Abstract

We examine the impact of oil price uncertainty on US stock returns by industry using the US Oil Fund options implied volatility OVX index and a GJR-GARCH model. We test the effect of the implied volatility of oil on a wide array of domestic industries’ returns using daily data from 2007 to 2016, controlling for a variety of variables such as aggregate market returns, market volatility, exchange rates, interest rates, and inflation expectations. Our main finding is that the implied volatility of oil prices has a consistent and statistically significant negative impact on nine out of the ten industries defined in the Fama and French (J Financ Econ 43:153–193, 1997) 10-industry classification. Oil prices, on the other hand, yield mixed results, with only three industries showing a positive and significant effect, and two industries exhibiting a negative and significant effect. These findings are an indication that the volatility of oil has now surpassed oil prices themselves in terms of influence on financial markets. Furthermore, we show that both oil prices and their volatility have a positive and significant effect on corporate bond credit spreads. Overall, our results indicate that oil price uncertainty increases the risk of future cash flows for goods and services, resulting in negative stock market returns and higher corporate bond credit spreads.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Oil prices are known to be an integral part of the economy. The relation between oil prices and stock returns, however, is not as clear as one might think. While a plethora of papers have examined the impact of oil price movements on the stock market, academic research has not yet come to a consensus on the specific nature of the relationship. On the one hand, one can make a case for oil and equities to be negatively correlated, as higher oil prices trigger a rise in the cost of production for goods and services; this phenomenon can lower corporate earnings as well as households’ residual budgets and consumption levels and thus affect stock market returns in general. On the other hand, one can also argue that oil and equities are positively correlated, as higher (lower) oil prices can cause oil and related energy companies’ profits to increase (decrease), a phenomenon that can boost (drag down) both the economy and the stock market overall.

In this paper, we posit that financial markets react not so much to oil prices themselves, but to the uncertainty of their direction, in other words, to the volatility of oil prices. Bernanke (1983) and Pindyck (1991) argue that as uncertainty in general increases, firms tend to delay future investment in capital equipment. Following that logic, the uncertainty and volatility of oil prices should play a major role in a firm’s decision making and subsequent profits and, consequently, in stock market returns. Additionally, recent research shows that an increase in aggregate uncertainty in the macro economy results in lower future economic growth (e.g., Fernández-Villaverde et al. 2011; Basu and Bundick 2012; Bansal et al. 2014; Bloom 2014; Gilchrist and Williams 2005). Similarly, increased aggregate volatility is shown to depress the valuation of assets and to increase their risk premia (e.g., Bansal and Yaron 2004; Bansal et al. 2005; Lettau et al. 2008). Therefore, given the direct impact that oil prices have on the economy and corporate profits, it would appear intuitive to posit that oil price uncertainty can impact financial markets through its effect on future oil prices. In fact, Gao et al. (2017) argue that oil price uncertainty can capture significant information about economic growth and asset prices beyond that captured by other predictors of future economic conditions such as market volatility.

Traditional studies have generally not focused on the volatility of oil prices and have therefore reached varying conclusions. Some research concludes that oil prices and financial markets are negatively correlated. Hamilton (1983), for instance, finds a strong negative correlation between crude oil price changes and US gross domestic product (GDP) growth after World War II, a result later confirmed by Mork (1989). Jones and Kaul (1996) show that markets are fully rational in their stock price reaction to oil price movements as these fluctuations can justify significant differences in future cash flows to the economy. More recently, Jiménez-Rodríguez and Sánchez (2005) also find that the price of oil has a negative impact on the GDP growth of most countries examined in their paper, while Hondroyiannis and Papapetrou (2001) find a negative relation in Greece. More conclusions of a negative relation between oil prices and stock market returns can be found in Sadorsky (1999), Basher and Sadorsky (2006), Nandha and Faff (2008), Driesprong et al. (2008), Chen (2010), Basher et al. (2012), and Cunado and Perez de Gracia (2014).

Other studies, however, find the relation between oil prices and the markets to be positive. For example, Mohanty et al. (2011) show that oil price shocks have a positive impact on Gulf Cooperation Council countries, a somewhat expected result given these countries’ reliance on oil exports. For non-oil-producing countries, a significant drop in oil prices can be an indication that global growth is decelerating, or can at least be perceived as such, again causing financial markets to fall and the economy to slow down. Lastly, the impact of lower oil prices on oil-exporting countries such as Russia, Venezuela, or Brazil can be cause for concern about a new emerging debt market crisis. Higher oil prices tend to benefit the oil industry, which in turn can benefit the stock market. Rising oil prices can also be seen as a sign that the global economy is either on the rise or at least performing well, an incentive for firms and consumers to invest, thus benefiting both. Mollick and Assefa (2013) use a GARCH model to find a weak negative relation between oil prices and the US stock market before the 2007–2008 financial crisis, but a positive relationship both during and after the crisis. Kang et al. (2016) demonstrate that the positive relationship with oil prices and stock returns in the USA is due to the drastic increase in US oil production, while Tsai (2015) finds a positive relationship between oil prices and financial markets both during and after the 2007–2008 financial crisis, particularly in energy-intensive and manufacturing sectors. One potential explanation for this is that oil-demand shocks have a positive effect on the market as they reflect global economic growth, an interpretation consistent with Kilian and Park (2009) and Foroni et al. (2017).

