Abstract

A major issue for socioeconomic development, especially in developing countries, is income inequality. In terms of the financial sector and income inequality, the Kuznets curve is expanded upon by the financial Kuznets curve (FKC). Using a panel dataset of eight EAGLE nations from 1991 to 2019, the current study aims to empirically investigate the existence of non-linearity between financial systems (financial development, financial institutions, and financial markets) and income inequality. The financial development index, the financial institutions index, and the financial markets index are the three additional components that make up finance. The feasible generalized least squares (FGLS) and panel-corrected standard errors (PCSE) estimators have been used for robustness assessments because of the cross-sectional dependency in the panel dataset. The empirical findings confirmed that there is an inverted U-shaped relationship in EAGLE nations between financial development, financial institutions, financial markets, and income inequality. This suggests that after a certain level is achieved, income inequality may decline. It may rise in the early stages of financial development, financial institutions, and financial markets. Moreover, our empirical results showed that while GDP growth, school enrollment, and trade openness reduce income inequality, factors like unemployment, inflation, population growth, and age dependency increase it. According to the study, income inequality can be reduced by the current government's prudent socioeconomic policies and advanced financial systems.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

In the past few decades, there has been a contentious debate on the efficacy of financial sector development in supporting economic growth and decreasing income inequality. High economic development with equitable income distribution is a major concern for all developing and developed countries. Most of the developing nations are facing low levels of economic growth with a higher level of income inequality (Younsi et al., 2022). Prudent financial sector growth may be a powerful instrument for addressing income inequality. The development and efficient management of the financial sector contribute to quicker and more sustainable economic growth. Easy access to financial resources leads to increased investment and job creation, benefiting the poorest portions of the community. It allows underprivileged populations to invest in education, health, and socioeconomic development for their children and family members, leading to increased human capital accumulation. Financial growth decreases income and wealth inequalities, addressing issues associated with rising inequality.

Financial sector development (FD) may impact income disparity through a variety of mechanisms. It promotes capitalization, which leads to increased economic activity and growth. Additionally, the financial sector facilitates access to financial resources for low-income individuals (Galor & Zeira, 1993). It empowers the underprivileged population to develop or support small businesses and companies. It helps disadvantaged families feed and educate their children, leading to improved income distribution (Canavire-Bacarreza & Rioja, 2009). In the agrarian sector, the financial sector helps farmers with reduced-cost loans to enhance the rural economy and lessen income disparity, hence reducing poverty (Arora, 2012). Greenwood and Jovanovic (1990) found that FD initially raises income disparity, but it eventually decreases as the sector develops. This supports the inverted U-shaped relationship between the financial system and income inequality. The studies conducted by Banerjee and Newman (1993), Galor and Zeira (1993), and Mookherjee and Ray (2003) predict that FD will reduce income inequality by relaxing the poor's credit restrictions. The financial system would expand with higher income levels, economic growth would speed up, and income inequality between the rich and the poor would worsen.

Kuznets’s law integrates the financial system and income inequality, known as the Financial Kuznets’ curve (FKC). The present concern of this study is followed by Kuznets (1955), who claimed an inverse U-shaped relationship exists between economic growth and income inequality. It means that income inequality first rises, accompanied by a rise in economic growth, and then declines as economic growth increases. The inverse U-shaped relationship shows the non-linear association between the financial system and income inequality. According to Kuznets, as industrialization emerges, people who engage in the industrial sector increase their income and financial development. Ultimately, FD encourages capital accumulation, stimulates economic activities, and increases economic growth. Economic expansion spurs income disparity (Banerjee & Newman, 1993).

Each economy is striving to eliminate income disparity in order to achieve the desired economic development. Specifically, in the case of emerging and growth-leading economies (EAGLEs), chasing high economic growth causes high income inequality. The role of EAGLEs in international development is changing rapidly. The following figures depict the trend of income inequalityFootnote 1 and financial developmentFootnote 2 in a time-series pattern. Figure 1 shows the fluctuation of income inequality in eight EAGLE countries. These fluctuations showed the importance of other aspects that increase or decrease income inequality. One strong possibility may be an increase in the FD system. Figure 2 shows FD from 1991 to 2019.

Figure 3 shows the FD and income inequality combination for eight EAGLE countries. Brazil's FD increases with decreased income inequality. In 2019, both have negative trends. Since 1991, China has experienced both positive and negative changes in FD and income inequality, but from 2015 onwards, an increase in FD reduced income inequality. For instance, Kanbur and Zhang (2005), Wan and Zhou (2005), and Tsui (2007) focused on the issue of income inequality in China and claimed the further determinants of the increase in income inequality. In addition, Rajan and Zingales (2014) argued that in the initial stages of financial development, the financial system increases wealth and widens income gaps. After a long time, FD decreases income inequality because every person has access to wealth and assets.

India's case is very different. FD and income inequality had a positive direction. Indonesia did not develop much in finance in that period. FD and income inequality are accompanied by each other. In the case of South Korea, FD has witnessed higher development with lower growth in income inequality. It means that high FD leads to a decrease in income inequality in South Korea. In Mexico, the increase in FD leads to a decrease in income inequality. In the case of the Russian economy, there is also a very energetic role for FD in reducing income inequality. An increase in FD decreases income inequality. In the case of Turkey, there is also an increase in FD towards a decrease in income inequality. The facts show the dynamic movement of FD and income inequality in the sample of EAGLE countries from 1991 to 2019. It shows mixed trends in FD and income inequality in the selected countries. Furthermore, it shows the existence of both a linear and nonlinear association between FD and income inequality.

Emerging countries have attracted our interest due to the reasons stated above. From the sample of eight emerging countries, two major economies, China and India, are often regarded as rising markets. These two countries' worldwide influence continues to grow. The World Bank believes that emerging markets play an important role in global economic growth and stability. Despite the phenomenal rise of developing economies over the last decade, empirical studies on the influence of FD on income disparity have mostly been overlooked. As such, this study adds to the current literature on the finance-inequality nexus by conducting an assessment utilizing accessible data for eight EAGLE nations from 1991 to 2019.

The crux of this study is followed by a question: Do financial development (FD), financial institutions (FI), and financial markets (FM) have a nonlinear relationship with income inequality for EAGLE countries? The prime objective of this paper is to integrate Kuznets’s theory on FD, FI, and FM and income inequality, identified as the financial Kuznets’ curve (FKC), and find the existence of linearity or non-linearity for a panel dataset of eight EAGLE countries between 1991 and 2019.

The remainder of this paper is organized as follows. The “Literature Review” section presents the existing literature on the linear and nonlinear connections between FD and income inequality. The “Data and Methodology” section presents the data sources, model specifications, and estimation methods. The “Empirical Results and Discussion” section discusses the empirical results. The “Conclusion and Policy Implications” section summarizes the main findings and suggests policy implications.

Literature Review

This literature review explores the relationship between FD and income inequality. It is divided into two subsections: the first focuses on the linear relationship between FD and income inequality, while the second examines the nonlinear relationship between the two variables.

