Abstract

The aim of this study is to test the validity of the classical Kuznets curve and financial Kuznets curve (FKC) hypotheses. In addition, in this study, the relationship between financial development and income inequality is discussed, the effect of financial development on income inequality is empirically explored, and policy recommendations are made within the framework of the analysis in 10 newly ındustrialized countries. The annual data spanning 1985–2019 were collected to examine the nexus among financial development, per capita GDP, and income inequality. Moreover, control variables of government expenditures, urban population, foreign direct investment, and economic globalization index were added to the empirical model as explanatory variables. Income inequality is measured by Gini coefficient. Panel autoregressive distributed lag model (Panel ARDL) and panel generalized moment method-system (Panel GMM) were used in the analyses. According to the results obtained in the study, while economic globalization increases income inequality, government expenditures, and urban population and foreign direct investments reduce income inequality. However, while GDP and financial development itself increased the Gini coefficient, it decreased the squares. Therefore, it is concluded that both classical Kuznets curve and financial Kuznets curve hypotheses are valid for newly ındustrialized countries. It is possible that the findings obtained in the analysis will be used by the policy makers of these countries for the development of financial systems in order to reduce inequality. Increasing the efficiency of the financial sector with structural regulations and various incentive policies is important for countries with financially underdeveloped.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Income inequality is one of the defining problems of our age all over the world. It is well known that most countries in the world have faced the problem of income inequality in recent years. It is accepted that increasing inequality has important effects on growth, economic injustice, inequality of opportunity, social instability, economic activities, and macroeconomic stability of global economy. More unequal income distribution also brings about political instability, inequality of political power, and financial crises (Akan et al., 2017: 2; Chiu & Lee, 2019: 1; Lee et al., 2022: 137). It harms the economic, social, and political development of a country. Ensuring fairness in income distribution has become one of the most important goals, especially in developing countries that are trying to catch up with the growth trend of developed countries. Being aware of the problems associated with increasing inequality, governments resort to various tools to reduce the negative consequences of income inequality (Destek et al., 2017: 153). There are many ways to reduce inequality; one is to promote financial sector development, among other benefits. An advanced financial system is seen as an important tool in tackling inequality. (Azam & Raza, 2018: 90). It is increasingly advocated that the development in the financial sector and the proper management of the system will help faster and more stable growth.

One of the most important subsystems of the economy is the financial system. Financial system in an economy: it is a whole that is formed as a result of certain people and institutions, markets, tools, and organizations coming together to fulfill various functions (Türkmen & Özbek, 2021, 2099). Factors such as increasing credit card usage rates, widespread use of internet banking, increasing digitalization in economic activities, and increases in consumer loans constitute the indicators of financialization (Ağır et al., 2020: 72). An active and well-established financial system is necessary for national goals that foster a market-oriented, dynamic, and competitive economy. A strong financial system will encourage the advancement of investment and economic growth at the desired level (Azam & Raza, 2018: 89). Financial development, on the other hand, is basically the sector in which financial assets can be invested in addition to banking and stock markets, and at the same time, various funds and loans are provided to those who want to borrow. Financial development affects capital accumulation, which is one of the basic elements of growth, through savings, and enables savers to use their funds more effectively. Thus, it helps the economy to perform better and become operational by converting savings into investments and providing fund flow to the investor who has a lack of savings (Altunöz, 2021: 115; Argun, 2016: 62). With the increase in investment, it is thought that the income of the poor will increase and new employment opportunities will be provided. In addition, it is accepted that with easy access to financial resources, investments in education, health, and various socioeconomic fields will increase and opportunities to develop human capital will be provided to the poor segments of the population, their children, and family members (Destek et al., 2017: 154; Shahbaz et al., 2015: 358; Doğan, 2018: 529). Social welfare and development can be affected by income distribution disorders in many ways and in various ways. If a small part of the country’s population has a large part of the total income in a country, impoverishment is experienced in addition to the problems that arise in various issues such as education and health. As a result, serious social, economic, and political instability emerges. From this point of view, examining the relationship between income inequality and finance is a matter of interest for policy makers as well as researchers in many social sciences (Altıner et al., 2022: 349). In addition, this relationship is important in terms of determining and implementing effective policies that will accelerate the fight against poverty.

The globalization of financial crises along with globalization has led to healthier investments in the financial sector, improvement of regulations, and taking measures to maintain the functioning of the system. Increasing product diversity in the financial sector and reaching wider audiences thanks to financial literacy reinforce the importance and contribution of the financial system to the economy. With the increase in the level of financialization, serious economic crises were experienced in the 1990s, especially in developing countries, and as a result, unemployment, income inequality, and poverty increased (Altıner et al., 2022: 350; Arat et al., 2022: 1). There is consensus among economists that a well-functioning financial sector should ensure the exchange of goods and services, allocate savings to the most productive areas, monitor investments, conduct corporate governance, diversify and increase liquidity, and reduce intertemporal risk. However, it is unclear how the increased wealth as a result of financial development is reflected in different income brackets. In other words, there is no consensus on the effect of financial development on income inequality (Destek, 2019: 71). Especially as a result of the 2008 global financial crisis, macroeconomic instability and deepening of income inequality in the world increased the interest in this issue and started to cause discussions (Jauch & Watzka, 2016: 292; Nguyen et al., 2019: 1). It also led to the questioning of the effect of financial development on income inequality. Thus, aforementioned relationship become one of the core issues worth a more in-depth investigation in the current literature (Lee et al., 2022: 137).

The main objective of this article is to empirically explore the effect of financial development on income inequality in newly ındustrialized countriesFootnote 1 and to make policy recommendations in line with the analysis. This study tests the validity of both the classical Kuznets curve hypothesis and the financial Kuznets curve (FKC) hypothesis. In this context, annual data for the period 1985–2019 are used in the empirical analysis. The 1990s were the years when studies began theoretically investigating the effect of financial development on income inequality. Empirical studies have increased in the 2000s. There is not any widely accepted view and there are limited studies about this subject. The main motivation of this study is the lack of consensus in the theoretical and empirical studies in the literature on the relationship between financial development and income inequality. The contribution of this study to the extant knowledge in the area is four folds. First, to the best of our knowledge, the countries included in this study have not been previously analyzed in the literature. We are able to investigate the nonlinear income inequality-financial development relationship for a group of countries with similar economic development levels. Second, the Kuznets’ (1955) inverted U-curve hypothesis and the Greenwood and Jovanovic’s (1990) FKC hypothesis both have been tested in this study. Thus, it is possible to investigate how financial development affects income inequality and how this impact will differ depending on the economic development and financial development of the country. Since there are very few studies examining these two hypotheses simultaneously in the national and international literature, it is thought that the study will contribute to the literature. Third, current data were used in this study, in which current panel econometric methods were preferred. We use advanced panel data techniques, which provide better results than other methods, to make the required estimations in our analyses. These methods provide robust estimates when it comes to cross-sectional dependence, serial correlation, and endogeneity. Panel ARDL and panel GMM methods can be used when the series are stationary to different degrees. In addition to the classical ARDL model, the panel GMM method also includes the dynamic structure by including the lagged structure of the dependent variable into the model. This allows us to make stronger comments with more information. It is expected that our study will contribute to the literature with these differences and the results obtained from the analyzes. Finally, the study provides economic and political decision-makers with information on the relationship between financial development and income inequality and help them in how financial development can reduce income inequality.

The following parts of the study are organized as follows: in “Theoretical Framework,” Kuznets (1955)’s inverted U hypothesis and FKC hypothesis are explained theoretically; in “Literature Review,” empirical studies on the subject are presented as a summary; in “Data, Empirical Model, and Methodology,” the data set is introduced and the econometric model and the method are explained. In “Results of the Model,” analysis results are examined. In “Discussion,” the discussion section regarding the results is presented. Finally, in “Conclusion and Recommendations,” conclusions and policy recommendations are given.

Theoretical Framework

Today, it is known that access to economic resources is the cause of inequality, and recently increasing inequality is one of the most controversial issues in many countries around the world. Whether there is a relationship between this income inequality and financial development is one of the issues that researchers wonder. The first studies on this subject in the literature are studies investigating the relationship between economic growth and income inequality.

