Abstract

This paper considers a polluting firm, subject to environmental policy, who seeks to deter the entry of potential competitors. We investigate under which conditions firm profits are enhanced by regulation. We show that, contrary to common belief, inefficient firms may support environmental regulation when their production is especially polluting. In addition, we evaluate how this result is affected by the regulator’s prior beliefs accuracy and the environmental damage from pollution.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Environmental regulation is often deemed detrimental for firm profits. While this result generally holds under complete information, we show that, under incomplete information, regulation can facilitate firms’ information transmission, and thus have a positive effect on profits.Footnote 1

We consider a setting in which an incumbent monopolist faces entry threats from a potential newcomer, which is uninformed about the incumbent’s production costs (efficient or inefficient). The incumbent’s output generates an environmental externality that the regulator seeks to correct with the use of pollution taxes. For completeness, our model allows the regulator to hold different beliefs about the incumbent’s costs. In this incomplete information setting, the regulator must set a first-period emission fee on the incumbent, who responds by choosing an output level. Both fee and output are subsequently observed by the entrant before deciding whether to join the market. Our model, therefore, helps analyze industries that have been monopolized for long periods of time, and that develop products whose costs are difficult to assess by regulators and potential entrants. For instance, Dow Chemical’s magnesium production plants were publicly owned and managed during the Korean War, a period in which regulators gathered detailed information about Dow’s production costs. In addition, Dow was a monopolist in the U.S. magnesium industry until the 1970s, when the EPA introduced the National Ambient Air Quality Standards (NAAQS), regulating two pollutants emitted in magnesium production: carbon monoxide and particulate matter. Interestingly, Dow substantially increased its magnesium production during the early 1970s, which successfully deterred the entry of potential competitors, such as Kaiser Aluminum and Norsk Hydro, and delayed the entry of Alcoa until 1976.Footnote 2

In our study, we first show that the unregulated efficient firm increases its output relative to complete information in order to reveal its type to potential entrants and thus deter entry. That is, the efficient incumbent exerts a “ separating effort” that cannot be profitably mimicked by the inefficient type of firm. We demonstrate that such effort is ameliorated by regulation. Hence, emission fees give rise to two opposite effects on profits: a negative effect, as firms are forced to decrease their output; and a positive effect, as they reduce the incumbent’s separating effort. We show that the positive effect dominates when pollution is sufficiently damaging, and thus fees are high enough. In this context, the inefficient type of firm finds it unprofitable to mimic the output level of the efficient incumbent, thus allowing the latter to reveal its type by exerting a small separating effort. As a consequence, stringent regulation can become profit enhancing under incomplete information settings. In summary, environmental policy helps the efficient firm more easily convey its type to potential rivals.

Second, we explore whether the profit-enhancing effect of emission fees is sensitive to the regulator’s beliefs. In particular, a regulator assigning a large probability on the incumbent’s costs being high when they are actually low, sets a low fee on this firm. Hence, two effects on profits arise: a positive effect (from the less stringent regulation), and a negative effect (as the incumbent is now forced to increase its separating effort in order to convey its type to potential entrants). We identify under which conditions the positive effect dominates and, hence, profits monotonically increase as the regulator’s beliefs are ex-post incorrect. In particular, we show that such monotonicity arises when the environmental damage from pollution is relatively large. In this context, fees become high, hindering the ability of the inefficient firm to mimic the output decision of the efficient firm, which ultimately reduces the separating effort that the latter needs to exert to convey its type.

Finally, we study the equilibrium in which the inefficient type of incumbent deters entry by concealing its costs from potential rivals. We demonstrate that emission fees lower the firm’s costs of concealing information, thus providing more incentives to practice entry deterrence than when regulation is absent. Hence, regulators can expect support from the most unexpected ally: inefficient firms which, in addition, are especially polluting.Footnote 3

1.1 Related literature

Several papers analyze settings in which environmental regulation increases profits under contexts of complete information, since such a policy may foster innovation and corporate social responsibility; see Maloney and McCormick (1982), Farzin (2003), Schoonbeek and de Vries (2009), and Palmer et al. (1995) for a review of the literature. Our paper shows that even in the absence of the above arguments, firms can still favor regulation if they operate under a context of incomplete information. Specifically, a firm favors emission fees when they facilitate its signaling ability, i.e., conveying or concealing information from potential rivals.

Our study also contributes to the literature on entry-deterring models with signaling; see Milgrom and Roberts (1982), Harrington (1986), and Ridley (2008). This literature, however, abstracts from the regulatory contexts in which firms operate. We demonstrate that considering such regulatory setting is crucial to understand firms’ incentives to support or oppose environmental policies, thus providing an additional motive for firms to favor emission fees.

Our paper extends Espinola-Arredondo and Munoz-Garcia (2013, 2015), who examine entry decisions when the potential entrant observes one signal originating from the incumbent firm (output) and another from the regulator (emission fee), demonstrating that a pooling equilibrium exists in which entry is deterred if the incumbent’s and regulator’s preferences are aligned, i.e., when entry is damaging for the incumbent and it can be deterred without generating large welfare losses.Footnote 4 While Espinola-Arredondo and Munoz-Garcia (2015) describes under which conditions the incumbent firm seeks to deter entry in a given information and regulatory context (incomplete information and emission fees), it does not evaluate firms’ interests towards regulation and information, our main investigation in this paper. Therefore, our results help understand in which settings firms would actually support the introduction of environmental regulation while practicing entry deterrence, and if regulation can become profit enhancing.Footnote 5 This result is relevant for policymakers who evaluate the implementation of environmental policy on polluting industries facing entry threats.

