Abstract

We study private equity in a dynamic general equilibrium model and ask two questions: (i) Why does the investment of venture funds respond more strongly to the business cycle than that of buyout funds? (ii) Why are venture fund returns higher than those of buyout? On (i), venture brings in new capital whereas buyout largely reorganizes existing capital; this can explain the stronger co-movement of venture with aggregate Tobin’s Q. On (ii), the cost of reorganized capital has been high compared to new capital. Our model embodies this logic and fits the data on investment and returns well. At the estimated parameters, the two PE sectors together contribute between 7 and 11% of observed growth relative to the extreme case where private equity is absent. Using an alternative plausible measure of PE excess returns in the literature, this contribution could be as low as 5.8–9.7%.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Private equity funds account for a growing share of real investment in the U.S. economy, with the amounts placed in these funds reaching more than 6% the size of private domestic investment on average since 2001.Footnote 1 We build a model of private equity investment consistent with its cyclical properties, and fit the model to the observed levels and returns.

We focus on the empirical regularity that investments in both venture capital (VC) and buyout funds rise relative to other forms of investment as a function of aggregate Tobin’s Q, but that venture responds more strongly. The left panel of Fig. 1 shows the relative “intakes” of VC and buyout funds along with fluctuations in Q from 1987 to 2016, and the scatterplot in the right panel shows the positive relation between the two.Footnote 2 The left panel of Fig. 2 shows the individual intakes and the closer link of venture with Q is apparent there as well.

Why is intake more Q-elastic for VC than for buyouts? Our model implies it is because buyout funds reorganize existing capital, which is costlier to acquire when Q rises, whereas VC does not face this impediment (and indeed ordinary investment faces it to an even greater extent than buyout). The right panel of Fig. 2 shows our second empirical regularity: payoffs to venture funds on average exceed those of buyout funds over the cycle.Footnote 3 In our model this occurs because both ventured and bought-out capital collect the same amount, Q, per unit when sold to the public, and it is thus only the difference in costs that drives the stronger response of VC intakes. Moreover, both types of private equity outperform the S&P 500, and both co-move with it, yet venture returns respond more strongly to returns on the S&P 500.

The key feature of the model is that the returns to venture and buyout are drawn from different distributions with the expected returns known before investment decisions are made. This implies that the investment choice for each type of fund is described by a simple cutoff rule: invest as long as the return is sufficiently high. The cutoffs vary over the business cycle, and the relative returns, as well as the cyclical variation in relative intakes of venture compared to buyout funds, are determined by the shapes of the distributions from which the returns are drawn. We show that, so long as the distribution of venture funds returns has a thinner tail than buyout returns, and the cutoffs are sufficiently close to each other, the model is consistent with the empirical regularities documented above. The model delivers premia over the S&P 500 return because private equity pays more when the cost of capital is high, but that’s also the time when aggregate investment is low and consumption is high. Higher returns to private equity thus tend to be realized when consumption is valued less at the margin. Earnings of the S&P 500 firms, on the other hand, depend primarily on TFP shocks, and there is no incentive to substitute toward consumption when TFP is high. Hence the premium for private equity.Footnote 4

Why do these distinctions between the two types of private equity matter for macroeconomics? Although monies placed in these two types of funds together amount to only 2–7% of the size of total domestic investment, with the average exceeding 6%, this ratio is growing rapidly. With VC intakes and returns more procyclical than those for buyout, it is clear that VC can amplify business fluctuations, and importantly at times when activity is expanding and less promising ideas are getting implemented. At the same time, venture has higher external benefits than buyout that may offset the change in the average quality of ideas: Gompers et al. (2005), for example, show that founders of venture capital-backed start-ups disproportionately come from prior positions at previously venture-backed companies. This is learning-by-investing and therefore the Arrow (1971) type of effect that Searle (1945) and Lucas (1993, Fig. 1) document, with such learning disproportionately associated with new ventures.

In particular, we embed VC and buyout funds in a traditional Ak model and show, analytically and numerically, that their addition contributes to growth while retaining all of the standard implications of the Ak model. A stylized parametric example shows that PE can account for as much as half of observed growth. This effect falls to 7% of observed growth in numerical estimations with less extreme distributional assumptions about the quality of new projects and under Epstein–Zin preferences. Under CRRA preferences the effect is 11% of observed growth. Using another plausible measure of PE excess returns in the literature, these contributions could be as low as 5.8–9.7%. In all cases the effect of venture on growth is larger than that of buyout, and the overall growth effects could be even larger if PE were embedded in a heterogeneous-idea model of the Lucas and Moll (2014) or Perla and Tonetti (2014) types.

We then ask if the Ak structure of our model, with its constant returns to factors, may overstate the growth effect of PE funds if in reality returns to factors diminish. In that case PE raises not long-run growth but the steady-state level of GDP. We indeed find the effect to be three or four times smaller than in the Ak version. That said, we believe that the Ak framework should apply to PE generally and especially to the venture capital sector, which deals with projects close to the technological frontier. Since technologies build on one another, they probably do not face the diminishing returns that ordinary capital faces.

Opp (2019) also models the implementation of heterogeneous ideas by VC funds, and in his model as in ours VC activity is procyclical, with funding standards declining during booms in the sense that the average quality of implemented ideas is countercyclical. He analyzes venture only, whereas we also analyze buyouts. As a result, we can study the movements in the relative intakes (Fig. 1) as well as the relative performance of venture and buyout funds (Fig. 2). To the best of our knowledge, our paper is the first to endogenize both types of investments or “intakes” in a dynamic general equilibrium model. In addition, Opp (2019) quantifies VC funds’ impact on aggregate growth and welfare while we study contributions to growth from both types of PE funds.

A complementary explanation for the premium in private equity returns is illiquidity, where there is an effective lock-up period of as long as 10–12 years. Sorensen et al. (2014) model the effects of these lock ups and find an annual premium of slightly more than 1%, which we subtract from the returns that we target when estimating the model. Ang et al. (2014) also find the premium to be about 1%. Amihud and Mendelson (1986) argue that the low liquidity premia are the result of a selection effect whereby investors who can tolerate risk more easily are drawn into private equity—a preferred habitat view.

Our discussion of private equity is confined to PE funds. A broader measure of private equity includes occupation-specific investments in physical and human capital such as those made by self-employed people. Hamilton (2000) and Moskowitz and Vissing-Jørgensen (2002) find the risk-adjusted return to self employment insufficient to compensate for foregone wage earnings, and that perhaps non-pecuniary benefits play a major role. Such benefits are presumably not present when investing in PE funds. Vereshchagina and Hopenhayn (2009) point out, however, that the option of liquidating a private equity investment after realizing a low return can also lower its equilibrium return.

Earlier work finds that the mode of business investment varies across firms and over the cycle; in particular, young firms contribute a larger fraction of investment when stock prices are high. Gompers et al. (2008) find that VC investment is positively related to Q. Jovanovic and Rousseau (2014) show that a rise in aggregate Tobin’s Q leads incumbents to reduce investment, thereby creating opportunities for investments by new firms.

The paper is organized as follows. Section 2 introduces our model. Section 3 characterizes the equilibrium and provides analytical examples. Section 4 discusses the plausibility of the model by first providing some empirical evidence, and then provides estimates from baseline calibrations of the model. Section 5 examines robustness of our findings to alternate modeling assumptions. Section 6 concludes. All data sources, estimation methods, and derivations are in the “Appendix”.

2 Model

We begin with a model of the real side of the economy in Sect. 2.1, and then add a private equity sector in Sect. 2.2.

2.1 An Ak structure

Output, y, is produced with physical capital, k as

where z is a shock. Output is consumed, C, or invested in k in amount X at the unit cost of q. The income identity reads

The law of motion for k is

where a prime, “\(^{\prime }\)”, denotes a variable’s next-period value, and \(\delta \ \) is the rate of depreciation.

Households. Households are homogeneous with preferences \( E_{0}\left\{ \sum _{t=0}^{\infty }\beta ^{t}U\left( C_{t}\right) \right\} \), with \(U\left( C\right) =\frac{C^{1-\gamma }}{1-\gamma }.\) They own the firms, which pay out profits as dividends back to households.

Firms. Firms own k, and optimal investment in k requires that the cost of a unit of physical capital, q, equals the present marginal value of expected dividends (discounted at the household’s stochastic discount factor) of that unit. Expressed recursively, the condition reads

where \(y^{\prime }\) is next period’s output and where the two aggregate shocks, \(\left( z,q\right) \equiv s\), follow first-order Markov processes with the CDF of \(s^{\prime }\) given by \(F\left( s^{\prime },s\right) \). The value q is the price of a unit of k, and the gross return on equity is \( R_{\text{E}}=\frac{1}{q}\left( z^{\prime }+\left( 1-\delta \right) q^{\prime }\right) \).

2.2 Private equity and the implementation of ideas

The arrival process for new ideas. Households get new ideas, and their number is proportional to the capital stock k. The number of ideas implementable by VC funds is \(\lambda k\), and the number implementable by buyout funds is \(\theta k\). Not all the ideas are implemented. The presence of \(\lambda \) and \(\theta \) is external to the households’ and firms’ decisions.

