Abstract

In recent times, economic policy uncertainty (EPU) and geopolitical risk (GPR) are increasing significantly where the economy and environment are affected by these factors. Therefore, the goal of this paper is to investigate whether EPU and GPR impede CO2 emissions in BRICST countries. We employ second-generation panel data methods, AMG and CCEMG estimator, and panel quantile regression model. The conclusions document that most of the variables are integrated at I (1), and there exists co-integration among considered variables of the study. Moreover, we note that EPU and GPR have a heterogeneous effect on CO2 emissions across different quantiles. EPU adversely affects CO2 emissions at lower and middle quantiles, while it surges the CO2 emissions at higher quantiles. On the contrary, geopolitical risk surges CO2 emissions at lower quartiles, and it plunges CO2 emissions at middle and higher quantiles. Furthermore, GDP per capita, renewable energy, non-renewable energy, and urbanization also have a heterogeneous impact on CO2 emissions in the conditional distribution of CO2 emissions. Based on the results, we discuss the policy direction.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In the energy and environmental debate, carbon dioxide (CO2) often leads to negative consequences on natural and human activities. This is not all-time true, because CO2 has its important roles being exercised on natural and human events like the air we exhale, the nutrition we consumed, and the product we buy. In addition, CO2 is discharged when plants and animal inhale oxygen and nature such as the ecosystem maintain the situation by absorbing and consequently eradicating the CO2 through plants and oceans. However, when an excess of CO2 is emitted by human activities on earth, it often causes damage to the environment, thereby leading to climate change and/or global warming. At this stage, CO2, like other greenhouse gases (methane, and water vapor, etc.), holds heat from escaping from the atmosphere, and thus, the systematic pattern of weather is disrupted, global temperature is increased, and other climate changes occurred. CO2 emission is caused through different means of activities from individuals, services or events, government, organization, etc. This is emitted through deforestation, burning of fossil fuels, civil construction, transportation, government and commercial industry, manufacturing of foods, and other services. All these are needed for the sustainable economic growth of a country, and if stopped could pose threat to the global economy, so policymakers need to focus on policy uncertainty, political uncertainty, and climate change.

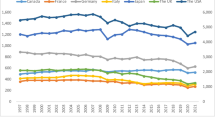

Fighting to reduce greenhouse gas emissions, especially CO2, is fighting against nature, it required no transport or permission to contribute to environmental problems everywhere, it is a threat to human life, and even a major cause of economic instability and jeopardized the nation’s security. Nonetheless, Antonakakis et al. (2017) show that the environmental changes are correlated by all man-made activities, and these are like burning of fossil fuel for energy use, pitched toward economic growth, thereby actuating adverse effects to the quality of the real global environment. Therefore, the meaning is that a nation will continue to develop through the consumption of certain energy through government and commercial industry. For instance, in Fig. 1 which represents the CO2 consumption in BRICST (Brazil, China, India, Russia, South Africa, and Turkey) countries, it was observed that increase, in metric tons, from the start of 1990 until 2015. In lieu of this, previous scholars have been investigated the problem, for decades, for the proper maintenance of sustainable development growth across the globe.

Fossil energy utilization is normally seen as the lead cause of extreme carbon dioxide emission issues, and diminishing its consumption is a required process for both industrial and non-industrial nations to address the environmental change issue. In any case, because of the acknowledged view that energy utilization is perhaps the main driver of monetary development (WEF, 2018), the execution of energy measures has raised significant worries for financial development. In particular, assuming energy utilization causes fossil fuel byproducts yet are needed for monetary development, receiving energy preservation approaches will give numerous nations the issue of picking between the “climate and the economy.”

Over the years, many researchers have studied the correlation between economic growth, energy consumption (renewable, nonrenewable energy), greenhouse gas emission, but their findings are conflicting (Liu et al. 2019a, b). The conflicting outcomes had made many countries choose different energy policies. For instance, this is specified by the energy conservation hypothesis, that energy consumption makes slow economic development (Rahman and Kashem 2017; Menegaki 2011; Kraft and Kraft 1978). For this reason, policies can promote the reduction of CO2 without taking into consideration, its adverse effect on economic growth. On the other side, the economic led-growth hypothesis study by Appiah (2018), Cai et al. (2018), and Ha et al. (2018) revealed that energy consumption is consistent with economic growth. For this reason, policy implications might face environmental or economic problems, because controlling energy consumption may hinder economic growth. Moreover, an increase in CO2 emission resulting from economic growth means that at the expense of the environment, economic growth is realized (Shahbaz et al. 2016; Mirza and Kanwal 2017), thus lowering the CO2 emission to make economic growth ecologically friendly will be the priority of policy direction in such case (Liu et al. 2019a, 2019b). Consequently, an exact understanding of the driver of carbon emissions and economic growth is essential for policy authorities to cautiously design proper administration guidelines that can help their nations realize the win–win of the climate and the economy. With these, this paper attempt to identify the economic growth-emission nexus while considering two uncertainties—economic policy uncertainty (EPU) and geopolitical risk (GPR) in the BRICST countries for a period of 1990–2015. The literature claimed that the behavior of the economic agent, delay in consumption decision, and investment are influenced by these uncertainties.

EPU, according to the description of Jin et al. (2019), is portrayed as the vulnerability related to spikes in government administrative, financial, and monetary strategies that change the climate wherein people and organizations work. Different evidence from the empirical study has revealed that higher EPU is a yardstick for effect in economic growth, tourism, financial development, investment, inflations, and other macroeconomic variables (Ashraf and Shen 2019; Jin et al. 2019; Akron et al. 2020). Also, EPU is associated with vulnerabilities relating to monetary, fiscal, trade, and other interrelated policies (Tiwari et al. 2019). Next, there exist three strands of literature related to the EPU-environment nexus. The first strand confirms that EPU increases environmental degradation (Anser et al. 2021a, 2021c), while the second strand of related literature documents that EPU decreases environmental degradation (Syed and Bouri 2021; Chen et al. 2021). Parallel to this, the third strand of EPU-environment nexus expounds that EPU does not affect the environment (Abbasi and Adedoyin 2021). These aforementioned contrasting conclusions are confusing for policymakers at the time of any policy proposal, therefore, the vague relationship between EPU and environment propels us to reinvestigate the EPU-environment relationship to reach a particular conclusion, and to complement the prior studies. Defining GPR is associated with political hullaballoo, discrepancy, and hostile issues, and it is perceived as a yardstick for change in the business cycle (Tiwari et al. 2019). There are two dimensions of GPR-environment literature. One shows that GPR upsurges environmental pollution (Anser et al. 2021b), whereas the other reports that GPR improves environmental quality (Anser et al. 2021c). The vague relationship between GPR and the environment calls for further probing for clear policy implementations, which motivates this study.

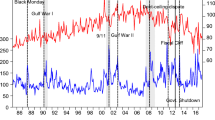

Based on the above milieu, the objective of this study is to explore the impact of EPU and GPR on CO2 emissions in the case of BRICST countries. It is well known that BRICST countries are among the top emerging countries with significantly high economic growth rates with the consort of higher CO2 emissions (Erdogan et al. 2019). So, it is inevitable to explore the drivers of carbon emissions in the case of BRICST countries. Therefore, we are interested to know whether the trend in EPU (Fig. 2) and GPR (Fig. 3) for the period of 1990–2015 have a significant association with emissions, and if so, we are keen to know whether the relationship surges or diminish the emission.

