Abstract

The 2007 financial crisis profoundly affected most American metropolitan areas. Over the past 10 years, Columbus, Ohio, has experienced a housing downturn, recovery, and subsequent increases. This allows to investigate the response of housing market in different periods of the recession. Ordinary and geographically-weighted regression (GWR) models were developed to examine global and local built-environment effects on home-price appreciations for the three periods while controlling for other physical and socioeconomic variables. The results found that home buyers showed an unchanged preference for residential privacy and amenity and avoided those features that might attract negative external effects from a period to another. The home-price appreciation rates showed different spatial patterns across the study region in the three periods. Nevertheless, the results suggested that suburban areas, particularly those in northern Columbus, better resisted, recovered from, and adapted to the recession. In the wake of the recession, a smaller house was preferred by home buyers. GWR models also provided some interesting findings. In the downturn, accessibility to a park or library helped sustain home prices in the northwest. Bus stop density had a positive effect in eastern Columbus in the recovery, most likely due to the high fuel price at that time. Neighborhoods with a higher income better retained their home value in the downturn, especially those in southern Columbus. Finally, this study found that the recession hit harder on minority neighborhoods in all three periods. This finding suggests that housing policies should focus on these neighborhoods with other social support.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The built environment of a city has been long recognized as an important factor in home values. This idea is based on the hedonic pricing theory that a home price can be considered as a price combination of a set of internal house attributes and surrounding environmental features, such as land uses, transportation infrastructure, and public facilities and services. The effects of built-environment features on home values have been intensively examined in the literature. However, few studies focused on comparing such effects in a housing downturn with those in a recovery and the time after. Since the financial crisis occurred in late 2007, many American cities have experienced a housing downturn with an average drop of 30% in home prices (NaKajiMa 2013). Over the past 10 years, the economy seems to recover from the global recession with a relatively low unemployment rate of 4.1% in the spring of 2018 (Bureau of Labor Statistics). This exactly provides an opportunity to investigate and compare the effects of the built environment on home-price resilience in the housing downturn, recovery, and subsequent increases.

Homebuyers might be willing to pay a premium for properties with some built-environment features (Ewing 1997; Plaut and Boarnet 2003; Song and Knaap 2003). However, the effect of a built environment feature might be valued differently in different urban contexts. For instance, some empirical studies found that public transit has a positive and significant effect on home prices (Ahlfeldt and Wendland 2009; Gibbons and Machin 2005), while some found that such effect is moderate or even negative (Baum-Snow and Kahn 2000; Chatman et al. 2012). Bowes and Ihlanfeldt (2001) reported that the effect of public transit on home prices could be nonlinear. More importantly, built-environment effects could vary spatially across a geographical area. Homebuyers in a neighborhood might see a built-environment feature as a positive factor on home prices, while those in another might treat it as a negative one (Song and Quercia 2008). These all resort to the need for a spatial statistical model, which is often neglected in past research, to better understand how each of the built environment features locally helps sustain, recover and increase home prices in different periods during the recession.

The purpose of this study is to (1) explore which location in a city that would better resist, recover from and adapt to the recent recession, and (2) examine which built environment feature/social demographical characteristic that would better sustain home values in downturn, recovery, and the time after. In this study, home-price changes in the period of housing downturn, recovery, and recent increases were computed respectively for Columbus, Ohio, using the repeat sales parcel-data from Franklin County. Columbus is the only city that shows stable population growth in the past few decades among the 3-C cities (Cleveland, Columbus, and Cincinnati) in Ohio. As a medium-size city in the Midwest, Columbus has also experienced a housing market downturn, recovery, and recent boom. The home-price changes were first mapped to show the locations that best retained home prices in the housing downturn, foremost recovered from the recession, and ascended the most in recent years. Ordinary (OLS) and geographically weighted regression (GWR) models were estimated to investigate how the built-environment features globally and locally affect home-price depreciation/appreciation in the three periods over the past 10 years. The explanatory variables were characterized into six groups, including metropolitan location effects, land uses, capital investments, accessibility, house attributes, and socioeconomic characteristics. This study adds to the existing literature by examining the local built environment effects on home-price resilience for the three housing periods (i.e. downturn, recovery, recent increases). The spatially-varied relationships would help better understand how each of the built-environment features was locally capitalized in a home price.

2 Background

The financial crisis occurred in late 2007 profoundly impacted most American metropolitan areas. There has been a vast research literature focusing on factors resulting in foreclosures, the impacts from foreclosures, and the relationships between foreclosures and socioeconomic conditions of neighborhoods. The loosening of credit standards and an increase in high-risk and predatory lending have been identified as the major causes of this crisis (Crump et al. 2008; Hyra et al. 2013; Immergluck 2008). In addition, some studies attempted to more thoughtfully understand this financial crisis by extending to other research topics, such as resale mechanism and duration, market segmentation, and neighborhood effects (Kim and Cho 2016; Li and Walter 2013). Unlike the research mentioned above, this study aims at better understanding how the housing market responds to the recent recession and how it adapts to that afterward.