Formally, the production function (1) remains the same, but in (3), X is broadened as follows:

where \(X_{c}\) represents investment in continuing projects, \(X_{v}\) is venture-backed investment in new projects, \(X_{b}\) is investment mediated by buyout funds, and \(n_{b}\) is the intake of buyout funds, which is formally defined in Sect. 2.2.2. The term \(n_{\text{b}}k\) is subtracted to avoid double counting the capital from firms purchased by the buyout funds.

In other words, all three methods create the same commodity—physical capital, but their production functions differ. We now describe each in turn:

-

(i)

Continuing projects. \(X_{\text{c}}\) is created via existing projects and its total cost is \(qX_{\text{c}}\) in units of consumption.

-

(ii)

VC-backed projects. \(X_{\text{v}}\) denotes efficiency units of k created by implementing new projects. A project uses as inputs a unit of the consumption good and an idea. As output it delivers \( \varepsilon \) units of capital ready for use in the next period. The quality of the project, \(\varepsilon \), is known at the start. New projects are born each period, and their quality is distributed with a CDF \(G^{\text{v}}\left( \varepsilon \right) \). Ideas arrive at the rate \(\lambda \) so that the unnormalized distribution of new ideas is \(\lambda G^{\text{v}}\left( \varepsilon \right) \).

-

(iii)

Upgraded projects. \(X_{\text{b}}\) denotes efficiency units of k created by buyout funds; \(\theta k\) units of existing physical capital k can be upgraded at a cost \(\tau \) per unit. When upgraded, its efficiency changes from unity to \(\varepsilon \). Idea qualities for upgrading are described by \(\varepsilon \)’s drawn from the CDF \(G^{\text{b}}\). The unnormalized distribution of new ideas is \(\theta G^{ \text{b}}\left( \varepsilon \right) \). As with the venture funds, \( \varepsilon \) is known before the fact.

Contracting between agents and PE funds. Funds raise new subscriptions each year and close the following period. Each vintage of investors thus receives a return on their investments alone—there is no mixing of dividends among investments of different vintages. Costs predate returns by a period.Footnote 5 We assume that the PE fund owners get all the rents from the projects in which they invest.Footnote 6 It takes one period for the projects to mature. PE funds sell the capital to incumbents at the start of the following period. Capital created though new projects is sold by venture funds to incumbent firms or floated by IPO also at the start of the following period. Similarly, capital created through buyout activity results in an effectively larger capital stock in the hands of existing firms.

2.2.1 Venture funds

Let \(\varepsilon _{\text{v}}\) be the minimum project quality accepted by a VC fund.

The intake of VC funds. Each implemented idea costs one unit of consumption, and the total VC fund investment then is the same as the number of projects

VC fund payout. Since capital is delivered in time for next-period production, next period fund dividends and their closing revenues are

where

The VC fund’s project-portfolio decision. A VC fund chooses \(\varepsilon _{\text{v}}\) to maximize the expected utility of its investors:

Since \(\int \left( \frac{C}{C^{\prime }}\right) ^{\gamma }D_{\text{v}}{\textit{dF}}=x_{ \text{v}}\int \left( \frac{C}{C^{\prime }}\right) ^{\gamma }\left( z^{\prime }+\left( 1-\delta \right) q^{\prime }\right) {\textit{dF}}=\frac{q}{\beta }\lambda \int _{\varepsilon _{\text{v}}}^{\infty }\varepsilon dG^{\text{v}}\), the problem in (9) reduces to

where \(n_{\text{v}}\) is given in (6). The first-order condition states that

2.2.2 Buyout funds

Let \(\varepsilon _{\text{b}}\) be the minimum project quality accepted by a buyout fund.

The intake of Buyout funds. Each implemented idea costs \( \tau \) units of consumption and one unit of physical capital the price of which is q. The total buyout fund investment then is

Buyout fund payout. Next period dividends are the closing revenue

where

Buyout fund’s project-portfolio decision. The fund chooses \(\varepsilon _{\text{b}}\) to maximize the expected utility of its investors,

and using the same logic as that behind the proof of (11), we get the buyout fund’s decision problem

with its optimal cutoff rule

To summarize: Firms live forever and are publicly owned with share prices q in (4). Funds live for one period and are not publicly tradable. The timing from one period to the next is as follows:

-

(i)

\(s\equiv \left( z,q\right) \) and the profile of \( \varepsilon \)’s are realized at the start of the period;

-

(ii)

Incumbent firms purchase capital created in the previous period by PE funds—the capital is productive this period and incumbent firms buy it at zero profits, paying \(z+\left( 1-\delta \right) q\) per unit;

-

(iii)

Production and ideas implementation occur, determining \( \varepsilon _{\text{v}},\varepsilon _{\text{b}}\), \(x_{\text{c}}\) and \( k^{\prime }\);

-

(iv)

The equity market opens; firms invest, converting goods into \(k^{\prime }\);

-

(v)

firms and PE funds distribute their profits to households and consumption takes place.

2.2.3 Differences between the two funds

In the model, venture funds create new physical capital whereas buyout funds transform and upgrade existing physical capital units into new ones subject to an implementation cost \(\tau \). One can interpret a VC fund in our model as an investment vehicle that provides equity financing to startups and growth firms in their early stage. In our sample for empirical analysis, the majority of VC funds (1070 out of 1680 funds) are in the early stage and earn large and positive net-of-fee returns; this is consistent with Korteweg and Nagel (2016), who document that VC start-up investments earn large positive abnormal net returns whereas those in the later stage earn net returns closer to zero.Footnote 7

On the other hand, buyout funds can be interpreted as investment vehicles that acquire existing firms. As a result, the implementation cost \( \tau \) could include any transaction fees charged when a buyout fund buys or sells a company, similar to the M&A fees charged by banks. Metrick and Yasuda (2010) argue that transaction fees are common features for buyout funds but are rare for VC funds.Footnote 8 A buyout fund therefore does not pay \(\tau \) to its capital providers; rather, \(\tau \) is a real cost that may in fact compensate fund managers (i.e., the general partners) for the due diligence they perform with takeover deals. That is why the cutoff quality \(\varepsilon _{ \text{b}}\) depends positively on \(\tau \).

3 Equilibrium and its properties

We write variables relative to k. The law of motion for k in (3) changes to

where \(i=X/k\) so that corresponding to (5),

Second, in the absence of PE the income identity would read

The two PE funds, however, generate k at a cost lower than q and the difference is reflected in their profits \(\pi _{\text{v}}+\pi _{\text{b}}\) that are added to the LHS of (19) along with \(\frac{q}{\tau +q}n_{ \text{b}}\) of the buyout funds’ costs, which are transfer payment costs not reflected in \(\pi _{\text{b}}\). Thus the income identity becomes

With k dropping out of the equations, the state of the economy is \( s=\left( z,q\right) \). Using \(\Gamma \left( s\right) \) (defined in 17)), we substitute into (4) to get

The functions \(\left( \varepsilon _{i},n_{i},\pi _{i}\right) \) are defined in terms of primitives. The remaining unknowns are \(c\left( s\right) \), \(x_{ \text{c}}\left( s\right) \), and \(\Gamma \left( s\right) \); these three functions solve Eqs. (20), (17) and (21) for all s.

Existence and characterization. Let the constant L solve

“Appendix B1” shows that if

a unique solution for L in Eq. (22) exists. Then “Appendix B1” also proves

Proposition 1

If Eq. (23) holds, the equilibrium c and i are

and

We use both c and i from Eqs. (24) and (25) to estimate parameters of the model, and when we generalize the model in Sect. 5.1 to include Epstein–Zin preferences, Eqs. (24) and (25) will continue to hold with only the constant L differing.

3.1 Private equity and growth

According to (54), y grows at the same rate as k in the long run. From (17), the growth rate of k is

We first consider an analytical example when project qualities are distributed as Pareto.

Example: Pareto \(G^{\text{v}}\) and \(G^{\text{b}}\). For \( i\in \left\{ v,b\right\} \), let \(\rho _{i}>1\). And for \(\varepsilon \ge \varepsilon _{\text{i, }0}\), let

“Appendix B3” then proves the following result in the deterministic case where z and q are fixed:

Proposition 2

If households have log preferences so that \(\gamma =1\) and if \(G^{\text{v}}\) and \(G^{\text{b}}\) follow the Pareto distribution in Eq. (26), with lower bounds satisfying \(\varepsilon _{\text{v, }0}<\frac{1}{q}\) and \( \varepsilon _{\text{b, }0}<\frac{\tau +q}{q}\), then the growth rate is

where

Growth is increasing in z and in the thickness of each tail,

and decreasing in q and in the implementation cost of buyout funds \(\tau \),

The solution in (27) is of the same general character as other Ak models of growth, increasing in z and decreasing in q. What we add is a role for PE. When q is high, so also are the costs of reorganizing capital through buyouts relative to VC, and while both forms of PE rise to offset the general decline in investment partially, VC rises more.Footnote 9 These points are clearer in the linear approximation. “Appendix B4” further shows the following:

Corollary 1

A first-order Taylor approximation around \(\left( \lambda ,\theta \right) =\left( 0,0\right) \) yields the following expression for the growth rate,

where

are the PE-adjusted TFP term and the PE-adjusted discount rates, and where

are proportional to the arrival rate \(\lambda \) and \(\theta \). Moreover, \( {\tilde{A}}\) increases with z and decreases with q, and the opposite is true of a.

