Abstract

This paper addresses incomplete exchange rate pass-through (ERPT) and pricing-to-market (PTM) by proposing an optimal control model of dynamic monopolistic pricing on a foreign market, which accounts for dynamic demand effects (such as diffusion or saturation) and learning curve effects. It is shown how the optimal dynamic export pricing results in partial or full ERPT in the long-term equilibrium. Moreover, transitional price dynamics are illustrated, which may explain dumping, i.e., temporary prices below unit costs, and (asymmetric) short-run overshooting dynamics of the optimal export price level as a reaction to exchange rate changes.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Exchange rate pass-through (ERPT) and pricing-to-market (PTM) studies have been dominating the new international trade and new industrial organization literature for nearly the last three decades. A number of empirical studies suggest that the law one price (LOP) does not hold in reality, and show that the ERPT is often incomplete as international trade participants are actively involved in price discrimination across destinations (see, e.g., Goldberg and Knetter 1997). Exchange rates and the way exporting firms deal with their fluctuations become increasingly important in this setting: Ohno (1990) suggests that the more forward-looking is the foreign firm relative to the domestic firm, the lower is the degree of exchange rate pass-through and the higher is the export penetration. Froot and Klemperer (1989) show that demand of an exporting firm depends on its current market share and exchange rate changes might create incentives to shift profits between periods and affect the pricing strategy of the exporter, leading to an incomplete pass-through in local currency prices. This study of Froot and Klemperer (1989) is the first study that considers the importance of cost effects (learning curve), switching costs of consumers and network effects in the context of PTM. Yet, the authors do not introduce these effects to their model and do not intend to come up with an intertemporal optimal price solution.

The trade-off between lower profit in the short-run due to aggressive pricing and higher profit in the long run due to reduced competition and the role of learning-by-doing in the economics of predation is further explored by e.g., Cabral and Riordan (1994) and Besanko et al. (2014). Although the idea of learning curve effects was around since the 1930s (Wright 1936), the industrial organization literature on learning effects emerged mostly in 1980s (Lee 1975; Spence 1981; Ghemawat and Spence 1985). These studies focused mostly on a domestic market setting, not expanding to the case of international trade.

This paper attempts to bridge these two directions of theoretical work. Since most of PTM models have the shortcoming of being static (or limited to a two-period model)Footnote 1 and the studies related to learning-curve effects focus on domestic markets, we intend to fill this gap in the literature and propose an optimal control model of dynamic pricing on a foreign market that builds on the study of Kalish (1983). For a domestic market Kalish (1983) shows how firms adjust their profit-maximizing pricing over time if—due to learning-by-doing—costs decline with production activity and/or if there are (positive or negative) intertemporal demand-spillover effects, e.g., if positive previous consumption experience and word-of-mouth effects result in an increasing demand over time, or, in contrast, if due to saturation effects past sales lead to a decrease of demand in the future. Since export prices and the costs of imported intermediates are affected by the exchange rate, the latter is considered in our study as an important determinant of the optimal pricing strategy.Footnote 2 The optimal control model of export pricing is presented in a general formulation and, additionally, for the simple case of isoelastic demand and cost functions. For this isoelastic specification we are able to calculate long-run steady state equilibrium solutions algebraically and, furthermore, to calculate numerical simulations for the short-run transitional dynamics. We demonstrate that positive intertemporal demand spillover effects and cost reducing learning-by-doing act as an incentive to set low prices directly after a firm has entered a foreign market (which can be considered as a kind of dumping strategy). Moreover, these dynamic effects result in incomplete ERPT and PTM-strategies even in the long run. Moreover, the short-run transitional reaction to exchange rate changes shows overshooting characteristics of the dynamically optimal price strategy.

The remainder of this paper is structured as follows: Section 2 presents some related literature. Dynamic optimization based on a general formulation of the model is presented in Section 3. Section 4 illustrates how dynamic optimization works when the model is specified with isoelastic functions. Section 5 provides some numeric simulations, Section 6 illustrates the transitional (overshooting) dynamics of the optimal price level after an exchange rate shock has occurred and Section 7 concludes.

2 Related Literature

2.1 Seminal Studies on Incomplete ERPT and PTM

While the LOP assumes that prices of goods are equal in different countries and currencies—when adjusted for exchange rates, tariffs and transportation costs—due to arbitrage, Dornbusch (1987) shows that the LOP fails to describe the situation when firms engage in strategic pricing in the international market.

Krugman (1987) in his seminal work starts the analysis from the observation that prices of many imports into the US did not fall during the era of an appreciating dollar. Krugman labels this phenomenon when foreign firms maintain or increase their export prices during domestic currency appreciation PTM. To explain PTM, Krugman concentrates on two types of models: static, in which the belief that a dollar appreciation is temporary does not affect firms’ pricing behavior; and dynamic, in which a dollar appreciation is taken as temporary, so the pricing of foreign firms is based on the expected long-run costs rather than low costs due to a temporarily strong dollar.

Static models brought into focus by Krugman include a supply and demand model, a monopolistic competition model and an oligopoly model. The supply and demand model, which was initially proposed by Haberler (1949), assumes a world of two countries engaged in trade, in which markets clear and the LOP holds. Although this model is able to answer the question how a dollar appreciation may result in a less than proportional dollar price decline, it fails to explain why the prices of goods sold to different countries differ, if no dynamic issues (e.g., marketing and distribution) are taken into account. The monopolistic price discrimination model assumes that a monopolistic firm can sell either in a domestic or a foreign market. As these markets are separated, there is no arbitrage across them. The optimal pricing rule of the monopolist in this model heavily depends on the elasticity of demand with respect to price paid in local currency. PTM in this setting arises if the elasticity of demand increases in local currency price. The simple monopolistic price discrimination model was used by Knetter (1989) in order to derive an empirical specification which has been excessively employed over the last decades to test for PTM on various markets. Later on, Knetter (1993) labels this markup adjustment—undertaken by an exporter in order to offset exchange rate fluctuations and prevent drastic changes in prices paid in destination markets’ currencies—the ‘local currency price stabilization’ (LCPS) mechanism.

