Abstract

This paper analyzes both R&D in pollution control technology and pollution abatement by firms that are subject to environmental liability law (either strict liability or negligence) and are granted R&D subsidies. Firms differ in their R&D costs (private information) and experience technology spillovers. Policy makers may induce first-best abatement and R&D levels despite asymmetric information by graduating policy instruments to screen firms. The chances of implementing first-best activity levels by such means differ under strict liability and negligence, and examples suggest that negligence performs better. The paper also studies the case in which uniform policy levels are imposed on heterogeneous firms, showing that strict liability tends to outperform negligence from a social welfare perspective in this scenario.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The impact of environmental policy on incentives to advance abatement technology has recently attracted great interest in environmental economics. The performance of policy instruments with regard to the inducement of optimal investment in “green” technical progress has been considered in various settings (see, e.g., Endres 2011; Endres and Rundshagen 2013; Parry 2003; Requate 2005; Requate and Unold 2003; Ulph and Ulph 2007; Youssef and Zaccour 2014).Footnote 1 A related issue is the diffusion of new “green” technologies (see the recent survey by Allan et al. 2014). However, this literature commonly focuses on tradable discharge permits, emission taxes, as well as command and control policies. In contrast, the policy focus of the present paper is on environmental liability law, an important policy instrument in its own right (e.g., Bartsch 1997; Bennear and Stavins 2007; Bentata 2014; Calcott and Hutton 2006; Cropper and Oates 1992; Endres 2011; Faure and Wang 2010; Xepapadeas 1997).

The present paper considers the joint use of environmental liability law and R&D subsidies to address two market failures: a pollution externality and an externality resulting from imperfect appropriability of innovation (i.e., knowledge spillovers). To address the former imperfection, this paper considers environmental liability law.Footnote 2 In our paper, environmental liability law is analyzed in terms of two alternative liability rules. Under strict liability, a polluter is required to compensate harm irrespective of behavior. Under negligence, a polluter’s liability is contingent on his breach of a behavioral norm. In practical legislation, whether strict liability or negligence applies depends on the activity.Footnote 3 To address the second market imperfection, namely, knowledge spillovers, this paper focuses on R&D subsidies.Footnote 4 We seek to describe the outcomes attainable with these two policy instruments (environmental liability law and R&D subsidies) and to assess the relative performance of strict liability and negligence.

In our analysis, firms that differ in their R&D costs select both pollution abatement and R&D investment, where R&D deterministically lowers abatement costs. Firms interact via knowledge spillovers.Footnote 5 The analysis in the present paper complements the one of Endres et al. (2015), where it is asserted that both strict liability and negligence can induce the first-best outcome when the policy maker can verify the firms’ cost level and the R&D subsidy internalizes the external effect on the other firm. For the scenario in which the policy maker cannot tailor standards and R&D subsidies to firms (i.e., when there is asymmetric information), Endres et al. (2015) in particular elaborate on the performance of the so-called “double negligence rule”, a rule that uses a standard for both abatement and investment when the firm’s liability is in question. It is established that this liability rule performs relatively well in inducing the first-best outcome. However, this liability rule is hardly practically relevant (as the imposition of liability on the tortfeasor is made contingent on an activity not directly related to the occurrence of the accident) and its attractiveness depends on the number of cost types. In the present paper, we exclusively consider the scenario in which the policy maker observes only firm behavior but not the firm’s R&D costs (i.e., its type) and explore two different policy designs. First, we consider the possibility of inducing socially optimal firm choices by graduating policy instruments to obtain a truthful self-selection of firm types. We establish that this is indeed possible, detail the corresponding requirements, and show that these requirements differ depending upon whether strict liability or negligence is applied. The possibility of partial liability that is key to our study of negligence is not considered in Endres et al. (2015). Next, we analyze the case in which the policy maker addresses uniform standards toward heterogeneous agents. Under strict liability, this uniformity applies to R&D subsidies; under negligence, it applies to both the R&D subsidy and due-abatement levels. For negligence, we assume in this second policy design that the due-abatement level is backed by fierce consequences (e.g., high criminal penalties), making non-compliance with the standard a dominated action for firms. There are related arrangements in practice: it is quite common that the due-care standard in negligence is defined by what regulation requires polluters to do. Then, under negligence per se, breaching the due-care standard implies civil liability and additionally brings about regulatory repercussions (e.g., Bentata 2014; Bentata and Faure 2012, Burrows 1999, Faure 2007, 2014; Faure and Van den Bergh 1987). The latter include sanctions of criminal and administrative law. In the light of these legal circumstances, we treat negligence in this section similar to what is otherwise understood as regulation.Footnote 6 For this second policy framework with uniform policy, we characterize optimal policy and compare the performance of strict liability and negligence. In Endres et al. (2015), some undifferentiated instruments are included in the analysis, but the optimal level of these instruments is derived only in the present paper. Moreover, firms always weigh the pros and cons of complying with standards in Endres et al. (2015), whereas in the paper at hand the regulatory backing is sufficiently strong in our second policy design to make compliance privately beneficial.

Our paper more generally adds to studies on the management of two externalities that focus on other policy instruments, such as a tax combined with an R&D subsidy (e.g., Katsoulacos and Xepapadeas 1996) or emissions taxes, permits, and/or performance standards (e.g., Fischer et al. 2003; Parry 1998).Footnote 7 Fischer and Newell (2008), Jaffe et al. (2005), and Ulph and Ulph (2007) also discuss a setup with knowledge spillovers and environmental externalities, but do not consider environmental liability law. Overall, the literature on technical change and environmental policy instruments has neglected environmental liability law. The exceptions to date are Endres and Bertram (2006), Endres et al. (2007), Endres et al. (2008), and Endres and Friehe (2011a), Endres and Friehe (2011b), Jacob (2015) in addition to Endres et al. (2015) referred to above.Footnote 8

Overall, our comparison of the liability rules in the present paper leads to the following results: We find that the performances of strict liability and negligence differ in the two policy scenarios analyzed below. Negligence tends to induce worse outcomes when uniform policy is applied, but may be better positioned to implement the screening of firms. As a result, the policy maker ought to make the choice between liability rules contingent on their actual implementation.

The rest of the paper is structured as follows: Section 2 introduces the model, and the social optimum is characterized in terms of abatement and R&D levels. Section 3 presents decentralized decision making when polluters are subject to either strict liability or negligence, discussing policy options and the optimal design thereof when there is information on firm behavior but not on firm type. Section 4 concludes.

The main part of the present paper (Sect. 3) differs from Endres et al. (2015) as explained above. In contrast, the material in Sect. 2 parallels the corresponding material from the aforementioned paper. Nevertheless, small differences in the modeling setup and the obvious advantages of a self-contained design of the present paper for readers’ convenience make the inclusion of this short paragraph into the present paper useful.

2 The model and the social optimum

2.1 The model

We consider risk-neutral firms. Firm \(i\), \(i=H,L\), determines its level of abatement \(x_{i}\ge 0\). A higher level of abatement lowers the level of (firm-specific and verifiable) expected environmental harm \(D(x_{i})\) at a diminishing rate, \(D'<0< D''\). Abating emissions at level \(x_{i}\) entails costs of \(C(x_{i},T_{i})\), where \(C_{x}, C_{x x}> 0\) holds and \(T_{i}\) represents the state of the abatement technology. The state of technology is determined by the firm’s own R&D investments \(r_{i}\) and those of the other firm \(r_{j}\) according to \(T_{i}=r_{i}+\alpha r_{j}\), \(i,\,j=H,\,L\), \(i\ne j\). We consider spillovers between the two firms, as measured by \(\alpha \,\in \,(0,1)\). The state of technology affects abatement costs, such that \(C_{T}< 0 < C_{TT}\) and \(C_{x T}<0\). This means that a technological improvement lowers the level of abatement costs at a diminishing rate for any given level of abatement and that technical change lowers marginal abatement costs for all levels of abatement.Footnote 9 A unit of R&D investment comes at cost \(i\), where it holds that \(H>L\) (i.e., firm H is the high-cost and firm L is the low-cost firm).