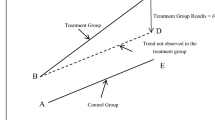

The concept of resilience provides a theoretical basis to help frame our research method for this purpose. Resilience is conceptualized in different ways from a discipline to another (Ainuddin and Routray 2012). In the area of natural hazard management, for instance, resilience is referred to as the ability of a city to resist, absorb, accommodate, recover from, and, more emphasized recently, adapt to the impacts of a disaster in a timely manner (Sharifi 2016; Stoyle et al. 2008; UNISDR 2009). For this study, the concept of resilience can be used to build a research framework that aims to examine which location and which built environment feature in a city would better resist, recover from, and adapt to the impacts of the recent recession. Therefore, the focus of this review is on the modeling interface between built environment effects and home price changes. In the following, two streams of research are considered: (1) the built environment effects on home prices, and (2) spatial statistical modeling.

Subprime loans (pre-foreclosure) or the likelihood of the owned property being sold (post-foreclosure) were found to be associated with low income, high shares of minority, and weak educational attainment (Allen 2011; Immergluck 2008; Li 2011; Li and Walter 2013). Low-income and minority families were hit by the recession more likely to cluster in the areas around the city center. In this case, the inner city could be seen as a more vulnerable location to the recent housing recession. However, it was also found that suburban and exurban areas, the home of many middle-class families, were deeply impacted by the recession, especially those in a formerly hot market (Crump et al. 2008; Reid 2010). These findings suggest that the spatial pattern of the recession impacts might vary from a metropolitan area to another (Immergluck 2010). Nevertheless, there have been few studies that provided a systematical research approach to identify the locations in a city that would best sustain home value in a housing recession. In addition, such studies that also look at the spatial pattern in the time period after the housing recession are much rarer and thus needed.

The effect of the built environment is another focus in the studies of the recent housing recession. The built environment could influence a home price through a way of offering different neighborhood types. This idea originates from the hedonic pricing theory. Lancaster (1966) was the first to recognize that the utilities of goods are essentially based on their characteristics, and Rosen (1974) was the first to present a theory of hedonic pricing that the price of a commodity can be considered as a price sum of each homogeneous attribute. This implies that home prices can be regressed on a set of housing characteristics, including internal configuration, location effects, neighborhood quality, and environmental amenities (Freeman 1979; Xiao and Webster 2017). For the built-environment effects, the majority of previous studies pointed out that home buyers would be willing to pay premiums for mixed land-use, better walkability, proximity to transit, and environmental amenity, but dislike a neighborhood with higher density or too many public facilities that would attract numerous activities (Dong 2015; Morrow‐Jones et al. 2004; Song and Knaap 2003). It is worth noting that a built-environment feature might have opposite effects on home process in different neighborhood contexts (Ahlfeldt and Wendland 2009; Chatman et al. 2012; Gibbons and Machin 2005; Kilpatrick et al. 2007), and such effects might be not always linear (Bowes and Ihlanfeldt 2001). More importantly, the effect of a built environment feature may vary across different time periods of an economic recession. Therefore, it would be interesting to examine for which built-environment feature home buyers change their preference after the housing recession, and the results might help reveal how the housing market adapts to that recession.

Furthermore, spatial autocorrelation is one of the major criticisms of using a hedonic model (Xiao and Webster 2017). Spatial statistics has been extensively used in recent studies to better understand the nature of spatial dependence on various physical and social issues (Wang and Chen 2017). It is concerned with the degree to which observations at some locations are similar to those nearby in a statistical model (Tobler 1970). A drawback of previous studies on the built-environment effects is the neglect of the spatial variation of such effects on home values. For instance, Dziauddin et al. (2015) reported that the increased accessibility by the light rail transit system in Greater Kuala Lumpur, Malaysia, has a positive effect on home values in some areas, but a negative effect at some others. These opposite effects might cancel each other out and therefore are not captured in an ordinary regression model. Another concern is whether these effects would be all statistically significant over the region (Mou et al. 2017). Among a variety of spatial statistical models, graphically weighted regression (GWR) models allow for the estimated relationships in a regression model to vary in a geographical space (Fotheringham et al. 2015; Yu et al. 2007) and is therefore selected here to better understand how each of the built environment features in a city performs locally in the three different housing periods.

Given the previous discussion, this study proposes a research framework that investigates how the built environment features influence home price changes while controlling for the other socioeconomic factors, during the recession and the time after. The idea is to apply the hedonic pricing theory as the modeling interface to identify the most resilient housing locations and compare the built environment effects among the three study periods (i.e. downturn, recovery, and recent increases). This modeling framework also integrates with a spatial statistical approach that would allow for visualizing the spatial variations of the built environment effects.

3 Data and methodology

3.1 Home price changes

A set of repeat sales data was collected for Columbus, Ohio, in three defined housing periods (downturn, recovery, subsequent increases) during the housing recession. According to the home price indices reported by FRED Economic Data (2018), home prices in Columbus, using the price in early 1995 (100) as reference, reached a peak in early 2008 (156.05), hit bottom in late 2011 (140.97), bounced back in middle 2015 (158.74), and sky-rocketed to a new peak in early 2018 (190.08). In this study, the peak period was defined as the time from July 2005 to March 2008, the bottom period was from July 2010 to July 2012, the recovery period was from July 2014 to July 2015, and the recent increase period was from April 2017 to December 2017. Repeat sales were then identified for each of the three study periods (i.e. downturn, recovery, and recent increases), using the residential transaction data from Franklin County Auditor Data Library. The idea of defining these three study periods is to make sure: (1) an obvious gap of home price indices between each pair of sequential periods can be observed, and (2) the length of each defined period would allow to have enough cases of repeat sales for the statistical modeling.

