Abstract

This paper is an empirical study that used econometric techniques to analyze the causal relationship between income inequality and financial disturbances in developed economies. The author used annual data from panels of OECD countries. In this study, income distribution is represented by the share of GDP that accrued to the top 10 percent earners, wage share of GDP, and disposable income Gini Coefficient in annual data series. The test included three channels, through which income inequality may affect the financial system. The results suggest that the effect of income inequality on the national financial stability is ambiguous, as the study concluded that this effect is radically different according to the channel tested. The study found that a rise in income inequality has a negative impact on public finance, but it has a positive effect on the private debt market, and on the external balance from a financial stability standpoint.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The substantial rise in income inequality that had preceded major world financial crises has raised the suspicion of income inequality as a perpetrator of financial disturbances. One major cause of financial disturbances is debt inflation, as it raises the risk of large waves of default that can be systemic due to the interconnectedness of financial institutions. This may lead to the banking sector’s failure. In a country with a relatively large amount of foreign investment, debt inflation may threaten a currency crisis since the high probability of default would create a large movement of capital outflows. In the past few decades, income inequality and public and private debt have risen together in several developed economies. The rise of the two variables together, income inequality and excessive indebtedness, may suggest a causal relationship between them.

In the existing economic literature, which is overviewed in the next chapter, the link between income inequality and financial crises was studied as a potential two-way causal relationship. There is a near consensus in the literature that income inequality is a major source of financial disturbances through various channels, most notably the credit demand channel, the credit supply channel, and the public debt channel. This paper, through the use of different econometric models and different data, is an empirical investigation of the potential causal relationship between income inequality and financial crises.

The study in this paper is undertaken through empirically testing three channels that may transmit the impact of changes in the national income distribution to the financial sector, namely income inequality influence on government borrowing behavior, on the private debt market, and on the national external balance.

The methodology followed is a panel data analysis of different groups of OECD countries for different time periods, according to the availability of the data of the channel that is being tested. I regressed the time series of three financial measures, representing the aforementioned three channels, on the time series of variables reflecting national income distribution. The three financial measures are public debt as a percentage of GDP, bank capital to asset ratio, and current account as a percentage of GDP. The income distribution measures are disposable income Gini Coefficient, wage share of GDP, and the share of GDP that accrues to the top 10 percent earners.

The results show that the effect of income inequality on the financial system is ambiguous, as the study concluded that this effect is radically different according to the channel tested. The study concluded that a rise in income inequality is an exertion on public finance, but it positively affects the private debt market and the national external balance.

The remainder of the paper is structured as follows: Chapter II presents a literature review on the relationship between income inequality and the probability of financial crises. Chapter III contains facts and historical trends of income inequality in major world economies. Chapter IV is an empirical investigation of the association between income inequality and financial disturbances. Chapter V is a discussion of the results presented in Chapter IV. Chapter VI concludes the analysis.

2 Literature Review

There has been a spike in the literature on the link between income inequality and financial crises since the occurrence of the Great Recession. According to the mainstream relevant literature, income inequality increases the probability of a financial crisis through a number of channels that inflate public and private debts, and disturb the national external balance.

2.1 Income Inequality, and Public Debt Inflation and Degeneration

Bohoslavski (2016) claims that income inequality is a source of public debt inflation and crisis. It leads to sovereign debt increase through its direct effect on tax revenues. According to this view, the more economically unequal a nation, the less tax revenues are accrued to the government. That makes the government more dependent on borrowing, which increases the risk of a sovereign debt default, and that may lead to a banking crisis. This claim of sovereign debt inflation that arises because of income inequality is supported by empirical evidence. Aizenman and Jinjarak (2012) used data from 50 countries in 2007, 2009 and 2011, and found a strong negative association between income inequality and the tax base and a positive association with sovereign debt. Brzozowski et al. (2010) undertook a study of the link between income inequality and consumption in Canada. They found evidence that while income inequality has increased, consumption inequality has not, and this happened through government transfers. Domeij and Floden (2009) reached a similar conclusion. Their study was on a presumed link between income inequality with consumption inequality in Sweden in the period of 1978–2004. They found that the Swedish welfare system offset the increase in income inequality, so there was not an observed increase in consumption inequality.

If according to these views, income inequality negatively affects tax revenues, and increases demand for transfers and government social spending, then it negatively affects public finances, inducing government borrowing and public debt inflation.

Milasi (2013) undertook a panel analysis using data from 17 OECD countries covering the period of 1974–2005 found a positive correlation between the top 1 percent income share, and fiscal deficits. Azzimonti et al. (2014) developed a multi-country politico-economic model, where the incentive of governments to borrow increases as income inequality rises. They have conducted a cross-country empirical analysis using data from OECD countries, and the results were found to be consistent with their theoretical predictions.

