Abstract

The aim of the paper is to study an evolutionary quasi-variational inequality, which expresses the equilibrium conditions of a general oligopolistic market equilibrium model, and to present its inverse formulation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The paper is devoted to study existence and regularity results for a general evolutionary quasi-variational inequality, which expresses the generalized Cournot-Nash equilibrium principle. Furthermore, an optimal control perspective on the equilibrium problem is provided by introducing an inverse variational inequality.

Quasi-variational inequalities were introduced by Bensoussan and Lions in a series of papers [1–4] in connection with the study of impulse control problems and their applications. Then, they have been extensively studied in several publications, mainly from the point of the view of the existence of solutions (see [5–7] among others). In the same years, an iterative scheme for a class of quasi-variational inequalities has been introduced by Noor [8]. More recently, many scholars, as F. Facchinei, A. Khan, A.G. Khan and K.I. Noor, have presented other efficient numerical iterative methods; see [9–12]. Particularly, in the last decade a lot of problems considering a feasible set depending on equilibrium solutions have been studied (see, e.g., [13–17]).

The class of quasi-variational inequalities, which we study in this paper, results to be an effective tool to describe the dynamic oligopolistic market equilibrium model in which both the production and demand functions depend on the expected equilibrium solution. This is a more realistic situation since the perception of the expected equilibrium solution influences the choice of the economic market users. In fact, the firms adjust their production commodity in relation of the commodity shipments in order to reduce production excesses. On the other hand, the request of commodities can be altered by the demand markets according to the equilibrium distribution. In this perspective, the problem is called “elastic” or “with adaptive constraint set”. Furthermore, the presence of production excesses may be justified in periods of economic crisis, while demand excesses may have origin from the request of fundamental goods. Moreover, since the market model evolves in time, their simultaneous presence may be a consequence of the evident limited physical transportation of commodities between a firm and a demand market.

In [18, 19], the pioneering model presented in [20] has been improved in a more realistic way with the addition of production and demand excesses. Here, the important question of finding some regularity properties for the solution has been answered. Such regularity results are very helpful for the introduction of numerical schemes to compute equilibrium solutions (see [21]). In [22, 23] the analysis of the problem from a producer’s perspective whose purpose is to maximize its own profit is abandoned. In such papers the attention is focused on the policy-maker’s perspective whose aim is to control the commodity exportations by means of the imposition of taxes or incentives. The resulting optimization problem for the taxes and the commodity distribution is formulated as an inverse variational inequality. Lately, in [24] the authors analyzed the dynamic oligopolistic market equilibrium problem by considering only production as a function effectively dependent on equilibrium solutions. Hence, the paper completes the investigation on the dynamic oligopolistic market equilibrium model by including also the demand excesses and the dependence of the demand function on the expected equilibrium solution. Moreover, the possibility that control policies may be imposed to regulate the amounts of exportation is analyzed. In particular, control policies take place with the imposition of higher taxes or subsidies in order to restrict or encourage the exportation (the control optimization problem).

The paper is organized as follows. In Sect. 2, we present the dynamic elastic model and we formulate the equilibrium conditions by a suitable evolutionary quasi-variational inequality. In Sect. 3, under quite general assumptions, we prove an existence result. In Sect. 4, Kuratowski’s set convergence is presented because it is preliminary to obtain the continuity of the solution. Section 5 is devoted to the inverse formulation of the problem. At last, in Sect. 6, we provide a numerical example.

2 Quasi-variational Inequalities in Dynamic Oligopolistic Markets

Let us introduce the dynamic oligopolistic market equilibrium model in which the constraint set depends on the expected equilibrium solution. Let us consider m firms \(P_i,\;i=1,\ldots ,m\), that produce a homogeneous commodity and n demand markets \(Q_j\), \(j=1,\ldots ,n,\) that are generally spatially separated. Assume that the homogeneous commodity, produced by the m firms and consumed by the n markets, is involved during a time interval \(\left[ 0,T\right] \), \(T>0\). Let \(x_{ij}(t)\), \(i=1,\ldots ,m\), \(j=1,\ldots ,n,\) denote the nonnegative commodity shipment between the supply market \(P_i\) and the demand market \(Q_j\), \(t \in \left[ 0,T\right] .\) In particular, let us set \(x_i(t)=(x_{ij}(t))_{j}\), \(i=1,\ldots ,m\), \(t \in \left[ 0,T\right] \), as the strategy vector for the firm \(P_i\), and \(x(t)=(x_{ij}(t))_{ij}\), \(t \in \left[ 0,T\right] \). Let us suppose that \(x\in L^2(\left[ 0,T\right] ,\mathbb {R}^{mn}_+).\) Furthermore, we assume that the nonnegative commodity shipment \(x_{ij}\) between the producer \(P_i\) and the demand market \(Q_j\) has to satisfy time-dependent constraints; namely, there exist two nonnegative functions \(\underline{x}, \overline{x} \in L^2(\left[ 0,T\right] ,\mathbb {R}^{mn}_+)\) such that \(0 \le \underline{x}_{ij}(t)\le x_{ij}(t)\le \overline{x}_{ij}(t)\), \(\forall i=1,\ldots ,m\), \(\forall j=1,\ldots ,n\), a.e. in \(\left[ 0,T\right] \). Let us consider

