Abstract

We test whether preferences over different well-being domains significantly correlate with life satisfaction. A sample of respondents is asked to simulate a policymaker decision consisting in allocating hypothetical financial resources among 11 well-being domains. We find that the willingness to invest more in the economic well-being domain is negatively correlated with life satisfaction. We argument that this evidence, while not excluding other rationales, is consistent with the utility misprediction hypothesis suggesting that individuals make systematic errors in estimating the well-being implied from their choices. Subsample estimates document that the less educated are more affected by the problem.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

γνῶθι σεαυτόν (know thyself)

1 Socrate

The empirical analysis developed in this paper originates from descriptive empirical evidence identifying a puzzling pattern of correlations between subjective well-being (life satisfaction) and the desire to invest in economic well-being versus social relationships (see Fig. 1 discussed in detail in Sect. 4). What we find in our large sample is that individuals in the lowest (highest) range of self-assessed life satisfaction are those willing to invest more (less) in economic well-being versus social relationships. In what follows we wonder whether this finding may be interpreted in terms of utility misprediction and compare this interpretation with alternative rationales.

Following the misprediction interpretation, one possible answer to why more money does not always lead to a similar increase in happiness is that we often ignore the consequences of our choices/activities on our well-being. In other words, we commit systematic errors in predicting whether we will be happier from making a particular choice, with errors depending on the type of choice we make. In an economic framework, where individuals’ choices are assumed to reflect true underlying preferences, we should observe individuals investing time and effort in doing exactly what makes them happy. However, individuals sometimes end up with taking choices that do not always fulfil their predicted level of happiness. For instance, when it comes to choose whether consuming “material” goods relative to alternative choices, the standard utilitarian approach in economics would suggest to go for the former as they make individual utility higher. This choice might instead lead them to higher unhappiness as the well-being expected from consumption of material goods has been overestimated. This phenomenon is defined “utility misprediction” in the economic literature (Frey and Stutzer 2014).

Several authors have provided rationales explaining why individuals may mispredict utility [see, among others, Lebergott (1993), Lane (1991), Frank (1999) and Frey et al. (2004)]. Among the most relevant of them we find underestimation of asymmetric adaptation to the effects of extrinsic/intrinsic aspects to subjective well-being, distorted past memories due to peak-end rules and effects of marketing policies advertising comfort goods more than stimulus goods.

As far as asymmetric adaptation is concerned, the life satisfaction literature documents that individuals adapt quickly to positive changes in income (van Praag 1993; Easterlin 2001; Stutzer 2004; Di Tella et al. 2010), while much less so to negative non pecuniary events such as illnesses, shocks to relational goods and job losses (e.g. Easterlin 2005; Oswald and Powdthaveem 2008; Luhman et al. 2012). With respect to past memory bias, Frey and Stutzer (2005) argue that extrinsic attributes are more related to peak emotions that are demonstrated to distort retrospective assessments of feelings in psychological experiments (Kahneman 1999). Due to such peak emotions materialistic events are remembered with more satisfaction.

The advertisement effect of specific types of goods on utility misprediction hinges on the theorized differentiation of goods in “stimulus” and “comfort” which was first introduced by Scitovsky (1992). Stimulus goods are goods whose consumption is not possible without previous investment in activities or skills which make such consumption possible. The concept may be applied for instance to cultural, language or sport abilities. The main example provided by Scitovsky is the enjoyment of culture and arts and study and investment in humanistic culture accumulates the crucial “capital” which allows to enjoy this kind of stimulus good. In alternative, comfort goods are goods that provide immediate satisfaction but may create in the long run dependence. Consumption of these goods may weaken investment in the acquisition of the skills necessary to consume stimulus goods, thereby contributing to create a happiness paradox (Pugno 2013). Since comfort goods may produce dependence, and consequently a much more stable flow of profits, they are by far more advertised than stimulus goods. Frey and Stutzer (2013) argue that advertising emphasizes extrinsic more than intrinsic aspects of goods. Our point is that advertising pushes toward comfort goods that in turn require more economic well-being to be consumed and negatively affect life satisfaction. Addiction to comfort goods and insufficient investment in skills required to consume stimulus goods may contribute to explain why the negative effects of utility misprediction may not be easily corrected over time.

Utility misprediction may also explain the often observed positive (negative) correlation between life satisfaction and intrinsic (extrinsic) life goals (e.g. Richins and Rudmin 1994; Cohen and Cohen 1996; Kasser and Ryan 1996; Sirgy 1998; Burroughs and Rindfleisch 2002; Rindfleisch et al. 1997, 2009; Frey and Stutzer 2014; Roberts and Clement 2007; Karabati and Cemalcilar 2010). This is because the above-mentioned rationales lead individuals to overestimate the impact on life satisfaction of extrinsic and material goods. Advocates of the utility misprediction hypothesis must however explain why people do not correct their misprediction and, from an empirical point of view, mitigate in their analysis reverse causality and endogeneity issues.

We aim to contribute to this literature by documenting from an original source of empirical evidence a strong and negative correlation between life satisfaction and materialism proxied for by expenditure preferences for economic well-being. In this sense our paper relates to the vast literature on materialism and subjective well-being (for a survey see Kasser 2002). Among the most relevant contributions in this field, Kasser et al. (2014) addressing dynamics and causality issues by presenting four studies that investigate the relationship between changes in materialism and changes in subjective well-being. The last of them is a randomized experiment showing that the treatment (a financial education program that is designed to help families to orient their adolescent children away from ‘‘spending’’ and towards ‘‘sharing’’ and ‘‘saving’’) increases self-esteem of adolescents with ex ante high levels of materialism. A positive causal link going from materialism to a specific aspect of subjective well-being seems to emerge from this analysis.

