Abstract

To improve the effectiveness of urban green innovation, digitalization has become increasingly vital in the framework of the period of energy and digital transformation, permitting the “dual carbon” aim. In this article, the influence of information and communication technology on green economic recovery in China’s cities is explored in a novel way. This research examines the direct impact, mediating effect, nonlinear connection, and geographical and development disparities of ICT growth on green economic recovery using panel data from China's 216 prefecture-level cities from 2010 to 2019. In addition to regional and urban variation in green innovation performance, this study demonstrated that technology transformation greatly enhanced the level of entrepreneurial orientation after accounting for carbon dioxide emissions from energy consumption. A new dynamic threshold model illustrates how the influence of information technology growth on green economic recovery changes depending on the degree of resource imbalance. Research shows that digitalization has a beneficial effect on technological development and that tech development has a favorable impact on green innovation performance. As a result, technical innovation serves as a bridge between digitalization and green innovation. The influence of digitization on the implementation of sustainable performance might be moderated by different exposure to environmental regulations.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

According to the IPCC's fifth assessment, around 90% of the temperature increase in the past fifty years can be ascribed to GHGs emissions (Huang et al. 2021). One of the principal GHGs, carbon dioxide (CO2), leads to global warming and affects human output. Because of this, China is under significant pressure to cut its carbon output. China's economy has grown at a medium to the high rate during the last forty years, owing to the country's reform and opening-up policies. Meanwhile, industrialization drove economic expansion in China in the past, despite its high energy use, pollutants, and waste. Given these facts, China has to make profound changes to create a prosperous economy (Wang et al. 2022e). According to the Central Economic Work Conference, stabilizing economic growth in 2021 is just as important as achieving carbon peak and neutrality targets. As a consequence, China's industrial growth is becoming more dependent on efforts to curb carbon emissions and explore avenues for sustainable development (Mohsin et al. 2022a). It is impossible to meet the goal of lowering carbon dioxide emissions in China at the price of the economy (Li et al. 2021b). Improving green economic growth is a practical and efficient strategy for developing nations like China to strike a proper balance between CO2 emission and digitization. In theory, digital finance might be linked to green economic growth in several ways; this multiplicity of pathways would complicate the implications of digital finance's far-reaching influence (Mohsin et al. 2022). Organizations may benefit from reduced financing limitations by increasing their liquidity and green economic growth, which aid in mitigating greenhouse gas emissions and other contaminants (Darling et al. 2022). For instance, research demonstrated that digital technologies might scour a borrower's social networks for financial information, which in turn helps reduce information inequality. The technological aspects of digital finance may also result in the development of new technical assistance for businesses, which in turn may increase the total level of innovation within those businesses or areas, including green innovation. Monetary digitalization and counterproductive development (Ahmadian-Yazdi et al. 2022) are possible outcomes of digital finance that is powered by modern technology. This might cause turmoil in the banking markets and hamper business operations, which would have a chilling effect on green innovation (Mohsin et al. 2021a)

The finance system desperately needs restructuring and development to ease the funding restrictions of green innovation ventures. As a result of advancements in ICT, digital finance has emerged as a novel approach to money management in the modern day (Nhuong and Quang 2022). Traditional banking and online banking operate in very different ways (Tu et al. 2021). Through the utilization of digital technologies like the Internet, big data, and cloud computing, companies may better serve their clients and lower the costs of providing access to financial services via what is known as “digital finance.” To remove the financial barrier to new green technologies, the advent of digital finance, a relatively new form of financial services, presents an exciting new possibility. Digital finance in China has advanced swiftly, expanding at a compound annual growth rate of 44.652% from 2010 to 2018, as measured by the Peking University Digital Financial Inclusion Index of China (Krishnan 2016). In light of the Paris Agreement's goal of achieving carbon neutrality by 2060 and China's rapid adoption of digital finance, we investigate whether this latter trend has become a significant factor in boosting the rate and caliber of innovation in environmentally friendly technologies. If this is the case, we look at how digital funding might be directed into various green innovation channels. Finally, we explore if there is regional variability in how digital banking and green technical developments interact in various cities. Research and empirical debate are needed to solve these real-world issues, as they have important theoretical underpinning for coordinating China's economic digitization and low-carbon growth. Experts and organizations concerned with the environment warn that increasing temperatures pose a danger to daily life by increasing GHG emissions and severely affecting human and animal life and the ecosystem (Ren et al. 2022). Similarly, suppose the 2 °C thresholds are breached. In that case, the frequency and severity of droughts, sea levels, storms, wildfires, crop failures, and the melting of fresh water and ice are all expected to increase dramatically (Chang et al. 2022). Because of this, environmental, health, and food conditions deteriorate (Chabi Simin Najib et al. 2022). Several scholars have argued that implementing novel economic guidelines and policies may enhance environmental balance. But improving environmental quality via energy conservation slows down economic expansion. Decision-makers face a challenging balancing act between economic growth and environmental protection as they work to reduce carbon dioxide emissions while maintaining universal access to affordable and dependable power sources (Dilanchiev and Taktakishvili 2022).

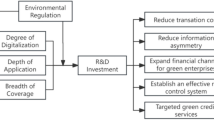

These are contributions by this article: First, using data from 216 prefecture-level cities in China between 2010 and 2019, this paper develops a China urban Information communication technology national transformation index based on five dimensions: Internet penetration rate, percentage of Internet-related staff members, output associated with the Internet, smart Phones users, and the comprehensive digitization financial services, which could more conclusively reflect urban digital marketing levels and contribute to digitization. As a result, the level of digitalization can be calculated, the level of regional digitalization can be quantified, and current research may be successfully complemented by the three main components of digital foundation, digital implementation, and digital development. As a second step, we examine the relationship between digitalization's impact on green economic recovery and the regulatory function of environmental standards, as well as the intermediate mechanism of technical innovation, from ecological protections and innovative technology perspectives. For the third time, the utilization of regional capital city panel data offers in-depth quantitative evidence for the mechanism and impact of digitization on green innovation performance. On the other hand, this article relies on the oldest data available in China, particularly the 1984 statistics on postal and telecommunication services, to minimize the endogeneity issue. Third, we investigate the possible link between Information and communication technology and green economic recovery using moderating effect and dynamic threshold panel models. The dynamic threshold model has been used to examine the impact of technological and structural improvements on green economic recovery and varying degrees of resource mismatch.

