Abstract

We analyze empirically export-price strategies across export destinations using detailed firm-product data. Most recent studies using disaggregated data to investigate why firms charge different prices for the same product on different markets focus on the cost component of prices and neglect the markup component. In this paper, we concentrate on the markup component and examine how variations in firms’ export prices may reflect price discrimination by comparing the markup of firms with different pricing strategies. We make use of detailed firm-level data for exporting firms in the Swedish food sector consisting of both manufacturing and intermediary trading firms. The paper documents the export-price variations within the two sub-sectors and explores how different price strategies correlate with markups. The results offer new information beyond the fact that exporters tend to have a higher markup. In particular, we find that firms in the food-processing sector with a greater ability to discriminate across markets mark their products up even more. This result points to the importance of underlying firm decisions in order to explain differences in export premiums across firms. In addition, the results reveal that markups are a complex function of firm and destination characteristics, and that the relationship between markups and pricing strategies in the manufacturing sector is not necessarily observed in other sectors of the supply chain.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper explores markups and price-setting behavior of exporting firms. Research in international marketing has identified firm’s export-pricing strategy as a key determinant of export performance as it has a direct effect on firms’ revenues (see Tan and Sousa 2011). In the international-trade literature, however, price strategies have gained fairly little attention. This has changed with newer models of heterogeneous firms, inducing a growing interest in the diversity of prices as well as markups across firms and markets.

A number of recent papers using detailed firm-level data have investigated firms’ free on board (f.o.b.) export prices and found systematic variations in prices charged for the same product across destinations (Görg et al. 2010; Bastos and Silva 2010; Harrigan et al. 2011; Martin 2012; Manova and Zhang 2012). The price variations are not only observed across firms but also within individual firms exporting to different destinations. These studies typically focus on the cost component of product prices and propose variations in product quality as an important explanation why a particular product is priced differently on different export markets.

Unless there is perfect competition, prices contain a markup component reflecting the ability for a firm to set a price above marginal costs. Despite the theoretical development, the importance of markups has been neglected in most empirical studies so far, resulting in an incomplete picture of how prices are set in export markets. We try to fill this gap by focusing on firms’ pricing strategies and their correlation with markups. We believe that analysis of price-setting and markups, and consequently firms’ profit margins, might be a fruitful way to get a deeper understanding of firms’ export performance. Moreover, a focus on markups allows a role for imperfect competition in markets for traded goods and recognizes the ability for firms to exert monopoly power. Such an approach is supported by firm surveys providing empirical evidence for the importance of price discrimination across export markets. For instance, Fabiani et al. (2005) reveal that more than 80 % of firms within the euro area apply price-discriminating strategies.

In order to thoroughly investigate firms’ export-price strategies and markups across sectors and different distribution networks, we make use of detailed firm-level data for exporting firms in the Swedish food sector focusing on manufacturing firms and wholesalers. Firms’ pricing strategies are assessed on the basis of export unit prices calculated for narrowly defined products.

The empirical analysis is divided into two parts. The first part documents the export-price variations within the two sub-sectors and investigates how the price variations correlate with different product and firm characteristics. The second part examines the relationship between export-pricing strategies and markups (defined as price over marginal cost) and whether high price variations are associated with high markups. The paper is related to De Loecker and Warzynski (2012). They propose a new methodology to estimate markups and find that exporters have higher markups than non-exporters. As argued, their result may explain why exporters are found to be more productive than non-exporters and may thus contribute to an understanding of the export premiums found in the literature. The present paper uses the same method as De Loecker and Warzynski and takes the analysis one step further by analyzing the heterogeneity of exporters’ price-setting behavior and how the export-pricing strategies relate to the markup.

The paper contributes to the existing literature in several ways. First, while previous empirical research on export-price variations across countries has focused on quality differences, our approach takes into account imperfect competition and market segmentation. Second, by considering both processing and intermediary firms, we are able to compare differences in competitive pressures and price-setting behavior across manufacturing and service sectors. Finally, as our empirical analysis shows that food-processing firms with greater price dispersion across export markets have higher markups, we provide new information about the behavior of exporting firms in the manufacturing sector and their markups.

The paper is organized as follows. Section 2 reviews previous work in international trade on variations in export prices and outlines the approach of the present paper. Section 3 describes the data and Sect. 4 displays export-price variations within the Swedish food sector. Section 5 explores how price variations correlate with firms’ markups and Sect. 6 concludes.

