Abstract

We develop a model of monetary policy implementation in which banks bid for liquidity provided by the central bank in fixed rate auctions, considering liquidity injections and extractions as well as the impact of a subsequent interbank market. We derive the equilibrium demands of banks. We also investigate the impact the central bank auction has on the subsequent interbank market and find that while lending in the interbank market is reduced, the interest rates are moving in the desired direction. In the context of the interbank network, the impact of monetary policy on banks depends on their network locations, which may give rise to the prospects of distributional effects of monetary policy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In the aftermath of the global financial crisis 2007/8, central banks around the world provided banks with significant amounts of liquidity to counter the freeze in the interbank market, but also in order to maintain low interest rates. There has been considerable effort to assess the impact this liquidity injection had on the lending behaviour of banks and the wider economy through the monetary policy transmission channel, see e.g. Bernanke and Blinder (1992), Sims (1992), Kashyap and Stein (2000), Ehrmann et al. (2001), Rudebusch and Wu (2008), Petrevski and Bogoev (2012), Andries and Billon (2016) and Carpenter et al. (2014). What has received very little attention, however, is the impact this monetary policy had on the interbank market structure and how banks with different properties are affected. As the interbank market is the first to feel the effect of monetary policy implementation and spreads it through the economy, understanding this link between monetary policy and interbank markets is paramount to monetary policy implementation. Specifically, it is crucial to not only assess the impact of such monetary policy on systemic risk but also how the reversal of the very loose monetary policy of recent years might affect banks.

This paper seeks to address the question of how banks’ demand for central bank liquidity impacts the interbank market. We will consider the strategic behaviour of banks when bidding for central bank liquidity and also include the impact of an interbank market for liquidity on this behaviour. In our paper, we consider monetary policy in the form of the auction of short-term central bank funds, similar that used by the European Central Bank, before the interbank market commences. The central bank may choose to implement either liquidity injection or liquidity extraction via auctions to conduct their monetary policy, the extent of which is determined exogenously. Banks face an idiosyncratic liquidity shock leading to different valuations of liquidity and subsequently different bid schedules for central bank funds. Any demand for liquidity that is not met by the central bank through their auction facility can in a second step be offset in the interbank market. Thus, our model combines in a new way the demand for liquidity in central bank operations with that of the interbank market and shows the interactions between these two facilities. We can use our model to investigate monetary policy implementation, as banks’ demand for liquidity is explicitly described and interest rates are obtained endogenously.

The interbank market is modelled by an agent-based approach, which is also applied by Biondi and Zhou (2019) to explore interbank credit coordination in money generation, and by Shimizu (2017) to offer a microfoundation of interbank liquidity hoarding. We also stress the fact that the impact of monetary policy on banks is heterogenous, as also pointed out by Gambacorta and Marques-Ibanez (2011), Horváth and Podpiera (2012). In terms of interest rates, monetary policy has the strongest effect on the rates of core banks lending to those in the periphery. In the interbank market, core banks are borrowing at a lower rate than they are lending, while for periphery banks this is reversed; thus, core banks show a higher profitability.

Our model is not only useful for the analysis of monetary policy transmission, but also relevant to systemic risk. The importance of the interbank market for systemic risk has been explored in Freixas et al. (2000), Allen and Gale (2000), Furfine (2003), Battiston et al. (2012), Krause and Giansante (2012), Georg (2013), Acemoglu et al. (2015), Krause and Giansante (2018), and Teply and Klinger (2019) amongst others. In these contributions, it has become clear that the structure of the interbank market affects the level of systemic risk. Most notably Craig and Von Peter (2014), Langfield et al. (2014), and Fricke and Lux (2015) have established that the interbank market exhibits a core–periphery structure, i.e. a small number of banks are highly interconnected and form the core, while the vast majority of banks only connect to this core but not other banks in this periphery. Such network structures and bank heterogeneity are found to be important determinants of systemic risk in the presence of financial contagion. This paper will explore how monetary policy affects the network structure of the interbank market in addition to interest rates in interbank markets. Thus, our model shows how monetary policy implication can have side effects on systemic risk through its heterogenous impact on banks in different network positions in the interbank market.

One important feature of our model is that banks have preference for both liquidity and returns. The motivation of introducing preference for liquidity into banks’ utility function is that banks would like to have a liquidity buffer in response to unexpected cash outflows and funding risks as observed during the global financial crisis. In other words, we assume just as banks seek to maximize profitability, liquidity is also desirable. Consequently, banks in our model face an internal trade off between these two objectives when maximizing utility. This is unlike other comparable studies where banks only optimize returns but are essentially indifferent about their liquidity level, which has important and interesting implications for the modelling of the demand for central bank funds and the resulting equilibrium.

Our main findings show that central bank tenders affect the structural features of interbank markets that operate subsequently to such tenders. In particular, we show that the core–periphery structure of the market is weakened when liquidity is injected by the central bank, having implications for the systemic risk of the banking system. Furthermore, we see that bank interbank lending from core banks to periphery banks of the interbank network will typically be more affected by liquidity injections or extractions of the central bank than lending between core banks. With banks in the periphery typically being smaller banks, lending to smaller companies, this will consequently affect the impact of monetary policy for these firms.

We continue as follows: the following section provides a brief overview of the relevant literature, while Sect. 3 details the model for the demand of central bank funds and Sect. 4 assesses the results of our model in the interbank market. Finally, Sect. 5 compares results with other studies and discusses policy implications, while Sect. 6 concludes our findings. All proofs are provided in Appendix.

2 Literature review

The focus of our model is on the short-term funding provided by the central bank to commercial banks. While a wide range of mechanisms are employed around the world, most notably open-market purchases by the US Federal Reserve, the mechanism that provides the basis of our model is most closely resembling that of the European Central Bank (ECB). The ECB uses a system of repurchase agreements with a maturity of one week. To allocate the funding in these repurchase agreements, the ECB conducts them either in fixed rate or variable rate tenders, where in fixed rate tenders the ECB specifies the interest applicable and banks bid for the volume they want to obtain at these conditions with the bank allocating the amounts subject to a global limit on the provision of liquidity. In contrast to that, in variable rate tenders the ECB specifies the total quantity of liquidity to be supplied and banks submit a bid schedule specifying the amount and interest rate they are requesting, subject to a minimum interest rate and a maximum number of ten different bids. In all cases, banks have to provide collateral and be financially stable.

Until June 2000, the ECB used only fixed rate tenders and subsequently changed to variable rate tenders until October 2008. After this date in response to the financial crisis the ECB reversed to fixed rate tenders and allowed banks to bid for and be allocated unlimited amounts, provided they have sufficient collateral and are financially stable. The ECB also operates a more long-term provision of liquidity to banks for the duration of three months, also by variable or fixed rate tenders. For more details on the operation of the ECB’s operation of monetary policy, see European Central Bank (2011).

2.1 Central bank operation using auctions

Despite the importance of auctions to provide liquidity to banks, the literature investigating these mechanisms either theoretically or empirically is relatively limited. Nautz and Oechssler (2003) introduce a model of banks strategically bidding in a fixed rate tender where banks minimise the deviations between the liquidity acquired in the auction and the liquidity they desire. Although they find the resulting game does not have an equilibrium, they also demonstrate that banks increasingly exaggerate their demand with an adaptive bidding rule. Ayuso and Repullo (2003) extend this model by including an expectation of interbank market rates, assuming the interbank market to be efficient. Furthermore, they assume that the central bank minimises a loss function of the difference between the interbank rate and a target policy rate and find that if the loss function punishes more heavily when interbank rate moves below rather than above the target (which has a similar effect as rationing), fixed rate tenders have a unique equilibrium with high overbidding.

Nyborg and Strebulaev (2003) take a different approach that allows for a brief squeeze in the interbank market commencing after the auction. They also differ from the above model as they assume banks to maximize interest earnings. They find that pre-auction positions can affect a bidder’s behaviour in equilibrium. Specifically, bidders with short positions tend to bid more aggressively due to the concern of experiencing a loss of access to sufficient liquidity in the interbank market. Ewerhart et al. (2010) take an alternative approach, assuming collateral to be heterogeneous and central bank funds supply to be uncertain. Banks with a goal to maximize interest earnings can either get the liquidity in the auction or alternatively in the interbank market at a cost of putting up more expensive collateral. In equilibrium, their model also predicts bid shading, i.e. the submission of bids that do not reflect their true preferences. This model is close to ours as it uses a private value for liquidity; however, our model differs substantially in that they assume a bank’s valuation for funds is based on the cost of using collateral, while our model will be driven by the desire of a high profitability and high liquidity.