The remainder of this study is arranged in the following way: Literature review is presented in Sect. 2 and 3 section is about methodology and data section. Empirical results are in Sect. 4. Conclusion and policy implications are discussed in Sect. 5.

2 Literature review

Environmental degradation, pollution reduction, and green economic growth are all issues that have sparked widespread interest in the concepts of “green economic growth” and “green growth” (Mohsin et al. 2022a). The term “green economy” has been defined in detail by a number of sources (Ullah et al. 2020), and a numerous international organizations have adopted it as a unified strategic idea (Xiuzhen et al. 2022) defined green growth and its main effects and offered a critical overview of the concept. Before assessing the relationship between a green economy and sustainable development, used a bibliometric analysis to identify the aspects and aspects of a green economy.

The development of the green economy has been the subject of a number of studies. Green economic development has been shown by Mohsin et al. (2021a) to have positive effects on both greenhouse gas emissions and resource consumption and found that green growth was understood to have three goals: sustainable growth, environmental conservation, and employment creation. Energy input–output analysis was used by to identify possible pathways for green growth in USA under a variety of scenarios. Efficiency of green growth in 286 Chinese cities was analyzed by Iqbal et al. (2019). The green development gap between different resource-based Chinese cities was examined by Iram et al. (2020). The variables that encourage sustainable development have been the subject of several research. Using an analytical methodology, assessed the state of China's green economy at the city level, attributing differences in the sector to demographic shifts, educational opportunities, and other socioeconomic variables. A ecological sustainability growth indicator for all Thirty provinces in China was developed by Sun et al. (2019) using the GMM approach. The impact of changes in the gaps between best practices, technologies, and efficiencies on green growth was then investigated using the quantile approach. Using information from investigated how an abundance of natural resources affects green development. They proved the “resource curse” theory, which states that places rich in natural resources are also more likely to have poor environmental protections. Tang et al. (2020) used data from China's provinces to determine the low-carbon economy index through a dimensional criterion, and then used a DEA model to examine the elements that contributed to this index. The causes that have led to the environmentally friendly expansion of China's iron and steel sector were explored by Banerjee et al. (2021) looked at how China's green economic development was affected by power substitute policy.

The impact of technical advancement on pollution levels and economic development has been recognized for some time (Bourcet 2020). Additionally, chances for economic development are made available to emerging nations as a result of digitalization and spillover. But technological progress brings both benefits and risks in terms of pollution and economic development (Gilal et al. 2020). Green economic development is expected to benefit from technical advancements on the one hand (Hickel & Kallis 2020). Through increased productivity, technological advancements may lower product costs, which in turn boosts customer demand and economic development (Guan et al. 2019). The resource curse may be lifted by advancing technology, allowing for the green economy to flourish sustainably (Iqbal et al. 2021). Innovations in technology have increased the variety of manufacturing inputs, which has stimulated environmentally friendly economic expansion (Zhu et al. 2012). However, technological advancement will raise the overall consumption of natural resources owing to the economic growth, which would worsen environmental degradation and hinder green economic development. It is clear that technical advancement has a measurable effect on eco-friendly economic expansion (Chang et al. 2023).

To put it simply, innovation is a kind of technical advancement and innovation that emerged as a direct consequence of the natural merging of the worlds of finance and information technology (Li et al. 2021a). Fintech's effect on the economy may be seen most clearly in the way it fosters green growth. Hence, Fintech's effect on sustainable development is one of a kind. Erumban et al. (2019) “financial accelerator hypothesis” postulates that when the economy affects a company favorably or adversely, the company's net worth will increase or decrease, and the credit market will amplify the effect on the economy and the environmental. Financial institutions will be better able to filter borrower data thanks to technological advancements, which will in turn reduce seasonal downturns caused by financial friction induced by asymmetric information (Shahbaz et al. 2022). Many academics think that technical development is the key to ending the economic hardships, enhancing quality of the environment, and achieving sustained economic growth. There is a tight link between consumption of resources, environmental degradation, and economic growth, which is influenced by economic innovation and technological innovation (Wang et al. 2022b). China's green growth exhibits a tendency of swings from year to year, and the acceleration of this phenomena is provided by economic expansion and technological innovation (Ahamd 2019). While studies have indicated that green growth volatility will rise as microfinance companies and stock markets expand in size and scope, others have demonstrated that this volatility may be mitigated via the interplay between financial growth and technology advancement. Having a favorable effect on the natural environment, financial sustainability, and economic structure, green finance is shown to be a complete tool for promoting high-quality economic growth (Wang et al. 2022b). This means that technologies like big data, AI, the cloud, and blockchain are crucial to the development of cutting-edge financial systems (Zheng et al. 2022). Enhanced green credit capacity and increased green investment, accelerated green finance development, increased financial support, optimized degree of urbanization, increased capital allocation effectiveness, decreased economic friction, and enhanced ecological environments are all ways in which innovations in financial scientific and technological advances contribute to green growth (Zhang et al. 2022).

