Abstract

A growing number of firms in software industry are embracing free entry strategy to promote product adoption. The prevalence of free strategy can be partly attributed to the positive network externalities exhibited by the information goods. In this paper, we model a new firm’s entry into an existing market with the free strategy. Consumers can use the new product’s basic functionality for free and pay a subscription fee for accessing the add-ons. The entrant firm’s new product infringes on the market in one of the three ways: homogeneous product competition, high-end encroachment and low-end encroachment. We find that the equilibrium market structure varies across the three settings. In particular, there exists a Bertrand equilibrium when the new firm provides a homogeneous product. When the new firm offers a heterogeneous product, our results show that the network externalities intensify the price competition and thus lead to a reduction in the profits. Moreover, whether the new firm should encroach on the existing market with high-end product or low-end product depends on the level of switching cost. If the switching cost is low, the new firm will benefit more from high-end encroachment and vice versa. We also find that it is not always optimal for the new firm to adopt the free entry strategy. In the high-end encroachment, the new firm will be better off providing a product for free if the network intensity is high enough, whereas in the low-end encroachment, the free strategy is dominant only when the network intensity falls within a given threshold.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

New product entry is quite common in many industries, especially in information industry due to the rapid product innovations. The incumbent firm enjoys temporary monopoly power until a new firm enters the market with a competing product. The new entrant firms adopt different strategies when introducing their products into the market. In recent years, free strategy has become one of the most prevalent business models among mobile app developers and Internet start-ups. The free strategy enables consumers to use the basic functionality without any payment, but if they want to access the add-ons for richer features and functionality, an additional payment is required. For example, the antivirus software AVG AntiVirus Free provides essential antivirus protection free of charge. For more advanced functionalities such as online shield and data safe, customers have to pay a premium for the AVG AntiVirus Pro. In addition, mail software such as MailChimp and Mailjet, and online games like League, provide users free access to the basic product. It is also a common practice for mobile app providers to offer free applications with in-app purchases. Examples of free apps include mobile games like Supercell’s Clash of Clans and King’s Candy Crush Saga. Market research firm Gartner predicted that 94.5% of global mobile app downloads in 2017 are estimated to be free, and the free applications with in-app purchases will account for 48% of the total revenue [17].

A critical reason for the firms to provide free offerings is that most of information goods exhibit positive network externalities, which refers to an increase in the utility that a user derives from a product when more and more consumers use the same product [21]. In the presence of positive network externalities, the fact of more users implies higher consumer valuation for the product, which in turn brings more and more consumers and thus expands its market share. Therefore, the free strategy promotes product diffusion and increases consumer installed base, which contributes to boosting the sales of value-added products. As a motivating example, consider the competition between the popular video game app Minecraft and the Minecraft-like CraftWorld. Minecraft is a very popular pay-to play sandbox game which was first released to the public on 17 May 2009. An iOS version of Minecraft was released on 17 November 2011 at the price of $6.99. After the release of Minecraft, some video games were released with various similarities with Minecraft since the game is so popular. CraftWorld, which was released on Windows Phone Store on December 13, 2011, cites Minecraft as one of direct inspirations for the design aspect of the game. CraftWorld uses free strategy and also provides additional features and functionality by charging a fee.

In our paper, we study the entry of a new firm that offers a product including two parts: a base product and the associated add-ons. The new firm provides the base product for free and charges a price for its add-ons. When introducing a new product into the market, the entrant firm not only attracts new customers from the untapped market but may also capture customers who switch from the incumbent firm. Typically, the switching cost is incurred if a consumer abandons the initial used product and moves to the other firm’s product [23, 24]. The underlying sources of switching cost may include converting data to new format, replacement of equipment, and learning a new system. It has long been recognized that switching cost is a barrier for the adoption of a new product and it hinders the new firms’ entry to the market. While the free strategy is effective to generate a large user base for the new firm, a higher switching cost reduces consumers’ incentive to switch to the new firm. Therefore, in this paper we focus on the impact of network externalities and switching cost on the firms’ pricing strategies. In particular, we address the following research questions: How does the new firm’s free strategy affect the market structure when the products offered by the firms are heterogeneous? Should the new firm infringe on the market with high-end product or low-end product? Whether is it always optimal for the new entrant firm to offer a free product? If not, under what conditions should the new firm adopt the free strategy? What are the equilibrium prices if the new firm offers a free base product? How do the network externalities and switching cost affect the new firm’s strategy choice, the firms’ profits and consumer welfare?

To answer the above questions, we establish a framework in an incumbent-entrant setting where the new firm offers a free base product and the incumbent firm offers one single product. To investigate the impact of high-end encroachment and low-end encroachment on the new firm’s profit, we model consumers as heterogenous in terms of their valuation on product quality. Our analysis generates several interesting findings. First, we find that it is not always optimal for the new entrant to use free strategy to compete with the existing firm. In the high-end encroachment, the firm will be better off providing a free product if the network intensity exceeds a given threshold. This result gives a possible explanation why so many instant messaging applications, which exhibit strong network externalities are introduced into the market for free and only the value-added goods or services are charged for. On the other hand, in the low-end encroachment, the free strategy is optimal for the new firm only when the network intensity falls within a given threshold. Second, in the case of high-end encroachment, the new entrant firm gains high valuation customers from the existing firm, while in the case of low-end encroachment, the new firm only captures low-valuation consumers from the untapped market. If the new entrant firm could choose between high-end encroachment and low-end encroachment, the level of switching cost is a key factor to consider for the firm. If the switching cost is relatively low, the new firm will benefit more from high-end encroachment, whereas if the market is characterized by a high switching cost, low-end encroachment will be better. Further, while one may expect that an increase in the network intensity will result in higher profits for the firms, we find that higher network intensity actually reduces the profits. This happens because the network externalities intensify price competition between the firms.

The rest of the paper is organized as follows. In Sect. 2, we review the related literatures. Section 3 presents our model setup. In Sect. 4, we identify the market structure and derive market equilibriums under different quality levels. Section 5 presents theoretical and numerical analysis of the equilibrium outcomes. Section 6 studies an extension in which the price of the new firm’s base product is endogenously given. Finally, we conclude our paper and discuss the future research directions in Sect. 7.

2 Related work

Our work is related to four streams of literature, i.e., software versioning, free trial strategy, add-on pricing and new product pricing.

There is a rich literature that studies software versioning in various contexts (e.g., [1, 10, 37, 42, 43]). Shapiro and Varian [35] conclude that the information goods providers will offer free versions only when they are likely to achieve the following goals: building awareness, gaining follow-on sales, creating a network, attracting eyeballs and gaining competitive advantage. Jing [19] investigates the role of network externalities in a software provider’s product line decisions in a monopoly setting. He concludes that a low-quality product should be offered for free under very general conditions to enlarge the network for its high quality product. Cheng and Tang [6] focus on a monopolist software provider that offers a free low quality version and a high quality version. The monopoly trades off consumer valuation upshift due to the existence of network effects and the demand cannibalization due to the provision of free product. In our paper, we generalize the model in Cheng and Tang [6] by specifically analyzing the free strategy in an incumbent-entrant setting. Niculescu and Wu [29] compare a monopoly’s profit under three business models: feature limited freemium, uniform seeding and charge for everything. They find that offering a feature-limited version for free is optimal when the customers’ prior on premium features is either low or high. In our model, the base product is similar to the limited version in Niculescu and Wu [29], but we focus on the price competition between an incumbent and a new entrant firm that uses free strategy.

In the literature on free trial strategy, some studies investigate the effect of free trial on consumer demand and the firms’ decisions. Gallaugher and Wang [16] empirically study the impact of network externalities on software prices and emphasize the role of free goods in web server market. Bawa and Shoemaker [3] focus on consumer goods and examine the effect of free sampling on the evolution of market shares. Conner [7] focuses on the commercial software and its “clone” with a lower quality, the clone in some sense can be viewed as a free product by setting its price to zero. She finds that when the network effect is large, it is profitable for an innovator to allow a “clone” of its product. More recently, several studies examined software free trial strategy of different forms (e.g., [4, 5, 14]). A common finding in these papers is that the strength of network externalities or word-of-mouth effect is a critical factor in deciding which strategy to implement for providers. Cheng and Liu [5] explore two free trial strategies: time-locked free trial and limited version free trial in the context of network externalities and consumer uncertainty. In another paper,Cheng et al. [4] extend the work in Cheng and Liu [5] by adding the hybrid strategy which combines the time-locked free trial and limited version to the optimal strategy analysis. Unlike the prior studies that focus on a monopolistic firm, we specifically investigate the free strategy in the context of new product entry and analyze the impact of the switching cost and network externalities on the firm’s entry decision and product pricing.

