Abstract

In this paper, we investigate the relationship between oil price volatility and US real stock returns using a multivariate framework in which a structural vector autoregression (SVAR) is modified to accommodate the effects of stochastic volatility (SV) in oil prices on stock returns. Our measure of oil price volatility is the conditional variance of the oil price change forecast error. We isolate the effects of volatility in the change in the price of oil on real stock returns and calculate the dynamic responses of stock returns to a shock to oil price volatility. We find evidence that increased oil price volatility has a negative effect on US real stock returns. We support our evidence with the transmission mechanism that details on how the effects of oil price volatility shocks might be channeled into the stock market. Our results remain unchanged in the context of the disaggregate returns for a number of industry portfolios, suggesting that investors should consider oil price volatility in addition to other potential factors that affect stock returns.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Although oil price shocks have both the first and second moment components, this paper concentrates on the independent effects of the second moment shock on stock returns due to large and unanticipated fluctuations in the price of oil over the past years. Existing studies have explored the relationship between the price of crude oil and stock returns [see Chen et al. (1986), Jones and Kaul (1996), Wei (2003), Kilian and Park (2009), and Alsalman and Herrera (2015)]. Several papers have also investigated the relationship between oil price volatility and real economic activities. Elder and Serletis (2010), for example, investigated the effects of oil price uncertainty on output growth in the USA, over the modern OPEC period, and found that uncertainty about the price of oil has had a negative and significant effect on US real economic activities.

On the other hand, relatively few studies have examined the direct effects of oil price volatility on stock market activity. Sadorsky (1999) investigated the responses of stock returns to oil price volatility shocks, by first modeling volatility with a univariate GARCH (1,1) model and then introducing it into various forms of vector autoregression (VAR) systems. In a similar paper, Diaz et al. (2016) examined the relationship between oil price volatility and stock returns in the G7 economies using a univariate GARCH (1,1) model to generate oil price volatility and include it in a reduced form VAR framework with interest rates, industrial production, and stock returns. In another paper, Alsalman (2016) used a structural bivariate GARCH-in-mean model that was introduced in Elder and Serletis (2010) to investigate the effects of oil price volatility on the US stock returns. The paper finds an insignificant effect of oil price volatility on the US stock market.

In this paper, we move the empirical literature forward by specifying an empirical model in the context of a multivariate framework in which a structural vector autoregression (SVAR) is modified to accommodate the effects of stochastic volatility (SV) in oil prices on US stock returns, as detailed in Jo (2014). Similar to other studies in this area, we define oil price volatility as the time-varying variance of the oil price change forecast error. We estimate this volatility using a stochastic volatility model. It generates volatility independently of any changes to the levels of the variables in the system and, therefore, allows us to identify the dynamic effects of exogenous volatility shocks separately from shocks to the levels. We isolate the stochastic volatility from variance equations and use a time-varying Kalman filter to add it to the realized volatility. The combined volatility is then included in the mean equation of real stock returns to investigate the relationship between oil price volatility and stock returns.

We estimate the parameters of our SVAR-SV model using Bayesian econometric techniques, which allow us to jointly estimate the mean and variance equations to address the issue of generated regressor problem as mentioned later. In doing so, we impose recursive identification restrictions, consistent with structural interpretations, on the contemporaneous parameters of each equation in the model. The parameter estimates are then used to conduct an impulse response analysis that identifies the dynamic effects of exogenous oil price volatility shocks on stock returns, independently of any effects of oil price shocks.

Our empirical results suggest that the SVAR-SV model embodies a reasonable description of the monthly data used in this paper, over the period from 1973:01 to 2015:08. The estimates on the effects of oil price volatility present evidence that increased volatility about the change in the real price of oil is associated with a lower real stock returns. This is further supported by our impulse response analysis, as stock returns show a strong negative response to a shock to oil price volatility.

We next study our empirical results in the context of how oil price volatility shocks are transmitted into the stock market. The literature on investment under uncertainty and real options [see, for example, Bernanke (1983) and Pindyck (1991)] suggests that high oil price volatility creates cyclical fluctuations in investment by lowering the firms’ incentive for current investment. This affects cashflows generated by a firm and the discount rate that is used to calculate stock prices and, hence, stock returns. In addition, since stock prices are the sum of discounted cashflows including dividend, oil price volatility can affect stock prices by decreasing the overall profit that a firm generally uses to pay dividend. This happens, because the firm needs to pay some extra costs in order to avoid risk associated with oil price volatility. We re-estimate our SVAR-SV model by replacing the stock returns with aggregate and disaggregate real investment as well as real dividend yield. We find that oil price volatility shocks, in general, decrease investment expenditure and the dividend for stockholders. This supports our main findings of the paper.