We remark that D is a nonempty, compact and convex subset of \(L^2(\left[ 0,T\right] ,\mathbb {R}^{mn}).\) Let \(p_i(t,x(t))\), \(i=1,\ldots ,m,\) denote the nonnegative commodity output produced by firm \(P_i\), \(t \in \left[ 0,T\right] \). Let \(q_j(t,x(t))\), \(j=1,\ldots ,n,\) denote the nonnegative demand for the commodity at demand market \(Q_j\), \(t \in \left[ 0,T\right] \). Here, unlike [24], we assume that both production and demand functions may depend upon the entire production pattern. With these assumptions we want to represent an actual situation in which a firm plans its production taking into account the expected equilibrium distribution. As well as, the expected equilibrium distribution influences the demand of the supply markets. Let \(\epsilon _i(t)\), \(i=1,\ldots ,m,\) be the nonnegative production excess for the commodity of the firm \(P_i\), \(t \in \left[ 0,T\right] .\) Let \(\delta _j(t)\), \(j=1,\ldots ,n,\) be the nonnegative demand excess for the commodity of the demand market \(Q_j\), \(t \in \left[ 0,T\right] \). The dependence of the commodity shipment x on the unknown solution \(x^*\) satisfies the following feasibility conditions:

More precisely, condition (1) states that, given the unknown equilibrium solution, the quantity produced by each firm \(P_i\), \(t\in \left[ 0,T\right] \), must be equal to the commodity shipments from that firm to all the demand markets plus the production excess, at the same time \(t\in \left[ 0,T\right] \). Moreover, conditions (2) states that, given the unknown equilibrium solution, the quantity demanded by each demand market \(Q_j\), \(t\in \left[ 0,T\right] \) must be equal to the commodity shipments from all the firms to that demand market plus the demand excess, at the same time \(t\in \left[ 0,T\right] .\) Making use of (1), (2) and the nonnegativity of production and demand excesses, we obtain

As a consequence, the set of feasible vectors \(x\in L^2(\left[ 0,T\right] ,\mathbb {R}^{mn})\) is defined by the multivalued mapping \(\mathbb {K}:D \rightrightarrows L^2(\left[ 0,T\right] ,\mathbb {R}^{mn}_+)\) as

For each \(i=1,\ldots ,m\) and \(t \in [0,T]\), let us associate each firm \(P_i\) with a production cost \(f_i(t,x(t))\). Similarly, let us associate each demand market \(Q_j\) with a demand price for unity of the commodity \(d_j(t,x(t)),\) \(j=1,\ldots ,n,\) \(t \in [0,T]\). Let \(g_i(t,x(t))\), \(i=1,\ldots ,m,\) \(t \in [0,T]\), denote the storage cost of the commodity produced by the firm \(P_i\). Let \(c_{ij}(t,x(t))\), \(i=1,\ldots ,m\), \(j=1,\ldots ,n,\) \(t \in [0,T]\), denote the transaction cost, which includes the transportation cost associated with trading the commodity between firm \(P_i\) and demand market \(Q_j\). Let \(\eta _{ij}(t)\), \(i=1,\ldots ,m\), \(j=1,\ldots ,n,\) \(t \in [0,T]\), be the supply or resource tax imposed on supply market \(P_i\) for the transaction with the demand market \(Q_j\). Let \(\lambda _{ij}(t)\), \(i=1,\ldots ,m\), \(j=1,\ldots ,n,\) \(t \in [0,T]\), be the incentive pay imposed on supply market \(P_i\) for the transaction with the demand market \(Q_j\). Let \(h_{ij}(t)\), \(i=1,\ldots ,m\), \(j=1,\ldots ,n,\) \(t \in [0,T]\), be the difference between the supply tax and the incentive pay for the transaction with the demand market \(Q_j\), namely \(h_{ij}(t)=\eta _{ij}(t)-\lambda _{ij}(t)\), \(i=1,\ldots ,m\), \(j=1,\ldots ,n,\) \(t \in [0,T]\), \(t \in [0,T]\). Hence, the profit \(v_i(t,x(t))\), \(i=1,\ldots ,m,\) of the firm \(P_i\), at the time \(t\in \left[ 0,T\right] \) is, then,

namely, it is equal to the price that the demand markets are disposed to pay minus the production costs, the storage costs and the transportation costs and taxes.

Let us denote by \(\nabla _Dv=\left( \dfrac{\partial v_i}{\partial x_{ij}} \right) _{ij}\). Let us assume the following assumptions:

-

(i)

\(v_i(t,x(t))\) is continuously differentiable for each \(i=1,\ldots ,m,\) a.e. in \(\left[ 0,T \right] \),

-

(ii)

\(\nabla _D v\) is a Carathéodory function (namely, it is measurable in the first variable and continuous with respect to the second one) such that

$$\begin{aligned} \exists h \in L^2(\left[ 0,T\right] ): \ \left\| \nabla _D v(t,x(t))\right\| _{mn} \le h(t)\left\| x(t)\right\| _{mn},\; \mathrm{a.e.\,in} \left[ 0,T\right] , \end{aligned}$$(7) -

(iii)

\(v_i(t,x(t))\) is pseudoconcave with respect to the variables \(x_i,\) \(i=1,\ldots ,m\), a.e. in \(\left[ 0,T\right] \), namely a.e. in \(\left[ 0,T\right] \):

$$\begin{aligned}&\left\langle \nabla _Dv_i(t,x_1,\ldots ,x_i,\ldots ,x_m),x_i-y_i\right\rangle = \sum _{j=1}^n\dfrac{\partial v_i(t,x(t))}{\partial x_{ij}}(x_{ij}(t)-y_{ij}(t))\ge 0\\&\quad \Rightarrow v_i(t,x_1,\ldots ,x_i,\ldots ,x_m)\ge v_i(t,x_1,\ldots ,y_i,\ldots ,x_m). \end{aligned}$$

In the model the m firms supply the commodity in a noncooperative fashion, according to the dynamic elastic Cournot-Nash principle in the presence of excesses.

