Abstract

Environmental pollution is a geopolitical problem, and researchers have not considered it seriously yet. This study examines the asymmetric influence of geopolitical risk on energy consumption and CO2 emissions in BRICS economies using the non-linear autoregressive distributed lag model (NARDL) testing method over the period of 1985–2019. Therefore, we observed that in the long run, a positive and negative change in geopolitical risk has negative effect on energy consumption in India, Brazil, and China. The outcomes confirmed that an increase in geopolitical risk has negative effect on CO2 emissions in Russia and South Africa. Although a decrease in geopolitical risk has negative effects on CO2 emissions in India, China, South Africa, it has positive coefficient in Russia in the long run. Based on empirical findings, we also revealed that asymmetries mostly exist in terms of magnitude rather than direction. Our empirical results are country and group specific. The findings call for important changes in energy and environment policies to accommodate geopolitical risks.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Geopolitical risks can influence environmental and economic indicators in such a way that societies are likely to lose their welfare gains. The ongoing efforts to achieve sustainability largely require addressing the challenges related to the geopolitical crisis (Ladislaw et al. 2014; Al-Nuaimi et al. 2019). In the contemporary world, the global challenge of environmental degradation is not just simply a matter of scientific research, but it is also influencing the ways economies operate, how interests are splitting, and the new landscape of geopolitics is playing a central role in the international connections. After the release of IPCC (2014), the increasing global initiatives to manage global warming, and pursuing decarbonization initiatives, climate change is exerting increasingly high pressures on global securities related to energy, water and food, and other global risks associate with economic integration (Wang and Liu 2015; Hafeez et al. 2019b; Majeed and Mazhar 2019; Yang et al. 2020a).

In the contemporary global geopolitical economy, energy transition and its consequences for the existing ways of employment, production, and accumulation are increasingly becoming the central focus of public policy all over the world. It is widely believed that transferring existing carbon-intensive energy systems need to be transferred in the context of global warming and climate change. The recent decades are witnessing a large number of policy initiatives toward developing renewable energy systems. The scale and pace needed for decarbonizing is disproportionally higher than that of the ongoing substituting green technology and resources (Li et al. 2019; Galvin & Healy 2020).

These decarbonizing targets based on the energy sector represent a welcome change in Brazil, Russia, India, China, and South Africa (BRICS) economies; however, these economies need deep decarbonization beyond the energy sector. These goals need to be aligned with wider social objectives like enhancing social welfare and lowering socio-spatial disparities. The initiative for energy transition sets the path for brainstorming in the setting of “geographically differentiated political economy.” The pathways for decarbonization depend on prevailing geographic conditions and political institutions. That is, geopolitical issues are becoming compelling policy challenge for energy system transition. The Federation of Russia is the largest economy in the world energy market. According to BP (2019), Russia is ranked as the largest exporter of gas, the second-largest exporter of oil, and the third largest of coal in the global economy. Russia is playing a vital role in the global energy market of non-renewable energy sources.

China’s geographical position comprises complex geopolitics. It has the largest number of neighboring countries. It has 14 neighbors which is the largest number in the world. It has improved its international outlook and economic strengths after the national reforms and global participation. However, despite such strengths, it faces such challenges as security of international pipelines for energy transportation. China is trying to manage its geopolitical issues while constructing one belt and one road initiative since 2013 (Li et al. 2021). An empirical understanding of geopolitics, energy, and environment is necessary for the given complex geopolitical positions of China.

The literature highlights the importance of geography and political factors for energy and environmental outcomes (Da Graça Carvalho 2012; Wang et al. 2012; Cao and Bluth 2013; Lv & Xu 2019; Sun et al. 2020). However, these studies do not provide empirical evidence as they are based on the qualitative discussion. Some studies provide empirical evidence on geopolitical risk and the energy sector (Rasoulinezhad et al. 2020; Yang et al. 2020b; Sweidan 2021; Alsagr and van Hemmen 2021). However, these studies mainly provide country-specific evidence. Besides, these studies mainly focus on energy transition and deployment overlooking the environmental effects of geopolitical risks.

Based on the premises above, understanding the importance of geopolitical risks for the environment and clean energy transition in the wide spectrum is essential for designing policies and decision-making. The aforementioned discussion reveals that the research in this field is relatively scarce, and the literature on geopolitical concerns is generally based on scholarly arguments, discussions, reports, and case studies. The empirical literature is quite limited; perhaps the datasets representing geopolitical risks were not available in the distant past.

