Abstract

This paper considers the relative efficiency of unit tax and ad valorem tax in a Cournot duopoly market in the presence of licensing opportunities after the announcement of the tax rates by the government. In case of fixed-fee licensing, if the unit cost difference of the firms is low and tax revenue of the government is high, then unit tax is more efficient than the ad valorem tax. If tax revenue of the government is low, then ad valorem tax is more efficient than unit tax. Ad valorem tax is more efficient than unit tax in the case of royalty licensing.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Taxes that are levied on the production or consumption of goods and services or on imports and exports and paid indirectly by the final consumers are generally known as indirect taxes. Some common examples of indirect taxes are: sales taxes, value-added taxes (VAT), taxes on any aspect of manufacturing or production, taxes on legal transactions, and customs or import duties. Among these, unit taxes are levied on per unit of output produced or sold and ad valorem taxes are collected on the value of the production or transaction. An extensive literature in economic theory, is devoted to the study of the welfare consequences of various taxations under alternative market structures.Footnote 1 In a perfectly competitive market, unit taxes and ad-valorem taxes are symmetrical in terms of welfare. Both these types of taxes, generate an identical equilibrium with the same output, when they are imposed to extract equal tax revenues.Footnote 2 Thus, if a benevolent government is willing to extract a certain amount of tax revenue, it can choose either of the two taxation schemes as both of these schemes are equally efficient. However, in case of imperfectly competitive markets, the story gets more nuanced. Suits and Musgrave (1953) proves the superiority of ad valorem taxes over unit taxes in a general monopoly setting, as the ad valorem taxation yields a larger social surplusFootnote 3 than the unit tax with the same tax revenue. Moreover, Skeath and Trandel (1994) shows that in monopoly for any given specific tax, there exists an ad valorem tax that not only results in higher social surplus but also leads to greater tax revenue, profit, and consumer surplus. Schroder (2004), shows unit taxes are less efficient than ad valorem taxes in a market characterized by monopolistic competition. This is because unit taxes distort prices while ad valorem taxes, since it is levied on profits, only reduce the number of firms operating in the market. Myles (1996) and Hamilton (1999) argue that tax/subsidy policies can be used to improve welfare by reducing the distortion due to product market imperfection. Though in a homogeneous product oligopoly with a fixed number of firms, both specific and ad valorem taxes reduce industry output and lead to efficiency loss one may be less distortionary than the other. Delipalla and Keen (1992) and Anderson et al. (2001) show the superiority of ad valorem tax in case homogeneous Cournot oligopoly if the firms have symmetric costs. Anderson et al. (2001) argues that ad valorem taxes are welfare-superior to unit taxes in the short run when production costs are identical across firms. Denicolo and Matteuzzi (2000) and Anderson et al. (2001) also extends this result by considering asymmetric firms.

A parallel literature in industrial organization deals with the issue of technology licensing among firms in an oligopolistic market structure. Technology transfer between firms has become a common phenomenon in the present days (See Vishwasrao, 2007 and Hu et al., 2005). The most common forms of licensing are by either fixed-fee or royalty. Rostocker (1984) for example, shows that royalty alone is used for 39 percent of time, fixed-fee alone for 13 percent and both instruments together for 46 percent. Shapiro (1985) discusses the possibilities of licensing in a Cournot duopoly market where firms produce a homogeneous product via fixed-fee, royalty and two-part tariff. It is shown by him that the licensor cannot charge a per-unit royalty such that the effective unit cost of the licensee is greater than in case of no-licensing, as this type of agreements are abandoned by the anti-trust law.Footnote 4 Marjit (1990) discusses the possibilities of licensing by fixed-fee in a Cournot duopoly model and shows that technology is licensed if the initial cost difference is low. Gallini and Winter (1985) and Wang (1998) also considers licensing by royalty. Wang (1998) and Fauli-Oller and Sandonis (2002) show that in the case of royalty licensing technology is always licensed. Sen and Tauman (2007) however, provides a general licensing schemes to explore the implications of licensing for both the outside and the inside innovator. Sen (2014) studies the role of licensing in affecting the innovation decisions of the firms. Mukherjee and Tsai (2013) also examines the role of government policy in technology licensing decision.

The present paper closely builds on Anderson et al. (2001) and is the first attempt to incorporate the possibility of technology licensing, in a set up where, the government imposes ad valorem and unit taxation. In a duopoly market, firms with asymmetric costs of production are assumed to engage in Cournot (quantity) competition. As in Anderson et al. (2001) and Wang and Zhao (2009), we define one tax type to be more efficient if more tax revenue is raised for the same (or more) social surplus (consumer surplus plus profit plus tax revenue). In the present model, the government initially chooses the tax schemes (either ad valorem tax or unit tax). Observing the tax schemes, the firms may engage in technology licensing. Finally, the firms produce the output depending on the licensing agreement and the profits are then realised.

It is shown that under unit taxation, if technology is licensed by fixed-fee, tax revenue, consumer surplus and industry profit increases after transfer. On the other hand, if technology is licensed by fixed-fee when an ad valorem tax has been levied, the tax revenue reduces but consumer surplus and industry profit increases. This implies that under ad valorem taxation, for higher tax revenue, government may set the ad valorem tax rate as high as possible such that technology is not licensed. In many countries the government sets forth a target indirect tax revenue,Footnote 5 that is to be achieved in any financial yearFootnote 6. It is shown in the present paper, that if the unit cost difference of the firms is low and the tax revenue of the government is high, then in case of fixed-fee licensing unit tax is more efficient than the ad valorem tax. For any tax revenue to be achieved by ad valorem tax, there always exists a unit tax such that technology is licensed and the tax revenue and the social surplus are more than in the case of the ad valorem tax scheme. Otherwise, when the tax revenue of the government is low, then ad valorem tax is more efficient than unit tax. As in Anderson et al. (2001) on the other hand, if the cost difference is much higher such that technology is never licensed, then ad valorem tax dominates unit tax.

Technology licensing will always take place if the mode of licensing is per unit royalty, independent of the mode of taxation. Tax revenue and the consumer surplus remain unchanged after licensing, while only the industry profit increases. Under royalty licensing, thus for any ad valorem tax rate there exists a unit tax rate, which ensures equal equilibrium output in the two tax schemes. This not only ensures equal consumer surplus and equal gross industry profit, but also same social surplus under the two tax schemes. However, if the government chooses ad valorem tax in such a situation, then after licensing the government tax revenue will be more and the net industry profit will be less in ad valorem tax than in case of unit tax. Hence, under royalty licensing the ad valorem tax is more efficient than the unit tax. Footnote 7

The structure of the chapter is as follows. Section 2 discusses the benchmark case where technology could not be transferred in the presence of any kind of indirect taxation. Sections 3 and 4 discuss the effect of taxation in the presence of fixed-fee and royalty licensing respectively. Finally it concludes.

