis to demonstrate the results. Section 4 concludes the paper. The research was conducted between October 2019 and June 2020 in Jiangsu University.

Materials and methods

This paper develops a two-period model to explore the optimal strategies for manufacturers and retailers, respectively. In this first period, manufacturers determine the wholesale price \({\text{W}}_{1}\) and sell the products to retailers. Then, retailers set the retail price \({\text{P}}_{1} { }\) based on \({\text{W}}_{1}\) and distribute the products to consumers. Since the demand of products has a negative relationship with the price, the demand in the first period \({\text{D}}_{1}\) can be expressed as follows:

where a > 0 is the maximal potential demand and b is the sensitivity of consumers to price. Here the demand is assumed to only depend on the price of products.

Since the used products have residual value for manufacturers, they may implement policies to encourage consumers to return their used products. De Giovanni and Zaccour (2019a) assumed that the return rate \({\text{h}}\) may depend on the quality improvement of new products and the strength of subsidy policy. Here the study follows their assumptions and the return function is defined as follows:

where Q is the quality improvement, S is the recycling subsidy to consumers provided by manufacturers, and h0, h1, h2 are positive parameters. In this function, h0 represents the passive return, which is independent of manufacturers' strategies. h1Q + h2S represents the active return, which may be affected by manufacturers’ policies. Manufacturers could decide the quality improvement Q and the corresponding cost is specified as follows:

where \(g\) is a positive parameter. They also can determine the strength of subsidy policy S to attract more returns.

Similarly, in the second period, manufacturers set the wholesale price of the new products \({ }W_{2}\) and sell them to retailers. Then retailers set the retail price \(P_{2} { }\) based on \(W_{2}\) and distribute the new products to consumers. Due to the effects of quality improvement and the recycling of old products, the demand in the second period can be specified as follows:

where \(\eta Q\) denotes the increased sales due to improved quality, and \(\eta\) is the sensitivity of consumers to quality improvement. Here \(h\left( {Q,S} \right){\text{ D}}_{1}\) denotes the demand of customers involved in product recycling.

Let \(C_{{\text{m}}}\) be the unit cost for manufacturers to recycle the used products. The recycled product provides a residual valueδto manufacturers. Thus, manufacturers earn \(\delta - C_{{\text{m}}} - S\) for each recycled product. Let \(C_{1}\) and \(C_{2}\) be the unit production cost for manufacturers in the period 1 and period 2, respectively. The profit functions of manufacturers retailers can be expressed as follows:

where \(\xi \in \left( {0, 1} \right)\) is a discount factor for the second-period profits.

Another choice for manufacturers is to plus a certain percentage \(\theta\) of cost to retailers and entrust retailers to recycle the used products. Let \(C_{{\text{r}}}\) be the unit cost for retailers to recycle the used products. In this scenario, manufacturers outsource the recycling process to retailers completely and retailers will pay the subsidies \({\text{S}}\) to consumers. Then, manufacturers earn \(\delta - \left( {1 + \theta } \right)C_{{\text{r}}}\) for each recycled product. The profits functions of manufacturer and retailer can be expressed as follows:

Table 1 summarizes the notations used in the paper.

Results and discussion

Results

The retailers’ strategies are influenced by the manufacturers’ pricing strategy, i.e., the retail price depends on the wholesale price. So the problem is solved backward.

Manufacturer recycling

For manufacturer recycling, the profits of manufacturers and retailers are defined in Eqs. 5 and 6. There is a gambling between manufacturers and retailers. Thus, according to the decision process, the optimal strategies for both manufacturers and retailers can be solved sequentially as follows.

-

Step 1 The optimal retail price in the second period \(P_{2}^{*}\) can be solved by taking the first-order derivative,

$$\frac{{\partial {\Pi }_{{\text{R}}}^{{\text{M}}} \left( {W_{1} ,W_{2} ,P_{1} ,P_{2} ,Q} \right)}}{{\partial P_{2} }} = 0 \Rightarrow P_{2}^{*} = f_{1} \left( {W_{1} ,W_{2} ,P_{1} ,Q} \right)$$(9)Here the solution \(P_{2}^{*}\) is a function of \(W_{1} ,W_{2} ,P_{2} ,Q\).

