Abstract

In this experimental investigation, we explore the impact of justification on project choices. Introducing a novel element, we implement asymmetric payoff schemes commonly employed in business, signifying distinct payoff distributions for the firm (principal) and the manager (agent). The agent has to choose one project from two options that differ in their risk-return profiles. The outcomes of our experiment substantiate our hypothesis, indicating that a mandate for justification decreases the probability of agents selecting the project with higher risk and return. The degree of this reduction appears to hinge on the nature of justification. Increased profit shares for the agent or a project recommendation from the principal can partially counterbalance the distortion in the project choice.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

It is a standard practice for managers to provide a rationale for their decisions and elucidate the outcomes of their choices or actions. In business, examples of justifications encompass various scenarios such as employees reporting to superiors, top management addressing inquiries during investor calls, or the board commenting on company performance in general meetings. The requirement to justify decisions and outcomes in these and similar situations may lead to personal costs, manifesting as pressure, discomfort, or even severe stress for individuals tasked with defending themselves (Frimanson et al., 2021; Roberts, 2009). For instance, at the upper echelons of management, the CEO bears accountability to the board of directors. Consequently, the CEO must rationalise major decisions, particularly those of a strategic nature that impact the company’s long-term success, and address (negative) past outcomes before the board. However, the pressure to provide justifications is not exclusive to the top tier. Taking, for instance, a project manager who must explain delays or budget overruns in completing a project.

The experimental research on justification predominantly utilises settings involving a single-person (Vieider, 2009, 2011), single-person settings with hypothetical second parties (Bauch & Weißenberger, 2020); Fehrenbacher et al., 2020), or two-person settings with symmetric payoff structures (Pahlke et al., 2012).Footnote 1

However, in a business context, payoff structures commonly exhibit asymmetry, leading to unequal payoff shares for the decision-maker, i.e., the manager, and the firm. Aligned with the primary goal of this study, we explore whether and in what manner justification influences project decisions within a context representative of control issues in firms. In this scenario, the authority to make project choices is delegated to a manager whose compensation is tied to the project’s success. However, acting as the residual claimant, the firm typically receives a share of the success distinct from the manager’s.

The second aim of our study is connected to the conclusions drawn by Vieider (2009) and Pahlke et al. (2012), which propose that justifications heighten the probability of opting for risky projects that could result in losses. Given that analytical evidence (Lukas et al. (2019), or the model in the present paper) suggests a contrary prediction, indicating less inclination towards risk-taking, we examine our asymmetric payoff scheme concerning the decision maker’s propensity.

Our third objective explores whether the nature of what the decision-maker has to justify makes a difference. Insights from the performance evaluation literature indicate that the mere expectation of defending one’s actions can be profoundly stressful for individuals tasked with justifying their actions and outcomes (Frimanson et al., 2021; Messner, 2009; Roberts, 2009). The way individuals perceive these personal costs may vary. Nevertheless, their impact probably also hinges on the justification, specifically, whether one has to justify outcomes or decisions. We contribute to the literature by investigating how three distinct justification regimes or types commonly employed in management practices influence the perceived costs of justification. These regimes differ in that the individual is required to justify (1) the decision, (2) the outcome, or (3) the outcome when it falls below a threshold.

Another factor affecting the costs of justification may be superiors’ preferred courses of action, such as shareholders’ favoured investment strategy or the level of risk the firm or division is willing to bear for its returns. Opting for a decision aligned with the preferred strategy is the most easily defensible choice (Tetlock, 1985), whereas varied preferences are likely to escalate the costs associated with justification. While these effects are intuitively understandable, as of our knowledge cutoff date, no specific evidence is derived from a setting with asymmetric payoff schemes as in our study. Hence, our fourth objective is to investigate how the communication of a preference interacts with asymmetric pay and types of justification concerning perceived costs of justification and project choice.

To address our research inquiries, we conducted a computerised laboratory experiment involving 360 undergraduate and graduate student participants at Leibniz University Hannover (Germany) in several sessions in 2015 and 2019. We established an agency situation where the agent is accountable for choosing a project. The principal (firm owner) is the residual claimant of the project’s payoff and requires the agent to justify the project choice or performance if it falls below a predetermined level. The principal-agent pairs engage in interactions across multiple decision rounds. In each round, the agent chooses between two available projects: a standard project and a visionary project with a higher mean return and variance. We represent these projects as basic lotteries with two distinct but equally probable outcomes (low/high). Notably, the ex-ante efficient (visionary) high-risk/high-return project may result in a loss for the principal.

The experiment involves three manipulations: first, we modify the agent’s payoffs from the available projects (adjusting his/her variable pay); second, we change the requirement to justify decision-making or performance; and third, we alter the principal’s opportunity to communicate project preferences (recommendations) to the agent.

We formulate our hypotheses using a straightforward analytical model connected to Lukas et al. (2019). This model is situated within the framework of management control alternatives proposed by Merchant and Van der Stede (2007). It integrates results control (outcome-contingent pay), action control (justification), and personnel control (project recommendation clarifies the firm’s expectation). The experimental results essentially support our hypotheses. Here are our key findings: (i) the presence of a justification requirement decreases the probability of agents selecting more lucrative and riskier projects, (ii) principals’ initial recommendations and increased variable pay for such projects counteract the impact of justification, resulting in more frequent selection of such projects, and (iii) decision justification elicits the highest compliance with recommendations for such projects.

We make two contributions to the experimental literature on justification effects. The first contribution relates to the (a)symmetry of the payoff scheme relevant in a setting with a justification requirement. The second contribution pertains to the event triggering the justification. Concerning the first contribution, we incorporate an asymmetric payoff scheme in a simplified manager-firm scenario. Contrary to studies utilising symmetric payoffs (Pahlke et al., 2012) or single-person settings (Vieider, 2009), our findings show that justification decreases the probability of participants opting for high-risk/high-return choices. Our study also diverges from Pollmann et al. (2014) who employ a reward-based justification approach where the decision-maker does not actively justify the decision or outcome. Instead, the principal rewards either the decision or the realised outcome, resulting in decreased risk tolerance. In contrast, our research explores the interactive effects of justification and asymmetric payoff schemes on project choices. As part of that investigation, we can demonstrate that justification does not consistently align with the principal’s best interests. Considering the evidence that decision-making on behalf of others is typically linked with a decrease in loss aversion (e.g., Chakravarty et al., 2011; Polman, 2012; Andersson et al., 2016), one might anticipate the riskiest decisions in our experimental conditions with justification. However, our observations reveal a more or less opposite outcome.

Concerning the second contribution, we explore the effects of different “triggering events” of justifications on decisions. It is an empirical question if it makes a difference for decision-making whether the decision itself, low outcomes or losses following a decision trigger the justification requirement. Prior literature focuses on decision justification (Vieider, 2011; Fehrenbacher et al., 2020). We investigate low outcome justification and loss justification in addition to decision justification. Given our results, the various justification regimes appear to influence project selection and compliance with project recommendations from supervisors in distinct manners. Our experiment finds that for higher risk strategies, decision justification results in higher compliance rates than justifications for outcomes. This result may have implications for business as it suggests that firms could best align management decisions with the firms’ preferred strategy by requiring a justification for decisions rather than outcomes of decisions. Consequently, our findings contribute to comprehending diverse (justification-related) management controls, as outlined by Merchant and Otley (2007).

The rest of this paper is organised as follows. The subsequent section provides an overview of related literature. Section 3 establishes the theoretical framework and introduces a straightforward model that can derive testable hypotheses. Section 4 outlines the experiment, and Sect. 5 presents its results. The concluding discussion in Sect. 6 evaluates the findings of our study.

