Abstract

This paper investigates the hitting time problems of sticky Brownian motion and their applications in optimal stopping and bond pricing. We study the Laplace transform of first hitting time over the constant and random jump boundary, respectively. The results about hitting the constant boundary serve for solving the optimal stopping problem of sticky Brownian motion. By introducing the sharpo ratio, we settle the bond pricing problem under sticky Brownian motion as well. An interesting result shows that the sticky point is in the continuation region and all the results we get are in closed form.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

We denote by (\(\Omega\), \(\mathcal {F}\), \(\mathbf {P}\)) a complete probability space throughout this paper and the filtration \(\{\mathcal {F}_t\}_{t\ge 0}\) is assumed to satisfy the usual conditionsFootnote 1. For a Markov process \(X=\{X_t\}_{t\ge 0}\), the notation (\(X_t\), \(\mathcal {F}_t\)) signifies that \(X=\{X_t\}_{t\ge 0}\) is adapted to the filtration \(\{\mathcal {F}_t\}_{t\ge 0}\). For parameter (sticky coefficient) \(\kappa \ge 0\), we define the sticky Brownian motion (\(X_t\), \(\mathcal {F}_t\)) as a weak solution to

where W is a standard Brownian motion on the probability space (\(\Omega\), \(\mathcal {F}\), \(\mathbf {P}\)) and \(\hat{L}^X(0)\) is the symmetric local time of X at 0 (for symmetric local time, we refer the readers to Revuz and Yor (1999)). The aim of this paper is to investigate hitting time problems of sticky Brownian motion and the its application to optimal stopping problem.

Since the sticky boundary behaviour of diffusion processes was discovered by Feller in his 1952 paper Feller (1952) (see also Feller (1954, 1957)), many researchers have been interested in sticky diffusions satisfying certain stochastic differential equations (SDEs) that has a sticky point. Skorokhod conjectured that the SDE has no strong solution and Chitashvili published a technical report Chitashvili (1997) in 1989 claiming a proof (the paper was published after his death in 1997). In the same year, Warren (1997, 1999) further investigated solutions to (1) demonstrating that the process X is not adapted to the filtration generated by W and has some “extra randomness”. More general results on the non-cosiness of filtrations appeared in Watanabe (1999). Recently, Engelbert and Peskir (2014) and Bass (2014) proved that weak existence and weak uniqueness hold, but that pathwise uniqueness does not hold nor does a strong solution exist, respectively. In addition, Engelbert and Peskir considered the system of sticky Brownian motion with one-sided reflection boundary, and their results thus provide a new proof of those of Chitashvili. Besides, Nie and Linetsky (2020) focused on the sticky reflecting Ornstein-Uhlenbeck diffusions. It is worth noticing that Salins and Spiliopoulos (2017) proposed delayed process to study the sticky boundary and corresponding occupation times. Actually, the process with spatial delay in their paper seems to be similar to sticky process. The extension is that the authors studied a general class of Markov process where both skew and sticky behaviors exist. Besides, a most recent work by Zhang and Jiang (2020) studied the construction, time change and transition densities of sticky skew Brownian motion but with no applications.

From the definition on Chapter VII in Revuz and Yor (1999), we know that the sticky point is slowly reflecting. Here we emphasize the slowly reflecting, i.e. \(0\ne \int _0^t1_{\{X_s=0\}}ds=\kappa \hat{L}_t^X(0)\). Consider a standard Brownian motion W and define \(\tau ^W_{\delta }:=\inf \{t>0:|W_t|>\delta \},\) then we know

But for the sticky Brownian motion X, again define \(\tau ^X_{\delta }:=\inf \{t>0:|X_t|>\delta \}\), it follows that

which means that the sticky Brownian motion spends much more time in a \(\delta\)-neighborhood of 0 than standard Brownian motion. In particular, the sticky Brownian motion reduces to standard Brownian motion when \(\kappa =0\).