According to Simon Kuznets (1955)’s hypothesis, which is called the Kuznets curve hypothesis, income inequality first increases when an economy develops, and then income inequality decreases when a certain income level is reached (Chiu & Lee, 2019: 1; Azam & Raza, 2018: 90). Kuznets’ (1955) famous study shows that income inequality increases in the agricultural stage of economic development, slows down in the industrial development stage, and decreases in the service sector rise stage (Khatatbeh et al., 2022: 2; Destek et al., 2020: 1; Aza&m ve Raza, 2018: 90). This study hypothesized an inverted U-shaped association between economic development and income inequality (Destek et al., 2020: 1; Kavya &ve Shijin, 2020: 80; Ağır et al., 2020: 73; Chiu & Lee, 2019: 1). Kuznets stated that in the years when industrialization began, rural areas had more equal and lower average incomes than urban areas, and urbanization created inequality in a society. When a new generation is born from the first poor rural people who moved to the cities, they take advantage of the opportunities in the urban areas. Thus, wages of lower-income groups rise and income inequality decreases (Jauch & Watzka, 2016: 293–294). According to Kuznets, income in developing countries is more unevenly distributed than in developed countries. This hypothesis was later adapted to the relations between other variables (Altunöz, 2021: 116).

In the early 1990s, theories on the relationship between income inequality and financial development began to be formed, and four hypotheses were put forward in the literatüre: the inequality-narrowing hypothesis, the inequality-widening hypothesis, FKC hypothesis (Ağır et al., 2020: 72; Altıner et al., 2022: 351; Argun, 2016: 63; Baiardi & Morana, 2018: 41; Bükey & Akgül, 2021: 306; Lee et al., 2022: 140; Nguyen et al., 2019: 1; Türkmen & Özbek, 2021: 421), and the U-shaped finance-inequality hypothesis (Chiu & Lee, 2019: 2).

The first of the hypotheses explaining the relationship between income inequality and financial development is the approach that asserts the existence of a negative and linear relationship between these variables. The inequality-narrowing hypothesis put forward by Galor and Zeira (1993) and Banerjee and Newman (1993) argues that financial development will reduce income inequality (Ağır et al., 2020: 73; Argun, 2016: 63). Considering the borrowing costs in financial markets, the effect of human capital investments on income inequality has been investigated (Altıner et al., 2022: 351; Nikoloski, 2013: 899). According to this view, income distribution among individuals is parallel to the structure of wealth distribution (Bükey & Akgül, 2021: 305). According to the model developed by the authors, economies with high income inequality, lack of financial depth, and lack of capital markets will have lower growth rates than economies with fair income distribution and developed capital markets. Therefore, the existing inequality will continue to increase (Ağır et al., 2020: 73; Destek et al., 2017: 154; Dumrul et al., 2021: 339; Türkmen & Özbek, 2021: 422). According to this approach, it is possible with financial development that the low socioeconomic segments of the society can make up for the lack of funds. Transaction costs are considered to be high due to disruptions in financial markets and human capital investments are considered indivisible. In short, if there are disruptions in the financial market in an economy, the level of welfare is one of the main factors that determine income inequality. However, when financial markets develop, low-income households will be able to access credit more easily and invest in human capital due to lower borrowing costs (Altıner et al., 2022: 351; Altıntaş & Çalışır, 2018: 82; Baiardi & Morana, 2018: 41; Chiu & Lee, 2019: 2). Increasing financial development creates new employment opportunities by increasing investments. Thus, the gap between both the rich and the poor of the society will decrease and economic growth will be positively affected by this situation.

The second approach that explains the relationship between income inequality and financial development is put forward by Rajan and Zingales (2003). According to this view, which is called the inequality-widening hypothesis, financial development increases income inequality (Destek et al., 2017: 155; Ağır et al., 2020: 73; Lee et al., 2022: 140). Clarke et al. (2006) stated that when financial regulations in a country are lacking and financial institutions are not strong, the rich can benefit from financial development (Altıner et al., 2022: 352; Bükey & Akgül, 2021: 306; Nikoloski, 2013: 899). The poor are excluded in this system, as the financial system channels the money to the rich and well-connected segments, who can provide sufficient collateral and have the ability to repay the loan (Baiardi and & Morana, 2018: 41). In this case, the poor who cannot invest in education cannot start a new business. Advocates of this view emphasize that income inequality among households will increase at some stages, if not at all stages of financial development (Altıner et al., 2022: 352). In short, it is assumed that the poor cannot benefit from financial development if the institutional development is not at a sufficient level. Therefore, the difference between the poor and the rich is increasing (Ağır et al., 2020: 73; Türkmen & Özbek, 2021: 422). Financial liberalization policies may also lead to higher income inequality (Baiardi & Morana, 2018: 41).

Another approach most frequently used in the literature on the relationship between income inequality and financial development is the FKC approach. This approach emerged by Greenwood and Jovanovic (1990) by adapting the relationship put forward by Kuznets (1955) to financial development-income inequality (Akan et al, 2017: 2; Ağır et al., 2020: 73; Doğan, 2018: 529; Khatatbeh et al., 2022: 2). It includes elements of both inequality-narrowing and inequality-widening hypotheses (Baiardi & Morana, 2018: 42; Destek, 2019: 72). Greenwood and Jovanovic (1990) argued that there is a strong relationship between economic growth and financial development and that income differences among households will change depending on this relationship (Altıner et al., 2022: 351). They state that economic development is slow. Because the financial infrastructure is insufficient in the first stage of economic development and the activities of financial markets are new in the first stage of financial development. In this case, the rich can benefit from financial services more easily than the poor. The poor are deprived of financial developments. Thus, the income gap between these two groups in society is gradually increasing. However, households’ demand for financial instruments increases depending on the level of economic development, and transaction costs decrease with the development of the financial sector (Altıner et al., 2022: 351; Bükey & Akgül, 2021: 305; Destek et al., 2017: 154; Argun, 2016: 64). When a country’s financial sector begins to develop through various channels such as the banking and financial services sector, it directly affects economic growth and thus income distribution (Destek et al., 2020: 2). With the increasing financial development over time, the efficiency of financial markets increases and cost advantages emerge. Thus, besides the rich sections of the society, the poor can get the opportunity to participate in the financial markets. With the increase in financial development, there is an increase in savings with increasing economic growth and inequalities in income distribution increase. With the ongoing growth cycle, participation in financial markets from different segments of the society is increasing, and thanks to a more efficient and cost-effective financial system, a wider segment of the society uses financial instruments. Thus, a decrease in income inequality occurs (Ağır et al., 2020: 73; Baiardi & Morana, 2018: 42; Jauch & Watzka, 2016: 294; Nikoloski, 2013: 899). In the last stage, incomes are distributed among the economic units in a stable manner, and there is a decrease in economic growth and savings. These mechanisms reveal a non-linear inverted-U-shaped relationship between financial development and income inequality. This relationship is called FKC (Ağır et al., 2020: 73; Destek, 2019: 72; Doğan, 2018: 527; Kavya & Shijin, 2020: 81; Lee et al., 2022: 140; Türkmen & Özbek, 2021: 422). According to this approach, increasing financial development in an economic system first increases income inequality, but as financial development continues to increase after a certain threshold level, income inequality decreases (Ağır et al., 2020: 73; Altıntaş & Çalışır, 2018: 82; Argun, 2016: 63; Azam & Raza, 2018: 90; Chiu & Lee, 2019: 2; Dumrul et al., 2021: 339). According to a similar argument, it is emphasized that the importance of the financial system is critical in defining high-yield investments in order to change economic growth and income inequality (Destek et al., 2017: 154).

The fourth hypothesis was developed by Tan and Law (2012). It has been argued that the problem of income inequality can be improved in the early stages of financial development, thanks to financial deepening, but this problem will increase gradually as the level of financial development increases (Chiu & Lee, 2019: 2).