Regarding the uniqueness of this study, to the best of our knowledge, this is the first paper to consider the effect of EPU and GPR in panel emission of BRICST countries. Furthermore, this is the first study that employs the panel quantile regression approach, in consort with AMG and CCMG estimators, to evaluate the effect of EPU and GPR on carbon emissions. Panel quantile regression outperforms mean-based regression models since it covers individual heterogeneity and distributional heterogeneity. That is, panel quantile regression allows probing the effect of EPU and GPR on high-, average-, and low-emitter countries.

Literature review

We divide this chapter into two sub-parts. The impact of EPU and/or GPR on CO2 emissions is included in the first part and literature of the panel quantile regression method used on socio-economic factors of CO2 emissions are highlighted in the second part.

Economic policy uncertainty, geopolitical risk, and CO 2 emissions

There are many research studies on the relationship between EPU and CO2 emissions because it is one of the emerging socio-economic issues in recent times (Tables 1 and 2). Jiang et al. (2019) investigate the effect of EPU on the sector-wise CO2 emissions by employing the Granger causality test. The findings showed that there exists uni-directional causality from EPU to CO2 emissions in the US. Recently, several studies investigate the effect of EPU on environmental degradation, but they have not yet reached any conclusion. For instance, one group of studies reports that EPU escalates CO2 emissions, and the other group notes that EPU plunges the emissions. For instance, Danish et al. (2020) examined the dynamic relationship between EPU and CO2 emissions by applying dynamic ARDL methodology. According to the results from the study, EPU leads to higher CO2 emissions in the US. The EPU raises the level of CO2 emissions in the context of G7 countries mentioned by Pirgaip and Dinçergök (2020). Moreover, a few researchers proxied EPU by world uncertainty index (WUI), and highlight that EPU contributes to CO2 emissions (Wang et al. 2020).

Recently, Anser et al. (2021a) use a panel ARDL approach to examine the effect of EPU on CO2 emissions, and the study concludes that, in the short run, EPU is liable for the reduction in levels of CO2 emissions. Furthermore, one of the studies expounds that EPU is the key reason for the CO2 emissions in China (Yu et al. 2021). Similarly, Adedoyin and Zakari (2020) study the effect of the EPU on CO2 emissions and showed that EPU impedes CO2 emissions for the short run in the UK. Likewise, Syed and Bouri (2021) employ the bootstrap ARDL approach and conclude that EPU plunges CO2 emissions in the long run. In addition to this, Chen et al. (2021) investigate that EPU impedes CO2 emissions in both developing and developed countries. Next, Abbasi and Adedoyin (2021) employ the dynamic ARDL approach to investigate the effect of EPU, energy, and economic growth on CO2 emissions in China, and results of the study note that energy and GDP escalate on CO2 emissions.

Considering the literature on the relationship between GPR and CO2 emissions, Adams et al. (2020) investigate whether EPU and GPR affect CO2 emissions in top resource-rich economies. The findings reveal that EPU escalates CO2 emissions, while GPR plunges emissions. Recently, Anser et al. (2021b) employ an AMG regression estimator to investigate the long-run influence of GPR on CO2 emissions. The authors noted that GPR plunges renewable energy, R&D, and innovation. As a result, there exists a surge in the levels of CO2 emissions. Further, Zhao et al. (2021) investigate the impact of GPR on CO2 emissions in BRICS countries. The study concludes that GPR has an asymmetric impact on carbon emissions.

Determinants of CO2 emissions

There exist several studies that investigate the drivers of high CO2 emissions while employing the panel quantile regression method. For instance, Salman et al. (2019) employ the panel quantile regression approach to investigate the effect of imports, exports, energy intensity, and technology on CO2 emissions for ASEAN-7 countries. The study reports that exports and energy intensity escalate CO2 emissions at several quantiles, whereas imports and technological advancement plunge the carbon emissions. Also, the investigation shows the validity of the environmental Kuznets curve (EKC) hypothesis in ASEAN-7 economies. The study of Zhu et al. (2016) examines the effect of economic development, energy consumption, and foreign direct investment on CO2 emissions for 5-ASEAN economies. The findings reveal that the halo effect hypothesis exists for high emissions ASEAN countries, whereas there is no association between foreign direct investment (FDI) and CO2 emissions for low emission nations. Furthermore, energy consumption and GDP also have a heterogeneous impact on CO2 emissions across different quantiles. Besides, the study notes that the EKC hypothesis does not exist in the case of ASEAN-5 economies.

Zhang et al. (2016) study the impact of corruption and economic development on CO2 emissions for the Asia–Pacific Economic Cooperation region, and the results note heterogeneous impacts of corruption and GDP on carbon emissions. Xu and Lin (2016) used the provincial-level data for examining the influence of GDP, urbanization, industrialization, and energy intensity on CO2 emissions. The findings expound that the profound impact of economic development on CO2 emissions exists at higher quantiles, whereas a meager relationship exists between CO2 emissions and GDP at lower quantiles.

In addition, Zheng et al. (2019) investigate the heterogeneous impact of GDP, urbanization, industrialization, and population on CO2 emissions for selected Chinese cities. The authors report the positive effect of GDP on CO2 emissions, which escalates from lower to higher quantiles. Whereas, the positive impact of urbanization and industrialization plunges while moving from lower to higher quantile. In the case of selected West African countries, Nwaka et al. (2020) investigate the determinants of CO2 emissions. The results describe that EKC does not exist for the selected countries. Moreover, there exists a positive influence of the agriculture sector on CO2 emissions, whereas renewable energy curbs carbon emissions. Additionally, the study reports the adverse effect of trade on environmental quality. Chou et al. (2019) used the panel quantile regression approach in selected countries of South America and showed that democracy escalates energy efficiency and hence decreases the level of carbon emissions. Furthermore, Alola et al. (2020) examined the nexus among economic development, energy consumption, urbanization, tourism, and CO2 emissions for selected OECD nations by employing the panel quantile regression method. The study concludes that tourism, urbanization, and economic development upsurge CO2 emissions in upper (higher) quantiles.

Similarly, Akram et al. (2020) investigate the environmental effect of energy consumption for developing nations by the environmental Kuznets curve. The study confirms the validity of the environmental Kuznets curve and finds that energy efficiency mitigates CO2 emissions. Moreover, findings reveal that renewable and nuclear energy impedes CO2 emissions. Afterward, Luo et al. (2020) examined the convergence of carbon emission coupled with its determinants for selected provinces of China. The study expounds that there exists convergence in CO2 emissions in China. Moreover, inward FDI plunges the emissions across different quantiles, whereas outward FDI escalates the emissions. The study also validates the existence of the environmental Kuznets curve hypothesis. Liu et al. (2019a, b) investigate the nexus between income inequality and carbon emissions across the US states by panel quantile regression method. According to the findings of the study, inequality improves the environmental quality, especially in high emissions states in the USA. Similarly, Chen et al. (2020) investigated the relationship between income inequality and CO2 emissions in both the developing and developed nations by panel quantile regression method. The study showed that income imbalances escalate emissions in developing nations, whereas income imbalance has a meager effect on the level of emissions in developed countries. Cheng et al. (2021) investigate the nexus between technological innovation and CO2 emissions. The results showed that technological innovation impedes emissions; however, the impact is heterogeneous across quantiles in OECD nations. Next, Yu et al. (2020) also conclude the heterogeneous impact of renewable energy on carbon emissions in the case of China.

