Abstract

Remanufacturing has been widely recognized in practice. However, the low acceptance of remanufactured products deeply hinders the performance of remanufacturing. Recently, trade-in programs are growing in popularity for selling remanufactured products to promote consumptions. In this paper, under the constraint of consumer participation, we investigate the conditions under which a trade-in program for remanufactured products should be adopted and how to optimize the pricing and production decisions. Cannibalization between new and remanufactured products has been analyzed for both primary and replacement markets.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Remanufacturing has been widely recognized in practice. The cost advantages of remanufacturing have been addressed by a number of publications [1, 8, 9, 16]. The cost of producing a remanufactured product is generally considered to be lower than that of producing a new product [1, 3, 6, 7]. Thus, more and more firms choose to provide remanufactured products. However, as consumers generally give the remanufactured products a lower valuation compared to the new products [6,7,8], which severely disrupted the demands of remanufactured products. How to promote the scale of remanufacturing has become a major concern faced by the remanufacturing industry.

Remanufacturing is profitable and environmentally efficient [2, 3, 17]. Yet, along with its added benefit and environmental friendliness [20], remanufacturing also brings difficulties in the optimization of the operational and recovery decisions of a remanufacturing firm, such as internal cannibalization as well as disassembly and collection difficulties [4, 8]. Production planning has been considered as a hot topic in the field of production scheduling and operational research [4, 10,11,12,13,14,15]. Production planning in remanufacturing also troubles the remanufacturers because the collected used products could be unstable either in quantity or quality [21]. These features bring another major concern for the firms with potential options of remanufacturing.

Selling through trade-ins has extensively spread in various industries [18, 19, 22], such as cell phones, cars and computers. Implementing trade-ins can bring increased environmental awareness of consumers and cultivation of brand loyalty [5]. In the ways of collecting obsolete products, trade-in is special but also effective in both forward (expansion of the scale of new product sales) and reverse logistics (taking back used products and selling remanufactured products). Besides, taking back with trade-ins can also promote the environmental performance of a closed-loop supply chain [22]. In this research, we will therefore investigate the effectiveness of adopting a trade-in program in selling new and remanufactured products on both primary segment and replacement segment. Consider the fact that some consumers would not trade or sell their used products when they are obsolete, our paper is modeled by considering consumer participation constraints. For example, cell phone users might worry that the information in their used phones could be restored. Thus, some consumers will not consider trade-ins. To the best of our knowledge, this work is original. In such a context, this paper seeks to provide a better understanding of the following important questions:

-

(1)

Under what condition should remanufacturing be adopted? What is the firm’s optimal production planning strategy during two periods?

-

(2)

If the firm decides to provide a remanufactured product, on which market segment will the firm profit more? And on which segment will the remanufactured products take a larger market share?

Our analysis has several remarkable features. (1) We model the analysis on two market segments consisting of the primary and the replacement market, where remanufactured products are consumed by both segments. This makes our findings feasible and comprehensive. (2) We address the (re)manufacturer’s optimal production decisions by considering consumer participation constraints, and this allows the results and analysis to be more practical. (3) We derive the firm’s optimal strategy by investigating the product market share with firm profit.

The remainder of the paper is organized as follows. Section 2 presents the modeling framework. Section 3 demonstrates the optimal pricing solutions. Section 4 presents an analysis of market segmentation and profits. Section 5 concludes the paper.

2 Mathematical formulations

2.1 Notations

The following parameters listed in Table 1 will be used throughout the paper.

2.2 Demand function

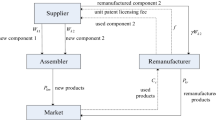

In this paper, we consider a firm which sells new products in period 1, and implements a trade-in program in period 2. The market consists of heterogeneous consumers indexed by \(\theta \), whose willingness to pay (WTP) is uniformly distributed over set \(\left[ {0, 1} \right] \). The market size is normalized into 1 in period 1, and there are n new consumers enter the market in period 2. The consumers will buy the new product if and only if its net utility (U) is positive. For example, a potential replacement consumers buys a new product if \(U_{2t}=\theta -(p_{2n} -p_{2t})-\theta \left( {1-\delta } \right) > 0\). The consumer whose valuation \(\theta \) equals \((p_{2n} - p_{2t})/\delta \) is indifferent between the two options, and the demands can be solved as \(d_{2n-t} =Pr(U_{2t} >0)=\int _{\frac{p_{2n} -p_{2t}}{\delta }} ^{1} {f(\theta ) d\theta } =1-({p_{2n}-p_{2t}}) /{\delta }\). Using similar techniques, the demands for the remanufactured can be solved (See Lemmas 1 and 2).

3 Optimal solutions

3.1 The case of no-remanufacturing-model NR

The second period net profit of the manufacturer is denoted as \(\varPi ^{NR}_2=(p_{2n}-c_n)d^{NR}_{2n}+(p_{2n}+s-p_{2t}-c_n)d^{NR}_{2n-t}\). The manufacturer sets \((p_{1n},p_{2n},p_{2t})\) to maximize its total profit during the two periods. Thus, the decision problem of the manufacturer can be formulated as follows,

By solving this profit-maximizing problem under consumer participation constraints, we derive Proposition 1 as follows to illustrate the optimal pricing decision during two period planning horizon.

Proposition 1

-

(1)

When the demand of trade-in for new is constrained by the number of potential replacement consumers in period 2, or equivalently, when \({{\tilde{\alpha }}}<(\delta -c_n+s)/[(1-c_n)\delta ]\), the optimal pricing strategy is given as follows

$$\begin{aligned} p_{1n}= & {} \frac{1+2{\tilde{\alpha }}^2\delta +c_n-{\tilde{\alpha }}\delta +{\tilde{\alpha }} c_n-{\tilde{\alpha }} s}{2(1+{\tilde{\alpha }}^2\delta )}, p_{2n}=\frac{1+c_n}{2}\quad and\\ p_{2t}= & {} \frac{{\tilde{\alpha }}\delta +{\tilde{\alpha }}^2\delta s-{\tilde{\alpha }}\delta c_n-{\tilde{\alpha }}^2\delta ^2-2\delta +1+\delta {\tilde{\alpha }}^2+c_n}{2(1+{\tilde{\alpha }}^2\delta )} \end{aligned}$$ -

(2)

