Abstract

Stock markets perform a creation function if the inflow of finance in the birth of new privately-held firms is stimulated by the promise of stock market liquidity at a later point in time. We test the creation function of the Alternative Investment Market (AIM), the junior segment of the London Stock Exchange, by regressing sectoral entry on capital raised at IPO on AIM and on the main market, venture capital investments, and controls for sectoral productivity and industry turbulence. Our panel includes UK manufacturing sectors between 2004 and 2012. We find that sectors raising more capital on AIM housed more entrants in the subsequent years. The number of venture capital deals is also a positive driver of entry; by contrast, main market IPO proceeds show a negative association with entry. Results hold after endogeneity tests (pseudo diff-in-diff and 2-stage residual inclusion estimators).

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

New firms rarely possess the financial resources they need to sustain the accumulation of technological capabilities; they can hardly rely on the traditional banking channel because of information asymmetries and radical uncertainty (Beck et al. 2005). The implementation of the Basel agreements has further discouraged the use of the banking channel (Wehinger 2012). “As credit sources tend to dry up more rapidly for small firms than for large companies during economic downturns, broadening the range of non bank financing instruments for SMEs should make them more resilient to financial shocks” (Nassr and Wehinger 2015, p. 1).

Junior stock markets, i.e. lightly regulated stock markets catering to small caps, represent one of these financing instruments (Giudici and Roosenboom 2004; Posner 2009). In the last 20 years, business and policy actors have increasingly pursued financial deregulation strategies, such as lowering the admission requirements and outsourcing the regulatory responsibilities to specialized financial intermediaries. International organizations, such as the World Bank and the European Commission, view junior stock markets as an effective way of addressing the financing gaps faced by SMEs, and recommend the development of these markets (EC 2015; IOSCO 2015; Eberhart and Eesley 2018). From 2014, the Jobs Act in the US facilitates the access of new technology firms to IPO markets (Barth et al. 2017). Emerging countries, given the importance of SMEs in their economies, are also following this trend (Harwood and Konidaris 2015; Bhattacharya 2017). As of the end of 2017, 6,807 companies were listed on 33 SME markets with a total market capitalization of over USD1.3 trillion (WFE 2018).

The longest standing and the most capitalized junior stock market is the Alternative Investment Market (AIM), a segment of the London Stock Exchange (LSE). Companies seeking admission to AIM face lighter regulation and disclosure rules with respect to the official list, and incur lower admission and listings costs. Companies are not required to comply with corporate governance and internal control standards (Revest and Sapio 2013a; Lagneau-Ymonet et al. 2014).

The deregulation of stock market listing begs the question as to whether the real economy will benefit in terms of new business formation and entrepreneurial activity. To the best of our knowledge, no research has been devoted to this issue.

In this paper, we fill this gap by studying whether the propensity to rely on AIM as a source of potential new equity translates into a higher rate of new firm formation in the economy, using sector-level data on UK manufacturing. This is, we believe, a worthwhile endeavor.

First, the literature offers several insights on new business creation as a dynamic process triggered, among other factors, by the expected availability of capital injections. Michelacci and Suarez (2004) argue that the stock market encourages business creation because it allows recycling of capital proceeds by providers of informed capital, such as venture capitalists (see Mason et al. 2010 for UK) . According to this view, the deregulation of stock market listing would allow a faster rate of capital recycling, and hence a wider availability of financial sources for startups in a given time frame. Similarly, Lazonick (2007) maintains that the stock market exercises a creation function for the innovative enterprise: the liquidity promise implicit in stock market trading (a future option for a startup) stimulates the inflow of equity capital at startup time.

Second, the increasing depth of stock markets is found to be more growth enhancing for industries that rely more on small firms (Beck et al. 2005) and for firms that are more dependent on external financing (Klapper et al. 2006; Love et al. 2010). A focus on how specific forms of capital sourcing affect entry may help dissipate the doubts that have emerged on the stability and linearity of the aggregate finance-growth relationship, with studies highlighting a declining effect of finance for higher income countries (Arcand et al. 2015; Law and Singh 2014; see Panizza 2018 for a review).

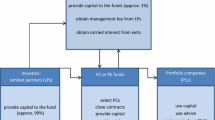

We analyze the time dynamics of entry at the sectoral aggregation level by estimating dynamic panel data models. Our sample includes UK 3-digit sectors in manufacturing (NACE Rev. 2 codes from 101 to 332) over the 2004-2012 time span. The dependent variable is the number of births to UK manufacturing sectors, as provided by the Office for National Statistics (ONS). In order to catch the intensity of equity market support to new firms, we use the money raised at IPO, measured at the sectoral level, for both AIM and the LSE main market (source: LSE), as well as venture capital (VC) investments by receiving sector (source: BVCA). If the junior stock market performs a creation or recycling function, one should observe more entry in sectors that relied more on AIM, all else given. In order to highlight broadly the impact of a “liquidity promise” on firm creation, we compare the effect of AIM IPOs on entry with the effects associated with venture capital funding and main market IPOs.

Our closest reference in the literature is Popov and Roosenboom (2013), yet instead of only studying the impact of VC on new business creation, we focus on the impact of a junior stock market, while controlling also for VC. Our approach departs from Aghion et al. (2007) and related literature: rather than focusing on aggregate measures of financial depth, we wish to disentangle the separate effects of a relatively liquid junior market from those of its parent exchange and from competing financial sources. Our contribution is original as we bridge the microeconomics of firm entry and the functions performed by a stock market. We rely on econometric models that are suitable to deal with the count nature of the entry data and allow for non-linear effects.

Based on our findings, we conclude that the AIM has performed a creation or recycling function for UK manufacturing firms. All things being equal, sectors that raised more capital at IPO on AIM and with more AIM-listed small caps were also those housing more new entrants in the subsequent years. The magnitude of this effect increases as the amounts of raised capital are aggregated over longer time horizons, when prospective entrants have better chances to disentangle the signals of interest from the short-term noise; and is stronger than for IPO proceeds on the LSE Main Market, the effect of which is negative in some specifications. Venture capital (when measured in deals, but not in disbursements) is a positive driver of entry. These effects survive to various robustness checks, when we control for a possible omitted variables bias through the pseudo diff-in-diff technique introduced by Rajan and Zingales (1998), and when we estimate a 2-stage residual inclusion model (Terza et al. 2008) allowing for exogenous variation in the supply of finance by institutional investors. Our conjecture is that prospective entrepreneurs use information from markets dominated by institutional investors (AIM, VC) in order to assess the future chances of collecting finance, consistent with the literatures on the creation function, on capital recycling, as well as with entrepreneurial spawning (Gompers et al. 2005; Cumming et al. 2016; Garrett et al. 2017). In sectors that rely more on main market IPOs, incumbents may limit entry in order to sustain their stock prices (see Rotemberg and Scharfstein (1990) and Kraus and Rubin (2010)). Future research may determine if the same effects are observed from less capitalized junior stock markets.

The paper is structured as follows. Section 2 outlines the theoretical and empirical background on how stock markets may affect the firm formation process. Data and variables described in Section 3 are used through the empirical methods of Section 4 to obtain the results (Section 5). Section 6 wraps up and concludes.

2 Background literature

2.1 Junior stock markets

The main organizational specificity of AIM, and of other junior stock markets modeled after it (i.e. Alternext, Tokyo AIM, JASDAQ, First North, AIM Italia), is a combination of low admission requirements with information disclosure processes centered on financial intermediaries known as Nominated Advisors, or Nomads (Doukas and Hoque 2016). AIM does not set any minimal initial requirement in terms of corporate governance, capitalization, assets, equity capital, trading history, free float. A Nomad must be appointed by every company seeking admission on AIM. Once the company is listed, these intermediaries have to ensure compliance of the issuers supervised by them with the AIM listing rules. Nomads act as gatekeepers, advisers and, ultimately, regulators of AIM-listed companies.