The following section describes the model. Sections 3 and 4 analyzes the separating and pooling equilibrium, while Sect. 5 discusses our results.

2 Model

Consider an incomplete information model whereby an incumbent firm, facing an inverse demand \(P(q)=1-q\), privately observes its production costs, \(c_{K} \), either high or low, i.e., \(K=\{H,L\}\), where \(1>c_{H}>c_{L}>0\). A potential entrant does not observe the incumbent’s costs, but knows that they are high with probability \(p\in \left( 0,1\right) \) and low otherwise. The costs of the entrant are high, \(c_{H}\), and under complete information it would only enter when the incumbent’s costs are also high.Footnote 6 The production of all firms generates pollution that the regulator addresses by setting emission fees in both periods. The social welfare function considers consumer and producer surplus, tax revenues, and environmental damage from pollution, \(ED(q)\equiv dq^{2}\), where \(d>1/2\) guarantees that emission fees are positive under all information contexts. (Emission fees are, hence, revenue neutral.)

The regulator can have access to different beliefs about the incumbent’s costs. In particular, the regulator assigns a belief \(\rho \) to the incumbent’s costs being high, where \(\rho >p\) indicates that his beliefs are biased upward while \(\rho <p\) describes the case in which his beliefs are biased downward. For instance, when the incumbent’s costs are low, the regulator’s prior could be \(\rho =0\) (implying that his priors are ex-post confirmed to be correct), \(\rho =1\) (assigning full probability on the incumbent’s cost being high, and thus being wrong ex-post), or any other less extreme belief \(\rho \in \left( 0,1\right) \). This setting allows for cases in which the regulator’s prior is ex-post confirmed to be closer to the incumbent’s actual cost than the entrant’s prior, i.e., \(\rho >p\) when incumbent’s costs are high (or \(\rho <p\) when incumbent’s costs are low). In this context, for example, the regulator could receive a non-public report from the IRS, helping him assess the incumbent’s costs. Our model also considers the opposite case, in which the entrant’s belief p is ex-post confirmed to be closer to the incumbent’s actual cost than the incumbent’s, i.e., \(\rho <p\) when incumbent’s costs are high (or \(\rho >p\) when incumbent’s costs are low), representing settings in which the entrant has already competed in similar markets in other countries. In the second stage of the game, firms compete a la Cournot if entry occurs; otherwise, the incumbent maintains its monopolistic position.

The time structure of the game is as follows: (1) the incumbent privately observes its production costs, \(c_{K}\), where \(K=\{H,L\}\); (2) the regulator sets an emission fee \(t_{1}\) on the incumbent’s output; (3) the K-type incumbent responds to fee \(t_{1}\) by choosing an output level \(q^{K}(t_{1})\); (4) the entrant observes the emission fee and output level, updates its prior beliefs about the incumbent’s type, and decides whether to enter; (5) the regulator sets emission fees either on the incumbent alone (under no entry) or on both firms (under entry); and (6) firm/s respond by selecting their output level.Footnote 7

Under complete information, the K-type incumbent solves

which yields an output function \(q^{K}(t_{1})=\frac{1-c_{K}-t_{1}}{2}\). The regulator seeks to induce the socially optimal output that maximizes social welfare, \(q_{K}^{SO}=\frac{1-c_{K}}{1+2d}\). In particular, anticipating the incumbent’s output function \(q^{K}(t_{1})\), the regulator sets an emission fee \(t_{1}^{K}=(2d-1)\frac{1-c_{K}}{1+2d}\) which solves \(\frac{1-c_{K}-t_{1} }{2}=\frac{1-c_{L}}{1+2d}\). In the second period, a similar analysis applies if no entry ensues, where the same fee is still optimal. If, instead, firms compete a la Cournot, every firm i produces \(q_{i}^{K}(t_{2})=\frac{ 1-2c_{i}+c_{j}-t_{2}}{3}\) where \(j\ne i\). In this context, the regulator induces \(q_{K}^{SO}\) by setting a fee that solves \( q_{i}^{K}(t_{2})+q_{j}^{K}(t_{2})=q_{K}^{SO}\). For more details on complete information strategies, see Espinola-Arredondo and Munoz-Garcia (2013). [Appendix 1 considers an alternative model with convex production costs, showing that our main results are qualitatively unaffected.]

The next sections analyze the separating equilibrium (SE) and pooling equilibrium (PE). In the SE (PE), we examine the output and profits for the low-cost (high-cost) incumbent since the high-cost (low-cost, respectively) firm behaves as under complete information.

3 Separating equilibrium

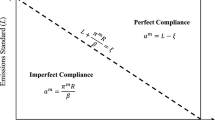

In a context in which regulation is absent, as in standard entry-deterrence games, the low-cost firm increases its output (relative to complete information) in order to convey its type to the potential entrant and thus deter entry; see Milgrom and Roberts (1982). When regulation is present, the incumbent similarly increases its production in order to signal its efficient cost structure to potential rivals, but such additional production generates more pollution. In this context, the regulator sets more stringent emission fees in order to curb such additional externality. In particular, as shown in Espinola-Arredondo and Munoz-Garcia (2013, 2015), a separating equilibrium can be sustained where the low-cost firm increases its output function, from \(q^{L}(t_{1})=\frac{ 1-c_{L}-t_{1}}{2}\) under complete information to \(q^{A}(t_{1})=\frac{ (1-c_{H})(1+2d+\sqrt{3\delta })}{2(1+2d)}-\frac{t_{1}}{2}\), where \(\delta \) denotes the discount factor. The regulator, anticipating output function \( q^{A}(t_{1})\), sets an emission fee

which yields an output level \(q^{A}(t_{1}^{*})=\frac{2+\rho \sqrt{ 3\delta }-\rho \left( 2+\sqrt{3\delta }\right) c_{H}-2\left( 1-\rho \right) c_{L}}{2(1+2d)}\) in equilibrium. Hence, the output difference \( q^{A}(t_{1}^{*})-q^{L}(t_{1}^{L})\) can be interpreted as the low-cost firm’s separating effort. The next lemma examines how such effort is affected by the regulator’s information accuracy, \(\rho \).

