Abstract

To study the extent of green finance development in China, this article constructs a green finance index system and employs the entropy value method to measure China’s green finance by using a yearly provincial panel data from 2001 to 2020. The Thiel and Moran indices are then used to systematically analyze the temporal and spatial distribution of China’s regional green finance. The findings are summarized as follows. Firstly, the overall green finance index in China experiences an upward trend. The development of green finance in the eastern region is superior to that in other regions in terms of absolute value and growth rate. Moreover, the differences in China’s green finance index have shown an increasing trend over the last two decades, which is mostly contributed by the intra-regional differences. Finally, the inter-regional distribution of green finance index demonstrates that green finance development has a spatial spillover effect.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

As China proposed the goals of “carbon peaking” by 2030 and “carbon neutrality” by 2060 in 2020, the development of green finance has become an important task for the government to promote the green economic development and to achieve the “double carbon” national strategy. Green finance is a valuable mean to realize the industry transformation and upgrading and reduce carbon emissions through allocating more capital to green projects (Udemba and Tosun 2022a; Liu et al. 2023). Several green financial instruments are emerging and widely accepted, such as green credit, green bond, and green insurance. Public data from the People’s Bank of China shows that by the end of 2022, the size of China’s green financial assets exceeded 25 trillion yuan. Among them, the balance of domestic and foreign currency green loans is 22.03 trillion yuan, an increase of 38.5% year-on-year. The cumulative issuance size of domestic green bonds reached 2.62 trillion yuan, up 44.66% year-on-year. Insurance, green trusts, green funds, and other green financial assets have all achieved rapid development and the support for the green real economy has been effective.

With the development of green finance, the methods to evaluate the development of green finance are becoming increasingly diversified. The research methods mainly focus on DEA envelope analysis and coupling degree analysis. By using DEA envelope analysis, it was demonstrated that environmental energy inputs in the USA contribute to the efficiency of green industries (Sueyoshi and Wang 2014). Measuring the efficiency of green financial development in China from the perspective of green financial resources injected into enterprises through the DEA-Malmquist index (Zhou and Xu 2022). Due to the small differences in the comprehensive development level of green finance among provinces, the coupled coordination degree of green finance and eco-efficiency was analyzed using the coupled coordination degree model (Xie and Hu 2022). To study the development of green finance in different regions, a coupled coordination degree model is used to analyze the coupled coordination relationship between circular economy and green finance in the Beijing-Tianjin-Hebei region.

The high-quality development of green finance is important to accelerate the realization of the “double carbon” goal (Philip et al. 2022; Xing et al. 2023). China is still in a period of growth in total carbon emissions, and the primary goal is to achieve “carbon peaking.” Therefore, more studies have been conducted to explore the relationship between financial development and carbon emissions. There are two main views among academics. One view is that financial development can have a dampening effect on carbon emissions. The development of finance will have a dampening effect on carbon emissions by providing incentives for firms to upgrade their technology and increase their environmental focus (Shahbaz et al. 2013). At the same time, financial development contributes to corporate technological innovation, which can improve energy use efficiency and further achieve emission reductions (Yan et al. 2016). Others hold the viewpoint that financial development inevitably increases the intensity of carbon emissions. A country’s financial development is accompanied by an increase in its level of economic development, which inevitably generates a greater demand for resources and thus higher levels of carbon emissions. By examining the heterogeneous relationship between financial development and carbon emissions, it was found that the role of financial development on carbon emissions is not simply inhibitory or facilitative (Shao and Liu 2017; Udemba and Tosun 2022b).

Compared with the existing literature, the marginal contribution of this paper is reflected in the following aspects. From an academic theoretical point of view, the measurement of green financial development is broadened—specific measurement of green finance development by using the entropy method and then further specifying the quantitative indicators through the Thiel and Moran indices. The green financial development of different regions is visualized by Moran scatter plot and regional distribution map. From the perspective of practical application, the analysis of the green finance index provides a quantitative analysis method for the practical work of the government, in order that the government has a more scientific basis as a reference before making decisions.

The rest of the paper is structured as follows. The second section compares the research methods of green finance index measurement in China. The third section is an empirical analysis of the green finance index measure in China. Finally, based on the empirical findings, relevant policy recommendations are proposed.