Until now, empirical works have assessed the survival rates, operating performances, and stock returns of the companies listed on the AIM. The conclusions about the impact of the AIM on the listed firms are mixed (see, for recent works, Baldock2015; Doukas and Hoque 2016; Farinha et al. 2018; Newell and Marzuki 2018; reviews on previous research are in Revest and Sapio (2012) and Hornok (2014)). More interestingly for our concerns, few empirical works focus on real performance measures, such as the growth of sales, assets, and productivity of the listed companies.Footnote 1 The ability of AIM to nurture the growth of its listed companies has been assessed by comparing the growth rates of AIM-listed and private manufacturing companies between 1997 and 2009 (Revest and Sapio 2013b). Their results show that the AIM enhances the growth of employees of its listed companies, yet a negative treatment effect of AIM on productivity is detected. Toward a wider assessment of the impact of AIM on the real economy, we choose to turn to another measure, corresponding to one of the original policy-making goals behind the set up of junior stock markets: the birth rate of new firms.

2.2 Finance and entry determinants

The literature on industry dynamics highlights the heterogeneity of entry determinants (Geroski 1995; Bartelsman et al. 2009). Favorable economic conditions, such as economic growth and high technological opportunities, are viewed as “progressive determinants”, while low wages, poor working conditions, or being unemployed are considered as “regressive determinants” (Santarelli and Vivarelli 2007; Quatraro and Vivarelli 2014).

Access to finance is especially interesting for us among the main determinants of new business creation. Credit constraints, and more generally the lack of financial resources, should limit new firm formation directly, but also indirectly, as they diminish the survival probability and the rate of growth of existing firms, thus discouraging potential entrants (Campello 2003). The mere existence of alternatives to banking, such as junior stock markets, venture capital, or crowdfunding, may be interpreted as favorable economic conditions, progressive determinants, or opportunities to enjoy lower financial barriers to entry. A future entrepreneur may consider, among other pieces of information, measures of IPO activity, considered as a positive signal stimulating business creation decisions, despite IPOs being, in absolute terms, a small percentage in the population of manufacturing firms. The number of IPOs and the money raised could shape the expectations of an attractive funding environment. Even if a newly created firm does not plan to go public, stock market activity nevertheless conveys information on the overall degree of investor confidence. This highlights a peculiar function of stock exchanges that shall be discussed in the next subsection.

That stock market activity may influence firm founders is also supported by the literature on entrepreneurial spawning. Stuart and Sorenson (2003) consider liquidity events, such as IPOs, as catalysts in the founding decision. IPOs may encourage the birth of a new firm because they signal the availability of resources for a particular type of company at a given time and place (Ritter 1984). “If a successful IPO triggers investor’s enthusiasm for a company sector, then one organization’s public stock offering may open the equity market to other, related securities” (Stuart and Sorenson 2003, p. 180). Lee et al. (2011) empirically show that IPOs may send encouraging signals on future profitability of the industry to directly competing incumbents. It may, however, be argued that IPOs allow firms to grab market shares from competitors (Chemmanur and He 2011; Chod and Lyandres 2011). Further, IPO activity may sap the strength of financial bonds that linked employees (as potential spinoff entrepreneurs) and their employers. In other words, liquidity events alter the incentives and opportunities faced by potential entrepreneurs. Lastly, some new entrepreneurial founders, being employees of incumbents, are exposed to the know-how of the organizations to which they belonged before creating their own companies, and are able to interpret signals coming from liquidity events such as IPOs. When the spawning process relies on younger firms backed by VC, the future entrepreneur is introduced to networks that are used to deal with start-up companies. From an evolutionary viewpoint, this mechanism could also be interpreted as learning from the business parents (Klepper 2001; Sevilir 2010; Yeganegi et al. 2016; see Garrett et al. (2017) for a meta-analysis about determinants of entrepreneurial spawning).

It is also worth noting that the entry process is influenced by the sector-specific combinations of technological opportunities and appropriability and by the sector-specific weight of “revolving door” firms (Santarelli and Vivarelli 2007; Rocha et al. 2015). The state and dynamics of an industry affect the entry opportunities, as suggested by previous evidence of a multiplier/demonstration effect (Nyström 2007), based on the insight that entry in a sector signals the existence of unexploited profit opportunities. Entry might increase the sectoral probability to attract even more potential entrants. As observed by Geroski (1995), entry comes in bursts. Entry may also be stimulated by the disappearance of incumbent firms, according to the replacement effect (Carree and Thurik 1999), but may nonetheless induce more exit due to a competition effect (Nyström 2007). Moreover, one should expect entry to correlate negatively with past sectoral size, which is a measure of the contendibility of incumbent positions. Evidence on dynamic interdependencies between entry and exit rates has been produced by Manjon-Antolin (2010) and Resende et al. (2015), among others.

2.3 Stock market functions and the AIM

Within the broader research agenda on the real impact of financial markets, Lazonick (2007) has outlined the social conditions that must be satisfied for firms to collect the strategic, organizational, and financial resources required for innovation. The author defined five distinct and interrelated functions performed by the stock market for the innovative firm: creation, control, combination, compensation, and cash. We are interested in the creation function, which indicates the ability of the stock market to encourage the flow of financial resources into new firm formation by providing a promise of liquidity at a later point in time.

At first sight, junior stock markets do not seem well suited to perform a creation function, because of their limited ability to guarantee liquidity to their issuers. The evidence, however, highlights junior stock markets as platforms mainly catering to institutional investors interested in supporting firms that are relatively young and small. Espenlaub et al. (2012) study post IPO performance and change in ownership structure and leverage for companies listed on the AIM and on the main market, showing that ownership, control, and leverage for AIM companies did not change substantially during the IPO. As companies do not systematically deleverage, the money raised at IPO appears as additional financing but not a substitute to debt. Furthermore, most of the IPOs on the AIM are offered almost exclusively to institutional investors and are equivalent to private placements (see also Vismara et al. (2012)). Institutional investors may perform a certification role to soften the opacity problem, hence making the creation function a useful interpretative concept for the performance of junior stock markets as well. Notice that, besides providing finance around the margin, junior stock markets may allow SMEs to enact stock-based compensation programs and stock repurchase strategies, and to obtain the visibility for post-IPO company sales.

2.4 Research questions

Based on the above literature review, we seek answers to research questions about firm creation and the propensity of sectors to rely on junior equity markets. In addition, we formulate questions on financing sources that may compete with junior market financing or that are dynamically related to it. Specifically, we investigate issues about the possible creation function performed by venture capital and by the main stock exchange segment. Indeed, junior markets can provide exit opportunities for VC-backed companies, while junior market companies can seek to “graduate” to the main market segment.

A first question is:

Are sectors that rely more on junior stock market financing characterized by more entry of new firms?

In other words: do measures of AIM activity in a given sector at a certain time exercise a positive impact on subsequent entry in that sector? Based on the insights from the previous literature, we would expect a positive answer, since potential entrepreneurs may consider liquidity events, such as IPOs, as favorable drivers of their decision to start a new business.

We then formulate a set of questions on VC:

Do sectors with a higher reliance on venture capital financing host more new entrants? Is this creation function of VC more or less strong than through junior markets? Does it differ across sectors?

Given that venture capital provides managerial assistance along with funding, we may find that VC investments are not less important for a sector to stimulate entry. Moreover, the creation function of VC may be stronger in high-tech sectors than in more traditional ones, since venture capitalists are expected to target high-risk, high-return companies with innovative propensities.

Lastly, concerning the main stock market segment, we ask:

Do sectors relying more on main stock market financing house more entry of new firms?

We do not have specific priors on this issue. There may as well be no significant effect on new firm creation from main market IPOs, as the main market is less fit for small and young companies, due to higher listing costs and more stringent regulations. Yet, the performance of the stock exchange is always in the news, as new firms can hardly ignore the signals it conveys.

In general terms, answering the above question may involve estimating correlations between measures of entry and of financial market activities, but deeper implications for policy and practice require an investigation of causality. As detailed in Section 4, we seek to identify causal relationship by means of appropriate econometric estimators.