The starting point of our investigation is the process of construction of equitable and sustainable well-being indicators (Benessere Equo e Sostenibile) enacted by the Italian Statistical Institute in 2011 following the guidelines of the Sen/Stiglitz commission (see Sect. 2 for details). The result of such process is the identification of 11 well-being domains that were regarded as fundamental by representatives of different groups of the Italian population. Our research builds on such classification by asking individuals to simulate the hypothetical policymaker decision to allocate a given sum of money among the 11 domains.

Our work is novel from this point of view since, to our knowledge and with the exception of Becchetti et al. (2013), the studies on the determinants of political preferences have so far concentrated on single factors affecting support for a specific well-being domain (i.e. environmental sustainability, redistribution), while ignoring how the weights across different domains are distributed. As suggested by Campbell (1981), individual well-being is only one aspect of overall quality of life and “additional research is needed to understand materialism’s relationship to economic well-being, physical wellness, environmental sustainability, and other indicants of quality of life.” (Burroughs and Rindfleisch 2002, p. 366).

In this regard, our empirical analysis on preferences over well-being domains documents that individuals who would invest more in economic well-being are significantly less satisfied with their life. The maintained assumption behind our reasoning is that willingness to invest more in economic well-being in the simulated policymaker action should mirror excess effort dedicated to its pursuit in private life, thereby producing negative consequences on life satisfaction. Under this assumption, our results are consistent with the utility misprediction hypothesis: individuals who overestimate utility from material well-being (and underestimate utility from other non-material domains, like e.g. socializing) declare higher willingness to invest in economic well-being but, due to a systematic estimation error in their utility estimation, lower life satisfaction than those who attach higher value to other non-material domains.

Most of the empirical work in the paper aims to disentangle the above discussed utility misprediction interpretation from alternative ones based on omitted variable bias, endogeneity and reverse causality.

A first alternative rationale may in fact be that available explanatory variables do not adequately capture all economic well-being dimensions. According to this interpretation, individuals would invest more in economic well-being while being relatively less satisfied with life because they are relatively worse off in terms of unobservable economic well-being components (i.e., they may be relatively more indebted or suffer from other forms of financial fragility not captured by the information available). Or, alternatively, more materialistic individuals may more often engage in harsher social comparisons ending up being unhappy. In order to net out utility misprediction from these two alternative interpretations, we introduce income satisfaction among regressors in our benchmark specification. On the one hand, such variable captures the impact of all unobservables related to economic well-being which may also include own perceived relative position in the society. It also accounts for a potential gap between expectations and realisations in terms of material satisfaction, on the other, which may produce a negative impact on life satisfaction even when income and other unobservable economic components are at levels that may be objectively considered as adequate.

A second rationale for our findings, alternative to utility misprediction, can be explained in terms of a reverse causal link going from life satisfaction to preferences towards a particular well-being domain (i.e. reverse causality)—reduced life satisfaction may push individuals to search compensation for their unhappiness in material goods. According to this view, whatever the causes of unhappiness (idiosyncratic time invariant psychological traits or life events), it life satisfaction that drives materialistic preferences as by satisfying the latter would help in compensating for low levels in the first.

A third rationale for the observed findings is that individuals with good social life are happierFootnote 1 and therefore they would like to continue to invest in it. This explains the positive nexus between life satisfaction and desired investment in social relationship (see Fig. 1) and, conversely, the negative sign between life satisfaction and investment in economic well-being given that investment in social relationship and in economic well-being are substitutes and that the total amount to be invested in the different domains is fixed in our survey (substitution is however partial since respondents can reduce investment in other domains while keeping investment in social relationships fixed).

A final rationale is suggested by Oishi et al. (2011) showing that lower perceived fairness and general trust negatively affect life satisfaction for low income individuals in years of high income inequality. This rationale may be broadly consistent with our descriptive findings: individuals with low income in times of high income inequality may desire to bridge the economic gap in terms of relative income while being less happy with life.

We control for these alternative interpretations with instrumental variable regressions and a sensitivity analysis à la Imbens (2003) which allows us to evaluate the robustness of our results to the introduction of a simulated unobserved variable (i.e. the quality of social life under our third alternative rationale) correlated both with life satisfaction and well-being preferences. Note as well that the sensitivity analysis also provides a sound alternative to the introduction of income satisfaction among regressors when controlling for unobservables related to financial fragility or relative income.

Our findings are robust to these econometric checks, thereby confirming that utility misprediction is a valid candidate interpretation. They would therefore underline the need of broadening our theoretical horizons from a standard framework—mostly adopted in the economic modelling—in which preferences are generally regarded as exogenous, context independent and time invariant (de gustibus non est disputandum) to a framework in which individuals progressively discover their preferences in a noisy environment in which psychological or sociological biases may make this work not simple (de gustibus errari potest).

The paper is divided into six sections. In the second section we describe the institutional process of construction of the equitable and sustainable well-being indicators which are at the root of our empirical work. In the third section we illustrate the design of our empirical investigation. In the fourth section we provide and comment descriptive findings and hypothesis testing. In the fifth we illustrate and discuss our econometric results and robustness checks. The final section concludes.

2 The BES Process

The selection of proper well-being indicators is of crucial importance since it relates to the ultimate ends of socioeconomic activity and policymaking. The well-known limits of GDP in capturing the multiplicity of well-being dimensions have recently led the Sen-Stiglitz commission to recommend and provide guidelines for the adoption of a more articulated set of indicators.Footnote 2 Italy was one of the first countries to follow the advice launching in 2011 a three-phase process. In the first, CNEL members representing different stakeholders in the Italian society were asked to identify the most important well-being domains. In the second, ad hoc commissions of experts were created for each domain with the goal of identifying a proper set of indicators that could adequately capture specific different well-being dimensions. In the third, the set of indicators were presented to the CNEL stakeholders for validation.