2 Related literature

The body of literature on justification pressure and justification effects is expanding, as summarised by Patil et al. (2014).Footnote 2 Our study aligns with the experimental literature exploring justification for choices involving risky alternatives or projects. In particular, it is related to the work of Vieider (2009), Pahlke et al. (2012), and Pahlke et al. (2015). Vieider (2009) observes in a single-person setting that loss aversion diminishes if the decision-maker is required to explain their choice after the fact. In essence, justification raises the probability of making risky decisions that could result in losses. Similar findings are reported in Pahlke et al. (2012) and Pahlke et al. (2015), who employ a two-person setting with symmetric payoffs and show that justification reduces loss aversion while leaving other elements of risk attitude unaffected. Symmetric payoffs imply that the person who decides and the other passive recipient receive the same yield for each potential choice. The asymmetric payoff structure in our paper enables us to also examine how variations in the agent’s pay for performance affect risky project choices under justification pressure.

By incorporating various types of justification, our study is related to the literature analysing if and how different justification arrangements interact and whether they affect decision-making differently. Siegel-Jacobs and Yates (1996) experimentally investigated how different justification types, outcome justification and decision justification, affect judgements about individual attitudes of other persons. The results suggest that decision justification incentivises people to consider relevant information in more detail, while outcome justification only produces additional noise in the individuals’ judgements.

Justification arrangements are also particularly relevant in project management. Mac Donald et al. (2020) conducted interviews with project managers and revealed that these managers undergo various effects of justification. In response to the need for justification, project managers cultivate skills to facilitate decisions, anticipate problems, and manage multiple priorities. Mir and Rezania (2023) analysed data from a survey of project managers. They show that project managers’ justification of the project management decision process moderates the effect of the managers’ interactive use of project management control systems on project performance via team learning. While Leong (1991) considers justification of the decision process of project management and justification of project outcomes as accountability arrangements that are running parallel, Rezania et al. (2019) observe differences in the strength of both justification types among organisations.

Finally, our investigation aligns with studies exploring both justification’s positive and negative effects on decision-making. Various experimental studies at the individual level have extensively documented the positive impacts of justification. For instance, justification pressure has been shown to decrease preference reversals (Vieider, 2011), mitigate overconfidence or order effects (Ashton, 1990; Jermias, 2006), diminish the influence of positive affective reactions (Fehrenbacher et al., 2020), and address inaccurate judgements and favouritism (Ashton, 1992; Bauch & Weißenberger, 2020). Additionally, studies by Webb (2002) and Arnold (2015) investigated the impact of perceived pressure to justify decisions and financial pressure on budgeting decisions. They observe that such pressure tends to reduce slack and enhance cooperation in decision-making processes. The experimental results of Ashton (1990) indicate that performance pressure may harm or improve performance depending on the existence of a decision aid. The availability of a decision aid can hurt performance as it changes the nature of the decision maker’s task. As we add the principal’s recommendation for the project choice to our experiment, we also consider some “decision aid” in our investigation. However, the decision aid is not based on a statistical regression like in Ashton (1990) but it is provided by the superior who has own interests. Thus, we complement the above findings by analysing how a decision aid from a superior who induces the justification pressure affects the decision maker’s choice.

3 Formulation of model and hypothesis development

Theoretical framework In business, numerous firms are overseen by managers rather than their owners, granting these managers significant decision-making authority. Firms employ various management controls to ensure that managers’ actions align with the owners’ objectives. Merchant and Van der Stede (2007) state that these controls can be categorised into results, action, personnel, and cultural controls. The interplay of these controls is essential, and when firms utilise different controls while considering potential interactions, they employ management control as a system (Grabner & Moers, 2013).

Results controls are widespread and commonly manifest as outcome-contingent pay for management. Action controls include delegating decision rights or mandating justifications for decisions and outcomes. Personnel controls are means designed to communicate the firm’s expectations or what it “wants,” while cultural controls involve elements such as shaping the organisation’s identity.

In our model, a firm engages a manager and presents a contract featuring outcome-contingent pay. The manager faces a decision between two distinct projects. The selection of a project, coupled with a random state of nature, determines the project’s outcome and, consequently, the payoffs for both the manager and the firm. Our model incorporates and integrates three types of controls: variable pay contingent on the project’s outcome, serving as a results control; justification, functioning as an action control; and a project recommendation, operating as a personnel control. In formulating the management control system, the model firm considers the interaction between these controls. The firm’s primary aim is to prompt the management to make the desired project choice at the lowest possible cost. The underlying framework of the model draws on agency theory, where we designate the firm as the principal and the manager as the agent.

The setting We examine a principal-agent scenario in which the principal delegates the decision regarding a project to an agent. It is assumed that both contracting parties are risk-neutral. The outcome, denoted as \(x_{i}\) of Project \(i=A,B\), is contingent on the realised state of nature. There are two equally likely states of nature denoted as: {state 1, state 2}. If state 1 occurs, the outcome of Project i is \(L_{i}\), while in state 2 it is \(H_{i}\), with \(H_{i}>L_{i}\). We categorise Project A as the “standard project” and Project B as the “visionary project.” In the event of state 1 realisation, the gross outcome of the visionary project for the principal is less than that of the standard project, \(L_{B}< L_{A}\). Additionally, we assume that Project B has a higher expected outcome and higher outcome variance. Hence,

with \(H_B>H_A\).

The agent’s compensation, denoted as \(w_i\) and contingent on the selection of Project i, corresponds to a bonus contract, a common practice in many firms. Specifically, the compensation function \(w_i=(f,s_i)\) comprises a fixed payment f and a bonus (rate) \(s_i\). The fixed payment f remains unaffected by the project choice or outcome. Alongside the fixed payment, the agent is entitled to a bonus of \(s_i\) monetary units per unit of the project outcome, provided the outcome is positive. This arrangement implies the use of results controls by the principal. The bonus rate \(s_i\) can be interpreted as the agent’s share of the (positive) outcome of Project i.

We assume \(L_{B}<L_{A}= 0\) and \(H_{i}>0\) for \(i=A,B\) to streamline the analysis. In formal terms, the compensation contract for the agent comprises a menu of two compensation functions \(\lbrace w_A,w_B \rbrace\) from which the agent chooses one by implementing Project i. Therefore, the agent’s expected compensation, given project choice i is expressed as:

We assume that the agent is protected by limited liability, necessitating that \(s_i\ge 0\) and \(f\ge 0\) must be satisfied.

Justification pressure The agent is tasked with the responsibility of project selection. In response, the principal requires a justification from the agent, contingent on poor project performance or for the chosen project. The justification serves as an action control implemented by the principal. In practice terms, the justification provides the agent with a chance to clarify deviations from anticipated results, elaborate on factors that impeded the project’s proper implementation, or provide evidence supporting the view that a particular project choice was optimal based on pre-project analysis. While this may lead to positive outcomes for both the agent and the company, the process undeniably induces stress and discomfort for the agent (Messner, 2009; Frimanson et al., 2021). Stress is notably probable when an explanation is required following subpar performance. Nevertheless, even if the justification pertains to the decision rather than its outcome, there is a basis to assume that the ultimate result influences how the agent’s decision is assessed by superiors or shareholders (Lipe, 1993).

When the agent decides while the outcome remains uncertain, the agent will consider the potential for suboptimal project performance. We denote the psychological stress and effort associated with justification as justification pressure \(JP_{i}\) for Project i. \(JP_{i}\) signifies the expected costs of justification, and is expressed as follows:

The function \(JC(x_i),x_i=L_i,H_i\), represents the justification costs when the outcome \(x_i\) occurs after choosing Project i. The indicator variable \(\iota _{x_i} \in \{0,1\}\) is zero if the principal does not request a justification for outcome \(x_i\); if a justification is required, \(\iota _{x_i}=1\). Intuition suggests that \(JC(x_i)\) is a monotone decreasing function - the higher the realised outcome \(x_i\) the less stressful it is to justify the result or decision.Footnote 3 Establishing the following relations then is straightforward:

If the principal requires a justification for a loss, \(\iota _{L_B}=1\); if a low outcome necessitates justification, \(\iota _{L_A}=\iota _{L_B}=1\); all other indicator variables are set to zero. Given Eqs. (3) and (4), it is then easy to establish the following relationship:

If the agent is required to justify a loss or a low outcome, the anticipated justification costs for choosing option B are consistently higher than for option A. Furthermore, suppose \(JC(x_i)\) is sufficiently strictly convex, indicating that justifying the potential loss from Project B is sufficiently stressful. In that case, the inequality in (5) remains valid even when the agent has to justify the project choice regardless of the outcome.