Research methodology

Liu and Fang (2015) conducted a comprehensive evaluation analysis of green economic development in Hebei Province using the entropy value method. Zhang et al. (2019) used the entropy method to measure the level of financial agglomeration in Ningbo. Zhou et al. (2022) measured and evaluated the level of green financial development using the entropy method. Combining the methods of the above scholars, the entropy method is applied to measure the green finance index in China.

Entropy method

Standardization of indicators

Guo (2012) argues that to eliminate the differences in the scale between different indicators, the raw data need to be standardized so that they are all in the [0,1] interval and thus comparable. In the indicator system, indicators are divided into two categories: positive and negative indicators. The larger the value, the better the indicator is a positive indicator. The standardized calculation formula for positive and negative indicators is as follows.

where \({y}_{ij}\) is the first \(i\) original value of the j indicator of the first city, and \({\text{max}}\left({x}_{j}\right),{\text{min}}({x}_{j}\)) denotes the maximum and minimum values of the j indicator for all cities, respectively.

Entropy value method calculation

-

(1)

Standardized adjustment of indicators.

To eliminate the influence of extreme values of “0” in the logarithmic calculation process, the standardized index values are adjusted. Referring to the idea of Jia et al. (2000) study, the standardized indicator values are shifted by 0.001, \({Y}_{ij}={y}_{ij}\) +\(d\), where \(d\) = 0.001.

-

(2)

Calculate \({P}_{ij}\) the weight of the j indicator of the i province.

$$\begin{array}{cc}{P}_{ij}={Y}_{ij}/\sum_{i=1}^{m}{Y}_{ij},& 0\end{array}\le {P}_{ij}\le 1$$ -

(3)

Calculate the entropy value of the \(j\) entropy value of the index \({E}_{j}\).

$${E}_{j}=-k\sum\nolimits_{i=1}^{m}Pln{P}_{ij}$$

K > 0, ln is the natural logarithm, the constant k is related to the number of provinces m, generally let k = 1/\({\text{ln}}m\),then 0 ≤ \({E}_{j}\)≤1.

-

(4)

Calculate the coefficient of variability of the j indicator \({D}_{j}\).

The coefficient of variability indicates the role played by the indicator on the study subject. And the larger the value, the greater the impact on the study subject.

Thiel’s index and its decomposition method

The Thiel index is just one of the most widely used special cases of the entropy index. The expression for the Thiel index is as follows.

where T is a measure of the degree of gap in the green finance index. Thiel index \({y}_{i}\) and‾ y represents the green finance index of province \(i\) and the average green development index of all provinces, respectively.

The Thiel index as a measure of inequality in the green finance index has good decomposability. That is say when the sample is divided into multiple clusters, the Thiel index can measure the contribution of the within-group gap and the between-group gap to the total gap separately.

The Thayer index is a widely used measure of economic variation and is a special form of the generalized entropy index. In the financial sector, the measurement of the Green finance index is also a form of measuring economic development. This is more conducive to understanding the development trend of green finance in China.

Suppose the sample containing n individuals is divided into K clusters, each group being \({g}_{k}\) (k = 1,2…k), and the k group\({g}_{k}\). The number of individuals in the group is \({n}_{k}\), then there are\(\sum_{k=1}^{k}{n}_{k}=n\),\({y}_{i}\) and \({y}_{k}\) denote the share of green financial index of a province i and the total share of green financial index of a cluster k, respectively.

As well as denote \({T}_{b}\) and \({T}_{w}\) are the inter-cluster gap and intra-cluster gap, respectively. Then the Thiel index can be decomposed as follows.

In the above equation, the between inter-cluster gap \({T}_{b}\) and intra-cluster gap \({T}_{w}\) have the following expressions, respectively.

Moran index

The Moran’s I statistic for spatial autocorrelation can be expressed as

where \({z}_{i}\) is the element \(i\) attributes of the elements, and their mean \((x_i-{}^-x)\) is the deviation of the element from its mean. Then \({w}_{i,j}\) is the deviation of the element \(i\) and \(j\). The spatial weight between \(n\) is equal to the total number of elements, and \({S}_{0}\) is the aggregation of all spatial weights.

