Abstract

Pricing decisions of exporters who are facing imperfect competition in their destination markets might depend on exchange rate changes. While empirical literature often assumes that the impact of the exchange rate on the exporters’ prices is linear and the markup adjustment does not depend on magnitude or direction of the exchange rate change (or allows for short-run asymmetries only), we question this statement and test for the long-run hysteresis and asymmetry of pricing-to-market (PTM). Using the German export beer market as an example, we show that both types of nonlinearities play an important role in PTM decisions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Pricing-to-market (PTM) is a price discriminating strategy of an exporter who adjusts markups destination specifically as exchange rates change. PTM behavior is often used in order to explain an incomplete pass-through of the exchange rates in some markets, and it has remained in the focus of both empirical and theoretical studies for nearly three decades now. Empirical literature often finds PTM to be more pronounced in European Footnote 1 and Japanese exports of manufactured goods, e.g., machinery, food, and spirits (e.g., Gagnon and Knetter 1995). Theoretical literature on PTM has been recently developing in different directions including the macroeconomic implications of PTM (see, e.g., Devreux and Engel 2002; Campa and Goldberg 2005), the business cycle models of PTM (e.g., Ravn et al. 2007; Alessandria 2009), and PTM models based on heterogeneous productivity of firms (e.g., Atkeson and Burstein 2008; Melitz and Ottaviano 2008). Very recent contributions include attempts to model trade liberalization through controlling for non-tariff barriers to trade (e.g., Benedictow and Boug 2013) and using very disaggregated data to assess which factors contribute to PTM along the supply chain (e.g., Goldberg and Hellerstein 2013). Despite vast PTM-related literature, some aspects of PTM still remain neglected. Among those are asymmetry and hysteresis of PTM.

PTM was first introduced by Krugman (1987, p. 49) as “the phenomenon of foreign firms maintaining or even increasing their export prices to the United States when the dollar rises....” Knetter (1993, p. 473) defined PTM when the dollar falls as the situation when the “sellers reduce markups to buyers whose currencies have depreciated against the seller, thereby stabilizing prices in the buyer’s currency relative to a constant markup policy.” These two definitions, which show how PTM in the form of local currency price stabilization (LCPS) mechanism emerges in cases of currency appreciation and depreciation, do not make any assumptions about the extent of the markup adjustment toward exchange rate changes in different direction or magnitude.Footnote 2 Even though it was found that “prices rise faster than they fall” (e.g., Peltzman 2000) and the prices are sticky to nominal shocks (e.g., Delgado 1991), PTM is often regarded empirically as symmetric and linear.

The studies, which consider different effects of appreciations and depreciations on price-setting decisions, are very scarce (e.g., Knetter 1994; Stahn 2007; Bussière 2013) and focus on the short-run dynamics, neglecting the underlying long-run relationships beyond PTM. Still, even in the short run, separation of different changes in exchange rates is proved to be important. For example, Bussière (2013) concluded that asymmetries in the exchange rate pass-through cannot be ignored, especially on the export side. There are even fewer studies which consider a different price reaction toward small and large exchange rate changes (e.g., Larue et al. 2010, who explicitly considered menu costs in firms’ price adjustment decisions for exported goods). The only attempt to model both types of nonlinearities implicitly within PTM framework that we are aware of was performed for sugar confectionery exports by Fedoseeva (2013). She showed that PTM can be regarded neither as linear nor as symmetric and suggested that price hysteresis needs to be taken into account as it influences exporters’ price decisions in the long run. Unfortunately, this study did not quantify PTM in a way that would allow us to interpret the degree of price adjustments, focusing mostly on the symmetry testing.

We intend to fill the gap in the empirical literature by addressing both the hysteresis and the asymmetry in the underlying long-run relationship between exporters’ prices and the exchange rates. This is done using the example of German beer exports, as beer has been an especially popular focus of PTM studies. Knetter (1989) was the first to include beer in the sample of investigated exported products. As PTM models grew more complicated, beer consistently remained within the group of studied products. Along with Knetter, who often returned to beer exports (e.g., Knetter 1994, 1995; Goldberg and Knetter 1999), there are numerous studies, where strategic pricing of (often German) beer exports is addressed (e.g., Kasa 1992; Hellerstein 2008; Goldberg and Hellerstein 2013 or Dreyer et al. 2013). With some variation in coefficients, empirical studies often find evidence of strategic pricing in beer exports, which makes it a perfect market to test for PTM nonlinearities.

As the German domestic beer market stagnates, exports become more and more important for the beer industry. According to Schmid and Luber (2013), around one hundred out of more than a thousand German breweries are active internationally and export their beer.Footnote 3 As the destination market entry requires sunk investments (e.g., Baldwin 1990; Campa 2004) related to, e.g., marketing researches, advertisement, and establishment of distribution channels, exporters might wish to stay in the market that they have entered and thus protect their market shares. This might lead to a cautious pricing policy, where the exporter partially absorbs, e.g., non-favorable exchange rate changes by the means of his markup and shifts the pass-through in time to assure that the price in the local currency of the destination market does not change that much. A nonlinear price adjustment, driven by a “wait-and-see” strategy of the exporter and neglecting the minor changes until some pain threshold is passed (as in Larue et al. 2010), describes hysteresis in prices. In this case, the minor changes are passed through to the local currency price of the destination market, while larger changes in the exchange rate result in a markup adjustment. From the asymmetric perspective, we expect especially large Euro appreciations to be partially offset in order to protect the market shares, while depreciations might be used to compensate for those offsets (in sense of LCPS) or might be fully passed through (as a tool of expansion). On the other hand, an amplification of the exchange rate appreciations on prices might indicate a market power realization on some markets.