Empirically, a number of properties have been found that a model of such auctions should capture: overbidding, bid shading and flat bids. Overbidding, i.e. requesting more funds than required in anticipation of rationing, is observed empirically in fixed rate tenders with (possible) rationing, as shown in Ayuso and Repullo (2003) and Nautz and Oechssler (2003). They also found the switch by the ECB from fixed rate to variable tenders mitigated overbidding without losing much control over interbank rates.

Bid shading is when banks submit bids for liquidity that do not fully reflect their true preferences. They will submit bids that show a lower willingness to pay for a given quantity than their preferences would imply in order to improve their utility from this auction. Empirically bid shading is usually measured by the differences between the auction rate and subsequent interbank market rate. The evidence on bid shading is mixed and depends on the sample period and the index of interbank market rates used. For instance, Ayuso and Repullo (2003) use the 1-week Euribor and Eonia on the day of settlement of the central bank operation. For both fixed and variable rate tenders, the interbank rate is 3 (Eonia) or 4 (Euribor) basis points above the average tender rate and the latter is significant. Bindseil et al. (2009) use swap rates 15 minutes before auctions and find them 3.33 bp higher than the weighted average bid and 1.64 bp higher than the weighted average winning bid. In contrast, Nautz and Oechssler (2003) use Eonia on the day of announcement of the central bank operation and find it to be very close to the marginal rate of the ECB’s variable rate tender. Therefore, they argue the difference is not empirically relevant and the small difference could be due to differences in collateral requirements. Cassola et al. (2013) cover the height of the financial crisis in 2007 and find that the spread between bank bids and Eonia is 4 bp on average. Moreover, they find that after the financial crisis this spread increases to 10 basis points and argue that the central bank operation resembles an auction of a common value good where bidders have private information. The interbank market rate is viewed as this ”common value” of liquidity. Bidders strategically shade their bids to avoid the ”winner’s curse” in this auction and thus bid shading would increase with uncertainty about the common value. However, Bindseil et al. (2009) find no support for this in empirical evidence, suggesting this framework may not fit central bank operations.

In the ECB’s variable rate tender, a bank can submit a bid schedule of up to 10 bids, but banks seldom utilize all of them. The average number of bids is 2 to 3 and the bid schedule is quite flat as reported in Bindseil et al. (2009) and Cassola et al. (2013). The average winning tender rate is only 1.7 bp above the marginal tender rate according to Ayuso and Repullo (2003).

There have also been a small number of investigations into the relationship between central bank auctions for liquidity and the interbank market. Brunetti et al. (2010) and Linzert and Schmidt (2011) have shown that in the Euro zone area, prior to the crisis period of 2007/8, central bank interventions are usually reducing interbank spreads. For the USA, where the Federal Reserve used a term auction facility for maturities of one to three months in response to the financial crisis 2007/8, Wu (2008) and McAndrews et al. (2017) find that liquidity injections reduce the interbank spread, even if excluding the credit risk associated with interbank markets. Taylor and Williams (2009) find the opposite effect, but McAndrews et al. (2017) suggest their model is incorrectly specified.

2.2 Multi-unit auction theory

The theoretical framework for the demand for central bank funds through auctions is auction theory. As banks can request different amounts of liquidity, the auctions are for multiple units. Hence, theories of auctions of a perfectly divisible good are the appropriate theoretical framework. Such a multi-unit auction problem was first studied by Wilson (1979), where a known number of symmetric bidders bid for shares of an item of common value. He first considers uniform pricing and discusses cases where the item value is certain and where it is not. He also discusses cases where bidders have proprietary information and where they have not. In all these cases, he finds that there is some equilibrium where the sale price of the item is a lot lower than if the auction is a single-unit auction. In other words, in such an equilibrium a bidder’s strategy is not to reveal their true value of the item (bid shading). On the contrary, bidders can ”collusively” shade their true demand and be better off. It is worth mentioning that in a single-unit auction of a good of common value there is also an incentive for bidders to shade their bids when bidders have a noisy signals of the good’s value. This is because the bidder who wins the auction must have a signal that is the highest value and can still win by paying a bit less (the ”winner’s curse”) and thus it is not optimal to bid according to one’s signal.

The results from Wilson (1979) have been generalized in Back and Zender (1993) and alternative information settings been applied in Back and Zender (2001). A framework of private value goods instead of common value goods has also been investigated. For instance, the split award procurement auction is studied in both a complete information setting in Anton and Yao (1989) and an incomplete information setting by Anton and Yao (1992). There are also a number of studies that consider endogenous supply and find it helps to reduce bid shading, e.g. Klemperer and Meyer (1989) and Back and Zender (2001).

A major topic in this area is the comparison between uniform and discriminatory pricing mechanisms (comparable to fixed and variable rate tenders in our model) in terms of which is optimal, e.g. Tenorio (1997), Back and Zender (2001), or Ausubel et al. (2014). Studies on treasury auctions in Binmore and Swierzbinski (2000), Abbink et al. (2006), Goldreich (2007), Hortaçsu and McAdams (2010), and Kang and Puller (2008) as well as electricity markets by Federico and Rahman (2003) and Fabra et al. (2006) also continue the debate from auction theory. However, the general finding is inconclusive as the results depend on the detailed assumptions about bidders and the auction mechanism itself as pointed out in Ausubel et al. (2014).

3 A model of central bank borrowing

We consider a banking system with \(N>2\) banks where each bank i seeks to maximize its utility, which consists of two elements. Firstly banks seek to maximize their profitability measured by the return on equity. Using the stylized balance sheet of a bank from Fig. 1, we can define the return on equity as

where \(r^f\) is the risk free rate, \(r^L_i\) is the weighted average rate on interbank lending, \(r^{CB}_i\) is the average rate on central bank funds, \(r^C_i\) is the average rate on external asset, \(r^D_i\) is the average rate paid on external deposit, \(r^B_i\) is the weighted average rate on interbank borrowing, and \(Q_i\) is the amount of central bank funds with positive numbers indicating a loan from the central bank a negative number a deposit at the central bank.

Secondly, banks will seek to hold large cash reserves as that allows them to withstand any large withdrawals of deposits without having to resort to costly asset liquidation or declare themselves illiquid. We define the cash reserve ratio as

Obviously, large cash reserves reduce profitability as the interest paid on these will be smaller than on other investment opportunities. To balance these two aspects, we use the following utility function:

where \(0<\theta _i<1\) denotes the relative importance of concerns of liquidity relative to profitability, \(\gamma _i>0\) is simply a scaling factor. These banks face non-optimal liquidity holdings, e.g. due to a liquidity shock. We assume that the size and sign of this liquidity shock are common knowledge for all banks.

The main motivation to add a preference for liquidity in the utility function arises from the understanding of bank behaviour during the financial crisis. A bank may fail not only because of accumulated losses but also a lack of liquidity. In other words, even if a bank whose assets are sufficient to cover liabilities, it also can be in distress because its assets are in illiquid form. Meanwhile, funding risk as a result of a loss of confidence among depositors and other funders may also further deteriorate the bank’s position. Thus, a liquidity buffer in the form of highly liquid asset, cash in our model, is vital to protect a bank from the consequences unexpected cash outflows and funding risk.

In addition to commercial banks, we introduce a central bank into the banking system. The purpose of this central bank is to conduct its monetary policy by increasing or reducing the amount of liquidity in the banking system. How the central bank makes this decision is beyond our scope, and we take this decision as exogenously given. Using this approach allows us to focus on how banks react to the decision of the central bank and how it affects interbank markets.

In order to assess the commercial banks’ behaviour, we will investigate the injection and extraction of liquidity by central banks through fixed rate and variable rate tenders and will also compare models in which banks neglect the existence of the interbank market that opens after the central bank intervention and a model where they consider the opportunities in this market.

3.1 Fixed rate tenders

In a fixed rate tender, the central bank determines an interest rate at which it will lend (borrow) to (from) commercial banks and anyone willing to pay (receive) this interest rate will be able to do so, i.e. we do not view the global limit on the amount the central bank is willing to borrow or lend to be binding. Banks do not know the interest rate the central bank applies and will thus submit a bid schedule for each possible interest rate, i.e. specify the quantity they demand.

If we use \(Q_i>0\) to denote borrowing from the central bank and \(Q_i<0\) for depositing additional funds, we know from Xiao and Krause (2017) that for an amount of \(Q_i\) the reservation price of banks is given by the following expression:

for \(Q_i>0\) and

for \(Q_i<0\). It is shown in Xiao and Krause (2017) that \(r^f<r^a_i<r^b_i\), i. e. the bid-ask spread is always positive. We can easily see this still holds even when \(Q_i\) approaches 0 as shown in the following lemma:

Lemma 1

\(\lim _{Q_i\rightarrow 0}r^b_i\left( Q_i\right) -r^a_i\left( Q_i\right) >0.\)

Obviously banks would not bid at their reservation prices, as this would not allow the banks to increase their utility level. Hence, we would require banks to maximize their utility by submitting their bids optimally.