The main motivation for selecting BRICS economies is that these are the largest economies of the present world and represent the interests and concerns of the developing world in the global geopolitical landscape. According to World Bank (2020), these economies collectively comprise a US$19.6 trillion GDP. Besides, BRICS collectively demonstrates 42% of the world population, 23% of global GDP, 30% of the territory, and 18% of trade. Further, these economies are ranked among high carbon-emitting countries. Particularly, China, India, and Russia are ranked among the four top global emitters. Empirical inquiry on environment, energy transition, and geopolitical uncertainty in the BRICS presents a strong inference which can be helpful for many other emerging and developing economies in shaping energy market security and a smooth transition from conventional energy sources to clean energy industry. At present, geopolitical risks have increased in the BRICS, and empirical outcomes can help to better manage the interests of the BRICS economies and the rest of the world.

Among BRICS economies, China is the leading emitter of carbon emissions; it is consuming the largest quantity of energy where 67% comes from primary energy consumption, and 73% electricity is generated from the coal. China is planning to gain 16% renewables by 2030 while some studies suggest that China needs to achieve 26% renewable energy by 2030 (Yang et al. 2016). India is planning to enhance renewable energy production by about 40% by 2030 and expecting to mitigate emissions by 34% over 2005 levels (Schmidt and Sewerin 2017). The Russian federation is aiming to transit for clean energy about 5% of total energy consumption by 2030. Brazil is aiming to achieve the target of 23% clean energy (Gielen and Saygin 2017). South Africa is also transiting toward clean energy sources, and it has the greatest potential of solar and wind energy due to its geographic location. South Africa plans to install 8.4 GW of wind power by 2030 (IRENA 2015).

The extant literature on the geopolitical economy and climate change suggests complex relationships. We untangle the complex effects using the asymmetric estimation approach because the symmetric estimation approach can provide counterfeit impacts of explanatory variables on explained variables and discourses the hitches of behavior and interpretation of symmetric estimation approaches. Moreover, dynamic connotations among time series indicators rely on several factors such as social-economic, political, and global circumstances, contemplating only symmetric interactions can create vague implications. Thus, it is crucial to separate the impacts of positive and negative shocks of the dynamic variable to trace out their varied influences on pollution and energy transition in BRICS economies. In this background, we supplement the present literature on energy and environment by incorporating the positive and negative shocks of monetary and geopolitical risks on CO2 emissions and energy transition. In this way, we utilize the “Shin et al. (2014) nonlinear ARDL approach and Hatemi-j (2012) asymmetric causality test” to enhance the existing literature on geopolitical risks, CO2 emissions, and energy transition.

In this milieu, the objective of this research is to extend the literature by estimating the asymmetric effects of geopolitical risks on environmental pollution and energy consumption. This study contributes to the literature on energy and the environment in the following ways. First, to the best of our knowledge, this is the first empirical study that explores the asymmetric role of geopolitical risks on CO2 emissions and energy consumption for BRICS economies over the period of 1985–2019. The geopolitical risks may intervene with global efforts for clean energy and sustainable development by exerting external effects among BRICS member countries and the rest of the world. Geopolitical risks may distract focus on energy market failures and environmental regulations that are overlooked by the member countries. Second, the prior research does not untangle the asymmetric effects of geopolitical risks on emissions and energy consumption. The findings of the study are useful for managing environmental sustainability in an uncertain geopolitical environment. Our research presents leading research studies on BRICS economies across the world that establishes asymmetric associations between geopolitical risks, CO2 emissions, and energy transition providing the grounds for a novel framework of the analysis in geopolitical, environmental, and energy economics.

The empirical findings of this study are helpful for various stakeholders in the arena of geopolitical, energy, and environmental economics such as geography experts, political scientists, social scholars, energy enterprises, academic scholars, energy experts, public institutes, regional organizations, international organizations, and policymakers. Our research provides new fresh insights on geopolitical uncertainty, CO2 emissions, and energy transition for political scientists, geography experts, and economists to implement appropriate geopolitical strategies to promote the use of clean energies and to manage sustainable development goals. The results of this study are useful for other large economies of the world with similar characteristics. Further, the analysis is useful for the economies which are seeking effective management of the energy market and environmental performance.

The remaining discussion is structured as follows. The next section provides a review of the related literature. A brief discussion on model, data, and methodology is provided in “Model and methods”. The empirical results and their interpretation are discussed in “Results and discussion”. Finally, “Conclusion and policy” concludes the discussion and provides some suitable policy implications.