Due to the country's size and the wide range of local economic conditions and financial technology, China's many regions experience varying degrees of green development and technological advancement. Eastern China has a greater degree of green growth than central and western China, reflecting the clear geographical variation of green development (Iqbal and Bilal 2021). It has been the subject of preliminary study by a number of academics. Resource use, social and economic returns, and environmental indices all vary widely from city to city in China, according to the available research (Wang et al. 2022d). According to the study's findings, large-scale R and D expenditures have a favorable effect on green economy development over the long run but a negative effect in the northern and southern at the current time. Green growth is positively affected by FDI in eastern and central China, but negatively affected by FDI in western China due to pollution (Cao et al. 2021). Some academics weighed in on the relative importance of green technology innovation in driving forward green finance in the eastern and central China and its subsequent effects on regional GDP growth. Green development as a consequence of technological progress in the field of renewable resources seems to be significantly different in the East, Central, and West. China's quest of green development is predicted to cost the country 7 to 8% of GDP, according to empirical analyses based on data from Chinese provinces. However, strong carbon control regulations will mostly impact the central and western areas, with little impact on the eastern region (Wang et al. 2022a, c). There is mixed evidence from other research on the influence of public spending on human resource department and green energy technologies R&D on green economy growth via labor and technology-oriented manufacturing activities (Yang et al. 2022). For this reason, there is clear geographical variability in the effect of financial science and technological innovation on green development (Sun et al. 2022).

3 Method and data

3.1 Theoretical framework

The proposed panel data model consists of various data blocks with a multi-level factor structure that generates the cross-sectional dependence. This cross-sectional dependence is characterized by some prevalent variables that influence all the blocks and block-specific variables that only affect a particular block of the panel. In the research, these aspects are sometimes referred to as global factors in enhancement.

The approach is adaptable enough to analyze blocks of financial or macro prudential panel data made up of time series that could display long-range dependency. Several writers have examined panel data models with nonstationary dynamics in unobserved and observable components. On the one hand (Kiranyaz et al. 2021) provide a scenario where unmeasurable components follow unit-root processes while the regression errors continue to be processed and finished of order zero, or I (0). On the other hand, the local aspects of frameworks are considered by Yi et al. (2021). These suggestions, though, only address the scenario with a single-level construct measure.

According to the suggested configuration, the model may receive long-range dependent dynamics via a variety of routes, including top-level unobservable variables, block-specific unobserved heterogeneity factors, and any of the individualistic aspects. The GDP of the observable sequence is given by \({y}_{\mathrm{r},\mathrm{it}}\), where be the measurement on the \(i=1,\dots ,N,\) -th cross section unit at time \(t=1,\dots ,T,\) in the block for and with limited.

The technique used is a cross-sectional measurement characteristic of panel data models embedded in a reduced form of spatial regression. Due to their various benefits, panel data models have been utilized to answer many research problems in the fields of business and economics, and finance (Lyytimäki et al. 2018). First, panel data reveal the changing and constant interdependence between variables. Moreover, second, they may be used to evaluate the effect of an external shock in one variable on the others. Third, panel VARs allow for considering micro-level, unobserved heterogeneity variations. Moreover, in panel data models, variables are assumed as endogenous; however, identifying limitations may be applied to study the impact of uncontrollable factors on the model. Hence, estimating the model does not need any a priori homogeneity constraints.

3.2 Spatial weight matrix

The first process in a spatial correlation test is establishing the weights and biases. A spatial weight matrix (W1), an inverted length observed covariance matrix (W2), and an economic proximity geographic (W3) (Brunner and Norouzi 2021) are all widely utilized in academic research (W3). According to this matrix, nearby regions have a 1 weight while non-adjacent ones have a 0 weight. Spatial weights of, regardless of geographical distance, are used to examine the spatial variability features of variables in terms of the effect of these factors, as continues to follow:

Cities with a roadway dij of and are represented by the element of W2. Cities' yearly per capita GDP is represented by the elements \(\mathop {GDP_{i} }\limits^{ - }\) and \({\mathop {GDP_{{\text{j}}} }\limits^{ - } }\) represented in equation 1, 2, 3, 4.

represented in equation 1, 2, 3 and 4. The first-order mapping applications spatial weight matrix cannot fully incorporate specific geographical variables and economic and social development factors, as well as the institutional location weights and biases, which are susceptible to endogenous challenges; this method even further creates the based-on geography financial system nested spatial weights and biases in Eq. (5).

3.3 Spatial panel regression results

The SAR, SEM, and the Spatial Durbin Model are now the most often utilized spatial econometric models. With the SDM model, researchers may examine the impact of the explanatory variables (Hafner et al. 2020) on their neighboring explanatory (Diao et al. 2019) variables, which would be the size of an area, in addition to endogenous and environmental observed association. As a general rule, the following is how it should look in Eq. 6,7,8 and 9:

The explanatory variable's coefficient, weight matrixes that might be equal, is the spatial autoregressive coefficient, which means “the spatial lag term”; reflects a perfectly natural disruption term that follows normally distributed rules.

3.4 Data

All variables have been converted to a natural log by checking previous research, resulting in elasticities that make green economic recovery as comprehensive measures with digitalization. The study is obtained from the World Development Indicators (WDI). For this study, 216 cities in China were chosen as the research target due to the lack of city and county-level data. Jiang et al. (2020) Time frame for the study is 2010–2019. According to statistics from China's official agency, data on province green economic recovery levels have not been updated in digitize ways, since 2018. China's yearbooks, energy, and industrial statistics also provided additional data (Erahman et al. 2016).

3.5 Study variables

Measurement specificity of green economic recovery. GER measures the amount of green innovation that has been incorporated into a company's production over time or the ratio of green innovation to output. As an index of green innovation, GI is also a result of multiple performances, innovation capability, and ecological effectiveness. Input factors include labor (L), energy (E), and capital stock (K). Counts of R&D workers in prefecture-level urban areas are included in this study assessment of the labor force. When calculating R&D expenditures, the continuous inventory approach is used to estimate capital stock. The total amount of energy used in an area measures energy. Green technology patent applications in provincial and district cities are projected to represent a measure of innovation generation. CO2, SO2, sewage, and soot are all examples of unwelcome byproducts from industrial processes (D). CO2 emissions are measured as the total energy used in each location divided by its energy and greenhouse coefficient multiplied by the emission rate. Outflows of sulfur dioxide from prefecture-level urban regions reflect sulfur dioxide. The emission of contemporary wastewater in prefecture-level metropolitan areas is an example of municipal effluents (W). The regional capital cities' industrial soot emissions indicate industry soot (D).