3 Data and variables

Our selection of data and variables has been guided by the literature on firm entry and on its financial determinants. The intensity of the creation function performed by AIM could be assessed by measuring how many new firms have been created in the whole UK economy because of the sheer presence of AIM, in comparison with a counterfactual in which the only option available to potential entrepreneurs was to create a privately-held firm. Such a counterfactual could be built by comparing data on the birth of new firms before and after the establishment of AIM, controlling for the time dynamics in all other possible determinants of firm entry. Yet, shortage of industrial and financial data prior to 1995, the year when AIM was inaugurated, was decisive in pushing us to pursue another approach: focusing on the time dynamics of entry at the sectoral level of disaggregation.Footnote 2

Indeed, in some sectors IPOs are more rare; the amount of money raised can also vary, as firms are highly heterogeneous across sectors as regards their dependence on external providers of finance. In particular, even a cursory glance at the data published by the LSE suggests that the extent to which AIM is used for IPOs varies considerably across industrial sectors.Footnote 3

Before proceeding with the dataset description, quantitative information on equity markets in the UK may help in embedding the analysis in the specific context of the UK economic and financial system. As of January 2004, the AIM housed 757 companies with a total market capitalization of 19,875 million pounds (source: Historical AIM Statistics). At the end of our sample period (December 2012), both figures had substantially increased, respectively to 1096 and 61,747 million pounds. For comparison, by December 2012 on the LSE main market there were 2845 companies totaling 8199 GBPm in capitalization (LSE 2012 Annual Report). Money raised in 2012 on AIM amounted to 3,144 GBPm, versus 4,656 GBPm in 2004, with fluctuations along the business cycle, peaking at over 15,000 GBPm in 2008. As pointed out by Nielsson (2013), the overall capitalization of AIM is comparable to the main segments of stock exchanges in Poland, Thailand, or Turkey, and larger than in Argentina, Ireland, or Austria. The sectoral composition of issues in both segments as well as in venture capital investments can be appreciated from statistics reported in Section 3.5.

3.1 Sectoral classifications

The selected data come with different sectoral classifications. Amadeus provides information on the NACE Rev. 2 classification, whereas the ONS data are classified according to SIC 2007, which is equivalent to NACE. We had to face some conversion issues concerning the stock market data that are disaggregated according to the Industrial Classification Benchmark (ICB), devised by FTSE and Dow Jones, from 2006 onwards, and according to an older FTSE classification until 2005. After a careful examination of the sector definitions, we built a correspondence table between the ICB and NACE Rev. 2 sectors, whereas the old FTSE sectors have been converted into ICB sectors based on documentation available at the Dow Jones website. Table 1 summarizes these correspondences (see Appendix).Footnote 4

3.2 ONS data

The number of new firms in sector s and year t, entrys, t is defined here as the number of firms that are reported by the Office of National Statistics (ONS) as births in year t in each sector. This variable allows us to focus on de novo firms, as opposed to the broader concept of entry into an industry that also accounts for diversifying entrants. The raw number of entrants is the most obvious candidate as dependent variable. Gross entry, i.e. the sheer change in the number of firms, is less suited to isolating the “genuine” entry of new firms from mergers, acquisitions, and exits. The ONS also provides data on the numbers of firms in each sector and on exits. Considering exit, along with entry, can be interesting as it would provide insights on replacement effects and churning. We also draw, from the ONS, the change in the output per hour index, available at the NACE 2-digit aggregation level. Growing labor productivity would be seen by potential entrepreneurs as an encouraging signal, and notably an indicator of expanding technological opportunities to be tapped.

3.3 LSE data

The LSE website provides measures of stock market activity, the main explanatory variables of interest in this work. One measure is the number of IPOs on AIM, by sector. Another measure is the sector-level amount of money raised at IPO on AIM. This would be a signal of the stock market financing for firms that cannot access the official list. In addition, we consider the number of small caps listed on AIM, taking a 5 million pounds capitalization as a threshold.Footnote 5 These variables are aggregated by 3-digit NACE Rev. 2 sectors, after conversion from the original ICB and FTSE classification systems (see Section 3.1 and Appendix). Focusing on only AIM, however, would hide the possibly relevant impact of the LSE Main Market, which is arguably more visible and liquid than AIM. Hence, we also use the number of IPOs and the money raised at IPO on the LSE main market, while the number of small caps is not considered, as there are no companies with capitalization below the 5 million pound threshold on the main market.

3.4 Other data sources

Significant partial correlation between entry and the stock market variables may appear as a result of omitting relevant determinants of entry decisions, related to alternative funding sources and to the real side of the economy. Alternative funding sources for potential entrants include venture capital, that can be seen as a competitor with (or complementary to) AIM for entrepreneurial finance.Footnote 6 Every year, the annual report of the British Venture Capital Association (BVCA) publishes the amounts invested by sector of destination, using the ICB classification. Although these data do not allow to distinguish between different stages, they still provide a reliable picture of the cross-sectoral patterns of venture capital investments. Similar to AIM, venture capital investments can be seen as a proxy for the propensity of institutional investors to finance young and small firms.

3.5 Summary statistics

Table 2 reports summary statistics for all variables used in the econometric analysis, as well as definitions and data sources, whereas Table 3 summarizes their time evolution (see Appendix).

Tables 2 shows that the average amounts of money raised at IPO on the main market are larger than on the AIM (46.990 million pounds vs. 28.776). Only 15% of sectors/years have raised money on the LSE Main Market, a percentage that grows up to 60.3% for AIM, consistent with its lighter listing procedures and costs.

In Table 3, one finds that the average number of entrants had two peaks in 2004 and 2008 - and dropped to the lowest in 2010, with a slight increase afterwards. Exit, too, had a local peak in 2004; then, after a temporary decline, it surged again to peak in 2009 and then went down again. Concerning equity variables, there are interestingly different time patterns. Money raised at IPO on either AIM or the LSE Main Market dropped to nearly zero in 2009, although some signs of weakness were already visible in 2008. While the main market recovered strongly in 2011, the AIM nearly reached an all-time low; both segments fared poorly in 2012. VC investments, instead, recorded higher levels in 2009-2010 than in 2004-2005, although still very far from the very high amounts invested in 2006-2007. The number of AIM small caps (with capitalization below five million pounds) reached its highest values in 2008 and 2009, and understandably so, as this was due to stock prices dropping.

4 Empirical methods

In performing our empirical analysis, we resort to a panel regression in which the unit of observation is sector-year. The capital raised at IPO on AIM (aims, t) and the number of AIM-listed small caps (aim.smalls, t) are the variables of interest for our analysis, but we also compare their effects with those associated with the capital raised at IPO on the LSE main market (mms, t) and with the value of venture capital investments (vcs, t). Control variables include the lagged number of entrants, number of firm exits, number of firms, and labor productivity growth. These are meant to capture, respectively, the multiplier/demonstration effect, the substitution effect, the contendibility of incumbent positions, and technological opportunities. Sectoral and time dummies are denoted by Ds and Dt, respectively.

In the baseline regressions, we use the three-year average values of the explanatory variables. Specifically, aims, t− 1:3, aim.smalls, t− 1:3, mms, t− 1:3, and vcs, t− 1:3 are defined as in Table 2. All the other regressors are likewise averaged between t − 1 and t − 3, whereas labor productivity growth is computed between t − 4 and t − 1. Control variables are included in matrix Xs, t− 1:3.

Taking just a yearly lag may not allow us to capture fully the effects of interest, if any. If new entrants take account of stock market trends, they may not trust short-term signals riddled with idiosyncratic shocks, and may use longer term information (e.g. the average activity over several years back; see also Popov and Roosenboom (2013)). Also, creating a new company may be a lengthy process, so that a company incorporated in year t may have taken its entry decision well before year t − 1. Moreover, as highlighted by Popov (2009), VC staging may give rise to a measurement error problem: a single financing round may provide funds to be spent over two-three years. The associated risk of attenuation in the estimated coefficients is mitigated by aggregating the equity variables over periods longer than one year.

Due to the count nature of the dependent variable, entry, and the over-dispersion of the entry counts that we have detected through likelihood ratio tests, the Negative Binomial model is a natural choice:

where λs, t is the expected value of the entry counts, conditional on the explanatory variables. The variance is equal to \(\lambda _{s,t} + \sigma ^{2} \lambda ^{2}_{s,t}\) where σ2 is the variance of an iid random variable zs, t, such that entrys, t|zs, t ∼ Poisson(λs, tzs, t).

