Abstract

This paper takes a two-level green supply chain composed of a manufacturer and a retailer as the research object, and investigates the influence of loss aversion preference and corporate social responsibility (CSR) on the optimal pricing, green decision-making and performance of supply chain members. Firstly, the basic game models under three different decision-making situations are constructed, and the optimal decision of the above models is obtained. Secondly, the results of different decision-making models are compared, and the influence of corporate social responsibility level and loss aversion preference on supply chain decision-making and performance is analyzed. Finally, in order to improve the performance of supply chain, a combined contract of revenue sharing and responsibility sharing is designed to coordinate the green supply chain under different preferences of the manufacturer. The results show that the retailer undertaking CSR is conducive to the green development of the supply chain, but the loss aversion preference of the manufacturer will have a negative impact on the supply chain members. In addition, when the manufacturer has rational preference, with the improvement of the retailer’s CSR level, the effective coordination interval length of coordination factors under combined contracts increases, and the coordination flexibility of supply chain increases. When the manufacturer loss aversion preference, the upper and lower limits of the coordination factor of the combined contract will increase with the increase of loss aversion preference, and the length of the coordination interval will decrease, which will lead to the difficulty of cooperation among supply chain members.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

With the rapid development of the social economy, the increasingly serious problems of resource depletion and environmental pollution have attracted widespread attention from governments, enterprises, and scholars around the world. Countries around the world have successively introduced a series of low-carbon emission reduction measures to motivate enterprises to improve their product greening level and fulfill their environmental protection obligations. For example, the UK has enacted the Climate Change Act and promised to reduce greenhouse gas emissions by 80% from 1990 levels by 2050. China has launched a carbon emissions trading pilot and proposed that the carbon dioxide emissions per unit of GDP in 2020 will decrease by 40% compared to 2005. In order to cope with the pressure of low-carbon development from the government and enhance brand image, more and more enterprises are starting to set emission reduction and environmental protection as their strategic goals for business management. For example, Volkswagen Group has developed a comprehensive decarbonization plan and expects to achieve carbon neutrality by 2050. Huawei has developed a green supply chain plan to incorporate ecological design into product life cycle management. Haier, Lenovo, Huawei, Changhong and other home appliance companies are also actively carrying out low-carbon production and have formed a complete clean production system. The green development of enterprises plays an important role in promoting the healthy development of the ecological environment. On the one hand, with the vigorous promotion of ecological civilization construction and the continuous improvement of consumers’ green consumption awareness, implementing green and green supply chain management can better meet consumers’ demand for eco-friendly products and increase consumers’ recognition of products. On the other hand, the government restricts the green development of enterprises through regulatory measures such as green product subsidies, carbon trading and carbon taxes, in order to reduce the impact of enterprise production and operation activities on the environment. Therefore, in the era of green development, implementing green supply chain management in enterprises can meet the green needs of consumers and governments, while helping enterprises improve their competitive advantages and achieve sustainable development.

From the perspective of sustainable development, corporate social responsibility (CSR) mainly includes two aspects: environmental responsibility and social welfare responsibility. Among them, environmental responsibility refers to the proactive improvement of emission reduction technologies by enterprises in the supply chain, and the production of green products to reduce environmental pollution. Social welfare responsibility refers to the preference of enterprises paying attention to stakeholders such as retailers, suppliers, and consumers. For example, Wal Mart actively participates in CSR activities while cooperating with Patagonia to develop environmentally friendly products. Apple invests in wind energy conservation projects for its suppliers and improves labor conditions by sharing construction costs with them. The research by Reham et al. [1]shows that taking social responsibility can enhance a company's reputation, attract more consumers, and expand market share. Conversely, if a negative attitude is taken towards CSR, it will have a serious impact on the company’s reputation and sales. However, the main purpose of enterprise operation is profit, so when undertaking corporate social responsibility, responsibility costs and corporate profits will be comprehensively considered, which will have an impact on the decisions of members in the supply chain channel.

Most existing literature assumes that business members are rational. However, people’s decisions often deviate from the results of rational models. Therefore, introducing behavioral factors into decision models and further exploring the impact of decision preferences on practical operations have important practical significance. In the green supply chain, due to the improvement of green technology, high economic costs need to be invested in the early stage, which will lead to a significant decrease in manufacturer’ economic profits. Therefore, when distributing profits, the manufacturer tends to pay more attention to the loss of profits, which means they exhibit loss aversion behavior. Kahnman and Tversky [2] proposed the concept of loss aversion based on prospect theory, which mainly refers to the fact that when faced with the same amount of benefits and losses, people find it more difficult to accept losses, that is, the negative utility brought by the same amount of losses is greater than the positive utility brought by the same amount of benefits. At present, loss aversion preference has been widely applied in economics, marketing, and organizational preference.

Coordination contracts can effectively alleviate or eliminate conflicts between supply chain channel members. At present, there is a large amount of relevant literature on coordination contracts in green supply chains. However, these studies aim to design coordination contracts with the goal of maximizing the profits of supply chain members. There is little research in existing literature on how to design coordination contracts in green supply chains when companies undertake CSR. In the actual supply chain enterprise environment, more and more retailers are taking on CSR to improve social welfare, which is also a key factor for enterprises to achieve sustainable development. For example, the BMW Group not only actively implements green manufacturing (by 2030, its single car carbon dioxide emissions will be reduced by one-third compared to 2019), but also encourages its downstream retailers to fulfill CSR by selecting the BMW Dealer Best Corporate Social Responsibility Practice Award. Large retailer Tesco ensures food safety by establishing a production quality management system, and protects consumer rights by improving various systems to achieve its corporate social responsibility. At the same time, in order to create an environmentally friendly supply chain, Tesco has purchased land in China and built its own green logistics center. Compared with traditional logistics centers of the same size, it can save 45% electricity and 40% water. Therefore, how to design reasonable contracts to achieve coordination of supply chain channels under different decision-making objectives has important practical significance, which is also one of the main contributions of this paper.

Based on the above analysis, this article takes the green CSR supply chain as the research object, uses Stackelberg game method to study the supply chain decision-making problem under different preferences of the manufacturer, and designs a combination contract to coordinate the supply chain. Mainly solve the following problems:

(1) What impact does CSR level have on the decision-making and performance of green supply chain members when the retailer taking corporate social responsibility?

(2) How does the manufacturer’s loss aversion preference affect the optimal pricing, green decision-making, and performance of channel members?

(3) From the perspective of the supply chain, when the manufacturer exhibit loss aversion preference, what are the differences in decision-making and performance between members of the green supply chain under centralized and decentralized decision-making?

(4) How to design contracts to improve supply chain performance and promote cooperation among supply chain members based on different preferences of the manufacturer?

In order to solve the above problems, this article studies a two-level supply chain composed of a single manufacturer and a single manufacturer, taking into account the different preferences of the manufacturer and the corporate social responsibility of the retailer. Five game models are constructed using game theory: centralized decision-making model, manufacturer rational preference decision-making model, manufacturer loss aversion preference decision-making model,the manufacturer’s rational preference model under combined contracts and the manufacturer’s loss aversion model under combined contracts. The optimal decisions and performance of supply chain members in different situations were obtained through the above decision-making model. Research has found that the CSR behavior of the retailer has a positive impact on green supply chains and is beneficial for the manufacturer and the improvement of supply chain system profits. Under the influence of manufacturer’s loss aversion preference, the level of product greening decreases and retail prices increase. Loss aversion preference not only damages the profit of the retailer, but also harms the manufacturer’s own profits. When the CSR level of the retailer is high, the supply chain economic profit under decentralized decision-making may be greater than that under centralized decision-making, and the manufacturer’s loss aversion preference further exacerbates the dual marginal effect under decentralized decision-making. Research also shows that when the supply chain system implements a revenue sharing responsibility sharing combination contract to coordinate a green supply chain, the manufacturer’s loss aversion preference will increase coordination difficulty and narrow the cooperation space of supply chain members. However, the impact of CSR level on the degree of cooperation among supply chain members depends on the combined effect of loss aversion preference and CSR fulfillment degree.

The rest of this article is arranged as follows. Section 2 is a literature review. Section 3 describes the supply chain problem studied in this paper and assumptions. Section 4 constructs three different green CSR supply chain models. Section 5 compares and analyzes the supply chain decision-making results under different decision-making models. Section 6 proposes a combination contract for coordination. Numerical analysis is shown in Sect. 7.Finally, there are management suggestions, conclusions, and future work.