The first constraint ensures that the bank remains solvent, i.e. any losses it might make do not exceed its equity, while the second constraint ensures that any borrowing does not exceed any limit set by the central bank on borrowing, \(\bar{Q_i}\), e.g. resulting from absolute limits, limits on leverage, or collateral requirements. The final constraint ensures that the bank does not seek to deposit more funds within the central bank than it has cash reserves available.

Conducting this optimization, we obtain the demand for central bank money as detailed in the following proposition:

Proposition 1

Let \(\psi _i=\frac{1}{2}\left( \frac{1}{1-\theta _i}\left( {\mathbf {D}}_i+{\mathbf {B}}_i\right) +\frac{1-2\theta _i}{1-\theta _i}{\mathbf {R}}_i\right) \) and \(\varphi =\psi _i^2-\left( {\mathbf {D}}_i+{\mathbf {B}}_i\right) {\mathbf {R}}_i\frac{r^{CB}_f-r_i^a(0)}{r^{CB}_f-r^f}\). The equilibrium bid schedule is then given by

with \(\frac{\partial Q_i^f\left( r^{CB}_f\right) }{\partial r^{CB}_f}\le 0\).

Here, note that \(Q_i^f\) contains both demand for central bank funds (\(Q_i>0\)) as well as deposits with the central bank (\(Q_i<0\)). If the central bank is conducting liquidity injection, i.e. \(Q^{CB}>0\), only demand for liquidity is accepted as a bid; hence, bank i should submit \(\max \left\{ 0,Q_i^f\right\} \). If the central bank is conducting liquidity extraction, i. e. \(Q^{CB}<0\), banks can only deposit funds and should submit \(\min \left\{ 0,Q_i^f\right\} \).

The equilibrium is then trivially determined at the interest rate such that \(\sum _{i=1}^NQ_i^f\left( r^{CB}_f\right) =Q^{CB}\); due to the monotonicity of the bid schedule this equilibrium will be unique.

By inverting the demand function for central bank funds, we can easily see that the demand for a given interest rate is lower than the reservation price. Equivalently, the interest rate that can be charged by the central bank for banks borrowing (lending) must be smaller (higher) if they want to increase (decrease) the liquidity by a given amount. This result is detailed in Lemma 2.

Lemma 2

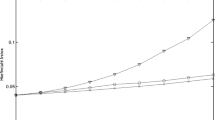

The inverse bid schedule in equilibrium is given by

Reservation and equilibrium bid schedules in fixed rate tenders. The vertical axis depicts the interest rate of central bank tenders(\(r_f^{CB}\)) and the reservation prices by banks for borrowing (\(r^a_i\)) and lending (\(r^b_i\)) from the central bank. The horizontal axis is bank i’s demand for central bank funds \(Q_i^f\), where positive values represent bank i borrowing from the central bank and negative values indicate bank i lending to the central bank

Figure 2 illustrates this so-called bid shading, where banks submit their bid schedules optimally in order to maximize their utility and do not submit their reservation prices. As we do not consider the objective function of the central bank in our model, we cannot analyse the welfare implication of this behaviour as any losses suffered by the central bank cannot be quantified.

We also note from Fig. 2 that the reservation prices, as well as the optimal prices, exhibit a jump at \(Q_i=0\). This jump is the equivalent of the bid-ask spread as explained in Lemma 1. The reason for this discontinuity is that the liquidity ratio \(\rho _i\) has different properties either side of \(Q_i^f=0\). If bank i is deposits money with the central bank (\(Q_i^f<0\)) only cash changes affect \(\rho _i\). On the other hand, if bank i is borrowing from the central bank, both cash and the total assets change, each affecting \(\rho _i\). Because of this, the derivative of \(\rho _i\) with respect to \(Q_i^f\) is not continuous at \(Q_i=0\), which results in a jump observed in both bank i’s reservation price and optimal bid schedule. This result is summarized in the following lemma:

Lemma 3

The equilibrium rates have the following properties:

-

1.

\(\lim _{Q_i^f\rightarrow 0^-}r^{CB}_f\left( Q_i^f\right) = \lim _{Q_i^f\rightarrow 0}r^b_i\left( Q_i^f\right) \),

-

2.

\(\lim _{Q_i^f\rightarrow 0^+}r^{CB}_f\left( Q_i^f\right) = \lim _{Q_i^f\rightarrow 0}r^a_i\left( Q_i^f\right) \),

-

3.

\(\lim _{Q_i^f\rightarrow 0^-}r^{CB}_f\left( Q_i^f\right) >\lim _{Q_i^f\rightarrow 0^+}r^{CB}_f\left( Q_i^f\right) \),

-

4.

\(\forall Q_i^f\le 0: r^b_i\left( Q_i^f\right) \le r^{CB}_f\left( Q_i^f\right) \),

-

5.

\( \forall Q_i^f\ge 0: r^a_i\left( Q_i^f\right) \ge r^{CB}_f\left( Q_i^f\right) \).

While these considerations are based on the inverse bid schedule, it is easy to revert back to the actual bid schedule. We thus have established that in fixed rate tenders bid shading exists in that banks submit bids for lower quantities at a given tender rate in the case of depositing with the central banks as well as borrowing from the central bank. We could also establish that moving from depositing with the central bank to borrowing from it will involve a discontinuity on the bid schedule in that banks are requiring a significantly higher interest rate to deposit a small amount with the central bank than to borrow a small amount.

We conduct the same analysis for variable rate tenders, the details of which are given in Appendix B. We find that provided banks know each other’s liquidity position, the equilibrium is identical to that derived here for fixed rate tenders, i.e. amounts and interest rates are identical.

Thus far we implicitly assumed that banks ignore the fact that after the bidding for central bank funds an interbank market opens that allows banks to adjust their liquidity holdings. In the following section, we will now relax this assumption and allow banks to anticipate this market fully.

3.2 Banks anticipating the interbank market

Until now, we have assumed that banks ignore the existence of an interbank market after the central bank intervention in their considerations. If, however, they anticipate that such an interbank market exists, banks would form expectations about the future interbank rate and include this in their utility maximization, thus affecting their bidding for central bank money. In interbank markets, the total demand and supply of funds must balance given the bilateral nature of these transactions. Banks, however, have to consider the impact of the central bank contribution \(Q^{CB}\) such that they would anticipate a rate of

where \({\hat{Q}}_i=Q_i+{\hat{Q}}_i^{IB}\) is the total amount of liquidity bank i gets from the central bank and it anticipates to get from interbank market. Having anticipated this rate, banks will now engage in variable rate tender bidding. Banks are not willing to bid at a rate higher (lower) to borrow from (deposit with) the central bank as waiting for the interbank market would be more profitable. Similarly, banks would not bid at a lower (higher) rate as the additional profits would entice other banks to submit a marginally higher bid, such that competition would ensure the rate submitted to converge towards \({{\hat{r}}}^{IB}\).

Thus banks’ bid schedules would be flat at \({{\hat{r}}}^{IB}\), the amount being such that any rationing in the allocation is fully anticipated. We summarize this outcome in the following proposition.

Proposition 2

Let \({\widehat{r}}^{IB}\in \left\{ r|\sum _i^N {Q}_i^f=Q^{CB}\right\} \) and \(\lambda =\frac{Q^{CB}}{\sum _{i=1}^N Q_i^I}\), then the equilibrium demand for central bank funds with banks anticipating the interbank market is given by \(\left( {\widehat{r}}^{IB}, \lambda Q_1^I\left( {\widehat{r}}^{IB}\right) ,\ldots , \lambda Q_1^I\left( {\widehat{r}}^{IB}\right) \right) \), where

Having established the properties of the equilibrium if banks anticipate the interbank market, we can now continue in the following section to conduct computer experiments of the interbank market itself and see how the existence of the central bank affects this market.

4 The interbank market

We have thus far only assessed the bidding behaviour of banks for central bank funds. In this section, we will introduce the mechanism of the subsequent interbank market and then evaluate the impact of the central bank on the properties of this market. The interbank market is set up identically to Xiao and Krause (2017), and we give a brief description of the interbank market simulation incorporated with a central bank auction. For further details of the interbank model, please refer to Xiao and Krause (2017).

