Abstract

We investigate whether financial deepening improves income distribution and whether there exists a financial Kuznetz curve in Latin America. A fixed effect estimation is based on a newly compiled panel for 16 major Latin American countries, including recent data from 1990 onward but excluding the pandemic. The dynamic panel estimates, based on Driscoll-Kraay robust standard errors and dynamic GMM instrumental variable methodology, reveal that financial deepening worsens income distribution by increasing the Gini coefficient. At the same token, there exists a financial Kuznetz curve for the region implying initial worsening and then improvements in the income gap as the financial sector develops. Additionally, educational attainment, economic growth and level of output contribute to a reduction in inequality. In contrast, we find that FDI, exports and poverty rate exacerbate the income gap.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

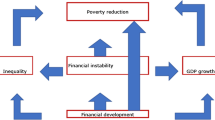

While remaining the region with the highest inequality (Gini Index Map, 2019), Latin America has recently seen a strong downward trend in income inequality (Lustig, 2013; Gasparini & Lustig, 2011; Gasparini et al., 2011). However, how much of this trend can be attributed to financial development in the developing countries of the region? In fact, literature provides contrasting answers to this question. While some claim that financial deepening worsens income distribution (Dabla-Norris et al., 2015), others suggest that financial development is beneficial for reducing the income gap (Zhang & Naceur, 2019). Therefore, we ask whether financial deepening was an important contributor to the recent inequality trends in Latin America. Furthermore, we wonder if a financial Kuznetz curve may be at work in this region.

The contribution of this paper to the existing literature, thus, consists of investigating the effect of financial deepening on income distribution focusing specifically on Latin America. Unlike the previous studies, we ask whether there exists a financial Kuznetz curve in this region and what is the effect of financial deepening on Gini coefficients. Additionally, we study the relevance of education to income distribution in the context of financial deepening. Furthermore, unlike the three previous studies that either focused on Europe (Baiardi & Morana, 2016) or a very broad set of quite different developing countries (Nikoloski, 2010; Sahay et al., 2015), we focus on a rather narrowly defined group of countries. They have similar economic characteristics closely related to their colonial past with predominantly extractive institutions to benefit the colonizers. Different from these studies, we use an updated panel with a different time period that covers the 2008–2009 global economic crisis but excludes COVID pandemic.

The decreasing income inequality in Latin America has been a persistent trend over the last few decades. The overall downward trend has been suggested by, for example, Gasparini and Lustig (2011) and Lustig (2013). This is clearly illustrated by Fig. 1, which shows the Gini coefficients for most Latin American countries between 1990 and 2017. The trend has become even more pronounced after 2000.

While initially Brazil exhibited the highest levels of the Gini coefficient, reaching to about 60,Footnote 1 it was Bolivia and Honduras that showed the highest inequality between 2000 and 2005. Finally, Colombia with 50.8, Panama with 50.4 and Brazil with 51.3 have the highest income gap at the end of the sample. The lowest income inequality at the end of the sample is in El Salvador at 40.6 and Uruguay at 40.2. These levels are comparable to the USA at 41 but still higher than most of the developed countries.

Two countries that started with relatively low Gini coefficients are Argentina and Costa Rica. As can be seen in Fig. 2, Argentina’s inequality was increasing until 2002 and has experienced a substantial drop after that, with an overall downward trend. Thus, Costa Rica is the only country in the group that exhibits an upward trend over the sample period. The dynamics are surprising for a country with rather strong social transfers and relatively good support for health care. Hidalgo (2014) reports that this is the outcome of substantial growth coupled with a failure to reduce poverty and Arauz (2016) suggests that the main source for this are hours of working and the dynamics of real wages. It seems that Gini has stabilized after 2009.

Our results suggest that (1) there exists a financial Kuznetz curve in Latin America and (2) confirm that financial deepening contributes to higher income inequality. Additionally, we found that (3) years of schooling is a very important contributor to the downward trend in income distribution in Latin America. Finally, we found (4) no evidence of the existence of the traditional Kuznetz curve in this dataset and discovered that (5) FDI over the period exacerbated the income gap in the region.

The rest of the paper is organized as follows: We review the relevant literature in Sect. 2. The data along with the methodology are described in Sect. 3. Section 4 presents and discusses the empirical results and provides some robustness checks. We conclude with a summary and some policy implications in Sect. 5.

2 Review of relevant literature

While there are many studies of inequality devoted to advanced economies (Chintrakarn et al., 2012; Cingano, 2014; Figini & Goerg, 2011; Hellenbrandt, 2014), other research includes rapidly expanding China and India. However, the income inequality in advanced countries and China or India differs strongly from Latin America (Acemoglu et al., 2001; Acemoglu et al., 2002; Dabla-Norris et al., 2015), which is our main focus.

2.1 Financial development

The research on the effect of financial deepening on income gap reports contradictory results. Many authors found that financial development aggravates income inequality. Dabla-Norris et al. (2015) note large differences in the use of financial services between developed and developing economics. They claim that financial deepening “is associated with rising inequality” in emerging markets and developing economies. They suggest that the low level of financial inclusion is to blame as it limits benefits to small groups. Similarly, Zhang and Naceur (2019) report that financial liberalization “tends to exacerbate” the income gap.

In contrast, a number of studies show that financial deepening reduces income inequality: among others Beck et al. (2007), Meyer Bittencourt (2006) for Brazil, Shabaz et al. (2014) for Iran, Ang (2010), Shabaz and Islam (2011) for India, and Jauch and Watzka (2016) and Zhang and Naceur (2019) for a large number of developing countries. Moreover, Demirguc-Kunt and Levine (2009) report that a majority of emerging empirical research tentatively suggests that rapid improvements in financial intermediaries and particularly in financial technology stimulate growth, improve the income gap, and have favorable effects on poverty rates. Nasreddine and Mensi (2020) suggest that financial development does contribute to closing the income gap in democratic, but not in autocratic, countries.

However, the apparent contradiction between positive and negative effects is likely due to the existence of the financial Kuznets curve.Footnote 2 We are aware of only three papers on the topic (Baiardi & Morana, 2016; Nikoloski, 2010; Sahay et al., 2015). They find that income inequality increases as financial deepening approaches a threshold value. However, beyond that, further financial deepening decreases the income gap. The result seems to be robust across various regions. While Nikoloski (2010) and Sahay (2015) work with a broad dataset of developed and developing countries, which may have very different dynamics between income gap and financial development, Baiardi and Morana (2016) focus on Europe. We are not aware of any study identifying the financial Kuznetz curve specifically in Latin America.