Some studies find mixed or insignificant relationships. Huang et al. (1996) find no evidence of a relation between oil price futures and stock market returns. Wei (2003) argues that the decrease in US stock prices in 1974 cannot be explained by the oil crisis of 1973 and 1974, while Miller and Ratti (2009) use a cointegrated vector error-correction model to find that oil prices have a negative relationship with the financial markets of six OECD countries, but not after 1999. Using a VAR model, Lee et al. (2012) conclude that oil price shocks do not impact the stock indices of G7 countries, although they do impact some individual sectors. Finally, Sim and Zhou (2015) show that while a negative oil price shock could affect the US market, a positive one has a very weak effect.

Various studies find that oil price volatility is an important component of the economy. Park and Ratti (2008) examine the impact of oil prices and oil volatility in the USA and 14 European countries. Their results show that oil price volatility has an inverse relationship with the markets in nine out of the 14 countries studied. This measure of oil price volatility remains statistically significant in seven of those nine countries after oil prices are included in their VAR model. Elder and Serletis (2010) measure oil price volatility as the conditional standard deviation of an oil price GARCH-in-Mean model forecasting errors and find that volatility in oil prices has a negative effect on investment, durable consumption, and GDP. Elyasiani et al. (2011) explore the volatility of both spot and futures oil prices and find that their volatility has a direct negative impact on some US industries’ excess returns. Similarly, Jo (2014) uses a vector autoregressive stochastic volatility model to show that an increase in the volatility of oil prices has a negative impact on world industrial production. Diaz et al. (2016), using a GARCH and VAR model, find that increases in oil price volatility have an adverse impact on the stock markets of G7 countries. Finally, Gao et al. (2017) show—through a two-sector production model—that when the volatility of oil supply is high, firms tend to stock up on oil and do not invest in physical capital, resulting in a decrease in investment, consumption, and production. Despite the existence of studies linking oil volatility to various measures of investment and production, there is a limited amount of research on the impact of oil volatility on financial markets and more specifically at the industry or sector level. Additionally, some measure of historical volatility of oil prices is typically used, with the challenges and possible biases that such an approach typically entails. Luo and Qin (2017) use an implied oil price volatility measure (OVX) and find that using a forward-looking oil volatility index has a significant and negative impact on the Chinese stock market while the impact of realized volatility is negligible, confirming the greater explaining power of a forward-looking measure. Therefore, rather than using a form of realized volatility, this paper contributes to the literature by using a forward-looking oil volatility measure to examine its impact on financial markets in the USA.

Our paper studies the impact of oil price uncertainty on a variety of US industries from 2007 to 2016 using OVX daily data beginning in May 2007, as well as on corporate bond credit spreads. While data on crude oil prices have been available for decades, the OVX is the first crude oil implied volatility index officially reported by the Chicago Board of Exchange (CBOE) and is calculated by applying the well-known CBOE VIX index methodology to the US Oil Fund options spanning a wide range of strike prices. The CBOE approach—studied in detail by Aboura and Chevallier (2013)—essentially yields an implied volatility measure of oil prices. The idea behind using an implied oil volatility measure for our study relates to Peng and Ng (2012), who find that while financial contagion for major equity markets sometimes cannot be clearly detected by stock market movements, links between markets can be better captured by examining the dependence between implied volatility indices. The implication of this finding is that implied volatility indices reveal changes in information more quickly than do stock market indices. Similarly, the OVX index provides information about future oil prices more quickly than current oil prices themselves, as the OVX implied volatility measure captures the market’s aggregate expectation of future oil volatility. Although Park and Ratti (2008), Diaz et al. (2016), and Elyasiani et al. (2011) have shown—using a realized measure of oil price volatility—that oil price fluctuations are negatively correlated with stock prices, to the best of our knowledge no study has done so using an industry-level approach combined with a forward-looking implied volatility measure of oil price movements.

The impact of oil price volatility on financial markets cannot be examined in isolation; however, as other factors such as exchange rates and monetary policy are known to be closely linked to stock market returns. The economic literature proposes a relationship between exchange rates and stock returns through their effects on companies’ overseas revenues. Phylaktis and Ravazzolo (2005) find that stock and foreign exchange markets are both positively related in the Pacific Basin. Similarly, Mollick and Assefa (2013) find US stock returns to be positively affected by oil prices and a weaker USD/Euro rate after the 2007–2008 financial crisis. Likewise, Bartram and Bodnar (2012) find that exchange rates have a significant impact on the stock returns of 37 countries, including the USA. Yet, Griffin and Stulz (2001) show that the importance of exchange rate shocks is economically small, and Bartov and Bodnar (1994) find no correlation between abnormal returns and changes in the exchange rate. Finally, monetary policy has been known to impact financial markets and the economy in general. Estrella and Mishkin (1996) argue that the yield difference between the 10-year Treasury note and the 3-month Treasury bill is a better predictor of business cycles than any other financial or macroeconomic indicators. Thorbecke (1997) uses the federal funds rate in a VAR model and finds that an expansionary policy by the Federal Reserve increases stock market returns. The significant impact of monetary policy on stock returns is examined in event studies such as Bernanke and Kuttner (2005) and Tsai (2013). For all these reasons, we control for the USD exchange rate, the shape of the yield curve, and changes in the federal funds rate.