Lemma 1

Separating effort \(q^{A}(t_{1}^{*})-q^{L}(t_{1}^{L})=\frac{\rho \left[ \sqrt{3\delta }(1-c_{H})-2(c_{H}-c_{L}) \right] }{2(1+2d)}\) is increasing in \(\rho \), and becomes nil when \(\rho \rightarrow 0\).

The separating effort, depicted in Fig. 1, is nil when the regulator’s beliefs about the incumbent’s costs are ex-post confirmed to be correct, i.e., \(\rho =0\).Footnote 8 However, when his beliefs satisfy \(\rho >0\), he assigns a positive probability to the incumbent’s costs being high, thus setting a less stringent fee. Such a fee makes the output decision of the low-cost firm easier to mimic by the high-cost type and, hence, forces the former to increase its output in order to signal its type. This result is illustrated by rightward movements in Fig. 1 (higher \(\rho \)) for a given damage d. Figure 1 also depicts the effect of more polluting output on the separating effort of the efficient firm. In particular, as d increases emission fees become more stringent, thus hindering the ability of the inefficient incumbent to imitate its production decision. As a consequence, the efficient firm does not need to exert such a large separating effort when pollution is damaging, e.g., \(d=1.5\), than when it is not, e.g., \( d=0.51 \), which shrinks the difference between output levels \( q^{A}(t_{1}^{A})\) and \(q^{L}(t_{1}^{L})\). (Recall that emission fees become zero for all \(d<1/2\), implying that the separating effort when \(d=0.51\) closely resembles that in standard entry-deterrence models in which the regulator is absent.)

The above results suggest that a regulator with beliefs that are ex-post confirmed to be incorrect (i.e., \(\rho >0\)) gives rise to two opposite effects on profits: a positive effect, as he sets less stringent fees; and a negative effect, since such a fee forces the firm to increase its separating effort. The next lemma compares these two effects.

Lemma 2

The equilibrium profits of the low-cost incumbent in the SE, \(\pi _{SE}^{L,R}(\rho )\), increase in \(\rho \) for all \(\rho <\rho _{1}\), but decrease otherwise; where cutoff \( \rho _{1}\equiv \frac{\left( 1-2d\right) \left( 1-c_{L}\right) }{ 2(c_{H}-c_{L})-\sqrt{3\delta }(1-c_{H})}\). In addition, \(\rho _{1}\) increases in d.

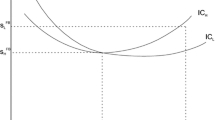

Figure 2a depicts equilibrium profits of the low-cost incumbent as a function of \(\rho \), illustrating their non-monotonicity.Footnote 9 In words, the incumbent obtains a larger profit with a regulator with priors taking an intermediate value (\(\rho =\rho _{1}\) in Fig. 2a) than with priors that are ex-post confirmed to be correct (\(\rho =0\)) or confirmed to be wrong (\(\rho =1\)). When \(\rho <\rho _{1}\), the regulator sets stringent fees, and thus an increase in \(\rho \) entails an overall positive effect on profits. In contrast, when \(\rho >\rho _{1}\), fees are lax, and further increases in \( \rho \) help the high-cost firm to easily mimic the low-cost incumbent, reducing the profits of the latter.

Figure 2b depicts the effect of environmental damage on profits. When d is low (e.g., \(d=0.51\)), the emission fee is lax and attracts the high-cost firm to mimic, ultimately requiring a large separating effort from the low-cost incumbent; a behavior that is emphasized when the regulator has priors that are ex-post confirmed to be wrong (rightward movement in Fig. 2b). Hence, in this case equilibrium profits monotonically decrease. The opposite argument applies when d is high (\(d=1.5\)), and thus emission fees are stringent. In this context, the output level of the low-cost firm cannot be profitably mimicked for any \(\rho \). Therefore, when \(\rho \) increases, fees become laxer thus yielding a monotonic increase in profits.

We next examine whether regulation leads efficient firms to obtain higher profits under the SE than in complete information (CI).

Proposition 1

Profits satisfy \(\pi _{SE}^{L,R}(\rho )\ge \pi _{CI}^{L,R}\) if and only if \(\rho \ge \rho _{2}\), where \(\rho _{2}\equiv \frac{2(1-2d)(1-c_{L})(\Gamma +\gamma )}{3\delta (1-c_{H})^{2}+2\Gamma \gamma +\gamma ^{2}}\), \(\rho _{2}\ge 0\) for all parameter conditions, and \(\rho _{2}\le 1\) for all \(d\le \frac{(2+\sqrt{3\delta })(1-c_{H})}{4(1-c_{L})}\). In addition, \(\Gamma \equiv \sqrt{3\delta }(c_{H}-1)\) and \(\gamma \equiv 2(c_{H}-c_{L})\).