Our study also relates to the literature on add-on pricing. As a complement to the base product, the offering of add-ons can improve user experience. Verboven [41] examines the pricing practice of base products and optional add-ons by considering various alternative models: a model in a monopoly setting, a model of brand rivalry with full consumer information and a model of brand rivalry with limited consumer information. In his model, the add-ons are sold at high prices as premium products. Ellison [11] considers two models when consumers have both vertical and horizontal taste heterogeneity: a standard competitive price discrimination model and an add-on pricing model. In the former model, all prices are observed by consumers, while in the latter one the add-on prices are unobserved. He shows that if the consumers with a low valuation for add-ons are more sensitive to price differences, the add-on pricing can soften competition and increase equilibrium profits. Shulman and Geng [38] extend Ellison’s model by allowing for quality asymmetry. Then, they examine the impact of add-ons pricing on firm profits when boundedly rational consumers exist. Erat and Bhaskaran [12] focus on the role of a customer’s mental account of the base product in the add-on purchase decision and explore the effect of this behavioral bias on a company’s optimal pricing and development decisions. Using a parsimonious model, Fruchter et al. [15] characterize the optimal pricing policy of a seller with monopoly power when it sells a primary offering with an optional add-on. A recent study by Etzion and Pang [13] analyze the competition between two firms that sell differentiated physical products and can choose to offer a complementary add-on service. Although they model the complementary add-on service with network externalities, the primary offering does not exhibit network externalities. In contrast to their work, our paper focuses on the information goods which display positive network externalities. In addition, the base product in our paper are offered free of charge.

In the literature on new product pricing, Moorthy [27] investigates the product quality design levels and optimal pricing strategies for the earlier and later entrants. He shows that the early entrant has a first-mover advantage to compete with the later entrant by means of preempting the best position. Schmidt and Porteus [33] consider two competing substitute products in a vertically differentiation model, where the new product enters the market in the way of either high-end encroachment or low-end encroachment. Schmidt [32] further studies the low-end and high-end encroachment strategies on the foundation of Schmidt and Porteus’s [33] linear reservation price framework. In a recent paper, [18] examine an incumbent’s optimal strategy for its new product in a duopolistic market. They compare three sequential entry strategies and find that the price, quality and the intensity of competition have a great impact on the incumbent’s decision. Prior literature on new product pricing have also addressed some important strategic issues involving new product entry, such as product upgrades [26], entry order decisions [25], entry timing [34, 39, 39, 40] and entry strategy under firm heterogeneity [28]. However, few academic literature in this stream explore the free strategy, which plays an important role in the introduction of new products. In this paper, we examine a firm’s optimal entry strategy by focusing on the role of network externalities and the offering of a free product.

The study by Mehra et al. [26] is the most relevant to our research. They develop a game-theoretic model involving an incumbent and an entrant to investigate the competitive upgrade discount pricing strategy. The entrant in their paper employs price discrimination between the new customers and the old customers of the existing firm. They assume that both products are of the same quality. We relax this assumption and study the entrant’s encroachment under different quality levels. In addition, our model is different from the model in Mehra et al. [26]. In our model, the products are vertically differentiated and consumers are heterogeneous to their valuations on product quality, whereas Mehra et al. use the Hotelling model and the products in their model are horizontally differentiated.

3 Model

We develop a new product entry model by considering two firms, labeled as Firm A and Firm B. Firm A is an incumbent while Firm B is an entrant that offers a new product to infringe on the existing market. Before Firm B enters the market, Firm A sells product A of quality \(v_A\) at price \(p_{Am}\). Firm A is assumed to myopically set the product price due to the rapidly changing technologies [9]. In other words, the decisions of firms and consumers are best responses to the current options available to them. Consumers have different valuations for the product, and those who have positive valuation for product A in the market can be divided into two segments: those who do not buy product A and those who buy it. The proportions of the two types of consumers are represented by r and \(1-r\), respectively \((0\le r \le 1)\). In the later period, Firm B enters the market with its substitute product B. Product B contains two parts: the base product and the add-ons. The quality of product B is denoted by \(v_B\), and \(v_B = v_{Bb} + v_{Ba}\), where \(v_{Bb}\) is the quality of the base product and \(v_{Ba}\) is the quality of the add-on. The add-on is a complement of the base product and thus cannot exist without the base product. Firm B can strategically decide the quality of its product so as to compete with the incumbent firm. Both product A and product B display positive network externalities with the same network intensity \(\alpha\) \((0\le \alpha \le 1)\).

In the second period, Firm B enters the market and provides a base product for free. We later drop this free strategy assumption in the extension and examine the condition under which it is more profitable for the new entrant firm to provide a product for free than offering it for a fee. The free strategy allows consumers to use the basic functionality for free, but for access to the additional features they have to pay a fee. The price of the add-ons is denoted by \(p_{Bd}\). In response to Firm B’s infringement, the incumbent resets a lower price \(p_{Ad}\) for product A (\(p_{Ad} < p_{Am}\)) in the competition period. The firms simultaneously determine their respective prices. When product B is introduced into the market, some consumers who previously use product A will switch to product B. The cost that they incur from switching is denoted by c (\(c>0\)). Without loss of generality, we normalize the mass of consumers in the market to 1. The consumer’s willingness to pay for a given product, denoted by \(\theta\), is uniformly distributed over [0,1]. Each consumer in the market demands at most one unit of product from either firm. A consumer of type \(\theta\) derives a net utility of \((\theta +\alpha Q)v-p\) from using the product of quality v, where Q is the expected network size [21], \(\theta v\) is the intrinsic value or standalone value derived from using the product and \(\alpha Qv\) is the network-generated value from the user base [19]. Specially, if the product is free, we have \(p=0\). If some consumers switch to the competing firm’s product, they incur a switching cost and thus obtain a net utility of \((\theta +\alpha Q)v-p-c\).

4 Market segmentation

Before Firm B enters the market, Firm A has built its user base by selling product A. The following lemma illustrates the optimal price of product A and the corresponding market segmentation in the monopoly period.

Lemma 1

Before Firm B enters the market, the incumbent offers its product at the price of \(v_{A}/2\). There are two segments of consumers in the market. The proportion of customers who do not buy from the incumbent is \(r=(1-2\alpha )/(2(1-\alpha ))\) and the proportion of buyers is \(1-r=1/(2(1-\alpha ))\).

Figure 1 describes the market segmentation under the monopoly of Firm A. The consumers located between 0 and r do not buy product A while the consumers between r and 1 buy it. In addition, if the network intensity \(\alpha\) increases, more consumers will purchase from Firm A since \(d(1-r)/d\alpha >0\) and thus Firm A gains a larger market share.

When Firm B enters the market with its new product, the incumbent and entrant firms engage in a competition. Firm B makes a commitment that consumers can use the base product for free and only the add-on is charged. In responding to Firm B’s entry, the incumbent lowers its price for product A. As a result, consumers reconsider their purchase decisions in face of multiple available options. Consumers located between [0, r] have three options: use the base part of product B, use the base part of product B and pay for the add-ons (i.e., use the whole product B), and buy product A. Likewise, the consumers between [r, 1] also have three choices: switch to the base part of product B, switch to the whole product B, and continue to pay for product A. Consumers choose the option that provides them the maximum net utility. Note that there will be no consumers who use neither product A nor product B in our model setup, because the consumers who have not buy from Firm A can get a positive surplus from using Firm B’s free offering. The options and the corresponding net utilities are listed below.

-

(1)

Consumers who have not purchased product A now use the free base part of product B and obtain a net utility of \(U_{1}=(\theta +\alpha Q_{Bd})v_{Bb}\).

-

(2)

Consumers who have not purchased product A now use the whole product B and obtain a net utility of \(U_{2}=(\theta +\alpha Q_{Bd})v_{B}-p_{Bd}\).

-

(3)

Consumers who have not purchased product A now adopt it and obtain a net utility of \(U_{3}=(\theta +\alpha Q_{Ad})v_{A}-p_{Ad}\).

-

(4)

Consumers who have purchased product A now switch to Firm B’s free offering and the net utility is \(U_{4}=(\theta +\alpha Q_{Bd})v_{Bb}-c\).

-

(5)

Consumers who have purchased product A now switch to the whole product B and the net utility is \(U_{5}=(\theta +\alpha Q_{Bd})v_{B}-p_{Bd}-c\).

-

(6)

Consumers who have purchased product A now continue to pay for it. The net utility is \(U_{6}=(\theta +\alpha Q_{Ad})v_{A}-p_{Ad}\).

All the above expressions are the continuous function of \(\theta\). Therefore, consumers who make the same choice will be contiguous. Note that it is possible that the six segments of customers do not coexist in equilibrium, because some options may be dominated. Each possible configuration of market segments represents a market structure, for example, a configuration of segments (1), (2), (3) and (5) constitutes a market structure. In addition, the same combination of market segments in different orders represents different market structures. For example, the configuration of market segments (1), (2), (3), (5) and that of segments (2), (1), (3), (5) constitute two different market structures. One specific assumption about product quality is given below to achieve a tractable analysis.

Assumption 1

\(v_{A}>v_{Bb}\)

Assumption 1 is a key assumption in the analysis of market structure. When Firm B introduces product B into the market, different market structures are generated under different levels of quality of product B. We first analyze the case of high-end encroachment \((v_{B}>v_{A})\). In the net utility functions of options (1), (2) and (3), the coefficients of consumer valuation \(\theta\) are \(v_{Bb}\), \(v_{B}\), and \(v_{A}\), respectively. When \(v_{B}>v_{A}\), the market structure must encompass the segments in the order (1), (3), (2), (4), (6) and (5) from the left, as illustrated in Fig. 2. In this case, we refer to the marginal consumers as \(\theta _{1}\), \(\theta _{2}\), r, \(\theta _{3}\) and \(\theta _{4}\). Note that this does not mean that all the six segments must exist in the market. It just implies that when the segments exist in the market, this order must be followed.