We further extend our empirical analysis by examining the effects of oil price volatility shocks on the returns of industry portfolios that include a number of energy-intensive and non-intensive sectors. We find evidence that oil price volatility shocks have significant negative impact on the returns of almost every portfolio. This again supports our main finding that a rapid increase in oil price volatility has had a negative effect on stock returns. However, we find that the magnitude of impact in case of disaggregate returns differs across industries. It is overall large compared to the magnitude that we find in case of aggregate returns and even larger for some of the energy-intensive sectors. Thus, our analysis of disaggregate returns suggests that an unexpected increase in oil price volatility may have an important implication for investors’ portfolio choice.

Our paper differs from the recent literature on the effects of oil price shock and its uncertainty. In particular, we specify a SVAR-SV model in our paper, whereas Elder and Serletis (2010) use a bivariate SVAR model, which includes GARCH-in-mean errors. We prefer the SVAR-SV framework, as it allows us to capture the effects of oil price volatility shocks separately from the oil price (level) shock. Thus, our paper is different from Alsalman (2016) that ignores the independent effects of the oil price volatility shock on stock returns. On the other hand, although we are applying a similar econometric approach, our underlying macroeconomic model, as explained in Sect. 2, is different from the one used in Jo (2014). This paper is also different from Sadorsky (1999) and Diaz et al. (2016) in terms of parameter estimation as well as the origin and the process of volatility. In particular, the empirical estimates of these two papers have some methodological flaws, as they apply the two-step estimation method and, therefore, are subject to the generated regressor problem, described by Pagan (1984). This leads to inefficient, inconsistent, and/or biased estimates of the parameters. Moreover, they do not detail the transmission mechanism on how the effects of oil price volatility might be transmitted into the stock market. Finally, we focus on the relationship between oil price uncertainty and stock market, which has been omitted in Kilian and Park (2009) and Alsalman and Herrera (2015).

We mention a caveat in interpreting our empirical results. Our macroeconomic model does not include any variables representing separate effects of oil demand and supply shocks, although there is evidence in the literature on the independent economics effects of these shocks. Kilian (2009), for example, applied a structural VAR to decompose the oil price shocks into different components due to unexpected changes in oil demand and oil supply and reported differential effects of these shocks on macroeconomic aggregates. Baumeister and Hamilton (2019), on the other hand, used a Bayesian framework to identify these shocks and found that oil demand shock has insignificant effects on economic activities. We, however, are unable to extend our model to include any more variables due to computational difficulties in the estimation process. Moreover, the objective of this paper is to analyze the effects of oil price uncertainty shocks, which in our model are not driven by movements in the price of oil due to unexpected changes in oil demand and oil supply. We consider that oil price uncertainty is the result of the market participants’ speculation about future demand and supply for oil regardless of current economic conditions.

In the following section, we provide a brief description of the multivariate SVAR-SV Model and address issues associated with specification of the model. Section 3 presents the data and discusses the estimation of the SVAR-SV model. Section 4 analyzes the empirical results to investigate whether oil price volatility has an impact on US stock returns. Section 5 explains the transmission mechanism of oil price volatility shocks to the stock market. In Sect. 6, we show that our results are valid in case of disaggregate returns. The final section concludes.

2 The multivariate SVAR-SV model

2.1 Econometric specification

We start with a pth order VAR, describing the dynamic interrelations among a set of variables collected in an \(n \times 1\) vector, y \(_{t}\), as follows

where C is an \(n \times 1\) parameter vector, \({\varvec{\Gamma }} (j)\) (\(j =1 ,\ldots ,p\)) are \(n \times n\) parameter matrices, and \({{\textit{\textbf{u}}}}_{t} \sim N \left( {{\textit{\textbf{0}}}} ,{\varvec{\Omega }}_{t}\right) \). The variance–covariance matrix, \({\varvec{\Omega }}_{t}\), and the disturbance term, \({{\textit{\textbf{u}}}}_{t}{,}\) are defined as

where \({{\textit{\textbf{e}}}}_{t}\) is the structural error term that follows a conditional multivariate standard normal distribution, i.e., \({{\textit{\textbf{e}}}}_{t} \sim N \left( \mathbf{0 }, {{\textit{\textbf{I}}}} _{n}\right) {,}\) \({{\textit{\textbf{B}}}}_{t}\) is a lower triangular matrix,

and \({{\textit{\textbf{H}}}}_{t}\) is a diagonal matrix,

The parameters in \({{\textit{\textbf{B}}}}_{t}\) matrix show the contemporaneous correlations among variables in y \(_{t}\). In order to deal with the dynamics of these parameters, we follow Jo (2014) and assume that they evolve as a random walk process as follows

where \({{\textit{\textbf{b}}}}_{t}\) is a vector, stacked by rows, of the nonzero and non-one elements of the matrix \({{\textit{\textbf{B}}}}_{t}\) and \({{\textit{\textbf{v}}}}_{t} \sim N \left( \mathbf{0} , {{\textit{\textbf{S}}}}\right) {.}\) Here, S is a block diagonal matrix of the form