2.2 Education

A number of studies report a positive relationship between higher educational attainment and more equal distribution of education, and income inequality, including De Gregorio and Lee (2002), Abdullah et al. (2015) for Africa, Qazi et al. (2016) for the long run in Pakistan. Some authors focus on the effects of dispersion of education on the income gap (Coady & Dizioli, 2018; Dabla-Norris et al., 2015; De Gregorio & Lee, 2002). Importantly, Knight and Sabot (1983) distinguish between the “composition” (temporary increase in inequality due to education) and the “wage compression” effects (lower returns to education as the skilled labor supply increases). They suggest an overall inequality-improving effect. Relatedly, O’Neil (1995) cautions that returns to education in the form of a high skill premium may initially imply a greater income gap. However, he suggests that the dynamics of human capital are a good predictor of the temporal pattern of income convergence.

A number of authors suggest a variety of policy measures, from devoting more resources towards education (De Gregorio & Lee, 2002; Sylwester, 2004) to developing secondary and higher education, as they have a stronger effect on inequality (Abdullah et al., 2015; Qazi et al., 2016). Finally, focusing specifically on Latin America, Dabla-Norris et al. (2015), Mikek and Simmons (2019) and Tsounta and Ouseke (2014) report that more education spending was the most important driver of the declining income gap in Latin America.

2.3 Income levels, growth, and poverty

The importance of income level for inequality is well documented. Several studies find a favorable, albeit sometimes small, effect of increasing income levels on income disparities (Chen & Tsai, 2012; Jauch & Watzka, 2016; Mikek & Carter, 2017; Tsounta & Ouseke, 2014). In contrast, Celic and Basdas (2010) report conflicting correlations between GNI per capita and the income gap. Some authors (Jauch & Watzka, 2016; Kuznetz, 1955; Mah, 2003; Tsounta & Ouseke, 2014) claim that income distribution first deteriorates before it improves at higher levels of income, suggesting the inverse U Kuznetz curve effect.

The nexus between economic growth and inequality with the dynamic feedback loop from growth to inequality and back commands the attention of many researchers. Some authors found a negative effect of inequality on growth. Dabla-Norris et al. (2015) claim that inequality slows economic growth.Footnote 3 In contrast, several authors (Dabla-Norris et al., 2015; Ostry et al., 2014) turn the argument around and report a negative effect of growth on inequality. This closes the vicious cycle from low growth to high inequality that again causes low growth.

Growth has been associated with “skill-biased technological change” (Acemoglu, 1998; Card & DiNardo, 2002; Dabla-Norris et al., 2015). The process favors high skill jobs over low skill jobs and through the dynamics of skill premiums worsens inequality. Moreover, a higher growth objective is frequently pursued through liberalization of job markets. Dabla-Norris et al. (2015) find that easing labor market regulations exacerbates wage gap. Therefore, growth could aggravate income inequality, as could be seen in Costa Rica. Furthermore, the global crisis of 2008–2009 slowed down growth substantially and, thus, aggravated income inequality (Chen & Ravallion, 2009; Mikek & Carter, 2017).

Poverty worsens income distribution and increases inequality (Chen & Tsai, 2012; Mikek & Carter, 2017; Nijhawan & Dubas, 2006; Ravallion, 1997). The conclusion seems to be robust with respect to using either dummy variables or the share of population below a poverty line (2$ per day is common) to measure poverty.

2.4 FDI and exports

Surveying literature for the effects of globalization gave conflicting results. A multitude of studies reports increasing inequality due to more openness (Barro, 2000; Baten & Fraunholz, 2004; Freeman, 2010; Ravallion, 2001) and, in particular for Latin America, international liberalization (Boglianccini, 2013; Dabla-Norris et al., 2015). Similarly, Chen and Tsai (2012) and Mikek and Carter (2017) concluded that export incentives were a key strategy for attracting FDI and aggravate inequality.

In contrast, Dabla-Norris et al. (2015) report no significant effect of trade and Dollar and Kraay (2004) and Jaumotte et al. (2013) suggest that openness contributes to growth and, thus, a smaller income gap. In a bit more nuanced study, McLeod and Lustig (2011) study the composition of exports and point out that export of minerals and fuel worsens, while export of agricultural products improves, the income gap.

Finally, Chen and Tsai (2012), Mikek and Carter (2017) and Sylwester (2004) investigate the role of exchange rates and in general find a rather weak effect. Sylvester (2004) claims that a high real exchange rate variability, as a symptom of an unstable economy, is likely associated with higher inequality.

Research of the relationship between FDI and inequality also reports contrasting findings. Basu and Guariglia (2007), Chintrakarn et al. (2012), Choi (2006), Feenstra and Hanson (1997), Hoi and Pomfret (2011), Mah (2012) and Jaumotte et al. (2013) all suggest that FDI exacerbates the income gap by increasing high skill premiums. Figini and Goerg (2011) offer an interesting perspective by suggesting “a nonlinear effect in developing countries: wage inequality increases with FDI inward stock, with such effect diminishing with further increases in FDI.” te Velde (2003) suggests that FDI affects each country differently. Lastly, specifically for Latin America, Cornia (2012) suggests that FDI increases income disparities. However, Mikek and Carter (2017) find no effect, while Tsounta and Ouseke (2014) suggest that FDI is actually inequality-improving.

2.5 Redistribution through fiscal policy

To consider redistribution through fiscal policy, researchers include various fiscal measures. While some research finds government spending to be a significant determinant of Gini coefficients (Dabla-Norris et al., 2015; Zhang & Naceur, 2019), a number of studies include tax revenues, instead (Chen & Tsai, 2012; Joumard & Bloch, 2012; Mikek & Carter, 2017; Pirttila, 2004; Tsounta & Ouseke, 2014). Several authors report that redistribution through taxes reduces the income gap (Cingano, 2014; Hellenbrandt, 2014; Mikek & Carter, 2017; Pirttila, 2004; Tsounta & Ouseke, 2014). In contrast, some authors find a very limited effect of taxes on inequality (Chen & Tsai, 2012; Goñi et al., 2008). The opposing claims are likely due to different levels of progressivity in taxation.

