Abstract

This study investigates the effects of environmental tax and environmental spending on CO2 emissions of 27 countries of the European Union EU27 countries using annual time series data from 1995 to 2022. The study used linear and non-linear autoregressive distributive lag (ARDL and NARDL) to examine the relationship. Estimates claim that the variables have a symmetric and asymmetric long-term and short-term relationship. The negative impacts of environmental taxes on CO2 emissions prove that emissions are reduced when polluting activities are taxed. Fiscal policy instrument such as taxation changes the behaviour of the private sector in the EU27 nations by disincentivizing polluting activities. On the other hand, government investment in environmental protection has encouraged the private sector in the EU27 nations to embrace and invest in green technologies, decreasing CO2 emissions. The ECM term is negative and statistically significant at a 1 percent significance level for ARDL and NARDL models, implying a stable long-run relationship between variables. It demonstrates that short-run disequilibrium converges to long-run equilibrium at a speed of 9.2% (in the ARDL model) and 22.7% (in the NARDL model). The study also sheds fresh light on the effectiveness of environmental taxes vs. expenditure, where taxes serve as a counter-incentive policy for CO2 emissions, and spending is a positive policy intervention.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

The biggest threat to humankind is environmental deterioration, which harms economic growth and our health (Wolde-Rufael and Mulat-Weldemeskel 2021). As the worldwide population expands, so do the needs and environmental degradation caused by human-caused pollutants. The increasing global temperature, the deterioration of biological equilibrium, and the worsening of the environment all over the globe are severe modern challenges that endanger life on Earth (Aydin and Esen 2018). Most nations are cognizant of the negative consequences of rising CO2 levels in the atmosphere and are taking steps to prepare for the hazards and severe conditions associated with climate change (Farhani and Ozturk 2015; B. Li and Haneklaus 2022; Malinauskaite et al. 2019, 2020; Patel and Mehta 2023). The European Union (EU) is the third largest economy in the world, having $ 16.6 trillion (nominal) GDP and a net wealth of $69 trillion (Redesigning Service Financial 2021).

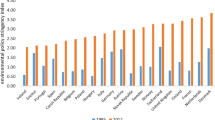

CO2 emissions in the EU countries were 6.5% (0.17 Gt) in 2020 compared to 2021. However, this rise is only half of the decline between 2019 and 2021 (-10.8%), resulting in a 5% reduction in EU emissions between 2021 and 2019 (Crippa et al. 2022). CO2 emissions in the long run (in the past 20 years) in the EU have been declining, and in 2021, they were 2.78 Gt, or 27.4% lower than in 1990. The contribution of the EU to global emissions has similarly declined in recent years, falling from 16.8% in 1990 to 8.5% in 2015 and 7.3% in 2021 (Crippa et al. 2022). Reducing CO2 emissions and other ecological concerns that make nations accountable to each other is the only sustainable strategy for the world. In an effort to reduce these emissions, the EU has used subsidies, laws, and a variety of economic tools. Though these measures are routinely out regarding emission-reduction procedures, the argument over which mechanisms are the most effective continues (Aydin and Esen 2018). Environmental taxes and government expenditures on the environment are essential fiscal policy measures for limiting CO2 emissions (Aydin and Esen 2018; Wolde-Rufael and Mulat-weldemeskel 2023, 2021). An environment-focused tax, particularly one that aims at curbing CO2 emissions, is crafted to modify actions by introducing a monetary burden on actions that produce carbon dioxide. The objective of such taxation is to diminish these emissions and motivate people, businesses, and sectors to embrace greener and more enduring approaches (Allan et al. 2014; Bao et al. 2013; Gemechu et al. 2012; Li 2017; Yang 2009) (see Fig. 1).

The relevance of environment tax as a fiscal tool in an effort against environmental issues is emphasised in both the updated Lisbon strategy and the Sixth Environment Action Programme (EAP) of the EU, both of which were agreed by the European Parliament and Council in 2002 (Aydin and Esen 2018). The loss that which represented in market pricing, commonly referred to as externalities or external costs, has an impact on society as a whole, as well as the emitter of pollutants and tax levies, which address these market imperfections (Aydin and Esen 2018; Hanson and Sandalow 2006). Environmental taxes appear as one of the most significant fiscal policy tools employed in internalising “negative externalities.” Environmental taxes can impact people’s economic choices while also serving to safeguard the environment (Aydin and Esen 2018; Wolde-Rufael and Mulat-Weldemeskel 2021).

Government spending on the environment is a fiscal policy measure aimed at enhancing the sustainability and quality of the environment (Adebola Solarin et al. 2017; Solarin and Al‐Mulali 2021). These expenses may reduce CO2 emissions in a number of ways, either directly by supporting initiatives that reduce emissions or indirectly by encouraging environmentally friendly behaviour. Government spending, such as environmental subsidies, may have a big impact on CO2 emissions by supporting practices, technologies, or activities that result in lower emissions and a more sustainable environment overall (Gerlagh and van der Zwaan 2006b; Grafton et al. 2014; Liu et al. 2022; Machado et al. 2021). EU has been successful in curbing its CO2 emissions compared to other countries around the world (see Fig. 2). The contribution of these study is two folds; first, it compares how well environmental spending and taxes work to cut CO2 emissions in the EU, using asymmetric model approach. Policymakers may get important insights from this direct comparison, which enables a greater understanding of which policy option has a more significant impact on carbon reduction. Second, the research adds to the existing literature and provides useful insights to other nations hoping to emulate the EU’s achievements. By providing actual data and an asymmetric (positive and negative) effect of fiscal instruments, this research covers a critical gap. Insights of this study can help set the groundwork for future policy discussions and function as a guide for international efforts to successfully tackle climate change.

This research will cover a wide range of stakeholders, such as governmental organisations, academic institutions, scientific societies, financial institutions, international organisations like the United Nations (UN) and Intergovernmental Panel on Climate Change (IPCC), energy-related industries, the general public, utilities, and technology developers. This study will provide empirical evidence of how policies of environment tax and spending can impact CO2 emissions, which can be very useful for other developing and developed nations. The study will contribute to better understand and mitigate the effects of CO2 emissions through the implementation of solutions aimed policies and funding. Which will address climate change and promoting sustainability. In “Literature review” section, the review of the literature is expanded upon, discussing the research conducted on carbon dioxide emissions, environmental taxes, expenditure, and economic growth. The model and data description are in “Data description and methodology” section, while the findings and interpretations are in “Results and discussion” section. The paper’s conclusion, limitations, and future research scope are covered in “Conclusion” section.

Literature review

The goal of environmental policy is not just to raise revenue but also to significantly change consumer and corporate behaviour by encouraging them to buy less harmful goods and corporations to adopt environmentally friendly technology (see Aydin and Esen 2018; Borozan 2019; Shahzad 2020; Wolde-Rufael and Weldemeskel 2020). Legislative measures like taxes and strict environmental laws and regulations are the most effective tools for resolving environmental degradation. Because environmental degradation consists of negative externalities, it should not be left to the market to offer remedies (Haites 2018; Pigou and Aslanbeigui 2017; Wolde-Rufael and Mulat-weldemeskel 2023).

