Abstract

We offer theory and evidence that supports the view that systemic financial crises impact income inequality negatively in richer countries, where institutions, such as social safety nets, work better than in developing countries. More generally, to our knowledge, our work is the first to provide empirical evidence that supports the view that systemic financial crises may have a causal impact on income inequality and that a driving mechanism may be vulnerable employment. In order to do this, we apply a diff-in-diff approach and provide evidence that the parallel trends assumption is complied with.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

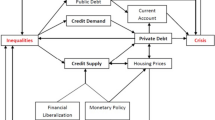

It is believed that systemic financial crises produce devastating impacts on the economy, not only reflected in slower rates of growth and high interest rates, but equally important, via protracted and pervasive negative effect in living standards and overall welfare of a significant part of the population. This because the resources committed to resolving a crisis may be diverted from alternative productive uses, delaying structural economic reforms as well as stabilization programs, which means that the economy may see higher unemployment rates for a protracted period, which in turn, may be translated to structural increases in income inequality and depending on the depth of the crisis, may become quite pervasive (e.g. Čihák and Sahay 2020).

According to the conventional wisdom, richer countries are better positioned to deal with systemic financial crises due to their stronger institutions, which may help governments contain any negative impacts that may arise due to productive and distributive misallocations resulting from a crisis. Richer economies tend to have more expansive, such as unemployment insurance, job-retraining, and poverty-fighting mechanisms and, in general, more widespread, and deep social safety nets. A question that remains unanswered is whether countries with good institutions, typically the richer economies, are actually able to withstand systemic financial shocks and minimize welfare related impacts and, in particular, a decrease in income inequality, a variable of particular concern by policymakers and academics alike. In fact, to our knowledge, our work is the first to provide empirical evidence that supports the view that systemic financial crises may have a causal impact on income inequalityFootnote 1.

2 Simple Theoretical Model

Our theory links the effect of a systemic crisis on income inequality through its impact on vulnerable employment, which are proxied by an increase in the variance of economy’s skills distributionFootnote 2. In order to do this, we extend Chong and Gradstein (2007) and assume that the economy is populated by households that sum to a measure of 1. Each household i is populated by a parent and a child, with parent being the sole decision-maker in discrete time t. \({y}_{i0}\) is household i’s exogenously given initial income in period 0 and \({y}_{it}\) is household i’s endogenously determined income in period t, with \({y}_{it} \sim lognormal ({\mu }_{t}\), \({\sigma }_{t}^{2})\). Household i’s budget constraint is given by:

where prices are normalized to 1, \({c}_{it}\ge 0\) is household i’s current consumption (which also includes productive investment in skills) and \({r}_{it+1}\ge 0\) is their unproductive investment in rent seeking. Based on Chong and Gradstein (2007) we assume that A > 0 is the economy’s total productive resources and is constant in every period t. The proportion of A that accrues to household i is given by:

where \({w}_{t+1}\in \left[0, 1\right]\) is the institutional quality and \({r}_{it+1}^{{w}_{t+1}}\) is the rent-seeking investment. Our interest is on the case when \({w}_{t+1}\) is close to 0, that is, economies with strong institutionsFootnote 3. Household i’s income in period t, \({y}_{it}\), is determined by:

where \({\epsilon }_{it}\) are household i’s productive skills, \({\epsilon }_{it} \sim lognormal\; (0,{\gamma }^{2})\), with \({\gamma }^{2}\) assumed to be small, and \({a}_{it}^{{w}_{t}}\) are household i’s appropriated resources. Individuals who are at the left tail of productive skills distribution represent vulnerable employment, as evidence shows that economic crisis adversely impacts the latter (e.g., Oulton and Sebastiá-Barriel 2017). We proxy this impact with an increase in variance of the skill distribution, represented by the shape parameter, \({\gamma }^{2}\). Household i optimizes the following symmetric utility function in time t:

The optimal budget allocation rules for individual i are as follows:

with the evolution of income rule as follows:

Taking logs in (6), the evolution of income inequality equation is:

With strong institutions, \({w}_{t+1}=0\), inequality will fall and converge to a constant, \({\gamma }^{2}\). Following (7) inequality will converge to the following steady state:

Consider the scenario when this economy experiences a situation of economic crisis in period t. This gives an exogenous shock to the skills distribution affecting people in vulnerable employment more, thus increasing the shape parameter (and variance), such that \({\epsilon }_{it} \sim\)\(lognormal (0\), \({\gamma ^{\prime }}^{2})\) with \({\gamma }^{{\prime }}> \gamma\).Footnote 4 From Eq. (7), we can conclude that inequality will converge to the new constant, \({\gamma ^{\prime }}^{2 }\). Thus, an economic crisis increases the base level of income inequality to a higher level. When institutions are strong, income inequality remains constant every period at this new base levelFootnote 5. It follows that a systemic crisis changes the steady state level of income inequality to:

In short, according to our simple extension of Chong and Gradstein (2007) an economic crisis increases the likelihood of occurrence of the steady state with higher inequality.

3 Data and Empirical Strategy

Our data are all publicly available and come from the World Bank (2021) and United Nations (2021) and focus on OECD countries as, on average, these are the group of countries that have shown stronger institutions from a historical perspective. Our key variable of interest is income inequality, which we capture using the well-known Gini coefficient, an index that goes from zero to one and where higher numbers indicate higher income inequality. We also include time-varying covariates at the country level, in particular, the GDP growth, the log of per capita GDP, and the years that a country has suffered from a systemic financial crisis since 1970Footnote 6. Our period of study covers the years 1973 to 2016. Table 1 presents summary statistics. Methodologically, we estimate the following equation:

where \({y}_{ct}\) denotes an inequality indicator in country \(c\) in year \(t\), where \({SC}_{ct}\) is an indicator equal to one if country \(c\) had a systemic crisis prior year \(t\), \(X\) is the set of country–level covariates described above and \({\gamma }_{c}\), \({\lambda }_{t}\) are country and year fixed effects, respectively. We test for the critical parallel pre-trend assumptions by the specification:

where \({\tau }_{ctk}\) takes a value equal to one when an observation is \(k\) years away from the year the first systemic financial crisis struck. We normalize all estimates to the year before the first crisis occurred by omitting \(k=1\). Note that \(k\) equal to \(-7\) or 7 denotes more than six years before and after crises.

4 Findings

Table 2 shows our main empirical results. The estimated coefficient of systemic financial crises on income inequality, as measured by the Gini coefficient, indicates that systemic crises do increase income inequality, reflected in the fact that the coefficient of our variable of interest is positive and statistically significant at conventional levelsFootnote 7. Our preferred specification is the one shown in Column 4, which also includes year fixed effects, country fixed effects as well as standard errors clustered at the country level. As taxing as this specification is, the statistical significance of our variable of interest holds at conventional levelsFootnote 8.

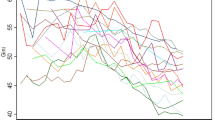

For our difference-in-differences strategy to be valid, we show the results of specification (2) above. Countries that suffer from systemic financial crises must show similar inequality trends as countries that do not suffer from systemic crises. This is the so-called common trends assumption. Finding this implies that systemic crises are not driven by confounding trends in unobserved factors that systematically affect income inequality. Figure 1 reports our findings for the Gini coefficient. As observed in this figure, trends in the pre-event period are flat and indistinguishable from zero, thus providing support on the common trend assumption. In addition, Fig. 1 shows that the negative impact of systemic crises on income inequality persist in subsequent years after they occur.

Using the same approach as above, we test whether a likely mediating mechanism between crises and inequality may be vulnerable employment. As shown in Fig. 2 we find supporting evidence that this may be the case. Pre-systemic shock, the behavior of this variable is very clear. The coefficient of vulnerable employment is zero. However, post-systemic shock, this variable sees a dramatic and steady increase in its coefficient, which is statistically significant at conventional levels and lasts for at least six periods sub-sequent to the first occurrence of the first systemic shock.