We find that nine out of the 10 industries examined—as defined by the Fama and French (1997) 10-industry classification—have their stock returns negatively influenced by oil price volatility. Additionally, oil price returns have a positive and significant impact on only three industries and have a negative and significant impact on two industries. These results show that higher oil prices are not necessarily a negative factor for equity markets, but that the uncertainty of where they are headed is. These findings also demonstrate the importance of analyzing stock returns with both oil prices and oil volatility, as oil volatility is revealed to be a more consistent predictor of industry returns than oil prices themselves. Additionally, we find that oil price uncertainty and crude oil prices also have a positive and significant impact on the credit spreads of both AAA and BBB corporate bonds, demonstrating that oil price and oil volatility have an influence on credit spreads. Lastly, we investigate the asymmetric effect of oil volatility changes on all the sectors included in this study as well as on corporate bond credit spreads. The results show that oil volatility fluctuations do not have any type of asymmetric effect on most industries nor on corporate bond credit spreads.

This paper differs from previous studies in several ways. First, in view of the prominence of oil as an integral component of the domestic production of goods and services, it is essential to consider how the volatility of oil prices impacts financial markets returns not just in an ex-post historical way but in an ex-ante forward-looking manner. This is made possible by the use of the fast-adjusting forward-looking OVX implied oil volatility index instead of a realized historical measure of oil volatility. Second, examining the impact of oil price volatility on a variety of industries rather than on an aggregate market measure offers additional information about how oil uncertainty possibly impacts various sectors in the USA differently. Third, using daily rather than monthly data provides more accurate insights into how oil volatility impacts stock returns at a higher frequency and has the additional benefit of providing more observations to the study. Fourth, to measure market uncertainty with conditional volatility over time, we use a generalized autoregressive conditional heteroscedasticity model following Glosten et al. (1993) (GJR-GARCH) to analyze the dynamic impact of the implied volatility of oil prices. Finally, to the best of our knowledge, we are the first to examine the impact of an increase in the implied volatility of oil on corporate bond credit spreads.

The remainder of this paper is structured as follows. Section 2 describes the data and methodology. Section 3 presents the empirical results, Sect. 4 examines the asymmetric effect of volatility changes on financial markets, Sect. 5 examines the effect of oil price uncertainty on credit spreads, and Sect. 6 concludes.

2 Data and methodology

We collect daily data from May 10, 2007, to December 30, 2016—yielding a sample of 2429 observations—from a variety of sourcesFootnote 1: the measure of implied oil price volatility (OVX) is from the CBOE; the federal funds rate, 3-month Treasury bill, 10-year Treasury bond, 10-year TIPS, trade-weighted exchange rate of the USD, and Moody’s seasoned corporate bond data are from the Federal Reserve website; the S&P 500 index levels adjusted for dividends and WTI crude oil prices are from Datastream; and the Fama–French 10 industries’ returns are retrieved from the Kenneth French’s data library.Footnote 2 Although one could argue that using daily data may add noise to the model, financial markets tend to react to contemporaneous data rather than to information from the previous weeks or months. As a result, many studies work with information collected at a daily frequency (e.g., Mollick and Assefa 2013; Tsai 2015; Luo and Qin 2017) and we follow the same approach.

The 10 industries’ portfolios are created following Fama and French (1997). The benefit of selecting these portfolios is that they include all stocks listed on the NYSE, AMEX, and NASDAQ indexes. “Appendix A” provides a list of the 10 industries as well as their abbreviations.Footnote 3

We employ a GJR-GARCH model to examine the impact of oil price uncertainty on the various industries. The GARCH family model is adopted for its parsimony and its ability to capture conditional time-varying volatility levels of stock (industry) returns (Glosten et al. 1993; Engle 2004; Cifarelli and Paladino 2010; Elyasiani et al. 2011; Mollick and Assefa 2013). The GJR-GARCH model is more specifically chosen for its ability to allow for the asymmetric effect of shocks on volatility (Glosten et al. 1993). The model is described by:

where Ri represents the return of industry i. On the right-hand side, we set p and q to 1 (with no significant impact on results) and use the following predictor variables: ROVX, ROIL, RM, RVIX, Re, Δπ, Δts, and Δr. The first predictor ROVX is the return on the oil price volatility index (OVX) designed to examine the impact of oil price uncertainty on industry returns. The second predictor ROIL denotes the return of WTI (West Texas Intermediate) crude oil prices, designed to gauge how movements in the oil market impact industry returns. The third predictor RM represents the total return of the S&P 500 index that includes dividends and controls for changes in the macroeconomy and business cycles (i.e., consumption demand). The fourth predictor RVIX denotes the return of the VIX index, intended to control for global uncertainty and risk aversion not captured by the returns of the S&P 500. Another important reason for the presence of RVIX in the list of regressors is a concern that macroeconomic and consumption demand uncertainty could be driving oil market uncertainty and thus that an increase in the VIX could be causing an increase in the OVX index—and therefore that the VIX would be the element really driving equity returns. By including both the VIX and OVX indices in the regression, we are able to isolate their respective effects on equity markets. The fifth predictor Re represents the return of the trade-weighted exchange rate of the USD (following Tsai 2015) to control for the documented impact of exchange rates on stock returns (see also, e.g., Phylaktis and Ravazzolo 2005; Mollick and Assefa 2013; Bartram and Bodnar 2012). The sixth predictor Δπ denotes the change in expected inflation computed as the difference between the 10-year Treasury bond and 10-year “inflation protected” TIPS, following Mollick and Assefa (2013), and should have a direct impact on industry returns since theory shows an inverse relationship between expected inflation and expected earnings growth and equity returns. The seventh predictor Δts is the difference between the 10-year Treasury bond and the 3-month Treasury bill—following Mollick and Assefa (2013) and Tsai (2015)—and is designed to control for macroeconomic conditions as Estrella and Mishkin (1996) argue that this variable is a better predictor of business cycles than other financial and macroeconomic indicators with predictive power for equity returns. The last predictor Δr is the change in the federal funds rate, following Tsai (2015), chosen to control for monetary policy shown to have a direct impact on equity returns (e.g., Thorbecke 1997; Bernanke and Kuttner 2005). Finally, the error term is denoted by εt.Footnote 4