where blocks of S are independent with

In addition, we follow Jo (2014) to model volatilities, measured by conditional variances in \({{\textit{\textbf{H}}}}_{t}\) matrix, using a multivariate volatility model that is specified as a first-order autoregressive process as follows

where \({{\textit{\textbf{n}}}}_{t} \sim N \left( {{\textit{\textbf{0}}}} , {{\textit{\textbf{W}}}}\right) \text {,}\) \({\varvec{\mu }}\) is an \(n \times 1\) vector, \({\varvec{\rho }}\) is an \(n \times n\) diagonal matrix with autoregressive coefficients on the diagonal, and “diag” denotes a diagonal operator. We assume that W is a diagonal matrix that makes the error terms in Eq. (7) independent of each other. Since these terms act as free driving forces in the volatility process, the equation in (7) belongs to the class of stochastic volatility models. They generate volatility independently of any changes to the levels of the variables in the system and, therefore, allow us to identify the dynamic effects of exogenous volatility shocks separately from shocks to the levels. Thus, the stochastic volatility approach, in general, offers a more flexible way to model volatility than the GARCH-type models, as volatilities in the GARCH process are driven by changes in levels as well as past volatilities.

Finally, we offer structural interpretations to the innovations, \({{\textit{\textbf{e}}}}_{t}\text {,}\) \({{\textit{\textbf{v}}}}_{t}\text {,}\) and \({{\textit{\textbf{n}}}}_{t}\text {,}\) by assuming that they are uncorrelated with each other and jointly normally distributed with mean zero and the following variance–covariance matrix,

To examine the effects of volatility on the conditional mean of the variables of interest, we generalize Eq. (1) by making the conditional mean of y \(_{t}\) a function of the conditional variance, \({{{\textit{\textbf{h}}}}}_{t}\), as follows

where \({\varvec{\Lambda }}\) is an \(n \times n\) parameter matrix that shows the effects of volatility on conditional means.

2.2 Macroeconomic model

To guide the relationship between oil price volatility and stock market activity, we draw on extensive VAR literature that attempts to identify oil price shocks using a different set of macroeconomic variables. Kilian (2009), for example, decomposes the underlying demand and supply shocks in the global crude oil market, using a recursive structural VAR that includes global crude oil production, index of real economic activity, and the real price of oil. In a recent paper, Baumeister and Hamilton (2019) revisited the structural model in Kilian (2009) using a Bayesian framework and find that although oil supply shocks have lagged significant effects on economic activity, the effect of oil demand shocks on economic activity is insignificant.

On the other hand, Elder and Serletis (2010), Alsalman and Herrera (2015), and Kilian and Vigfusson (2001, (2017) use a simple bivariate framework in the price of crude oil and a macro aggregate to investigate its response to oil price shocks. In our modeling framework, we do not differentiate between oil demand and supply shocks, since it requires a higher-dimensional VAR that is computationally more intensive to estimate based on our econometric methodology. Hence, our macroeconomic model is a simple trivariate framework that includes the changes in the real price of oil, \( \Delta \log R O L\), real stock returns, \( \Delta \log R S P\), and the fed funds rate, \(F F R\text {.}\) We include an indicator of monetary policy, the fed funds rate, FFR, here to isolate the effects of monetary policy changes from oil price shocks on stock returns, since the monetary authority may follow a feedback rule by responding to oil price shocks. In fact, there is a large literature that investigates whether the economic effects of oil price changes depend on how monetary policy responds. See, for example, Bernanke et al. (1997), Herrera and Pesavento (2009), and Kilian and Lewis (2011). Then, following Eq. (9), our empirical model is

In order to identify our macroeconomic model in (10), we allow the following recursive structure on the contemporaneous relationship between the underlying structural and the reduced form disturbances

We follow the standard approach in the literature that the fluctuations in the key macroeconomic variables occur due to unanticipated shocks to the real price of oil, ROL. Similar to Kilian and Vega (2011), we order the price of oil first in (11), by assuming that shocks to the price of oil are predetermined with respect to other variables in the system. That is, the identifying restrictions in the equations for the federal funds rate and the stock market take the real price of oil as being contemporaneously exogenous to domestic variables. We order US stock returns after the federal funds rate in (11) to assume that the stock market instantaneously responds to monetary policy changes, but monetary policy responds to any unpredictable movements in stock returns with a lag. This last assumption seems trivial in the context of the relationship between monetary policy and the stock market, regarding how they respond to each other (immediate or lagged). In this regard, we interchanged the order of these two variables in (11); however, our results remain qualitatively and quantitatively same.