By the seminal work of Feller (1957), we know that virtually any one dimensional, homogeneous, continuous Markov process can be uniquely characterized via its infinitesimal generator and the definition domain of the generator, and vice versa. We remark two recent optimal stopping work by Mordecki and Salminen (2019a, b) based on generalized Brownian motion, being oscillating Brownian motion and Brownian motion with broken drift, respectively. To our knowledge, there exists some of classical papers concerned with the construction and basic properties of sticky Brownian motion which are significant to be explored. In our paper, we first compute some meaningful properties of first hitting time over a constant boundary and a random jump boundary, respectively. Laplace transform and strong Markov property play an important role when dealing with these problems. Second, we turn to investigating the applications in optimal stopping and bond pricing of sticky Brownian motion. The results of first hitting time over constant boundary and sharpo ratio are essential.

The rest of our paper is organized as follows. In Section 2, we focus on the first hitting time problems over two kinds of boundaries: a constant boundary and a random jump boundary, respectively. Section 3 studies the applications in optimal stopping and bond pricing under sticky Brownian motion. By the results about hitting the constant boundary, we solve the optimal stopping problem; By introducing the sharpo ratio, we get the bond price. All the results we get are closed-form. Section 4 concludes.

2 First Hitting Time of Sticky Brownian Motion

In this section, we explore the basic first hitting time problems for sticky Brownian motion X defined by (1) over a constant boundary and a random jump boundary, respectively.

2.1 First Hitting Time Over the Constant Boundary

Set a constant level \(l\ge 0\) and define the first hitting time of X for touching l by

The Laplace transform of \(\tau _l\) is

where \(X_0=x\ge 0\) is the initial point of X and \(\theta >0\). Then we have the following theorem about the Laplace transform of the first hitting time.

Theorem 1

The Laplace transform of the first hitting time of sticky Brownian motion X is

where

and

with the coefficients \(a_i\) and \(b_i\) \((i=1,2)\) given by

Proof

It is easy to show that f is an increasing continuous function satisfying the boundary conditions

and g is a descreasing continuous function satisfying the boundary conditions

The boundary conditions come from the infinitesimal generator and the definition domain of the generator of sticky Brownian motion. Furthermore, for arbitrary \(z\ne 0\), both f and g satisfy the Sturm-Liouville equation (h represents f or g)

Applying Itô-Tanaka formula (see, Revuz and Yor (1999)) to \(e^{-\theta t}h(X_t)\), we have

By the optional stopping theorem, for any \(t>0\)

Then, we get

When \(h:=f\) (case \(x\le l\)), we have \(X_{\tau _l\wedge t}\le l\). Since f is increasing, it implies that

As a result, both

and

hold as \(t\rightarrow \infty\) by the dominated convergence theorem. A similar argument for the case when \(h=g\) leads to

and we end this proof.

Remark 1

It should be noted that the definition domain of function h in (10) is actually \(z\in (-\infty ,\infty )\) containing 0 which is explained by (11). Intuitively, the construction of sticky Brownian motion can be viewed as a combination of continuous part and discontinuous part (symmetric local time, in our paper). Naturally, \(h^{''}(z)\) makes sense at 0 and takes the form of \(h^{''}(0)=2\theta h(0)\) according to (11). This fact can also come from the definition domain of infinitesimal generator of delayed process appeared in Salins and Spiliopoulos (2017), i.e., \(\mathcal {A}h\in C(\mathbb {R})\) but \(h\in C(\mathbb {R})\cap C^2(\mathbb {R})\setminus \{0\}\).

By virtue of the above theorem, we have the following corollary describing the mean time of sticky Brownian motion for first hitting l.

Corollary 1

The mean time of sticky Brownian motion for first hitting l are \(\infty\), i.e.

Proof

Because

then a straightforward calculation by using the L’Hôpital’s rule produces the result.

Remark 2

It is obvious that \(\mathbf {E}_x[\tau _l]=\infty\), because there exists no limited boundaries which guarantees the trajectory of sticky Brownian motion not far away from the hitting level l.

In addition, if we set \(a\le x\le l\) and define

we acquire the next useful corollary.

Corollary 2

The two-sided exit identities are

Proof

By the strong Markov property, we adopt

and

Then, the proof is finished by solving the equations.

Next, we provide a direct result for the Laplace transform representation of first exit time which follows from the above corollary. In addition, the proof of next corollary parallels with Corollary 3.7 in Li and Zhou (2013), hence we omit it. Suppose that \(a<0<l\), then we provide the following corollary.

