Abstract

In today’s era of sustainable development, green inventory systems with a motto to reduce carbon emissions are crucial for economic growth and development. Green inventory systems managing perishable products need special attention since spoilage and deterioration result in a significant loss of items which hampers consumers’ satisfaction. The perishable products (e.g., vegetables, fruits, milk, juices, frozen foods, baked foods) have an adverse impact on demand as the products decay continuously which also has a strong influence on the customers’ purchase decision. Thus, a price-sensitive demand is a more realistic assumption. In addition, perishable products have a time-varying deterioration rate, which also depends on the expiration date of the products. Further, the main sources of carbon emissions in operating the inventory system are transhipments, inventory holding, and deterioration of the perishable products. Being environmentally conscious, carbon tax policy proves to be a more flexible and effective tool to mitigate carbon emissions. The research so far has addressed different types of sustainable inventory models, but still, there is a scope to explore the green inventory models further for practical use. Hence, the present paper addresses an inventory model for perishable products with the expiration date, under carbon tax policy in order to achieve sustainability goals. The mathematical model is developed with an objective to determine the optimal cycle length and selling price so as to maximize the total profit. Numerical example and sensitivity analysis have been presented to elucidate the model characteristics.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The growing concern towards environmental issues and sustainable development is receiving great attention of the researchers worldwide. Due to the threats of climate change and global warming, carbon emissions have become a concern for humans and the environment. With the intensification of global warming, more and more attention is being paid on the ways to reduce emissions. Policymakers and researchers have taken various efforts to measure and control GHG emissions. In recent years, the deterioration of the ecological environment caused by climate change not only has affected the quality of life but also had a profound effect on human society. Further, the environment experts are signifying the importance of green strategies as they are beneficial in both ways, economically and environmentally.

The inventory reduction because of deterioration cannot be overlooked in an inventory system. The presence of deterioration affects the revenue and thereby decreases the total profits of the system. Food spoilage creates financial and ecological damages for the vendors (e.g., perishable products such as vegetables, fruits, milk, juices, frozen foods, baked foods). Generally, the deterioration rate is treated as constant in the inventory models, but it may not be realistic. In reality, deterioration of the product is not constant throughout its lifetime; initially, it increases and then decreases gradually. It is observed that the perishable products degrade gradually, and the product completely deteriorates as it approaches the expiration rate. Therefore, in such a scenario, the deterioration rate is taken as a variable which depends on the expiration date. Life of perishable products is comparatively shorter than other products as they cannot be retailed later than its due date. The age of a perishable products (e.g., vegetables, fruits, milk, juices, frozen foods, baked foods) have an adverse impact on demand as health-conscious consumers prefer a perishable product with a longer expiration date.

In a more realistic and practical system, the demand is reliant to price. Price is an important factor in a consumer’s purchasing decision. The price of the perishable product is fixed throughout its lifetime regardless of the expiration date. However, customers prefer products with a later expiration date because it is available at the same price. Hence, demand for perishable goods is influenced by the selling price; thus, the more practical scenarios should include selling price as a decision variable.

Developing an inventory system to relieve the environment from carbon emissions is the major challenge in the present era. Government and non-governmental organizations have been introducing some policies, rules, and regulations to mitigate the impact of carbon emissions such as the development of renewable sources and promoting the use of natural fuels and eco-friendly objects. One of the common policies implemented by regulatory authorities all over the world to curtail the carbon emissions is “Carbon Tax”. Initially, the USA has executed a tax policy on carbon, which is imputable. A “carbon tax” is a toll that imposes on carbon discharges; it is a form of carbon pricing. The returns made by the tax would then be applied to a payroll tax rebate of revenues to taxpayers. Thus the idea of managing supply chains under different carbon policies is gaining momentum. The operational decisions pertaining to “carbon emission penalty” i.e to penalize the emitters by assigning penalty (or taxing) factor to the quantity of carbon emissions have drawn significant consideration for a sustainable transformation.