Figure 3 depicts the difference between the profits in the SE and CI, \(\pi _{SE}^{L,R}(\rho )-\pi _{CI}^{L,R}\). Let us first consider this difference when \(d=0.75\). Starting from \(\rho \rightarrow 0\) where \(\pi _{SE}^{L,R}(\rho )=\pi _{CI}^{L,R}\), a marginal increase in \(\rho \) entails a positive effect on profits (laxer fees) that dominates its negative effect (easier to mimic output), thus yielding \(\pi _{SE}^{L,R}(\rho )>\pi _{CI}^{L,R}\). Further increases in \(\rho \), however, entail a less stringent emission fee, and a easier to mimic production, ultimately generating the opposite profit ranking.

Figure 3 also shows that, as the environmental damage increases, the profit ranking \(\pi _{SE}^{L,R}(\rho )\ge \pi _{CI}^{L,R}\) holds under a wider range of \(\rho \). Intuitively, when pollution is very damaging the regulator sets stringent emission fees, which the high-cost firm cannot profitably mimic. Hence, when regulation is present the efficient firm can be better off under incomplete than complete information; a result contrasting that when regulation is absent; see Milgrom and Roberts (1982).Footnote 10

4 Pooling equilibrium

Espinola-Arredondo and Munoz-Garcia (2015) show that a pooling equilibrium (PE) can be sustained in which the high-cost incumbent mimics the output function of the low-cost firm. If the regulator supports such concealing strategy, he increases the emission fee from \(t_{1}^{H}\) under CI to \(t_{1}^{L}\) under the PE. As a consequence, this firm’s output level increases from \(q^{H}(t_{1}^{H})=\frac{ 1-c_{H}}{1+2d}\) to \(q^{L}(t_{1}^{L})=\frac{1-c_{L}}{1+2d}\), and its mimicking effort is given by the difference \( q^{L}(t_{1}^{L})-q^{H}(t_{1}^{H})=\frac{c_{H}-c_{L}}{1+2d}\).Footnote 11 Let us next evaluate the equilibrium profits of the high-cost firm.

Lemma 3

The equilibrium profit of the high-cost incumbent in the PE, \(\pi _{PE}^{H,R}\), is constant in \(\rho \). In addition, \(\pi _{PE}^{H,R}\) increases in d if and only if \(d<d_{4}\); where \(d_{4}\equiv \frac{1+\delta (1+c_{H}^{2})+c_{H}(1-2\delta -c_{L})+c_{L}(2c_{L}-3)}{2(1-c_{H})(1+\delta -\delta c_{H}-c_{L})}\).

First, the profits of the high-cost incumbent do not depend on \(\rho \), since in the PE the regulator mimics the emission fee he would set on the efficient firm, \(t_{1}^{L}\), and the incumbent responds by mimicking its output function, \(q^{L}(t_{1})\), thus yielding an output level \( q^{L}(t_{1}^{L})\) which is independent on \(\rho \).Footnote 12 In addition, lemma 3 identifies that profits are non-monotonic in d. This property arises because an increase in d yields two opposite effects on profits: a negative effect from a more stringent fee; and a positive effect, since such strict fee reduces the mimicking output \(q^{L}(t_{1}^{L})\). In particular, the mimicking effort \( q^{L}(t_{1}^{L})-q^{H}(t_{1}^{H})=\frac{c_{H}-c_{L}}{1+2d}\) decreases in d at a decreasing rate. Hence, the positive effect of an increase in d on profits is large when \(d<d_{4}\), thus dominating its negative effect, but it becomes small otherwise; as illustrated in Fig. 4.

While profits under the PE are positive, we still need to determine whether they are larger than under CI, as evaluated in Proposition 2.

Proposition 2

Profits satisfy \(\pi _{PE}^{H,R}\ge \pi _{CI}^{H,R}\). In addition, \(\pi _{PE}^{H,R}-\pi _{CI}^{H,R}\) increases in d if and only if \(d<d_{5}\); where \( d_{5}\equiv \frac{(2-\delta )c_{H}^{2}-\delta +6c_{L}-4c_{L}^{2}-2c_{H}(3-\delta -c_{L})}{2(1-c_{H})\left[ (\delta -2)c_{H}+2c_{L}-\delta \right] }\).

Our results, hence, go in line with those in standard entry-deterrence models without regulation, which predict that profits are larger in the PE than in CI. The profit difference \(BDE^{R}\equiv \pi _{PE}^{H,R}-\pi _{CI}^{H,R}\) can then be interpreted as the benefit from deterring entry (BDE). Such a benefit is increasing in d if \(d<d_{5}\), since the positive effect of more stringent regulation (easier to mimic production) outweighs its negative effect. We next analyze whether the benefit of deterring entry is affected by regulation.

Corollary 1

\(BDE^{R}\ge BDE^{NR}\) for all \(d\in (d_{6},d_{6}^{^{\prime }})\). (See appendix for cutoffs \(d_{6}\) and \( d_{6}^{^{\prime }}\).)

As depicted in Fig. 5, BDE is larger without than with regulation when environmental damages are small, \(d<d_{6}\). Intuitively, emission fees are less stringent, implying that the high-cost incumbent must exert a large mimicking effort. Hence, the positive effect of regulation is offset by its negative effect. However, when pollution is more damaging, \(d>d_{6}\), emission fees become stringent, thus reducing the incumbent’s mimicking effort. In this case, BDE is larger with than without regulation.