When the demand of trade-in for new is not constrained by the number of potential replacement consumers in period 2, or equivalently, when \({\tilde{\alpha }}\ge (\delta -c_n+s)/[(1-c_n)\delta ]\), the optimal pricing strategy is given as follows

$$\begin{aligned} p_{1n}=p_{2n}=\frac{1+c_n}{2}, and\, p_{2t}=\frac{-\delta +1+s }{2} \end{aligned}$$

Proposition 1 demonstrates that when the participation rate of consumers who are willing to trade their old products is small enough, i.e., \({\tilde{\alpha }}<(\delta -c_n+s)/[(1-c_n)\delta ]\), or equivalently when the unit salvage value of the collected used products is large enough (\(s>\bar{s}^{NR}=\delta +\delta {\tilde{\alpha }}-\delta {\tilde{\alpha }}c_n+c_n\)), the demand for new products sold through trade-in will be bind the potential consumer, and all of the potential consumers trade their used old ones for new ones. In other words, when the salvage value of the collected used products is high enough, the seller is willing to collect more used products through trade-ins. In condition (2), when the number of potential trade-ins consumers is large enough , i.e., \({\tilde{\alpha }}\ge (\delta -c_n+s)/[(1-c_n)\delta ]\), or when the salvage value of used products is not high enough (\(s\le \bar{s}^{NR}=\delta +\delta {\tilde{\alpha }}-\delta {\tilde{\alpha }}c_n+c_n\)), then the firm will collect a fraction of used products from the potential consumers. In the following lemma, we show the closed form of demands and profits.

Lemma 1

-

(1)

When \({\tilde{\alpha }}<(\delta -c_n+s)/[(1-c_n)\delta ]\), the binding demands during the two periods and the manufacturer’s profit is expressed as

$$\begin{aligned} {\bar{D}}_{1n}^{NR}= & {} 1-p_{1n}=\frac{1-c_n+{\tilde{\alpha }}\delta -{\tilde{\alpha }} c_n+{\tilde{\alpha }} s}{2(1+{\tilde{\alpha }}^2\delta )}\\ {\bar{D}}_{2n}^{NR}= & {} n\cdot (1-p_{1n})=\frac{n(1-c_n)}{2}\\ {\bar{D}}_{2n-t}^{NR}= & {} \frac{\delta -p_{2n}+p_{2t}}{\delta }=\frac{1-c_n+{\tilde{\alpha }}\delta -{\tilde{\alpha }} c_n+{\tilde{\alpha }} s}{2(1+{\tilde{\alpha }}^2\delta )} \end{aligned}$$and,

$$\begin{aligned} \bar{\varPi }^{NR}=\frac{n(1-c_n)^2}{4}+\frac{{\begin{array}{l}(c_n+{\tilde{\alpha }}\delta -\alpha c-n+\alpha s+2c_n\alpha \delta )(\alpha c_n-\alpha s-\alpha \delta +c_n-1)+\\ \alpha (\alpha c_n-\alpha s-\alpha ^2\delta +c_n-1)[(2+\alpha ^2\delta )(c_n-s-\delta )+\alpha \delta (1-c_n)] \end{array}}}{4(1+{\tilde{\alpha }}^2\delta )} \end{aligned}$$ -

(2)

When \({\tilde{\alpha }}\ge (\delta -c_n+s)/[(1-c_n)\delta ]\), the demands without binding constraints during the two periods and the manufacturer’s profit is expressed as

$$\begin{aligned} D_{1n}^{NR}= & {} 1-p_{1n}=\frac{1-c_n}{2}\\ D_{2n}^{NR}= & {} n\cdot (1-p_{1n})=\frac{n(1-c_n)}{2}\\ D_{2n-t}^{NR}= & {} \frac{\delta -p_{2n}+p_{2t}}{\delta }=\frac{\delta -c_n+s}{2\delta } \end{aligned}$$and,

$$\begin{aligned} \bar{\varPi }^{NR}=\frac{(n+1)(1-c_n)^2}{4}+\frac{\delta ^2+2\delta s+c_n^2-2c_ns+s^2-2\delta c_n }{4\delta } \end{aligned}$$

Lemma 1 demonstrates the demand for new products in each market segment. \({{\partial D}}_{2n-t}^{NR}/\delta <0\) shows that trade-in demand increases when quality retention. It can be found that the demand decreases with the unit production cost, i.e., \({\partial D}_{1n}^{NR}/c_n<0\), \({\partial D}_{2n}^{NR}/c_n<0\) and \({\partial D}_{2n-t}^{NR}/c_n<0\). This is intuitive as the optimal price always decreases with the production cost in a single product environment (Tables 2, 3).

3.2 The case of remanufacturing-model R

When remanufacturing is implemented, the consumers on both the primary and the replacement market would have two options: new products and the remanufactured products. In this section, we focus on the case that the two differentiated products have positive demands on each market segment. Then the demand functions in period 2 can be drawn in Table 1.

In model R, the firm’s decision problem can be formulated as

Proposition 2

-

(1)

When the demand of trade-ins is constrained by the number of potential replacement consumers in period 2, or equivalently, when \({\tilde{\alpha }}<(s+\mu -c_r-\delta )/[(1-c_n)(\mu -\delta )]\), the optimal pricing strategy is given as follows

$$\begin{aligned}&p_{1n}=\frac{2{\tilde{\alpha }}^2(\delta -\mu )-{\tilde{\alpha }}(\delta -\mu + c_r-s)-c_n-1}{2(-1+{\tilde{\alpha }}^2\delta -{\tilde{\alpha }}^2\mu )}, p_{2n}=\frac{1+c_n}{2}, p_{2r}=\frac{\mu +c_r}{2},\\&and\, p_{2t}=\frac{{\tilde{\alpha }}^2\delta ^2+({\tilde{\alpha }}-\mu \alpha ^2-{\tilde{\alpha }} c_n-2)\delta +{\tilde{\alpha }}^2s(\delta -\mu )-\mu {\tilde{\alpha }}(1-c_n)+\mu -c_r}{2(-1+{\tilde{\alpha }}^2\delta -{\tilde{\alpha }}^2\mu )} \end{aligned}$$ -

(2)

When the trade-ins demand is not constrained by the potential replacement consumers in period 2, or equivalently, when \({\tilde{\alpha }}\ge (s+\mu -c_r-\delta )/[(1-c_n)(\mu -\delta )]\), the optimal pricing strategy is given as follows

Proposition 2 implies that when the participation rate of trade-ins is small enough, i.e., \({\tilde{\alpha }}<(s+\mu -c_r-\delta )/[(1-c_n)(\mu -\delta )]\), or equivalently when salvage value s is large enough (\(s>\bar{s}^{NR}=c_r+\delta -\mu +{\tilde{\alpha }}[(1-c_n)(\mu -\delta )]\)), the demands of trade-ins for new will be bind the potential consumer, and all the potential consumers trade their used products for new ones. When the participation rate is large enough , i.e., \({\tilde{\alpha }}\ge (s+\mu -c_r-\delta )/[(1-c_n)(\mu -\delta )]\), or when the unit salvage value s is not high enough (i.e., \(s\le \bar{s}^{NR}\)), then the firm will collect a fraction of used products from the potential consumers. This can also be explained that when salvage revenue is not that high, the firm will price the rebate low. The following lemma shows the closed form of demands and profits.