Definition 2.1

\(x^*\in \mathbb {K}(x^*)\) is a dynamic oligopolistic market equilibrium in the presence of excesses if and only if for each \(i=1,\ldots ,m\) and a.e. in \(\left[ 0,T\right] \) we have

where \(\hat{x}^*_i(t)=(x^*_1(t),\ldots ,x^*_{i-1}(t),\) \(x^*_{i+1}(t),\ldots ,x^*_m(t))\), for \(i=1, \ldots , m\), a.e. in \(\left[ 0,T\right] \).

Definition 2.1 states that each firm \(P_i\) maximizes its own profit considered the given optimal strategy \(\hat{x}^*_i(t)\) of the other firms. The following result establishes the equivalence between the equilibrium distribution and the solution of an evolutionary quasi-variational inequality (for the proof see, for instance, [24], Theorem 2).

Theorem 2.1

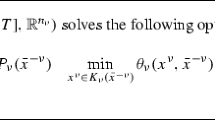

Let us suppose that assumptions (i), (ii), (iii) are satisfied. Then, \(x^*\in \mathbb {K}(x^*)\) is a dynamic oligopolistic market equilibrium according to Definition 2.1 if and only if it satisfies the evolutionary quasi-variational inequality

3 An Existence Theorem for Equilibrium Solutions

Thanks to the variational formulation of the equilibrium problem, we are able to show our main result about the existence of equilibrium solutions.

Theorem 3.1

Let \(v \in C^{1}(\left[ 0,T\right] \times D, \mathbb {R}^{m})\), let \(p \in L^{2}(\left[ 0,T\right] \times D, \mathbb {R}^{m})\) and let \(q \in L^{2}(\left[ 0,T\right] \times D, \mathbb {R}^{n})\) be such that

-

(I)

\(\nabla _Dv(t, x)\) is measurable in t, for every \(x \in \mathbb {R}^{mn}_{+}\), continuous in x, a.e. in [0, T], such that

\(\exists \gamma \in L^{2}(\left[ 0,T\right] )\): \(\Vert \nabla _Dv(t,x)\Vert \le \gamma (t) + \Vert x\Vert \), \(\forall x \in \mathbb {R}_+^{mn}\), a.e. in [0, T];

-

(II)

p(t, x) is measurable in t, for every \(x \in \mathbb {R}^{mn}_{+}\), continuous in x, a.e. in [0, T], such that

\(\exists \phi \in L^{1}([0,T])\): \(\Vert p(t,x)\Vert \le \phi (t) + \Vert x\Vert ^{2}\), \(\forall x \in \mathbb {R}_+^{mn}\), a.e. in [0, T];

-

(III)

q(t, x) is measurable in t, for every \(x \in \mathbb {R}^{mn}_{+}\), continuous in x, a.e. in [0, T], such that

\(\exists \psi \in L^{1}([0,T])\): \(\Vert q(t,x)\Vert \le \psi (t) + \Vert x\Vert ^{2}\), \(\forall x \in \mathbb {R}_+^{mn}\), a.e. in [0, T];

-

(IV)

\(\exists \eta (t) \ge 0\), a.e. in [0, T], \(\eta \in L^{\infty }([0,T])\) such that

\(\Vert p(t,x_{1})-p(t,x_{2})\Vert \le \eta (t) \Vert x_{1}-x_{2}\Vert \), \(\forall x_1,x_2 \in \mathbb {R}_+^{mn}\), a.e. in [0, T];

-

(V)

\(\exists \theta (t) \ge 0\), a.e. in [0, T], \(\theta \in L^{\infty }([0,T])\) such that

\(\Vert q(t,x_{1})-q(t,x_{2})\Vert \le \theta (t) \Vert x_{1}-x_{2}\Vert \), \(\forall x_1,x_2 \in \mathbb {R}_+^{mn}\), a.e. in [0, T].

Then, the evolutionary quasi-variational inequality (9) admits a solution.

Proof

Firstly, let us observe that under assumptions (I), (II) and (III) and if \(x^* \in L^{2}([0,T], \mathbb {R}^{mn}_{+})\), it results that \(t \mapsto \nabla _Dv(t, x^*(t)) \in L^{2}(\left[ 0,T\right] , \mathbb {R}^{mn})\), \(t \mapsto p(t, x^*(t)) \in L^{1}(\left[ 0,T\right] , \mathbb {R}^{m}_{+})\), \(t \mapsto q(t, x^*(t)) \in L^{1}(\left[ 0,T\right] , \mathbb {R}^{n}_{+})\). Moreover, by (I), (II) and (III) it follows that \(\nabla _Dv\), p and q belong to the class of Nemytskii operators.