If the principal can indicate a preference for a particular project using personnel controls, this will probably impact justification costs. For instance, if the principal prefers ventures with higher risk, such as Project B in our model, justifying the potential loss from Project B is likely less burdensome. In a broader sense, when the principal signals a preference for Project i, justifying the selection of i for a specific outcome is expected to be less stressful than in situations without the signaled preference. Conversely, indicating a preference for Project j should raise the costs of justifying i. To integrate the impact of the recommendation, we modify Eq. (2) as follows:

Here, \(REC_j\) indicates the principal’s preference or recommendation for Project j, communicated to the agent. The variable \(\rho _{ji}\) reflects the effect of the recommendation. We assume \(0< \rho _{AA}=\rho _{BB}<1\). If the selected Project i aligns with the recommended Project j, meaning \(i=j\), it results in a vertical downward shift of the initial justification cost function. Conversely, if the agent does not choose the recommended Project j, justification costs increase, \(\rho _{AB}=\rho _{BA} > 1\). Following this reasoning, the subsequent relations are derived:

Relations in (7) and (8) establish connections between justification costs or justification pressure depending on the project choice i and potentially distinct recommendations. Additionally, we require comparisons depending on recommendation i and potentially different project choices:

Relation (9) asserts that, contingent on recommendation i, the agent faces higher costs in justifying outcome \(x_j\) compared to \(x_i\) as \(x_j\) is lower than \(x_i\) and the agent deviated from the principal’s recommendation. If the result from Project j surpasses that of Project i, the agent might or might not experience lower costs in justifying \(x_j\) than \(x_i\). The determination rests on whether the outcome holds greater significance than adherence to the recommendation. If there is an outcome bias in decision evaluation, as proposed by Baron and Hershey (1988), the connection between outcomes, \(x_i \gtreqless x_j\), will likely dictate the relationship between justification costs.

Project choice Incorporating justification pressure into the agent’s utility function, the agent’s expected utility at the contracting date, depending on the selection of Project i, is expressed as \(U_{i}=f+0.5s_{i}H_{i}-JP_{i}\). When the agent anticipates the optimal project choice to be i, the agent is inclined to accept the contract if and only if

holds, where \(\overline{U}\) represents the agent’s reservation utility. Consequently, the expected compensation must sufficiently compensate the agent for the anticipated cost of justification, as captured by \(JP_{i}\) and the agent’s opportunity cost arising from alternative employment (measured by \(\overline{U}\)).

The principal’s surplus \(V_{i}\) if Project i has been selected comprises its expected outcome \(0.5\left( H_{i}+L_{i}\right)\) minus the agent’s expected compensation. Therefore,

The principal favors Project B over Project A (\(V_{B} > V_{A}\)) if and only if

which is equivalent to

Assume \(s_B=s_A=s\). Then, if s is sufficiently small, the principal favours Project B (for \(s=0\), the left-hand side of (11) corresponds to the difference \([E(x_B)-E(x_A)]\)). The higher the agent’s outcome share for Project B (\(s_B\)) relative to Project A (\(s_A\)), the lower the principal’s payoff from Project B relative to Project A.Footnote 4

Post-acceptance, i.e., after the agent has agreed to the contract but before choosing the project, the agent’s incentives depend only on the variable compensation linked to the two projects (influenced by the principal’s choice of \(s_{A}\) and \(s_{B}\)) and the induced costs of justification \(JP_{i}\). Consequently, the agent’s project selection condition for Project B is given as:

If not met, the agent chooses Project A.

Without a justification requirement, where justification costs are zero, the agent consistently opts for Project B as long as \(s_B \ge s_A \cdot \frac{H_A}{H_B}\). holds. Introducing a justification requirement does not result in more choices favoring Project B. On the contrary, if a justification is mandated, the agent may lean towards Project A, as \(JP_B > JP_A\) [see Eq. (5)]. Accordingly, our first hypothesis is as follows:

Hypothesis 1

Given a justification requirement, agents opt for the high-risk/high-return project (Project B) less frequently than in situations without justification.

The agent opts for Project A if (12) does not hold. The principal has two potential strategies to enhance the agent’s probability of selecting Project B. The first option is to (i) decrease the justification pressure for Project B. Alternatively, the principal could (ii) offer the agent higher compensation for choosing B. Regarding (i), it is assumed that the principal aims to diminish the perceived justification pressure \(JP_{B}\) relative to \(JP_{A}\). A presumably highly effective factor in this regard is the “preference” expressed by the principal. Owners or supervisors can convey their desired course of action to managers by expressing a preference to the management to pursue innovative projects. The literature on non-binding communication (in experiments) demonstrates the effectiveness of this approach (Brandts et al., 2019).

The relationships (7) and (8) established in the model summarise the impact of the principal’s recommendation to opt for Project B. On the one hand, the justification pressure for choosing B is altered, resulting in \(JP_B(REC_B) < JP_B\); on the other hand, justification pressure for choosing A changes, leading to \(JP_A(REC_B) > JP_A\). Combining these two relations leads to:

Consequently, the right-hand side of condition (12) decreases, indicating that the agent is more likely to choose B following a corresponding recommendation. We formalise this assertion in Hypothesis 2.

Hypothesis 2

If principals express a preference for the high-risk/high-return project (Project B) and communicate this preference to agents, agents choose this project more frequently.

Regarding option (ii), the principal can influence the manager’s decisions through compensation. Assigning distinct outcome shares for various projects in the model is equivalent to presenting a menu of contracts.Footnote 5 The principal can incentivise the choice of the visionary project by increasing the associated bonus rate \(s_{B}\), relative to the standard project, \(s_{A}\). Hence, the following hypothesis is formulated:

Hypothesis 3

Raising variable pay for the high-risk/high-return project (Project B) leads to more frequent choices of this project by agents.

The justification pressure for Project B choices is higher than for Project A [Eq. (5)]. Furthermore, according to Eq. (8), there is a decrease in the justification pressure for Project i if that is the project the principal recommends. A reduced justification pressure, in turn, increases the likelihood that the agent adheres to the recommendation and selects the suggested project. What has not been explored thus far is whether variations exist in how effectively the personnel control “recommendation” prompts the agent to choose the principal’s favored project under different justification regimes. In particular, it is yet to be determined whether adherence to recommendations under decision justification (DEC) varies from compliance under justification for low outcomes (LOW) or losses (LOS).

The basic idea is that the justification requirement is presumably more effective the more often the agent must justify the project choice. Therefore, one would expect DEC to be more effective than LOW and LOS because four project-outcome combinations require a justification under DEC, but only two and one under LOW and LOS, respectively.

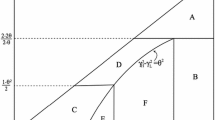

Figure 1 illustrates the three justification regimes: DEC, which demands justification in every project-outcome combination indicated by the four narrowly-dashed arrows originating from each possible cell to the “Justification DEC” box; LOW, requiring justification in a strictly smaller subset of cases indicated by the two bold solid arrows pointing to the “Justification LOW” box; and LOS, which, in turn, necessitates justification in a subset of cases smaller than the one under LOW; there is only one widely-dashed arrow indicating a justification requirement. Even though, as argued above, recommendations for specific projects can mitigate the justification effects, DEC should be more effective than LOW and LOS if principals can recommend projects.