The interbank market considered is a decentralized one where all transactions are bilaterally determined and of fixed size \(Q^{IB}\). Before the interbank market begins, all banks complete updating their balance sheets from central bank auctions. Banks quote interest rates according to their reservation valuation given by equations (4) and (5), based on balance sheet information after central bank tenders. Each randomly selected bank entering the market will approach all banks in a random order and enquire their quotes. One of the following three decisions is made after an enquiry by comparing the quoting bank i’s rates with the enquirer j’s reservation valuation, given by equations (4) and (5): (i) to borrow if \(r_i^b \le r_j^a\), (ii) to lend if \(r_i^a\ge r_j^b\), or (iii) to do nothing if \(r_i^b > r_j^a\) and \(r_i^a < r_j^b\). The transaction (if any) is conducted at the relevant quoted rate. After each transaction, the banks involved update their balance sheets and consequently their reservation prices. All quotes previously obtained will be memorized by the bank approaching other banks to ensure the most favourable quote available is used in future transactions. This process continues until all banks have been approached and involved in a transaction whenever it is possible. After this, the next bank enters the market and the process restarts until no further transactions are possible.

In Xiao and Krause (2017), it is shown that the network of interbank lending normally exhibits a core–periphery structure, i.e. a small number of banks are highly connected with each other (the core) and all other banks (the periphery) connect to these core banks while having very few connections with each other. Meanwhile, as core banks engage in more interbank trading, they grow larger in size as a result. In other words, heterogeneity in network positions and in size emerge simultaneously. We will investigate whether this structure is maintained in the presence of a central bank and will also evaluate other characteristics of the interbank lending network, like the size of the core, the density, but also properties of the interest rates between banks, how much they are lending and borrowing in the interbank market, or the return on equity achieved.

The only difference to the model in Xiao and Krause (2017) is the introduction of a central bank. As in their paper, we assume that banks face an idiosyncratic liquidity shock, using a uniform distribution \(U\left( {\underline{\rho }},{\overline{\rho }}\right) \), which they then seek to offset via the central bank and the interbank market. In contrast to Xiao and Krause (2017), this liquidity shock does not have to be balanced on aggregate but will have aggregate positive shock to allow enough room for central bank liquidity extraction. The interbank market cannot be analysed analytically; hence, we use computer experiments in our assessment. We run 8000 such experiments with a wide range of parameter constellations chosen within ranges as detailed in Table 1. For the parameter ranges used, we choose reasonable values based on historical data of major economies in non-crises time periods and covering a wide range of scenarios. For the preference parameter, we choose the range where the model is not too sensitive to single inputs.

In order to focus on the effect monetary policy has on the interbank market, we assume that all banks are homogeneous, e.g. have the same size or leverage; they will only differ ex ante in the idiosyncratic liquidity shock they receive. We assess the impact of the central bank in the cases of liquidity injection and liquidity extraction, both anticipating the existence of a interbank market and not anticipating its existence, as well as assessing the interbank market only, that is without the presence of a central bank for comparison purposes.

Looking at the characteristics of the interbank market in Table 2, we can see that while the main properties still remain valid in the presence of a central bank conducting its monetary policy, there are some distinct properties that deserve closer attention. Firstly, we notice that the injection of liquidity by the central bank reduces the interbank rate, while the extraction increases it. This validates the empirical observation that central bank operations affect interbank lending rates. We also note that this effect is stronger for liquidity injections than liquidity extractions. While we observe this effect across lending between all groups of banks, core and periphery, we have the strongest effect on banks in the core lending to those in the periphery. Finally, in the case of liquidity injection the differences in interest rates between core and periphery banks overall reduce; thus, the advantages core banks have over periphery banks in terms of profitability from engaging in the interbank market will also be smaller.

The amount of interbank lending reduces in the presence of a central bank, particularly when injecting liquidity, suggesting that those banks facing a liquidity shortfall can meet a sizeable fraction of their demand from the central bank. This reduced interbank lending then manifests itself in a weaker core–periphery structure. However, the density of the interbank lending network is not affected significantly as, on the one hand, less interbank lending occurs overall but, on the other hand, less banks are active in the interbank market. Given that inactive banks are not included in our network analysis, the density remains approximately stable. Overall, differences between the case of banks anticipating the subsequent interbank market and not anticipating it are minimal, thus suggesting that such an anticipation is not important to the interbank structure.

Our observations suggest that monetary policy decisions to inject or extract liquidity affects most strongly banks in the periphery, i.e. mostly smaller banks that engage less in interbank lending and borrowing. This stronger effect arises from the fact that for these banks borrowing rates from core banks are changing more than those of core banks borrowing from each other or periphery banks. Hence, while central bank operations have the desired effect on the interbank market as a whole, its effect varies between banks, depending on their position in the interbank network. This has potential implications for central banks as differences in the change of costs for funds can have distributional effects and might well affect the lending these banks do, with clients of periphery banks more affected than those of core banks.

Furthermore, the amount of interbank lending and borrowing reduces, potentially affecting the liquidity of the interbank market. By looking in more detail at the borrowing and lending in interbank markets in Table 3, we are able to shed some further light on this aspect. We see clearly that interbank borrowing and lending reduces mainly for core banks, with periphery banks actually experiencing an increase in interbank borrowing for liquidity injections and interbank lending for liquidity extractions. Hence, with central bank interventions the borrowing and lending of core banks reduces while periphery banks will increase their exposure to the interbank market to meet their liquidity needs.

Interestingly, core banks will see a reduced return on equity with liquidity injection. With liquidity extraction, their returns remain more or less the same when not anticipating interbank market and are slightly increased when anticipating the interbank market. However, periphery banks increase their return on equity in all cases. Both participation in the central bank operation and the interbank market affect banks’ return on equity. For the former, we see that periphery banks are more engaged compared to core banks, especially when anticipating the existence of the subsequent interbank market. This is still the case, although not as evident, when they are not anticipating the interbank market, because auction allocations are then concentrated among a much smaller group of banks and this is not reflected in medians. Even though the amounts involved are small, it can actually increase returns of some periphery banks compared to the case in which no central bank is present. The core banks are much less reliant on central bank funds, their change in returns can be explained by interbank lending/borrowing rates as discussed below.

We see that core banks are borrowing at a lower rate than they are lending with or without the presence of a central bank, while for periphery banks this is reversed. The difference between the borrowing and lending rates is reduced for both core and periphery banks in liquidity injection and remain roughly the same in liquidity extraction. This means the profits core banks can get from borrowing at lower rates is reduced in liquidity injection and therefore they have lower returns. Similarly, periphery banks also benefit from lending (borrowing) at a lower (higher) rates for liquidity injection and see an increase in returns. And although such benefits are not as pronounced in liquidity extraction, lending to the central bank still increases their returns.

From these statistics, we can clearly see that central bank interventions through the injection or extraction of liquidity affects banks differently, depending on their position in the network. With funding costs and liquidity affecting the lending behaviour of banks, such an asymmetry can have a profound impact on the type of companies that are able to receive loans. It is reasonable to say that periphery banks will normally be smaller, regionally focused banks that will have a different client base to the usually larger and often globally acting core banks.

While these results suggest the importance of the position of a bank in the network to assess how it is affected by any policies of the central bank, we have also seen that the network structure itself is affected by the conduct of the central bank. In order to assess how the network structure is affected by the significant number of independent variables in our model, we have conducted a number of regressions in Tables 4, 5, 6, and 7 that use the log changes in the network from the situation in which only the interbank market existed as the dependent variable. Firstly, we note that the results are highly consistent across the four different market types (liquidity extraction and injection with and without anticipating the interbank market) and thus can be analysed jointly.

How much the network structure is affected by the fact that a central bank injects or extracts liquidity is mainly determined by the amount of liquidity the central bank seeks to inject or extract (\(Q^{CB}\)), the preferences for liquidity (\(\theta \)), the size of an interbank transaction (\(Q^{IB}\)), the bank leverage (\(\lambda \)), and, in some instances, also the size of the liquidity shock (\(\frac{{\overline{\rho }}+{\underline{\rho }}}{2}\)) and its variability (\({\overline{\rho }}-{\underline{\rho }}\)). In the case of liquidity injection, a larger central bank intervention weakens the core–periphery structure of the interbank network and also reduces the number of banks participating in the interbank network itself. This arises from the fact that with the additional liquidity banks have less need to seek such funds in the interbank market, thus reducing their participation and any borrowing and lending gets more equally spread out between banks often trading excess liquidity. The same effect can be observed if banks have a stronger preference for liquidity over returns.

Interestingly, for liquidity extractions this effect is reversed, although the effect here is much smaller. Due to banks’ preference for liquidity the lower liquidity in the banking system after the central bank operation will see banks attempting to secure additional funds in the interbank market. Banks in the core are best placed to offer terms that are favourable to other banks due to their increased leverage and this reinforces the core–periphery structure by having banks link to them.