The dependence of λs, t on the explanatory variables is modeled through a log link, i.e.

so that the predicted values of the expected number of entrants are non-negative.

Both Hausman-type and likelihood-based Breusch-Pagan tests suggest to estimate fixed effect (FE) models. In particular, we estimate two-way FE models that include both sectoral and yearly dummies, in order to control for the possible omission of time-varying variables that affect all sectors alike.Footnote 7 In all models, the estimation relies on robust standard errors.

Finding positive coefficients for AIM variables (βaim > 0, βas > 0) would suggest that sectors relying more on AIM for financing new firms experience, on average, more entry subsequently.

5 Results

Baseline estimates, as well as extensions and robustness exercises, are illustrated in this section.

5.1 Baseline results

Table 4 summarizes the negative binomial results, using sectoral and time fixed effects (2-way FE, col. i), and compares them with results from estimating 2-way FE Poisson and log-linear models.Footnote 8 Reported in the tables are the elasticities estimated at the mean of the explanatory variables, along with their respective standard errors.

The impact of the capital raising variables differs across sources (aim, mm, vc) in sign and magnitude, despite the fact that segments of the same stock exchange and the venture capital industry tend to move together along the business cycle. The elasticity of entry with respect to aim is about 9.2% and is statistically significant. The number of AIM small caps has a positive and significant effect (a 17.2% elasticity). Quite surprisingly, the effect of main market IPOs is negative and significant, corresponding to a -5.7% elasticity. There is a negative effect of VC investments, but it is not statistically significant. Our questions on the creation function performed by AIM receives a positive answer, albeit we cannot yet make causality claims. Similarly about VC, whereas the negative effect of the main market was less expected. Concerning control variables, we observe positive autocorrelation in entry counts, suggesting a multiplier/demonstration effect, whereas lagged exit does not significantly affect entry. Expectedly, the coefficients associated to the number of firms and to productivity growth are, respectively, negative and positive, and significant in both cases.Footnote 9

For the sake of comparison, we also report estimates of Poisson (col. ii) and log-linear models (col. iii). In the Poisson case, capital raising signs are confirmed, but the coefficients to mm and aim.small lose significance. The demonstration effect and the negative effect of sectoral size are confirmed, with lower magnitudes, whereas the productivity effect loses ground. Log-linear estimates fail to capture the effects observed through count models, although the elasticity of entry with respect to aim.small is significant and equal to 6.9%. Consider that the Poisson model does not take care of over-dispersion. Sectors with zero entry, indeed, are those with higher main market participation (in terms of IPOs, as can be shown through summary statistics), hence the effect of main market IPOs is diluted in the Poisson model. Even worst for the log-linear model, which fails to account for the count nature of the entry data.

5.2 Alternative measures and time patterns

In Table 5 we repeat the Negative Binomial estimates by ’unpacking’ the three-year average values of the capital raising variables and including all of their three lags, with the goal of uncovering time patterns in their influence, which may help grasping the reasons behind the opposite effects of main market and AIM activity. In col. (i), AIM IPO proceeds become significant from the second lag onwards, whereas aim.small only does so on the third lag. The effect of main market activity, instead, does not stretch back as far: it is significant (and negative) only at the first and second lag. Further differences between AIM and the main market are thus highlighted, as if the two segments conveyed different pieces of information to potential entrepreneurs.

We investigate this intuition further, by using alternative measures of stock market activity, namely, the number of money-raising IPOs on the AIM and on the main market, as well as the number of VC deals (first three lags of all these variables). The number of IPOs can be considered as an indicator of hot market conditions. Consistent with the insight from the previous estimates, col. (ii) shows that the effect of main market IPOs dries out after two lags and shows a similar elasticity as in the previous estimate. Quite the same for the number of AIM small caps, whereas the number of AIM IPOs, unlike its value, does not exercise any significant effect on entry. On the contrary, the number of VC deals is a positive and significant driver of entry, with a 11.9% elasticity at time t − 3, much higher (in absolute terms) than that associated to main market IPOs and with the previously estimated elasticity to AIM IPO proceeds.

The estimates in col. (iii) are based on a specification combining the ones on (i) and (ii), by picking up the terms entering significantly into the equation. Specifically, we include the first three lags of main market and AIM IPO proceeds, and the first three lags of the VC investment counts. Previous results are confirmed: the elasticity of entry to main market IPOs (in value) is around − 2.4% and significant in the first two lags; the elasticity to AIM IPO proceeds is significant from the second lag on (with estimates of 3.1% and 4.4%, respectively); VC investment counts are significant drivers at the third lag, with a stronger elasticity (10.4%). The message is much the same in col. (iv), where we only retain one lag for each equity variable (lag 2 for the main market, lag 3 for AIM and VC) in order to dispel doubts of collinearity. The elasticity to VC counts is now even stronger, whereas the one associated to AIM IPO proceeds is weaker, yet significant.

5.3 High-tech sectors

The foregoing estimates, while controlling for sectoral fixed effects, only suggest what is the elasticity of sectoral entry with respect to equity market measures, evaluated at the average. This boils down to assuming that the effects of a funding mechanism are the same across sectors. Yet, VC is largely flowing into technology and life sciences industries, whereas AIM is oriented towards a broader industry scope. Hence, VC specializes in certain industries and therefore a fair “horserace” between VC and stock markets should focus more on these industries and not so much on traditional manufacturing.

In order to tackle this issue, we re-run the Negative Binomial model (in its ’mixed’ version, including IPO values and VC investment counts) and evaluate the elasticities at the average values of the covariates, conditional on a sector being classified as “high-tech”. Eurostat defines as high-tech sectors the following NACE Rev. 2 sectors: Manufacture of basic pharmaceutical products and pharmaceutical preparations (NACE code: 21); Manufacture of computer, electronic and optical products (26); Manufacture of air and spacecraft and related machinery (30.3). We adopt this convention here and create a dummy high − tech equal to 1 for Eurostat high-tech sectors, and 0 otherwise.

Results in Table 6 show that entry elasticities with respect to equity markets do indeed differ if one compares high-tech and non high-tech sectors. Specifically, a 10% increase in the number of VC investments brings about 2.8% more entrants in high-tech sectors three years later, and a 0.91% increase in non-high-tech. Elasticities with respect to the value of AIM and main market IPOs differ less across sectors, yet they are slightly stronger outside of high-tech, consistent with the higher accessibility of stock market equity in more traditional sectors. Therefore, our questions about the effects of VC on entry in different sectors receives an answer that is in line with expectations.

5.4 Dealing with data issues

By performing the main estimates on three-year lags, we indirectly had taken care of an econometric and intepretive issue with the previous estimates. Indeed, the sign and significance of the coefficients attached to IPO proceeds in shorter horizons may be driven by the presence of zeros, and so they may conflate an “extensive margin” effect - due to the sheer presence of IPOs - with an “intensive margin” effect, according to which what stimulates entry is the amount of money raised at IPO. Yet, the percentage of sectors-years that launched IPOs on the LSE Main Market over a four year time span was 74.5%, and 97.6% on AIM; 99.1% of sector-years received venture capital. Hence, the coefficients based on longer horizons can be seen as mainly capturing an intensive margin effect.

Nonetheless, we repeat the estimates of the baseline model (2-way FE, 3-year horizon) while replacing aim, mm, and vc by means of dummies taking unit values whenever there was a positive amount of raised capital, and zero otherwise. Coefficients associated to these variables convey information on the extensive margin effect of stock market listing and venture capital. Consistent with the above insight, the estimates, reported in Table 7 (col. i), show that the extensive margin effect lacks statistical significance. The baseline estimates, thus, can be taken as measuring the intensive margin effect on entry of capital raised on the stock market.