The growth rate depends on the TFP term z and the cost q of physical capital as in all Ak models, but also depends on the value added from the two PE sectors in our model. Value added by buyout is linear in \(\rho _{ \text{b}}/\left( \rho _{\text{b}}-1\right) \), which is the mean of \( \varepsilon _{\text{b}}\). The value added from the two PE funds becomes zero in the limit case where \(\lambda \) and \(\theta \) are zero so that there are no implementable ideas in the PE sectors, or when the distribution of \( \varepsilon \) converges to a degenerate distribution, as discussed next.

Limiting case. As \(\lambda \rightarrow 0\) and \(\theta \rightarrow 0\), the supply of PE projects disappears. And as \(\rho _{b}\rightarrow \infty \) and \(\rho _{v}\rightarrow \infty \), the two Pareto distributions collapse to a degenerate distribution at \(\varepsilon _{0, \text{v}}\) and \(\varepsilon _{0,\text{b}}\). In these limiting cases PE plays no role in the model and

which is the same as Eq. (2) of Rebelo (1991) with his CRRA parameter \( \sigma =1\) and the share of capital set to unity.

Parametric example. We now provide a simple quantitative illustration of the impact from the PE sectors to growth in the model using (27) and the Pareto assumptions above. This is meant as a benchmark—we later refine the model to consider alternative and more realistic distributions for \(G^{\text{v}}\) and \(G^{\text{b}}\). For now, we target the moments listed in Table 3 reported in Sect. 4 using the Pareto with \(\rho _{b}=\rho _{v}=1.6\), which Jovanovic and Szentes (2013) used in their simulations.Footnote 10 The estimated growth rate from Eq. (29) is 2.66% per annum, and is reduced to 2.36 and 2.24% when we shut down buyout funds (\(\theta =0\)) and venture funds (\(\lambda =0\)), respectively. When there are no PE funds at all \(\left( \lambda =\theta =0\right) \), the annual growth rate is reduced to 2.17%. In this parametric example, the PE sectors contribute to nearly 20% of total growth and the effect of venture is larger than that of buyout. Figure 7 in “Appendix C” further shows that the marginal impact of PE funds on growth flattens out as \(\rho _{v}\) and \(\rho _{b}\) increase, which indicates that the PE sector has a larger impact on the real side of the economy when the distributions of its projects’ qualities are more dispersed.

While these relatively large growth effects and the contrast between VC and buyout rely on log utility and Pareto distributions, they represent closed-form analytical solutions for how much PE may affect the economy. We relax these assumptions in Sect. 4, and further connect the model to the macro data and evaluate its empirical plausibility. We derive the model’s implications for asset prices next.

3.2 Asset returns

We first derive the general expressions for returns, and then provide three examples.

Return on equity. By (54) we have \(y^{\prime }/k^{\prime }=z^{\prime }\) and therefore the gross return on equity is

which depends on both \(z^{\prime }\) and \(q^{\prime }\).

Gross return of VC and Buyout funds. Realized returns are

With the return on equity, \(R_{\text{E}}\), defined in (31) and the project-selection rules \(\varepsilon _{\text{v}}\) and \(\varepsilon _{\text{b} }\) defined in (11) and (16), returns relative to \(R_{ \text{E}}\) are

Cyclical implications. The model has the following cyclical implications for the ratios in (33). The means of the \( \varepsilon \)’s and their truncation points are scaled by their costs which are unity for venture and \(\tau +q\) for buyout. Three examples now follow—the derivations are in “Appendix B2”.

Example 1

Exponential \(G^{\text{v}}\) and \(G^{\text{b}}\). For \(\varepsilon \ge 0\), let \(G^{\text{i}}\left( \varepsilon \right) =1-\exp \left( -\lambda _{\text{i}}\varepsilon \right) \) for \(i\in \left\{ v,b\right\} \). Then

so that

Example 2

Pareto \(G^{\text{v}}\) and \(G^{\text{b} } \). We consider again the Pareto example in Eq. (26). Then

As a result, the distribution with the thicker tail yields the higher returns:

It’s worth noting that under Pareto distribution, the return ratios no longer depend on q.

Example 3

Normal \(G^{\text{v}}\) and \(G^{\text{b} }\). Let \(\varepsilon _{\text{v}}\sim N\left( \mu _{\text{v}},\sigma _{ \text{v}}^{2}\right) \) and \(\varepsilon _{\text{b}}\sim N\left( \mu _{\text{b }},\sigma _{\text{b}}^{2}\right) \). Then for the generic normal distribution \(N\left( \mu ,\sigma ^{2}\right) \), the inverse Mills ratio is expressed as

where \(\phi \) and \(\Phi \) are PDF and CDF of the standard normal distribution \(N\left( 0,1\right) \), respectively. In our model the truncation points are \(\varepsilon _{\text{v, min}}=1/q\) and \(\varepsilon _{ \text{b, min}}=\left( \tau +q\right) /q\), and the ratio of returns is proportional to the ratio of inverse Mills ratios

Choice of \(G^{\text{v}}\) and \(G^{\text{b}}\). While the Pareto case provides closed-form expressions for returns, (38) implies that higher returns are associated with thicker-tailed distributions. Yet we will show in Sect. 4.3 that the actual cross-sections of buyout and VC returns reveal the opposite: a lower average return for buyout coexists with a thicker cross-sectional tail. On the other hand, when \(G^{\text{v}}\) and \(G^{\text{b}}\) follow normal or exponential distributions, (39) and (36) show that even if VC has a thinner tail (smaller \(\sigma \)) than buyout, VC could still have a higher mean return \(E\left[ R_{\text{v}}\right] >E\left[ R_{\text{b}}\ \right] \) for sufficiently large q and implementation cost \(\tau +q\). We find that this inequality indeed holds at the estimated parameter values reported in Sect. 4.

In the Pareto case, (37) implies that the relative returns \( R_{v}/R_{b}\) are driven entirely by choices of distributional parameters and thus do not depend on q or aggregate risk, but there is less support for this empirically as we will show in the next section. This, however, is true for the Pareto case only. For these reasons, we assume \(G^{\text{v}}\) and \(G^{\text{b}}\) follow normal distributions in the estimation that follows.

4 Empirics and model estimation

Figures 1 and 2 in the introduction provide some preliminary and distinct features of buyout and venture funds. We begin this section by describing the empirical evidence in more detail and follow with estimation of the model to verify its ability to fit the aggregate time series of private equity investment and returns, as well as some key macro moments. See “Appendix A” for details of the data sources and estimation methods.

4.1 Empirical evidence

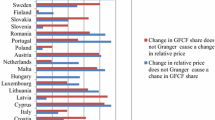

We begin with regression tests of our model’s predictions. We first verify the implications for observed intakes and returns to private equity. Table 1 reports the results of time-series regressions of the logs of venture and buyout intakes, as well as their log ratio, with respect to aggregate Tobin’s \(Q_{t-1}\). The table shows that both log intakes are positively related at the 1% level to aggregate \(Q_{t-1}\) (i.e., measured at the start of the period), but that venture intakes are more responsive to \( Q_{t-1}\). The regressions in the right-most panel show that the log ratio of the intakes is also positively related to \(Q_{t-1}\) at the 1% level when we include a linear time trend and at the 5% level without a trend. These results offer empirical evidence that venture activities co-move more strongly with the business cycle and therefore should pay higher premia than buyout.

Table 2 reports time-series regressions for the returns to the two funds and their ratio on aggregate Q and the productivity shock \(z_{t}\). Returns to both venture and buyout funds are related negatively to start-of-period \( Q_{t-1}\) and positively to end-of-period \(Q_{t}\) as the model predicts, and typically at the 5% level or less, and returns to venture are more Q-elastic than buyout returns. Consistent with the model in showing no significant relation between the ratio \(R_{\text{v}}/R_{\text{b}}\) and \( Q_{t-1}\), the regression in the right-most panel indicates that the relation with end-of-period \(Q_{t}\) is positive but is imprecisely estimated.

Comparing to the findings in the literature, Kaplan and Strömberg (2009) measure returns over the previous year and find in their Table 3 that they relate positively to current period commitments. Our model also predicts this: commitments rise in q and so do returns over the previous period—see Eq. (37). Gompers et al. (2005) also find that an increase in initial public offering (IPO) valuations leads venture capital firms to raise more funds, an effect that is particularly strong among younger venture firms (Kaplan & Schoar, 2005).