We make a further analysis of the possible market segmentation when \(v_{B}>v_{A}\). The new customers with very low valuations will use the free product offered by the new firm in the second period, from which they can derive positive net utility. This implies that in equilibrium, the segment of consumers exercising option (1) exists in the market. In addition, we assume that the price set by Firm A after Firm B enters with a free product is low enough such that there will be consumers purchasing product A from Firm A. In other words, Firm A’s price should be low enough to ensure that the segment of consumers exercising option (3) or the segment of consumers exercising option (6) exists in the market. Accordingly, the possible market structures under high-end encroachment are (1)(4)(6)(5), (1)(3)(6)(5), (1)(3)(2)(5), (1)(6)(5) and (1)(3)(5). Likewise, a similar result is obtained in the case of low-end encroachment where \((v_{B}<v_{A})\). Consequently, combining this analysis with Assumption 1, we are left with with three possible market structures with free strategy, as illustrated in the following proposition (the proof is given in “Appendix 1”).

Proposition 1

When Firm B enters the market with the free base product strategy, the specific market structure depends on the values of \(v_{A}\) and \(v_{B}\):

-

(i)

If \(v_{B}>v_{A}\), there exists a unique Nash equilibrium and the only possible market structure is (1)(3)(6)(5).

-

(ii)

If \(v_{B}<v_{A}\), there exists a unique Nash equilibrium and the only possible market structure is (1)(2)(3)(6).

-

(iii)

If \(v_{B}=v_{A}\), there exists a Bertrand equilibrium.

According to Proposition 1, the equilibrium market structure changes with the quality of product B. When \(v_{B}>v_{A}\) , Firm B enters the market in a way of high-end encroachment to attract the high-valuation consumers, namely consumers in segment (5). When \(v_{B}<v_{A}\), Firm B introduces its new product in a way of low-end encroachment for drawing the low-end consumers, namely those in segments (1) and (2). Proposition 1 also shows that if Product B is of the same quality as Product A, then neither firm gains positive profit. This is because when \(v_{B}=v_{A}\), all customers will buy from the firm that charges a lower price, and so the firm whose price is a little higher obtain no profit. In that case, both firms will cut their prices, and consequently the prices are reduced to zero. Therefore, if Firm B enter the market with a homogeneous product, the firms compete themselves down to zero profit under Bertrand competition.

5 Analysis

In this section, we analyze the equilibrium prices and profits of the two firms when the entrant firm’s new product infringes on the market in two ways: high-end encroachment and low-end encroachment.

5.1 High-end encroachment

5.1.1 Equilibrium outcomes in the high-end encroachment

We first analyze the case where \(v_{B}>v_{A}\). In this case, Firm B’s new product infringes on the market to attract high-end consumers. As a direct consequence of Proposition 1, the only possible market structure is (1)(3)(6)(5). In equilibrium, the market is characterized by \(\theta _{2}=\theta _{3}=r\). A simplified figure of the market segmentation is shown in Fig. 3, where \(\theta _{1}\) denotes the marginal consumers who are indifferent between exercising option 1 and option 3, and \(\theta _{4}\) denotes the marginal consumer indifferent between option 6 and option 5.

As shown in Fig. 3, in equilibrium, consumers located in \([0, \theta _{1}]\) use the free base part of product B, consumers located in \([\theta _{1}, r]\) and \([r, \theta _{4}]\) purchase product A from Firm A, while those in \([\theta _{4}, r]\) correspond to the users of the whole product B.

The marginal consumers between two adjacent segments receive equal utility from either segment. Hence, these marginal consumers are described by the following equations:

We denote the demand of product A and the demand of product B by \(q_{Ad}\) and \(q_{Bd}\), where \(q_{Ad}+q_{Bd}=1\). The profit of Firm A in the duopoly period, denoted by \(\pi _{1d}\), is generated from consumers in \([\theta _{1},\theta _{4}]\), who buy product A at price \(p_{Ad}\). Firm B’s profit, \(\pi _{2d}\), is completely contributed by customers in \([\theta _{4},1]\), who are willing to pay for the add-ons of product B at price \(p_{Bd}\). Thus, the demand of add-ons of product B, denoted by \(q_{Bad}\), determines the profit of Firm B. Hence, we have

In the rational expectation equilibrium, we have \(q_{jd}=Q_{jd}(j=A,B)\). In equilibrium, the incumbent and the entrant seek to set their respective prices \(p_{Ad}\) and \(p_{Bd}\) to maximize their profits by solving the following problems:

The constraint in the above optimization problems ensures that the values of \(q_{Ad}\), \(q_{Bd}\) and \(q_{Bad}\) are positive. Solving the optimization problems for \(p_{Ad}\) and \(p_{Bd}\) yields the equilibrium prices. The closed form of expressions of prices and profits under high-end encroachment are

where \(m=(v_{B}-v_{A})(v_{A}-v_{Bb})-2\alpha v_{A}v_{Ba}\).

In equilibrium, the condition \(m=(v_{B}-v_{A})(v_{A}-v_{Bb})-2\alpha v_{A}v_{Ba}>0\) is required to ensure that the new entrant firm derives positive profit.

5.1.2 Impact of switching costs on profits

The following result shows the impact of switching cost on firms’ prices and profits under high-end encroachment.

Proposition 2

When Firm B enters the market with free strategy under high-end encroachment, as the switching cost increases, the price of product A and the profit of Firm A increase, whereas the price of product B’s add-on and the profit of Firm B reduce.

Proposition 2 states that the switching cost has a positive impact on Firm A but a negative impact on Firm B. This finding is consistent with prior research on the impact of switching cost (e.g. [8, 23, 24]). The switching cost provides the incumbent firm an advantage by locking in its existing customers. As the switching cost increases, the existing customers are less willing to move to the new firm. Thus Firm A can charge a higher price and thus gains a higher profit. On the other hand, Firm B responds the increased switching cost by lowering its price, so as to induce the old customers to purchase its product. However, the increase in the switching cost eventually leads to a reduction in Firm B’s profit.

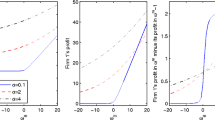

We use Fig. 4 to further demonstrate the impact of switching cost on the equilibrium profits. In performing the numerical analysis, we set \(v_{A}=90\), \(v_{B}=100\), \(v_{Bb}=70\) and \(\alpha =0.01\). Figure 4 shows that as the switching cost increases, Firm A will be better off while Firm B will be worse off. When \(c=5.5074\), the firms gain the same profit. When \(c<(>)5.5074\), Firm B’s profit is higher (lower) than Firm A’s profit.

5.1.3 Impact of switching costs on consumer surplus and social welfare

We now investigate the welfare implication of the impact of switching cost by computing consumer surplus and social welfare. Substituting the equilibrium prices and demands to consumer’s net utility functions, we get the net utility for each customer segment. Accordingly, the total consumer surplus (CS), is given by

Social welfare (SW), is defined as the sum of consumer surplus and industry profit:

It is analytically intractable to deal with Eqs. (12) and (13) to examine the impact of switching cost on consumer surplus and social welfare. Hence, we resort to numerical analysis. Figure 5 is depicted using the same numerical example discussed previously. In Fig. 5, we find that a higher switching cost results in lower consumer surplus, which contrasts with the result in Mehra et al. [26]. This happens because when the switching cost is high, the incumbent firm (i.e., Firm A) can charge a high price to consumers for its product after Firm B enters the market. Because in our model setup the incumbent firm does not implement price discrimination between the old customers and the new customers, all consumers are charged the same price that increases in the switching cost. This impact is high enough to more than offset any benefit in consumer surplus due to the increased switching cost. While our result that an increase in the switching cost hurts consumers is inconsistent with that in Mehra et al. [26], it actually consists with prior studies (e.g., [2, 23, 30]) according to which switching costs reduce consumer surplus. We also observe from Fig. 5 that social welfare first decreases in the switching cost and then slowly increases in it. This happens because switching cost is a barrier for consumers to adopt a new product that may otherwise fit them better. The higher the switching cost, the lower utility that consumers derive. Since Firm A can benefit from a higher switching cost, there must exist a threshold value that when switching cost exceeds this value, the social welfare will increase. The threshold value in Fig. 5 is equal to 11.0809. When \(c>11.0809\), social welfare increases in the switching cost.