A larger amount of interbank loans in each transaction (\(Q^{IB}\)) strengthens the core–periphery structure as larger interbank loans will result in less transactions for the same total amount of borrowing and lending. These fewer transactions will then be more concentrated with the larger banks in the core and thus lead to less transactions between banks in the periphery. Banks with a higher leverage will have a stronger emphasis on profitability due to the impact on return on equity and thus encourage borrowing and lending from them, resulting in a core–periphery structure.

With more banks, it is easier to sustain a core–periphery structure and a larger core as generally more trading will occur, allowing for this property to emerge. More diversity in the liquidity shocks banks face (\({\overline{\rho }}-{\underline{\rho }}\)) strengthens the core–periphery structure while ensuring more banks participate. This arises as more diversity of liquidity needs increases the need and the ability to offset any imbalances banks have in their liquidity positions. If the mean of the liquidity shock increases this seems to have very limited effect on the structure of the network, mainly increasing the size of the core and due to the excess liquidity more transactions are required to offset them between banks.

It is noteworthy that the overall fit of the regressions reported in Tables 4, 5, 6, and 7, as measured by \(R^2\), is significantly lower for liquidity extraction. The origin of this observation can be found in the fact that for large liquidity extractions the preferences of the banks for liquidity become overwhelming, which leads to nonlinearities which these regressions do not allow to incorporate.

Finally, we have also considered the determinants of the rate the central bank applies to their lending or deposits, comprising the final column in Tables 4, 5, 6, and 7. Not surprisingly a larger amount of central bank intervention reduces (increases) the interest rate for liquidity injection (extraction). Also, intuitively understandable is that banks having a stronger preference for liquidity increases the interest rate. While this result is not surprising, it is worth mentioning explicitly as it shows how preferences of banks, as they vary in light of adverse conditions, might affect funding costs directly and thus at least partially offset the policy decisions of central banks. A larger number of banks competing for a given amount of central bank funds will obviously increase (decrease) the interest rate in the case of liquidity injection (extraction).

If the liquidity shock is on average more positive, this means more liquidity is in the banking system, thus reducing the interest rates due to the lower demand for liquidity. A larger variability of liquidity will, however, increase the interest rates. Here, the variability means that more banks face large imbalances and thus are keen to offset these. Those facing a liquidity shortage will demand larger funds from the central bank in the case of a liquidity injection, while those facing larger excess liquidity will stay out of this market, thus increasing this interest rate. In the case of liquidity extraction, the missing demand for central bank deposits by banks with liquidity shortages will similarly drive up interest rates.

Banking systems exhibiting a high leverage are increasingly unwilling to bid at high rates in the central bank auction. Due to the higher leverage the impact of central bank funds on the liquidity ratio is smaller, thus making them less important to the bank and they are demanding less central bank funds, reducing the interest rate. Also, a higher leverage tends to be associated with a lower return prior to the commencement of the central bank operation, which makes a bank value liquidity less. The observation that higher deposit rates reduce interest rates and higher lending rates increase it arises from their respective effects on the returns of the banks. A higher deposit rate reduces returns to banks and thus banks are more concerned about this aspect. Consequently, they are less willing to pay high interest rates, while the exact opposite is the case for high lending rates.

Thus, the effect of monetary policy on the interbank market in terms of interest rates applied is as anticipated and that the overall quantity of interbank lending and borrowing reduces is also expected. However, the effect will differ between banks, depending on their position in the network of interbank lending. This has the potential for significant distributional effects in an economy.

5 Comparison of results and implications

Our results are consistent with other studies on central bank auctions, despite different model settings. The downward sloping shape of bid schedules is similar to Ewerhart et al. (2010), although for different reasons; in our case it is the result of banks balancing liquidity and profitability needs, while Ewerhart et al. (2010) rely on heterogenous collateral. Also similar with Ewerhart et al. (2010), but differing from Ayuso and Repullo (2003), we have no overbidding in auctions as banks’ bid schedules terminate when they reach their limit on collateral requirements. In our model, the central bank’s policy is exogenously given and not maximizing its revenue as in Ayuso and Repullo (2003). As we do not seek to model the rationale for the central bank’s decision on injecting or extracting liquidity, this is of no consequence for our model. Our results about interbank market responses to central bank tenders are consistent with findings during non-crisis periods, as presented in Brunetti et al. (2010) and Linzert and Schmidt (2011). The interbank market commonly has narrower spreads arising from central bank interventions. For crisis periods, the empirical evidence on interbank markets is mixed in the literature, such that there exists evidence that contradicts our findings, e.g. in Taylor and Williams (2009). It is worth noting that our model is not designed for crisis periods as we assume a market in which there is no general liquidity shortage, interbank market freeze, and the banks are not considering the risk of interbank lending. Thus, we find that, neglecting crisis periods, our results are broadly consistent with other models and empirical evidence, and allows a more detailed analysis of the impact on the interbank markets, specifically on banks with different positions in this market. The different impact of monetary policy on core and periphery banks is not explored yet in the literature and our paper provides a first theoretical contribution in this direction.

There are mainly two implications from our model for policy makers in central banks. Firstly, central bank tenders not only affect the quantity of liquidity in the banking system, but also the structure of the interbank market. As has been well established that the topology of the interbank market affects the vulnerability of the banking system for systemic risk, see e.g. Acemoglu et al. (2015), Georg (2013); Krause and Giansante (2012), the weakening of the core–periphery structure in the case of liquidity injections should be taken into account for its implications on systemic risk. By considering this consequence of their monetary policy, central banks will be able to more fully understand the implications of their decisions.

Secondly, as lending and borrowing between core and periphery banks are asymmetrically affected by monetary policy decisions, and in general core banks obtain more favourable conditions, conducting monetary policy has potentially distributional implications in the economy. Central banks may want to consider levelling the playing field between larger (core) and smaller (periphery) banks, e.g. through discriminatory pricing in auctions and standing facilities, depending on the network status of the banks, which could lead to a ’fairer’ dissemination of liquidity and more equal costs for banks in obtaining liquidity. Alternatively, central banks may well consider tenders targeted at a subgroup of banks only.

Apart from levelling the field between banks, as our model shows that changes in the cost of funds due to central bank operations can differ between core and periphery banks, the central bank should also be aware of the different effect their monetary policy has on the borrowing and savings rates of banks. The pass-through of monetary policy will not be equal and thus might well affect customers differently. A homogenous or ’one-size-fits-all’ monetary policy might not be suitable as periphery banks would benefit more from liquidity injections, and assuming they rely to some extent on interbank borrowing from core banks, their funding costs would reduce more than for core banks. Similarly, they would be more affected by liquidity extractions. Periphery banks are often smaller or more specialized banks and the limited transmission of monetary policy onto their customers, such as SME companies, could limit the effectiveness of the central bank’s monetary policy as the effect is felt stronger in some parts of the economy than others. A tender targeted to these specialized periphery banks, in addition or on its own, may be helpful to ensure that monetary policy is most effective and has no undesired side-effects, such as not reaching all parts of the economy equally.

6 Conclusions

We have developed a model of the demand by banks for central bank funds. Banks have a preference for liquidity as well as profitability and as such balance those two needs; this is in contrast to most models developed previously that assume banks are only optimizing profitability. Our model considered fixed rate tenders and included the anticipation of a subsequent interbank market. We derived the equilibrium bid schedules and allocations of central bank funds in these tenders.

We then assessed the structure of the interbank market and how it changes in the presence of a central bank. While we found that while overall the core–periphery structure is maintained, its significance is reduced with liquidity injections. We were also able to establish that the position in the interbank network is relevant to how banks are affected. It was found that the greatest impact of monetary policy on interest rate is for banks in the core lending to those in the periphery, which corresponds roughly to larger banks lending to smaller banks. In the presence of a central bank, banks in the periphery tend to participate more in the interbank market. This asymmetry in the effect on banks arising from the presence of a central bank might have significant policy implications as it could well affect the lending policies of banks differently and subsequently the supply of loans to the economy. This aspect is left for further investigation in future research.

In this paper, we only considered auctions, but open market operations are a significant and often the only way central banks manage the liquidity in the banking system. While many aspects of open market operations will be similar to auctions, it would be worth in future research to investigate such a setting. Furthermore, we do not consider what banks actually do with the liquidity they obtain as in many cases banks will re-invest them into loans, in particular if liquidity is provided for longer terms. Such re-investments will naturally affect the rate of return and might alter the incentives for banks. However, such extensions are beyond the scope of this paper and therefore left for future research.