To address the symmetry and hysteresis of PTM, we apply two newly developed approaches which allow us to capture both types of PTM nonlinearities and shed more light on the reasons behind the exporters’ price decisions. First, we fit the hysteresis model of Belke et al. (2013) into a PTM framework. This model allows us to separate the effects of small and large exchange rate changes on prices and lets us test whether PTM is hysteretic and whether there is some band of inaction, within which all exchange rate changes are ignored. Second, we apply a partial sum decomposition approach and a nonlinear autoregressive distributed lag (NARDL) framework by Shin et al. (2014) to test whether assuming the price reaction to be invariant to the type of the exchange rate change and, hence, PTM to be linear and symmetric is too restrictive.

This paper contributes to the existing literature by extending the PTM analysis through (a) addressing nonlinearity of the exporter pricing not only in the short, but also in the long run, (b) testing for hysteresis of PTM, and (c) focusing on a large sample of destination countries (which covers more than 80 % of German beer exports outside of the Eurozone). This allows us to analyze the pricing behavior of German beer exporters outside typically considered markets.

The remainder of the paper is as follows. Section 2 briefly introduces the theoretical models and describes the empirical specifications in more detail. Section 3 provides information on the data. Section 4 presents and discusses the results, and Sect. 5 concludes.

2 Theoretical model and empirical solution(s)

For the theoretical framework, we stick to a classical model of Krugman (1987) and Knetter (1989) and assume an exporter selling to \(N\) destination countries and maximizing his profit. Solving the profit maximization problem with respect to the price charged in each market \(i\) in each period \(t\) yields a set of first-order conditions.Footnote 4

where \(P\) is the free-on-board (fob) export price, set for destination market \(i,\; \hbox {MC}\) is the marginal cost of production in period \(t\); and \(\varepsilon _{it} \) is the elasticity of demand with respect to the local currency price in destination market \(i\).

In the case of perfect competition, the export price equals marginal costs of production and is similar for all destination markets. In the case of market segmentation with constant elasticity of demand, a fixed country-specific markup over costs is added to the price. PTM in this framework arises when the elasticity of demand with respect to the local currency price is not constant, making price setting in the source country’s currency a strategic decision, which might depend on a development of the exchange rate:

so that the export fob price is a function of marginal costs of production, the exchange rate between the trading countries (ER), and various demand and supply shifters (Z). This study applies two different approaches to assess the potential nonlinearity of the exchange rate in this function.

2.1 Hysteresis

The first approach searches for hysteresis. The idea of hysteresis is that the current state of an output variable depends not only on the current value of an input variable but also on the former local extreme values of it. So, a path-dependent nonlinear system results that reacts only to large variations in the input variable. Originating in physics, this concept is applicable to the study of various economic problems, such as modeling labor markets (e.g., Belke and Goecke 2001; Mota et al. 2012) or exporter behavior (e.g., Baldwin 1990; Campa 2004; Kannebley 2008). Here, we apply the hysteresis approach to assess the nonlinearity of PTM. As sunk costs are required to enter foreign markets and high competition in those often involves implementing pricing strategies to keep market shares, PTM might turn out to be hysteretic as well.

Hysteresis in our context is associated with a price reaction, which follows large exchange rate changes but ignores small ones. Every exporter is expected to have two individual thresholds: one that causes price adjustments when the exchange rate increases, and the other, lower one, that leads to price changes in case the exchange rate declines. The area between these two thresholds is called the band of inaction. In this band of inaction, the past movements of the exchange rate determine the actual price level. This behavior corresponds to the (mechanical) theory of a non-ideal relay, as described in, e.g., Krasnoselskii and Pokrovskii (1989) or Mayergoyz (2003).

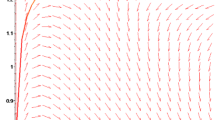

The non-ideal relay (Fig. 1) sketches the behavior of an exporting firm which uses the LCPS mechanism. If the exchange rate is increasing and the initial price level is rather high, the exporting firm will keep its price until a threshold is passed. To stabilize the price in local currency, the exporting firm will at some point react and change its price to a lower level. If the exchange rate decreases after the firm changed its price, it will not alter its price level immediately, but wait until it has more certain expectations about the future behavior of the exchange rate as every price change involves costs. If the exchange rate increases once more, the exporting firm will keep the low price level, but if the exchange rate decreases, there will be a second threshold where the exporting firm will raise its price again. Analogously, as long as the exchange rate stays low, the exporting firm will keep its high price level, and although the exchange rate may rise again, it will not alter its price until the first threshold is passed.

The aggregation of exporting firms with individual thresholds gives a hysteresis loop as every change in the exchange rate direction, that is from decreasing to increasing, for example, triggers first a few exporter thresholds and, when the increase in prices continues, causes more and more exporters to adjust their prices, that is, every change in direction of the exchange rate and therefore every local extreme value result first in slight adjustment processes, called play, and, if the change continues, in strong reactions, called spurt (see, e.g., Goecke 2002 or Mayergoyz 2003). The model of Belke and Goecke (2001) linearizes the classic hysteresis loop.