5 Discussion and conclusions

5.1 Is pollution good for profits?

We demonstrate that profits are not necessarily decreasing in d; a result that holds both in the SE and PE. Under the SE, if the regulator’s beliefs are confirmed to be wrong, the profits of the low-cost firm are larger when pollution becomes more damaging. Intuitively, regulation hinders the mimicking ability of the high-cost firm. Hence, an incumbent facing an uninformed regulator and operating in polluting (not-so-polluting) industries would favor (oppose) regulation since it facilitates (hinders) its entry-deterring practices.

5.2 Regulator’s beliefs and profits

At first glance, one may suspect that a low-cost incumbent could prefer a regulator assigning a large probability on its costs being high, as that entails less stringent emission fees. Such a result undoubtedly holds when the incumbent faces no entry threats. However, under entry threats, the profits of the low-cost firm are not necessarily monotonic in \(\rho \), since laxer emission fees facilitate the mimicking effort of the high-cost firm, thus hindering its profits.

5.3 Inefficient firms favoring stringent emission fees?

We also show that, when damages are significant, the benefits from deterring entry are actually larger when regulation is present than absent; see Corollary 1. This yields a rather unexpected prediction: the high-cost firm would actually favor environmental regulation when pollution is damaging, since such a regulation ameliorates its mimicking effort.

5.4 Empirical implication

Consider a polluting monopoly with relatively flat abatement costs which faces the threat of entry. A model of complete information, such as that in Maloney and McCormick (1982), could not rationalize this firm’s support of environmental policy. However, our model can explain why a firm favors regulation when such policy helps the monopoly convey information (in the SE) or conceal it (in the PE), thus deterring entry.

5.5 Further research

Our model considers a single incumbent facing the threat of entry. However, in some industries several firms face such a threat. When regulation is absent, Harrington (1987) shows that, in a context of homogeneous products, firms’ behavior under the separating equilibrium coincides with that under complete information, and that the pooling equilibrium cannot be sustained. However, when product differentiation is allowed, Schultz (1999) demonstrates that such equilibrium can be supported whereby incumbents coordinate their production decisions to deter entry. The literature has, nonetheless, overlooked the effect of regulation on these equilibrium results, i.e., whether it facilitates entry-deterring practices (as shown in our model) or, instead, hinders them. In addition, our setting can be extended in several other dimensions: first, considering that firms’ environmental damage is a function of their production costs; and second, allowing for emission fees to affect firms’ abatement decisions, where abatement costs are type-dependent. Finally, the model could be extended to consider a non-linear emission fee in which the regulator offers a menu of two-part tariffs \((F_{H},t_{H})\) and \((F_{L},t_{L})\), where \(F_{i}\) denotes a fixed payment while \(t_{i}\) represent a per-unit emission fee, for \(i=\{H,L\}\). Since our entry deterrence model examines regulation during two periods, the incumbent’s choice of a policy pair would follow the incentives described in the literature on repeated adverse selection, as in Laffont and Tirole (1988).

Notes

Maloney and McCormick (1982) show that when marginal cost of abatement is sufficiently steep, environmental regulation under complete information can increase industry profits.

Maloney and McCormick (1982) empirically analyze which firms support environmental regulation in different U.S. industries, such as textile mills and smelting plants for cooper, lead and zinc. Their study shows that, while these firms are subject to a costly regulation, their market share increases, potentially indicating larger profits.

Denicolò (2008) also examines a signaling model, in which a firm decides whether to acquire advanced technology in order to convey its costs of regulatory compliance to an uninformed regulator. However, firms are always active in the industry, and thus entry deterrence cannot arise. In addition, Denicolò (2008) does not allow for the regulator to sustain different beliefs about the incumbent’s costs. Other studies considering firms’ incentives to signal its costs to a regulator in order to raise rivals’ costs include Heyes (2005) and Lyon and Maxwell (2016).

Espinola-Arredondo and Munoz-Garcia (2013) considers a signaling model in which the regulator perfectly observes the incumbent’s costs and, as a consequence, the only uninformed agent is the potential entrant. In contrast, Espinola-Arredondo and Munoz-Garcia (2015) extends that model to allow for the regulator to have access to different beliefs.

This is a common assumption in the literature of entry-deterrence without regulation, often justified by the lack of experience of the potential entrant in the industry. When environmental regulation is present, this assumption can be rationalized on the basis of the newcomer’s inexperience in complying with the administrative and legal details of the policy.

If environmental regulation uses, instead, a production quota, potential entrants would only observe one signal, i.e., the production level corresponding to the quota. In that setting, environmental policy would nullify the signaling role of the incumbent’s output.

For simplicity, Fig. 1 considers costs \(c_{H}=1/3\), \(c_{L}=1/4\), and no discounting. These cost parameters allow for the separating equilibrium to arise, i.e., \(c_{H}<\frac{\sqrt{3\delta }+(1+2d)c_{L}}{\sqrt{3\delta }+(1+2d) }\). For our numerical example such inequality becomes \(\frac{1}{3}<\frac{4 \sqrt{3}+(1+2d)}{4\sqrt{3}+4(1+2d)}\), which holds for all \(d>\frac{1}{2}\). Other parameter combinations yield similar results and can be provided by the authors upon request.

When \(d=0.51\) emission fees are close to zero. Figure 3 shows that our results predict that \(\pi _{SE}^{L,R}(\rho )<\pi _{CI}^{L,R}\) for all values of \(\rho \), resembling that in standard entry-deterring models without regulation.