Finally, the effects of policy actions may depend on a number of other factors. Acosta-Ormaechea et al. (2017) find that inequality is not affected by growth-friendly fiscal reforms. The reduction of poverty and inequality may be due to improvements in public policy, favorable trade conditions (Gasparini & Cruces, 2013), and more extensive social transfers (Lustig, 2013). While Dabla-Norris et al. (2015) study the contributions of labor market liberalization, Mahler (2004) focuses on the importance of the dynamics and constellations of political power and stability of the political system for inequality outcomes.

3 Data and methodology

Our updated data set covers almost three decades of data from 1990 to 2017. The time period includes the global crisis of 08–09. In contrast to Nikoloski (2010) and Sahay et al. (2015), and to improve the focus and reliability of the results, we define a rather narrow set of Latin American countries with similar economies. The choice of countries was partly dependent on data availability. We include 16 major Latin American countries: Argentina, Bolivia, Brazil, Chile, Colombia, Costa Rica, Dominican Republic, Ecuador, Guatemala, Honduras, Mexico, Panama, Paraguay, Peru, El Salvador, Uruguay. These Latin American countries have been shaped by common colonial past, predominantly extractive economies, a relative abundance of natural resources, and exports to Europe and the US of raw materials and agricultural products. While some differences clearly remain, the strong effects of their past colonial institutional arrangements (including the suppression of natives and slavery), main cultural developments, and patterns of economic interactions with the world make them a coherent group.

Most of our variables are from the World Bank data set from World Development Indicators (2019). However, we had to complement them with some variables from International Financial Statistics (IFS) available from the IMF (IFS, 2019). We measured educational attainment as mean years of schooling, and data is from the United Nations Development Program (HDI, 2019).

There is a particular issue with the inflation data for Argentina, since it is not available from the IMF or World Bank for the whole period of interest as Argentina underwent substantial economic turmoil. Inflation data for 1990–2013 is from the St. Louis Fed FRED database (FRED, 2018). After that, the inflation data was missing or was reported as unreliable. An alternative was provided by The Billion Price Project (Cavallo & Rigobon, 2016), which measured price data over the whole time period of interest also in Argentina. The dataset only measures online (and sometimes cell phone) price movements. We used it to verify the official Argentinian data provided by Banco Central de la Republic Argentina. The correlation with the official data from their central bank is extremely high and both measures diverge only slightly (it looks like a shift in the intercept). This verified the credibility of the official statistics and, thus, inflation for Argentina after 2013 is from its central bank (Argentina, 2019).

We measure income inequality with the standard income Gini coefficient (Gini, 1912) reported by the World bank (GINI, 2019). Our main variable of interest, however, is financial deepening, defined as a share of private credit in GDP. It is rather widely used, including in, for example, Dabla-Norris et al. (2015), Nikoloski (2010), Jauch and Watzka (2016) and Zhang and Naceur (2019). The data source for this is also the World Bank Human Development Indicators database (HDI, 2019). A data description is given in Table 2 and summary statistics for the data are in Table 3 in the appendix.

Following a widespread approach (Barone & Mocetti, 2015; Nikoloski, 2010; Zhang & Naceur, 2019), we used the panel data techniques in estimating the models with fixed country effects to account for systematic variability between individual countries. We estimated the dynamic panel using the Instrumental Variables GMM technique to address endogeneity. Thus, we estimated various versions of the following model:

i = 1,…, N = 16, indicates individual country. t = 1,…,T = 28, indicates the time period.

uit is the white noise error term, Gini is the Gini coefficient, b0i is a country specific constant, GNIPC is gross national income per capita, school stands for mean years of Schooling, FD measures financial deepening, Growth is GDP growth, Crisis is a dummy variable that takes value 1 for 2008 and 2009, Poverty is the share of people in poverty living below $1.9 per day, Controls is a vector of control variables and b is a corresponding vector of coefficients. Controls include export growth, FDI as a share in GDP, inflation rate, government expenditures, and tax revenues.

Initially, we ran the simple panel and performed the Hausman test to discriminate between fixed and random effects. The results are provided at the bottom of Table 5 in the appendix as χ2 second. The test clearly rejects random effects as a better alternative. Thus, we proceeded with the fixed effects approach. Similarly, we tested for heteroscedasticity between cross-section elements of the panel (countries). The test is provided at the bottom of Table 5 in the appendix as χ2 first, with the H0: σi2 = σ2 for all i. The test resolutely rejects the assumption of homoscedasticity, further justifying our choice of fixed effects.

As the Arellano-Bond (1991) GMM technique is not suitable for panels with small N and large T, we resorted to estimation of the panel using Driscoll-Kraay (1998) standard errors. Here the errors are assumed to be autocorrelated and heteroskedastic across countries. The errors are robust to cross-sectional and temporal dependence as t becomes large. These estimates based on 2 lags are provided in Table 5 in the appendix.

Endogeneity plagues static panels estimating inequality equations. To address this, we used the instrumental variables GMM approach initially suggested by Anderson and Hsiao (1981) and included at least 3 lags of each regressor as the instruments. The method is suitable for panel models with some endogenous regressors, as is the case with our data. “The estimators are two-stage least squares generalization of simple panel-data estimators for exogenous variables and the fixed effects option uses the two-stage least squares within estimator” (STATA). In addition to handling the endogeneity, the lags capture the dynamic nature of relationships embedded in the models, such as the delayed effects of education on earnings and income inequality. Additionally, we used the cluster option for standard errors that allows for intragroup correlation.

In Tables 1 and 4, we report results of this instrumental variable GMM approach and provide the Wald test statistic that was modified for heteroskedasticity in fixed effect models. We also provide the j-statistics of overidentifying restrictions that test joint hypotheses that the instruments are valid. The test is based on 2-step GMM estimation and is robust to heteroskedasticity and clustering on individual countries.