Environmental tax and CO2 emissions

According to (Shahzad 2020) and (Mardones and Baeza 2018), a carbon tax alters the structure of production and consumption by forcing the domestic sector to adopt more environmentally friendly technology, energy-saving measures, and a cleaner, healthier environment; taxes have the potential to cut emissions. Numerous studies on the impact of environmental taxes on a range of pollutants indicators, including carbon dioxide (CO2) emissions, sulphur dioxide emissions, exhaust emissions, wastewater discharge, municipal waste, and deforestation, have found that environmental taxes have a significant impact on environmental improvements (Alfsen et al. 1995; Aydin and Esen 2018; Bohlin 1998; Manne and Richels 1992; Nakata and Lamont 2001; Nordhaus 1991; Whalley and Wigle 2017). A study by (Millock and Nauges 2003) on air pollution tax in France found a negative relationship between tax and emissions of pollutant gas in the air. Using a dynamic recursive general equilibrium model, (Lu et al. 2010) found a negative and significant impact of the carbon tax policy on carbon emissions in China. Complimenting (Lu et al. 2010), a study by (Yang et al. 2014) also discovered that China’s carbon tax had a negative impact on the regional emissions of CO2. Furthermore, the impact of carbon taxes in reducing CO2 emissions is significantly hampered by inelastic fuel demand, primarily determined by price elasticity (also see, (Shafi et al. 2023; Xu and Long 2014; Zhang and Lu 2023).

Similar studies done in European economics also assert that environment-related tax will significantly reduce CO2 emissions by de-incentivizing polluting activities (see, (Agostini et al. 1992; Ghazouani et al. 2020). European economics has successfully used its fiscal policy instrument for environmental preservation, a carbon tax intended to help reduce greenhouse gas emissions. Such tax tries to factor costs associated with reducing environmental harm into pricing choices for the pollution-generating sectors. A study by (Hájek et al. 2019) found that the carbon tax in the energy sector is ecologically beneficial, with a higher tax rate enabling the reduction of greenhouse gases output, which is statistically strongly influenced by the use of fossil fuels. The estimates indicate that increasing the carbon price by one euro per tonne can reduce yearly per-person emissions by 11.58 kg. The study by (Hájek et al. 2019) also compliments to the studies like (Alper 2017) and (Charlier et al. 2023) done in the European context, which found a similar relationship between the environmental tax and CO2 emissions (also see, (Bothner et al. 2022).

Contrarily, (Bruvoll and Larsen 2004) claimed that environmental taxes had a limited impact. They attributed this comparatively small effect to the numerous exemptions from taxation as well as the quite inflexible demand in the industries where these taxes are applied. (Lin and Li 2011) and (Hotunluoğlu and Tekeli 2007) explored the effects of carbon taxes employed for the purposes of reducing emissions by using data from European countries. Other studies which found limited impact of environmental tax and CO2 emissions are (Bruvoll and Larsen 2004; Gerlagh and Lise 2005; Loganathan et al. 2014).

Environment spending and CO2 emissions

According to (Pearce and Palmer 2005), conservation of the environment is an excellent instance of a public good since it addresses market failures caused by environmental externalities and provides improvements that benefit numerous individuals at once. Government expenditure on ecological issues is a fiscal policy tool intended to improve the environment’s quality and sustainability (Adebola Solarin et al. 2017; Solarin and Al‐Mulali 2021). According to studies like (Gerlagh and van der Zwaan 2006a; Grafton et al. 2014; Machado et al. 2021; Rizwanullah et al. 2022), environmental protection spending, such as subsidies, may have a significant impact on CO2 emissions by fostering behaviours, innovations, and operations that lead to lower emissions and a more sustainable environment as a whole. But there are limited empirical studies measuring the impact of environmental spending on CO2 emission in European context. It is expected that higher spending on environment friendly technologies, subsidies, and research will help in reducing the CO2 emissions (Caglar and Yavuz 2023).

The environmental effects of fiscal expenditure patterns have been investigated by (López et al. 2011); the study concluded that government spending in favour of social and public goods will lower pollution. (Bostan et al. 2016) conducted research on how public spending affects environmental protection in European nations. They discovered that spending on the environment lowers the emissions of air pollutants such CO2, SO2, NOX, and PM10. Similar research by (Ercolano and Romano 2018) equivalently supports a favourable relationship between environmental performance and environmental protection spending in 21 European nations. In order to empirically analyse the impact of environmental protection spending that is insufficient for European Union economies, the study by (Caglar and Yavuz 2023) uses the CS-ARDL technique. They discovered that environmental spending significantly affected CO2 emissions. They also came to the conclusion that nations in the European Union should set aside additional funding from their general budgets for environmental preservation in order to attract the business sector as well as the governmental sector.

Economic growth and CO2 emissions

Following the most well-known EKC theory by (Grossman and Krueger 1991), several research have looked at the connections between economic growth and environment. The majority of research discovered a link between emissions and economic development (Agrawal and Mehta 2016; Ali et al. 2020; Ali et al. 2017; Alshehry and Belloumi 2015; Farhani and Ozturk 2015; Menyah and Wolde-Rufael 2010; Pao and Tsai 2011; Park and Hong 2013; Pata 2018; Saidu Musa and Maijama’a 2020; Sharma et al. 2020; Song 2021; Zaidi and Saidi 2018).

According to study by (Saidu Musa and Maijama’a 2020), a growing the economy uses more energy resulting in the increase of environmental pollution. (Pata 2018) also found that the per capita GDP, per capita energy consumption, financial expansion, urbanisation, and manufacturing are the major were all contributing to a rise in CO2 emissions (also see, (Pata and Caglar 2021). According to the findings of (Sharma et al. 2020), globalisation greatly raises South Asia’s carbon emissions, and GDP and CO2 are positively correlated (also see, (Shahbaz et al. 2021). A related research by (Song 2021) discovered a relationship between GDP per capita and carbon emissions per capita that was positive. Additionally, a linked relationship between GDP and pollution was discovered by (U and Mitra 2020) (also see, (Pal and Mitra 2017).

According to a brief review of the literature, an empirical study that tried to examine the effects of environmental tax, expenditure, and economic growth on CO2 emissions came up with a contradictory outcomes. The mixed results is because of the methodology, time frame, and sample size. Limited empirical research have been conducted, particularly in the European setting, on the effect of expenditure related to environmental issues and CO2 emissions. Given that the European economies has been more successful than the rest of the world in reducing its CO2 emissions, it is necessary to investigate if environmental expenditure or taxation had a more significant role in this achievement.