The result of this process led to the definition of the following twelve BES domains.Footnote 3:

-

1.

Health.

-

2.

Education and training.

-

3.

Work and life balance.

-

4.

Economic well-being.

-

5.

Social relationship.

-

6.

Politics and Institutions.

-

7.

Safety.

-

8.

Subjective well-being.

-

9.

Natural and cultural heritage.

-

10.

Environment.

-

11.

Research and innovation.

-

12.

Quality of services.

A first description of Italy on their basis was presented the 12th March 2012. A nice property of the Italian process is its attempt to overcome the trade-off between subjective indicators (which may fall into the “happy slave” Sen’s critique)Footnote 4 and objective indicators which tend to be “paternalistic” (that is, imposed on the population by a commission of experts) (Sugden 2008). BES indicators are not paternalistic since domains in the first step of its creation process are proposed from stakeholders of the Italian society (see footnote 5) and the indicators suggested by commissions of experts for each domain are validated by the same stakeholders in the third final step. At the same time they do not fall into the happy slave critique since the role of subjective well-being indicators is very limited.Footnote 5

3 The Survey Design and the Theoretical Framework

Our empirical analysis is based on an online survey we launched on March 2013. The survey appeared on three main Italian newspapers (Messaggero,Footnote 6 Avvenire,Footnote 7 Unità)Footnote 8 and on several other minor newspapers and websites.Footnote 9 We insert checks and identification processes in the online survey which prevent the same respondent from filling the form more the once. We terminated it by end of July collecting around 3346 complete questionnaires.Footnote 10

In the main question around which we concentrate our interest we ask respondents to allocate the hypothetical sum of 100 million euros to promote well-being improvement in one of the 11 (subjective well-being excluded) considered BES domains (see the attached questionnaire in the ESM Appendix C). This question is followed by sub-questions in which respondents are asked to identify the five priorities in terms of indicators in each of the considered domains.Footnote 11 The questionnaire is completed by questions aimed to provide standard socio-demographic information. Given the questionnaire structure and the presence of several questions, it is unlikely that respondents may understand that the researcher is interested in investigating the link between life satisfaction and well-being expenditure on the economic well-being domains.

The logic behind our main question of interest (desired investment in the 11 domains) may be resumed in the following theoretical framework illustrated by Becchetti et al. (2013) where it is assumed that each individual i has the following utility function defined over the set of the j = 1,…, J domains

with W j being the j-th well-being domain and M ij is the total amount that the individual i would like to invest in the domain j (with the total amount to be invested among different domains being equal for all individuals).

First order conditions from utility maximization imply that individuals equalize the marginal utility arising from investing one euro in each of the different domains, that is

What illustrated above clearly shows that the marginal utility of the investment of one euro in a given domain is the product of two factors: the expected impact of one euro invested on the advancement of that well-being domain and the effect of such advancement on individual utility.

Based on this theoretical framework individual choices reflect beliefs on what politicians should do to maximize their well-being even though their expectations on the first of the two factors might be wrong. To make an example individuals may overestimate the impact of one euro spent on a given domain (i.e., safety) on the improvement of well-being in that domain (i.e. \(\frac{{\partial E\left[ {W_{i1} } \right]}}{{\partial M_{i1} }} > \frac{{\partial W_{i1} }}{{\partial M_{i1} }}\)) and therefore find desirable high investment in it or may, on the contrary, consider that domain very important but erroneously believe that investment in that given domain is useless (i.e. \(\frac{{\partial E\left[ {W_{i1} } \right]}}{{\partial M_{i1} }} < \frac{{\partial W_{i1} }}{{\partial M_{i1} }}\)). In this sense it should be better to define what we observe as expenditure well-being preferences more than well-being preferences. Consider as well that incorrect expectations of the kind described above cancel out if we assume that they are normally distributed in our sample. Furthermore, the discrepancy between the expected marginal improvements in a well-being domain by one-euro invested in that domain (\(\frac{{\partial E\left[ {W_{i1} } \right]}}{{\partial M_{i1} }}\)) and the real marginal impact of such investment (\(\frac{{\partial W_{i1} }}{{\partial M_{i1} }}\)) can be due to region-specific factors like, for instance, lack of trust in local politicians and/or regional budget constraints which can be controlled for in the econometric analysis by introducing regional fixed effects. It is as well reasonable to assume that the incorrect expectation problem is less serious in the case of the economic well-being domain—the main object of our inquiry—since a government has many direct or indirect effective ways to affect this domain (such as subsidies, tax allowances, etc.).

What must be also remarked is that the typical distortion of the contingent evaluation literature should not apply to our question. Individuals tend to provide biased answers when they want to convey a given message to the interviewer or when they are asked to make evaluations which can strategically affect their payoffs (i.e., they tend to declare lower willingness to pay for public goods in order to free ride or they misreport income for fear of being taxed) (Carson et al. 2001). The question we pose has no power of producing such an effect. In our case if the respondent wants to emphasize the importance of a given well-being domain she/he just has to declare to be willing to invest a higher amount on it. Hence the strategic goal should lead in this case to a true and not to a biased declaration.

4 Descriptive and Empirical Findings

In Table A1 (ESM Appendix A) we report summary statistics of the main variables used in the econometric analysis. The variable used is the standard cognitive measure of subjective well-being (life satisfaction).Footnote 12 Consistently with most of the empirical literature the distribution of self-reported life satisfaction is right skewed with most values concentrated between 6 and 9. Respondents’ self-declared life satisfaction level (life_sat) is on average 7.2 while their average level of satisfaction with economic conditions is 5.5 (income_sat).

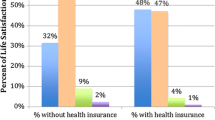

The preferred well-being domain in which respondents would invest is health (16.5%, driver_health), followed by education and training (13.5%, driver_edu), work and life balance (10.3%, driver_job) and economic well-being (9.6%, driver_ecowell), the least preferred domain being politics and institution (3.9%, driver_politics). Differences in well-being preferences across domains are not negligible given that equal distribution of investment among them would predict an average investment of around 9% for each.