The research on financial deepening has rendered conflicting evidence, as described above. For example, Zhang and Naceur (2019) report that most of the considered elements of financial development reduce inequality. In contrast, Dabla-Norris et al. (2015) report that financial deepening is associated with higher income inequality. Financial deepening supports more lively investment activity and contributes to consumption through income smoothing. These provide more business opportunities for entrepreneurial individuals with lower incomes. Both of them stimulate output and therefore reduce Gini coefficients. However, if the access is in some way restricted, the effects may be just the opposite. In particular, if the affluent part of the income spectrum has easier access to finance, the income gap is likely to widen. A number of studies mentioned above report inequality-reducing effects of financial deepening. Thus, we cannot suggest an expected sign for the estimate. Furthermore, the research suggests that there may exist a financial Kuznetz curve for financial development (Baiardi & Morana, 2016; Nikoloski, 2010; Sahay, et al., 2015). If such curve does exist in Latin America, we would expect to see a negative coefficient on the squared financial deepening regressor.

As the surveyed literature above suggests, a higher level of income per capita reduces income inequality through better infrastructure and easier access to education and finance. We will measure it as gross national income per capita (Chen & Tsai, 2012) and expect a negative sign for the corresponding coefficient. Additionally, the initial Kuznetz’s contention (Kuznetz, 1955) that there exists an inverted U curve where inequality increases to a certain level of income and then starts to drop has been corroborate by several authors (Jauch & Watzka, 2016; Tsounta & Ouseke, 2014). We wish to check if this is validated also in our sample. Furthermore, the growth of income has been studied as a possible determinant of the inequality gap (Chen & Tsai, 2012; Dabla-Norris et al., 2015; Mikek & Carter, 2017) and we expect a negative coefficient on growth. Finally, the poverty rateFootnote 4 was found to be an important determinant of income inequality (Nijhawan & Dubas, 2006; Ravallion, 1997). A larger share of people living in poverty is likely associated with higher income inequality (Ravallion, 2001).

FDI also features prominently in explanations of income inequality in Latin America. For example, in Tsounta and Ouseke (2014) it is one of the central explanatory variables behind the decreasing income gap in Latin America. As we mentioned in the review of literature above, FDI and export growth can be associated with technological improvements and therefore they stimulate a skill premium and in general exacerbate income inequality. However, their contribution to growth and income levels have just the opposite effect. Thus, we are not sure what sign on the corresponding coefficients to expect for our sample. Similarly, the signs for inflation could vary depending on the dominant mechanism through which inflation affects income distribution.

Several authors (Acosta-Ormaecha et al., 2017; Gasparini & Cruces, 2013; Goñi et al., 2008; Lustig, 2013; Mikek & Carter, 2017; Tsounta & Ouseke, 2014) have suggested that government policies are a major determinants for the income distribution in Latin America. For this reason, we include tax revenues and government expenditures as control variables. We expect that each of these will contribute to a reduction in inequality and therefore negative signs on the estimates. Finally, we investigate whether the Great Recessions had a major effect on income distribution in our sample. While Mikek and Carter (2017) found that the crisis worsened the income gap, Chen and Ravalion (2009) suggest that this is only true for the countries where inequality was falling. However, a rather broad claim of no effect of crises on inequality is found in Ferreira and Ravallion (2009).

4 Empirical results

For robustness, we estimate a number of alternative specifications. Our results are summarized in Table 1. It includes a number of specification tests, including the Wald χ2 test that is adjusted for groupwise heteroskedasticity in fixed effect models, Rho as a fraction of variance due to ui, and j-statistic for overidentifying restrictions, where the test statistic is robust to heteroskedasticity and clustering on countries. All the tests suggest that the equations are highly significant and that the valid instruments are included.

Our main focus remains financial deepening. The results in the first row of the table seem to suggest that a higher share of private credit in GDP contributes to higher income inequality levels. All the estimated models produced significant and positive coefficients on financial deepening. Thus, an increase in the share of credit in GDP by a percentage point is associated with an increase in Gini coefficient of 0.278–0.308 percentage points. It seems that access to credit is more readily available to those with higher incomes and therefore financial deepening contributes to worse Gini coefficients. The wealthy are more readily able to provide the necessary collateral, and have resources and knowledge (including a substantial advantage in tacit financial and legal knowledge) that facilitates easier access to credit. This further exacerbates the existing inequality in income distribution, corresponding to the results of Dabla-Norris et al. (2015) and Sahay et al. (2015).

However, there seems to be a dampening effect on these dynamics. The coefficients on squared financial deepening are all highly significant and negative, as can be seen in the third row in Table 1. In other words, our results offer evidence of the financial Kuznetz curve for Latin America over the observed period. The inverted U-curve implies that financial deepening contributes progressively less and less to the worsening of income distribution in the initial stages of financial development.

These dynamics indicate that it may be easier to obtain credit for richer customers when the credit markets are relatively limited. However, as they progressively develop, they are more readily available also to the less wealthy parts of the distribution spectrum. This narrows the income gap. The result roughly corresponds to the three other studies that found a financial Kuznetz curve in Europe (Baiardi & Morana, 2016) or in a large set of very diverse developing countries across several continents (Nikoloski, 2010; Sahay et al., 2015). However, these results confirm the existence of the financial Kuznetz curve specifically for Latin America. To summarize, after including a variety of control variables, the basic results remain unchanged. Financial deepening remains a significant contributor to inequality, albeit with decreasing rates, across a variety of specifications.

Along with some previous studies (Dabla-Norris et al., 2015; De Gregorio & Lee, 2002; Mikek & Simmons, 2019; Tsounta & Ouseke, 2014), we too find that years of education is highly significant and, as expected, negative. Thus, an additional year of schooling on average reduces the Gini coefficient by 1.9–2.6 percentage points, which is a substantial effect. This variable reflects an increase in government expenditures for education. While the relationship is by no means automatic, it indicates that government educational policies are relevant to income distribution outcomes in Latin America. As the mean years of schooling on average increased by almost 3 years during the observed period, its contribution to the dropping Gini coefficients in the region has been substantial (estimated here between about 6 and 7.8 percentage points). There is obviously some delayed effect of additional schooling as it may take some time to express itself in terms of additional income. However, by including lags as instruments, our estimation captures those dynamic effects.

As in many previous studies (Chen & Tsai, 2012; Dabla-Norris et al., 2015; Jauch & Watzka, 2016), we found that the level of income per capita is an important determinant of income inequality. As can be seen in Table 1, it is significant in most of the estimated equations. The signs are all negative indicating a reduction in income inequality as the level of income per capita increases. In general, more developed economies are able to provide additional funds for those on the bottom of the income spectrum in a variety of forms, including better infrastructure and access to health services. Additionally, antipoverty programs are more easily financed in countries with higher income per capita. In general, the benefits to the lower part of the income spectrum are higher in countries with higher incomes and manifest through improvements in infrastructure, expanding and simplifying access to communication networks, direct government support programs, more comprehensive health and nutrition programs, etc.