In cases where finance is less developed, low-income individuals cannot invest in human and physical capital or cannot cover the initial costs required to start a new business unless they are in debt. As financial markets develop, it becomes easier for low-income individuals to access the funds they need for physical and human capital, and thus, they are more likely to have a higher level of welfare than they would have in the presence of less developed financial markets. On the other hand, individuals in high-income brackets can benefit from their own resources for investment, regardless of the level of financial sector development. Thus, while the developing financial system does not offer extraordinary opportunities for high-income earners, it increases the welfare of low-income earners and reduces income inequality.

Demirgüç-Kunt and Levin (2008) argued that financial market imperfections affect the level of education or human capital of the poor, thus promoting persistent income inequality. According to Demirgüç-Kunt and Levin (2008), under perfect financial market conditions, individuals with academic desire can receive adequate education regardless of parental wealth. This shows that a person’s economic opportunity depends entirely on his ability. On the contrary, under financial market conditions that are imperfect in functions such as information asymmetries, transaction costs, and contractual liability, schooling is influenced not only by academic desire but also by parental wealth. Low-income parents need to borrow money to educate their children. However, imperfections in financial markets create obstacles to financing education, and academically talented low-income individuals have difficulty obtaining an education. Relatively less talented individuals with wealthier parents can receive a good education. Thus, under imperfect financial market conditions, one’s level of human capital and economic opportunities are determined not only by one’s ability but also by parental wealth. As a result, while obstacles to financing education in an imperfect financial market increase income inequality to the detriment of low-income individuals, financial development reduces income inequality in favor of low-income individuals by allowing them to find financing for their human capital (Kuşçuoğlu & Çiçek, 2021: 82). These approaches, which argue that as financial markets develop, low-income individuals who previously did not have access to finance will be the main beneficiaries of this development and thus income inequality will decrease, are called “ınequality convergence hypothesis” in the literature.

Literature Review

In the studies examining the relationship between financial development and income inequality in the literature, the subject was primarily dealt with in a theoretical framework, and the theoretical views that emerged in the 1990s were followed by empirical studies in the 2000s. Along with empirical studies, this theoretical ground on the subject has begun to be tested. There is no consensus on the relationships between these variables. When empirical studies are examined, the results may differ according to the country/country groups, the variables used, the preferred econometric method, and the analyzed period. The results obtained are highly controversial.

Clarke et al. (2006) tested the relationship between financial development and income distribution in developed and developing countries between 1960 and 1995 by using panel data analysis method. The results showed that income inequality decreased with the development of the financial system and, as stated in the FKC hypothesis, the effect of financial development on income inequality was not initially negative. Tan and Law (2012) determined that the FKC hypothesis is not valid for 35 developing countries by using the dynamic panel GMM method. According to their findings, there is a U-shaped relationship between financial development and income distribution inequality rather than an inverted-U-shaped relationship. Nikoloski (2013) used the panel GMM method in his study to test the validity of the FKC hypothesis in 75 developed and developing countries and concluded that the FKC hypothesis is valid. Park and Shin (2015) examined the effect of financial development on income distribution using panel data analysis for a group of 162 countries, mostly developing Asian countries, between 1960 and 2011. They stated that the direction and degree of the relationship between financial development and income distribution varies according to countries, but the relationship between financial development and income distribution is U-shaped. Shahbaz et al. (2015) examined the relationship between these two variables for Iran with ARDL analysis, taking into account the period 1965–2011, and found evidence supporting the Greenwood-Jovanovic (1990) hypothesis. Sehrawat and Giri (2016) tested the long-run relationship between financial development and income distribution in India in 1982–2012 using the ARDL model. They found that the relationship between financial development and income distribution is not supported by the FKC hypothesis. Argun (2016) examined the relationship between these two variables with the random effects model for 10 countries in the 1989–2013 period. He obtained evidence to support the FKC hypothesis.

Topuz and Dağdemir (2016) used the GMM method in their analysis for 94 countries during the 1995–2011 period and stated that the FKC hypothesis is valid. They found that financial development has a reducing effect on income inequality in high-income countries and increasing it in low- and low-middle-income countries and upper-middle-income countries. Baiardia and Morana (2018) tested the FKC hypothesis using panel least squares and panel GMM methods in their study for 19 Euro countries and concluded that there is an inverted-U-shaped relationship between financial development and income distribution inequality. Jauch and Watzka (2016) investigated a similar relationship for 138 developed and developing countries. They used the fixed-effect two-stage least squares method in their study for the period 1960–2018 and found that financial development positively affects income inequality. Destek et al. (2017) tested the validity of the FKC hypothesis using ARDL bounds test approach and VECM methods for Turkey in the 1977–2013 period and concluded that it is valid. Hepsağ (2017) tested the relationship between the mentioned variables for the G-7 countries in the 1961–2015 period. He determined that the FKC hypothesis was valid in the USA, Italy, and Canada, but not in Germany and England. He found that the classical Kuznets curve hypothesis is not valid in the USA, Germany, England, Italy, and Canada. Doğan (2018) determined a U-shaped relationship between financial development and income inequality with the Maki cointegration test and DOLS estimator for Argentina in the 1974–2014 period. According to the results, FKC hypothesis is not valid for Argentina. Younsi and Bechtini (2018) investigated the relationship between financial development, income inequality, and economic growth for BRICS countries in the 1990–2015 period. They concluded that the FKC hypothesis was supported.

Şahin (2018) analyzed the effects of financial development, trade openness, and economic growth on income inequality in 15 developed countries during the 1995–2014 period. He determined that there is a long-term relationship between the mentioned variables. Azam and Raza (2018) analyzed the impact of the financial sector on income inequality in ASEAN-5 countries. In their study covering the years 1989–2013, they found that the FKC was valid. Nguyen et al. (2019) examined the relationship between financial development and income inequality in their study covering 21 developing countries during the 1961–2017 period, and as a result of the analysis, they determined that the relationship between the two variables was in an inverted-U shape. Sayar et al. (2020) tested the FKC hypothesis in 23 developing countries in the 1990–2013 period with the help of panel data analysis and proved that the FKC hypothesis does not exist. Destek et al. (2020) examined the role of financial development on income inequality in Turkey using ARDL bounds test method for the period 1990–2015. According to the results, while FKC is valid for the general financial development index and the banking sector development index, there is a decreasing relationship between the stock market development index and income inequality. The relationship between income inequality and the bond market development index is not significant. Pata (2020) tested the validity of the FKC hypothesis in Turkey in the 1987–2016 period and concluded that the hypothesis is valid. In another study conducted for Turkey, Torusdağ and Barut (2020) investigated the validity of FKC in the 2002–2017 period and found that the hypothesis is not valid in the Turkish economy. Kavya and Shijin (2020) investigated the effect of financial development on income inequality in low, middle and high-income countries in the 1984–2014 period using the panel GMM method. According to the findings, the existence of the FKC hypothesis is supported in high-income countries, while the existence of the U-shaped relationship is confirmed in low and middle-income countries.

Koçak (2021) examined the effects of economic growth and financial development on income inequality in emerging economies between 1993 and 2017, using panel data analysis within the framework of Kuznets curve and FKC approaches. While the findings support the Kuznets curve relationship between economic growth and income inequality, they did not provide evidence for the validity of the FKC between financial development and income inequality. Kuşçuoğlu and Çiçek (2021) investigated the relationship between these variables in Turkey using the ARDL bounds test approach for the period 1987–2017. Empirical findings have shown that the FKC hypothesis is valid. Türkmen and Özbek (2021) examined the relationship between financial development and income inequality in E7 countries in the period of 1988–2016 in the new globalization period with panel data analysis. They revealed that there is a cointegration relationship between the variables. Uygur and Han (2021) investigated the effect of financial liberalization on income inequality in selected G10 countries during the 1997–2019 period. According to their results, the effect of financial liberalization on income inequality is uncertain. Van (2021) examined the relationship between financial development level and income inequality in 79 countries between 1995 and 2016. Panel analysis results showed that there was an inverted-U-shaped relationship between the variables. Yılmaz and Demirgil (2021) tested the validity of the FKC hypothesis for Turkey in the 1980–2018 period and concluded that the hypothesis is valid. Another study investigating the aforementioned relationship in terms of Turkey was conducted by Altunöz (2021) for the period 1992–2019. The ARDL bounds test was used in the study, and findings regarding the existence of FKC were reached. Again in Turkey, this relationship was tested by Dumrul et al. (2021) in the 1980–2017 period and it was found that there was no significant relationship between the two variables. Özdemir (2021) investigated the validity of FKC in 27 OECD countries for the period 1990–2017, depending on the facts of income inequality and economic globalization. The empirical results obtained showed that the stated nexus has a U-related structure.