2.2 The social optimum

The social planner seeks to minimize the expected social costs associated with pollution. These costs consist of abatement costs, expected harm, and R&D costs. Consequently, the social planner minimizes

with respect to R&D and abatement. The first-order conditions for interior solutions are

for \(i,\,j=H,L\), \(i\ne j\), where \(T^{\rm FB}_i=r^{\rm FB}_i+\alpha r^{\rm FB}_j\). First-best levels are denoted by the superscript ‘FB.’

The social planner takes into account that R&D by firm \(i\) entails a marginal benefit with respect to firm \(i\)’s abatement costs and, because of the technology spillover \(\alpha\), to those of firm \(j\) (see (2)). Condition (3) states that first-best abatement \(x^{\rm FB}_{i}\) is attained when marginal abatement costs are equal to the marginal reduction of environmental harm. Regarding the ranking of respective first-best levels, we obtain the intuitive order \(x^{\rm FB}_{\rm L}>x^{\rm FB}_{\rm H}\) and \(r^{\rm FB}_{\rm L}>r^{\rm FB}_{\rm H}\).Footnote 10

3 Decentralized decision making

We are now concerned with the implementation of the social optimum when private agents choose their behavior in a decentralized way subject to the two policy instruments environmental liability law and R&D subsidies. When applying the policy instruments, policy makers may have full information or not.

When the policy maker has information on both firm type (i.e., the firm’s R&D costs) and firm behavior (i.e., the firm’s equilibrium and abatement decisions), the joint use of environmental liability law and R&D subsidies can induce first-best firm activity levels. This is established in Endres et al. (2015). The R&D subsidy \(s^{\rm FB}_{i}\) that firm \(i\) obtains must internalize the technology spillover and thus lower firm \(i\)’s private marginal R&D costs by the marginal reduction in the other firm’s abatement costs (i.e., by \(s_{i}^{\rm FB}=-\alpha C_{T}(x^{\rm FB}_{j},T^{\rm FB}_{j})\)). Intuitively, the R&D subsidy granted to firm L is higher than that granted to firm H (i.e., that \(s^{\rm FB}_{\rm L}>s^{\rm FB}_{\rm H}\)).Footnote 11 In other words, low-cost firms obtain stronger incentives for R&D investment via the applicable subsidy.

Realistically, policy makers cannot observe firm type. This precludes having subsidies and negligence standards contingent on firm type. In the following analysis, we will discuss two ways of dealing with this informational constraint. First, it may be possible to disentangle firm types by designing policy instruments in such a way that firms self-select the abatement and R&D levels that are first-best for their types (Sect. 3.1). Second, policy makers may impose uniform policy measures on a population of heterogeneous agents (Sect. 3.2). The latter system implies a uniform R&D subsidy under strict liability, and both a uniform abatement standard and a uniform R&D subsidy under negligence. This dichotomy of policy implementations—screening versus uniform policy measures—is investigated to broaden the scope of the present study.Footnote 12

3.1 Screening firms

We will now discuss the possibility of screening polluting firms by means of environmental liability law and an R&D subsidy, focusing on the incentive compatibility of various scenarios.Footnote 13 Screening is possible when the policy maker can make two distinct offers to firms, one of which is preferable to firm L and the other, to firm H. We first turn to the case of strict liability.

3.1.1 Strict liability and R&D subsidies

Under strict liability, firms are required to compensate those harmed by their activities irrespective of how the activity was undertaken (see, e.g., Shavell 2007). This means that the policy maker cannot condition compensatory duties on the level of abatement. With respect to the R&D subsidy, however, it is possible to posit:

where \(s^{\rm FB}_{\rm L}\ge s_{\rm L}>s^{\rm FB}_{\rm H}\ge s_{\rm H}>0\). This function reflects a price–quantity relationship at firms. Here, as in other settings with self-selection (see, e.g., Laffont and Martimort 2002), the principal designs a scheme to separate types. In addition, in the present setup, the different firm types are interdependent, since the R&D investment made by firm type \(j\) influences firm \(i\)’s state of technology due to knowledge spillovers.

Assuming that firm H selects type-specific first-best R&D (i.e., \(r_{\rm H}=r^{\rm FB}_{\rm H}\)), firm L seeks to find \(\hbox {min}\{U_{\rm L},V_{\rm L},W_{\rm L}\}\), where

The cost level \(U_{\rm L}\) represents the minimal costs of firm L when it chooses \(r_{\rm L}=r^{\rm FB}_{\rm L}\) and is thus granted the subsidy \(s_{\rm L}\). The level of private costs \(V_{\rm L}\) represents minimal costs when firm L restricts R&D to the set \(R\). Alternatively, firm L may invest at a level \(r_{\rm L}<r_{\rm H}^{\rm FB}\) (\(W_{\rm L}\)). The high-cost firm faces similar options represented by the three cost levels \(U_{\rm H},\,V_{\rm H}\), and \(W_{\rm H}\).

As a next step, we specify the level \(s_{i}\) in (4). Since our interest lies in whether or not the first-best outcome is attainable in the presence of the three imperfections discussed, it is natural to assume that this level corresponds to \(s^{\rm FB}_{i}\). From this, it follows that \(U_{\rm L}=\hbox {min}\{U_{\rm L},V_{\rm L},W_{\rm L}\}\), such that firm L finds it cost-minimizing to select \(r^{\rm FB}_{\rm L}\). In other words, firm L has no incentives to mimic firm H. This is intuitive, since \((x^{\rm FB}_{\rm L},r^{\rm FB}_{\rm L})\) represents the global minimum of firm L’s private costs when \(s_{\rm L}=s^{\rm FB}_{\rm L}\). In contrast, firm H may find it profitable to imitate firm L. Firm H will choose between \((x^{\rm FB}_{\rm H},r^{\rm FB}_{\rm H})\) and \(({\bar{x}}(r^{\rm FB}_{\rm L}(1+\alpha )),r^{\rm FB}_{\rm L})\), where \({\bar{x}}(T)=\hbox {arg min}\{C(x,T)+D(x)\}\). The following condition would have to hold for firm type separation to be successful:Footnote 14

with \(s_{i}=s_{i}^{\rm FB}\).