2 Theoretical outline and related studies

2.1 Price discrimination in international markets

The practice of price discrimination across markets requires both the existence of arbitrage costs and the ability of firms to exert some kind of market power (Goldberg and Knetter 1999). The first prerequisite implies that resale is costly, which has been asserted in empirical findings on pricing-to-market.Footnote 1 These findings show that there are large deviations from the law of one price across international markets due to, e.g., transportation costs, trade barriers and exchange-rate volatility.Footnote 2 The market-power condition implies an imperfect-competition setting and firms’ ability to charge prices above their marginal costs. As consumers on segmented markets will face different prices, not all consumers will face prices that equal marginal costs (assuming marginal cost of the good to be independent of its destination). International price discrimination thus suggests that firms’ price-cost margins—the markups—will vary due to differences in firms’ monopoly power across export markets.

To analyze this idea, consider a firm selling its product to several destinations. Profit maximization implies that the firm equates marginal revenue from sales in each market, indexed by k, to a common marginal cost, mc. The export price on a particular market will be the product of the marginal cost and a destination-specific markupFootnote 3:

where ε k is the price elasticity of demand in the foreign market. Hence, the export price is a decreasing function of the (absolute value of the) elasticity and variations in export prices across markets that are not cost based will be determined by factors influencing ε such as the level of competition and consumers’ valuation of the firm’s good. Equation (1) shows how export-market characteristics may influence the export price charged by the firm and suggests that firm knowledge about differences in these characteristics across markets leads to price adaption.

2.2 Markups and export prices in the international-trade literature

Until recently, price discrimination and segmented markets received fairly little attention in the international-trade literature. This can be explained partly by the extensive use of monopolistic-competition models with CES preferences and iceberg trade costs in which price discrimination does not occur.Footnote 4 Early exceptions can be found in the reciprocal-dumping models by Brander (1981) and Brander and Krugman (1983) explaining intra-industry trade in homogenous goods. In these models, firms are able to segment international markets which results in lower markups on exports compared to the domestic market.Footnote 5 Lately, variations in markups have been introduced in a heterogeneous-firms framework. Melitz and Ottaviano (2008) propose a monopolistic-competition model in which markets are segmented. In particular, they demonstrate how markups will vary across firms and export destinations when firms face linear demand as opposed to CES demand. In their setting, firms with lower costs (i.e. more productive firms) will charge lower prices and have higher markups. Moreover, the ability to price-discriminate across markets will lead to lower markups and prices in markets characterized by higher competition. Bernard et al. (2003) also model variations in markups across firms using a Ricardian framework with Bertrand competition. Although more efficient firms will have higher markups on average, the markup is not linked to the cost efficiency of the firm. Hence, in their model, a firm’s markup and price will be higher in markets where it can exert more market power.

The relationship between markups and export status is investigated in De Loecker and Warzynski (2012). In particular, using data on the Slovenian manufacturing sector, they find that exporters on average have higher markups than non-exporters. This result is consistent with a productivity premium for exporters as suggested in heterogeneous-firms settings. De Loecker and Warzynski (2012) also find that about one third of the markup premium for exporters is not due to costs or productivity, suggesting that price discrimination may constitute a substantial part of the markup.

Some recent empirical studies use detailed firm-level data to investigate within-firm price variations across export destinations.Footnote 6 These studies focus on the spatial pattern of export prices, taking both quality and markup explanations into account.Footnote 7 For instance, Martin (2012) analyses how within-firm export prices of French firms vary with distance and finds that firms set higher prices in more distant markets. As pointed out, this positive relationship cannot be explained by existing international-trade models, whether due to quality upgrading or higher markups.Footnote 8 A similar approach is taken by Görg et al. (2010) who use Hungarian export data for the year 2003. Besides quality-to-market they suggest a markup explanation where exporting firms add transport costs to f.o.b. prices, resulting in higher export prices in more distant markets.Footnote 9 Using data on Chinese exporting firms in 2005, Manova and Zhang (2012) examine how export prices vary with distance and market size in different heterogeneous-firm settings. For within-firm export price variations they find that firms earn higher revenues in markets where they set higher prices and charge higher prices in richer destinations. They explain the second finding by non-homothetic preferences and take this to indicate quality differences where demand for higher-quality products increases with income. As Simonovska (2011) shows, however, non-homothetic preferences are also consistent with variations in markups. In particular, focusing on the positive relationship between within-firm export prices and per capita incomes she finds empirical support for the hypothesis that consumers in rich countries are less responsive to price changes. Consequently, firms will optimally price identical products higher in richer countries.Footnote 10