Opposite to static models, dynamic models that include supply-side dynamics and dynamics of demand allow for a dynamic reaction of prices to exchange rate changes.

Using the supply-side dynamics model Krugman (1987) formalizes the idea that PTM can result from temporary bottlenecks caused by changing import volumes. In this case the price-discriminating monopolist is not able to expand his sales without providing an additional distribution and service infrastructure which is costly. As the exporter’s currency depreciates, limited capacities prevent him from fully responding to the increasing demand, and prices do not fall immediately, but rather gradually adjust as new infrastructure is put in place, provided that the currency continues to depreciate. Thus, the degree of PTM depends both on how recently the exchange rate has changed and how persistent this change is expected to be.

The dynamics of demand model relies on the assumption of slow demand adjustments and relates PTM literature to the hysteresis and sunk cost literature. In this model an exporter invests in his market share and future profits by focusing his pricing strategy on the long run exchange rate developments. Then an exchange rate appreciation that is perceived to be temporary has a smaller effect on prices than a permanent appreciation and does not lead to a proportional price increase.

2.2 Sunk Entry Costs and Hysteresis Models

Sunk entry costs and hysteresis models are related to the dynamics of demand model of Krugman (1987) mentioned above. Hysteresis literature (e.g., Baldwin 1988, 1989; Dixit 1989; Campa 2004; Herger 2014) suggests that a firm’s behavior in the international market is partially determined by its past decisions, e.g., sunk costs of the market entry. These costs—once paid—influence the motivation of the firm to stay in the market and might lead to strategic pricing that—along the lines of Krugman (1987) and Froot and Klemperer (1989)—may result in an incomplete pass-through of negative cost shocks to consumer prices, meant to gain market shares in strategically important markets. The degree of the pass-through in this situation depends on the magnitude and persistence of the shock.

2.3 Optimal Dynamic Pricing and Intertemporal Spillovers

ERPT and PTM strategies might result from dynamic optimization considerations of an exporting firm in a situation with intertemporal demand spillover effects and dynamic economies of scales based on learning-by-doing. Current sales can, e.g., be positively influenced by past sales, if positive experiences of early buyers—via word-of-mouth as a positive information about the product—lead to a higher demand in the future. Moreover, past production experiences may reduce the current unit costs due to learning-by-doing. Thus, cumulative sales and/or production play a role for current demand and costs—and thus have to be considered for optimal dynamic pricing strategies. If a firm enters a foreign market, positive dynamic demand spillovers are an incentive to set low prices at the beginning, even if this leads to negative profits for a transitional period. This kind of “market-entry investment” consideration is interrelated with the optimal reaction of foreign export market prices to exchange rate changes. Therefore, an incomplete ERPT or a PTM strategy may—in part—be the result of dynamic pricing in a situation in which intertemporal spillovers prevail. Moreover, since the initially negative profits can be interpreted as a “market-entry investment” and, thus, as a special type of sunk entry costs, there is a close relation to the hysteresis models of international trade.

Optimal dynamic pricing in a situation with dynamic demand and cost effects was analyzed in a non-export/domestic market framework by Kalish (1983). An overview of the application of optimal control models to marketing strategies is given by Feichtinger et al. (1994, especially chapter 4, addressing cumulative sales models). For more recent examples of optimal dynamic pricing in situations with dynamic demand and cost effects using optimal control methods, see e.g., Jørgensen et al. (1999, including inventory optimization), Lin (2008, additionally addressing optimal quality) or Fan et al. (2005, with an emphasis on numerical solution methods). However, all these examples are related to domestic market situations, in which naturally no effect of exchange rates on pricing is considered.

In the following section we apply an optimal control model of dynamic pricing in a situation with demand and cost learning in analogy to Kalish (1983). However, in contrast to the existing dynamic pricing literature, a foreign export market for the final product of a monopolistic firm and an international intermediates import market is modeled. Thus, the focus of our model is the exchange rate effect on the optimal dynamic pricing, and the question how ERPT and PTM strategies can be ascribed to demand spill-overs and to cost reducing learning effects.

3 Dynamically Optimal Export Pricing in a General Formulation

The demand quantity on the export market of a firm depends positively on exogenous demand factors, summarized by Qt, and negatively on the foreign currency price p. Furthermore, intertemporal demand spill-over effects are represented via a variable At, which captures the cumulated sold quantities on this market in the past as a kind of accumulated capital stock.

with:

- x:

-

demand quantity on export market

- Q:

-

exogenous part of demand

- p:

-

price on export market (in foreign currency)

- A:

-

accumulated sales in the past

- t:

-

index of time

Intertemporal demand spill-over effects can be both, positive or negative. If current sales increase with past sales (∂x/∂A > 0), this may be the result of a positive experience/learning of the buyers with the product, and a positive word-of-mouth spread by past buyers.Footnote 3 Analogously, negative spillover effects (∂x/∂A < 0) occur in the case of negative consumer experiences and negative word-of-mouth effects. Furthermore, in the case of durable goods due to saturation effects the remaining market potential is reduced by past sales. The accumulation of “experience capital” At is based on cumulated past sales (the dot “°” characterizes changes/derivatives in time t):

with:

- A:

-

“experience capital” (equivalent to accumulated produced & sold products in the past)

- β:

-

depreciation rate (β ≥ 0)