Data description and methodology

Data description

This study try to measure the impact of environment related taxes and spending on the CO2 emission of European Union countries. Table 1 contains the list of EU countries used for the study based on the availability of the data.

Environmental fiscal reforms (EFR) policy and CO2 emissions

The role of government policy and its intervention has been a highly debated theme in economics literature. On the one hand, the classical paradigm argues that the self-equilibrating capacity of markets makes government policies irrelevant, and on the other hand, the Keynesian paradigm argues that government policies are designed for economic growth and stabilisation (including externality). Environmental taxes and government spending on the environment are two of the environmental fiscal reforms (EFR) policy tools that the EURO-27 countries have used to reduce their CO2 emissions (Aydin and Esen 2018; Wolde-Rufael and Mulat-weldemeskel 2023, 2021). An environmental tax, especially one that attempts to reduce CO2 emissions, is designed to change behaviour by placing a financial burden on activities that release carbon dioxide. The aim of this kind of taxation is to reduce these emissions and encourage individuals, companies, and industries to adopt more sustainable and environmentally friendly practices. Government spending on the environment is directed at enhancing its sustainability and quality (Adebola Solarin et al. 2017; Mehta and Derbeneva 2024; Solarin and Al‐Mulali 2021). By supporting initiatives that do so directly or indirectly by encouraging ecologically conscious behaviour, these expenses may reduce CO2 emissions in a number of ways. Equation (1) shows the linear model for CO2 as a function of environment tax and environment spending by government:

where CO2t is carbon emissions, ETAXt is environment tax, and EEXPt is environment expenditure.

Environmental Kuznets curve

The environmental Kuznets curve (EKC) by (Grossman and Krueger 1991), theory proposes the connections between economic growth and environment. According to EKC hypothesis, growing the economy uses more energy resulting in the increase of environmental pollution. The economic growth is measured by income growth and manufacturing sector contribution (see, (Shahbaz et al. 2021). By adding MUFt (Manufacturing sector contribution) and Yt (income growth) in Eq. (1), we get Eq. (2):

The time series data of the variables from 1995 to 2022 is considered for the study with data sources and description as mentioned in Table 2.

Model

Equation (2) can be further expressed in the form of a linear equation to estimate the impact of ETAX, EEXP, MUF, and Y, on CO2 emissions (see Eq. (3)):

To verify the presence of long-run relationship among the variables of Eq. (2), the cointegration tests of (Pedroni 1999, 2004), (Kao 1999), and Johansen-Fisher are used. The Pedroni tests assess the stationarity of the residual \({\varepsilon }_{it}\) in Eq. (2), and whether it has a unit root. Second, the (Kao 1999) test is similar to the approach of the Pedroni test but imposes the condition that the independent variables are subjected to cross-sectional specific intercepts and homogenous coefficients (Esily et al. 2022).

To measure the long-run and short-run relationship among the variables of Eq. (2), the study has used the pooled group mean (PMG) estimation methods (Pesaran et al. 1999; Pesaran and Smith 1995). PMG is preferred due to its ability to capture both short-run coefficients and error variances while considering a lower degree of heterogeneity. The assumptions of PMG include a normally distributed error correction term that is free from correlation bias and exogeneity of explanatory variables. Furthermore, the equation assumes a long-run relationship between the dependent and explanatory variables, and the long-run parameters remain consistent across countries (Qamruzzaman and Jianguo 2020). The following Eq. (4) is the generalized panel ARDL model proposed from Eq. (3):

where \(i\) =1……N is the cross-section and \(t\)=1……T is the time period. \({\delta }_{0i}\) to \({\delta }_{5t}\) represents long-run coefficient, and \({\vartheta }_{1J}\) to \({\vartheta }_{5J}\) represents short-run coefficients. To estimate the asymmetry effect of explanatory variables, the panel NARDL model incorporates both positive and negative shocks of explanatory variables into the analysis. From Eq. (4), the panel NARDL model is estimated as follows:

where \({ETAX}^{+}\) and \({ETAX}^{-}\) stand for the positive and negative shock of environment tax and \({EEXP}^{+}\) and \({EEXP}^{-}\) represents positive and negative shock environment related expenditure. Equation (6) and Eq. (7) represent the positive and negative partial sum decomposition of ETAX and EEXP:

Equation (8) estimates the error correction model of Eq. (5):

In panel asymmetric Eq. (8), the error correction term (ECT) reflects how quickly the system adjusts to its long-run equilibrium. On the other hand, the coefficient associated with the explanatory variable explains the adjustment rate for the system to reach its long-run equilibrium in the presence of shocks, during the short run. The research further hypothesized the following relationship between environmental spending, environment tax, economic development, and CO2 emissions (Table 3):

The null hypothesises will stand true if \({{\delta }_{2t},\beta }_{2i}^{+}, {\beta }_{3i}^{-},{\gamma }_{ij}^{+}, and {\gamma }_{ij}^{-}\) value is zero, invalidating the policy measure of taxing to counter negative externality in from of CO2 emissions in the long run and short run. The alternate hypothesis will stand true if \({{\delta }_{2t},\beta }_{2i}^{+}, {\beta }_{3i}^{-},{\gamma }_{ij}^{+}, and {\gamma }_{ij}^{-}\) value is not zero, upholding the policy relevance in form of taxation to control negative externality of CO2 emissions in the long and short run. The null hypothesis \({H0}_{B}\) and \({H0}_{D}\) will stand true if \({{\delta }_{3t},\beta }_{4i}^{+}, {\beta }_{5i}^{-}, {\delta }_{ij}^{+}, and {\delta }_{ij}^{-}\) value is zero, invalidating policy measure of environment spending on CO2 emission in long run and short run whereas the alternate hypothesis will stand true if \({\beta }_{4i}^{+}, {\beta }_{5i}^{-}, {\delta }_{ij}^{+}, and {\delta }_{ij}^{-}\) value is not zero, validating the impact of environment spending on CO2 emissions in the long run and short run.

Results and discussion

The pairwise correlation and descriptive statistics summary are presented in Table 4 for CO2, ETAX, EEXP, MUF, and Y for the EU27 panel data. The standard deviation of each variable is lower than its mean value, indicating steady variance across the sample period (see Table 4). The insignificant Jarque–Bera test statistic supported all variables’ normal distribution. Primary evidence of the negative relationship between CO2 emissions, ETAX, and EEXP is asserted by the pairwise correlation estimates between CO2 and ETXA (-0.1535) and CO2 and EEXP (-0.0686).

The unit root test estimates are shown in Table 5. The findings demonstrate that all variables exhibit stationary at the I(1) level of integration, which satisfies the requirement for panel ARDL and NARDL proposed by (Pesaran et al. 1999) to examine the long- and short-run relationship while taking into account the cross-sectional dependence and heterogeneity of the panel data. Panel data analysis frequently encounters the cross-section dependence problem, in which observations from many countries are correlated to one another because they have the same economic characteristics (Gaibulloev et al. 2014). One of the fundamental premises of panel data analysis, that the observations across several cross-sections are independent of one another, is violated by this connection. Therefore, investigation of the presence of cross-sectional dependency is most likely demand in the empirical investigation with panel data (Breusch and Pagan 1980; Pesaran 2004).