Literature review

This section provides a discussion on geopolitical risks in relation to the energy sector and environmental concerns. Moreover, the available empirical literature is also discussed. In an earlier study, Ó Tuathail (1998) introduced the idea of geopolitics by explaining the association between geography and global affairs by considering the perpetual rivalry, territorial extension, and military tactics of colonial superpowers. Winston Churchill altered the energy system of the British Navy from coal to oil. Besides, oil imports sored particularly with industrial upgrading of the emerging economies such as Brazil, Russia, India, China, and South Africa. The transport sector also played a vital role in increasing the demand for oil consumption. Consequently, with such dynamics, oil security changed from a military perspective to an economic growth outlook, and finally, it became an important part of household living. In this milieu, oil-producing locations like Persian Gulf are influenced by the effects of geopolitics. Consequently, the replacement of oil with an alternative energy resource has become a prime focus of the leading economies. Clean energy such as renewable energy not only improves environmental quality by mitigating emissions, but it is also widely available (Hafeez et al. 2019a; Overland 2019; Majeed and Luni 2019; Sun et al. 2020).

Geopolitical economy considers the reactions of nations to global matters and attempts to maximize their absolute and relative advantages. Geopolitics emphasizes the pressures of topography on worldwide connections. Geography has inherent associations with climate change. After Cold War, global and non-state players have been incorporated into the theoretical viewpoints related to the geopolitical economy. Since climate disruption is increasingly influencing the national competitive advantages of nations and strategically significant regional groups of countries like Middle East, Central Asia, and the Arctic are making the links of climate change and geopolitics more complex and disparate. From a geopolitical stand view, large economies need to play a greater role in the international arena in response to climate change (Chen and Chiu 2018).

The hostility between the Eastern and the Western nations ended in the post-cold War era. As a result, geopolitics concerns in China, its neighbor countries, and the rest of the world transformed substantially. After Cold War, the global rules remained in the domain set by the United Nations (UN), the World Bank, the IMF, and the WTO. The regional tussle, energy development, economic struggles, and political economy were evolving all over the world. For instance, the “Shale Gas Revolution” in the US caused a considerable effect on the worldwide energy market scenario. Similarly, incasing deployment of renewable energy in Europe also wielded a massive impact on the world environmental structure. The complications of world geopolitics are demonstrated by the “energy dispute” behind the conflicts in Ukraine, oil pipeline alterations between Russia and China, the upsurge of Southeast Asian economies, and the clashes over the South China Sea. Orthodoxly, geopolitics reflects efforts for the ownership and control of natural resources, for example terrestrial, minerals, oil, gas, and pipelines (He et al. 2018). The research studies highlighted the importance of geopolitics and national energy security (Da Graça Carvalho 2012; Wang et al. 2012; Cao and Bluth 2013; Lv & Xu 2019; Sun et al. 2020). However, these studies are generally qualitative in their essence.

The empirical literature generally focuses on the economic dimensions of geopolitical risks. For example, Cheng and Chiu (2018) attempt to answer the question how are crucial worldwide geopolitical risks to emerging countries? They provided empirical analysis based on structural VAR models for 38 emerging economies employing annual data between 1980 and 2011. The finding of their study suggests that geopolitical risks are significantly associated with economic contractions. The empirical literature related to geopolitical risks, energy, and environment is quite limited.

In a recent study, Rasoulinezhad et al. (2020) investigated energy transition behavior for Russia with a focus on geopolitical risks employing autoregressive distributive lag model (ARDL) estimation approach from 1993 to 2018. The results suggest that geopolitical risks are positively associated with energy transition. Further, carbon emissions, financial openness, and exchange rate also promote energy transition while economic growth, population growth, and inflation have negative impact on energy transition. Yang et al. (2020a) demonstrated empirically that geopolitical risks significantly cause risk spillover impacts on renewable energy stock markets in China. However, their findings do not confirm a clear positive or negative pattern of risk spillovers.

One strand of the literature suggests that spatial factors play a critical role in explaining environmental performance of economies. The main argument is that economies are spatially dependent on each other, and the environmental and energy-related policies have spillover effects on the neighbor economies (Samreen & Majeed 2020). According to Wang and Ye (2017)’s hypothesis “All the subjects that are related to environmental issues are inherently spatial.” In a recent study, Bridge and Gailing (2020) concluded that “the geographical conditions of possibility for energy system transformation are now emerging as a compelling public policy challenge.”