To exclude outliers, the repeat sales for the three periods defined above were edited as follows. First, parcels with transaction prices lower than $50,000 or higher than $2 million were not considered as arm’s length transactions and therefore dropped. Second, parcels with transaction price changes larger than positive or negative 50% of the previous sale price were excluded. Third, parcels were removed if the built-years of the property between the two sales are different. Lastly, parcels were dropped if the total floor changes between the two sales are larger or smaller than 5% of the previous total area. After the cleaning, 2731 repeat sales were left for the downturn period, 720 sales for the recovery period, and 631 sales for the recent increase period.

Figure 1a shows the spatial distribution of home prices in the peak period. Census tracts were used as neighborhood proxies in this study. Neighborhoods with a higher home price cluster in a longstanding wealthy neighborhood (Upper Arlington) a few miles northwest of the city center, and extend to a relatively new developed neighborhood (Dublin) in the northwest (see the upper-left plot in Fig. 1a). Figure 2 displays several built environment features and their locations in the study region. A cluster of higher home prices is located around a newly developed wealthy neighborhood (New Albany) in the northeast (see the upper-right plot in Fig. 2). Additionally, two small clusters along highway 70 (Short North and Franklin Park) hold high-value properties close to the downtown area. Short North is a gentrified neighborhood and Franklin Park shares environmental amenities due to the nearby regional botanical park (ses the corresponding features in Fig. 2a).

The Midwest was found to have a shallower recession depth but a longer recession duration (2008–2012), as compared to other regions in the US (Dong and Hansz 2016). Figure 1b shows the percentages of home-price changes, with an average of − 12.21%, between the peak and bottom period. Clearly, northern Columbus better resisted the impacts of the recession than southern Columbus did. It is also interesting to see that the longstanding wealthy neighborhoods (Upper Arlington, Clintonville, and Worthington) even saw a home-price increase in the downturn. The percentages of home price changes between the bottom and recovery periods are shown in Fig. 1c. Most neighborhoods saw a home-price recovery with an average of 16.06%, particularly those that fall in an inner-ring about 5 miles away from the city center. Since home prices were back to the prerecession level of 2008, this housing upturn, with an average of 20.57%, has continued and expended to outer rings in the city (see Fig. 1d). Note that many neighborhoods in the inner city did not have transaction records in the recovery and recent increase period.

Ordinary regression (OLS) models were also used to compare the spatial patterns of home price changes at the census tract level among the three study periods. Table 1 presents the results of a simple regression model of home price changes between any two time periods. For instance, model DT_RC represents a model that regressed the downturn (DT) home price changes on the recovery (RC) home price changes. The positive sign from the results of both models DT_RC and RC_IN shows that home price changes indicate a similar spatial pattern between the downturn and the recovery, and so do those between the recovery (RC) and recent increase (IN). However, model DT_IN results indicate that the spatial pattern of home price changes in the downturn (DT) is not associated with that in the recent increase (IN). This spatially analytic approach was also applied to the community opportunity index (COI), which was developed by Wang and Chen (2017), using a set of physical and socioeconomic factors. Similarly, the model results (COI_DT, COI_RC, COI_IN), by regressing COI on home price changes in the three periods, show that neighborhoods with higher opportunity (COI) better sustained their home value in the downturn (DT) and recovered from the recession (RC). However, we did not find such a relationship between the spatial pattern of COI and that of home price changes in the recent housing increase (IN).

3.2 Explanatory variables

This study classified the explanatory variables into six groups: metropolitan location effect, land use, capital investment, accessibility, house attribute, and socioeconomic characteristic. The metropolitan location effects were calculated in ArcMap as the Euclidean distances from each parcel to Columbus downtown, The Ohio State University, and the Port Columbus International Airport. The four types of land uses in Table 2 were specified as the percentage of areas at the census tract level using the 2008 parcel data from Franklin County Auditor. The shares of residential and commercial uses and corresponding vacant land for these types of land uses reflect the existing and future real estate market. Capital-investment variables represent the quality of transportation network and public amenities at the census tract level, including highway ramp, street intersection, bus stop, bike lane, park, school, library, and hospital. These variables were assembled from US Census TIGER/Line Shapefiles, Central Ohio Transit Authority, and Mid-Ohio Regional Planning Commission Regional Data Catalog. Euclidean distances were also calculated for each parcel centroid to indicate parcels’ ability to reach the nearest transportation infrastructure and public facilities. Socioeconomic characteristics were collected from various sources, including UC American Community Surveys 2012–2016 estimates and 2008 US Department of Housing and Urban Development (for foreclosure risk). Table 2 presents the variable definitions and descriptive statistics for the downturn period. Note that the variables at the parcel level in the other two periods (recovery and recent increases) have similar descriptive statistics to those in the downturn.