We measure oil price volatility as the conditional variance of the forecast error of \( \Delta \log R O L\), denoted \(h_{11 ,t}\). It is interpreted in a statistical sense—that is, as the variance of the one-month-ahead conditional forecast of \( \Delta \log R O L\), with the conditional forecast being formed from an information set that includes information from the financial markets and the Fed policy. We include oil price volatility in the \( \Delta \log R S P\) equation to investigate its impact on stock market returns. However, in addition to oil price volatility, the multivariate SVAR SV model allows us to include volatility in the interest rate and stock returns in the \( \Delta \log R S P\) equation, and therefore, we investigate their independent effects on stock returns as well. The early theoretical literature regarding macroeconomic effects of volatile interest rates suggests that volatility in these variables, in addition to oil price volatility, can affect the stock market. For example, Mascaro and Meltzer (1983) and Evans (1984) argue that interest rate volatility raises the riskiness of bonds. This increase in the risk of holding bonds increases the demand for money and interest rates and, therefore, will have an impact on the discount rate used in calculating stock returns. On the other hand, there is a large number of theoretical and empirical papers that investigate the relationship between mean and volatility of stock returns. Some of these papers identify a proportional relationship, while some others regard this relationship as less precise. In our empirical model, the interest rate and stock returns volatility is calculated in the same way as for the volatility of the price of oil—the conditional variances of the forecast error of FFR and \( \Delta \log R S P\), denoted \(h_{22 ,t}\) and \(h_{33 ,t}\), respectively. If \(\Gamma _{3 i}\) (\(i =1 ,2 ,3\)) are the coefficients on the lagged endogenous variables in the \( \Delta \log R S P\) equation and \(\Lambda _{3 i}\) (\(i =1 ,2 ,3\)) are the coefficients representing the effects on stock returns of volatility in oil price changes, interest rates, and stock returns, then after allowing for these effects, the \( \Delta \log R S P\) equation can be written as,

3 Data and estimation

We use (aggregate) monthly data for the USA over the period from 1973:01 to 2015:08. This sample period is primarily chosen due to publicly available data for our macroeconomic aggregates. We conducted a robustness check regarding our choice of the sample period, by estimating the model using data from 1973:01 to 2008:06, as the federal funds rate hits the zero lower bound at the end of 2008. We also re-estimated our model after replacing federal funds rate with the shadow interest rate based on the estimates of Wu and Xia (2016). Our empirical results, however, remain the same.

We collected data on oil prices, stock returns, and interest rates from the Federal Reserve Economic Database (FRED) and compute real stock returns from the return on the S & P 500 index less the inflation rate. In the same way, we obtain the real price of oil using the spot price on West Texas Intermediate (WTI) crude oil as the nominal price of oil. The inflation rate is calculated as the logarithmic first difference on the consumer price index (CPI), which is available in the FRED database as well. In this regard, it is to be noted here that the use of the refiner’s acquisition cost of crude oil as the nominal price of oil does not make any difference in our empirical results.

Since most of the papers have used “difference stationary” series in modeling volatility for macroeconomic variables, we estimate the multivariate SVAR-SV model using logarithmic first differences of the variables. In fact, the augmented Dickey–Fuller unit root tests and KPSS level and trend stationary tests (available upon request) suggest that, for logged level of each of the ROL and RSP variables, the null hypothesis of a unit root cannot be rejected and the null hypotheses of level and trend stationarity can be rejected. We do not difference the interest rates, \(F F R\text {,}\) consistent with the monetary VAR literature.

The multivariate SVAR-SV model in (10) is estimated using Bayesian methods described in Jo (2014). Bayesian methods here are a better choice over classical likelihood methods, since high dimensionality and nonlinearity of our model make it difficult to reach the global maximum in the regions of the parameter space, when maximizing the likelihood function. As explained in Jo (2014), Bayesian methods allow us to divide the whole estimation process into simple and smaller ones and thus, deal with the problem of high dimensionality and nonlinearity.

Our estimation strategy is based on Gibbs sampling procedures, a variant of Markov Chain Monte Carlo (MCMC) methods, which numerically evaluates the conditional posterior distributions of the parameters of interest. They include observable states, \({\varvec{\Gamma }}\) and \({\varvec{\Lambda }}\text {,}\) unobservable states, \({{\textit{\textbf{B}}}}_{t}\) and \({{\textit{\textbf{H}}}}_{t}\text {,}\) and the hyperparameters of the variance–covariance matrix, V. The details of the sampling procedures are provided in Jo (2014). We make necessary adjustments to those procedures in order to investigate the effects of volatility on stock returns. In doing so, we follow the augmented model proposed in Jo (2014) to incorporate realized volatility and use the time-varying Kalman filter to estimate the model. As argued in Jo (2014), there is considerable efficiency gain in estimating oil price volatility if the information content of realized volatility is added to the stochastic volatility.

In estimating the model in (10), we decided to add a 6-month length of autoregressive lags (\(p =6)\). We understand that this selection of lag order is inconsistent with other papers in this area including Kilian (2009), as they stress the fact that the primary effect of any change in the price of crude oil on macroeconomic aggregates occurs at or before 1 year. However, we could not choose a full-year length lag in (10), due to computational difficulties in implementing the Gibbs sampling algorithm. We use first forty observations as training sample in order to calibrate the priors for estimating the parameters.