Figure 2 shows the aggregated hysteresis loop in case of LCPS. If the exchange rate is low and the exporters’ price in Euro is rather high, a first increase in the exchange rate will result in only slight or no adjustments. But, if the exchange rate increases further, more and more thresholds of individual exporters will be passed and a strong price reaction on the spurt line will follow. After a local maximum, the exchange rate will decrease, and the exporters will keep their low prices as long as the exchange rate stays within this band of inaction. If the exchange rate decreases further, the exporters will raise their prices again. The drawn play lines in Fig. 2 are not fixed. They will be shifted as soon as a movement on a spurt line changes its direction.

To test for this behavior, a filtered version of the input variable (spurt) is added to a standard linear model. This spurt variable is constant as long as the underlying variable, the exchange rate, stays within a play area and follows the movement of the exchange rate as soon as it leaves it. After a local extreme value and an ensuing change in the direction of the exchange rate, the spurt again stays constant as long as the exchange rate stays within the play range. Therefore, the model analyzes whether there is a difference in the slope of the play line and the spurt line.

To test whether this is the case, two models, a linear and a nonlinear one (including spurt), are estimated, using both OLS and FMOLS estimation methods to account for cointegration issues.Footnote 5

Here, the fob export price in Euro is the dependent variable. The aim was to examine whether there is any influence by the exchange rate on the price. First, the additional spurt variable has to be computed, which is done by means of the algorithm provided by Belke and Goecke (2001). The play width used by the algorithm represents the necessary change in the exchange rate which causes an adjustment in price. As the actual play width is unknown, it is estimated with a grid search. The models for all reasonable play values are estimated, and the results of the one with the highest explanatory power are presented in the outcomes section.

The coefficients of the exchange rate and the spurt are our primary interest. The coefficient \(\alpha _{1}\) of the first equation represents the influence of the exchange rate on prices and, therefore, captures PTM behavior in the static linear model. In the second equation, the coefficient \(\alpha _{2}\) of the exchange rate represents the slope of the play area, that is, the area with no or only slight reactions to the exchange rate movements. The coefficient \(\beta \) of the spurt variable is the amount of slope to add to \(\alpha _{2}\) outside the play area (Fig. 3). If \(\beta \) is significant, the relationship between exchange rate and price is nonlinear, and there is hysteresis. Due to the indirect quotation of the exchange rate, we interpret a negative sign of the coefficient of the exchange rate \(\alpha _1, \alpha _2\) and the spurt \(\beta \) as an application of LCPS mechanisms. In this case, exporters tend to offset the effect of the exchange rate change on prices in local currencies through adjustment of their own export prices in Euro. Positive signs mean amplification of the exchange rate effects on the price.

Hysteretic behavior of exporters which use PTM strategies would be to adjust their Euro prices to large changes in the exchange rate. Small changes would have no significance and would therefore be ignored. Therefore, a negative and significant \(\beta \)-coefficient indicates hysteresis in the case of LCPS. If the exporters do not wait to apply LCPS mechanisms, there would be no hysteresis, and so, the coefficient \(\beta \) would not be significant. But, the coefficients \(\alpha _1, \alpha _2\) of the exchange rate are expected to be negative and significant to indicate LCPS.

The amplification of the exchange rate change effect on prices will be revealed by positive signs of the exchange rate coefficients. Such amplification might be driven by the ability of the exporter to exploit market power on some destination markets.Footnote 6 However, in case the exporters do not use every small exchange rate movement to amplify their prices, they behave hysteretically again. So, the coefficient of the spurt variable is expected to be positive and significant. Figure 4 illustrates hysteresis for the case of amplification of the exchange rate effect on prices.

Prices which are amplified without delay will be driven by a positive exchange rate influence but not by a spurt influence. The \(\beta \)-coefficient is not significant in this case. If neither \(\alpha _1, \alpha _2\), nor \(\beta \) are significant, the exchange rate has no influence on the price. There is no PTM in this case. Table 1 Footnote 7 provides a brief overview of the interpretations of the coefficients.

2.2 Asymmetry: partial sum decomposition

The second approach allows us to test whether currency appreciations and depreciations influence the price adjustment similarly. To do so, we follow Shin et al. (2014), who propose a decomposition of the independent variable into a partial sum of its positive and negative changes, which allows the introduction of nonlinearity and asymmetry into a standard ARDL framework. For the PTM study, such a decomposition allows us to model all kinds of asymmetry (between, e.g., positive/negative, small/big changes in short and long runs) and to estimate a nonlinear asymmetric model by means of linear estimation technics, including a simple testing of hidden cointegrationFootnote 8 (Granger and Yoon 2002) directly within the model.

To correctly specify the model and account for the presence of hysteresis, for which we test implicitly by means of the hysteresis analysis introduced in the previous subsection, we extend the variable decomposition from the one-threshold case (where only positive and negative changes are separated) to the two-threshold decomposition. A similar decomposition was applied by Verheyen (2013) to the study on exchange rate nonlinearities in exports from the countries of the European Monetary Union to the USA in order to test whether especially large changes affect exports:

where \(\hbox {ER}_0 \) is the value of the exchange rate at the time \(t_0 , \,\hbox {ER}_t^- \) is the partial sum process of large negative changes, \(\hbox {ER}_t^+ \) is the partial sum process of large positive changes, and \(\hbox {ER}_t^\pm \) is the partial sum process of all small changes. As the magnitude of the exchange rate changes differs between currencies, we fix the thresholdFootnote 9 at the level of one standard deviation (STD) of the first difference in the exchange rate \(\Delta \hbox {ER}\) Footnote 10 so that:

where I{Z} denotes an indicator function which takes the value of 1 if the condition Z is satisfied and 0 otherwise. Decomposing the log of the original exchange rate series will enable us to estimate the entire model in a log–log form and overcome the problem of taking logs of negative numbers, noted by Shin et al. (2014) and Verheyen (2013).