3.3 Methodology

Three ordinary regression (OLS) models were first developed to account for the global built-environment effects on home-price appreciation rates in the downturn, recovery, and recent increases, while controlling for a set of location-effect, market condition, and socioeconomic variables. Next, three log-linear geographically weighted regression (GWR) models, due to the skewed distribution of the depreciation/appreciation rates, were estimated to capture the spatially-varied built-environment effects, written as:

where Pt1i/Pt0i represents the appreciation rate of sale case i between two periods, which is calculated as the ratio of the sale price in the current period to that in the previous period. In this study, there are three sets of appreciation rates, in a natural log form, used as dependent variables in the models, including downturn, recover, and recent increases. Xik is the explanatory variable k for sale case i, and β0 (ui, vi) and βk (ui, vi) are parameters to be estimated. The explanatory variables are classified into six categories: metropolitan location effects, land uses, capital investments, accessibility, house attributes, and socioeconomic characteristics. Note that (ui, vi) denotes the coordinates of the sale case i. Therefore, the estimated parameters, β0 (ui, vi) and βk (ui, vi) are allowed to vary over the study region. The modeling considerations for the GWR estimations are explicitly explained in Sect. 5. Readers interested in the statistical aspects of GWR modeling might usefully consult Fotheringham et al. (2002), Wheeler and Páez (2010), and Gollini et al. (2013).

4 Result

The OLS estimates for the three models of home-price appreciation rates (DOWN, RECO, and INCR) are presented in Table 3. GWR models were also estimated to visualize the spatial variations in the effects of explanatory variables. A Gaussian kernel weighting function with an adaptive bandwidth was used for the GWR estimations. The Akaike Information Criterion (AIC) approach was used to select the optimal bandwidth that would give the best goodness-of-fit for the GWR estimations (Fotheringham et al. 2002; Wheeler and Páez 2010), because the other most-used bandwidth selection approach, cross-validation (CV), might be sensitive to a small number of observations (Farber and Páez 2007). Using the AIC approach, the optimal adaptive bandwidth quantile is set at 15% for model DOWN, 85% for model RECO, and 25% for model INCR (Table 3). Moreover, multicollinearity is a potential problem in a GWR model that might lead to augmented standard errors (Mulley 2014; Wheeler and Tiefelsdorf 2005). Therefore, local variance inflation factors (VIFs) were computed to see if local collinearity substantially increases the estimated variance of a coefficient (Wheeler and Páez 2010; Wheeler and Tiefelsdorf 2005). From Table 3, all the VIFs are below the critical value of 10 (Cardozo et al. 2012; Mason et al. 1989; Neter et al. 1989), suggesting there is no serious multicollinearity problem. The three GWR models all improve the results with a higher R2 and a lower AIC (Table 3). Note that insignificant explanatory variables were dropped but some variables of which the significance were slightly larger than the 0.05 level were kept in the OLS models because they might be locally significant in the GWR models. In addition, a Moran’s I (MI) test was used to examine whether any spatial autocorrelation (SA) still remains in the residuals of a GWR model (Leung et al. 2000). Each of the three above-mentioned optimal adaptive bandwidth quantiles (15%, 85%, and 25%) was converted into a k-value (i.e. the number of k-nearest neighboring observations) as a neighborhood structure used for the calculation of spatial weights. The inverse-distance-weighting (IDW) function was also used to make sure that the spatial weights would be attenuated with distance to mimic the Gaussian kernel weighting function. The insignificant results of the three MI tests suggest that none of the three GWR models finds reminding SA in the residuals (see Table 3). In this study, the local estimated coefficients were interpreted in the context of the OLS results. The OLS and GWR results are presented below in six subsections, together with maps that show the spatial variations of selected explanatory variables.

4.1 Metropolitan location effects

For each repeat sales case, distance to the city center (DCBD), The Ohio State University (DOSU), and the airport (DAIR) are the three measures of metropolitan location effects. The variable DCBD has a significant and positive sign in the OLS modes in the downturn and recovery, indicating that suburban areas better sustained and recovered their home value than the downturn area did. More interestingly, the GWR results show that the locations where better sustain home values, at the 0.05 significance level, cluster in the west in the downturn, in the south in the recovery, and in the north in the recent increases (see Fig. 3a–c).

The OLS results show that the variable DOSU has a significant and negative sign in the downturn and recent increases, while the variable DAIR does so in the recovery and recent increases. GWR results give more geographical details, and therefore add more information to the changing of the spatial patterns mentioned above. From Fig. 3d, the best locations to sustain home values in the downturn cluster in the west where is close to OSU. In the recovery, additional such locations are found in the north of the airport (Fig. 3e). Finally, northern Columbus saw a housing upturn in the recent increases (Fig. 3f). These findings are consistent with Fig. 1 that neighborhoods near OSU saw home-price increases in the downturn, then those a few miles northwest of the airport better recovered from the recession, and then those in the northwest experienced a new housing boom.