2 The Benchmark Case

This section reproduces the basic intuitions of Anderson et al. (2001), which shows that in a Cournot duopoly market ad valorem taxation is more efficient than unit tax. In the next sections we build a model to understand how this dominance goes through when inter firm technology licensing opportunities are present. To facilitate comparison we discuss the model of Anderson et al. (2001) briefly, assuming a linear market demand.

Consider a Cournot duopoly, where each firm produces a homogeneous product. The (inverse) market demand is given by P = a − q, where q = q 1 + q 2, and q, q 1 and q 2 are the output produced by the industry, firm 1 and firm 2 respectively. Firm 1 and firm 2 respectively produce output, q 1 and q 2, at constant unit production cost c 1 and c 2 respectively (c 1 > c 2). P is the market price; a > 0. Further assume that \(c_{1}<\bar {c_{1}}=\frac {a+c_{2}}{2}\), as for \(c_{1}\geq \bar {c_{1}}\), firm 2 is the monopolist in absence of any tax. In the equilibrium, output and profit of firm i in absence of any tax are

respectively, where i,j = (1, 2) and i ≠ j.

Without any loss of generality assume c 2 = 0 throughout. Under a unit tax, t(>0), levied on per unit output, the effective unit cost of the firms increases by t. For firm 1 and firm 2 the effective unit cost under unit tax are c 1 + t and t respectively. In this context the profit function of firm i is

Therefore in the equilibrium outputs of firm 1 and firm 2 in presence of unit tax of level t are

Similarly, the profits of firm 1 and firm 2 areFootnote 8

Therefore the tax revenue collected is

However, under an ad valorem tax, the net revenue received per unit of output sold is (1 − τ)P, where τ ∈ (0, 1) is the advalorem tax rate. Therefore the profit function of firm i is

Hence, in the equilibrium, outputs of firm 1 and firm 2 are

Similarly, the profits of firm 1 and firm 2 in case of an ad valorem tax of level τ are Footnote 9

Thus, comparing equations (1) and (4) it can be shown that the industry output is same under the two different tax regime, \({q_{1}^{u}}+{q_{2}^{u}}={q_{1}^{a}}+{q_{2}^{a}}\), if

This also implies that given relation (6), the equilibrium price is also same in the two tax regime. Thus, it can be said as in Anderson et al. (2001) that “any equilibrium under the unit tax is also an equilibrium under the ad valorem tax (and vice versa)”, given relation (6). The tax revenue collected under the ad valorem tax of level τ is

where \(P^{a}=\frac {(a+\frac {c_{1}}{1-\tau })}{3}\) is the price and \({q_{1}^{a}}+{q_{2}^{a}}=\frac {2a-\frac {c_{1}}{1-\tau }}{3}\) is the industry output under ad valorem tax. Comparing the tax revenues under the two different tax schemes, given relation (6), it is found that

This implies that as R a − R u > 0, for any given unit tax t, τthere exists an ad valorem tax τ with a higher tax revenue. Since the industry output is same in the two tax scheme, therefore the consumer surplus and price are also same. This implies that the total industry revenue is also same under the two tax schemes. One tax type is said to be more efficient than the other if more tax revenue is raised for the same (or more) social surplus Footnote 10. Therefore, to compare the relative efficiencies of the two tax schemes, evaluating the total industry cost and finding out which taxation minimizes it is sufficient (as R a − R u > 0). The total industry cost in case of unit tax is \(TC_{u}=c_{1}{q_{1}^{u}}\) and in case of ad valorem tax it is \(TC_{a}=c_{1}{q_{1}^{a}}\), as the unit cost of firm 2 is zero. Using relation (6) it can be showed that T C u − T C a = t c 1 > 0. This implies that industry profit (gross, without paying tax) is more under ad valorem tax than under unit tax. Therefore as shown in Anderson et al. (2001), the ad valorem tax is more efficient than the unit tax.

The Benchmark Result: In a homogeneous Cournot market the ad valorem tax is more efficient than the unit tax in absence of licensing opportunities.

3 Taxation in Presence of Fixed-fee Licensing

The present analysis incorporates the licensing opportunities via fixed-feeFootnote 11 licensing in the benchmark case to observe whether the ad valorem tax still dominates the unit tax. This is important, because after the announcement of tax rates by the government the firms may decide for licensing of technology before it produces the output. Before analysing the possibility of technology transfer, it is useful to mention the sequence of the game. At stage 1, the government decides whether to impose a unit tax (t) or an ad valorem tax (τ) to extract a certain level of revenue. The governmnet considers one tax type to be more efficient than the other, if more tax revenue is raised for the same (or more) social surplus. At stage 2 the firms decide for the licensing. In this stage, firm 2 offers a fixed-fee(F) to license its technology to firm 1 after observing the tax announced by the government in stage 1. In this stage, firm 1 accepts the contract and pays F if it is not worse off than rejecting it. At stage 3, conditional on licensing decision, the firms compete like Cournot duopolists and the profits are then realised and the tax revenue is received by the government. The game is solved through backward induction. In the next two sections, Sections 3.1 and 3.2, we solve for the second stage of the game (licensing stage considering the pay-offs realised in the third stage), if the government announces the unit tax or ad valorem tax in stage 1 respectively. At the end in Section 3.3 we solve for the first stage, where we compare the efficiency of the unit tax and ad valorem tax.

3.1 Unit tax

Let us first consider fixed-fee licensing by assuming that the government has imposed a unit tax(t) in the first stage of the game. If t(>0) is levied per unit of output sold, the effective unit cost of firm 1 and firm 2 are c 1+t and t respectively. It is assumed that (see Marjit (1990) and Wang (1998) for example), if firm 2 licenses its technology to firm 1 then the unit cost of firm 1 becomes zero.

If technology is not licensed then the profits of firm 1 and firm 2 are \({{\Pi }_{1}^{u}}\) and \({{\Pi }_{2}^{u}}\) respectively as defined in (2). However, if firm 2 licenses its technology at a fixed-fee (F u), then the output of each firm is

and the profits of firm 1 and firm 2 are respectively

In this regard firm 2 will set F u as high as possible such that, \({\Pi }_{1}^{uf}=\frac {(a-t)^{2}}{9}-\bar {F^{u}}={{\Pi }_{1}^{u}}\). In this situation technology will be licensed if

This also implies that technology is licensed if \(\frac {2(a-t)^{2}}{9}{\geq {\Pi }_{1}^{u}}+{{\Pi }_{2}^{u}}\), i.e. the industry profit must increase after licensing. This happens only when

If technology is licensed then not only the industry profit (net of tax) increases but also the consumer surplus and government tax revenue, as licensing leads to higher industry output.