5.1.4 Impact of network intensity on profits, CS and SW

Although we have obtained closed form expressions for \(\pi _{1d}^*\) and \(\pi _{2d}^*\) in the case of high-end encroachment [(see Eqs. (10) and (11)], the derivatives of \(\pi _{1d}^*\) and \(\pi _{2d}^*\) with respect to \(\alpha\) are too complex to derive. Hence, we use numerical methods to illustrate the impact of network intensity. To examine the impact of network intensity (\(\alpha\)) on equilibrium outcomes, we ran extensive numerical experiments with different switching cost (c). We find that the trajectory patterns of equilibrium prices, profits, consumer surplus and social welfare turn out to be identical for different values of c. Hence, we use a representative example shown in Figs. 6 and 9 to report these results. In this example, we set \(v_{A}=90\), \(v_{B}=100\), \(v_{Bb}=70\) and \(c=5\). However, the trajectory pattern of Firm A’s demand (\(q_{Ad}^*\)) with respect to \(\alpha\) turn out to be different for different values of c, and so does the demand of Firm B’s add-ons (\(q_{Bad}^*\)). Therefore, we use Figs. 7 and 8 to report the results of impact of \(\alpha\) on \(q_{Ad}^*\) and \(q_{Bad}^*\) respectively for different values of c.

Figure 6 shows that an increase in the network intensity results in a decline in the firms’ prices in equilibrium. Moreover, we observe in Fig. 6 that for a given \(\alpha\), Firm B gains a higher profit compared to Firm A. As the network intensity strengthens, both firms’ profits decrease. While the results of prior studies on network externalities suggest that in a monopoly market, a firm’s profit increases in the network intensity (e.g., [6]), our numerical results show that in a duopolistic setting, the firms’ profits may decrease in the network intensity due to the intensification of price competition. We also observe that Firm B’s price is higher than Firm A’s price. The reason is that when \(v_B>v_A\), the paying customer are all switchers from Firm A as illustrated in Fig. 3. These customers are also high valuation customers who have high willingness to pay for the high quality product. Therefore, Firm B can charge a higher price to them for its high quality product. Figures 7 and 8 show that the impact of network intensity on firms’ demands depends on the level of switching cost. When \(c=4\), \(q_{Ad}^*\) first increases in \(\alpha\) and then decreases in it, while \(q_{Bad}^*\) always increases in \(\alpha\). When c becomes higher such that \(c=7\), an increase in \(\alpha\) generates higher demand for Firm A’s product but lower demand for Firm B’s add-ons. Figure 9 shows that the network intensity has a positive impact on consumer surplus and social welfare. This happens because the utility that consumers derive from a product increases in the network intensity. In addition, the intense competition caused by the increased network intensity leads to lower product prices. As a result, consumer surplus increases. The rise in social welfare implies that the increase in the consumer surplus fully compensates for the reduction in industry profits.

5.2 Low-end encroachment

5.2.1 Equilibrium outcomes in the low-end encroachment

Now we study Firm B’s entry into the market in the way of low-end Encroachment, i.e., \(v_{A}>v_{B}\). According to Proposition 1, the only possible market structure in this setting is (1)(2)(3)(6) as shown in Fig. 10. The marginal consumer, who is indifferent between using only the base part of product B and buying the add-ons of product B, is located at \(\theta _{5}\), and the one who is indifferent between buying the add-ons of product B and buying product A is located at \(\theta _{6}\).

In Fig. 10, consumers in \([0,\theta _{5}]\) use the free product offered by Firm B, consumers in \([\theta _{5},\theta _{6}]\) buy the add-ons of product B, while those in \([\theta _{6},r]\) and [r, 1] buy product A from Firm A. Since the customers located in [r, 1] use product A for two periods, there exist no customers switching to product B in this setting. In other words, when Firm B enters the market with a lower quality product compared to that of the existing one in the market,i.e., \(v_{A}>v_{B}\), it can not take any market share from the incumbent firm.

The locations of the marginal customers, \(\theta _{5}\) and \(\theta _{6}\), are derived by solving the following equations:

With the above boundary points, we get the demand of product A in the second period,

For Firm B, the number of consumers that use its free offing and the number of customers that pay for the add-ons are given by

Both firms set their respective prices to maximize the profits. The corresponding optimization problems are given by

The constraint in the optimization problems guarantees that the number of customers in each segments are positive. In equilibrium, the closed form expressions for prices and the corresponding profits in the low-end encroachment are

The firms’ profits in this setting are not affected by the switching cost because no customers switch to the new firm when it enters with a low-end product. Hence, we do not observe the term c in the expressions of the equilibrium profits.

In equilibrium, the consumer surplus is

and the social welfare is given by

where \(U_{1}=(\theta +\alpha q_{Bd})v_{Bb}\), \(U_{2}=(\theta +\alpha q_{Bd})v_{B}-p_{Bd}^*\) and \(U_{3}=U_{6}=(\theta +\alpha q_{Ad})v_{A}-p_{Ad}^*\).

5.2.2 Impact of network intensity on profits, CS and SW

We use numerical examples to investigate the impact of network intensity on firms’ profits, consumer surplus and social welfare in this case. The numerical analysis is performed by setting \(v_{A}=90\), \(v_{B}=80\), \(v_{Bb}=50\). Note that the value of c is not given in that there are no consumers switching to the new product under low-end encroachment. We show the results of numerical analysis in Figs. 11 and 12. Figure 11 shows that for a given network intensity, Firm B’s profit is lower than Firm A’s profit. In addition, the increase in the network intensity causes the firms to respond by reducing their respective prices. In Fig. 11 we also observe that Firm A sets a higher price and gains a larger demand compared with Firm B. This happens because when \(v_B<v_A\), all customer who buy from Firm A in the monopoly period still purchase from it after the entry of Firm B, and the consumers who have not purchased from Firm A now choose to buy from it. In this case, Firm B only gains low valuation consumers from the untapped market. As the network intensity increases, Firm A’s demand increases whereas the demand of Firm B’s add-ons decreases. As a result, Firm B’s profit reduces. For Firm A, the benefit from the increased demand is not high enough to make up the profit loss caused by the reduction in prices. Consequently, Firm A’s profit declines as well. According to Fig. 12, an increase in the network intensity results in higher consumer surplus and higher social welfare. This result is the same as that in the setting where Firm B enters with a high-end product. Therefore, we could conclude that under both high-end encroachment and low-end encroachment, the network intensity has a negative impact on the firms’ profits but a positive impact on the consumer surplus and social welfare.

To compare Firm B’s profits under high-end encroachment and low-end encroachment, we plot Fig. 13 to illustrate the profit difference between the two cases with respect to the switching cost and network intensity. For this example, we set \(v_B=100\) and \(v_{Bb}=70\) when Firm B adopts high-end encroachment strategy, and \(v_B=80\) and \(v_{Bb}=50\) when it adopts low-end encroachment. In both settings, we set \(v_A=90\). Figure 13 shows that when the switching cost is relatively low, the high-end encroachment strategy generates higher profit than the low-end encroachment strategy. However, as the switching cost increases, Firm B might derive more profit by using low-end encroachment strategy. In addition, from Fig. 11 we observe that higher network intensity reduces the profit difference between the high-end encroachment and low-end encroachment. In other words, if the market is characterized by strong network intensity, the profit that the new entrant firm derives from high-end encroachment may be close to the profit derived from low-end encroachment.

6 Extension: free or not free?

In this section, we extend the basic model to a more general case in which Firm B offers the base product at price \(p_f\) rather than give it away for free. We then examine under what conditions providing a product for free is a dominant strategy for the new entrant firm. Similar to Sect. 5, we analyze the equilibrium market outcomes when the new firm infringes on the market with high-end product and low-end product, respectively.

6.1 High-end encroachment

When Firm B offers a high-end product, i.e., \(v_B>v_A\), the marginal customers located at \(\theta _{1}\) and \(\theta _{4}\) as illustrated in Fig. 3, are described by the following equations:

where \(Q_{Bd}=\theta _{1}+1-\theta _{4}\) and \(Q_{Ad}=\theta _{4}-\theta _{1}\) by employing the concept of rational expectation equilibrium.

The optimization problems of the firms are written as

Lagrangean function of Eq. (28) is formulated as

The derivation of equilibrium solutions are presented in the appendix.

If \(\mu >0\), it is optimal for the new entrant firm to offer a free product, whereas, if \(\mu <0\), charging a price for the base product as well as for the add-ons are more profitable than offering a free product. Since the expression for \(\mu\) is so complex that it is analytically intractable to derive the specific condition for \(\mu >0\) to hold. We thus turn to numerical analysis. For this example we set \(v_A=90\), \(v_B=100\), \(v_{Bb}=70\) and \(c=5\). We examine how the network intensity affects the condition under which the free strategy is dominant for Firm B. In Fig. 14 we find \(\mu <0\) when \(\alpha <0.0172\), and \(\mu >0\) when \(\alpha >0.0172\). This implies that for this particular example, it is optimal for Firm B to offer a free product only when the network intensity is higher than 0.0172. Otherwise, Firm B is better off setting prices for both the base product and the add-ons.

6.2 Low-end encroachment

Now we analyze the optimal strategy for Firm B when it enters the market with a low-end product, i.e., \(v_B<v_A\). The indifferent points, \(\theta _{5}\) and \(\theta _{6}\), as illustrated in Fig. 10, are described by the following equations:

where \(Q_{Bd}=\theta _{6}\) and \(Q_{Ad}=1-\theta _{6}\).