The empirical specification of the model stated in Eq. (1) for the case of the two-threshold exchange rate decomposition can be extended to the following NARDL form:

where \(\eta \) is an error correction term, which shows the speed of adjustment toward the long-run equilibrium, the \(\kappa \)-coefficients refer to the long-run relations, and the coefficients referring to variables in first differences capture the contemporaneous adjustments. The upper bound for \(\tau \) is chosen according to the Schwarz criterion of lag selection. A maximum of 12 lags is tested as we work with monthly data. If in the selected model the problem of autocorrelation is still present, lags of \(\Delta \!P\) are added to overcome it.

Since Eq. 9 is estimated by means of ordinary least squares using Eviews, the coefficients that we obtain as a result of the estimation are long-run elasticities multiplied by a value of the coefficient that refers to the lagged dependent variable (e.g., \(\eta *\kappa _1 )\). In order to recalculate long-run elasticities, these coefficients should be divided by \(\eta \). The long-run elasticities of price with respect to nominal exchange rates are:

for large depreciations, the inner regime, and large appreciations, respectively. Standard errors for long-run elasticities are calculated using the Delta method. Asymmetry is tested by means of a Wald test.

As PTM allows for both effects (amplification of the effect of the exchange rate change on prices and the local currency price stabilization), coefficients of both signs can be obtained. No significant coefficients would indicate a complete pass-through of the Euro fluctuations to the price in local currency (hence, no PTM). Significant coefficients would signal the presence of some pricing strategy. LCPS is identified when the coefficients are negative, implying that a part of the exchange rate change is absorbed through the exporter’s price. This is valid for both appreciation and depreciation. A higher rate of the offset is expected for depreciations, as it allows exporters to extract extra profits, while keeping the local currency price stable. A partial offset of Euro appreciation would suggest that the exporters cut the Euro prices to offset a part of change in price in local currency. Such behavior supports a cautious pricing policy of the exporter in an attempt to protect sales volumes. A positive coefficient related to the Euro appreciation might be a sign of market power realization in the destination market, when the exchange rate appreciation is used as a reason for an additional increase in prices. Earlier studies suggest LCPS to be found for large important markets, while for small markets, there might be no effect. As for the inner regime, no significant estimates are expected, due to hysteresis in prices. If any are obtained, it could be a sign that persistent changes in the same sign can trigger a price adjustment as well.

3 Data

The study concentrates on German beer exports to sixteen non-Euro destination countries, to which more than 40 % of beer exports were sent in 2012. Around 50 % of total beer exports do not go further than to neighboring countries, which have introduced the Euro and hence cannot be included in a PTM study. Hence, we cover around 80 % of all exports, where PTM might potentially arise. Figure 5 shows the role of these countries in German beer exports.

Beer is defined according to the SITC classification (product group code 11230). Prices are constructed as unit values, which are calculated from Eurostat’s export values and quantities. We are well aware of potential problems we introduce into the estimation by concentrating on average unit values (see, e.g., Lavoie and Liu 2007). Using unit values instead of individual firm-level export prices introduces an aggregation bias, which influences the outcomes toward smooth adjustment and implicitly imposes an assumption of a similar price strategy of different beer exporters on individual markets. This might not be true in all the cases. Nevertheless, due to data limitations, there seems to be no better alternative than to follow the previous studies (as, e.g., above-mentioned studies of Krugman and Knetter) and use unit values as a measure of export prices. We assume, however, that it is mostly premium quality beer that is exported, especially to faraway destinations (see, e.g., Goerg et al. 2010). Then, the price difference between different sorts is hopefully not so large, and as the exchange rate changes, there is no product substitution between the premium and “cheap” beer in the composition of exports. Furthermore, we assume that on the international market, German exporters are rather competing with domestic breweries, so their pricing strategies would be more similar than contradicting. Then, our estimates will reveal some industry average price adjustment, due to changes in exchange rates, which might somewhat differ between individual exporters.Footnote 11 Exchange rates are measured as units of local currencies per one Euro. Exchange rate series are obtained from the IMF database or from national banks. In both cases, nominal exchange rates are monthly averages. In order to adjust the exchange rates for the period before the introduction of the Euro, we use the official conversion rates to obtain the bilateral exchange rate series. Non-observable marginal costs are approximated analogously to Silvente (2005) as estimated time-specific effects from the original Knetter (1989) model.Footnote 12

Whenever it was possible, the estimation period was chosen from January 1991 to December 2012. For some destinations, though, the information was available only for a part of the sample for all or some required series. Because the spurt variable computation requires starting at a local maximum or minimum of the exchange rate, the samples for the hysteresis analysis had to be additionally adjusted. Due to these adjustments, some countries had to be dropped from the hysteresis analysis, as we did not have enough data. However, those were only a few cases. Appendix 3 gathers the information on data availability for each destination of our sample.

4 Results

4.1 Hysteresis

In Table 2, the outcomes of the estimated hysteresis model are presented. In Panel A, the results of the model without the spurt variable (linear model) are presented and in Panel B the coefficients of the nonlinear model with the spurt variable. Appendix 4 presents the results obtained with the FMOLS estimation. For some countries (China, Japan, New Zealand, and Thailand), it was not possible to estimate the model with the spurt due to the zero playwidth. There are no results for the Ukraine because the remaining sample was too short.