Recently, a few studies expound several key drivers of CO2 emissions, such that Qin et al. (2021) highlight that green innovations, composite risk, and environmental policy control environmental degradation. Similarly, Su et al. (2021) explore the political risk-environment nexus using advanced econometric methods. The authors documented that improved political scenario helps to achieve a clean environment. Similarly, Alola et al. (2021) pointed out that economic growth and technological innovation lead to sustainable development. Furthermore, Usman et al. (2021) document that ICT has an asymmetric impact on carbon emissions in the case of selected Asian economics. Likewise, Shan et al. (2021) noted that institutional quality and energy prices have detrimental impacts on levels of emissions in the case of the top 7 OECD countries. Recently, Ali and Kirikkaleli (2021) confirm that exports, income, and renewables help to impede consumption-based emissions in the case of Italy. Similarly, Kirikkaleli and Adebayo (2021) document that financial development and renewables improve environmental sustainability worldwide.

Theoretical framework

This section theoretically describes that how EPU and GPR affect CO2 emissions. According to Jiang et al. (2019), there are two channels/ effects that link EPU with CO2 emissions: (1) direct policy modification effect; (2) indirect policy demand effect. The direct policy modification effect expounds that increase in EPU averts the focus of policymakers from environmental quality to economic stability. As a result, CO2 emissions escalate in the economy. Parallel to this, the indirect policy demand channel showed the EPU affects the decision-making and economic behavior of both consumer and producer, which in turn raises the levels of energy consumption. As a result, CO2 emissions surge in the country.

Likewise, Wang et al. (2020) explained that EPU alters carbon emissions through investment and consumption effects. According to the consumption effect, EPU impedes the consumption of energy and carbon-emitting consumers’ goods. As a result, CO2 emissions will be decreased. Contrarily, the investment channel/effect notes that EPU mitigates the investment in research and development, technological advancement, and innovation. Hence, CO2 emissions will surge as EPU escalates.

Similarly, Yu et al. (2021) also developed three channels that link economic policies uncertainty with CO2 emissions. These three channels comprise of the innovations; share of fossil fuel energy; and energy intensity. Innovation channel shows that policy-related uncertainties lead to fewer innovations, thus, the level of CO2 emissions will be increased. Next, the share of fossil fuel channel describes that EPU surges the part of non-renewable energy within the energy mix, which leads to high levels of CO2 emissions. Moreover, the energy intensity channel explains that EPU upsurges the energy intensity, which on the contrary, intensifies levels of CO2 emissions.

Parallel to this, Anser et al. (2021c) put forward escalating effect and mitigating effects of GPR, which link GPR with environmental degradation. According to escalating effect, GPR impedes R&D, technological advancement, and innovation. As a result of this, CO2 emissions will be escalated. Conversely, mitigating effect reports that GPR plunges economic activity and energy utilization, hence, CO2 emissions will be reduced.

Model and methodology

Model

To evaluate the impact of human activities on environmental degradation, IPAT (I (influence) = P (population), A (affluence), T (technology)) framework has extensively been applied in empirical studies related to environmental economics. However, it has been noticed that IPAT contains a few limitations: (1) due to its mathematical form, application of hypothesis testing is not conceivable; (2) fixed proportionality through all independent variables is assumed in IPAT framework, which is invalid; (3) IPAT model does not discriminate the relative imperativeness of every independent variable (Anser et al. 2021a; York et al. 2003). To cover these aforementioned demerits, Dietz and Rosa (1994) develop a stochastic impact through the regression on population, affluence, and technology (STIRPAT) framework. The STIRPAT approach in its general form is presented as follows:

In Eq. (1), I denotes influence (proxied by carbon dioxide emissions), P represents the population, A represents affluence (proxied by per capita of GDP), and T represents technology (represented by energy consumption). Furthermore, \(\varnothing\) denotes intercept, i is a cross-section (country in this study), t represents time, and \(\varepsilon\) represents the error term. Also, βi (i = 1,2,3) is coefficient. We incorporate EPU and GPR in STIRPAT approach for this analysis.

In Eq. (2), β4 and β5 are the coefficients of EPU and GPR, respectively. After taking the logarithm of all variables, and substituting A, P, T, and I for their proxies, the final equation (i.e., empirical model of this study) is reported in Eq. (3):

where LCO2 represents the log of CO2 emissions (proxy of influence), LURB is the log of urbanization (proxy of the population), LGDP denotes log of GDP per capita (proxy of affluence), LNRE represents the log of non-renewable energy consumption, LREN represents the log of renewable energy, LEPU denotes log of EPU, and LGPR represents the log of GPR. It is worth mentioning that energy consumption (renewable and non-renewable) is used as a proxy of technology (T). Furthermore, \(\varnothing\) is intercept, i is a cross-section, t denotes period, and \(\varepsilon\) is the error term. In addition, βi (i = 1, 2,…, 6) is the coefficient of the STIRPAT model.

Methodology

It is known that OLS regression renders an unbiased estimator with a minimum variance if (1) error term of OLS regression has zero mean, and it has identical distribution (i, i, d); and (2) error term follows the normal distribution. According to De Silva et al. (2016), these aforementioned assumptions are not realistic, provided the nature of economic variables is real. Koenker and Bassett (1978) presented a quantile regression approach to cover the demerits of OLS regression. There exist several advantages of quantile regression: (1) the quartile regression does not possess any assumption related to the occurrence of moment function (Zhu et al. 2016); (2) quantile regression renders relatively correct and robust outcomes even in the case of outliers and fat tail distribution (Bera et al. 2016); (3) this method does not develop any assumption regarding the distribution (Sherwood and Wang 2016). These aforementioned properties of quantile regression prompt this study to employ this methodology.

Equation (4) demonstrates the conditional quantile \({Y}_{i}\) in a given \({x}_{i}\); however, \(\varnothing\) denotes the quantile. While using quantile regression methodology in panel data, unobserved heterogeneity is taken into account which prompts to employ panel quantile regression approach with the fixed effect. This panel quantile regression approach with the fixed effect is mentioned as follows.

In Eq. (5), \({\varphi }_{i}\) captures the fixed effect that also brings the incidental parameter problem (Lancaster 2000). With fixed time-series observations for every cross-sectional part, the estimator becomes inconsistent when the cross-sectional part approaches infinity (Galvao and Kato 2016). Thus, we cannot use conventional linear models in the panel quantile regression approach.

Koenker (2004) develops a method, known as the shrinkage model, to solve the aforementioned problem of the panel quantile regression model. This method introduces a penalty term to fix the issue of unobserved fixed effects. Hence, the parameters of the model are estimated as follows.