Corollary 3

The Laplace transform of the occupation time of X satisfies

where

and

with the coefficients specified in Theorem 1.

2.2 First Hitting Time Over the Random Jump Boundary

In this subsection, we explore the joint Laplace transform problem for first hitting time over a random jump boundary, which is associated with an exponential random variable. Let us first introduce some notations and definitions used in this subsection.

Define a random jump boundary by

where \(l>0\), H denotes a positive jump with distribution function F, and \(\eta\) is an exponential random variable with parameter \(\lambda\). In addition, H, \(\eta\) and the sticky Brownian motion X are independent. Now define

Obviously, \(\tilde{\tau }_l=\tau _l\) when \(t<\eta\), and \(\tilde{\tau }_l=\tau _{l+H}\) when \(t\ge \eta\). We focus on the joint Laplace transform

where \(x<l\).

Proposition 1

The joint Laplace transform \(\eta (\theta _1,\theta _2;x)\) admits the following decomposition:

where \(L(\theta ;x,l)\) is defined in (3).

Proof

We decompose \(\eta (\theta _1,\theta _2;x)\) as

Recalling the definitions (2) and (3), we have

and

Noticing that \(\mathbf {E}_x[e^{-\theta _2(\tilde{\tau }_l-\eta )} | \mathcal {F}_\eta ]=\mathbf {E}_{X_\eta }[e^{-\theta _2\tau _{l+H}}]\) holds for the strong Markov property of X and the memoryless property of \(\eta\), we finish the proof.

3 Applications: Optimal Stopping and Bond Pricing Under Sticky Brownian Motion

3.1 Optimal Stopping

Throughout this subsection, \(\theta\) is replaced with r in the expressions (5) and (6). We will show that the sticky point is in continuation region and we also obtain the value of optimal stopping problem for sticky Brownian motion. For an excellent exposition on optimal stopping problem, see for instance Taylor (1968), Salminen (1985), Christensen and Irle (2011), Crocce and Mordecki (2014), Alvarez and Salminen (2017) and references therein. Optimal stopping problem is to look for a stopping time \(\tau ^*\) such that

where \(r>0\) denotes the prevailing discount rate and \(G:\mathbb {R}\rightarrow \mathbb {R}_+\) is the pay-off function satisfying that G is continuous, twice differentiable, non-decreasing, non-negative, and has finite left and right derivatives.

As is known from the literature on optimal stopping, V is the smallest r-excessive majorant of G (Theorem 1 on pp. 124 of Shiryaev (1978)). As usual, we call \(\mathcal {S}:=\{x:V(x)=G(x)\}\) the stopping region and \(\mathcal {C}:=\{x:V(x)>G(x)\}\) the continuation region.

Theorem 2

Assume that \(G^{''}(0)>0\), i.e. G is convex. Then for sticky Brownian motion X defined by (1), the sticky point 0 is in the continuation region \(\mathcal {C}\).

Proof

Denote by \((dG^{-}/dS)\) and \((dG^{+}/dS)\) the left and the right scale derivatives of G, respectively. Thanks to the fact \((dG^{+}/dS)(0)-(dG^{-}/dS)(0)=m(\{0\})\mathcal {A}G(0)\) in Engelbert and Peskir (2014), we obtain \((dG^{+}/dS)(0)-(dG^{-}/dS)(0)=\kappa \mathcal {A}G(0)\) in our paper, where \(\mathcal {A}G(0)=(1/2)G^{''}(0)\) and m is the speed measure.

Assume that \(0\in \mathcal {S}\). Then following the results in Alvarez and Salminen (2017), we obtain

On the other hand, according to Corollary 3.7 in Shiryaev (1978), for any r-excessive function H it follows that

Because V is the smallest r-excessive majorant of G, we get the contradiction. Hence, \(0\in \mathcal {C}\).

Recalling the result on speed measure m of sticky Brownian motion X in Bass (2014), the scale function for X is computed by

Moreover, the so-called Wronskian

is independent of x.