Income inequality is also found to negatively affect the quality of sovereign debt as it increases the risk of sovereign default. Kabukcuoglu and Jeon (2015) regressed the time series of the credit rating for sovereign bonds, which they claimed to be strongly correlated with the volume of the sovereign debt, on the time series of Gini Coefficient as a representative of income inequality for 40 countries for the period of 1994–2009. They found that a higher Gini Coefficient lowers the credit worthiness of long-term government bonds significantly. That implies that an increase in income inequality is associated with an inflation of public debt, which increases the risk of default on it and degenerates its quality. Jeon and Kabukcuoglu emphasized that sudden and large rises in income inequality can considerably increase the sovereign default risk. The authors specify that such “inequality shocks” generate a far higher probability of default than a fall of the domestic output of the same magnitude.

2.2 Income Inequality and the Private Debt Market

Bohoslavski (2016) argued that high levels of inequality contribute substantially to an increase in private debt. Private debt increases as households try to maintain certain levels of consumption, while their relative income falls as income inequality rises. Krueger and Perri (2005) undertook a study, which revealed that over 25 years prior to 2005 income inequality in the United States had increased without being followed by an increase in consumption inequalities. They found that the time series of the ratio of consumer credit to disposable income and the time series of Gini Coefficient for US household income have a similar trend for the period of 1968–2004. That implies that credit growth may have replaced income growth to keep consumption at desired levels.

Another view presented by Fitoussi and Saraceno (2009), which connects inequality and credit demand through monetary policy, claims that a highly unequal income distribution depresses aggregate demand and leads to overreliance of economic growth on investment and luxury consumption. This may not be sufficient for acceptable economic growth rates and prompts the monetary authority to lower interest rates, which stimulates excessive borrowing and debt inflation. Moreover, as income inequality rises, the top earners become more active looking for high return investment opportunities, which leads to the emergence of financial bubbles. Net wealth becomes overvalued, giving a false impression of the sustainability of the current volume of debt.

Lysandrou (2011) stated that the rise in the incomes of the rich segments of society increases their savings, leading to a large accumulation of private wealth. This rising supply of financial capital requires more investment opportunities and consequently boosts the credit supply. This has made credit more accessible, including to risk loving borrowers, and that may have led to private debt inflation. Rajan (2010) contributed to the literature that blames rising income inequality of being a driver of financial disturbances through what is referred to as “the credit supply channel”. According to his view, increased income inequality in the United States encouraged a government response aiming at making homeownership more affordable. That happened through government intervention in the mortgage market, which motivated real estate purchases beyond people’s means fueling the housing bubble, which burst in 2007 unleashing a global financial crisis, followed by an economic recession.

Baziller and Hericourt (2014) similarly argued with the aforementioned views on income inequality as a source of financial disturbances. Their study presented descriptive evidence of the link between income inequality and financial crisis through three channels, namely a public debt, a credit demand, and a credit supply channels.

2.3 Income Inequality and the External Balance

Another channel through which income inequality may lead to financial disturbances is through its effect on the external balance of a nation. According to the well-known Identity, X-M = (S−I) + (T−G), if it is true that a rise in income inequality leads to debt inflation, then the right- hand side will be under downward pressure, as the aggregate national net saving and/or fiscal space drop. If the right-hand side goes down, then the current account will be going towards a deficit. That puts a downward pressure on the currency, and it threatens a currency crisis. Kumhof et al. (2012) performed a multivariate analysis of current account determinants using data from a panel of 18 OECD countries over the period of 1968–2006. They found evidence that higher top income shares are associated with substantially larger external deficits. They also built a dynamic stochastic general equilibrium model that helps understand the transmission mechanism from higher income inequality to higher domestic indebtedness and eventually to higher foreign indebtedness. Similar conclusions were reached by Behringer and Van Treeck (2013). Current account large deficits can lead to a currency crisis that may unleash a full-scale financial crisis in a country with relatively large amounts of foreign debt.

2.4 Summary of the Literature Review on Income Inequality as a Driver of Financial Crises

According to the presented views, income inequality leads to an inflation of public debt through its influence on tax revenues and social spending, and of private debt through the credit demand channel and the credit supply channel. Debt inflation increases the risk of large and systemic waves of debt default, which leads to a banking crisis. Through income inequality’s effect of indebtedness, it may negatively affect the national external balance. This puts a depreciating pressure on the currency and may lead to a currency crisis.

The views in the mainstream literature on income inequality as a driver of financial crises are presented in Fig. 1

Source: Baziller and Hericourt (2014)

2.5 The Other Way Around: The Effects of Financial Disturbances on Income Inequality

Literature covering the topic of rising income inequality as a consequence of financial crises is almost consensual. It matters in this analysis to differentiate between banking crises (e.g. The Great Recession), currency crises (e.g. Tequila Crises) and twin crises (e.g. Asian Crisis). Bordo et al. (2000) studied the history of financial crises and their impact on the economy since the late nineteenth century in Western countries. Their study suggested that the negative consequences of financial crises on macroeconomic performance raise income inequality. Nevertheless, the consequences have become less severe since World War Two thanks to the relative enhancement of the safety nets in Western capitalist countries. Bordo et al. claimed that the negative economic consequences of banking crises and combined (twin) crises are almost always larger than the negative economic consequences of currency crises alone. The effect on income inequality is a function of the volume of these negative consequences.