Next, baseline results may have been biased if sectors with larger IPO proceeds are also those with more entry, since the pool of potential IPO firms is fed by the process of firm creation itself. Hence we remove the sectors with the highest and the lowest raised capital at IPO on AIM between 2002 and 2012 (namely, NACE 192 “Manufacture of refined petroleum products” and NACE 120 “Manufacture of tobacco products”, respectively). In col. (ii) the baseline results are largely confirmed, although with slightly weaker elasticities with respect to AIM capital raised (2.83% and significant only at time t − 2) and AIM small caps (19.7%).

Finally, public and private equity market variables enter the regression equations separately, yet one may argue that their effects are interrelated, since going public is a possible exit route for VC-backed companies (Black and Gilson 1998; Da Rin et al. 2006). Following Cumming and Knill (2012), the impact of VC finance on entrepreneurship should be enhanced by higher-quality prospectus disclosure. In other words: venture capitalists are more eager to invest in companies that wish to go public on a market, such as the main market, characterized by tight information standard, to the extent that this allows a more accurate valuation of the company.

We have operationalized this insight by creating two interaction variables: vc ∗ mm and vc ∗ aim, where vc here indicates the number of VC investments, whereas mm and aim stand for the value of IPO proceeds, respectively, on main market and AIM. If information standards have any role in stimulating VC investments, we should have positive coefficients associated to the interaction terms, namely, sectors with VC investments should display more new firms if they also host more IPOs, as if the signals from the availability of VC and IPOs reinforced each other. This should be true at least for the main market, since it is characterized by higher quality of information prospectuses and, generally, less opacity.

Col. (iii) in Table 7 confirms the intuition for the main market (positive and significant coefficient associated to vc ∗ mm), but not for AIM (the coefficient to vc ∗ aim is not statistically significant).

5.5 Endogeneity

Omitting non-observed or non-observable variables that affect firm creation decisions would induce correlation between the stock market variables and the error term. One cure for this problem is the pseudo diff-in-diff approach pioneered by Rajan and Zingales (1998) that includes interaction terms in order to take care of sector-time effects. Our capital raising variables (mm, aim, vc) are hereby interacted with a measure of entry barriers, i.e. the sectoral averages of the Herfindahl-Hirschman index, built from Amadeus data on UK manufacturing companies for the period 1997-2009. A similar approach was followed by Popov and Roosenboom (2013), who used US sectoral entry rates to proxy entry barriers in a relatively frictionless economy (see also Beck et al. (2005)). We depart from the approach of taking the US as a benchmark, because the UK is already one of the countries with the most frictionless stock markets in the world.

In Table 8 (col. i), 2-way FE Negative Binomial with three lags are augmented with interaction terms. AIM raised capital keeps affecting entry, but only in its stand-alone version (with an elasticity of 8.4% with respect to capital raised, and 17% to small caps), whereas capital raised through main market IPOs loses its significance. The AIM effect is not channeled through interaction terms, the coefficients of which lack significance. The main message from the baseline estimates is confirmed.

The analysis performed so far could also be criticized on the grounds of reverse causality: it could be entry that drives IPOs and not the opposite. Arguably, there can hardly be IPOs in sectors where entry is rare. Regulatory and technological barriers that deter entry, thus, constrain the pool of potential IPOs. Moreover, firms in concentrated sectors may rather look at the main market as the venue for IPO financing, as they are characterized by relatively large efficient scale at entry and thus can afford to bear the higher costs of an official listing.

Therefore, we implement an estimator based on instrumental variables and attempt to identify the causal effect of our financial variables. Besides the AIM IPO proceeds, VC investments could also be considered as endogenous for very similar reasons. Main market IPOs, instead, are hardly endogenous with respect to the rates of new business creation, since the official listing requirements are typically unattainable by infant firms.

Instrumental variables need to be correlated with capital raising on AIM and with VC, but not with the error term of the firm creation equation, which can be seen as collecting the unobserved component of entrepreneurial opportunities. More specifically, we know that new firm creation increases the demand for funding, which is why aim and vc could be endogenous. Hence, identification of the causal effects requires exogenous variation in the supply of funding. We follow Popov and Roosenboom (2013) and works cited therein and use instrumental variables based on buyout assets and the size of pension funds (data source: Eurostat). Indeed, both buyout fund-raising and pension funds measure the spending capacity of institutional investors, important in both VC and AIM.Footnote 10

We generate three instrumental variables. The first is buyout fund-raising interacted with the sectoral shares of VC investments (with respect to total annual VC). Buyout fund-raising is an aggregate variable, hence interacting it with sectoral VC shares allows to provide a rough estimate of how much buyout assets would be potentially available to each sectors. We take the three-years lag of this interaction term.

The second variable is the size of pension funds, as a ratio of GDP, interacted with the sectoral amounts of VC before the adoption of the pension funds directive by the European Commission in 2003, and with a dummy equal to 1 after the adoption (cf. Popov and Roosenboom (2013)). The idea is that after this directive, the UK, which had liberalized years before, became a potential market for investments by pension funds in other EU countries. The third variable exploits exogenous variation due to amendments to the stamp duty regime of exchange-traded funds (ETFs) in 2007, which enhanced the possibility of non-UK European issuers to list on AIM.Footnote 11 The instrumental variable we build is equal to the size of pension funds as a ratio of GDP, times the sectoral amounts of AIM IPO proceeds before the stamp duty reform, times a dummy equal to 1 from 2007 on.

The insight behind the two latter IVs is that risky investments, such as those in VC and in AIM-listed companies, should attract more financing if pension funds are larger, but more so in sectors that attracted VC and AIM IPOs even before the reforms, and should take account that liberalization events allowed the UK market to be targeted by a larger “audience”.Footnote 12

In case one or more regressors are suspected of endogeneity in a Negative Binomial model, Wooldridge (2002) and Terza et al. (2008) suggest using the two-stage residual inclusion (2SRI) method to identify causal effects. In the first stage, the possibly endogenous variables are regressed on the excluded and included instruments. In the second stage, the non-linear model at hand is estimated by including the first-stage residuals along with all regressors (both exogenous and endogenous). First-stage residuals approximate for the unobservable variable that is supposed to cause jointly the outcome variable and the endogenous regressors. The number of IVs must be no less than the number of endogenous regressors, and the usual criteria (instrument relevance, exclusion restriction) must be satisfied. In the second stage, standard errors need to be corrected, e.g. by means of bootstrapping.Footnote 13 Exogeneity of aim and vc can be tested by means of a joint F-test on the coefficients associated to the first-stage residuals in the second-stage equation. The null is that all those coefficients are jointly zero.

In Table 8 we also report the estimates from the 2SRI procedure: columns (ii) and (iii) include the first-stage results (assuming, respectively, AIM IPO capital raised and VC proceeds as endogenous variables), whereas col. (iv) reports the second-stage results. The joint F-test on the instruments coefficients in the first-stage regressions confirms the relevance of the instruments: in the AIM equation, the F(3,429) statistic is 19.76 (p-value: 0.000); F(3,429) = 26.71 in the VC equation (p-value = 0.0000). Correlations between the instruments and the second-stage Pearson error term are negligible, as shown in the bottom-right of the table, motivating us to believe in the exclusion restriction. Our choice of instrumental variables is in line with the usual requirements. Though, it is worth noting that the coefficients attached to the first-stage residuals in the second-stage equation are not statistically significant. Hence, we conclude that capital raised at IPO on AIM and that VC investments are probably exogenous with respect to sectoral entry counts. Consequently, the estimates obtained in the previous subsections may capture the causal effects of capital raising on sectoral entry.Footnote 14

5.6 Summary and discussion of results

Our results suggest that entry decisions take account of stock market information, even though, in all likelihood, very few firms plan ever to go public. Consequently, during the period 2004-2012, the AIM has performed a creation function: sectors that have raised more capital at IPO on AIM were also those housing more entrants in subsequent years, ceteris paribus. We can give a causal interpretation to these results, since our tests indicate that capital raised through AIM and VC are exogenous with respect to entrepreneurial opportunities. Moreover, we capture an intensive margin effect, i.e. the effect is due to more IPO proceeds, not to IPO counts; and it is robust to the exclusion of sectors housing very large IPOs.