Lemma 2

-

(1)

When \({\tilde{\alpha }}<(s+\mu -c_r-\delta )/[(1-c_n)(\mu -\delta )]\), the demands with binding constraints during the two periods and the manufacturer’s profit is expressed as

$$\begin{aligned} {\bar{D}}_{1n}^{R}= & {} 1-p_{1n} =\frac{-1+c_n+{\tilde{\alpha }} \delta -{\tilde{\alpha }} \mu +{\tilde{\alpha }} c_r-{\tilde{\alpha }}s}{2(-1+{\tilde{\alpha }}^2\delta -{\tilde{\alpha }}^2\mu )}\\ {\bar{D}}_{2n}^{R}= & {} n\cdot \left( 1-\frac{p_{2n}-p_{2r}}{1-\mu }\right) =\frac{n(-1+c_n+\mu -c_r)}{2(\mu -1)}\\ {\bar{D}}_{2r}^{R}= & {} n\left( \frac{p_{2n}-p_{2r}}{1-\mu }-\frac{p_{2r}}{\mu }\right) =\frac{n(\mu c_n-c_r)}{2\mu (1-\mu )}\\ {\bar{D}}_{2n-t}^{R}= & {} 1-\frac{p_{2n}-p_{2r}}{1-\mu } =\frac{-1+c_n+\mu -c_r}{2(\mu -1)} \end{aligned}$$$$\begin{aligned} \begin{array}{r@{~}l} &{}D_{2r-t}^{R}=\frac{p_{2n}-p_{2r}}{1-\mu }-\frac{p_{2r}-p_{2t}}{\mu -\delta }\\ &{}\quad \quad \quad \quad =\frac{((\mu -1) s+\delta (c_n-c_r)+c_r-\mu c_n)\alpha ^2+(\mu -1)(1-c_n)\alpha -\mu +1-c_n+c_r}{2(\mu -1)(-1+{\tilde{\alpha }}^2\delta -{\tilde{\alpha }}^2\mu )} \end{array} \end{aligned}$$and, the firm’s total profit is given as follows,

$$\begin{aligned} \bar{\varPi }^{R} =\bar{\varPi }_{1n}^{R}+\bar{\varPi }_{2n}^{R}+\bar{\varPi }_{2r}^{R}+\bar{\varPi }_{2n-t}^{R} +\bar{\varPi }_{2r-t}^{R} \end{aligned}$$where, \(\varPi _{1n}^{R}=\frac{(1-c_n+\alpha \delta +\alpha \mu -\alpha c_r) (1+2\alpha ^2\mu -2\alpha ^2\delta -c_n+\alpha \delta -\alpha \mu +\alpha c_r-2c-n\alpha ^2\mu +2c_n\alpha ^2\delta )}{4(-1-\alpha ^2\mu +\alpha ^2\delta )^2}\), \(\varPi _{2r-t}^{R}=\frac{(\delta -\mu )[\alpha (1-c_n)-c_r-2+\alpha (\delta -\mu )-2c_r] [(c_n\delta -c_r\delta +c_r-\mu cn)a^2+[a(\mu -1)-1](1-c_n)+c_r-\mu ]}{4(-1-a^2\mu +a^2\delta )^2(-1+\mu )}\), \(\varPi _{2n-t}^{R}=\frac{\alpha (\delta -\mu )((1-c_n)(1-\alpha )+\alpha (\delta +\mu ))+1-c_n+\mu -c_r-2\delta }{4(-1+ro)(-1-a^2\mu +a^2\delta )}\), \(\varPi _{2r}^{R}=\frac{(\mu c_n-c_r)(-\mu +c_r)}{4(-1+\mu )\mu }\), \(\varPi _{2n}^{R}=\frac{n(-1+\mu +c_n-c_r)(1-c_n)}{4(-1+\mu )}\).

-

(2)

When \({\tilde{\alpha }}\ge (s+\mu -c_r-\delta )/[(1-c_n)(\mu -\delta )]\), the demands with non-binding constraints during the two periods and the manufacturer’s profit is expressed as

$$\begin{aligned} D_{1n}^{NR}= & {} 1-p_{1n}=\frac{1-c_n}{2}\\ D_{2n}^{R}= & {} n\cdot \left( 1-\frac{p_{2n}-p_{2r}}{1-\mu }\right) =\frac{n\left( -1+c_n+\mu -c_r\right) }{2(\mu -1)}\\ D_{2r}^{R}= & {} n\left( \frac{p_{2n}-p_{2r}}{1-\mu }-\frac{p_{2r}}{\mu }\right) =\frac{n(\mu c_n-c_r)}{2\mu (1-\mu )}\\ D_{2n-t}^{R}= & {} 1-\frac{p_{2n}-p_{2r}}{1-\mu } =\frac{(-1+c_n+\mu -c_r)}{2(\mu -1)}\\ D_{2r-t}^{R}= & {} \frac{p_{2n}-p_{2r}}{1-\mu }-\frac{p_{2r}-p_{2t}}{\mu -\delta } =\frac{-\mu c_n+c_n\delta -c_r\delta +c_r-s+s\mu }{2(\mu -1)(\mu -\delta )} \end{aligned}$$and, the profit of the firm can be derived as,

$$\begin{aligned} {\varPi }^{R} ={\varPi }_{1n}^{R}+{\varPi }_{2n}^{R}+{\varPi }_{2r}^{R}+{\varPi }_{2n-t}^{R} +{\varPi }_{2r-t}^{R} \end{aligned}$$where, \(\varPi _{1n}^{R}=\frac{(1-c_n)^2}{4}\), \(\varPi _{2r-t}^{R}=\frac{(-\mu c_n+c_n\delta -c_r\delta +c_r-s+s\mu )(-\mu +c_r+\delta +s)}{4(-1+\mu ) (-\mu +r)}\), \(\varPi _{2n-t}^{R}=\frac{(-1+\mu +c_n-c_r)(c_n-1+\delta +s)}{4(1-\mu )}\), \(\varPi _{2r}^{R}=\frac{n(\mu c_n-c_r)(-\mu +c_r)}{4\mu (-1+\mu )\mu }\), \(\varPi _{2n}^{R}=\frac{n(-1+\mu +c_n-c_r)(1-c_n)}{4(-1+\mu )}\).