Linear Relationship Between FD and Income Inequality

The bulk of the literature showed the association between FD and income inequality for time series and panel dataset sample countries in the linear form. For example, Banerjee and Newman (1993), Galor and Zeira (1993), and Aghion and Bolton (1997) explored that FD benefits the poor by causing their incomes to rise at a relatively fast pace. Ultimately, reducing income inequality. The dynamic interaction between FD and income inequality using a panel data approach was examined by Clarke et al. (2006). The results argued that FD reduces income inequality. The connection between FD and income distribution was analyzed by Liang (2006). Using the generalized method of moments (GMM) estimation, the results indicated that FD reduces income inequality. Moreover, Rehman et al. (2008) investigated the link between income inequality, economic growth, and FD. The empirical findings revealed that FD has an inverse effect on income inequality. In addition, in the case of Brazil, Bittencourt (2010) investigated the dynamic link between FD and income inequality by applying the DOLS estimator and noted that unemployment and FD reduce income inequality. Similarly, Batuo et al. (2010) found a linear association between income inequality and FD. In addition, Jalil and Feridun (2011) examined the long-run association between income inequality and FD in the case of China by applying the ARDL bounds-testing approach and examined the linear effect of FD on income inequality. Their findings showed that there is a significant link between FD and income inequality and that FD reduces income inequality. Moreover, Hamori and Hashiguchi (2012) described the effect of financial deepening on income inequality. The results of the fixed-effect model revealed that FD showed a negative relationship with income inequality. Tan and Law (2012) also found a negative linear relationship between FD and income inequality. Jauch and Watzka (2016) examined the relationship between FD and income inequality using pooled regression estimation and found that FD reduces income inequality. FD, income inequality, and poverty were investigated by Seven and Coskun (2016) in 45 emerging countries. The results showed that FD leads to a reduction in income inequality. Another study conducted by Seven (2022) proved that FD is negatively associated with income inequality using panel data from developed and developing countries. In the case of financial markets, Westley (2001) highlighted how highly flawed financial markets (FM) significantly contribute to income inequality in Latin America. Similarly, Mookherjee and Ray (2003) advocated that persistent income inequality stems from imperfect capital markets.

Nonlinear Relationship Between FD and Income Inequality

Greenwood and Jovanovic (1990) proposed a Kuznets curve connection between the FM and income inequality in their examination of the finance-growth-inequality nexus. They also postulated a non-linear link between FD and income inequality, known as the ''inverted U'' hypothesis. They argued that while FD first raises economic disparity, it eventually enhances income distribution. Li et al. (1998) found a U-shaped Kuznets curve between FD and income inequality in East Asian countries. It was observed that financial growth reduces the disparity in income by increasing the mean income of the poorest 20% of the overall population. Sebastian and Sebastian (2011) used a fixed effects model to investigate the link between FD and income inequality. The study found that FD affects income inequality but did not support the Greenwood and Jovanovic (1990) hypothesis. Ling-zheng and Xia-hai (2012) disclosed the connection between FD and income inequality in the provincial data of China and found that there exists a U-shaped relationship between them. Furthermore, the nonlinear association between FD and income inequality was analyzed by Kim and Lin (2011). The empirical analysis indicated that FD reduces income inequality and confirmed the existence of FKC. In addition, Tan and Law (2012) applied the GMM model and found that FD reduces income inequality in a nonlinear fashion for developing countries. Similarly, Nikoloski (2013) reported the negative link between FD, income inequality, and the existence of the FKC. Using an international sample of 138 countries, Kaidi and Sami (2016) also highlighted an inverted U-shaped association between FD and income inequality. Baiardi and Morana (2016) examined the existence of a nonlinear association between FD and income inequality using panel data from European countries and found that GDP per capita, FD, and age dependency ratio reduce income inequality. Whereas Baiardi and Morana (2018) worked on income inequality and FD in the euro area, and the results confirmed the existence of the FKC. The existence of an inverted U-shaped relationship between FD and income inequality was also confirmed by Akan et al. (2017) in the European Union, Chiu and Lee (2019) in low-income countries, Cong Nguyen et al. (2019) in 21 emerging countries, Destek et al. (2020) in Turkey, Younsi and Bechtini (2020) in BRICS countries, Younsi et al. (2022) for a sample of 11 Asian and 4 North African countries, and Zungu et al. (2022) in 21 African countries. This suggests that income inequality may increase in the initial stage of FD and then decline beyond some threshold.

The bulk of the literature, as mentioned above, explores a lot of work that has been done on the linear and nonlinear association between FD and income inequality. A substantial number of studies exist on the association between FD and income inequality (Odhiambo, 2009; Ang, 2010; Tiwari et al., 2013). Only a few studies are available in the empirical literature that examine the existence of FKC (Nikoloski, 2013; Shahbaz et al., 2015; Kaidi and Sami 2016; Baiardi & Morana, 2016; Akan et al., 2017; Chiu & Lee, 2019; Cong Nguyen et al., 2019; Destek et al., 2020; Younsi & Bechtini, 2020; Younsi et al., 2022; Seven, 2022; Zungu et al., 2022). Previous research provides evidence of linear and nonlinear connections between FD and income inequality. Most of the literature measured FD by credit to the private sector by banks and other proxies. In this study, the financial system is measured by FD, FI, and FM released by the IMF. The novelty is that there has been no work done on panel datasets of these eight EAGLE countries by using the data of the financial system from the IMF. Finally, the study is an attempt to find out the existence of the nonlinear impact of FD on income inequality. The rationale of the study is to investigate whether FD, FM, and FI have a nonlinear relationship to income inequality in EAGLE countries.

Data and Methodology

Data

This study employs a panel dataset of eight EAGLE countries from 1991 to 2019, including Brazil, China, India, Indonesia, Korea, Mexico, Russia, and Turkey. Table 8 in the Appendix presents definitions of the variables utilized in this study. This paper uses the Gini index from the Standardized World Income Inequality Databases (SWIID) to measure income inequality (Banerjee & Newman, 1993; Clarke et al., 2006; Baiardi & Morana, 2016; Chiu & Lee, 2019; Solt, 2020; Younsi & Bechtini, 2020; Miled et al., 2022; Younsi et al., 2022). By using the same measure, we are able to compare our findings with the existing literature.