The statistical \({Z}_{I}\) score is calculated in the following form.

where \(E\left[I\right]=-1/(n-1)\); \(V\left[I\right]=E\left[{I}^{2}\right]-E{[I]}^{2}\)

Principal component analysis method

Suppose the object under study contains m original variables \({x}_{1}\),\({x}_{2}\),…..\({x}_{m}\), and each variable has n observations. The sample matrix of the original data is as follows.

Based on the original data, a linear combination of m variables is performed to obtain a new composite variable. To explain as much information as possible in the original variables, when constructing the first new variable, the coefficients should be chosen so that the variance of the variables is maximized. The second variable constructed on this basis must be independent of the first variable in order to avoid duplication of information, and the coefficients should be chosen so that the variance of the new variable is as large as possible and so on to obtain a total of m composite variables by linear combination \({F}_{1},{F}_{2},\dots .{F}_{m}.\) In total, m composite variables are constructed by linear combination.

where the variable \({F}_{1}\) has the largest variance, contains the most explanatory information, and is referred to as the first principal component. And \({F}_{2},{F}_{3},\dots {F}_{m}\) are referred to as the second, third…m principal components, respectively. By mathematical derivation, \({\lambda }_{1}\) is the eigenvalue of the covariance matrix of the original data after normalization, and the elements of the principal component coefficient matrix are the eigenvectors corresponding to the eigenvalues of the covariance matrix of the original data.

Empirical findings and discussion

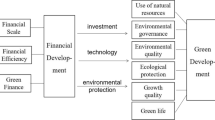

To assess the level of green financial development of each province more accurately in China, a more complete evaluation index system should be constructed. By referencing the existing research, this article constructs a green finance index measurement index system in China from four perspectives, namely green credit, green investment, green insurance, and government support. The relevant indexes are shown in Table 1. The original data of this article are obtained from the China Statistical Yearbook, the Statistical Yearbook of each province, and the China Insurance Yearbook.

In September 2015, the State Council of the Central Committee of the Communist Party of China (CPC) issued the General Plan for the Reform of the Ecological Civilization System, in which the overall goal of “establishing a green financial system” was proposed for the first time and green finance was formally introduced. Although the development of green finance is relatively short, the construction of ecological environment and the emergence of green industry in China originated in the last century. Therefore, it is more intuitive to observe the evolution of this index over the years. Second, to ensure the scientific and accurate analysis, this article takes the data of 30 provinces, municipalities, and autonomous regions in China, except Tibet, Hong Kong, Macao, and Taiwan, as samples. Third, it adopts the entropy value method to calculate the final score, which is one of the more recognized and concise measurement methods. It can avoid the subjectivity in assigning weights to indicators to a certain extent. Fourth, to analyze the development differences between regions, the division of the country into the three regions of central and east–west, which is routine, was adopted. The country’s provinces were divided into three groups using the central-east–west region, with the central region containing eight provinces and the eastern and western regions containing 11 provinces respectively.

Entropy method

The area of the green finance index measured with the entropy method is shown in Fig. 1. As shown in this figure, the development of green finance in China differs significantly in each province, and the development level in the eastern region is significantly higher than that in the middle and western regions. This result is in line with Zhou and Xu (2022).

To further visualize the differences among the groups, the trend of the East, Middle, and West with the overall green finance impact index is further analyzed. From left to right, the three groups are divided in the order of east, middle, and west. As shown in Table 2 and Fig. 2, China’s overall green financial impact index shows a clear upward trend and reaches its maximum value in 2020.

Theil index

To further explore the regional variability of China’s green development index, the Theil index is then introduced for analysis. The Theil index can be a good measure of regional development differences. Using this index, the overall differences in green finance are decomposed into intra-group differences and inter-group differences by grouping them according to the east, middle and west in Table 3.

Stata software is used to calculate the Thayer index for each component, and Excel software is used for graphical analysis. Figure 3 summarizes the overall Thayer index of financial development in China over the years and the relationship between the overall intra-group differences and inter-group differences.