Lemma 2 demonstrates the demands of the two products on two segments under binding and non-binding consumer participation. In the binding case, one can check that \({\bar{D}}_{2r-t}^{R}=\alpha \cdot {\bar{D}}_{1n}^{R}-{\bar{D}}_{2n-t}^{R}\). We also have \(\partial {\bar{D}}_{2n}^{R}/\mu <0\), \(\partial {\bar{D}}_{2n-t}^{R}/\mu <0\), this is intuitive. It can be found that the demand varies when the unit production cost varies, e.g., \(\partial {\bar{D}}_{2n}^{R}/c_n<0\), \(\partial {\bar{D}}_{2n}^{R}/c_r>0\), \(\partial {\bar{D}}_{2r}^{R}/c_r<0\) and \(\partial {\bar{D}}_{2r-t}^{R}/c_n<0\). This implies that product substitution induces that the consumption of remanufactured products decreases with the remanufacturing cost and increases with the new product cost.

4 Analysis

In this section, we will answer the questions proposed in Sect. 1.

4.1 When should remanufacturing be adopted?

By comparing the total profit in models NR and R, we have the following result.

Proposition 3

\(\varPi _{R}\le \varPi _{NR}\) if \(c_{r1}<c_r<c_{r2}\) is hold, and \(\varPi _{R}>\varPi _{NR}\) otherwise.

where \(c_{r1}=\frac{(\delta ^2-2\mu \delta +\mu \delta ^2)(H+2\sqrt{L})}{2}\), and \(c_{r21}=\frac{(\delta ^2-2\mu \delta +\mu \delta ^2)(H-2\sqrt{L})}{2}\), \(H=2\mu (\mu \gamma s+2\delta ^2c_n-s\delta -2 \mu c_n\delta )\), and \(L=\mu \delta (1-\mu )(\delta -\mu )[(2\gamma ^3+(c_n^2-5)\delta ^2+(3c_n^2+2+2s^2-6sc_n)r-2(c_n-s)^2]\mu +2\gamma ^3-(1+c_n^2)\delta ^2+(c_n^2-2sc_n+2s^2)\delta )\).

Proof

The proof is straightforward by solving the roots of \(\varPi _{R}=\varPi _{NR}\).

Proposition 3 demonstrates the decision zone in which remanufacturing should be implemented. We can also show that \(\varPi _{R}-\varPi _{NR}\) is convex on \(c_r\). This proposition also shows that with \(c_r\) increases, the advantage of selling remanufactured products first decreases and then increases, which implies that providing remanufactured products can still be profitable when \(c_r\) is large. \(\square \)

4.2 The trade-off between selling and collecting

4.2.1 When remanufacturing is not adopted

In model NR, when remanufacturing is not adopted, the direct income from trade-ins with bindings participation rate can be solved as

In the non-binding case, the direct revenue from a trade-in selling is solved as follow

Note that we are working under \({\tilde{\alpha }}>(\delta -c_n+s)/[(1-c_n)\delta ]\), which can be transformed to \(s<{\tilde{\alpha }}s-\delta +(1-{\tilde{\alpha }}s)c_n\). Therefore, we can conclude that when \({\tilde{\alpha }}s-\delta +(1-{\tilde{\alpha }}s)c_n>1-\delta \) is hold, and when the unit salvage value of an used product lies in the interval \([1-\delta , {\tilde{\alpha }}s-\delta +(1-{\tilde{\alpha }}s)c_n]\), the direct income from collecting an used product is non-negative. This condition can be transformed as \(c_r>\delta +[1-{\tilde{\alpha }}(1-c_n)](\mu -\delta )\). When the trade-ins demands are bind, i.e., \({\tilde{\alpha }}\le (\delta -c_n+s)/[(1-c_n)\delta ]\), which can be turned into \(s\ge {\tilde{\alpha }}s-\delta +(1-{\tilde{\alpha }}s)c_n\). Therefore, we can conclude the above as follows

Proposition 4

(1) When \(\delta <[{\tilde{\alpha }}(1-c_n)-1](\mu -\delta )+c_r\) is hold, if \(s\in [\delta , (\mu -\delta )[{\tilde{\alpha }}(1-c_n)-1]+c_r]\), the direct income from collecting used products in the non-binding case is non-negative; (2) When the salvage value of the used product is large enough, i.e., \(s>s_{NR}\), the direct income from collecting used products in the binding case is non-negative;

where \(s_{NR}=\max \{ \frac{1+c_n-a^2 \delta ^2-(2+a c_n-a^2-a)\delta }{2(1+a^2\delta )}, {\tilde{\alpha }}s-\delta +(1-{\tilde{\alpha }}s)c_n\)}

4.2.2 When remanufacturing is adopted

On the binding case in Model R, we have,

Then we can obtain that \(\bar{\varDelta }^{R}>0\) if \(s>\frac{(a+a^2\delta -ac_n-1)\mu -a^2\delta ^2+(2+ac_n-a)\delta +c_r}{2+a^2(\mu -\delta )}\) is satisfied. In the non-binding case, by solving the difference of s and \(p_{2t}\), we have

Therefore, we have \(\varDelta ^{R}>0\) if \(s>\delta \).