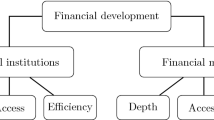

To examine whether financial sector development impacts income inequality, we employ three major financial system components: the Financial Development Index (FD), the Financial Institutions Index (FI), and the Financial Markets Index (FM) from the International Monetary Fund (IMF) database. The IMF recognized that, as initially shown by Cihak et al. (2012) and then further by Sahay et al. (2015), it is important to consider the variety of financial systems among nations when evaluating FD. This realization prompted the use of Svirydzenka's (2016) technique to create a comprehensive set of financial system metrics in the form of indices. Several studies have used financial systems from the IMF source database (e.g., Islam et al., 2020; Baloch et al., 2021; Ejemeyovwi et al., 2021; Laktionova et al., 2021; Mignamissi, 2021; Nguyen & Su, 2021; Mbona, 2022; Ben Belgacem et al., 2024). In this study, a general FD index as well as its two major components, i.e., the FI index and the FM index, which respectively capture the characteristics of FI and FM, have been taken.Footnote 3

The FI is a corporation engaged in business dealing with finance and monetary transactions such as investments, loans, currency exchange, and deposits. It includes a broad variety of business operations inside the financial services sector, including trustee companies, banks, insurance companies, investment dealers, and brokerage firms. The conventional banking sector depth measure employed in the literature (bank credit to the private sector) is supplemented with indicators for other FI, such as the assets of the mutual fund and pension fund sectors and the amount of life and non-life insurance premiums. Because it covers most countries, insurance premium data is preferred over insurance firms' assets. Given a shortage of data for other FIs, access and efficiency indicators for FIs are more bank-specific. The number of bank branches and ATMs per 100,000 individuals is used as a proxy for FI access. Indicators including the proportion of businesses with lines of credit, the number of bank accounts per 1,000 individuals, and the use of mobile phones for money transfers were also taken into consideration.

FM indicators emphasize the growth of the stock and debt markets. The depth sub-index considers the size (capitalization, or the value of listed shares), the activity (stocks traded), the volume of outstanding foreign debt securities of sovereigns, as well as the domestic and international debt securities of financial and nonfinancial corporations. To better match the statistics on sovereign debt, corporate debt securities are based on nationality rather than residency. We exclude information on the volume of outstanding domestic sovereign debt securities. Further, the use of the proportion of market capitalization outside the top ten largest corporations as a proxy for stock market access when discussing financial market access. When there is a higher level of market concentration, it should be harder for younger or smaller issuers to access the stock market. We evaluate bond market access as the number of financial and nonfinancial firm issuers on the domestic and international debt markets each year per 100,000 people. The number of separate issuers is reflected by this variable, such that a repeat issuance by the same business during a given year is only counted once. The stock market turnover ratio, or the ratio of the value of traded stocks to stock market capitalization, is the foundation of the financial market efficiency sub-index. A higher turnover should indicate improved market efficiency and liquidity.

This study, like earlier studies, accounts for various factors such as GDP growth as a proxy for economic growth, population growth, unemployment rate, inflation, secondary school enrollment rate, trade openness, and age dependency ratio (Liang, 2006; Rehman et al., 2008; Meschi & Vivarelli, 2009; Law & Tan, 2009; Bittencourt, 2010; Mahesh, 2011; Shahbaz & Islam, 2011; Tan & Law, 2012; Franco & Gerussi, 2013; Nikoloski, 2013; Shahbaz et al., 2015; Abosedra et al., 2016; Baiardi & Morana, 2016; Roser & Cuaresma, 2016; Younsi et al., 2019; Younsi & Chakroun, 2020; Dorn & Fuest, 2021; Younsi & Bechtini, 2023). These variables are taken from the World Bank’s World Development Indicators (WDI) database.

Model Specification

The current study seeks to examine the relationship between FD and income inequality for the panel data sample of eight EAGLE countries from 1991 to 2019. Furthermore, the study divided the financial system into FD, FI, and FM. The focus is to empirically analyze the nonlinear effect of FD, FI, and FM on income inequality. The literature discussed in “Literature Review” explored the linear connection between FD and income inequality (Clarke et al., 2006; Liang, 2006; Law & Tan, 2009), while nonlinear relationships existed (Nikoloski, 2013; Shahbaz et al., 2015; Baiardi & Morana, 2018; Cong Nguyen et al., 2019; Younsi & Bechtini, 2020; Zungu et al., 2022).

According to the primary goal of this study, the general form of income inequality function is as follows:

where GINI shows income inequality, and FD and FD2 represent financial development and its square. FI represents the financial institutions, and FI2 is its square term. FM shows financial markets, and FM2 is the square term. CV represents the control variables used in this study.

Based on Greenwood and Jovanovic (1990) hypothesis, the following econometric model is based on the general model, which is as follows:

GINI shows the dependent variable, \({X}_{it}\) refers to the linear proxies for FD, FI, and FM, and \({X}_{it}^{2}\) refers to the nonlinear proxies as the square term of the FD, FI, and FM. The \({Z}_{it}\) refers to the set of control variables, and \({\varepsilon }_{it}\) is the error term. The \({\alpha }_{0}\) is an intercept, while \({\beta ,}_{s}\) are the estimated coefficients of linear, nonlinear, and control variables, respectively. By including the control variables, the econometric models are as follows:

where GDPG shows economic growth, POPG demonstrates population growth, UNEMP shows the unemployment rate, INF expresses inflation, SENROL shows the secondary school enrollment rate, TO demonstrates trade openness as a percentage of GDP, and AGEDEP represents the age dependency ratio.

Estimation Methods

In this study, the estimating methodology consists of four steps. In the first step, the cross-sectional dependency (CD) test is utilized in this work to identify the presence of CD in our panel dataset. The dataset (panel) may contain CD, potentially resulting in inaccurate and inconsistent estimations. To gain accurate results, we utilized the Pesaran (2004) CD test. The next step is to check the heteroskedasticity in the panel dataset. For this, we apply the modified Wald test. Heteroscedasticity is an econometric issue in which the variance of the error term varies with the values of the independent variables. It is regarded as an issue since the OLS estimator separates the blue characteristics (Hurd, 1979; Jarque & Bera, 1980; Koenker, 1981). The third step is to check the autocorrelation in our panel dataset. The Wooldridge test (Wooldridge, 2002) is used to test the existence of serial correlation. The Wooldridge test shows the presence of serial correlation, implying that the observations were not independent of one another. Fourth, using panel diagnostics, the FGLS approach is used to empirically analyze the relationship between the FD, FI, FM, and income inequality.

In line with the empirical literature, we formulated a hypothesis about parameter directions. For linear core variables, we anticipated that FD, FI, and FM have a positive impact on income inequality, suggesting that FD, FI, and FM cause an increase in income inequality in the early stages. Furthermore, the square of core variables such as FD2, FI2, and FM2 reduces income inequality. For control variables, we hypothesized that UNEMP, INF, POPG, and AGEDEP increase income inequality, whereas GDPG, SENROL, and TO decrease income inequality for a sample of eight EAGLE countries.

Empirical Results and Discussion

Descriptive Statistics

Table 1 discloses the descriptive statistics of our interested variables used for eight EAGLE countries from 1990 to 2019. The descriptive statistics show changes in the distribution of the variables, which indicate different patterns. The mean of income inequality is 44.18, which shows that the average income inequality is 44 with a standard deviation of 7.39, a minimum value of 31.52, and a maximum value of 58.12. For FD, the mean value is 0.45 with a standard deviation of 0.15, and the minimum and maximum values are 0.19 and 0.84, respectively. The mean value of the FI is 0.42, and for the FM, the value is 0.46. Overall, the mean value of GINI, FD, FI, FM, GDPG, POPG, UNEMP, INF, SENROL, TO, and AGEDEP is greater than the standard deviation, which means the data is properly dispersed.