As shown in Fig. 3, the intra-group and inter-group differences of the overall Thiel index and green finance index show a continuous growth trend, indicating that the regional imbalance in the development of green finance in China is gradually expanding. From 2001 to 2011, the overall Thiel index showed a slow growth trend. From 2012 to 2014, there was a decreasing trend. After 2015, it started to grow one after another, which corresponds to the introduction and rise of supporting measures of green finance policies. In addition, after the implementation of various green finance policies on the ground, the original dynamic balance of development may be broken and new development standards established, which will have a certain degree of impact on the overall development. In these two decades, its within-group differences have been much smaller than between-group differences. In 2017, its within-group differences were almost equal to the between-group differences. All these findings are consistent with Xie and Hu (2022).

As shown in Table 4 and Fig. 4, the within-group variance in the eastern region contributes the most to the overall within-group variance, but the within-group variance in both the central and western regions is much lower than the overall within-group variance. Meanwhile, the overall within-group variance shows a slow increase over the years. Between 2001 and 2014, the overall within-group variance shows a slow increase. Between 2014 and 2017, the overall within-group variance showed a steep climb and peaked in 2017. Between 2017 and 2020, the overall within-group variance shows a steep decline followed by a slow increase. This change in growth rate corresponds to the implementation and improvement of relevant policies. The within-group variation is the largest in the eastern region, which the eastern region is the economic leader and has an imbalance with other regions in green finance development. As can be seen from Fig. 4, the western region has the smallest variation in development, which to a certain extent explains the lag in the promotion of green finance in the western provinces.

Moran index

The first law of geography has pointed out that “everything is correlated with each other and this correlation becomes stronger when their locations are close to each other” (Song 2022). To verify whether there is an obvious spatial correlation between the green financial development of each province in China, the analysis is carried out by introducing the Moran index. The Moran index is an index used in spatial econometrics to measure spatial autocorrelation.

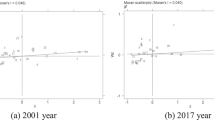

The Moran index of green finance index of 30 provinces in China from 2001 to 2020 was calculated by using Stata software and analyzed graphically by Excel. As shown in Table 5 and Fig. 5, the range of Moran index is between [− 1,1]. And the larger the value, the stronger the positive spatial correlation. As can be seen from Fig. 5, the global Moran index of China’s green finance index is positive, which indicates that the development of green finance in each province in China in the past 20 years has shown a significant positive spatial distribution. At the same time, the Moran index shows an overall increasing trend in fluctuation, indicating that the spatial autocorrelation of green finance development is strengthening.

To further analyze the spatial aggregation status of green financial development in China, the Moran scatter plot is introduced to visually measure the changes in spatial aggregation of green financial development over the years. In addition, the spatial weight matrix used to calculate the Moran scatter plot is consistent with the method used to calculate the Moran index.

In this article, the green financial indexes in 2001, 2005, 2010, 2015, and 2020 are used as the basis for the calculation of Moran scatter diagram and the analysis of its spatial evolution pattern. Using Geoda software, the calculation results are shown in the following figures.

As shown in Fig. 6, the distribution of most provinces is in the third quadrant and the first quadrant since these two decades and their distribution status is of low-low aggregation type or high-high aggregation type. Therefore, it also proves the positive spatial aggregation characteristics of green finance development in each province in China. It can thus be shown that the spatial autocorrelation characteristics of green financial development in China are significantly robust and do not fluctuate easily. Meanwhile, in terms of the characteristics of aggregation, the spatial correlations of green financial development in China are both high-high aggregation type and low-low aggregation type characteristics.

The data of green finance index of each province in the last two decades were used to carry out the spatial variation pattern of the Moran scatter plot based on the graphical drawing using Geoda software, as shown in the following figures.

As shown in Fig. 7, the area in the figure belongs to the light pink color, Shanxi Province shows a high and low clustering distribution, being the high value adjacent to the low value, indicating that its local Moran index I is negatively correlated. As shown in the blue area, Gansu Province and Hubei Province show a low-low agglomeration distribution, being low values adjacent to low values, indicating that their Moran index I is positively correlated. As shown in the red area, Tianjin shows a high-high agglomeration distribution, which is the high value adjacent to the high value, indicating that its Moran index I is positively correlated.

As shown in Fig. 8, the local Moran index for Tianjin, Hubei Province, and Gansu Province are significant at the 5% level as shown in the region belonging to light green. As shown in the dark green area, the local Moran index for Shanxi Province is significant at the 1% level.