In model R, the condition when the trade-in demands are not bind, i.e., \({\tilde{\alpha }}>\frac{(s+\mu -c_r-\delta )}{(1-c_n)(\mu -\delta )}\), which can be transformed as \(s<[{\tilde{\alpha }}(1-c_n)-1](\mu -\delta )+c_r\). Therefore, we can conclude that if \([{\tilde{\alpha }}(1-c_n)-1](\mu -\delta )+c_r>\delta \) holds, when the unit salvage value lies in the interval \([\delta , {\tilde{\alpha }}(1-c_n)-1](\mu -\delta )+c_r]\), the direct income from collecting an used product is non-negative. This condition can be transformed as \(c_r>\delta +[1-{\tilde{\alpha }}(1-c_n)](\mu -\delta )\). The condition when the trade-ins demands are not bind, i.e., \({\tilde{\alpha }}\ge \frac{(s+\mu -c_r-\delta )}{(1-c_n)(\mu -\delta )}\), can be transformed as \(s\ge [{\tilde{\alpha }}(1-c_n)-1](\mu -\delta )+c_r\). Therefore, we can conclude as follows.

Proposition 5

(1) When \(\delta <(\mu -\delta )[{\tilde{\alpha }}(1-c_n)-1]+c_r\) is hold, if \(s\in [\delta , (\mu -\delta )[{\tilde{\alpha }}(1-c_n)-1]+c_r]\), \(\varDelta ^{R}>0\); (2) When s is large enough, i.e., \(s>s_{R}\), \(\bar{\varDelta }^{R}>0\);

where, \(s_R=\max \{ \frac{(a^2\delta +a-ac_n-1)\mu -a^2\delta ^2+(2+ac_n-a)\delta +c_r}{2+a^2(\mu -\delta )}, (\mu -\delta )[{\tilde{\alpha }}(1-c_n)-1]+c_r\}.\)

4.3 Product differentiation on primary and purchased market

To better understand the performance of applying trade-ins on selling new and remanufactured products in period 2, we assume that the market potential of primary consumer in period 2 equals that of period 1 (\(n=1\)). First, it can be found that in the non-binding case, \(d_{2n-t}^{R}=d_{2n}^{R}=\frac{c_n-1+\mu -c_r}{2(\mu -1)}\), and in the binding case when consumer participation rate, we have \(\bar{d}_{2n-t}^{R}=\bar{d}_{2n}^{R}=\frac{c_n-1+\mu -c_r}{2(\mu -1)}\). Then, it can be summarized as below,

Proposition 6

No matter whether there is enough consumers on the trade-in market, the demands for new products on the primary segment equals the new products demands on the trade-in market.

Proposition 6 demonstrates that on the two segments, a same quantity of new products is sold. Because the profit margin on selling the new products on the two segments are different, i.e., \((p_{2n}-c_{n})\) and \((p_{2n}-c_{n}+s-p_{2t})\) are the profit margin of selling new products on the primary and the replacement market respectively. Thus, on which segments will the firm obtain a larger margin depends on \(s-p_{2t}\). By comparing the new and the remanufacturing demand on the trade-in segment without constraints, we have

It can be found that when \(c_r>\frac{(-1 + \mu ) (\delta - \mu + s) + 2 (\delta - \mu ) c_n}{-\mu +2\delta -1}\) is satisfied, \(D_{2n-t}^{R}-D_{2r-t}^{R}>0\). This can be explained that when \(c_r\) is large enough, the selling price of the remanufactured product is comparatively high, and thus more consumers would choose to buy new products than to buy remanufactured products. In the binding case, we have,

Therefore it can be obtained that when the remanufacturing cost \(c_r\) is low enough, i.e., \(c_r< \frac{(\mu \delta -2\mu c_n+2c_n\delta +\mu -\mu ^2-\delta +\mu s-s)a^2+(-1+\mu +c_n-\mu c_n)a+2-2c_n-2\mu }{2a^2\delta -2-a^2\mu -a^2}\) is satisfied, \({\bar{D}}_{2n-t}^{R}-{\bar{D}}_{2r-t}^{R}<0\). This can also be explained that when the unit remanufacturing cost is low enough, the remanufactured product is competitive in selling price, and thus consumers are more willing to buy remanufactured products than to buy new products.

Observing the demands given in Lemma 2, we can find that in both the binding and the non-binding case, the demands hold the same. On the primary segment, by deriving the difference of demands of new and remanufactured products, we have,

The following Proposition concludes the above findings.

Proposition 7

-

(1)

On primary market, if \(c_r<\frac{-\mu (1-\mu -2c_n)}{1+\mu }\), the remanufactured products incurs a larger market share. i.e., \(M_{2r}^{R}=\frac{D_{2r}^{R}}{D_{2n}^{R}+D_{2r}^{R}}>\frac{D_{2n}^{R}}{D_{2n}^{R}+D_{2r}^{R}}=M_{2n}^{R}\);

-

(2)

On trade-in market, (i) If \(c_r<\frac{\mu -\delta -\mu ^2+\mu \delta -2c_n\mu +2c_n\delta -s+s\mu }{-\mu +2\delta -1}\) is satisfied, the remanufactured products incurs a larger market share in the non-binding case; (ii) If \(c_r< \frac{[\mu (\delta -2 c_n+1-\mu + s)-\delta +2c_n\delta -s]a^2-(1-\mu )(1-c_n)a+2(1-c_n-\mu )}{2a^2\delta -2-a^2\mu -a^2}\), the remanufactured products incurs a larger market share in the binding case.

We demonstrate how remanufacturing cost affects market share of the differentiated products. A larger market share of the remanufactured products would be welcomed by the government or the environmental groups. However, a larger market share does not mean a larger profit. Next, we will investigate which product is more profitable. The investigation will be given on primary and trade-in market respectively. On the primary market, by comparing the profits of selling new and remanufactured products, we have,

By solving the equation of \(\varPi _{2n}^{R}-\varPi _{2r}^{R}=0\) with respect to \(c_r\), we have two roots as follows,

This implies that \(\varPi _{2n}^{R}-\varPi _{2r}^{R}\) is concave on the unit remanufacturing cost \(c_r\). As we are working under the non-binding case with the condition that \({\tilde{\alpha }}\ge (s+\mu -c_r-\delta )/[(1-c_n)(\mu -\delta )]\), or equivalently, \(c_r>s+[1-{\tilde{\alpha }}(1-c_n)](\mu -\delta )\), then the following finding can be derived.

Proposition 8

-

(1)

\(\varPi _{2n}^{R}\ge \varPi _{2r}^{R}\) if and only if \(c_n\le \frac{c_r+\sqrt{\mu }-\mu }{\sqrt{\mu }}\) is satisfied; and

-

(2)

\(\varPi _{2n}^{R}<\varPi _{2r}^{R}\) if and only if \(c_n>\frac{c_r+\sqrt{\mu }-\mu }{\sqrt{\mu }}\) is satisfied.