Another strand of the literature suggests political economy as an important factor in explaining environmental performance of the economies. The political economy and the role of the public sector are conducive in the energy market because this sector needs strong commitment, coordination, information, and experience (Burke and Stephens 2018). Moreover, the dynamic association between clean energy and institutions can be linked by non-pecuniary motives. That is, institutional factors can be linked with political constrictions, environmental ethics, democratic values, control for corruption, statutory topographies, and bureaucratic quality (Sequeira and Santos 2018). In this milieu, the political stability and geography landscapes play a critical role in founding and upholding clean energy reforms.

Recently, some studies predicted a positive association between geopolitical risk and clean energy deployment. In this regard, Sweidan (2021) explored the association between geopolitical risk and renewable energy deployment for United States (US) using quarterly data from 1973: q1 to 2020: q1. The empirical analysis was conducted using cointegration analysis and ARDL approach. The findings of the study suggest that geopolitical risk has a positive and significant impact on renewable energy diffusion. Thus, geopolitical drives renewable energy diffusion instead of discouraging it. Similarly, Alsagr and van Hemmen (2021) investigated the effect of geopolitical risk on renewable energy consumption in emerging economies over the period 1996–2015. They employed a two-step system generalized method of moments (GMMs) approach. The results showed that geopolitical risk has a positive and significant impact on renewable energy consumption. Besides, financial development also supports renewable energy consumption in emerging economies.

The empirical literature on geopolitical risks, energy consumption, and CO2 emissions is quite limited. Particularly, the impact of geopolitical risk on environmental quality is not determined. Moreover, an empirical investigation for BRICS economies is not yet available. Besides, few available studies use conventional estimation approaches such as ARDL, Granger causality tests, GMM, and structural VAR model. These studies mainly focus on the linear associations between geopolitical risks and clean energy overlooking the nonlinear dynamic effects. The present research, however, introduces a novel inquiry on the association among geopolitical risks, environmental pollution, and clean energy transition in BRICS countries from 1985 to 2019.

Model and methods

The increasing role of geographical standpoint on energy transition within the public policy domain is important. Energy transition in a geopolitical economy is shaped by many factors such as innovations, competition, and social mobility among others which are formed spatially (Bridge and Gailing 2020). Therefore, geopolitical risk has also a dynamic significant impact on the environment. Based on previous empirical studies on the geopolitical risk (Adams et al. 2020 and Rasoulinezhad et al. 2020), we observe the impact of the geopolitical risk on the carbon emissions and energy consumption in BRICS economies; we have created the following models (1 and 2) based on the information provided by previous studies:

Equations (1 and 2) are long-run models in which carbon emission (CO2) and energy consumption (CE) in BRICS economies depend on the geopolitical risk (GPR). Regarding control variables, Xt is a vector of government stability (GS) and GDP per capita (GDP). A complete description of variables along with their sources is provided in Table 1. However, specifications (1 and 2) will only provide us with the long-run estimates of our variables, and to get short-run estimates, and we need to state them in the error correction format as shown below:

Specifications (3 and 4) are known as the ARDL model provided by Pesaran et al. (2001). These equations provide both the short-run and long-run estimates; the coefficients attached to the ∆ sign provide the short-run estimates and the other gives the long-run estimates. However, the long-run estimates are considered genuine only if they are co-integrated. For that purpose, Pesaran et al. (2001) trusted on the bounds F-test and also developed its critical values. Besides, there is no need for pre-unit root testing as this method can be applied even if the variables are I(0), I(1), or a combination of both.

The major goal of our study is to see the response of CO2 emissions and energy consumption to asymmetric changes in the geopolitical risk. To that end, we follow the footpath of Shin et al. (2014) and decomposed the GPR variable into its positive and negative components using the partial sum procedure.

Equation (5) shows the positive change in the GPR, while Eq. (6) represents the negative change in the GPR. We then replace the positive and negative components in Equations (1 and 2) in place of the GPR variable which will, in turn, become the asymmetric or non-linear ARDL.

Arrangements (7 and 8) are known as the NARDL model proposed by Shin et al. (2014), and we can estimate this model in the same way just like the linear model. Shin et al. (2014) treated both the positive and negative components of the variable as one; hence, the bounds F-test of the linear ARDL model is applicable in the case of the NARDL model. Moreover, other diagnostic tests of the linear ARDL model are also equally applicable in the case of NARDL. Though, we have to perform a few additional tests to confirm whether the positive and negative components or our main variable perform asymmetrically or not. Firstly, to test the short-run adjustment asymmetry, we see whether the number of lags attached to ∆GPR+ is different from the lag length attached to ∆GPR−, and if different asymmetric effects of the variable are confirmed. Secondly, if the aggregate of estimates of positive components is not equal to the aggregate of negative components, i.e., ∑γ2p ≠ ∑ γ3p, ∑δ2p ≠ ∑ δ4p, this is an assurance of combined short-run asymmetric impacts. Finally, the long-run asymmetric impacts are confirmed if we can approve this condition \( \frac{\pi_2}{-{\pi}_1}\ne \frac{\pi_3}{-{\pi}_1} \) , \( \frac{\varphi_2}{-{\varphi}_1}\ne \frac{\varphi_3}{-{\varphi}_1} \) through Wald’s test.