In Eq. (6), i and t respectively represent the country and year. Furthermore, k represents the quantile however \({\rho }_{\varnothing k}\) shows the quantile loss functions. Moreover, \({\Omega }_{k}\) denotes the given weight that is assigned to k-th quantile. Also, \({\Omega }_{k}\) captures the contribution of different quantiles. Similar to Lamarche (2011), we also set \({\Omega }_{k }=1/k\). In addition, \(\eta\) is tunning term/parameter that is used to plunge the individual effect to zero for better estimation of slope coefficients in the model. We also set the value of \(\eta\) = 1 as many investigations; for example, Zhu et al. (2018) set the value of \(\eta\) =1.

Data

The present investigation aims to evaluate the influence of economic policy uncertainty and geopolitical risk on carbon emissions in BRICST nations. We make use of panel data spanning 1990–2015 on annual frequency. The dependent variable of the current study is carbon emissions (measured in metric tons per capita), whereas key independent variables are EPU and GPR. World uncertainty index (WUI), which is computed on the frequency of the articles containing the “uncertainty” associated words in the EIU (Economic Intelligence Unit) reports, is used as a proxy for EPU. Recently, several studies employ WUI as a proxy to measure EPU (see, for example, Adams et al. 2020; Wang et al. 2020; Anser et al. 2021a). Also, the GPR index, which is also calculated on the frequency of articles containing “geopolitics” related words in a leading newspaper, is used as a proxy of geopolitical risk. Recently, many researchers use this proxy such as Adams et al. (2020) and Anser et al. (2021b). The data on both of these variables (i.e., world uncertainty index and geopolitical risk index) were gathered from policyuncertainty.com. Also, GDP per capita (measured in constant $2010), urbanization (a percentage of urban population), renewable energy (share of renewables in total energy), and non-renewable energy (oil equivalent per capita) were the control variables. The data on these aforementioned variables coupled with data on CO2 emissions were taken from the WDI database. Table 3 shows the description of the data.

Table 4 depicts the descriptive statistics of the considered variables. The mean value of LURB is the highest, whereas it is the lowest for LEPU. Similarly, the standard deviation of LURB is also the highest, while it is the lowest for LGPR. The value of skewness elaborates that all variables have either positive or negative skewness except for LNRE, which is neither positively nor negatively skewed. In the same way, kurtosis expounds that a few considered variables (e.g., LEPU) contain heavy/ fat tail. In addition, the Jarque–Bera test reveals that all considered variables of this study contain non-normal distribution.

Apart from the Jarque–Bera test, we also employ a Q-Q plot to graphically show the distribution of the variables. In the Q-Q plot, the linear diagonal blue line shows the normal distribution, while the dotted line describes the deviation from the normal distribution. Figures 4, 5, 6, 7, 8, 9, 10 in the Appendix elaborate that all selected variables have non-normal distribution.

Moreover, the pairwise correlation between all selected variables of this study was described in Table 5. According to Table 5, the correlation of LCO2 with LNRE and LURB is negative, while it is positive for all other variables. Additionally, correlation is the highest between LCO2 and LNRE, which is 0.96. Also, it is the lowest between LCO2 and LEPU, which is 0.08.

Results and discussions

We follow the five-step procedure to report the findings in a plausible form. In step 1, we probe the cross-sectional dependence (CD) using several tests (e.g., Pesaran CD test, Friedman CD test, and Frees CD test), and slope heterogeneity test by Pesaran and Yamagata (2008). In the panel dataset, CD refers to the spillover effect of a shock from one cross-section to another, and the proper scrutiny of CD is indispensable because its presence could lead to spurious findings (Pesaran 2007). Parallel to this, ignoring slope heterogeneity may also lead to spurious outcomes. The findings from the CD tests and slope heterogeneity test are presented in Table 6.

As can be seen from Table 6, the null hypothesis of no cross-sectional dependence could be rejected from all tests. Thus, it could be implied that there exists CD. Similarly, the findings from the slope heterogeneity test document that there exists slope heterogeneity since we could reject the null hypothesis of no slope heterogeneity.

In step 2, we probe the unit root/stationary property of variables. This application is imperative for appropriate estimation/regression methodology, and reliable results. In the literature we find numerous unit root tests for panel data; however, most of the tests (e.g., LLC and IPS) do not cover the issue of CD. Hence, these tests may lead to unreliable findings. On the contrary, the CIPS and CADF unit root tests cover the CD, therefore, these tests outperform other panel unit root tests. For this reason, we applied CIPS and CADF unit root tests. Table 7 describes the findings from CIPS and CADF unit root tests. The results reveal that we could not reject the null at I (0). Next, we could reject the null hypothesis at I (1) for each variable, suggesting that the selected dataset is stationary at I (1).

We explore the co-integration in step 3, which is the long-run correlation between all the selected variables in this study. In prior literature, there are many panel co-integration methods. However, conventional panel co-integration methodologies (e.g., Kao test and Pedroni test) do not incorporate the issue of CD and heterogeneity, which could render spurious results. To overcome the demerits of the first-generation (conventional) co-integration methodologies, Westerlund (2007) test is developed which covers the problem of CD and heterogeneity. Table 8 shows the results from Westerlund (2007) test, and the results note that the null hypothesis of no co-integration could be rejected for all four test statistics. Thus, it could be stated that there exists a long-run relationship among the selected variables in this investigation.

Next, step 4 of this section employs both the augmented mean group (AMG) and common correlated effects mean group (CCEMG) estimators for long-run elasticity. The motivation behind the application of AMG and CCEMG is twofold: (1) these aforementioned methodologies cover both the CD and heterogeneity (Pesaran 2006; Adedoyin et al. 2021); (2) there was no need to examine the unit root and co-integration before applying these methods (Anser et al. 2021b). Table 9 presents the findings from AMG and CCEMG estimators.

The findings from the AMG estimator depict that all variables are statistically insignificant except LREN and LNRE, which are statically significant at 1%. The value of LREN is –0.39, which implies that a 1% increase in renewable energy plunges the carbon emissions by 0.39%. On the other hand, the value of LERE was 0.87, depicting that a 0.87% rise in CO2 emissions was fostered by a 1% rise in non-renewable energy. Regarding the implication of the result, renewable energy share among the panel countries (BRICST) drives the environmental sustainability agenda while traditional energy such as fossil fuel remained a setback to such aspired agenda. The respective evidence of the negative and positive influence of renewable and non-renewable energy on environmental degradation has been significantly illustrated in the prior studies (Bekun et al. 2019; Saint Akadiri et al. 2019; Usman et al. 2020).