3 Data

We make use of detailed firm-level data provided by Statistics Sweden for exporting firms in two parts of the Swedish food chain: food processing and wholesale.Footnote 11 The data cover the period 1997–2006 for food processing firms and the period 2003–2006 for firms in wholesale.Footnote 12 The food sector is an interesting case study for several reasons. First, food products constitute a large and stable share of consumers’ expenditures, accounting for about 15 % of such expenditures during the last decade.Footnote 13 Hence, the pricing behavior of firms in this sector has a substantial impact on consumers’ welfare. Second, the food-supply chain is an important part of the Swedish economy since it employs around 7 % of all employees and around 10 % of all firms in Sweden in 2006 (the dataset in this study covers around 200,000 employees) and food processing ranks as the third to fourth largest manufacturing industry in the country (depending on whether one focuses on the number of employees or on sales).Footnote 14 Third, the two sub-sectors are characterized by different market situations.Footnote 15 Thus, we get an opportunity to compare pricing behavior of exporters operating in different parts of the same production chain.

It is also interesting to note that the structure of the food sector varies across countries. According to McCorriston (2002), the concentration ratio of the five largest firms in the retail / wholesale sector in the EU15 varied from around 96 % in Finland to 30 % in Italy in the mid-1990s, and a similar variation is found in the food processing sector. Since the structure of the food chain differs across countries, we can expect the market power of a Swedish firm selling its product to different foreign markets to vary across the export destinations.

The export behavior of firms in the Swedish food sector has been found to resemble the behavior of firms in other countries and sectors (Greenaway et al. 2010; Gullstrand 2011). Hence, the number of exporting firms is quite small when all firms are considered. In 2003, the share of exporting firms was around 14 % in food processing and 16 % in wholesale. In addition, a comparison between exporters and non-exporters within the two sub-sectors support the findings of other studies, i.e. that exporters are more productive. Since exporting firms in the Swedish food sector display an otherwise representative behavior, their export-pricing strategies are also likely to be generally applicable.

The data set reports export values and quantities by product and trading partners at the 8-digit level of the Combined Nomenclature. The information on values and quantities is used to calculate f.o.b. export unit prices (values divided by quantities) for each product and export destination. Our motivation for using a very detailed product classification is that we want to compare one firm’s price of a narrowly defined product in different export destinations. As products are defined at a highly disaggregated level, we thus minimize the problem of comparing prices of products of different quality.Footnote 16 For additional data sources and details concerning the construction of variables that we use in the paper, see Table 7 in “Appendix 1”.

Table 1 presents some descriptive figures for our sample divided into single- and multi-destination exporters (i.e. firms exporting the same product to several destinations) in the two sub-sectors. Notice that a single-destination exporter may be active in more than one destination if it exports several products but to different markets. The figures reveal a common pattern in both sub-sectors. Multi-destination exporters are bigger (both in terms of sales and number of employees) and more productive, and they export a greater number of products than do single-destination exporters. The figures resemble those in recent studies focusing on differences between exporting manufacturing firms and intermediary exporters in wholesale and retail. That is, intermediary exporters are generally found to be smaller and to have a higher industry diversification but also to be less geographically diversified (Bernard et al. 2010).

4 Price variations across firms and destinations

This section documents how export prices vary in the Swedish food sector taking both product, firm and destination characteristics into account.Footnote 17 The first question we address is how the price of a particular product (defined at the CN 8-digit level) varies across export destinations. This is done by the use of the median absolute deviation from the median (MAD), that is, median of \( |x_{fdp} - median_{p} (x_{fdp} )| \) where a higher figure implies greater variation within a given product p due to price differences across firms f and destinations d. In a similar way we investigate the variability of product prices within firms across destinations, that is, median of \( |x_{fdp} - median_{fp} (x_{fdp} )| \).

Table 2 summarizes the median MAD statistics on the product and the firm-product level for the year 2006 for different product groups with respect to level of technology and product complexity according to the Lall (2000) and Rauch (1999) classifications, respectively. The figures show that the variability of prices increases with the technology level of the product. The variation is also greater in manufactures and differentiated goods compared to more standardized products. An interesting observation is that the variability of a product’s export price is almost as great within firms as it is within products. This finding suggests that, in addition to firm characteristics, the market situation on the export destination may be an important component of the price variations.