-

Step 2 Given \(P_{2}^{*}\), the optimal wholesales price in the second period \(W_{2}\) can be solved by taking the first order derivative,

$$\frac{{\partial {\Pi }_{{\text{M}}}^{{\text{M}}} \left( {W_{1} ,W_{2} ,P_{1} ,P_{2}^{*} ,Q} \right)}}{{\partial W_{2} }} = 0 \Rightarrow W_{2}^{*} = f_{2} \left( {W_{1} ,P_{1} ,Q} \right)$$(10)So given \(P_{2}^{*}\), the solution of \(W_{2}^{*}\) is a function of \(W_{1} ,P_{1} ,Q.\)

-

Step 3 Given \(P_{2}^{*} , W_{2}^{*}\), the optimal retail price in the first period \({\text{P}}_{1}^{*}\) can be solved by taking the first order derivative,

$$\frac{{\partial {\Pi }_{{\text{R}}}^{{\text{M}}} \left( {W_{1} ,W_{2}^{*} ,P_{1} ,P_{2}^{*} ,Q} \right)}}{{\partial P_{1} }} = 0 \Rightarrow P_{1}^{*} = f_{3} \left( {W_{1} ,Q} \right)$$(11)So given \(P_{2}^{*} ,W_{2}^{*}\), the solution of \(P_{1}^{*}\) is a function of \(W_{1} ,Q\).

-

Step 4 Given \(P_{1}^{*} , P_{2}^{*} , W_{2}^{*}\), the optimal wholesale price in the first period \(W_{1}^{*}\) and the quality improvement \(Q\) can be solved by taking the first order derivative with respect to \({ }W_{1}\) and Q,

$$\left\{ {\begin{array}{*{20}c} {\frac{{\partial {\Pi }_{{\text{M}}}^{{\text{M}}} \left( {W_{1} ,W_{2}^{*} ,P_{1}^{*} ,P_{2}^{*} ,Q} \right)}}{{\partial W_{1} }} = 0} \\ {\frac{{\partial {\Pi }_{{\text{M}}}^{{\text{M}}} \left( {W_{1} ,W_{2}^{*} ,P_{1}^{*} ,P_{2}^{*} ,Q} \right)}}{\partial Q} = 0} \\ \end{array} } \right.$$(12)variables \(P_{1} ,{ }P_{2} ,{ }W_{2}\).

-

Step 5 Substituting \(W_{1}^{*}\) and \(Q^{*}\) into Eq. 11, then \(P_{1}^{*} = f_{3} \left( {W_{1}^{*} ,Q^{*} } \right)\). Substituting \(W_{1}^{*} ,P_{1}^{*} ,Q^{*}\) into Eq. 10, then \(W_{2}^{*} = f_{2} \left( {W_{1}^{*} ,P_{1}^{*} ,Q^{*} } \right)\). Substituting \(W_{1}^{*} ,W_{2}^{*} ,P_{1}^{*} ,Q^{*}\) into Eq. 10, then \(P_{2}^{*} = f_{1} \left( {W_{1}^{*} ,W_{2}^{*} ,P_{1}^{*} ,Q^{*} } \right)\). Therefore, each variable can be solved individually independent with each other.

Retailer recycling

For recycling, the profits of manufacturers and retailers are defined in Eqs. 7 and 8. The optimization procedure is similar with that in manufacturer recycling. The only difference is to replace \({\Pi }_{{\text{M}}}^{{\text{M}}}\) and \({\Pi }_{{\text{R}}}^{{\text{M}}}\) by \({\Pi }_{{\text{M}}}^{{\text{R}}}\) and \({\Pi }_{{\text{R}}}^{{\text{R}}}\) defined in Eqs. 7 and 8.

In the above sections, the optimal strategies for the manufacturer recycling and retailer recycling with active return have been solved. For the case of passive return, i.e., \(h_{1} = h_{2} = 0\) in Eq. 2, the return function is \(h\left( {Q,S} \right) = h_{0}\). The similar procedures can be followed in Sect. 4.1 to find the optimal strategies for manufacturers and retailers.