Using a panel of 120 years, Bordo et al. (2000) showed that a twin crisis is associated with an output loss of 20 percent of GDP on average. The average recovery time is between 3 and 4 years. Studying the effect of financial crises on the economy in a number of developing economies over the period of 1975–1997, Hutchinson and Noy (2005) found that, on average, currency crises reduce national outputs by 5–8 percent, and banking crises by 8–10 percent over a two to four year period. The combined effect of a twin crisis is estimated between 13 and 18 percent on average over the same period of national outputs of developing economies. For a currency crisis, Bazziller and Hericourt (2014) argued that it may hamper growth through two channels: (a) It leads to balance sheet deterioration of firms and financial institutions that are indebted in foreign currency, and that may negatively affect credit extension. (b) It may provoke capital flow reversal and an escape of investments out of the country in times of crises.

Unemployment rises in times of financial crises as a consequence of the decline in aggregate demand directly affecting the income of the lower percentiles in the income distribution. According to Reinhart and Kenneth (2009), in the aftermath of banking crises, the associated unemployment rate rises on average by 7 percent with a duration of over four years. Baziller and Najman (2017) used an international panel data, and they found that currency crises are associated with a strong fall of the labor share of GDP. They concluded that in the three years following a currency crisis, the labor share of GDP is reduced by 2 percent per year on average, which is only partially compensated in the following years. This means that income inequality rises as a consequence of financial crises.

As an outcome of the decline in output because of a financial crisis, tax revenues substantially decline, which pressures governments to reduce public spending. That may affect transfers and social spending leading to more economic inequality. Ball et al. (2013) used data from a panel of 17 OECD countries over the period of 1978–2009, and they showed that a 1 percent decrease in social spending is associated with a rise of 0.2–0.7 percent in disposable income Gini Coefficient. Fiscal contraction may lead to public sector job loss affecting the middle-class income. This widens the gap between the rich and the poor in the aftermath of financial crises. An economic recession hits different economic classes disproportionally. It has distributional effects, and economic inequality may increase as a consequence, as the poor, without wealth buffers, are more prone to economic pains than the rich.

3 Empirical Motivation

In the decades prior to the financial crisis that led to the Great Recession in the US in 2008 and to the decade before the financial crisis that led the Great Depression in 1929, there was a steady and noticeable rise in income inequality expressed in the share of US GDP that accrued to the top 1 percent earners as shown in Fig. 2.

After the Great Depression, there was a near consensus among economists that income inequality was a major driver of the financial crisis that led to the depression. (Eccles, 1951; Galbraith (1975). An outcome of this consensus was that policymakers in the U.S. increased top income and wealth tax rates, and imposed more regulation and surveillance on the financial markets. Among the prominent imposed regulations on the financial markets in the U.S was the legislation of Glass-Steagall Act of 1933, which imposed separation between commercial banks and investment banks to prevent excessive risk taking, and the Securities Act of 1933, which regulated the securities market. Moreover, policymakers decided to strengthen the social safety net through the enactment of the New Deal Act in 1933. These policy changes, along with post-WW2 economic boom, resulted in a steep fall in income inequality in the U.S. This trend continued until mid- 1970′s, and then it went in reverse. A new policy program started to take over at that time, which has become to be known as Neoliberalism. The policy program was characterized by government bias towards the capital class with reductions in corporate income tax rates, financial deregulation, weakening of the bargaining power of the working class in several major world economies, and rapid globalization that have brought fierce competition to workers in high-income capitalist economies. Besides other potential factors such as skill-based disruptive technological changes and unorthodox monetary policy regimes such as Quantitative Easing, the Neoliberal policy changes may have contributed to a gradual rise in income inequality.

Figure 3 illustrates the rise of income inequality as represented by the share of the top 10 percent earners of GDP in the US, the UK, Japan, and Germany in the time period of 1975–2015.

A similar trend of increasing income inequality since the mid- 1970′s has been observed in most parts of the world. In the Euro Area (12 countries),Footnote 1 the UK and Japan, wage share of GDP has fallen gradually in the past decades as shown in Fig. 4.

Source: European Commission, https://ec.europa.eu/economy_finance/db_indicators/ameco/

Adjusted wage share as percentage of GDP at current prices.