We found no evidence for an inverted standard Kuznetz curve in this data set for Latin America. The estimates on squared income in row 5 of Table 1 are not significant and absolutely minute (of the order 10–8 or even smaller). This stands in contrast with some previous literature on the topic. For example, Tsounta and Ouseke (2014) claim to find evidence for the existence of the Kuznetz curve. However, their sample includes countries outside Latin America.

GDP growth is significant across all but one estimated equation and it has a positive sign. Thus, higher income growth exacerbates income inequality. The magnitude of the effect is relatively small but consistently significant.

Along with many others, such as Chen and Tsai (2012), Dabla-Norris et al. (2015), Mikek and Carter (2017) and Zhang and Naceur (2019), we find that the poverty rate (or share of low income households) significantly contributes to income disparities. This can be seen in all of our estimated specifications. An increase in the share of people in poverty by a percentage point is associated with an increase in Gini coefficient by about 0.6 percentage points on average, ceteris paribus. Large share of people in poverty indicates that the benefits of economic growth are concentrated in small groups, increasing income gap. Additionally, people in poverty have limited access to financial services, quality education, and adequate health care, contributing to worsening inequality. Moreover, they are likely less able to take advantage of a variety of economic opportunities due to information, health, transportation, and other barriers. Finally, redistribution policies in the countries may not have been effective in combating high poverty rates.

Given their colonial roots, most of the countries across the continent heavily rely on international economic relations for their economic prosperity. The research on the role of FDI on the dynamics of income inequality found varied results (as reviewed above). While one line of literature suggests that foreign direct investment brings additional know-how and broad benefits to the lower spectrum of the income distribution, the alternative view suggests that it is frequently associated with introducing new technologies and therefore requiring more skilled labor. The second argument implies higher wages for skilled labor and therefore a widening of the income gap. Along this second line of reasoning and similarly to Cornia (2012), te Velde (2003), and others, our results suggest that a higher share of FDI in GDP contributes to widening the income gap in Latin America [see models (1)–(5) in Table 1]. Thus, an increase of FDI share in GDP by one percentage point increases the Gini coefficients on average by 0.158–0.178 percentage points. In contrast, the export growth rate is not significant. The extractive nature of most of the exports from Latin America may play a role in this result. We suspect that additional demand for raw materials from abroad does not increase the wages of low skilled laborers in those sectors by much as employers can relatively easily find additional low skilled labor.

The inflation rate may affect the income gap in at least three, possibly opposing, ways. First, it reduces the purchasing power of fixed incomes that are frequently the source of income support for people with low incomes. Second, it has a direct effect on the real exchange rate and therefore export performance and the real burden of foreign debts. Third, it redistributes purchasing power from lenders to borrowers. We found that overall inflation coefficients were not significant in models (1), (5), and (6). The coefficients likely reflect the opposing effects of inflation.

We checked whether the dummy for crisis including the Great Recession years of 2008 and 2009 contributed to income disparities in the region. In contrast with Fereira and Ravallion (2009), the coefficient on this dummy is significant in the models (1) and (2) in the table. This suggests that at least some of the influence of the crisis was not transmitted only through the change in growth and/or level of income.

Tax revenues are considered a variable that reduces income inequality if the taxation is progressive, since it reduces high incomes more substantially. Mikek and Carter (2017) and Tsounta and Ouseke (2014) among others found taxes significant in reducing income disparities. Our results for Latin America, however, indicate that this is not a significant variable. This corroborates the results of Goñi et al. (2008), suggesting that progressive taxation has only a small redistributive effect because of a lack of resources available for collection and unimpressive transfer targets.

Similarly, some papers (Dabla-Norris et al., 2015; Jauch & Watzka, 2016) include government expenditures as a measure of income redistribution through the government. Some find a significant correlation, while others don’t. Our results do suggest a significant relationship between government expenditures and Gini coefficients during the observed period in the region. This is likely due to a variety of government-sponsored programs across the continent (such as in Chile, Mexico, and Brazil).

4.1 Additional robustness checks

The first robustness check comes from the alternative specifications included in Table 1. The coefficients of primary interest (FD, FD2, schooling, and poverty) are both of very similar magnitudes and significant across all alternative specifications. Additionally, j-statistics do not reject the H0 that the instruments are valid instruments that are uncorrelated with the error term. This validates the included instruments.

Second, in Table 5 in the appendix, we provide the estimates of the dynamic panel with Driscoll-Kraay (1998) robust standard errors. They are robust to general forms of cross-sectional and temporal dependence. In all the specifications included, we used 2 lags for this estimation. Similarly to what we find in Table 1, the coefficients are of similar magnitude and significant across various specifications. They are, however, slightly smaller. For example, the FD coefficient was about 0.28 in Table 1, while it is about 0.19 here. Similarly, the coefficients for school are a bit lower here (about 2.2 vs. about 1.7). However, these differences are small and show the same pattern of significant coefficients for our most important variables. Driscoll-Kray standard errors are robust but, unlike in Table 1, the problem of endogeneity here remains an issue. Additionally, Table 5 provides some further specification tests. In particular, we tested for heteroskedasticity across the elements of the panel and in all cases the H0 of homoskedasticity is rejected at high significance levels. Finally, Table 5 provides the results of the Housman test that reject the random effects model in favor of the fixed effects model.

Third, we experimented extensively with different lag structures. While these details are not included here, we found that alternative lag specifications had a miniscule effect on the Driscoll-Kraay estimates. Even more important were results for different lag structures for the instrumental variable GMM estimations from Table 1. The estimates reported are based on 3 lags for all instruments. However, the coefficients for school, GNIPC, growth, and FD were not sensitive to changes in lags for these instruments (with one minor exception). Changing lags for poverty from 1 to 3, however, did affect these coefficients in the following manner: FD ranged between 0.23 and 0.31, poverty ranged between 0.54 and 0.61, and school from − 1.84 to − 1.24. Thus, while in general the coefficients were insensitive to changing lag structure, we observed some rather minute variation of the coefficients for different lags of poverty.