(2) Green economic recovery in each region. There are 216 prefecture-level cities in China, and this study calculates each city's energy and environmental performance from 2010 to 2019. Comparative data on power and environmental performance from 2010 to 2019 depicts the study's results: Energy efficiency and environmental friendliness have been on a steady upward trajectory for some time. And this demonstrates that China's energy preservation and emissions decrease strategy(CEPED) has produced greater success in energy saving than emission reduction in the course of implementation during the last several years. For the total green innovation index(GIP) to be valid, it must be larger than 0 and less than 1. The better the GIP is, the closer its value is to 1. The energy environment has made significant progress in China's green innovation performance.

The level of digitalization may be measured. The indication approach is used to measure each area digitally. Per capita Internet use and fixed-line subscribers may be attributed to digital apps. This covers the percentage of digital industry workers, the rate of digital industry revenue and fixed assets, and the percentage of digital sector fixed assets in total industrial capital.

3.6 Control variable

Technological development is the mediating variable (Tech). The amount of telecommunications infrastructure is determined by the level of investment, the level of R&D expenditure, and the number of R&D workers. According to the available statistics, this article uses the percentage of scientific research money in each city's total economic production to quantify technological innovation Table 1. The more the company invests in R&D, the more capable it is of developing new technologies. Environmental regulation is a second moderating factor (ER). Many methods exist to gauge the extent to which environmental regulations are being enforced. The complete metrics technique described by Farkas et al. (2022) is used in this study for data collection.

4 Results and Discussion

Descriptive numbers are provided in Table 2. Green economic growth (GER) ranges from 0.249, with 0.549 as the average and 0 as the median. Digital technology financing ranges from a minimum of − 0.998 to a high of 9.817, with a mean of 0.036 and a median value of 0.0836. We discover that cities with green economic growth are more inclined to disregard the issue's significance owing to the low estimated cost after comparing the median and mean of digital innovation. Regarding investments in technology innovation, the variation is more even, with a (England 2000) median value that's not far from the mean. All indicators in these samples show statistically significant inter-country variation. Indicator associations should be accurately estimated.

China's average energy efficiency is poor, but improvements have been constant across the period studied, showing that the country is making progress. Pincus and Winters (2019) The energy efficiency of China's various regions differs greatly, at least from the viewpoint of particular provinces. Peking, Hangzhou, Wenzhou, Zhuhai, and Qinghai are the greatest in the region regarding average population and land area. This observation is the result of two factors. First and foremost, it is more industrialized than the west. The market has given more support to energy efficiency improvements (Ghisellini et al. 2016) Some regions have economic processes that make it easier to enhance the energy efficiency, such as counties with a heavy focus on secondary or primary industries. Considering the presence of cross-sectional dependency in our panel dataset, we use (Triki 2005) CIPS test to examine the unit-root hypothesis for the factors in models (IPS, Fisher-ADF, CIPZ, and CZ). Table 3 displays the panel unit-root test and the results of study are found significant at p-value < 0.01 (e.g. ***) in Tables 3, 4, 5, 6 and 7 respectively.

Table 4 displays the findings of the first regression analysis of the relationship between digital innovation and financing for green economic growth. When using the fixed effects model and the GMM model, the regression findings show that all conflict indicators' correlations are negative and have a high degree of significance. By way of illustration, the GMM regression findings in model (4) show that for every one percent increase in the occurrence of war, energy investment reduces by 0.690%. This finding supports our hypothesis that war discourages renewable energy financing (Perez et al. 2010). Digital innovation and urbanization in Chinese regions have a negative impact on the availability of funds for renewable energy projects.

Overall, from 2010 to 2019, the Gini coefficient decreased throughout all four areas. However, its value fluctuated between 0.28 and 0.51 in the Northeast of china. Ranged from 0.05 to 0.41 in the east of China and from 0.15 to 0.41 in the central region. Southern China sees values between 0.18 and 0.37 on the scale. There were significant variations throughout the three main areas in the east, central, and west, where the average decline was 12.32 percent, 14.11 percent, and 20.11 percent, correspondingly. Before 2016, there was no massive disparity between the four primary areas (Smith and Stulz 1985). The Gini coefficients in the east, middle, and western areas have stabilized around 0.25since 2016, but in the northern areas have decreased. There was not a massive gap between any of the differences. A substantial disparity between the Northeast and the other three main areas can indicate a lack of spatial equilibrium.

China's regional disparities and the trajectory of its green financing sector are shown in Table 5. It is clear that, except for the gaps in the East and North, all other uneven development is changing and reducing, and the coefficients (Bessembinder 1991) are progressively becoming the same. Green finance development gaps average 0.56 between the eastern and western hemispheres, 0.52 between the eastern and central hemispheres, 0.41 between the central and western hemispheres, and 0.34 between the central and northeastern hemispheres. In 2019, the Gini coefficient was highest in the northeast region (0.54), then lowest in the west/northwest region (0.31), highest in the central/east region (0.35), lowest in the east/central region (0.36), and lowest in the west/northwest region (0.38). (0.25). This range of variation is most pronounced and noticeable between the eastern region and the other three central regions. Disparities between the east and west, the east and center, and the east and the Northeast tend to increase, decrease and level out. Mealy and Teytelboym (2020) Ranges in differences between the east and west have reduced by 41.52% and 32.84%, respectively, whereas ranges in differences between the north by the USA have grown by 59.62%. Green finance in China's four key regions has been progressively closing the gap between these regions. Barbier and Burgess (2017) There is a huge disparity in the rates at which energy efficiency is improving in various parts of the country. With an energy efficiency of 0.567, East China leads the way, followed by the central area (0.456) and the western region (0.376), which is in line with previous studies. Therefore, the energy efficiency disparity between the northern and southwestern areas is quite minimal, as in Table 3. Between the two areas, there is a significant disparity in their values. One possible explanation is that the research data intervals varied. In addition, regional economic development levels are assumed to be distributed similarly to energy efficiency values. Hence, the study results endorsed previous findings (Zhao et al. 2022; Alemzero et al. 2021).