To provide further evidence for our model’s implications on returns in Sect. 3.2, Fig. 3 plots, in the left and right panels respectively, the ratios of VC and buyout returns to those of the S&P 500 against q. The figure shows that, consistent with model’s prediction, both \(\frac{R_{\text{v}}}{R_{\text{E}}}\) and \(\frac{R_{\text{b}}}{R_{\text{E}}}\) are rising in q, whether we include the extremely high \(R_{v}\) observation from 2000 or not, and are statistically significant at 10% level or less. The correlations with q are 0.42 and 0.32 for \(\frac{R_{\text{v}}}{ R_{\text{E}}}\) and \(\frac{R_{\text{b}}}{R_{\text{E}}}\), respectively.

4.2 Model estimation

In this section we estimate the model and evaluate its performance with respect to the available time series for private equity returns, intakes and other variables of interest. To do this, we assign values to \(\beta \), \( \gamma \), and \(\delta \) and then choose \(\lambda \), \(\theta \), \(\tau \), and the parameters of \(G_{\text{b}}\) and \(G_{\text{v}}\) jointly to target the means of c, \(n_{\text{v}}/i\), \(n_{\text{b}}/i\), \(R_{VC}\), \(R_{B}\), and \( R_{ \text{S} \& \text{P}}\), using the S&P 500 return as our observed measure of the return on equity in (31). As Kaplan and Schoar (2005, p. 1792) point out, if high-quality general partners (GPs) are scarce, differences in returns between funds could persist, and a buyout fund’s GPs may require better proprietary deal flow to succeed, thus allowing better GPs to invest in better deals. In this case the reward to GP skill could include a higher probability of obtaining a follow-on fund. This effect is not included in the model but one could plausibly think of \(\tau \), which is a real cost parameter paid in terms of foregone consumption of the representative agent, as payment to a buyout GP.

For q, we use fourth quarter observations underlying Hall (2001) for 1987–1999, and then join them with estimates underlying Abel and Eberly (2011) for post-1999 periods. Details on the construction of the series are in “Appendix A”. The National Income and Product Accounts provide us with z, the ratio of output to physical capital. Gross domestic product is defined as \(y=zk\).

Table 3 reports the values we assign for parameters \(\beta \), \(\gamma \), and \(\delta \), along with those we estimate. We assume the \(\varepsilon \)’s are normal: \(\varepsilon _{\text{v}}\sim N\left( \mu _{\text{v}},\sigma _{\text{v }}^{2}\right) \) and \(\varepsilon _{\text{b}}\sim N\left( \mu _{\text{b} },\sigma _{\text{b}}^{2}\right) \). We set the model to an annual frequency with \(\beta =0.95\) and a 1% rate of capital depreciation.Footnote 11 Table 3 shows that all estimated parameters are statistically significant at the 5% level or less based upon 95% confidence intervals computed using GMM. The estimated distribution of \(\varepsilon \) for buyout has a larger mean (\(\mu _{b}>\mu _{v}\)) and a thicker tail than VC (\(\sigma _{b}>\sigma _{v}\)).

Table 4 reports the means of the series of interest as estimated and in the data for 1987–2016. The table incorporates two adjustments to the data:

Adjustment for early versus late-stage. For PE returns, Korteweg and Nagel (2016) document that VC start-up investments earn large positive abnormal returns whereas those in later stages earn excess returns near zero, net of fees. To address this, we adjust VC returns as follows

where \(\omega _{VC}=\frac{\#\text{ VC funds in early stage}}{\#\text{ Total VC funds}}\) and \({\tilde{R}}_{VC}\) is the combined VC return (i.e., without adjusting for early versus later stage funds).Footnote 12 In our sample, 1070 out of 1680 VC funds are early stage, indicating that \(\omega _{\text{VC}}=65\%\). We also note that the average combined VC return, \({\tilde{R}}_{VC}\), in our sample is 18.1%, which is in line with the estimates in Table IA.II of Harris et al. (2014).

Adjustment for capital share. PE funds incur direct expenses in setting up the fund and its infrastructure, and in managing the fund. These include the fees of attorneys, consultants, custodians, administrators, accountants, litigation expenses, and others. More importantly, much of the proceeds placed with PE funds are used to compensate labor in projects that are undertaken and thus do not end up being used for capital investments. To correct for this, we multiply the observed intake values by one-third, the standard capital share in the literature, to approximate the amounts going directly to capital investments.

Adjustment for the liquidity premium. We further subtract 1.05% from buyout and venture returns, which is the liquidity premium reported by Sorensen et al. (2014) for these types of funds. This value was also subtracted from the series shown in the top two panels in Fig. 4. The 1.05 premium is similar to the value of 0.9% reported by Ang et al. (2014). One concern is that buyout funds are highly levered whereas our model doesn’t feature any leverage. The Modigliani–Miller theorem, however, states that leverage should not affect returns because investors can undo the financial positions of the firms that they invest in. This holds because our model has no private information or other frictions that would affect this reasoning.

The column labelled “\(\hbox {Model}^{\text{D}}\)” shows the model’s prediction for asset returns with z and q held constant at their sample averages (i.e., the opposite of a mean-preserving spread). In this case, the predicted S&P return falls by 4.7%, becoming a risk-free rate, the VC return drops by 6%, and the buyout return falls by 5.6%. This occurs because, as Eqs. (31)–(34) show, each return is convex in q and as a result of Jensen’s inequality. The returns are all linear in \(z^{\prime }\) and \(q^{\prime }\) and mean preserving spreads in \(z^{\prime }\) and \(q^{\prime }\) do not matter.

Table 4 shows that the model matches most of the means in the data well, and matches the second moments of asset returns and average investment i reasonably well. The model predicts larger average returns for VC than for buyout because the estimated average q-adjusted Mills ratio for VC, \(E\left[\text{MR}_{v}\left( \tau +q\right) \right] \), is larger than for buyout E[ \(\hbox {MR}_{b}]\), as was discussed in example 3 in Sect. 3.2. The model, however, overestimates the average growth rate in order to match average stock returns based on (31). Using the estimated parameters, the PE sectors together contribute to 11% of growth. Table 8 in Sect. 5.3 below shows that the model can match the average growth rate g with capital depreciation \(\delta \) set to 4% per annum but at a cost of slightly lower fitted average stock returns. In addition, the model overpredicts the volatility for buyout whereas the estimated venture return is less volatile than the data.

The last non-targeted moment in Table 4 relates to Kortum and Lerner’s (2000) findings that, from 1983 to 1992, the ratio of venture intake to R&D spending averaged less than 3% and venture generated 8% of industrial innovations. Assuming that the return to R&D would be the same as to ordinary investment, our model indicates that the ratio of the average to marginal product of VC, \(\varepsilon _{v}\), was \(8/3\approx 2.67\). Our model would interpret this via Eqs. (11) and (33) as implying

Our data on average show that \(q=1.83,\) and \( \frac{R_{\text{VC}}}{R_{\text{S} \& \text{P}}}=1.32\), and their product is 2.416, which as shown in the last row of Table 4, is a slight underestimate.

Figure 4 shows the intakes of venture and buyout funds as percentages of gross private domestic investment in the data and in the model.Footnote 13 The upper panel of Fig. 4 shows that the model fits the cyclical properties of the intake for venture investment well, with a correlation of 0.68 between model and data. The series in the lower panel have a correlation of 0.75, and indicate the model can reproduce the spike in buyout funds that occurred in the year 2000, albeit overly so.

Role of Spikes in 2000. It is worth noting that the high correlation between the model estimates and the data is not driven by observations from the year 2000: when we exclude 2000 from the sample, the upper and lower panels of Fig. 4 continue to exhibit high correlations of 0.73 and 0.69 respectively.

Figure 5 shows the fit between the model and data with respect to returns. The model once again fits venture well with a correlation of 0.65 (upper panel) when we include the spike in 2000 and 0.64 without the spike, and fits the returns to buyout funds even more closely with a correlation of model and data of 0.73 (center panel). The lower panel shows the fit to the S&P 500 return, where the correlation of the model with the data is 0.90.

Returns to buyout, venture, and the S&P 500 in the model and the data, 1987–2016. Aggregate returns to U.S. PE funds are from Cambridge Associates (2016a)

In sum, our model is able to match the dynamics of returns to buyout, venture and stock well using data on the macro series \(\left( z,q\right) \).

4.3 Evidence from returns distributions

One of the key distinctions between venture and buyout funds in the model is the difference in the distributions \(G^{\text{v}}\left( \varepsilon \right) \) and \(G^{\text{b}}\left( \varepsilon \right) \). In fact, under the Pareto case (Example 2 in Sect. 3.2), we show that the relative returns are driven only by the parameters of the distributions, \(\rho _{v}\) and \(\rho _{b}\). In general, the model requires buyout \(\varepsilon _{\text{b}}\) to have a thicker tail than venture \(\varepsilon _{\text{v}}\) to match the mean returns in the data. Does this hold empirically? To answer this question, given that systematic data on the individual projects of venture and buyout funds are generally unavailable, we construct an empirical counterpart of \(G^{\text{v}}\left( \varepsilon \right) \) and \(G^{\text{b}}\left( \varepsilon \right) \) using actual IPOs and acquisitions from the Securities Data Company (SDC) Platinum and CRSP/Compustat Merged (CCM) databases.