On the contrary, the findings from the CCEMG estimator highlight that all variables are statistically significant except LGDP and LEPU, which are statistically insignificant. Regarding LREN, the value of the coefficient is − 0.48, revealing that a 1% increase in renewable energy impedes carbon emissions by 0.48%. The coefficient of LNRE was 0.81, which implies that a 0.81% surge in carbon emissions was fostered by a 1% increase in non-renewable energy consumption. On the contrary, the value of LURB was − 2.44, highlighting that a 1% rise in urbanization plunges carbon emissions by 2.44%. In the Prior literature, there has been a divergent and inconclusive perspective on the role of urbanization as a driver of environmental sustainability. For instance, Onifade et al. (2021) affirm the influence of urbanization on the environmental quality among the OPEC countries. The studies of Asongu et al. (2020) for Africa and Koyuncu et al. (2021) for Turkey report findings that are similar to the results of the current study. Moreover, the coefficient of LGPR was − 0.05, depicting that a 0.05% decrease in CO2 emissions was raised by a 1% rise in geopolitical risk. Olanipekun and Alola (2020) noted that GPR hampers oil production in the Persian Gulf region, suggesting that geopolitical risk potentially mitigates environmental damage as supported in the current study. It is worth noting that AMG and CCEMG estimator is mean-based regression methodologies, and we find contrasting results from these aforementioned methodologies.

In the fifth step, we render outcomes from panel quantile regression, which expectedly addresses the drawbacks of the mean-based approach. Additionally, we present findings from the fixed-effects model to facilitate comparison. In Table 10, the results from the fixed-effects model expound that all variables are statistically significant except LEPU, which is statistically insignificant. Further, it could be concluded that renewable energy plunges LCO2 emissions, whereas LGDP per capita, non-renewable energy, geopolitical risk, and urbanization contribute to high levels of CO2 emissions.

Regarding the findings from the panel quantile regression approach, this study presents the outcomes at 10th, 20th, 30th, 40th, 50th, 60th, 70th, 80th, and 90th quantiles. There exists a positive impact of LGDP (log of GDP per capita) on LCO2 (log of CO2 emissions per capita) across all quantiles, however, the strength of the relationship seems to be heterogeneous. Thus, we note that LGDP escalates LCO2 in high-, middle-, and lower-emission countries. It is worth noting that the impact of LGDP on emissions is relatively strong at extreme quantiles (i.e., 10th and 90th), confirming that the impact of LGDP is profound on countries with either higher or lower levels of emissions. Our finding is somehow backed by the studies of Zheng et al. (2019). Further, there is a negative impact of renewable energy (LREN) on carbon emissions (LCO2) at all quantiles, and this relationship is relatively strong at higher quantiles. This implies that renewable energy is a tool to impede carbon emissions, especially in high emission countries. Additionally, the relationship is relatively strong at higher and lower quantiles (i.e., 10th, 20th, 80th, 90th). This implies that renewable energy is a tool to impede CO2 emissions, especially in higher and lower emission countries. This depicts that higher emitter BRICST countries are on the right path of achieving carbon neutrality through the use of renewables. This outcome is backed by the study of Yu et al. (2020). Next, we conclude that LNRE (non-renewable energy) surges CO2 emissions at all quantiles. Although the strength of this relationship is heterogeneous at all quantiles, yet there is a profound influence of LNRE on carbon emissions at 10th and 20th quantiles. It is worth reporting that non-renewables consist of fossil fuels, which possess high carbon proportions. As a result, carbon emissions will be increased in the BRICST countries. This conclusion is in line with the results of Zhu et al. (2016). The results of LURB (urbanization) are slightly different from other control variables. That is, a negative relationship between LURB and carbon emissions exists at lower quantiles. Contrarily, the relationship between LURB and CO2 emissions is positive at the middle and higher quantiles. Hence, we note that LURB mitigates CO2 emissions in lower emission nations, while LURB leads to high carbon emissions in high emissions nations. It might be possible that in the low emitter countries, urbanization brings relatively better infrastructure, e.g., renewable energy-based technologies, etc. Moreover, urbanization may propel individuals to demand a healthy environment. On the contrary, in higher emission countries, urbanization can also increase the NREN, to meet the higher energy demand, and hence can contribute to emissions. These results are similar to the conclusion of Alola et al. (2020).

As far as LEPU (economic policy uncertainty) is concerned, there exists a negative effect of LEPU on carbon emissions at lower and middle quantiles. Whereas, LEPU escalates the LCO2 at higher quantiles. Therefore, we report the heterogeneous impact of LEPU, which is contrary to the positive relationship that has been largely revealed in the literature (Adedoyin & Zakari 2020; Anser et al. 2021a; Syed & Bouri 2021; Yu et al. 2021). At lower and middle quantiles (i.e., countries with relatively low emission levels), it could be reported that the strength of the consumption effect is higher than the other channels/effects. Hence, EPU plummets the use of non-renewable energy and pollution-intensive goods, thereby reducing CO2 emissions is relatively low emission countries. Conversely, in high emission countries (at high quantiles), the magnitude of the consumption effect is smaller than the other channels. This implies, EPU plummets the investment in renewable energy, rises the percentage of non-renewable energy in the energy mix, and escalates the energy strength. As a result, the level of CO2 emission surges in high carbon emitter countries (i.e., China and Russia). Notably, China and India are among the top emitters in the case of BRICST countries wherein economic uncertainty has also been upsurging over the years. Parallel to this, the level of emissions in these countries is also rising, inferring that uncertainty in economic policies also causes carbon emissions. On the contrary, Brazil and Turkey are among the lowest emitters in the case of BRICST countries wherein emissions have witnessed meager growth over time. Also, uncertainty related to economic policy in these aforementioned countries has relatively been plunging, inferring that EPU may cause detrimental impacts on emissions.

Additionally, the effect of LGPRU on LCO2 is positive at the 10th, 20th, 30th, and 40th quantiles. While, we report the negative impact of LGPR on LCO2 at all other quantiles (i.e., 50th, 60th, 70th, 80th, and 90th). Moreover, the strength of the relationship plunges from the 10th to 40th quantile, and then it increases from the 50th to 90th quantile. At 10th, 20th, 30th, and 40th quantile, escalating effect is dominant, implying that GPR discourages investment in R&D and renewable energy. As a result, carbon emission escalates in low-emitter nations. These outcomes are parallel with the conclusions of Anser et al. (2021b). On the other side, the strength of the mitigating effect is relatively high at 50–90th quantiles. This indicates that GPR impedes production activity and non-renewable energy consumption, thereby magnitude the carbon emissions drop in high emitter countries. These results are supported by the results of Adams et al. (2020) and Anser et al. (2021c). These findings note that, in low emitters (i.e., Brazil and Turkey), LGPR is one of the critical drivers of emissions. On the contrary, in high emitter countries (i.e., China and India), LGPR curbs emissions.

In Table 11, we summarize the findings from panel quantile regression. As can be seen that LGDP and LNRE positively affect LCO2 at all quantiles, while LREN adversely affects LCO2 across all quantiles. Moreover, at lower quantiles, LURB plunges LCO2, while it surges LCO2 at middle and higher quantiles. Regarding LEPU, it adversely affects LCO2 at lower and middle quantiles. However, LEPU escalates LCO2 at higher quantiles. On the contrary, LGPR impedes LCO2 at lower and middle quantiles, whereas it surges LCO2 at higher quantiles.