In particular, for the PE to arise: (1) the high-cost incumbent must be sufficiently symmetric to the low-cost firm, since otherwise its mimicking effort would be too costly; and (2) the efficiency loss that the regulator generates by “ overtaxing” the high-cost incumbent must be small.

Parameter \(\rho \) affects, however, the regulator’s willingness to support the high-cost incumbent in its concealing strategy. In particular, the regulator behaves as prescribed in this PE if the savings in entry costs arising from deterring entry exceed the (expected) inefficiencies from setting a stringent fee \(t_{1}^{L}\) on a firm which could possibly have high production costs.

References

Denicolò, V. (2008). A signaling model of environmental overcompliance. Journal of Economic Behavior and Organization, 68, 293–303.

Espinola-Arredondo, A., & Munoz-Garcia, F. (2013). When does environmental regulation facilitate entry-deterring practices? Journal of Environmental Economics and Management, 65(1), 133–152.

Espinola-Arredondo, A., & Munoz-Garcia, F. (2015). Can poorly informed regulators hinder competition? Environmental and Resource Economics, 61(3), 433–461.

Farzin, Y. H. (2003). The effects of emission standards on industry. Journal of Regulatory Economics, 24, 315–327.

Harrington, J. E, Jr. (1986). Limit pricing when the potential entrant is uncertain of its cost function. Econometrica, 54, 429–437.

Harrington, J. E, Jr. (1987). Oligopolistic entry deterrence under incomplete information. RAND Journal of Economics, 18(2), 211–231.

Heyes, A. G. (2005). A signaling motive for self-regulation in the shadow of coercion. Journal of Economics and Business, 57, 238–246.

Laffont, J. J., & Tirole, J. (1988). The dynamics of incentive contracts. Econometrica, 56(5), 1153–1175.

Lieberman, M. (1987). Excess capacity as a barrier to entry: an empirical appraisal. The Journal of Industrial Economics, 35(4), 607–627.

Lieberman, M. (2001). The magnesium industry in transition. Review of Industrial Organization, 19(1), 71–80.

Lyon, T., & Maxwell, J. (2016). Self-Regulation and regulatory discretion: Why firms may be reluctant to signal green. Advances in Strategic Management (forthcoming).

Maloney, M., & McCormick, R. (1982). A positive theory of environmental quality regulation. Journal of Law and Economics, 25(1), 99–124.

Milgrom, P., & Roberts, J. (1982). Predation, reputation, and entry deterrence. Journal of Economic Theory, 27, 280–312.

Palmer, K., Oates, W. E., & Portney, P. R. (1995). Tightening environmental standards: The benefit-cost or the no-cost paradigm? The Journal of Economic Perspectives, 9(4), 119–132.

Ridley, D. B. (2008). Herding versus hotelling: market entry with costly information. Journal of Economics and Management Strategy, 17(3), 607–631.

Schoonbeek, L., & de Vries, F. P. (2009). Environmental taxes and industry monopolization. Journal of Regulatory Economics, 36, 94–106.

Schultz, C. (1999). Limit pricing when incumbents have conflicting interests. International Journal of Industrial Organization, 17, 801–825.

Acknowledgments

We are very grateful to the editor, Michael Crew, and two anonymous referees for their valuable comments and their constructive suggestions. We would also like to thank all participants of the 13th International Industrial Organization Conference, especially to Ramya Shankar for her insightful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Appendix 1: Convex production costs

We examine how our equilibrium results are affected by the consideration of convex production costs, i.e., every firm’s costs become \(c_{K}\cdot q^{2}\) where \(K=\{H,L\}\). In particular, we first identify output levels under complete information and under the separating equilibrium. Next we evaluate the low-cost incumbent separating effort (as in Lemma 1), its profits under the separating equilibrium \(\pi _{SE}^{L,R}(\rho )\) (as in Lemma 2) and, finally, the profit difference \(\pi _{SE}^{L,R}(\rho )-\pi _{CI}^{L,R}\) (as in Proposition 1).

1.1.1 Complete information

When the incumbent maximizes its first-period profits, \((1-q)q-c_{K}q^{2}-t_{1}q\), it obtains an output function \( q^{K}(t_{1})=\frac{1-t_{1}}{2(1+c_{K})}\). The socially optimal output in this context is \(q_{K}^{SO}=\frac{1}{1+2d+2c_{K}}\). Hence, the regulator sets an emission fee \(t_{1}\) that solves \(\frac{1-t_{1}}{2(1+c_{K})}=\frac{1 }{1+2d+2c_{K}}\), i.e., \(t_{1}^{K}=\frac{2d-1}{1+2d+2c_{K}}\), ultimately yielding an output level \(q^{K}(t_{1}^{K})=q_{K}^{SO}\).

1.1.2 Separating equilibrium

Espinola-Arredondo and Munoz-Garcia (2015), Appendix 2, shows that under convex production costs the low-cost incumbent selects an output function \( q^{A}(t_{1})=\frac{\left( 1-t_{1}\right) \left( 1+2d+2c_{inc}^{H}\right) +\left( 1+c_{inc}^{H}\right) \sqrt{3\delta }}{2\left( 1+c_{inc}^{H}\right) \left( 1+2d+2c_{inc}^{H}\right) }\), and that the regulator, anticipating such output, sets an emission fee \(t_{1}^{*}\). The expression of the emission fee is, however, intractable and thus we next provide it evaluated at the same parameter values considered throughout the paper, \(c_{H}=1/3\), \( c_{L}=1/4\) and \(\delta =1\).

where \(A\equiv 5+6d\). At these parameter values, the low-cost incumbent is, thus, induced to produce

in the separating equilibrium, and \(q^{L}(t_{1}^{L})=\frac{2}{3+4d}\) in the complete information context. Hence, the separating effort is \(q^{A}\left( t_{1}^{*}\right) -q^{L}(t_{1}^{L})\). Figure 6 evaluates the separating effort at the same environmental damages as Fig. 1. Hence, convex costs also yield a separating effort that increases in \(\rho \), and experiences a downward shift as d increases. Unlike with linear costs, the separating effort is larger under convex costs, given that marginal costs are lower than in the linear case.