We have assumed that central bank tenders are preceding the interbank market. In reality, of course, the interbank market is open at any time and the banks could act strategically in the interbank market in the full knowledge of having access to central bank tenders afterwards. As our focus has been on the impact of monetary policy, specifically tenders, on the interbank market, we leave this interesting aspect for future research.

References

Abbink K, Brandts J, Pezanis-Christou P (2006) Auctions for government securities: a laboratory comparison of uniform, discriminatory and spanish designs. J Econ Behav Organ 61(2):284–303

Acemoglu D, Ozdaglar A, Tahbaz-Salehi A (2015) Systemic risk and stability in financial networks. Am Econ Rev 105(2):564–608

Allen F, Gale D (2000) Financial contagion. J Polit Econ 108(1):1–33

Andries N, Billon S (2016) Retail bank interest rate pass-through in the euro area: an empirical survey. Econ Syst 40(1):170–194

Anton JJ, Yao DA (1989) Split awards, procurement, and innovation. RAND J Econ, pp 538–552

Anton JJ, Yao DA (1992) Coordination in split award auctions. Q J Econ 107(2):681–707

Ausubel LM, Cramton P, Pycia M, Rostek M, Weretka M (2014) Demand reduction and inefficiency in multi-unit auctions. Rev Econ Stud 81(4):1366–1400

Ayuso J, Repullo R (2003) A model of the open market operations of the European central bank. Econ J 113(490):883–902

Back K, Zender JF (1993) Auctions of divisible goods: on the rationale for the treasury experiment. Rev Financ Stud 6(4):733–764

Back K, Zender JF (2001) Auctions of divisible goods with endogenous supply. Econ Lett 73(1):29–34

Battiston S, Gatti DD, Gallegati M, Greenwald B, Stiglitz JE (2012) Liaisons dangereuses: Increasing connectivity, risk sharing, and systemic risk. J Econ Dyn Control 36(8):1121–1141

Bernanke BS, Blinder AS (1992) The federal funds rate and the channels of monetary transmission. Am Econ Rev, pp 901–921

Bindseil U, Nyborg KG, Strebulaev IA (2009) Repo auctions and the market for liquidity. J Money Credit Bank 41(7):1391–1421

Binmore K, Swierzbinski J (2000) Treasury auctions: uniform or discriminatory? Rev Econ Design 5(4):387–410

Biondi Y, Zhou F (2019) Interbank credit and the money manufacturing process: a systemic perspective on financial stability. J Econ Interac Coord 14(3):437–468

Brunetti C, Di Filippo M, Harris JH (2010) Effects of central bank intervention on the interbank market during the subprime crisis. Rev Financ Stud 24(6):2053–2083

Carpenter S, Demiralp S, Eisenschmidt J (2014) The effectiveness of non-standard monetary policy in addressing liquidity risk during the financial crisis: the experiences of the federal reserve and the European central bank. J Econ Dyn Control 43:107–129

Cassola N, Hortaçsu A, Kastl J (2013) The 2007 subprime market crisis through the lens of European central bank auctions for short-term funds. Econometrica 81(4):1309–1345

Craig B, Von Peter G (2014) Interbank tiering and money center banks. J Financ Intermediat 23(3):322–347

Ehrmann M, Gambacorta L, Martínez-Pagés J, Sevestre P, Worms A (2001) Financial systems and the role of banks in monetary policy transmission in the euro area. European Central Bank Working Paper No. 105

European Central Bank (2011) The implementation of monetary policy in the euro area

Ewerhart C, Cassola N, Valla N (2010) Declining valuations and equilibrium bidding in central bank refinancing operations. Int J Ind Organ 28(1):30–43

Fabra N, Fehr N-H, Harbord D (2006) Designing electricity auctions. RAND J Econ 37(1):23–46

Federico G, Rahman D (2003) Bidding in an electricity pay-as-bid auction. J Regul Econ 24(2):175–211

Freixas X, Parigi BM, Rochet J-C (2000) Systemic risk, interbank relations, and liquidity provision by the central bank. J Money Credit Banking, pp 611–638

Fricke D, Lux T (2015) Core-periphery structure in the overnight money market: evidence from the e-mid trading platform. Comput Econ 45(3):359–395

Furfine C (2003) Interbank exposures: quantifying the risk of contagion. J Money Credit Bank 35(1):111–128

Gambacorta L, Marques-Ibanez D (2011) The bank lending channel: lessons from the crisis. Econ Policy 26(66):135–182

Georg C-P (2013) The effect of the interbank network structure on contagion and common shocks. J Bank Finance 37(7):2216–2228

Goldreich D (2007) Underpricing in discriminatory and uniform-price treasury auctions. J Financ Quantitative Anal 42(2):443–466

Harris M, Raviv A (1981) Allocation mechanisms and the design of auctions. Econometrica, pp 1477–1499

Holt CA Jr (1980) Competitive bidding for contracts under alternative auction procedures. J Polit Econ 88(3):433–445

Hortaçsu A, McAdams D (2010) Mechanism choice and strategic bidding in divisible good auctions: an empirical analysis of the Turkish treasury auction market. J Polit Econ 118(5):833–865

Horváth R, Podpiera A (2012) Heterogeneity in bank pricing policies: the Czech evidence. Econ Syst 36(1):87–108

Kang B-S, Puller SL (2008) The effect of auction format on efficiency and revenue in divisible goods auctions: a test using Korean treasury auctions. J Ind Econ 56(2):290–332

Kashyap AK, Stein JC (2000) What do a million observations on banks say about the transmission of monetary policy?. Am Econ Rev, pp 407–428

Klemperer PD, Meyer MA (1989) Supply function equilibria in oligopoly under uncertainty. Econometrica, pp 1243–1277

Krause A, Giansante S (2012) Interbank lending and the spread of bank failures: a network model of systemic risk. J Econ Behav Organ 83:583–608

Krause A, Giansante S (2018) Network-based computational techniques to determine the risk drivers of bank failures during a systemic banking crisis. IEEE Trans Emerg Top Comput Intell 2(3):174–184

Langfield S, Liu Z, Ota T (2014) Mapping the UK interbank system. J Bank Finance 45:288–303

Linzert T, Schmidt S (2011) What explains the spread between the euro overnight rate and the ecb’s policy rate? Int J Finance Econ 16(3):275–289

McAndrews J, Sarkar A, Wang Z (2017) The effect of the term auction facility on the London interbank offered rate. J Bank Finance 83:135–152

Nautz D, Oechssler J (2003) The repo auctions of the European central bank and the vanishing quota puzzle. Scand J Econ 105(2):207–220

Nyborg KG, Strebulaev IA (2003) Multiple unit auctions and short squeezes. Rev Financ Stud 17(2):545–580

Petrevski G, Bogoev J (2012) Interest rate pass-through in south east europe: an empirical analysis. Econ Syst 36(4):571–593

Rudebusch GD, Wu T (2008) A macro-finance model of the term structure, monetary policy and the economy. Econ J 118(530):906–926

Shimizu T (2017) Heterogeneity of expectations and financial crises: a stochastic dynamic approach. J Econ Interac Coord 12(3):539–560

Sims CA (1992) Interpreting the macroeconomic time series facts: the effects of monetary policy. Eur Econ Rev 36(5):975–1000

Taylor JB, Williams JC (2009) A black swan in the money market. Am Econ J Macroecon 1(1):58–83

Tenorio R (1997) On strategic quantity bidding in multiple unit auctions. J Ind Econ 45(2):207–217

Teply P, Klinger T (2019) Agent-based modeling of systemic risk in the European banking sector. J Econ Interac Coord 14(4):811–833

Vickrey W (1961) Counterspeculation, auctions, and competitive sealed tenders. J Finance 16(1):8–37

Wilson R (1979) Auctions of shares. Q J Econ, pp 675–689

Wu T (2008) On the effectiveness of the federal reserve’s new liquidity facilities. Federal Reserve Bank of Dallas Working Paper 0808

Xiao D, Krause A (2017) Balancing liquidity and profitability through interbank markets: endogenous interest rates and network structures. Working Paper, University of Bath

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This work was supported by Humanities and Social Sciences Foundation of the Ministry of Education of China No. 20YJCZH184.