Variables and data description

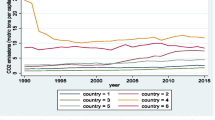

The current study used annual data series over the period 1985–2019 for the BRICS economies such as India, Brazil, Russia, China, and South Africa. The definition and description of variables are represented in Table 1, and the data has been taken from the World Bank (2020), except for two variables. This study transforms all the concerned variables in the natural logarithm, and descriptive analysis is denoted in Table 2. Besides, the results show that China has discharged high carbon emissions into the atmosphere, and the approximate average value is 6.678, and the lowest mean value is 5.510 in Brazil. Thus, the highest mean value of energy use is 2.422% for China, and the lowest average value of 1.961% for Brazil. Meanwhile, 2.006 high average value of geopolitical risk for Russia, and the lowest mean index value is 1.952 for India in BRICS economies. Similarly, the average value of government stability 8.921 is higher, and the lowest is 6.957 for China and India, respectively. The descriptive statistics of GDP indicate that the maximum average value of 12.43 belongs to China and a minimum average value of 11.40 belongs to South Africa.

Results and discussion

In the first step, we employed PP and ADF unit root tests to inspect the order of integration of all the selected variables. The estimated results are given in Table 3, and the turn out indicates the variables have a mixed order of integration such as I(1) or I(0), and the none of variable integrated order is I(2). In order to examine the short-run and long-run elasticity’s of coefficient, we used ARDL and NARDL estimation methods.

Symmetric ARDL both short-run and long-run empirical turns out are reported in Table 4. Besides, panel A offered the short-run outcomes for both the models. Thus, in model 1, we take energy consumption as the dependent variable and independent variables are a geopolitical risk, government stability, and GDP, while carbon emissions are a dependent variable in model 2. The short run turns out to indicate that geopolitical risk has a negative association with energy consumption for India and South Africa while geopolitical risk has an insignificant effect for Brazil, Russia, and China, respectively. Moreover, the empirical results demonstrate that government stability leads to reduce energy consumption in Russia. On the contrary, the results show an insignificant effect for Brazil, India, South Africa, and China. However, surprisingly the results revealed that GDP has a negative link with energy use in the BRICS economies except for Brazil; it has an insignificant impact in the short run. However, panel B represents the long-run estimates for the BRICS economies. The ARDL estimates indicate that geopolitical risk is negatively associated with energy use in the long run for India, Brazil, and South Africa while China and Russia have an insignificant result. Furthermore, our outcomes indicate that government stability leads to an increase in energy use, and results also indicate that government stability shows a statistically significant and negative impact on energy use for Russia in the long run, while other countries have insignificant results. Meanwhile, GDP is negatively associated with energy use in BRICS economies.

Symmetric ARDL results for model 2 are also given in Table 4. The results highlight that geopolitical risk shows a negative impact on carbon emissions in the short run for South Africa and other country gives insignificant results in the short run for India, Brazil, China, and Russia, respectively. Additionally, the outcome also demonstrates that the coefficient of government stability leads to mitigate the pollution emissions in the short run for China while other BRICS economies show insignificant results. Hence, the results revealed that an increase in the output growth contributes to pollution emissions in the BRICS countries except India in the short run. Panel B shows the long-run estimates, and the results elaborate that the geopolitical risk reduces the carbon emissions in the long run for India and South Asia. Also, government stability plays a key role in the reduction of pollution emissions in China in the long run. The empirical results indicate that increase in output stimulates the pollution emissions in the BRICS economies except for India and Russia in the long run.

Panel C demonstrates the various diagnostic statistics of the ARDL model. The results revealed that F-statistics are significant for India, China, and South Africa in both models; model 1 for Brazil is also significant and shows a long-run relationship. Additionally, the value of ECM in model 1 and 2 confirms the presence of cointegration in mostly economies. The diagnostic statistics show that most models are free from any statistical issues because LM and RESET statistics are insignificant. Besides, RESET test statistics indicate that our entire model has been correctly specified for each BRICS economies. Additionally, CUSUM elaborates that all the models are stable while CUSUM squares display instability for few economies in both model.