4.2 Land uses

Residential (RESI) and commercial (COMM) uses are two important land-use activities in a city. From the OLS results, neighborhoods with a higher share of residential (RESI) or commercial (COMM) uses experienced a larger home-price depreciation in the downturn. The GWR results indicate that the northwest side of the city with a higher residential share was more vulnerable in the downturn, while the opposite side saw a lower home-price rise in the recent increases. In addition, home prices in the downturn were depreciated more in the neighborhoods with a higher share of vacant residential uses (RESV), particularly in southern Columbus. However, an opposite result was found from the OLS model with a positive sign for the variable RESV in the recent increases, although the estimate is not very significant (p value = 0.15). Nevertheless, this indicates that a neighborhood with more available land for future residential uses saw a higher home-price rise in the recent housing boom.

4.3 Capital investments

Among a number of capital investments, the presence of a highway ramp (RAMP) in a neighborhood shows a negative effect in the downturn at a slightly significant level (p value = 0.11). However, the GWR results show a cluster of significant local RAMP coefficients located around the largest shopping mall (Eaton Town Center) in Columbus. The negative effects of a highway ramp are most likely due to the increased traffic and separated living environment by the highways. The variable BUDN (bus stop density) has a significant and positive sign in the OLS model in the recovery, suggesting that home buyers might consider using transit to save travel costs due to the high fuel price at that time. The GWR results also show that such positive effects were exerted more in eastern Columbus to help recover from the recession (Fig. 4a).

The OLS results indicate that the more libraries (LIBR) allocated in a neighborhood, the less likely a residential house becomes to sustain its value in the downturn and recovery. Figure 4b also shows that such negative effects in the recovery exerted more in northern Columbus. A possible explanation is that homebuyers were not willing to see many strangers coming from other neighborhoods to the library which is close to homes. Similarly, homebuyers did not see hospitals (HOSP) as a premium in the recent increases.

4.4 Accessibilities

From the OLS results, a significant and positive sign for the variable DROD (distance to the nearest primary and secondary road) in the downturn and recovery indicates that neighborhoods further away from major roads (e.g. suburban areas) better sustained and recovered their home value, most likely due to the preference for less traffic noise, privacy, and residential amenity. The GWR results suggest that Dublin at the northwest corner held this preference strongly in the downturn (Fig. 5a), while eastern Columbus did so in the recovery. In the downturn, distance to the nearest bus stop (DBUS) has a significant and positive sign in the OLS model, and a cluster of local significant and positive coefficients were found in northeastern Columbus from the GWR results (Fig. 5b). More interestingly, northeastern Columbus, as discussed above, saw positive effects of bus stop density (BUDN) in the recovery (Fig. 4a). This might imply that home buyers in eastern Columbus did not appreciate the proximity to a bus stop in the downturn, most likely due to the concern of foreign visitors, but they, however, appreciated the availability of bus stops in the neighborhood in the recovery, probably because of the need of using public transit.

The variables DPAK (distance to the nearest park) and DLIB (distance to the nearest library) both have a significant and negative sign in the OLS model, implying that access to such facilities helped sustain home prices in the downturn. In addition, the GWR results show that New Albany at the northwest corner particularly appreciated such effects (Fig. 5c, d). It is worth noting that the OLS results show that home buyers did not value a large number of libraries in the neighborhood as a home-price premium in the downturn, and the GWR results indicate that such effects occurred in a small area at the southeast corner. To summarize, in the downturn, we observe that home buyers in northeast Columbus, New Albany, appreciated the proximity to a library, while those in the southeast corner disliked the possible external effects caused by those libraries in the neighborhood. A possible explanation is that New Albany is a newly developed area without many libraries allocated, and therefore the accessibility to a library in an accessible driving distance was preferred by home buyers. Finally, the variable DHOP has a significant and positive sign in the OLS model in the recent increases. In this case, proximity to a hospital might not be seen as a premium to home prices in the recent boom. Similarly, proximity to a bike lane (DBIK) did not help increase home prices, although such effects were not very significant (p value = 0.14).

4.5 House attributes

In the downturn, single-family (SFAM) houses were found better sustaining their value, as compared to other house types. However, such effects were not very significant (p value = 0.07). The variable YRBT has a significant and negative sign in the OLS model in the downturn and recovery, implying that a house built in a more recent time tended to lose its value more during the recession. The GWR results also show that new builds lost more in the southeast than in the northwest (Fig. 6a). This finding is consistent with Fig. 1b that old wealthy neighborhoods in the north better resisted the recession impacts. More interestingly, the OLS results show that the home price of a smaller house (SIZE, FLOR) tended to increase more in the recovery and recent boom. This finding suggests that home buyers might seek to reduce financial risks in the awake of the recent recession. The GWR results also point out that such effects exerted more influence in northern Columbus (Fig. 6b). It is worth noting that this change can be seen as a way how the housing market adapts to the recent recession.