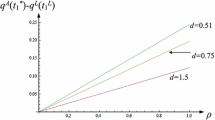

It is central to this analysis that firms differ in their R&D costs. Firm H requires higher compensation in terms of a higher subsidy for a given increase in R&D than firm L does in order for private cost to remain constant. This fact can be illustrated in the \((r_{i},s)\)-space. Using \(C({\bar{x}}_{i}(T_{i}),T_{i})+D(\bar{x}_{i}(T_{i}))+(i-s)r_{i}\), we find that the slope of firm \(i\)’s isocost curve is \(\hbox {d}s/\hbox {d}r_{i}=(C_{T_{i}}+i-s)/r_{i}\). This clearly establishes that the so-called single-crossing property is fulfilled (see, e.g., Laffont and Martimort 2002). Starting from an intersection of an isocost curve of firm L and one of firm H in the \((r_{i},s)\)-space, there is an area between these isocost curves to the right of the intersection that comprises combinations of subsidy and firm R&D that imply lower costs only for firm L (see Fig. 1). The stylized isocost curve \(\hbox {IC}_{\rm H}\) is horizontal at \((r^{\rm FB}_{\rm H},s^{\rm FB}_{\rm H})\), since this R&D level is cost-minimizing for firm H given the level of the subsidy. In contrast, the isocost curve of the low-cost firm \(\hbox {IC}_{\rm L}\) is downward-sloping at \((r^{\rm FB}_{\rm H},s^{\rm FB}_{\rm H})\), because firm L finds it cost-minimizing to choose a higher level of R&D than \(r^{\rm FB}_{\rm H}\) when \(s=s^{\rm FB}_{\rm H}\). The separation of types can succeed when the combination \((r^{\rm FB}_{\rm L},s^{\rm FB}_{\rm L})\) is an element of the set of combinations between the respective isocost curves. In this case, firm L is better off choosing \((r^{\rm FB}_{\rm L},s^{\rm FB}_{\rm L})\), while firm H’s costs are lower at \((r^{\rm FB}_{\rm H},s^{\rm FB}_{\rm H})\).

R&D at level \(r^{\rm FB}_{\rm L}\) is not firm H’s best response, given both \(s=s^{\rm FB}_{\rm L}\) and \(r_{\rm L}=r^{\rm FB}_{\rm L}\). Referring to Fig. 1, there is an isocost curve for firm H that is upward-sloping at \((r^{\rm FB}_{\rm L},s^{\rm FB}_{\rm L})\), while the slope of the corresponding isocost curve of firm L is equal to zero. If the high-cost firm could choose its best response and still obtain \(s^{\rm FB}_{\rm L}\), firm H would be more likely to invest more in R&D than \(r^{\rm FB}_{\rm H}\), because this would signify a higher transfer with the opportunity to optimally adapt R&D. However, as the level \(r^{\rm FB}_{\rm L}\) is optimal only for the low-cost firm, the high-cost firm would have to tolerate a level of R&D that is not optimal for firm H given the circumstances to obtain the high subsidy level.

The preceding analysis allows us to state the following result:

Proposition 1

Assume that firm type is private information. Then, the joint use of strict liability and the subsidy scheme \(s^{S}\) that uses \(s^{\rm FB}_{i}\) induces firms to choose socially optimal abatement and R&D when condition (11) holds.

Proof

It is incentive compatible for firm L to select \((x^{\rm FB}_{\rm L},r^{\rm FB}_{\rm L})\), given that firm H chooses \(r^{\rm FB}_{\rm H}\). Firm H chooses \((x^{\rm FB}_{\rm H},r^{\rm FB}_{\rm H})\), given that firm L chooses \(r^{\rm FB}_{\rm L}\) when condition (11) is fulfilled. \(\square\)

Example

Assume the following specification: Abatement costs are \(C(x_{i},T_{i})=\frac{2{,}500 x_{i}^2}{\sqrt{T_{i}}+1}\), where \(\alpha =0.2\), R&D costs are \(L=1\) and \(H=2\), and environmental harm is \(D(x_{i})=60/x_{i}\) for \(i,\,j=1,\,2\), \(i\ne j\). This leads to first-best abatement and R&D levels for the low-cost and high-cost firm, \((x^{\rm FB}_{\rm L},\,r^{\rm FB}_{\rm L})=(0.45,\,44.61)\) and \((x^{\rm FB}_{\rm H},\,r^{\rm FB}_{\rm H})=(0.39,\,7.41)\), respectively. The first-best levels for the R&D subsidy are given by \(s^{\rm FB}_{\rm L}=0.375\) and \(s^{\rm FB}_{\rm H}=0.125\). Under these circumstances, the incentive compatibility constraint for firm H, condition (11), is fulfilled.

3.1.2 Negligence and R&D subsidies

Under negligence, the polluter is obliged to compensate harm done if there has been a breach of a behavioral duty. If firm’s cost levels were verifiable, it would be possible to address a lower behavioral standard at firm H than at firm L. In other words, firm H would be judged non-negligent at a level of abatement at which firm L would still be judged negligent. With regard to the screening of different firm types under incomplete information, we consider the possibility of partial liability, such that intermediate abatement levels entail a positive level of liability short of the total level of harm. There are aspects of real-world tort law that correspond to allowing the level of liability to decrease with the behavioral standard adhered to by firms (see, e.g., Miceli 2006).

Firm \(i\) seeks to minimize

by finding privately optimal behavior in view of two step-wise functions given by the liability level

with \(\delta \in (0,1)\) and (4) with \(s_{i}=s^{\rm FB}_i\) (i.e., the R&D subsidy function used in the analysis of strict liability).

In contrast to our analysis of strict liability, firm L does not necessarily choose \((x^{\rm FB}_{\rm L},r^{\rm FB}_{\rm L})\). For example, the fact that intermediate levels of abatement imply only liability \(\delta D\) weakens the firm’s incentive to select \(x^{\rm FB}_{\rm L}\) in comparison to the full information benchmark. There are three possible ways for firm L to behave: (a) \(x_{\rm L}=x^{\rm FB}_{\rm L}\) and \(r_{\rm L}=r^{\rm FB}_{\rm L}\), (b) \(x_{\rm L}\in X\) and \(r_{\rm L}=r^{\rm FB}_{\rm L}\), and (c) \(x_{\rm L}\in X\) and \(r_{\rm L}\in R\).Footnote 15

Defining \(K_{\rm L}=C(x^{\rm FB}_{\rm L},T^{\rm FB}_{\rm L})+(L-s^{\rm FB}_{\rm L})r^{\rm FB}_{\rm L}\) as the level of private costs incurred by firm L when applying first-best activity levels, firm L prefers \((x^{\rm FB}_{\rm L},r^{\rm FB}_{\rm L})\) to \(x_{\rm L}\in X\) and \(r_{\rm L}=r^{\rm FB}_{\rm L}\) when

Firm L prefers \((x^{\rm FB}_{\rm L},r^{\rm FB}_{\rm L})\) to \(x_{\rm L}\in X\) and \(r_{\rm L}\in R\) when

It is clear that \(B_{1}\) and \(B_{2}\) increase with \(\delta\) and are greater than zero when \(\delta =1\). As a result, there exists a range of values for the factor \(\delta\) consisting of levels that ensure that firm L selects \((x^{\rm FB}_{\rm L},r^{\rm FB}_{\rm L})\). It is intuitive that \(\delta\) must be sufficiently large to not tempt firm L to deviate from first-best abatement.