When it comes to socio-demographic characteristics we find that most survey participants have the Italian nationality (Italian), are from the “South or Islands” Italian macro-area (South and Islands), have an open-ended type of employment (open-ended contract) and declare that their income ranges between 15,000 and 30,000 euros; roughly 13% of the sample is unemployed (not working). About 35% of respondents have a high school diploma, 39% a Master’s degree, while a negligible share of the sample has no education (0.3%). As far as the civil status is concerned, the majority of individuals is married/cohabitant (57%) while about 35% is single.

In Fig. 1 we plot money allocation (as percentage of the total) between the two domains of economic well-being and social-relations (without considering all the others) against declared levels of life satisfaction in order to emphasize the relationship between life satisfaction and preferences for material versus non-material well-being. Figure 1 clearly shows the presence of a negative correlation between life satisfaction and investment in economic well-being especially at the left tail of the life satisfaction distribution. Among individuals with low levels of satisfaction (between 1 and 3) the amount spent in economic well-being over the total of the two domains of economic well-being and social relationship (the most typical intrinsic goal among the 11 domains) is largely above 60%. On the contrary, at the highest level of life satisfaction (between 8 and 10) investment in the economic well-being and social relations domains tend to converge.

A negative (positive) correlation between preferences for material (non-material) well-being—proxied for by investment in economic well-being (social-relations) domain—and life satisfaction is also found when comparing material versus non-material investment preferences by levels of life satisfaction under parametric and non-parametric tests (see Table 1). As already suggested by Fig. 1, low levels of life satisfaction are associated with stronger preferences toward material than toward non-material well-being, the differences being statistically significant under both parametric and non parametric tests for the interval of low levels of life satisfaction and when the entire life satisfaction range is considered. On the contrary, consistently with what found in Fig. 1 at high levels of life satisfaction we do not detect significant differences between investment in the economic well-being driver and in social-relations.

The descriptive evidence provided so far highlights a negative nexus between investment in the economic well-being domain and life satisfaction. In order to further investigate the rationale behind such a negative relationship and account for potential endogeneity by controlling for a set of individual’s socio-demographic and economic characteristics as well as regional fixed effects, we estimate the following OLS model:

where the dependent variable (Life_sat) is subject i’s self-declared level of life satisfaction on a 1–10 scale (1 = completely unsatisfied, 10 = completely satisfied), BES_Driver is the share of money hypothetically invested by subject i in the j-th BES domain (social well-being being the omitted category), SocioDem is a set of respondent’s sociodemograpic characteristics including political orientation (RightWing) expressed by respondents on a −10/+10 scale (−10 extreme left, +10 extreme right), a (0/1) dummy for Italian nationality (Italian), a set of dummies for the respondent’s age class capturing 5-year age intervals (the 30–35 age class is the omitted benchmark), education level dummies (primary-middle education being the omitted benchmark), a gender dummy taking value one if the respondent is female and zero otherwise and MaritalStatus dummies for the Divorced, Single, Separated and Widowed conditions (Married/Cohabitant being the omitted benchmark). The specification also includes the respondent’s income class (DIncomeClass) and job status (DJobStatus) dummies, with Income_class < 15,000€ and Not Working/Unemployed/Looking for a Job being the excluded categories respectively. Individual’s geographic location (i.e. depending on the specification, either North-East, North-West or South and Islands macroregions of Italy or region dummies) are also controlled for with DArea dummies. Dsource includes a set of dummy variables capturing the source of information through which the respondent came to know about the survey. The omitted benchmark is represented by those who filled the questionnaire through word of mouth (i.e. acquaintances/friends). The Dsource variables may capture part of the unobserved individual’s traits which can introduce a bias in our econometric estimates.

Table 2 reports results from an ordered logit estimate of different specifications of the baseline model in (3). In column 1 we estimate the baseline model without introducing the BES investment decisions and find that women, non-married/non-cohabitant, unemployed and/or low income individuals tend to report a lower degree of life satisfaction, while more educated and right-wing oriented individuals report a higher degree of life satisfaction. Interestingly, those who came to know about this questionnaire through sources not involving direct social activities (i.e. blog, social networks, etc.) are less satisfied with their life than those who were instead directly informed about it by friends/acquaintances. As argued above, the introduction of these dummies may capture individuals’ unobserved traits (e.g., sociability) which are both correlated with BES investment choices and life satisfaction.

In Table 2, column 2 we introduce the share of money that individuals would allocate to the different BES well-being domains. Our results confirm the above-mentioned negative nexus between life satisfaction and investment in economic well-being. In particular, our main finding suggests that higher expenditure preferences for economic well-being relatively to the social well-being (the excluded category) is detrimental for life satisfaction. As a consequence (if alternative rationales related to reverse causality and endogeneity may be ruled out) the utility maximization hypothesis that individuals optimally balance their investment in each domain so to maximise their final utility (see Eq. 2) seems to be rejected by the data. Even though reduced in magnitude, this main effect is robust to the introduction of the respondent’s level of satisfaction with economic conditions (income_sat). This variable captures unobserved determinants of happiness and well-being preferences such as the aspiration-realisation gap, the respondents’ economic and financial status (Table 2, column 3) as well as their perceived socio-economic status in the society (e.g., relative income). The main effect is also robust to the introduction of regional fixed effects accounting for unobserved region-specific quality of institutions and/or local public expenditure (Table 2, column 4).