The firms’ optimization problem in this setting are given below,

Lagrangean function of Eq. (33) is formulated as

The derivation of equilibrium solutions for the optimization problems is given in the appendix. The condition under which Firm B will be better off adopting the free strategy in the low-end encroachment is summarized in Proposition 3.

Proposition 3

When the new entrant firm infringes on the market with low-end product, it is more profitable for the firm to offer a free product than to charge a price for it if the network intensity satisfies \(\min \{\alpha _1,\alpha _2\}<\alpha <\max \{\alpha _1,\alpha _2\}\).

An implication of Proposition 3 is that it is not always optimal for the new entrant firm to offer a free product even though its product has no advantage over the incumbent’s product in terms of quality. Whether the free strategy will generate higher profit depends on the intensity of network externality. The new firm could make more profit by offering a free product only if the network intensity falls within a given threshold.

7 Conclusions

This paper presents a stylized model of new product entry, where the new entrant firm encroaches on an existing market with the free strategy. The incumbent firm is a monopoly before the new firm enters. We analyze the competition outcomes under different quality levels of the new firm’s product.

Our paper provides several interesting findings. First, we find that if the new entrant firm introduces a homogeneous product into the market, a Bertrand equilibrium exists. However, if the new firm enters the market with a heterogeneous product, the specific market equilibrium depends on the quality difference between the firms’ products. In the case of high-end encroachment, the high-valuation customers will switch from the incumbent to the new entrant. These customers have high willingness to pay for the new firm’s add-ons. On the other hand, in the case of low-end encroachment, there will be no customers switching to the new firm’s product due to its low quality, but some low-valuation customers will buy from it because of the low price it charges. Second, the network externalities intensify price competition between the firms, resulting in a reduction in the equilibrium prices. As the network intensity increases, the firms are worse off while the consumer surplus and social welfare are better off in both high-end encroachment and low-end encroachment. Third, an increase in the switching cost generates higher profit for the incumbent firm and lower profit for the new entrant firm. By comparing the new firm’s profit difference between high-end and low end encroachments, we find that it is optimal for the new firm to encroach on the market with a high-end product especially in a relatively low switching cost environment. We also extend the basic model to examine under what conditions the new entrant firm should provide a product for free. Our results show that in the high-end encroachment, the new firm will be better off offering a free product when the network intensity is high enough. By contrast, in the low-end encroachment, it is more profitable for the new firm to offer a free product than charging a price for it when the network intensity falls within a given threshold.

Our model has several limitations and several research directions are possible to address these issues. First, the quality of the products are given exogenously. In our model, we mainly discuss the market structure and equilibrium results in two settings: In the first setting, the new entrant firm offers a higher quality product compared to the exiting firm; In the second setting, the product quality of the new firm is lower than that of the existing firm. For future research, we could consider the case where the new firm strategically determines the quality of its free base product and the add-on. Second, we focus on the impact of direct network externalities on the pricing decisions of the firms. In practice, when it comes to information products, the demand of which is often affected by cross-sided network externalities. Parker and Alstyne [31] point out that a firm can invest in a product it intends to give away for free, because the increased profit of the premium product more than covers the investment cost of the free product. Future research could extend the current model to platform-based where there exist cross-sided network externalities. Further, the incumbent firm in our model does not change its strategy after the new firms enters the market with the free strategy. It is of interest to allow the incumbent to adopt a similar free product strategy so as to improve its competitiveness in fighting for the market share.

References

August T, Niculescu MF, Shin H (2014) Cloud implications on software network structure and security risks. Inf Syst Res 25(3):489–510

Barua A, Kriebel CH, Mukhopadhyay T (1991) An economic analysis of strategic information technology investments. MIS Q 15(3):313–331

Bawa K, Shoemaker R (2004) The effects of free sample promotions on incremental brand sales. Mark Sci 23(3):345–363

Cheng HK, Li S, Liu Y (2014) Optimal software free trial strategy: limited version, time-locked, or hybrid? Prod Oper Manag 24(3):504–517

Cheng HK, Liu Y (2012) Optimal software free trial strategy: the impact of network externalities and consumer uncertainty. Inf Syst Res 23(2):88–504

Cheng HK, Tang QC (2010) Free trial or no free trial: optimal software product design with network. Eur J Oper Res 205(2):437–447

Conner KR (1995) Obtaining strategic advantage from being imitated: when can encouraging ‘clones’ pay? Manag Sci 41(2):209–225

Demirhan D, Jacob VS, Raghunathan S (2007) Strategic IT investments: the impact of switching cost and declining IT cost. Manag Sci 53(2):208–226

Dhebar A (1994) Durable-goods monopolists, rational consumers, and improving. Mark. Sci. 13(1):100–120

Dogan K, Ji Y, Mookerjee VS, Radhakrishan S (2011) Managing the versions of a software product under variable and endogenous demand. Inf. Syst. Res. 22(1):5–21

Ellison G (2005) A model of add-on pricing. Q J Econ 120(2):585–637

Erat S, Bhaskaran SR (2012) Consumer mental accounts and implications to selling base products and add-ons. Mark. Sci. 31(5):801–818

Etzion H, Pang MS (2014) Complementary online services in competitive markets: maintaining profitability in the presence of network effects. MIS Q 38(1):231–247

Faugre C, Tayi GK (2007) Designing free software samples: a game theoretic approach. Inf Technol Manag 8(4):263–278

Fruchter GE, Gerstner E, Dobson PW (2011) Fee or free? How much to add on for an add-on. Mark Lett 22(1):65–78

Gallaugher JM, Wang YM (1999) Network effects and the impact of free goods: an analysis of the web server market. Int J Electron Commer 3(4):67–88

Gartner (2013) Forecast: Mobile App stores, Worldwide, Update. 2013. www.gartner.com/doc/2584918/

Haruvy EE, Miao D, Stecke KE (2013) Various strategies to handle cannibalization in a competitive duopolistic market. Int Trans Oper Res 20(2):155–188

Jing B (2000) Versioning information goods with network externalities. In: Proceedings of the twenty first international conference on Information systems. Association for Information Systems, Atlanta, pp 1–12

Jones R, Mendelson H (2011) Information goods vs. industrial goods: cost structure and competition. Manag Sci 57(1):164–176

Katz ML, Shapiro C (1985) Network externalities, competition, and compatibility. Am Econ Rev 75(3):424–440

Klastorin T, Tsai W (2004) New product introduction: timing, design, and pricing. Manuf Serv Oper Manag 6(4):302–320

Klemperer P (1987a) Markets with consumer switching costs. Q J Econ 102(2):375–394

Klemperer P (1987b) The competitiveness of markets with switching costs. RAND J Econ 18(1):138–150

Lieberman MB, Montgomery DB (2013) Conundra and progress:research on entry order and performance. Long Range Plan 46(4):312–324

Mehra A, Bala R, Sankaranarayanan R (2012) Competitive behavior-based price discrimination for software upgrades. Inf Syst Res 23(1):60–74

Moorthy KS (1988) Product and price competition in a duopoly. Mark Sci 7(2):141–168

Narasimhan C, Zhang ZJ (2000) Market entry strategy under firm heterogeneity and asymmetric payoffs. Mark Sci 19(4):313–327

Niculescu MF, Wu DJ (2014) Economics of free under perpetual licensing: implications for the software industry. Inf Syst Res 25(1):173–199

Nilssen T (1992) Two kinds of consumer switching costs. RAND J Econ 23(4):579–589

Parker G, Alstyne M (2005) Two-sided network effects: a theory of information product design. Manag Sci 51(10):1494–1504

Schmidt GM (2004) Low-end and high-end encroachment strategies for new products. Int J Innov Manag 8(2):167–191

Schmidt GM, Porteus EL (2000) The impact of an integrated marketing and manufacturing innovation. Manuf Serv Oper Manag 2(4):317–336

Seref MMH, Carrillo JE, Yenipazarli A (2015) Multi-generation pricing and timing decisions in new product development. Int J Prod Res. doi:10.1080/00207543.2015.1061220

Shapiro C, Varian HR (1998) Versioning: the smart way to sell information. Harv Bus Rev 107(6):107

Sheer I (2014) Player tally for “League of Legends” Surges. http://blogs.wsj.com/digits/2014/01/27/player-tally-for-league-of-legends-surges/. 2014-1-27

Shivendu S, Zhang Z (2015) Versioning in the software industry: heterogeneous disutility from underprovisioning of functionality. Inf Syst Res 26(4):731–753

Shulman JD, Geng X (2013) Add-on pricing by asymmetric firms. Manag Sci 59(4):899–917

Swinney R, Cachon GP, Netessine S (2011) Capacity investment timing by start-ups and established firms in new markets. Manag Sci 57(4):763–777

Vakratsas D, Rao RC, Kalyanaram G (2003) An empirical analysis of follower entry timing decisions. Mark Lett 14(3):203–216

Verboven F (1999) Product line rivalry and market segmentation with an application to automobile optional engine pricing. J Ind Econ 47(4):399–425

Wei XQ, Nault BR (2013) Experience information goods: “Version-to-upgrade”. Decis Support Syst 56:494–501

Wu S, Chen P (2008) Versioning and piracy control for digital information goods. Oper Res 56(1):157–172

Acknowledgements

This research is partially supported by research grants from the National Science Foundation of China under Grant Nos. 71271148, 71471128, and the Key Program of National Natural Science foundation of China under Grant No. 71631003.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Proof of Lemma 1

Before the entrant (i.e., Firm B) enters into the market, the incumbent (i.e., Firm A) offers the product A at a monopoly price, \(p_{Am}\). Consumers in the market have two choices: buy or not buy the incumbent’s product. The corresponding net utilities are: \(U_{Am}=(\theta +\alpha Q_{Am})v_{A}-p_{Am}\) and 0. The marginal consumer, who is indifferent between buying and not buying, is located at \(\theta _{0}\), and

We derive \(\theta _{0}\) from Eq. (35) as follows:

where \(Q_{Am}\) is the expected network size. The consumers in \([0,\theta _{0}]\) do not purchase, while those in \([\theta _{0},1]\) purchase from the incumbent firm. Hence, the demand of product A is

Substituting Eqs. (37) into (36) and using the rational expectations theory, we derive the demand of product A,

The incumbent sets the price \(p_{Am}\) to maximize its profit \(\pi _{1m}=p_{Am}q_{Am}\).