4 Empirical evidence

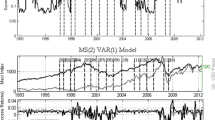

In Fig. 1, we plot the conditional standard deviations of \( \Delta \log R O L\), FFR, and \( \Delta \log R S P\), with the shaded areas indicating years of major declines in the S & P 500 index. As can be found, the price of oil has been occasionally highly volatile. However, the largest episodes of oil price volatility took place in 1986, 1990, and 2009. Two of these volatility jumps happen around two major stock market crashes. In fact, the relatively higher volatility jump in the oil price change in 2009 coincides with the largest stock market crash in the sample. We also find that the federal funds rate, FFR, was highly volatile during the Volcker disinflation period (October 1979-October 1982), but significantly dropped over the Volcker–Greenspan period. On the other hand, compared to oil price and interest rate volatility, stock returns have been consistently volatile throughout the whole sample period. In general, as Fig. 1 indicates, volatilities in interest rates and stock returns do not show any systematic relations with major stock market crashes. Finally, in order to check the specification of our empirical model, in Fig. 2, we plot volatility in \( \Delta \log R O L\) as well as Chicago Board Options Exchange (CBOE) Volatility Index (on the secondary y-axis). As shown in Fig. 2, oil price volatility appears to follow several big spikes in other broad volatility measure such as VIX, indicating a reasonable specification.

4.1 Parameter estimates on the effects of oil price volatility

In Eq. (12), we included contemporaneous oil price, interest rates, and stock returns volatility, as measured by \(\log h_{11 ,t}\text {,}\) \(\log \text {} h_{22 ,t}\text {,}\) and \(\log h_{33 ,t}\text {,}\) to investigate their effects on stock returns. Hence, in our paper, the primary coefficients of interests that measure these volatility effects are \(\Lambda _{3 1} ,\text {}\) \(\Lambda _{3 2}\text {,}\) and \(\Lambda _{3 3}\text {.}\) Figure 3 shows the posterior distributions of these coefficients, and Table 1 reports their summary statistics. As can be found in Table 1, the mean of the distribution of the coefficient, \(\Lambda _{3 1}\), that estimates the effect of oil price volatility on stock returns, is -\(\,3.045\), with a standard deviation of 0.433. In addition, panel A of Fig. 3 shows that the posterior distribution of \(\Lambda _{3 1}\) is fully concentrated around negative draws, which indicates \(100 \%\) probability of drawing a negative \(\Lambda _{3 1}\). This high probability strongly suggests that increasing oil price volatility has negative effects on stock returns. Our finding is in contrast to Alsalman (2016) that uses a different empirical method reports a statistically insignificant effect of oil price volatility on US stock returns.

On the other hand, the posterior distributions and the summary statistics of the coefficient for interest rate volatility, \(\Lambda _{3 2}\text {,}\) and the coefficient for stock returns volatility, \(\Lambda _{3 3}\text {,}\) show some limited evidence on the negative effects of these volatilities on stock returns. For example, in panels B and C of Fig. 3, we find that although \(\Lambda _{3 2}\) and \(\Lambda _{3 3}\) draws have on average negative signs, as the mean of the distribution for \(\Lambda _{3 2}\) is − 0.116 and for \(\Lambda _{3 3}\) is − 0.079, these distributions fairly include both positive and negative draws, suggesting that, compared to \(\Lambda _{3 1}\text {,}\) there is a much lower probability of drawing a negative \(\Lambda _{3 2}\) and \(\Lambda _{3 3}\). In fact, we find in Table 1 that only 62.8% of \(\Lambda _{3 2}\) draws and 65.4% of \(\Lambda _{3 3}\) draws are negative.

The negative effect of interest rate volatility on stock returns should not be too surprising, as excessive variation in interest rates creates riskiness in bond holding, increases the demand for money and interest rates, and hence reduces investment and output. On the other hand, there is mixed evidence on the relation between stock returns and their volatility. French et al. (1987), for example, find that expected market premium is positively related to stock returns volatility, using ARIMA and GARCH-in-mean models. Baillie and DeGennaro (1990), however, apply variants of the GARCH-in-mean model to daily and monthly returns data and report a weak relationship between a portfolio’s returns and its volatility.

4.2 Evidence based on impulse response functions

In Fig. 4, we investigate the relationship between the price of oil and oil price volatility, by plotting \( \Delta \log R O L\) and the conditional standard deviations of \( \Delta \log R O L\). A careful inspection of these two plots reveals that, in 1976:11–1979:01, although the price of oil mostly remained relatively stable, we find some fluctuations in oil price volatility. On the contrary, despite some sharp rises or drops in the price of oil during 1982:09–1982:12, oil price volatility does not show any significant changes. Finally, in several episodes throughout our whole sample period, the price of oil and oil price volatility sometimes move in the same direction.