Cross-sectional Dependence Test

The first and most critical stage in panel studies is to assess whether the targeted variables are cross-sectionally dependent or not. An empirical investigation of Pesaran's (2004) CD test shows in Table 2 that all targeted variables are cross-sectionally dependent. It indicated that empirical results based on cross-sectional dependence are misleading. The CD test does not reject the null hypothesis, implying that CD exists in our panel data at a 1% level of significance.

Heteroskedasticity and Serial Correlation Tests

For accurate estimation, the following tests must be fulfilled. Heteroskedasticity describes a situation in which a regression model's error term or residual term variance fluctuates significantly. The modified Wald test indicated an issue of heteroskedasticity. Table 3 shows the heteroskedasticity and serial correlation tests. Models 5–7 include the core variables with control variables such as FD, FI, and FM.

The Wooldridge test result shows that serial correlation exists. Because of serial correlation, the estimated variances of the regression coefficients are skewed, which makes it challenging to confirm the validity of the hypothesis. The test statistic is distributed as n2 with k degrees of freedom since it is a chi-squared test. If the p-value of the test statistic is less than a suitable threshold (p < 0.05), homoskedasticity is rejected as the null hypothesis, and heteroskedasticity is accepted. In panel data models, the significance of random effects (RE) is assessed using the Breusch-Pagan LM test (Breusch & Pagan, 1980). We employed FGLS and PCSE since Kmenta (1986) and Stock and Watson (1988) recommended that when T > N, FGLS is a better alternative. The existence of heteroskedasticity and autocorrelation motivates the use of RE with robust models such as PCSE and FGLS.

The Nonlinear Impacts of FD, FI, and FM on Income Inequality

Table 4 displays the estimations made for the presence of non-linearity between the financial system and income inequality using the Feasible Generalized Least Squares (FGLS) and Panel-Corrected Standard Error (PCSE) approaches. The results of the FGLS and PCSE estimators show a more flexible covariance structure for the RE and their disturbance.

The empirical results revealed that FKC, or inverted U-shaped, exists in both FGLS and PCSE models in terms of FD, FI, and FM. For the case of FD, as shown in models 1 and 4, the FGLS and PCSE estimation results reveal that FD has a positive and significant effect on income inequality. Model 1 explores the idea that an increase in FD raises income inequality. This implies that a 1% increase in FD increases income inequality by 29.70 and 57.62% in models 1 and 4, respectively. There are multiple ways in which FD might create income disparity. According to Dollar and Kraay (2002), Behrman et al. (2007), and Beck et al. (2007), in the early stages of FD, the financial sector may charge high set-up costs for financial services in order to benefit from screening and risk pooling, which may be out of reach for low-income individuals. As a result, impoverished people are unable to break out of the cycle of economic disparity. Poor people are unable to obtain loans from financial institutions due to inaccurate data, intermediary services, and transaction costs in money markets. This is due to a lack of collateral, credit records, and political and personal connections with high authorities in the financial sector, making it difficult for them to obtain reasonable interest rates. Even if funds are available at a respectable rate of interest, impoverished individuals are often unable to use these services. According to Perotti (1996) and Claessens (2006), disadvantaged individuals face barriers to financial progress. They contended that the formal banking industry did not prioritize impoverished individuals with less education. In high-income nations, the financial industry often provides both loans and other financial services.

The empirical results of models 1 and 4 indicate that the squared term of FD reduces income inequality. This shows that a 1% increase in square FD helps to reduce income inequality by 52.864 and 74.551% in models 1 and 4, respectively. It indicates that, due to the fixed cost of joining the financial alliance in the early stages of growth, only wealthy people could obtain financial services, which led to greater economic inequality. As the economy grows, the financial system opens to the poor segments of the population and becomes cheaper for them as human capital takes the place of physical capital as the primary engine of expansion. Greenwood and Jovanovic (1990) empirically tested a non-linear link between FD and income inequality. They believed that initially, FD raises income inequality but improves income distribution as the financial sector develops. This empirical result matches the findings of Rehman et al. (2008), Shahbaz et al. (2015), and Kaidi and Sami (2016). Moreover, the FGLS and PCSE estimate results show that there exists an inverted U-shaped FKC in terms of FI in models 2 and 5. As FI increases, income inequality increases, i.e., a 1% increase in FI increases income inequality by 26.99 and 66.19% in models 2 and 5, respectively. The FI2 shows the negative impact on income inequality. This means that the square of FI reduces income inequality. Indeed, the FGLS and PCSE estimation results indicate that a 1% increase in the FI square reduces income inequality by 51.64 and 82.79% in models 2 and 5, respectively. This expresses that FI increases income inequality, whereas the square of FI reduces income inequality. Initially, FI increases and has expensive costs, increasing income inequality. An increase in bank branches, ATMs, and credit facilities provides easy access for everyone. Ultimately, income inequality will decrease. Moreover, in their recent works, Levine (2021) and Brei et al. (2023) advocated that financial institutions, with ease in the banking system and credit facilities, reduce income inequality.

In terms of FM, the empirical results of FGLS and PCSE for models 3 and 6 confirm the presence of FKC with an inverted U-shaped curve. It shows that FM increases income inequality, as a 1% increase in FM raises income inequality by 38.36 and 30.036% in models 3 and 6, respectively, whereas the square of FM shows the inverse relationship with income inequality, which means that a 1% increase in the square of FM reduces income inequality by 58.046 and 48.62%, respectively. The role of stock markets is very impressive in reducing income inequality. Our study result matches the findings of Westley (2001), who found that advanced financial markets minimize economic disparity in Latin American nations by providing simple access to financial resources. For nonlinear analysis, our empirical results stand in line with the findings of several earlier studies (e.g., Clarke et al., 2006; Rehman et al., 2008; Law & Tan, 2009; Jalil & Feridun, 2011; Kim & Lin, 2011; Shahbaz & Islam, 2011; Hamori & Hashiguchi, 2012; Shahbaz et al., 2015; Baiardi & Morana, 2016; Kaidi & Sami, 2016; Seven & Coskun, 2016; Cong Nguyen et al., 2019; Younsi et al., 2022; Zungu et al., 2022).

Robustness Checks

Robustness checks for FD were conducted in Table 5. It represents the robustness check in terms of FD for the presence of FKC in nine models. The empirical results confirm the existence of FKC for all models and show that the coefficient of FD and its squared term have a positive and negative sign, respectively. The association between FD and income inequality is positive, but FD2 is negative across all specifications. Furthermore, to ensure robustness, we incorporated important control factors with significant influence on income inequality into our primary model. Regarding the control variables, there are mixed results. However, our empirical results indicate that population growth, age dependency, unemployment, and inflation positively affect income inequality, but GDP growth, school enrollment, and trade openness are found to have negative effects on income inequality. If there is any increase in GDP growth, school enrollment and trade openness will reduce income inequality. For model 1, population growth raises income inequality, i.e., a 1% increase in population growth leads to an increase in income inequality of 3.98%. This result is consistent with the findings of Rehman et al. (2008) and Kaidi and Sami (2016), who showed the positive impact of population growth on income inequality. As private-sector credit and capitalization of the stock market to GDP rise, FD first increases income inequality, and later, after a threshold level, further increases the private-sector credit to GDP, and capitalization of the stock market to GDP leads FD to reduce income inequality.