2 Literature review

The literature related to this article mainly includes three aspects: the first aspect is the supply chain that considers corporate social responsibility. The second aspect is the green supply chain under irrational preference. The third aspect is the coordination contract in the supply chain.

2.1 Supply chain considering corporate social responsibility

As carriers of market economy competition, the research on the fulfillment of social responsibility by supply chain members has attracted the attention of many scholars in the academic community. Currently, relevant research literature mainly focuses on the following two aspects: (1) treating the CSR behavior of supply chain enterprises as endogenous variables to improve the welfare of stakeholders and characterize the CSR behavior of enterprises. For example, Ma et al. [3] explored the supply chain under the condition of asymmetric social responsibility cost information between the manufacturer and the retailer, and found that the change in retailer profits depends on the size of the social responsibility coefficient, while manufacturer profits are positively correlated with the uncertainty of social responsibility information; Raj et al. [4] established a sustainable supply chain model that considers both green and corporate social responsibility. Starting from different decision-making entities, they compared and analyzed the applicability of five contracts: wholesale price contract, two-part tariff contract, green cost sharing contract, revenue sharing contract, and revenue sharing cost sharing contract. Liu et al. [5] analyzed the decision-making problem of a retailer led supply chain considering corporate social responsibility under government subsidies, compared the optimal decisions with or without government subsidies, and found that compared to non-governmental subsidies, a certain range of government subsidies can promote supply chain members to fulfill corporate social responsibility, and improve the overall performance and social welfare of the supply chain. (2) Consider the CSR behavior of supply chain enterprises as an exogenous variable, and from the perspective of stakeholders, characterize CSR behavior as a concern for consumer surplus. For example, Panda and Modak [6] explored the issue of supply chain channel coordination and profit distribution under the proportional assumption of corporate social responsibility by channel members, and proposed that the goal of maximizing non economic profits in the supply chain can help improve the economic profits of enterprises. Sinayi and Rasti-Barzoki [7] conducted a study on the social responsibility of green supply chain enterprises under the government’s carbon tax, and found that different government policies have a significant impact on the profits and product greenness of supply chain members. They also proposed a two-part pricing contract to coordinate the green supply chain. Biswas et al. [8] explored four combinations of green manufacturing and CSR responsibilities among channel members. The study found that the retailer engaging in green manufacturing and undertaking CSR are most beneficial for supply chain development, and a two-part pricing contract is used to coordinate the supply chain. Ni et al. [9] explored the issue of CSR allocation in supply chains under different power structures and found that reasonable CSR allocation can always improve the overall revenue of the supply chain under different power channels.

Although the above literature has studied the operational decision-making problem of CSR supply chain from different perspectives, there is still relatively little research on supply chain operational decision-making from the three dimensions of economic benefits, corporate social responsibility, and environmental benefits. Due to the proximity of the retailer to the consumer market in the supply chain, they usually stimulate consumption by investing in CSR, which directly increases consumer surplus. Meanwhile, Kopel and Brand [10] shows that in the case of manufacturer led supply chain, compared to the manufacturer fulfilling social welfare responsibilities, the retailer taking CSR can more incentivize the manufacturer to improve emission reduction levels, assume environmental responsibility, and increase the purchase of green products in the consumer market. Therefore, this article introduces CSR into the decision-making problem of green supply chain optimization, analyzing the impact of product pricing, greening level, member profits, and overall performance of the green supply chain where the retailer taking CSR.

2.2 Loss aversion in supply chain

When facing unknown risks, people usually take various measures to avoid losses. At present, research on loss aversion behavior mainly starts from two perspectives: supply chain member enterprises and consumers. Liu et al. [11] constructed four models to compare and analyze the impact of loss aversion on enterprise ordering decisions. The research results showed that loss aversion preference does not always affect supply chain member decisions. Under certain conditions, logistics service integrators can benefit from their loss aversion preference. Choi et al. [12] found that retailers with higher levels of loss aversion will lead to manufacturers increasing wholesale prices, while manufacturers with higher levels of loss aversion will provide lower wholesale prices, causing retailers to lower their selling prices. Xu et al. [13] considered a loss averse newsboy model and constructed a CVaR model with shortage costs to determine the optimal decision. Feng and Tan [14] considered the manufacturer’s loss aversion behavior and constructed three different decision models to explore the impact of loss aversion and green efficiency on supply chain performance. Qiu et al. [15] considered the joint pricing and inventory decision-making optimization problem of loss averse retailers with reference point effects, and compared it with classical pricing and inventory decision-making. In recent years, some scholars have begun to pay attention to consumers’ loss aversion. Liao and Li [16] studied the problem of reengineering a closed-loop supply chain based on consumers’ loss avoidance psychology. They found that when choosing a multi-channel structure, when manufacturers maintain lower prices and larger discounts, all customers will choose online stores. Zhang et al. [17] studied the pricing strategy of pre-sales under resale or agency contracts in a supply chain composed of manufacturers and electronic retailers, taking into account consumer loss aversion.

The theory of loss aversion emphasizes that loss is more important than profit, which means that the decision result depends not only on loss aversion preference, but also on the selection of reference points. However, in existing research literature, it is often assumed that the loss aversion reference point is equal to zero or given by exogenous factors, but exogenous reference points cannot accurately describe the bargaining power and contribution of endogenous factors, thus losing the accuracy of loss judgment. The Nash bargaining solution satisfies four axioms: Pareto efficiency, symmetry of decision order, invariance of equivalent returns, and independence of unrelated choices. It can effectively balance efficiency and profit and loss in a two person negotiation game [18]. Therefore, this article takes the Nash negotiation solution as a reference point for loss aversion, considers the manufacturer’s loss aversion preference, fills the gap in the impact of different preferences on the green supply chain, and explores how the cross effect between retailer CSR and manufacturer’s different preferences affects the equilibrium decision-making and performance of the green supply chain.

2.3 Coordination contract design in supply chain

Coordinating contracts in the supply chain can promote cooperation among supply chain channel members and improve supply chain performance. There is already a wealth of research on green supply chain coordination. Scholars have studied various contracts to coordinate green supply chains. Ghosh and Shah [19] studied green supply chain coordination under cost sharing contracts. Aslani and Heydari [20] designed a forwarding contract to coordinate a green dual channel supply chain under channel disruptions. Zhang and Liu [21] conducted research on three-level supply chain coordination by establishing revenue sharing mechanisms, asymmetric Nash negotiation mechanisms, and Shapley value coordination mechanisms. Chen et al. [22] proposed a two-part pricing contract to coordinate green supply chains under three different power structures. Xu et al. [23] considered revenue sharing and linear two-part tariff contracts to coordinate a two-level sustainable supply chain under carbon tax and trade regulation. Wang et al. [24] proposed a cost sharing joint commission contract to coordinate a green e-commerce supply chain that considers manufacturer’s equity concerns.

For the supply chain coordination contract under CSR undertaken by enterprises, Panda and Modak [25] extended the social responsibility supply chain model to a three-level supply chain and discussed wholesale price contracts with fixed discounts.Modak et al. [26] studied the impact of the manufacturer undertaking CSR on the operational strategy of dual channel supply chains, and utilized a combination of quantity discounts and two-part pricing contracts to achieve supply chain coordination. Ma et al. [27] proposed a two-part pricing contract to coordinate the two-level CSR supply chain under information asymmetry. Hsueh [28] incorporated CSR into a two-level supply chain with random demand settings and proposed a revenue sharing contract embedded in corporate social responsibility to coordinate the two-level supply chain. The above research only designed channel coordination contracts from a CSR perspective and did not consider the impact of environmental responsibility.

Brandenburg et al. [29], Zhu and He [30] pointed out that there is still a lack of literature that comprehensively considers green, corporate social responsibility, and channel coordination, and there is still a lack of research on developing coordination contracts to explore the joint impact of green and corporate social responsibility on coordination mechanisms. To address the research gap mentioned above, based on wholesale price contracts, we propose a revenue sharing responsibility sharing combination contract to coordinate a green supply chain considering CSR. Based on the coordination contract, this study further explores the impact of key factors on the cooperation space of supply chain channel members by analyzing the impact of loss aversion preference and CSR level on the coordination flexibility of coordination factors.