3 Empirical results

We report the main summary statistics in Table 1. Daily statistics are chosen to avoid artificially magnifying of some of the variables. For instance, a minimum value of − 12% for oil price returns in the full sample, as seen in Table 1, would be converted to an astonishing − 12% × 252 = − 3024%, an obviously nonsensical annual figure for a rate of return. The inflation, term structure, and federal funds rate variables show mean and median values close to zero. The OVX, S&P 500 index, VIX, and exchange rate return variables, however, are more positive, with annualized equivalent mean levels of about 37, 6, 74, and 2%, respectively. Overall, the skewness and kurtosis levels do indicate non-normality. The non-symmetrical nature of the distributions is even more apparent when one compares the mean levels to the median values, with even the signs drastically changing in the case of OVX and the VIX. This finding is not at all surprising given that our sample includes the 2008 financial crisis, confirmed by the large standard deviation levels found across several of the variables.

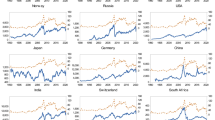

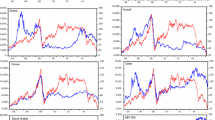

Figure 1 displays OVX oil volatility index levels, WTI oil prices, S&P 500 index, VIX levels (left), and their corresponding returns (right). While oil prices seem to dip in unison with the S&P 500 index in 2008 and subsequently appear to rise along with the market when the latter recovers, the OVX index tends to move in an opposite fashion. During the financial crisis of 2008, OVX levels spiked when the stock market plummeted and, more generally, spikes in oil volatility values tend to correspond to decreases in S&P 500 levels. The return plots additionally tend to demonstrate that OVX returns are much more volatile than the S&P 500, with daily spikes reaching over 40% in magnitude. Additionally, while the OVX and VIX appear to move in similar fashion, there does appear to be quite a difference in magnitude of returns.

Figure 2 plots USD exchange rates, federal funds rate, term structure yield, and inflation expectations on the left, and their corresponding returns on the right. The USD experiences a significant amount of volatility during the financial crisis, but begins appreciating after 2012. Prior to the crisis, the federal funds rate was around 5%. During the crisis, however, the Federal Reserve rapidly brought the rate down near zero, where it has remained, approximately, ever since. The difference between the 10-year Treasury bond and the 3-month Treasury bill rose from near-zero pre-crisis levels to slightly below 4% during the crisis and has remained between 2 and 3% since 2011. Finally, inflation expectation sharply fell during the financial crisis, but has since returned to pre-crisis levels.

Time series of levels and returns for the USD exchange rate, federal funds rate, term structure yield, and inflation expectations. Note This figure reports the trade-weighted exchange rate of the USD, federal funds rate, term structure yield, and inflation expectations both in levels (left) and in returns (right) for the full sample going from May 2007 to December 2016

Table 2 reports the various cross-correlation levels. The implied oil price volatility OVX index shows a − 33% correlation level with the S&P 500 index, while oil price returns display a 35% correlation level with the S&P 500 index, indicating how important and different oil prices and their volatility are in their relation to the stock market in general. Additionally, with respect to the VIX, the OVX index and oil prices show correlation levels of 43 and − 26%, respectively. Lastly, implied oil price volatility levels appear negatively correlated with expected inflation and differences in the yield curve, and positively correlated with the federal funds rate.

Intuitively, one may posit that the macroeconomy is what drives crude oil prices and that oil prices should thus follow the S&P 500 index. For instance, Schalck and Chenavaz (2015) find that exchange rates, shifts in global demand, and the S&P 500 index are all determinants of oil commodity returns. Therefore, it would stand to reason that macroeconomic uncertainty would drive oil market uncertainty and thus that the OVX should presumably follow the VIX. Consistent with this intuition, Robe and Wallen (2016) do indeed show that the VIX, among other variables, displays some explanatory power in various oil implied volatility measures. Conversely, one may also, as we do, argue that movements in the oil market affect the economy as well as the stock market [Baumeister and Kilian (2016) investigate the impact of the oil market on the US economy, with Hamilton (2016) providing an extensive review of the article] and therefore that the OVX can cause changes in the VIX itself. We therefore proceed to test the direction of the causality, if present, between the OVX and VIX indices.