In order to evaluate the impact of technology innovation on green economic growth, we first estimate the baseline model using the panel data regressions with five alternative specifications, as shown in Table 5. Based on the work of Opie and Riddiough (2020), we define our dependent variable as the accumulated, which is calculated by multiplying the aggregated green economic growth from the previous year by the cumulative green economic recovery from the current year (accumulated GTP during the first year is equal to 1). Estimates from the POLS, RE, FE), two-way fixed effect (two-way FE), and generalized method of moments (GMM) models are shown in columns (1) through (5) of Table 2. In terms of the primary explanatory parameter of interest, the table shows that the correlations of GF are positive and significant at the 5% level, indicating that advancements in green finance may boost green production. This conclusion is in line with and expands upon the research of Schoderer et al. (2021), which suggests that green investment and credit may foster green economic growth and competitiveness by establishing a win–win scenario between the economy and the environment. Therefore, a very well green finance system is necessary if China is to reach its goal of reducing emissions in the second half of the year. This means that the central government should prioritize addressing businesses' challenges when trying to engage in green initiatives due to a lack of resources. The growth of the green economy would benefit from the increased likelihood of business participation in ecological and economic initiatives.

The amount of economic liberalization has had little impact on energy efficiency across the different regions of China. Because of this, the significance of the effective factors in these two categories was ruled out. Every regions energy efficiency has been influenced by new progress, with effect factors ranging from 1.104 to 1.132 to 1.96 and 0.972 to pass the 1% significance test for any area (Chien et al. 2021). R&D significantly affects the town's science-technical capabilities and ability to support fuel efficiency, preservation, and reducing emissions. We achieved our principal objectives with this technique. Therefore, the advancement of industrial buildings has seemed to have had a considerable effect on total power consumption, linked to an increase in energy demands and an increase in the amount of money generated from the use of energy, which implies that the improvement of structures has effectively reduced main power generation. Both the effects on greenhouse gas emissions and energy consumption were found to be equivalent (Jun et al. 2021). Although the lowered PM2.5 and DI by 20.3 percent and 26.3 percent, the carbon capture and results of replacing key indicators are presented in Table 6.

For this part of the analysis, we used the instrument variables of long-term output elasticity analysis. The results of the tests are shown in Table 7. The results show that the green finance index is inversely related to carbon dioxide emissions. A 1% increase in green funding reduces carbon emissions by 3.6% in one model and 3.6% in the other. In Chinese regions, renewable energy development negatively affects environmental quality. However, it helps to minimize pollution as new knowledge about the environment spreads, and more modern technologies become available. The negative green finance coefficient shows the Chinese financial industry's capital allocated to environmental protection. As a result, businesses and factories are encouraged to use environmentally friendly manufacturing methods. According to Fraccascia et al. (2018), free trade and financial liberalization will encourage international investment and innovation. There is a strong inverse relationship between carbon emissions and renewable energy sources. Thus the consequent green investment and fiscal requirements boost energy-related efficiency and help decrease emissions. The study found that although using renewable energy sources climbed by 1%, carbon emissions fell by 0.031 percent. This drop demonstrates the inverse relationship between the use of non-fossil energy and CO2 emissions and the protective effect of lowering emissions on environmental quality (Graham and Rogers 2002) for Russia, for the USA, and the UK are consistent with our results.

The green economic growth and Action Plan aims to improve energy efficiency by creating digital innovation and environmentally friendly stock markets and encouraging technological innovation and research by businesses via green financial reforms. So, can digital technology encourage green economic growth and reduce energy use? Table 7 displays the results of a test of the mechanisms that affect the impact of Green innovations. As a proxy for green innovation, we use digital technology development (Kim et al. 2014). Green finance reform indirectly influences business environmental performance because, as shown in column (1), the coefficient of green finance is notably negative at the 1% level. The error correction term on the green economic growth is positively significant, as shown in column (2), demonstrating that implementing green finance development has encouraged businesses to invest in R&D for environmentally friendly technologies. Both the green economic growth and technology innovation calculated values are negative in column (3). Green economic growth energy-saving impact is lower than in column (1), suggesting that it may help businesses save money by lowering their energy cost of production (ECI). Following are some of the reasons why this legislation will have an impact on green innovation. Green finance policy, on the one hand, encourages businesses to actively develop green technology by providing financial assistance for technical research and upgrades. Green innovations are used by businesses to create renewable energy and revamp energy-intensive sectors. In addition, businesses will enhance their manufacturing processes, French (2017) speed up energy recycling, and cut energy waste, all of which will aid in the transition of industries toward a greener, lower-carbon future. However, green finance regulations increase the availability of capital for green businesses and proprietary technologies by encouraging corporate investment in these sectors. New energy businesses may use green financial instruments extensively as a risk mitigation strategy. Promoting increasing energy production and supply via innovation capability in finance goods and services also boost green economic growth.

5 Conclusion and Policy Implications

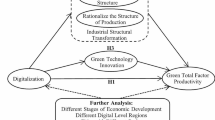

Digitalization became a great breakthrough in the green economic recovery latest influx of scientific and technological revolution and smart manufacturing. This research uses panel data and mediator impact methods to examine the impact of digitalization on green economic recovery and its transition process, utilizing data from 216 Chinese regional capital cities from 2010 to 2019. Digital economy and green economic growth efficiency have a linear connection that supplies imbalance impacts. According to our findings, which are listed below:

For “carbon neutrality,” the overall performance of Chinese green innovation looks relatively excellent, and huge advancements have been realized in the economic sector concerning green product innovation. In terms of sustainable development, digitalization has a good influence. The beneficial impact seems to have a semi-relationship. Digitalization has a greater effect on environmental innovativeness in a reduced network than in an elevated system. In cities with a low level of digitization, it becomes even more critical that the coordination and integration of green innovation into the global innovation system be taken to another degree.