Proposition 1

If technology is licensed then under unit taxation tax revenue, consumer surplus and industry profit are more than in no-licensing stage.

Let us assume that \(c_{1}\leq \frac {2a}{5}\) as otherwise technology will never be transferred. From relation (12) it can be said that if

then only technology will be transferred. Therefore the tax revenue collected is:

R uf is the tax revenue after transfer, while R un Footnote 12 is the tax revenue when technology is not transferred.

3.2 Ad valorem tax

Similarly we consider the possibilities of fixed-fee licensing by assuming that the government has imposed an ad valorem tax(τ) in the first stage of the game. In case of ad valorem tax of level τ, as \({\Pi }_{i}=(1-\tau )[P-\frac {c_{i}}{1-\tau }]q_{i}\), the effective unit cost (ignoring the constant term 1−τ in the profit function) of firm 1 and firm 2 can be considered as \(\frac {c_{1}}{1-\tau }\) and 0 respectively. In this regard if firm 2 licenses its technology to firm 1 then the actual unit cost of firm 1 becomes zero. The effective unit cost of firm 1 also reduces from \(\frac {c_{1}}{1-\tau }\) to 0.

In the presence of ad valorem tax, if technology is not licensed the profits of firm 1 and firm 2 are \({{\Pi }_{1}^{a}}\) and \({{\Pi }_{2}^{a}}\) respectively (see equation (5)). On the other hand, if firm 2 licenses its technology at a fixed-fee (F a), then the output of each firm is

and the profits of firm 1 and firm 2 are

respectively. In this regard firm 2 will set \(F^{a}=\bar {F^{a}}\) as high as possible such that firm 1 remains indifferent between licensing and no-licensing i.e. \({\Pi }_{1}^{af}=\frac {(1-\tau )a^{2}}{9}-\bar {F^{a}}={{\Pi }_{1}^{a}}\). Therefore technology will be licensed if

The above condition implies that technology is licensed if \(\frac {2(1-\tau )a^{2}}{9}{\geq {\Pi }_{1}^{a}}+{{\Pi }_{2}^{a}}\), the industry profit increase after licensing or

As in case of unit tax if technology is licensed then not only the industry profit (net of tax) increases but also the consumer surplus.

Let us assume that \(c_{1}\leq \frac {2a}{5}\). From relation (18) it can be said that if

then only technology will be transferred. Therefore the tax revenue collected is:

R af and P af are the tax revenue collected and price respectively if technology is transferred, while R an Footnote 13 is the tax revenue if technology is not transferred (for higher tax rate charged by the government). Moreover, \(R_{a}-R_{af}=\frac {c_{1}\tau }{9(1-\tau )}(a-\frac {c_{1}}{1-\tau })>0\) for \(\tau \leq \bar {\tau }\), where R a is the tax revenue in the no-licensing stage. Hence, the tax revenue after licensing is always less than the revenue earned in the no-licensing stage.

Proposition 2

If technology is licensed then under ad valorem taxation the tax revenue is less but consumer surplus and industry profit are more than under no-licensing.

This implies that if technology is licensed the government revenue will definitely fall. In case of unit taxation, tax revenue is tq. As after licensing industry output expands it leads to increase in the tax revenue under unit taxation for any tax rate t. However, in case of ad valorem tax, as tax is levied on the value of the industry output, the tax revenue is τPq. After the expansion in the industry output due to licensing, the fall in price dominates the expansion in industry output and hence leads to fall in the tax revenue for the government under ad valorem taxation.Footnote 14

Moreover, from equation (20), R af (τ) is increasing in τ and \(R_{af}(\bar {\tau })=\frac {a(2a-5c_{1})}{9}\) and \(R_{an}(\bar {\tau }+\epsilon )>R_{af}(\bar {\tau })\). R an is also increasing in τ, this therefore implies that \(R_{an}>R_{af}(\bar {\tau })\) for \(\tau \in (\bar {\tau },\tau ^{m})\) or R an > R af always.

Proposition 3

In case of ad valorem taxation, for higher tax revenue the government will set τ as high as possible (\(\tau \in (\bar {\tau },\tau ^{m})\)) such that technology is not licensed if \(c_{1}<\frac {2a}{5}\).

It can be construed from the above proposition that licensing has a negative impact on the government earnings and therefore for ensuring higher tax revenue the government must restrict licensing by charging higher τ.

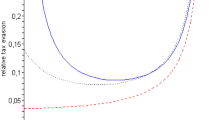

3.3 Comparison

This section models the incentives of the government and there by tries to determine what type of tax (unit -tax or ad valorem tax) will be levied by the government in the first stage of the game. It is established in the literature by Delipalla and Keen (1992) and Anderson et al. (2001) that ad valorem tax is relatively more efficient than unit tax in homogeneous Cournot oligopoly is absence of licensing possibilities. This implies that the government in the absence of licensing possibilities will always charge an ad valorem tax. This is true in our model as well, if \(\frac {2a}{5}<c_{1}<\frac {a}{2}\), as then technology will not be transferred always. However, licensing may change this welfare ranking if \(c_{1}\leq \frac {2a}{5}\). To fix ideas, we concentrate on two examples separately assuming \(c_{1}\leq \frac {2a}{5}\). In the following discussion we show two examples: a) Example 1: where unit tax is efficient and b) Example 2: where ad valorem tax is efficient. Actually there are four different cases:

-

i)

technology is licensed in case of unit tax (\(t\leq \bar {t}\)), but not licensed in case of ad valorem tax (\(\tau \in (\bar {\tau },\tau ^{m})\)),

-

ii)

technology is not licensed in case of unit tax (\(t\in (\bar {t},t^{m})\)), but licensed in case of ad valorem tax (\(\tau \leq \bar {\tau }\)),

-

iii)

technology is licensed in case of unit tax (\(t\leq \bar {t}\)) as well as in case of ad valorem tax (\(\tau \leq \bar {\tau }\)) and

-

iv)

technology is not licensed in case of unit tax (\(t\in (\bar {t},t^{m})\)) and not licensed in case of ad valorem tax (\(\tau \in (\bar {\tau },\tau ^{m})\)) also.

However, the two examples which are discussed in the next two sections are sufficient to show the main ideas. Let us now consider the first example.