Appendices

Appendix: Proofs

1.1 Proof of Lemma 1

Based on reservation prices in equations (4) and (5), we easily get \(\lim _{Q\rightarrow 0} r_i^a\left( Q_i\right) =r_i^a(0)=r^f+\frac{\theta _i}{1-\theta _i}\frac{\left( 1+r_i^E\right) {\mathbf {E}}_i\left( {\mathbf {D}}_i+{\mathbf {B}}_i-{\mathbf {R}}_i\right) }{{\mathbf {R}}_i\left( {\mathbf {D}}_i+{\mathbf {B}}_i\right) }\) and \(\lim _{Q\rightarrow 0} r_i^b\left( Q_i\right) =r_i^b(0)=r^f+\frac{\theta _i}{1-\theta _i}\frac{\left( 1+r_i^E\right) {\mathbf {E}}_i}{{\mathbf {R}}_i}\). From this, we easily obtain that \(r_i^b(0)-r_i^a(0)=\frac{\theta _i}{1-\theta _i}\frac{\left( 1+r^E_i\right) {\mathbf {E}}_i}{{\mathbf {R}}_i}\frac{{\mathbf {R}}_i}{\left( {\mathbf {D}}_i+{\mathbf {B}}_i\right) }>0.\)

1.2 Proof of Proposition 1

Let us first consider the case of liquidity injection, i. e. \(Q_i>0\). The optimization problem (6) has a unique solution as \(U_i\) is a concave function of \(Q_i\) whose second derivative is

where \(U_1=\frac{\partial U_i}{\partial \rho _i}>0\), \(U_{11}=\frac{\partial ^2 U_i}{\partial \rho _i^2}<0\), \(U_{12}=U_{21}=\frac{\partial ^2 U_i}{\partial \rho _i \partial {r^E_i}}>0\), \(U_{22}=\frac{\partial ^2 U_i}{\partial {r^E_i}^2}\,{<}\,0\).

Therefore, the solution to the problem in equation (6) is either at the boundary if one of the constraints is binding or at the local maximum of \(U_i\). Solving for \(\frac{\partial U_i}{\partial Q_i}=0\) gives the local maximum. The first constraint cannot be binding as insolvency gives zero utility. Also note the last constraint is binding when bank i’s valuation for borrowing is already lower than \(r^{CB}_f\) at \(Q_i=0\), that is \(r_i^a(0)<r^{CB}_f\). Therefore, we can write the solution to problem in equation (6) as,

where \(\varphi =\psi _i^2-\left( {\mathbf {D}}_i+{\mathbf {B}}_i\right) {\mathbf {R}}_i\frac{r^{CB}-r_i^a(0)}{r^{CB}-r^f}\).

Secondly, consider liquidity extraction, i. e. \(Q_i<0\). Similarly, this problem has a unique solution because \(U_i\) is a concave function of \(Q_i\) whose second derivative is

The second constraint is binding when bank i’s valuation for lending is already higher than \(r^{CB}_f\) at \(Q_i=0\), or \(r^{CB}_f>r_i^b(0)\). Solving for the local maximum by letting \(\frac{d U_i}{d Q_i}=0\) completes the solution.

Combining these two results gives us the result shown in the proposition.

Dropping the constraint that \(Q_i\le {\overline{Q}}_i\) as it does not affect the sign of the derivative of \(Q_i^f(r)\), we obtain that

in the case of liquidity injection and

in the case of liquidity extraction.

1.3 Proof of Lemma 2

The proof is trivial from inverting the equilibrium bid schedule in Proposition 1.

1.4 Proof of Lemma 3

We prove the individual parts in turn:

-

1.

By inserting \(Q_i^f=0\) into the inverse bid schedule given in Lemma 2 we instantly see that these are identical to the reservation prices defined in Lemma 1.

-

2.

By inserting \(Q_i^f=0\) into the inverse bid schedule given in Lemma 2 we instantly see that these are identical to the reservation prices defined in Lemma 1.

-

3.

\(r_i^a(0)-r_i^b(0)=\frac{\theta _i}{1-\theta _i}\frac{\left( 1+r_i^E\right) {\mathbf {E}}_i}{{\mathbf {D}}_i+{\mathbf {B}}_i}>0\) which in combination with claims 1 and 2 of this lemma completes this proof.

-

4.

Suppose there is a \(Q_i^f<0\) such that \(r^{CB}\left( Q_i^f\right) <r_i^b\left( Q_i^f\right) \). As the reservation prices are determined such that upon making a deposit of \(Q_i^f\), the utility level does not change from the situation of not making a deposit. Receiving an amount less than \(r_i^b\left( Q_i^f\right) \) will reduce the utility level of bank i, contradicting the requirement that \(r^{CB}\left( Q_i^f\right) \) maximizes the utility.

-

5.

Suppose there is a \(Q_i^f>0\) such that \(r^{CB}\left( Q_i^f\right) >r_i^a\left( Q_i^f\right) \). As the reservation prices are determined such that upon taking a loan from the central bank of \(Q_i^f\), the utility level does not change from the situation of not taking a loan. Paying an amount more than \(r_i^a\left( Q_i^f\right) \) will reduce the utility level of bank i, contradicting the requirement that \(r^{CB}\left( Q_i^f\right) \) maximizes the utility.

1.5 Proof of Lemma 4

The marginal prices here are bank i’s marginal valuation for liquidity. Thus, for \(Q_i>0\), \({\widetilde{r}}_i^{a}= \frac{\partial Q_ir_i^a}{\partial Q_i}\), while for \(Q_i<0\), \({\widetilde{r}}_i^{b}= \frac{\partial Q_ir_i^b}{\partial Q_i}\), where \(r_i^a\) and \(r_i^b\) are the reservation prices given determined in equations (4) and (5).

1.6 Proof of Proposition 3

We prove both claims in this proposition in turn, commencing with the case of liquidity injection. Let us consider an arbitrary bank i and denote the equilibrium demand schedule of any bank by \(Q_i^v(r)\). If all banks, apart from bank i submit their optimal demand schedules and the total supply of liquidity by the central bank is \(Q^{CB}\), the residual demand schedule this bank faces, considering the constraint on the amount it can bid for, is given by

where we require that \(r > r^f\). Assume now that \(Q_i^c\) is on the optimal demand curve for bank i at an interest rate \(r^c\). This rate \(r^c\) would be the lowest possible rate at which the bank can submit its bid and still obtain the requested amount. Due to discriminatory pricing in variable rate auctions, any bid higher than \(r^c\) would result in a utility loss as the bank pays more than it has to. Thus, for any rate \(r>r^c\) the submitted demand is zero. On the other hand, at a rate \(r<r^c\) a bid would not be successful as it is too low; hence, what price or amount is submitted becomes irrelevant. Hence, the only possible equilibrium would be for a bank to submit a bid at exactly \(r^c\) for the quantity it requires at that rate.

In the following, we show that in equilibrium a bank will submit a bid schedule as indicated in the proposition.

If \(r^a_i(0)\le {\widetilde{r}}\) the reservation price of not submitting a bid, or equivalently a bid of zero, is optimal as exceeding your reservation price will result in a loss of utility.

In all other cases, we now show that alternative points on the residual demand schedule give the bank a lower utility and can thus not be an equilibrium. Let us now consider another equilibrium \({\widehat{r}}\ne {\widetilde{r}}\). If we have that \(r^a_i(0)>{\widehat{r}}>{\widetilde{r}}\), we find that \(Q^c_i={\overline{Q}}_i\) as can be easily seen by inserting the expressions for \(Q_j^v\) into \(Q_i^c\) above.

In the case of \({\widehat{r}}\le {\widetilde{r}}\) we compare \({\widetilde{Q}}_i\left( {\widehat{r}}\right) \) and \(Q_i^c\left( {\widehat{r}}\right) \). By construction \({\widetilde{Q}}_i\left( {\widehat{r}}\right) \) gives the same utility level at \({\widehat{r}}\) as \(Q_i^f\left( {\widetilde{r}}\right) \) at \({\widetilde{r}}\), i.e. it lies on the same indifference curve as the optimal demand schedule. If \({\widetilde{Q}}_i\left( {\widehat{r}}\right) \ge Q_i^c\left( {\widehat{r}}\right) \) then \(Q_i^c\) would give the bank less cash than \({\widetilde{Q}}_i\) at the same price; given that banks prefer more cash, this would lead to a lower utility level and would thus not be optimal.

We now show that \({\widetilde{Q}}_i\left( {\widehat{r}}\right) \ge Q_i^c\left( {\widehat{r}}\right) \) as follows:

where the last step is obtained as \(Q_{i}^f\left( {\widetilde{r}}\right) \le {{\bar{Q}}}_i\) and \({{\bar{Q}}}_j-Q_{j}^f\left( {\widetilde{r}}\right) \) and \(Q_{k}^f\left( {\widetilde{r}}\right) -{\widetilde{Q}}_k({\widehat{r}})\) are always non-negative. If there exists one \(j \ne i\), such that \({{\bar{Q}}}_j-Q_{j}^f\left( {\widetilde{r}}\right) \ge \max _{k=1,\ldots ,N} \left( Q_{k}^f\left( {\widetilde{r}}\right) -{\widetilde{Q}}_k({\widehat{r}})\right) \), we have,

Otherwise we have

In the case of liquidity extraction the same steps are followed as above. The possible demand by bank i given the demand by all other banks is determined as

where we take into account that banks cannot deposit more than their cash reserves and require that \(r>r^f\). With the same arguments made before, for any \(r<r^c\), the optimal interest rate, the bank does not receive sufficient interest on their deposits with the central bank and thus will bid an amount of zero. Furthermore, if \(r_i^b(0)\ge {\widetilde{r}}\), the reservation price is too high for the bank to bid for depositing cash with the central bank, and thus will also bid an amount of zero.