We define a firm’s value by that of its common stock and trim the top and bottom 2.5% of firm-year observations to avoid extreme values that may reflect data errors.Footnote 14 We examined various other definitions of firm value such as total assets (common stock plus cash, debt, and preferred stock), but chose to work with the value of common stock to obtain the largest possible number of venture and buyout observations, although results using total assets are very similar. The final sample contains 8209 venture and 665 buyout observations spanning the period from 1986 to 2017. “Appendix A” provides detailed descriptions of data and sources.

When a firm has an IPO or is taken over, its \(\varepsilon _{\text{v}}\) or \( \varepsilon _{\text{b}}\) is computed as follows:

where both the IPO value and “Combined Value” are defined as the number of common shares outstanding at year end multiplied by the annual closing price. Following the model, we further truncate the distribution of \(\varepsilon _{\text{v}}\) and \(\varepsilon _{\text{b}}\) by cutoffs 1/q and \(1+\tau /q\).

Figure 6 shows the estimated conditional probability densities of \( \varepsilon \) for venture (blue dashed line in the upper panel) and buyout (red dashed line in the lower panel), using the parameters reported in Table 3, against their corresponding empirical distributions from the SDC database. The data are pooled over years and more observations tend to come from years when q was high. The model implies that in year t, \(\varepsilon _{v}\) would be included only if \(\varepsilon _{\text{v} }>1/q_{t} \), and \({\varepsilon }_{\text{b}}\) would be included only if \( \varepsilon _{\text{b}}>\left( \tau +q_{t}\right) /q_{t}\). The predicted number of IPOs in year \(t_{0}\) is therefore \(\left( 1-G^{\text{v}}\left( \frac{1}{q_{\text{0}}}\right) \right) /\sum _{t=1}^{T}\left( 1-G^{\text{v} }\left( \frac{1}{q_{t}}\right) \right) \), and similarly for the number of buyouts. Thus the predicted distributions are calculated as

where \(g^{\text{i}}\) is the PDF of \(N\left( \mu _{i},\sigma _{i}\right) \) with the values \(\mu _{i}\) and \(\sigma _{i}\) reported in Table 3 for \(i=\) v, b, and \(G^{\text{v}}\) and \(G^{\text{b}}\) are the associated CDFs. \(I\left( \cdot \right) \) is an indicator function.Footnote 15

Figure 6 shows that, consistent with model’s implication, the distribution of project qualities for buyout indeed has a thicker tail than that for venture. This is consistent with Fig. F.3 of Gupta and Van Nieuwerburgh (2019), which shows the profit distribution of buyout has a thicker tail than venture. Other evidence on fat tails in PE returns include Scherer (2000) and Silverberg and Verspagen (2007).

Before we conclude this section, it’s worth noting that we generate the estimated distributions by fitting the same moments used in Table 4 rather than by fitting the targeted empirical distributions directly. Therefore, Fig. 6 can be considered as further empirical validation of the model.Footnote 16

5 Additional robustness checks

In this section, we consider alternative estimations of model and different calibration targets as robustness checks on our results.

5.1 Extension to recursive preferences

In the model, households are assumed to have power utility over consumption C. Even though this simplifies the analysis and allows for closed-form solutions of PE returns under certain distributional assumptions, it also leads to excessive volatility of the implied risk-free rate and an implausibly low equity risk premia as analyzed by Mehra and Prescott (1985). To address these issues, we now relax the power utility assumption using Epstein and Zin (1989) preferences, which separate parameters of risk aversion and the elasticity of intertemporal substitution.

More specifically, we extend the model to allow for EZ recursive preferences

where \(\psi \) is the inverse of the elasticity of intertemporal substitution (EIS) and \(\gamma \) is the curvature parameter. Our baseline power utility is a special case with \(\psi =\gamma \). The stochastic discount factor \( m_{t+1}\) is

For firms, optimal investment in k requires that the cost of a unit of physical capital, q, equals the present marginal value of expected dividends (discounted at the household’s stochastic discount factor) of that unit. The condition now reads

The following proposition, proven in “Appendix B5”, shows that the Ak property is preserved under EZ preferences:

Proposition 3

Proposition 1holds under EZ preferences and the value function takes the form \(V(k,z,q)=v(z,q)k.\)

Next, let the constant \(L_{\text{EZ}}\) satisfy the following equation:

Then “Appendix B6” proves that the optimal policies take on the same functional form under EZ preferences as they do under CRRA preferences except that the constant L is different. In particular, analogously to Proposition 2, we have:

Proposition 4

With recursive preferences in Eq. (42), the solutions for c and i in Eqs. (24) and (25) remain valid but with \(\psi \) substituted for \(\gamma \), and with \(L_{\text{EZ}}\) substituted for L.

Comparison to Proposition 2. When \(\gamma \ne \psi \), the only effect of the additional parameter on the policies c and i is through \(L_{\text{EZ}}\) being different from L. Equations (24) and (25) remain the same. In “Appendix B6”, we show that \(L_{\text{EZ}}=L\) when \( \gamma =\psi \), and so are c and i.

We next estimate the extended model and evaluate its performance with respect to the available time series for private equity returns, intakes and other variables of interest. Similar to the baseline estimation with power utility, we preset \(\beta =0.95\), but choose a higher depreciation rate \( \delta =5\%\) as in Jovanovic and Rousseau (2014). We further set \(1/\psi \), the elasticity of intertemporal substitution (EIS), to be 0.95 which is in line with studies such as Hall (1988), and let the data determine the curvature parameter \(\gamma \). Table 10 in “Appendix C” shows an alternative estimation result when we freely estimate both \(\gamma \) and \(\psi \) where the estimated EIS \(1/\psi \) remains less than 1.

As in the baseline estimation, we choose \(G_{\text{b}}\),\(G_{\text{v}}\), \( \lambda \), \(\theta \), and \(\tau \) to target the means of c, \(n_{\text{v} }/i \), \(n_{\text{b}}/i\), \(R_{VC}\), \(R_{B}\), and \( R_{\text{S} \& \text{P}}\). We again assume the distributions of \(\varepsilon \)’s are normal: \(\varepsilon _{ \text{v}}\sim N\left( \mu _{\text{v}},\sigma _{\text{v}}^{2}\right) \) and \( \varepsilon _{\text{b}}\sim N\left( \mu _{\text{b}},\sigma _{\text{b} }^{2}\right) \). The additional parameter \(\gamma \) is jointly estimated with other parameters by targeting the mean of the risk free rate defined as

Table 5 reports that all estimated parameters are statistically significant at the 5% level or less based on 95% confidence intervals. Similar to the results reported under power utility, the estimated distribution of \(\varepsilon \) for buyout has a larger mean and a thicker tail than VC.

Table 6 shows that the extended model matches most of the means in the data well and improves upon the fit of the baseline model. The model is able to match the non-targeted average growth, mean investment, and volatility of both PE returns and equity return \( R_{\text{S} \& \text{P}}\). More importantly, the use of EZ preferences provides a much closer fit to both the mean risk-free rate (targeted) and its non-targeted volatility, as highlighted in the last row of the table. The model under EZ can thus jointly fit the volatility of the risk free rate and the equity risk premium. Moreover, the model’s non-target average growth is 1.9%, which is very close to the 2.0% observed in the data, and under the estimated parameters, the two PE sectors together contribute 7% of observed growth, relative to the extreme case when both \(\lambda \) and \(\theta \) are set to zero, in which growth is 1.8%.

5.2 Combined venture capital returns

Table 7 reports estimation results using combined VC returns without adjusting for early versus later stage funds. In this case, average venture returns rise to 17% from 13.9%. We now use the same pre-set parameters and targets from the baseline calibration to re-estimate the model, and Table 7 shows that it continues to fit the data well.

5.3 Higher capital depreciation under power utility

Table 8 reports the results when we increase the annual depreciation rate from 1 to 4%, as in Karabarbounis and Neiman (2014), and to 6% as estimated by Nadiri and Prucha (1996). It shows that the model generates an annual growth rate of 2.5% with \(\delta \) set at 4%, which is closer to the 2.0% growth rate in the data than the baseline estimate, albeit at a cost of slightly lower returns on the S&P 500. Table 8 also shows that the model can still match the means of growth and investment and the means and volatilities of various returns report results well with depreciation set at 6%, but that the average equity return is about half of that in the data. As shown earlier in Table 6, however, this discrepancy can be partially resolved under general EZ preferences.

5.4 Using alternative estimates for PE excess returns

One potential concern is that our estimates of excess returns for PE in Table 4 are larger than others in the literature. To explore this, we consider alphas estimated by Harris et al. (2014, Table III, p. 1864) using the public market equivalent (PME) method, where they get 1.36% and 1.12% for venture and buyout funds respectively. We then add these alphas to the S&P return to bring our venture and buyout returns in line with HJK. Table 9 reports the results. Compared to the baseline results in Table 4, our model produces a similar fit to both first and second moments of growth and investment with these alternative estimates for PE excess returns, and the two funds now contribute to 9.7% of growth, down from 11%. Under less restrictive EZ recursive preferences, the two PE sectors together now contribute 5.8% of observed growth, down from 7%.