Now introduce for a differential function F

and

where the coefficients \(a_1\) and \(a_2\) are defined by (7). Let

be the set of points at which the ratio G/f is maximized. Next we introduce a useful lemma which provides a candidate strategy to verify the optimization in the optimal stopping problem. This is exactly a corollary in Shiryaev (1978), and the proof also appears in Alvarez and Salminen (2017).

Lemma 1

Let \(A\subset B\) be a nonempty Borel subset of B and \(\tau _A:=\{t\ge 0:X_t\in A\}\). Assume that the function

is r-excessive and dominates g. Then \(V=\widehat{V}\) and \(\tau _A\) is an optimal stopping time. Morever, \(\tau _A\) is finite almost surely.

Then we state the main theorem.

Theorem 3

(A) Let \(x^{*}\in \mathcal {M}\). Then, \((-\infty ,x^{*})\setminus \mathcal {M}\subset \mathcal {C}\).

(B) Assume that \(\mathcal {M}=\{x^{*}\}\), where \(x^{*}>0\), and the pay-off function G satisfies the property \(G^{''}-2r G(x)\le 0\) for all \(x\ge x^{*}\).

Then, \(\tau _{x^{*}}:=\inf \{t\ge 0:X_t\ge x^{*}\}\) is an optimal stopping time and the value reads as

Proof

Let \(\widehat{V}\) denote the proposed value function on the right hand side of (14). Clearly, \(V\ge \widehat{V}\). To show that \(V=\widehat{V}\), we apply Lemma 1 and proof that \(\widehat{V}\) is an r-excessive majorant of G. Since \(x^{*}\in \mathcal {M}\), it follows that \(\widehat{V}(x)\ge G(x)\) for all \(x\in \mathbb {R}\). Select \(x_0>x^{*}\) such that \(G(x_0)>0\) and define \(H(x):=\widehat{V}(x)/\widehat{V}(x_0)=\widehat{V}(x)/G(x_0)\). To show that H is r-excessive, let for \(x\ge x_0\)

and for \(x\le x_0\)

Firstly, the monotonicity and the non-negativity of G imply that \((L_g G)(x)\ge 0\) for \(x\ge x^{*}\), i.e. \(\sigma _{x_0}^H((x,\infty ])\ge 0\) for \(x\ge x_0\). Moreover, the property of G in (B) guarantees

for all \(x\ge x^{*}\) implying that \(x\mapsto \sigma _{x_0}^H((x,\infty ])\) is non-increasing. Secondly, Since \(x^{*}\in \mathcal {M}\), then \((L_f G)(x^{*})=0\). Again by the property of G in (B), we have

and thus \((L_f G)(x)\le 0\) for \(x\ge x^{*}\), i.e. \(\sigma _{x_0}^H([-\infty ,x))\ge 0\) for \(x\le x_0\), and \(x\mapsto \sigma _{x_0}^H([-\infty ,x))\) is non-decreasing. Thirdly, it follows, recalling the definition (13) of the Wronskian, that

Based on the calculation above and setting \(\sigma _{x_0}^H(\{x_0\})=0\) lead that \(\sigma _{x_0}^H\) constitutes a probability measure on \([-\infty ,\infty ]\). Then, \(\sigma _{x_0}^H\) induces via the Martin representation an r-excessive function (Salminen (1985) and Shiryaev (1978)) which coincides with H. Since \(\widehat{V}(x)=\widehat{V}(x_0)H(x)\) the proposed \(\widehat{V}\) is excessive as well. Combining Lemma 1 finishes the proof.

Remark 3

In our paper, the increasing fundamental solution f satisfies the sticky boundary condition (see, (8)). Differently, the increasing fundamental solution \(\psi _r(x)\) satisfies the skew boundary condition \((\beta \psi _r^{'}(0+)=(1-\beta )\psi _r^{'}(0-))\) in Alvarez and Salminen (2017).

3.2 Bond Pricing

In this subsection, we study the bond pricing problem under sticky Brownian motion \(X_t\). Suppose that the financial market is arbitrage-free and the default-free bond price at time t is denoted by \(B(X_t, \tau )\) or \(B(t, T, X_t)\), where T is the maturity and \(\tau =T-t\) is the bond’s term. Let \(B(t, T, X_t)\) be the bond price based on \(X_t\) with the maturity T at time t. By Itô formula (see Revuz and Yor (1999)), we have for \(X_t\ne 0\),

where

What follows next is our main result about the bond price under sticky Brownian motion.