Cheng et al. (2021) investigated the relationship between financial development, information and communication technologies diffusion, and economic growth. They created a broad financial development index to determine the overall impact of financial development on economic growth. They used dynamic GMM based on panel data covering 72 countries in the period 2000–2015. Regardless of the level of national income, empirical results have shown that financial development is always negative for economic growth, but this negative effect is greater in high-income countries. Özbek and Oğul (2022) tested the short- and long-term validity of the FKC hypothesis in the Turkish economy between 1990 and 2019. Empirical findings revealed that the FKC hypothesis is valid in the short and long term. Tekbaş (2022) examined the relationship between the variables mentioned in the 1992–2014 period in ASEAN-5 countries. He found that economic growth has a positive effect on income inequality, but the effect of financial development on income inequality is not significant. Keskin (2022) discussed the impact of financial development on income inequality in Turkey with the ARDL bounds test, using annual data for the period 1987–2019. He found evidence that financial development increases income inequality. Ünlü (2022) investigated the moderator effect of institutions for a similar relationship between 2002 and 2018 for emerging market economies. He stated that the effect of the moderator variable is negative in the long run and that financial development does not affect income inequality.

Erauskin and Turnovsky (2022) empirically examined the relationship between income inequality and financial globalization for the period 1970–2015 by focusing on both the Gini coefficient and the incomes of quintiles on the income scale. In the study, high-income developed OECD countries, other high-income countries, middle-income countries, and middle-low-income countries were discussed. In general, they found that financial globalization tends to increase income inequality. They also found evidence that the level of development has a strong nonlinear effect on income inequality and found that this evidence is consistent with the “inverted Kuznets curve.” Idrees and Majeed (2022) investigated the relationship between income distribution and environmental quality for Pakistan in the period 1972–2018, using linear and non-linear autoregressive distributed lag models. The study follows the extended environmental Kuznets curve approach. The results showed that inequality increases environmental pollution. They also concluded that further financial development increases carbon emissions. The non-linear analysis confirms the asymmetric effect of inequality on the ecological footprint. However, EKC is not validated for Pakistan. Mbona (2022) investigated both the linear and non-linear impact of different components of financial sector development on income inequality. The study used the GMM system on panel data of 120 countries in the period 2004–2019. The analysis results revealed that the overall financial sector development index, individual financial institutions, and the market development index all narrow income inequality. It has shown that different dimensions of financial sector development have heterogeneous effects on income inequality, where increased access to financial services reduces income inequality in both linear and non-linear models.

Khatatbeh and Moosa (2022) applied extreme bounds analysis to examine the robustness of financialization variables as determinants of income inequality. The sample comprises 5 year average cross-sectional data for 105 countries, over the period 2012–2016. The results show that financialization is a precursor to income inequality and that the effects are larger when transmitted through financial markets. Islam (2022) examined the link between remittances and economic growth for a panel of four South Asian economies using data for the period 1986–2019. The study used cross-sectional dependency test, second generation panel unit root test, panel generalized least squares, panel fully modified ordinary least squares, and Dumitrescu-Hurlin panel causality tests. Analysis has shown that remittances have a positive impact on economic growth. Additionally, there is unidirectional causality from remittances to economic growth. Khatatbeh and Moosa (2023) investigated the financial Kuznets curve hypothesis for 20 developed and developing countries using fully modified ordinary least square (FMOLS) and unobserved components model (UCM). The results showed that the inverted U-shaped curve as well as the U-shaped curve were valid in more than half of the countries. Overall, the findings of this research suggest that financialization does not have a uniform effect on income inequality. Vo et al. (2023) examined the long-run effects of financial development, economic growth, and their combined effects on income inequality for 12 Asia Pacific countries for the period 1990–2021. Empirical results revealed that the effect of financial development on income inequality is in the form of an inverted U-shaped relationship. Wang et al. (2023) investigated the relationship between technological innovation and income inequality for China based on the financial Kuznets curve hypothesis. In the study, time series data for the period 1985–2019 and Johansen cointegration, ARDL model, and VECM Granger causality techniques were used. DOLS, FMOLS, and CCR mechanisms were also used to estimate long-term parameters. The analysis results revealed that the financial Kuznets curve is valid for the Chinese economy in the long run.

Data, Empirical Model, and Methodology

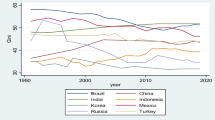

The aim of the study is to test the FKC and Kuznets (1955) inverted U curve hypotheses, along with revealing the effects of variables affecting income inequality. The annual data spanning 1985–2019 were collected to examine the nexus among financial development, per capita GDP, and income inequality in 10 newly ındustrialized countries. In addition, control variables of government expenditures, urban population, foreign direct investment, and economic globalization index were added to the empirical model as explanatory variables. The selection of the period and variables to be able to perform the analysis of the study depends on the availability of the relevant data. As to the main variable of interest, income inequality is measured by Gini coefficient which is retrieved from the Standardized World Income Inequality Database (SWIID) (SWIID 9.4) proposed by Solt (2020), which is one of the most comprehensive and comparable datasets on income inequality, and the World Bank (World Development Indicators-WDI). As reported in SWIID, it is estimated by using household disposable income (post-tax and post-transfer). The value of this indice ranges from 0 to 100. A higher Gini coefficient means a more unequal distribution of income in a country. The annual data of real GDP per capita, financial development, government expenditure, urban population, and foreign direct investment were downloaded from the WDI. In addition, the economic globalization index is obtained from KOF Index of Globalization. The variables used in the study are defined in Table 1.

The model in Eq. (1) used by authors such as Jauch and Watzka (2016), Younsi and Bechtini (2018), Nguyen et al. (2019), Altıner et al. (2022), Gezer (2021), Koçak (2021), Hepsağ (2017), and Kavya and Shijin (2020) shows the relationship between the variables in Table 1 above. Model is built in order to test the validity of Kuznets (1955) inverted U-shape hypothesis, and Greenwood and Jovanovic (1990) inverted U-shape hypothesis in a common equation at this section. Therefore, quadratic values of GDP and FD are added for this objective to model.

Equation (1) can be expressed econometrically as

\({\alpha }_{0}, {\alpha }_{1},\dots , {\alpha }_{8}\) imply the unknown parameters to be estimated, with u error term, i (i = 1, 2, …, N) denotes the respective countries and t (t = 1, 2, …, T) indicates the period chosen for this study. Equation (2) is of both linear and non-linear form. The effect of financial development on GN is investigated with the FD. To observe the possible non-linear relationship between GN and GDP, on the one hand, or FD on the other, we plug in the square of GDP and FD as an explanatory variables. Thus, by using the FD and FD2 variables, an idea about Greenwood and Jovanovic (1990) FKC hypothesis. The GDP and GDP2 variables are used to test the Kuznets (1955) inverted U-shaped hypothesis. In the case of \({\alpha }_{1}\)< 0 and \({\alpha }_{2}\)= 0, the inequality reducing hypothesis is confirmed, while if \({\alpha }_{1}\)> 0 and \({\alpha }_{2}\)= 0, the inequality increasing hypothesis is confirmed. If the predicted parameters follow \({\alpha }_{1}\)> 0 and \({\alpha }_{2}\)< 0, the inverted U-shaped FKC hypothesis is confirmed. If \({\alpha }_{3}\)>0 and \({\alpha }_{4}\)<0 then the inverted U-shaped Kuznets (1955) hypothesis is accepted. If \({\alpha }_{1}\)< 0 and \({\alpha }_{2}\) > 0 then U-shaped relationship is accepted.