3.3.1 Example 1

Assume τ is high such that technology is not transferred via fixed-fee as relation (18) is not satisfied (\(\tau \in (\bar {\tau },\tau ^{m})\)). It can be assumed that the government charges a higher τ such that technology is not transferred under ad valorem tax scheme as it reduces the tax revenue (See Proposition 3, assume that the objective of the government is to extract revenue greater than \(R_{af}(\bar {\tau })\).). Footnote 15

Proposition 4

If the ad valorem tax rate is such that technology is not licensed, and thus the government gets higher tax revenues, then there exists a unit tax such that technology is licensed and social surplus as well as tax revenue are more than in case of ad valorem tax.

Proof

Assume τ much high such that technology is not transferred via fixed-fee (such that government gets higher tax revenue) as relation (18) is not satisfied, this implies that industry output in such a situation will be

Contrarily assume that t is set such that technology is transferred as relation (12) holds. Then under unit tax industry output will be

From equation (21) and (22) it can be said that if

then industry output will be same under the two tax schemes. Putting the value of t from equation (23) in relation (12) such that technology is licensed in case of unit tax implies that

Relation relation (18) does not hold if

This therefore implies that τ must be much greater than \(\frac {1}{5}\) such that relation (12) holds and (18) does not.

As technology is transferred under unit tax, the tax revenue under unit tax is \(R_{uf}=t(q_{1}^{uf}+q_{2}^{uf})\), and that under ad valorem tax is \(R_{a}=\tau ({q_{1}^{a}}+{q_{2}^{a}})P^{a}=\frac {\tau }{3} ({q_{1}^{a}}+{q_{2}^{a}})[a+\frac {c_{1}}{1-\tau }]\) (as technology is not transferred). Moreover, as the outputs are the same as equation (23) holds, then R uf > R a if \(t>\frac {\tau }{3}[a+\frac {c_{1}}{1-\tau }]\) or

as \(t=\frac {c_{1}}{2(1-\tau )}\) (see equation (23)). Therefore if relation (24), (25) and (26) holds then consumer surplus as well as total industry revenue will be same under two tax schemes (output same) while tax revenue will be more in case of unit tax than in case of ad valorem tax. It is sufficient to show that if \(\frac {1}{5}<\tau <\frac {3}{7}\) then all these relations hold.

Therefore to compare the relative efficiencies of the two tax schemes, as in the benchmark case evaluating the total industry cost and finding out which taxation minimizes it is sufficient. The total industry cost in case of unit tax is TC uf = 0, as technology is licensed and in case of ad valorem tax it is \(TC_{a}=c_{1}{q_{1}^{a}}\). Therefore TC u < TC a . This implies that industry profit (gross, without paying tax) is more under unit tax than under ad valorem tax. Hence the social surplus and tax revenue are more in unit tax than in the ad valorem tax. Therefore contrary to Anderson et al. (2001), the ad valorem tax turns out to be less efficient than the unit tax, if the tax revenue is much higher. □

3.3.2 Example 2

Assume that the objective of the government is to extract revenue lower than \(R_{af}(\bar {\tau })\). This implies that the government will set a lower ad valorem tax rate (\(\tau \leq \bar {\tau }\)) such that technology is licensed as it increases the consumer surplus as well as the industry profit.

Proposition 5

Under fixed-fee licensing if \(c_{1}<\frac {2a}{5}\), and the tax revenue is low then ad valorem tax will dominate unit tax.

Proof

If the tax rates are low then relation (12) and (18) will be satisfied, ensuring licensing of technology both under ad valorem and unit tax schemes. In this case if technology is licensed in both the tax schemes the revenues of the government under unit tax and ad valorem tax are respectively

The consumer surplusFootnote 16 and industry profit under unit tax are respectively

while under ad valorem tax the consumer surplusFootnote 17 and industry profit are respectively

From equations (28) and (29) it can be said that

Relation (12) holds if 2t ≤ 2a−5c 1 and relation (18) holds if 2aτ ≤ 2a − 5c 1. Putting the value of t = t ∗ in relation (12) and comparing with relation (18), such that technology is transferred under both tax schemes, it is found that

Therefore to compare the relative efficiency of the two tax schemes, comparing the revenues is sufficient at t = t ∗. Moreover, putting t ∗ in equation (27), it is found that \(R_{af}>R_{uf} as \frac {2a^{2}\tau }{9}>\frac {2a^{2}}{3}[\sqrt {1-\frac {\tau }{2}}-1+\frac {\tau }{2}] or 1-\frac {\tau }{6}>\sqrt {1-\frac {\tau }{2}}\). So, this implies that for earning higher revenue via unit tax, the government has to set \(t\in (t^{*},\bar {t})\). However, this will lead to lower consumer surplus and industry profit under unit tax than in case of ad valorem tax. This implies that under fixed-fee if technology is licensed under both the schemes, then ad valorem tax will dominate unit tax. □

4 Taxation in Presence of Royalty Licensing

This section incorporates the royalty licensing in the benchmark case to observe whether the ad valorem tax still dominates the unit tax. The stages of the game is same as in fixed-fee licensing, only the difference is that the firm 2 licenses its technology via a per-unit royalty (r). The game is solved through backward induction. In the next two sections, Sections 4.1 and 4.2, we solve for the second stage of the game (licensing stage considering the pay-offs realised in the third stage), if the government announces the unit tax or ad valorem tax in stage 1 respectively. At the end in Section 4.3 we solve for the first stage, where we compare the efficiency of the unit tax and ad valorem tax.

4.1 Unit tax

The government imposes a unit tax (t). If technology is not licensed then the profits of firm 1 and firm 2 are \({{\Pi }_{1}^{u}}\) and \({{\Pi }_{2}^{u}}\) respectively as defined in (2). However, if firm 2 licenses its technology at a per-unit royalty (r u), then the profits of firm 1 and firm 2 are

respectively. Evidently, firm 2 will set r u as high as possible such that, \({\Pi }_{1}^{ur}=\frac {[a-2(r^{u}+t)+t]^{2}}{9}={{\Pi }_{1}^{u}}\) or r u = c 1, as post licensing profit of firm 2 increases in r u. The licensor cannot charge r u > c 1, as this will entail paying bribe to the licensee, violating the antitrust law as discussed in Shapiro (1985). Therefore technology is licensed always as

Unlike fixed-fee licensing, the consumer surplus and government tax revenue remains unchanged when licensing takes place via royalty payments. Fauli-Oller and Sandonis (2002) and Wang (1998) discusses that a royalty licensing scheme keeps the industry output unaltered and thus no possible channel exits through which consumer surplus and tax revenues can change. It is to be noted that competition remains unchanged after licensing of technology, as the effective unit cost of firm 1 remains unchanged. Only the profit of the firm 2 increases, leading to increase in the industry profit by the amount of the cost reduction produced by the use of the new technology of firm 2.