We now analyze firm H. There are four possible ways in which firm H can be expected to behave: (a) \(x_{\rm H}=x^{\rm FB}_{\rm H}\) and \(r_{\rm H}=r^{\rm FB}_{\rm H}\), (b) \(x_{\rm H}=x^{\rm FB}_{\rm L}\) and \(r_{\rm L}\in R\), (c) \(x_{\rm H}\in X\) and \(r_{\rm H}=r^{\rm FB}_{\rm L}\), and (d) \(x_{\rm H}=x^{\rm FB}_{\rm L}\) and \(r_{\rm H}=r^{\rm FB}_{\rm L}\).Footnote 16

Defining \(K_{\rm H}=C(x^{\rm FB}_{\rm H},T^{\rm FB}_{\rm H})+\delta D(x^{\rm FB}_{\rm H})+(H-s^{\rm FB}_{\rm H})r^{\rm FB}_{\rm H}\) as the level of private costs incurred by firm H when applying first-best activity levels, firm H prefers \((x^{\rm FB}_{\rm H},r^{\rm FB}_{\rm H})\) to \(x_{\rm H}=x^{\rm FB}_{\rm L}\) and \(r_{\rm L}\in R\) when

Firm H prefers \((x^{\rm FB}_{\rm H},r^{\rm FB}_{\rm H})\) to \(x_{\rm H}\in X\) and \(r_{\rm H}=r^{\rm FB}_{\rm L}\) when

Firm H prefers \((x^{\rm FB}_{\rm H},r^{\rm FB}_{\rm H})\) to \(x_{\rm H}=x^{\rm FB}_{\rm L}\) and \(r_{\rm H}=r^{\rm FB}_{\rm L}\) when

It holds that \(B_{3}\) to \(B_{5}\) decrease with \(\delta\). It is intuitive that \(\delta\) must be sufficiently small to not tempt firm H to deviate from first-best abatement. In contrast to the conditions derived for firm L, it may be that the conditions that result from firm H’s optimization cannot be fulfilled for any \(\delta\) between zero and one.

Defining \(\bar{\delta }_{k}\) as the level of \(\delta\) that entails that \(B_{i}=0\), \(k=1,\ldots ,5\), we can state the following result:

Proposition 2

Assume that firm type is private information. The joint use of negligence and R&D subsidies induces firms to choose socially optimal abatement and R&D levels when \(\min \{\bar{\delta }_k\}_{k=3,4,5}\ge \delta \ge \max \{\bar{\delta }_k\}_{k=1,2}\).

Proof

Follows from the above. \(\square\)

The above analysis establishes that the policy maker may be able to induce first-best decisions under negligence even though firms’ costs are private information.

Example

Consider again the functional specifications used in the discussion of strict liability: Abatement costs are \(C(x_{i},T_{i})=\frac{2{,}500 x_{i}^2}{\sqrt{T_{i}}+1}\), where \(\alpha =0.2\), R&D costs are \(L=1\) and \(H=2\), and environmental harm is \(D(x_{i})=60/x_{i}\) for \(i,\,j=1,\,2\), \(i\ne j\). It results that negligence can induce each firm type to self-select the activity levels that are socially optimal for their type if \(\delta\) is chosen according to \(\delta \in [0.11,0.16]\).

3.1.3 Comparing strict liability and negligence

Under negligence, the policy maker has more levers to adjust firm payoffs in the different contingencies to make first-best activity levels incentive compatible for firms. Under strict liability, the policy maker can only use the two levels of the R&D subsidy; firms then behave privately optimally given the two levels of the subsidy. In contrast, under negligence, the policy maker additionally erects abatement standards and may choose to impose an intermediate level of liability for intermediate levels of abatement. Firms’ optimization then comes closer to choosing among different packages of activity levels predefined by the policy maker. This suggests that whenever the socially optimal activity levels are a Nash equilibrium under strict liability, the socially optimal activity levels can also be induced under the negligence rule by choosing an adequate level of \(\delta\). However, it must be noted that when firm L is subject to negligence rather than strict liability, it is no longer necessarily immune to choosing behavior different from the first-best levels (as is clear from \(B_{1}\) and \(B_{2}\)).

We will now illustrate the importance of the relative advantage of negligence just described for the example considered throughout, where \(C(x_{i},T_{i})=\frac{2,500 x_{i}^2}{\sqrt{T_{i}}+1}\), \(L=1\), and \(D(x_{i})=60/x_{i}\). Figure 2 describes a parametric space by variations of the technology spillover parameter and the level of marginal R&D costs of the high-cost firm. For any level of the technology spillover considered, it turns out that it is impossible to induce the first-best outcome with either strict liability or negligence when the difference in marginal R&D costs vanishes (i.e., when \(H\) is too small). Almost indistinguishable marginal R&D costs lead to very similar states of technology, which make comparable levels of abatement privately optimal. In consequence, imitating the other cost type requires very little change in behavior from what would be optimal for the own type. For the negligence regime, deriving the (im-)possibility of inducing the first-best outcome for a given combination of \(\alpha\) and \(H\) implies checking the conditions (14)–(18) for any possible division of harm between the firm and victims (i.e., for \(\delta \in (0,1)\) ). In this search, a lower boundary of \(\delta\) ensures that the low-cost firm is not tempted to choose a different abatement level and an upper boundary of \(\delta\) prevents the high-cost firm from trying to avoid all liability by exerting the high level of abatement. For intermediate levels of marginal R&D costs of the high-cost firm, only negligence can implement the first-best levels of abatement and R&D investment (taking the appropriate choice of \(\delta\) for granted). Finally, for any level of the technology spillover, it results that it is possible to induce the first-best outcome with both strict liability and negligence when the difference in marginal R&D costs is sufficiently great (i.e., when \(H\) is high).

3.2 Uniform policy

In practice, policy instruments are often set at levels that are optimal given the total set of heterogeneous firms. In this section, we discuss the optimal level of such uniform policy instruments.

3.2.1 Strict liability and uniform R&D subsidies

For our analysis, we assume the following game: (1) The policy maker determines the R&D subsidy, cognizant of the spillover \(\alpha\). (2) Firms simultaneously choose the extent of R&D. (3) Firms simultaneously select abatement. We solve the game backwards.

Firm \(i\) chooses abatement at Stage 3 given the abatement technology \(T_{i}\) such that the first-order condition

is fulfilled. At Stage 2, firm \(i\) minimizes private costs by choosing the R&D investment \(r_{i}\) that, given the R&D investment by the other firm and the anticipated level of abatement at Stage 3 \(\bar{x}_{i}(T_{i})\), fulfills

It is unambiguous that \(\hbox {d}r^*_{\rm L}/\hbox {d}s+\hbox {d}r^*_{\rm H}/\hbox {d}s>0\). With respect to individual levels, one must differentiate between a direct and an indirect effect.Footnote 17

The policy maker anticipates the privately optimal activity levels, realizing the direct impact of subsidies on R&D and the indirect impact on abatement. We may state the objective function of the policy maker as follows:

where \(x^*_i\) and \(r^*_i\) denote privately optimal abatement and R&D by firm \(i\), and \(T^*_i=r^*_i(s)+\alpha r^*_j(s)\) represents the resulting state of technology. The first-order condition for the uniform R&D subsidy results as

where the simplification uses (19) and (20). As a result, the uniform R&D subsidy in the case of strict liability can be implicitly defined by

The statement in (23) makes clear that the subsidy is a weighted average of the individual marginal effects due to R&D that are not internalized by private firms. The total change in R&D levels is given by \(\hbox {d}r^*_{\rm L}/\hbox {d}s+\hbox {d}r^*_{\rm H}/\hbox {d}s\). The two changes are not equally important, which is reflected by the nominator: a given change \(\hbox {d}r^{*}_{i}/\hbox {d}s\) is weighted by the impact of relevance for the social cost minimization, \(C_{T_j}\).

Proposition 3

The socially optimal uniform R&D subsidy to be used with strict liability, \(s^{\rm SL}\), is implicitly defined by (23).