Model 2 reveals that with the existence of FKC, GDP growth is negatively related to income inequality, i.e., a 1% rise in GDP growth decreases income inequality by 0.19%. Similarly, in model 3, the coefficient of school enrollment is negative, indicating that a 1% increase in school enrollment reduces income inequality by 0.17%. This result supports the findings provided for Kazakhstan by Shahbaz et al. (2017) and for India by Sethi et al. (2021), who showed that if people are more literate, the level of income distribution will also improve.

For model 4, age dependency has been included, where age dependency positively impacts income inequality. Furthermore, Liang (2006) showed that more employment opportunities reduce age dependency and income inequality, but Rehman et al. (2008) and Bittencourt (2010) found the opposite results. The unemployment rate shows an affirmative impact on inequality in Model 5. It shows that a 1% increase in unemployment increases income inequality by 0.50%. In the same vein, Cysne (2009) found a positive association between unemployment and income inequality in Model 6. It also proves that a 1% increase in inflation reduces income inequality by 0.007%. Inflation reduces the purchasing power of low-income populations and also increases income inequality. Rehman et al. (2008), Bittencourt (2010), Hamori and Hashiguchi (2012), Tan and Law (2012), and Kaidi and Sami (2016) found that inflation raises income inequality. Similarly, Shahbaz and Islam (2011) found a negative influence of inflation on inequality, which is contradictory to Law and Tan (2009), who found a positive relationship between inflation and income inequality. Trade openness decreases income inequality. An increase in trade opportunities with countries stimulated by exports also increases income and wealth, which reduces income inequality. This result is consistent with the findings of Rehman et al. (2008), Seven and Coskun (2016), and Mahesh (2011), who found a negative link between trade openness and income disparity. This demonstrates that increased trade openness (exports + imports as % of GDP) is associated with higher living standards and lower income inequality. However, this finding contradicts Meschi and Vivarelli (2009), Kaidi and Sami (2016), and Younsi et al. (2019), who suggested that trade openness resulted in high levels of income inequality. The population growth variable has been omitted from model 8 for the robustness evaluation of FD.

Table 6 depicts the robustness check for the presence of FKC in all models using FI as a core variable. FI includes insurance premiums, trustee businesses, bond markets, and other financial organizations that exacerbate economic disparity. The FI2 indicated a detrimental influence on income inequality. It verifies the existence of FKC in terms of FI.

Furthermore, population growth, age dependency, unemployment, and inflation have a significant positive effect on income inequality, while GDP growth, school enrollment, and trade openness have a significant negative effect.

Table 7 shows the FKC in terms of FM for all models. FM also includes depth, access, and efficiency indicators. Financial depth indicators such as the stock market, the stock traded, and the debt security of financial and non-financial corporations initially increase income inequality because a small number of people have access to them, which provides evidence of the concentration of wealth in the hands of limited people. Ultimately, new people are induced to enter this type of market, which reduces income inequality. The market capitalization of the top ten largest companies and debt issuers relates to sub-indicators such as access to FM. The stock market turnover ratio provides the efficiency of the FM. Overall, the access, depth, and efficiency indicators of FM first increase income inequality; after some time, when new investors and businesspersons enter, income inequality may be reduced, which shows the existence of the FKC in EAGLE countries.

In the case of FM indicators, population growth increases income inequality for the selected sample countries. An increase in population growth utilized access to resources. To fulfill the daily needs of life, some people earn a supernormal profit, and some face loss, which boosts income inequality.

EAGLE countries have emerging business status. In this scenario, income inequality is not an extraordinary case. GDP growth shows a negative influence on income inequality. High GDP growth innovates new employment opportunities, which increase the level of GDP and decrease the income inequality of common people. The empirical results of school enrollment confirm the reduction of income inequality. High human capital plays a vital role in accelerating the economy and ultimately reducing income inequality. Age dependency is the extra economic burden in the household. The high age dependency accelerates household expenditure and finally pushes up income inequality. The empirical results confirm the positive role of age dependency on income inequality. Moreover, unemployment and inflation are the two worst extremes for society and the economy. Our empirical results confirm that unemployment and inflation have a positive impact on income inequality. Trade openness has the catalytic power to uplift the economy and reduce income inequality. The results reveal that trade openness provides employment and other economic opportunities, thereby reducing income inequality in EAGLE countries.

Conclusion and Policy Implications

The relationship between financial structure and income inequality is empirical, and it is unclear which way the two variables are related. In this work, we examine empirically, for a sample of eight EAGLE countries, the nonlinear relationship between financial systems and income inequality between 1991 and 2019. Financial development (FD), financial institutions (FI), and financial markets (FM) are used to measure financial systems. Additional factors contributing to income inequality include the GDP growth rate, population growth rate, secondary school enrollment rate, inflation, age dependency, and trade openness. The cross-sectional dependency problem exists in the panel dataset in question. The FGLS and PCSE techniques are used for robustness assessments in order to obtain accurate results. It appears that there is an inverted U-shaped relationship between income inequality and FD, FI, and FM, respectively. The empirical results show that providing FD, FI, and FM initially increases income inequality. Then, in EAGLE nations, FD, FI, and FM lessen income inequality. The financial system has a non-linear relationship that causes income inequality to fluctuate over time. Specifically, financial expansion causes income disparities to rise and subsequently fall.

Our empirical findings have led to the emergence of policy implications. To lessen income inequality, EAGLE governments should fortify their financial systems, which include financial development, financial institutions, and financial markets. According to this study, broadening financial systems benefits the poor more than the wealthy, which lowers wealth and income disparity and addresses a number of issues brought on by rising income inequality. Therefore, lowering income inequality necessitates financial innovation—improvements in financial systems' ability to improve information and lower transaction costs. The governments of the nations that make up the EAGLE can improve allocational efficiency and, hence, financial access by promoting competition among financial intermediaries. Easy access to financial resources encourages investment, which raises incomes by creating jobs for the population's lowest parts. One effective tool in the fight against income inequality might be the growth of the Prudential Financial sector. Income inequality may be lessened in the event that the banking industry runs smoothly. Governments should therefore create and put into effect policies that encourage the growth of the financial markets, especially the banking industry. Because an efficient banking industry interacts with fewer lending restrictions, increasing economic opportunities for all in the economy, it facilitates more efficient capital allocation. Thus, there is a reduction in income disparity. Furthermore, as income inequality in the aforementioned nations may be significantly decreased when financial development and economic growth are closely correlated, these governments ought to concentrate on coordinated policies that support both of these goals. Furthermore, financial inclusion can aid in closing the income inequality gap. Financial inclusion is typically seen as a critical predictor of financial development. The motivation to reduce income inequality is probably higher when financial inclusion and development are combined. Governments in EAGLE countries should thus make sure that increases in "access" to financial services are matched by growth in "use" of those services in order to successfully reduce income inequality. Similarly, income taxation and banking services are examples of inclusive growth policies that politicians should support for rural development areas. Lastly, in order to reduce income inequality, policymakers should take GDP growth into account while promoting financial development, enhancing trade openness, maintaining low inflation, and expanding employment opportunities.