The differences between this study and some other studies are shown in Table 1.

3 Problem description and assumption

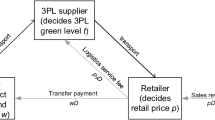

The green supply chain studied in this paper consists of a manufacturer and a retailer, where the manufacturer is responsible for developing and producing green products, and has an impact on market demand by controlling the greenness of the products. Retailer is responsible for product sales and taking corporate social responsibility for the green supply chain. In supply chain decision-making system, a Stackelberg game is played between the manufacturer and the retailer. The manufacturer, as the leader, first determines the unit wholesale price \(w\) and greenness \(e\) of the product, and then the retailer determines the unit retail price \(p\) of the green product based on the manufacturer’s decision results.

Assumption 1

The market demand for green products is influenced by the combined effects of retail prices and greenness levels. Similar to the research by Biswas [8],Ghosh and Shah [19], a linear demand function is established i.e.,\(q(p,e) = \alpha - \beta p + \tau e\), where \(\alpha\) is the potential market demand for green products,\(\beta\) is the retail price elasticity coefficient of green products, \(\tau\) is consumers’ green preferences,\(e\) is the greenness of products, and has a positive impact on market demand. Retail price is the most important factor affecting market demand, therefore its impact on market demand is greater than the greenness of the product,ie,\(\beta > \tau\). In addition, when the impact of product greenness on demand is not considered, market demand is positive, i.e.,\(\alpha - \beta p > 0\).

Assumption 2

In order to produce green products, manufacturer needs to invest funds to obtain green production technology. Assuming the manufacturer’s green investment cost function is \(C(e){ = }\frac{{he^{2} }}{2}\), where \(h(h > 0)\) is the green investment cost coefficient. This assumption is similar to the research of Ni et al. [9], Xu et al. [23]. From the above expression, it can be seen that the cost of green investment has the characteristics of convexity and decreasing marginal cost. In addition, to avoid the trial analysis, green investment cost costs should be large enough,i.e.,\(h{ > }\frac{{\tau^{2} }}{\beta }\), its form is similar to the hypothesis of Chen [22],Moon [34].

Assumption 3

Drawing on the research of Panda and Modak [6], Kopel and Brand [10], Choi [12], CSR of the retailer is defined as the degree of attention to consumer surplus. Consumer surplus is the difference between the actual price of a product and consumers’ willingness to pay, i.e., \(CS{ = }\int_{{p_{\min } }}^{{p_{\max } }} {q(p,e)} dp = q^{2} /2\beta\). The level of attention that the retailer pay to consumer surplus is expressed by \(\theta (0 \le \theta \le 1)\). When \(\theta = 0\), the retailer did not assume CSR and pursued profit maximization. When \(\theta = 1\), the retailer pursued stakeholder welfare maximization. In addition, social welfare is defined as the sum of the total profit of the supply chain system and consumer surplus CS, i.e.,\(W = \pi_{m} + \pi_{r} + CS\),which can be seen in relevant literature, such as Li [35] and Chen [36].

Assumption 4

Assuming that supply chain members are risk neutral, the manufacturer with loss aversion preferences makes decisions based on utility maximization, the retailer with CSR also makes decisions based on utility maximization, while manufacturer with rational preferences makes decisions based on profit maximization.

Assumption 5

Assuming that the information between supply chain members is completely symmetrical, all parameters in the model are determined and transparent.

The notations are shown in Table 2.

4 Model construction and solution

In this section, this article first constructs a supply chain problem that does not consider loss aversion, including centralized and decentralized decision-making, and analyzes the optimal decisions and profits of supply chain members. Secondly, a manufacturer’s loss aversion model was constructed to analyze the pricing and green decision-making changes of supply chain members under loss aversion preferences, and to explore the impact of manufacturer’s loss aversion on supply chain members and system performance.

4.1 Centralized decision-making

Under centralized decision-making, the manufacturer and the retailer form a decision-making organization. When implementing CSR behavior in the supply chain system, they jointly make decisions on the greenness level and retail price of products by maximizing the channel utility. At this time, the channel utility of the supply chain can be expressed as

It is easy to prove that the supply chain channel utility function is a joint concave function of product greenness level \(e\) and retail price \(p\). The optimal greenness level and retail price under centralized decision-making are as follows:

The economic profit, utility, consumer surplus and social welfare of the supply chain system areas follows:

4.2 The manufacturer’s rational preference for decentralized decision-making

In the decentralized decision-making mode, a Stackelberg game is established between the manufacturer and the retailer. At this time, the target functions of channel members can be expressed as

where \(V_{r}\) is the retailer’s utility goal, which is composed of its economic goal and CSR goal.In the manufacturer’s rational preference for decentralized decision-making model.the manufacturer first determines the greenness level \(e_{d}\) and wholesale price \(w_{d}\) of the green product, and then the retailer decides the retail price \(p_{d}\) of the product. Using the inverse induction method, each equilibrium result can be obtained as follows:

By introducing \(w_{d}^{*}\),\(e_{d}^{*}\) and \(p_{d}^{*}\) into the corresponding expression, the economic profit, consumer surplus, utility and social welfare of the supply chain system areas follows:

\(\pi_{m}^{d*} = \frac{{h(\alpha - \beta c)^{2} }}{{2(2\beta h(2 - \theta ) - \tau^{2} )}}\);\(\pi_{r}^{d*} = \frac{{\beta h^{2} (1 - \theta )(\alpha - \beta c)^{2} }}{{(2\beta h(2 - \theta ) - \tau^{2} )^{2} }}\);\(\pi_{sc}^{d * } = \frac{{h(\alpha - \beta c)^{2} (2\beta h(3 - 2\theta ) - \tau^{2} )}}{{2(2\beta h(2 - \theta ) - \tau^{2} )^{2} }}\);

Corollary 1

①\(\frac{{\partial w_{d}^{*} }}{\partial \theta } > 0\),\(\frac{{\partial e_{d}^{*} }}{\partial \theta } > 0\),\(\frac{{\partial p_{d}^{*} }}{\partial \theta } < 0\).②\(\frac{{\partial \pi_{m}^{d*} }}{\partial \theta } > 0\), when \(\theta \le \frac{{\tau^{2} }}{2\beta h}\),\(\frac{{\partial \pi_{r}^{d*} }}{\partial \theta } \ge 0\), whereas,\(\frac{{\partial \pi_{r}^{d*} }}{\partial \theta } < 0\),\(\frac{{\partial \pi_{sc}^{d*} }}{\partial \theta } > 0\).③ \(\frac{{\partial V_{r}^{d*} }}{\partial \theta } > 0\),\(\frac{{\partial CS_{d}^{*} }}{\partial \theta } > 0\),\(\frac{{\partial W_{d}^{*} }}{\partial \theta } > 0\).

Proof

\(\partial w_{d}^{*} /\partial \theta = h\tau^{2} (\alpha - \beta c)(2\beta h(2 - \theta ) - \tau^{2} )^{2} > 0\).other parameters are similar to the above proof.

Corollary 1 shows that with the improvement of the CSR level of the retailer: ① the wholesale price of green products increases, the retail price decreases, and the green degree level and demand of products increase. the manufacturer transfer the increase of green research and development costs caused by the increase of green degree level by raising the wholesale price. ② The increase of green degree of products and the reduction of retail price have led to the rapid expansion of market demand. As the increase of profit brought by demand expansion has made up for the increase of green R&D costs of the manufacturer, the economic profit of the manufacturer has increased. When the corporate social responsibility is small, the retailer’s willingness to make profits to consumers is weak, and its economic profit rises. When corporate social responsibility is high, excessive profit sharing behavior by the retailer will lead to a decrease in its own economic profit, but the utility goal will always increase. ③ The improvement of CSR level of the retailer is conducive to the improvement of economic profits and social welfare of the supply chain system.