Equilibrium profits for the low-cost incumbent, \(\pi _{SE}^{L,R}(\rho )\), are also intractable, but for the above parameter values become

when \(d=0.51\), \(\frac{1134+\rho \left[ 117+9\sqrt{3}\left( 9+3\rho \right) -302\rho \right] }{9\left( 18+\rho \right) ^{2}}\) when \(d=3/4\), and \(\frac{ 75816+432\rho (11+27\sqrt{3})+\rho ^{2}\left( 972\sqrt{3}-10883\right) }{ 324\left( 27+\rho \right) ^{2}}\) when \(d=1.5\). Figure 7 depicts these profits as a function of \(\rho \), showing that profits reach a maximum at \( \rho _{1}\cong 0.01\) when \(d=0.51\), but increases to \(\rho _{1}\cong 0.25\) at \(d=3/4\), and to \(\rho _{1}\cong 1\) when \(d=1.5\); thus reflecting a similar pattern as when production costs are linear.

We now compare equilibrium profits under the separating equilibrium and complete information, \(\pi _{SE}^{L,R}(\rho )-\pi _{CI}^{L,R}\), where \(\pi _{SE}^{L,R}(\rho )\) was obtained above and \(\pi _{CI}^{L,R}\left( q_{L}^{SO}\right) =\frac{(1+\delta )\left[ 8(d+c_{L})-1\right] }{ 4(1+2d+2c_{L})^{2}}\), which becomes \(\frac{3175}{7938}\) when \(d=0.51\), \( \frac{7}{18}\) when \(d=3/4\), and \(\frac{26}{81}\) when \(d=1.5\). The profit difference as a function of \(\rho \) is depicted in Fig. 8, illustrating that the value of \(\rho \) for which \(\pi _{SE}^{L,R}(\rho )=\pi _{CI}^{L,R}\left( q_{L}^{SO}\right) \), \(\rho _{2}\), increases in d, as in the case of linear costs.

1.1.3 Pooling equilibrium

Let us next analyze the pooling equilibrium (PE) under convex production costs. Specifically, we first find the high-cost incumbent profits, \(\pi _{PE}^{H,R}\) (as in Lemma 3), and compare them relative to complete-information profits, \(\pi _{CI}^{H,R}\) (as in Proposition 2).

Under the PE, in the first period, the high-cost incumbent produces according to the low-cost output function \(q^{L}(t_{1})=\frac{1-t_{1}}{ 2(1+c_{L})}\) and the regulator sets a fee \(t_{1}^{L}=\frac{2d-1}{1+2d+2c_{L}} \) that helps the incumbent conceal its type. In the second period, since entry is deterred, the incumbent produces monopoly output and regulation is set accordingly. Hence, its profits are

which are constant in \(\rho \). In addition, for the above parameter values, \( \pi _{PE}^{H,R}\) is monotonically decreasing in damage d. Intuitively, the negative effect of a more stringent fee dominates its positive effect (ameliorating the incumbent’s mimicking effort), as this effort is cheaper under convex than linear costs, i.e., marginal costs are lower for all inframarginal units.

Finally, comparing \(\pi _{PE}^{H,R}\) against \(\pi _{CI}^{H,R}\), where \(\pi _{CI}^{H,R}=\frac{(4+\delta )(1+c_{H})}{4(1+2d+2c_{H})^{2}}\) we obtain that their difference is

which for our parameter values yields \(\pi _{PE}^{H,R}>\pi _{CI}^{H,R}\) for all values of d.

Proof of Lemma 1

The output difference \(q^{A}(t_{1}^{*})-q^{L}(t_{1}^{L})\) is positive if \(c_{H}<\frac{\sqrt{3\delta }+2c_{L}}{\sqrt{3\delta }+2}\equiv \alpha _{A}\), a cutoff that originates at \(c_{H}=\frac{\sqrt{3\delta }}{\sqrt{3\delta }+2}\) when \(c_{L}=0\) and reaches \(c_{H}=1\) when \(c_{L}=1\). In addition, cutoff \( \alpha _{A}\) satisfies \(\alpha _{A}>\alpha _{1}\equiv \frac{\sqrt{3\delta } +(1+2d)c_{L}}{\sqrt{3\delta }+(1+2d)}\) since \(\alpha _{1}\) originates at \( c_{H}=\frac{\sqrt{3\delta }}{\sqrt{3\delta }+(1+2d)}\) and reaches \(c_{H}=1\) when \(c_{L}=1\), and their vertical intercepts satisfy \(\frac{\sqrt{3\delta } }{\sqrt{3\delta }+(1+2d)}<\frac{\sqrt{3\delta }}{\sqrt{3\delta }+2}\) since \( d>1/2\). Hence, for all parameter values in which the SE exists, \(\alpha <\alpha _{1}\), the output difference \(q^{A}(t_{1}^{*})-q^{L}(t_{1}^{L})\) is positive. Finally, the output difference increases in \(\rho \), reaches its highest value, \(\frac{\sqrt{3\delta }(1-c_{H})-2(c_{H}-c_{L})}{2(1+2d)}\) , when \(\rho =1\); and collapses to zero when \(\rho =0\). \(\square \)