Table 6 shows the estimation of the cross-section dependence tests. The variables under examination display a cross-sectional dependency, indicating a similarity in their dynamics across all EU27 countries, the estimates rejects the null hypothesis of cross-sectional independence for CO2, ETAX, EEXP, MUF and Y asserting the certain common patterns and behaviours across all the EU27 countries.

The estimates of the panel cointegration tests are presented in Table 7. The results of the Pedroni, KAO, and Johansen-Fisher panel cointegration test shows that estimated statistic is significant at a 1% level and confirm that the variables are co-integrated in the long run. The Johansen-Fisher panel cointegration trace-test and maximum Eigen value also confirm a long-run association between the variables at 1% level of significance. Hence, it safe to implies that CO2, ETAX, EEXP, MUF, and Y have a long-run relationship.

The symmetrical and asymmetrical panel ARDL and NARDL models are used for the panel data of EU27 countries by assuming linear and non-linear relationship between CO2, ETAX, EEXP, MUF, and Y using PMG estimation proposed by (Pesaran et al. 1999). The pooled mean group (PMG) is a panel data estimation method that extends the mean group (MG) estimator by allowing for heterogeneous slopes and a common intercept across the panel. In general, the PMG estimator is preferred over the MG estimator when there is a potential for parameter heterogeneity across groups. The PMG model imposes homogeneity in long-term equilibrium across countries but permits heterogeneity in the short-term relationship (Asteriou et al. 2021). The Hausman test to confirm the acceptance of null indicates that PMG is better than MG model (see Table 8).

The long-run estimates of ARDL show that a 1% increase in ETAX reduces CO2 emissions by 0.050%, indicating that the environment protection tax successfully de-incentivises polluting activities, resulting in reduced CO2 emissions (accepting H1A and rejecting HOA). It can be inferred that CO2 emission decreases by penalising (through taxing) the polluting activity, and the estimates are in line with the previous studies (see, (Chen et al. 2017; Floros and Vlachou 2005; Lu et al. 2010; Meng et al. 2013). Furthermore, the negative and significant coefficient of EEXP (-0.1837) suggests that a 1% increase in expenditure for environment protection activities leads to a 0.18% reduction in CO2 emissions in EU27 countries (Accepting H1B and Rejecting HOB). It can be inferred that by supporting and promoting environment-friendly activities by incentivising through environmental spending (EEXP), it will reduce CO2 emissions in EU27 countries (see, (Adebola Solarin et al. 2017; Caglar and Yavuz 2023; Ercolano and Romano 2018; Solarin and Al‐Mulali 2021). The ARDL long-run estimates of control variables for economic growth highlight the positive but diminutive impact on CO2 emissions in EU27 countries. The MUF and Y coefficient show that a 1% increase in manufacturing activities will lead to increase in CO2 emission in EU27 countries by 0.013% and 0.001% respectively. The results support the well-known EKC theory (Grossman and Krueger 1991), which asserts that a growing economy uses more energy for manufacturing, increasing environmental pollution. The estimates are in line with the previous studies done on EKC theory (see, (Pata 2018; Pata and Caglar 2021; Saidu Musa and Maijama’a 2020; Shahbaz et al. 2021; Sharma et al. 2020). The estimates open a new window of further discussion and research on inverting the impact of economic growth on CO2 emissions. The short-run ARDL estimates assert a negative relationship between environmental tax (ETAX) and spending (EEXP) in EU27 countries (see, (Caglar and Yavuz 2023; M. Liu et al. 2020; Solarin and Al‐Mulali 2021; Yang et al. 2014). The coefficient of \(\Delta\)(ETAX) and \(\Delta\)(EEXP) show that a 1% increase leads to decreased CO2 emissions by 0.09% and 0.03%, respectively (accepting H1C and H1D). The positive and significant coefficient of \(\Delta\)(MUF) and \(\Delta\)(Y) shows that in the short run, a 1% increase in manufacturing activities will increase CO2 emission by 0.06% and 0.01% respectively supporting the EKC theory by (Al-Mulali et al. 2016; Farooq et al. 2022; Grossman and Krueger 1991; Ozturk and Acaravci 2013) (Table 9).

The NARDL long-run estimates confirm the asymmetry impact of ETAX, EEXP, MUF, and Yon CO2 emissions in EU27 countries. The negative and significant coefficient on ETAX + (-0.0315) professes that a positive change in environment tax will reduce CO2 emissions by 0.03%, whereas the impact of adverse change in ETAX- has a higher impact on CO2 emissions, as a 1% reduction in ETAX will increase CO2 emissions by 0.07% in EU27 countries (accepting H1A). It can be inferred that an increase in environmental tax will reduce CO2 emissions and work as a counter-incentive for polluting activities, but reducing the tax can lead to higher emissions (see, (Gemechu et al. 2014; Lu et al. 2010; Nakata and Lamont 2001). The significant coefficient on EEXP + affirms that increased environment protection spending will reduce CO2 emissions in EU27 countries by 0.08%. Contrary to the negative change of EEXP-, it has a higher impact on CO2 emissions, as a 1% reduction in spending will increase emissions by 0.12%. The estimates of environmental tax and spending align with previous studies on the impact of tax and spending on carbon emissions (accepting H1B) (see, (Caglar and Yavuz 2023; Chen et al. 2017; Solarin and Al‐Mulali 2021). The significant and positive coefficients of MUF and Y, though very minuscule, support the EKC theory (see, (Pata and Caglar 2021; Patel and Mehta 2023; Saidu Musa and Maijama’a 2020; Shahbaz et al. 2021).

Short-run non-linear estimates show that an increase in ETAX + and EEXP + reduce CO2 emissions by 0.01%, respectively (accepting H1C and H1D). Furthermore, adverse changes in ETAX- and EEXP- will increase CO2 emissions by 0.07% and 0.02%, making the impact equivalence in the short-run for EU27 countries. The error correction term in the dynamic model represents the rate of adjustment that restores the equilibrium relationship. The ECM term is negative and statistically significant at a 1% significance level for ARDL and NARDL models, implying a stable long-run relationship between variables. It demonstrates that short-run disequilibrium converges to long-run equilibrium at a speed of 9.2% (in ARDL model) and 22.7% (in the NARDL model); this suggests that the NARDL models provide a better speed adjustment to long-run relationship equilibrium. The symmetric and asymmetric relationship are graphically summarised in Fig. 3.