Table 2 indicates that both firm, product and market characteristics may be important in order to explain the variation in prices. This variation is explored further by investigating firm and export destination characteristics for different types of firms. In particular we compare firms that reach out to several destinations to those that only reach out to one (i.e. multi- and single-destination exporters), and firms that display high variability in prices to those with low price variation. Table 3 reports the ratio between means for the different groups of firms. As revealed, both dimensions seem to matter when it comes to skill intensity of the firm and GDP per capita of the export destination. Thus, multi-destination firms use a higher degree of skilled workers and tend to export to richer countries than single-destination firms. A similar pattern is found when comparing firms with different price variation where high-price variation firms are even more skill intensive and more prone to reach out to high-income countries than low-price variation firms. For the additional variables in Table 3, no significant effects are found.

To sum up, there is a high variability in f.o.b. prices at the product and firm-product level. This variability is higher for more high-tech products and high-skilled firms and for exporters reaching out to more and richer markets.

5 Markups and price strategies

5.1 Markups of exporting firms

To start, we investigate the level of markups for firms in the Swedish food sector. The empirical literature in industrial organization and international trade offers several ways to estimate markups. We follow the production approach based on Hall (1988) which requires only standard production data (see De Loecker 2011). This approach relies on the insight that cost shares of factors of production are equal to their revenue shares only if markets are characterized by perfect competition. Imperfect competition, on the other hand, drives a wedge between the cost and revenue shares, as measured by the markup. We use the methodology by De Loecker and Warzynski (2012) which offers a flexible framework to estimate firm-specific markups. This method and its application are further described in “Appendix 2”.

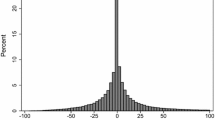

We estimate markups for all firms in the sector including both exporters and non-exporters.Footnote 18 As the markup is defined as price over marginal cost, a value greater than one implies a positive markup. The markup statistics presented in Table 4 show that firms do tend to charge prices above marginal cost but the standard deviation is rather high, especially in the wholesale sector. In food processing, the figures clearly suggest that exporters have larger markups than non-exporters. For firms in wholesale, the picture is less clear. The figures suggest that there are some exporters with large markups but also many exporting firms that in fact have lower markups than the non-exporting firms.

5.2 Markups and export price variations

The next step is to investigate the relationship between the firm’s price-setting behavior in a particular market and markups. By focusing on markups we directly relate the price-setting behavior to firm performance. We introduce a measure of price variation based on whether or not the firm’s export prices vary considerably across export markets. Specifically, a dummy variable is constructed defining the international pricing strategy of each firm’s product (see Table 7 for an exact definition). If the price of a firm’s product in a market deviates from the mean by more than a given percentage the firm’s international pricing strategy is defined as local. Otherwise the pricing strategy is defined as global since the price is more or less the same on all markets. We use different definitions of local pricing (40, 50 and 15 % deviations).

The analysis considers both all exporting firms and a restricted sample consisting of only multi-destination firms. As the restricted sample only includes firms that export a particular product to more than one market, it allows us to focus on exporters that actually have the possibility to set a local price.

We estimate a log–log linear specification looking at the correlation of the different thresholds of the local pricing dummy on the markup (in logarithms). The estimations include firm-product fixed effects and time dummies and are based on robust standard errors. The results are presented in Table 5 and show a notable difference between firms in food processing and wholesale. For the food processing industry, local pricing varies positively with the markup, implying that markups are higher for firms in this sector if they pursue a more diversified pricing behavior on the export market. This finding is robust to changes in the threshold of the local pricing dummy and seems valid for both the restricted and unrestricted sample. For the wholesale sector, on the other hand, the results indicate that firms charging different prices on different markets in this sector may instead have a lower markup.

The results in Table 5 might to some extent reflect correlations between the ability to price-discriminate across markets and other characteristics influencing the markup pattern across firms and destinations. To investigate this possibility, we extend the model by incorporating other variables that may influence the markup. In particular, we try to control for the quality level of exports by including the skill intensity of the firm and a price-based variable indicating whether the firm exports more high-quality products than the average firm (see Table 7 for an exact definition). Other firm-level variables considered are the number of export destinations (this variable may be associated with a greater ability to price-discriminate and higher markups) as well as the number of exported products. We also include average market characteristics of the export destinations of each exported product such as the weighted distance, weighted GDP and weighted GDP per capita of the destinations (using export shares of a particular product as weights). Finally, we show the results from using the complete sample (both single- and multi-destination exporters of an exported product) and from using a restricted sample (only multi-destination exporters).