However, this study has certain limitations because it only examines whether the expansion of the financial sector, including its sub-components of efficiency, depth, and access, contributes to the reduction of income inequality in eight EAGLE countries. Furthermore, this study downplays the significance of institutions and overseas remittances in determining income inequality. There is a need for further research to shed light on how financial development and structure, remittances, and institutional quality could all contribute to a reduction in income inequality. Additional control macroeconomic factors that affect income inequality include foreign direct investment (FDI) and fiscal policy, which includes government spending and taxation. By conducting country-specific research, the effects of these factors can be compared, leading to the development of more policies that are tailored to the unique circumstances of each nation, including changes in the financial system and initial development conditions. When paired with suitable time series techniques, a single-country analysis will produce policies that are focused on that nation.

Data Availability

The data supporting the findings of this study are available from the corresponding author upon reasonable request.

Notes

Income inequality is measured by the Gini coefficient from the Standardized World Income Inequality Database (SWIID).

Financial development data has been taken from International Monetary Fund (IMF).

To avoid making assumptions about the significance of certain indicators in gauging FD and its sub-indicators, this data uses a statistical technique called principal components analysis (PCA). To create a composite indicator that incorporates as much of the data shared by all the collinear individual indicators as feasible, PCA joins together the collinear individual indicators. The underlying series' PCA squared factor loadings (so that their sum adds up to 1) are used to build sub-indices as weighted averages of the normalized series. The coefficients known as factor loadings connect the observed variables to the factors or major components. The percentage of the indicator's total unit variation that is explained by a factor is shown by the square of the factor loadings.

References

Abosedra, S., Shahbaz, M., & Nawaz, K. (2016). Modelling causality between financial deepening and poverty reduction in Egypt. Social Indicators Research, 126, 955–969. https://doi.org/10.1007/s11205-015-0929-2

Aghion, P., & Bolton, P. (1997). A theory of trickle-down growth and development. The review of economic studies, 64(2), 151–172. https://doi.org/10.2307/2971707

Akan, Y., Köksel, B., & Destek, M. A. (2017). The financial Kuznets curve in European Union. In EconWorld2017 Rome Proceedings, pp. 25–27.

Ang, J. B. (2010). Finance and inequality: the case of India. Southern Economic Journal, 76(3), 738–761. https://doi.org/10.4284/sej.2010.76.3.738

Arora, R. U. (2012). Finance and inequality: a study of Indian states. Applied Economics, 44(34), 4527–4538. https://doi.org/10.1080/00036846.2011.597736

Baiardi, D., & Morana, C. (2016). The financial Kuznets curve: Evidence for the euro area. Journal of Empirical Finance, 39(part B), 265–269. https://doi.org/10.1016/j.jempfin.2016.08.003

Baiardi, D., & Morana, C. (2018). Financial development and income distribution inequality in the euro area. Economic Modelling, 70, 40–55. https://doi.org/10.1016/j.econmod.2017.10.008

Baloch, M. A., Ozturk, I., Bekun, F. V., & Khan, D. (2021). Modelling the dynamic linkage between financial development, energy innovation, and environmental quality: Does globalization matter? Business Strategy and the Environment, 30(1), 176–184. https://doi.org/10.1002/bse.2615

Banerjee, A. V., & Newman, A. F. (1993). Occupational choice and the process of development. Journal of Political Economy, 101(2), 274–298. https://doi.org/10.1086/261876

Batuo, M. E., Guidi, F., & Mlambo, K. (2010). Financial development and income inequality: Evidence from African Countries. MPRA Paper No. 25658. Available online at: https://mpra.ub.uni-muenchen.de/25658/. Accessed 11 May 2020.

Beck, T., Demirgüç-Kunt, A., & Levine, R. (2007). Finance, inequality and the poor. Journal of Economic Growth, 12, 27–49. https://doi.org/10.1007/s10887-007-9010-6

Behrman, J. R., Birdsall, N., & Székely, M. (2007). Economic policy changes and wage differentials in Latin America. Economic Development and Cultural Change, 56(1), 57–97. https://doi.org/10.1086/520556

Ben Belgacem, S., Younsi, M., Bechtini, M., Alzuman, A., & Khalfaoui, R. (2024). Do Financial Development, Institutional Quality and Natural Resources Matter the Outward FDI of G7 Countries? A Panel Gravity Model Approach. Sustainability, 16(6), 2237. https://doi.org/10.3390/su16062237

Bittencourt, M. (2010). Financial development and inequality: Brazil 1985–1994. Economic Change Restructuring, 43, 113–130. https://doi.org/10.1007/s10644-009-9080-x

Brei, M., Ferri, G., & Gambacorta, L. (2023). Financial structure and income inequality. Journal of International Money and Finance, 131, 102807. https://doi.org/10.1016/j.jimonfin.2023.102807

Breusch, T. S., & Pagan, A. R. (1980). The Lagrange multiplier test and its applications to model specification in econometrics. Review of Economic Studies, 47(1), 239–253. https://doi.org/10.2307/2297111

Canavire-Bacarreza, G., & Rioja, F. (2009). Financial development and the distribution of income in Latin America and the Caribbean. Well-Being and Social Policy, 5, 1–18.

Chiu, Y.-B., & Lee, C.-C. (2019). Financial development, income inequality, and country risk. Journal of International Money Finance, 93, 1–18. https://doi.org/10.1016/j.jimonfin.2019.01.001

Cihak, M., Demirguc-Kunt, A., Feyen, E., & Levine, R. (2012). Benchmarking financial systems around the world. Policy Research Working Paper No. 6175. World Bank. http://hdl.handle.net/10986/12031. Accessed 13 May 2020.