Literature Review

Due to rising GHG emissions, developing sustainable models have become the prime objective for all the organizations in the present times, to prevent environmental degradation. Deterioration has got significant attention in the inventory research literature. Initially, Ghare and Schrader (1963) discussed the effect of the constant rate of deterioration on the classical EOQ. Generally, deterioration rate is considered to be constant, but in a more realistic scenario deterioration of product is not constant throughout its lifetime. The perishable products deteriorate over time and might lose their value either gradually or abruptly at the expiration date. Fujiwara and Perera (1993) discussed that all perishable products not only deteriorate continuously but also have their expiration date. Chen et al. (2016) studied that the expiration dates are often an important factor in a consumers purchase decision. Sarkar (2012) discussed a time-dependent demand and deterioration rate model. Wu et al. (2018) studied perishable products with an expiration date. Hsu et al. (2006) developed a model with an expiration date when the product is deteriorating with time. Herbon (2014) discussed the consumer’s sensitivity to the perishable products with a fixed lifetime. Teng et al. (2016) explored the inventory model with variable deterioration rate. Iqbal and Sarkar (2019) discussed the recycling of deteriorated products, and the rate of deterioration is dependent on the maximum lifetime. Gautam et al. (2020) proposed an integrated inventory system under the expiration date and price-sensitive demand.

In the present competitive market, price is one of the decisive factors because an increase in the price of the item is always deterred the customers. Price reliant demand rate is given by Abad (1996). Polatoglu and Sahin (2000) developed the optimal procurement policies under price-dependent demand. With the law of economics, a low price can fetch a high demand for firms. Therefore, setting an optimal price for a product to obtain maximum profit is one of the challenges for the firm is discussed by You (2005). Mo et al. (2009) explored the inventory replenishment policy with price-sensitive demand. Dey et al. (2019) developed a sustainable integrated model with price-dependent demand and investment. Ullah et al. (2019) proposed the joint inventory and dynamic pricing policy by considering price-dependent demand.

Further, continuous GHG emissions have raised a threat to the environment and society. To reduce carbon emissions, organizations implement different carbon policies. Metcalf (2009) discussed the different market-based policy options to control GHG emissions. X. Chen et al. (2013) considered the EOQ model with different carbon constraints to reduce emissions. He et al. (2015) investigated the impact of two carbon regulations on the lot size and emissions. Ahmed et al. (2017) discussed the effect of a carbon tax and uncertainty in an economic policy for the second-generation biofuel supply chain. Ghosh et al. (2018) proposed a collaborative model for a supply chain under carbon tax policy. Mishra et al. (2020) discussed a sustainable inventory model for a controllable carbon emissions rate. Khanna and Yadav (2020) explored the different carbon policies on an inventory system. Mishra et al. (n.d.) explored an inventory model with deterioration under controllable carbon emissions. Table 1 shows the comparison of the current research with the existing research in the related field.

Research Gap and our Contribution

The above discussed literature summarizes different types of models developed in the field of sustainable inventory management. However, there are some issues and challenges which remain to be addressed in this emerging field of green systems. Motivated by this, the present study aims to develop a green inventory model for perishable products incorporating some practical aspects, viz., time-varying deterioration rate, expiration date, price-sensitive demand, and carbon emission tax policy. It is observed that the loss of inventory due to deterioration results in the financial as well as economic loss. In general, the deterioration rate is considered to be constant, but in more realistic scenario, deterioration of product is not constant throughout its lifetime. The perishable products deteriorate over time and might lose their value either gradually or abruptly at the expiration date. Thus, the deterioration rate is considered to be time-varying which also depends on the expiration date. Moreover, the price of a product influences the purchasing decision of a customer. Usually, customers prefer the products with a later expiration date as price remains fixed throughout the lifetime of a product. Hence, setting the right price is very important for such products, so the demand is considered to be price-sensitive. Further, while managing inventory systems, it is accepted that carbon emissions are caused due to transhipment, inventory holding, and deteriorating items. Thus, in order to achieve environmental sustainability, “carbon emission tax policy” has been implemented to reduce carbon footprints. A mathematical model is formulated for the given scenario so as to determine the optimal cycle time and selling price which maximizes the total profit of the inventory system. Some significant managerial insights have been explicated from numerical and sensitivity analysis. To restate, the present article addresses the following research questions:

-

What is the optimal ordering policy for perishable products with expiration date for a green inventory system?

-

What is the optimum selling price under the proposed model?

-

How the carbon tax policy assists in controlling carbon emissions?

-

What will be the impact of different model parameters on the order policy, selling price, carbon emissions, and total profit?

The paper is organized in the following manner: Section 2 presents the literature review; Section 3 and 4 give the notations and assumptions used in the model development; Section 5 presents the mathematical formulation; Section 6 discusses the necessary and sufficient conditions for the optimal solution; numerical and sensitivity analysis has been illustrated in Sections 7 and 8 respectively; and lastly, Section 9 summarizes the paper with concluding remarks and future directions.