The outcomes suggest that exporters’ reaction to the exchange rate changes differs between destination countries. Negative coefficients of the linear static model indicate LCPS behavior for four countries, Canada, Israel, Great Britain, and the USA. Positive coefficients indicate price amplification for seven countries, including Australia, Brazil, China, Russia, Singapore, Sweden, and Ukraine.

This coarse assignment can be specified by a closer examination of the \(\beta \)-coefficients. Hysteresis in the local currency price stabilization mechanism is expected if the \(\beta \)-coefficient is negative and significant. This is found for Canada, Israel, Norway, Singapore, and the USA. The negative \(\alpha _{1}\)-coefficients of the model without spurt support the LCPS interpretation, except for Singapore where we get ambiguous results. For Canada, Norway, and the USA, the \(\alpha _{2}\)-coefficient is positive and \(\beta \) is negative, but as \(\alpha _{2} +\beta <0\), there is no contradiction to the linear model.

A special case is Great Britain. Here, the spurt coefficient is not significant, and the exchange rate coefficients of both models are negative. Therefore, we conclude that German beer exporters adjust their Euro prices without delay, that is, LCPS, but no hysteresis, is found for the UK.

On the other hand, there seem to be some countries where beer exporters use exchange rate fluctuations to raise prices excessively. In this case, we also find hysteresis strategies. A positive, significant spurt coefficient indicates hysteretic price amplification in Australia, Brazil, and Sweden. The positive exchange rate coefficients of the model without spurt support this interpretation. As above, a conflicting sign of the \(\alpha _{2}\)-coefficient to \(\beta \) is no problem especially when it is not significant. Switzerland seems to be a special case of pricing because on the one hand, the spurt coefficient is positive and significant, but on the other hand, the exchange rate coefficient is negative, of the same magnitude and significant as well.

Besides, \(\alpha _{1}\) of the model without spurt is not significant and, as the sum \(\alpha _{2} +\beta \) of the coefficients of the model with spurt, close to zero. As the coefficients or the sum of them are nearly zero, we conclude that there are other factors involved that determine the price of German beer in Switzerland.

As mentioned above, we could not estimate a spurt model for Japan, New Zealand, and Thailand. However, the linear model suggests no relation between prices and exchange rates for those destinations. Hence, we conclude that the exchange rate is fully passed through to the prices of these three markets, which is further tested within the NARDL approach.

4.2 Asymmetry

Table 3 presents the long-run elasticities of prices with respect to the exchange rate. The outcomes of the originally estimated NARDL model are reported in Appendix 5.

Results suggest that German exporters rather stabilize prices in local currencies, as the number of negative coefficients is prevailing. The magnitude of such adjustments varies for different types of exchange rate changes. Negative coefficients are obtained for nine out of 16 countries in the depreciation \((e^{-})\) regime. This implies that in exports to these destinations, Euro depreciation is followed by a price increase in Euro, so that the price paid in local currency changes only slightly, while the exporter extracts extra profits. LCPS related to Euro depreciation is found to be highly significant for markets including Canada (77.3 %) and Great Britain (92.6 %). For those markets, such price increase during a period of Euro depreciation is a source of smoothing the Euro appreciation effect on the destination market prices, when the Euro appreciation is offset via a markup reduction.

As for the USA, a coefficient of 146 % suggests overshooting, and a more than proportional price increase as the Euro depreciates. A positive coefficient in the case of Euro depreciation would imply an additional price decrease, which is more difficult to explain from the theoretical point of view. Most of the positive coefficients (besides the one for Australia) we obtained in our estimations are not statistically significant or come from equations, for which we could not reject the no long-run relationship between the level variables according to bounds testing (as in the case of Singapore).

Inner regime outcomes in general support the necessity of introducing hysteresis into the model. Most of the coefficients are only of a very low statistical significance or are found for equations, for which we could not reject the hypothesis of no long-run relationship.

The coefficients referring to the Euro appreciation tell us two stories, as different as the signs of the coefficients obtained. A negative coefficient suggests a case of LCPS, when an exporter offsets a part of the appreciation via a reduction in the markup. This leads to a decrease in the profits the exporter would normally receive, if the price and quantity sold remained unchanged. Without price adjustment, the price paid by the partner country will rise, as the Euro appreciates, which might lead to a decrease in the quantity demanded. LCPS in this situation assures that the price in the local currency does not change too much, and the exporter is able to keep his market share on the destination market.

A positive coefficient related to the Euro appreciation means that the exporter uses a change in the exchange rate to additionally increase the price. This would only be possible in markets where exporters are able to realize market power, as they are sure that the demand stays constant, no matter what happens to the price. A 50/50 distribution of positive and negative coefficients was found for our sample. Negative coefficients seem to appear more often for countries which contribute the most to the total exports of German beer (e.g., the USA, Great Britain, Switzerland, Canada, and Sweden). This proves the idea of cautious policy of German exporters on important markets, where protecting of the market share is of high priority. Among those destination markets, Canada, Great Britain, and the USA tend to be the destinations with the most pronounced LCPS policy, as all exchange rate changes, irrespective of their sign, are at least partially offset.