Differentiating \(\pi _{1m}\) with respect to \(p_{Am}\) yields the following optimal price \(p_{Am}^*\), demand \(q_{Am}\) and profit \(\pi _{1m}^*\) for Firm A,

Thus, we find that

\(\square\)

Proof of Proposition 1

-

(i)

When \(v_{B}>v_{A}\), the analysis in Sect. 4 show that the possible market structures are (1)(4)(6)(5), (1)(3)(6)(5), (1)(3)(2)(5), (1)(6)(5) and (1)(3)(5). For the market structure (1)(4)(6)(5), we have \(\theta _{1}=\theta _{2}=r\). At the boundary point r, we have \(U_{1}(r)=U_{4}(r)\) (see Fig. 2). Simplify this equation and we can find that \(c=0\). Obviously, this violates our setup of \(c>0\). Therefore, this market structure does not exist equilibrium. Similarly, the market structure (1)(3)(2)(5) cannot exist in equilibrium either. For the market structure (1)(6)(5), we get that \(\theta _{1}=\theta _{2}=r=\theta _{3}\). At the boundary point r, we have \(U_{1}(r)=U_{6}(r)\). Furthermore, the price will be set such that \(U_{1}(r)\ge U_{3}(r)\). Note that \(U_{3}(r)=U_{6}(r)\), so we find a contradiction. As a result, the market structure (1)(6)(5) cannot exist when the market comes into equilibrium. Similarly, the market structure (1)(3)(5) cannot exist either. Hence, when \(v_{B}>v_{A}\), the only possible market structure is (1)(3)(6)(5).

-

(ii)

When \(v_{B}<v_{A}\), the proof is similar to that of (i).

-

(iii)

When \(v_{B}=v_{A}\). As noted above, in equilibrium, segment (1) and segment (4) cannot coexist, segment (2) and segment (5) cannot exist, and segment (3) and segment (6) cannot exist.

Hence, if segment 3 exists, we must have

In this case, we obtain that

This implies that no consumers will exercise option (2) and option (5). As a result, Firm B makes no profit in this case. If, however, Firm B charges a low enough price such that \(U_{2}(\theta )\ge U_{3}(\theta )\) and \(U_{5}(\theta )\ge U_{6}(\theta )\), then all consumers will buy from Firm B instead of from Firm A. In that case, Firm A will reduce its price in response to Firm B’s low price. This consequently leads to zero prices in the market and neither firm can be profitable.

Derivation of equilibrium outcomes for Sect. 5.1. Substituting Eqs. (3) and (4) into Eqs. (1) and (2) and employing the rational expectation theory, we derive the marginal consumers and the firms’ demands below.

We first compute the first order conditions of problems (P1) and (P2) and then solve the two conditions simultaneously for the prices \(p_{Ad}\) and \(p_{Bd}\). The closed form of expressions of equilibrium prices are

where \(m=(v_{B}-v_{A})(v_{A}-v_{Bb})-2\alpha v_{A}v_{Ba}\).

Substituting \(p_{Ad}^*\) and \(p_{Bd}^*\) back into the objective functions of problems (P1) and (P2) yields the equilibrium profits, \(\pi _{1d}^*\) and \(\pi _{2d}^*\), for the two firms.

Derivation of equilibrium outcomes for Sect. 5.2. Substituting Eqs. (16) and (17) back into Eqs. (14) and (15), we have

Solving the optimization problems (P3) and (P4) yields the equilibrium prices,

Substituting the above equilibrium prices into the objective functions of problems (P3) and (P4) yields the optimal profits, which are given by

Proof of Proposition 2

The first-order conditions of the profits of Firm A and Firm B with respect to c are given as follows.

where \(\partial p_{Ad}^*/\partial c\) and \(\partial p_{Bd}^*/\partial c\) are the first-order conditions of Eqs. (52) and (53). Taking the derivative of \(p_{Ad}^*\) and \(p_{Bd}^*\) with respect to c yields

The price of product A, \(p_{Ad}^*\), should be positive. According to Lemma 2, we have \(m>0\). Hence, the sign of \(\partial \pi _{1d}^*/\partial c\) depends on the sign of \(\partial p_{Ad}^*/\partial c\), which is positive as given by Eq. (58). Therefore, \(\partial \pi _{1d}^*/\partial c>0\). That is, the price of product A and the profit of Firm A increase with switching cost. Similarly, we can get that \(\partial \pi _{2d}^*/\partial c<0\), which means that the price of product B and the profit of Firm B decrease in the switching cost. \(\square\)

Derivation of equilibrium solutions for Sect. 6.1. By using Kuhn-Tucker conditions of the above function and the first-order condition of Firm A’s profit function, we find that the case of \(\mu >0\) yields the condition under which offering a free version product (i.e, \(p_f=0\)) is an optimal solution for Firm B. It follows that

where \(m=(v_{B}-v_{A})(v_{A}-v_{Bb})-2\alpha v_{A}v_{Ba}\), and

Derivation of equilibrium solutions for Sect. 6.2. The optimization problems could be solved in the same way as in Sect. 6.1. The case of \(\mu >0\) provides the condition under which offering a free version product (i.e, \(p_f=0\)) is an optimal solution for Firm B. It follows that

Proof of Proposition 3

In equilibrium, we find that \(\mu =\theta _{6}^{*}g(\alpha )\), where \(\theta _{6}^{*}\) is obtained by substituting the equilibrium prices back into the indifferent points, and \(g( \alpha )=-\frac{{{\alpha }^{2}}{{v}_{Ba}}+\alpha (2{{v}_{A}}+3{{v}_{B}}-{{v}_{Bb}})-2({{v}_{A}}-{{v}_{B}})}{\alpha ({{v}_{Bb}}+2{{v}_{A}}+{{v}_{B}})+{{v}_{B}}+{{v}_{Bb}}-2{{v}_{A}}}\). Because \(\theta _{6}^{*}>0\) in equilibrium, the above solution is feasible if and only if \(g( \alpha )>0\). Consequently, we have

where \({{\alpha }_{1}}=\frac{-2{{v}_{A}}-3{{v}_{B}}+{{v}_{Bb}}+\sqrt{4{{v}_{A}}({{v}_{A}}+5{{v}_{B}}-3{{v}_{Bb}})+{{({{v}_{B}}+{{v}_{Bb}})}^{2}}}}{2({{v}_{B}}-{{v}_{Bb}})}\), and \({{\alpha }_{2}}=\frac{2{{v}_{A}}-{{v}_{B}}-{{v}_{Bb}}}{2{{v}_{A}}+{{v}_{B}}+{{v}_{Bb}}}\).

Appendix 2

In Appendix 2, we consider a first time user cost in consumer utility functions. The first time user cost is incurred when the consumers use a new product at the first time. The consumers who buy from Firm A in stage 1 do not incur such a cost, but they incur a switching cost if moving to Firm B’s product. Let f denote the first time user cost. There are a total of six options available for consumers. Consequently, the utility for various options available to the consumers are listed below:

-

(1)

Consumers who have not purchased product A now use the free base part of product B and obtain a net utility of \({{U}_{1}}=\left( \theta +\alpha {{Q}_{Bd}} \right) {{v}_{Bb}}-f\).

-

(2)

Consumers who have not purchased product A now use the whole product B and obtain a net utility of \({{U}_{2}}=\left( \theta +\alpha {{Q}_{Bd}} \right) {{v}_{B}}-{{p}_{Bd}}-f\).

-

(3)

Consumers who have not purchased product A now adopt it and obtain a net utility of \({{U}_{3}}=\left( \theta +\alpha {{Q}_{Ad}} \right) {{v}_{A}}-{{p}_{Ad}}-f\).

-

(4)

Consumers who have purchased product A now switch to Firm 2’s free offering and the net utility is \({{U}_{4}}=\left( \theta +\alpha {{Q}_{Bd}} \right) {{v}_{Bb}}-c\).