Fourth, we provide Table 4 that includes the instrumental variable GMM estimates for the dynamic panel but excludes time trend. In general, the estimates hardly differ from those with time included. The only exception is school, where we find slightly smaller estimates—about − 2.3 vs. about − 1.3. The pattern of significance remains almost the same, again confirming that both FD and school are important determinants of inequality in Latin America (along with the other regressors).

Fifth, for a final robustness check, we estimated the same 7 specifications for the time period before the Great Recession (not reported here to save space). Summarizing these results, we found FD and FD2 significant across all specifications. However, one major difference was school, which did not appear to be a significant determinant of the inequality in the pre-financial-crisis period. This indicates that the major gains in the effect of schooling on inequality have been gained over the last decade or so.

Thus, overall, the robustness checks confirmed out initial findings to a high degree.

5 Conclusion

Despite the recent uptick, Latin America continues to experience a trend of decreasing income inequality. Introduction of improved financial technology poses the question of how financial deepening correlates to inequality. Therefore, we asked whether financial deepening reduces inequality or not. More specifically, we were interested in whether there is a financial Kuznetz curve that explains the dynamics. Our additional interest was in the effect of schooling on inequality. Our panel data for 16 Latin American countries spans 27 years and was collected mostly, but not exclusively, from the World Bank (World Development Indicators, 2019) and IMF (IFS, 2019). We employed a dynamic panel instrumental variable GMM estimation to handle possible endogeneity and included 3 lags of each instrument (Anderson & Hsiao, 1981).

The results of a narrowly-focused dynamic panel suggest that financial deepening in Latin America exhibits a financial Kuznetz curve. While previously studied in a broad sample of developing countries and in Europe, this new result suggests that financial development at first contributes to an opening income gap in Latin America. However, further financial development brings about ever smaller additions to income inequality and, eventually, becomes inequality-improving.

The recent extension of educational attainment across the continent by almost 3 years is estimated to reduce inequality substantially. The dynamic effects are likely to be long-lasting as the economic effects of the skill-building fully materialize only with some lag.

Along with these main results, we find that Gini coefficients have an inequality-improving negative correlation with income level, government expenditures, and income growth. In contrast, FDI, exports, the poverty rate and the Great Recession exacerbate the income gap. We found no unequivocal evidence that taxes were a particularly important determinant of income inequality in Latin America.

These results suggest a number of implications for policy making. First, after a certain point, widely-shared access to the benefits of a developed financial industry are shown to reduce inequality. The policy maker desiring reduction of inequality should, thus, stimulate the development of the financial sector. However, special attention should be devoted to widely spreading the benefits of such development, as it initially leads to a higher income gap. Some possible ways to mitigate this would be to devote some resources to easier approval procedures for credit for small entrepreneurs, to provide wide-spread access to financial services, and to improve financial literacy among the general population. An example of the first is the successful micro-credit industry in some developing countries. Additionally, the policy makers may put in place some redistribution measures to alleviate the initial increase in inequality as the financial sector develops. Second, education decidedly reduces inequality. The extension of schooling that contributes to the accumulation of human capital and provides a skill premium to skilled labor is inequality-improving. Public policy to prolong schooling, improve school attendance, expand the number of people actually enrolled in schools, and develop better educational programs improves inequality outcomes. Third, antipoverty programs should be a staple of any government program seeking better inequality results. In particular, the programs that provide economic incentives for health and job training among the poor are likely to reduce the income gap. Fourth, any programs stimulating economic growth in general improve income distribution.

The results invite some further research to expand the range of possible measures of financial development. In particular, some kind of an index of financial development that would include a variety of financial elements, such as access to finance, financial deepening, the spread of financial networks, financial literacy, etc., would be very welcome. Additionally, the extensive research on the effects of international economic relations on inequality is still inconclusive. Furthermore, documenting the effects of the substantial disruptions of the COVID pandemic on inequality in Latin America and beyond would be useful. Finally, further exploring the dynamic aspects of inequality determinants is likely to be a fruitful area for further research.

Notes

For comparison, recent Ginis stand at 32.7 for France, 33.2 UK, 31 for Germany, 39.7 for Indonesia, 37.2 Russia, 35.5 for Portugal, and 41 in the US (GINI, 2019).

“If the income share of the top 20 percent increases by 1 percentage point, GDP growth is actually 0.08 percentage point lower in the following five years, suggesting that the benefit do not trickle down. Instead, a similar increase in the income share of the bottom 20 percent (the poor) is associated with 0.38 percentage point higher growth” (Dabla-Norris et al., 2015).

The World Bank measures it as income per person below $1.90 per day (WB, 2019).

References

Abdullah, A., Doucouliagos, H., & Manning, E. A. (2015). Does education reduce income inequality? A meta-regression analysis. Journal of Economic Surveys, 29, 301–316.

Acemoglu, D. (1998). Why do new technologies complement skills? Directed technical change and wage inequality. Quarterly Journal of Economics, 113, 1055–1089.

Acemoglu, D., Johnson, S., & Robinson, J. (2001). The collonial origins of comparative development: An empirical investigation. American Economic Review, 91(5), 1369–1401.

Acemoglu, D., Johnson, S., & Robinson, J. (2002). Reversal of fortune: Geography and institutions in the making of the modern world income distribution. Quarterly Journal of Economics, 117, 1231–1294.

Acosta-Ormaecha, S., Komatsuzaki, T., & Correa-Caro, D. (2017). Fiscal reforms, long-term growth and income inequality. J IMF Working Paper, 17(145), 1.

Anderson, T. W., & Hsiao, C. (1981). Estiamtion of dynamic models with error components. Journal of American Statistical Association, 76(375), 598–606. https://doi.org/10.1080/01621459.1981.10477691

Ang, J. B. (2010). Financial liberalization and income inequality. Southern Economics Journal, 73, 738–761.

Arauz, A. F. (2016). Income Inequality in Costa Rica According to the National Household Income and Expenditue Surveys of 2004 and 2013. Retrieved 08 19, 2019, from https://repositorio.cepal.org/bitstream/handle/11362/40783/1/RVI119_Fernandez.pdf

Arellano, M., & Bond, S. (1991). Some test of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58(2), 277–297. https://doi.org/10.2307/2297968

Argentina, B. C. (2019). Main Variables. Retrieved August 2, 2019, from https://www.bcra.gob.ar/PublicacionesEstadisticas/Principales_variables_i.asp

Baiardi, D., & Morana, C. (2016). The financial Kuznetz curve: Evidence from the Euro Area. Journal of Empirical Finance, 39, 265–269.