Table 3 reports Granger causality test results, showing that the VIX causes movements in the OVX. However, we additionally find that OVX also causes movements in the VIX, leading to the conclusion that the two measures are closely intertwined. Additionally, our results indicate that the price of oil also causes movement in the S&P 500 index. To account for this dual causality, we include both the OVX and the VIX in the list of our GJR-GARCH model regressors.

Table 4 reports the GJR-GARCH estimates for the full sample period.Footnote 5 The results show that nine out of the 10 industries display a negative and significant relationship with implied oil volatility. Oil prices, on the other hand, show a positive and statistically significant effect in only three of the 10 industries and a negative impact on two industries, a result challenging the previous literature examining oil prices on industry returns without incorporating oil volatility in the model (Elyasiani et al. 2011; Tsai 2015). This finding demonstrates the necessity of including oil volatility in any framework designed to examine the impact of oil on stock returns. While this result may appear somewhat puzzling at first, it can be explained by the fact that oil prices and implied oil volatility (OVX) tend to be negatively correlated in the same way that the S&P 500 and its implied volatility (VIX) tend to be negatively correlated. Additionally, our finding is related to Peng and Ng (2012), who find that implied volatility indices can capture important information before the corresponding market does. Although the analogy might appear slightly counterintuitive, our results confirm the notion that a decrease in oil prices can often be perceived by investors as symptomatic of a cooling down of the global economy and thus a cause for concern and, correspondingly, that the market can view an increase in oil prices as a sign of global recovery, or at least as an indication of future positive economic times.Footnote 6

Our results are consistent with other studies, such as Mollick and Assefa (2013), who find that US stock returns have been positively correlated with oil prices since 2008, Tsai (2015), who finds that oil prices have had a more positive impact on industry returns since 2009 compared to prior to 2007, and Wang et al. (2013), who—using Kilian and Park’s (2009) framework—find that since 1999 oil price shocks have had no impact on oil-importing countries such as the USA. We find that while more industries are positively rather than negatively related to oil prices, not all industries are impacted by changes in the price of oil. Neither do all industries display the same relationship with oil, indicating the need to analyze the relationship at the industry level. It is also important to note that the Arch, Garch, and Tarch coefficients of the GJR-Garch model are generally statistically significant, demonstrating the value of allowing for asymmetry or leverage effects in the shocks.Footnote 7

As a robustness check, we run the same regressions on the 49 industries identified by Fama and French (1997) and find similar results, further demonstrating oil volatility’s superior impact compared to that of oil prices themselves (not reported here in the interest of space but available upon request). Additionally, the VIX—used here to control for the uncertainty of the macroeconomy’s future—only shows a negative and significant relationship with the healthcare and business equipment industries and a positive and significant relationship with the “other” industry category. The result that oil price uncertainty has more of an impact than the VIX on stock returns may seem surprising, but a similar conclusion is found by Gao et al. (2017) when examining future economic growth.

While the focal point of this paper is the impact of oil price volatility on various sectors, a byproduct of controlling for a variety of other variables is the identification of their statistical relevance. Table 4 shows that the effect of the aggregate market—a gauge of the macroeconomy—is statistically significant in all industries. Additionally, a weaker dollar is positively related to the returns of three industries and negatively related to those of one. Similarly, changes in inflation expectations show a positive and significant relationship with eight industries. Similar results are found in Mollick and Assefa (2013), who postulate that returns responding positively to expectations of higher inflation and/or higher oil prices are likely due to the anticipation of a recovery from an economic trough. Finally, a steepening of the yield curve has a negative and significant impact on two industries and a positive impact on one industry, whereas the federal funds rate provides negligible results. While these variables could have been expected to be statistically significant predictors in our model, it is likely that part of their impact is already captured by the returns of the S&P 500.

4 Asymmetric effect of oil volatility on financial markets

In this section, we explore one additional characteristic of the implied volatility of oil and its effect on financial markets. The asymmetric effect of oil prices on equities is investigated frequently in the literature (see, e.g., Park and Ratti 2008; Adetunji Babatunde et al. 2013; Wang et al. 2013; Herrera et al. 2015), but to the best of our knowledge, the asymmetric effect of oil volatility on financial markets has not yet been examined. Since some asymmetric reactions of equity markets to other implied volatility measures, such as the implied volatility of the S&P 500 index (Hibbert et al. 2008) and the implied volatility of the Euro (Daigler et al. 2014), have been established, one might expect to find an asymmetric effect of implied oil price volatility on the returns of the various industries examined in this paper. If such an effect is confirmed, it would indicate that investors do not react to an increase in oil price volatility in the same way that they react to a decrease in it.

Following previous work on the asymmetric effect of oil prices (see, e.g., Mork 1989; Park and Ratti 2008), we separate the oil implied volatility returns into positive and negative time series defined by:

Furthermore, we input both ROVXP and ROVXN into Eq. (1) and use ROVXP, ROVXN, ROIL, Re, Δπ, Δts, Rg, and Δr as predictors of Ri. To test for asymmetry, we implement a Chi-square (χ2) test, with the null hypothesis positing that the coefficients on the positive and negative oil volatility returns are equal.

Table 5 reports the estimated coefficients for ROVXP and ROVXN as well as the results of the pair-wise equality Chi-square tests on the said coefficients for all industries. The results show that no industry exhibits any asymmetric response to oil price volatility changes. We therefore conclude that industry returns overall do not show an asymmetric response to oil volatility changes: a similar conclusion is drawn by Park and Ratti (2008), Adetunji Babatunde et al. (2013), Wang et al. (2013), and Herrera et al. (2015) in their examination of asymmetric reactions to oil price shocks.