4.3 The manufacturer’s loss aversion preference decentralized decision-making

To more reasonably characterize the loss aversion preference of the manufacturer, this article draws on the research result of Du et al. [37] and takes the Nash bargaining solution of all parties in the supply chain as the reference point for loss aversion. At this time, the retailer who bear social responsibility and the manufacturer with loss aversion preference make decisions based on their respective utility, and the utility functions can be expressed as follows:

The retailer’s utility goal consists of its economic goal and CSR goal.where \(V_{m}\) is the utility goal of the manufacturer with loss aversion preference under the Nash bargaining reference point.In the manufacturer’s loss aversion preference decentralized decision-making model.the manufacturer first determines the greenness level \(e_{f}\) and wholesale price \(w_{f}\) of the green product, and then the retailer decides the retail price \(p_{f}\) of the product. Using the inverse induction method, each equilibrium result can be obtained as follows:

Corollary 2

①\(\frac{{\partial w_{f}^{*} }}{{\partial \lambda_{m} }} > 0\);\(\frac{{\partial e_{f}^{*} }}{{\partial \lambda_{m} }} < 0\);\(\frac{{\partial p_{f}^{*} }}{{\partial \lambda_{m} }} > 0\)②\(\frac{{\partial \pi_{r}^{f*} }}{{\partial \lambda_{m} }} < 0\);\(\frac{{\partial \pi_{m}^{f*} }}{{\partial \lambda_{m} }} < 0\); \(\frac{{\partial \pi_{sc}^{f*} }}{{\partial \lambda_{m} }} < 0\).

Proof

\(\partial w_{f}^{*} /\partial \lambda_{m} = h(\theta - 1)(\alpha - \beta c)(\beta h(\theta - 2) + \tau^{2} )/(\beta h(2\left( {2 - \theta } \right) + \lambda_{m} (1 - \theta )) - \tau^{2} )^{2}\).other parameters are similar to the above proof.

Corollary 2 shows that with the increase of the manufacturer’s loss aversion coefficient, on the one hand, the manufacturer will reduce the intensity of green manufacturing and increase the wholesale price of green products. The manufacturer’s negative preference of "increasing price and reducing quality" will reduce the purchase volume of green products and reduce the manufacturer’s economic benefits. On the other hand, in order to protect their own profits from being affected, the retailer as followers will increase the retail price of green products within a certain range. Although at this time, their marginal profits will gradually increase with the manufacturer’s loss aversion coefficient, namely \(\partial (p_{f}^{*} - w_{f}^{*} )/\partial \lambda_{m} = h(1 - \theta )(\alpha - \beta c)/(\beta h(2\left( {2 - \theta } \right) + \lambda_{m} (1 - \theta )) - \tau^{2} ) > 0\), However, the increase of marginal profit can’t make up for the negative impact of the reduction of market demand caused by the manufacturer’s reduction of product quality, which makes the economic profit of the retailer suffer. From the perspective of the supply chain system, with the increase of the manufacturer’s loss aversion, the marginal profit of the system gradually increases, but the negative impact of the manufacturer’s "price increase and quality reduction" behavior on the reduction of market demand is far greater than the positive effect of the increase of marginal profit, and leads to the loss of profits in the supply chain system.

Corollary 3

\(\frac{{\partial W_{f}^{*} }}{{\partial \lambda_{m} }} < 0\),\(\frac{{\partial CS_{f}^{*} }}{{\partial \lambda_{m} }} < 0\).

Proof

\(\partial CS_{f}^{ * } /\partial \theta = \beta^{2} h^{3} (\lambda_{m} + 2)(\alpha - \beta c)^{2} /(\beta h(2\left( {2 - \theta } \right) + \lambda_{m} (1 - \theta )) - \tau^{2} )^{3} < 0\).other parameters are similar to the above proof.

Corollary 3 shows that consumer surplus and social welfare are negatively correlated with the manufacturer’s loss aversion coefficient. When manufacturer pays too much attention to the gains and losses of profits, they will increase their own economic profits by reducing the green level of products, which will lead to the reduction of product market demand and reduce consumer surplus. The aggravation of the manufacturer’s loss aversion has negatively affected the economic profits of supply chain channel members, and caused a decline in social welfare.

Through the analysis of Corollary 2 and 3, it can be seen that the irrational preference of the manufacturer’s loss aversion reduces the level of green products, weakens the profits of the retailer and also damages their own economic profits, and has a negative impact on the cooperation between the supply chain members, and promotes the green supply chain to continue to develop in a negative direction.

5 Comparison of different equilibrium strategies

In order to further explore the impact of the manufacturer’s loss aversion preference on the optimal strategy of the supply chain system, this section compares and analyzes the equilibrium results under three different decision-making models.

Proposition 1

\(e_{c}^{*} > e_{d}^{*} > e_{f}^{*}\),\(p_{c}^{ * } < p_{d}^{ * } < p_{f}^{*}\),\(w_{d}^{ * } < w_{f}^{ * }\).

Proof

Compare the product green level in different decision-making models as follows:

\(e_{f}^{*} - e_{d}^{*} = \frac{{\beta h\lambda_{m} \tau (\theta - 1)(\alpha - \beta c)}}{{(2\beta h(2 - \theta ) - \tau^{2} )(\beta h(2\left( {2 - \theta } \right) + \lambda_{m} (1 - \theta )) - \tau^{2} )}}< 0;\)\(e_{d}^{ * } - e_{c}^{ * } = \frac{\beta h\tau (2 - \theta )(\alpha - \beta c)}{{(2\beta h(2 - \theta ) - \tau^{2} )(\tau^{2} - 2\beta h + \beta h\theta )}} < 0\).

From this we can get \(e_{c}^{*} > e_{d}^{*} > e_{f}^{*}\).other parameters are similar to the above proof.

Proposition 1 compares the optimal decision-making under three different modes. Because centralized decision-making can eliminate the double marginalization between the upstream and downstream members of the supply chain, it can reduce the retail price, improve the green degree of products and market demand, and promote the optimal decision-making of the supply chain. Compared with centralized decision-making and rational decentralized decision-making of the manufacturer, when the manufacturer have loss aversion preference, the optimal decision-making of each member in the supply chain system is the most unfavorable mode for itself, that is, the wholesale price of green products increases, the retail price continues to rise, the level of greenness decreases,and the market demand also decreases. From the above analysis, it can be seen that the irrational preference of the manufacturer’s loss aversion aggravates the double marginalization under the decentralized decision-making of the supply chain, and has a negative impact on the development of the green supply chain.

Proposition 2

\(\pi_{m}^{f * } < \pi_{m}^{d * }\),\(\pi_{r}^{f * } < \pi_{r}^{d * }\),\(\pi_{sc}^{f*} < \pi_{sc}^{d*}\).

Proof

Compare the profits of the manufacturer in different decision-making models as follows:

From this we can get \(\pi_{sc}^{f*} < \pi_{sc}^{d*}\).other parameters are similar to the above proof.

Proposition 2 shows that manufacturer with loss aversion preference, in order to protect their own profits from being damaged, reduce their greenness level while increasing the wholesale price of products, and reduce market demand. Under the adverse behavior of "reducing quality and increasing price" of the manufacturer, although their profits per unit product continue to rise, they cannot make up for the negative impact caused by the sharp reduction of market demand. Therefore, the manufacturer’ profits continue to decline, Even more unfavourable is that the retailer is also adversely affected by the reduction of market demand, and their profits have dropped sharply, which ultimately leads to the reduction of profits in the supply chain system.

Proposition 3

when \(\theta \le \theta_{1}^{ * }\),\(\pi_{sc}^{d * } \le \pi_{sc}^{c * }\),whereas,\(\pi_{sc}^{d * } > \pi_{sc}^{c * }\);when \(\theta \le \theta_{3}^{ * }\) 时,\(\pi_{sc}^{f * } \le \pi_{sc}^{c * }\),whereas,\(\pi_{sc}^{f * } > \pi_{sc}^{c * }\).where \(\theta_{1}^{ * } = \frac{{10\beta h - 3\tau^{2} - \sqrt \Delta }}{8\beta h}\),\(\Delta = (3\tau^{2} - 10\beta h)^{2} - 32\beta h(2\beta h - \tau^{2} )\),\(\theta_{3}^{ * } = \frac{{\delta - \sqrt {\psi_{1} } }}{{4\beta h(2 + \lambda_{m} )}}\),\(\psi_{1} = 4\beta h\phi + \tau^{4} (\lambda_{m} + 3)^{2}\),\(\delta = 2\beta h(5 - 2\lambda_{m} ) - \tau^{2} (3 + \lambda_{m} )\).