Euro appreciations are estimated to be offset up to 67.1 % for Canada, 32.6 % for Israel, 36.3 % for Sweden, 78.8 % for Great Britain, and 64.7 % for the USA. The amplification of the Euro appreciation is recorded for Australia (36.4 %), Brazil (16.2 %), and Ukraine (21.1 %). Positive coefficients found for China (98.7 %) and Singapore (156.1 %) cannot be trusted as no long-run relation was found for these models, and the estimates lie beyond reasonable expectations.

Table 4 presents the outcomes of symmetry testing. In most cases, the hypothesis of a long-run symmetry between all regimes is rejected. Few exceptions are New Zealand, Norway, and Great Britain. While in the first two countries pricing seems to be rather independent of exchange rate fluctuations, the UK shows a very pronounced but symmetric LCPS. For most of the sample, symmetry was rejected for large appreciation and depreciation regimes, while the asymmetry between appreciations/depreciations and inner regime is not so pronounced. The short-run dynamics do not seem to play an important role in our sample. This is also reflected in symmetry test results, most of which support symmetry in the short run.

4.3 Discussion

The outcomes of our estimations suggest that German beer exporters apply different pricing strategies on individual destination markets. For the markets, for which PTM was found, we could often show that the application of PTM strategies depends on the size and the sign of the exchange rate changes. We were able to find evidence in favor of hysteresis in around 40 % of the estimated models and for all countries (but Great Britain), for which PTM was detected. This implies that for changing export prices for some markets, there is a certain band of inaction, within which exporters do not adjust their prices immediately but wait for the following development of the exchange rate.Footnote 13 This finding is line with the literature on sunk-cost hysteresis in exports (e.g., Belke et al. 2013), menu costs, and price hysteresis literature (e.g., Larue et al. 2010) and a previous study of Fedoseeva (2013), who found some evidence in favor of hysteresis in pricing of German exports of sugar confectionery.

The outcomes of the NARDL models suggest that German exporters apply PTM strategies on some markets, while for other countries no evidence of PTM was found as the outcomes obtained were not statistically significant (in line with Dreyer et al. 2013). Furthermore, the analysis revealed a number of countries, for which the no long-run relationship between the level variables could not be rejected by means of bound testing. Furthermore, we showed that pricing decisions of exporters depend not only on the magnitude, but also on the direction of the exchange rate change. Table 5 summarizes the information regarding hysteresis and asymmetry in our sample.

PTM in the form of LCPS was found for Canada, Israel, Great Britain, and the USA. These countries host a large share of German beer exports (Fig. 6), and the competition on these markets with other countries’ brands is very strong. Those markets require high sunk costs of market entry, and keeping the market share is a challenge for an exporter. To protect their market shares on these destination markets, the exporters partially offset Euro appreciations by means of their markups, which allows smoothing the local currency price change. During Euro depreciations, exporters adjust the prices in a similar manner to keep the price in local currency stable (the adjustment is often higher in absolute terms), therefore accumulating extra profits, which might be used to offset Euro appreciations. The ability of such price adjustments might be interpreted as a sign that German exporters are able to exploit market power on those markets, as they are able to charge a markup over price. Still, LCPS is used in order to smooth the shocks of the exchange rate changes in the domestic prices, which is in line with the literature on price rigidity (e.g., Blinder et al. 1998).

On the other hand, there seem to be markets, where German exporters exercise their market power differently and use Euro appreciations as an exogenous reason to raise the export prices (e.g., Brazil and Ukraine). Since the national currencies of both these countries are depreciating against Euro most of the time, a further markup increase might not be perceived by customers as such.

Most of the countries from the “No PTM” or “Ambiguous” group have little variation in their exchange rate series (e.g., Norway, Sweden, Switzerland, Thailand) as can be seen in Appendix 2. Thus, price changes for these destination countries are determined by other factors, rather than exchange rate changes. Additionally, these two groups of countries host only a little part of the German exports, as can be seen in Fig. 6. For those countries, no PTM strategies are used, and the changes in the exchange rates are fully passed through. In the cases of countries such as Russia and China, it might well be that the sample size for these countries is too small to be able to capture the long-run relationships between variables. Gathering more data on these markets could help to overcome this limitation in future studies.

Finally, only for very few countries, symmetry and linearity could not be formally rejected, proving the hypothesis of asymmetric and nonlinear nature of PTM in line with Bussière (2013) and Fedoseeva (2013).

5 Summary and conclusions

In this study, we relaxed the assumption of linear and symmetric PTM and allowed the exporter’s markup to adjust asymmetrically, depending on signs and magnitudes of exchange rate changes. To address the nonlinearity of PTM, we applied the hysteresis framework (to test whether there is a difference in the exporter’s price reactions toward small and large exchange rate fluctuations) and the NARDL approach (to test whether those price responses are symmetric for currency appreciations and depreciations). This makes the study the first attempt at assessing both types of nonlinearities not only in the short but also in the long run in order to obtain more information on the exporters’ pricing behavior. To test the nonlinearity of PTM, we concentrated on German beer exports, for which empirical studies often find evidence of strategic pricing. Furthermore, we increased the number of considered trade partners up to sixteen, covering more than 80 % of all beer exports outside of the Eurozone, in order to test whether some special patterns can be found for rarely (or never) considered destinations.