5 Credit spreads and oil price uncertainty

In addition to examining how oil price uncertainty affects equity markets, we also examine its impact on the larger bond market. More specifically, we investigate whether an increase in the implied volatility of oil drives corporate bond credit spreads upward. Such a result would indicate that the effect of oil uncertainty is not limited to equities, but extends to the bond market as well, with oil uncertainty being captured in the form of a higher risk premium. We follow Angelidis et al. (2015) and define credit spreads as the difference between Moody’s seasoned corporate bond yield and the 10-year Treasury constant maturity rate, for both AAA- and BBB-rated bonds. Although these two default spreads are obviously correlated, we would nevertheless expect to find subtle differences as investors may react to the riskier BBB bonds differently than to the AAA ones.

To examine the impact of implied oil volatility and oil prices on corporate bond credit spreads, we regress the change in the default spread Δdf on all the prior variables of Eq. (1) as well as on a lagged value of Δdf for both the AAA and BBB default spreads, yielding:

Table 6 reports the GJR-GARCH estimates for both AAA- and BBB-rated credit spreads. The results show that, indeed, both oil price volatility and the price of crude oil have a positive relationship with AAA and BBB corporate bond default spreads, while the S&P 500 has a negative and significant impact. Additionally, a depreciation of the USD, a flatter yield curve, and lower inflation expectations all lead to higher credit spreads. For completeness, we conclude this analysis by checking whether implied oil price volatility has any type of asymmetric effect on default spreads. Table 7 shows that default spreads do not respond asymmetrically to changes in oil price uncertainty for AAA bond spreads, but show a weak asymmetric impact on BBB bond spreads at the 10% level.

6 Conclusion

This paper applies a GJR-GARCH model to changes in option-implied oil volatility levels and industry returns stretching from 2007 to 2016 to analyze the impact of oil price uncertainty on a broad array of US industries as classified in the Fama and French (1997) 10-industry grouping methodology, as well as on the credit spreads of AAA- and BBB-rated corporate bonds. We estimate oil uncertainty with the OVX index, a forward-looking measure of implied oil price volatility published by the Chicago Board of Exchange since 2007. Controlling for a wide range of variables, our GJR-GARCH estimates reveal that implied oil volatility has a statistically significant negative impact on nine out of 10 industries. Oil prices, on the other hand, are much less consistent, with only three industries having a positive and significant relationship and two being negatively related. Additionally, implied oil volatility and changes in crude oil prices have a positive and significant impact on corporate credit spreads.

Prior literature generally uses a variety of realized oil price volatility measures to find evidence of the negative impact of oil volatility on the market at the aggregate level in the USA and other countries (Park and Ratti 2008; Elder and Serletis 2010; Elyasiani et al. 2011; Jo 2014; Diaz et al. 2016). Historical volatility measures, however, are backward-looking as well as sensitive to the look-back window’s selected length and, due to their moving-average nature, unable to react quickly to world events or new information in general. Our paper contributes to the literature by examining the impact of oil volatility across a broad spectrum of sectors using a forward-looking volatility measure capable of adjusting rapidly to new information and demonstrates oil volatility’s statistically significant direct negative impact on the market at the sector level. The impact of oil implied volatility is felt more consistently and for more industries than are oil prices themselves, making a case for the need to include a forward-looking oil volatility measure whenever studying the impact of oil on financial markets, including in studies focusing on oil supply, demand, and shocks, and their effect on the stock market.

Notes

The initial date of the sample period is governed by the availability of the implied oil volatility measure (OVX).

Downloaded from Kenneth French’s data library: https://doi.org/mba.tuck.dartmouth.edu/pages/faculty/ken.french.

For details about how SIC codes align with each industry, see Fama and French (1997).

Following the literature, all return variables are calculated using a log transformation of the levels in order to obtain continuously compounded returns.

While Table 2 reveals somewhat elevated correlation levels between some independent variables, the variance inflation factor (VIF) demonstrates that there are no multicollinearity issues with the model.

Comparable results are obtained when separating the sample between before and after the 2008 financial crisis.

Similar conclusions are obtained when using a more traditional Garch model. We also test for possible endogeneity in the unlikely event that a given industry return affects a right-hand side independent variable. We compute correlation levels between each independent variable and the error terms, for each industry, yielding a total of 80 correlations. Their values are very close to zero, thus alleviating the endogeneity concern and its potential effect on the results.