In order to show that \(\mathbb {K}(x^*)\) is a closed multifunction, we fix two arbitrary sequences \(\{ x^k\}\) and \(\{ y^k \}\) such that \(x^{k} \rightarrow x\) and \(y^{k} \rightarrow y\) in \(L^{2}([0,T], \mathbb {R}^{mn})\), with \(y^k \in \mathbb {K}(x^k)\), \(\forall k \in \mathbb {N}\), and we prove \(y \in \mathbb {K}(x)\). Since \(y^k \in \mathbb {K}(x^k)\), we have \(\underline{x}_{ij}(t)\le y^k_{ij}(t)\le \overline{x}_{ij}(t)\), for \(i = 1, \ldots , m\), \(j = 1, \ldots , n\) and a.e. in [0, T]. The convergence of the sequence \(\{y^{k}\}\) in \(L^{2}([0,T], \mathbb {R}^{mn})\) implies that also y satisfies the capacity constraints. Moreover, the following relationships hold:

The left-hand sides converge almost everywhere to \(\displaystyle \sum _{j=1}^n y_{ij}(t)\); the right-hand sides, meanwhile, for \(i= 1,\ldots , m\) and \(j= 1,\ldots ,n,\) respectively, for (IV) and (V), it follows

Since the convergence of \(\{x^k \}\) in \(L^2([0,T], \mathbb {R}^{mn})\) implies the convergence even in \(L^1([0,T], \mathbb {R}^{mn})\), we get that \(\left\{ \dfrac{1}{T} \displaystyle \int _0^Tp_{i}(t, x^{k}(\tau ))\hbox {d}\tau \right\} \) and \(\left\{ \dfrac{1}{T} \displaystyle \int _0^Tq_{j}(t, x^{k}(\tau ))\hbox {d}\tau \right\} \) converge uniformly to \(\dfrac{1}{T} \displaystyle \int _0^Tp_{i}(t, x(\tau ))\hbox {d}\tau \) and \(\dfrac{1}{T} \displaystyle \int _0^Tq_{j}(t, x(\tau ))\hbox {d}\tau \) in \(L^1([0,T], \mathbb {R}^m)\), respectively.

Let us show the lower semicontinuity of the multifunction \(\mathbb {K}\). To this aim we fix an arbitrary sequence \(\{x^{k} \}\) such that \(x^k \rightarrow x\), in \(L^2([0,T], \mathbb {R}^{mn})\), and an arbitrary \(y \in \mathbb {K}(x)\), we prove that there exists a sequence \(\{y^{k}\}\) such that \(y^{k} \rightarrow y\), in \(L^2([0,T], \mathbb {R}^{mn})\), with \(y^{k} \in \mathbb {K}(x^{k})\), \(\forall k \in \mathbb {N}\). Let us note that, for \(i=1, \ldots , m\), \(j=1, \ldots , n\) and \(k \in \mathbb {N}\), and if

we obtain, by virtue of the uniform convergence of \(\left\{ \dfrac{1}{T} \displaystyle \int _0^Tp_{i}(t, x^{k}(\tau ))\hbox {d}\tau \right\} \) to \(\dfrac{1}{T} \displaystyle \int _0^Tp_{i}(t, x(\tau ))\hbox {d}\tau \) in \(L^1([0,T], \mathbb {R}^m)\) and the uniform convergence of

\(\left\{ \dfrac{1}{T} \displaystyle \int _0^Tq_{j}(t, x^{k}(\tau ))\hbox {d}\tau \right\} \) to \(\dfrac{1}{T} \displaystyle \int _0^Tq_{j}(t, x(\tau ))\hbox {d}\tau \) in \(L^1([0,T], \mathbb {R}^n)\), that

As a consequence, there exists an index \(\nu _1\) such that for \(k > \nu _1\) it results \(a^k_{ij}(t)\ge 0\), \(\forall i=1, \ldots , m\), \(\forall j=1, \ldots , n\), a.e. in [0, T], and there exists an index \(\nu _2\) such that for \(k > \nu _2\) we have \(b^k_{ij}(t)\ge 0\), \(\forall i=1, \ldots , m\), \(\forall j=1, \ldots , n\), a.e. in [0, T]. Then, let \(\nu =\max \left\{ \nu _1,\nu _2\right\} \), let us define the sequence \(\{y^k\}\) as:

-

for \(k > \nu \), \(\forall i=1, \ldots , m,\) \(\forall j=1, \ldots , n,\)

$$\begin{aligned} y^k_{ij}(t)=\underline{x}_{ij}(t)+ \min \{\overline{x}_{ij}(t)-\underline{x}_{ij}(t), a^k_{ij}(t),b^k_{ij}(t)\},\quad \mathrm{a.e. \ in }\ [0,T], \end{aligned}$$ -

for \(k \le \nu \), \(\forall i=1, \ldots , m,\) \(\forall j=1, \ldots , n,\)

$$\begin{aligned} y^k_{ij}(t) = P_{\mathbb {K}(x^k)} y_{ij}(t),\quad \mathrm{a.e. \ in }\ [0,T], \end{aligned}$$

where \(P_{\mathbb {K}(x^k)}( \cdot )\) denotes the Hilbertian projection on \(\mathbb {K}(x^k)\).

It is easy to verify that \(y^k \in \mathbb {K}(x^k)\), \(\forall k \in \mathbb {N}\). Moreover, \(\{y^{k}\}\) converges to y in \(L^2([0,T], \mathbb {R}^{mn})\). Finally, it is simple to show that \(\mathbb {K}(x)\) is a closed, bounded and convex subset of D and since the space D is compact, \(\mathbb {K}(x)\), \(\forall x \in D\), is compact too. As a consequence, all the assumptions of Tan’s Theorem (see [7]) are satisfied and the existence of at least one solution is guaranteed. \(\square \)

4 Regularity and Sensitivity Results for Equilibrium Solutions

The section is devoted to show continuity and sensitivity results for solutions to the evolutionary quasi-variational inequality which expresses the dynamic elastic Cournot-Nash principle in the presence of excesses.