The plots of CUSUM and CUSUMSQ also confirmed the model stability (see Figs. 4 and 5). The significant Wald test confirms the long-run and short-run asymmetric nexus between CO2 emission and independent variables. The cumulative dynamic multiplier is used to assess the short and long-run asymmetric influence of ETAX and EEXP on CO2 emissions (see Fig. 5). The cumulative dynamic multiplier graphs are shown in Fig. 6. These graphs show how asymmetry varies over time for positive and negative shocks on CO2 emissions. The VIF estimates of panel-ARDL and panel-NARDL coefficients are less than 4 which asserts no multicollinearity among the variables (see Table 4) (see, (Mehta and Mallikarjun 2023; Tamura et al. 2019).

Conclusion

The current study examines the short- and long-term effects of environmental expenditures and taxes on CO2 emissions in a panel of 27 European Union nations. Estimates claim that the variables have a symmetric and asymmetric long-term and short-term relationship. The negative impacts of environmental taxes on CO2 emissions prove that emissions are reduced when polluting activities are taxed. Fiscal policy instrument such as taxation changes the behaviour of the private sector in the EU27 nations by disincentivising polluting activities. On the other hand, government investment in environmental protection has encouraged the private sector in the EU27 nations to embrace and invest in green technologies, decreasing CO2 emissions.

This analysis finds that compared to environmental taxes, environmental spending has more impact on curbing CO2 emissions. Economic expansion and manufacturing activity increase CO2 emissions. It is reasonable to anticipate a positive correlation between industrial development, the production of energy from fossil fuels, and these emissions. By presenting fresh evidence from the European Union, the present study contributes to the literature on CO2 emissions and economic policies. The study also sheds fresh light on the effectiveness of environmental taxes vs. expenditure, where taxes serve as a counter-incentive policy for CO2 emissions, and spending is a positive policy intervention. For correcting their unbalanced energy mix and increasing the amount of cleaner alternative energy sources, EU27 nations serve as examples for policymakers throughout the globe. Global industrialisation has advanced more quickly than before, increasing CO2 emissions. The energy policies of the EU27 serve as an exemplar for both established and emerging nations. If the world wants to uphold its commitment to environmental protection, it must develop laws that support the development of non-polluting industries and more ecologically friendly production methods.

Policy implications

-

Sustainable development goals (SDG) number 13 calls for immediate action to mitigate the effects of climate change. One of the main focuses of this objective is CO2 emissions because they are a major cause of climate change and global warming. But CO2 emissions also indirectly affect other sustainable development goals (SDGs), including SDG 7 (affordable and clean energy), SDG 14 (life below water), and SDG 15 (life on land). Thus, reducing CO2 emissions using environmental taxes and spending is crucial to accomplishing a number of SDGs and guaranteeing a sustainable future for all.

-

Putting in place environmental taxes to cut CO2 emissions can help a number of stakeholders, particularly in industrialised and developing nations. A reduction in CO2 will help governments earn tax revenues for climate initiatives and international obligations. Further, it will help businesses innovate and save costs by implementing cleaner technologies; consumers will make more sustainable decisions; and public health outcomes will also improve. Nevertheless, it is important to make sure that these policies are equitable and fair and to take into account any potential distributional effects.

-

Government spending on environmental initiatives will cut carbon emissions, which in turn will benefit governments by showcasing their resolve to combat climate change and promoting economic expansion. The businesses will benefit from cleaner practices, cost savings, and improved brand recognition, and consumers will take advantage of better air quality, cheaper energy bills, and easier access to clean energy.

By providing fresh evidence of effective policies like environmental taxes and spending and how they are used to reduce CO2 emissions in EU-27 nations, the research contributed to the current pool of literature on policy relevance and interventions for sustainable environmental initiatives. The research may be extended by adding more macroeconomic factors, such as CO2 emissions and their relationship to health indicators, technological advancements, and other socioeconomic indicators. More investigation may be done by conducting empirical studies on a different panels of comparable economies.

References

Adebola Solarin S, Al-Mulali U, Ozturk I (2017) Validating the environmental Kuznets curve hypothesis in India and China: the role of hydroelectricity consumption. Renew Sustain Energy Rev 80(July):1578–1587. https://doi.org/10.1016/j.rser.2017.07.028

Agostini P, Botteon M, Carraro C (1992) A carbon tax to reduce CO2 emissions in Europe. Energy Econ 14(4):279–290. https://doi.org/10.1016/0140-9883(92)90034-B

Agrawal V, Mehta D (2016) Proposal for energy social responsibility. J Soc Dev Sci 7(2):14–19. https://doi.org/10.22610/jsds.v7i2.1301

Alfsen KH, Birkelund H, Aaserud M (1995) Impacts of an EC carbon/energy tax and deregulating thermal power supply on CO2, SO2 and NOx emissions. Environ Resour Econ 5(2):165–189. https://doi.org/10.1007/BF00693022

Ali W, Abdullah A, Azam M (2017) Re-visiting the environmental Kuznets curve hypothesis for Malaysia: fresh evidence from ARDL bounds testing approach. Renew Sustain Energy Rev 77(August 2016):990–1000. https://doi.org/10.1016/j.rser.2016.11.236

Ali MU, Gong Z, Ali MU, Wu X, Yao C (2020) Fossil energy consumption, economic development, inward FDI impact on CO2 emissions in Pakistan: Testing EKC hypothesis through ARDL model. Int J Finance Econ 1–12. https://doi.org/10.1002/ijfe.1958

Allan G, Lecca P, McGregor P, Swales K (2014) The economic and environmental impact of a carbon tax for Scotland: a computable general equilibrium analysis. Ecol Econ 100:40–50. https://doi.org/10.1016/j.ecolecon.2014.01.012

Al-Mulali U, Solarin SA, Ozturk I (2016) Investigating the presence of the environmental Kuznets curve (EKC) hypothesis in Kenya: an autoregressive distributed lag (ARDL) approach. Nat Hazards 80(3):1729–1747. https://doi.org/10.1007/s11069-015-2050-x

Alper AE (2017) Analysis of carbon tax on selected European countries: does carbon tax reduce emissions? Appl Econ Finance 5(1):29. https://doi.org/10.11114/aef.v5i1.2843

Alshehry AS, Belloumi M (2015) Energy consumption, carbon dioxide emissions and economic growth: the case of Saudi Arabia. Renew Sustain Energy Rev 41:237–247. https://doi.org/10.1016/j.rser.2014.08.004

Asteriou D, Pilbeam K, Pratiwi CE (2021) Public debt and economic growth: panel data evidence for Asian countries. J Econ Finance 45(2):270–287. https://doi.org/10.1007/s12197-020-09515-7

Aydin C, Esen Ö (2018) Reducing CO 2 emissions in the EU member states: do environmental taxes work? J Environ Plan Manag 61(13):2396–2420. https://doi.org/10.1080/09640568.2017.1395731

Bao Q, Tang L, Zhang Z, Wang S (2013) Impacts of border carbon adjustments on China’s sectoral emissions: simulations with a dynamic computable general equilibrium model. China Econ Rev 24:77–94. https://doi.org/10.1016/j.chieco.2012.11.002