This is a simple specification of the demand function, since the consumers are assumed to react to current prices and not to anticipate future price changes. In reality, the expectation of price changes should alter the consumers present behavior, if some kind of intertemporal substitution in consumption of this good is possible, or if the good is durable: the expectation of decreasing prices would reduce current demand, and an expected price increase should increase present demand. Therefore, a more sophisticated modeling of demand dynamics should be based on an dynamic optimization on the consumers’ side as well. Moreover, if the exporter would expect the consumers anticipation reaction, price setting would become a dynamic game between foreign consumers and the domestic exporter.Footnote 4 However, this would increase the complexity of the model dramatically. Thus, for the reasons of simplicity, consumers (in contrast to the exporting firm) are assumed not to anticipate price changes and just react to the current price (and to past experiences with the product). This may be justified by the different levels of information that are available on both market sides. Since the correct information is essential for the exporter, performing market research is worthwhile and, hence, the structure of demand is known to the firm. Furthermore, since the firm carries out production, information about learning effects is available. In contrast, the consumers can be assumed to be less informed, since they are not familiar with the production process, and expenditures for this special good may be only a small part of the overall consumption expenditures, so that gathering information and starting efforts to dynamically optimize consumption is too costly in terms of transaction costs. Besides, in a more simple setting, one can assume the good to be perishable, or/and without the option of intertemporal substitution.

The unit costs of producing exports are determined by exogenous factors k, and—since some factors and intermediates have to be imported—the exchange rate r (in the price notation, i.e., the price of the foreign currency stated in the domestic currency). Dynamic economies of scale are addressed via past sales/production quantities: learning-by-doing results in a reduction of unit costs in the course of past production. For reasons of simplicity, it is assumed, that the whole production is exported, so past export sales and past production both are modeled by At:

with:

- c:

-

unit costs (in home currency)

- k:

-

exogenous part of unit costs

- r:

-

exchange rate (price of foreign currency stated in domestic currency)

Due to the reason of analytical simplicity, we do not model a joint production of the good for the domestic and the international market, resulting in joint cumulated production quantity effects on learning. Otherwise we would have to model two different stocks of “experience capital”, one relevant for demand on the foreign market and another capital stock relevant for the cost level of the overall production. Moreover, using a single capital stock At for capturing dynamic cost and demand effects does not allow us to differentiate between accumulated production, which is relevant for costs, and accumulated sales, which are relevant for demand spillovers. Thus, the storage of goods and dynamic price effects due to changes in the level of stored goods, which may be important for dynamic pricing decisions, cannot be addressed. Furthermore, this simplification implies the same rate of depreciation (β) for both, demand and cost effects. However, since we use two different functions to incorporate the dynamic effects of the capital stock At on intertemporal cost and demand spillovers, the resulting consequences of these different effects on optimal dynamic pricing are separated in our simple model. The simplification of using only one stock of capital and a firm that solely produces for exporting may be justified if storage of the exported good is not possible or not important in terms of quantities and if the exported product is very country specific, e.g., due to special product regulations in the destination markets. This can at the same time be the reason why the export market is separated from other countries’ markets, and why no price arbitrage is taking place.

Contemporaneous profit (gt) of exporting at time t is calculated based on the price in domestic currency (rt ⋅ pt):

If the final product market is not a foreign export market but a domestic market, and if no intermediates are imported, we have a special case of our model, in which the exchange rate is fixed at 1. This special case corresponds to Kalish’s (1983) specification of the cumulative sales model. However, the exchange rate is considered twice in our internationally extended version of the model: (1) unit revenues in the home currency change with the exchange rate, caused by the (proportional) conversion of the foreign currency price level of the export market, and (2) (typically under-proportional) effects of exchange rate changes on unit costs, due to imported raw materials and intermediates.

The firm maximizes the present value G of all future profits, based on a (constant) rate of time preference ρFootnote 5:

The (present-value) Hamiltonian is:

The first order optimality condition for the dynamic pricing strategy is calculated by taking the derivative w.r.t. the control variable pt and equalizing it to 0.

This leads to an expression for the shadow price mt of the experience capital (time subscript “t” mostly omitted in the following):

Using (absolute) price elasticity of demand \( \left(-{\updelta}_{\left(\mathrm{t}\right)}\right)\equiv \frac{\partial \mathrm{x}/\mathrm{x}}{\partial \mathrm{p}/\mathrm{p}}\equiv \frac{\partial \mathrm{x}/\partial \mathrm{p}}{\mathrm{x}/\mathrm{p}} \):

The negative derivative of the Hamiltionian w.r.t. the state variable At determines the motion of the costate mt, i.e., the dynamics of the shadow price of At:

The transversality condition is:

The derivative of the first order optimality condition (7′) w.r.t. time t leads to a second expression for \( \overset{\circ }{\mathrm{m}} \). Equalizing this with \( \overset{\circ }{\mathrm{m}} \) from Eq. (8) and inserting the RHS of Eq. (7′) for m results in the following rule of optimal price setting on the export market:

The first line of this price-setting rule addresses the endogenous effects of the experience capital A on the price level: the cost reducing learning-by-doing (first/left fraction) and the dynamic demand spillovers (second/right fraction). The second line captures pricing effects of exogenous changes of the exchange rate (r), the unit costs (k) and the demand (Q).

4 Isoelastic Functions and Dynamic Optimization

As a simple example, the model is now specified with isoelastic functions (i.e., with constant elasticities). In this specification the effects of cumulative production/sales are based on separable functions, i.e., the price elasticity of demand is independent of A.Footnote 6 Furthermore, constant elasticities are “compatible” with constant long-run growth rates (i.e., “balanced growth”). Thus, this simple functional type allows us to apply standard calculation procedures as common in optimal growth models, and to calculate closed long-run solutions.