Based on the above observation, we use our empirical model to identify oil price volatility shocks, which capture changes to oil price volatility but overlooks any changes to \( \Delta \log R O L\). Our multivariate SVAR-SV Model is able to produce this shock, as it generates volatility independently of any changes to the levels of the variables in the system. Therefore, in order to investigate how the model captures the dynamic effects on stock returns due to shocks to oil price volatility, ignoring any shocks to oil prices, we increase the logged oil price volatility by one unit. This is equivalent to an increase in oil price volatility by 100%, which is comparable to what we found before in panel (A) of Fig. 1, since, in multiple episodes oil price volatility increases by an equivalent of, or more than 100%. Figure 5 represents the responses of stock returns to a shock to oil price volatility. They are calculated over a horizon of 24 months and include 90% and 95% posterior credible set. As shown in Fig. 5, stock returns decrease on impact and gradually return to the original position within about 8 months. In particular, in response to an oil price volatility shock, stock returns decline by 3% in the first month. This is significant at the 95% posterior credible set and, thus, supports our earlier findings that increases in oil price volatility would result in a drop in stock returns.

5 The transmission of oil price volatility shocks to stock returns

Oil price volatility shocks can affect stock returns in two ways: firm’s investment decision and its dividend payment. Following Bernanke (1983), the literature on irreversible investment predicts that uncertainty about energy prices can produce fluctuations in firms’ investment, which may adversely affect their cash flows. In addition, oil price volatility might reduce firms’ opportunity to generate enough profits which can adversely affect the dividend payments to stockholders.

5.1 Investment

Bernanke (1983) argues that, for irreversible investment projects, increased volatility in energy prices raises the option value attached with waiting to invest and, therefore, the firm’s incentive to invest in the current period declines. Oil price volatility thus produces cyclical fluctuations in investment, which will have an impact on the financial market, by affecting both the expected cash flows accruing to stockholders and discount rates and, thus, stock returns. In this section, we check this transmission mechanism by investigating the effects of oil price uncertainty shocks on investment. In doing so, we estimate the model (10) after replacing stock returns with data on the aggregate and various disaggregate real private fixed investment. The results are reported in Table 2.Footnote 1 Moreover, in order to make our empirical results in this section consistent with our main results in Sect. 4, we further estimate the model (10), using quarterly data on the changes in the real price of oil, \( \Delta \log R O L\), the fed funds rate, FFR, and real stock returns, \( \Delta \log R S P\), and conduct an impulse response analysis on the effects of oil price volatility shocks. The empirical results using quarterly data are similar to those reported in Sect. 4 in terms of the relation between oil price volatility and stock returns. These empirical results are available upon request.

As can be found in Table 2, oil price volatility has a strong negative relation with real gross domestic private investment. It also has a similar negative relation with investment in some specific sectors, such as manufacturing, mining exploration, shafts, and wells, and power and communication. The posterior distributions of \({\varvec{\Lambda }}_{3 1}\) in all of these cases indicates a high probability of \({\varvec{\Lambda }}_{3 1}\) being negative and the means are centering around a number that is higher than one. However, in some other sectors, for example, equipment and software and commercial and health care, Table 2 suggests a negative but somewhat weaker relation between oil price volatility and investment, as in these sectors, we find a lower probability that \({\varvec{\Lambda }}_{3 1}\) is negative.

We next investigate the dynamic effects of oil price volatility shocks on real investment in Fig. 6, by raising volatility in the changes in the price of oil, \( \Delta \log R O L\text {,}\) by 100%. As shown in Fig. 6, an unexpected increase in the volatility of oil price changes significantly reduces the real gross domestic private investment by more than 3% in the first quarter. In addition, oil price volatility shocks negatively affect the real private fixed investment in those sectors that show a strong negative relation between oil price volatility and investment in Table 2. The largest impact, however, happens in the manufacturing sector, where investment decreases by almost 5% in 1 month due to shocks to oil price volatility.

5.2 Dividend

Oil price volatility can also affect stock returns though dividends, since, in theory, stock prices can be expressed as the discounted sum of all the future cash flows. In particular, it increases the firms’ adjustment and transaction costs and reduces their profits, which lowers firms’ incentive to offer dividends to their stockholders. For example, if oil is taken as an important input of production, the producers need to adjust their production process in advance, based on the expected price of crude oil. This imposes an extra cost on them, as it is not always possible to perfectly hedge against uncertainty about oil prices. Moreover, if producers are risk averse, they will be willing to incur an additional transaction cost to avoid the risk associated with oil price volatility, since hedging against this risk is costly or sometimes is impossible.