Based on this last specification, we evaluate the economic significance of our main result and find that a 1%-point increase in investment in economic well-being is correlated with an increase (decrease) in the probability of declaring a life satisfaction level below (above) the sample median by .57 (.64) percentage points. A graphical evidence of the magnitude of driver_ecowell is also shown in Fig. 2 in which marginal effects from a proportional increase in the investment in economic well-being with respect to the maximum potential investment (i.e. 100 units) are plotted against the probability that life_sat is below the sample median (i.e., seven).

Economic well-being investment versus above-median life satisfaction. Notes the Figure reports marginal effects for unit-changes in the driver_ecowell/100 variable computed after estimating a logistic regression model in which the independent variables are those used in the specification in column 4 of Table 2 while the dependent variable (Satbelmed) is a dummy equal to one if life_sat i < 7 and 0 otherwise (seven is the sample median value of life_sat)

The main econometric results described above are also shown in the scatterplot in Fig. 3 in which the predicted probability of declaring a level of life satisfaction below the sample median is plotted against the predicted values from an OLS regression of the amount of units invested in the economic well-being (driver_ecowell) on a set of controls as in (3). The scatterplot analysis confirms the negative relationship between life satisfaction and the amount of money invested in the economic well-being driver.

Life satisfaction and investment in economic well-being. Notes [1] Variable Prob. Life_sat < mean_LS (i.e. the prob. that the individual’s life_sat is below the regional average life_sat) contains the predicted probabilities from a logistic regression of Prob. Life_sat < mean_LS on a set of socio-economic characteristics including civil status, income satisfaction, age, education, regional dummies, employment status, gender, nationality, income class, source of information (see Tables 2, 3). [2] Variable Driver_ecowell contains the predicted probabilities from a logistic regression of the amount invested in economic well-being on the above-mentioned set of socio-economic characteristics

5 Correcting for Endogeneity

So far we have described the relationship between preferences for material well-being and life satisfaction in terms of statistical correlation. In this section we check the robustness of our main finding and try to correct for endogeneity arising from reverse causality and omitted variable bias by using an instrumental variable approach (Sect. 5.1). We also discussing heterogeneous life-satisfaction effects of the preferences towards economic well-being by comparing subsamples of individuals by income class and education level (Sect. 5.2). In addition, our results are robust to a sensitivity analysis (Imbens 2003) where the exogeneity assumption is relaxed and to a weighting procedure aimed at correcting for the non-representativeness of our sample due to voluntary-based response. For reasons of space, the methodology and the results concerning these two robustness checks are explained in details in the appendix of the paper (Sections A4.3 and A4.4 in ESM Appendix A). Note that findings from this robustness check ensure that the utility misprediction interpretation and alternative interpretations such as that assuming that the observed nexus is driven by a correlation between quality of social relationships and life satisfaction can coexist. In the sensitivity analysis we in fact test whether a confounder Z (that can be identified with the unobserved enjoyed level of social relationships) that is correlated with X (desired investment in social relationship) and affects the dependent variable Y (life satisfaction) may create a spurious relationship between X and Y. Our findings show that this is not the case even under extremely high levels of correlation between X and Z.

5.1 Instrumental Variable Regressions

In what follows we implement an instrumental variable approach in order to mitigate endogeneity and reverse causality, i.e. the existence of a causal nexus between preferences for material well-being (driver_ecowell) and life satisfaction going in an opposite direction with respect to that presented in (3).

Before doing this, we first estimate the following baseline specification

which is similar to the model in Table 2, column 4 with the only exception that the benchmark BES domain is now composed by all the other domains not included in (4) (since all other domains are excluded from right hand side variables). The rationale behind such a specification hinges on the necessity to instrument the main choice-variable of interest for this study that is suspected of endogeneity—Driver_ecowell—with instruments that are valid and relevant as we will document below.

Table 3, columns 1–2 report results from the OLS estimates of Eq. 4. The negative relationship between investment in economic well-being and life satisfaction is confirmed also under this model specification. In addition, since the omitted BES benchmark is now composed by all the BES domains but Driver_ecowell, the new estimates reinforce our main finding since those investing more in the economic well-being domain with respect to all the other domains appear to be less satisfied with their life (Table 3, column 1). In column 2 we re-estimate the previous specification by replacing life satisfaction, investment in economic well-being and satisfaction with economic conditions with a ratio between the individual-i’s value for the latter variables and their regional sample average calculated excluding the individual i (see variable legend in the ESM Appendix A). The introduction of these ratios allows us to reduce the additional endogeneity due to the high correlation and/or simultaneity among Driver_ecowell, Life_sat and Income_sat. Estimation results reported in column 2 (Table 3) are consistent with those in column 1 and, more in general, with our core finding.

We then instrument Driver_ecowell with its sample average computed in individual-i’s region excluding i’s investment decision in the economic well-being domain. More specifically, for each individual i living region j we construct the variable \(Mean\_EW_{ - i,j} = \frac{{\mathop \sum \nolimits_{j} Driver\_ecowell_{ - i,j} }}{{n_{j} - 1}}\) (where n j is the total number of individuals in the sample living in region j) and use it to instrument Driver_ecowell in the above-described estimates in columns 1–2 (Table 3). Once regional characteristics are controlled for in the reduced form equation, the validity of the chosen instrument is guaranteed by the plausible assumption that the regional average investment in economic well-being affects life satisfaction only through the individual’s investment in that domain (which, as explained above, has not been included when computing the regional mean). As an indirect test for the validity of the exclusion restriction we check for the significance of the instrumental variable in the main equation and find that Mean_EW −i,j does not significantly account for the variation in the life satisfaction variable (columns 3–4, Table 3). Possible theoretical channels making such an exclusion restriction valid can derive from social imitation and/or cultural norms which explain also the correlation between other’s average and individual’s investment in economic well-being. The existence and the magnitude of such a correlation provides support for the relevance of our instrumental variable which is also empirically confirmed by ad-hoc statistical tests commented below.