Digital revolution and environmental innovation capability differ by location. Environmental management systems implementation in eastern districts is more influenced by technology than in western and central places; technology in periphery urban areas has a greater influence than that in major metropolitan areas for innovative activity. There is a clear need for cities in less advantaged regions to engage in deeper collaboration and innovation and actively join the incorporation if digitalization is to go forward with vigor. Digital economy has indisputably influenced technological advance, and technology advance has a beneficial effect on green innovation. Through technical innovation, digitization affects green innovation capability, and in natural control, digitalization is much more valuable to enhancing green innovation capability.

Furthermore, we suggest several policy recommendations. On the one hand, the Chinese government needs to promote the rapid growth of the Internet economy, enhance the R&D services of digital technologies, establish regulatory frameworks, and construct an Internet research institute to encourage the green penetration of the digital economy. Instead, the government should expedite the adoption of Internet use in homes and businesses and establish Internet backbones in all regions of the country. Future government policy should also prioritize bolstering the information business by creating IoT and extensive data services infrastructure and increasing the information sector's greening impact.

As a second point, the Chinese government should use the Internet to boost human capital by spreading awareness of online education, enhancing the effectiveness of in-house technical training programs, and boosting business output. To help businesses improve efficiency and reach green economic growth goals faster, the government should give regulatory support, practical counseling, and financial aid. It should encourage firms to use more new technologies to develop sustainable energy. To cut power output from coal-fired nuclear reactors and pledge to replace electricity with renewable energy, the Chinese government should implement the measures agreed upon at COP26. Government support is needed to facilitate the conversion and support of the Internet in the energy sector and to facilitate the growth of convergence between the energy and Internet sectors. The conventional energy sector, for instance, has actively used digital technologies and Data services to steer businesses through the digital transformation process. It is essential to strengthening government-business information technology services to achieve the dual goals of low-carbon administration and business.

Finally, initiatives that aim to boost Internet speed in diverse ways should be considered. To achieve green and low-carbon development, governments in regions with lower green economic growth should produce advertising Internet enterprises to encourage local economic growth. This is accomplished by increasing the industrial chain's intellectual capabilities and industrialization. It is recommended that provinces with the more significant green rise in economic growth, the confluence of the telecommunication and conventional sectors, create appropriate information technology zones and advocate for the development of local greening levels. To accomplish green economic growth, the central provinces of China should speed up their industrialization process, boost the development of information adoption of heavy industry, and encourage the growth of the green economy.

References

Ahamd M (2019) State of the art compendium of macro and micro energies. Adv Sci Technol Res J 13(1):88–109

Ahmadian-Yazdi F, Mesgarani M, Roudari S (2022) Natural resource rents and social capital interaction: new evidence on the role of financial development. J Environ Assmt Pol Mgmt 24(01):2250021. https://doi.org/10.1142/S1464333222500211

Alemzero DA, Iqbal N, Iqbal S, Mohsin M, Chukwuma NJ, Shah BA (2021) Assessing the perceived impact of exploration and production of hydrocarbons on households perspective of environmental regulation in Ghana. Environ Sci Pollut Res 28:5359–5371

Banerjee R, Mishra V, Maruta AA (2021) Energy poverty, health and education outcomes: evidence from the developing world. Energy Econ. https://doi.org/10.1016/j.eneco.2021.105447

Barbier EB, Burgess JC (2017) Natural resource economics, planetary boundaries and strong sustainability. Sustain (Switzerland) 9(10):1858. https://doi.org/10.3390/SU9101858

Bessembinder H (1991) Forward contracts and firm value: investment incentive and contracting effects. J Financ Quanti Anal 26(4):519. https://doi.org/10.2307/2331409

Bourcet C (2020) Empirical determinants of renewable energy deployment: a systematic literature review. Energy Econ 85:104563

Brunner R, Norouzi S (2021) Going green across borders: a study on the impact of green marketing on the internationalization of SMEs

Cao J, Law SH, Samad ARBA, Mohamad WNBW, Wang J, Yang X (2021) Impact of financial development and technological innovation on the volatility of green growth—evidence from China. Environ Sci Pollut Res 28(35):48053–48069

Chang L, Qian C, Dilanchiev A (2022) Nexus between financial development and renewable energy: empirical evidence from nonlinear autoregression distributed lag. Renew Energy 193:475–483. https://doi.org/10.1016/j.renene.2022.04.160

Chang L, Iqbal S, Chen H (2023) Does financial inclusion index and energy performance index co-move? Energy Policy 174:113422

Chien FS, Sadiq M, Kamran HW, Nawaz MA, Hussain MS, Raza M (2021) Co-movement of energy prices and stock market return: environmental wavelet nexus of COVID-19 pandemic from the USA, Europe, and China. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-021-12938-2

Darling S, Harvey B, Hickey GM (2022) Advancing pluralism in impact assessment through research capacity: lessons from the Yukon Territory, Canada. J Environ Assess Pol Manag. https://doi.org/10.1142/S1464333222500260

Diao X, McMillan M, Rodrik D (2019). The recent growth boom in developing economies: a structural-change perspective. In: The Palgrave handbook of development economics. Springer, pp 281–334

Dilanchiev A, Taktakishvili T (2022) Macroeconomic determinants of household consumptions in Georgia. Annal Financ Econ. https://doi.org/10.1142/S2010495221500202

England RW (2000) Natural capital and the theory of economic growth. Ecol Econ 34(3):425–431. https://doi.org/10.1016/S0921-8009(00)00187-7

Erahman QF, Purwanto WW, Sudibandriyo M, Hidayatno A (2016) An assessment of Indonesia’s energy security index and comparison with seventy countries. Energy 111:364–376. https://doi.org/10.1016/j.energy.2016.05.100

Erumban AA, Das DK, Aggarwal S, Das PC (2019) Structural change and economic growth in India. Struct Chang Econ Dyn 51:186–202