Table 5 displays both short-run and long-run turns out of nonlinear ARDL for energy consumption. In Panel A, the results indicate that the positive change in geopolitical risk has a negative linkage with energy use in Russia and China while the negative change in geopolitical risk leads to reduce the energy use in the short run in only India and South Africa. However, a negative change of geopolitical risk improves the energy consumption in Russia, but government stability leads to a decline in energy use in only Russia. Additionally, the results show that GDP has a significant negative impact on energy use in the BRICS economies except India, China, and South Africa, respectively, in the short run. In long-run NARDL estimates, empirical results imply that positive change in geopolitical risk leads to reduce the energy use by approximately 0.043% in Brazil, 0.777% in China, and 0.069% in India while negative change in geopolitical risk leads to a decrease in the energy use by approximately 0.064% in India, 0.065% in Brazil, and 1.119% in China in the long run. On the other hand, Russia has a significant positive coefficient, which means that geopolitical risk increased 0.048% energy consumption in only Russia. Moreover, the results also indicate that government stability leads to reduce energy use in the long run in Russia, and the remaining BRICS economies give us insignificant outcomes. The turnout shows that a 1% increase in GDP leads to reduce the energy use by approximately 0.036% in India, 0.048% in Russia, 1.148% in China, and 0.427% in South Africa respectively.

Table 5 describes the nonlinear ARDL turns out for model 2. Short-run empirical results indicate that a positive change in geopolitical risk has negatively connected with carbon emissions for South Africa and positively in only India, and other countries give us insignificant results in the short run. Furthermore, the outcome indicates that a negative change in geopolitical risk is negatively connected with carbon emissions in the short run for China and South Africa. While, on the other hand, the results show that negative change in geopolitical risk leads to enhance carbon emissions in Russia in the short run. The outcome indicates that government stability leads to reduce pollution emissions in Russia and China. Besides, the empirical results demonstrate that GDP contributes to pollution emissions in BRICS economies except for India and South Africa.

In long run, empirical turnout indicates that a positive change in geopolitical risk is negatively linked with carbon emissions in Russia and South Africa, and estimates are 0.272% and 0107%. On the other hand, a negative change of geopolitical risk leads to a decrease in carbon emissions by 0.397% in India, 0.673% in China, and 0.065% in South Africa in the long run, while it has a positive coefficient in only Russia in long run. This means that increased and decreased geopolitical risk has a significant negative effect on carbon emissions because energy consumption is also reduced in the long run. This also infers that geopolitical risk has dramatically changed the energy consumption and CO2 emissions in BRICS. Geopolitical risk is of the time-varying process which has a similar effect on the environment. This also infers that geopolitics is becoming a more efficient tool to reduce carbon emissions, which also affects clean energy consumption. Geopolitical risk is also sudden changes in the supply routes, which in return reduces carbon emissions. The empirical result suggests that geopolitical uncertainties can cause economic activities negatively by reducing economic growth. Geopolitical risk destabilized the environment in Russia. Geopolitical risk also increases the energy transition; therefore, BRICS economies have a smaller speed of climate change. Besides, the empirical results depict that a 1% increase in government stability declines in carbon emissions by approximately 0.011% in Russia and 0.013% in China. Thus, the results depict that a 1% increase in GDP stimulates the carbon emissions by 0.634% in Russia and 0.791% in South Africa while other BRICS counties show insignificant results.

Panel c describes the various diagnostic statistic tests of the nonlinear ARDL model. The ECM results show that the long-run relationship exists in each model of BRICS economies. Furthermore, F-statistics also confirms the presence of the long-run relationship, and it improves the reliability of the outcomes. The diagnostic tests revealed that outcomes are not suffered from statistical issues. Additionally, RESET, CUSUM, and CUSUM square tests show that the entire model has been correctly specified and depicts the stability in models in BRICS economies. The Wald test demonstrates positive and negative shock in geopolitical risk asymmetrical effect on energy use and carbon emissions in each model in the short run and long run.