It is also worth noting that venture capital in our estimates affects subsequent entry more strongly than the value of AIM IPOs, but not when we compare it with the number of AIM small-caps. Venture capital and AIM, moreover, stimulate entry according to different sectoral patterns, VC being more effective with respect to high-tech, AIM with respect to traditional manufacturing. Also interestingly, AIM and VC affect subsequent entry on longer time horizons than the main market.

Our results on the creation function performed by the AIM may be viewed as complementary with the case study explored by Baldock (2015). To the extent that the number of IPOs in a sector is a favorable market-wide condition, the present results suggest that economic, financial and institutional conditions surrounding entrepreneurial activity matter not less than corporate-specific features on the decision to set up a new firm.

The varying role of AIM in fostering entry over different time horizons sheds new light on the issue of short-termism induced by stock markets. The magnitude of the AIM’s influence of UK firms entry increases with longer time horizons, illustrating the desire of prospective entrants to avoid information distorted by short-term noise. In parallel, Baldock (2015), regarding the decisions to do IPOs on the AIM, stresses the existence of frictions between the longer term motivations for retained ownership belonging to “lifelong entrepreneurs” and the shorter term motivations of private equity investors who are seeking optimum exit value. Indeed, as pointed out by the author, “It is not always preferable for young firms to rely on junior stock markets, it depends on the profile on the entrepreneurs (short term versus long term), and also on the corporate strategies”. Regarding the AIM, the Kay Review (2012) reports that the short-term vision of the intermediaries may alter the effectiveness of the market functions for listed companies and, we would add, for prospective companies that consider stock market indicators as informational inputs in their entrepreneurial decision-making. The tensions that this market is facing between short-and long-term horizons may hamper the ambitions for a “buoyant” AIM that would support high-growth firms in the UK (Baldock 2015). There is a need for more fine grained understanding of the motivations and goals of entrepreneurs and investors (Carsrud and Brännback 2011).

Concerning venture capital, its coefficient is only significant with a positive sign in our estimates when we consider the number of deals. The sectoral value of VC disbursements, as such, does not seem to be relevant in entrepreneurial decisions. Perhaps, prospective firm founders know that the size of venture capital deals is a poor proxy for the overall value of venture capital, which includes advice on technological and commercial matters. In any case, our findings are consistent with previous results by Popov and Roosenboom (2013).

The above results on AIM and the VC correlate with recent evidence on the UK finance escalator. According to this concept, growing SMEs use these different sources of finance at different stages in their development. North et al. (2013) show that the UK escalator has been altered by breakages since 2007, illustrating a growing disconnection between business angels, venture capital investors and the public market: some investors favour fast exits - such as trade sales - over IPOs (see also Mason et al. (2010)). Yet, that evidence is about high-tech SMEs and does not conflict with the stimulating role of AIM for traditional manufacturing sectors.

One surprising result is that sectors raising more capital through main market IPOs are characterized, on the margin, by fewer new entrants. Such a negative association can be interpreted in two (not mutually exclusive) ways, possibly throwing light on the role of AIM in firm creation, too.

One interpretation is that, in sectors with more reliance on stock market financing, incumbents compete more aggressively, thereby preventing entry or harshly responding to it. Consider listed companies wherein ownership and control are separated and the managers are instructed to maximize shareholders value, but are imperfectly monitored. Rotemberg and Scharfstein (1990) showed that a firm can boost its stock price - and thereby its shareholders value - by competing aggressively on the product market: indeed, this is a way to enhance its profitability and to cause the rivals’ performance to fall, information that would be incorporated in higher stock prices. At the same time, listed incumbents may compete more harshly because they are more tolerant to earnings variability than unlisted firms (Chod and Lyandres 2011).

Kraus and Rubin (2010) built a theoretical model implying that the higher the shareholders diversification, the higher the propensity of managers to initiate “cannibalistic” projects that decrease their rivals’ market shares, as opposed to “economy-increasing” projects that would instead open up entry opportunities. Incumbents whose shares are traded on the official list have a more dispersed ownership base, and therefore may seek to sustain their stock prices by limiting entry. Ownership-control separation is mandatory in the London Stock Exchange main market, hence an industry that relies more on stock market financing is also an industry in which more companies adopt the “best practice” governance structure and suffer from the associated agency issues. No discrepancy between shareholders value maximization and profit maximization ought to occur outside of the stock market. Hence, fewer main market IPOs in an industry imply lower incentives for incumbents to compete aggressively. If so, more entry should be observed in industries that rely less on the main market, all else being given. Such incentives are expected to be weaker among AIM-listed companies.

Nomads may advice to adopt the standard governance, but it is not mandatory, thereby leading to governance structures that mitigate the incentives for managers to use cannibalization (Kraus and Rubin 2010). Another story is that potential entrants face higher financial barriers to entry in sectors that rely more on stock market funding, especially if access to stock markets is limited. This is rooted in the negative association between product market entry and concentration among financiers, previously observed in the literature mainly with respect to banking competition (see e.g. Campello (2003)). That evidence may be relevant for stock market financing, too. Indeed, listing requirements set by the main market effectively reduce the access to finance, as smaller and younger firms can only rely on loans or private equity if they do not have enough own funding. This cannot be said about AIM, wherein listing requirements ultimately are tailored by Nomads in a case-wise fashion. What is less convincing about this story is that stock market listing need not be the primary financial source of choice for newcomers according to the pecking order hypothesis.

A last explanation is rooted in the possible joint causation of entry barriers and stock market financing. This has been already taken care of through the 2SRI method (Table 8) and the estimates on a sample excluding sectors with large IPO proceeds (Table 7, col. ii).

In interpreting our results about the entry effects of AIM and the main market, it is worth noting that according to Doukas and Hoque (2016), the AIM and the main list of the LSE attract companies that have different investment and financing priorities. While many SMEs list to obtain financing, many others list to increase their visibility, advertise their products, or gain credibility; “thus, the level of new financing does not always have to be the barometer of success for an SME exchange” (Harwood and Konidaris 2015).

Some tentative implications for policy and practice can be induced. In public policy terms, the evidence produced here can be interpreted as a sort of positive externality or informational spillover from publicly floated and VC-backed companies to prospective new firms. Economic theory would therefore justify fiscal incentives or tax rebates for companies receiving public or private equity, but a broader debate should assess the possibly adverse macroeconomic effects of expanding the size of financial markets, in tune with the concerns expressed in Arcand et al. (2015) on excessive financialization.

In respect to business strategy, a key issue concerns the role of junior markets as possible competitors with VC. Carpentier et al. (2010) showed that the junior segment of the Toronto Stock Exchange outperformed VC in terms of rates of return and graduations to the main segment, despite the comparative advantage of VC in performing business and technology advice functions. We conjecture that would-be high-tech entrepreneurs perceive the VC industry as providing more useful signals on profit opportunities than junior markets. Junior market managers who seek to compete with VC need to stimulate the quotation of high-tech companies and mitigate the current preference for investments in less risky (and less rewarding) companies in traditional manufacturing. Clearly, it is a matter of strategic choice, since AIM managers possibly target a segment of investors oriented towards longer term horizons than those typical of VC.

6 Conclusion

In the years under examination, 2004-2012, a period characterized by the emergence and subsequent crash of the subprime bubble, the AIM seems to have performed a creation function for UK manufacturing firms. All things being equal, sectors that raised more capital at IPO on AIM and with more AIM listed small caps were also those housing more new entrants in the subsequent years, in line with Lazonick’s (2007) work as well as with the recycling hypothesis (Michelacci and Suarez 2004) and with entrepreneurial spawning (Gompers et al. 2005). The magnitude of this effect increases over longer time horizons, but it is weaker than for the closest alternative source, venture capital (at least when measured in investment counts). Moreover, while VC has an advantage in high-tech, AIM is more effective in fostering entry in traditional manufacturing, consistent with the empirical observations by Lagneau-Ymonet et al. (2014) on the relatively large size of AIM-listed companies.

Our robustness checks show that this statistical relationship captures an intensive margin effect, i.e. the effect is related to more IPO proceeds, not to more IPOs; and it is not driven by a few sectors that rely on very large IPOs. The results are robust when we control for an omitted variables bias through pseudo diff-in-diff estimates, interacting capital raised with market concentration indices, and when we allow for exogenous variation in the supply of finance from institutional investors, through a 2-stage residual inclusion method.