The demand function Eq. (1) in this special case is:

with:

- δ:

-

(absolute) price elasticity of demand (δ ≥ 0)

- τ:

-

elasticity of demand w.r.t. experience capital (τ < 1)

Thus, the accumulation of experience capital (2) now is:

The unit costs function of producing (3) in isoelastic formulation is:

with:

- κ:

-

(absolute) elasticity of unit costs w.r.t. experience capital (κ ≥ 0)

- ε:

-

exchange rate elasticity of unit costs (0 ≤ ε ≤ 1)

Thus, dynamic spillover effects are modeled by two elasticity parameters: if learning-by-doing results in a reduction of costs, this is captured by a positive parameter κ > 0. Intertemporal demand spillover effects are described by the parameter τ: if τ > 0, there are positive effects of past sales on the present demand (i.e., due to positive experiences of consumers with the product), for τ < 0 there are negative effects of past on current sales (if e.g., the product is a durable good, or if consumers’ experiences were negative).

Analogous to constant elasticities, all exogenous variables have a constant (expected) growth rate (which may be 0), indicated by a hat “^”:

The Hamiltonian (6) for isoelastic functions is (if the time index is omitted):

The FOC (7) again leads to an expression for the costate m, i.e., the shadow price of experience:

The motion of the shadow price (8) is in this special case:

As in the general case of Eq. (10), the optimal dynamics of the control variable p is calculated by taking the time derivative of the FOC (16) to determine another expression for \( \overset{\circ }{\mathrm{m}} \), equalizing this with \( \overset{\circ }{\mathrm{m}} \) from Eq. (17) and inserting the solution for m from Eq. (16):

Equation (18) shows that for a typical case (with only partial unit costs effects of the exchange rate, 0 < ε < 1, and a monopolistic price elasticity δ > 1), positive demand diffusion effects (τ > 0) result in positive price changes related to the level of cumulated sales A, while negative saturation effects (τ < 0) result in a price reduction effect of A. Moreover, in the case of cost reducing effects of learning (κ > 0), experience capital A has a negative effect on optimal price changes.

4.1 Stationary Steady State

In a stationary case without any exogenous disturbances (i.e., if \( \widehat{\mathrm{r}}=\widehat{\mathrm{k}}=\widehat{\mathrm{Q}}=0 \), and Q = Q0, r = r0, k = k0), the optimal price setting (18) is simplified to:

For the stationary case—after transitional adjustment dynamics have taken place—a steady state equilibrium is characterized by a constant price [\( {\overset{\circ }{\mathrm{p}}}_{\left(\mathrm{stat}\right)} \) = 0] and by a constant level of experience [i.e., if \( \overset{\circ }{\mathrm{A}} \) = 0 in Eq. (12)]. The resulting st.st.-price level is:

The corresponding steady-state level of the experience A is determined by \( \overset{\circ }{\mathrm{A}} \) = 0 in Eq. (12):

The steady state level of the dynamically optimal (foreign currency) price in the export market depends on the levels of exogenous variables, the exchange rate r (in price notation), the exogenous part of (domestic currency) costs k and the exogenous part of demand Q. The comparative static effects are—stated as elasticities ηp(st.st),(.)—as follows:

Thus, in a typical case, with small values of the dynamic spillover elasticities τ and κ [i.e., if (τ + κ ⋅ δ) < 1, and assuming positive intertemporal demand spillover effects with τ > 0], a permanent increase in the exchange rate r (defined as the price of the foreign currency, i.e., a devaluation of the home currency), will in the long-run result in a decrease of the dynamically optimal export price level (denoted in foreign currency). This price decrease is the stronger, the larger demand-spillover effects τ and the larger the effect of cost reduction due to learning κ are. The price decrease is dampened by the imported intermediates cost effect of a domestic devaluation, captured by the parameter ε. Furthermore, if (τ + κ ⋅ δ) < 1, the price level increases with higher autonomous costs k (this effect is the stronger, the larger τ and κ). An increase in the autonomous demand Q reduces the steady-state price level (the stronger, the larger τ and κ).

A complete 1:1-exchange rate pass-through—in the long run for the steady state equilibrium—results if the (absolute) elasticity |ηp(st.st),r| of the foreign currency price level p w.r.t. the exchange rate is 1 (i.e., 100 %). If 0 < |ηp(st.st),r| < 1 the equilibrium ERPT is incomplete, and if |ηp(st.st),r| > 1 the ERPT is over-proportional, and for ηp(st.st),r = 0, exchange rate changes are not even partially passed through and the price level on the foreign market is independent of the exchange rate. This independence of the foreign currency price respective to exchange rate changes can be interpreted as a kind of pricing-to-market.Footnote 7

For the static standard textbook case of monopolistic price setting—without any dynamic spillover effects of experience (τ = κ = 0)—we have the static monopoly Cournot-price p(C) as a special case of p(st.st) and the respective elasticities ηp(C),(.) w.r.t. the exogenous variables:

Comparing the elasticities of this static standard case with the positive dynamic spillover case (τ, κ > 0), we see that the absolute size of the effects of the exogenous variables is amplified by dynamic demand and cost spillovers:

Sufficient conditions for the optimal control problem were not algebraically computed due to mathematical complexity. The simple (but too restrictive) conditions of the Mangasarian sufficiency theorem do not apply, since the objective function and the dynamic accumulation constraint are not concave in the control p and the state variable A. Moreover, even the simple special case of the Cournot-price p(C) shows that not all parameter combinations are feasible: e.g., the price elasticity of demand has to be in absolute terms δ > 1 in order to avoid negative prices; and to ensure that using the necessary conditions of the FOCs leads to the profit maximum (since a minimum and a saddle point as well as a maximum in principle satisfies the FOC). However, in the case of numerical simulations the calculated path of the dynamically optimal price and the resulting profits will make it obvious whether the present value of the profits was maximized or minimized by application of the FOCs.