The results in Table 6 not only suggest that the markup is indeed a complex function of firm characteristics but also make the impact of the firm-product price variation on markups more conclusive. Specifically, it is only in food processing that firms with a greater price variation are associated with a higher markup. This result provides evidence of the importance of price discrimination in this sector as an explanation of the heterogeneity of firms’ export premiums. In the wholesale sector the markup is now significantly and negatively correlated with local pricing (using the 40 % deviation definition) for both the whole and the restricted sample. The contrasting price-setting behavior between exporters in the food-processing sector and in wholesale is in line with reported discrepancies in the use of price discrimination between firms in the manufacturing and trading sectors. For instance, Fabiani et al. (2005) show that firms in the trade sectors more often choose uniform pricing strategies. The combined results for wholesale thus suggest that firms in this sector make profits without any price variability across destinations.

When it comes to the other results in Table 6, we find more support for the firm characteristics than the average market characteristics. The high-quality dummy is positively correlated with markups for wholesale but not for food processing whereas the coefficients for skill intensity are positive for both sectors. Still, when we control for quality at firm level the positive relationship between local pricing and markups does not disappear in food processing. The different role of trade for wholesalers is also displayed by the negative correlation between the markup and the number of destinations to which the product is exported for this sector. For the food processing industry, on the other hand, our results reveal that the positive impact of price variation on the markup is not just a reflection of firms having a stronger international focus and reaching out to more markets. In addition, the results hold for both the restricted and unrestricted sample. Hence, the positive relationship in food processing between firms’ markup and price variability across export destinations is not only about exporting to many destinations, it is also related to the possibility of using very different prices across destinations. Finally, the results are robust to the use of an alternative methodology. The results in Table 8 in “Appendix 2” show that firms with a local price strategy are related to a higher markup when the methodology of Roeger (1995) is applied.

6 Conclusions

This paper starts from the observation that firms charge different prices on different export markets. We analyze these price variations and correlate them with firms’ markups. By focusing on markups, the role for imperfect competition in international markets and the ability for firms to exert monopoly power are recognized. Also, by linking price-setting behavior to markups we provide new information that may explain the heterogeneity among exporting firms when it comes to export performance. Export-price variations and markups are investigated using data for the Swedish food sector including firms both in food processing and in wholesale. Thus, the study offers a comprehensive analysis of pricing behavior of exporters in different market situations.

The results from the markup estimations show that the pricing decisions vary between firms in the two sub-sectors. In particular, it is only in the food-processing industry that firms with a greater variation in export prices are associated with a higher markup. In wholesale, on the other hand, markup appears to vary negatively with export prices. This result lends support to survey findings suggesting that price discrimination is more prevalent in the manufacturing sector than in other sectors. In highlighting the different pricing behavior of manufacturing and trade firms, the study also adds to the recent research on intermediary firms in international trade. In addition, the paper identifies other variations across different parts of the supply chain, showing how price setting and markups are a complex function of firm characteristics. Together, these results suggest that the conclusions about firm behavior reached in other studies that focus on firms in the manufacturing sector cannot easily be extended to firms in other sectors of the economy.

Notes

The pricing-to-market literature stemming from Krugman (1987) typically deals with international price discrimination that is induced by exchange rate fluctuations.

See the discussion in Martin (2012).

Several empirical studies have identified a positive correlation between average export prices and distance. In international-trade models with heterogeneous producers, this observation is consistent with product quality differences across export destinations. In particular, Baldwin and Harrigan (2007) explain this in a model where higher-quality products are more costly to produce but also more profitable and therefore better at penetrating distant markets. Similarly, Johnson (2012) shows that prices increase with distance and the difficulty of entering a market. In addition, he finds that more productive firms produce higher-quality goods and consequently can charge higher prices.

In order to explain the positive correlation between export prices and distance, he proposes additive trade costs instead of iceberg trade costs, which also makes it possible to maintain the monopolistic-competition setting with CES preferences. Additive trade costs are also considered in Hummels and Skiba (2004).

The argument in Görg et al. (2010) is that when the firm has found an export destination, it buys transport services and adds these to export prices. Thus, in reality f.o.b. prices may contain transport costs.

Also, Alessandria and Kaboski (2011) propose a model where high-income consumers have higher search costs allowing firms to set higher prices for identical goods in rich countries.