5 Final Remarks

Some researchers claim that the direction of causality between financial crisis and income inequality may go from inequality to banking crises. Among others, Rajan (2010) describes a scenario where inequality may create pressure for easy credit and where the financial sector provides unequal access to education and health care, which may increase the risk for financial crisis. Recent research, however, cast very serious doubts on the existence of a causal link from income inequality to financial crises (e.g., Bordo and Meissner 2012)Footnote 9. Whereas our findings appear to be very robust, we agree that statistically speaking we cannot fully rule out other sources of endogeneity, which might weaken our findings. Additional research is needed in this regard.

Notes

A systemic financial crisis is defined as financial runs that lead to the closure, merging, or takeover by the public sector of one or more financial institutions.

Vulnerable employment refers to those that are less likely to have formal work arrangements, inadequate earnings, lack decent working conditions, adequate social security and effective representation (World Bank 2021).

wt + 1 close to 1 implies weak institutions.

Such a shock will also affect the scale parameter of the log-normal skills distribution. However, qualitatively the results will move in the same direction as with change in the shape parameter. For simplicity, we do not discuss the changes in scale parameter in our model.

If institutions are weak, i.e., wt + 1 = w > 0, inequality will always be greater than ‘2, and with t 2 moderately high, inequality would continue to increase at a rate higher than the rate without an economic crisis, t + 12- t2=’2 + t 2w-1 > 2 + t 2w-1 > 0. When institutions are weak and existing inequality is moderately high, economic crisis also increases the likelihood that the economy experiences an increase in inequality every period.

The countries in our sample, including the first year of crisis in parentheses are: Belgium (2008), Chile (1976), Denmark (2008), Finland (1991), Germany (2007), Greece (2008), Iceland (2007), Ireland (2007), Italy (2008), Japan (1997), Korea (1997), Mexico (1981), Netherlands (2008), Norway (1987), Poland (1991), Spain (1977), Sweden (1991) and Turkey (1982). Excluding Chile and Mexico, the two newest OECD members, which are also considered to be the ones with relatively weakest institutions, do not change our findings.

While not reported, these results are very robust to broad changes in specification.

Callaway and Sant’Anna (2021) have very recently raised some issues related to the application of staggered differences and differences. Unfortunately, our data does not have enough observations with the requirements needed in order to apply such test correctly and as a result, we are unable to rule out the issue raised by these researchers.

References

Bordo M, Meissner CM (2012) Does inequality lead to a financial crisis? J Int Money Finance 31:2147–2161

Callaway B, Sant’Anna PHC (2021) Difference-in-differences with multiple time periods. J Econ 225:200–230

Chong A, Gradstein M (2007) Inequality and institutions. Rev Econ Stat 89:454–465

Čihák M, Sahay R (2020) In collaboration with Adolfo Barajas, Shiyuan Chen, Armand Fouejieu, and Peichu Xie, Finance and Inequality. IMF Staff Discussion Note, Washington, DC

Oulton N, Sebastiá-Barriel M (2017) Effects of Financial crises on Productivity, Capital and Employment. Rev Income Wealth 63:S90–S112

Rajan R (2010) Fault lines: how hidden fractures still threaten the World Economy. Princeton University Press, Princeton, NJ

United Nations (2021) World Income Inequality Data. https://www.wider.unu.edu/database/world-income-inequality-database-wiid

World Bank (2021) World Development Indicators. http://datatopics.worldbank.org/world-development-indicators/

Acknowledgements

We are greatly indebted to Guillermo Cruces for detailed comments and suggestions. We would also like to thank Michele Baggio, Arlette Beltrán and Luisa Zanforlin for useful comments. All remaining errors are obviously ours.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Arora, P., Chong, A. & Srebot, C. Systemic Financial Crises and Income Inequality in OECD Countries. Open Econ Rev 35, 687–694 (2024). https://doi.org/10.1007/s11079-023-09741-6

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-023-09741-6