5.5 Decreasing returns to factors

The growth effect in our model arises in part because of its AK structure, which has constant returns to factors. This may, however, be overstating the growth effect if PE funds have decreasing returns to factors, and we consider the possibility with some back-of-the-envelope calculations for growth with decreasing returns in an otherwise similar model. To illustrate, consider a steady state with k and n given. The level effect is \(\hbox {MPK} \times \Delta \), where \(\Delta \) is the amount of extra capital PE creates. If output is Cobb Douglas in capital k and fixed labor n we have

where returns to k diminish with k. Since the capital-output ratio is roughly 2.5 (or 5/2), and the capital share \(\alpha \) is about 1/3, the level effect on output is \(\frac{2}{15}\Delta \):

With measured PE intakes at roughly 1% of GDP, this implies that

so that in levels PE raises GDP by about 2/15 of 1%. Of course, the capital created by PE, \(\Delta \) in this notation, is smaller than the intakes plotted in Fig. 1, and thus the 13.3% we calculate is an upper bound on the level effect. When we assume only one third of the intake is used for new capital, the level effect of PE is slightly less than 0.05 of a percent of GDP. By contrast, our new estimate in the Ak version is between 7 and 11% of observed growth. With annual growth at 1.9% of GDP, the year-to-year level effect in the Ak version is between 0.13 and 0.21% of GDP, i.e., three or four times larger than when returns to k are assumed to be diminishing. While it’s true that the contribution to growth is smaller, a case could be made that the Ak framework, if anywhere, should be particularly applicable to the venture capital sector, which is arguably more about pushing the technological frontier than just ordinary capital accumulation.

5.6 Adding human capital to the model

This section adds human capital, h, to the production function

where Z now stands for the TFP shock. Output is invested in amounts X and \(X_{\text{h}}\) in the two types of capital at the unit cost of q and \( q_{\text{h}}\). The income identity (2) becomes

The law of motion for k in (3) is unchanged and for h we have

where \(\delta \) is the rate of depreciation, same for h and for k.

Households own h, which earns the competitive wage

Profits and dividends become \(\pi \left( k,h\right) =\alpha y-wh-qX\). Optimal household investment in h requires that the cost of a unit of h equals the present value of its expected wage payments. Written recursively, this condition reads

and optimal investment in k now requires that

where \(s\equiv \left( Z,q_{\text{h}},q\right) \).

Firms. They own k and the gross return on equity becomes \(R_{\text{E}}=\frac{1}{q}\left( \alpha \frac{y^{\prime }}{k^{\prime } }+\left( 1-\delta \right) q^{\prime }\right) \).

Let

If \(\zeta \) is a constant, the model simplifies as k and h can be aggregated into a composite that is proportional to k. Let

and let z be the scaled TFP shock

We summarize the results as follows:

Proposition 5

If \(\zeta \) is constant, then h is proportional to k,

output can be written as a function of k alone,

the goods cost of a unit of composite capital is

and the income identity reduces to a function of C, k, and composite capital investment, X, reads \(zk=C+\frac{q}{\alpha }X,\) or in units of k,

where \(x=X/k\) is investment in physical capital.

Proof

Equations (51) and (53) imply that

Substituting from (50) and (57) into (48) yields (4). Equation (55) follows from (50) and (51). Finally, (46) reads

and division by k yields (56). \(\square \)

Households still get the new ideas, but the number arriving is now \(\lambda hG^{\text{v}}\left( \varepsilon \right) \) and \(\theta hG^{\text{b}}\left( \varepsilon \right) \). The households get no net revenue from these ideas because PE funds will collect all the rents that these ideas generate, and so investment in h still satisfies (48). Equation (5) is unchanged.

Proposition 6

For \(i\in \left\{ \text{v, b}\right\} \) the fund intakes \(n_{i}\) in (6) and (12), the number of backed projects in the payouts, \(D_{i}\) in (7) and (13), and (15) are multiplied by the factor \(\kappa \) in (51). As a result, the funds’ objective functions \(\pi _{i}\left( q\right) \) in (10) are also just scaled by \(\kappa \). Thus the \(\varepsilon _{i}\) still satisfy (11) and (16).

Equilibrium. With the following minor changes, Proposition 1 still holds:

Instead of (22) let the constant L now solve

and “Appendix B1” shows that if (23) holds, a unique solution for L to Eq. (58) exists. Then “Appendix B1” also proves that

Proposition 7

If Eq. (23) holds, the equilibrium c and i are

and

The stocks of k and h grow at the common rate \(g\equiv i-\delta \). And for the Pareto example in Eq. (26) and log preferences \(\left( \gamma =1\right) \), “Appendix B3” proves the extended version of Proposition 6 for the deterministic case where z and q are fixed; in Proposition 6 as stated, (27) and (28) become

where

Corollary 1 changes in a minor way so that a first-order Taylor approximation around \(\left( \lambda ,\theta \right) =\left( 0,0\right) \) yields the following expression for the growth rate:

where

are the PE-adjusted TFP term and the PE-adjusted discount rates, and where

are proportional to the arrival rate \(\lambda \) and \(\theta \). Moreover, \( {\tilde{A}}\) increases with z and decreases with q, and the opposite is true of a.

Identification of \(\kappa \). From Proposition 6, one can see that we cannot identify \(\kappa ,\lambda \), and \(\theta \) separately, only \(\left( \kappa \lambda ,\kappa \theta \right) \). As a result, adding human capital does not quantitatively change model’s fit to the data described in Sect. 4

6 Conclusion

We document that the returns to venture funds are higher than those of buyout funds, and that venture funds’ intake responds more strongly to the business cycle than buyout funds’ intake. The model assumes that venture brings in new capital whereas buyout largely reorganizes existing capital, leading venture intake to co-move more strongly with aggregate Tobin’s Q.

Our focus on private equity funds may raise questions about their net contribution to growth, given that incumbent firms can and do fund similar extensive investments internally. Yet incumbents may lack the flexibility to bring new ideas to market quickly and productively due an inability of management and governance to offer appropriate incentives to retain key members of internal entrepreneurial teams (Gompers & Lerner, 1998). Even when done successfully, Gompers (2002) notes that internal VC is set up through an arms-length division that insulates the group from the established (and potentially entrenched) corporate management. The rapid growth of independent PE funds likely reflects the difficulties incumbents face in operating internal VC-like divisions. Incumbents may also engage in buyout fund-like activities for reasons that do not promote growth. Cunningham et al. (2021), for example, contends that “incumbent firms may acquire innovative targets solely to discontinue the target’s innovation projects and preempt future competition.” Together, these arguments suggest a unique role for private equity as an innovation contributing to growth beyond what could be accomplished internally by incumbent firms.

An extension we do not pursue is that of returns to self employment. Perhaps the modeling distinction we make between how VC and buyout funds add value to capital also applies in the domain of self employment choices. One can open a store in an entirely new location, or one can buy someone else out or simply take over a location that someone else has vacated. Another extension would be to an open economy; U.S. private equity firms are active abroad and our estimate that private equity contributes between 7 and 11% of observed growth does not include the effects that private equity activity in or from the U.S. has on growth elsewhere in the world.

Notes

According to estimates from Thomson Reuters and the Bureau of Economic Analysis (BEA).

Annual estimates of monies placed with U.S. venture and buyout funds are from the Thomson One VentureXpert database. Private domestic investment is from the BEA, and estimates of aggregate Q are constructed from Hall (2001), Abel and Eberly (2011), and the Federal Reserve Board’s Flow of Funds Accounts. See “Appendix A” for detailed descriptions of all data and methods used in our analysis.

Annual estimates of returns to U.S. venture and buyout fund investments are from Cambridge Associates, and real returns on the S&P 500 are from Damodaran (2017), deflated with the CPI. See “Appendix A” for details.

Not pictured is the relation between returns and investment, but Kaplan and Stromberg (2009, Table 3, panel B) find that private equity commitments rise as a function of returns realized over the previous year, and this occurs in our model as well.

The typical fund lasts 10–12 years but our data will allow us to infer the year-to-year returns.

For VC funds Jovanovic and Szentes (2013) obtain this outcome if VCs are scarce relative to founders of new firms.