Proof

“See Appendix”.

In this proposition, we show that producing and selling remanufactured products are more profitable than selling new products on the primary market when the unit production cost of producing a new product is low enough, i.e., \(c_n\le \frac{c_r+\sqrt{\mu }-\mu }{\sqrt{\mu }}\), or equivalently when the remanufacturing cost is high (\(c_r>\mu +\sqrt{-2\mu c_n+\mu +\mu c_n^2}\)). The results also indicates that selling remanufactured products is more profitable than selling new products on the primary market when the \(c_n\) is high, i.e., \(c_n>\frac{c_r+\sqrt{\mu }-\mu }{\sqrt{\mu }}\), or equivalently when the remanufacturing cost is low enough (\(c_r<\mu +\sqrt{-2\mu c_n+\mu +\mu c_n^2}\)). \(\square \)

Another finding is that the difference of the profits is concave on \(c_r\), and this indicates that in the interval \((0, \mu )\), the difference \((\varPi _{2n}^{R}-\varPi _{2r}^{R})\) increases when \(c_r\) increases, and specially when \(c_r=\mu +\sqrt{-2\mu c_n+\mu +\mu c_n^2}\), the firm obtains an equal profit in selling new and remanufacture products on the primary market (\(\varPi _{2n}^{R}=\varPi _{2r}^{R}\)). On the trade-in market, by solving \(\varPi _{2n-t}^{R}\) and \(\varPi _{2r-t}^{R}\), we have

By solving \(\varPi _{2n-t}^{R}-\varPi _{2r}^{R}=0\), we have two roots as follows,

With these results, we have

Proposition 9

-

(1)

if \(c_n>\xi -\sqrt{\frac{\xi -\mu }{\mu -\delta }}\), then \(\varPi _{2n-t}^{R}\ge \varPi _{2r-t}^{R}\) if and only if \(c_{r3}<c_r<c_{r4}\), and \(\varPi _{2n-t}^{R}<\varPi _{2r-t}^{R}\) if \(0<c_r<c_{r3}\) or \(c_{r4}<c_r<1\);

-

(2)

if \(c_n\le \xi -\sqrt{\frac{\xi -\mu }{\mu -\delta }}\), then \(\varPi _{2n-t}^{R}\ge \varPi _{2r-t}^{R}\) if and only if \(c_{r3}<c_r<1\), and \(\varPi _{2n-t}^{R}<\varPi _{2r-t}^{R}\) if \(0<c_r<c_{r3}\).

where \(\xi =1+s-\delta \), \(c_{r3}=\mu -\delta +s-\sqrt{\frac{(c_n-\xi )^2(\mu -\delta )}{1-\delta }}\) and \(c_{r4}=\mu -\delta +s+\sqrt{\frac{(c_n-\xi )^2(\mu -\delta )}{1-\delta }}\).

Proof

“See Appendix”.

Proposition 9 can be analyzed similarly as Proposition 8. Deriving the second order derivatives of \(\varPi _{2n-t}^{R}-\varPi _{2r-t}^{R}\) on \(c_r\), we have \(\partial ^2(\varPi _{2n-t}^{R}-\varPi _{2r-t}^{R})/\partial c_r^2=(\delta -1)/[2(\mu -1)(\delta -\mu )]<0\), which implies that \(\varPi _{2n-t}^{R}-\varPi _{2r-t}^{R}\) is also concave on the remanufacturing cost \(c_r\). We use Figs. 1 and 2 to show the results in Propositions 7, 8 and 9. Figures 1 and 2 shows that there exists a zone where the remanufactured products has a advantage on both profits and market share. In zone A of Fig. 1, when the new product cost \(c_n\) is large, we can simultaneously have \(\varPi _{2r}^{R}<\varPi _{2n}^{R}\) and \(M_{2r}^{R}<M_{2n}^{R}\). In zone C, we have a contrary conclusion that \(\varPi _{2r}^{R}\ge \varPi _{2n}^{R}\) and \(M_{2r}^{R}\ge M_{2n}^{R}\) when \(c_n\) is small. \(\square \)

5 Conclusion

Remanufacturing has been widely recognized both in practice and in literature. However, due to the fact that remanufactured products are generally valued lower compared to new products, the implementation of remanufacturing industry is deeply hindered. In recent years, trade-in programs are growing in popularity for selling remanufactured products as well as selling new products. In a two-period planning horizon with the constraint of consumer participation, we derive the optimal production and pricing strategy when a trade-in program for remanufactured products is adopted by the firm. We investigate the performance of implementing a trade old for remanufactured program on marketing and profits between new and remanufactured products on both primary and replacement markets. Findings with managerial insights are given in the paper.

References

Abbey, J.D., Blackburn, J.D.: Optimal pricing for new and remanufactured products. J. Oper. Manag. 36, 130–146 (2015)

Atasu, A., Sarvary, M., Wassenhove, L.N.V.: Remanufacturing as a marketing strategy. Manag. Sci. 54(10), 1731–1746 (2008)

Atasu, A., Guide, J.V.D.R., Van Wassenhove, L.N.: So what if remanufacturing cannibalizes my new product sales? Calif. Manag. Rev. 52(2), 56–76 (2010)

Cai, X.Q., Lai, M.H., Li, X., Li, Y.J., Wu, X.Y.: Optimal acquisition and production policy in a hybrid manufacturing/remanufacturing system with core acquisition at different quality levels. Eur. J. Oper. Res. 233, 374–382 (2014)

Desai, P.S., Purohit, D.: Competition in durable goods markets: the strategic consequences of leasing and selling. Mark. Sci. 18, 42–58 (1999)

Ferrer, G., Swaminathan, J.M.: Managing new and differentiated remanufactured products. Eur. J. Oper. Res. 203(2), 370–379 (2010)

Gan, S.S., Pujawan, I.N., Suparno Widodo, B.: Pricing decision for new and remanufactured product in a closed-loop supply chain with separate sales-channel. Int. J. Prod. Econ. 190, 120–132 (2016)

Guide Jr., V.D.R., Li, J.: The potential for cannibalization of new products sales by remanufactured products. Decis. Sci. 41, 547–572 (2010)