Proposition 6

Under unit taxation technology is always licensed. The tax revenue and the consumer surplus remain unchanged, while the industry profit increases after transfer of technology.

4.2 Ad valorem tax

Let us now consider the effect of royalty licensing in the presence of ad valorem tax. As in equation (5) if technology is not licensed then the profits of firm 1 and firm 2 are \({{\Pi }_{1}^{a}}\) and \({{\Pi }_{2}^{a}}\) respectively. On the other hand, if firm 2 licenses its technology at a royalty rate (r a), then the profits of firm 1 and firm 2 are

respectively. As in case of unit tax, here also firm 2 will set r a as high as possible such that, \({\Pi }_{1}^{ar}=\frac {(1-\tau )[a-2\frac {r^{a}}{1-\tau }]^{2}}{9}={{\Pi }_{1}^{a}}\) or r a = c 1 , as post licensing profit of firm 2 increases in r a . Therefore technology is licensed always as

It can be shown as before that the consumer surplus and government tax revenue remains unchanged. However, the profit of the firm 2 increases, leading to increase in the industry profit.

Proposition 7

Under ad valorem taxation via royalty technology is always licensed. The tax revenue and the consumer surplus remain unchanged, while the industry profit increases after transfer of technology.

4.3 Comparison

Moreover, R ur = R u and R ar = R a as the industry output remains unchanged after royalty licensing for both the tax schemes, where R ur and R ar are the tax revenue earned by the government under unit tax and ad valorem respectively after licensing. As R ar − R ur = R a − R u > 0, (which is discussed in the Benchmark case), for any given unit tax t, there exists an ad valorem tax τ with a higher tax revenue. Since the industry output is same in the two tax scheme after licensing, if it is assumed that \(t=\frac {\tau }{1-\tau }\frac {c_{1}}{2}\) (See the section “The Benchmark case” equation (6)), then the consumer surplus and price are also same. This in turn implies that the total revenue (from sell of goods) remains equal in both tax schemes after licensing. The total industry cost in case of unit tax after licensing is TC ur = 0 and in case of ad valorem tax it is TC ar = 0, as technology is always licensed and the unit cost of firm 2 is zero. Therefore the (net) industry profit is more in case of unit tax than in ad valorem tax, as the tax paid is more in case of ad valorem tax than in case of unit tax. As social surplus comprises of the consumer surplus, tax revenue and (net) industry profitFootnote 18; the social surplus after licensing is same under the two tax schemes. However as the government acquires higher tax revenue from ad valorem taxation for a given social surplus, it turns out to be more efficient than unit tax.

Proposition 8

Under royalty licensing ad valorem tax is superior to unit tax.

5 Conclusion

This paper considers the relative efficiency of unit tax and ad valorem tax in Cournot duopoly in the presence of licensing opportunities after the announcement of the tax rates by the government. If technology is licensed by fixed-fee, tax revenue, consumer surplus and industry profit increases after transfer under unit taxation. However, the tax revenue reduces but consumer surplus and industry profit increases after fixed-fee licensing under ad valorem taxation. This implies that under ad valorem taxation, for higher tax revenue the government may set the ad valorem tax rate as high as possible such that technology is not licensed. If the unit cost difference of the firms is low, then in case of licensing by fixed-fee unit tax is more efficient than the ad valorem tax if the tax revenue of the government is high. It not only results in higher social surplus than in ad valorem tax but also higher tax revenue than any tax revenue to be achieved by ad valorem tax. However, if the tax revenue of the government is low then ad valorem tax is more efficient than unit tax. On the other hand if the cost difference is much higher such that technology is not licensed in the absence of tax also, then ad valorem tax dominates unit tax as in Anderson et al. (2001).

Both under unit tax and ad valorem taxation technology is always licensed via per unit royalty. In both of the tax schemes tax revenue and the consumer surplus remains unchanged after licensing and only the industry profit increases. This implies that there always exits a unit tax rate for any given ad valorem tax rate such that after licensing equilibrium output and total industry revenue are same under the two tax schemes. Thus, royalty licensing ensures equal consumer surplus and equal gross industry profit under the two tax schemes. This ensures same social surplus under the two tax schemes, however the government gets higher tax revenues under the ad valorem taxation. Hence, under royalty licensing ad valorem tax is more efficient than unit tax. Wang (1998), Fauli-Oller and Sandonis (2002) and Sen (2014) show that in homogeneous goods Cournot model with constant unit cost optimal two-part tariff licensing entails to only positive per-unit royalty with zero fixed-fee. Thus we desist from discussing two part tariffs in the present model.

The results that have been derived, can be suitably modified and developed in a market where firms engage in quantity competition and produce differentiated goods. In the Appendix it is shown that the main intuitions developed in the model remains valid, though, the level of differentiation among the goods, now becomes an additional parameter that affects the results.Footnote 19

Notes

There has been substantial reform in the tax policies in various countries in the last century. Ahmad and Stern (1984) addresses these issues in the Indian context.

Governments generally impose taxes to generate revenue.

Social Surplus is the sum of consumer surplus, net industry profit (profit after payment of tax) and tax revenue of the government.

In case of royalty licensing the present paper considers this type of restrictions in framing the licensing contracts.

In India the budget target for indirect tax revenue is Rs.6,46,267 crore for 2015-16. http://www.thehindu.com/business/Economy/indirect-tax-collections-up-462-in-april/article7198411.ece.

See Koethenbuerger (2011) for how the local governments decide for the tax revenue and expenditure. In US, payroll taxes are designated as trust funds, which can be used only for very specific purposes - mainly to pay for Social Security and Medicare. https://www.nationalpriorities.org/budget-basics/federal-budget-101/revenues/

In an adjoining Appendix, all these results have been related to the literature on differentiated goods in an oligopolistic set up.

It is assumed that t < t m = a − 2c 1, as for higher t firm 2 is the monopolist.

As in case of unit tax it is assumed that \(\tau <\tau ^{m}=1-\frac {2c_{1}}{a}\), as otherwise firm 2 is the monopolist.

Social Surplus comprises of consumer surplus, net industry profit (profit after payment of tax) and tax revenue of the government.

We discuss the royalty licensing separately in the next section.

R un = R u for \(t\in (\bar {t},t^{m})\).

R an = R a for \(\tau \in (\bar {\tau },\tau ^{m})\).

In general the effect of licensing on tax revenue under ad valorem taxation is ambiguous, as it depends on the elasticity of the demand.

Thus, it can be assumed that the target indirect tax revenue (in many countries the government sets the target indirect tax revenue for various purposes - say to pay for Social Security and Medicare) to be achieved in a financial year by the government is more than \(R_{af}(\bar {\tau })\).