Bohlin F (1998) The Swedish carbon dioxide tax: effects on biofuel use and carbon dioxide emissions. Biomass Bioenerg 15(4–5):283–291. https://doi.org/10.1016/S0961-9534(98)00036-1

Borozan D (2019) Unveiling the heterogeneous effect of energy taxes and income on residential energy consumption. Energy Policy 129:13–22. https://doi.org/10.1016/j.enpol.2019.01.069

Bostan I, Onofrei M, Dascălu E-D, Fîrţescu B, Toderaşcu C (2016) Impact of sustainable environmental expenditures policy on air pollution reduction, during European integration framework. Amfiteatru Econ 18(42):286–302

Bothner F, Schrader SM, Bandau F, Holzhauser N (2022) Never let a serious crisis go to waste: the introduction of supplemental carbon taxes in Europe. J Publ Policy 42(2):343–363. https://doi.org/10.1017/S0143814X21000210

Breitung J (2000) The local power of some unit root tests for panel data. In: Baltagi, B.H., Fomby, T.B. and Carter Hill, R. (Ed.) Nonstationary Panels, Panel Cointegration, and Dynamic Panels (Advances in Econometrics, (Vol. 15). Emerald Group Publishing Limited, pp. 161–177. https://doi.org/10.1016/S0731-9053(00)15006-6

Breusch TS, Pagan AR (1980) The Lagrange multiplier test and its applications to model specification in econometrics. Rev Econ Stud 47(1):239. https://doi.org/10.2307/2297111

Bruvoll A, Larsen BM (2004) Greenhouse gas emissions in Norway: do carbon taxes work? Energy Policy 32(4):493–505. https://doi.org/10.1016/S0301-4215(03)00151-4

Caglar AE, Yavuz E (2023) The role of environmental protection expenditures and renewable energy consumption in the context of ecological challenges: Insights from the European Union with the novel panel econometric approach. J Environ Manag 331:117317. https://doi.org/10.1016/j.jenvman.2023.117317

Charlier D, Fodha M, Kirat D (2023) Residential CO2 emissions in Europe and carbon taxation: a country-level assessment. Energy J 44(01). https://doi.org/10.5547/01956574.44.4.dcha

Chen W, Zhou J-F, Li S-Y, Li Y-C (2017) Effects of an energy tax (carbon tax) on energy saving and emission reduction in Guangdong province-based on a CGE model. Sustainability 9(5):681. https://doi.org/10.3390/su9050681

Crippa M, Guizzardi D, Banja M, Solazzo E, Muntean M, Schaaf E, Pagani F, Monforti-Ferrario F, Olivier J, Quadrelli R, Risquez Martin A, Taghavi-Moharamli P, Grassi G, Rossi S, Jacome Felix Oom D, Branco A, San-Miguel-Ayanz E (2022) CO2 emissions of all world countries - JRC/IEA/PBL 2022 Report, EUR 31182 EN. https://doi.org/10.2760/730164

Ercolano S, Romano O (2018) Spending for the environment: general government expenditure trends in Europe. Soc Indic Res 138(3):1145–1169. https://doi.org/10.1007/s11205-017-1695-0

Esily RR, Ibrahiem DM, Sameh R, Houssam N (2022) Assessing environmental concern and its association with carbon trade balances in N11 Do financial development and urban growth matter? J Environ Manag 320:115869. https://doi.org/10.1016/j.jenvman.2022.115869

Farhani S, Ozturk I (2015) Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environ Sci Pollut Res 22(20):15663–15676. https://doi.org/10.1007/s11356-015-4767-1

Farooq S, Ozturk I, Majeed MT, Akram R (2022) Globalization and CO2 emissions in the presence of EKC: a global panel data analysis. Gondwana Res 106:367–378. https://doi.org/10.1016/j.gr.2022.02.002

Floros N, Vlachou A (2005) Energy demand and energy-related CO2 emissions in Greek manufacturing: assessing the impact of a carbon tax. Energy Econ 27(3):387–413. https://doi.org/10.1016/j.eneco.2004.12.006

Gaibulloev K, Sandler T, Sul D (2014) Dynamic panel analysis under cross-sectional dependence. Polit Anal 22(2):258–273. https://doi.org/10.1093/pan/mpt029

Gemechu ED, Butnar I, Llop M, Castells F (2012) Environmental tax on products and services based on their carbon footprint: a case study of the pulp and paper sector. Energy Policy 50:336–344. https://doi.org/10.1016/j.enpol.2012.07.028

Gemechu ED, Butnar I, Llop M, Castells F (2014) Economic and environmental effects of CO 2 taxation: an input-output analysis for Spain. J Environ Plan Manag 57(5):751–768. https://doi.org/10.1080/09640568.2013.767782

Gerlagh R, van der Zwaan B (2006a) Options and instruments for a deep cut in CO2 emissions: carbon dioxide capture or renewables, Taxes or Subsidies?. Energy J 27(3). https://doi.org/10.5547/ISSN0195-6574-EJ-Vol27-No3-3

Gerlagh R, van der Zwaan B (2006b) Options and instruments for a deep cut in CO2 emissions: carbon dioxide capture or renewables, taxes or subsidies?. Energy J 27(3). https://doi.org/10.5547/ISSN0195-6574-EJ-Vol27-No3-3

Gerlagh R, Lise W (2005) Carbon taxes: A drop in the ocean, or a drop that erodes the stone? The effect of carbon taxes on technological change. Ecol Econ 54(2–3):241–260. https://doi.org/10.1016/j.ecolecon.2004.12.037

Ghazouani A, Xia W, Ben Jebli M, Shahzad U (2020) Exploring the role of carbon taxation policies on CO2 emissions: contextual evidence from tax implementation and non-implementation European Countries. Sustainability 12(20):8680

Grafton RQ, Kompas T, Long NV, To H (2014) US biofuels subsidies and CO2 emissions: an empirical test for a weak and a strong green paradox. Energy Policy 68:550–555. https://doi.org/10.1016/j.enpol.2013.11.006

Grossman G, Krueger A (1991) Environmental impacts of a North American free trade agreement. In National Bureau of Economic Research (Issue 3914). https://doi.org/10.3386/w3914

Haites E (2018) Carbon taxes and greenhouse gas emissions trading systems: what have we learned? Clim Policy 18(8):955–966. https://doi.org/10.1080/14693062.2018.1492897

Hájek M, Zimmermannová J, Helman K, Rozenský L (2019) Analysis of carbon tax efficiency in energy industries of selected EU countries. Energy Policy 134:110955. https://doi.org/10.1016/j.enpol.2019.110955

Hanson C, Sandalow DB (2006) Greening the tax code. In: Tax reforms, energy and the environment, no. 1, Washington, DC 20036: The Brookings Institution, pp 1–12. [Online]. Available: https://www.brookings.edu/wp-content/uploads/2016/06/sandalow200604wri.pdf. Accessed 10 Oct 2023