Proof of Lemma 2

First-period profits in the SE are \(\left( 1-q^{A}(t_{1}^{*})\right) q^{A}(t_{1}^{*})-c_{L}\cdot q^{A}(t_{1}^{*})\), and rearranging yields

where \(\lambda \equiv \rho c_{H}(2+\sqrt{3\delta })\). Differentiating with respect to \(\rho \), yields \(\frac{[\sqrt{3\delta }(1-c_{H})-2(c_{H}-c_{L})][ \lambda +c_{L}(1-2d-2\rho )-(1+\sqrt{3\delta }\rho -2d)]}{2(1+2d)^{2}}\) which is zero if \(\rho =\frac{\left( 1-2d\right) \left( c_{L}-1\right) }{ \sqrt{3\delta }(1-c_{H})-2(c_{H}-c_{L})}\equiv \rho _{1}\). In addition, cutoff \(\rho _{1}\) increases in d. That is, \(\frac{\partial \rho _{1}}{ \partial d}=\frac{2(1-c_{L})}{\sqrt{3\delta }(1-c_{H})-2(c_{H}-c_{L})}>0\) if \(\sqrt{3\delta }(1-c_{H})-2(c_{H}-c_{L})>0\) or \(c_{H}<\frac{\sqrt{3\delta } +2c_{L}}{\sqrt{3\delta }+2}\equiv \overline{c_{H}}\) which always is satisfied since the cost parameter that supports the separating equilibrium is \(c_{H}<\frac{\sqrt{3\delta }+(1+2d)c_{L}}{\sqrt{3\delta }+(1+2d)}< \overline{c_{H}}.\) \(\square \)

Proof of Proposition 1

Profits in the SE, \(\pi _{SE}^{L,R}\left( \rho \right) \), are

since \(x_{inc}^{L}(t_{1}^{L})=\frac{1-c_{L}}{1+2d}\), \(\pi _{SE}^{L,R}\left( \rho \right) \) simplifies

where \(\Gamma \equiv -\sqrt{3\delta }(1-c_{H})\) and \(\gamma \equiv 2(c_{H}-c_{L})\). Under CI, profits \(\pi _{CI}^{L,R}=(1+\delta )\frac{ 2d(1-c_{L})^{2}}{(1+2d)^{2}}\). Hence, the profit difference \(\pi _{SE}^{L,R}(\rho )-\pi _{CI}^{L,R}\) is

which becomes zero for all \(\rho \ge \rho _{2}\), where \(\rho _{2}\equiv \frac{2(1-2d)(1-c_{L})(\Gamma +\gamma )}{3\delta (1-c_{H})^{2}+2\Gamma \gamma +\gamma ^{2}}\). In addition, cutoff \(\rho _{2}\) is positive for all feasible values of d, and \(\rho _{2}\le 1\) for all \(d\le \frac{ (2+\sqrt{3\delta })(1-c_{H})}{4(1-c_{L})}\). \(\square \)

Proof of Lemma 3

Profits in the PE are

Plugging output levels \(q^{L}(t_{1}^{L})\) and \(q^{H}(t_{1}^{H})\) into \(\pi _{PE}^{H,R}\) yields

Differentiating \(\pi _{PE}^{H,R}\) with respect to d, and solving for d, we obtain s

\(\square \)

Proof of Proposition 2

Profit \(\pi _{PE}^{H,R}\) is in the proof of Lemma 3, and

Hence, \(\pi _{PE}^{H,R}\ge \pi _{CI}^{H,R}\) for all \(d<d_{5}\); where \( d_{5}\equiv \frac{(c_{H}-c_{L})(1-c_{L})}{(1-c_{H})\left[ \delta +(2-\delta )c_{H}-2c_{L}\right] }\). In addition,

Differentiating with respect to d, and solving for d yields

\(\square \)

Proof of Corollary 1

Profit difference \(\pi _{PE}^{H,R}-\pi _{CI}^{H,R}\) is given in the proof of Proposition 2. Since

and \(\pi _{CI}^{H,NR}=\frac{\left( 1-c_{H}\right) ^{2}}{4}+\delta \frac{ \left( 1-c_{H}\right) ^{2}}{9}\), then

Hence, \(\pi _{PE}^{H,R}-\pi _{CI}^{H,R}\ge \pi _{PE}^{H,NR}-\pi _{CI}^{H,NR} \) for all \(d\in \left[ d_{6},d_{6}^{\prime }\right] \), where

and

where \(\varphi =5\delta +(5\delta -9)c_{H}^{2}\), \(\psi =2c_{H}(5\delta -9c_{L})+9c_{L}^{2}\), \(D\equiv 9(c_{H}-c_{L})(c_{H}+c_{L}-2)-4\delta (1-c_{H})^{2}\), and \(E\equiv \varphi +9c_{L}(3c_{L}-4)-2c_{H}(9c_{L}+5\delta -18)\). \(\square \)

Rights and permissions

About this article

Cite this article

Espínola-Arredondo, A., Muñoz-García, F. Profit-enhancing environmental policy: uninformed regulation in an entry-deterrence model. J Regul Econ 50, 146–163 (2016). https://doi.org/10.1007/s11149-016-9298-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11149-016-9298-2