4.6 Socioeconomic characteristics

A number of socioeconomic characteristics were controlled for in the OLS and GWR models. The foreclosure rates (FORE) estimated in 2008 were negatively associated with home-price appreciation rates. This finding is as expected that a house, especially those around Upper Arlington, with a higher loan-cost ratio would more likely turn out to be a foreclosure in a downturn. The spatial variation of such effects is illustrated in Fig. 7a. The variable PREP (the average home price in the previous time) has a significant and negative sign in the downturn, implying that the home prices before the recession were most likely overvalued by home buyers. On the contrary, a significant and positive sign for the variable PREP in the recovery indicates that neighborhoods with a higher home price in the downturn recovered better from the recent recession.

In the downturn, wealthier neighborhoods (INCO) were found better sustaining their home prices, and southern Columbus was influenced more by such effects (Fig. 7b). Neighborhoods with a higher home ownership share (OWNE), particularly in the north, were found being more seriously hit in the downturn. As expected, school quality (SCQU) overall showed a positive effect on sustaining home prices in the downturn. Finally, it is worth noting that a neighborhood with a higher minority share was more vulnerable in all three periods. This finding is consistent with those from past studies on the recession impacts, see Allen (2011), Immergluck (2008), Li (2011), and Li and Walter (2013).

5 Discussion

5.1 Where were more resilient to the housing recession?

The three metropolitan location effect factors computed in this study can help investigate where better resisted, recovered from, and adapted to the impacts of the recent recession. First, the OLS results show that distance to the city center (DCBD) has a positive effect on home-price appreciation rates in all three periods. Second, a negative sign for the other two location-effect factors (DOSU, DAIR) in the OLS models suggests that houses in the proximity to these two locations better sustained, recovered, and then increased their home prices. The local location effects captured in the GWR models give additional information, together with the mapping of home price changes in the three periods (i.e. Fig. 1), to better understand how the spatial pattern of such effects changed from a period to another.

In conclusion, the longstanding wealthy neighborhoods a few miles northwest of the city center (Upper Arlington) better sustained their home value in the downturn, those clustering in the inner ring of the city better recovered from the recession, and those extending out to the outer rings better increased their home prices in the recent boom. In a word, suburban areas, particularly in northwestern Columbus, are more resilient in the recent housing recession. It is not surprising to find such a decentralized pattern in a medium-size city in the Midwest. However, this finding might not apply to other metropolitan areas in the US. For instance, Dong (2015) reported that proximity to the city center had a significant and positive effect in the case of Portland, Oregon, due to the long term efforts to revitalize the Portland downtown.

5.2 What built-environment features helped sustain and recover home prices?

A number of built-environment features were examined in this study while controlling for location effects, house attributes, and socioeconomic characteristics. In the downturn, only proximity to a park (DPAK) or library (DLIB) has a positive effect on sustaining home values, particularly for the newly developed wealthy neighborhoods (New Albany) at the northeast corner of the city. Homebuyers did not show a preference for those built-environment features that would bring negative externalities, such as a higher share of residential (RESI) and commercial (COMM) uses, the presence of a highway ramp (RAMP), and a higher number of libraries (LIBR) in the neighborhood. Also, proximity to a primary or secondary road (DROD) or bus stop (DBUS) also shows a negative effect, indicating the preference for residential amenity, privacy, and safety.

A study also reported similar findings that home buyers in Columbus prefer lower density, more open space and other amenities (Morrow-Jones et al. 2004). Moreover, homebuyers did not show a strong preference for those features (e.g. RESI, DROD, LIBR, HOSP, and DHOS) that would bring neighborhoods negative externalities in the recovery and recent boom. This might suggest that home buyers did not change their preference for this type of feature after the recession. However, bus stop density (BUDN) did help recover home prices, because there was a high fuel price at that time (Dodson and Sipe 2008).

5.3 Other findings

There are several interesting findings from the model results for the remaining variables. Neighborhoods with higher income (INCO) or better school quality (SCQU) were found better sustaining their home value in the downturn. New builds (YRBT) were more vulnerable to the recession in the downturn, especially those in southern Columbus. Neighborhoods with higher foreclosure risks (FORE) tended to lose more value in the downturn. More interestingly, the model results suggest that home prices (PREP) before the bust were most likely overvalued, and a higher home price in the bottom period helped recover its value. In the wake of the recession, smaller houses (SIZE, FLOR) were found better recovering and then increasing their home prices. Finally, the economic recession hit harder on the neighborhoods with a higher share of the minority.

6 Conclusion

A spatial analytical framework has been developed to investigate the built-environment effects on home values for Columbus, Ohio, using a set of OLS and GWR models. The geographical mapping of the home price changes was first presented for the three different periods (downturn, recovery, recent increases). The maps show different spatial patterns, indicating that most housing resilient locations might shift from a place to another in different periods of the recession. The OLS and GWR results confirm these findings that the most resilient locations shifted from old wealthy neighborhoods a few miles northeast of the city center in the downturn, to the inner ring of the city in the recovery, and then to the outer rings in the recent increases. Overall, suburban areas, in particular those in the north, better resisted, recovered from and adapted to the recession impacts. The model results reveal that homebuyers showed a strong preference for residential amenity, privacy, and safety, and dislike for those built-environment features with negative externalities. Home prices were overvalued before the housing downturn, and smaller houses were found more attractive to home buyers in the wake of the recession. Finally, the model results point out that neighborhoods with a higher share of the minority were hit harder in all the three periods, most likely due to the high-risk lending (Dong 2015).