In the period of 1991–2012, the average annual increase in real wages is estimated to have had been ~ 1 percent in the US, 1.5 percent in the UK, 0.6 percent in Germany, and almost 0 in Italy and Japan.Footnote 2 These numbers are less than the average real growth rates in these economies in the same time period, which implies that for this period, the return on capital has been growing faster than GDP growth rates increasing the economic gap between workers and capital owners. The paradox is that this fall in the share of income that accrues to labor has occurred while aggregate productivity, which encompasses labor productivity, has increased at an almost steady rate since the end of WW2.

The income of a working individual is expected to rise with a similar proportion to the rise in their productivity. However, this was not what happened in the U.S as shown in Fig. 5, which shows a clear decoupling between labor compensation and labor productivity. That has been attributed to the Neoliberal regime, which is driven by “free-market fundamentalism” that views trade unions as distortionary and inefficient. The lack of government support to and protection of labor union activity shows in policies such as the Taft-Harley Act of 1946 in the US, the Labor Relations Adjustment Act of 1946 in Japan Union Law of Japan, and the Industrial Relations Act of 1971 in Britain. These policies undermined labor collective political action and this is evidenced by the rapid decline of the unionization rate in the U.S from more than ~ 27% in 1967 to ~ 10% in 2019, in Germany from ~ 26% in 1998 to ~ 16% in 2018, in the UK from ~ 30% to ~ 23% in Japan from ~ 22% to ~ 17% in the same period. The correlation is clear between the Neoliberal policy and the decline in labor collective bargaining power. As a result, workers’ compensation relative to their productivity has been negatively affected.

Data are for compensation (wages and benefits) of production/nonsupervisory workers in the private sector and net productivity of the total economy. “Net productivity” is the growth of output of goods and services less depreciation per hour worked.

Despite the fall of the wage share of GDP, which is the income of the majority of the population, the consumption share of GDP did not, but increased in major economies such as Japan, US, UK, and almost did not change for the EU. Steady consumption-based economic growth that accompanied the gradual decline of labor share of output since the mid 1970′s suggests that the gap between wages and the desired consumption level is filled by either government transfers and social spending, as shown by Brzozowski et al. (2010), and Domeij and Floden (2009), or the gap was filled by household borrowing as claimed by Bohoslavski (2016), Krueger and Perri (2005), or both. However, other factors may have led to an increase in consumption-oriented borrowing other than the sluggish labor income growth. One of these factors can be the decline in interest rates and increased accessibility to credit. The fall in the wage share of GDP means an increase in the capital share of income, which may lead to excessive accumulation of savings by the capital owners. That drives them to look for lucrative investment opportunities through excessive credit supply, which may reduce interest rates. This has shown to fuel asset bubbles, and increase the risk of default and financial crisis, as what happened in the US in 2007–2008.

Figure 6 shows the historical time series of consumption as a % of GDP.

4 Econometric Analysis of the Causal Relationship between Income Inequality and Financial Disturbances

In this chapter, the study used econometric techniques to analyze if income inequality is a driver of financial disturbances. The test included three channels. The first channel tested is on the effect of income inequality on public debt. The second channel tested is on the influence of income inequality on bank capital to asset ratio, which reflects the state of the private debt market. The third channel tested is on the effect of income inequality on the external balance. The chapter is divided into three parts: (1) The model (2) Data (3) Results.

4.1 The Model

The methodology used is a panel data analysis using Two Stage Least Square regressions as follows:

The use of the Two Stage Least Square regression model is intended to control for the potential measurement errors that may arise because of the potential existence of simultaneous causality between national income distribution and financial fluctuations.Footnote 3

4.2 Data Footnote 4

Dependent Variables (Y) that represents the national financial stance are (1) Public debt as a percentage of GDP (for the first channel), (2) Bank capital to asset ratio (for the second channel), and (3) The current account balance as a percentage of GDP (for the third channel). Data of these variables were obtained from data.worldbank.org.

Independent Variable (s) (X) that represent the income distribution are (1) The share of GDP that accrues to top 10 percent earners of the nation. Data were obtained from “World Wealth& Income Data Base”. www.wid.world, (2) Wage share of GDP. Data were obtained from data.worldbank.org, and (3) Disposable income Gini Coefficient. Data were obtained from wider.unu.edu.

Instrumental Variables: (1) Average years of schooling as I assumed that countries with higher average years of schooling tend to be less unequal since education and the attainments of skills are more accessible to the population. It is reported every 5 years, and were interpolated to be annual. Data were obtained from Barro-Lee Dataset for Educational Attainment (2014), (2) median age, as I assumed that countries with higher median age would be less unequal as the variation of incomes of relatively older individuals tends to be less. It is reported every 5 years and were interpolated to be annual. Data were obtained from data.un.org, (3) life expectancy at birth, which is a proxy for median age. Data were obtained from data.worldbank.org. (4) FDI in constant USD. FDI was found to be positively correlated with income inequality in a study conducted by Herzer and Nunnenkamp (2011), using a sample of 10 European countries for the period 1980–2000, (5) a dummy variable representing the level of corruption in each country. I expected that countries which are more corrupt would tend to be more unequal because of the strong favoritism that benefits the cronies of the ruling class. On an ad-hoc basis, I decided to assign a dummy of 1 for countries that scored less than 7 (out of 10) and 0 otherwise in the “Corruption Perception Index” of 2007 (in the middle of the period of the test when the instrument is used). The index is reported annually by Transparency International (TI).