Barone, G., & Mocetti, S. (2015). Inequality and trust: New evidence from panel data. Economic Inquiry, 54, 794.

Barro, R. (2000). Inequality and growth in a panel of countries. Journal of Economic Growth, 5, 5–32.

Basu, P., & Guariglia, A. (2007). Foreign direct investment, inequality and growth. Journal of Macroeconomics, 29, 824–839.

Baten, J., & Fraunholz, U. (2004). Did partial globalization increase inequality? The case of the Latin American periphery, 1950–2000. Cesinfo Economic Studies, 50, 45–84.

Beck, T., Demirguc-Kunt, A., & Levine, R. (2007). Finance, poverty and income inequality: cross-country evidence. NBER Working Paper Seris 10979.

Boglianccini, J. A. (2013). Trade liberalization, deindustrialization, and inequality: Evidence from middle-income Latin American countries. Latin America Research Review, 48, 79–105.

Bozoklu, S., Demir, A. O., & Ataer, S. (2020). Reassessing the environmental Kuznets curve: A summability approach for emerging market economies. Eurasiasian Economic Review, 10(3), 513–531.

Card, D., & DiNardo, J.E. (2002). Skill biased technological change and rising wage inequality: Some problems and puzzles. NBER Working Paper 8769.

Cavallo, A., & Rigobon, R. (2016). The Billion prices project: Using online data for measurement and research. Journal of Economic Perspectives. https://doi.org/10.7910/DVN/6RQCRS

Celik, S., & Basdas, U. (2010). How does globalization affect income inequality? A panel data analysis. International Advances in Economic Research, 16, 358–370.

Chen, J., & Tsai, W. (2012). A comparison of international income inequality: An ordered probit model analysis. Applied Economics, 44, 1701–1716.

Chen, S., & Ravallio, M. (2009). The Impact of the Global Financial Crisis on the World's Poorest. Retrieved 07 15, 2018, from http://www.voxeu.org/index.php?q=node/3520

Chintrakarn, P., Herzer, D., & Nunnenkamp, P. (2012). FDI and income inequality: Evidence from a panel of U.S. states. Economic Inquiry, 50, 788–801.

Choi, C. (2006). Does foreign direct investment affect domestic income inequality? Applied Economics Letters, 13, 811–814.

Cingano, F. (2014). Trends in income inequality and its impact on economic growth. In: OECD Social, Employment and Migration Working Papers, 163. OECD Publishing, Paris. https://doi.org/10.1787/5jxrjncwxv6j-en.

Coady, D., & Dizioli, A. (2018). Income inequality and education revisited: persistence, endogeneity and heterogeneity. Applied Economics, 50, 2747–2761.

Cornia, G. A. (2012). Inequality trends and their determinants: Latin America over 1990–2010. WIDER Working Paper 2012(09).

Dabla-Norris, E., Kochhar, K., Sphaphiphat, N., Ricka, F., & Tsounta, E. (2015). Causes and consequences of income inequality: A global perspective. IMF Staff Discussion Note 15(13).

De Gregorio, J., & Lee, J.-W. (2002). Education and income inequality: New evidence from cross-country data. The Review of Income and Wealth, 48, 395–416.

Demirguc-Kunt, A., & Levine, R. (2009). Finance and inequality: Theory and evidence. World Bank Policy Research Working Paper 4967.

Dollar, D., & Kraay, A. (2004). Trade, growth, and poverty. The Economic Journal, 114, 22–49.

Driscoll, J., & Kraay, A. (1998). Consistent covariance matrix estimation with spatially dependent panel data. Review of Economics and Statistics, 80, 549–560.

Feenstra, R., & Hanson, G. (1997). Foreign direct investment and relative wages: Evidence from Mexico’s Maquiladoras. Journal of International Economics, 42, 371–393.

Ferreira, H., & Ravallion, M. (2009). Poverty and inequality: The Global context. In W. Salverda, B. Nolan, & T. Smeeding (Eds.), The Oxford Handbook of Economic Inequality. Oxford Universithy Press.

Figini, P., & Goerg, H. (2011). Does foreign direct investment affect wage inequality? An empirical investigation. The World Economy, 34, 1455–1475.

FRED, S. L. (2018). Inflation, consumer prices for Argentina. Retrieved August 5, 2019, from Economic Research Federal Reserve Bank of St. Louis: https://fred.stlouisfed.org/series/FPCPITOTLZGARG

Freeman, R. (2010). Does inequality increase economic output? In Controversies about inequality. Stanford, CA: Stanford University Press

Gasparini, L., & Cruces, G. (2013). Poverty and inequality in Latin America: A story of two decades. Journal of International Affairs, 66, 51–63.

Gasparini, L., Cruces, G., & Tornarolli, L. (2011). Recent trends in income inequality in Latin America. Economia, 11, 147–201.

Gasparini, L., & Lustig, N. (2011). The Rise and Fall of Income Inequality in Latin America. Society for the Study of Economic Inequality Working Paper no. 2011–213.

GINI. (2019). GINI index (World Bank estimate). Retrieved 08 09, 2019, from iresearch.worldbank.org/PovcalNet/index.htm

Gini, C. (1912). Variability e mutabilita: Contributo allo studio delle distribuzione e delle relazioni statistiche. Studi Economico-Giuridici Della Regia Facolta Giurisprudenza, 3, 3–159.

Gini Index Map. (2019). Retrieved 08 09, 2019, from https://data.worldbank.org/indicator/SI.POV.GINI?view=map&year=2017

Goda, T., Onaran, Ö., & Stockhammer, E. (2017). Income and wealth concentration in the recent financial crisis. Development and Change, 48, 3–27.

Goñi, E., López, J. H., & Servén, L. (2008). Fiscal redistribution and income inequality in Latin America. Policy Research Working Paper 4487.

HDI. (2019). Human Development Index. Retrieved August 2, 2019, from United Nations Development Programme: http://hdr.undp.org/en/data

Hellenbrandt, T. (2014). Income inequality developments in the Great Recession. Peterson Institute for International Economics Policy Brief 14–3.