Results from IV estimates are consistent with those from OLS estimates described above (i.e. they do not exhibit the typically larger standard errors and changes in coefficient magnitudes which occur when the set of instruments has not enough variability) and are reported in columns 5–6 of Table 3. Instrument relevance and the absence of weak instrument bias is confirmed by two statistical checks, i.e. (1) the F-statistics from the first stage are relatively high (i.e. 12.73 and 9.18 for the specification in columns 5 and 6 respectively) and (2) the F-statistics from the Stock and Yogo (2005)’s weak-instrument test are greater than all the related Stock and Yogo critical values. We finally re-estimate the previous instrumental variable models accounting for the specific characteristics of the dependent variables both in the first and the second stage, i.e. categorical (life_sat) or censored (driver_ecowell, ratio_LS and ratio_EW). Estimation results reported in columns 7–10 (Table 3) confirm all the previous findings. Incidentally, the individual level of satisfaction with her/his own economic conditions enters significantly both the first and second stage but with an opposite sign, i.e. it positively affects life satisfaction but it does negatively for investment in economic well-being. Therefore, by including income_sat in both stages we are also likely to capture omitted variables representing an additional source of bias like, for instance, the unobserved economic and financial conditions, relative income and/or the aspiration-realisation gap which can simultaneously influence both life satisfaction and investment in material well-being.

5.2 Heterogeneous Effects

Columns 8 and 10 (Table 3) show that being female, right-wing oriented, young, less educated, under a seasonal contract or redundancy fund benefits (relative to the being unemployed) and wealthier are among the factors which positively influence the investment in the economic well-being domain. In order to test for sample heterogeneous effects of the economic well-being investment we re-estimate the IV specification in columns 7–8 in Table 3 by comparing subsamples of individuals below/above the median income class and education level.

Columns 1–2 in Table 4 show that individuals with income class above the median sample level register a negative correlation of economic well-being investment with life satisfaction while the effect of investment in economic well-being is not significant for those reporting an income class level not above the sample median (columns 3–4, Table 4) ruling out the possibility that our findings hide a pattern similar to that observed by Oishi et al. (2011) where the correlation is mainly due to low income individuals suffering high inequality. In other terms, the former show higher preferences for the economic well-being domain but derive lower life satisfaction from it relative to the latter. A possible interpretation is that richer individuals seem to be more subject to utility misprediction due to higher consumption of (comfort, extrinsic) goods subject to adaptation (see Easterlin 2001 and Stutzer 2004). The same occurs for those who are less educated (i.e. have at least a high school diploma)—and hence more exposed to media influence and/or imitation when consuming “status” or comfort goods (see footnote 3)—since they invest more in the economic well-being domain but also enjoy less from it in terms of life-satisfaction (columns 5–6, Table 4) relative to the higher educated respondents (columns 7–8, Table 4).

6 Conclusions

In this paper we exploit a unique database combining information on self-reported life satisfaction with individual preferences for government expenditure on different well-being domains. We find a strong and significant negative correlation between subjective well-being and willingness to invest more in the economic well-being domain. We document that utility misprediction is one of the relevant interpretation of our findings, net of the alternative and equally plausible explanations related to endogeneity, reverse causality, relative income and social comparisons, omitted variable bias (with special focus on the role of quality of social relationships) and measurement errors on our set of regressors (especially unobservables related to our objective economic well-being measures).

We reach this conclusion since our main findings remain significant when: (1) we control for income satisfaction with which we capture all unobservables related to economic well-being (e.g. relative income) and the potential gap between achievements and expectations in the economic well-being domain; (2) we use an instrumental variable approach (3) we perform a sensitivity analysis which relaxes the exogeneity assumptions necessary to interpret our finding in a causal way and (4) we use ad hoc design weights to correct for non-random sampling. Interestingly, higher income and lower educated respondents seem to be more exposed to utility misprediction, possibly because of income-adaptation (the former) and exposure to the media or status-based imitation (the latter).

The robustness of the utility misprediction rationale in the interpretation of our findings implies non-trivial consequences for the related literature. Most of the theoretical models are based on the assumption of rational individuals with time invariant preferences who “know their type”, i.e. are fully aware of the characteristics of their utility function. We find on the contrary not just that “de gustibus est disputandum” (i.e. each individual is perfectly informed about her/his time invariant preferences) but also that “de gustibus errari (pot)est” (i.e. individuals make systematic errors in predicting utility from their choices).

Empirical support for the hypothesis of utility misprediction opens the way to a much broader and general framework according to which the true content of utility functions in the classic economic analysis may not be perfectly known by individuals but can be gradually discovered through processes (i.e. education) which would reduce psychological (underestimation of asymmetric adaptation, peak-end rules) or social (impact of advertising) distortions. The suggestion stemming from this paper is therefore that the related economic literature should adopt a broader view on preferences which takes into account related concepts which are well known in sociology, psychology and marketing.

Our robust empirical evidence on the existence utility misprediction calls for further investigation on the determinants of and the rationales behind the persistence of such prediction errors and on the factors which might reduce them. Regarding this last point, several policy suggestions which may be drawn from the above-mentioned view. Regulation or taxation reducing psychological or social factors influencing the discovery process of one’s own preferences can create positive effects on individual well-being. Implications can be huge in other fields such as limits to TV advertising (especially for children) as it already occurs in several countries although web exposure reduces the effectiveness of these measures. Similar positive effects on economic well-being may arise from investment in education that may help individual to reduce the noise produced by such psychological and social disturbances on preference discovery.

Notes

Downloadable at http://www.stiglitz-sen-fitoussi.fr/documents/rapport_anglais.pdf.

The complete list of the 134 specific indicators created in the different BES domains by ISTAT is attached in ESM Appendix A. For a more complete and detailed information on the process of BES creation see the English version of the ISTAT/BES official website: http://www.misuredelbenessere.it/index.php?id=48.