It might not be determined whether these findings would reflect a long-term trend of the housing market in Columbus, due to the short-term nature of the present study. Also, the findings might not be used to infer for other similar size cities since each place has its own urban contexts. However, the proposed research framework in this study can be applied to another city to help better understand how the local housing market responded to the recent recession and the time after. Some findings in this study might raise questions to planners, such as how to reduce negative external effects for land uses and public facilities. Also, it has been a challenge for homebuyers to trade privacy and residential amenities off against accessibility. These two features both help sustain home prices in the recession. These challenges apply to planners to better balance the benefits of both features through the means of planning and design. More importantly, this paper advocates that housing policies should focus on minority neighborhoods to increase their housing resilience through land-use planning and capital investments, together with other social supports (e.g. public housing, tax reduction, and financial support).

References

Ahlfeldt, G. M., & Wendland, N. (2009). Looming stations: Valuing transport innovations in historical context. Economics Letters, 105(1), 97–99.

Ainuddin, S., & Routray, J. K. (2012). Community resilience framework for an earthquake prone area in Baluchistan. International Journal of Disaster Risk Reduction, 2, 25–36.

Allen, R. (2011). The relationship between residential foreclosures, race, ethnicity, and nativity status. Journal of Planning Education and Research, 31(2), 125–142.

Baum-Snow, N., & Kahn, M. E. (2000). The effects of new public projects to expand urban rail transit. Journal of Public Economics, 77(2), 241–263.

Bowes, D. R., & Ihlanfeldt, K. R. (2001). Identifying the impacts of rail transit stations on residential property values. Journal of Urban Economics, 50(1), 1–25.

Bureau of Labor Statistics Labor Force Statistics from the Current Population Survey.

Cardozo, O. D., García-Palomares, J. C., & Gutiérrez, J. (2012). Application of geographically weighted regression to the direct forecasting of transit ridership at station-level. Applied Geography, 34, 548–558. https://doi.org/10.1016/j.apgeog.2012.01.005.

Chatman, D. G., Tulach, N. K., & Kim, K. (2012). Evaluating the economic impacts of light rail by measuring home appreciation: A first look at New Jersey’s River Line. Urban studies, 49(3), 467–487.

Crump, J., Newman, K., Belsky, E. S., Ashton, P., Kaplan, D. H., Hammel, D. J., et al. (2008). Cities destroyed (again) for cash: Forum on the US foreclosure crisis. Urban Geography, 29(8), 745–784.

Dodson, J., & Sipe, N. (2008). Planned household risk: Mortgage and oil vulnerability in Australian cities. Australian Planner, 45(1), 38–47.

Dong, H. (2015). Were home prices in new urbanist neighborhoods more resilient in the recent housing downturn? Journal of Planning Education and Research, 35(1), 5–18.

Dong, H., & Hansz, J. A. (2016). The Geography of the Recent Housing Crisis: The Role of Urban Form. Housing Policy Debate, 26(1), 150–171.

Dziauddin, M. F., Powe, N., & Alvanides, S. (2015). Estimating the effects of light rail transit (LRT) system on residential property values using geographically weighted regression (GWR). Applied Spatial Analysis and Policy, 8(1), 1–25.

Ewing, R. (1997). Is Los Angeles-style sprawl desirable? Journal of the American planning association, 63(1), 107–126.

Farber, S., & Páez, A. (2007). A systematic investigation of cross-validation in GWR model estimation: Empirical analysis and Monte Carlo simulations. Journal of Geographical Systems, 9(4), 371–396.

Fotheringham, A. S., Brunsdon, C., & Charlton, M. (2002). Geographically Weighted Regression: The Analysis of Spatially Varying Relationships. Wiley.

Fotheringham, S., Crespo, R., & Yao, J. (2015). Geographical and temporal weighted regression (GTWR). Geographical Analysis, 47(4), 431–452.

FRED Economic Data. (2018). Economic research.

Freeman, A. M. (1979). Hedonic prices, property values and measuring environmental benefits: A survey of the issues. The Scandinavian Journal of Economics, 81(2), 154–173. https://doi.org/10.2307/3439957.

Gibbons, S., & Machin, S. (2005). Valuing rail access using transport innovations. Journal of urban Economics, 57(1), 148–169.

Gollini, I., Lu, B., Charlton, M., Brunsdon, C., & Harris, P. (2013). GWmodel: An R package for exploring spatial heterogeneity using geographically weighted models. arXiv preprint. arXiv:1306.0413.

Hyra, D. S., Squires, G. D., Renner, R. N., & Kirk, D. S. (2013). Metropolitan segregation and the subprime lending crisis. Housing Policy Debate, 23(1), 177–198.

Immergluck, D. (2008). From the subprime to the exotic: Excessive mortgage market risk and foreclosures. Journal of the American Planning Association, 74(1), 59–76.

Immergluck, D. (2010). The accumulation of lender-owned homes during the US mortgage crisis: Examining metropolitan REO inventories. Housing Policy Debate, 20(4), 619–645.