Then, some numerical simulations are presented to demonstrate the results. The parameters are set as follows according to the literature De Giovanni et al. (2019a):

When manufactures recycle the used products by themselves, the optimal strategies are solved by Sect. 4.1. According to the parameters in Eq. 13, the profits of manufacturers with active and passive return are compared and discussed. Figures 1 and 2 present the optimal profits of manufacturers and retailers under different scenarios by varying \(h_{1} \in \left( {0,{ }0.1} \right)\) and \(h_{2} \in \left( {0,{ }0.4} \right)\). Since the return function with passive return is independent of \(h_{1}\) and \(h_{2}\), the plot is a horizontal plane.

Figure 1 demonstrates that manufacturers always gain more profits in the active return than passive return for manufacturer recyling.

Figure 2 demonstrates that retailers also always gain more profits in the active return than passive return for manufacturer recyling.

When retailers are responsible for recycling the used products, manufacturers should give the retailer some economic incentives. The profits of manufactures and retailers are solved by varying \(h_{1} \in \left( {0,{ }0.1} \right)\) and \(h_{2} \in \left( {0,{ }0.4} \right)\). The results are presented in Figs. 3 and 4.

Figures 3 and 4 demonstrate that manufacturers and retailers can always gain more profits with active return than passive return for retailer recycling.

In general, the study can conclude that:

Claim 1

Manufacturers and retailers can always gain more profits with active return than passive return for both manufacturer recycling and retailer recycling.

Pricing strategies

This section discusses the optimal pricing strategies of manufacturers and retailers.

Here compare the optimal price for manufacturer recyling (M-recycle) and retailer recycling (R-recycle) with active return.

Figures 5 and 6 present the optimal wholesale pricing and retail pricing strategies in the first period under different \(h_{1}\) and \(h_{2}\). They demonstrate that both the optimal wholesale and retailer price are lower in the first period for manufacturer recyling than for retailer recycling.

Figures 7 and 8 present the optimal wholesale pricing and retail pricing strategies in the second period under different \(h_{1}\) and \(h_{2}\). It is different from the optimal pricing strategies in the first period. They demonstrate that the optimal wholesale price and retail price are equal for manufacturer recycling and retailer recycling in the second period.

In general, the study can conclude that:

Claim 2

In the first period, the optimal wholesale price and retail price in manufacturer recycling are lower than that in retailer recycling. In the second period, the optimal wholesale price and retail price are equal for two recycling channels.

Then, it conducts a sensitivity analysis to explore the relationship between optimal pricing strategies and given parameters. Tables 2 and 3 show the relationships for manufacturer recycling and retailer recycling. Here ‘ + ’ denotes positive relationship and ‘-’ denotes negative relationship.

For example of manufacturer recycling, the relationship between \(a\) and \(W_{1}\) is positive. It means manufacturers can set a higher wholesale price when the potential marker is larger. But if the consumer’s sensitivity \(b\) is higher, they may need to set a lower price to attract more consumers. Hence the relationship between \(b\) and \(W_{1}\) is negative. Higher values of h0, h1, and h2 mean higher return rate in the second period. It leads to that manufacturers reduce the wholesale prices in the first period to increase the market in the second period. Therefore the relationship between h0, h1, h2 and \(W_{1}\) is negative, and the relationship between h0, h1, h2 and \(W_{2}\) is positive. Other parameters can be explained similarly.

For passive return, i.e., \(h_{1} = h_{2} = 0\) in Eq. 2, the optimal pricing strategies are equal in manufacturer recycling and retailer recycling through the numerical analysis. It means there are the same wholesale price and retail price in these two scenarios. The pricing strategy will not be influenced by recycling channels.

Then, it conducts a sensitivity analysis to explore the relationship between optimal pricing strategies and given parameters.

Since the optimal pricing strategies are the same for manufacturer recycling and retailer recycling, it can be concluded in one table. Table 4 indicates how the decision variables vary when one of the parameter values is changed in passive returns. And it can be explained similarly with that in Tables 2 and 3.

Manufacturer recycling or retailer recycling

In the model, manufacturers have the initiative in decisions: They could decide to recycle by themselves or entrust it to retailers. Assume that manufacturers are reasonable and they should recycle the used product exclusively if and only if they can get more profits than entrust it to retailers. This section explores the impact of return rate and collection cost on manufacturers’ choices and when they should recycle exclusively and when they should entrust it to retailers.