4.2 Balanced Growth

Not only stationary situations can be described by the model, but a balanced growth equilibrium with constant growth rates as well—if at least one of the exogenous factors is growing with a constant non-zero rate. For this, an absolute change of the price level \( \overset{\circ }{\mathrm{p}} \) from Eq. (18) is divided by p, and the resulting growth rate \( \widehat{\mathrm{p}} \) ≡ (\( \overset{\circ }{\mathrm{p}} \)/p) is again differentiated w.r.t. time t. The change of the growth rate [\( \mathrm{d}\left(\widehat{\mathrm{p}}\right)/\mathrm{d}\mathrm{t} \)] is zero in the case of a balanced growth equilibrium with constant growth rates of all endogenous variables. The same procedure applies to the growth rate of the experience  ≡ (\( \overset{\circ }{\mathrm{A}} \)/A), which has to be constant as well. The resulting expression for the equilibrium dynamics of the dynamically optimal price level is:

The balanced growth equilibrium p(b.g) is a generalization of the steady state p(st.st), or turned around, p(st.st) is a special case of p(b.g): the b.g. equilibrium is equivalent to the st.st., if all exogenous growth rates are 0 [i.e., \( \widehat{\mathrm{r}} \) = \( \widehat{\mathrm{k}} \) = \( \widehat{\mathrm{Q}} \) = 0 ⇔ p(b.g) = p(st.st)]. The balanced growth solution of the experience A(b.g) can be calculated analogously, but is not explicitly stated here [only the resulting b.g. growth rate for A(b.g) can be seen below in Eq. (27)]. The equilibrium/balanced growth rate of the endogenous variables p, A and sales/production x (for constant exogenous growth rates) are:

The partial effects of a single growth rate of exogenous variables on the balanced growth rate of the export price level are similar to the elasticities computed for the st.st equilibrium:

In the static standard/textbook case of no dynamic spillover effects of experience (τ = κ = 0) the resulting equilibrium growth rates of the endogenous variables reduce to:

5 Numerical Simulation

In the following, a numerical example for the adjustment processes towards a stationary steady state (with \( \widehat{\mathrm{r}}=\widehat{\mathrm{k}}=\widehat{\mathrm{Q}}=0 \)) is simulated. The parameters for the numerical example are r0 = 1, k0 = 1, Q0 = 3, κ = 1/10, τ = 1/5, ε = 1/10, δ = 2, ρ = 1/10, β = 1/4.Footnote 8 The steady state in this case is: A(st.st) = 12.4678 and p(st.st) = 1.26265. The differential equations in time for experience accumulation and optimal price setting are:

Linearization around the steady state via Taylor-expansion and calculating the eigenvalues of the linearized system results in one positive and one negative eigenvalue, i.e., the system is saddle path stable (as typical for an optimal control problem with one control and one state variable). Here we apply the time-elimination method (see Mulligan and Sala-i-Martin 1993, pp. 753 ff., and Barro and Sala-i-Martin 1995, pp. 490 f.) for finding the saddle path, and the software Maple for the calculations.Footnote 9 Time-elimination converts the boundary condition problem (i.e., the steady state for t → ∞) into a more simple initial condition problem. It leads to the following policy function (which determines the change of the control variable p depended on the level of the state variable A):

For particular solutions of this differential equation two alternative initial points were applied to visualize both branches of the saddle path: [1] one trajectory starting with 1 % of A(st.st) [with A(t = 0) = 0.124678 and p(t = 0) = 0.802524, depicted on the left hand side of Figs. 1 and 2], and [2] another (symmetric) starting point with 199 % of A(st.st) [right side of the graphs, with A(t = 0) = 24.811 and p(t = 0) = 1.25139]. The dynamics were calculated for 15 periods (t = 0,…,15). Additionally the steady state is depicted in Fig. 2 as a stationary path in the middle.

For the (more relevant) case of starting with very little experience, the 1 % level trajectory [A(t = 0) = 0.124678 and p(t = 0) = 0.802524] was used to calculate the time paths of other endogenous variables of the model (see Fig. 3 and the following figures).

The simulation reveals some interesting characteristics of a situation with positive intertemporal spillovers. The implicit internal rate of return to experience capital A, i.e., the growth rate of the shadow price of experience \( \widehat{\mathrm{m}} \) ≡ [\( \overset{\circ }{\mathrm{m}} \)/m], is high in the beginning when experience is very scarce (see Fig. 4). Due to diminishing returns to scale (if κ,τ < 1) this rate of return declines with the accumulation of experience; and converges to the rate of time preference ρ in the steady state.

Via accumulating experience, unit costs are declining (due to learning-by-doing) and the price is increasing (due to a higher demand). Thus, the profits g(t) are increasing with ongoing production and sales (see Fig. 5).

Optimal dynamic pricing results in very low prices at the beginning of the experience accumulation, which leads to even negative optimal profits in the beginning of the market activity. The firm accepts negative profits as a kind of sunk “market-entry investment” and produces and sells at a relatively high level in the beginning, since—due to a rapid cost reduction and demand increase—accumulation of experience is very profitable if a firm starts with very little experience. Thus, after a foreign market is entered, the firm initially sells at a price below unit costs, which can be regarded as a kind of “dumping”. However, the reason behind this aggressive pricing strategy is not to push competing firms out of this market, but to accumulate experience and reputation capital as fast as possible—and to be able to produce and sell a large quantity at lower costs and at higher prices in the future. The production quantity dynamics (see Fig. 6) are not monotonous. The firm starts with a high level of production x(t = 0), based on very low prices, leading to negative profits in the first period(s). This market entry investment phase is followed by increasing prices, and at first decreasing sales/production. However, later on the decreasing costs and increasing demand lead to an increase of production/sales again.