Furthermore, we probe the robustness of findings by setting different values of λ (i.e., λ = 0.9 and λ = 1.5). The results are almost similar to our aforementioned findings when λ = 1 and λ = 0.9. To save the space, and for the ease of readers, we just mention a summary of the panel quantile models at λ = 0.9, and 1.5. Table 12 presents the results.

Conclusion

In recent times, EPU and GPR have escalated exponentially, and these uncertainties affect both the economy and the environment. Therefore, the goal of this investigation is to explore whether EPU and GPR impede CO2 emissions in BRICST countries. We employ second-generation panel data methods, AMG and CCEMG estimator, and panel quantile regression model. The findings noted that all variables are integrated at I (1), and there exists co-integration among considered variables of the study. Moreover, we note that EPU and GPR have a heterogeneous influence on CO2 emissions across different quantiles. EPU adversely affects carbon emissions at lower and middle quantiles, while it surges the CO2 emissions at higher quantiles. On the contrary, geopolitical risk surges CO2 emissions at lower quartiles, and it plunges CO2 emissions at middle and higher quantiles. Furthermore, per capita GDP, renewable and non-renewable energy, and urbanization have a heterogeneous impact on carbon emissions in the conditional distribution of carbon emissions.

Based on the aforementioned findings, we deduce a few policy implications reported as follows:

-

(1)

Since EPU impedes carbon emissions in low- and middle-emissions countries, any attempt to control uncertainty in economic policies will raise the level of CO2 emissions. Therefore, policymakers should be well aware of the environmental impacts that EPU can exert;

-

(2)

We report that EPU surges CO2 emissions at high-emissions countries, therefore, policymakers should control economic policy uncertainty to limit CO2 emissions in those countries. In this regard, they should introduce anticipated economic policies. Also, the economic policies should be announced for next a few years to eliminate the uncertainty;

-

(3)

Policymakers should control GPR in low- and middle-emissions countries since there exists a positive connection between GPR and carbon emissions. To do this, governments should initiate peace programs, sign peace treaties, and take measures to control terrorism, wars, and geopolitical conflicts;

-

(4)

Since external shocks (e.g., pandemics and economic crisis) contribute to EPU and hence emissions in high emitter countries, the policymakers need to devise plans to counter the environmental impacts of external shocks;

-

(5)

In low and middle emissions countries, government officials should devise policies to control civil wars, impeachments, and religious and ethnic conflicts that boost geopolitical tensions and hence cause strong emissions;

-

(6)

There is a need to initiate cultural exchange programs, international student scholarship programs, and multinational peace summits to bring people together that may limit the conflicts among nations, which, in turn, helps to control emissions;

-

(7)

International organizations (e.g., United Nations) should play their role to shrink the geopolitical tensions, which, in turn, can control emissions;

-

(8)

There should be restrictions on imports of goods that consume non-renewable energy. Further, the percentage of renewable energy in total energy consumption should be escalated by rendering different incentives. For instance, there should be tax exemption on renewables imports. Next, investment in R&D related to renewable energy should also be encouraged;

-

(9)

To encourage renewables, proper policies related to feed-in-tariff should be introduced.

Data availability

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

References

Abbasi KR, Adedoyin FF (2021) Do energy use and economic policy uncertainty affect CO 2 emissions in China? Empirical evidence from the dynamic ARDL simulation approach. Environ Sci Pollut Res 28:23323–23335. https://doi.org/10.1007/s11356-020-12217-6

Adams S, Adedoyin F, Olaniran E, Bekun FV (2020) Energy consumption, economic policy uncertainty and carbon emissions; causality evidence from resource rich economies. Economic Analysis and Policy 68:179–190. https://doi.org/10.1016/j.eap.2020.09.012

Adedoyin FF, Zakari A (2020) Energy consumption, economic expansion, and CO2 emission in the UK: the role of economic policy uncertainty. Sci Total Environ 738:140014. https://doi.org/10.1016/j.scitotenv.2020.140014

Adedoyin FF, Alola AA, Bekun FV (2021) The alternative energy utilization and common regional trade outlook in EU-27: evidence from common correlated effects. Renew Sustain Energy Rev 145:111092. https://doi.org/10.1016/j.rser.2021.111092

Akram R, Chen F, Khalid F, Ye Z, Majeed MT (2020) Heterogeneous effects of energy efficiency and renewable energy on carbon emissions: evidence from developing countries. J Clean Prod 247:119122. https://doi.org/10.1016/j.jclepro.2019.119122

Akron S, Demir E, Díez-Esteban JM, García-Gómez CD (2020) Economic policy uncertainty and corporate investment: Evidence from the US hospitality industry. Tour Manage 77:104019. https://doi.org/10.1016/j.tourman.2019.104019

Ali M, & Kirikkaleli D (2021) The asymmetric effect of renewable energy and trade on consumption-based CO2 emissions: the case of Italy. Integrated Environmental Assessment and Management.

Alola AA, Lasisi TT, Eluwole KK, Alola UV (2020) Pollutant emission effect of tourism, real income, energy utilization, and urbanization in OECD countries: a panel quantile approach. Environ Sci Pollut Res 28(2):1752–1761. https://doi.org/10.1007/s11356-020-10556-y

Alola AA, Ozturk I, Bekun FV (2021) Is clean energy prosperity and technological innovation rapidly mitigating sustainable energy-development deficit in selected sub-Saharan Africa? A myth or reality. Energy Policy 158:112520. https://doi.org/10.1016/j.enpol.2021.112520

Anser MK, Apergis N, Syed QR (2021a) Impact of economic policy uncertainty on CO2 emissions: evidence from top ten carbon emitter countries. Environ Sci Pollut Res 28:29369–29378. https://doi.org/10.1007/s11356-021-12782-4

Anser MK, Syed QR, Apergis N (2021b) Does geopolitical risk escalate CO2 emissions? Evidence from the BRICS countries. Environ Sci Pollut Res 28:48011–48021. https://doi.org/10.1007/s11356-021-14032-z

Anser MK, Syed QR, Lean HH, Alola AA, Ahmad M (2021c) Do economic policy uncertainty and geopolitical risk lead to environmental degradation? Evidence from Emerging Economies. Sustainability 13(11):5866. https://doi.org/10.3390/su13115866

Antonakakis N, Chatziantoniou I, Filis G (2017) Energy consumption, CO2 emissions, and economic growth: an ethical dilemma. Renew Sustain Energy Rev 68:808–824. https://doi.org/10.1016/j.rser.2016.09.105

Appiah MO (2018) Investigating the multivariate Granger causality between energy consumption, economic growth and CO2 emissions in Ghana. Energy Policy 112:198–208. https://doi.org/10.1016/j.enpol.2017.10.017

Ashraf BN, Shen Y (2019) Economic policy uncertainty and banks’ loan pricing. J Financ Stab 44:100695. https://doi.org/10.1016/j.jfs.2019.100695

Asongu SA, Agboola MO, Alola AA, Bekun FV (2020) The criticality of growth, urbanization, electricity and fossil fuel consumption to environment sustainability in Africa. Sci Total Environ 712:136376. https://doi.org/10.1016/j.scitotenv.2019.136376