Theorem 4

Suppose that the underlying zero coupon interest rate satisfies (1) and \(\lambda\) is the sharpe index in the modern market which is arbitrage-free. Then the bond price \(B(t,T,X_t)\) of the zero coupon interest rate with the maturity time T is represented by

with the coefficients

Proof

In the bond pricing theory, if a bond market is arbitrage-free, the sharpe ratio of trading bonds with different terms should be equal. Thanks to Vasicek (1997), we let sharpo ratio be \(\lambda\) for \(X_t\ne 0\), and derive the same pricing problem by

With the displays of (15), (16) and (17), we establish

To solve the pricing problem, we suppose that the solution to (18) takes the form of

with \(\alpha (0)=\beta ^{+}(0)+\beta ^{-}(0)=0.\) Taking the partial derivatives for B results in

Substitute them into (18), then we obtain

which holds for arbitrary \(X_t\ne 0\). It suggests that

Recalling the infinitesimal generator and its domain for B in Remark 1, it follows that

where the last equation comes from (18). Obviously, we get

After solving the equations, we complete this proof.

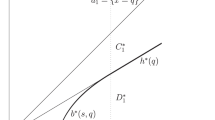

Next, we will provide some numerical results for the bond price under sticky Brownian motion with different sticky coefficients \(\kappa\). More precisely, we set \(\lambda =0.5\) as the common parameter. Noted that 0 is the sticky point which later causes some interesting analysis for sticky phenomenon. In addition, in the following three figures, the bond’s \(\tau\) is considered with respect to three different conditions, respectively. In each of three figures, different sticky coefficients are further discussed.

Figure 1 shows the displays of the bond price in the case of \(\tau =0.3\). Usually, bond price decreases as underlying interest rate increases. The red line represents the classical bond price with respect to sticky coefficient \(\kappa =0\). It is interesting to see that around sticky point 0, the bond prices exhibit different behaviors. With a bigger sticky coefficient \(\kappa\), the underlying interest rate will spend more time at 0, leading to an aggregation phenomenon and such phenomenon obviously influences the bond price which decreases weakly with respect to the “aggregated” interest rate.

As Bass (2014) said that for a corporation having a takeover offer at 10. The stock price is then likely to spend a great deal of time precisely at 10 but is not constrained to stay at 10. Thus 10 would be a sticky point for the solution of the stochastic differential equation that describes the stock price. For interest rate, we also take sticky phenomenon into consideration. Suppose an interest rate is modelled by the sticky Brownian motion. Then it is possible for bond price to have more choice at the sticky point because the underlying interest rate will spend more time at such fascinating point. But once interest rate passing sticky point, the bond price will exhibit normal principle immediately regardless of the sticky phenomenon. Similar analysis applies to Figs. 2 and 3 for \(\tau =0.5\) and \(\tau =0,7\), respectively.

For different bond’s term \(\tau\), we can learn from Figs. 1, 2 and 3 that the bond price decreases as the bond’s term increases. This coincides with the classical results in bond pricing theory.

4 Conclusion

In this work, we have studied the Laplace transform of the first hitting time of sticky Brownian motion and their applications in optimal stopping and bond pricing. The first hitting time problems and related properties of sticky Brownian motion have been acquired by Laplace transform, strong Markov properties and the definition domain of its generator. It should be noticed that our method for solving first hitting time problems is applicable to other models (different boundary conditions). In optimal stopping application, we have solved the problem about which region sticky point belongs to, and as a corollary of result in Alvarez and Salminen, we have obtained the value function of the optimal stopping problem. To derive the bond price under sticky Brownian motion, by introducing the sharpo ratio, we calculate the closed-form solution. More explanations about the sticky phenomenon are shown by the numerical results. In the future study, it is significant for us to pursue: (1) Investigate the explicit value of optimal stopping based on sticky Brownian motion under more weak assumptions; (2) Extend our results under other sticky processes like sticky OU, sticky CIR; (3) Consider the option pricing of American styles, which needs to find the exact stopping time to maximize the value function.