4.1 Set Convergence

The Kuratowski’s set convergence (see [25]) has an important role in order to establish regularity results.

Let \(\{ \mathbb {K}_n \}\) be a sequence of subsets of a metric space (X, d). Recall that

where eventually means that there exists \(\delta \in \mathbb {N}\) such that \(x_n \in \mathbb {K}_n\) for any \(n \ge \delta \) and frequently means that there exists an infinite subset \(N \subseteq \mathbb {N}\) such that \(x_n \in \mathbb {K}_n\) for any \(n \in N\).

We say that \(\{\mathbb {K}_n\}\) converges to some subset \(\mathbb {K} \subseteq X\) in Kuratowski’s sense, and we briefly write \(\mathbb {K}_n \rightarrow \mathbb {K}\) if \(d - \underline{\lim }_n \mathbb {K}_n = d - \overline{\lim }_n \mathbb {K}_n = \mathbb {K}\).

In order to verify that \(\mathbb {K}_n \rightarrow \mathbb {K}\), it suffices to check that

-

(K1)

for any \(x\in \mathbb {K}\), there exists a sequence \(\{x_n\}\) converging to \(x \in X\) such that \(x_n\) lies in \(\mathbb {K}_n\) for all \(n\in \mathbb {N},\)

-

(K2)

for any subsequence \(\{x_n\}\) converging to \(x\in X\) such that \(x_n\) lies in \(\mathbb {K}_n\), for all \(n\in \mathbb {N}\), then the limit x belongs to \(\mathbb {K}.\)

The following lemma ensures that the feasible set of the model satisfies the property of Kuratowski’s set convergence.

Lemma 4.1

Let \(\underline{x},\overline{x}\in C^0\left( \left[ 0,T\right] ,\mathbb {R}^{mn}_+\right) ,\) let \(p \in C^0([0, T] \times \mathbb {R}_{+}^{mn}, \mathbb {R}_{+}^{m})\) be such that \(\exists \phi \in C^0([0, T], \mathbb {R}_{+})\): \(\Vert p(t, y) \Vert \le \phi (t) + \Vert y \Vert ^{2}\), let \(q \in C^0([0, T] \times \mathbb {R}_{+}^{mn}, \mathbb {R}_{+}^{n})\) be such that \(\exists \psi \in C^0([0, T], \mathbb {R}_{+})\): \(\Vert q(t, y) \Vert \le \psi (t) + \Vert y \Vert ^{2}\), and let \(\{t_k\}\) be a sequence such that \(t_k\rightarrow t,\) with \(t\in \left[ 0,T\right] ,\) as \(k \rightarrow +\infty .\) Then, the set sequence

\(\forall k \in \mathbb {N}\), converges to

as \(k\rightarrow +\infty ,\) in Kuratowski’s sense.

Proof

In the first part, we prove condition (K1). Let \(\{t_k\}\) be a sequence such that \(t_k\rightarrow t,\) with \(t\in \left[ 0,T\right] ,\) as \(k\rightarrow +\infty \). Using the assumptions, we obtain that \(\Vert p(t, x^*(\tau )) \Vert , \Vert q(t, x^*(\tau )) \Vert \in L^{1}([0,T])\). Moreover, by virtue of the continuity of p and q with respect to the first variable and making use of a well-known generalization of Lebesgue’s Theorem, we have

Let us fix \(x(t)\in \mathbb {K}(t)\) and let us set

it results

As a consequence, there exists an index \(\nu _1\) such that, for \(k > \nu _1\), we get \(a_{ij}(t_k)\ge 0\), \(\forall i=1, \ldots , m\), \( \forall j=1, \ldots , n\). We remark

where \(\varepsilon \) is the production excess function. Then, there exists an index \(\nu _2\) such that for \(k > \nu _2\) we have, \(\forall i=1, \ldots , m\),

Moreover, it results

where \(\delta \) is the demand excess function. Hence, there exists an index \(\nu _3\) such that for \(k > \nu _3\) we have, \(\forall j=1, \ldots , n\),

Hence, we can consider a sequence \(\{x(t_k)\}\) such that:

-

for \(k > \nu = \max \{ \nu _1, \nu _2, \nu _3 \}\), \(\forall i=1, \ldots , m,\) \(\forall j=1, \ldots , n,\)

$$\begin{aligned} x_{ij}(t_k)=\underline{x}_{ij}(t_k)+ \min \{x_{ij}(t)-\underline{x}_{ij}(t),\overline{x}_{ij}(t_k)-\underline{x}_{ij}(t_k), a_{ij}(t_k)\}, \end{aligned}$$ -

for \(k \le \nu \), \(\forall i=1, \ldots , m,\) \(\forall j=1, \ldots , n,\)

$$\begin{aligned} x_{ij}(t_k) = P_{\mathbb {K}(t_k, x^*)} x_{ij}(t). \end{aligned}$$

It is easy to verify that \(x(t_k) \in \mathbb {K}(t_k, x^*)\), \(\forall k \in \mathbb {N}\) and that \(x(t_k) \rightarrow x(t)\), as \(k \rightarrow +\infty \). Then, condition (K1) is shown. Finally, it is simple to check condition (K2). \(\square \)

4.2 Continuity of Solutions to Quasi-variational Inequalities

In [26, 27] some continuity results for quasi-variational inequalities in infinite-dimensional spaces have been proved. It is worth to remark that similar results have been obtained for weighted quasi-variational inequalities in nonpivot Hilbert spaces (see [13]). In the following, making use Theorem 8 in [27] and Lemma 4.1, we can show the continuity theorem for dynamic elastic oligopolistic market equilibrium solutions in the presence of excesses.