Kilpatrick, J., Throupe, R., Carruthers, J., & Krause, A. (2007). The impact of transit corridors on residential property values. Journal of Real Estate Research, 29(3), 303–320.

Kim, J., & Cho, G.-H. (2016). Unending foreclosure crisis: Uneven housing tenure trajectories of post-REO properties. Applied Geography, 70, 49–58.

Lancaster, K. J. (1966). A new approach to consumer theory. Journal of Political Economy, 74(2), 132–157.

Leung, Y., Mei, C.-L., & Zhang, W.-X. (2000). Testing for spatial autocorrelation among the residuals of the geographically weighted regression. Environment and Planning A: Economy and Space, 32(5), 871–890. https://doi.org/10.1068/a32117.

Li, Y. (2011). Geography of opportunity and residential mortgage foreclosure: A spatial analysis of a U.S. housing market. Journal of Urban & Regional Analysis, 3(2), 195–213.

Li, Y., & Walter, R. (2013). Single-family housing market segmentation, post-foreclosure resale duration, and neighborhood attributes. Housing Policy Debate, 23(4), 643–665.

Mason, R. L., Gunst, R. F., & Hess, J. L. (1989). Statistical design and analysis of experiments: With applications to engineering and science. Wiley.

Morrow-Jones, H. A., Irwin, E. G., & Roe, B. (2004). Consumer preference for neotraditional neighborhood characteristics. Housing Policy Debate, 15(1), 171–202.

Mou, Y., He, Q., & Zhou, B. (2017). Detecting the spatially non-stationary relationships between housing price and its determinants in China: Guide for housing market sustainability. Sustainability, 9(10), 1826.

Mulley, C. (2014). Accessibility and residential land value uplift: Identifying spatial variations in the accessibility impacts of a bus transitway. Urban Studies, 51(8), 1707–1724. https://doi.org/10.1177/0042098013499082.

NaKajiMa, M. (2013). The diverse impacts of the great recession. Business Review Q, 2, 2013.

Neter, J., Wasserman, W., & Kutner, M. H. (1989). Applied linear regression models. Irwin.

Plaut, P. O., & Boarnet, M. G. (2003). New Urbanism and the value of neighborhood design. Journal of Architectural and Planning Research, 20(3), 254–265.

Reid, C. K. (2010). Shuttered subdivisions: REOs and the challenges of neighborhood stabilization in suburban cities. REO Vacant Properties: Strategies for Neighborhood Stabilization, The Federal Reserve Banks of Boston and Cleveland and the Federal Reserve Board.

Rosen, S. (1974). Hedonic prices and implicit markets: Product differentiation in pure competition. Journal of Political Economy, 82(1), 34–55.

Sharifi, A. (2016). A critical review of selected tools for assessing community resilience. Ecological Indicators, 69, 629–647. https://doi.org/10.1016/j.ecolind.2016.05.023.

Song, Y., & Knaap, G.-J. (2003). New urbanism and housing values: A disaggregate assessment. Journal of Urban Economics, 54(2), 218–238.

Song, Y., & Quercia, R. G. (2008). How are neighbourhood design features valued across different neighbourhood types? Journal of Housing and the Built Environment, 23(4), 297–316.

Stoyle, J., Pierro, D., & Zuppa, M. (2008). Engineering resilience solutions from earthquake engineering to extreme events 1997–2007: A decade of earthquake engineering and disaster reslience. U. a. Buffalo. https://ubir.buffalo.edu/xmlui/handle/10477/25298.

Tobler, W. R. (1970). A computer movie simulating urban growth in the Detroit region. Economic geography, 46(sup1), 234–240.

UNISDR. (2009). Disaster risk reduction in the United Nations. https://www.preventionweb.net/files/9866_DisasterRiskReductionintheUnitedNat.pdf.

Wang, C.-H., & Chen, N. (2017). A geographically weighted regression approach to investigating the spatially varied built-environment effects on community opportunity. Journal of Transport Geography, 62, 136–147. https://doi.org/10.1016/j.jtrangeo.2017.05.011.

Wheeler, D. C., & Páez, A. (2010). Geographically weighted regression. In M. Fischer & A. Getis (Eds.), Handbook of applied spatial analysis Berlin and. Heidelberg: Springer.

Wheeler, D. C., & Tiefelsdorf, M. (2005). Multicollinearity and correlation among local regression coefficients in geographically weighted regression. Journal of Geographical Systems, 7(2), 161–187. https://doi.org/10.1007/s10109-005-0155-6.

Xiao, Y., & Webster, C. (2017). Urban morphology and housing market. Springer.

Yu, D., Wei, Y. D., & Wu, C. (2007). Modeling spatial dimensions of housing prices in Milwaukee, WI. Environment and Planning B: Planning and Design, 34(6), 1085–1102.

Funding

This research was supported by the 2018 summer research grant awarded by the Gazarian Real Estate Center at California State University, Fresno.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Wang, CH., Chen, N. A geographically weighted regression approach to investigating local built-environment effects on home prices in the housing downturn, recovery, and subsequent increases. J Hous and the Built Environ 35, 1283–1302 (2020). https://doi.org/10.1007/s10901-020-09742-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10901-020-09742-8