Farkas A, Degiuli N, Martić I, Barbarić M, Guzović Z (2022) The impact of biofilm on marine current turbine performance. Renewa Energy 190:584–595. https://doi.org/10.1016/j.renene.2022.03.134

Fraccascia L, Giannoccaro I, Albino V (2018) Green product development: what does the country product space imply? J Clean Prod 170:1076–1088. https://doi.org/10.1016/j.jclepro.2017.09.190

French S (2017) Revealed comparative advantage: what is it good for? J Int Econ 106:83–103. https://doi.org/10.1016/j.jinteco.2017.02.002

Ghisellini P, Cialani C, Ulgiati S (2016) A review on circular economy: the expected transition to a balanced interplay of environmental and economic systems. J Clean Prod 114:11–32. https://doi.org/10.1016/j.jclepro.2015.09.007

Gilal FG, Chandani K, Gilal RG, Gilal NG, Gilal WG, Channa NA (2020) Towards a new model for green consumer behaviour: a self-determination theory perspective. Sustain Dev. https://doi.org/10.1002/sd.2021

Graham JR, Rogers DA (2002) Do firms hedge in response to tax incentives? J Financ 57(2):815–839. https://doi.org/10.1111/1540-6261.00443

Guan F, Liu C, Xie F, Chen H (2019) Evaluation of the competitiveness of China’s commercial banks based on the G-CAMELS evaluation system. Sustainability 11(6):1791

Hafner S, Jones A, Anger-Kraavi A, Pohl J (2020) Closing the green finance gap–A systems perspective. Environ Innov Soc Trans 34:26–60

Hickel J, Kallis G (2020) Is green growth possible? New Politic Econ 25(4):469–486

Huang J, Wang X, Liu H, Iqbal S (2021) Financial consideration of energy and environmental nexus with energy poverty: promoting financial development in G7 economies. Front Energy Res 9:777796

Iqbal S, Bilal AR (2021) Energy financing in COVID-19: how public supports can benefit? China Finan Rev Int 12(2):219–240

Iqbal W, Yumei H, Abbas Q, Hafeez M, Mohsin M, Fatima A, Jamali MA, Jamali M, Siyal A, Sohail N (2019) Assessment of wind energy potential for the production of renewable hydrogen in Sindh province of Pakistan. Processes. https://doi.org/10.3390/pr7040196

Iqbal S, Bilal AR, Nurunnabi M, Iqbal W, Alfakhri Y, Iqbal N (2021) It is time to control the worst: testing COVID-19 outbreak, energy consumption and CO2 emission. Environ Sci Pollut Res 28:19008–19020

Iram R, Zhang J, Erdogan S, Abbas Q, Mohsin M (2020) Economics of energy and environmental efficiency: evidence from OECD countries. Environ Sci Pollut Res. https://doi.org/10.1007/s11356-019-07020-x

Jiang L, Wang H, Tong A, Hu Z, Duan H, Zhang X, Wang Y (2020) The measurement of green finance development index and its poverty reduction effect: dynamic panel analysis based on improved Entropy method. Discrete Dynamicn Nat Soc 2020:1–13

Jun W, Ali W, Bhutto MY, Hussain H, Khan NA (2021) Examining the determinants of green innovation adoption in SMEs: a PLS-SEM approach. Eur J Innov Manag 24(1):67–87. https://doi.org/10.1108/EJIM-05-2019-0113

Kim SE, Kim H, Chae Y (2014) A new approach to measuring green growth: application to the OECD and Korea. Futures 63:37–48

Kiranyaz S, Avci O, Abdeljaber O, Ince T, Gabbouj M, Inman DJ (2021) 1D convolutional neural networks and applications: A survey. Mech Syst Signal Process 151:107398

Krishnan R (2016) Energy security through a framework of country risks and vulnerabilities. Energy Sour Part B 11(1):32–37. https://doi.org/10.1080/15567249.2011.563260

Li W, Chien F, Hsu CC, Zhang Y, Nawaz MA, Iqbal S, Mohsin M (2021a) Nexus between energy poverty and energy efficiency: estimating the long-run dynamics. Resour Policy 72:102063

Li W, Chien F, Ngo QT, Nguyen TD, Iqbal S, Bilal AR (2021b) Vertical financial disparity, energy prices and emission reduction: empirical insights from Pakistan. J Environ Manag 294:112946

Lyytimäki J, Nygrén NA, Pulkka A, Rantala S (2018) Energy transition looming behind the headlines? Newspaper coverage of biogas production in Finland. Energy Sustain Soc. https://doi.org/10.1186/s13705-018-0158-z

Mealy P, Teytelboym A (2020) Economic complexity and the green economy. Res Pol 51(8):103948

Mohsin M, Kamran HW, Atif Nawaz M, Sajjad Hussain M, Dahri AS (2021a) Assessing the impact of transition from nonrenewable to renewable energy consumption on economic growth-environmental nexus from developing Asian economies. J Environ Manage. https://doi.org/10.1016/j.jenvman.2021.111999

Mohsin M, Taghizadeh-Hesary F, Panthamit N, Anwar S, Abbas Q, Vo XV (2021b) Developing low carbon finance index: evidence from developed and developing economies. Financ Res Lett 43:101520. https://doi.org/10.1016/j.frl.2020.101520

Mohsin M, Taghizadeh-Hesary F, Iqbal N, Saydaliev HB (2022a) The role of technological progress and renewable energy deployment in green economic growth. Renew Energy. https://doi.org/10.1016/j.renene.2022.03.076

Mohsin M, Taghizadeh-Hesary F, Shahbaz M (2022b) Nexus between financial development and energy poverty in Latin America. Energy Pol 165:112925. https://doi.org/10.1016/j.enpol.2022.112925

Najib DCS, Fei C, Dilanchiev A, Romaric S (2022) Modeling the impact of cotton production on economic development in benin: a technological innovation perspective. Front Environ Sci. https://doi.org/10.3389/fenvs.2022.926350