Proof

Compare the profits of the manufacturer in different decision-making models as follows:

where \(f(\theta ) = 2\beta h(2 + \lambda_{m} )\theta^{2} + ((3 + \lambda_{m} )\tau^{2} - 2\beta h(5 - 2\lambda_{m} ))\theta + 2\beta h(2 - \lambda_{m} ) - \tau^{2} (\lambda_{m} + 2)\),the only real root \(\theta_{3}^{*}\) that meets the premise can be obtained from \(f(\theta ) = 0\), so when \(\theta \le \theta_{3}^{ * }\),\(\pi_{sc}^{f * } \le \pi_{sc}^{c * }\) whereas, \(\pi_{sc}^{f * } > \pi_{sc}^{c * }\).other parameters are similar to the above proof.

From Proposition 3, when the retailer taking CSR, the system profit under centralized decision-making is not necessarily better than the two decentralized decision-making models.

Because the centralized decision-making mode can eliminate the double marginal effects in the supply chain system and further improve the margin of the supply chain system to consumers, it will lead to the loss of the economic profits of the supply chain system, there is \(\partial \pi_{sc}^{c*} /\partial \theta < 0\); In the decentralized decision-making mode, the retailer’s profit-sharing behavior of assuming CSR reduces the double marginal effect under the rational decentralized decision-making to a certain extent, and then reduces the scope of the supply chain system’s profit-sharing to consumers, the existence of \(\partial \pi_{sc}^{d*} /\partial \theta > 0\),based on the above analysis, it can be seen that when \(\theta > \theta_{1}^{ * }\), the profit of supply chain system under the rational decentralized decision of manufacturer is higher than that under the centralized decision. When the manufacturer has irrational preference of loss aversion, its essence is to further aggravate the double marginalization effect under decentralized decision-making. Therefore, the supply chain system requires the retailer to undertake more CSR to make it obtain more economic benefits, thus achieving the effect of \(\pi_{sc}^{f * } > \pi_{sc}^{c*}\),there is \(\partial \theta_{3}^{ * } /\partial \lambda_{m} { = }(\tau^{2} - 2\beta h)(\sqrt \psi - \delta )/4\beta h(2 + \lambda_{m} )^{2} \sqrt \psi > 0\) at this time. According to the above analysis, when \(\theta > \theta_{3}^{ * }\), the economic profit of the supply chain system under the loss aversion mode will be better than the centralized decision-making mode.

Proposition 4

\(CS_{f}^{*} < CS_{d}^{*} < CS_{c}^{*}\); \(W_{f}^{*} < W_{d}^{*} < W_{c}^{*}\).

Proof

Compare the Consumer surplus in different decision-making models as follows:

From this we can get \(CS_{f}^{*} < CS_{d}^{*} < CS_{c}^{*} \;\).other parameters are similar to the above proof.

It can be seen from Proposition 4 that the consumer surplus and social welfare under the manufacturer’s loss aversion decision are the smallest among the three decision-making models, the centralized decision-making model is the highest, and the manufacturer’s rational decentralized decision-making is between the two. Due to the reduction of the double marginal effect under centralized decision-making, the level of product greening and market demand have been improved, which has further promoted the increase of consumer surplus and supply chain system profits, and social welfare has also reached the optimum under three kinds of decision-making. At the same time, the loss aversion preference of the manufacturer in order to protect their own interests, while reducing the profits of the retailer, also indirectly causes their own profits to be damaged. This kind of behavior of "damaging others and not benefiting themselves" reduces the economic profits of the supply chain system, which compresses the rising space of consumer surplus and social welfare, and hinders the green development of the supply chain.

6 Supply chain implementation portfolio contract

It can be seen from Proposition 1 that the green supply chain with corporate social responsibility under the wholesale price contract cannot achieve the common coordination between the retail price of products and the level of green degree. Based on this, this paper uses the core idea of the revenue-sharing and cost-sharing contract for reference, and proposes a more practical and effective "revenue-sharing and responsibility-sharing" combined contract to alleviate the negative impact of double marginalization on the green supply chain Encourage the retailer to actively fulfill corporate social responsibilities. The relevant factor in the combined contract of "revenue sharing—responsibility sharing" can be expressed as \(\left\{ {w,\eta } \right\}\), where \(w\) is the manufacturer’s wholesale price under the combined contract;\(\eta\) is the sharing factor under the combined contract, that is, the manufacturer’s share of the green supply chain sales revenue, green manufacturing cost and corporate social responsibility, and \(1 - \eta\) is the proportion of the retailer to retain sales revenue, share the manufacturer’s green manufacturing cost and corporate social responsibility. Both the manufacturer and the retailer conduct Stackelberg game with the goal of maximizing their own utility.

6.1 The manufacturer's rational preference for decentralized decision-making

Under the manufacturer’s rational preference, the utility of supply chain channel members after the introduction of the revenue-sharing and responsibility-sharing combined contract can be expressed as

\(\left\{ {\overline{{w_{d}^{*} }} ,\eta_{d} } \right\}\) represents the coordination factor of the combination contract under the manufacturer’s rational preference. From the above two formulas, it can be seen that the overall utility of the supply chain has not changed after the introduction of the combination contract of revenue sharing and responsibility sharing.

Proposition 5

When \(\overline{{w_{d}^{ * } }} = c \cdot (1 - \eta_{d} )\) and \(\eta_{d} \in \left[ {\;\underline{\eta }_{d} ,\overline{\eta }_{d} \;} \right]\), the supply chain system under the manufacturer’s rational preference can achieve coordination. where.

\(\underline{\eta }_{d} { = }\frac{{\beta h(2 - \theta ) - \tau^{2} }}{{2\beta h(2 - \theta ) - \tau^{2} }}\),\(\overline{\eta }_{d} { = 1} - \frac{{\beta h(2 - \theta )(\beta h(2 - \theta ) - \tau^{2} )}}{{(2\beta h(2 - \theta ) - \tau^{2} )^{2} }}\).

Proof

the inverse induction method is used to solve the model, and the equilibrium solutions of green level and retail price are as follows:

where \(\xi { = }\tau^{2} (\beta (w - c) + \alpha \eta_{d} )/\eta_{d} (\beta h(2 - \theta ) - \tau^{2} )\), under the rational preference of the manufacturer, to achieve supply chain coordination must meet \(\overline{{p_{d}^{ * } }} = p_{c}^{ * }\)、\(\overline{{e_{d}^{ * } }} = e_{c}^{ * }\),From this, it can be concluded that the optimal wholesale price under the revenue-sharing and responsibility-sharing contract is \(\overline{{w_{d}^{ * } }} = c \cdot (1 - \eta_{d} )\). bring it into \(\overline{{e_{d}^{ * } }}\) and \(\overline{{p_{d}^{ * } }}\) to obtain the optimal solution under contract coordination. From this, the utility of the manufacturer and the retailer can be obtained as follows:

In order to enable all participants to accept the contract, it is also necessary to further meet the incentive compatibility conditions:

The value range of coordination factor \(\eta_{d}\) in the combination contract can be obtained from formula (14), Proposition 5 is proved.

It can be seen from proposition 5 that corporate social responsibility supply chain coordination can be achieved through the combination contract of revenue sharing and responsibility sharing under the decentralized decision of the manufacturer’ rational preferences. At this time, the manufacturer provide products to the retailer at wholesale prices not higher than the production cost, and the sharing factor \(\eta_{d}\) of the supply chain system can achieve the simultaneous coordination of product greenness and retail prices within the range \(\left[ {\;\underline{\eta }_{d} ,\overline{\eta }_{d} \;} \right]\).

Corollary 4

\(\frac{{\partial \underline{\eta }_{d} }}{\partial \theta } < 0\),\(\frac{{\partial \overline{\eta }_{d} }}{\partial \theta } > 0\)。

Proof

\(\frac{{\partial \underline{\eta }_{d} }}{\partial \theta }{ = }\frac{{ - \beta h\tau^{2} }}{{(2\beta h(2 - \theta ) - \tau^{2} )^{2} }} < 0\),\(\frac{{\partial \overline{\eta }_{d} }}{\partial \theta }{ = }\frac{{\beta h\tau^{4} }}{{(2\beta h(2 - \theta ) - \tau^{2} )^{3} }} > 0\).