We use our multivariate SVAR-SV model in (10) to investigate the effects of oil price volatility on dividends, using monthly data on the real price of oil, the fed funds rate, and the real dividend yield. We follow Torous et al. (2004) to construct the real dividend yield from the monthly returns on the value-weighted market portfolio with and without dividends. These returns data are available on the data library that is published and maintained by Kenneth R. French.Footnote 2 Table 3 shows the mean of the posterior draws for the coefficients that represent the effects of volatility in the prices of oil, interest rates, and stock returns on dividend yield. The high probability that \(\Lambda _{3 1}\) is negative clearly suggests that increases in oil price volatility have a dampening impact on dividend yield. The parameter estimates on \(\Lambda _{3 2}\) and \(\Lambda _{3 3}\), however, do not indicate any negative relationship between dividend yield and volatility in interest rates and stock returns. We show in Fig. 7 the impact on dividend yield of doubling the oil price volatility, as we did before, and find that the oil price volatility shock has negative effects on the dividend yield.

6 Effects of oil price volatility on portfolio returns

Our empirical results in Sect. 4 suggest that oil price volatility has tended to cause aggregate stock returns to decline. In this section, we check the robustness of our main results by applying the SVAR-SV model to disaggregate stock returns. In this regard, we re-estimate the SVAR-SV model in (10), by replacing \( \Delta \log R S P\) with monthly data on the returns of 49 major industry portfolios. These returns data are available in Kenneth French’s data library, as mentioned before. The portfolios are constructed by assigning Compustat four-digit SIC codes, or CRSP SIC codes if Compustat codes are not available, to each of the stocks listed in NYSE, AMEX, and NASDAQ. They include a range of energy-intensive and non-intensive sectors such as agriculture, mining, construction, manufacturing, transportation and public utilities, wholesale and retail trade, finance, insurance and real estate, and services. The complete list of the four-digit SIC industries is available in French’s website. We calculate the real portfolio returns by subtracting the inflation rate from nominal returns. The sample period spans from 1973:01 to 2015:08.

Table 4 reports the estimates of the parameters that show the independent effects of oil, interest rate, and stock market volatility on the returns of different industry portfolios. As it is shown, in contrast to Alsalman (2016), oil price volatility has strong negative effects on industry returns, since, in almost all cases the coefficient on oil price uncertainty, \(\Lambda _{3 1}\text {,}\) is large in magnitude and, in particular, even larger for energy-intensive sectors, such as mining, coal, and steel. Moreover, the posterior distributions of \(\Lambda _{3 1}\) (not reported in this paper to conserve space) indicate that the probability of \(\Lambda _{3 1}\) being negative is one. The only anomalous finding, however, exists in the precious metals industry, where oil price volatility appears to have a positive effect on stock returns. This may reflect the investors’ choice in favor of gold over crude oil in allocating their investments for different commodities, when there is a considerable uncertainty about the price of oil. On the other hand, interest rate volatility and stock market volatility, on average, show a weak but mostly negative relation with the portfolio returns, which is similar to what we found before.

We next calculate the responses of real returns, for each of the 49 industries, to a 100% percent increase in oil price uncertainty, and show them in Fig. 8, with 90% and 95% posterior credible set. They are calculated over a horizon of 24 months and are not very persistent, since the mean responses in most cases return to zero within the first quarter. In response to an oil price volatility shock, we find that stock returns decrease in all industries except precious metal. Moreover, the initial responses are highly statistically significant, which supports the earlier findings in this paper that increases in oil price volatility have a dampening impact on stock market. However, we find that the responses of disaggregate returns vary across industries, and the magnitude of decreases at the disaggregate level is overall higher than the magnitude that we observed before for the response of aggregate returns. These larger varying negative effects of oil price volatility on industry returns, due to an unexpected increase in oil price volatility, may have an important implication on investors’ portfolio choices.

7 Conclusion

Recent empirical research on the relationship between energy prices uncertainty and the financial market used an empirical approach that has some serious shortcomings on the estimates of the parameters and, thus, cast doubt on the validity of their empirical results. In this paper, we use the recent advances in financial econometrics to explore this relationship by modifying a structural vector autoregression (SVAR) in the changes in the price of oil, interest rate, and stock returns to accommodate the effects of stochastic volatility (SV) in oil prices. In doing so, we measure oil price volatility, which evolves independently of any changes to oil price shocks, as the conditional variance of the oil price change forecast error. After isolating the effects of volatility in the change in the price of oil on US stock returns, we calculate impulse response functions to trace the effects of independent oil price volatility shocks on the conditional means of stock returns. Our empirical results suggest that the increased volatility about the change in the real price of oil is associated with a lower real stock returns.

We re-estimate our SVAR-SV model after replacing stock returns with aggregate and disaggregate real investment and dividend yield. This helps us to investigate our main empirical results in the context of how oil price volatility shocks are transmitted into the stock market, as shocks to oil price volatility decrease a firm’s current investment and overall profit, thereby affecting cash flows generated by the firm and dividend for its stockholders. We find evidence in favor of our main findings that oil price volatility shocks have negative effects on investment and dividend yield.