Notations

The following notations are used in the model development:

Decision variables | |

T | Cycle length (months) |

p | Retailing (selling)price($/unit), with p > c |

Constant parameters | |

K | Ordering cost ($/order) |

c | Purchase cost ($/unit) |

h | Cost of carrying ($/unit/unit time) |

m | Expiration date (maximum lifetime) (months) |

y0 | Initial deterioration rate (unit/month) |

y(t) | Deterioration rate at time t (unit/month),0 ≤ y(t) ≤ 1 |

I(t) | Inventory level at time t ∈ [0, T] |

Q | Order Quantity in a cycle (units) |

D(p) | Price-dependent demand (units) |

CT | Carbon charge ($/kg) |

s0 | Fixed emission factor for shipping (kg/month) |

s1 | Variable emission factor for shipping (kg/month) |

h0 | Fixed emission factor for inventory holding (kg/month) |

h1 | Variable emission factor for inventory holding (kg/month) |

V1 | Fixed shipment cost($/unit) |

V2 | Variable shipment cost ($/unit) |

γ | emissions per deteriorated item (kg/unit) |

Assumptions

The assumptions of this model are listed as:

-

1.

The market demand is assumed to be price-sensitive and is defined as

Here, a > 0 is a scaling factor, and 0 < b < 1 is a price elasticity coefficient, and both are positive known constants.

-

2.

All perishable products continuously degrade over time, and cannot be sold when time is approaching the expiration date. Rate of deterioration depends on the expiration date, which is calculated as follows:

where m is the expiration date. When t → 0, the deterioration rate is minimum, and when t → m, the deterioration rate is 1 which means that all the products deteriorate at its expiration date as in (Wu et al. 2018).

-

3.

Instantaneous replenishment rate with zero lead time.

-

4.

No replacement, repair, or salvage value of perished items during [0, T].

-

5.

Transhipment cost for transporting Q units is SC = V1 + V2Q, where V1 is the fixed shipment cost and V2 is the variable shipment cost and both are positive known constants.

-

6.

Emissions of carbon are caused due to transhipment, inventory holding, and deteriorating items.

-

7.

Carbon emissions for shipping Q units is s0 + s1Q, where s0 and s1 are the fixed and variable emission factor for shipping.

-

8.

Carbon emission for holding Q units is h0 + h1AI, where h0 and h1 are the fixed and variable emission factor for holding.

-

9.

Carbon emission emitted due to the deterioration of the item and γ are the emissions per deteriorated item.

Mathematical Model

Preserving perishable products is a very difficult and important task. All perishable products such as fruits, vegetables, bakery products, milk etc., not only deteriorate continuously but also have expiration date i.e., maximum lifetime which is time-bound. Further, the demand of the perishable products continuously declines as the consumers prefer the product with a later expiration date because of the availability of the product at the same price throughout its lifetime which also affects the purchasing decision of a consumer.

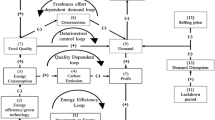

By using the above-mentioned assumptions, the inventory scenario is shown by Fig. 1. The cycle begins at time t = 0 with inventory Q and then gradually depletes to zero at t = T. During [0, T], the inventory is gradually depleted to zero at time T due to the combined effect of demand and deterioration and cannot be sold when time is approaching to the maximum lifetime m.

The inventory differential equation I(t) at time t in [0, T] is:

where \( y(t)=\frac{1}{1+m-t} \); 0 ≤ t ≤ T ≤ m

Using boundary condition I(T) = 0 in Eq. (3)

Consequently, the order quantity Q is

Total average inventory is

No. of deteriorated items is

The carbon emission in shipping, inventory holding, and deterioration is

Now, the total profit of the inventory system is given by:

The total profit = “sales revenue − ordering cost − purchase cost − shipping cost − holding cost − tax cost”.