Proof

Follows from the above. \(\square\)

Example

Abatement costs are \(C(x_{i},T_{i})=\frac{2,500 x_{i}^2}{\sqrt{T_{i}}+1}\), where \(\alpha =0.2\), R&D costs are \(L=1\) and \(H=1.2\), and environmental harm is \(D(x_{i})=60/x_{i}\) for \(i,\,j=1,\,2\), \(i\ne j\). This leads to first-best abatement and R&D levels for the low-cost and high-cost firm, \((x^{\rm FB}_{\rm L},\,r^{\rm FB}_{\rm L})=(0.44,\,32.589)\) and \((x^{\rm FB}_{\rm H},\,r^{\rm FB}_{\rm H})=(0.424,\,22.099)\), respectively. The first-best levels for the R&D subsidy are given by \(s^{\rm FB}_{\rm L}=0.208\) and \(s^{\rm FB}_{\rm H}=0.158\). When strict liability applies, the socially optimal uniform R&D subsidy is \(s^{\rm SL}=0.188\). With regard to firm behavior, we obtain \((x_{\rm L},\,r_{\rm L})=(0.438,\,31.524)\) and \((x_{\rm H},\,r_{\rm H})=(0.426,\,23.102)\), while the level of social costs is \(\hbox {SC}=476.113\).

In the pursuit of minimal social costs, the policy maker sets \(s^{\rm SL}\) at Stage 1, given the way in which firms of type L and H reach their private cost minimum, inducing firm \(i\)’s abatement and research level to be \((x^*_i(s^{\rm SL}),\,r^*_i(s^{\rm SL}))\). It is important to note that the uniform subsidy still allows for type-specific abatement and research levels. All else held equal (i.e., for given abatement levels and states of technology), the uniform R&D subsidy will fall short of \(s^{\rm FB}_{\rm L}\) but exceed \(s^{\rm FB}_{\rm H}\) as it is a convex combination. The effect this entails for the respective states of technology may be stated as \(\hbox {d}T_{i}=\hbox {d}r^*_i+\alpha \hbox {d}r^*_j\), where \(\hbox {d}r^*_{\rm L}=-\int _{s^{\rm SL}}^{s^{\rm FB}_{\rm L}}\hbox {d}r^*_{\rm L}/\hbox {d}s\, \hbox {d}s\) and \(\hbox {d}r^*_{\rm H}=\int _{s^{\rm FB}_{\rm H}}^{s^{\rm SL}}\hbox {d}r^*_{\rm H}/\hbox {d}s\, \hbox {d}s\). It can be expected that the uniform R&D subsidy will mean that \(\hbox {d}T_{\rm L}<0\) and \(\hbox {d}T_{\rm H}>0\) in contrast to the outcome under perfect information.

3.2.2 Negligence and uniform R&D subsidies

Under negligence, uniform policy instruments in our setup imply a uniform abatement standard and a uniform R&D subsidy. The timing is given as: (1) The policy maker determines the level of the uniform R&D subsidy \(s^N\) and the uniform abatement standard \(x^N\). (2) Firms simultaneously choose the extent of R&D investment. (3) Firms simultaneously decide on their level of abatement.

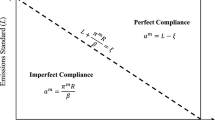

The abatement standard \(x^N\) will be more moderate in what it requests from firm L than the type-specific standard, all else held equal, because the uniform standard takes the state of both firms’ abatement technologies into account. In this case, firm L can be expected to comply with the behavioral standard, whereas firms of type H might not want to implement the required level of abatement. Compliance with \(x^N\) will be cost-minimizing for a firm of type H if

where \(x^+_{\rm H}\) and \(r^+_{\rm H}\) are cost-minimizing given \(s^N\), the liability burden, and \(\bar{\bar{r}}_{i}=\hbox {arg min}_{r_{i}}\{C(x^N,r_i+\alpha \bar{\bar{r}}_j)+(i-s^N)r_i\}\). This condition need not hold. In such a case, firm L would adhere to prescribed abatement while firm H would not, and this outcome at Stage 3 would be anticipated at Stage 2. For concreteness, we will focus on the case in which both firm types comply with \(x^N\). This results because the abatement standard is now also a regulatory one, such that a breach implies regulatory repercussions in addition to civil liability (as discussed in Sect. 1).

At Stage 2, firm \(i\) chooses the level of R&D simultaneously with firm \(j\). The condition determining the privately optimal level of R&D when both firms plan to obey the abatement standard is given by

The privately optimal R&D is thus a function of the R&D subsidy \(s^N\) (because this subsidy influences marginal R&D costs) and of the abatement standard (since this standard influences marginal R&D benefits).Footnote 18 In this regard, it is again unambiguous that \(\frac{\hbox {d}\bar{\bar{r}}_{\rm L}}{\hbox {d}s^N}+\frac{\hbox {d}\bar{\bar{r}}_{\rm H}}{\hbox {d}s^N}>0\). In other words, the policy maker will under all circumstances induce a higher total level of research investment by increasing the level of the subsidy. A similar argument applies to the comparative statics with respect to changes in the abatement standard \(x^N\).

At Stage 1, the policy maker arrives at \(x^N\) and \(s^N\) by minimizing

where \(\bar{\bar{T}}_{i}=\bar{\bar{r}}_{i}(s^{N})+\alpha \bar{\bar{r}}_{j}(s^{N})\). The first-order conditions that must be fulfilled at the social optimum are given by

The condition (27) clearly establishes that the abatement standard averages the marginal abatement costs resulting from the respective states of technology. With regard to the optimal level of the R&D subsidy, the condition (28) can be rearranged as

This implicit definition of the uniform R&D subsidy is structurally similar to the implicit definition in the case of strict liability. The central difference lies in the fact that both firms anticipate abating according to the standard \(x^N\), whereas under strict liability they planned to implement different abatement levels.

Proposition 4

Under negligence, given that both firm types obey the abatement standard, the policy maker chooses the socially optimal uniform R&D subsidy \(s^{N}\) implicitly defined in (29) and the socially optimal abatement level \(x^N\) implicitly defined in (27); this usage induces firm \(i\)’s abatement and R&D to be \((x^N,\,\bar{\bar{r}}_i(s^{N},x^N))\).

Proof

Follows from the above. \(\square\)

Example

Abatement costs are \(C(x_{i},T_{i})=\frac{2,500 x_{i}^{2}}{\sqrt{T_{i}}+1}\), where \(\alpha =0.2\), R&D costs are \(L=1\) and \(H=1.2\), and environmental harm is \(D(x_{i})=60/x_{i}\) for \(i,\,j=1,\,2\), \(i\ne j\). This leads to first-best abatement and R&D levels for the low-cost and high-cost firm, \((x^{\rm FB}_{\rm L},\,r^{\rm FB}_{\rm L})=(0.44,\,32.589)\) and \((x^{\rm FB}_{\rm H},\,r^{\rm FB}_{\rm H})=(0.424,\,22.099)\), respectively. The first-best levels for the R&D subsidy are given by \(s^{\rm FB}_{\rm L}=0.208\) and \(s^{\rm FB}_{\rm H}=0.158\). When negligence applies, the socially optimal abatement level is \(x^{N}=0.432\) and the socially optimal uniform R&D subsidy is \(s^{N}=0.188\). With regard to firm behavior, we obtain \((x_{\rm L},\,r_{\rm L})=(0.432,\,30.603)\) and \((x_{\rm H},\,r_{\rm H})=(0.432,\,23.949)\), while the level of social costs is \(\hbox {SC}=476.219\).