All is not well with the real effects of financial markets, though. Quite surprisingly, more capital raised at IPO in the main market does not translate into a greater flow of new firms, possibly because financialized incumbents, under ownership-control separation, have incentives to compete fiercely in order to sustain their stock prices.

As suggested by our results, the relative illiquidity of a junior listing venue such as AIM is not, as such, a limiting factor with respect to providing signals for new firm formation, despite previous evidence highlighting the opacity and speculative behaviors typical of this listing venue (see e.g. the results on the declining labor productivity by Revest and Sapio (2013b)). The number of small caps and the amounts of raised capital on the junior stock market may have been taken as indicators by prospective firm founders, helping mitigate the uncertainty faced in launching their entrepreneurial activities. Yet, this does not mean that junior markets are able to provide reliable estimates of the fundamental value of the listed shares. Rather, founders and managers of new firms may place too much weight on market value in their decision processes. The number of entrants can be inflated by false expectations, disconnected from the real value of the existing firms. Fostering entry is, after all, a necessary but not sufficient condition for generating highly-skilled, innovative jobs.

Care must be taken with respect to the external validity of these results. However small and opaque may AIM be, it is nevertheless the most capitalized among junior stock markets, and may benefit from its linkage with the London financial center. The same creation function effect need not be performed by less capitalized markets in more financially peripheral countries. These are matters for further empirical scrutiny. Further, junior markets around the world differ in terms of admission and oversight rules, as well as in their propensity to feed companies to the main stock market segments. Such institutional specificities correlate with differences among financial systems (Dosi et al. 2016) and a systematic understanding of these patterns is the subject of on-going research. The creation function of a junior stock market might be stronger if the observed graduation rates are higher than on AIM, as in Japan or in Canada (see Carpentier et al. (2010)).

One limitation of our analysis relates to the lack of debt data at the sectoral level. We have partly accounted for this omission by using sectoral and time fixed effects, as well as through the pseudo diff-in-diff method. It must be remarked that the UK has experienced a growing amount of credit in the period of interest, but not a monotonic trend in new firm formation. The hint in the available statistical information is that bank-based financing has satisfied mainly the needs of large and established companies (Monteiro 2013). Especially lending to SMEs has been characterized by a continued retraction from 2004 until 2012, meanwhile, between 2004 and 2008, and between 2010 and 2012, credit flows oriented toward larger corporate firms were increasing. Hence, our results would probably survive to including sectoral credit data.

On a final note, in future research we may develop econometric models able to account more explicitly for the dynamic relationship between firm creation, private equity, and public equity, since the latter two can be viewed as complements (stock market quotation is a possible exit route for venture capitalists) or substitutes (junior markets and VC funds may target the same firm types). Relatedly, a future research avenue should focus on the influence of stock market activity on the growth rates of new firms, whether or not publicly floated. Firm growth is not a linear organic process, but may result from acquisition or organizational change (Brown et al. 2017). Often, public decision-makers only target High-Growth Firms (HGFs) experiencing organic growth, and they omit that a significant proportion of UK HGFs are involved in acquisition activity, which is influenced by stock market dynamics. The sectoral shares of HGFs may correlate with the availability of alternative funding sources such as private equity and ”junior” public equity. Another research direction concerns the role of the market intermediaries (brokers, nominated advisers, financial analysts). Eberhart and Eesley (2018) show that junior stock market intermediaries can reduce new firm growth rates due to institutional conflict. Similar adverse effects may involve the entry process, since opaque and conflictual behaviors by market intermediaries can deteriorate the quality of information upon which entrepreneurial decisions are assumed. One needs to understand better the functions performed by intermediaries in this respect.

Notes

Related research work, but focused on the Toronto Stock Exchange Venture Capital (TSXV) market, the Canadian junior market, has been performed by Carpentier and Suret (2018).

Even if data were available, the causal effect of AIM would be difficult to disentangle, because the AIM is not the first junior market to be created in the UK. The Unlisted Securities Market (USM) was in operation between 1980 and 1995. Acting as a competitor with other funding sources for young SMEs, it may have influenced entry decisions as well. Some of the early AIM-listed companies were actually transfers from the USM, so the overall performances of AIM and USM were related, at least in the early years.

For instance, in the tobacco sector (NACE Rev. 2 code: 120) between 2002 and 2012 there were no money-raising IPOs on either AIM or the main market. On the contrary, manufacture of coke oven products (NACE Rev. 2 code: 191) had 40 money-raising IPOs on AIM in 2005. Money raised at IPO also varies dramatically: for instance, according to LSE data, in 2005 it ranged from 443.01 million pounds (petroleum products), to 98.85 million pounds (electronic and electrical equipment), to 12 million pounds (manufacture of beverages) or even lower values.

In short, stock market data prior to 2006 have been converted from the old FTSE classification to ICB sectors and the latter, in turn, into NACE Rev. 2 sectors. NACE Rev. 2 sector 33 was removed, as no correspondence could be found with the ICB codes. Stock market data for NACE Rev. 2 sectors 13, 14, and 15 were available only from 2006 onwards. A similar concordance problem was faced and solved by Popov and Roosenboom (2013). An ICB-NACE conversion table had been reported in Ortega-Argiles et al. (2011, Appendix A) but it refers to the previous revision of the NACE classification (Rev. 1.1) and is more aggregated (2 digits).

Taking 10 million and 25 million pound thresholds does not change the results in any significant way. These figures have been computed by using data on the capitalization of individual stocks at the year end, published by the LSE on its website.

We only have aggregate data on bank loans. Fixed sectoral effects may capture, among other things, the sector-specific influence of loan supply on new firm formation.

This corresponds to demeaning, an approach that is better than the alternative approach of first-differencing, because it does not artificially induce serial correlation of the error term. This also takes care of pro-cyclicality in stock market variables, as in Popov and Roosenboom (2013).

1-way FE Negative Binomial estimates, omitting time dummies, yield very similar results as 2-way FE Negative Binomial estimates.

Further results, not reported here for the sake of brevity, show that elasticity estimates are higher in magnitude when we average capital raising variables over four years, and lower when we take two-year averages.

Some papers have used lagged values of the endogenous variable to this end, but in our case longer lags of vc and aim may still be correlated with entrepreneurial opportunities (see Section 4 for a discussion on this point).

See interview with LSE official Gillian Walmsley for Morningstar, 20 July, 2010.

Caveats on the two latter instruments are discussed in Popov and Roosenboom (2013) on VC, and similar remarks can be made on AIM.

See, however, Wooldridge (2002) for an exact computation of standard errors.

Similar results are obtained if we include instrumental variables one at a time, and if we use as possibly endogenous explanatory variables the AIM IPO and VC number of investments instead of their monetary values.

References

Aghion P, Fally T, Scarpetta S (2007) Credit constraints as a barrier to the entry and post-entry growth of firms. Econ Policy 22(52):732–779

Arcand JL, Berkes E, Panizza U (2015) Too much finance?. J Econ Growth 20(2):105–148

Baldock R (2015) What is the role of public feeder markets in developing technology-based small firms? An exploration of the motivations for listing on AIM since the GFC. Ventur Cap 17(1-2):87– 112

Bartelsman E, Haltiwanger J, Scarpetta S (2009) Measuring and analyzing cross-country differences in firm dynamics. Producer dynamics: New evidence from micro data. University of Chicago Press: 15–76

Barth ME, Landsman WR, Taylor DJ (2017) The JOBS Act and information uncertainty in IPO firms. Account Rev 92(6):25–47

Beck T, Demirgüç-Kunt A, Maksimovic V (2005) Financial and legal constraints to growth: Does firm size matter?. J Financ 60(1):137–177

Bhattacharya A (2017) Innovations in new venture financing: Evidence from Indian SME IPOs. Glob Financ J 34:72–88

Black B, Gilson R (1998) Venture capital and the structure of capital markets: banks versus stock markets. J Financ Econ 47(3):243–277