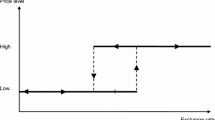

6 A Qualitative Analysis of Transitional Short Term Dynamics

Based on the results for the steady state equilibrium, as stated in Eq. (22), combined with the graphic representation of the stable saddle path, as depicted in Fig. 1 for the simulated example, we are able to conduct a qualitative analysis of the transitional adjustment dynamics resulting from a “once and for all” (i.e., permanent) change of an exogenous variable. As an example we discuss a depreciation of the home currency. The respective dynamics are graphically illustrated by an (A,p)-diagram (see Fig. 7).

If 0 ≤ ε, τ > 0, (τ + κ ⋅ δ) < 1, and thus, ηp(st.st),r < 0, a depreciation of the home currency, i.e., an increase in the exchange rate (in price notation) of the foreign currency, results in a negative change of the steady-state equilibrium level of the price p on the export market (which is stated in foreign currency), consequently leading to higher production/sales, and eventually resulting in a higher steady-state level of experience capital A. Starting from a steady-state equilibrium which is based on an exchange rate r0 (point S in Fig. 7), a permanent depreciation of the home currency (e.g., due to a realignment in a fixed exchange rate system), with a higher exchange rate level r1 (> r0), results in a new steady state equilibrium with a lower price (pst.1 < pst.0) on the export market and a higher level of experience (Ast.1 > Ast.1). I.e., the new steady state (point Z) has a position south-east of the old equilibrium (point S) in the (A,p)-diagram.

Not only the long-run equilibrium point is shifted, but the whole saddle path. Thus, a permanent devaluation shifts the saddle path to the south-east, too. If the exchange rate suddenly changes to a new permanent level (from r0 to r1), the accumulated experience is given in the short-run. For this starting level of experience Ast.0 the new position on the shifted saddle path is depicted with point T. Due to the positive slope of the saddle path on the left hand side of point Z, the optimal price level initially “jumps” to p′< pst.1 (from point S to T): i.e., in the short run the dynamically optimal price transitionally “overshoots” the new equilibrium level.Footnote 10 With such a low price level, sales/production rise and thus more experience is accumulated, resulting in a transitional movement on the new saddle path towards the new steady state equilibrium (from point T to Z). Due to the overshooting price reaction, the short-run exchange rate effect on dynamically optimal export price-setting is amplified compared to the long-run equilibrium effects as stated in Eq. (22). The economic intuition behind the overshooting of the price adjustment is the following: As a consequence of the permanent devaluation of the home currency, selling in the foreign market becomes more profitable. In order to exploit this long-run market potential quickly, the optimal price is transitionally set even below the long-run equilibrium level, because this—since production/sales are transitionally higher—leads to a faster accumulation of experience and reputation (which is the base for a quicker increase of profits in the future). As a potential consequence of this transitional pricing strategy, a parameter situation which is in the long run characterized by only partial ERPT, may—due to overshooting—in the short-run even show an over-proportional response to a permanent devaluation.

However, on the right hand side of the equilibrium, the saddle path (due to its convexity) has a flat or even a negative slope. Thus, a permanent appreciation of the home currency does not result in overshooting price adjustments. This becomes obvious, if we swap the initial and final equilibrium situation: Now assume the initial exchange rate r1 which has led to a long-run equilibrium point Z. If now a permanent appreciation takes place (with a new exchange rate r0), this leads to a jump of the price level to point R, and then to a transitional adjustment from point R to the equilibrium in point S. During this transitional process the optimal price level is close to the new equilibrium price level pst.0, i.e., there is actually no overshooting in the appreciation case. Consequently, although the long-run price effects are symmetric concerning a depreciation or an appreciation, the short-run dynamics of the optimal price level are asymmetric.

7 Conclusion

Many recent contributions show how different factors result in an incomplete exchange rate pass-through (ERPT). We contribute to the vast literature on ERPT and pricing to market (PTM) by proposing a model, in which those pricing strategies may be obtained as a result of dynamic optimization of exporting firms, once intertemporal demand spillover effects and learning curve effects are taken into account, analogous to the “cumulative sales” dynamic pricing literature (e.g., Kalish 1983). Dynamic pricing is relevant if current and future sales are affected by the past sales, e.g., when positive word-of-mouth effects occur, and if past production experience might reduce current costs due to learning-by-doing. Contrary to the standard dynamic pricing models, we analyse a two-country model with a foreign export market. Export prices and the costs of imported intermediates are affected by the exchange rate—and have to be considered as important determinants of the optimal pricing strategy. Thus, dynamic pricing interrelates to questions of ERPT and PTM. Besides presenting the optimal control model in a general formulation, we show how the dynamic optimization problem can be solved when the model is specified with isoelastic demand and cost functions. We are able to determine the algebraic solution of the transitional dynamics for the isoelastic version and to compute the equilibrium for two different situations: a steady state (without exogenous disturbances) and a balanced growth equilibrium (when all exogenous variables grow at constant rates). Based on a numerical simulation of the transitional dynamics, it is shown that once a firm enters a foreign market, positive intertemporal spillovers act as an incentive to set low export prices in the beginning, despite of temporary negative profits, which can be considered as a kind of “market-entry investment” or as a kind of dumping strategy. Intertemporal spillover effects can be related to the optimal reaction of export prices to exchange rate changes, thus, allowing us to draw incomplete ERPT and PTM-strategies back to the effects of demand spillover and learning-by-doing.

Moreover, the analysis of the short-run transitional dynamics that result from a permanent devaluation of the home currency shows that the short-run transitional response of the dynamically optimal price shows overshooting characteristics. Thus, even in the case of only partial ERPT in the long-term equilibrium, in the short run even an over-proportional response of the optimal price to exchange rate shocks may occur. However, short-run dynamics are (in contrast to symmetric long-run price effects) asymmetric, as overshooting will typically not occur in the case of a permanent appreciation of the producer’s home currency.