Both firms will abide by the uniform abatement standard as long as it is not too demanding for firm H. As a result, both firm types choose the same abatement level. In contrast, the privately optimal R&D levels will vary between firms. Although the marginal benefits of R&D are no longer different if both firms plan to abate exactly \(x^N\), the difference in R&D costs still creates a divergence between \(\bar{\bar{r}}_{\rm L}\) and \(\bar{\bar{r}}_{\rm H}\).

3.2.3 Comparing strict liability and negligence

The above analysis suggests that negligence is inferior to strict liability if policy instruments cannot be made contingent on firm type. This is confirmed by the example used in Sects. 3.2.1 and 3.2.2. Whereas the uniform R&D subsidy under strict liability allows for firm-specific R&D investment and abatement levels, the use of both uniform R&D subsidies and abatement standards under negligence no longer admits variance in abatement when both firm types obey the norm. As a result, firm behavior is tailored to firm type to a lesser degree under negligence, which conflicts with efficiency requirements.

4 Conclusion

This paper analyzes R&D in pollution control technology and abatement decisions by polluting firms that are subject to environmental liability law and are granted R&D subsidies. The two externalities present in our framework (the pollution externality and the externality due to knowledge spillovers) can be offset when the policy maker has access to perfect information. In this case, both liability rules considered can be used to obtain first-best decisions by private actors. This symmetry between liability rules no longer holds when we allow for the more realistic scenario of secrecy regarding firms’ costs. In the present paper, we consider two different policy settings. First, the policy maker can graduate the policy instruments trying to screen firms. Under strict liability, this implies setting subsidies in combination with R&D thresholds to make it incentive compatible for firms to choose first-best abatement and R&D. Under negligence, the policy maker does not only set subsidies in combination with R&D thresholds but also due-abatement standards. We argue that the greater set of policy measures available to the policy maker under negligence makes it more likely that first-best levels can be induced in that legal setting. Second, we address the possibility of using uniform policy levels for a heterogeneous population of firms; that is, a uniform subsidy under strict liability and both a uniform subsidy and a uniform abatement standard under negligence. In this context, the multitude of policy levers available to the policy maker becomes a disadvantage, since they are all set at the ‘average’ level. Consequently, if firms stick to the behavioral prescription, firm abatement levels are no longer tailored to different levels of abatement costs. Consequently, strict liability suggests itself as superior to negligence in the setting where uniform policy is applied.

Notes

In this paper, we assume technical change to be the result of investment in R&D. An alternative assumption might be that technical progress is achieved via learning by doing. See Clark et al. (2008) for more on the economic theory of these alternative assumptions and on their practical applications.

The practical importance of environmental liability is evident in many real-world contexts. For instance, the 1988 Exxon Valdez disaster prompted the 1990 Oil Pollution Act, under which the owners of tankers involved in oil spills in US waters face massive liability. Another example is the Deepwater Horizon oil spill catastrophe which occurred in April 2010 in the Gulf of Mexico. At that time, eleven workers lost their lives to a fire on the platform and about 800 million liters of oil were spilled into the Gulf. To date, British Patrol paid damages of 3.84 billion USD. The company expects to be liable for more than another 5 billions USD (see Kennedy and Cheong 2013). In addition to such notorious cases, liability law is similarly important in smaller cases. A well-researched case-in-point is litigation based on the US “Superfund” legislation. For instance, Chang and Sigman (2007, 2014) have recently conducted empirical research related to this issue.

For instance, the Environmental Liability Directive of the European Union (Directive 2004/35/CE) lists activities subject to strict liability; other activities are subject to negligence.

R&D subsidies are often provided by means of tax credits and are commonly used in the United States, the United Kingdom, and Germany, among other countries.

We focus on regulatory effects resulting from environmental liability law and thus abstract from strategic effects resulting from market interactions (which are dealt with in, e.g., Puller (2006)).

The authors gratefully acknowledge the useful information and insightful discussion that Prof. Michael Faure, LL.M., University of Maastricht, provided on this issue in personal communication.

An overview of instruments to cope with the problem of spillovers is provided by Martin and Scott (2000).

Endres et al. (2008) similarly consider technology spillovers and environmental liability law. However, there are two central differences that set the present paper apart. First, we allow for a second policy instrument besides environmental liability law, namely R&D subsidies. Second, we incorporate heterogeneous firms with private cost structure information.

Progress in abatement technology is usually modeled as a downward shift in marginal abatement costs. Recently, it has been argued that some technical change can differently affect marginal abatement costs (see Amir et al. 2008; Bauman et al. 2008; Bréchet and Jouvet 2008; Baker et al. 2006, 2008; Baker and Adu-Bonnah 2008; Baker and Shittu 2006, 2008; Endres and Friehe 2013). For simplicity, we focus on the “traditional” kind of technical change. Another stylization assumes technical change to have an impact on environmental damage in addition to the one on abatement cost (see Endres and Friehe 2012 as well as Jacob 2015 for this variant which is ignored in the present paper for simplicity).

This is shown in Appendix 1.

This is established in Appendix 2.

However, we confine our analysis of the screening scenario to the case of “perfect screening.” How the policy maker may screen firms without insisting on implementation of first-best abatement and R&D levels is a topic left for future research.

In a related analysis, Friehe (2009) discusses a policy maker seeking to screen accident victims with different harm levels in a tort setting.

For a more detailed formal argument, see Appendix 3.

See Appendix 4 for a formal argument.

See Appendix 5 for a formal argument.

See Appendix 6 for a derivation.

See Appendix 7 for a derivation.

References

Allan C, Jaffe AB, Sin I (2014) Diffusion of green technology: a survey. Int Rev Environ Resour Econ 7:1–33

Amir R, Germain M, van Steenberghe V (2008) On the impact of innovation on the marginal abatement cost curve. J Public Econ Theory 10:985–1010

Baker E, Clarke L, Weyant J (2006) Optimal technology R&D in the face of climate uncertainty. Clim Change 78:157–179

Baker E, Shittu E (2006) Profit-maximizing R&D in response to a random carbon tax. Resour Energy Econ 28:160–180

Baker E, Adu-Bonnah K (2008) Investment in risky R&D programs in the face of climate uncertainty. Energy Econ 30:465–486

Baker E, Clarke L, Shittu E (2008) Technical change and the marginal cost of abatement. Energy Econ 30:2799–2816

Baker E, Shittu E (2008) Uncertainty and endogenous technical change in climate policy models. Energy Econ 30:2817–2828

Bartsch E (1997) Legal claims for environmental damages under uncertain causality and asymmetric information. Finanzarchiv 54:68–88

Bauman Y, Lee M, Seeley K (2008) Does technological innovation really reduce marginal abatement costs? Some theory, algebraic evidence, and policy implications. Environ Resour Econ 39:507–527

Bennear LS, Stavins RN (2007) Second-best theory and the use of multiple policy instruments. Environ Resour Econ 37:111–129

Bentata P, Faure M (2012) The role of environmental civil liability: an economic analysis of the French legal system. Environ Liabil 20:120–128

Bentata P (2014) Liability as a complement to environmental regulation: an empirical study of the French legal system. Environ Econ Policy Studies 16:201–228

Bréchet T, Jouvet PA (2008) Environmental innovation and the cost of pollution abatement revisited. Ecol Econ 65:262–265

Burrows P (1999) Combining regulation and legal liability for the control of external costs. Int Rev Law Econ 19:227–244