Brown R, Mawson S, Mason C (2017) Myth-busting and entrepreneurship policy: the case of high growth firms. Entrep Reg Dev 29(5-6):414–443

Campello M (2003) Capital structure and product markets interactions: evidence from business cycles. J Financ Econ 68(3):353–378

Carree MA, Thurik AR (1999) The carrying capacity and entry and exit flows in retailing. Int J Ind Organ 17(7):985–1007

Carpentier C, L’her JF, Suret JM (2010) Stock exchange markets for new ventures. J Bus Ventur 25(4):403–422

Carpentier C, Suret JM (2018) Three decades of IPO markets in Canada: Evolution, risk and return. Account Perspect 17(1):123–161

Carsrud A, Brännback M (2011) Entrepreneurial motivations: what do we still need to know? J Small Bus Manag 49(1):9–26

Chemmanur TJ, He J (2011) IPO waves, product market competition, and the going public decision: Theory and evidence. J Financ Econ 101(2):382–412

Chod J, Lyandres E (2011) Strategic IPOs and product market competition. J Financ Econ 100(1):45–67

Cumming D, Knill A (2012) Disclosure, venture capital and entrepreneurial spawning. J Int Bus Stud 43(6):563–590

Cumming D, Walz U, Werth JC (2016) Entrepreneurial spawning: experience, education, and exit. Financ Rev 51(4):507–525

Da Rin M, Nicodano G, Sembenelli A (2006) Public policy and the creation of active venture capital markets. J Public Econ 90(8):1699–1723

Dosi G, Revest V, Sapio A (2016) Financial regimes, financialization patterns and industrial performances: preliminary remarks. Rev Econ Ind 2:63–96

Doukas JA, Hoque H (2016) Why Firms Favour the AIM when they can List on Main Market? J Int Money Financ 60:378–404

Eberhart R, Eesley CE (2018) Intermediaries and Entrepreneurship. Strategic Management Journal (Forthcoming)

EC (2015) Capital markets union: an action plan to boost business funding and investment financing. European Commission, Brussels, 30 September

Espenlaub S, Khurshed A, Mohamed A (2012) IPO survival in a reputational market. J Bus Financ Acc 39(3-4):427–463

Farinha J, Mateus C, Soares N (2018) Cash holdings and earnings quality: evidence from the Main and Alternative UK markets. Int Rev Financ Anal 56:238–252

Garrett RP, Miao C, Qian S, Bae TJ (2017) Entrepreneurial spawning and knowledge-based perspective: a meta-analysis. Small Bus Econ 49(2):355–378

Geroski PA (1995) What do we know about entry? Int J Ind Organ 13 (4):421–440

Giudici G, Roosenboom P (eds) (2004) The Rise and Fall of Europe’s New Stock Markets. Elsevier, Oxford

Gompers P, Lerner J, Scharfstein D (2005) Entrepreneurial spawning: Public corporations and the genesis of new ventures, 1986 to 1999. J Financ 60(2):577–614

Harwood A, Konidaris T (2015) SME exchanges in emerging market economies: a stocktaking of development practices world bank policy research working paper 7160

Hornok JR (2014) The alternative investment market: helping small enterprises grow public. Ohio St. Entrepren Bus LJ 9:323

IOSCO (2015) SME financing through capital markets. The International Organization of Securities Commissions

Kay Review (2012) The Kay review of uk equity markets and long term decision making, July

Klapper L, Laeven L, Rajan R (2006) Entry regulation as a barrier to entrepreneurship. J Financ Econ 82(3):591–629

Klepper S (2001) Employee startups in high-tech industries. Ind Corp Chang 10(3):639–674

Kraus A, Rubin A (2010) Reducing managers’ incentives to cannibalize: Managerial stock options when shareholders are diversified. J Financ Intermed 19 (4):439–460

Lagneau-Ymonet P, Rezaee A, Riva A (2014) Is the proof of the pudding in the eating? Les leçons d’une comparaison entre l’Alternative Investment Market et Alternext. Revue d’Economie Financiere 2:189–206

Law SH, Singh N (2014) Does too much finance harm economic growth? J Bank Financ 41:36–44

Lazonick W (2007) The US stock market and the governance of innovative enterprise. Ind Corp Chang 16(6):983–1035

Lee SH, Bach SB, Baik YS (2011) The impact of IPOs on the values of directly competing incumbents. Strateg Entrep J 5(2):158–177

Love I, Chavis LW, Klapper LF (2010) The impact of the business environment on young firm financing. The World Bank

Manjon-Antolin MC (2010) Firm size and short-term dynamics in aggregate entry and exit. Int J Ind Organ 28(5):464–476

Mason CM, Jones L, Wells S (2010) The City’s role in providing for the public equity financing needs of UK SMEs, Report to City of London

Michelacci C, Suarez J (2004) Business creation and the stock market. Rev Econ Stud 71(2):459–481

Monteiro D (2013) The flow of credit in the UK economy and the availability of financing to the corporate sector. European Commission Economic Papers 509 - December 2013

Nassr IK, Wehinger G (2015) Opportunities and limitations of public equity markets for SMEs. OECD Journal: Financial Market Trends 3(1):1–36

Newell G, Marzuki MJB (2018) The significance and performance of property companies on the AIM stock market. Journal of European Real Estate Research 11 (1):28–43

Nielsson U (2013) Do less regulated markets attract lower quality firms? Evidence from the London AIM market. J Financ Intermed 22(3):335–352

North D, Baldock R, Ullah F (2013) The finance escalator and the growth of UK technology-based small firms since the financial crash. Ventur Cap 15(3):237–260

Nyström K (2007) An industry disaggregated analysis of the determinants of regional entry and exit. Ann Reg Sci 41(4):877–896

Ortega-Argiles R, Potters L, Vivarelli M (2011) R&D and productivity: testing sectoral peculiarities using micro data. Empir Econ 41(3):817–839

Panizza U (2018) Nonlinearities in the relationship between finance and growth. Comp Econ Stud 60(1):44–53

Popov A (2009) Does finance bolster superstar companies? Banks, venture capital, and firm size in local U.S. markets. European Central Bank Working Paper Series, n. 1121 December 2009

Popov A, Roosenboom P (2013) Venture capital and new business creation. J Bank Financ 37(12):4695–4710

Posner E (2009) The origins of Europe’s new stock markets. Harvard University Press, Cambridge

Quatraro F, Vivarelli M (2014) Drivers of entrepreneurship and post-entry performance of newborn firms in developing countries. World Bank Res Obs 30 (2):277–305

Rajan RG, Zingales L (1998) Financial dependence and growth. American Economic Review, pp 559–586

Resende M, Ribeiro EP, Zeidan R (2015) Dynamic entry and exit linkages in the Brazilian manufacturing industry: An econometric investigation. Int J Econ Bus 22(3):379–392

Revest V, Sapio A (2012) Financing technology-based small firms in Europe: what do we know? Small Bus Econ 39(1):179–205

Revest V, Sapio A (2013a) An essay on the emergence, organization and performance of financial markets: the case of the alternative investment market. In: Pyka A, Burghof HP (eds) Innovation and finance routledge/lisbon civic forum studies in innovation, pp 69–99

Revest V, Sapio A (2013b) Does the Alternative Investment Market nurture firm growth? A comparison between listed and private firms. Ind Corp Chang 22-4:953–979

Ritter J (1984) The “hot issue” market of 1980. Journal of Business, pp 215–240

Rocha V, Carneiro A, Varum CA (2015) Entry and exit dynamics of nascent business owners. Small Bus Econ 45(1):63–84

Rotemberg JJ, Scharfstein DS (1990) Shareholder-value maximization and product-market competition. Rev Financ Stud 3(3):367–391

Santarelli E, Vivarelli M (2007) Entrepreneurship and the process of firms’ entry, survival and growth. Ind Corp Chang 16(3):455–488

Sevilir M (2010) Human capital investment, new firm creation and venture capital. J Financ Intermed 19(4):483–508

Stuart T, Sorenson O (2003) Liquidity events and the geographic distribution of entrepreneurial activity. Adm Sci Q 48(2):175–201