To formally derive a corresponding hypothesis, it is worth noting that the indicator variables take non-zero values as follows: \(\iota _{L_B}=1\) for LOS, \(\iota _{L_B}=\iota _{L_A}=1\) for LOW and \(\iota _{x_i}=1\) for all outcomes and projects under DEC. Setting aside recommendations for the moment, the following relations can be derived using the Eq. (2):

where DEC, LOS, and LOW refer to the justification regimes introduced before. Equations (14)–(15) illustrate that the justification pressure may fluctuate based on the justification regime.

Introducing recommendations into the scenario requires considering the specific recommendation when evaluating the impact of the justification regime on compliance. The relation (14) remains unchanged if the principal recommends B, and (15) will not change if the principal recommends A. However, if the recommendation and project choice differ, a more detailed examination of the relations becomes necessary.

Commencing with the comparison between DEC and LOS, adherence to a Project B recommendation becomes more probable under DEC if:

holds. Condition (16) contrasts disparities in justification pressure based on the justification regime. As condition (12) indicates, the smaller the difference \((JP_B-JP_A)\) is, the more inclined the agent is to select Project B. Utilizing Eq. (7), we can simplify (16) to obtain:

Considering \(H_B >H_A\), the decreasing justification cost function, and \(\rho _{BB} < \rho _{AB}\), one can establish the relation \(0.5\rho _{BB}JC(H_B)\) < \(0.5 \rho _{BA} JC(H_A)\), implying condition (17) holds. Thus, DEC increases the likelihood that the agent complies with the Project B recommendation compared to LOS. A similar comparison between DEC and LOW leads to the same finding. The only difference in the comparison is that the term \(0.5 \rho _{BA} JC (L_A)\) drops out of (17).

If the principal recommends Project A, the agent is more likely to heed the recommendation the higher the value of \((JP_B-JP_A)\), which is the right-hand side of condition (12). Consequently, when comparing DEC and LOS, the condition for compliance being more likely under DEC is:

which simplifies to:

Given (10) and a sufficiently strong outcome bias (Baron & Hershey, 1988), the following relation holds: \(0.5 \rho _{AA} JC(H_A) > 0.5 \rho _{AB} JC(H_B)\). This occurs because \(H_A < H_B\) and outcome bias emphasise the realised outcome more than the expected outcome when evaluating a decision ex-post. Consequently, outcome bias also counteracts the effect of not following the recommendation, where \(\rho _{AB}>\rho _{AA}\). Hence, condition (19) does not hold. A similar analysis comparing DEC and LOW leads to the same conclusion, suggesting that DEC might be less effective for the principal than LOW in regard to inducing compliance with a Project-A recommendation. The only difference in the comparison is that the term \(0.5 \rho _{AA} JC(L_A)\) drops out of condition (19).

Building on the outcomes of the preceding comparisons, we formulate the following hypothesis:

Hypothesis 4

(a) Decision justification leads to higher justification pressure than loss justification and low outcome justification. (b) In direct comparisons, decision justification leads to higher compliance with recommendations for the high-risk/high-return project (Project B) and lower compliance with recommendations for the low-risk/low-return project (Project A) than low outcome justification and loss justification, respectively.

4 Design of the experiment

Our experiment employs a 4\(\times\)2\(\times\)6 multifactorial design with both between-subject and within-subject analyses. Across different treatments, we manipulate the presence of justification (no justification; obligation to justify the decision, the low state of nature, or a loss) and the information provided about the principal’s preferred project (no recommendation to the agent; recommendation to the agent). Within each treatment, we vary the payoff distribution over the decision rounds, adding depth to exploring different conditions. Table 1 provides an overview of all treatments.

We create random and anonymous pairs of principals and agents at the experiment’s outset. Throughout all sessions, we employ neutral language, referring to the agent as “Player 1” and the principal as “Player 2.” The projects are labeled as “Alternatives” accordingly. Pairs of Player 1 and Player 2 remain unchanged throughout six decision sets, maintaining consistent partner matching. Nonetheless, to counterbalance sequence effects, we alter the order of the payment schemes across the six decision rounds. Within each treatment, approximately half of all principal-agent pairs encounter payoff schemes in ascending order (1–6 in sets 1–6), while the other half experiences descending order (6–1 in sets 1–6). We align the decision sets with the same payoff schemes for subsequent statistical analyses.

At the start of each decision round, the agent chooses between two possible projects, Project A or Project B. As outlined in the previous section, there are two equally likely states of nature, state 1 and state 2. Depending on the state, each project produces a project-specific low outcome (in state 1) or a high outcome (in state 2). Specifically, the project outcome is negative only if Project B is selected and the unfavorable state transpires.

Given limited liability for the agent, any losses are absorbed by the principal. High outcomes are shared between the principal and the agent. The exogenous sharing rule is unique for each decision round. It ensures that, in accordance with our model, Project B results in higher expected compensation compared to Project A (i.e., \(s_B \ge s_A \cdot \frac{H_A}{H_B}\) in terms of our model). Simultaneously, in comparison to Project A, Project B results in a higher expected surplus for the principal. The two available projects and the payoff allocation are common knowledge for the current decision round. The complete instructions and payoff distributions are provided in the appendix (Table 3).

Our baseline (BL) test assesses the setting without any additional features. If the principal and the agent maximise expected payoffs, both would prefer Project B to A.

In all treatments involving justification (LOS, DEC, LOW, LOS-REC, DEC-REC, and LOW-REC), the agent must justify the decision or the project outcome. In LOS and LOS-REC treatments, the agent must justify the outcome whenever the principal incurs a financial loss. Therefore, only Project B exposes the agent to the risk of justifying a loss in these instances. This reflects the real-world business practice where unfavorable outcomes, particularly losses, often require justification. At the same time, poor project choices may not need justification as long as the overall results are satisfactory. In DEC and DEC-REC, we examine conditions in which agents must justify their decisions regardless of the actual project result. While justification for results might be a more prevalent scenario in practice, we contend that a strategic decision alone imposes significant justification pressure on several occasions.

Lastly, we introduce treatments where agents must randomly justify outcomes (LOW and LOW-REC). Specifically, agents must justify whenever state 1 is realised. This justification for being “unlucky” facilitates a more in-depth analysis of the determinants of justification pressure. Figure 1 provides a summary of the experiment.

In each regime, we implement the justification manipulation through a computer chat. The agent is mandated to enter the justification, and the principal has the opportunity to respond. We (correctly) anticipate that agent participants experience sufficient discomfort when they justify themselves.

Our second manipulation seeks to understand the effects of communication of owners’ preferences (recommendations) for project decisions. This is executed by enabling upfront communication of the principal’s preference in treatments REC, LOS-REC, DEC-REC, and LOW-REC. Technically, in every decision round, the principal’s project preference is presented on the agent’s computer screen before the agent makes a project decision. The agent has the liberty to either adhere to or disregard the recommendation. No additional communication, such as through chat, is allowed.

Our third manipulation involves varying the principal and agent payoff shares if Project B is chosen (Table 3 in the appendix). The escalating outcome share for the agent reflects the increase in variable pay that might be necessary to incentivise projects with higher expected returns (and return variance). This variation allows us to portray Project B as relatively more attractive to the agent than Project A regarding expected compensation. The manipulation of outcome shares enhances the internal validity of the experiment.

Implementing the three manipulations, the initial substantial part of our analysis concentrates on examining how these manipulations influence the agents’ frequencies of selecting the project with higher risk and return. Correspondingly, the number of agents’ selections of Project B (ChoiceB) is the primary variable of interest.