According to Corollary 4, the upper limit \(\overline{\eta }_{d}\) of the green supply chain sharing factor under the combination contract increases with the increase of the retailer’s CSR level, while the lower limit \(\underline{\eta }_{d}\) decreases gradually. From the perspective of cooperation between the manufacturer and the retailer, the increase of CSR level of the retailer can effectively expand the cooperation space of upstream and downstream members of the supply chain, reduce the difficulty of green supply chain coordination under the rational decentralized decision-making of the manufacturer, and have a positive and positive effect on supply chain coordination.

6.2 The manufacturer’s loss aversion preference decentralized decision-making

Under the manufacturer’s loss aversion preference decision, when the corporate social responsibility supply chain implements the revenue-sharing and responsibility-sharing contract, each member of the supply chain carries out a Stackelberg game based on the principle of maximizing its own utility. At this time, the utility of the manufacturer and the retailer can be expressed as

Using \(\left\{ {\overline{{w_{f}^{*} }} ,\eta_{f} } \right\}\) to represent the coordination factor of the combination contract under the manufacturer’s rational preference, and use the inverse method to solve the game process of the model construction to obtain proposition 6.

Proposition 6

When \(\overline{{w_{f}^{ * } }} = c \cdot (1 - \eta_{f} )\) and \(\eta_{f} \in \left[ {\;\underline{\eta }_{f} ,\overline{\eta }_{f} \;} \right]\), the supply chain system under the manufacturer’s rational preference can achieve coordination. where \(\underset{\raise0.3em\hbox{$\smash{\scriptscriptstyle-}$}}{\eta } _{f} = \frac{{2(\beta h\;(2 - \theta ) - \tau ^{2} ) + \lambda _{m} (\beta h\;(2(2 - \theta ) + \lambda _{m} \;(1 - \theta )) - \tau ^{2} )}}{{(2 + \lambda _{m} )\;(\beta h(2\;(2 - \theta ) + \lambda _{m} \;(1 - \theta )) - \tau ^{2} )}}\),\(\overline{\eta }_{f} { = 1} - \frac{{\beta h(2 - \theta )(\beta h(2 - \theta ) - \tau^{2} )}}{{(\beta h(2(2 - \theta ) + \lambda_{m} (1 - \theta )) - \tau^{2} )^{2} }}\).

The solution process is similar to that in Sect. 6.1, which is omitted here.

Corollary 5

\(\frac{{\partial \underline{\eta }_{f} }}{{\partial \lambda_{m} }} > 0\),\(\frac{{\partial \overline{\eta }_{f} }}{{\partial \lambda_{m} }} > 0\)。

Proof

\(\frac{{\partial \underline{\eta }_{f} }}{{\partial \lambda_{m} }} = \frac{{2\beta h(\beta h(\lambda_{m}^{2} (\theta - 1)^{2} + 2\lambda_{m} (\theta^{2} - 3\theta + 2) + (4 - 2\theta )) - \theta \tau^{2} )}}{{(\lambda_{m} + 2)^{2} (\beta h(2\left( {2 - \theta } \right) + \lambda_{m} (1 - \theta )) - \tau^{2} )^{2} }} > 0\),other parameters are similar to the above proof.

It can be seen from Corollary 5 that when the manufacturer has a loss aversion preference, the upper and lower limits of corporate social responsibility supply chain sharing factors under the revenue-sharing and responsibility sharing contract increase with the increase of \(\lambda_{m}\), and the cooperation difficulty of supply chain members increases.

Corollary 6

when \(\lambda_{m} < \tau^{2} /(\beta h - \tau^{2} )\),\(\frac{{\partial \underline{\eta } {}_{f}}}{\partial \theta } < 0\),whereas,\(\frac{{\partial \underline{\eta } {}_{f}}}{\partial \theta } \ge 0\);when \(\lambda_{m} < \tau^{4} /(\beta h(\tau^{2} (3 - \theta ) + 2\beta h(\theta - 2)))\), \(\frac{{\partial \overline{\eta }_{f} }}{\partial \theta } > 0\),whereas,\(\frac{{\partial \overline{\eta }_{f} }}{\partial \theta } \le 0\).

Proof

\(\frac{{\partial \underline{\eta }_{f} }}{\partial \theta } = \frac{{ - 2\beta h(\lambda_{m} \tau^{2} + \tau^{2} - \beta h\lambda_{m} )}}{{(\lambda_{m} + 2)(\beta h(2\left( {2 - \theta } \right) + \lambda_{m} (1 - \theta )) - \tau^{2} )^{2} }}\); \(\frac{{\partial \overline{\eta }_{f} }}{\partial \theta } = \frac{{\lambda_{m} (\beta h(\tau^{2} (3 - \theta ) + 2\beta h(\theta - 2))) + \tau^{4} }}{{(\beta h(2\left( {2 - \theta } \right) + \lambda_{m} (1 - \theta )) - \tau^{2} )^{3} }}\)

when \(\lambda_{m} < \tau^{2} /(\beta h - \tau^{2} )\),\(\partial \underline{\eta } {}_{f}/\partial \theta < 0\),whereas,\(\partial \underline{\eta } {}_{f}/\partial \theta \ge 0\).Similarly,when \(\lambda > \tau^{4} /(\beta h(\tau^{2} (3 - \theta ) + 2\beta h(\theta - 2)))\),\(\partial \overline{\eta } {}_{f}/\partial \theta > 0\),whereas,\(\partial \overline{\eta } {}_{f}/\partial \theta \le 0\).

It can be seen from Corollary 6that in order to achieve the coordination of the supply chain system, when the manufacturer’s loss aversion is low, the upper limit of the combined contract sharing factor increases and the lower limit decreases with the increase of the retailer’s degree of corporate social responsibility. At this time, the coordination range of the sharing factor \(\eta_{f}\) expands, the enthusiasm of cooperation among supply chain members increases, and the cooperation space is large.On the contrary, when the manufacturer shows high concern about the profit and loss of its own utility, the upper limit of the combined contract sharing factor decreases and the lower limit increases with the increase of the retailer’s degree of corporate social responsibility. In this case, the coordination range of CSR supply chain sharing factor \(\eta_{f}\) decreases, and the enthusiasm of supply chain channel members decreases. The above conclusion further proves the negative impact of the manufacturer’s loss aversion on CSR supply chain coordination.

7 Numerical analysis

This section will further explore the specific impact of the manufacturer’s loss aversion coefficient and the retailer’s CSR level on supply chain coordination in different situations through numerical examples.The relevant parameters are set to:\(\alpha = 200\),\(\beta = 10\),\(\tau = 8\),\(c = 6\),\(h = 16\),It should be pointed out that the values of the above parameters meet \(h > \tau^{2} /\beta\).

7.1 Comparative analysis of profits under different decision-making modes

Figure 1 compares the profits of the manufacturer, the retailer, and the supply chain system in green CSR supply chains under different decision-making modes. It can be seen that the changes in profits of upstream and downstream members of the supply chain and the supply chain system with the level of the retailer corporate social responsibility and the manufacturer’s loss aversion coefficient are consistent with the relevant conclusions of Corollary 1 and Corollary 2 in this article. When the manufacturer focus on their own profits and losses, the profits of each member enterprise and supply system in the supply chain are lower than those under the manufacturer’s rational preference, that is, compared to loss aversion, the manufacturer’s rational preference is the dominant strategy. Observing Fig. 1a, it can be seen that for the retailer, when they pursue maximizing corporate social responsibility (\(\theta = 1\)), their economic profits are completely lost, but they achieve maximum utility. At this time, the economic profits lost by downstream retailer is transferred to upstream manufacturer, and the manufacturer accumulate the total profits of the supply chain system. In summary, if the retailer balance the goals of economic profit and corporate social responsibility, they cannot maximize their CSR level, otherwise their economic profit will be completely destroyed. In addition, the irrational preference of the manufacturer’s loss aversion will not change the above conclusion. At this point, the manufacturer still obtains all the economic profits of the supply chain system. Therefore, in Fig. 1c, when \(\theta = 1\), the supply chain system profits under the manufacturer’s rational preference and loss aversion preference are equal.