Calcott P, Hutton S (2006) The choice of a liability regime when there is a regulatory gatekeeper. J Environ Econ Manag 51:153–164

Chang HF, Sigman H (2007) The effect of joint and several liability under superfund on brownfields. Int Rev Law Econ 27:363–384

Chang HF, Sigman H (2014) An empirical analysis of cost recovery in superfund cases: implications for brownfields and joint and several liability. J Empir Legal Studies 11:477–504

Clark C, Weyant J, Edmonds J (2008) On the sources of technological change: what do the models assume? Energy Econ 30:409–424

Cropper ML, Oates WE (1992) Environmental economics: a survey. J Econ Lit 30:675–740

Endres A, Bertram R (2006) The development of care technology under liability law. Int Rev Law Econ 26:503–518

Endres A, Bertram R, Rundshagen B (2007) Environmental liability and induced technical change—the role of discounting. Environ Resour Econ 36:341–366

Endres A, Rundshagen B, Bertram R (2008) Environmental liability law and induced technical change—the role of spillovers. J Inst Theor Econ 164:254–279

Endres A (2011) Environmental Economics—theory and policy. Cambridge University Press, Cambridge

Endres A, Friehe T (2011a) R&D and abatement under environmental liability law: comparing incentives under strict liability and negligence if compensation differs from harm. Energy Econ 33:419–425

Endres A, Friehe T (2011b) Incentives to diffuse advanced abatement technology under environmental liability law. J Environ Econ Manag 62:30–40

Endres A, Friehe T (2012) Generalized progress of abatement technology: incentives under environmental liability law. Environ Resour Econ 53:61–71

Endres A, Friehe T (2013) Led on the wrong track? A note on the direction of technical change under environmental liability law. J Public Econ Theory 15:506–518

Endres A, Rundshagen B (2013) Incentives to diffuse advanced abatement technology under the formation of international environmental agreements. Environ Resour Econ 56:177–210

Endres A, Friehe T, Rundshagen B (2015) “It’s all in the mix!” Internalizing externalities with R&D subsidies and environmental liability. Soc Choice Welfare 44:151–178

Faure M (2007) Economic analysis of tort and regulatory law. In: van Boom WH, Lukas M, Kissling C (eds) Tort and regulatory law. Springer, Berlin, pp 399–415

Faure M (2014) The complementary roles of liability, regulation and insurance in safety management: theory and practice. J Risk Res 17:689–707

Faure M, Van den Bergh R (1987) Negligence, strict liability and regulation of safety under belgian law: an introductory economic analysis. Geneva Papers Risk Insur 12:95–114

Faure M, Wang H (2010) Civil liability and compensation for marine pollution - lessons to be learned for offshore oil spills. Oil Gas Energy Law Intell 8:1–27

Fischer C, Newell RG (2008) Environmental and technology policies for climate mitigation. J Environ Econ Manag 55:142–162

Fischer C, Parry IWH, Pizer WA (2003) Instrument choice for environmental protection when technological innovation is endogenous. J Environ Econ Manag 45:523–545

Friehe T (2009) Screening accident victims. Int Rev Law Econ 29:272–280

Jacob J (2015) Innovation in risky industries under liability law: the case of double-impact innovations. J Inst Theor Econ (forthcoming)

Jaffe AB, Newell RG, Stavins RN (2005) A tale of two market failures: technology and environmental policy. Ecol Econ 54:164174

Katsoulacos Y, Xepapadeas A (1996) Environmental innovation, spillovers and optimal policy rules. In: Carraro C, Katsoulacos Y, Xepapadeas A (eds) Environmental policy and market structure. Kluwer, Dordrecht, pp 143–150

Kennedy CJ, Cheong S (2013) Lost ecosystem services as a measure of oil spill damages: a conceptual analysis of the importance of baselines. J Environ Manag 128:43–51

Laffont JJ, Martimort D (2002) The theory of incentives. Princeton University Press, Princeton

Martin S, Scott JT (2000) The nature of innovation market failure and the design of public support for private innovation. Res Policy 29:437–447

Miceli TJ (2006) On negligence rules and self-selection. Rev Law Econ 2 (Article 1)

Parry IWH (1998) Pollution regulation and the efficiency gains from technological innovation. J Regul Econ 14:229–254

Parry IWH (2003) On the implications of technological innovation for environmental policy. Environ Dev Econ 8:57–76

Puller SL (2006) The strategic use of innovation to influence regulatory standards. J Environ Econ Manag 52:690–706

Requate T, Unold W (2003) Environmental policy incentives to adopt advanced abatement technology: will the true ranking please stand up? Eur Econ Rev 47:125–176

Requate T (2005) Dynamic incentives by environmental policy instruments—a survey. Ecol Econ 54:175–195

Shavell S (2007) Liability for Accidents. In: Polinsky AM, Shavell S (eds) Handbook of law and economics 1. Elsevier, Amsterdam, pp 139–182

Ulph A, Ulph D (2007) Climate change—environmental and technology policies in a strategic context. Environ Resour Econ 37:159–180

Xepapadeas A (1997) Advanced principles in environmental policy. Edward Elgar, Cheltenham

Youssef SB, Zaccour G (2014) Absorptive capacity, R&D-spillovers, emissions taxes and R&D subsidies. Strateg Behav Environ 4:41–58

Acknowledgments

The authors are indebted to Michael Faure, University of Maastricht, Frederik Schaff, University of Hagen, the editor-in-charge, Takayoshi Shinkuma, and two anonymous referees for their helpful comments on an earlier draft of this paper.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

In Sect. 2, we propose that \(x^{\rm FB}_{\rm L}>x^{\rm FB}_{\rm H}\) and \(r^{\rm FB}_{\rm L}>r^{\rm FB}_{\rm H}\). This may be established by assuming otherwise and showing a contradiction.

-

(i)

Suppose that \(x^{\rm FB}_{\rm L}<x^{\rm FB}_{\rm H}\), then \(C_x(x^{\rm FB}_{\rm L},T^{\rm FB}_{\rm L})=-D'(x^{\rm FB}_{\rm L})>-D'(x^{\rm FB}_{\rm H})=C_{x}(x^{\rm FB}_{\rm H},T^{\rm FB}_{\rm H})\) holds using (3). Given that \(C_{xx}>0\), \(C_x(x^{\rm FB}_{\rm H},T^{\rm FB}_{\rm H})> C_x(x^{\rm FB}_{\rm L},T^{\rm FB}_{\rm H})\). This leads to \(C_x(x^{\rm FB}_{\rm L},T^{\rm FB}_{\rm L})>C_x(x^{\rm FB}_{\rm L},T^{\rm FB}_{\rm H})\). This would imply that \(T^{\rm FB}_{\rm L}<T^{\rm FB}_{\rm H}\) (i.e., that \(r^{\rm FB}_{\rm H}>r^{\rm FB}_{\rm L}\)) because \(C_{xT}<0\). Social costs cannot be minimal at such a vector of individual behavior \((x_{\rm L},x_{\rm H},r_{\rm L},r_{\rm H})=(x^{\rm FB}_{\rm L},x^{\rm FB}_{\rm H},r^{\rm FB}_{\rm L},r^{\rm FB}_{\rm H})\) because costs would be lower when firms behave according to \((x_{\rm L},x_{\rm H},r_{\rm L},r_{\rm H})=(x^{\rm FB}_{\rm H},x^{\rm FB}_{\rm L},r^{\rm FB}_{\rm H},r^{\rm FB}_{\rm L})\). In detail, we obtain

$$\begin{aligned}&C\left( x^{\rm FB}_{\rm L},T^{\rm FB}_{\rm L}\right) +D\left( x^{\rm FB}_{\rm L}\right) +Lr^{\rm FB}_{\rm L}+C\left( x^{\rm FB}_{\rm H},T^{\rm FB}_{\rm H}\right) +D\left( x^{\rm FB}_{\rm H}\right) +Hr^{\rm FB}_{\rm H} \nonumber \\&\qquad -\left( C\left( x^{\rm FB}_{\rm H},T^{\rm FB}_{\rm H}\right) +D\left( x^{\rm FB}_{\rm H}\right) +Lr^{\rm FB}_{\rm H}+C\left( x^{\rm FB}_{\rm L},T^{\rm FB}_{\rm L}\right) +D\left( x^{\rm FB}_{\rm L}\right) +Hr^{\rm FB}_{\rm L}\right) \nonumber \\&\quad =(H-L)\left( r^{\rm FB}_{\rm H}-r^{\rm FB}_{\rm L}\right) >0. \end{aligned}$$(30) -