The countries that make up the panel, that is, cross-section units are independent. It is based on the assumption that all cross-section units are affected at the same level by a shock to one of the units that make up the panel and that other countries are not affected by a macroeconomic shock that occurs in any of the countries. While there is a cross-sectional dependence between the series, analysis without taking this into account significantly affects the results (Breusch & Pagan, 1980; Pesaran, 2004; Baltagi et al., 2012). Before proceeding to the analysis, it is necessary to test the cross-sectional dependence on behalf of the variables and the cointegration equation. Considering cross-section dependence when selecting unit root and cointegration tests will make the results of the analysis performed biased and inconsistent.

Within the scope of the study, Breusch and Pagan (1980), Pesaran LM (2004), Pesaran scaled LM (2004), and Baltagi et al. (2012) bias-corrected scaled LM (2012) tests were used. The null hypothesis for each test is “there is no cross section dependence.” Depending on the null hypothesis, the CDLM1 test statistic equation is as follows (Breusch & Pagan, 1980):

The CDLM1 test cannot be applied in case of an increase in the number of cross-sections (N → ∞). To solve this problem, Pesaran (2004) developed the CDLM2 test statistic. The equation is as follows:

Pesaran (2004) created the CDLM3 test in order not to depend on the size-smallness relationship between T and N. Thus, the CDLM3 statistic shows an asymptotic standard normal distribution. The CDLM3 equation is as follows:

Baltagi et al. (2012) developed the LMadj test due to his tendency to not reject the null hypothesis in the CDLM3 test, and the test statistic is T > N, while the asymptotic standard shows a normal distribution. The LMadj equation is as follows:

Another assumption that needs to be tested before proceeding to panel data analysis is the homogeneity assumption. Estimating with the least squares method, assuming that the coefficients are homogeneous while they are heterogeneous, may cause the values of the coefficients to be obtained to be biased (Baltagi, 2005). With the delta tests of Pesaran and Yamagata (2008), it can be determined whether the constant term (α) and the slope coefficients, which represent the constant coefficient including individual effects and are estimated depending on time and cross-section size, are homogeneous or heterogeneous for each country. Pesaran and Yamagata (2008) created the homogeneity test (slope homogeneity test) in their study. Two different test statistics are provided for small and large samples. The homogeneity of the slope coefficient expressing the basic hypothesis is tested in both test statistics. The first of these (\(\widetilde{\Delta }\)) is recommended for large samples and is calculated as follows:

Another test statistics (\({\widetilde{\Delta }}_{adj}\)) is recommended for small samples and is calculated as follows.

In the next step, the stationarity of the variables used in the model is handled with the second generation unit root tests that take into account the cross-section dependence and homogeneity. In the study, CADF and CIPS panel unit root tests developed by Pesaran (2007) were preferred. CADF and CIPS unit root tests are an extended version of the ADF unit root test. This approach is known as CADF. Equation (9) is used for the CADF unit root test.

In the above equation, \({\alpha }_{i}=(1-{\phi }_{i}){\mu }_{i}\), \({\beta }_{i}=-(1-{\phi }_{i})\), and \({\Delta y}_{it}={y}_{it}-{\Delta y}_{it-1}\) are expressed.

The basic hypothesis addressed in the CADF test is that the series contains a unit root for cross-section units. By calculating the mean of each series, Pesaran provides the cross-sectional ındependent panel unit root test (CIPS) statistic as follows (Pesaran, 2007: 268):

The panel ARDL approach, a panel error correction model, was developed by Pesaran et al. (1999). There are two types of estimators in the panel ARDL approach. The first of these is the mean group (MG) estimator, and the other is the pooled mean group (PMG) estimator. The MG estimator has no restrictions on the parameters. MG derives long-term parameters from the mean of individual ARDL model parameters. The PMG estimator allows for long-term homogeneity and short-term heterogeneity of parameters (Pesaran et al., 1999; 621). In addition, Hausman test can be used to select the regression between MG and PMG (Peseran et al., 1999).

The long ARDL model used in the study is as follows:

The short-term panel ARDL model is as follows:

Here, Δ is the difference operator and ω is the error correction coefficient. In the short-run equation, the error correction coefficient is expected to be statistically significant and in the range of−1 < ω < 0. In this way, the existence of a long-term relationship between the variables is revealed.

Finally, in the study, the system panel GMM method was applied to test the dynamic structure. Models in which the lagged values of the dependent variable are included as independent variables in the model are called dynamic models. The general structure is shown as follows (Hsiao, 2003: 69):

Here, xit is independent variable vector of size K × 1; βi, K × 1 dimension coefficients matrix; yi,t‒1, the lagged value of the dependent variable yit, ηi unobservable individual effects; λt unobservable temporal effects; and εit indicates the error term. In the model, it is assumed that ηi and λt are constant.

In the dynamic model structure, the dependence of the lagged value of the dependent variable and the error term causes standard least squares estimators to give deviated and inconsistent results (Baltagi, 2005: 135). In order to eliminate this situation, GMM has been proposed in dynamic panel estimations. This method is frequently used in the estimation of dynamic models due to its practicality of application and the relative simplicity of the assumptions required for estimation. Among GMM estimators, the estimator put forward by Arellano and Bond (1991) is frequently used. This approach, also called difference GMM, takes the first-order differences of the variables in the model and uses the lagged values of the independent variables as ınstrument variables (Soto, 2009: 2). Another frequently used estimator based on GMM is the system GMM approach introduced by Arellano and Bover (1995). This version is based on combining the difference equation and level equations. In their studies, Blundell and Bond (1998) and Blundell et al. (2000) found that system GMM has better predictive power than difference GMM, especially in finite samples. For this reason, the system GMM approach was used in the study. The econometric model structure used in the study for the system GMM approach is as follows:

Results of the Model

Before the analysis part of the study, descriptive statistics are given in Table 2.

Regarding the variables, the gini coefficient was calculated as 45.306% on average for 10 newly ındustrialized countries in the 1985–2019 period. The average value for financial development was found to be 58.278. The average gross domestic product per capita is 4,987,186 million dollars. The variable with the least variability was foreign investments with a standard deviation of 1.565. For the period of 1985–2019, the share of government expenditures in gross domestic product in newly ındustrialized countries is 12.91%. The economic globalization index value was determined as 48,896 for 10 countries. The more this value increases, the more globalization will increase. The ratio of the urban population, which expresses the urbanization rate, to the gross domestic product was obtained as 53.548%. It can be said that a half-and-half urbanization is possible for these countries.

After descriptive statistics, we give Pearson correlation for variables in Table 3. According to correlation results, a positive and strong relationship was found between UP and GDP. A positive but weak relationship was found between GN and GDP, FD and GDP, FODI and GDP, GE and FODI, UP and FODI, and UP and EGI. A weak and negative relationship was found between GN and FD, GN and FODI, GN and EGI, GE and EGI, and UP and FD. A moderate and positive relationship was found between FD and FODI, GN and GE, GDP and GE, and EGI and FODI.

After the descriptive statistics and correlation results, what needs to be done before the analysis is to investigate whether the series carry the assumptions of cross-sectional dependence and homogeneity regarding the created model. The cross-sectional dependence and homogeneity results of the model are given in Table 4.

According to the results, the main hypothesis that includes cross-section independence in terms of both variables and the model is rejected. This means that in the panel created for the newly industrialized countries, the economic or social changes that may occur in any country affect other countries as well. Therefore, policies will be influenced by each other by the countries that make up the panel.

According to the homogeneity test results, the slope coefficient has a heterogeneous structure. The existence of significant differences in the economic structures of the countries has brought this result.

Stationarity of the series is of great importance before model estimation, especially to prevent spurious regression and to obtain reliable and consistent estimators. For this reason, the stationarity of the series was tested at this stage of the analysis. In this part of the study, both constant and trend structured CADF for variables and CIPS results for the whole panel are included.