Claessens, S. (2006). Access to financial services: A review of the issues and public policy objectives. The World Bank Research Observer, 21(2), 207–240. https://doi.org/10.1093/wbro/lkl004

Clarke, G. R., Xu, L. C., & Zou, H.-F. (2006). Finance and income inequality: what do the data tell us? Southern Economic Journal, 72(3), 578–596. https://doi.org/10.1002/j.2325-8012.2006.tb00721.x

Cong Nguyen, T., Ngoc Vu, T., Hong Vo, D., & Thi-Thieu Ha, D. (2019). Financial development and income inequality in emerging markets: a new approach. Journal of Risk and Financial Management, 12(4), 173. https://doi.org/10.3390/jrfm12040173

Cysne, R. P. (2009). On the Positive Correlation between Income Inequality and Unemployment. The Review of Economics Statistics, 91(1), 218–226. https://doi.org/10.1162/rest.91.1.218

Destek, M. A., Sinha, A., & Sarkodie, S. A. (2020). The relationship between financial development and income inequality in Turkey. Journal of Economic Structures, 9(11), 1–14. https://doi.org/10.1186/s40008-020-0187-6

Dollar, D., & Kraay, A. (2002). Growth is good for the poor. Journal of Economic Growth, 7, 195–225. https://doi.org/10.1023/A:1020139631000

Dorn, F., & Fuest, C. (2021). Trade openness and income inequality: New empirical evidence. Economic Inquiry, 60(1), 202–223. https://doi.org/10.1111/ecin.13018

Ejemeyovwi, J. O., Osabuohien, E. S., & Bowale, E. I. (2021). ICT adoption, innovation and financial development in a digital world: An empirical analysis from Africa. Transnational Corporations Review, 13(1), 16–31. https://doi.org/10.1080/19186444.2020.1851124

Franco, C., & Gerussi, E. (2013). Trade, foreign direct investments (FDI) and income inequality: empirical evidence from transition countries. The Journal of International Trade & Economic Development, 22(8), 1131–1160. https://doi.org/10.1080/09638199.2011.647048

Galor, O., & Zeira, J. (1993). Income distribution and macroeconomics. The Review of Economic Studies, 60(1), 35–52. https://doi.org/10.2307/2297811

Greenwood, J., & Jovanovic, B. (1990). Financial Development, Growth, and the Distribution of Income. Journal of Political Economy, 98(5, Part 1), 1076–1107. https://doi.org/10.1086/261720

Hamori, S., & Hashiguchi, Y. (2012). The effect of financial deepening on inequality: Some international evidence. Journal of Asian Economics, 23(4), 353–359. https://doi.org/10.1016/j.asieco.2011.12.001

Hurd, M. (1979). Estimation in truncated samples when there is heteroscedasticity. Journal of Econometrics, 11(2–3), 247–258. https://doi.org/10.1016/0304-4076(79)90039-3

Islam, M. A., Khan, M. A., Popp, J., Sroka, W., & Oláh, J. (2020). Financial development and foreign direct investment—The moderating role of quality institutions. Sustainability, 12(9), 3556. https://doi.org/10.3390/su12093556

Jalil, A., & Feridun, M. (2011). Long-run relationship between income inequality and financial development in China. Journal of the Asia Pacific Economy, 16(2), 202–214. https://doi.org/10.1080/13547860.2011.564745

Jarque, C. M., & Bera, A. K. (1980). Efficient tests for normality, homoscedasticity and serial independence of regression residuals. Econometrics Letters, 6(3), 255–259. https://doi.org/10.1016/0165-1765(80)90024-5

Jauch, S., & Watzka, S. (2016). Financial development and income inequality: a panel data approach. Empirical Economics, 51, 291–314. https://doi.org/10.1007/s00181-015-1008-x

Kaidi, N., & Sami, M. (2016). Financial Development and Income Inequality: The Linear versus the Nonlinear Hypothesis. Economics Bulletin, 36(2), 609–626.

Kanbur, R., & Zhang, X. (2005). Fifty years of regional inequality in China: a journey through central planning, reform, and openness. Review of development Economics, 9(1), 87–106. https://doi.org/10.1111/j.1467-9361.2005.00265.x

Kim, D.-H., & Lin, S.-C. (2011). Nonlinearity in the financial development–income inequality nexus. Journal of Comparative Economics, 39(3), 310–325. https://doi.org/10.1016/j.jce.2011.07.002

Kmenta, J. (1986). Latent Variables. Elements of Econometrics (2nd ed., pp. 581–587). Macmillan.

Koenker, R. (1981). A note on studentizing a test for heteroscedasticity. Journal of Econometrics, 17(1), 107–112. https://doi.org/10.1016/0304-4076(81)90062-2

Kuznets, S. (1955). Economic growth and inequality income. American Economic Review, 45((1), 1–28. http://www.jstor.org/stable/1811581.

Laktionova, O., Koval, V., Savina, N., & Gechbaia, B. (2021). The Models of Matching Financial Development and Human Capital in National Economy. Bulletin of the Georgian National Academy of Sciences, 15(2), 177–184.

Law, S. H., & Tan, H. B. (2009). The role of financial development on income inequality in Malaysia. Journal of Economic Development, 34((2)), 153–168. https://jed.cau.ac.kr/archives/34-2/34-2-8.pdf.

Levine, R. (2021). Finance, Growth, and Inequality. IMF Working Papers, 2021(164), A001. Retrieved from https://doi.org/10.5089/9781513583365.001.A001

Li, H., Squire, L., & Zou, H.-f. (1998). Explaining international and intertemporal variations in income inequality. The Economic Journal, 108(446), 26–43. https://doi.org/10.1111/1468-0297.00271

Liang, Z. (2006). Financial development and income distribution: a system GMM panel analysis with application to urban China. Journal of Economic Development, 31(2), 1–21. https://sid.ir/paper/595709/en.

Ling-zheng, Y., & Xia-hai, W. (2012). Has Financial Development Worsened Income Inequality in China? Evidence from Threshold Regression Model. Journal of Finance and Economics, 38(3), 106–115.

Mahesh, M. (2011). The effect of trade openness on income inequality: evidence from developing countries. Available at SSRN. https://doi.org/10.2139/ssrn.2736721

Mbona, N. (2022). Impacts of Overall Financial Development, Access and Depth on Income Inequality. Economies, 10(5), 118. https://doi.org/10.3390/economies10050118

Meschi, E., & Vivarelli, M. (2009). Trade and income inequality in developing countries. World Development, 37(2), 287–302. https://doi.org/10.1016/j.worlddev.2008.06.002

Mignamissi, D. (2021). Digital divide and financial development in Africa. Telecommunications Policy, 45(9), 102199. https://doi.org/10.1016/j.telpol.2021.102199

Miled, K. B. H., Younsi, M., & Landolsi, M. (2022). Does microfinance program innovation reduce income inequality? Cross-country and panel data analysis. Journal of Innovation and Entrepreneurship, 11(7), 1–15. https://doi.org/10.1186/s13731-022-00195-7

Mookherjee, D., & Ray, D. (2003). Persistent inequality. The Review of Economic Studies, 70(2), 369–393.

Nguyen, C. P., & Su, T. D. (2021). Financing the economy: The multidimensional influences of financial development on economic complexity. Journal of International Development, 33(4), 644–684. https://doi.org/10.1002/jid.3541

Nikoloski, Z. (2013). Financial sector development and inequality: is there a financial Kuznets curve? Journal of International Development, 25(7), 897–911. https://doi.org/10.1002/jid.2843

Odhiambo, N. M. (2009). Finance-growth-poverty nexus in South Africa: A dynamic causality linkage. The Journal of Socio-Economics, 38(2), 320–325. https://doi.org/10.1016/j.socec.2008.12.006

Perotti, R. (1996). Growth, income distribution, and democracy: What the data say. Journal of Economic Growth, 1, 149–187. https://doi.org/10.1007/BF00138861

Pesaran, M. H. (2004). General Diagnostic Tests for Cross Section Dependence in Panels. Working Paper 0435. Faculty of Economics, University of Cambridge

Rajan, R., & Zingales, L. (2014). Saving capitalism from the capitalists: Unleashing the power of financial markets to create wealth and spread opportunity. HarperCollins Publishers India

Rehman, H. U., Khan, S., & Ahmed, I. (2008). Income distribution, growth and financial development: A cross countries analysis. Pakistan Economic Social Review, 46(1), 1–16.