Bekun FV, Alola AA, Sarkodie SA (2019) Toward a sustainable environment: Nexus between CO2 emissions, resource rent, renewable and nonrenewable energy in 16-EU countries. Sci Total Environ 657:1023–1029. https://doi.org/10.1016/j.scitotenv.2018.12.104

Bera AK, Galvao AF, Montes-Rojas GV, Park SY (2016) Asymmetric laplace regression: maximum likelihood, maximum entropy and quantile regression. Journal of Econometric Methods 5(1):79–101

Cai Y, Sam CY, Chang T (2018) Nexus between clean energy consumption, economic growth and CO2 emissions. J Clean Prod 182:1001–1011. https://doi.org/10.1016/j.jclepro.2018.02.035

Chen J, Xian Q, Zhou J, Li D (2020) Impact of income inequality on CO2 emissions in G20 countries. J Environ Manage 271:110987. https://doi.org/10.1016/j.jenvman.2020.110987

Chen Y, Shen X, Wang L (2021) The heterogeneity research of the impact of EPU on environmental pollution: empirical evidence based on 15 Countries. Sustainability 13(8):4166. https://doi.org/10.3390/su13084166

Cheng C, Ren X, Dong K, Dong X, Wang Z (2021) How does technological innovation mitigate CO2 emissions in OECD countries? Heterogeneous analysis using panel quantile regression. J Environ Manage 280:111818. https://doi.org/10.1016/j.jenvman.2020.111818

Chou LC, Zhang WH, Wang MY, Yang FM (2019) The influence of democracy on emissions and energy efficiency in America: new evidence from quantile regression analysis. Energy & Environment 31(8):1318–1334. https://doi.org/10.1177/0958305X19882382

Danish, Ulucak R, Khan SUD (2020) Relationship between energy intensity and CO2 emissions: does economic policy matter? Sustainable Development 28(5):1457–1464. https://doi.org/10.1002/sd.2098

De Silva PNK, Simons SJR, Stevens P (2016) Economic impact analysis of natural gas development and the policy implications. Energy Policy 88:639–651. https://doi.org/10.1016/j.enpol.2015.09.006

Dietz T, Rosa EA (1994) Rethinking the environmental impacts of population, affluence and technology. Human Ecol Rev 1(2):277–300

Erdoğan S, Yıldırım DC, Gedikli A (2019) Investigation of causality analysis between economic growth and CO2 emissions: the case of BRICS-T countries. Int J Energy Econ Polic 9(6):430–438. https://doi.org/10.32479/ijeep.8546

Galvao AF, Kato K (2016) Smoothed quantile regression for panel data. J Econometr 193(1):92–112. https://doi.org/10.1016/j.jeconom.2016.01.008

Ha J, Tan PP, Goh KL (2018) Linear and nonlinear causal relationship between energy consumption and economic growth in China: new evidence based on wavelet analysis. PLoS ONE 13(5):e0197785. https://doi.org/10.1371/journal.pone.0197785

Jiang Y, Zhou Z, Liu C (2019) Does economic policy uncertainty matter for carbon emission? Evidence from US sector level data. Environ Sci Pollut Res 26(24):24380–24394. https://doi.org/10.1007/s11356-019-05627-8

Jin X, Chen Z, Yang X (2019) Economic policy uncertainty and stock price crash risk. Accounting & Finance 58(5):1291–1318. https://doi.org/10.1111/acfi.12455

Kirikkaleli D, Adebayo TS (2021) Do renewable energy consumption and financial development matter for environmental sustainability? New Global Evidence. Sustain Develop 29(4):583–594

Koenker R (2004) Quantile regression for longitudinal data. J Multivar Anal 91(1):74–89. https://doi.org/10.1016/j.jmva.2004.05.006

Koenker R, Bassett G Jr (1978) Regression quantiles. Econometr J Econometr Soc 46:33–50. https://doi.org/10.2307/1913643

Koyuncu T, Beşer MK, Alola AA (2021) Environmental sustainability statement of economic regimes with energy intensity and urbanization in Turkey: a threshold regression approach. Environ Sci Pollut Res 28:42533–42546. https://doi.org/10.1007/s11356-021-13686-z

Kraft J, Kraft A (1978) On the relationship between energy and GNP. J Energy Dev 3:401–403

Lamarche C (2011) Measuring the incentives to learn in Colombia using new quantile regression approaches. J Dev Econ 96(2):278–288. https://doi.org/10.1016/j.jdeveco.2010.10.003

Lancaster T (2000) The incidental parameter problem since 1948. J Econometrics 95(2):391–413. https://doi.org/10.1016/S0304-4076(99)00044-5

Liu C, Jiang Y, Xie R (2019a) Does income inequality facilitate carbon emission reduction in the US? J Clean Prod 217:380–387. https://doi.org/10.1016/j.jclepro.2019.01.242

Liu H, Lei M, Zhang N, Du G (2019b) The causal nexus between energy consumption, carbon emissions and economic growth: new evidence from China, India and G7 countries using convergent cross mapping. PLoS ONE 14(5):e0217319. https://doi.org/10.1371/journal.pone.0217319

Luo Y, Lu Z, Long X (2020) Heterogeneous effects of endogenous and foreign innovation on CO2 emissions stochastic convergence across China. Energy Economics 91:104893. https://doi.org/10.1016/j.eneco.2020.104893

Menegaki AN (2011) Growth and renewable energy in Europe: a random effect model with evidence for neutrality hypothesis. Energy Economics 33(2):257–263. https://doi.org/10.1016/j.eneco.2010.10.004

Mirza FM, Kanwal A (2017) Energy consumption, carbon emissions and economic growth in Pakistan: dynamic causality analysis. Renew Sustain Energy Rev 72:1233–1240. https://doi.org/10.1016/j.rser.2016.10.081

Nwaka ID, Nwogu MU, Uma KE, Ike GN (2020) Agricultural production and CO2 emissions from two sources in the ECOWAS region: new insights from quantile regression and decomposition analysis. Sci Total Environ 748:141329. https://doi.org/10.1016/j.scitotenv.2020.141329

Olanipekun IO, Alola AA (2020) Crude oil production in the Persian Gulf amidst geopolitical risk, cost of damage and resources rents: Is there asymmetric inference? Resour Policy 69:101873. https://doi.org/10.1016/j.resourpol.2020.101873

Onifade ST, Alola AA, Erdoğan S, Acet H (2021) Environmental aspect of energy transition and urbanization in the OPEC member states. Environ Sci Pollut Res 28(14):17158–17169. https://doi.org/10.1007/s11356-020-12181-1

Pesaran MH (2006) Estimation and inference in large heterogeneous panels with a multifactor error structure. Econometrica 74(4):967–1012. https://doi.org/10.1111/j.1468-0262.2006.00692.x

Pesaran MH (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Economet 22(2):265–312. https://doi.org/10.1002/jae.951

Pesaran MH, Yamagata T (2008) Testing slope homogeneity in large panels. J Econometr 142(1):50–93. https://doi.org/10.1016/j.jeconom.2007.05.010

Pirgaip B, Dinçergök B (2020) Economic policy uncertainty, energy consumption and carbon emissions in G7 countries: evidence from a panel Granger causality analysis. Environ Sci Pollut Res 27:30050–30066. https://doi.org/10.1007/s11356-020-08642-2