In Table 5, the maximum lag length for the stationarity test was determined as 8 within the framework of the Schwarz information criterion. Table 5 separately shows the constant trend CADF statistical results for the variables included in the study for the newly ındustrialized countries. The GDP, GDP2, GE, and EGI variables were stable in level values for most countries and for the overall panel. Variables GN, FD2, and UP contain a unit root level for both countries and countries in general. While the FD variable is stationary for India and Turkey, it is non-stationary for other countries and the panel in general. The FODI variable also has a unit root outside of the Philippines.

According to the unit root test results for non-stationary series in Table 6, the variables GN, FD, FD2, FODI, and UP became stationary as a result of the difference taking process. Thus, while these variables are I(1); GDP, GDP2, GE, and EGI variables are I(0). In this direction, ARDL test will be used in the continuation of the analysis.

The biggest advantage of the ARDL test is that it provides the opportunity to establish an integrated model in cases where the variable group considered is not stationary at the same level within itself. Information criterions were used to determine the lag lengths in the panel ARDL model. Model selection results are given in Table 7. The optimum model is determined as Panel ARDL(2,1,1,1,1,1,1,1,1).

After the model selection criterion stage, the effects of long-term and short-term estimators on the dependent variable for ARDL analysis were discussed based on the specified lags. In the Table 8, the results of the long- and short-term model estimations are given.

Table 8 shows the panel ARDL test results. The model includes the results of PMG and MG estimator. The PMG estimator was determined as an efficient estimator based on the Hausman test. According to the panel ARDL test results, financial development affects income inequality first positively and then negatively. A similar structure to this situation is also valid for the economic growth variable. Therefore, Kuznets (1955) inverted U hypothesis and FKC are valid in 10 newly ındustrialized countries. FKC is found by the studies of Nikoloski (2013), Shahbaz et al. (2015), Baiardi and Morana (2018), Zhang and Chen (2015), Akıncı and Akıncı (2016), Destek et al. (2017), Nguyen et al. (2019), Pata (2020), Destek et al. (2020), Kuşçuoğlu and Çiçek (2021), Yılmaz and Demirgil (2021), Koçak and Uzay (2019), and Hassan and Meyer (2021). These studies coincide with this study. Many existing studies such as Greenwood and Jovanovic (1990), Galor and Zeira (1993), List and Gallet (1999), Thornton (2001), Barro (2008), Bhandari et al. (2010), Younsi and Bechtini (2018), Nguyen et al. (2019), Martinez-Navarro et al. (2020), and Gezer (2021) also find the classical Kuznets hypothesis. The findings of these studies are parallel to the results of this study. When the coefficients of the control variables are considered; for the long-term model, it is the UP variable that reduces income equality the most. In terms of work, urban populations significantly reduce income equality in newly ındustrialized countries. This variable is followed by FODI and GE variables, respectively. Among the control variables, only EGI increased income equality. The economic perspective of the effects of the variables is mentioned in detail in “Discussion.”

In terms of short-term model results, parallel results are observed, except for the increasing effect of FODI on income equality. It is expected that foreign investors entering the economy will increase income inequality in the short term. The sign of the error correction coefficient is negative (− 0.107) and statistically significant. While this result supports the validity of the long-term relationship between the variables, it shows that the short-term shocks are temporary and the variables will converge to the long-term equilibrium. Unit-based diagnostic test results for the model based on the PMG estimator are shown in Table 9.

For the diagnostic results obtained as a result of the model, no country has the problem of heteroscedasticity and autocorrelation in terms of the PMG estimator.

After proving the theoretical consistency of the financial Kuznets curve hypothesis, panel GMM was considered to test the dynamic structure. Before examining the panel regression results in Table 10, the consistency of the system GMM estimators was evaluated. Firstly, the Wald test was examined to determine whether the variables used in the model were significant as a whole, in other words, to determine the significance of the model. Since the probability value of the chi-square statistic of the Wald test is less than the significance levels (1%, 5%, and 10%), the model is completely significant. Secondly, the consistency of the dynamic structure used in the model, whether the error terms of the variables are related or not, in other words, whether there is an overdetermination constraint in the panel estimation, Sargan test was discussed. Since the probability value is greater than the significance levels (1%, 5%, and 10%), it is concluded that the dynamic structure is valid in the model and there is no overdetermination. Third and finally, Arellano-Bond tests were used to examine whether there was a 1st and 2nd-degree autocorrelation problem in the model. Probability values for both orders indicate that there is no autocorrelation problem in the model. All these criteria show that the system GMM estimators are consistent.

When the panel GMM results were evaluated, it was shown that financial development and economic growth had first a positive and then a negative effect on income inequality, as in the ARDL structure of the dynamic structure. The fact that the lagged structure of the Gini coefficient is significant shows that GMM based on the dynamic structure supports the FKC hypothesis. Similar to the ARDL results, within the panel GMM system structure, FODI, GE, and UP reduce income inequality, while EGI increases it.

Discussion

Since both ARDL and GMM results show exact parallelism with each other, economic explanations of the coefficients are included in the discussion section. The parts of the findings that overlap with the literature are included in “Results of the Model.” In this section, the results of the model, in other words, the economic theory of the relationships between the independent variables and the dependent variable, are discussed.

In the long run, FODI reduces income inequality. The same variable increases income inequality in the short run. Theoretically, this is in line with the modernization theory. According to modernization theory, in the early stages of development, there is an increase in the employment rate in modern and high-income sectors of the economy, a large gap between high- and low-income people, and a widening of income differences between sectors. All of this means deteriorating income distribution within the country. In the later stages, the problem of income inequality will disappear as production increases, the surplus labor in the agricultural sector disappears with the transfer of labor from the agricultural sector to the industrial sector, and the marginal product of the labor force in the agricultural sector raised the level of the marginal product of the labor force in the industrial sector (Ongan, 2004; Ridzuan et al., 2021; Tsai, 1995). In the short term, since financial development is not yet perfect, the rich are more likely to obtain funds than the poor, which may increase income inequality. In the long term, when financial development occurs, small businesses or the poor increase their financing opportunities, gradually reducing income inequality (Lee et al., 2022). Although growth from FODI may initially be limited to a few sectors where workers earn higher wages, in the long run growth in these leading sectors has the potential to contribute to reducing income inequality in the host country. The reason why FODI increases inequality in the short run is related to the transfer of technologies that FODI encourages. These technologies often require the use of skilled labor. The high demand and limited supply of such labor in the host economy initially leads to an increase in the wages of skilled workers, and hence the widening of the wage gap between skilled and unskilled workers, contributing to increased income inequality. However, in the long run, income inequality begins to decrease as the spread of education improves, the level of human capital gradually increases, and new technologies are adopted by local companies (Mihaylova, 2015).

Public expenditures reduce income inequality in the short and long term. Since government spending is related to the size of the welfare system, the provision of public goods, the degree of market intervention, and the redistributive spending, government spending is expected to be negatively correlated with income inequality. Redistribution of income through increasing national income and increasing public expenditures leads to a decrease in income inequality. Public expenditures increase the welfare of the general public, especially the low-income group, and provide opportunities for everyone. The state’s expenditures on education and health sectors, the expenditures on roads, water, electricity, etc. for rural areas, investment expenditures that create employment, unrequited transfer expenditures and social security expenditures benefiting lower-income groups, also positively affect income distribution (Ürper, 2018; Alwafai, 2019; Kuşçuoğlu & Çiçek, 2021; Baiardi & Morana, 2018).

From another perspective, economic globalization increases income inequality for 10 newly ındustrialized countries, both in the short and long term. Debates still continue about how globalization affects income inequality. Globalization exposes some geographical regions and groups to marginalization due to differences in increases in the returns to skills and education. This view is valid for most transition economies that experience higher levels of inequality after the removal of trade boundaries with the outside world. Greater integration of the domestic economy with the global economy gives the upper-income class more undue and more opportunities than the middle- and lower-income classes. This widens the income gap and worsens income inequality. Removing trade barriers exposes transition economies to unhealthy competition that unequally distributes the returns on skills. This increases income inequality in the country’s economy (Alwafai, 2019).