The second significant aspect of our investigation centers on the psychological effects of the manipulations, specifically, justification pressure (\(JP_i\) in the model). In line with the definition of Lerner and Tetlock (1999), we posit that only agents in justification conditions experience justification costs. To assess its perception and extent, we examine data from a computerised post-experimental questionnaire that mandates agents in justification conditions to report their experience with the justification requirements. As measurements after each decision likely influence behavior in subsequent rounds, we collected the data after completing the experiment. The questionnaire comprises seven questions where subjects rate their experience with justification on a 9-point scale. We calculate Cronbach’s alpha coefficient to evaluate whether the items are conceptually related. With a value of 0.84, the internal consistency of our questionnaire’s scale is considered good. Following standard practice, we operationalise the construct with the justification pressure variable JP, representing the average scores agents achieve on the corresponding items.

To ensure the internal validity of our experiment, we employ standardised questionnaires that are acknowledged for their reliability and validity. Additionally, we utilise various tests and regression models to verify the robustness of the results. Several controls complement the data of our main variables. Alongside sociodemographic information (Age, Sex), we gather data on the subjects’ risk attitude (WillRisk) through a pre-experimental questionnaire. The questionnaire is constructed based on the German Socio-Economic Panel (SOEP). Furthermore, we consider inequality aversion since other-regarding preferences could impact decision-making in our experiment. We ascertain the variable for inequality aversion (InequalityF) using a test from Fortin et al. (2007), that categorises participants into three classes of inequality aversion (low, medium, and high).

Other influences that merit consideration stem from the repeated interaction of the participants (multiple decision sets, fixed matching). The first such influence is reputation building. For instance, as the principal observes the agent’s track record of decisions, it could be possible that the agent aims to shape the principal’s perception of her/him. However, we do not believe that agents have the incentive to manage their reputation. If the agent is unaware of the principal’s preference, it is unclear which image is “right.” Even if the principal’s recommendation (preference) is known, it is uncertain whether an image as a “B-decision maker” or “A-decision maker” enhances the agent’s utility.

As a second factor, we examine the participants’ potential for cooperative or retaliatory behavior in chat communication treatments. Accordingly, we analyse chat contents to differentiate between undesired communication and behaviors influenced by justification, actual recommendations, or the pay scheme. An instance of undesired collusion is a principal communicating her/his preference to the agent through the justification chat in treatments with justification but without a recommendation. Another example involves principals and agents revealing their names via chat and agreeing to share the payoff after the experiment. Identifying suspicious chats for a principal-agent pair in a given round excludes all observations after the particular round.Footnote 6 In total, 76 out of 1080 agent-round observations are eliminated due to collusive behavior. The majority of eliminations are identified under decision justification (36), followed by low outcome justification (21) and loss justification (19). We attribute the variation between the treatments to the fact that there is the most frequent opportunity for collusion under decision justification, followed by low outcome justification and loss justification. No disputes or acts of retaliation are identified.

The experiment was conducted in the Leibniz Laboratory of Experimental Economics at Leibniz University Hannover. The software hroot (Bock et al., 2014) was employed for organisation and administration processes. The experiment was programmed using the software zTree (Fischbacher, 2007). 360 undergraduate and graduate students from various fields participated, resulting in an overall sample of 180 principal-agent pairs. The proportion of female subjects in the experiment is 40.56%. The gender distributions of principals and agents are similar within each treatment and do not vary significantly between treatments. The highest proportion of female agents is found in the loss justification condition (50%). On average, the students are 23.84 years of age and attend courses in the 5th semester. Regarding content, 49.72% of the participants are enrolled in STEM courses, while the rest are distributed between economics and management, teaching, and some other fields. Experimental sessions lasted approximately 60 min, and earnings averaged 11.23 Euro.Footnote 7

After arriving in the lab, participants received written instructions containing all relevant details about the experiment. A video film was played in which an experimenter (who was not present during the experiment) read the complete instructions, and explanatory screenshots for the upcoming experiment were presented. This was followed by participants reading the written instructions at their assigned seats. Any clarifying questions were addressed at the participants’ seats. Prior to the commencement of the actual experiment, participants were required to answer several control questions to ensure a thorough understanding of the experimental situation. Our experiment participants received compensation through an initial endowment of 30 Taler (3 Taler = 1 Euro) and the payoff from a specific decision round. Instead of all rounds, paying for only one round was done to avoid wealth effects (Charness et al., 2016). The round relevant to the payoff was publicly and randomly selected after the experiment. The initial endowment for each participant guaranteed that the sum of the initial endowment and the payoff in the relevant decision round could not be negative, meaning no participant could incur a monetary loss in the experiment.

5 Results of the experiment

Concerning Hypothesis 1, we examine how decision-making is influenced by justification. Figure 2 illustrates the Project-B choices of agents without recommendation.Footnote 8

Descriptive statistics for Project B choices (ChoiceB) of agents under no (JustDum=0) and any justification (JustDum=1), excluding treatments with recommendations. The bar chart displays the mean rates at which agents choose Project B in various decision sets. The percentage values above each bar indicate the average selection rates for Project B across all decision sets. The number of observations is presented at the bottom of each bar. Error bars are included to represent the 95% confidence intervals

Agents choose the risky Project B less frequently when justification is present. This suggests that the manipulation in the experiment (justification yes/no) was effective. To determine whether these differences are statistically significant, we conducted a t-test. The Shapiro-Wilk test confirms normality for the corresponding variables. We find the difference between agents operating under any justification (without a recommendation) and the baseline statistically significant (t-test: \(t=2.511\), \(df=522\), \(p=0.012\)). This result provides initial support for Hypothesis 1.

Asserting that the best decision aligns with the principal’s interest, not necessarily maximising expected value, we control for the principals’ preferences when assessing the impact of justification. Although our model predicts that principals prefer Project B, it is reasonable to assume that there might be principals favoring the less risky investment (Project A). Again, focusing only on treatments without a recommendation, Fig. 3 illustrates the agents’ decisions.

Descriptive statistics for Project B selections of agents operating under no justification or any justification (no distinction between types), controlling for uncommunicated project preferences of principals. Bar charts, differentiated by lighter (no justification) and darker (with justification) gray, illustrate the impact on Project B choices (ChoiceB) by agents in treatments without (JustDum = 0) and with (JustDum = 1) justification. The two left bar charts depict the impact of justification on Project B choices (ChoiceB) agents make when their principals prefer Project B (PrefB). The two bar charts on the right show the effect on agents’ Project B choices (ChoiceB) when principals prefer Project A (PrefA). Treatments with recommendations, where principal preferences are communicated, are excluded. The percentage numbers above each bar represent the mean rates of selecting Project B across all decision sets, with the number of observations displayed at the bottom of each bar. Error bars are included to represent the 95% confidence intervals

It appears that justification reduces agents’ selections of Project B even when principals prefer the risky Project B (t-test: \(t=2.097\), \(df=265\), \(p=0.037\)). When considering principal-agent pairs where the principals prefer Project A, the effect of justification on Project B choices shows a similar trend but does not reach a significant level (t-test: \(t=-1.367\), \(df=255\), \(p=0.173\)). In a preliminary summary, it seems that justification generally results in less risky choices by agents. When principals prefer higher-risk (investment) strategies without the agents being aware of this preference, the justification works against the interests of the principals. However, when principals prefer lower-risk strategies, justification does not appear to work against their interests.

To better understand the agents’ decisions, we performed logistic regression analysesFootnote 9 for the agents’ choices of Project B and Table 2 presents the results. Concerning Hypothesis 1, models (1) and (2) are pertinent, focusing on agents who must justify decisions or outcomes without controlling for the type of justification. While model (1) includes the variables of interest, model (2) also incorporates various control measures.