Qin L, Kirikkaleli D, Hou Y, Miao X, Tufail M (2021) Carbon neutrality target for G7 economies: examining the role of environmental policy, green innovation and composite risk index. J Environ Manage 295:113119. https://doi.org/10.1016/j.jenvman.2021.113119

Rahman MM, Kashem MA (2017) Carbon emissions, energy consumption and industrial growth in Bangladesh: empirical evidence from ARDL cointegration and Granger causality analysis. Energy Policy 110:600–608. https://doi.org/10.1016/j.enpol.2017.09.006

Saint Akadiri S, Alola AA, Akadiri AC, Alola UV (2019) Renewable energy consumption in EU-28 countries: policy toward pollution mitigation and economic sustainability. Energy Policy 132:803–810. https://doi.org/10.1016/j.enpol.2019.06.040

Salman M, Long X, Dauda L, Mensah CN, Muhammad S (2019) Different impacts of export and import on carbon emissions across 7 ASEAN countries: a panel quantile regression approach. Sci Total Environ 686:1019–1029. https://doi.org/10.1016/j.scitotenv.2019.06.019

Shahbaz M, Loganathan N, Muzaffar AT, Ahmed K, Jabran MA (2016) How urbanization affects CO2 emissions in Malaysia? The application of STIRPAT model. Renew Sustain Energy Rev 57:83–93. https://doi.org/10.1016/j.rser.2015.12.096

Shan S, Ahmad M, Tan Z, Adebayo TS, Li RYM, Kirikkaleli D (2021) The role of energy prices and non-linear fiscal decentralization in limiting carbon emissions: Tracking environmental sustainability. Energy 234:121243. https://doi.org/10.1016/j.energy.2021.121243

Sherwood B, Wang L (2016) Partially linear additive quantile regression in ultra-high dimension. Ann Stat 44(1):288–317. https://doi.org/10.1214/15-AOS1367

Su ZW, Umar M, Kirikkaleli D, Adebayo TS (2021) Role of political risk to achieve carbon neutrality: evidence from Brazil. J Environ Manage 298:113463. https://doi.org/10.1016/j.jenvman.2021.113463

Syed QR, Bouri E (2021) Impact of economic policy uncertainty on CO2 emissions in the US: evidence from bootstrap ARDL approach. Journal of Public Affairs 2021:e2595. https://doi.org/10.1002/pa.2595

Tiwari AK, Das D, Dutta A (2019) Geopolitical risk, economic policy uncertainty and tourist arrivals: evidence from a developing country. Tour Manage 75:323–327. https://doi.org/10.1016/j.tourman.2019.06.002

Usman O, Alola AA, Sarkodie SA (2020) Assessment of the role of renewable energy consumption and trade policy on environmental degradation using innovation accounting: Evidence from the US. Renewable Energy 150:266–277. https://doi.org/10.1016/j.renene.2019.12.151

Usman A, Ozturk I, Ullah S, Hassan A (2021) Does ICT have symmetric or asymmetric effects on CO2 emissions? Evidence from selected Asian economies. Technol Soc 67:101692. https://doi.org/10.1016/j.techsoc.2021.101692

Wang Q, Xiao K, Lu Z (2020) Does economic policy uncertainty affect CO2 Emissions? empirical evidence from the United States. Sustainability 12(21):9108. https://doi.org/10.3390/su12219108

Westerlund J (2007) Testing for error correction in panel data. Oxford Bull Econ Stat 69(6):709–748. https://doi.org/10.1111/j.1468-0084.2007.00477.x

Xu B, Lin B (2016) A quantile regression analysis of China’s provincial CO2 emissions: Where does the difference lie? Energy Policy 98:328–342. https://doi.org/10.1016/j.enpol.2016.09.003

York R, Rosa EA, Dietz T (2003) STIRPAT, IPAT and ImPACT: Analytic tools for unpacking the driving forces of environmental impacts. Ecol Econ 46(3):351–365. https://doi.org/10.1016/S0921-8009(03)00188-5

Yu S, Hu X, Li L, Chen H (2020) Does the development of renewable energy promote carbon reduction? Evidence from Chinese provinces. J Environ Manage 268:110634. https://doi.org/10.1016/j.jenvman.2020.110634

Yu J, Shi X, Guo D, Yang L (2021) Economic policy uncertainty (EPU) and firm carbon emissions: evidence using a China provincial EPU index. Energy Economics 94:105071. https://doi.org/10.1016/j.eneco.2020.105071

Zhang YJ, Jin YL, Chevallier J, Shen B (2016) The effect of corruption on carbon dioxide emissions in APEC countries: a panel quantile regression analysis. Technol Forecast Soc Chang 112:220–227. https://doi.org/10.1016/j.techfore.2016.05.027

Zhao W, Zhong R, Sohail S, Majeed MT, Ullah S (2021) Geopolitical risks, energy consumption, and CO2 emissions in BRICS: an asymmetric analysis. Environ Sci Pollut Res 28:39668–39679. https://doi.org/10.1007/s11356-021-13505-5

Zheng H, Hu J, Wang S, Wang H (2019) Examining the influencing factors of CO2 emissions at city level via panel quantile regression: evidence from 102 Chinese cities. Appl Econ 51(35):3906–3919. https://doi.org/10.1080/00036846.2019.1584659

Zhu H, Duan L, Guo Y, Yu K (2016) The effects of FDI, economic growth and energy consumption on carbon emissions in ASEAN-5: evidence from panel quantile regression. Econ Model 58:237–248. https://doi.org/10.1016/j.econmod.2016.05.003

Zhu H, Xia H, Guo Y, Peng C (2018) The heterogeneous effects of urbanization and income inequality on CO2 emissions in BRICS economies: evidence from panel quantile regression. Environ Sci Pollut Res 25(17):17176–17193. https://doi.org/10.1007/s11356-018-1900-y

Acknowledgements

The authors acknowledge the participatory contribution of all respondents to this study.

Author information

Authors and Affiliations

Contributions

All authors strongly believe that they have made equal and substantial contribution to prepare this manuscript. Qasim Raza Syed: Conceptualization, data curation, formal analysis, methodology, project administration, software, visualization, roles/writing—original draft, writing—review and editing. Roni Bhowmik: Conceptualization, data curation, investigation, project administration, resources, supervision, visualization, roles/writing—original draft, writing—review and editing. Festus Fatai Adedoyin: Investigation, methodology, supervision, validation, writing—review and editing. Andrew Adewale Alola: Investigation, methodology, software, supervision, validation, writing—review and editing. Noreen Khalid: Data curation, formal analysis, resources, software, roles/writing—original draft.

Corresponding author

Ethics declarations

Ethics approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Consent to participate

Not applicable.

Consent for publication

Not applicable.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Syed, Q., Bhowmik, R., Adedoyin, F. et al. Do economic policy uncertainty and geopolitical risk surge CO2 emissions? New insights from panel quantile regression approach. Environ Sci Pollut Res 29, 27845–27861 (2022). https://doi.org/10.1007/s11356-021-17707-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-17707-9