Sargan Hansen test, with the null hypothesis that the instruments are exogenous to the dependent variable, and F Test of Excluded instruments with the null hypothesis that the instruments are not relevant to the independent variable, are used after each regression to test the validity and strength of the used set of instruments.

4.2.1 For the Test of the First Channel (Income Inequality and Public Debt)

The test for a causal relationship between income inequality and public debt inflation used data of 17 OECD countries for the period of 1995–2015.Footnote 5 The control variables that are used for this test are (1) GDP growth rates, (2) Dependency ratio, and (3) The current account balance. These control variables are selected based on a study of the determinants of public debt/GDP ratio in middle and high income countries by Sinha et al. (2011). In addition to this set. I added bond yield, which affects the quantity demanded of government bonds, and unemployment rate, which may call for more social spending, and may stimulate more government borrowing.

4.2.2 For the Test of the Second Channel (Inequality and Private Debt)

The panel data model investigates the association between income inequality used data of 22 OECD countries for the period of 2002–2013.Footnote 6 The control variables that are used in this test are (1) Bank lending rate, which directly influences quantity demanded of bank loans, (2) A dummy variable that controls for the effect of the financial crisis of 2007/2008 and the implementation of Basel II Accord, (3) corporate tax rate, which affects bank net profits, and that may affect its lending behavior, (4) log GDP per capita to control for the development of the economy, which reflects the development of the financial system, and (5) GDP growth rates, which affect the level of optimism in the economy and may influence bank lending behavior.

4.2.3 For the Test of the Third Channel (Inequality and the External Balance)

The panel data model investigates the association between income inequality the external balance used data of 17 OECD countries for the period of 1995–2015.

The control variables that are used in this test are (1) GDP growth rate, (2) Government budget balance as a percentage of GDP, (3) Portfolio balance/GDP, (4) FDI/GDP, and (5) Total dependency ratio. This set of control variables is based on a study of the determinants of the current account balance undertaken by Chinn and Prasasd (2002). I added (6) Real effective exchange rate (2010 = 100).

The instrumental variables that are used in the tests are mentioned after every table. The used set of instruments in each regression is the one that performed best in Sargan Hansen test and F test of Excluded Instruments.

5 Results

In the results’ tables, column 1 reports the results of the single OLS regression of the measure of the financial variable on the income inequality variable, column 2 reports results of the OLS regression with all control variables, and column 3 reports the results of the Two Stage Least Square Regressions, with using all control variables and the set of instrumental variables that performed best in Sargan Hansen Test and F Test of Excluded instruments. The used instruments are reported in a footnote after each table. Whenever Hausman Chi-Squared P-Value is reported in a column in a table, a random effects model was used in the regression instead of fixed effects model. The null hypothesis of Hausman test is that the use of random effects is valid.

5.1 Channel One: Income Inequality and Public Debt

The coefficient of the share of GDP that accrues to top 10 percent earners came out positive and significant in all variation of the model. The result of the 2SLS regression shows that an increase of 1 percent in the share of income accrues to the top 10 percent earners is associated with an increase of ~ 0.04 percent in public debt as a percentage of GDP.

The coefficient of the wage share of GDP came out negative and significant in the OLS with control and the 2SLS regressions. Column 3 shows that a decrease in wage share of GDP of 1 percent leads to an increase of ~ 0.04 percent in public debt as a percentage of GDP.

5.2 Channel Two: Income Inequality and Bank Capital to Asset Ratio

The coefficient of the disposable income Gini Coefficient came out positive and significant in the 2SLS regression. Column 3 shows that an increase of 0.1 in the disposable income Gini Coefficient leads to an increase of approximately 0.29 percent in bank capital to asset ratio.

The coefficient of the 2age share of GDP came out significant and negative in all variations of the model, which implies an increase in income share of wages is associated with a decrease in capital to asset ratio. Column 3 shows that a decrease of 1 percent of wage share of GDP leads an increase of 0.18 percent of bank capital to asset ratio.

The coefficient of the share of income of GDP that accrues to the top 10 percent came out significant and positive in the 2SLS regression. According to this results, as the share accrues to the top 10 percent increase by 1 percent, bank capital to asset ratio increases by 0.72 percent.