Han, X., Yang, Q., Shang, J., Pu, X.: Optimal strategies for trade-old-for-remanufactured programs: receptivity, durability, and subsidy. Int. J. Prod. Econ. 193, 602–616 (2017)

Pei, J., Liu, X.B., Fan, W.J., Pardalos, P.M., Lu, S.J.: A hybrid BA-VNS algorithm for coordinated serial-batching scheduling with deteriorating jobs, financial budget, and resource constraint in multiple manufacturers. Omega (2017). https://doi.org/10.1016/j.omega.2017.12.003

Pei, J., Cheng, B.Y., Liu, X.B., Pardalos, P.M., Kong, M.: Single-machine and parallel-machine serial-batching scheduling problems with position-based learning effect and linear setup time. Ann. Oper. Res. (2017). https://doi.org/10.1007/s10479-017-2481-8

Pei, J., Liu, X.B., Pardalos, P.M., Migdalas, A., Yang, S.L.: Serial-batching scheduling with time-dependent setup time and effects of deterioration and learning on a single-machine. J. Glob. Optim. 67(1), 251–262 (2017)

Pei, J., Liu, X.B., Liao, B.Y., Pardalos, P.M., Kong, M.: Single-machine scheduling with learning effect and resource-dependent processing times in the serial-batching production. Appl. Math. Model. (2017). https://doi.org/10.1016/j.apm.2017.07.028

Pei, J., Liu, X.B., Pardalos, P.M., Fan, W.J., Yang, S.L.: Single machine serial-batching scheduling with independent setup time and deteriorating job processing times. Optim. Lett. 9(1), 91–104 (2015)

Pei, J., Pardalos, P.M., Liu, X.B., Fan, W.J., Yang, Shanlin: Serial batching scheduling of deteriorating jobs in a two-stage supply chain to minimize the makespan. Eur. J. Oper. Res. 244(1), 13–25 (2015)

Savaskan, R.C., Bhattacharya, S., Van Wassenhove, L.N.: Closed-loop supply chain models with product remanufacturing. Manag. Sci. 50, 239–252 (2004)

Wang, L., Cai, G., Tsay, A.A., Vakharia, A.J.: Design of the reverse channel for remanufacturing: must profit-maximization harm the environment? Prod. Oper. Manag. 26(8), 1585–1603 (2017)

Ray, S., Boyaci, T., Aras, N.: Optimal prices and trade-in rebates for durable, remanufacturable products. Manuf. Serv. Oper. Manag. 7(3), 208–228 (2005)

Rao, R.S.: Understanding the role of trade-Ins in durable goods markets: theory and evidence. Mark. Sci. 28, 950–967 (2009)

Yenipazarli, A.: Managing new and remanufactured products to mitigate environmental damage under emissions regulation. Eur. J. Oper. Res. 249(1), 117–130 (2016)

Zhao, S., Zhu, Q.: Remanufacturing supply chain coordination under the stochastic remanufacturability rate and the random demand. Ann. Oper. Res. 257(1–2), 661–695 (2017)

Zhu, X., Wang, M., Chen, G., Chen, X.: The effect of implementing trade-in strategy on duopoly competition. Eur. J. Oper. Res. 248(3), 856–868 (2016)

Acknowledgements

We thank professor Minglun Ren for his assistance on improving the language. The work was supported by the Ministry of education of Humanities and Social Science Project of China [15YJC630125], the Fundamental Research Funds for the Central Universities [JZ2017HGBZ0926], Philosophy and Social Science Project of Anhui Province [AHSKY2016 D21, AHSKY2016D25], the Natural Science Foundation of Anhui Province [18080 85QG231, 1808085QG222], the National Natural Science Foundation of China [61473141,71531008], Key Project of Youth Foundation of Anhui Agriculture University [2016ZR017], Talent Project of Introduction and Stabilization of Anhui Agriculture University [yj2017-23].

Author information

Authors and Affiliations

Corresponding author

Appendix. Proofs

Appendix. Proofs

Proof of Proposition 1

Substituting \(D_{1n}^{NR}=1-p_{1n}\), \(D_{2n}^{NR}=n\cdot (1-p_{2n})\) and \( D_{2n-t}^{NR}=1-\frac{p_{2n}-p_{2t}}{\delta }\) into the profit function given in Eq. (1), we can transform the decision problem as follows:

The first inequality tells that the trade-in demand can not be larger than the demands of buying new products in period 1, and the trade-in demands must be non-negative. Because the last two non-negative constraints will lead to trivial cases, thus we omit them. Let \({\tilde{\alpha }}=1-\alpha \), the corresponding Lagrangian problem can be formulated as follows:

with

Because the Hessian of this Lagrangian is positive definite, we have 4 cases to consider (see the following table).

For Case NR-1, it requires \(q_{1n} =q_{2n-t}=0\), which is not possible to happen, so it should be omitted. For Case NR-2, by solving the systems of equations, it can be obtained that \(p_{1n}=\frac{1+2{\tilde{\alpha }}^2\delta +c_n-{\tilde{\alpha }}\delta +{\tilde{\alpha }} c_n-{\tilde{\alpha }} s}{2(1+{\tilde{\alpha }}^2\delta )}\), \( p_{2n}=\frac{1+c_n}{2}\), \(p_{2t}=\frac{{\tilde{\alpha }}\delta +{\tilde{\alpha }}^2\delta s-{\tilde{\alpha }}\delta c_n-{\tilde{\alpha }}^2\delta ^2-2\delta +1+\delta {\tilde{\alpha }}^2+c_n}{2(1+{\tilde{\alpha }}^2\delta )} \) and \(\ell _1=\frac{(\delta -\tilde{a}\delta +\tilde{a}\delta c_n-c_n+s)}{1+\tilde{a}^2\delta }\). \(\ell _1>0\) requires that \(s>(1-{\tilde{\alpha }}\delta )c_n-\delta (1-{\tilde{\alpha }})\). In this case, we have \(D_{2n-t}=D_{1n}=\frac{1-c_n+{\tilde{\alpha }}\delta -{\tilde{\alpha }} c_n+{\tilde{\alpha }} s}{2(1+{\tilde{\alpha }}^2\delta )}\), and the non-negativity of this demand requires that \(s>\frac{c_n-1+{\tilde{\alpha }}(c_n-\delta )}{{\tilde{\alpha }}}\). Because \((1-{\tilde{\alpha }}\delta )c_n-\delta (1-{\tilde{\alpha }}) -\frac{c_n-1+{\tilde{\alpha }}(c_n-\delta )}{{\tilde{\alpha }}}= \frac{({\tilde{\alpha }}^2 \delta +1)(1-c_n)}{{\tilde{\alpha }}}>0\), thus, the existence of Case NR-2 requires that \(s>(1-{\tilde{\alpha }}\delta )c_n-\delta (1-{\tilde{\alpha }})\). Similarly we can see that the condition when Case NR-3 exists is \(s\le (1-{\tilde{\alpha }}\delta )c_n-\delta (1-{\tilde{\alpha }})\). Note that in Case NR-4, the trade-in demand is 0 with \(\ell _2=-\delta +c_n-s\), and \(\ell _2>0\) requires \(s<-\delta +c_n\). \(\square \)