How do our theoretical findings relate to the existing empirical literature? As empirical PTM studies often deal with aggregated export data, firm-specific characteristics of individual actors (e.g., learning effects or even marginal costs) are mostly non-observable. Empirics on learning effects still lag behind theory due to a lack of firm-specific data (Ghemawat and Spence 1985). The situation might change given the increasing availability of firm-level data and expanding research related to estimation of marginal costs (Gullstrand et al. 2014 and De Loecker and Warzynski 2012). Furthermore, empirical quantification of a potential price overshooting (if any) due to a currency depreciation as a result of learning effects faces the obstacle of separating firms that are already active in a foreign market and the newcomers. Moreover, our model is based on a very stylized situation (with a one product firm, solely producing for one export market, and starting producing and exporting simultaneously), while in reality a firm is selling on the domestic market as well as on many foreign markets at the same time, and typically already sells on a domestic market (and learns to reduce costs) before starting to export. Still, there are numerous empirical studies that found evidence in favor of incomplete pass-through and pricing-to-market especially in a form of local currency price stabilization, implemented in order to gain and protect exporters’ market shares on a foreign market (e.g., Knetter 1989, 1993, or Gagnon and Knetter 1995) as suggested by our analysis. For instance, Balaguer et al. (2004) focus on European automobile exports and found evidence in favor of LCPS adjustments up to 50 % of the size of the shock, though these markup adjustments were proved to be very heterogeneous across destination countries and types of vehicles. Irandoust (1999) suggests PTM with a tendency to stabilize local currency prices to be a critical factor in explaining the evolution of the external trade balance with strategic interaction present in the case of prices on tradable goods. Frankel et al. (2012) show that despite a traditionally higher level of pass-through in the case of developing countries, an incomplete pass-through recently became relevant for both developing and developed countries. In general, PTM seems to be often applied by European firms in their exports of machinery, chemicals and processed food to strategically important partners that account for a large share of their exports. The degree of markup adjustment varies across exporters, destination countries and product groups. A potential theoretical explanation of these heterogeneities in PTM might be attributed to differences in the importance of learning effects in different industries or differences in intertemporal demand spillovers between different destination markets.

Notes

One of the notable exceptions is a study of Gopinath et al. (2010) who propose a model of endogenous currency choice in a multiperiod dynamic price-setting environment and suggest that the currency choice is endogenous and can be adjusted given the short-, medium- or long-term goals of an exporter.

Though the Kalish (1983) model of optimal pricing in a situation with intertemporal effects like learning originally stems from marketing science, the application in economics and a transition of this approach to exchange rate effects on export market pricing is straightforward. For economics applications of the Kalish dynamic pricing approach see, e.g., Majd and Pindyck (1989), Goering (1993) and Cabral et al. (1999), or Fruchter and Sigué (2013).

The phenomenon of “diffusion” of a new product spreading to members of a social system is closely related. For an example of a diffusion model (in food markets) see Duval and Biere (2001).

See Shimomura (1998) for a discussion of the consequences of consumers which are dynamically optimizing purchases of a durable good on the price setting of a monopolist.

Our model is based on deterministic optimization, i.e., no uncertainty is considered. This is rather unrealistic, since future exchange rates are typically seen as stochastic. However, the assumption of a deterministic exchange rate may be adequate in the case of a (stable) fixed exchange rate system. For an example of a stochastic (demand) version of the Kalish model see Raman and Chatterjee (1995).

This is a case of the type of functions described in Section 3.2 (Multiplicative Separable Functions) in Kalish (1983), pp. 142 ff.

In a narrow sense, PTM implies differences in the markup between different markets. However, in our simple two-country model with only one export destination we do not have different foreign export markets with country-specific prices. In our model for the pricing of exports to only one market it can be shown that—for some parameter constellations—pricing is independent from the exchange rate, which can be interpreted as pricing-to-market in a more general definition.

Since our model is based on a very simplified stylized situation of a hypothetical firm starting production at the same time as exporting, not differentiating aggregate production and sales, accumulating experience solely by producing exports, etc., a simulation exercise cannot have the purpose to closely mimic real pricing decisions. The simulation rather serves to show the principle dynamics resulting from intertemporal cost and demand effects. However, a discount rate of ρ = 1/10, an exchange rate elasticity of unit cost of ε = 1/10 due to imported intermediates, an (absolute) price elasticity of δ = 2 in a monopolistic situation, and a depreciation rate of experience of β = 1/4, seem not to be outside plausible ranges. Furthermore, the experience elasticities of unit costs (κ = 1/10) and of demand (τ = 1/5) are chosen to be at a moderate level in order not to overdraw these effects.

See Fan et al. (2005) for an alternative method for numerical simulations in the case of dynamic pricing.

The “overshooting” in our model differs from the original case of Dornbusch (1987), since we calculate the consequences of a permanent “once for all” change of the exchange rate (from r0 to r1) on the dynamically optimal export price level. Not the exchange rate itself is overshooting (as in Dornbusch 1987), but the resulting optimal price level jumps from the old equilibrium pst,0 to the short-run level p′ (i.e., from S to T in Fig. 7). Thus, the price level in the short-run “overshoots” the new long-run equilibrium price level (pst,1, in Z) when the exchange rate—as an exogenous variable of our model—suddenly shows a discrete permanent change.