When \(G^{\text{v}}\left( \varepsilon \right) \) is Pareto, as in Eq. (26) with \(\rho >1\), this means that \(n_{\text{v}}=\lambda \varepsilon _{v,0}^{\rho }\varepsilon _{\text{v}}^{-\rho }\) \(\Rightarrow \varepsilon _{ \text{v}}=\lambda ^{1/\rho }\varepsilon _{v,0}n_{\text{v}}^{-1/\rho }\), and therefore that

$$\begin{aligned} E\left( \varepsilon \mid \varepsilon \ge \varepsilon _{\text{v}}\right)&= {} \varepsilon _{v,0}^{\rho }\int _{\varepsilon _{\text{v}}}^{\infty }\rho \varepsilon ^{-\rho }d\varepsilon =\frac{\rho }{\rho -1}\varepsilon _{\text{v }}^{1-\rho }=\frac{\rho }{\rho -1}\left( \lambda ^{1/\rho }\varepsilon _{v,0}n_{\text{v}}^{-1/\rho }\right) ^{1-\rho } \\ &= \frac{\rho \varepsilon _{0}^{1-\rho }}{\rho -1}\lambda ^{\left( 1-\rho \right) /\rho }n_{\text{v}}^{\left( \rho -1\right) /\rho }. \end{aligned}$$Equation (4) of Opp (2019) assumes that, as a function of the number of projects, expected venture output is proportional to \(n_{\text{v}}^{\eta }\) with \(\eta \) set at 0.59. Our returns to scale would therefore be the same if we set

$$\begin{aligned} \eta =\frac{\rho -1}{\rho }\Longleftrightarrow \rho =\frac{1}{1-\eta }=\frac{ 1}{0.41}=2.4. \end{aligned}$$As \(\rho \) rises the right tail gets thinner as the left tail thickens, and returns to scale rise because more projects are undertaken without that much loss in quality. Since buyout has a thicker right tail (see Fig. 6 in Sect. 4.3 below), its left tail is thinner and \(\rho \) is smaller, meaning that its returns diminish more rapidly, i.e., the parameter \(\eta \) in Eq. (4) of Opp (2019), had buyout been modeled there, would be smaller than that for venture.

Different from parameters in Table 3, we set \(\gamma =1\) as used in Proposition 3 and further set the depreciation rate to 8% to achieve a reasonable range of growth rates. Similar to Table 3, we preset \(\beta =0.95\). The estimated parameters are \(\lambda =0.016\), \(\tau =0.76\), \(\theta =0.001 \).

We set \(\delta =1\%\) to match the level of equity returns. Realistically, however, in a one-capital Ak model, k is an amalgam of physical and human capital. Lucas (1988), for example, assumes zero depreciation of h and in Eq. (30) he assumes that it even can appreciate through learning by doing. We later show that the results are robust to depreciation rates of 4% as in Karabarbounis and Neiman (2014), 5% as in Jovanovic and Rousseau (2014), and 6% as in Nadiri and Prucha (1996).

Table 7 in the robustness section later shows that our model also fits the data well using combined VC returns.

To produce the model-based time series, we insert historical \(\left( q,z\right) \) into the corresponding policy functions in the model.

Results are highly robust to how we trim the sample.

By construction then, \(\int {\hat{g}}^{i}\left( \varepsilon \right) d\varepsilon =1\) for \(i=\) v, b.

An additional validation of distributional assumption is based on Jovanovic and Szentes (2013), who use the Pareto distribution for their analog of \( \varepsilon _{\text{v}}\). When fitting distributions of waiting times to successful exit and to termination of venture projects, in their Table 1 for the parameter \(\rho _{\text{v}}\) (for which their analog was titled \(\lambda \)) they use 1.55, 1.6, and 1.73. At the middle value of \(\rho _{\text{v} }=1.6\) and the average q of 1.83, Eq. (37) from our model implies \(\frac{R_{\text{v}}}{R_{\text{E}}}=\frac{\rho _{\text{v}}}{\rho _{\text{v}}-1 }\frac{1}{q}=1.46\), which is close to the ratio \( \frac{R_{\text{VC}}}{R_{\text{S} \& \text{P}}}=1.32\) in the data.

The fees that go to general partners absorb most of the rents and are thus not compensation going to capital providers. While an investor obtains the return on the S&P 500 almost fully (an ETF costs a few basis points annually), an investors’ PE investment comes with a hefty fee, likely in excess of 10% (Metrick & Yasuda, 2010).

We also examined the CRSP Delistings Data, results do not change.

References

Abel, A. B., & Eberly, J. C. (2011). How Q and cash flow affect investment without frictions: An analytic explanation. Review of Economic Studies, 78(4), 1179–1200.

Amihud, Y., & Mendelson, H. (1986). Asset pricing and the bid-ask spread. Journal of Financial Economics, 17(2), 223–249.

Ang, A., Papanikolaou, D., & Westerfield, M. M. (2014). Portfolio choice with illiquid assets. Management Science, 60(11), 2737–2761.

Arrow, K. J. (1971). The economic implications of learning by doing. In Readings in the theory of growth (pp. 131–149). Palgrave Macmillan.

Cambridge Associates, LLC. (2016a). U.S. Venture capital index and selected benchmark statistics. Boston, MA.

Cambridge Associates, LLC. (2016b). Buyout and growth equity index and selected benchmark statistics. Boston, MA.

Cunningham, C., Ederer, F., & Ma, S. (2021). Killer acquisitions. Journal of Political Economy, 129(3), 649–702.

Damodaran, A. (2017). Annual returns on stocks, bonds, and bills, 1928-current. Downloaded from http://www.stern.nyu.edu/~adamodar/pc/datasets/histretSP.xls.

Epstein, L. G., & Zin, S. E. (1989). Substitution, risk aversion, and the temporal behavior of consumption and asset returns: A theoretical framework. Econometrica, 57(4), 937–969.

Gompers, P. A. (2002). Corporations and the financing of innovation: The corporate venturing experience. Economic Review, Federal Reserve Bank of Atlanta, 87(4), 1–18.

Gompers, P. A., & Lerner, J. (1998). The determinants of corporate venture capital success: Organizational structure, incentives, and complementarities, Chap. 1. In R. K. Morck (Ed.), Concentrated corporate ownership (pp. 17–54). Chicago: University of Chicago Press.

Gompers, P., Lerner, J., & Scharfstein, D. (2005). Entrepreneurial spawning: Public corporations and the genesis of new ventures, 1986 to 1999. Journal of Finance, 60(2), 577–614.

Gompers, P. A., Kovner, A., Lerner, J., & Scharfstein, D. (2008). Venture capital investment cycles: The impact of public markets. Journal of Financial Economics, 87(1), 1–23.

Gupta, A., & Van Nieuwerburgh, S. (2019). Valuing private equity strip by strip. In Working paper 26514. National Bureau of Economic Research.

Hall, R. E. (1988). The relation between price and marginal cost in U.S. industry. Journal of Political Economy, 96(5), 921–947.

Hall, R. E. (2001). The stock market and capital accumulation. American Economic Review, 91(5), 1185–1202.

Hamilton, B. H. (2000). Does entrepreneurship pay? An empirical analysis of the returns to self-employment. Journal of Political Economy, 108(3), 604–631.

Harris, R. S., Jenkinson, T., & Kaplan, S. N. (2014). Private equity performance: What do we know? Journal of Finance, 69(5), 1851–1882. Internet Appendix.

Jovanovic, B., & Szentes, B. (2013). On the market for venture capital. Journal of Political Economy, 121(3), 493–527.

Jovanovic, B., & Rousseau, P. L. (2014). Extensive and intensive investment over the business cycle. Journal of Political Economy, 122(4), 863–908.

Kaplan, S. N., & Schoar, A. (2005). Private equity performance: Returns, persistence and capital flows. Journal of Finance, 60(4), 1791–1823.

Kaplan, S. N., & Strömberg, P. (2009). Leveraged buyouts and private equity. Journal of Economic Perspectives, 23(1), 121–146.

Karabarbounis, L., & Neiman, B. (2014). Capital depreciation and labor shares around the world: Measurement and implications. In Working paper 20606. National Bureau of Economic Research.

Korteweg, A., & Nagel, S. (2016). Risk-adjusting the returns to venture capital. The Journal of Finance, 71(3), 1437–1470.

Korteweg, A., & Sorensen, M. (2010). Risk and return characteristics of venture capital-backed entrepreneurial companies. Review of Financial Studies, 23(10), 3738–3772.

Kortum, S., & Lerner, J. (2000). Assessing the contribution of venture capital to innovation. RAND Journal of Economics, 31, 674–692.

Lucas, R. E. (1988). On the mechanics of economic development. Journal of Monetary Economics, 22(1), 3–42.

Lucas, R. E. Jr. (1993). Making a miracle. Econometrica, 61(2), 251–272.

Lucas, R. E., & Moll, B. (2014). Knowledge growth and the allocation of time. Journal of Political Economy, 122(1), 1–51.

Mehra, R., & Prescott, E. C. (1985). The equity premium: A puzzle. Journal of Monetary Economics, 15(2), 145–161.

Metrick, A., & Yasuda, A. (2010). The economics of private equity funds. Review of Financial Studies, 23(6), 2303–2341.

Moskowitz, T. J., & Vissing-Jørgensen, A. (2002). The returns to entrepreneurial investment: A private equity premium puzzle? American Economic Review, 92(4), 745–778.

Nadiri, M. I., & Prucha, I. R. (1996). Estimation of the depreciation rate of physical and R &D capital in the US total manufacturing sector. Economic Inquiry, 34(1), 43–56.

Opp, C. C. (2019). Venture capital and the macro-economy. Review of Financial Studies, 32(11), 4387–4446.

Perla, J., & Tonetti, C. (2014). Equilibrium imitation and growth. Journal of Political Economy, 122(1), 52–76.