As the urban population increases, income inequality decreases. Urbanization is an important indicator of modernization, economic, and social development. Cities, it is the locomotive in generating economic income, attracting investment, providing business and employment opportunities, benefiting from human and technical/technological resources, and producing national income. Those living in cities have access to education, health, and other social opportunities. The process of urbanization can have a favorable impact on inequality and well-being through economic development and transformation. The increase in population living in urban areas is expected to lead to reduced income inequality and higher productivity in the urban sector through the growth-enhancing effect of urbanization. In this respect, urbanization is of critical importance in reducing poverty and income inequality and increasing human development (Pata, 2020; Koçak, 2021; Baiardi & Morana, 2018).

Conclusion and Recommendations

It is seen that an economic structure emerged in the 1980s, in which commercial liberalization took place throughout the world, and the share of financial markets has gradually increased from the period covering the 1990s to the present. With the emergence of financial crises in the 2000s, this situation reached its highest level. The issue of what the weight of financial development should be has started to be discussed frequently. Financial development, which has been criticized for creating inequality in income distribution, has been the subject of many studies in this respect. It is very important to shed more light on the relationship between financial development and income inequality for the implementation of necessary policies.

The aim of this study is to examine the validity of classical Kuznets curve hypothesis and FKC hypothesis in 10 newly ındustrialized countries for the period from 1985 to 2019. For this aim, we investigate the effects of real GDP per capita, the square of reel GDP per capita, financial development, and the square of financial development on the Gini coefficient. In our analysis, we employ more advanced panel data techniques to perform the required estimations. In comparison with the previous studies the methodology, time period and regressors in this study are somewhat different. According to the panel ARDL and panel GMM test results, Kuznets (1955) inverted U hypothesis and FKC hypothesis are valid in newly ındustrialized countries. It is possible that the findings obtained in the study will be used by the policy makers of these countries for the development of financial systems in order to reduce inequality.

Financial development is a very effective determinant in reducing income inequality, in this context, financial development and per capita income are less effective in reducing income inequality in financially underdeveloped countries. Increasing the efficiency of the financial sector with structural regulations and various incentive policies is very important for countries with medium and low level of financial development. In countries with medium and low level of financial development, government practices and policies should be prepared to facilitate for the households wishing to use the financial system to access the collateral they need. Thanks to the aforementioned facilitating practices and policies, individuals who have easier access to financial services will increase their capacity to invest in physical and/or human capital, which will, as a result, increase total savings and investments in the economy so that sustainable economic growth can be achieved. As a result, income inequality can be reduced through a process in which financial development and economic growth mutually enhance each other.

Deteriorations may occur in the income distribution of countries that have not completed their financial development. In order to achieve a better income distribution, it is recommended that financial markets and institutions develop and access to this system should be made easier, in short, the access and efficiency should be optimized along with the deepening. For future studies on the subject, it is thought that more reliable determinations will be reached with the formation of a data set of variables such as financial size and institutional quality that will increase the efficiency of financial markets.

The study provides governments and firms with information on the relationship between financial development and income inequality and helps them in how financial development can reduce income inequality. The findings obtained from the study are thought to be important findings in terms of helping to determine, plan, and implement economic policies. If a policy is to be followed to reduce income distribution inequality, especially in terms of the validity of the financial Kuznets curve hypothesis, it is understood that increasing financial development rather than economic growth would be a more rational policy. It is thought that in countries with medium and low financial development levels, giving importance to policies that increase financial depth and effective implementation of the financial system are important to ensure equitable income distribution. An effectively functioning financial system will enable the financing of projects with high social and economic returns while efficiently establishing the mobility and allocation of savings in an economy. It is thought that this will ensure efficiency in resource distribution, increase the level of welfare, and contribute to stable growth. Policymakers should work to integrate the poor into the financial system in order to eliminate the imbalance in income distribution. Facilitating low-income groups’ access to financial instruments through planned economic policies of the government and ensuring that these groups adapt to financial markets is very important for income distribution justice.

Based on the findings of the study, it can be said that governments and firms should take measures to reduce restrictions and disruptions in financial markets in the fight against inequality. Regulations that make access to financial resources and the financial system difficult should be audited and access to capital should be facilitated. Fighting against price and financial instabilities that deepen inequalities should be among the priority policies. Governments’ pursuit of policies that provide a trust and strengthen the institutional structure will reduce bureaucratic obstacles in the financial system and facilitate access to finance for all segments.

Data Availability

Data will be made available on request.

Notes

Brazil, China, India, Indonesia, Malaysia, Mexico, Philippines, South Africa, Thailand, Turkey.

References

Ağır, H., Türkmen, S., & Özbek, S. (2020). Finansal kuznets eğrisi yaklaşımı çerçevesinde finansallaşma ve gelir eşitsizliği i̇lişkisi: E7 Ülkeleri üzerine ekonometrik bir tahmin. BEYDER, 15(2), 71–84. https://dergipark.org.tr/tr/pub/beyder/issue/58428/833969

Akan, Y., Köksel, B., & Destek, M. A. (2017). The financial Kuznets curve in European Union. Economic World, 2017, 25–27, Rome, Italy. https://www.researchgate.net/publication/314952915_The_Financial_Kuznets_Curve_in_European_Union

Akıncı, G. Y., & Akıncı, M. (2016). Ters-u hipotezi bağlamında ekonomik büyüme, finansal kalkınma ve gelir eşitsizliği mekanizmaları üzerine. Finans, Politik and Ekonomik Yorumlar Dergisi, 53(622), 61–77. http://www.ekonomikyorumlar.com.tr/files/articles/152820006185_4.pdf

Altıner, A., Bozkurt, E., & Turesi, S. (2022). The relationship between ıncome ınequality and financial development: Panel data analysis. Business and Economics Research Journal, 13(3), 349–366. https://doi.org/10.20409/berj.2022.377

Altıntaş, N., & Çalışır, M. (2018). Finansal gelişmenin bankacılık ve sermaye piyasası bağlamında gelir dağılımına etkisi: ARDL Sınır Testi Yaklaşımı. Trakya Üniversitesi İktisadi ve İdari Bilimler Fakültesi E- Dergisi, 7(1), 81–97. https://dergipark.org.tr/tr/download/article-file/510743

Altunöz, U. (2021). Finansal Gelişmişlik ve Gelir Dağılımı Bağlamında Türkiye’nin Finansal Kuznets Eğrisi. ISPEC International Congress on Multidisciplinary Studies, 12–13, Adana, Turkey.

Alwafai, A. Y. N. (2019). The ımpact of financial development on ıncome ınequality. Master of Science in Banking and Finance, Eastern Mediterranean University, September 2019, Gazimağusa, North Cyprus. http://hdl.handle.net/11129/5195

Arat, Z., Hazar, A., & Babuscu, S. (2022). Relationship between financial development and ıncome ınequality for Turkey and selected countries with similar economy. The Journal of Corporate Governance, Insurance, and Risk Management, 9(1), 1–12. https://doi.org/10.51410/jcgirm.9.1.1

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58, 277–297. https://doi.org/10.2307/2297968

Arellano, M., & Bover, O. (1995). Another look at the ınstrumental variable estimation of error-components models. Journal of Econometrics, 68, 29–51. https://doi.org/10.1016/0304-4076(94)01642-D

Argun, A. İ. (2016). Gelişmekte Olan Ülkelerde Finansal Gelişme ve Gelir Eşitsizliği. İstanbul Üniversitesi Sosyal Bilimler Dergisi, 1, 61–74. https://dergipark.org.tr/en/download/article-file/270112

Azam, M., & Raza, S. A. (2018). Financial sector development and ıncome ınequality in ASEAN-5 countries: Does financial Kuznets curve exists? Global Business and Economics Review, 20(1), 88–114. https://doi.org/10.1504/GBER.2018.088482

Baiardia, D., & Morana, C. (2018). Financial development and ıncome distribution ınequality in the Euro area. Economic Modelling, 70, 40–55. https://doi.org/10.1016/j.econmod.2017.10.008

Baltagi, B. H. (2005). Econometric analysis of panel data. John Wiley&Sons Ltd.