Roser, M., & Cuaresma, J. C. (2016). Why is income inequality increasing in the developed world? Review of Income and Wealth, 62(1), 1–27. https://doi.org/10.1111/roiw.12153

Sahay, R., Čihák, M., N’Diaye, P., & Barajas, A. (2015). Rethinking financial deepening: Stability and growth in emerging markets. Revista de Economía Institutional, 17(33), 73–107. https://doi.org/10.18601/01245996.17n33.04

Sebastian, J., & Sebastian, W. (2011). Financial development and income inequality. CESifo working paper: Fiscal Policy, Macroeconomics and Growth, No. 3687

Sethi, P., Bhattacharjee, S., Chakrabarti, D., & Tiwari, C. (2021). The impact of globalization and financial development on India’s income inequality. Journal of Policy Modeling, 43(3), 639–656. https://doi.org/10.1016/j.jpolmod.2021.01.002

Seven, Ü. (2022). Finance, talent and income inequality: Cross-country evidence. Borsa Istanbul Review, 22(1), 57–68. https://doi.org/10.1016/j.bir.2021.01.003

Seven, U., & Coskun, Y. (2016). Does financial development reduce income inequality and poverty? Evidence from emerging countries. Emerging Markets Review, 26, 34–63. https://doi.org/10.1016/j.ememar.2016.02.002

Shahbaz, M., Bhattacharya, M., & Mahalik, M. K. (2017). Finance and income inequality in Kazakhstan: Evidence since transition with policy suggestions. Applied Economics, 49(52), 5337–5351. https://doi.org/10.1080/00036846.2017.1305095

Shahbaz, M., & Islam, F. (2011). Financial development and income inequality in Pakistan: An application of ARDL approach. Journal of Economic Development, 36(1), 35–58. https://doi.org/10.35866/caujed.2011.36.1.003

Shahbaz, M., Loganathan, N., Tiwari, A. K., & Sherafatian-Jahromi, R. (2015). Financial development and income inequality: Is there any financial Kuznets curve in Iran? Social Indicators Research, 124, 357–382. https://doi.org/10.1007/s11205-014-0801-9

Solt, F. (2020). Measuring Income Inequality Across Countries and Over Time: The Standardized World Income Inequality Database. Social Science Quarterly, 101(3), 1183–1199. https://doi.org/10.1111/SSQU.12795

Stock, J. H., & Watson, M. W. (1988). Testing for common trends. Journal of the American Statistical Association, 83(404), 1097–1107. https://doi.org/10.1080/01621459.1988.10478707

Svirydzenka, K. (2016). Introducing a New Broad-Based Index of Financial Development, International Monetary Fund. https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Introducing-a-New-Broad-based-Index-of-Financial-Development-43621. (Accessed 12 July 2023)

Tan, H.-B., & Law, S.-H. (2012). Nonlinear dynamics of the finance-inequality nexus in developing countries. The Journal of Economic Inequality, 10, 551–563. https://doi.org/10.1007/s10888-011-9174-3

Tiwari, A. K., Shahbaz, M., & Islam, F. (2013). Does financial development increase rural-urban income inequality? Cointegration analysis in the case of Indian economy. International Journal of Social Economics, 40(2), 151–168. https://doi.org/10.1108/03068291311283616

Tsui, K. Y. (2007). Forces shaping China’s interprovincial inequality. Review of Income and Wealth, 53(1), 60–92. https://doi.org/10.1111/j.1475-4991.2007.00218.x

Wan, G., & Zhou, Z. (2005). Income inequality in rural China: Regression-based decomposition using household data. Review of Development Economics, 9(1), 107–120. https://doi.org/10.1111/j.1467-9361.2005.00266.x

Westley, G. D. (2001). Can financial market policies reduce income inequality? Inter-American Development Bank.

Wooldridge, J. M. (2002). Econometric Analysis of Cross Section and Panel Data. MIT Press.

Younsi, M., Bechtini, M., & Lassoued, M. (2022). Causal Relationship Between Financial Development, Economic Growth, and Income Inequality: Panel Data Evidence from Asian and North African Countries. In: Mugova, S., Akande, J.O., Olarewaju, O.M. (eds) Corporate Finance and Financial Development. Contributions to Finance and Accounting. Springer, Cham. https://doi.org/10.1007/978-3-031-04980-4_8

Younsi, M., & Bechtini, M. (2023). Financing Health Systems in Developing Countries: the Role of Government Spending and Taxation. Journal of the Knowledge Economy. https://doi.org/10.1007/s13132-023-01623-z

Younsi, M., & Bechtini, M. (2020). Economic growth, financial development, and income inequality in BRICS countries: does Kuznets’ inverted U-shaped curve exist? Journal of the Knowledge Economy, 11, 721–742. https://doi.org/10.1007/s13132-018-0569-2

Younsi, M., & Chakroun, M. (2020). The conditional effect of income distribution on mortality risk of men in Tunisia: Poverty effect or wealth effect? The Social Science Journal, 57(1), 101–114. https://doi.org/10.1016/j.soscij.2019.01.002

Younsi, M., Khemili, H., & Bechtini, M. (2019). Does foreign aid help alleviate income inequality? New evidence from African Countries. International Journal of Social Economics, 46(4), 549–561. https://doi.org/10.1108/IJSE-06-2018-0319

Zungu, L. T., Greyling, L., & Kaseeram, I. (2022). Financial development and income inequality: a nonlinear econometric analysis of 21 African countries, 1990–2019. Cogent Economics & Finance, 10(1), 1–20. https://doi.org/10.1080/23322039.2022.2137988

Acknowledgements

The authors would like to thank the Deanship of Scientific Research at Shaqra University for supporting this work. We also express our thanks to the Editor-in-Chief, the Associate Editor, and the two anonymous referees for their helpful comments and suggestions.

Author information

Authors and Affiliations

Contributions

S.M. and M.Y. contributed to the study design. S.M. analysed the data, and M.Y. and Z.S. verified the results. M.Y and S.M. drafted the first version of the manuscript, and Z.S. edited the manuscript. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethics Approval and Consent to Participate

Not applicable.

Consent for Publication

Not applicable.

Statement of Human and Animal Rights

Not applicable.

Competing Interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Mushtaq, S., Younsi, M. & Sagheer, Z. Non-linearity Between Finance and Income Inequality: A Panel Data Analysis for EAGLE Countries. J Knowl Econ (2024). https://doi.org/10.1007/s13132-024-02302-3

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s13132-024-02302-3

Keywords

- Income inequality

- Financial development

- Financial institutions

- Financial markets

- Panel data

- Financial Kuznets curve