With subjective wellbeing indicators we may have the paradox of individuals who behave as “happy slaves” reducing aspirations to the low level of their achievements, thereby lacking of desire for social progress. Sen illustrates the point by arguing that “The defeated and the downtrodden come to lack the courage to desire things that others more favourably treated by society desire with easy confidence” (Sen 1985: 15).

Subjective indicators occupy in the BES only one of the 12 domains (n.8 subjective wellbeing) while few subjective indicators are included to complement objective indicators in some selected domains (i.e. those of economic wellbeing, health, safety) (for further details see ESM Appendix A and B). Note as well that, in spite of its limits and potential manipulations, subjective wellbeing worth being measured since satisfaction/lack of satisfaction with life is highly likely to have repercussions on objective indicators such as health, social capital and political stability.

Messaggero, has a reputation of moderate conservative political orientation and is the fifth most red Italian newspaper (excluding sport newspapers).

Avvenire, is the most important Italian catholic newspaper. As such it reflects the ideological divide of Italian believers which are equally divided between right and left wing orientation.

Unità has a left wing tradition being the official newspaper of the Democrat Party.

These are Forum Nazionale Terzo Settore, FQTS, ARCI, ConVol, CSV Net, Labsus, Dignità del lavoro, Auser, Avis, Anpas, Bandiera Gialla, La perfetta letizia, Mondo alla Rovescia, Confini online, Il Metapontino.it, ARCI, Campania, Blog vitobiolchini, Domos (domotica sociale).

An inescapable limit of our online survey is that it is not representative of the Italian population. Online compilation in fact automatically selects a subsample of individuals who tend to be relatively younger and more educated than average. This limit is at the same time an interesting aspect of our survey since the composition of our sample anticipates characteristics of the future population which is bound to be more educated in the future. Also for this reason we may have a specific interest in investigating the relationship at stake in this specific group of the population. From another point of view lack of representativeness of our sample with respect to the Italian population is a common characteristics of many econometric studies which are not interested in descriptive traits of the universe of reference but to econometric links in that specific sample. Last but not least, subsample estimates for high/low educated respondents help us to correct the bias and to understand what happens in the subsample of the less educated which is closer to country average characteristics. We also correct our main estimates for non-representativeness of our sample with specific design weights described in section A4.4 of ESM Appendix A.

Note that the survey question changes when we ask preferences about subdomain specific indicators (from the simulation of an invested sum to an more general indication of priorities). This is because some of these indicators are subjective and it is not clear whether others may be affected by government expenditure (see ESM Appendix B).

Using self-declared levels of life satisfaction as a proxy for individual utility is a standard approach in the literature on subjective well-being and happiness economics [see, e.g., Frey and Stutzer (2002), Layard (2005), Di Tella and MacCulloch (2006) and Stutzer and Frey (2010), as well as in psychology (e.g., Kahneman et al. 1999; Diener et al. 1999). As is well known alternative subjective wellbeing measures are of affective (negative/positive affect) and eudaimonic (evaluation of the sense of one’s own life) type. The cognitive measure we adopt is however probably the most widely used at least in the economic literature on life satisfaction.

References

Bartolini, S., Bilancini, E., & Pugno, M. (2013a). Did the decline in social capital decrease american happiness? A relational explanation of the happiness paradox. Social Indicators Research, 110(3), 1033–1059.

Bartolini, S., Bilancini, E., & Sarracino, F. (2013b). Predicting the trend of well-being in Germany: How much do comparisons, adaptation and sociability matter? Social Indicators Research, 114(2), 169–191.

Becchetti, L., Corrado, L. and Fiaschetti, M. (2013). The heterogeneity of wellbeing “expenditure” preferences: evidence from a simulated allocation choice on the BES indicators, CEIS Research Paper N. 297.

Becchetti, L., Pelloni, A., & Rossetti, F. (2008). Relational goods, sociability, and happiness. Kyklos, 61(3), 343–363.

Burroughs, J. E., & Rindfleisch, A. (2002). Materialism and well-being: A conflicting values perspective. Journal of Consumer Research, 29(3), 348–370.

Campbell, A. (1981). The sense of well-being in America: Recent patterns and trends. New York: McGraw-Hill.

Carson, R. T., Flores, N. E., & Meade, N. F. (2001). Contingent valuation: Controversies and evidence. Environmental and Resource Economics, 19, 173–210.

Cohen, P., & Cohen, J. (1996). Life values and adolescent mental health. Mahwah: Lawrence Erlbaum.

Di Tella, R., Haisken-DeNew, J. P., & MacCulloch, R. (2010). Happiness adaptation to income and to status in an individual panel. Journal of Economic and Behavior Organization, 76(3), 834–852.

Di Tella, R., & MacCulloch, R. (2006). Some uses of happiness data in economics. Journal of Economic Perspectives, 20(1), 25–46.

Diener, E., Suh, E. M., Lucas, R. E., & Smith, H. L. (1999). Subjective well-being: Three decades of progress. Psychological Bulletin, 125(2), 276–303.

Easterlin, R. A. (2001). Income and happiness: Towards a unified theory. Economic Journal, 111(473), 465–484.

Easterlin, R. A. (2005). A puzzle for adaptive theory. Journal of Economic Behavior and Organization, 56(4), 513–521.

Frank, R. H. (1999). Luxury fever. Why money fails to satisfy in an era of excess. New York: Free Press.

Frey, B. S., Benz, M., & Stutzer, A. (2004). Introducing procedural utility: not only what but also how matters. Journal of Institutional and Theoretical Economics, 160(3), 377–401.

Frey, B. S., & Stutzer, A. (2002). What can economists learn from happiness research? Journal of Economic Literature, 40(2), 402–435.