Conclusion and policy

This study scrutinized the asymmetric influence of geopolitical risk on energy consumption and carbon emissions in BRICS economies. The findings of the study are based on ARDL and NARDL by using a data span of 1985–2019. The symmetric ARDL outcomes suggest that geopolitical risk reduces the energy consumption in only India, while it also reduces the CO2 emissions in South Africa in the short run. While, geopolitical risk variable has also reduced the energy consumption in India, Brazil, and South Africa, it reduced the carbon emissions in only South Africa in long run. Our basic analysis shows that short- and long-run outcomes are also important in energy consumption and CO2 emissions. Therefore, we also deviate from the short- and long-run analysis in asymmetric ARDL. The non-linear estimates for the energy consumption model suggest that a positive change in geopolitical risk significantly reduces energy consumption in India, Brazil, and China in the long run. However, the negative change of the geopolitical risk is negatively significant in Brazil, China, and South Africa; however, their impacts on energy consumption are also positive in only Russia in the long run. These outcomes are more important in the context of the policy-making of energy consumption. Similarly, the long-run non-linear estimates propose that a positive change in geopolitical risk decreases the carbon emissions in Russia and South Africa. Likewise, it also estimates that a negative change in geopolitical risk has also decreased the carbon emissions in India, China, and South Africa. Our empirical results are country and group specific. Thus, based on findings, climate change is not a geopolitical phenomenon. The outcomes show that geopolitical risk has asymmetric influence in the direction and even in magnitude.

Based on the findings, we suggest a few policy implications for BRICS economies. Therefore, clean energy consumption can be a useful tool to reduce the geopolitical risks in BRICS economies, while clean energy is a suitable option for energy-poor economies. Clean energy can be a useful and effective tool to buffer against the possible geopolitical risks from economies that use interventions of gas and oil as geopolitical weapons. Developed and BRICS economies should strengthen their collaboration in the field of clean energy. However, BRICS authorities should stimulate the development of electric bikes, buses, cars, and public transport to surge the electricity demand and inspire demand for clean energy. The environmental quality of BRICS economies is a major challenge, but they are not impossible in the future. BRICS economies should balance political targets and energy consumption, and the environment is particularly important. Another recommendation is to regulate rapid decarbonizing policies in the BRICS economies. Energy and environment diplomacy also need to be made a central foreign policy consideration.

This study hurts from one limitation which is that geopolitical risks data is available for limited economies. Future empirical research should more focus on the effects of geopolitical risk on renewable energy and the environment in developing economies. More, using a novel estimation dynamic ARDL technique is suggested to carry out upcoming studies.

Data Availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

References

Adams S, Adedoyin F, Olaniran E, Bekun FV (2020) Energy consumption, economic policy uncertainty and carbon emissions; causality evidence from resource rich economies. Econ Anal Policy 68:179–190

Al-Nuaimi S, Banawi AAA, Al-Ghamdi SG (2019) Environmental and economic life cycle analysis of primary construction materials sourcing under geopolitical uncertainties: a case study of Qatar. Sustainability 11(21):6000

Alsagr N, & van Hemmen S. (2021). The impact of financial development and geopolitical risk on renewable energy consumption: evidence from emerging markets. Environ Sci Pollut Res: 1-14.

BP (2019) Statistical Review of World Energy 2019. Available online: https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2019-fullreport.pdf

Bridge G, Gailing L (2020) New energy spaces: towards a geographical political economy of energy transition. Environ Plan A: Economy and Space 52(6):1037–1050

Burke MJ, Stephens JC (2018) Political power and renewable energy futures: a critical review. Energy Res Soc Sci 35:78–93

Cao W, Bluth C (2013) Challenges and countermeasures of China’s energy security. Energy Policy 53:381–388

Cheng CHJ, Chiu CWJ (2018) How important are global geopolitical risks to emerging countries. Int Econ 156:305–325

da Graça Carvalho M (2012) EU energy and climate change strategy. Energy 40(1):19–22

Galvin R, Healy N (2020) The Green New Deal in the United States: What it is and how to pay for it. Energy Res Soc Sci 67:101529

Gielen D, & Saygin D (2017) REmap 2030 Renewable Energy Prospects for Russian Federation. Abu Dhabi. Available online: http://www.irena.org/remap.

Hafeez M, Yuan C, Khelfaoui I, Sultan Musaad OA, Waqas Akbar M, Jie L (2019a) Evaluating the energy consumption inequalities in the One Belt and One Road region: implications for the environment. Energies 12(7):1358

Hafeez M, Yuan C, Yuan Q, Zhuo Z, Stromaier D (2019b) A global prospective of environmental degradations: economy and finance. Environ Sci Pollut Res 26(25):25898–25915

Hatemi-j A (2012) Asymmetric causality tests with an application. Empir Econ 43(1):447–456

He T, Nair SK, Babu P, Linga P, Karimi IA (2018) A novel conceptual design of hydrate based desalination (HyDesal) process by utilizing LNG cold energy. Appl Energy 222:13–24