-

(5)

Consumers who have purchased product A now switch to the whole product B and the net utility is \({{U}_{5}}=\left( \theta +\alpha {{Q}_{Bd}} \right) {{v}_{B}}-{{p}_{Bd}}-c\).

-

(6)

Consumers who have purchased product A now continue to pay for it. The net utility is \({{U}_{6}}=\left( \theta +\alpha {{Q}_{Ad}} \right) {{v}_{A}}-{{p}_{Ad}}\).

Lemma B1

Before Firm B enters the market, the incumbent offers its product at the price of \(\frac{1}{2}({v_A}-f)\). There are two segments of consumers in the market. The proportion of customers who do not buy from the incumbent is \(r=\frac{f+{v_{A}}-2\alpha {v_{A}}}{2{v_{A}}(1-\alpha )}\) and the proportion of buyers is \(1-r=\frac{{{v}_{A}}-f}{2{{v}_{A}}(1-\alpha )}\).

In this model setup, we find that different market structure exists in equilibrium under different conditions. In the following, we analyze the market structure under different conditions and give the equilibrium result under each structure.

Case (i). \({{v}_{B}}>{{v}_{A}}\).

If \({{v}_{B}}>{{v}_{A}}\), the market structure must encompass the six segments in the order (1)(3)(2)(4)(6)(5) from the left. However, it does not imply all these six segments must exist. We show the equilibrium market structure under different conditions below.

Case (ia). \({{v}_{B}}>{{v}_{A}}\) and \(f>c>0\).

When \(f>c>0\), from the utility functions we obtain \({{U}_{2}}<{{U}_{5}}\). If in equilibrium the market structure is (1)(3)(2)(4)(6)(5), then the utility of the indifferent customers located at r should satisfy \({{U}_{2}}(r)={{U}_{4}}(r)\). Using \({{U}_{2}}<{{U}_{5}}\) and \({{U}_{2}}(r)={{U}_{4}}(r)\) gives us \({{U}_{4}}<{{U}_{5}}\), which implies that the customers on the right of indifferent point r will not choose option (4) and so option (4) is dominated. Therefore, the possible market structure is (1)(3)(2)(6)(5). Similarly, at the indifferent point r, the condition \({{U}_{2}}(r)={{U}_{6}}(r)\) should hold. Using \({{U}_{2}}<{{U}_{5}}\) and \({{U}_{2}}(r)={{U}_{6}}(r)\), we have \({{U}_{5}}>{{U}_{6}}\). This implies that option (6) is dominated by option (5). As a result, no consumers will exercise option (6) and the possible market structure is (1)(3)(2)(5). To implement this market structure, the condition \({{U}_{2}}(r)={{U}_{5}}(r)\) should be satisfied, but because \({{U}_{2}}<{{U}_{5}}\), we find a contradiction. Therefore, no consumers located on the left of r will exercise option (2). Consequently, the equilibrium market structure in this case is (1)(3)(5), as illustrated in Fig. 15.

In this setting, all consumers who have purchased from Firm A now switch to Firm B and pay for its add-ons. Next we determine the profit-maximizing prices set by Firm A and Firm B to implement this market structure. In segment (5), the price of Firm B is set so that the indifferent customers located at r get a weakly higher surplus from switching compared to the surplus from either continuing to buy from Firm A or use the free base product from Firm B. These constraints are given by

These constraints yield the price \({{p}_{Bd}}=\min \{\left( r+\alpha {{Q}_{Bd}} \right) {{v}_{B}}-\left( r+\alpha {{Q}_{Ad}} \right) {{v}_{A}}-c+{{p}_{Ad}},\left( r+\alpha {{Q}_{Bd}} \right) ({{v}_{B}}-{{v}_{Bb}})\}\), where \({{Q}_{Ad}}=r-{{\theta }_{13}}\), \({{Q}_{Bd}}=1-r+{{\theta }_{13}}\), and \(r=\frac{f+{v_{A}}-2\alpha {v_{A}}}{2{v_{A}}(1-\alpha )}\). Similarly, we can find \({{p}_{Ad}}=\min \{\left( {{\theta }_{13}}+\alpha {{Q}_{Ad}} \right) {{v}_{A}}-\left( {{\theta }_{13}}+\alpha {{Q}_{Bd}} \right) {{v}_{Bb}},\left( {{\theta }_{13}}+\alpha {{Q}_{Ad}} \right) {{v}_{A}}-\left( {{\theta }_{13}}+\alpha {{Q}_{Bd}} \right) {{v}_{B}}+{{p}_{Bd}}\}\). The indifferent point \({{\theta }_{13}}\) is obtained by solving \(\left( {{\theta }_{13}}+\alpha {{Q}_{Bd}} \right) {{v}_{Bb}}-f=\left( {{\theta }_{13}}+\alpha {{Q}_{Ad}} \right) {{v}_{A}}-{{p}_{Ad}}-f\).

The optimization problems of the firms are as follows:

Solving the above optimization problem of Firm A yields the price, indifferent point and profit as follows:

For Firm B’s optimization problem, we find that its profit is increasing in \(p_{Bd}\). By substituting \(p_{Ad}^*\) into the constraint, \({{p}_{Bd}}=\min \{\left( r+\alpha \left( 1-r+\theta _{13}^{*} \right) \right) {{v}_{B}}-\left( r+\alpha \left( r-\theta _{13}^{*} \right) \right) {{v}_{A}}-c+p_{Ad}^{*},\left( r+\alpha \left( 1-r+\theta _{13}^{*} \right) \right) ({{v}_{B}}-{{v}_{Bb}})\}\), we could get the optimal price of Firm B.

Case (ib). \({{v}_{B}}>{{v}_{A}}\) and \(0<f\le c\).

When \(0<f\le c\), we obtain \({{U}_{1}}\ge {{U}_{4}}\) and \({{U}_{3}}<{{U}_{6}}\). If the market structure in equilibrium is (1)(3)(2)(4)(6)(5), then at the indifferent point , the condition \({{U}_{2}}(r)={{U}_{4}}(r)\) should hold. Using \({{U}_{1}}\ge {{U}_{4}}\) and \({{U}_{2}}(r)={{U}_{4}}(r)\) gives us \({{U}_{1}}\ge {{U}_{2}}\), which implies that option (2) is dominated by option (1). Thus, no consumers will choose option (2). Hence, the possible market structure is (1)(3)(4)(6)(5). At point , we have \({{U}_{3}}(r)={{U}_{4}}(r)\). Using \({{U}_{3}}<{{U}_{6}}\) and \({{U}_{3}}(r)={{U}_{4}}(r)\) gives us \({{U}_{6}}>{{U}_{4}}\). Thus option (4) is dominated and the possible market structure is (1)(3)(6)(5). In this case, the condition \({{U}_{3}}(r)={{U}_{6}}(r)\) should be satisfied. However, from the utility function we have \({{U}_{3}}<{{U}_{6}}\). Hence, option (3) and option (6) cannot coexist. Consequently, the equilibrium market structure when \(0<f\le c\) is (1)(3)(5) or (1)(6)(5).

Under the market structure (1)(3)(5), we could derive the equilibrium results that are the same as in Case (ia). Next, we focus on the analysis on market structure (1)(6)(5), which is illustrated in Fig. 16.

In this setting, the consumers in segment (6) buy from Firm A and thus the demand of Firm A is \({{\theta }_{56}}-r\), the consumers whose valuation is higher than \({{\theta }_{56}}\) purchase the add-ons from Firm B, and the consumers on the left of use the free base product from Firm B. In addition, in segment (6), the price of Firm A is set so that the indifferent customers located at \({{\theta }_{56}}\) get a weakly higher surplus from continuing to buy from Firm A compared to the surplus from switching to either free product or add-ons offered by Firm B. These constraints are given by

This constraint yields the price \({{p}_{Ad}}=\min \{\left( r+\alpha {{Q}_{Ad}} \right) {{v}_{A}}-\left( r+\alpha {{Q}_{Bd}} \right) {{v}_{Bb}}+c,{{p}_{Bd}}+c\left( r+\alpha {{Q}_{Ad}} \right) {{v}_{A}}-\left( r+\alpha {{Q}_{Bd}} \right) {{v}_{B}}\}\), where \({{Q}_{Ad}}={{\theta }_{56}}-r\) and \({{Q}_{Bd}}=1-{{Q}_{Ad}}\). Following similar logic we find that \({{p}_{Bd}}=\min \{\left( {{\theta }_{56}}+\alpha {{Q}_{Bd}} \right) {{v}_{B}}-\left( {{\theta }_{56}}+\alpha {{Q}_{Ad}} \right) {{v}_{A}}-c+{{p}_{Ad}},\left( {{\theta }_{56}}+\alpha {{Q}_{Bd}} \right) ({{v}_{B}}-{{v}_{Bb}})\}\). The indifferent point \({{\theta }_{56}}\) is obtained by solving \(-{{p}_{Bd}}-c+\left( {{\theta }_{56}}+\alpha {{Q}_{Bd}} \right) {{v}_{B}}=\left( {{\theta }_{56}}+\alpha {{Q}_{Ad}} \right) {{v}_{A}}-{{p}_{Ad}}\).