As shown in Fig. 9, the region to which the red color belongs, Tianjin shows a high-high clustering distribution, with high values adjacent to high values, indicating that its local Moran index I is positively correlated. As shown in the area in light purple, Hebei Province shows a low–high clustering distribution, with low values adjacent to high values, indicating that its Moran index I is also negatively correlated. As shown in the blue area, Gansu Province shows a low-low agglomeration distribution, which is the low value adjacent to the low value, indicating that its Moran index I is positively correlated.

As shown in the light green area in Fig. 10, the local Moran index of Gansu Province, Hebei Province, and Tianjin are significant at the 5% level. This indicates that Gansu Province is in the inland of northwest China and has a fragile ecological environment, which urgently needs to develop green finance. Tianjin and Hebei Province are actively practicing their dual carbon goals and promoting the development of green finance.

As shown in the red area of Fig. 11, Tianjin shows a high-high clustering distribution, which is the high value adjacent to the high value, indicating that the local Moran index I is positively correlated. As shown in the blue area, Tibet, Sichuan, Inner Mongolia, and Gansu Provinces show a low-low agglomeration distribution, which is adjacent to the low value, indicating that the local Moran index I is positively correlated.

As shown in Fig. 12 for the regions to which the light green color belongs, the local Moran indexes for Tianjin, Tibet, Gansu, Sichuan, and Inner Mongolia are significant at the 5% level. This indicates that both Tianjin and Gansu Province continued to develop green finance from 2005 to 2010. At this point, with the increasing haze in the north and the successive introduction of environmental protection measures, green finance is also gradually developing.

As shown in the blue area in Fig. 13, Inner Mongolia, Ningxia, and Gansu provinces show a low-low agglomeration distribution, being low values adjacent to low values, indicating that the local Moran index I is positively correlated. As shown in the red area, Tianjin shows a high-high clustering distribution, with high values adjacent to high values, indicating that the local Moran index I is positively correlated.

As shown in the area belonging to light green in Fig. 14, the local Moran indexes of Gansu, Ningxia province, and Tianjin City are all significant at the 5% level. As shown in the dark green area, the local Moran index for Inner Mongolia province is significant at the 1% level. As the northernmost defense line of China, the level of environmental pollution in Inner Mongolia province should not be underestimated, and its green industry development level is even declining flatly. However, led by Ningxia and the neighboring province of Gansu, they are also gradually developing green finance.

As shown in the blue area in Fig. 15, Inner Mongolia province shows a low-low agglomeration distribution, being low values adjacent to low values, indicating that the local Moran index I is positively correlated. As shown in the red area, Tianjin shows a high-high clustering distribution, with high values adjacent to high values, indicating that the local Moran index I is positively correlated. As shown in the area belonging to light green in Fig. 16, the local Moran indexes of Inner Mongolia Province and Tianjin City are all significant at the 5% level. This indicates that there is a significant spatial spillover effect on the development of regional green finance in China.

Principal component analysis method

To further improve the measurement of green finance, the principal component analysis method is used to construct green finance indicators. Principal component analysis is an unsupervised dimensionality reduction method in the sense that the data are mapped to a space of lower dimensionality, which reduces the computational effort to perform calculations on these data. It is also important to ensure that the data is easy to extract features after the operation of principal component analysis, so that the variance of the mapped data is maximized. Therefore, making the direction with the largest variance in the current data set the direction of the principal component. The principal component analysis method realizes the dimensionality reduction of data through projection and transforms multiple indicators into a few representative composite indicators based on losing less data information, and the weights constructed are based on the objective data itself. Stata software is used to perform principal component analysis.

The KMO (Kaiser–Meyer–Olkin) sampling adequacy measure is applied as an important indicator to measure the strength of the correlation between variables. The KMO is obtained by comparing the correlation coefficient and the bias correlation coefficient of the two variables. SMC is the square of the complex correlation coefficient of one variable with all other variables, which is the decidable coefficient of the complex regression equation.

A higher KMO indicates a stronger commonality of variables. If the partial correlation coefficient is higher relative to the correlation coefficient, the KMO is lower. As can be seen from Table 6, the KMO coefficients are all higher, and the co-linearity between the variables is strong. SMC is the decidable coefficient of the complex regression equation; higher SMC indicates a stronger linear relationship and stronger co-linearity of the variables. From the figure, it can be seen that the SMC are higher, which indicates a strong linear relationship and a more appropriate principal component analysis.