The food chain also contains agricultural and retail. These sectors are not included in the analysis since there are very few exporting firms in these sectors.

Only wholesalers concentrating on agricultural products and food products are included in the analysis. All estimations control for time effects so that the longer time period for the food-processing sector only adds precision to the estimates. Restricting the period for food processors to 2003–2006 provides similar results to the ones discussed.

These figures stem from LivsmedelsSverige (a joint platform for the industry, consumer groups and academia) and can be found on the following web page (downloaded 28th June 2011) http://www.livsmedelssverige.se/hem/statistik/livsmedelskedjan.html.

In accordance with the standard Swedish industry classification, the food-processing industry includes production of beverages.

McCorriston (2002) argues that the European food chain market consists of a multi-stage oligopoly where one “oligopolistic sector sells its output to another oligopolistic sector”.

The food sector may be considered particularly well-suited for the purpose of this study since the scope for product differentiation within a given firm probably is more limited than in other manufacturing sectors. For instance, in our data material products with the CN-code 09102090 and 04031039 are described as crushed or ground saffron and yogurt (excl. flavored or with added fruit, nuts or cocoa), with added sugar or other sweetening matter, of a fat content, by weight, of >6.0 %, respectively. These categories are also examples of products that display high export-price variation at the firm level.

In this section, we do not differentiate between firms in the food-processing industry and in wholesale.

Only firms that exist for at least three consecutive years in our data are considered.

Considering the production function \( Q_{ft} = F\left( {X_{ft} ,K_{ft} } \right) \) with variable inputs, \( X_{ft} \), and fixed capital, \( K_{ft} \), note that the marginal cost \( c_{ft} \) will be equal to \( \frac{{P_{ft}^{X} \delta X_{ft} }}{{\delta Q_{ft} }} \).

References

Alessandria, G., & Kaboski, J. P. (2011). Pricing to market and the failure of the absolute PPP. American Economic Journal: Macroeconomics, 3(1), 91–127.

Aw, B. Y. (1993). Price discrimination and markups in export markets. Journal of Development Economics, 42(2), 315–336.

Aw, B. Y., Baatra, G., & Roberts, M. J. (2001). Firm heterogeneity and export–domestic price differentials: A study of Taiwanese electronics products. Journal of International Economics, 54(1), 149–169.

Aw, B. Y., Chung, S., & Roberts, M. (2003). Productivity, output, and failure: A comparison of Taiwanese and South Korean manufacturers. Economic Journal, 113(491), 485–510.

Badinger, H. (2007). Has the EU’s single markup programme fostered competition? Testing for a decrease in mark-up ratios in EU industries. Oxford Bulletin of Economics and Statistics, 69(4), 497–519.

Baldwin, R., & Harrigan, J. (2007). Zeros, quality and space: Trade theory and trade evidence. (NBER Working Paper No. 13214).

Bastos, P., & Silva, J. (2010). The quality of a firm’s exports: Where you export matters. Journal of International Economics, 82(2), 99–111.

Bernard, A., Eaton, J., Jensen, J. B., & Kortum, S. (2003). Plants and productivity in international trade. American Economic Review, 93(4), 1268–1290.

Bernard, A., Grazzi, M., & Tomasi, C. (2010). Intermediaries in international trade: Direct versus indirect modes of export. (Working Paper No. 199). National Bank of Belgium.

Brander, J. (1981). Intra-industry trade in identical commodities. Journal of International Economics, 11(1), 1–14.

Brander, J., & Krugman, P. (1983). A “reciprocal dumping” model of international trade. Journal of International Economics, 15(3–4), 313–321.

De Loecker, J. (2011). Recovering markups from production data. International Journal of Industrial Organization, 29(3), 350–355.

De Loecker, J., & Warzynski, F. (2012). Markups and firm-level export status. American Economic Review, 102(6), 2437–2471.

Engel, C., & Rogers, J. (1996). How wide is the border? American Economic Review, 86(5), 1112–1125.

Fabiani, S., Druant, M., Hernando, I., Kwapil, C., Landau, B., Loupias, C., Martins, F., Mathä, T., Sabbatini, R., Stahl, H., & Stokman, A. (2005). The pricing behavior of firms in the euro area: New survey evidence. (ECB Working Paper No. 535).

Goldberg, P. K., & Knetter, M. M. (1996). Goods prices and exchange rates: What have we learned? (NBER Working Paper No. 01238).