Given demand function as defined earlier consumer surplus is \(\frac {q^{2}}{2}\), where q is the industry output. From equation (9) we get that the industry output in case of unit tax after transfer is \(\frac {2(a-t)}{3}\).

From equation (15) we get that the industry output in case of ad valorem tax after transfer is \(\frac {2a}{3}\).

In this case tax revenue plus (net) industry profit is equal to the total revenue (from sell of goods).

Basically one can simply put d=1, to show that the propositions developed in the two cases (homogeneous goods and differentiated goods) are equivalent, where d is the index of differentiation.

We are thankful to an anonymous referee of this journal for suggesting us to incorporate this extension.

It is assumed that \(t<t^{m}=a-\frac {2c_{1}}{2-d}\), as for higher t, \({q_{1}^{u}}=0\).

As in case of unit tax it is assumed that \(\tau <\tau ^{m}=1-\frac {2c_{1}}{(2-d)a}\), as otherwise \({q_{1}^{a}}=0\).

See Proposition 1 and 2 of Wang and Zhao (2009).

If d reduces, then the goods become highly differentiated. If it is assumed that firm 1 can produce good 1 by using firm 2’s technology and d very low (goods very distinct, if d=0 then the markets are separate), then in the pre-licensing stage also firm 2 will produce good 1.

R un = R u for \(t\in (\bar {t},t^{m})\).

R an = R a for \(\tau \in (\bar {\tau },\tau ^{m})\).

It is the utility as defined in equation (A.2) as technology is always transferred and the firms produce at zero cost.

If d is low, then the optimal royalty rate is \(\frac {(2-d)(a-t)(4+2d-d^{2})}{16-6d^{2}}\). The licensor cannot charge r u > c 1, as discussed before.

If d is low, then the optimal royalty rate is \(\frac {(2-d)a(1-\tau )(4+2d-d^{2})}{16-6d^{2}}\). The licensor cannot charge r a > c 1, as discussed before.

In this context one can extend the model by considering Bertrand competition in a market characterized by differentiated goods. However, this analysis would be much like what has been done for the Cournot competition in a market characterized by differentiated goods. In case of fixed-fee licensing under Bertrand competition the analysis is very much similar to that of Cournot competition, as after licensing tax revenue increases in case of unit-tax regime, while the tax revenue falls after licensing in case of ad valorem tax. Secondly, in case of royalty licensing (or two-part tariff) if the royalty rate is set such that the degree of competition remains unchanged, then the results are similar to that of Wang and Zhao (2009). Otherwise, it would lead to an analysis similar to that of fixed-fee licensing, where the degree of competition reduces after licensing. Moreover, the algebra becomes messy. Hence, we think it would be better not to incorporate it as a separate exercise.

References

Ahmad E, Stern N (1984) The theory of reform and Indian indirect taxes. J Publ Econ 25:259–298

Anderson S, De Palma A (2001) The efficiency of indirect taxes under imperfect competition. J Publ Econ 81:173–192

Anderson S, De Palma A, Kreider B (2001a) Tax incidence in differentiated product oligopoly. J Publ Econ 81:231–251

Delipalla S, Keen M (1992) The comparison between advalorem and specific taxation under imperfect competition. J Publ Econ 49:351–367

Denicolo V, Matteuzzi M (2000) Specific and ad valorem taxation in asymmetric Cournot oligopolies. Int Tax Publ Finan 7:335–342

Fauli-Oller R, Sandonis J (2002) Welfare reducing licensing. Game Econ Behav 41:192–205

Gallini NT, Winter RA (1985) Licensing in the theory of innovation. Rand J Econ 16:237–252

Hamilton S (1999) Tax incidence under oligopoly: a comparison of policy approaches. J Publ Econ 71:233–245

Hu AGZ, Jefferson GH, Jinchang Q (2005) R&D and Technology Transfer: Firm-Level Evidence from Chinese Industry. Rev Econ Stat November 87:780–786

Koethenbuerger M (2011) How do local governments decide on public policy in fiscal federalism? Tax vs. expenditure optimization. J Publ Econ 95:1516–1522

Marjit S (1990) On a non-cooperative theory of technology transfer. Econ Lett 33:293–298

Mukherjee A, Tsai Y (2013) Technology licensing under optimal tax policy. J Econ 108:231–247

Myles G (1996) Imperfect competition and the optimal combination of ad valorem and specific taxation. Int Tax Publ Finan 3:29–44

Rostoker M (1984) A survey of corporate licensing. IDEA 24:59–92

Schroder P (2004) The comparison between ad valorem and unit taxes under monopolistic competition. J Econ 83:53–71

Shapiro C (1985) Patent Licensing R & D Rivalry. Am Econ Rev 75:25–30

Sen N (2014) Technology Transfer and its effect on Innovation MPRA Paper 55542. University Library of Munich, Germany

Sen D, Tauman Y (2007) General licensing scheme for a cost-reducing innovation. Game Econ Behav 59:163–186

Singh N, Vives X (1984) Price and Quantity Competition in a Differentiated Duopoly. RAND J. Econ. 15:546–554

Skeath S, Trandel G (1994) A Pareto comparison of ad valorem and unit taxes in non-cooperative environments. J Publ Econ 53:53–71

Suits DB, Musgrave RA (1953) Ad valorem and unit taxes compared. Q J Econ 67:598–604

Vishwasrao S (2007) Royalties vs. fees: How do firms pay for foreign technology? Int J Ind Organ 25:741–759

Wang X (1998) Henry Fee versus royalty licensing in a Cournot duopoly model. Econ Lett 60:55–62

Wang XH (2002) Fee versus royalty licensing in a differentiated Cournot duopoly model. J Econ Bus 54:253–266

Wang XH, Zhao J (2009) On the efficiency of indirect taxes in differentiated oligopolies with asymmetric costs. J Econ 96:223–239

Acknowledgments

We thank Dr. Sukanta Bhattacharya, Department of Economics, University of Calcutta for his valuable comments and suggestions on the present work. We are indebted to an anonymous referee of this journal in upgrading this paper. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Appendix A

Appendix A

Anderson et al. (2001a) and Wang and Zhao (2009) consider indirect taxes when oligopolistic firms produce differentiated goods. Anderson et al. (2001a) studies the incidence of these tax schemes with differentiated products and price-setting firms. Wang and Zhao (2009) shows that unit taxation can be welfare superior to ad valorem taxation in asymmetric and differentiated oligopolies. In this section the present paper is extended to consider the effect of licensing in differentiated goods Cournot duopoly with asymmetric cost structures to evaluate the efficiency of the tax schemes.Footnote 20