References

Balaguer J, Orts V, Pernías JC (2004) Measuring pricing to market in the Eurozone: the case of the automobile industry. Open Econ Rev 15(3):261–271

Baldwin R (1988) Hysteresis in import prices: the beachhead effect. Am Econ Rev 78:773–85

Baldwin R (1989) Sunk-cost hysteresis, NBER working paper No. 2911. National Bureau of Economic Research, Cambridge

Barro RJ, Sala-i-Martin X (1995) Economic growth. McGraw-Hill, New York

Besanko D, Doraszelski U, Kryukov Y (2014) The economics of predation: what drives pricing when there is learning-by-doing? Am Econ Rev 104(3):868–97

Cabral LMB, Riordan MH (1994) The learning curve, market dominance, and predatory pricing. Econometrica 62(5):1115–1140

Cabral LMB, Salant DJ, Woroch GA (1999) Monopoly pricing with network externalities. Int J Ind Organ 17(2):199–214

Campa JM (2004) Exchange rates and trade: How important is hysteresis in trade? Eur Econ Rev 48:527–48

De Loecker J, Warzynski F (2012) Markups and firm-level export status. Am Econ Rev 102(6):2437–2471

Dixit A (1989) Hysteresis, import penetration, and exchange rate pass-through. Q J Econ 104:205–28

Dornbusch R (1987) Exchange rates and prices. Am Econ Rev 77(1):93–106

Duval Y, Biere A (2001) Product diffusion and the demand for new food products. Agribusiness 18(1):23–36

Fan YY, Bhargava HK, Natsuyama HH (2005) Dynamic pricing via dynamic programming. J Optim Theory Appl 127(3):565–577

Feichtinger G, Hartl RF, Sethi SP (1994) Dynamic optimal control models in advertising: recent developments. Manag Sci 40(2):195–226

Frankel J, Parsley D, Wie S-J (2012) Slow pass-through around the world: a new import for developing countries? Open Econ Rev 23(2):213–251

Froot KA, Klemperer PD (1989) Exchange rate pass-through when market share matters. Am Econ Rev 79:637–54

Fruchter GE, Sigué SP (2013) Dynamic pricing for subscription services. J Econ Dyn Control 37(11):2180–2194

Gagnon J, Knetter MM (1995) Markup adjustment and exchange rate fluctuations: evidence from panel data on automobile exports. J Int Money Financ 14(2):289–310

Ghemawat P, Spence MA (1985) Learning curve spillovers and market performance. Q J Econ 100:839–852

Goering GE (1993) Learning by doing and product durability. Economica 60(239):311–326

Goldberg PK, Knetter MM (1997) Goods prices and exchange rates: what have we learned? J Econ Lit 35:1243–1272

Gopinath G, Itskhoki O, Rigobon R (2010) Currency choice and exchange rate pass-through. Am Econ Rev 100(1):304–336

Gullstrand J, Olofsdotter K, Thede S (2014) Markups and export-pricing strategies. Rev World Econ 150(2):221–239

Haberler G (1949) The market for foreign exchange and the stability of the balance of payments: a theoretical analysis. Kyklos 3:193–218

Herger N (2014) Market entries and exits and the nonlinear behaviour of the exchange rate pass-through into import prices. Open Econ Rev. doi:10.1007/s11079-014-9331-y, published online

Irandoust M (1999) The response of trade prices to exchange rate changes. Open Econ Rev 10(4):355–363

Jørgensen S, Kort PM, Zaccour G (1999) Production, inventory, and pricing under cost and demand learning effects. Eur J Oper Res 117:382–395

Kalish S (1983) Monopolist pricing with dynamic demand and production cost. Mark Sci 2(2):135–159

Knetter MM (1989) Price discrimination by U.S. and German exporters. Am Econ Rev 79(1):198–210

Knetter MM (1993) International comparisons of pricing-to-market behavior. Am Econ Rev 83(3):473–86

Krugman P (1987) Pricing to market when the exchange rate changes. In: Arndt SW, Richardson JD (eds) Real-financial linkages among open economies. MIT Press, Cambridge, pp 49–70

Lee WY (1975) Oligopoly and entry. J Econ Theory 11:35–54

Lin P-C (2008) Optimal pricing, production rate, and quality under learning effects. J Bus Res 61:1152–1159

Majd S, Pindyck RS (1989) The learning curve and optimal production under uncertainty. RAND J Econ 20(3):331–343

Mulligan CB, Sala-i-Martin X (1993) Transitional dynamics in two-sector models of endogenous growth. Q J Econ 108:739–773

Ohno K (1990) Exchange rate fluctuations, pass-through, and market share. IMF Staff Pap 37:294–310. doi:10.2307/3867291

Raman K, Chatterjee R (1995) Optimal monopolist pricing under demand uncertainty in dynamic markets. Manag Sci 41(1):144–162

Shimomura K (1998) A dynamic equilibrium model of durable goods monopoly. J Econ Behav Organ 33:507–520

Spence MA (1981) The learning curve and competition. Bell J Econ 12(1):49–70

Wright TP (1936) Factors affecting the cost of airplanes. J Aeronaut Sci 3:122–128

Acknowledgments

We are grateful to two anonymous referees for valuable comments and suggestions. This paper was written as a part of the German Research Foundation (DFG) project “Was erklärt den Agraraußenhandel der EU und Deutschlands? Theoretische und ökonometrische Untersuchungen zu Liberalisierung, Makroeffekten und Hysterese”.

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful to two anonymous referees for valuable comments and suggestions.

Rights and permissions

About this article

Cite this article

Göcke, M., Fedoseeva, S. Optimal Monopolist Export Pricing with Dynamic Demand and Learning Curve Effects. Open Econ Rev 27, 447–469 (2016). https://doi.org/10.1007/s11079-015-9380-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-015-9380-x

Keywords

- Dynamic pricing

- Demand diffusion

- Exchange rate pass-through

- Learning-by-doing

- Pricing-to-market

- Dumping

- Overshooting