References

Aboura, S., Chevallier, J.: Leverage vs. feedback: which effect drives the oil market? Finance Res. Lett. 10, 131–141 (2013)

Adetunji Babatunde, M., Adenikinju, O., Adenikinju, A.F.: Oil price shocks and stock market behaviour in Nigeria. J. Econ. Stud. 40, 180–202 (2013)

Angelidis, T., Degiannakis, S., Filis, G.: US stock market regimes and oil price shocks. Glob. Finance J. 28, 132–146 (2015)

Bansal, R., Yaron, A.: Risks for the long run: a potential resolution of asset pricing puzzles. J. Finance 59, 1481–1509 (2004)

Bansal, R., Khatchatrian, V., Yaron, A.: Interpretable asset markets? Eur. Econ. Rev. 49, 531–560 (2005)

Bansal, R., Kiku, D., Shaliastovich, I., Yaron, A.: Volatility, the macroeconomy, and asset prices. J. Finance 69, 2471–2511 (2014)

Bartov, E., Bodnar, G.: Firm valuation, earnings expectations, and the exchange-rate exposure effect. J. Finance 49, 1755–1785 (1994)

Bartram, S., Bodnar, G.: Crossing the lines: the conditional relation between exchange rate exposure and stock returns in emerging and developed markets. J. Int. Money Finance 31, 766–792 (2012)

Basher, S., Sadorsky, P.: Oil price risk and emerging stock markets. Glob. Finance J. 17, 224–251 (2006)

Basher, S., Haug, A., Sadorsky, P.: Oil prices, exchange rates and emerging stock markets. Energy Econ. 34, 227–240 (2012)

Basu, S., Bundick, B.: Uncertainty Shocks in a Model of Effective Demand (No. w18420). National Bureau of Economic Research (2012)

Baumeister, C., Kilian, L.: Lower oil prices and the US economy: is this time different? Brook. Pap. Econ. Act. 2016, 287–357 (2016)

Bernanke, B.: Nonmonetary effects of the financial crisis in the propagation of the great depression. Am. Econ. Rev. 73, 257–276 (1983)

Bernanke, B., Kuttner, K.: What explains the stock market’s reaction to federal reserve policy? J. Finance 60, 1221–1257 (2005)

Bloom, N.: Fluctuations in uncertainty. J. Econ. Perspect. 28, 153–175 (2014)

Chen, S.: Do higher oil prices push the stock market into bear territory? Energy Econ. 32, 490–495 (2010)

Cifarelli, G., Paladino, G.: Oil price dynamics and speculation: a multivariate financial approach. Energy Econ. 32, 363–372 (2010)

Cunado, J., Perez de Gracia, F.: Oil price shocks and stock market returns: evidence for some European countries. Energy Econ. 42, 365–377 (2014)

Daigler, R., Hibbert, A., Pavlova, I.: Examining the return–volatility relation for foreign exchange: evidence from the Euro VIX. J. Futures Mark. 34, 74–92 (2014)

Diaz, E., Molero, J., Perez de Gracia, F.: Oil price volatility and stock returns in the G7 economies. Energy Econ. 54, 417–430 (2016)

Driesprong, G., Jacobsen, B., Maat, B.: Striking oil: another puzzle? J. Financ. Econ. 89, 307–327 (2008)

Elder, J., Serletis, A.: Oil price uncertainty. J. Money Credit Bank. 42, 1137–1159 (2010)

Elyasiani, E., Mansur, I., Odusami, B.: Oil price shocks and industry stock returns. Energy Econ. 33, 966–974 (2011)

Engle, R.: Risk and volatility: econometric models and financial practice. Am. Econ. Rev. 94, 405–420 (2004)

Estrella, A., Mishkin, F.: The yield curve as a predictor of US recessions. Curr. Issues Econ. Finance 2, 1–6 (1996)

Fama, E., French, K.: Industry costs of equity. J. Financ. Econ. 43, 153–193 (1997)

Fernández-Villaverde, J., Guerrón-Quintana, P., Rubio-Ramírez, J.F., Uribe, M.: Risk matters: the real effects of volatility shocks. Am. Econ. Rev. 101, 2530–2561 (2011)

Foroni, C., Guérin, P., Marcellino, M.: Explaining the time-varying effects of oil market shocks on US stock returns. Econ. Lett. 155, 84–88 (2017)

Gao, L., Hitzemann, S., Shaliastovich, I., Xu, L.: Oil Volatility Risk. Working Paper (2017)

Gilchrist, S., Williams, J.C.: Investment, capacity, and uncertainty: a putty–clay approach. Rev. Econ. Dyn. 8, 1–27 (2005)

Glosten, L., Jagannathan, R., Runkle, D.: On the relation between the expected value and the volatility of the nominal excess return on stocks. J. Finance 48, 1779–1801 (1993)

Griffin, J., Stulz, R.: International competition and exchange rate shocks: a cross-country industry analysis of stock returns. Rev. Financ. Stud. 14, 215–241 (2001)

Hamilton, J.: Oil and the macroeconomy since World War II. J. Polit. Econ. 91, 228–248 (1983)

Hamilton, J.: Review of “Lower oil prices and the US economy: is this time different?”. Brook. Pap. Econ. Act. 2016, 337–343 (2016)

Herrera, A., Lagalo, L., Wada, T.: Asymmetries in the response of economic activity to oil price increases and decreases. J. Int. Money Finance 50, 108–133 (2015)

Hibbert, A., Daigler, R., Dupoyet, B.: A behavioral explanation for the negative asymmetric return—volatility relation. J. Bank. Finance 32, 2254–2266 (2008)

Hondroyiannis, G., Papapetrou, E.: Macroeconomic influences on the stock market. J. Econ. Finance 25, 33–49 (2001)

Huang, R., Masulis, R., Stoll, H.: Energy shocks and financial markets. J. Futures Mark. 16, 1–27 (1996)

Jiménez-Rodríguez, R., Sánchez, M.: Oil price shocks and real GDP growth: empirical evidence for some OECD countries. Appl. Econ. 37, 201–228 (2005)