Finally, our analysis was extended to include the effects of oil price volatility shocks on disaggregate returns that include a number of energy-intensive and non-intensive industries. The parameter estimates and the associated impulse response analysis suggest that shocks to oil price volatility have negative effects on the returns of industry portfolios, and these effects are considerably larger in magnitude for energy-intensive sectors. Thus, our disaggregate returns analysis support the main findings in this paper that shocks to oil price volatility decrease US stock returns, suggesting that oil price volatility, in addition to other potential factors, should be considered as an important determinant for stock returns.

Notes

In this context, we mention that since investment data (collected from the FRED) are available only on a quarterly basis, starting mostly from 1958 to 2015, our estimation of the model (10) considers only two lags and excludes the effects of returns volatility on stock market. This is required in order to effectively deal with the computational issues, such as estimating the model in a large parameter space as well as the problem of degrees of freedom.

References

Alsalman Z (2016) Oil price uncertianty and the U.S. stock market analysis based on a GARCH in mean VAR model. Energy Econ 59:251–260

Alsalman Z, Herrera AM (2015) Oil price shocks and the U.S. stock market: Do sign and size matter? Energy J 36:171–188

Baillie RT, DeGennaro RP (1990) Stock returns and volatility. J Fin Quant Anal 25:203–214

Baumeister C, Hamilton JD (2019) Structural interpretation of vector autoregressions with incomplete identification: revisiting the role of oil supply and demand shocks. Am Econ Rev 109:1873–1910

Bernanke BS (1983) Irreversibility, uncertainty, and cyclical investment. Q J Econ 98:85–106

Bernanke BS, Gertler M, Watson M (1997) Systematic monetary policy and the effects of oil price shocks. Brook Pap Econ Act 28:91–157

Chen N-F, Roll R, Ross SA (1986) Economic forces and the stock market. J Bus 59:383–403

Diaz EM, Molero JC, Garcia FP (2016) Oil price volatility and stock returns in the G7 economies. Energy Econ 54:417–430

Elder J, Serletis A (2010) Oil price uncertainty. J Money Credit Bank 42:1138–1159

Evans P (1984) The effects on output of money growth and interest rate volatility in the United States. J Polit Econ 92:204–222

French KR, Schwert GW, Stambaugh RF (1987) Expected stock returns and volatility. J Fin Econ 19:3–29

Herrera AM, Pesavento E (2009) Oil price shocks, systematic monetary policy and the great moderation. Macroecon Dyn 13:107–137

Jo S (2014) The effects of oil price uncertainty on global real economic activity. J Money Credit Bank 46:1113–1135

Jones C, Kaul G (1996) Oil and the stock markets. J Finance 51:463–491

Kilian L (2009) Not all oil price shocks are alike: disentangling demand and supply shocks in the crude oil market. Am Econ Rev 19:1053–1069

Kilian L, Lewis L (2011) Does the fed respond to oil price shocks? Econ J 121:1047–1072

Kilian L, Park C (2009) The impact of oil price shocks on the U.S. stock market. Int Econ Rev 50:1267–1287

Kilian L, Vega C (2011) Do energy prices respond to U.S. macroeconomic news? A test of the hypothesis of predetermined energy prices. Rev Econ Stat 93:660–671

Kilian L, Vigfusson RJ (2001) Are the responses of the U.S. economy asymmetric in the energy price increases and decreases? Quant Econ 2:419–453

Kilian L, Vigfusson RJ (2017) The role of oil price shocks in causing U.S. recessions. J Money Credit Bank 49:1747–1776

Mascaro A, Meltzer AH (1983) Long and short-term interest rates in a risky world. J Monet Econ 12:485–518

Pagan A (1984) Econometric issues in the analysis of regressions with generated regressors. Int Econ Rev 25:221–247

Pindyck R (1991) Irreversibility, uncertainty, and investment. J Econ Lit 29:1110–1148

Sadorsky P (1999) Oil price shocks and stock market activity. Energy Econ 21:449–469

Torous W, Valkanov R, Yan S (2004) On predicting stock returns with nearly integrated explanatory variables. J Bus 77:937–966

Wei C (2003) Energy, the stock market, and the Putty–Clay investment model. Am Econ Rev 93:311–323

Wu JC, Xia FD (2016) Measuring the macroeconomic impact of monetary policy at the zero lower bound. J Money Credit Bank 48:253–291

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank Soojin Jo for sharing her codes with us. We also thank three anonymous referees for valuable suggestions that helped to improve the paper.

Rights and permissions

About this article

Cite this article

Rahman, S. Oil price volatility and the US stock market. Empir Econ 61, 1461–1489 (2021). https://doi.org/10.1007/s00181-020-01906-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-020-01906-3