The odds ratios of JustDum indicate a reduction in the likelihood of a Project B choice due to justification. For example, the ratio of 0.542 suggests that under justification (compared to the baseline), we anticipate finding only 0.542 agents selecting Project B for every agent choosing Project A. This magnitude remains consistent when controlling for individual characteristics such as risk attitude and sociodemographic details. Both models narrowly miss the significance threshold for the main effect, however, the interaction between JustDum and Rec reaches statistical significance in Model (2). It seems that justification significantly affects project decisions when recommendations have been made beforehand. Figure 4 provides an overview of these effects.

Marginsplot of predicted probabilities for Project B choices by agents under no justification or any justification (no distinction between types), including Project B and Project A recommendations. The line with triangles (squares) depicts predicted probabilities after Project B (Project A) recommendations. The line with circles illustrates probabilities for agents receiving no recommendations. The percentage numbers next to each line represent the corresponding predicted probabilities. The analysis is based on 1.004 observations, and error bars are included to represent 95% confidence intervals

We notice that the decrease in predicted probabilities is more pronounced after a recommendation (triangle and square ends) than without a recommendation (circle ends). By calculating the margins, we discover that justification reduces the predicted probability of a Project B choice after a Project B recommendation by \(15.36\%\) (\(z=-2.590\), \(p=0.010\)) and by \(21,52\%\) (\(z=-2.670\), \(p=0.008\)) after a Project A recommendation.

Based on the results from our regression models and tests, we identify justification as a crucial factor in the agents’ decision-making. In line with the prediction of the theoretical model, justification seems to diminish the attractiveness of projects with high risks and returns. This effect appears to persist even in the presence of recommendations. Thus, for Hypothesis 1, we state:

Result 1

Experimental evidence supports Hypothesis 1, justification leads to a less frequent choice of the high-risk/high-return project (Project B).

Shifting our focus to Hypothesis 2, Fig. 5 illustrates descriptive data. Depending on the presence or absence of a justification requirement, it aligns the Project B choices of agents in treatments without recommendations with the Project B choices of agents in treatments with Project B recommendations. Our theoretical framework posits that when the principal makes a Project B recommendation, it signals a willingness to bear losses to the agent. This, in turn, results in lower justification pressure and has the potential to counteract the negative effect of justification on Project B choices, as predicted in Hypothesis 1 and documented above.

Descriptive statistics for Project B choices (ChoiceB) of agents with and without Project B recommendations. Bar charts, differentiated by light (without recommendations) and dark (with recommendations) gray, depict the impact of Project B recommendations (RecDum=0 vs. Rec=B). The percentage values above each bar represent the overall rates at which agents choose Project B across all decision sets, with the number of observations listed at the bottom of each bar. Error bars represent the 95% confidence intervals. The two bar charts demonstrate the effect of Project B recommendations when agents are not required to justify decisions or outcomes (JustDum=0). At the same time, the two bar charts on the right show the effect under justification (JustDum=1). The plots do not include the decisions of agents receiving a recommendation to choose the less risky Project A

Even though recommendations are not legally binding, it is evident that agents tend to follow them. We define this tendency as compliance. For instance, around 95% of participants chose Project B after receiving the corresponding recommendation in the REC treatment, whereas only 58% opted for Project B in the BL (see RecDum=0 vs. Rec=B comparison when JustDum=0). These differences are statistically significant (t-tests: \(t=-6.287\), \(df=245\), \(p<0.001\) (JustDum=0); \(t=-8.022\), \(df=506\), \(p<0.001\) (JustDum=1)).

Table 2 presents additional evidence regarding the influence of recommendations: the coefficients associated with Project B recommendations outweigh those of all other decision drivers.Footnote 10 For Hypothesis 2, we thus state:

Result 2

Experimental evidence supports Hypothesis 2, indicating that recommendations from principals favoring Project B increase the possibility of agents choosing the high-risk/high-return project (Project B).

Concerning Hypothesis 3, increasing the agent’s outcome share, i.e., rewarding the high outcome with a larger bonus, is expected to boost the probability of Project B choices. According to our model, a higher bonus compensates for the agent’s justification pressure and the discomfort potentially causing losses on the principal. This mechanism could shift the balance in favor of Project B. Observations from the experiment align with this idea, as evident from Table 2, where the expected bonuses for Project B statistically significantly motivate agent participants to choose Project B (indicated by coefficients of E[ShareB]). The logistic regressions in the baseline (BL) further demonstrate significant coefficients. This suggests that Project B choices (and the apparent “willingness” to cause losses for the principal) are potentially influenced by the agent’s profit share, even in the absence of justification pressure and recommendations (Table 6 in the appendix). We conclude as follows:

Result 3

Experimental evidence supports Hypothesis 3, suggesting that a higher profit share for the agent mitigates the impact of justification and increases the likelihood of opting for the high-risk/high-return project (Project B).

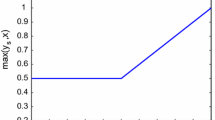

To test Hypothesis 4(a), we utilise our measure of justification pressure to compare the scores of agents operating under different types of justification. We predict the highest justification pressure score under decision justification for either project [see (14)-(15)]. The results for every type of justification are presented in Fig. 6.

Descriptive statistics for perceived justification pressure (JP) among all agents under various types of justification without recommendations: decision justification (DEC), low outcome justification (LOW), and loss justification (LOS). The numbers above each bar represent the mean justification pressure scores, with the number of observations indicated at the bottom of each bar. Error bars are included to depict the 95% confidence intervals

The justification pressure scores are roughly on the same level for each of the three justification regimes. We find greater variance in perceived justification pressure under decision justification compared to the low outcome and loss justification. Given that the Shapiro-Wilk test does not confirm normality for each variable, non-parametric testing using the two-sided Wilcoxon-Mann–Whitney test for independent samples (WMW) is employed. The results of this test confirm that the differences do not achieve statistically significant levels (WMW: DEC vs. LOW: \(z=-0.923\), \(p=0.356\); DEC vs. LOS: \(z=-0.309\), \(p=0.758\); LOW vs. LOS: \(z=-0.516\), \(p=0.606\)). In accordance with these results, there is no support for Hypothesis 4(a).

Moving to Hypothesis 4(b), Fig. 7 provides an overview of variations in compliance rates across different justification types.

Descriptive statistics for project choices of agents receiving specific recommendations under various types of justification: no justification (REC), decision justification (DEC-REC), low outcome justification (LOW-REC), and loss justification (LOS-REC). The percentage numbers above each bar indicate the mean compliance rates of agents with the principals’ project recommendations across all decision sets. The number of observations is presented at the bottom of each bar, with error bars representing 95% confidence intervals

Except for low outcome justification, adherence to Project A recommendations is generally lower than adherence to Project B recommendations, likely attributable to the higher expected payoff of Project B compared to A. When examining Project B recommendations and comparing the types of justification, it becomes evident that compliance is highest under decision justification, followed by loss justification and low outcome justification. As predicted, this pattern shifts for Project A recommendations, where compliance is weakest under decision justification. Given the lack of normality confirmed by the Shapiro-Wilk test, non-parametric tests were employed. It is observed that compliance with Project A recommendations is statistically significantly lower under decision justification (DEC-REC) compared to low outcome justification (LOW-REC) (WMW: \(z=-2.738\), \(p=0.006\)). The observed compliance differences between the justification types for Project B recommendations do not reach statistical significance. However, when investigating compliance rates within each treatment, it is found that compliance with Project A recommendations is significantly different from compliance with Project B recommendations under decision justification (WMW: \(z=-3.216\), \(p=0.001\)).Footnote 11

Overall, the findings partially confirm Hypothesis 4(b). There are differences in compliance with specific recommendations between the types of justification, and these differences align with the predicted directions. Similarly, the prediction that the spread between compliance with Project B and Project A recommendations is the highest under decision justification is correct. The observed pattern suggests that the effectiveness of decision justification may depend on the principal’s preferred project. If principals lean towards higher-risk (investment) strategies, it appears beneficial that agents are mandated to justify their decisions. Conversely, if principals prefer lower-risk (investment) strategies, justifying results (such as low outcomes and losses) may be more effective.