1.1 A.1 Benchmark Case

Consider a Cournot duopoly market, where each firm produces a differentiated product. The (inverse) market demand functions are given by

where a > 0, P i is the price charged by firm i and d ∈ (0, 1) represents the degree of product differentiation. q 1 and q 2 are the outputs produced by firm 1 and firm 2 respectively. Firm 1 and firm 2 respectively produce output, q 1 and q 2, at constant unit production cost c 1 and 0 (c 1 > 0 and it is assumed that \(c_{1}<\frac {(2-d)a}{2}\)). The demand functions given in equation (A.1) are derived from the utility maximization problem of a representative consumer (as in Singh and Vives (1984)), whose utility function separable in money (m) is

Under a unit tax, t(>0) the equilibrium outputs of firm 1 and firm 2 are

respectively, and the profits of firm 1 and firm 2 areFootnote 21

respectively. Therefore the tax revenue collected is

However, under an ad valorem tax, where τ ∈ (0, 1) is the advalorem tax rate, in the equilibrium, outputs of firm 1 and firm 2 are

respectively, and the profits of firm 1 and firm 2 are Footnote 22

respectively. The tax revenue collected under the ad valorem tax of level τ is

where \({P_{1}^{a}}=\frac {(2-d)a+\frac {c_{1}(2-d^{2})}{1-\tau }}{4-d^{2}}={q_{1}^{a}}+\frac {c_{1}}{1-\tau }\) is the price charged by firm 1 and \({P_{2}^{a}}=\frac {(2-d)a+\frac {dc_{1}}{1-\tau }}{4-d^{2}}={q_{2}^{a}}\) is the price charged by firm 2.

In the present context (in absence of licensing possibilities) it can be concluded as in Wang and Zhao (2009) that if total outputs are the same under the two tax regimes: i) ad valorem taxation is welfare superior to unit taxation, if the ad valorem tax rate is low and ii) unit taxation is welfare superior to ad valorem taxation, if the ad valorem tax rate is sufficiently high.Footnote 23 Condition (ii) is satisfied if the goods are sufficiently differentiated and the cost variance is sufficiently large. However, if the goods are not sufficiently differentiated (close substitutes) or the cost variance is sufficiently small, then condition (i) holds.

1.2 A.2 Fixed-fee Licensing

Let us first discuss the possibility of licensing if the government imposesunit tax in the first stage of the game. It is assumed that (see Fauli-Oller and Sandonis (2002) and Wang (2002) for example), if firm 2 licenses its technology to firm 1 then the unit cost of firm 1 becomes zero. In this context we also assume that d is close to 1, as otherwise it would mean that the licensed technology of firm 2 can be used to produce good 1 by firm 1, which is not a close substitute of good 2.Footnote 24 If the technology is not licensed then the profits of firm 1 and firm 2 are \({{\Pi }_{1}^{u}}\) and \({{\Pi }_{2}^{u}}\) respectively as defined in (A.4). However, if firm 2 licenses its technology at a fixed-fee (F u), then the output of each firm is

and the profits of firm 1 and firm 2 are respectively

In this regard firm 2 will set F u as high as possible such that, \({\Pi }_{1}^{uf}={{\Pi }_{1}^{u}}\), and technology will be licensed if \({\Pi }_{2}^{uf} \geq {{\Pi }_{2}^{u}}\). This happens only when

If technology is licensed then not only the industry profit (net of tax) increases but also the consumer surplus and government tax revenue, as licensing leads to higher industry output. Let us assume that \(c_{1}\leq \frac {2a(2-d)^{2}}{4+d^{2}}\) as otherwise technology will never be transferred. From relation (A.11) it can be said that if

then only technology will be transferred. Therefore the tax revenue collected is:

R uf is the tax revenue after transfer, while R un Footnote 25 is the tax revenue when technology is not transferred.

On the other hand in the presence of ad valorem tax imposed in stage 1, if technology is not licensed then the profits of firm 1 and firm 2 are \({{\Pi }_{1}^{a}}\) and \({{\Pi }_{2}^{a}}\) respectively (see equation (A.7)). On the other hand, if firm 2 licenses its technology at a fixed-fee (F a), then the output of each firm is

and the profits of firm 1 and firm 2 are

respectively. In this regard firm 2 will set F a as high as possible such that \({\Pi }_{1}^{af}={{\Pi }_{1}^{a}}\). Therefore technology will be licensed if \({\Pi }_{2}^{af}\geq {{\Pi }_{2}^{a}}\) or

Let us assume that \(c_{1}\leq \frac {2a(2-d)^{2}}{4+d^{2}}\). From relation (A.16) it can be said that if

then only technology will be transferred. Therefore the tax revenue collected is:

R af and P af are the tax revenue collected and price (charged by each firm) respectively if technology is transferred, while R an Footnote 26 is the tax revenue if technology is not transferred (for higher tax rate charged by the government). Moreover, \(R_{a}-R_{af}=\frac {\tau }{(4-d^{2})^{2}}[\frac {{c_{1}}^{2}(3d^{2}-4)}{(1-\tau )^{2}}+\frac {ad(2-d)^{2}c_{1}}{1-\tau }]>0\) for \(\tau \leq \bar {\tau }\) (as d is close to 1, as assumed before), where R a is the tax revenue in the no-licensing stage. Hence, if technology is licensed then under ad valorem taxation, the tax revenue is less but consumer surplus and industry profit are more than under no-licensing.

However, from equation (A.18), R af (τ) is increasing in τ and \(R_{an}(\bar {\tau }+\epsilon )>R_{af}(\bar {\tau })\) as d is close to 1. R an is also increasing in τ, this therefore implies that \(R_{an}>R_{af}(\bar {\tau })\) for \(\tau \in (\bar {\tau },\tau ^{m})\) or R an > R af always. In case of ad valorem taxation, for higher tax revenue the government will set τ as high as possible (\(\tau \in (\bar {\tau },\tau ^{m})\)) such that technology is not licensed if \(c_{1}\leq \frac {2a(2-d)^{2}}{4+d^{2}}\). This implies that licensing has a negative impact on the government earnings and therefore for ensuring higher tax revenue the government must restrict licensing by charging higher τ.

1.2.1 A.2.1 Comparison

This section tries to determine what type of tax (unit -tax or ad valorem tax) will be levied by the government in the first stage of the game. It is established in the literature by Wang and Zhao (2009) that ad valorem tax becomes superior to unit tax if the goods are slightly differentiated. This is true in our model as well, if \(c_{1}> \frac {2a(2-d)^{2}}{4+d^{2}}\), as then technology will not be transferred. However, licensing may change this welfare ranking if \(c_{1}\leq \frac {2a(2-d)^{2}}{4+d^{2}}\). To fix ideas, we concentrate on two examples separately assuming \(c_{1}\leq \frac {2a(2-d)^{2}}{4+d^{2}}\). In the following discussion we show two examples: a) Example 1: where unit tax is efficient and b) Example 2: where ad valorem tax is efficient.