For collection costs, \(C_{{\text{r}}}\) and \(C_{{\text{m}}}\) represent the collection cost of retailers and manufacturers, respectively. Figure 9 presents the optimal choice under \(C_{{\text{r}}} \in \left( {0,{ }0.4} \right)\) and \(C_{{\text{m}}} \in \left( {0,{ }0.4} \right)\).

For return rates, \(h_{0}\) represents the passive return rate in this paper. To distinguish the return rate for manufacturers and retailers, let \(h_{{\text{m}}}\) represents the passive return rate for manufacturers, and \(h_{{\text{r}}}\) represents the passive return rate for retailer. Figure 10 presents the optimal choice under \(h_{{\text{r}}} \in \left( {0,{ }1} \right)\) and \(h_{{\text{m}}} \in \left( {0,{ }1} \right)\).

In Figs. 9 and 10, the blue region represents that manufacturers should recycle the products by themselves and the red region means that they should entrust the recycling to retailers. Figure 9 demonstrates that manufacturers should recycle exclusively when \(C_{{\text{r}}} > C_{{\text{m}}}\). Similarly, Fig. 10 demonstrates that manufacturers should recycle exclusively when \(h_{{\text{m}}} > h_{{\text{r}}}\). These results are reasonable since manufacturers always choose the decision with lower costs and higher returns.

Conclusion

This paper proposes a two-period closed-loop supply chain made up of manufacturers and retailers. The optimal pricing and recycling strategies of manufacturers and retailers with active and passive return are discussed and solved. Based on the analysis, the study can draw the following conclusions:

First, both manufacturers and retailers gain more profits in active return than that in passive return. When returns are active, manufacturers can encourage more consumers to participate in recycling and create more demand by improving the quality of new products or providing consumers some subsidies. Active return can also maximize the environmental benefits.

Second, the wholesale price and retail price will be lower for manufacturer recycling. Lower prices bring more benefits to consumers. So if the manufacturer want to sell more product, they may need to recycle the product by themselves.

Third, in passive and active returns, the decision that manufacturers should recycle the product by themselves or outsource it to retailers depends on the return rate and collection cost. If the collection cost of manufactures is less than retailers, or manufacturers’ return rate is higher, they should collect the used product by themselves. On the contrary, they should outsource it to retailers so that manufacturers can get more profit.

There are still some shortcomings to be developed in this article. First, this paper assumes that all recycled products possess the same value to the manufacturer. But in fact, products can be in different values when they are taken from consumers. Further, this paper only considers two incentives inactive returns, i.e., quality and subside. There are many other incentives that can influence the consumer to recycle. More factors can be considered in future.

References

Atasu A, Toktay LB, Van Wassenhove LN (2013) How collection cost structure drives a manufacturer’s reverse channel choice. Prod Oper Manag 22(5):1089–1102

Bhattacharya S, Guide VDR Jr, Van Wassenhove LN (2006) Optimal order quantities with remanufacturing across new product generations. Prod Oper Manag 15(3):421–431

Bakal IS, Akcali E (2006) Effects of random yield in remanufacturing with price-sensitive supply and demand. Prod Oper Manag 15(3):407–420

De Giovanni P, Zaccour G (2019a) Optimal quality improvements and pricing strategies with active and passive product returns. Omega 88:248–262

De Giovanni P, Zaccour G (2019b) A selective survey of game-theoretic models of closed-loop supply chains. 4OR 17(1):1–44

De Giovanni P, Zaccour G (2013) Cost–revenue sharing in a closed-loop supply chain. Advances in dynamic games. Birkhäuser, Boston, pp 395–421

De Giovanni P, Zaccour G (2014) A two-period game of a closed-loop supply chain. Eur J Oper Res 232(1):22–40

De Giovanni P, Ramani V (2017) Product cannibalization and the effect of a service strategy. J Oper Res Soc. https://doi.org/10.1057/s41274-017-0224-5

Ferrer G, Swaminathan JM (2006) Managing new and remanufactured products. Manag Sci 52(1):15–26

Guide VDR Jr, Van Wassenhove LN (2001) Managing product returns for remanufacturing. Prod Oper Manag 10(2):142–155