Rebelo, S. (1991). Long-run policy analysis and long-run growth. Journal of Political Economy, 99(3), 500–521.

Scherer, F. M. (2000). The size distribution of profits from innovation. In D. Encaoua, B. H. Hall, F. Laisney, & J. Mairesse (Eds.), The economics and econometrics of innovation, Chap 19 (pp. 473–494). Boston, MA: Springer.

Searle, A. D. (1945). Productivity changes in selected wartime shipbuilding programs. Monthly Labor Review, 61, 1132–1147.

Silverberg, G., & Verspagen, B. (2007). The size distribution of innovations revisited: An application of extreme value statistics to citation and value measures of patent significance. Journal of Econometrics, 139(2), 318–339.

Sorensen, M., Wang, N., & Wang, J. (2014). Valuing private equity. Review of Financial Studies, 27(7), 1977–2021.

U.S. Department of Commerce, Bureau of Economic Analysis. (2017). National income and product accounts. Washington, DC.

Vereshchagina, G., & Hopenhayn, H. A. (2009). Risk taking by entrepreneurs. American Economic Review, 99(5), 1808–1830.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank Yakov Amihud, Christian Opp, and Stijn Van Nieuwerburgh for comments, Zahin Haque and Angelo Orane for research assistance, the National Science Foundation and C. V. Starr Center for financial assistance, and seminar participants at the Federal Reserve Bank of Chicago, the Federal Reserve Board, NYU Stern, and The Ohio State University for helpful comments. The views expressed are those of the authors and do not necessarily reflect those of the Federal Reserve Board or the Federal Reserve System.

Appendices

Appendix A: Data and methods

In this appendix we document the data sources and methods used to construct the series depicted in our figures and included in the empirical analysis.

Figures 1 and 4. The “intakes” are the sum of investments made annually in U.S. venture capital and buyout funds, divided by annual estimates of gross private domestic investment from the BEA (2017, Table 5.2.5, line 4). Venture and buyout investments are from the April 2017 version of Thomson One’s VentureXpert database, and are the sum of all investments made in a given calendar year at any stage or round across funds of each type. The “intake ratio,” \(n_{\text{v} }/n_{\text{b}}\), is the ratio of the respective investment sums in each year.

For aggregate \(q_{t}\), we use fourth quarter observations underlying Hall (2001) for 1987–1999, and then join them with estimates underlying Abel and Eberly (2011) for 1999–2005. Abel and Eberly derive aggregate Tobin’s Q from the Federal Reserve Board’s Flow of Funds Accounts as the ratio of total market value of equity and bonds to private fixed assets in the non-financial corporate sector. We bring these estimates forward through 2016 using the same sources. Hall’s measure of Q in 1999 is higher than that of Abel and Eberly (3.376 vs. 1.819), so we use a ratio splicing factor of 1.856 to adjust the series from 2000 forward.

Figures 2, 3 and 5. Aggregate returns to U.S. venture capital funds for 1987–2016 are from Cambridge Associates (2016a), and are annualized returns constructed by compounding one quarter horizon pooled returns. Aggregate returns to U.S. buyout funds for 1987–2016 are from Cambridge Associates (2016b), and are also annualized returns constructed from single quarter horizon pooled returns. Both series are net of fees, expenses, and carried interest.Footnote 17 The majority of the VC funds (1070 out of 1680) in our sample are in the early stage and earn large and positive returns. This is consistent with Korteweg and Nagel (2016), who document that VC start-up investments earn large positive abnormal returns whereas those in the later stage earn net returns close to zero. In addition, the positive VC returns could also reflect the possibility that general partners have considerable equity in the projects in addition to collecting fees. The average combined VC return \({\tilde{R}}_{VC}\) in our sample is 18.1%; this is in line with the estimates in Table IA.II in the Internet Appendix of Harris et al. (2014).

We convert each series into ex-post real returns using the annual growth of the consumer price index from the National Income and Product accounts. Annual returns to the S&P 500 are from Damodaran (2017),Footnote 18 and deflated by the consumer price index. We then subtract 1.05% from both venture and buyout returns, which is the liquidity premium reported in Sorensen et al. (2014).

Tables 1 and 2. For \(z_{t}\), we use private output, defined as GDP less government expenditures on consumption and investment from the BEA (2017) for 1987–2016. We then divide the result by \(K_{t-1}\) after adjusting it for inflation during year \(t-1\) by averaging the annual inflation factors across the 2 years that overlap \(t-1\) and then using its square root as a deflator. The \(K_{t}\) are end-year stocks of private fixed assets from BEA (2017, Table 6.1, line 1) for 1987–2016. The aggregate investment rate \(i_{t}\) is constructed as annual gross private domestic investment from BEA (2017, Table 5.2.5, line 4) for 1987–2016 divided by \(K_{t-1}\).

Figure 6. We obtained the data on venture and buyout funds from the Securities Data Company (SDC) Platinum and CRSP/Compustat Merged (CCM) Database.

For buyouts, the SDC lists the acquirer’s CUSIP and the market value before the merger. It also lists the year the merger occurred and the target’s assets. In the CCM, there are multiple CUSIPs per year in both the SDC and CRSP/Compustat data. The multiple CUSIPs per year in the SDC are due to an acquirer completing multiple mergers in a year. The multiple CUSIPs per year in the CRSP/Compustat are due to firms with different permanent numbers having the same CUSIPs. Unfortunately, the SDC does not contain permanent numbers (lpermno) so we can only match via CUSIPs. As a result, all observations in both datasets in which the same CUSIP appeared multiple times in a year were dropped from both datasets. We then merged the CCM and SDC based on the CUSIP and year of the merger. The combined value was then the shares outstanding at end of the year of the merger (CSHO from the CCM data) times the calendar year closing price (\(\hbox {PRCC}_{\text{C}}\) from CCM).

For venture, we use the firms from CCM, only keeping data for the first year a firm appears in the CCM data, and defining IPO value as the shares outstanding at the end of that year (CSHO) times the closing price (\(\hbox {PRCC}_{\text{C}}\)).Footnote 19

For both buyouts and venture, we further trim the sample based on firm’s value of common stock at 95% level (i.e. observations at the bottom 2.5% and top 2.5% of common stock values are dropped). Our final sample contains 8209 venture observations and 665 buyout observations. The annual data spans the periods from 1986 to 2017. For each venture and buyout funds in our sample, we compute the \(\varepsilon _{\text{v}}\) and \(\varepsilon _{ \text{b}}\) as defined in Eqs. (40) and (41), where IPO and combined value are defined as CSHO times the \(\hbox {PRCC}_{\text{C}}\). We truncate the distribution of \(\varepsilon _{\text{v}}\) and \(\varepsilon _{\text{b}}\) by \(\frac{1}{q_{t}}\) and \(\frac{q_{t}+\tau }{q_{t}}\), respectively, for each time t.

Appendix B: Proofs

1.1 B1: Proof of Proposition 1

Let L satisfy the equation

First, suppose that a solution for L exists (its existence will be shown at the end of this proof). Since \(\frac{C^{\prime }}{C}=\frac{c^{\prime }}{c} \frac{k^{\prime }}{k}\), (4) implies

therefore

where \(k^{\prime }/k\) is defined in (17).

To simplify notation, we now omit the input of the function and denote \( G\equiv \ G^{\text{b}}\left( 1+\frac{\tau }{q}\right) \). From income identity (20)

thus we have

where the second line uses the identity (56) which implies \( z-c=qx.\)

Therefore

i.e.,

i.e.,

where L is defined in (64), and

Existence of solution for L in Eq. (22). Next, we show that L exists when (23) holds. Divide both sides of (64) by L to get

Since \(L^{-1}\) ranges from zero to infinity as L ranges over the positive line, and since \(\gamma >0\), a necessary and sufficient condition for a solution for L to exist is that

This is equivalent to

Since \(\pi _{j}\) and \(\gamma \) are positive, for (66) to hold it suffices that

i.e., (23).

1.2 B2: Proof of Proposition 2

When \(\gamma =1\), z and q are constant, Eq. (64) becomes

This implies that

We denote

then L can be expressed as,

We then have

This implies

Thus the growth \(g=i-\delta \) becomes,

where

As for the comparative statics, first we have

Next, we observe that,

The last line follows because \(\varepsilon _{\text{b,}0}<\frac{\tau +q}{q} \) so that \(\frac{\tau +q}{q\varepsilon _{\text{b, }0}}>1\) or \(\ln \left( \frac{\tau +q}{q\varepsilon _{\text{b, }0}}\right) >0\). Therefore, we have,

Similarly,

where the inequality follows because \(\frac{1}{q\varepsilon _{\text{v, }0}} >1 \) or \(\ln \left( \frac{1}{q\varepsilon _{\text{v, }0}}\right) >0\). This implies that

which implies that

Similarly,

as stated in the proposition.

1.3 B3: Taylor approximation for growth and proof of Corollary 1

We consider a first-order Taylor expansion of the growth \(g\left( \lambda ,\theta \right) \) at \(\lambda =\theta =0\). First we notice that