The various components of the total profit equation are calculated as follows:

Ordering Cost

Within a certain time period, the retailer orders the new products with an ordering cost is:

Purchase Cost

Cost of the material depends on the order quantity purchased during the cycle and per-unit cost of material. The purchase cost is:

Shipping Cost

The products are transported to the retailer; thus, the retailer incurs a shipment cost. As both the quantity of the container and the distance may vary, so shipment cost has fixed as well as variable components. Thus, the cost is:

Holding Cost

Proper storage of perishable products is required to control its spoilage/deterioration. Thus, the retailer incurs the inventory holding cost for the maintenance of products in stock. It is calculated for the proposed model as:

Carbon Emission Cost Under Tax

Due to the transhipment, inventory holding, and deterioration of items, carbon emissions are produced in the environment. A carbon tax is imposed on carbon emission in a form of carbon pricing so as to keep a check and control the amount of carbon emissions. Thus, carbon emission cost under “emission tax” policy is given by

Tax Cost = CT ∗ (CE)

Using Eqs. (9), (10), (11), (12), (13), and (14) total profit per unit time is:

Optimality

The total profit function is a function of two variables p and T. Thus, in order to establish optimality, following necessary and sufficient conditions must be satisfied:

Necessary conditions:

Solving Eq. (18), we get p∗

Since the Eq. (20) is a highly complex function in T, thus, it is difficult to get a closed-form solution for T∗.

For the sufficient condition of optimality w.r.t p and T, the Hessian matrix is defined as:

Using Eqs. (21) and (22), the sufficient conditions are established (refer to Appendix A)

Further, to determine the optimal solution, the following procedure is proposed:

-

1.

Substitute the model parameters into TP.

-

2.

Derive the optimal values of p and T by using Eq. (19), and solving Eq. (20).

-

3.

Check the sufficient conditions for optimality which are given in Eqs. (21) and (22).

Moreover, Fig. 2 establishes the optimality by the graphical method with the help of software Mathematica.

Numerical Analysis

Case Study

The proposed model develops a green inventory system for the retail grocery industry facing challenges in reducing the carbon footprints associated with managing perishable food items. Consider an inventory system for perishable products (e.g., vegetables, fruits, milk, juices, frozen foods, baked foods, etc.) where special handling is needed to prevent damage and decay. Perishable products have random lifetimes, due to weather conditions such as temperature, humidity, and storage conditions. Moreover, these require different storage conditions such as cold or room temperature and also need airtight packaging to maintain the product’s durability. In addition, the expiration date of the product is also an important aspect for the retailer while deciding the optimal order policy. As a result, the retailer carefully examines the expiration date so that inventory may remain available for sale before it must be discarded, and along with this, the customers also get a reasonable time for storage at home before the product gets expire. Moreover, the demand for such products is also sensitive to price; hence, setting an optimum price is also a very crucial aspect of the inventory system. Because of globalization, supply chain managers adopt different environmental policies to prevent environmental degradation. The main sources of carbon emissions are the transportation, storage and deterioration of perishable products. Due to strict regulation by the authorities, retailers always try to reduce carbon emissions to achieve environmental as well as economic benefits. Thus, the following numerical results certainly would assist the managers in the retail grocery businesses to improve their business practices as well as contribute to positive environmental change.

The developed model is demonstrated using a numerical example. The following parameter values have been taken from Khanna and Yadav (2020) and Wu et al. (2018) inappropriate units for numerical illustration:

Using Table 2 numerical data and the given solution procedure, the optimal results are obtained as follows:

Significance of Sustainable Model

In the traditional models, the impact of carbon emissions due to the deterioration of perishable products is not generally addressed. Due to continuous emissions of GHG, government and the organizations have initiated different carbon policies to curb carbon emissions, intending to protect the climate and environment. In this study, a carbon tax policy is considered to mitigate carbon emissions, where a tax is a form of carbon pricing. The returns made by the tax would then be applied to a payroll tax rebate of revenues to taxpayers. Thus, it is recommended for firms to adopt different measures to curb carbon emissions, as it is environmental friendly. Further, to illustrate the significance of sustainability in inventory modelling, a comparative analysis of the present model is done with a traditional model (without carbon tax policy). Results are presented in Table 3.

Results from Table 3 illustrates that the model with the carbon tax cost performs better in terms of sustainability in comparison to the one without it. The profit of the model with the carbon tax is $2095.479, and the carbon emissions incurred is 38.943 kg/month. However, if the carbon tax cost is not considered then the profit is $2261.345, and the carbon emissions are 79.423 kg/month. The profit is little less in the present model due to the obvious reason of the carbon tax cost. But in today’s era of sustainable and green models, the present model performs far better than the traditional model as carbon emissions are reduced by more than 50% per month. Hence, undoubtedly, the results showcase the significance of carbon tax policy in reducing carbon emissions and achieving sustainability.

Sensitivity Analysis

Sensitivity analysis has been performed to study the effect of key parameters such as demand parameters (a) and (b), maximum lifetime (m), holding cost (h), and carbon tax cost (CT) on the optimal solution. Results have been recorded in Table 4. Moreover, Table 5 demonstrates the graphical representation of various parameters on total profit.