5.3 Channel Three: Income Inequality Influence on the National Currency

The coefficient of the share of GDP that accrues to the top 10 percent earners came out positive and significant in the 2SLS regression. Column 3 shows that an increase of 1 percent of the share of GDP that accrued to the top 10 percent earners leads to an increase of 0.45 percent of the current account/GDP ratio.

The coefficient of the Wage share of GDP came out negative and significant in three variations of the model, suggesting that a decrease in wage share of GDP moves current account balance towards a surplus. Column 3 shows that a decrease of 1 percent of wage share of GDP leads to an increase of 0.83 in the current account/GDP ratio.

6 Discussion

6.1 Income Inequality and Public Debt

Results reported in Tables 1 and 2 showed that an increase in income inequality increases government borrowing, which support the hypothesis in the mainstream literature that income inequality leads to an increase in public debt, as presented by Bohoslavski (2016). Column 3 in Table 1 shows that an increase of 1 percent in the share of income accrued to the top 10 percent earners was associated with an increase of 0.0432 percent in public debt as a percentage of GDP. Column 3 in Table 2 shows that a decrease in wage share of GDP of 1 percent led to an increase of 0.0357 percent in public debt as a percentage of GDP. Income inequality may reduce fiscal space through either negatively affecting tax revenues, as Aizenman and Jinjarak (2012) showed, or causing an increase in demand for government transfer and social spending. That keeps consumption less unequal than income as Brzozowski et al. (2010) and Domeij and Floden (2009) showed or through both; less tax growth, and more government spending. This induces more government borrowing, and it increases the risk of public debt default. Public debt default is a disturbance that is transmitted to government creditors, which are mostly financial institutions, leading to a macro-financial disturbance.

6.2 Income Inequality and the Private Debt Market

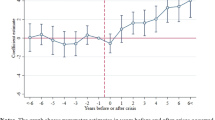

Most of the relevant literature claim that an increase in income inequality is associated with private debt inflation, as suggested by as Bohoslavski (2016), Krueger and Perri (2005), and Baziller and Hericourt (2014) Most of these studies support the permanent income hypothesis. Since real income per individual has been increasing in the past decades for the majority of the world’s economies, the present value of lifetime income has increased, and thus consumption is expected to have increased with a similar proportion as to the increase in income, and this happens in isolation to the changes in national income distribution that have occurred in the same time period. However, Duesenberry (1949) presented an opposing view in the “relative income hypothesis”, where consumption is not only a function of the present value of the lifetime income, but of the income compared to the incomes of other members of the same society. If this hypothesis holds, then an increase in income inequality would lead to a slowdown of the growth rate of the average household consumption because their relative income falls. That weakens the growth in the household’s debt that is oriented to reach the desired consumption level, as a response to their falling position in the income distribution. The fact that household debt as a percentage of GDP has increased in the past decades, in simultaneity with an increase in income inequality does not necessarily mean the existence of a causal relationship between them as claimed by Bohoslavski (2016), and Baziller and Hericourt (2014). It may have been due to the development of the banking sector and the increase in credit accessibility.Footnote 7 For example, there are countries whose income distribution as presented by wage share of GDP, did not change or slightly moved towards more equality between wage earners and capital owners in the time period 2002–2012, such as; Sweden, Switzerland, Norway, and Denmark and still experienced significant growth in household debt as a percentage of GDP. That can be illustrated in the following Figs. 7, 8.

Disposable income Gini Coefficient was at moderate levels and hardly changed in the period 2002–2013 for; Italy, Portugal, Greece, and Ireland, while non-performing loans as a percentage of total gross loans surged after 2007. While for Austria and Germany, disposable Gini Coefficient rose from 0.24 to 0.27, and from 0.28 to 0.29, respectively. However, there has not been an increase in non-performing loans as a percentage of the total gross loans. That suggests that inequality has little or nothing to do with the sudden and large wave of bank loan default (Figs. 9, 10).

I found a statistical and positive significance between income inequality and bank capital to asset ratio. In Tables 3, 4 and 5, results show that bank capital to asset ratio tends to increase as a response to an increase in income inequality, expressed by disposable income Gini Coefficient, wage share of GDP or the share of GDP that accrues to the top 10 percent earners. Column 3 in Table 3 shows that an increase of 0.1 in the disposable income Gini Coefficient led to an increase of ~ 2.9 percent in bank capital to asset ratio. Column 3 in Table 4 shows that a decrease of 1 percent of wage share of GDP led to an increase of 0.1793 percent of bank capital to asset ratio. Column 3 in Table 5 shows that as the share accrued to the top 10 percent increased by 1 percent, bank capital to asset ratio increased by 0.7220. It is important to remind the reader that the regressions were controlled for the effects of the financial crisis of 2007–2008 and for Basel Two Accord implementation, which led to an increase in bank capital adequacy ratio. In the light of these results, I conclude that the banking sector gets more cautious if income inequality increases, as the increase in income inequality leads to less collateral in the possession of the average household, which leads to weaker chances of getting approved for a loan. That leads to less growth in bank assets, and increases capital to asset ratio, moving banks to a more stable position, and that reduces the probability of the occurrence of a financial crisis. The results of the used econometric model in the former chapter and the presented data in this chapter did not support the hypothesis that income inequality is one of the direct drivers of crises in the private debt market. On the contrary, it seems to reduce the risk of bank failure. Drawing an inference from the results obtained from this model, the study concludes that a rise in income inequality has a positive impact on bank capital to asset ratio.