Notes

A filtration \(\{\mathcal {F}_t\}_{t\ge 0}\) is said to satisfy the usual conditions if it is right-continuous and \(\mathcal {F}_0\) contains all the \(\mathbf {P}\)-negligible events in \(\mathcal {F}\).

References

Alvarez L, Salminen P (2017) Timing in the presence of directional predictability: optimal stopping of skew brownian motion. Math Method Oper Res 86:377–400

Bass RF (2014) A stochastic differential equation with a sticky point. Electron J Probab 19(32):1–22

Chitashvili R (1997) On the nonexistence of a strong solution in the boundary problem for a sticky Brownian motion, (i) Report BS-R8901, Centre for Mathematics and Computer Science, Amsterdam, 1989 (10 pp); (ii) Proc. A Razmadze Math Inst 115:17–31

Christensen S, Irle A (2011) A Harmonic Function Technique for the Optimal Stopping of Diffusions. Stochasitcs 83(4–6):347–363

Crocce F, Mordecki E (2014) Explicit solutions in one-sided optimal stopping problems for one-dimensional diffusions. Stochastics 86(3):491–509

Engelbert HJ, Peskir G (2014) Stochastic differential equations for sticky Brwnian motion. Stochastics 86(6):993–1021

Feller W (1952) The parabolic differential equations and the associated semi-groups of transformations. Ann of Math 55(2):468–519

Feller W (1954) Diffusion processes in one dimension. Trans Amer Math Soc 77(1):1–31

Feller W (1957) Generalized second-order differential operators and their lateral conditions. Illinois J Math 1(1):459–504

Li B, Zhou X (2013) The joint Laplace transforms for diffusion occupation times. Adv Appl Probab 45(4):1049–1067

Mordecki E, Salminen P (2019a) Optimal stopping of Brownian motion with broken drift. High Frequency 2:113–120

Mordecki E, Salminen P (2019b) Optimal stopping of oscillating Brownian motion. Electron Commun Probab 50:1–12

Nie Y, Linetsky V (2020) Sticky Reflecting Ornstein-Uhlenbeck Diffusions and the Vasicek Interest Rate Model with the Sticky Zero Lower Bound. Stoch Models 36(1):1–19

Revuz D, Yor M (1999) Continuous martingales and Brownian motion, Springer

Salins M, Spiliopoulos K (2017) Markov processes with spatial delay: path space characterization, occupation time and properties, Stoch Dyn 17(6):1750042 (21 pages)

Salminen P (1985) Optimal Stopping of One-Dimensional Diffusions. Math Nachr 124(1):85–101

Shiryaev AN (1978) Optimal Stopping Rules, Springer

Taylor HM (1968) Optimal Stopping in a Markov Process. Anna Math Stat 39(4):1333–1344

Vasicek O (1997) O, An equilibrium characterization of the term structure. J Financ Econ 5(2):177–188

Warren J (1997) Branching processes, the Ray-Knight theorem, and sticky Brownian motion, Sém. de Probab. XXXIII, Lecture notes in Math. 1655, Springer, 1-15

Warren J (1999) On the joining of sticky Brownian motion, Sém. de Probab. XXXIII, Lecture notes in Math. 1709, Springer, 257-266

Watanabe S (1999) The existence of a multiple spider martingale in the natural filtration of a certain diffusion in the plane, Sém. de Probab. XXXIII, Lecture notes in Math. 1709, Springer, 277-290

Zhang H, Jiang P (2021) On some properties of sticky Brownian motion. Stoch Dyn 6(21):2150037. https://doi.org/10.1142/S0219493721500374

Acknowledgements

Authors would like to gratefully acknowledge the participants in financial engineering seminar in Nankai University for their stimulating comments and suggestions in earlier version of this article.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

This work is supported by the the National Natural Science Foundation of China (No. 12101602).

Rights and permissions

About this article

Cite this article

Zhang, H., Tian, Y. Hitting Time Problems of Sticky Brownian Motion and Their Applications in Optimal Stopping and Bond Pricing. Methodol Comput Appl Probab 24, 1237–1251 (2022). https://doi.org/10.1007/s11009-021-09923-0

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11009-021-09923-0