(ii)

Suppose that \(x^{\rm FB}_{\rm L}=x^{\rm FB}_{\rm H}\), then (3) implies that \(r^{\rm FB}_{\rm L}=r^{\rm FB}_{\rm H}\). Using these levels in (2) would imply \(H=L\), which contradicts a central assumption of our framework. From (i) and (ii), we know that \(x^{\rm FB}_{\rm L}>x^{\rm FB}_{\rm H}\) must hold. Since \(C_{x}(x^{\rm FB}_{\rm L},T^{\rm FB}_{\rm L})=-D'(x^{\rm FB}_{\rm L})<-D'(x^{\rm FB}_{\rm H})=C_{x}(x^{\rm FB}_{\rm H},T^{\rm FB}_{\rm H})< C_{x}(x^{\rm FB}_{\rm L},T^{\rm FB}_{\rm H})\), we conclude that \(r^{\rm FB}_{\rm L}>r^{\rm FB}_{\rm H}\).

Appendix 2

The first-best level of the subsidy is given by \(s^{\rm FB}_{i}=-\alpha C_{T}(x^{\rm FB}_{j},T^{\rm FB}_{j})\). Accordingly, the ranking \(s^{\rm FB}_{\rm L}>s^{\rm FB}_{\rm H}\) follows when \(-C_{T}(x^{\rm FB}_{\rm H},T^{\rm FB}_{\rm H})>-C_{T}(x^{\rm FB}_{\rm L},T^{\rm FB}_{\rm L})\). Restating condition (2) gives

Using \(L<H\) implies \(1+\alpha C_{T}(x^{\rm FB}_{\rm H},T^{\rm FB}_{\rm H})/C_{T}(x^{\rm FB}_{\rm L},T^{\rm FB}_{\rm L})<\alpha +C_{T}(x^{\rm FB}_{\rm H},T^{\rm FB}_{\rm H})/C_{T}(x^{\rm FB}_{\rm L},T^{\rm FB}_{\rm L})\), which in turn explains \(-C_{T}(x^{\rm FB}_{\rm H},T^{\rm FB}_{\rm H})>-C_{\rm T}(x^{\rm FB}_{\rm L},T^{\rm FB}_{\rm L})\).

Appendix 3

Under strict liability, firm L finds it privately optimal to select \((x^{\rm FB}_{\rm L},r^{\rm FB}_{\rm L})\) because \(U_{\rm L}=\hbox {min}\{U_{\rm L},V_{\rm L},W_{\rm L}\}\). The ranking \(U_{\rm L}<V_{\rm L}\) follows from

The ranking \(U_{\rm L}<W_{\rm L}\) follows from

Firm H optimizes given \(r_{\rm L}=r^{\rm FB}_{\rm L}\). The ranking \(U_{\rm H}<W_{\rm H}\) follows from

However, it may be that \(V_{\rm H}<U_{\rm H}\), i.e., that firm H finds it privately optimal to mimic firm L. There are no incentives to mimic when

Appendix 4

In the following analysis, we argue that firm L chooses \(x_{\rm L}\) from the set \([x^{\rm FB}_{\rm H},x^{\rm FB}_{\rm L}]\) and \(r_{\rm L}\) from the set \([r^{\rm FB}_{\rm H},r^{\rm FB}_{\rm L}]\). (i) Firm L chooses abatement at least as high as \(x^{\rm FB}_{\rm H}\) because

(ii) Firm L chooses R&D at least as high as \(r^{\rm FB}_{\rm H}\) because firm H does so under strict liability (see Proposition 1). This ensures that \(r_{\rm L}\ge r^{\rm FB}_{\rm H}\) because firm L enjoys a lower spillover than firm H (\(\alpha r^{\rm FB}_{\rm H}<\alpha r^{\rm FB}_{\rm L}\)), firm L bears lower R&D costs, and \(r_{\rm L}\) falling short of \(r^{\rm FB}_{\rm H}\) would mean that firm L would receive no subsidy at all. (iii) The privately optimal levels will not exceed \((x^{\rm FB}_{\rm L},r^{\rm FB}_{\rm L})\) because marginal benefits of choosing higher levels are smaller under the negligence regime than under strict liability. (iv) When firm L selects \(x_{\rm L}=x^{\rm FB}_{\rm L}\), it will select \(r^{\rm FB}_{\rm L}\). This follows from the analysis of strict liability.

Appendix 5

In the following analysis, we argue that firm H chooses \(x_{\rm H}\) from the set \([x^{\rm FB}_{\rm H},x^{\rm FB}_{\rm L}]\) and \(r_{\rm H}\) from the set \([r^{\rm FB}_{\rm H},r^{\rm FB}_{\rm L}]\). (i) Firm H chooses at least \((x^{\rm FB}_{\rm H},r^{\rm FB}_{\rm H})\) because

where \(W_{\rm H}\) is implied by activity levels below \((x^{\rm FB}_{\rm H},r^{\rm FB}_{\rm H})\). (ii) Firm H chooses weakly less than \((x^{\rm FB}_{\rm L},r^{\rm FB}_{\rm L})\). This has been established for firm L above and clearly also holds for firm H. (iii) Firm H choosing \(r^{\rm FB}_{\rm H}\) is inconsistent with firm H choosing \(x_{\rm H}\) from the interval \((x^{\rm FB}_{\rm H},x^{\rm FB}_{\rm L})\). This results from

The firm will either remain at \(x^{\rm FB}_{\rm H}\) or implement \(x^{\rm FB}_{\rm L}\). (iv) When firm H chooses \(x_{\rm H}\) from \(X\) and \(r_{\rm H}\) from \(R\), it will always select the combination of activity levels \((x^{\rm FB}_{\rm H},r^{\rm FB}_{\rm H})\).

Appendix 6

When firms are subject to strict liability, the privately optimal R&D levels change with the level of the uniform subsidy according to

where \(Z>0\) is the determinant of the according Hessian matrix.

Appendix 7

When firms are subject to negligence, the privately optimal R&D levels change with the level of the uniform subsidy according to

where \(Z>0\) is the determinant of the according Hessian matrix.

About this article

Cite this article

Endres, A., Friehe, T. & Rundshagen, B. Environmental liability law and R&D subsidies: results on the screening of firms and the use of uniform policy. Environ Econ Policy Stud 17, 521–541 (2015). https://doi.org/10.1007/s10018-015-0103-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-015-0103-8