Observations and Managerial Insights

From Table 4, the following observations and managerial insights are made:

-

With an increase in demand parameter (a), the total profit (TP) and the order size (Q) increase. Moreover, a bigger order size leads to a rise in carbon emissions (CE), but at the same time, it helps to increase the sales revenue which leads to higher profit. Hence, with an increase in demand parameter, it is suggested to place bigger orders for a short period of time (T), and the price (p) can also be raised.

-

As the demand parameter (b) rises, the total profit (TP) decreases, and the cycle length (T) increases slightly. There is a marginal effect on order size; however, carbon emissions (CE) are reduced. Here, it is suggested to decrease the price (p) of the item so as to boost the declining demand, which may help to increase the profit.

-

An increase in the product maximum lifetime (m) increases the total profit (TP) and the order quantity (Q) and a slight decrease in a selling price (p) which helps to raise the demand level. Hence, because of the low price, there is an increase in demand and thus a larger order size (Q). This leads to an increase in carbon emissions(CE).

-

With an increase in holding cost (h) the order size (Q), the cycle length (T) and the total profit (TP) decrease. A higher holding cost (h) indicates improved storage condition, and hence, the cost increases which decrease the total profit (TP). Here, it is suggested to order in small lots so as to manage the inventory effectively, which also leads to reduced carbon emissions (CE).

-

An increase in carbon tax cost (CT) contributes to the total cost component which obviously affects the total profit (TP) unfavorably. However, the cycle length (T), order quantity (Q), and the selling price (p) increase, whereas the carbon emissions (CE) decreases. In order to avoid emissions, it is advised to place small orders at smaller intervals of time, which may also help to manage the profit.

Concluding Remarks

Conclusion

In today’s global decision-making context, consumers are very conscious about their health and environment. The value of perishable products declines over time; therefore, consumers are very conscientious regarding the expiration date of the product and usually prefer products with a longer expiration date. Moreover, retail outlets face many challenges while managing perishable products. These products have random lifetimes and require careful management and special storage conditions (such as cold or room temperature, airtight packaging etc.), to maintain their durability. Further, green inventory systems work on the principle of reducing carbon emancipation produced in various process, viz., transhipments, inventory holding, and deterioration of perishable products. Hence, the present paper develops a sustainable inventory model to manage the perishable products where control the deterioration of the product varies with time and depends on its expiration date. Demand is assumed to be price-sensitive in order to capture more sales. In addition, a carbon tax policy is implemented to mitigate carbon emissions. A practical scenario of the study has been presented through a numerical example. Further, a comparative numerical analysis of the present model is done with a traditional model to highlight the significance of sustainability. Some important managerial insights are obtained from sensitivity analysis that would assist the retailers in optimal decision-making under varying parameter values. The key findings of the paper are concluded as:

-

An increase in expiration date elevates both cycle time and order quantity.

-

For higher holding costs, it is preferable to order small lots in order to manage the inventory effectively.

-

As the carbon tax cost increases the carbon emissions decrease.

-

Comparative analysis suggests that the model with carbon tax performs better than the one without the carbon tax with regard to sustainability, as carbon emissions are reduced by more than 50% per month in the present model.

-

Carbon tax policy is an effective tool for green inventory systems and a cleaner environment.

Future Directions and Limitation

For future studies, researchers might consider an integrated cooperative scenario for multiple players in the supply chain. It may be extended by including many other carbon policies (e.g., cap-and-trade policy, carbon cap, carbon offset). Furthermore, the demand sensitive to quality is also a good extension. Incorporating preservation investment for deteriorating items may yield additional interesting models and insights. A reverse supply chain with defective and waste products can be an extension for future study. The focus of the study is limited to the deterioration of perishable products. Future researchers may consider both perishable and non-perishable products to enhance their research.

References

Abad PL (1996) Optimal pricing and lot-sizing under conditions of perishability and partial backordering. Manag Sci 42(8):1093–1104

Ahmed, W., Sarkar, M., Sarkar, B., & Kim, S. (2017). Effect of carbon tax and uncertainty in an economic policy for second generation biofuel supply chain. Proceedings of the Fall Conference of the Korean Institute of Industrial Engineers, 1700–1707.