Govindan K, Popiuc MN (2014) Reverse supply chain coordination by revenue sharing contract: A case for the personal computers industry. Eur J Oper Res 233(2):326–336

Huang M, Song M, Lee LH, Ching WK (2013) Analysis for strategy of closed-loop supply chain with dual recycling channel. Int J Prod Econ 144(2):510–520

Huang Y, Wang Z (2017) Information sharing in a closed-loop supply chain with technology licensing. Int J Prod Econ 191:113–127

Krikke H, Blanc IL, van de Velde S (2004) Product modularity and the design of closed-loop supply chains. Calif Manag Rev 46(2):23–39

Kaya O (2010) Incentive and production decisions for remanufacturing operations. Eur J Oper Res 201(2):442–453

Li H, Wang C, Lang Xu (2017) Emission reduction, pricing and collection decisions and coordination in low-carbon closed-loop supply chain with hybrid collecting channel. Boletín Técnico 55(6):233–247

Leal Filho W, Ellams D, Han S, Tyler D, Boiten VJ, Paço A, Balogun AL (2019) A review of the socio-economic advantages of textile recycling. J Clean Prod 218:10–20

Ma WM, Zhao Z, Ke H (2013) Dual-channel closed-loop supply chain with government consumption-subsidy. Eur J Oper Res 226(2):221–227

Miao Z, Fu K, Xia Z, Wang Y (2017) Models for closed-loop supply chain with trade-ins. Omega 66:308–326

Minner S, Kleber R (2001) Optimal control of production and remanufacturing in a simple recovery model with linear cost functions. OR-Spektrum 23(1):3–24

Savaskan RC, Bhattacharya S, Van Wassenhove LN (2004) Closed-loop supply chain models with product remanufacturing. Manag Sci 50(2):239–252

Savaskan RC, Van Wassenhove LN (2006) Reverse channel design: the case of competing retailers. Manag Sci 52(1):1–14

Saha S, Sarmah SP, Moon I (2016) Dual channel closed-loop supply chain coordination with a reward-driven remanufacturing policy. Int J Prod Res 54(5):1503–1517

Shah NH, Jayswal EN, Suthar AH (2020) Mathematical modeling on investments in burning and recycling of dumped waste by plastic industry. Int J Environ Sci Technol. https://doi.org/10.1007/s13762-020-02839-1

Wang N, He Q, Jiang B (2019) Hybrid closed-loop supply chains with competition in recycling and product markets. Int J Prod Econ 217:246–258

Wang Y, Wang Z, Li B, Liu Z, Zhu X, Wang Q (2019) Closed-loop supply chain models with product recovery and donation. J Clean Prod 227:861–876

Xiong Y, Zhou Y, Li G, Chan HK, Xiong Z (2013) Don’t forget your supplier when remanufacturing. Eur J Oper Res 230(1):15–25

Xu J, Liu N (2017) Research on closed loop supply chain with reference price effect. J Intell Manuf 28(1):51–64

Yoo SH, Kim BC (2016) Joint pricing of new and refurbished items: a comparison of closed-loop supply chain models. Int J Prod Econ 182:132–143

Zhao J, Wang C, Xu L (2019) Decision for pricing, service, and recycling of closed-loop supply chains considering different remanufacturing roles and technology authorizations. Comput Ind Eng 132:59–73

Acknowledgements

The authors sincerely thank Professor Georges Zaccour for private communications

Funding

This research was funded by Six Talent Peaks Project in Jiangsu Province [JY-095,XYDXX-015], National Natural Science Foundation of China [71704066] and Outstanding Young foundation of Jiangsu Province [BK2020010118].

Author information

Authors and Affiliations

Contributions

LX was involved in conceptualization and literature review; JW contributed to methodology; XH was involved in calculation and simulation; LX, XH and CJW contributed to writing—original draft; LX was involved in writing—review and editing. All authors read and approved this version.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

This article does not contain any studies with human participants performed by any of the authors.

Additional information

Editorial Responsibility: Samareh Mirkia.

Rights and permissions

About this article

Cite this article

Xiao, L., Hu, X., Wang, C. et al. Optimal recycling and pricing strategies with active and passive return. Int. J. Environ. Sci. Technol. 19, 1625–1632 (2022). https://doi.org/10.1007/s13762-021-03226-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13762-021-03226-0