6.3 Inequality and the External Balance

Kumhof et al. (2012) and (Behringer and Van Treeck, 2013) suggested that top income shares are associated with current account deterioration. These studies attributed this deterioration to the rise of lower household net lending, which decreases the current account. My results suggest the opposite to the conclusion of Kumhof et al. (2012) and (Behringer and Van Treeck, 2013). Column 3 in Table 6 shows that an increase of 1 percent of the share of GDP that accrues to the top 10 percent earners leads to an increase of 0.45 of the current account/GDP ratio. Column 3 in Table 7 shows that a decrease of 1 percent of wage share of GDP leads to an increase of 0.83 in the current account/GDP ratio. It seems that as inequality increases, the current account moves towards a surplus. That could be due to a possibility that an increase in income inequality negatively affects the growth of the purchasing power of the bottom 90 percent of the income distribution, and that may render the bottom 90 percent less able to import. This moves the current account towards a surplus. Another channel through which a rise in income inequality may lead to an increase in the current account is that as the share of income of top earners increase, these top earners, especially in affluent countries, tend to save more and lend more to not only domestic, but also foreign markets. This may enhance the net foreign liabilities position of the nation in question, which could be rebound and demand exports of the lender country, and this contribute to an increase in the current account balance. If a rise in income inequality leads to a rise in the current account balance as a percentage of GDP, then a rise in income inequality does not disturb the balance of payment, which means it does not lead to a currency crisis. However, these are my speculations considering the results, and further research is needed on this issue.

7 Conclusion

This paper undertook an econometric exercise to investigate the causal relationship between income inequality and financial disturbances. The study tested three channels, through which income inequality may disturb the financial system, namely income inequality effect on public debt, private debt, and the external balance. The results found that higher income inequality increases the fiscal burden on the government and inflates public debt. I suggest that income inequality disturbs public finances through its negative effect on tax revenues and through a rise in demands for more social transfers and social spending, which invoke more government borrowing. The results found that a rise in income inequality has a positive effect on private debt represented by bank capital to asset ratio. I interpret this positive effect by the possibility that as income inequality rises, banks get more cautious since higher income inequality leads to less collateral held by the average citizen, and his ability to get a loan is reduced, which has a positive effect on banks’ balance sheets. The results show that a rise in income inequality has a positive effect on the external balance. I propose that this may happen through potential two channels; (1) an increase in income inequality reduces the relative purchasing power, and thus reduces the relative ability of the average citizen, and (2) an increase in income inequality drives top earners to save more and lend more, including lending abroad, enhancing net foreign liabilities, which may boost exports and affect the external balance positively. That puts an upward pressure on the currency.

I conclude that the overall effect of income inequality on the financial system is ambiguous. The study found that its high levels and/ or its rise to have a positive effect through two channels: (1) bank capital to asset ratio, and (2) external balance channels, and a negative effect on one channel: (3) public debt.

In light of the conclusion of this paper. Respective government agencies are advised to consider that income inequality may be a source of financial disturbances through potentially causing public debt inflation, and not through having a negative influence on the private debt market or on the external balance.

Notes

Euro Area 12 Countries: Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, Netherlands, Portugal, Spain, and Greece.

Data was obtained from data.OECD.org.

\(\alpha \left(i\right)\) is the country fixed effects.

Data are annual. Dependent variables, control variables, and instrumental variables are according to the channel tested. That was dictated by the availability of the data of the variables used in each model.

The choice of the number of countries, the time period, and the corresponding independent variables for the three channels was dictated by the availability of data.

The data of the first two independent variables are pre-tax values.

The increase in credit accessibility here is meant to have arisen because of the financial development in these countries, and not influenced by “the credit supply” channel” coupled with high income inequality, which was overviewed in the literature.

References

Aizenman, J., & Jinjarak, Y. (2012). Income Inequality, Tax Base and Sovereign Spreads. NBER.

Azzimonti, M., de Francisco, E., & Vincenzo, Q. (2014). Financial globalization, Inequality, and the rising of public debt. American Economic Review, 104(8), 2267–2302.

Ball, L., Furceri, D., Leigh, D., Loungani, P. (2013). The distributional effects of fiscal consolidation. IMF, IMF Working Paper WP/13/151.

Barro Lee Educational Attainment Data Base. (2010). “Average years of schooling”. Cited in May 2017, https://www.barrolee.com.