IPCC (2014) Climate change 2014: synthesis report. Cambridge University Press, London

IRENA RES (2015) International renewable energy agency. In: Renewable Energy Target Setting. UAE, Abu Dhabi

Ladislaw SO, Leed M, Walton MA (2014) New energy, new geopolitics: balancing stability and leverage. Center for strategic and international studies, Washington

Li J, See KF, Chi J (2019) Water resources and water pollution emissions in China’s industrial sector: A green-biased technological progress analysis. J Clean Prod 229:1412–1426

Li X, Sohail S, Majeed MT, & Ahmad W (2021) Green logistics, economic growth, and environmental quality: evidence from one belt and road initiative economies. Environ Sci Pollut Res: 1-11.

Lv Z, Xu T (2019) Trade openness, urbanization and CO2 emissions: Dynamic panel data analysis of middle-income countries. J Int Trade Econ Dev 28(3):317–330

Majeed MT, Luni T (2019) Renewable energy, water, and environmental degradation: a global panel data approach. Pak J Commer Soc Sci 13(3):749–778

Majeed MT, Mazhar M (2019) Environmental degradation and output volatility: a global perspective. Pak J Commer Soc Sci 13(1):180–208

Ó Tuathail G (1998) De-Territorialised threats and global dangers: Geopolitics and risk society. Geopolitics 3(1):17–31

Overland I (2019) The geopolitics of renewable energy: debunking four emerging myths. Energy Res Soc Sci 49:36–40

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Rasoulinezhad E, Taghizadeh-Hesary F, Sung J, Panthamit N (2020) Geopolitical risk and energy transition in russia: evidence from ARDL bounds testing method. Sustainability 12(7):2689

Samreen I, Majeed MT (2020) Spatial econometric model of the spillover effects of financial development on carbon emissions: a global analysis. Pakistan. J Commer Soc Sci 14(2):569–202

Schmidt TS, Sewerin S (2017) Technology as a driver of climate and energy politics. Nat Energ 2(6):1–3

Sequeira TN, Santos MS (2018) Renewable energy and politics: a systematic review and new evidence. J Clean Prod 192:553–568

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In: In Festschrift in honor of Peter Schmidt. Springer, New York, pp 281–314

Sun G, Yuan C, Hafeez M, Raza S, Jie L, Liu X (2020) Does regional energy consumption disparities assist to control environmental degradation in OBOR: an entropy approach. Environ Sci Pollut Res 27(7):7105–7119

Sweidan OD (2021) The geopolitical risk effect on the US renewable energy deployment. J Clean Prod 293:126189

Wang W, Liu Y (2015) Geopolitics of global climate change and energy security. Chin J Popul Resourc Environ 13(2):119–126

Wang Z, Ye X (2017) Re-examining environmental Kuznets curve for China’s city level carbon dioxide (CO2) emissions. Spatial Stat 21:377–389

Wang L, Gu M, Li H (2012) Influence path and effect of climate change on geopolitical pattern. J Geogr Sci 22(6):1117–1130

World Bank. (2020). World Development Indicators: World Bank. Retrieved from https://databank.worldbank.org/reports.aspx?source=world-development-indicators

Yang XJ, Hu H, Tan T, Li J (2016) China’s renewable energy goals by 2050. Environ Dev 20:83–90

Yang K, Wei Y, Li S, He J (2020a) Geopolitical risk and renewable energy stock markets: An insight from multiscale dynamic risk spillover. J Clean Prod 279:123429

Yang L, Hui P, Yasmeen R, Ullah S, Hafeez M (2020b) Energy consumption and financial development indicators nexuses in Asian economies: a dynamic seemingly unrelated regression approach. Environ Sci Pollut Res 27(14):16472–16483

Author information

Authors and Affiliations

Contributions

This idea was given by Weijun Zhao. Ruoyu Zhong, and Sidra Sohail, and Muhammad Tariq Majeed analyzed the data and wrote the complete paper. Sana Ullah read and approved the final version.

Corresponding authors

Ethics declarations

Ethical approval

Not applicable.

Consent to participate

I am free to contact any of the people involved in the research to seek further clarification and information.

Consent for publication

Not applicable.

Competing interests

The authors declare no competing of interests.

Additional information

Responsible editor: Ilhan Ozturk

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Zhao, W., Zhong, R., Sohail, S. et al. Geopolitical risks, energy consumption, and CO2 emissions in BRICS: an asymmetric analysis. Environ Sci Pollut Res 28, 39668–39679 (2021). https://doi.org/10.1007/s11356-021-13505-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-13505-5