Frey, B. S., & Stutzer, A. (2005). Does the political process mitigate or accentuate individual biases due to mispredicting future utility? In E. McCaffery & J. Slemrod (Eds.), Behavioral public finance. New York: Russell Sage Foundation.

Frey, B. S., & Stutzer, A. (2013). Economics and the study of individual happiness. In S. A. David, I. Boniwell, & A. C. Ayers (Eds.), The oxford handbook of happiness (pp. 431–447). Oxford: Oxford University Press.

Frey, B. S., & Stutzer, A. (2014). Economic consequences of mispredicting utility. Journal of Happiness Studies, 15(4), 937–956.

Helliwell, J. F., & Putnam, R. D. (2004). “The social context of well-being” philosophical transactions, 359(1449). In F. A. Huppert, B. Kaverne, & N. Baylis (Eds.), The science of well-being (pp. 1435–1446). London: Oxford University Press.

Imbens, G. W. (2003). Sensitivity to exogeneity assumptions in program evaluation. American Economic Review, 93, 126–132.

Kahneman, D. (1999). Objective happiness. In D. Kahneman, E. Diener, & N. Schwarz (Eds.), Well-being: the foundations of hedonic psychology (pp. 3–25). New York: Russell Sage Foundation.

Kahneman, D., Diener, E., & Schwarz, N. (1999). Well-being: The foundation of hedonic psychology. New York: Russell Sage Foundation.

Karabati, S., & Cemalcilar, Z. (2010). Values, materialism, and well-being: A study with Turkish university students. Journal of Economic Psychology, 31(4), 624–633.

Kasser, T. (2002). The high price of materialism. Cambridge: MIT Press.

Kasser, T., Rosenblum, K. L., Sameroff, A. J., Deci, E. L., Niemiec, C. P., Ryan, R. M., et al. (2014). Changes in materialism, changes in psychological well-being: Evidence from three longitudinal studies and an intervention experiment. Motivation and Emotion, 38(1), 1–22.

Kasser, T., & Ryan, R. M. (1996). Further examining the American dream: Differential correlates of intrinsic and extrinsic goals. Personality and Social Psychology Bulletin, 22(3), 280–287.

Lane, R. E. (1991). The market experience. Cambridge: Cambridge University Press.

Layard, P. R. G. (2005). Happiness: lessons from a new science. New York: Penguin.

Lebergott, S. (1993). Pursuing happiness: American consumers in the twentieth century. Princeton: Princeton University Press.

Luhman, M., Hofmann, W., Eid, M., & Lucas, R. E. (2012). Subjective well-being and adaptation to life events: A meta-analysis. Journal of Personality and Social Psychology, 102(3), 592–615.

Oishi, S., Kesebir, S., & Diener, E. (2011). Income inequality and happiness. Psychological Science, 22(9), 1095–1100.

Oswald, A., & Powdthaveem, N. (2008). Does happiness adapt? A longitudinal study of disability with implications for economists and judges. Journal of Public Economics, 92(5–6), 1061–1077.

Pugno, M. (2013). Scitovsky and the income-happiness paradox. The Journal of Socio-Economics, 43, 1–10.

Richins, M. L., & Rudmin, F. W. (1994). Materialism and economic psychology. Journal of Economic Psychology, 15(2), 217–231.

Rindfleisch, A., Burroughs, J. E., & Denton, F. (1997). Family structure, materialism, and compulsive consumption. Journal of Consumer Research, 23(4), 312–325.

Rindfleisch, A., Burroughs, J. E., & Wong, N. (2009). The safety of objects: materialism, existential insecurity, and brand connection. Journal of Consumer Research, 36(1), 1–16.

Roberts and Clement. (2007). Materialism and satisfaction with over-all quality of life and eight life domains. Social Indicators Research, 82, 79–92.

Scitovsky, T. (1992) [1976]. The joyless economy. Oxford: Oxford University Press.

Sen, A. K. (1985). Well-being, agency and freedom: The Dewey Lectures 1984. Journal of Philosophy, 82, 69–221.

Sirgy, M. J. (1998). Materialism and quality of life. Social Indicators Research, 43(3), 227–260.

Stock, J., & Yogo, M. (2005). Testing for weak instruments in linear IV regression. In D. W. K. Andrews (Ed.), Identification and inference for econometric models (pp. 80–108). New York: Cambridge University Press.

Stutzer, A. (2004). The role of income aspirations in individual happiness. Journal of Economic Behavior and Organization, 54(1), 89–109.

Stutzer, A., & Frey, B. S. (2010). Recent advances in the economics of individual subjective well-being. Social Research: An International Quarterly, 77(2), 679–714.

Sugden, R. (2008). Capability, happiness, and opportunity. In L. Bruni, F. Comim, & M. Pugno (Eds.), Capabilities and happiness. Oxford: Oxford University Press.

Van Praag, B. M. S. (1993). The relativity of the welfare concept. In M. Nussbaum & A. K. Sen (Eds.), The quality of life (pp. 362–416). Oxford: Clarendon.

Acknowledgements

The paper is part of a research coordinated by Laboratorio RicercAzione from Formazione Quadri Terzo Settore and sponsored by Fondazione con il Sud. The authors thank all the scientific board of FQTS, ISTAT and Fondazione con il Sud for their support, Stefano Bartolini, Tommaso Proietti and Maurizio Pugno for comments and suggestions, Sante Orsini, Roberto Porciello, Fabiola Riccardini and Focusmarketing for their precious coordination and research assistance in building the online survey and providing relevant data. Finally we thank the newspapers Messaggero, Avvenire and Unità for hosting the survey.

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Becchetti, L., Conzo, P. Preferences for Well-Being and Life Satisfaction. Soc Indic Res 136, 775–805 (2018). https://doi.org/10.1007/s11205-017-1566-8

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-017-1566-8