Jo, S.: The effects of oil price uncertainty on global real economic activity. J. Money Credit Bank. 46, 1113–1135 (2014)

Jones, C., Kaul, G.: Oil and the stock markets. J. Finance 51, 463–491 (1996)

Kang, W., Ratti, R.A., Vespignani, J.: The impact of oil price shocks on the US stock market: a note on the roles of US and non-US oil production. Econ. Lett. 145, 176–181 (2016)

Kilian, L., Park, C.: The impact of oil price shocks on the U.S. stock market. Int. Econ. Rev. 50, 1267–1287 (2009)

Lee, B., Yang, C., Huang, B.: Oil price movements and stock markets revisited: a case of sector stock price indexes in the G-7 countries. Energy Econ. 34, 1284–1300 (2012)

Lettau, M., Ludvigson, S.C., Wachter, J.A.: The declining equity premium: what role does macroeconomic risk play? Rev. Financ. Stud. 21, 1653–1687 (2008)

Luo, X., Qin, S.: Oil price uncertainty and Chinese stock returns: new evidence from the oil volatility index. Finance Res. Lett. 20, 29–34 (2017)

Miller, J., Ratti, R.: Crude oil and stock markets: stability, instability, and bubbles. Energy Econ. 31, 559–568 (2009)

Mohanty, S.K., Nandha, M., Turkistani, A.Q., Alaitani, M.Y.: Oil price movements and stock market returns: evidence from Gulf Cooperation Council (GCC) countries. Glob. Finance J. 22(1), 42–55 (2011)

Mollick, A., Assefa, T.: US stock returns and oil prices: the tale from daily data and the 2008–2009 financial crisis. Energy Econ. 36, 1–18 (2013)

Mork, K.: Oil and the macroeconomy when prices go up and down: an extension of Hamilton’s results. J. Polit. Econ. 97, 740–744 (1989)

Nandha, M., Faff, R.: Does oil move equity prices? A global view. Energy Econ. 30, 986–997 (2008)

Park, J., Ratti, R.: Oil price shocks and stock markets in the US and 13 European countries. Energy Econ. 30, 2587–2608 (2008)

Peng, Y., Ng, W.: Analyzing financial contagion and asymmetric market dependence with volatility indices via copulas. Ann. Finance 8, 49–74 (2012)

Phylaktis, K., Ravazzolo, F.: Stock prices and exchange rate dynamics. J. Int. Money Finance 24, 1031–1053 (2005)

Pindyck, R.: Irreversibility, uncertainty, and investment. J. Econ. Lit. 29, 1210–1248 (1991)

Robe, M., Wallen, J.: Fundamentals, derivatives market information and oil price volatility. J. Futures Mark. 36, 317–344 (2016)

Sadorsky, P.: Oil price shocks and stock market activity. Energy Econ. 21, 449–469 (1999)

Schalck, C., Chenavaz, R.: Oil commodity returns and macroeconomic factors: a time-varying approach. Res. Int. Bus. Finance 33, 290–303 (2015)

Sim, N., Zhou, H.: Oil prices, US stock return, and the dependence between their quantiles. J. Bank. Finance 55, 1–8 (2015)

Thorbecke, W.: On stock market returns and monetary policy. J. Finance 52, 635–654 (1997)

Tsai, C.: The high-frequency asymmetric response of stock returns to monetary policy for high oil price events. Energy Econ. 36, 166–176 (2013)

Tsai, C.: How do US stock returns respond differently to oil price shocks pre-crisis, within the financial crisis, and post-crisis? Energy Econ. 50, 47–62 (2015)

Wang, Y., Wu, C., Yang, L.: Oil price shocks and stock market activities: evidence from oil-importing and oil-exporting countries. J. Comp. Econ. 41, 1220–1239 (2013)

Wei, C.: Energy, the stock market, and the putty-clay investment model. Am. Econ. Rev. 93, 311–323 (2003)

Acknowledgements

The authors thank the two anonymous referees for their constructive and helpful comments.

Author information

Authors and Affiliations

Corresponding author

Appendix A: Abbreviations follow the industry nomenclature of Kenneth French’s data library

Appendix A: Abbreviations follow the industry nomenclature of Kenneth French’s data library

Abbreviations | Industry |

|---|---|

NoDur | Consumer non-durables—food, tobacco, textiles, apparel, leather, and toys |

Durbl | Durables—cars, TV’s, furniture, and household appliances |

Manuf | Manufacturing—machinery, trucks, planes, chemicals, office furniture, paper, and commercial printing |

Enrgy | Oil, gas, and coal extraction and products |

Hitec | Business equipment—computers, software, and electronic equipment |

TelCm | Telephone and television transmission |

Shops | Wholesale, retail, and some services (laundries, repair shops) |

Hlth | Healthcare, medical equipment, and drugs |

Utils | Utilities |

Other | Mines, construction, construction materials, transportation, hotels, business services, entertainment, and finance |

Rights and permissions

About this article

Cite this article

Dupoyet, B.V., Shank, C.A. Oil prices implied volatility or direction: Which matters more to financial markets?. Financ Mark Portf Manag 32, 275–295 (2018). https://doi.org/10.1007/s11408-018-0314-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11408-018-0314-7