Our findings reveal different pricing strategies in destination markets and show that price reactions of exporters toward exchange rate changes in different directions and magnitudes are not the same. The size of the market and its importance for exporters seem to play a decisive role in pricing decisions.Footnote 14 LCPS is often found for the large and important markets, where a lot of German beer is exported. This confirms the cautious behavior of German exporters, who are engaged in protecting their market shares in their key markets by adjusting their markup as the exchange rate changes in order to save the quantities shipped. In some markets, they are also able to exploit their market power by using Euro appreciations as an additional reason for price upward adjustments and collecting extra profits. Still, one should keep in mind that the outcomes we obtain are industry averages, and individual firm pricing behavior might well deviate from the general one described in this study. The only way to overcome this drawback is to apply the PTM framework to firm-level data, which, to the best of our knowledge, is not available at this point of time. Furthermore, a solid statement regarding exploiting market power on some markets would require the estimation of a market power model (e.g., residual demand elasticity), which is left for future research.

Notes

Neither do they focus on the amplification of the exchange rate change effect on the markup/price.

Opposite to, e.g., foreign direct investments, which are a less popular mean of internationalization among German brewers than among other large beer-producing nations.

For the details of the derivation, please address, e.g., Knetter (1989).

All variables enter the equations in logarithms. Here and further down, the country-specific index as well as the log notation are omitted to simplify notations.

This might be the case if the Euro appreciation is amplified on the exporters’ prices. We discuss this situation in the following chapter in some more detail.

This table is a reduced representation of all 30 possible combinations of the coefficients \(\alpha _1, \alpha _2\), and \(\beta \) (and the possibility that the nonlinear model cannot be estimated). \(\alpha _2\) is omitted from this table as it is mostly not significant and even when it is, the net effect \(\alpha _2 +\beta \) is important.

As we deal with a variable decomposition, standard cointegration tests might be not applicable. Thus, we apply a bounds testing approach by Pesaran et al. (2001) suggested by Shin et al. (2014) to test for a long-term relationship between level variables irrespective of their being I(0), I(1) or of a mixed nature.

We stick to such a threshold level following the study of Bussière (2013). Furthermore, this threshold is very close to the threshold which is estimated within the hysteresis analysis (those results are not reported here). Since the chosen threshold level influences the shape of the three new exchange rate variables, one should keep in mind that the empirical results might change if another level of the threshold is chosen. We thank one of the Reviewers for this remark.

Another drawback of using aggregate data is that they do not allow considering the impact of the exchange rate variation on firms‘ decision to enter or exit certain markets and corresponding effects on observed price variations in a context where prices vary across exporters. We thank one of the Reviewers for this observation. Indeed, the outcomes we obtain are industry averages instead of being firm-specific. More disaggregated data would be required to overcome these limitations.

Knetter (1989) estimated a fixed-effect model, where the export price was explained by a set of country-specific effects, time-specific effects, and the exchange rate. He argued that the time-specific effects can be regarded as a measure of marginal cost changes over time, as they capture changes in export price, similar between all the destination countries. The more countries are added to the model, the more trustable the outcome is. That is why (despite the fact that this estimate can capture other than marginal cost change factors), Silvente (2005) used the estimated time-specific effect of the Knetter model to proxy marginal costs in a residual demand elasticity study. Here, we stick to this approach as well, as using time-specific estimates results in a higher explanatory power of the models than, e.g., using barley prices. Being aware that the estimated time-specific effect is not a perfect proxy for not observable marginal costs, we treat the outcomes with caution.

This band is country-specific, and it heavily depends on the volatility of the exchange rate between the trading partners, which is a very interesting question for future research. One could think of an additional inclusion of exchange rate volatility in the model, as the hysteresis effect is usually amplified by exchange rate uncertainty. Here, we tried to keep the model very simple and tractable to allow the comparability of the outcomes between the two models.

Some industry case studies also prove this point (see, e.g., Schmid and Luber (2013), in case of Bitburger).

References

Alessandria G (2009) Consumer search, price dispersion, and international relative price fluctuations. Int Econ Rev 50(3):803–829

Atkeson A, Burstein A (2008) Pricing-to-market, trade costs, and international relative prices. Am Econ Rev 98:1998–2031

Baldwin R (1990) Hysteresis in trade. Empir Econ 15:127–142

Belke A, Goecke M (2001) Exchange rate uncertainty and employment: an algorithm describing “Play”. Appl Stoch Model Bus 17:181–204

Belke A, Goecke M, Guenther M (2013) Exchange rate bands of inaction and play-hysteresis in German exports—sectoral evidence for some OECD destinations. Metroeconomica 64(1):152–179

Benedictow A, Boug P (2013) Trade liberalization and exchange rate pass-through: the case of textiles and wearing apparels. Empir Econ 45:757–788

Blinder AS, Canetti ERD, Lebow DE, Rudd JB (1998) Asking about prices: a new approach to understanding price stickiness. Russell Sage Foundation, New York

Bussière M (2013) Exchange rate pass-through to trade prices: the role of non-linearities and asymmetries. Oxf Bull Econ Stat 75(5):731–758

Campa JM (2004) Exchange rates and trade: How important is hysteresis in trade? Eur Econ Rev 48:527–548

Campa JM, Goldberg LS (2005) Exchange rate pass-through into import prices. Rev Econ Stat 87(4):679–690

Delgado FA (1991) Hysteresis, menu costs and pricing with random exchange rates. J Monet Econ 28:461–484

Devreux MB, Engel C (2002) Exchange rate pass-through, exchange rate volatility, and exchange rate disconnect. J Monet Econ 49:913–940