Goldberg, P. K., & Knetter, M. M. (1999). Measuring the intensity of competition in export markets. Journal of International Economics, 47, 27–60.

Görg, H., Halpern, L., & Muraközy, B. (2010). Why do within firm-product export prices differ across markets? (Kiel Working Papers No. 1596). Kiel Institute for the World Economy.

Greenaway, D., Gullstrand, J., & Kneller, R. (2010). Firm heterogeneity and the geography of international trade. (GEP Discussion Papers No. 08/41). University of Nottingham.

Greenhut, M. L., Ohta, H., & Sailors, J. (1985). Reverse dumping: A form of spatial discrimination. The Journal of Industrial Economics, 34(2), 176–181.

Gullstrand, J. (2011). Firm and destination-specific export costs: The case of the Swedish food sector. Food Policy, 36(2), 204–213.

Hall, R. E. (1988). The relation between price and marginal costs in U.S. industry. Journal of Political Economy, 96(5), 921–947.

Harrigan, J., Ma, X., & Shlychkov, V. (2011). Export prices of U.S. firms. (NBER Working Paper No. 17706).

Hoover, E. (1937). Spatial price discrimination. The Review of Economic Studies, 4(3), 182–191.

Hummels, D., & Skiba, A. (2004). Shipping the good apples out? An empirical confirmation of the Alchian-Allen conjecture. Journal of Political Economy, 112(6), 1384–1402.

Johnson, R. C. (2012). Trade and prices with heterogeneous firms. Journal of International Economics, 86(1), 43–56.

Konings, J., & Vandenbussche, H. (2005). Antidumping protection and markups of domestic firms. Journal of International Economics, 65(1), 151–165.

Krugman, P. (1987). Pricing to market when the exchange rate changes. In S. W. Arndt & J. D. Richardson (Eds.), Real financial linkages among open economies. Cambridge: MIT Press.

Lall, S. (2000). The technological structure and performance of developing country manufactured exports, 1985–1998. (QEH Working Paper Series, No. QEHWPS44).

Levinsohn, J., & Petrin, A. (2003). Estimating production functions using inputs to control for unobservables. Review of Economic Studies, 70(2), 317–340.

Manova, K., & Zhang, Z. (2012). Export prices across firms and destinations. The Quarterly Journal of Economics, 127(1), 379–436.

Martin, J. (2012). Markups, quality and transport costs. European Economic Review, 56(4), 777–791.

McCorriston, S. (2002). Why should imperfect competition matter to agricultural economists? European Review of Agricultural Economics, 29(3), 349–371.

Melitz, M. J., & Ottaviano, G. I. (2008). Market size, trade, and productivity. Review of Economic Studies, 75(1), 295–316.

Olley, S. G., & Pakes, A. (1996). The dynamics of productivity in the telecommunications equipment industry. Econometrica, 64(4), 1263–1297.

Rauch, J. E. (1999). Networks versus markets in international trade. Journal of International Economics, 48(1), 7–35.

Roeger, W. (1995). Can imperfect competition explain the difference between primal and dual productivity measures? Estimates for U.S. manufacturing. Journal of Political Economy, 103(2), 316–330.

Simonovska, I. (2011). Income differences and prices of tradables. (UCDavis Working Paper Series No. 10–15).

Tan, Q., & Sousa, C. (2011). Research on export pricing: Still moving toward maturity. Journal of International Marketing, 19(3), 1–35.

Tybout, J. R. (2003). Plant and firm-level evidence on “new” trade theories. In K. Choi & J. Harrigan (Eds.), Handbook of international trade. Oxford: Basil-Blackwell.

Verboven, F. (1996). International price discrimination in the European car market. Rand Journal of Economics, 27(2), 240–268.

Acknowledgments

We would like to thank seminar participants at IFN Stockholm, University of Copenhagen, Lund University and Örebro University. We are also grateful to the conference participants at ETSG in Lausanne, September 2010, CAED Conference in London, September 2010, SNEE Conference in Mölle, May 2011, National Conference of Swedish Economists in Uppsala, September 2011, EITI in Tokyo, March 2012, RES Conference in Cambridge, March 2012, and NOITS in Reykjavik, May 2012. In addition, we thank an anonymous referee for helpful comments and Hans Carlsson for his advice. Financial support from Jan Wallander and Tom Hedelius Foundation is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Appendix 2