As can be seen from the gravel plot above (Fig. 17), the horizontal axis indicates the number of indicators, and the vertical axis indicates the eigenroot value. When the first ten factors are extracted, the eigenroot values are larger and change more significantly, which contribute more to explain the original variables. This shows that the extraction of the first ten factors has a significant effect on the original variables.

As shown in Table 7, 8, and 9, the cumulative variance contribution of comp1, comp2, comp3, comp4, comp5, comp6, comp7, comp8, comp9, and comp10 was 99.99%, which exceeded the empirical value criterion of 85%. Therefore, these ten principal components were selected. Twenty variables were identified based on the loadings of each variable on each of the selected principal components with the weighted average of the variance contribution of each principal component. Moreover, each year from 2001 to 2020 is a separate variable. The weights in the green finance index were calculated as 0.04888, 0.04999, 0.05035, 0.05053, 0.05049, 0.05071, 0.05051, 0.05099, 0.05113, 0.05116, 0.05098, 0.05095, 0.05083, 0.05088, 0.05088 0.05083, 0.05073, 0.05065, 0.05079, 0.05072, and 0.05063. As a result, the construction formula of our green finance index is the following.

As shown by the above equation, the coefficients of the variables are all positive, indicating that the green finance indices of all Chinese provinces have been growing positively over the two decades from 2001 to 2020. All provinces have different degrees of development in green finance.

Conclusion and policy implication

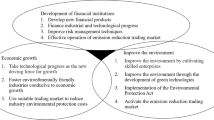

Based on the connotation of green finance, this article constructs an indicator system to measure the development of green finance in China. Using the entropy method, the trend of green finance index of each province in China over the past 20 years was measured based on 30 provincial panel data of China from 2001 to 2020. Subsequently, the Thiel index, Moran index, Moran scatter diagram, and spatial correlation diagram are introduced to study the regional characteristics of green finance development in China. Finally, with the help of principal component analysis, the formula of green finance index for the country in these two decades was constructed. The findings of the study are as follows. First, from the regional distribution status of China’s green financial development index, in the first decade, Beijing shows a high and low agglomeration distribution, and Gansu Province shows a low and high agglomeration distribution. In the latter decade, both Inner Mongolia and Gansu provinces show a low-low agglomeration distribution, and Beijing shows a high-high agglomeration distribution. Second, in terms of overall development changes, China’s green finance index has shown a trend of amplification within these two decades, and regions with more significant intra-regional differences have contributed more to the overall differences. Third, there is a spatial spillover effect of green development in all provinces, showing the distribution of high-high aggregation and low-low aggregation.

To better promote the overall development of green finance in China, this article puts forward the following policy recommendations. First, build a green financial system with regional characteristics. Overall, China’s construction of a green financial system has begun to bear fruit. However, the construction of a regional green financial system has major problems. There are obvious development imbalances across regions and provinces, and the level of green finance development varies from place to place. On the framework of the overall green financial system, it is particularly important to build a regional green development system according to the characteristics of the region.

Second, improve the mechanism of smooth information flow. There are limitations to the transparency of information from the environmental protection sector, as banks, insurance, and other institutions can only rely on the relevant environmental protection department for environmental information. Therefore, environmental protection departments should strengthen the integration of information on highly polluting and environmentally friendly enterprises, timely filing and disclosure of information and strengthen cooperation with financial institutions. Disapprove projects and loans applied for by companies that fail to disclose pollution and environmental information in a timely manner to promote transparency in environmental information.

Again, it is important to further strengthen the support for green finance across the country. The development of green finance should be strengthened not only in the northern cities of Beijing, Gansu, and Inner Mongolia, but also in other regions. Combined with the obvious spillover characteristics of China’s green financial development, to promote the development of each local for green finance. The comprehensive green finance index makes it possible to compare the level of green finance development among different regions, which provides a data base for predicting the green finance development of each region in the future.