Bazillier, R., & Héricourt, J. (2014). “The circular relationship between inequality, leverage, and financial crises: intertwined mechanisms and competing evidence”. CEPII, Working Paper No. 22.

Bazillier, R., & Bori, N. (2017). Labour and financial crises, is labour paying the price of the crisis? Comparative Economic Studies, 59(1), 55–76.

Behreniger, J., and van Treek T., (2013). “Income distribution and current account: A sectoral perspective”, IMK Working Paper No 125.

Bohoslavski, J. (2016). Report of the independent expert on the effects of foreign debt and other related international financial obligations of states on the full enjoyment of human rights, particularly economic, social and cultural rights (p. 2016). Human Rights Council: United Nations Publication.

Bordo, M., Eichengreen, B., Klingebiel, D., & Martinez-Peria, M. (2000). Is the crisis problem growing more severe? Economic Policy, 16(32), 51–82.

Brzozowski, M., Martin, G., Kelin, P., & Suzuki, M. (2010). Consumption, income, and wealthi inequality in Canada. Review of Economic Dynamics, 13(1), 52–75.

Chinn, M., & Prasad, E. (2002). Medium-term determinants of current accounts in industrial and developing countries: An empirical exploration. Journal of International Economics, 59(2003), 47–76.

Duesenberry, J. (1949). Income, saving, and the theory of consumer behavior. Harvard Economic Studies.

Domeij, D. and Floden, M. (2009). "Inequality Trends in Sweden 1978–2004," SSE/EFI Working Paper Series in Economics and Finance 720, Stockholm School of Economics.

Eccles, M. (1951). “Beckoning frontiers: Public and personal recollections” Alfred A. Knopf.

European Commission Publication. (2013). Financial dependence and growth since the crisis”. Quarterly Report on the Euro Area, 12(3), 7–18.

Floden, M., & Dmoeij, D. (2010). Inequality trends in Sweden 1978–2004. Review of Economic Dynamics, 13(1), 179–208.

Galbraith, J. (1975). Money: whence it came, where It went. Replica Books.

Herzer, D., Nunnenkamp, P. (2011). FDI and Income Inequality: Evidence from Europe. Working Paper No 1675. Kiel Institute for the World Economy.

Hutchinson, M., & Noy, I. (2005). How bad are twins? output costs of currency and banking crises. Journal of Money, Credit and Banking, 37(4), 725–752.

Jean-Paul F. & Saraceno, F. (2009). “How Deep is a Crisis? Policy Responses and Structural Factors Behind Diverging Performances”. Documents de Travail de l'OFCE.

Kabukcuoglu, Z., & Jeon, K. (2015). Income inequality and sovereign default. Journal of Economic Dynamics and Control, 95, 211–232.

KPMG International “Corporate and Indirect Tax Survey 2011” (2012). Cited May 2017.http://kpmg.de/

Krueger, D., & Perry, F. (2005). Does income inequality lead to consumption inequality? evidence and theory. The Review of Economic Studies.

Lysandrou, P. (2011). global inequality, wealth concentration and the subprime crisis: A marxian commodity theory analysis. Development and Change, 42(1), 183–208.

Kumhof, M., Lebarz, C., Ranciere, R., Richter, A., & Throckmorton, N. (2012). Income inequality and current account imbalances.http://stats.oecd.org/.

Milasi, S. (2013). Top income shares and budget deficits. CEIS Tor Vergata, research paper series, 10(11), 249.

Oecd.stat.(2014). “Income Distribution and Poverty”. OECD.http://stats.oecd.org/.

Rajan, R. (2010). Fault lines: How hidden fractures still threaten the world economy. New Jersey: Princeton University Press.

Reinhart, C., & Kenneth, R. (2009). The aftermath of financial crises. American Economic Review, 99(2), 466–472.

Research at the World Bank. (2014). “All the Ginis”, 1950–2012. Retreived in April 2017 https://econ.worldbank.org.

Sinha, P., Arora, V., & Bansal, V. (2011). Determinants of Public Debt for Middle Income and High Income Group Countries Using Panel Data Regression. Munich Personal RePec Archive.

United Nations. (2013). Department of Economic and Social Affairs, Population Division, World Population Prospects: The 2012 Revision “Median Age”. Cited May 2017. https://data.un.org/.

United Nations University, UNU Wider. (2017). “World Income Inequality Data Base”. Cited May 2017.http://data.un.ong/

World Wealth and Income Data Base. (2016). “Top 10% Income share”, “top 1% Income Share”. Cited May 2017.https://wid.world/data/

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix

Rights and permissions

About this article

Cite this article

Osman, O. Income Inequality and Financial Disturbances: Does Income Inequality Engender Financial Crises?. Soc Indic Res 157, 417–442 (2021). https://doi.org/10.1007/s11205-020-02535-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11205-020-02535-0