Proof of Proposition 8

Because \( c_{r1}-c_{r2}=2\sqrt{-2\mu c_n+\mu +c_n^2\mu }>0 \) then we have \(c_{r1}-c_{r2}>0\). As \(c_{r1}c_{r2}=\mu ^2-(-2\mu c_n+\mu +c_n^2\mu )=\mu [\mu -(c_n-1)^2]=\mu (\sqrt{\mu }+1-c_n)(\sqrt{\mu }-1+c_n)\). Because \(D_{2n}^{R}=\frac{n(-1+c_n+\mu -c_r)}{2(\mu -1)}>0\), which tells that \(\mu -c_r>1-c_n>0\), and because \(0<\mu <1\), then we have \(\sqrt{\mu }>\sqrt{\mu }-c_r>\sqrt{\mu }-c_r-1+c_n>\mu -c_r-1+c_n>0\). Thus \(c_{r1}c_{r2}=\mu (\sqrt{\mu }+1-c_n)(\sqrt{\mu }-1+c_n)>\mu (\sqrt{\mu }+1-c_n)(\sqrt{\mu }-c_r-1+c_n)>0\) and \(c_{r1}>c_{r2}>0\). By solving \(\partial (\varPi _{2n}^{R}-\varPi _{2r}^{R})/\partial c_r=0\), we have \(c_r=\mu \), where \((\varPi _{2n}^{R}-\varPi _{2r}^{R})\) reaches its maximum point. As \(0<\mu <1\), thus, \(0<c_{r2}<\mu <1\). The non-negativity of \(D_{2r}^{R}\) requires that \(\mu -c_r>\mu c_n-c_r>0\), which implies that \(\mu >c_r\). Thus, the possible \(c_r\) that makes \(\varPi _{2n}^{R}-\varPi _{2r}^{R}>0\) or \(\varPi _{2n}^{R}-\varPi _{2r}^{R}\le 0\) must satisfy \(c_r<\mu \). Because of the fact that \(\varPi _{2r}^{R}-\varPi _{2n}^{R}=\frac{(c_r-c_{r2})(c_r-c_{r1})}{\mu (1-\mu )}\), and therefore we have two conditions to consider: (1) when \(c_{r2}<c_r\), or equivalently, \(c_n\le \frac{c_r+\sqrt{\mu }-\mu }{\sqrt{\mu }}\), the value of \((\varPi _{2n}^{R}-\varPi _{2r}^{R})\) is positive because \(c_r-c_{r2}>0\) and \(c_r-c_{r1}<0\); (2) when \(c_{r2}\ge c_r\), or equivalently, \(c_n>\frac{c_r+\sqrt{\mu }-\mu }{\sqrt{\mu }}\), the value of \((\varPi _{2n}^{R}-\varPi _{2r}^{R})\) is negative because \(c_r-c_{r2}\le 0\) and \(c_r-c_{r1}<0\). \(\square \)

Proof of Proposition 9

It can be obtained that \( c_{r4}-c_{r3}=2\sqrt{\frac{(c_n-1+\delta -s)^2(\mu -\delta )}{1-\delta }}>0 \) then we have \(c_{r4}>c_{r3}\), where \(c_{r3}=\mu -\delta +s-\sqrt{\frac{(c_n-1+\delta -s)^2(\mu -\delta )}{1-\delta }}\). Because \(1<\mu <1\), then \(c_{r3}=\mu -\delta +s-\sqrt{\frac{(c_n-1+\delta -s)^2(\mu -\delta )}{1-\delta }}> \mu -\delta +s-\sqrt{\frac{(c_n-1+\delta -s)^2(1-\delta )}{1-\delta }}=\mu -\delta +s-\sqrt{(c_n-1+\delta -s)^2}\). As \(\mu -\delta +s>\mu -c_r-\delta +s>0\), then we have \(\mu -\delta +s+\sqrt{(c_n-1+\delta -s)^2}>0\), and with the assumption that \(\delta >s\), we can obtain \((\mu -\delta +s+\sqrt{(c_n-1+\delta -s)^2})(\mu -\delta +s-\sqrt{(c_n-1+\delta -s)^2})=(\mu -1+c_n)(\mu -2\delta +2s+1-c_n)>0\). Thus, we have \(c_{r3}>0\). By solving \(\partial (\varPi _{2n-t}^{R}-\varPi _{2r-t}^{R})/\partial c_r=0\), we obtain that when \(c_r={-\delta +s+\mu }\), \((\varPi _{2n-t}^{R}-\varPi _{2r-t}^{R})\) reaches its maximum point. As \(s-\delta <0\), then we have \(<0-\delta +s+\mu <1\). Because of the fact that the parabola \((\varPi _{2n-t}^{R}-\varPi _{2r-t}^{R})\) is completely axial symmetry on \(c_r\), and then we have two conditions to consider: (1) \(c_{r4}=\mu -\delta +s+\sqrt{\frac{(c_n-\xi )^2(\mu -\delta )}{1-\delta }}>1\), in this case. (2) \(c_{r4}=\mu -\delta +s+\sqrt{\frac{(c_n-\xi )^2(\mu -\delta )}{1-\delta }}\le 1\), The rest of the proof is similar to that of Proposition x, and we omit to show it. \(\square \)

Rights and permissions

About this article

Cite this article

Zhu, X., Wang, M. Optimal pricing strategy of a hybrid trade old for new and remanufactured products supply chain. Optim Lett 15, 495–511 (2021). https://doi.org/10.1007/s11590-018-1281-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11590-018-1281-7