Theorem 4.1

Let \(\underline{x},\overline{x}\in C^0\left( \left[ 0,T\right] ,\mathbb {R}^{mn}_+\right) ,\) let \(p \in C^0([0, T] \times \mathbb {R}_{+}^{mn}, \mathbb {R}_{+}^{m})\) be such that, in [0, T]:

\(\exists \phi \in C^0([0, T])\): \(\Vert p(t, x) \Vert \le \phi (t) + \Vert x \Vert ^{2}\), \(\forall x \in \mathbb {R}^{mn}\),

\(\exists \eta \in C^0([0,T], \mathbb {R}_+)\): \(\Vert p(t, x_{1})-p(t, x_{2})\Vert \le \eta \Vert x_{1}-x_{2}\Vert \), \(\forall x_{1},x_{2} \in \mathbb {R}^{mn}\),

let \(q \in C^0([0, T] \times \mathbb {R}_{+}^{mn}, \mathbb {R}_{+}^{n})\) be such that, in [0, T]:

\(\exists \psi \in C^0([0, T])\): \(\Vert q(t, x) \Vert \le \psi (t) + \Vert x \Vert ^{2}\), \(\forall x \in \mathbb {R}^{mn}\),

\(\exists \theta \in C^0([0,T], \mathbb {R}_+)\): \(\Vert q(t, x_{1})-q(t, x_{2})\Vert \le \theta \Vert x_{1}-x_{2}\Vert \), \(\forall x_{1},x_{2} \in \mathbb {R}^{mn}\).

Moreover, let \(\nabla _D v\in C^0([0, T] \times \mathbb {R}_{+}^{mn}, \mathbb {R}_{+}^{m})\) be an operator satisfying the following conditions, in [0, T]:

\(\exists \gamma \in C^0([0,T])\): \(\Vert \nabla _D v(t,x) \Vert \le \gamma (t)+ \Vert x \Vert \), \(\forall x \in \mathbb {R}^{mn}\),

\(\exists \mu >0\): \(\langle -\nabla _D v(t,x)+ \nabla _D v(t,y), x-y \rangle \ge \mu \Vert x-y \Vert ^2\), \(\forall x,y \in \mathbb {R}^{mn}\).

Then, the dynamic elastic market equilibrium distribution in the presence of excesses \(x^* \in \mathbb {K}(x^*)\) is continuous in [0, T].

4.3 A Sensitivity Result

Now, a sensitivity theorem is shown in order to clarify the behavior of solutions when some change in data occur (for the proof see, for instance, [24], Theorem 8).

Theorem 4.2

Let us assume that the profit function changes from \(v(\cdot )\) to the perturbed function \(\widetilde{v}(\cdot )\) and let us denote by \(x^*\) and \(\widetilde{x}\) the correspondent solutions of the corresponding quasi-variational inequalities. Let \(\nabla _D v\) be a Carathéodory function such that

\(\exists h \in L^2(\left[ 0,T\right] )\): \(\left\| \nabla _D v(t,x(t))\right\| _{mn} \le h(t)+\left\| x(t)\right\| _{mn}\), a.e. in \(\left[ 0,T\right] \),

\(\exists \alpha >0: \ \ll -\nabla _Dv(x)+\nabla _Dv(y),x-y\gg \ge \alpha \left\| x-y\right\| _{L^2}^2, \quad \forall x,y\in \mathbb {K}(x^*)\) Footnote 1.

Then, it follows that

5 The Policy-Maker’s Point of View: Inverse Formulation

The policy-maker has an important role to understand the problems derived from the economic world. For this reason, we want to analyze control policies in the dynamic elastic oligopolistic market equilibrium problem in the presence of excesses. Let us denote by the variable h the difference between the supply tax \(\eta \) and the incentive pay \(\lambda \) for transactions. In this new perspective the optimal control equilibrium conditions will be introduced.

Let \(x(h)=x(t,h)\) be the function of regulatory taxes. Let us assume that x(t, h) is a Carathéodory function and there exists \(\gamma (t)\in L^2(\left[ 0,T\right] )\) such that \(\left\| x(t,h(t))\right\| _{mn}\le \gamma (t)+\left\| h(t)\right\| _{mn}\), a.e. in \(\left[ 0,T\right] \). Let us introduce the set of feasible states

and define the optimal regulatory tax as follows.

Definition 5.1

A vector \(h^*\in L^2(\left[ 0,T\right] ,\mathbb {R}^{mn})\) is an optimal regulatory tax if and only if \(x(t,h^*)\in \Omega \) and for \(i=1,\ldots ,m,\;j=1,\ldots ,n\) and a.e. in \(\left[ 0,T\right] \) the following conditions hold:

Definition 5.1 means that if \(h^*\) is the optimal regulatory tax, then the corresponding state \(x(t,h^*)\) has to satisfy capacity constraints, namely \(x(t,h^*)\in \Omega .\) Moreover, if one requires that \(x_{ij}(t,h^*(t))=\underline{x}_{ij}(t),\) then the exportations must be promoted. If one postulates that \(x_{ij}(t,h^*(t))=\overline{x}_{ij}(t)\), then the exportations must be reduced. Finally, if one requires that \(\underline{x}_{ij}(t)<x_{ij}(t,h^*(t))<\overline{x}_{ij}(t)\), taxes equal incentive pays. We are able to show the inverse formulation of the model (see [22], Theorem 3.1):

Theorem 5.1

A regulatory tax \(h^*\in L^2(\left[ 0,T\right] ,\mathbb {R}^{mn})\) is an optimal regulatory tax if and only if it solves the inverse variational inequality:

Let us note that only recently the strict connection between the classical variational inequalities and inverse variational inequalities has been unveiled (see, for instance, [28–30]). Also in this case, we are able to provide a classical variational inequality formulation of the optimal equilibrium control problem. The advantage of such a standard formulation lies in the fact we can have disposal of all the theoretical and numerical advances in the theory of variational inequalities to treat fully the problem.