Compared to the rational preference of the manufacturer, under the preference of loss aversion, The retailer need to bear a higher degree of corporate social responsibility in order to achieve the goal of higher system profits under decentralized decision-making mode than under centralized decision-making mode. This is because the manufacturer’s irrational preference of loss aversion shifts their economic benefits to the retailer, By taking on more supply chain corporate social responsibility through the retailer, the increase in consumer demand is stimulated while reducing product retail prices. In this case, the essence of the retailer' CSR is to compress their own profit space, and then transfer some of the profits to the manufacturer, in order to meet the purpose of the manufacturer's high attention to their own profits and losses to obtain more economic profits.

7.2 Green CSR supply chain coordination under rational preference

The impact of the change in the level of corporate social responsibility of retailer on the contract coordination results is shown in Table 3. It can be seen from Table 3 that with the continuous improvement of the level of corporate social responsibility of the retailer, the retail price of products under the combined contract gradually decreases, and the level of greening continues to increase, indicating that retailer' undertaking corporate social responsibility has a positive impact on supply chain optimization.At the same time, with the improvement of the CSR level of the retailer, the coordination upper limit of the coordination factor \(\overline{{w_{d}^{ * } }}\) of the revenue-sharing and responsibility-sharing combination contract gradually increases, and the coordination lower limit gradually decreases; The coordination interval of coordination factor \(\overline{{w_{d}^{ * } }}\) also increases with the improvement of the level of CSR of the retailer. The above results show that the coordination of green supply chain that bears corporate social responsibility under the combination contract has certain flexibility, and its flexibility increases with the improvement of the level of CSR of the retailer. Therefore, for upstream and downstream members of the supply chain, with the continuous improvement of the level of CSR of the retailer, the negotiation space gradually increases, the feasibility of cooperation has increased.

7.3 Green CSR supply chain coordination under loss aversion preference

When the manufacturer has loss aversion preference, the coordination factor \(\eta_{f}\) of the supply chain system is affected by the loss aversion preference coefficient \(\lambda_{m}\) and the retailer's CSR level \(\theta\),the influence of \(\lambda_{m}\) and \(\theta\) on the upper limit \(\overline{\eta }_{f}\) and lower limit \(\underline{\eta }_{f}\) of the coordination factor can be obtained by MATLAB R2016a numerical simulation software, as shown in Fig. 2 and Fig. 3 respectively.

First of all, analyze the impact of the manufacturer's loss aversion preference on coordination factor \(\eta_{f}\). From Figs. 2 and 3, it can be seen that the upper limit \(\overline{\eta }_{f}\) and lower limit \(\overline{\eta }_{f}\) of green supply chain coordination factor increase with the increase of the manufacturer's loss aversion,that is, with the increase of \(\lambda_{m}\), in order to achieve the coordination of the green CSR supply chain, the manufacturer's share of the green supply chain sales revenue, low carbon emission reduction investment cost and corporate social responsibility will gradually increase, and then verify the conclusion of Corollary 5.Secondly, it analyzes the impact of the retailer's CSR level on the coordination factor \(\eta_{f}\). Combining with Figs. 2 and 3, it can be seen that in the coordination process of the green supply chain, when the manufacturer's loss aversion of the supply chain leader is low, the upper limit of the coordination factor increases, the lower limit decreases, the coordination area under the combination contract expands, and the cooperation space of the supply chain members increases; When the manufacturer pays close attention to their own profits and losses, the coordination range under the combination contract is reduced, and the cooperation difficulty of upstream and downstream members of the supply chain is increased, which further verifies the conclusion of Corollary 6.The essence of the CSR behavior of supply chain members is the profit-sharing behavior of consumers. Through the above analysis, it can be seen that when the manufacturer’s loss aversion is controlled in a small range, the improvement of the retailer’s corporate social responsibility for the supply chain system can offset the negative impact of loss aversion on the cooperation space under the combined contract, but when the manufacturer shows high concern about its own profits and losses, the retailer’ profit-sharing behavior of increasing CSR cannot offset the negative effects caused by loss aversion preference, which is not conducive to the coordination of green supply chain under CSR.

Finally, since the impact of \(\lambda_{m}\) on coordination factor \(\left\{ {\overline{{w_{f}^{*} }} ,\eta_{f} } \right\}\) has a single trend, in order to further verify the impact of \(\lambda_{m}\) on the coordination flexibility of the contract factor in the coordination contract, let \(\theta = 0.8\), we can get the change of the length of coordination interval of \(\left\{ {\overline{{w_{f}^{*} }} ,\eta_{f} } \right\}\) with \(\lambda_{m}\), as shown in Fig. 4. It can be seen from the analysis that in the process of coordinating the green supply chain with corporate social responsibility by the combination contract, with the increase of \(\lambda_{m}\), the effective coordination interval of contract factor \(\overline{{w_{f}^{*} }}\) decreases from 2.16 to 1.32, and the effective coordination interval of contract factor \(\eta_{f}\) decreases from 0.36 to 0.22, that is, the effective coordination interval length of coordination factor decreases.The above results show that the increase of the manufacturer’s loss aversion preference weakens the flexibility of the green supply chain with corporate social responsibility in coordination under the combination contract. For the upstream and downstream member enterprises of the supply chain, the negotiation space between the two sides will be reduced, and the coordination difficulty of the supply chain will be increased. When the loss aversion degree increases to a certain extent, the stability of the supply chain system will be greatly affected (Fig. 4).

8 Managerial implications

This article extends the literature on green CSR supply chain decision-making under irrational preferences. The research results enable managers to better understand the influencing factors in decision-making and take corresponding measures to respond. Provide the following management insights for different members in the supply chain:

For the retailer, the improvement of its CSR level is not only conducive to the greening of products, but also has a positive impact on the profit of the manufacturer and supply chain systems.Therefore, a reasonable responsibility mechanism should be established among supply chain members to incentivize node enterprises to improve their CSR level. Enhance the profits of the supply chain system and optimize consumer interests and overall social welfare.

The manufacturer is profitable enterprise, but loss aversion preference reduces both its own profit and the retailer profit.From the perspective of the leader of the supply chain, the manufacturer should develop effective incentive measures to share the economic pressure brought about by green investment with other members of the supply chain, in order to eliminate the adverse effects caused by loss aversion.

The environmental protection concept of consumers has a positive impact on the balanced decision-making of the green supply chain. Therefore, green enterprises should actively market and promote green products, convey green consumption concepts, and enhance consumers’ green awareness. In addition, the increase in CSR level has led to a decrease in the retail prices of green products, thereby increasing the market demand for products and enabling consumers to use them more efficiently.

The government pays attention to enterprises taking on CSR to improve social welfare, but the retailer taking on corporate social responsibility is not conducive to its own profit growth. Therefore, in order to motivate member enterprises to better fulfill CSR, the government can incentivize supply chain member enterprises to take on more social responsibilities through subsidies or tax exemptions.

9 Conclusions and suggestions for further research

This paper introduces the preference of enterprises to fulfill their social and environmental responsibilities into the supply chain. Based on the wholesale price contract, a two-stage green manufacturing supply chain model for the retailer to fulfill CSR responsibilities is constructed. First, the green supply chain decision-making problem under centralized decision-making, the manufacturer’s rational preference and loss aversion preference is discussed, and the optimal decision-making and performance of each member enterprise under the three decision-making modes are compared and analyzed. Secondly, the revenue-sharing and responsibility-sharing combined contract is designed to achieve green supply chain coordination under different preferences of the manufacturer. Through the above research, the following main conclusions are obtained:

(1)The implementation of corporate social responsibility by the retailer not only enhances the greenness of products, but also reduces retail prices, thereby promoting more effective market-oriented promotion of green products. When the retailer bear significant CSR responsibilities, although their own profits are damaged, the manufacturer’s profits, supply chain system profits, consumer surplus, and social welfare levels are effectively improved. Therefore, supply chain managers (the manufacturer) can develop effective incentive measures and CSR implementation codes of conduct to improve the performance of both supply chain members.

(2) The manufacturer’s loss aversion preference reduces the green level of products and increases the retail price, which leads to the reduction of product market demand, reduces the economic profit of the retailer and also damages the manufacturer’s economic profit, and has a negative impact on the consumer surplus and social welfare of the supply chain system.