Baltagi, B. H., Feng, Q., & Kao., C. (2012). A Lagrange multiplier test for cross-sectional dependence in a fixed effects panel data model. Journal of Econometrics, 170, 164–177. https://doi.org/10.1016/j.jeconom.2012.04.004

Banerjee, A., & Newman, A. F. (1993). Occupational choice and the process of development. Journal of Political Economy, 101, 274–298. https://doi.org/10.1086/261876

Barro, R. J. (2008). Inequality and growth revisited. Working Paper Series on Regional Economic Integration No. 11, Asian Development Bank. https://www.adb.org/sites/default/files/publication/28468/wp11-inequality-growth-revisited.pdf

Bhandari, R., Pradhan, G., & Upadhyay, M. P. (2010). Another empirical look at the Kuznets curve. International Journal of Economic Sciences and Applied Research, 3(2), 7–19. http://hdl.handle.net/10419/66587

Blundell, R., & Bond, S. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87, 115–143. https://doi.org/10.1016/S0304-4076(98)00009-8

Blundell, R., Bond, S., & Windmeijer, F. (2000). Estimation in dynamic panel data models: ımproving on the performance of the standard GMM estimator. In B. Baltagi (ed.), Advances in econometrics: Nonstationary panels, panel cointegration, and dynamic panels, 15. Amsterdam: JAI Elsevier Science. http://hdl.handle.net/10419/90837

Breusch, T. S., & Pagan, A. (1980). The Lagrange multiplier test and ıts applications to model specification in econometrics. Review of Economic Studies, 47, 239–253. https://doi.org/10.2307/2297111

Bükey, A. M., & Akgül, O. (2021). The effect of financial deepening on ıncome distribution: The case of BRICS-T. Sosyoekonomi, 29(47), 301–318. https://doi.org/10.17233/sosyoekonomi.2021.01.15

Cheng, C. Y., Chien, M. S., & Lee, C. C. (2021). ICT diffusion, financial development, and economic growth: An ınternational cross-country analysis. Economic Modelling, 94, 662–671. https://doi.org/10.1016/j.econmod.2020.02.008

Chiu, Y. B., & Lee, C. C. (2019). Financial development, ıncome ınequality, and country risk. Journal of International Money and Finance, 93, 1–18. https://doi.org/10.1016/j.jimonfin.2019.01.001

Clarke, G. R., Xu, L. C., & Zou, H. F. (2006). Finance and ıncome ınequality: What do the data tell us? Southern Economic Journal, 72(3), 578–596. https://doi.org/10.1002/j.2325-8012.2006.tb00721.x

Demirgüç-Kunt, A., & Levine, R. (2008). Finance and economic opportunity. Policy Research Working Paper, 4468, 1–31. https://documents1.worldbank.org/curated/en/789171468349832745/pdf/wps4468.pdf

Destek, M. A. (2019). Financial development and ıncome ınequality in the US Since 1870: Evidence from time-varying cointegration. 4th Internatıonal Conference on Economics Business Management and Social Sciences, 04–08, Budapest, Hungary. https://www.icebss.eu/sites/default/files/icebss_abstract_and_proceedings_v2.pdf

Destek, M. A., Okumuş, İ., & Manga, M. (2017). Türkiye’de Finansal Gelişim ve Gelir Dağılımı İlişkisi: Finansal Kuznets Eğrisi. Doğuş Üniversitesi Dergisi, 18(2), 153–165. https://dergipark.org.tr/en/download/article-file/2152166

Destek, M. A., Sinha, A., & Sarkodie, S. A. (2020). The relationship between financial development and ıncome ınequality in Turkey. Journal of Economic Structures, 9(11), 1–14. https://doi.org/10.1186/s40008-020-0187-6

Doğan, B. (2018). The financial Kuznets curve: A case study of Argentina. The Empirical Economics Letters, 17(4), 527–536. https://www.researchgate.net/publication/325854495_The_Financial_Kuznets_Curve_A_Case_Study_of_Argentina

Dumrul, C., İlkay, S. Ç., & Dumrul, Y. (2021). Finansal kuznets eğrisi hipotezi: Yapısal Kırılmalı Eşbütünleşme Testleri ile Türk Ekonomisine İlişkin Ampirik Bir Analiz. Sosyoekonomi, 29(50), 337–359. https://dergipark.org.tr/en/download/article-file/1541248

Erauskin, I., & Turnovsky, S. J. (2022). International financial ıntegration, the level of development, and ıncome ınequality: Some empirical evidence. International Review of Economics and Finance, 82, 48–64. https://doi.org/10.1016/j.iref.2022.05.013

Galor, O., & Zeira, J. (1993). Income distribution and macroeconomics. The Review of Economic Studies, 60(1), 35–52. https://doi.org/10.2307/2297811

Gezer, M. A. (2021). The effect of financial development on ıncome ınequality for selected country group, In Ş. Karabulut (ed.), Uluslararası ve Küresel Ölçekte İktisat Uygulamaları, Gazi Kitabevi, Ankara, 31–48.

Greenwood, J., & Jovanovic, B. (1990). Financial development, growth and the distribution of ıncome. The Journal of Political Economy, 98(5), 1076–1107. https://www.journals.uchicago.edu/doi/abs/10.1086/261720

Hassan, A. S., & Meyer, D. F. (2021). Financial development-ıncome ınequality nexus in South Africa: A nonlinear analysis. International Journal of Economics and Finance Studies, 12(2), 15–25. https://doi.org/10.34109/ijefs.202012206

Hepsağ, A. (2017). Finansal Kuznets Eğrisi Hipotezi: G-7 Ülkeleri Örneği. Sosyal Güvenlik Dergisi, 7(2), 135–156. https://dergipark.org.tr/en/download/article-file/397533

Hsiao, C. (2003). Analysis of panel data. Cambridge University Press.

Idrees, M., & Majeed, T. M. (2022). Income ınequality, financial development, and ecological footprint: Fresh evidence from an asymmetric analysis. Environmental Science and Pollution Research, 29, 27924–27938. https://springerlink.bibliotecabuap.elogim.com/article/10.1007/s11356-021-18288-3

Islam, M. S. (2022). Do personal remittances ınfluence economic growth in South Asia? A panel analysis. Review of Development Economics, 26, 242–258. https://doi.org/10.1111/rode.12842

Jauch, S., & Watzka, S. (2016). Financial development and ıncome ınequality: A panel data approach. Empirical Economics, 51, 291–314. https://springerlink.bibliotecabuap.elogim.com/article/10.1007/s00181-015-1008-x

Kavya, T. B., & Shijin, S. (2020). Economic development, financial development, and ıncome ınequality nexus. Borsa Istanbul Review, 20(1), 80–93. https://doi.org/10.1016/j.bir.2019.12.002

Keskin, N. (2022). The ımpact of financial development on ıncome ınequality in Türkiye: A comparative analysis for different ıncome groups. Journal of Economics and Administrative Sciences, 23(4), 915–931. http://esjournal.cumhuriyet.edu.tr/en/download/article-file/2401050

Khatatbeh, I. N., & Moosa, I. A. (2022). Financialization and Income Inequality: An Extreme Bounds Analysis. The Journal of International Trade & Economic Development, 31(5), 692–707. https://doi.org/10.1080/09638199.2021.2005668

Khatatbeh, I. N., & Moosa, I. A. (2023). Financialisation and ıncome ınequality: An ınvestigation of the financial Kuznets curve hypothesis among developed and developing countries. Heliyon, 9(e14947), 1–13. https://www.cell.com/heliyon/pdf/S2405-8440(23)02154-0.pdf

Khatatbeh, I. N., Salamat, W. A., Abu-Alfoul, M. N., & Jaber, J. J. (2022). Is there any financial Kuznets curve in Jordan? A structural time series analysis. Cogent Economics and Finance, 10(2061103), 1–17. https://doi.org/10.1080/23322039.2022.2061103