Theorem 5.2

Let \(W=L^2(\left[ 0,T\right] ,\mathbb {R}^{mn})\times \Omega ,\,F:\left[ 0,T\right] \times W\rightarrow L^2(\left[ 0,T\right] ,\mathbb {R}^{2mn})\), \(z(t) = \left( h(t), \omega (t) \right) ^T\), and \(F(t,z(t)) = \left( \omega (t)-x(t,h(t)), -h(t) \right) ^T\). The evolutionary inverse variational inequality (10) is equivalent to the evolutionary variational inequality

Proof

If (11) holds true, then we obtain easily that \(z^*=(h^*,\omega ^*)^T\in W\),

holds for every \(z=(h,\omega )^T\in W\). Setting \(h(t)=h^*(t)-\omega ^*(t)+x(t,h^*(t))\) and \(\omega (t)=\omega ^*(t)\) in (12), we have

Hence, \(x(t,h^*(t))=\omega ^*(t),\) a.e. in \(\left[ 0,T\right] .\) Thus, \(x(t,h^*(t))\in \Omega \) and (12) indicates that (10) holds. Conversely, if \(h^*\in L^2(\left[ 0,T\right] ,\mathbb {R}^{mn})\) is a solution to (10), then \(z^*=(h^*,x(t,h^*))^T\in W\) is a solution to (11). In fact, it results

\(\square \)

6 A Numerical Example

Let us consider two firms and two demand markets, as in Fig. 1. More precisely, let \(\underline{x},\overline{x}\in L^2([0,1], \mathbb {R}^{4})\) be the capacity constraints such that, a.e. in [0, 1],

Let \(D= \left\{ x \in L^2([0,T], \mathbb {R}^{4}): \ \underline{x}_{ij}(t) \le x_{ij}(t) \le \overline{x}_{ij}(t), \ \forall i=1, 2, \ \forall j=1,2 \right\} \). Furthermore, let \(p,q \in L^1([0,1] \times D,\mathbb {R}^{2})\) be the production and demand functions, defined as \(p(t)=\left( 10t+2x^*_{22}(t), 4t+2x^*_{11}(t)+2x^*_{12}(t) \right) ^T\) and

\(q(t)=\left( 6t+x^*_{11}(t)+x^*_{12}(t), 8t+2x^*_{21}(t) \right) ^T\), a.e. in [0, 1]. The feasible set is

Let \(v \in L^2([0,1] \times D, \mathbb {R}^2)\) be the profit function given by, a.e. in [0, 1],

Hence, the operator \(-\nabla _D v \in L^2([0,1] \times D, \mathbb {R}^{4})\) is, a.e. in [0, 1],

The dynamic oligopolistic market equilibrium distribution in the presence of excesses is the solution to the evolutionary quasi-variational inequality:

In order to compute the solution to (13) we make use of the direct method (see [31]). We solve the following system, a.e. in [0, 1],

The system solution is

We observe that \(x^* \not \in \mathbb {K}(x^*)\) because \(x^*_{21}(t)>\dfrac{1}{2}t.\) Now we consider the set

and the system

We can observe that the system solution

is an equilibrium solution, in [0, 1], since \(4x^*_{21}(t) +2x^*_{22}(t) -3t <0\), a.e. in [0, 1]. We remark that

then the production and demand excesses are \(\varepsilon (t)=\left( \dfrac{27t+2}{3}, \dfrac{19t+6}{6} \right) ^T\) and \(\delta (t)=\left( \dfrac{31t+3}{6}, \dfrac{14t+1}{2} \right) ^T\), respectively. We note that the adaptive constraints allow us to analyze a more general model. Moreover, the presence of the excesses influences the equilibrium distribution.

7 Conclusions

In the paper, we consider the dynamic oligopolistic market equilibrium problem in which the production and demand functions depend on the forecasted equilibrium commodity shipment. The equivalence between the dynamic elastic Cournot-Nash equilibrium principle and an evolutionary quasi-variational inequality is obtained. Thanks to the quasi-variational formulation, some existence and regularity results are proved. Finally, the policy-maker optimization problem is presented.

Notes

We recall that in the Hilbert space \(L^2([0,T], \mathbb {R}^k)\) we define the canonical bilinear form on \(L^2([0,T], \mathbb {R}^k) \times L^2([0,T], \mathbb {R}^k)\) given by

$$\begin{aligned} \ll \phi , w \gg := \in _0^T \langle \phi (t), w(t) \rangle dt, \end{aligned}$$where \(\phi \in L^2([0,T], \mathbb {R}^k)\).