2.1 Estimating firm markups

The benchmark approach to estimate firms’ markups is the framework of De Loecker and Warzynski (2012), which relies on the condition of cost minimization in order to relate elasticity of output, input shares and markups. By using a robust definition of the markup as the ratio between the price and the marginal cost, they show that the markup for firm f at time t may be defined as follows:

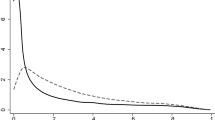

where \( \theta_{ft}^{X} = \frac{{\delta Q_{ft} X_{ft} }}{{\delta X_{ft} Q_{ft} }} \) is the output elasticity of the variable input \( X_{ft} \) and \( \alpha_{ft}^{X} = \frac{{P_{ft}^{X} X_{ft} }}{{P_{ft} Q_{ft} }} \) is the share of expenditures on input \( X_{ft} \) in total sales.Footnote 19 While the expenditure shares are directly obtained from the data, output elasticities have to be estimated. Note however that Q ft has to be adjusted by dividing it with exp(ε), where ε is the error term from the first stage regression, in order to sweep away variation in sales due to factors unrelated to input demand changes. The approach of De Loecker and Warzynski (2012) builds on two steps. The first one is to estimate the output elasticity by estimating the production function in line with the proxy methods of Olley and Pakes (1996) and Levinsohn and Petrin (2003). Once consistent estimates of the output elasticities are obtained, the markup in (A1) can be computed.

We use the translog-value added production function as in De Loecker and Warzynski (2012) with labor as a variable input while the capital stock (based on firms’ balance sheets) is assumed to be a dynamic input. This production function is used in the first stage together with a proxy for the productivity shock captured by inverting the demand for material (raw material and intermediate goods). Hence the proxy for productivity is captured by the expenditure on material, the stock of capital and the export status of the firm (similar variables as in De Loecker and Warzynski). Using this proxy in the production function implies that we may compute the productivity term as the difference between the expected output from the first stage and the sum of all inputs (using the estimated coefficients from the first stage production function as weights). The innovation of the productivity (given the coefficients from the first stage production function) is recovered by regressing productivity on its lag and additional variables influencing the productivity (we use export status and the propensity to exit). The production function parameters are then estimated in a second stage by relying on the moments that the innovation of the productivity is uncorrelated with capital (since it is decided a period before) and the lagged number of workers (since labor reacts on productivity). This finalize the procedure of estimating the parameters of the production function, and hence we may calculate the output elasticity for labor used in order to derive markups at the firm level.

2.2 Robustness—Roeger’s approach

As a robustness check of our results, we employ the commonly used method proposed by Roeger (1995) to estimate markups.Footnote 20 This method stems from Hall (1988) who showed how the markup can be obtained from the primal Solow residual (calculated from the production function) when there is market power. This residual, however, contains a productivity term that may cause endogeneity problems when the markup is estimated. Roeger demonstrated how this problem can be taken care of by subtracting the dual Solow residual (calculated from the cost functions) from the primal residual and the method only requires nominal data on firm sales and values of input factors. Thus, to obtain markups using Roeger’s approach, the following regression is to be estimated for each sector:

where ΔY ft = Δln(sales) − Δln(capital costs), ΔX ft = α Lft L ft [Δln(wage costs) −Δln(capital costs)] + α Mft M ft [Δln(materical costs) −Δln(capital costs)], and α Lft L ft = labor costs share in output = (wage costs)/(sales) and α Mft M ft = material costs share in output = (material costs) / (sales). Finally, μ is the markup to be estimated.

In order to analyze how the effect of firms’ price variations are related to their markups, we interact the price variable with the input growth composite, ΔX, according to:

In (A3), μ 2 reflects how the average markup changes with the variation in firm f’s export price of product p at time t, with PriceStrat fpt denoting the firm’s price strategy for product p. Although we do not observe changes in sales and inputs at the product level, there will be several observations for multi-product firms. β denotes the direct effect of the price variable.

The results in Table 8 are similar to those based on the method by De Loecker and Warzynski. In the benchmark estimations, positive and significant markups are found in both sectors. The estimated industry markup, however, is smaller, which echoes the finding in De Loecker and Warzynski. Looking at the interaction terms, the markup varies positively with the price variable only in the food-processing industry while the correlation is negative for wholesale.

About this article

Cite this article

Gullstrand, J., Olofsdotter, K. & Thede, S. Markups and export-pricing strategies. Rev World Econ 150, 221–239 (2014). https://doi.org/10.1007/s10290-013-0178-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-013-0178-x