Result 4

The experimental results do not support Hypothesis 4(a), indicating no statistically significant difference in perceived justification pressure between justification regimes. However, concerning Hypothesis 4(b), there is partial support, suggesting that justification types vary in compliance with recommendations. Specifically, as anticipated, decision justification proves more effective in recommendations for the high-risk/high-return project (Project B) than recommendations for the low-risk/low-return project (Project A), influencing the agent to make the project choice favored by the principal.

6 Concluding discussion

This paper investigates the impact of justification pressure on project choices. Justification is deemed necessary when the agent’s selection of a project leads to low profits, either in the form of a loss or low outcome, or following a decision. In our model, justification pressure is conceptualised as a psychological cost the agent must bear.

In our study, all treatments incorporate results control, and this control is complemented by action control (justification) and/or personnel control (recommendation) in certain treatments. Concerning Hypothesis 1, which explores the impact of adding the action control to results control, our findings indicate that individuals required to justify decisions or outcomes are less willing to take risks than those not held responsible. The observed behavior might be explained by the fact that, under justification, the desire for approval shifts the focus from outcomes to the justification of outcomes (Adelberg & Batson, 1978). Additionally, agents without personnel control (recommendations) may consider multiple perspectives and try to anticipate potential objections from principals (Lerner & Tetlock, 1999). They attempt to adhere to an unspoken societal norm, advocating for heightened caution (Pahlke et al., 2015). Despite this, our findings diverge from those of Pollmann et al. (2014), revealing that such conformity does not necessarily bring decision-making behavior into greater alignment with the principal’s interests. Furthermore, unlike the observations of Lefebvre and Vieider (2013), we observe no superiority of principal-agent pairs in justification conditions over pairs with agents in the baseline concerning overall payoff. The impact of justification on company interest appears to hinge on priorities related to risk and return.

Concerning Hypothesis 2, examining the effectiveness of incorporating personnel control as a “recommendation,” our findings align with existing literature. The experimental literature on non-binding communication, as demonstrated by Ben-Ner and Putterman (2009) and Brandts et al. (2019), emphasises the efficacy of such communication. Additionally, Tetlock (1983) and Tetlock et al. (1989) assert that conformity is the most efficient coping strategy. Individuals tend to align themselves with positions likely to favour those they report to, and they also steer clear of unnecessary cognitive effort, as discussed by Lerner and Tetlock (1999, p. 256). It suggests that communicating the preferred strategy serves as an effective tool in influencing decision-making. Doing so diminishes uncertainty and presents a cost-effective strategy to counter the influences of justification pressure. Significantly and relevant to business, our findings indicate that the instrument remains effective even when payoff schemes are asymmetric. Nevertheless, based on our results, it is important to note that recommendations cannot fully eliminate the potential adverse impact of justification.

Our findings additionally corroborate Hypothesis 3, indicating that appropriately selected results controls, such as pay levels, offer another avenue to influence decisions to a certain extent. This result extends beyond the conventional “more pay for more risk” argument, especially considering the protection of agents through limited liability. On the contrary, agents in our experiment appear hesitant to expose principals to risk. Interestingly, this effect diminishes as the agent’s payoff shares increase, aligning with the “money-buys-efficiency result” in Lukas et al. (2019).

In Hypothesis 4, we anticipate the impact of justification types on decision-making. In line with the existing literature, we observe distinctions among the three types of justification (see Langhe et al., 2011; Chang et al., 2013; Kim & Trotman, 2015; Chang et al., 2017; Hall et al., 2017; Patil et al., 2017). As an illustration, Kim and Trotman (2015) demonstrate that decision justification results in greater professional scepticism (equivalent to improved decision-making in our context) than outcome justification.

Our results indicate no statistically significant difference in terms of perceived justification pressure between justification types [Hypothesis 4(a)]. The primary factor contributing to the lack of support might be the limited sample sizes (DEC=3, LOW=8, LOS=21). It is worth noting that the JP data were collected post-experiment, meaning the sample size of JP scores corresponds to the number of agent participants. This size was reduced due to the control process implemented to prevent illegal collusion affecting our results.

However, our results suggest that the type of justification affects agents’ compliance with project recommendations [Hypothesis 4(b)]. While adherence to recommendations of projects with higher risk and return (henceforth referred to as high risk-return recommendations) is higher than to low risk-return recommendations in three out of four treatments, compliance with high risk-return recommendations is highest under decision justification. The overall disparity in compliance between high and low risk-return recommendations is likely attributed to the dilemma agents face in all treatments. There is a conflict between following the recommendation and maximising the expected payoff when the low risk and return project is recommended. Conversely, for high risk-return recommendations, compliance with the recommendation aligns with expected payoff maximisation, eliminating the conflict. Descriptive data suggest “better” decision-making, which aligns with Kim and Trotman (2015). Nevertheless, the lower compliance rates under loss and low outcome justification compared to decision justification are statistically insignificant. It is important to note that our higher risk and return project is the only project with the potential for a loss. There is speculation that compliance with high risk-return recommendations under loss justification may be higher if the lower risk and return project could also result in a loss.

In conclusion, the statistically significant higher compliance rate of high risk-return recommendations compared to low risk-return recommendations under decision justification aligns with Dalla Via et al. (2019). Their research indicates that decision quality is superior when individuals are required to justify their decision-making process rather than justifying the outcome. In this decision context, decision quality pertains to normatively optimal decisions.

Therefore, the conclusion can be two-fold. Firstly, when available strategies vary in risk (both high- and low-risk options exist), choosing decision justification enhances the likelihood of selecting the high-risk strategy if the principal signals a preference. Conversely, if low-risk strategies are preferable, the results suggest that the principal should avoid decision justification and instead opt for loss or low-outcome justification. As a caveat, it is essential to acknowledge that contract design, as a feature of the results control, also influences the outcomes. In our experiment, the incentive contract ensures that the agent is in a more favourable position and is better off if the high risk/return project is chosen. However, if the principal favours a lower risk, it is plausible that the principal would communicate this preference and structure the contract so that choosing the lower risk project results in a higher expected utility for the agent than choosing the higher risk project.

Due to the close alignment between the model and the experiment, we have confidence in asserting the experiment’s internal validity. However, subjecting the external validity to a critical evaluation is crucial. Typically, a conclusive determination of external validity requires empirical research conducted in the field (Weimann & Brosig-Koch, 2019, Ch. 1.5). Nonetheless, it is important to note that experimental results enhance the external validity of the model.

The effects observed in the justification treatments may be attributed to effort aversion rather than perceived justification pressure. If the argument holds, participants might avoid a particular project choice due to the prospect of investing effort in justifying it. In our post-experimental questionnaire, we inquired whether factors other than stress and discomfort arising from the justification requirement played a role in influencing participants’ decisions. The first part of the question only necessitated simply clicking “yes/no”; the second part prompted participants to type in the factors influencing their decisions. If aversion to typing effort prevented responses to the question, we would expect numerous clicks on “yes” if effort aversion were the primary explanation for our effects. However, this was not observed. Therefore, we have reasonable confidence that perceived justification pressure is a more likely explanation for our effects, or at least more likely than effort aversion.

In our experiment, anonymous communication signals the preferred project and justifies decisions or outcomes. The existing literature on non-binding communication suggests that face-to-face communication tends to be more effective (Brandts et al., 2019). For instance, in the study conducted by Vieider (2009), face-to-face communication increased risk tolerance when making decisions on behalf of others. If this finding applies to our experiment, it suggests we might be underestimating the impact of communicating preferences for a specific project. Personal communication could potentially enhance the effects we currently observe. However, as highlighted by Brandts et al. (2019), personal communication may introduce new challenges. In face-to-face interactions, emotions such as sympathy or antipathy may come into play, and these are factors that the experimenter typically cannot control.