Hotunluoglu H, Tekeli̇ R (2007) Economic analysis and effects of carbon tax: does carbon tax have emission reducing effect?. Socioeconomics 6(6). https://doi.org/10.17233/se.31848

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econom 115(1):53–74. https://doi.org/10.1016/S0304-4076(03)00092-7

Kao C (1999) Spurious regression and residual-based tests for cointegration in panel data. J Econom 90(1):1–44. https://doi.org/10.1016/S0304-4076(98)00023-2

Levin A, Lin C-F, James Chu C-S (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econom 108(1):1–24. https://doi.org/10.1016/S0304-4076(01)00098-7

Li H (2017) “Multi-dividend” effects research for environment tax preferential policy based on improved iterative CGE model. Agro Food Ind Hi Tech 28(3):2466–2471

Li B, Haneklaus N (2022) Reducing CO2 emissions in G7 countries: the role of clean energy consumption, trade openness and urbanization. Energy Rep 8:704–713. https://doi.org/10.1016/j.egyr.2022.01.238

Lin B, Li X (2011) The effect of carbon tax on per capita CO2 emissions. Energy Policy 39(9):5137–5146. https://doi.org/10.1016/j.enpol.2011.05.050

Liu M, Ren X, Cheng C, Wang Z (2020) The role of globalization in CO2 emissions: a semi-parametric panel data analysis for G7. Sci Total Environ 718:137379. https://doi.org/10.1016/j.scitotenv.2020.137379

Liu T-K, Jamshideasli D, Ramezanpour B, Ye W, Zeng Y, Zargar OA, Hu SC, Khodadadi JM, Leggett G (2022) Control of flow, thermal and pollutant concentration fields by entrainer air streams to improve fresh air quality intake into a semiconductor manufacture/ processing plant. Int J Thermofluids 16:100211. https://doi.org/10.1016/j.ijft.2022.100211

Loganathan N, Shahbaz M, Taha R (2014) The link between green taxation and economic growth on CO2 emissions: fresh evidence from Malaysia. Renew Sustain Energy Rev 38:1083–1091. https://doi.org/10.1016/j.rser.2014.07.057

López R, Galinato GI, Islam A (2011) Fiscal spending and the environment: theory and empirics. J Environ Econ Manag 62(2):180–198. https://doi.org/10.1016/j.jeem.2011.03.001

Lu C, Tong Q, Liu X (2010) The impacts of carbon tax and complementary policies on Chinese economy. Energy Policy 38(11):7278–7285. https://doi.org/10.1016/j.enpol.2010.07.055

Machado FLV, Halmenschlager V, Abdallah PR, da Teixeira GS, Sumaila UR (2021) The relation between fishing subsidies and CO2 emissions in the fisheries sector. Ecol Econ 185:107057. https://doi.org/10.1016/j.ecolecon.2021.107057

Malinauskaite J, Jouhara H, Ahmad L, Milani M, Montorsi L, Venturelli M (2019) Energy efficiency in industry: EU and national policies in Italy and the UK. Energy 172:255–269. https://doi.org/10.1016/j.energy.2019.01.130

Malinauskaite J, Jouhara H, Egilegor B, Al-Mansour F, Ahmad L, Pusnik M (2020) Energy efficiency in the industrial sector in the EU, Slovenia, and Spain. Energy 208:118398. https://doi.org/10.1016/j.energy.2020.118398

Manne AS, Richels RG (1992) CO2 emission limits: an economic cost analysis for the United States of America. In: International Energy Economics. Springer Netherlands, pp 323–345. https://doi.org/10.1007/978-94-011-2334-1_18

Mardones C, Baeza N (2018) Economic and environmental effects of a CO2 tax in Latin American countries. Energy Policy 114:262–273. https://doi.org/10.1016/j.enpol.2017.12.001

Mehta D, Derbeneva V (2024) Impact of environmental fiscal reforms on carbon emissions of EURO-4 countries: CS-NARDL approach. Int J Thermofluids 21:100550. https://doi.org/10.1016/j.ijft.2023.100550

Mehta D, Mallikarjun M (2023) Impact of deficit financing and trade openness on private consumption in India. Econ Reg 19:1293–1305

Meng S, Siriwardana M, McNeill J (2013) The environmental and economic impact of the carbon tax in Australia. Environ Resour Econ 54(3):313–332. https://doi.org/10.1007/s10640-012-9600-4

Menyah K, Wolde-Rufael Y (2010) Energy consumption, pollutant emissions and economic growth in South Africa. Energy Econ 32(6):1374–1382. https://doi.org/10.1016/j.eneco.2010.08.002

Millock KE, Nauges C (2003) The French tax on air pollution: some preliminary results on its effectiveness. Available at SSRN: https://ssrn.com/abstract=419082 or https://doi.org/10.2139/ssrn.419082

Nakata T, Lamont A (2001) Analysis of the impacts of carbon taxes on energy systems in Japan. Energy Policy 29(2):159–166. https://doi.org/10.1016/S0301-4215(00)00104-X

Nordhaus WD (1991) To slow or not to slow: the economics of the greenhouse effect. The Economic Journal, 101(407), 920–937. https://doi.org/10.2307/2233864

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267. https://doi.org/10.1016/j.eneco.2012.08.025

Pal D, Mitra SK (2017) The environmental Kuznets curve for carbon dioxide in India and China: Growth and pollution at crossroad. J Policy Model 39(2):371–385. https://doi.org/10.1016/j.jpolmod.2017.03.005

Pao HT, Tsai CM (2011) Multivariate Granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): Evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy 36(1):685–693. https://doi.org/10.1016/j.energy.2010.09.041

Park J, Hong T (2013) Analysis of South Korea’s economic growth, carbon dioxide emission, and energy consumption using the Markov switching model. Renew Sustain Energy Rev 18:543–551. https://doi.org/10.1016/j.rser.2012.11.003

Pata UK (2018) The effect of urbanization and industrialization on carbon emissions in Turkey: evidence from ARDL bounds testing procedure. Environ Sci Pollut Res 25(8):7740–7747. https://doi.org/10.1007/s11356-017-1088-6

Pata UK, Caglar AE (2021) Investigating the EKC hypothesis with renewable energy consumption, human capital, globalization and trade openness for China: Evidence from augmented ARDL approach with a structural break. Energy 216:119220. https://doi.org/10.1016/j.energy.2020.119220

Patel N, Mehta D (2023) The asymmetry effect of industrialization, financial development and globalization on CO2 emissions in India. Int J Thermofluids 20:100397. https://doi.org/10.1016/j.ijft.2023.100397

Pearce D, Palmer C (2005) Public and private spending for environmental protection: a cross-country policy analysis. Fisc Stud 22(4):403–456. https://doi.org/10.1111/j.1475-5890.2001.tb00048.x