For the case of \(r_i^b(0)< {\widehat{r}}<{\widetilde{r}}\), we can easily show that \(Q_i^c(r)=\max \left( -{\mathbf {R}}_i,Q^{CB}\right) \) by inserting for \(Q_j^v(r)\). In the case that \({\widehat{r}}\ge {\widetilde{r}}\) we follow the same arguments as in the case of liquidity injection and need to show that \({\overline{Q}}_i({\widehat{r}})\le Q_i^c({\widehat{r}})\). We obtain

The penultimate step arises as \(Q_{i}^f\left( {\widetilde{r}}\right) \ge -{\mathbf {R}}_i\) and \({\overline{Q}}_k({\widehat{r}})\ge Q_{k}^f\left( {\widetilde{r}}\right) \).

1.7 Proof of Lemma 5

This lemma follows from the definition of the inverse bid schedule, \(r_i^v(Q_i)=\inf \left\{ r>r^f| Q_i^v(r)\le Q_i\right\} \). It is also obvious that \(r_i^v(Q_i)\) is a non-increasing function of \(Q_i\). To show this, we only need to show that \(R^{-1}(Q_i)\) is a non-increasing function of \(Q_i\). This is true as when r increases, both \(\min \Big \{{{\bar{Q}}}_i,Q_{i}^f\left( {\widetilde{r}} \right) +\max _{j=1,\ldots ,N} \left( Q_{j}^f\left( {\widetilde{r}} \right) -{\widetilde{Q}}_j(r)\right) \Big \} \) and \( Q_{i}^f\left( \widetilde{{\widetilde{r}}} \right) -\max _{j=1,\ldots ,N} \left( \widetilde{{\widetilde{Q}}}_j(r)- Q_{j}^f\left( \widetilde{{\widetilde{r}}} \right) \right) \) are non-increasing as can easily be seen.

1.8 Proof of Proposition 4

We need to show the tuple \(\left( r^{CB}_f,Q_1^f,\ldots ,Q_N^f\right) \) also clears the market when bid schedules are as described in Proposition 3. First consider the case of \(Q_i^f\ge 0\), when the amount of operation is \(Q^{CB}=\sum _{i=1}^N Q_i^f=\sum _{i=1}^N \max \left( 0,Q_i^f\left( r^{CB}_f\right) \right) \), obviously \(r^{CB}_f \in \left\{ r\ge r^f|\sum _i^N \max \left( 0,Q_i^f(r)\right) = Q^{CB}\right\} \). Note that \(Q_i^f(r)\) is strictly decreasing before reaching limit \({{\bar{Q}}}_i\). Therefore, \(\sum _i^N \max \left( 0,Q_i^f(r)\right) \) is strictly decreasing as \(0<Q^{CB}<(N-1){{\bar{Q}}}_i\) and has thus a unique solution. Therefore, \({\widetilde{r}}\) defined in Proposition 3 equals \(r^{CB}_f\), since \(Q_{i}^v\left( r^*\right) =Q_{i}^f\left( r^*\right) \) (if \({\widetilde{r}}>r_i^a(0)\) this also holds as both are zero), what remains to be shown is \(r^{CB}_v={\widetilde{r}}\). This is obvious as \(\sum _{i=1}^N Q_{i}^v\left( {\widetilde{r}}\right) =Q^{CB}\) clears the market while any \(r<{\widetilde{r}}\) cannot.

The proof for \(Q_i^f\le 0\) follows exactly the same process.

1.9 Proof of Proposition 2

It is easy to verify that \(\left( {\widehat{r}}^{IB}, \lambda Q_1^I\left( {\widehat{r}}^{IB}\right) ,\ldots , \lambda Q_1^I\left( {\widehat{r}}^{IB}\right) \right) \) clears the market. We show here that a bank i cannot gain higher expected utility after the interbank market by deviating from the bid schedule proposed here. As shown in Proposition 3, it is optimal for any bank i to pay no more than the clearing rate of the primary market, so in the following we only consider bid schedules where a bank demands zero if the interest rate charged is larger than expected clearing rate in the interbank market. We show the case for liquidity injection here as for liquidity extraction the argument can be made in exactly the same way.

Let us consider bank i having any alternative bid schedule where it bids \(Q_i>0\) at a rate \(r_i^{CB}\) and \(Q_i=0\) at some rate \(r>r_i^{CB}\). Firstly, if \(r_i^{CB}<{\widehat{r}}^{IB}\), bank i does not participate in the primary market but only the interbank market. This does not change the clearing rate as the reduced allocation to bank i is compensated by increased allocation to other banks. Consequently, in the interbank market, bank i demands more funds, while other banks are expected to demand less due to their increased allocation by the central bank; hence, the aggregate amount is unchanged and so is the expected interbank rate. Here, bank i only shifts part of its demand from central bank funds to the interbank market and its expected overall utility increase is the same; hence, it is not better off.

Secondly, if \(r_i^{CB}={\widehat{r}}^{IB}\), but \(Q_i^f\left( {\widehat{r}}^{IB}\right) \ge Q_i\ne Q_i^I\left( {\widehat{r}}^{IB}\right) \), this results in bank i borrowing less from the central bank as the rate is less favourable and this has a similar effect as in the case where \(r_i^{CB}<{\widehat{r}}^{IB}\). If \(r_i^{CB}={\widehat{r}}^{IB}\), but \( Q_i^f\left( {\widehat{r}}^{IB}\right) <Q_i \ne Q_i^f\left( {\widehat{r}}^{IB}\right) \), bank i could be worse off. Its allocation could exceed \(Q_i^f\left( {\widehat{r}}^{IB}\right) \) which is the optimal amount that maximize i’s utility or by over-reporting its demand bank i also makes the demand for liquidity to be greater in subsequent interbank markets and thus raises the expected interbank rate for all banks, including itself.

Thirdly, if \(r_i^{CB}>{\widehat{r}}^{IB}\) and if \(Q_i\ge Q_i^I\left( {\widehat{r}}^{IB}\right) \) bank i would be strictly worse off because it pays more for liquidity from the central bank as well as the interbank market. The former is obvious, and the latter is because over-reporting bank i’s demand raises expected interbank rates as discussed above. On the other hand, if \(Q_i < Q_i^I\left( {\widehat{r}}^{IB}\right) \), bank i would still be worse off. Suppose in this case, bank i gets an allocation of \(Q_i^{CB}\) from the central bank and demands \(Q_i^{IB}\) in the interbank market. Obviously, for \(Q_i^{CB}\), bank i pays more than \({\widehat{r}}^{IB}\) which reduces its utility. For \(Q_i^{IB}\), there is a chance bank i pays less than \({\widehat{r}}^{IB}\), even so, this is not enough to compensate for i’s utility loss from central bank funds. Suppose the opposite is true, that bank i pays in the interbank market \(r_i^{IB}<{\widehat{r}}^{IB}\), keeping its utility the same as before. Consider all combinations of rate and quantity (r, Q) in the interbank market that gives the same utility as originally, i. e. \(\Big \{(r,Q)| U_i\left( \rho _i(Q),r_i^E(r, Q)\right) =U_i\left( \rho _i\left( Q_{i}^I\left( {\widehat{r}}^{IB}\right) \right) ,r_i^E\left( {\widehat{r}}^{IB},Q_{i}^I\left( {\widehat{r}}^{IB}\right) \right) \right) , {\widehat{r}}^{IB}>r >r^f\Big \}.\) If the collateral constraint is not binding for bank i, it has to demand \(Q_i^{IB}\) in order to maximize its utility, corresponding to the maximum of r, but \(r<{\widehat{r}}^{IB}\) implies \(Q_i^{IB}+Q_i^{CB}\ge Q_i^I \left( {\widehat{r}}^{IB}\right) \). If the collateral is binding, equality holds here.

Overall, this implies interbank markets cannot clear as banks’ aggregate demand must be more than the supply due to a drop in interbank market rate and the fact bank i is also demanding more than or equal as before. Therefore, bank i cannot reach the same level of utility as originally.

Appendix: Variable rate tenders