Nhuong BH, Quang PT (2022) Are FDI inflows crucial for environmental protection in various Asian Regions? J Environ Asst Pol Manage. https://doi.org/10.1142/S1464333222500284

Opie W, Riddiough SJ (2020) Global currency hedging with common risk factors. J Financ Econ 136(3):780–805

Perez EA, Moreno-Aspitia A, Thompson EA, Andorfer CA (2010) Adjuvant therapy of triple negative breast cancer. Breast Cancer Res Treat 120(2):285–291. https://doi.org/10.1007/S10549-010-0736-Z

Pincus JR, Winters JA (2019) Reinventing the World Bank. Cornell University Press, New York

Ren X, Qin J, Dong K (2022) How does climate policy uncertainty affect excessive corporate Debt? the case of China. J Environ Assess Pol Manage. https://doi.org/10.1142/S1464333222500259

Schoderer M, Karthe D, Dombrowsky I, Dell’Angelo J (2021) Hydro-social dynamics of miningscapes: Obstacles to implementing water protection legislation in Mongolia. J Environ Manage. https://doi.org/10.1016/j.jenvman.2021.112767

Shahbaz M, Wang J, Dong K, Zhao J (2022) The impact of digital economy on energy transition across the globe: The mediating role of government governance. Renew Sustai Energy Rev 166:112620. https://doi.org/10.1016/j.rser.2022.112620

Smith CW, Stulz RM (1985) The determinants of firms’ hedging policies. J Financ Quant Anal 20(4):391. https://doi.org/10.2307/2330757

Sun H, Ikram M, Mohsin M, Abbas Q (2019) Energy security and environmental efficiency: evidence from oecd countries. Singap Econ Rev. https://doi.org/10.1142/S0217590819430033

Sun L, Fang S, Iqbal S, Bilal AR (2022) Financial stability role on climate risks, and climate change mitigation: implications for green economic recovery. Environ Sci Pollut Res 29(22):33063–33074

Tang DYY, Yew GY, Koyande AK, Chew KW, Vo D-VN, Show PL (2020) Green technology for the industrial production of biofuels and bioproducts from microalgae: a review. Environ Chem Lett 18(6):1967–1985

Triki T (2005) Research on corporate hedging theories: a critical review of the evidence to date. SSRN Electron J. https://doi.org/10.2139/SSRN.734406

Tu CA, Chien F, Hussein MA, Ramli Mm Y, Psi Mm MSS, Iqbal S, Bilal AR (2021) Estimating role of green financing on energy security, economic and environmental integration of BRI member countries. Singap Econ Rev 1–19

Ullah K, Rashid I, Afzal H, Iqbal MMW, Bangash YA, Abbas H (2020) SS7 vulnerabilities—a survey and implementation of machine learning vs rule based filtering for detection of SS7 network attacks. IEEE Commun Surv Tutor 22(2):1337–1371. https://doi.org/10.1109/COMST.2020.2971757

Wang J, Dong K, Dong X, Taghizadeh-Hesary F (2022a) Assessing the digital economy and its carbon-mitigation effects: the case of China. Energy Econ 113:106198. https://doi.org/10.1016/j.eneco.2022.106198

Wang J, Dong K, Sha Y, Yan C (2022b) Envisaging the carbon emissions efficiency of digitalization: the case of the internet economy for China. Technol Forecast Soc Change 184:121965. https://doi.org/10.1016/j.techfore.2022.121965

Wang J, Dong X, Dong K (2022c) How does ICT agglomeration affect carbon emissions? The case of Yangtze River Delta urban agglomeration in China. Energy Econo 111:106107. https://doi.org/10.1016/j.eneco.2022.106107

Wang J, Wang B, Dong K, Dong X (2022d) How does the digital economy improve high-quality energy development? The case of China. Technol Forecast Soc Chang 184:121960. https://doi.org/10.1016/j.techfore.2022.121960

Wang S, Sun L, Iqbal S (2022e) Green financing role on renewable energy dependence and energy transition in E7 economies. Renew Energy 200:1561–1572

Xiuzhen X, Zheng W, Umair M (2022) Testing the fluctuations of oil resource price volatility: a hurdle for economic recovery. Resourc Policy 79:102982. https://doi.org/10.1016/j.resourpol.2022.102982

Yang Y, Liu Z, Saydaliev HB, Iqbal S (2022) Economic impact of crude oil supply disruption on social welfare losses and strategic petroleum reserves. Resour Policy 77:102689

Yi M, Lu Y, Wen L, Luo Y, Xu S, Zhang T (2021) Whether green technology innovation is conducive to haze emission reduction: empirical evidence from China. Environ Sci Poll Res 1–13

Zhang L, Huang F, Lu L, Ni X, Iqbal S (2022) Energy financing for energy retrofit in COVID-19: recommendations for green bond financing. Environ Sci Polluti Res 29(16):23105–23116

Zhao L, Saydaliev HB, Iqbal S (2022) Energy financing, COVID-19 repercussions and climate change: implications for emerging economies. Clim Change Econ 13(03):2240003

Zheng X, Zhou Y, Iqbal S (2022) Working capital management of SMEs in COVID-19: role of managerial personality traits and overconfidence behavior. Econ Anal Policy 76:439–451

Zhu Q, Sarkis J, Lai K (2012) Green supply chain management innovation diffusion and its relationship to organizational improvement: an ecological modernization perspective. J Eng Tech Manage 29(1):168–185

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing Interest

The author declares that he has no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

Financial or non-financial interests

The author declares no relevant financial or non-financial interests to disclose.

Consent to participate

I declare that I have no human participants, human data, or human issues.

Ethics approval

Not applicable.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Cai, S. Impact of digitization on green economic recovery: an empirical evidence from China. Econ Change Restruct 56, 3139–3161 (2023). https://doi.org/10.1007/s10644-022-09473-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10644-022-09473-6