Pedroni P (1999) Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxford Bull Econ Stat 61(s1):653–670. https://doi.org/10.1111/1468-0084.0610s1653

Pedroni P (2004) Panel cointegration: asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econom Theory 20(03). https://doi.org/10.1017/S0266466604203073

Pesaran MH, Smith R (1995) Estimating long-run relationships from dynamic heterogeneous panels. J Econom 68(1):79–113. https://doi.org/10.1016/0304-4076(94)01644-F

Pesaran MH, Shin Y, Smith RP (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc 94(446):621–634. https://doi.org/10.1080/01621459.1999.10474156

Pesaran MH (2004) General diagnostic tests for cross section dependence in panels. CESifo Working Paper Series No. 1229; IZA Discussion Paper No. 1240

Pigou AC, Aslanbeigui N (2017) The economics of welfare. Routledge. https://doi.org/10.4324/9781351304368

Qamruzzaman M, Jianguo W (2020) The asymmetric relationship between financial development, trade openness, foreign capital flows, and renewable energy consumption: Fresh evidence from panel NARDL investigation. Renew Energy 159:827–842. https://doi.org/10.1016/j.renene.2020.06.069

Redesigning Service Financial (2021) European Wealth Report. https://redesigning-fs.com/wp-content/uploads/2021/12/European_Wealth_Report.pdf

Rizwanullah M, Yu X, Ullah S (2022) Management of public and private expenditures-CO2 emissions nexus in China: do economic asymmetries matter? Environ Sci Pollut Res 30(12):35238–35245. https://doi.org/10.1007/s11356-022-24496-2

Saidu Musa K, Maijama’a R (2020) Economic growth, energy consumption and environmental pollution in Nigeria: evidence from ARDL approach. Energy Econ Lett 7(2):61–73. https://doi.org/10.18488/journal.82.2020.72.61.73

Shafi M, Ramos-Meza CS, Jain V, Salman A, Kamal M, Shabbir MS, ur Rehman M (2023) The dynamic relationship between green tax incentives and environmental protection. Environ Sci Pollut Res 30(12):32184–32192. https://doi.org/10.1007/s11356-023-25482-y

Shahbaz M, Sharma R, Sinha A, Jiao Z (2021) Analyzing nonlinear impact of economic growth drivers on CO2 emissions: designing an SDG framework for India. Energy Policy 148:111965. https://doi.org/10.1016/j.enpol.2020.111965

Shahzad U (2020) Environmental taxes, energy consumption, and environmental quality: theoretical survey with policy implications. Environ Sci Pollut Res 27(20):24848–24862. https://doi.org/10.1007/s11356-020-08349-4

Sharma R, Kautish P, Uddin GS (2020) Do the international economic endeavors affect CO2 emissions in open economies of South Asia? An empirical examination under nonlinearity. Manag Environ Qual: An Int J 31(1):89–110. https://doi.org/10.1108/MEQ-05-2019-0099

Solarin SA, Al-Mulali U (2021) Transportation fuel subsidies and CO2 emissions: the roles of economic complexity and uncertainty. Environ Prog Sustain Energy. https://doi.org/10.1002/ep.13797

Song Z (2021) Economic growth and carbon emissions: estimation of a panel threshold model for the transition process in China. J Clean Prod 278:123773. https://doi.org/10.1016/j.jclepro.2020.123773

Tamura R, Kobayashi K, Takano Y, Miyashiro R, Nakata K, Matsui T (2019) Mixed integer quadratic optimization formulations for eliminating multicollinearity based on variance inflation factor. J Glob Optim 73(2):431–446. https://doi.org/10.1007/s10898-018-0713-3

U TSC, Mitra A (2020) Development and degradation: the nexus between GDP, FDI, and pollution in India. Emerg Econ Stud 6(1):39–49. https://doi.org/10.1177/2394901520907712

Whalley J, Wigle R (2017) Cutting CO2 emissions: the effects of alternative policy approaches. In: International trade and the environment, 1st edn. pp 511–526. Routledge. https://www.taylorfrancis.com/chapters/edit/10.4324/9781315201986-33/cutting-co2-emissions-effects-alternative-policy-approaches-john-whalley-randall-wigl. Accessed 10 Oct 2023

Wolde-Rufael Y, Mulat-Weldemeskel E (2021) Do environmental taxes and environmental stringency policies reduce CO2 emissions? Evidence from 7 emerging economies. Environ Sci Pollut Res 28(18):22392–22408. https://doi.org/10.1007/s11356-020-11475-8

Wolde-Rufael Y, Mulat-weldemeskel E (2023) Effectiveness of environmental taxes and environmental stringent policies on CO2 emissions: the European experience. Environ Dev Sustain 25(6):5211–5239. https://doi.org/10.1007/s10668-022-02262-1

Wolde-Rufael Y, Weldemeskel EM (2020) Environmental policy stringency, renewable energy consumption and CO 2 emissions: panel cointegration analysis for BRIICTS countries. Int J Green Energy 17(10):568–582. https://doi.org/10.1080/15435075.2020.1779073

Xu S-C, Long R (2014) Empirical research on the effects of carbon taxes on economy and carbon emissions in China. Environ Eng Manag J 13(5):1071–1078. https://doi.org/10.30638/eemj.2014.112

Yang P (2009) Public finance and environment: correlations of selected taxes with pollution and CO2 emissions in China between 1999 and 2006. Int J Green Econ 3(1):48. https://doi.org/10.1504/IJGE.2009.026491

Yang M, Fan Y, Yang F, Hu H (2014) Regional disparities in carbon dioxide reduction from China’s uniform carbon tax: A perspective on interfactor/interfuel substitution. Energy 74:131–139. https://doi.org/10.1016/j.energy.2014.04.056

Zaidi S, Saidi K (2018) Environmental pollution, health expenditure and economic growth in the Sub-Saharan Africa countries: Panel ARDL approach. Sustain Cities Soc 41(May):833–840. https://doi.org/10.1016/j.scs.2018.04.034

Zhang K, Lu L (2023) Research on the articulated coupling effect of carbon tax policy under resource endowment in China. Environ Sci Pollut Res 30(21):60240–60253. https://doi.org/10.1007/s11356-023-26732-9

Author information

Authors and Affiliations

Contributions

All authors contributed to the study conception and design. Material preparation, data collection, analysis and writing were performed by DM. The review and editing the drafts of the manuscript was by PP. All authors read and approved the final manuscript.

Corresponding author

Ethics declarations

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors. The submitted work is original, and it is not published elsewhere in any form or language. No data, text, or theories by others are presented as if they were the author’s own.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Mehta, D., Prajapati, P. Asymmetric effect of environment tax and spending on CO2 emissions of European Union. Environ Sci Pollut Res 31, 27416–27431 (2024). https://doi.org/10.1007/s11356-024-32990-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-024-32990-y