Finally, real-world business processes and decisions might significantly differ from the controlled environment in the laboratory. In particular, real-world project selection often takes place in much more complex environments, where, for instance, market dynamics, strategic fit, and resource scarcity play a role. To fully understand the interplay between justification and project selection, a multi-method approach would be a fruitful way to provide further empirical evidence.

Since justification pressure is identified as the key factor influencing our experimental results, future research could explore its determinants. For instance, incorporating more sophisticated measures of justification pressure in experimental design could enhance our understanding of its psychological perception, connections to specific personality traits, and potential implications for decision-making. This avenue of research could contribute valuable insights into the nuanced aspects of justification pressure.

Notes

Pollmann et al. (2014) similarly utilised asymmetric payoffs, where the agent’s material payoff depends on the principal’s decision to reward the agent before or after the project choice.

There is a relation between justification and accountability. Lerner and Tetlock (1999) refer to accountability as the expectation that individuals may be obliged to justify their actions to others.

An alternative rationale for a decreasing justification cost function stems from the principle of loss aversion. It is widely acknowledged that individuals tend to loss aversion, wherein negative (monetary) values carry greater weight than positive values of equal magnitude (Brink & Rankin, 2013; Sawers et al., 2011; Tversky & Kahneman, 1991) Consequently, agents, perceiving a loss to be more impactful on the principal than the corresponding gain, face higher justification costs when justifying a loss than a gain of equivalent magnitude. Given that \(L_B<L_A=0\), where the low outcome under Project B signifies a loss, the justification cost function \(JC(x_i)\) would exhibit a convex decreasing trend caused by loss aversion.

The principal does not directly gain from inducing justification pressure; the potential benefit arises from the agent’s more thoughtful decision-making. Only if the (impact of) deliberation affects the outcome distribution or the agent’s implementation costs (such as effort costs), as in Lukas et al. (2019), a benefit of justification pressure becomes evident in the principal’s objective function.

The menu of two compensation functions can be interpreted in alignment with compensation practices that encourage risky choices. According to Eq. (1), the ratio of variable compensation to total compensation, \((0.5s_{i}H_{i})/(f+0.5s_{i}H_{i})\) increases with both the bonus rate \(s_{i}\) and the project outcome \(H_{i}\). This property of the compensation function menu is characteristic of compensation with an option component. In cases where a manager holds stock options, the value of these options increases with the outcome variance of the chosen project, leading to an increase in the fraction of variable (option-based) compensation over total compensation. Thus, the compensation contract outlined in Eq. (1) resembles option-based compensation strategies that companies employ to influence the risk-taking behaviour of their managers (Agrawal & Mandelker, 1987; Coles et al., 2006).

To maintain neutrality, the process of analysing chat contents and filtering observations was conducted by multiple third parties. These individuals were unfamiliar with the hypotheses and were uninterested in the experiment’s outcomes.

Additional details regarding the dataset can be provided upon request.

Unspecified comparisons are not addressed in the experimental findings, as they are not part of the stated hypotheses within the study’s scope.

References

Adelberg, S., & Batson, C. D. (1978). Accountability and helping: When needs exceed resources. Journal of Personality and Social Psychology, 36(4), 343–350. https://doi.org/10.1037/0022-3514.36.4.343

Agrawal, A., & Mandelker, G. N. (1987). Managerial incentives and corporate investment and financing decisions. The Journal of Finance, 42(4), 823–837.

Andersson, O., Holm, H. J., Tyran, J. R., & Wengström, E. (2016). Deciding for others reduces loss aversion. Management Science, 62(1), 29–36. https://doi.org/10.1287/mnsc.2014.2085

Arnold, M. C. (2015). The effect of superiors’ exogenous constraints on budget negotiations. The Accounting Review, 90(1), 31–57. https://doi.org/10.2308/accr-50864

Ashton, R. H. (1990). Pressure and performance in accounting decision settings: Paradoxical effects of incentives, feedback, and justification. Journal of Accounting Research, 28, 148–180. https://doi.org/10.2307/2491253

Ashton, R. H. (1992). Effects of justification and a mechanical aid on judgment performance. Organizational Behavior and Human Decision Processes, 52(2), 292–306. https://doi.org/10.1016/0749-5978(92)90040-E

Baron, J., & Hershey, J. C. (1988). Outcome bias in decision evaluation. Journal of personality and social psychology, 54(4), 569.

Bauch, K. A., & Weißenberger, B. E. (2020). The effects of accountability on favoritism in subjective performance evaluations: An eye-tracking study. SSRN. https://doi.org/10.2139/ssrn.3646301

Ben-Ner, A., & Putterman, L. (2009). Trust, communication and contracts: An experiment. Journal of Economic Behavior & Organization, 70(1–2), 106–121.

Bock, O., Baetge, I., & Nicklisch, A. (2014). hroot: Hamburg registration and organization online tool. European Economic Review, 71, 117–120. https://doi.org/10.1016/j.euroecorev.2014.07.003

Brandts, J., Cooper, D. J., & Rott, C. (2019). Communication in laboratory experiments. In Handbook of research methods and applications in experimental economics. Edward Elgar Publishing.

Brink, A. G., & Rankin, F. W. (2013). The effect of risk preference and loss aversion on individual behavior under bonus, penalty, and combined contract frames. Behavioral Research in Accounting, 25(2), 145–170.

Chakravarty, S., Harrison, G. W., Haruvy, E. E., & Rutström, E. E. (2011). Are you risk averse over other people’s money? Southern Economic Journal, 77(4), 901–913.

Chang, W., Atanasov, P., Patil, S. V., Mellers, B. A., & Tetlock, P. E. (2017). Accountability and adaptive performance under uncertainty: A long-term view. Judgment and Decicion Making, 12(6), 610–626.

Chang, L. J., Cheng, M. M., & Trotman, K. T. (2013). The effect of outcome and process accountability on customer-supplier negotiations. Accounting, Organizations and Society, 38(2), 93–107. https://doi.org/10.1016/j.aos.2012.12.002

Charness, G., Gneezy, U., & Halladay, B. (2016). Experimental methods: Pay one or pay all. Journal of Economic Behavior & Organization, 131, 141–150. https://doi.org/10.1016/j.jebo.2016.08.010

Coles, J. L., Daniel, N. D., & Naveen, L. (2006). Managerial incentives and risk-taking. Journal of Financial Economics, 79(2), 431–468. https://doi.org/10.1016/j.jfineco.2004.09.004

Dalla Via, N., Perego, P., & van Rinsum, M. (2019). How accountability type influences information search processes and decision quality. Accounting, Organizations and Society, 75, 79–91. https://doi.org/10.1016/j.aos.2018.10.001

Fehrenbacher, D. D., Kaplan, S. E., & Moulang, C. (2020). The role of accountability in reducing the impact of affective reactions on capital budgeting decisions. Management Accounting Research, 47, 100650. https://doi.org/10.1016/j.mar.2019.100650

Fischbacher, U. (2007). z-Tree. Zurich toolbox for ready-made economic experiments. Experimental Economics, 10(2), 171–178. https://doi.org/10.1007/s10683-006-9159-4

Fortin, B., Lacroix, G., & Villeval, M. C. (2007). Tax evasion and social interactions. Journal of Public Economics, 91(11–12), 2089–2112. https://doi.org/10.1016/j.jpubeco.2007.03.005

Frimanson, L., Hornbach, J., & Hartmann, F. G. (2021). Performance evaluations and stress: Field evidence of the hormonal effects of evaluation frequency. Accounting, Organizations and Society, 95, 101279. https://doi.org/10.1016/j.aos.2021.101279