(3) For CSR supply chain, the system economic profit under centralized decision is not always better than the two decentralized decisions.Centralized decision-making can eliminate the double marginal effects in the supply chain system, but it also increases the scope for the CSR supply chain system to give way to consumers.Therefore, when the retailer implement CSR behavior with a higher standard, the system profits under rational decentralized decision-making will be greater than centralized decision-making. In addition, the negative preference of the manufacturer’s loss aversion aggravates the double marginal effect under decentralized decision-making. At this time, the retailer need to bear more CSR to achieve the result that the system profit under loss aversion is higher than that under centralized decision-making.

(4) Under the rational decision of the manufacturer, when the members of the supply chain implement the revenue-sharing and responsibility-sharing combined contract, the effective coordination interval length of the coordination factor of the combined contract increases with the improvement of the level of the retailer’s corporate social responsibility, and the difficulty of reaching an agreement between the members of the supply chain decreases.

(5)Under the manufacturer’s loss aversion decision, the revenue-sharing and responsibility-sharing combined contract can achieve the coordination of the green CSR supply chain. From the perspective of the supply chain negotiation, the increase of the manufacturer’s loss aversion preference will increase the upper and lower limits of the coordination factor of the combined contract at the same time,and when the degree of loss aversion is large, the length of coordination interval under the combined contract will be reduced, so the manufacturer’s loss aversion preference increases the coordination difficulty of the green CSR supply chain, and has a negative impact on the green development of the supply chain.

This paper discusses the impact of the retailer’ CSR performance on the green supply chain under the assumption that the manufacturer and the retailer have symmetric information. However, in the actual operation decision-making process, the degree of loss aversion is private information. In order to improve their own profits, the manufacturer will disguise their loss aversion in strategy. Therefore, it is of great practical significance to study the green CSR supply chain under asymmetric information, It is worth further study.

References

Reham A, Eltantawy GL, Fox LG (2009) Supply management ethical responsibility: reputation and performance impacts. Supply Chain Manag Int J 14(2):99–108

Kahneman D, Tversky A (1979) Prospect theory: an analysis of decision under risk. Econometrica 47(2):263–291

Ma P, Shang J, Wang H (2017) Enhancing corporate social responsibility: contract design under information asymmetry. Omega 52:19–30

Raj A, Biswas I, Srivastava SK (2018) Designing supply contracts for the sustainable supply chain using game theory. J Clean Prod 185:275–284

Liu Y, Quan BT, Xu Q et al (2019) Corporate social responsibility and decision analysis in a supply chain through government subsidy. J Clean Prod 208:436–447

Panda S, Modak NM (2016) Exploring the effects of social responsibility on coordination and profit division in a supply chain. J Clean Prod 139:25–40

Sinayi M, Rasti-Barzoki M (2018) A game theoretic approach for pricing, greening, and social welfare policies in a supply chain with government intervention. J Clean Prod 196:1443–1458

Biswas I, Raj A, Srivastava SK (2018) Supply chain channel coordination with triple bottom line approach. Transp Res Part E 115:213–226

Ni D, Li KW, Tang XW (2010) Social responsibility allocation in two-echelon supply chains: Insights from wholesale price contracts. Eur J Oper Res 207(3):1269–1279

Kopel M, Brand B (2012) Socially responsible firms and endogenous choice of strategic incentives. Econ Model 29(3):982–989

Liu WH, Wang ML, Zhu DL (2019) Service capacity procurement of logistics service supply chain with demand updating and lossaverse preference. Appl Math Model 66(2):486–507

Choi TM, Ma C, Shen B, Qi S (2019) Optimal pricing in mass customization supply chains with risk-averse agents and retail competition. Omega 88:150–161

Xu XS, Chan CK, Langevin A (2018) Coping with risk management and fill rate in the loss-averse newsvendor model. Int J Prod Econ 195:296–310

Feng ZW, Tan CQ (2020) Pricing, green degree and coordination decisions in a green supply chain with loss aversion. Mathematics 239:2–25

Qiu RZ, Yu Y, Sun MH (2021) Joint pricing and stocking decisions for a newsvendor problem with loss aversion and reference point effect. Manag Decis Econ 42(2):275–288

Liao BF, Li BY (2018) A marketing strategy in a closed-loop supply chain with loss-averse consumers. Math Probl Eng 2018:1–9

Zhang YW, Li B, Zhao RD (2021) Resale or agency: pricing strategy for advance selling in a supply chain considering consumers’ loss aversion. IMA J Manag Math 33(2):229–254

Nash J (1953) Two-person cooperative games. Econ J Econ Soc 21(1):128–140

Ghosh D, Shah J (2015) Supply chain analysis under green sensitive consumer demand and cost sharing contract. Int J Prod Econ 164:319–329

Aslani A, Heydari J (2019) Transshipment contract for coordination of a green dual-channel supply chain under channel disruption. J Clean Prod 223:596–609

Zhang CT, Liu LP (2013) Research on coordination mechanism in three-level green supply chain under non-cooperative game. Appl Math Model 37(5):3369–3379

Chen X, Wang X, Chan HK (2017) Manufacturer and retailer coordination for environmental and economic competitiveness: a power perspective. Transp Res Part E Logist Transp Rev 97:268–281

Xu J, Chen Y, Bai Q (2016) A two-echelon sustainable supply chain coordination under cap-and-trade regulation. J Clean Prod 135:42–56

Wang YY, Fan RJ, Shen L, Jin MZ (2020) Decisions and coordination of green e-commerce supply chain considering green manufacturer’s fairness concerns. Int J Prod Res 58(24):7471–7489

Panda S, Modak NK (2016) Exploring the effects of social responsibility on coordination and profit division in a supply chain. J Clean Prod 139(1):25–40

Modak NM, Panda S, Sana SS et al (2014) Corporate social responsibility, coordination and profit distribution in adual-channel supply chain. Pac Sci Rev 16(4):92–104

Ma P, Shang J, Wang H (2017) Enhancing corporate social responsibility: contract design under information asymmetry. Omega 67:19–30

Hsueh CF (2014) Improving corporate social responsibility in a supply chain through a new revenue sharing contract. Int J Prod Econ 151(3):214–222

Brandenburg M, Govindan K, Sarkis J, Seuring S (2014) Quantitative models for sustainable supply chain management: developments and directions. Eur J Oper Res 233:299–312

Zhu W, He Y (2017) Green product design in supply chains under competition. Eur J Oper Res 258:165–180

Feng Z and Tan C (2019) Pricing, green degree and coordination decisions in a green supply chain with loss aversion. Mathematics:239(7).

Raza SA (2018) Supply chain coordination under a revenue-sharing contract with corporate social responsibility and partial demand information. Int J Prod Econ 205:1–14

Huang J, Wang X, Luo Y, Yu L, Zhang Z (2021) Joint green marketing decision-making of green supply chain considering power structure and corporate social responsibility. Entropy 23(5):564

Moon I, Dey K, Saha S (2018) Strategic inventory: manufacturer vs. retailer investment. Transp Res Part E Logist Transp Rev 109:63–82

Li S, Li M, Zhou N (2020) Pricing and coordination in a dual-channel supply chain with a socially responsible manufacturer. PLoS ONE 15(7):e0236099

Chen YH, Nie PY, Wang C, Meng Y (2019) Effects of corporate social responsibility considering emission restrictions. Energy Strateg Rev 24:121–131

Du S, Nie T, Chu C et al (2014) Newsvendor model for a dyadic supply chain with Nash bargaining fairness concerns. Int J Prod Res 52(17):5070–5085

Funding

This study is supported by National Natural Science Foundation of China (Nos.71361018,71671079); the Excellent Postgraduate Student “Innovation Star” Project of Gansu Province (2022CXZX-523);Gansu Natural Science Foundation (20JR5RA422), and Tianjin University Lanzhou Jiaotong University Independent Innovation Fund (2020054).

Author information

Authors and Affiliations

Contributions

WL: Conceptualization, Methodology,Writing—original draft. LL: Writing-review & editing. YL: Data curation, Writing—original draft. ZL: Writing - review & editing.

Corresponding author

Ethics declarations

Conflict of interests

The authors declare no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Li, W., Liu, L., Li, Y. et al. Decision-making and coordination of green supply chain with corporate social responsibility under loss aversion. Evol. Intel. 17, 399–415 (2024). https://doi.org/10.1007/s12065-023-00888-2

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s12065-023-00888-2