References

Bensoussan, A., Goursat, M., Lions, J.L.: Contrôle impulsionnel et inèquations quasi-variationnelles stationnaires. CR Acad. Sci. Paris 276, 1279–1284 (1973)

Bensoussan, A., Lions, J.L.: Nouvelle formulation des problèmes de contrôle impulsionnel et applications. CR Acad. Sci. Paris 276, 1189–1192 (1973)

Bensoussan, A., Lions, J.L.: Nouvelles méthodes en contrôle impulsionnel. Appl. Math. Optim. 1, 289–312 (1974)

Bensoussan, A., Lions, J.L.: Contrôle impulsionnel et inéquations quasi-variationnelles d’évolution. CR Acad. Sci. Paris 276, 1333–1338 (1974)

Baiocchi, C., Capello, A.: Variational and Quasivariational Inequalities. Applications to Free Boundary Problems. Wiley, New York (1984)

Chan, D., Pang, J.S.: The generalized quasivariational inequality problem. Math. Oper. Res. 1, 211–222 (1982)

Tan, N.X.: Quasi-variational inequality in topological linear locally convex Hausdorff spaces. Math. Nachr. 122, 231–245 (1985)

Noor, M.A.: An iterative scheme for a class of quasi variational inequalities. J. Math. Anal. Appl. 110, 463–468 (1985)

Facchinei, F., Kanzow, C., Sagratella, S.: Solving quasi-variational inequalities via their KKT conditions. Math. Program. 144, 369–412 (2014)

Jadamba, B., Khan, A., Sama, M.: Generalized solutions of quasi variational inequalities. Optim. Lett. 6, 1221–1231 (2012)

Noor, M.A., Noor, K.I.: Some new classes of quasi split feasibility problems. Appl. Math. Inf. Sci. 7, 1547–1552 (2013)

Noor, M.A., Noor, K.I., Khan, A.G.: Some iterative schemes for solving extended general quasi variational inequalities. Appl. Math. Inf. Sci. 7, 917–925 (2013)

Barbagallo, A., Pia, S.: Weighted quasi-variational inequalities in non-pivot Hilbert spaces and applications. J. Optim. Theory Appl. 164, 781–803 (2015)

Donato, M.B., Milasi, M., Scrimali, L.: Walrasian equilibrium problem with memory term. J. Optim. Theory Appl. 151, 64–80 (2011)

Donato, M.B., Milasi, M., Vitanza, C.: Quasi-variational approach of a competitive economic equilibrium problem with utility function: existence of equilibrium. Math. Models Methods Appl. Sci. 18, 351–367 (2008)

Donato, M.B., Milasi, M., Vitanza, C.: A new contribution to a dynamic competitive equilibrium problem. Appl. Math. Lett. 23, 148–151 (2010)

Scrimali, L.: Quasi-variational inequalities in transportation networks. Math. Models Methods Appl. Sci. 14, 1541–1560 (2004)

Barbagallo, A., Mauro, P.: Evolutionary variational formulation for oligopolistic market equilibrium problems with production excesses. J. Optim. Theory Appl. 155, 1–27 (2012)

Barbagallo, A., Mauro, P.: Time-dependent variational inequality for an oligopolistic market equilibrium problem with production and demand excesses. Abstr. Appl. Anal. 2012 art. no. 651975 (2012)

Barbagallo, A., Cojocaru, M.-G.: Dynamic equilibrium formulation of oligopolistic market problem. Math. Comput. Model. 49, 966–976 (2009)

Barbagallo, A.: Advanced results on variational inequality formulation in oligopolistic market equilibrium problem. Filomat 5, 935–947 (2012)

Barbagallo, A., Mauro, P.: Inverse variational inequality approach and applications. Numer. Funct. Anal. Optim. 35, 851–867 (2014)

Barbagallo, A., Mauro, P.: An inverse problem for the dynamic oligopolistic market equilibrium problem in presence of excesses. Procedia Soc. Behav. Sci. 108, 270–284 (2014)

Barbagallo, A., Mauro, P.: A quasi variational approach for the dynamic oligopolistic market equilibrium problem. Abstr. Appl. Anal. 2013 art. no. 952915 (2013)

Kuratowski, K.: Topology. Academic Press, New York (1966)

Barbagallo, A.: Regularity results for time-dependent variational and quasi-variational inequalities and application to calculation of dynamic traffic network. Math. Models Methods Appl. Sci. 17, 277–304 (2007)

Barbagallo, A.: Regularity results for evolutionary variational and quasi-variational inequalities with applications to dynamic equilibrium problems. J. Glob. Optim. 40, 29–39 (2008)

Yang, J.: Dynamic power price problem: an inverse variational inequality approach. J. Ind. Manag. Optim. 4, 673–684 (2008)

He, B., He, X.Z., Liu, H.X.: Solving a class of “black-box” inverse variational inequalities. Eur. J. Oper. Res. 234, 283–295 (2010)

Scrimali, L.: An inverse variational inequality approach to the evolutionary spatial price equilibrium problem. Optim. Eng. 13, 375–387 (2011)

Maugeri, A.: Convex programming, variational inequalities and applications to the traffic equilibrium problem. Appl. Math. Optim. 16, 169–185 (1987)

Acknowledgments

The first author was partially supported by STAR 2014 “Variational Analysis and Equilibrium Models in Physical and Socio-Economic Phenomena” (Grant 14-CSP3-C03-099). The authors would like to thank the referees for the helpful comments and suggestions which led to a clearer presentation of this work.

Author information

Authors and Affiliations

Corresponding author

Additional information

Communicated by Jean-Pierre Crouzeix.

Rights and permissions

About this article

Cite this article

Barbagallo, A., Mauro, P. A General Quasi-variational Problem of Cournot-Nash Type and Its Inverse Formulation. J Optim Theory Appl 170, 476–492 (2016). https://doi.org/10.1007/s10957-016-0924-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10957-016-0924-z