Accordingly, we can write the firms profit functions,

By examining the second order condition of \({{\pi }_{1d}}\), we find that \({{\pi }_{1d}}\) is convex in \({{p}_{Ad}}\). Thus, in equilibrium the optimal price of Firm A is \({{p}_{Ad}}=\min \{\left( r+\alpha {{Q}_{Ad}} \right) {{v}_{A}}-\left( r+\alpha {{Q}_{Bd}} \right) {{v}_{Bb}}+c,\left( r+\alpha {{Q}_{Ad}} \right) {{v}_{A}}-\left( r+\alpha {{Q}_{Bd}} \right) {{v}_{B}}+{{p}_{Bd}}+c\}\). Solving the optimization problem of Firm B yields \({{p}_{Bd}}=(-{{v}_{A}}\left( 1+a\left( 1-r \right) \right) +{{v}_{B}}\left( 1+ar \right) -c+{{p}_{Ad}})/2\) By substituting the expression for \({{p}_{Bd}}\) into \({{\theta }_{56}}\) and comparing \(\left( r+\alpha {{Q}_{Ad}} \right) {{v}_{A}}-\left( r+\alpha {{Q}_{Bd}} \right) {{v}_{Bb}}+c\) and \(\left( r+\alpha {{Q}_{Ad}} \right) {{v}_{A}}-\left( r+\alpha {{Q}_{Bd}} \right) {{v}_{B}}+{{p}_{Bd}}+c\) in the constraint for \({{p}_{Ad}}\), we could get the equilibrium prices and profits.

Case (ic). \({{v}_{B}}>{{v}_{A}}\) and \(f=0,c>0\).

When \(f=0,c>0\), we have \({{U}_{1}}>{{U}_{4}}\) and \({{U}_{3}}={{U}_{6}}\). If in equilibrium the market structure (1)(3)(2)(4)(6)(5) is implemented, then at point r, the condition \({{U}_{2}}(r)={{U}_{4}}(r)\) should satisfy. Using \({{U}_{1}}>{{U}_{4}}\) and \({{U}_{2}}(r)={{U}_{4}}(r)\), we have \({{U}_{1}}>{{U}_{2}}\). Thus, no consumers will exercise option (2) and so the possible market structure is (1)(3)(4)(6)(5). In this case, the condition \({{U}_{3}}(r)={{U}_{4}}(r)\) should hold at point . Using \({{U}_{3}}={{U}_{6}}\) and \({{U}_{3}}(r)={{U}_{4}}(r)\), we have \({{U}_{6}}\ge {{U}_{4}}\) for consumers on the right of point r. Thus, no consumers will exercise option (4). As a result, the market structure in equilibrium is (1)(3)(6)(5).

In the setting where \({{v}_{B}}>{{v}_{A}}\) and \(f=0,c>0\), we obtain the same results as shown in Sect. 5.1 in the main body.

Case (ii). \({{v}_{B}}<{{v}_{A}}\).

If \({{v}_{B}}<{{v}_{A}}\), the market structure must encompass the six segments in the order (1)(2)(3)(4)(5)(6) from the left.

Case (iia). \({{v}_{B}}<{{v}_{A}}\) and \(f>c>0\).

When \(f>c>0\), we have \({{U}_{3}}<{{U}_{6}}\). If in equilibrium the market structure (1)(2)(3)(4)(5)(6) is implemented, then at point , the condition \({{U}_{3}}(r)={{U}_{4}}(r)\) satisfies. Using \({{U}_{3}}<{{U}_{6}}\) and \({{U}_{3}}(r)={{U}_{4}}(r)\) gives us \({{U}_{6}}>{{U}_{4}}\), which implies that option (4) is dominated by option (6). Thus, no consumers will exercise option (4) and so the market structure is (1)(2)(3)(5)(6). At point , the condition \({{U}_{3}}(r)={{U}_{5}}(r)\) should be satisfied. Because \({{U}_{3}}<{{U}_{6}}\), we have \({{U}_{6}}>{{U}_{5}}\). Thus option (5) is dominated and so the possible market structure is (1)(2)(3)(6). In this case, however, the condition \({{U}_{3}}(r)={{U}_{6}}(r)\) cannot be satisfied because \({{U}_{3}}<{{U}_{6}}\). Therefore, option (3) will not be exercised. Consequently, the market structure in equilibrium is (1)(2)(6), as illustrated in Fig. 17.

In this setting, the new consumers located between \({{\theta }_{12}}\) and buy the add-ons from Firm B and all the old consumers located on the right of continue to buy from Firm A. In segment (2), the price of Firm B is set so that the marginal customers located at \({{\theta }_{12}}\) derive higher surplus from buying the add-ons compared to the surplus derived from either using Firm B’s free product or buy from Firm A. These constraints are

Thus we have \({{p}_{Bd}}=\min \{\left( {{\theta }_{12}}+\alpha {{Q}_{Bd}} \right) \left( {{v}_{B}}-{{v}_{Bb}} \right) ,\left( {{\theta }_{12}}+\alpha {{Q}_{Bd}} \right) {{v}_{B}}-\left( {{\theta }_{12}}+\alpha {{Q}_{Ad}} \right) {{v}_{A}} +{{p}_{Ad}}\}\). Here, \({{\theta }_{12}}\) is obtained by solving \(\left( {{\theta }_{12}}+\alpha {{Q}_{Bd}} \right) {{v}_{Bb}}-f=\left( {{\theta }_{12}}+\alpha {{Q}_{Bd}} \right) {{v}_{B}}-{{p}_{Bd}}-f\) and \({{Q}_{Bd}}=1-r\). Additionally, in segment (6), the price of Firm B is set so that the marginal customers located at r derive a weakly higher surplus from buying product A compared to the surplus that they derive from switching to either product offered by Firm B. These constraints are

Thus we get \({{p}_{Ad}}=\min \{\left( r+\alpha {{Q}_{Ad}} \right) {{v}_{A}}-\left( r+\alpha {{Q}_{Bd}} \right) {{v}_{Bb}}+c,\left( r+\alpha {{Q}_{Ad}} \right) {{v}_{A}}+{{p}_{Bd}}+c-\left( r+\alpha {{Q}_{Bd}} \right) {{v}_{B}}\}\).

The optimization problems of the firms are given below

It is straightforward that the profit of Firm A \({{\pi }_{1d}}\) is convex in \({{p}_{Ad}}\). Solving the problem of Firm B gives us the indifferent point, price and profit in equilibrium below,

The equilibrium price of Firm A could also be obtained by substituting \(p_{Bb}^{*}\) into the constraint \({{p}_{Ad}}=\min \{\left( r+\alpha {{Q}_{Ad}} \right) {{v}_{A}}-\left( r+\alpha {{Q}_{Bd}} \right) {{v}_{Bb}}+c,\left( r+\alpha {{Q}_{Ad}} \right) {{v}_{A}}-\left( r+\alpha {{Q}_{Bd}} \right) {{v}_{B}}+{{p}_{Bd}}+c\}\). Consequently, we have \(p_{Ab}^{*}=\{r+c+a\left( 1-r \right) {{v}_{A}}-r\left( 1+a \right) {{v}_{Bb}},r+c+a\left( 1-r \right) {{v}_{A}}-r\left( 1+a \right) {{v}_{B}}+({{v}_{B}}-{{v}_{Bb}})(a+r-ar)/2\}\).

Case (iib). \({{v}_{B}}<{{v}_{A}}\) and \(0<f\le c\).

When \(0<f\le c\), the market structure in equilibrium could be obtained in the same way as in Case (iia). Consequently, the equilibrium market structure in this case is (1)(2)(6). Furthermore, the market outcomes in this setting are also the same in the above setting. Hence, we rule out the corresponding analysis here.

Case (iic). \({{v}_{B}}<{{v}_{A}}\) and \(f=0,c>0\).

When \(f=0,c>0\), we have \({{U}_{3}}={{U}_{6}}\). If in equilibrium the market structure (1)(2)(3)(4) (5)(6) is implemented, then at point the condition \({{U}_{3}}(r)={{U}_{4}}(r)\) should hold. Using \({{U}_{3}}={{U}_{6}}\) and \({{U}_{3}}(r)={{U}_{4}}(r)\) yields \({{U}_{6}}>{{U}_{4}}\) for customers on the right of point . Hence, option (4) is dominated by option (6) and the possible market structure is (1)(2)(3)(5)(6). In this case, using \({{U}_{3}}(r)={{U}_{5}}(r)\) at point r and \({{U}_{3}}={{U}_{6}}\), we get \({{U}_{6}}>{{U}_{5}}\). Therefore, no customers will choose option (5). Consequently, the equilibrium market structure is (1)(2)(3)(6).

In the setting where \({{v}_{B}}<{{v}_{A}}\) and \(f=0,c>0\), we could obtain the same results as shown in Sect. 5.2 in the main body.

Rights and permissions

About this article

Cite this article

Nan, G., Li, X., Zhang, Z. et al. Optimal pricing for new product entry under free strategy. Inf Technol Manag 19, 1–19 (2018). https://doi.org/10.1007/s10799-016-0271-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10799-016-0271-7