Chen X, Benjaafar S, Elomri A (2013) The carbon-constrained EOQ. Oper Res Lett 41(2):172–179

Chen S-C, Min J, Teng J-T, Li F (2016) Inventory and shelf-space optimization for fresh produce with expiration date under freshness-and-stock-dependent demand rate. J Oper Res Soc 67(6):884–896

Dey BK, Sarkar B, Sarkar M, Pareek S (2019) An integrated inventory model involving discrete setup cost reduction, variable safety factor, selling price dependent demand, and investment. RAIRO Oper. Res 53(1):39–57

Fujiwara O, Perera U (1993) EOQ models for continuously deteriorating products using linear and exponential penalty costs. Eur J Oper Res 70(1):104–114

Gautam P, Khanna A, Jaggi CK (2020) Preservation technology investment for an inventory system with variable deterioration rate under expiration dates and price sensitive demand. Yugosl. J. Oper. Res 30(3):289–305

Ghare PM, Schrader GF (1963) An inventory model for exponentially deteriorating items. J Ind Eng 14(2):238–243

Ghosh A, Sarmah SP, Jha JK (2018) Collaborative model for a two-echelon supply chain with uncertain demand under carbon tax policy. Sādhanā 43(9):144

He P, Zhang W, Xu X, Bian Y (2015) Production lot-sizing and carbon emissions under cap-and-trade and carbon tax regulations. J Clean Prod 103:241–248

Herbon A (2014) Dynamic pricing vs. acquiring information on consumers’ heterogeneous sensitivity to product freshness. Int J Prod Res 52(3):918–933

Hsu P-H, Wee HM, Teng H-M (2006) Optimal lot sizing for deteriorating items with expiration date. J Inf Optim Sci 27(2):271–286

Iqbal MW, Sarkar B (2019) Recycling of lifetime dependent deteriorated products through different supply chains. RAIRO Oper. Res 53(1):129–156

Khanna A, Yadav S (2020) Effect of Carbon-tax and Cap-and-trade mechanism on an inventory system with price-sensitive demand and preservation technology investment. Yugosl. J. Oper. Res 30(3):361–380

Metcalf GE (2009) Market-based policy options to control US greenhouse gas emissions. J Econ Perspect 23(2):5–27

Mishra U, Wu J-Z, Sarkar B (2020) A sustainable production-inventory model for a controllable carbon emissions rate under shortages. J Clean Prod 256:120268

Mishra U, Wu J-Z, Sarkar B (n.d.) Optimum sustainable inventory management with backorder and deterioration under controllable carbon emissions. J Clean Prod 279:123699

Mo J, Mi F, Zhou F, Pan H (2009) A note on an EOQ model with stock and price sensitive demand. Math Comput Model 49(9–10):2029–2036

Polatoglu H, Sahin I (2000) Optimal procurement policies under price-dependent demand. Int J Prod Econ 65(2):141–171

Sarkar B (2012) An EOQ model with delay in payments and time varying deterioration rate. Math Comput Model 55(3–4):367–377

Teng J-T, Cárdenas-Barrón LE, Chang H-J, Wu J, Hu Y (2016) Inventory lot-size policies for deteriorating items with expiration dates and advance payments. Appl Math Model 40(19–20):8605–8616

Ullah M, Khan I, Sarkar B (2019) Dynamic Pricing in a Multi-Period Newsvendor Under Stochastic Price-Dependent Demand. Mathematics 7(6):520

Wu J, Teng J-T, Chan Y-L (2018) Inventory policies for perishable products with expiration dates and advance-cash-credit payment schemes. Int J Syst Sci 5(4):310–326

You PS (2005) Inventory policy for products with price and time-dependent demands. J Oper Res Soc 56(7):870–873

Acknowledgment

The authors deeply appreciate the editor and the anonymous reviewer for his valuable comments and suggestions to improve the quality of the research paper. The corresponding author would like to thank the University of Delhi, Delhi for funding this work through the Faculty Research Programme (FRP) of the IoE scheme under the grant number IoE/FRP/PCMS/2020/27.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of Interest

The authors declare that they have no conflict of interest.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix A

Appendix A

The second-order derivatives and the sufficient conditions are illustrated as follows:

Rights and permissions

About this article

Cite this article

Yadav, S., Khanna, A. Sustainable Inventory Model for Perishable Products with Expiration Date and Price Reliant Demand Under Carbon Tax Policy. Process Integr Optim Sustain 5, 475–486 (2021). https://doi.org/10.1007/s41660-021-00157-8

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s41660-021-00157-8