1.3 Example 1

Assume τ is high such that technology is not transferred via fixed-fee as relation (A.16) is not satisfied (\(\tau \in (\bar {\tau },\tau ^{m})\)). It can be assumed that the government charges a higher τ such that technology is not transferred under ad valorem tax scheme as it reduces the tax revenue (Assume that the objective of the government is to extract revenue greater than \(R_{af}(\bar {\tau })\)).

Proposition 9

If the ad valorem tax rate is such that technology is not licensed, and thus the government gets higher tax revenues, then there exists a unit tax such that technology is licensed and social surplus as well as tax revenue are more than in case of ad valorem tax.

Proof

Assume τ much high such that technology is not transferred via fixed-fee (such that government gets higher tax revenue) as relation (A.16) is not satisfied, this implies that industry output in such a situation will be

Contrarily assume that t is set such that technology is transferred as relation (A.11) holds. Then under unit tax industry output will be

From equation (A.19) and (A.20) it can be said that if

then industry output will be same under the two tax schemes. Putting the value of t from equation (A.21) in relation (A.11) such that technology is licensed in case of unit tax implies that

Relation relation (A.16) does not hold if

This therefore implies thatτ must be much greater than \(\frac {(2-d)^{2}}{4+d^{2}}\) such that relation (A.11) holds and (A.16) does not.

As technology is transferred under unit tax, the tax revenue under unit tax is \(R_{uf}=t(q_{1}^{uf}+q_{2}^{uf})\), and that under ad valorem tax is \(R_{a}=\tau [{{q_{1}^{a}}}^{2}+{{q_{2}^{a}}}^{2}+\frac {c_{1}}{1-\tau }{q_{1}^{a}}]\)(as technology is not transferred). Moreover, as the industry outputs are the same as equation (A.21) holds, then R u f > R a if

as \(t=\frac {c_{1}}{2(1-\tau )}\) (see equation (A.21)).Footnote 27 Therefore if relation (A.22), (A.23) and (A.24) holds then the tax revenue will be more in case of unit tax than in case of ad valorem tax.

Moreover, the social surplus in case of unit tax is U u f as technology is transferred and in case of ad valorem tax it is \(U_{a}-c_{1}{q_{1}^{a}}\) as technology is not transferred, where

Using equation (A.21) and \(U_{uf}=2aq_{1}^{uf}-\frac {(2q_{1}^{uf})^{2}}{2}+(1-d){q_{1}^{uf}}^{2}\), we get

Hence the social surplus and tax revenue are more in unit tax than in the ad valorem tax. Therefore contrary to Wang and Zhao (2009), ad valorem tax turns out to be less efficient than the unit tax, if the tax revenue is much higher. □

1.4 Example 2

Assume that the objective of the government is to extract revenue lower than \(R_{af}(\bar {\tau })\). This implies that the government will set a lower ad valorem tax rate (\(\tau \leq \bar {\tau }\)) such that technology is licensed as it increases the consumer surplus as well as the industry profit.

Proposition 10

Under fixed-fee licensing if \(c_{1}\leq \frac {2a(2-d)^{2}}{4+d^{2}}\) , and the tax revenue is low then ad valorem tax will dominate unit tax.

Proof

If the tax rates are low then relation (A.11) and (A.16) will be satisfied, ensuring licensing of technology both under ad valorem and unit tax schemes. In this case if technology is licensed in both the tax schemes the revenues of the government under unit tax and ad valorem tax are respectively

From equation (A.27) it can be said that

given relations (A.12) and (A.17) hold. Moreover, the social surplusFootnote 28 under such situation under unit tax and ad valorem tax are

respectively. However, U a f > U u f . This implies that as the social surplus is more under unit tax than in case of ad valorem tax, the government for earning lower tax revenue will prefer ad valorem tax. □

1.5 A.3 Royalty Licensing

Let us begin by considering that the government imposes a unit tax (t). If technology is not licensed then the profits of firm 1 and firm 2 are \({{\Pi }_{1}^{u}}\) and \({{\Pi }_{2}^{u}}\)respectively as defined in (A.4). However, if firm 2 licenses its technology at a per-unit royalty (r u), then the equilibrium outputs of firm 1 and firm 2 are

respectively, and the profits of firm 1 and firm 2 are

respectively. Evidently, firm 2 will set r u as high as possible such that, \({\Pi }_{1}^{ur}={{\Pi }_{1}^{u}}\) or r u = c 1 as the goods are slightly differentiated (d close to 1)Footnote 29, as post licensing profit of firm 2 increases in r u. Therefore technology is licensed always as

Moreover, under unit taxation technology is always licensed. The tax revenue and the consumer surplus remain unchanged, while the industry profit increases after transfer of technology.

Let us now consider the effect of royalty licensing in the presence of ad valorem tax. If technology is not licensed then the profits of firm 1 and firm 2 are \({{\Pi }_{1}^{a}}\) and \({{\Pi }_{2}^{a}}\) respectively. On the other hand, if firm 2 licenses its technology at a royalty rate (r a), then outputs of firm 1 and firm 2 are

respectively, and the profits of firm 1 and firm 2 are

respectively. As in case of unit tax, here also firm 2 will set r a as high as possible such that, \({\Pi }_{1}^{ar}={{\Pi }_{1}^{a}}\) or r a = c 1 as the goods are slightly differentiated.Footnote 30 Therefore technology is licensed always as

Under ad valorem taxation via royalty technology is always licensed. The tax revenue and the consumer surplus remain unchanged, while the industry profit increases after transfer of technology.

1.6 A.4 Comparison

Moreover, R u r = R u and R a r = R a as the industry output remains unchanged after royalty licensing for both the tax schemes, where R u r and R a r are the tax revenue earned by the government under unit tax and ad valorem respectively after licensing. Hence, as in Wang and Zhao (2009) i) ad valorem taxation is welfare superior to unit taxation, if the ad valorem tax rate is low and ii) unit taxation is welfare superior to ad valorem taxation, if the ad valorem tax rate is sufficiently high.Footnote 31

Rights and permissions

About this article

Cite this article

Sen, N., Biswas, R. Indirect Taxes in Oligopoly in Presence of Licensing Opportunities. J Ind Compet Trade 17, 61–82 (2017). https://doi.org/10.1007/s10842-016-0221-4

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10842-016-0221-4