Hidalgo, J. C. (2014). Growth without Poverty Reduction: The Case of Costa Rica. Retrieved 08 19, 2019, from Economic Development Bulletin no. 18: https://www.cato.org/publications/economic-development-bulletin/growth-without-poverty-reduction-case-costa-rica

IFS. (2019). IFS-International Monetary Fund. Retrieved 08 02, 2019, from http://data.imf.org/?sk=4C514D48-B6BA-49ED-8AB9-52B0C1A0179B

Jauch, S., & Watzka, S. (2016). Financial development and income inequality: A panel data approach. Empirical Economics, 51, 291–314. https://doi.org/10.1007/S00181-015-1008-X

Jaumotte, F., Lall, S., & Papageorgiou, C. (2013). Rising income inequality: Technology, or trade and financial globalization? IMF Economic Review, 61(2), 271–309.

Joumard, I., Pisu, M., & Bloch, D. (2012). Tackling income inequality: The role of taxes and transfers. OECD Journal: Economic Studies, 2, 37–70.

Knight, J. B., & Sabot, R. H. (1983). Educational expansion and the Kuznets Effect. Knight and Sabot: Educational Expansion, 73(5), 1132–1136.

Kuznetz, S. (1955). Economic growth and income inequality. The American Economic Review, 45, 1–28.

Le Hoi, Q., & Pomfret, R. (2011). Technology spillovers from foreign direct investment in Vietnam: Horizontal or vertical spillovers? Journal of the Asia Pacific Economy, 16, 183–201.

Lopez, J., & Perry, G. (2008). Inequality in Latin America: Determinants and consequences. Policy Research Working Paper 4504.

Lustig, N. (2013). Latin America’s inequality success story. Current History, 112, 64–69.

Mah, J. S. (2003). A note on globalization and income distribution- the case of Korea, 1975–1995. Journal of Asian Economics, 14, 157–164.

Mah, J. S. (2012). Foreign direct investment, labour, unionization and income inequality of Korea. Applied Economics Letters, 19, 1521–1524.

Mahler, V. A. (2004). Economic globalization, domestic politics, and income inequality in the developed countries: A cross-national study. Comparative Political Studies, 37(9), 1025–1053.

McLeod, D., & Lustig, N. (2011). Inequality and poverty under latin America’s New Left Regimes. ECINEQ WP 2011-208.

Meyer Bittencourt, F. (2006). Financial Development and Inequality:Brazil. SSRN Electronic Journal 12(2006).

Mikek, P., & Simmons, M. (2019). Crisis, education, and income inequality in latin america and asia: A panel approach. Manuscript.

Mikek, P., & Carter, A. (2017). Income inequality in Latin America and Eastern EU through the Great Recession: An ordered probit analysis. Advances in Economics and Business, 5(10), 539–549.

Nasreddine, K., & Mensi, S. (2020). Financial development, income inequality, and poverty reduction: Democratic Versus Autocratic Countries. Journal of Knowledge Economy, 11, 1358–1381.

Nijhawan, I., & Dubas, K. (2006). A reassessment of the relationship between income inequality and poverty. Journal of Economics and Economic Education Research, 7, 103–115.

Nikoloski, Z. (2010). Financial sector development and income inequality: Is there a financial Kuznetz curve? Journal of International Development, 25.

O’Neill, D. (1995). Education and income growth: Implications for cross-country inequality. Journal of Political Economy, 103(6), 1289–1301.

Ostry, J., Berg, A., & Tsangarides, C. (2014). Redistribution, inequality, and growth. IMF Staff Discussion Note, 14(02), 1.

Pirttila, H., & Tuomala, M. (2004). Poverty alleviation and tax policy. European Economic Review, 48, 1075–1090.

Qazi, W., Raza, S. A., Jawaid, S. T., & Abd Karim, M. Z. (2016). Does expanding higher education reduce income inequality in emerging economy? Evidence from Pakistan. Studies in Higher Education.

Ravallion, M. (1997). Can high-inequality developing countries escape absolute poverty? Economic Letters, 56, 51–57.

Ravallion, M. (2001). Growth, inequality, and poverty: Look beyond averages. World Development, 29, 1803–1815.

Sahay, R., Cihar, M., N’Diaye, P., Brajas, A., Bi, R., Ayala, D., Bi, R., Gao, Y., Kyobe, A., Nguyen, L., Saborowski, C., Svirydzenka, K., & Yousefi, S. R. (2015). Rethinking financial deepening: Stability and growth in emergining markets. IMF Staff Discussion Note, 15, 1.

Shahbaz, M., & Islam, F. (2011). Financial development and income inequality in Pakistan: An application of ARDL approach. Journal of Economic Development, 36, 35–53.

Shahbaz, M., Loganathan, N., Tiwari, A. K., & Sherafatian-Jahromi, R. (2014). Financial development and income inequality: Is there any financial Kuznets curve in Iran? Social Indicators Research., 124, 357–382.

STATA. (n.d.). STATA—help. USA. Retrieved March 06, 2023.

Sylwester, K. (2004). A note of geography, institutions, and income inequality. Economic Letters, 85, 235–240.

Tsounta, E., & Ouseke, A. (2014). What is Behind Latin America's Declining Income Inequality? IMF Working Paper no 14/124.

te Velde, D. W. (2003). Foreign direct investment and income inequality in Latin America: Experiences and policy implications. Documento de Trabajo, No. 04/03.

WB. (2019). Poverty—World Bank. Retrieved 08 20, 2019, from https://www.worldbank.org/en/topic/poverty/overview

World Development Indicators. (2019). Retrieved August 5, 2019, from The World Bank: https://databank.worldbank.org/source/world-development-indicators

Zhang, R., & Naceur, S. B. (2019). Financial development, inequality and poverty: Some international evidence. International Review of Economics & Finance, 61, 1–16.

Ziesemer, T. (2016). Gini coefficients of education for 146 countries. Bulletin of Applied Economics, 3, 1–8. Retrieved from https://cris.maastrichtuniversity.nl/portal/files/11256785/5886253.pdf

Funding

No funding was received for the research for this article.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Mikek, P. Financial deepening and income inequality: is there a financial Kuznetz curve in Latin America?. Eurasian Econ Rev 13, 103–125 (2023). https://doi.org/10.1007/s40822-023-00227-x

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40822-023-00227-x