Dreyer H, Fedoseeva S, Herrmann R (2013) Gravity meets pricing to market: What a combined-method approach tells us about German beer exports. Contributed Paper, Beeronomics Conference 2013, The Economics of Beer and Brewing, York, England, September 18–21, 2013

Fedoseeva S (2013) (A)symmetry, (non)linearity and hysteresis of pricing-to-market: evidence from German sugar confectionery exports. J Agric Food Ind Organ 11:69–85

Gagnon JE, Knetter MM (1995) Markup adjustment and exchange rate fluctuations: evidence from panel data on automobile exports. J Int Money Finance 14:289–310

Goecke M (2002) Various concepts of hysteresis applied in economics. J Econ Surv 16(2):167–188

Goerg H, Halpern L, Murakoezy B (2010) Why do within firm-product export prices differ across markets? Discussion Paper 7708, Center for Economic and Policy Research. http://hdl.handle.net/10419/32948. Accessed 24 March 2014

Goldberg PK, Hellerstein R (2013) A structural approach to identifying the sources of local-currency price stability. Rev Econ Stud 80(1):175–210

Goldberg PK, Knetter MM (1999) Measuring the intensity of competition in export markets. J Int Econ 47(1):27–60

Granger CWJ, Yoon G (2002) Hidden cointegration. Economics Working Paper No. 2002-02, University of California. http://repec.org/res2002/Granger.pdf. Accessed 24 March 2014

Hellerstein R (2008) Who bears the cost of a change in the exchange rate? Pass-through accounting for the case of beer. J Int Econ 76:14–32

Kannebley S Jr (2008) Tests for the hysteresis hypothesis in Brazilian industrialized exports: a threshold cointegration analysis. Econ Model 25(2):171–190

Kasa K (1992) Adjustment costs and pricing-to-market: theory and evidence. J Int Econ 32:1–30

Knetter MM (1989) Price discrimination by U.S. and German exporters. Am Econ Rev 79(1):198–210

Knetter MM (1993) International comparisons of pricing-to-market behavior. Am Econ Rev 83(3):473–486

Knetter MM (1994) Is export price adjustment asymmetric? Evaluating the market share and marketing bottlenecks hypotheses. J Int Money Financ 13:55–70

Knetter MM (1995) Pricing to market in response to unobservable and observable shocks. Int Econ J 9(2):1–25

Krasnoselskii MA, Pokrovskii AV (1989) Systems with hysteresis. Springer, Berlin

Krugman P (1987) Pricing to market when the exchange rate changes. In: Arndt SW, Richardson JD (eds) Real-financial linkages among open economies. MIT Press, Cambridge, pp 49–70

Larue B, Gervais J-P, Rancourt Y (2010) Exchange rate pass-through, menu costs and threshold cointegration. Empir Econ 38:171–192

Lavoie N, Liu Q (2007) Pricing-to-market: Price discrimination or product differentiation? Am J Agric Econ 89(3):571–581

Mayergoyz I (2003) Mathematical models of hysteresis and their applications. Elsevier, New York

Melitz MJ, Ottaviano GIP (2008) Market size, trade, and productivity. Rev Econ Stud 75:295–316

Mota PR, Varejão J, Vasconcelos PB (2012) Hysteresis in the dynamics of employment. Metroeconomica 63(4):661–692

Peltzman S (2000) Prices rise faster than they fall. J Polit Econ 108(3):466–502

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econom 16:289–326

Ravn MO, Schmitt-Grohé S, Uribe M (2007) Pricing to habits and the law of one price. AEA Pap Proc 97(2):232–238

Schmid S, Luber A (2013) Internationalisierung als Randaktivität. In: Schmid S (ed) Strategien der Internationalisierung: Fallstudien und Fallbeispiele. Oldenbourg, Muenchen, pp 113–123

Shin Y, Yu B, Greenwood-Nimmo MJ (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In: Horrace WC, Sickles RC (eds) Festschrift in honor of Peter Schmidt. Springer, New York

Silvente FR (2005) Price discrimination and market power in export markets: the case of the ceramic tile industry. J Appl Econ 8(2):347–370

Stahn K (2007) Has the export pricing behaviour of German enterprises changed? Empirical evidence from German sectoral export prices. J Econ Stat 227:295–329

Verheyen F (2013) Exchange rate nonlinearities in EMU exports to the US. Econ Model 32:66–76

Acknowledgments

We thank Alberto Bagnai, Christian Alexander Mongeau Ospina, and participants of the 16th INFER AC (Pescara, May 29–31, 2014), MURPHYS-HSFS (Berlin, April 7–11, 2014), 9th WIEM AC (Warsaw, July 10–12, 2014), the 14 th EAAE Congress (Ljubljana, August 26–29, 2014), and the 41st EARIE AC (Milan, August 29–31, 2014) for their valuable remarks and intensive discussions, as well as Mark Berman and Rose Lawson for revising our English. Financial support of the German Research Foundation (Deutsche Forschungsgemeinschaft) within the Project HE 1419/12-1 is much appreciated. The funding sources had no role in study design, in the collection, analysis, and interpretation of data, in the writing of the report, nor in the decision to submit the article for publication.

Author information

Authors and Affiliations

Corresponding author

Appendices

Rights and permissions

About this article

Cite this article

Fedoseeva, S., Werner, L.M. How linear is pricing-to-market? Empirical assessment of hysteresis and asymmetry of PTM. Empir Econ 50, 1065–1090 (2016). https://doi.org/10.1007/s00181-015-0957-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-015-0957-4