Finally, improve the effectiveness of green financial development. The lack of a unified carbon trading market, information asymmetry, and limited risk assessment will greatly reduce the effectiveness of green finance development. Therefore, it is necessary to continue to improve the transparency of the green financial market, establish uniform pricing standards and market guidelines, strengthen environmental information disclosure requirements, and establish a public data platform to quantify environmental factors. It is also necessary to strengthen the construction of green financial system.

Data availability

Data used in this research are taken from China Statistical Yearbook available at http://www.stats.gov.cn/sj/ndsj/ for the period of 2001 to 2020.

References

Guo YJ (2012) Comprehensive evaluation theory, methods and expansion. Beijing: Sci Press 05:78–84 (In Chinese)

Jia HF, Shao L, Luo S (2000) Comprehensive evaluation of ecological civilization in Qinghai Province based on entropy value method and coupled coordination degree model. Ecol Econ 11:215–220 (In Chinese)

Liu Q, Fang F (2015) Comprehensive evaluation analysis of green economic development in Hebei Province based on entropy value method. Hebei Enterprises 08:42–44 (In Chinese)

Liu X, Udemba EN, Emir F, Hussain S, Khan NU, Abdallah I (2023) Nexus between resource policy, renewable energy policy and export diversification: asymmetric study of environment quality towards sustainable development. Resour Policy 88:104402

Philip LD, Emir F, Udemba EN (2022) Investigating possibility of achieving sustainable development goals through renewable energy, technological innovation, and entrepreneur: a study of global best practice policies. Environ Sci Pollut Res 29:60302–60313

Shahbaz M, Tiwari AK, Nasir M (2013) The effects of financial development, economic growth, coal consumption and trade openness on CO2 emissions in South Africa. Energy Policy 61(10):1452–1459

Shao HH, Liu YB (2017) A study on the non-linear relationship between financial development and carbon emissions - an empirical test based on a panel smoothing transformation model. Soft Sci 31(05):80–84 (In Chinese)

Song YR (2022) The measurement of China’s green financial development index and its distribution characteristics analysis. Western Finance 04:29–36 (In Chinese)

Sueyoshi T, Wang D (2014) Radial and non-radial approaches for environmental assessment by Data Envelopment Analysis: corporate sustainability and effective investment for technology innovation. Energy Econ 45:537–551

Udemba EN, Tosun M (2022a) Moderating effect of institutional policies on energy and technology towards a better environment quality: a two dimensional approach to China’s sustainable development. Technol Forecast Soc Chang 183:121964

Udemba EN, Tosun M (2022b) Energy transition and diversification: a pathway to achieve sustainable development goals (SDGs) in Brazil. Energy 239:122199

Xie TT, Hu YZ (2022) Study on the coupling and coordination of green finance and eco-efficiency under the double carbon target. North China Finance 551(12):15–27 (In Chinese)

Xing L, Udemba EN, Tosun MS, Abdallah I, Boukhris I (2023) Sustainable development policies of renewable energy and technological innovation toward climate and sustainable development goals. Sustain Dev 31(2):1178–1192

Yan CL, Li T, Lan W (2016) Financial development, innovation and CO2 emissions. Financial Res 01:14–30 (In Chinese)

Zhang C, Zheng CJ, Li SY (2019) Measurement of financial agglomeration level in Ningbo county based on entropy value method. J Hubei Coll Arts Sci 02:24–28 (In Chinese)

Zhou GL, Xu YR (2022) Evaluation of green financial efficiency in China based on DEA-Malmquist index. Shanghai Finance 09:69–79 (In Chinese)

Zhou WH, Zhang M, Wang JX (2022) Measurement and evaluation of green financial development level. China Foreign Invest 12:39–41 (In Chinese)

Funding

This research was supported by the National Natural Science Foundation of China (grant no. 71663001).

Author information

Authors and Affiliations

Contributions

XH: conceptualization; data curation; validation; supervision; resources; writing—review and editing. SG: formal analysis; investigation; methodology; writing—original draft preparation.

Corresponding author

Ethics declarations

Ethics approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Nicholas Apergis

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Huang, X., Gao, S. Measurement and spatiotemporal characteristics of China’s green finance. Environ Sci Pollut Res 31, 13100–13121 (2024). https://doi.org/10.1007/s11356-023-31811-y

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-023-31811-y