Abstract

In this paper, we consider a mean–variance portfolio optimization problem for a fuzzy discrete-time insurance risk model. The model consists of independent, identically distributed net losses considered within successive time periods, and incorporates investment incomes from a two-asset portfolio. More precisely, in the beginning of each period, the surplus is invested in both a risk-free bond with fixed interest, and a risky stock with fuzzy return rate. Our purpose is to determine the proportion invested in the stock that maximizes the insurer’s expected wealth, while reducing his risks. Therefore, for this fuzzy model, we formulate mean–variance optimization problems that also include constraints on ruin, and we present a method for determining the resulting optimal proportion to be invested in the risky stock. This method is illustrated in a numerical study in which the fuzzy return rate is considered to be an adaptive fuzzy number that generalizes the well-known trapezoidal fuzzy number.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

We consider the following discrete-time insurance risk model: within period \( j,j=1,2,\ldots ,n\), we denote by \(X_{j}\) the net insurance loss (equal to the total outcome minus total premium income during period j, evaluated at the end of the period) and by x the initial reserve of the insurance company when starting this business. Moreover, we assume that the insurer is allowed to make investments in a two-asset portfolio consisting of a risk-free bond with a constant interest rate \(r>0,\) and a risky stock with a return rate \(R_{j}\in (-1,\infty )\) during period j. Note that in insurance practice, the insurer is not allowed to invest all into risky assets; therefore, we also assume that at the beginning of every period, the insurer invests a fraction \(\pi \in \)[0,1] of his current wealth in the stock and keeps the remaining wealth in the bond. The faction \(\pi \) being invariant with time, this two-asset portfolio becomes constant, which is commonly in mathematical finance.

In a stochastic setting, \(X_{j}\) and \(R_{j}\) are random variables (r.v.’s), while x is constant. An important problem related to this model consists in determining the proportion \(\pi \) invested in the stock that maximizes the insurer’s expected wealth, while reducing his risks. Since the main concern of portfolio selection consists in the allocation of capital in different risky assets to minimize the risk and to maximize the return, this risk model leads to a portfolio optimization problem in the insurance context. Moreover, as solvency constraints must be imposed due to insurance regulations, a constraint on the ruin probability can be added to the above described portfolio optimization problem. Probabilistic solutions of this type of problem under various (and usually restrictive) assumptions, mainly in continuous time, are given among others by Liu and Yang (2004), Tang and Yuan (2012). Related discussions on portfolio optimization with solvency constraints can be also found in Dickson and Drekic (2006), Azcue and Muler (2009) etc.

In this paper, we restate the above model in a fuzzy framework by assuming fuzzy return rates. Therefore, by keeping the assumption that the \(X_{j}\)s are independent and identically distributed (i.i.d.) r.v.’s while considering that the return rates are fuzzy numbers, fuzziness and randomness appear simultaneously in our model, and the corresponding optimization problem is placed in the field of fuzzy portfolio selection. Our motivation is based on the fact that even if probability theory remains the main technique for analyzing uncertainty in such optimization problems, investors are commonly provided with information such as high risk, high interest rate, low profit, etc., so that they should consider also non-probabilistic factors such as vagueness and ambiguity. This became possible once the fuzzy set theory has been introduced and its potential has been perceived by researchers that employed it to manage portfolio optimization problems. More motivation for considering fuzzy return rates is the lack of historical data, and the fact that working in such a fuzzy environment avoids some probabilistic limitations; moreover, a probability distribution can be estimated, but there is no guarantee that the return rates really obey it.

With the purpose to determine the optimal proportion to be invested in the stock, we restate the above portfolio optimization problem as a two-moment fuzzy decision model subject to a constraint on the ruin. Since in economic perception, the future value is a good criterion for evaluating fuzzy projects, the two moments that we consider are the expected value and variance of the future value fuzzy random variable. Moreover, we shall put a constraint on the mean chance of ruin defined on the basis of the fuzzy present value.

Therefore, the structure of the paper is as follows: in Sect. 2, we recall some fuzzy concepts needed in next sections, like fuzzy numbers and fuzzy random variables. In Sect. 3, after recalling some probabilistic aspects related to the ruin probability of the above discrete-time insurance risk model, we redefine the model in a fuzzy environment by considering the risky stock’s return rates as fuzzy numbers, and we also define its mean chance of ruin. Section 4 starts with a brief review of the literature on fuzzy portfolio selection, then, for the fuzzy risk model defined in Sect. 3, we present three alternative mean–variance portfolio optimization problems with constraint on ruin; after noticing the nonlinearity of these problems, we also propose a method to solve them. We illustrate the proposed method in a numerical study in Sect. 5, where we mainly discuss the effect of varying the parameters of the risky stock’s accumulation factor, which, in particular, is modeled by an adaptive fuzzy number. We conclude in Sect. 6 and we end the paper with an Appendix containing all the proofs.

2 Preliminaries: basic fuzzy concepts

We start by recalling some basic fuzzy concepts needed in the following.

2.1 Fuzzy numbers

A fuzzy number (f.n.) A is a special fuzzy set on the real line \( \mathbb {R}\), with a normal, fuzzy convex and at least piecewise continuous membership function \(\mu _{A}:U\rightarrow [0,1],U\subseteq \mathbb {R} \), whose highest membership values are clustered around a given real number (the mode). For \(\alpha \in [0,1] \), the \(\alpha \)-cut of the f.n. A is an interval \(\left[ A_{\alpha }^{L},A_{\alpha }^{R} \right] \), where \(A_{\alpha }^{L}=\inf \left\{ x\in U\left| \mu _{A}\left( x\right) \ge \alpha \right. \right\} \) and \(A_{\alpha }^{R}=\sup \left\{ x\in U\left| \mu _{A}\left( x\right) \ge \alpha \right. \right\} \). If the support of A, \(Supp\left( A\right) =\left\{ x\in U\left| \mu _{A}\left( x\right) >0\right. \right\} \subseteq \left( 0,\infty \right) \), the f.n. A is called positive.

For two fuzzy numbers A and B, the arithmetic operation \(A*B\) is defined by the membership function \(\mu _{A*B}\left( z\right) =\sup _{z=x*y}\min \left\{ \mu _{A}\left( x\right) ,\mu _{B}\left( y\right) \right\} \), where \(*\in \left\{ +,-,\times ,/\right\} \). The power of a f.n. A is recursively defined as \(A^{n}=A\times A^{n-1},n=2,3,\ldots ,\) while \(\mu _{A^{-1}}\left( x\right) =\mu _{A}\left( \frac{1}{x}\right) \) for any \(x\ne 0\). We shall also use the symbols \(\sum \) and \(\prod \) to denote the multiple fuzzy sum and, respectively, product. Therefore, the meaning of the arithmetic operators will depend on the context, but this should not be a problem since crisp numbers are particular cases of fuzzy numbers. By convention, an empty sum equals 0.

The \(\alpha \)-cuts can be used to easier express fuzzy arithmetic operations. More precisely, for two fuzzy numbers A and B, we recall that

Also based on \(\alpha \)-cuts, the crisp expected value of a f.n. A can be defined as \(E\left[ A\right] =\int \nolimits _{0}^{1}\left( A_{\alpha }^{L}+A_{\alpha }^{R}\right) \alpha d\alpha \). Moreover, the defuzzification function \(\mathcal {F}\), defined for the f.n. A by \(\mathcal {F}\left( A\right) =\frac{1}{2}\int _{0}^{1}\left( A_{\alpha }^{L}+A_{\alpha }^{R}\right) d\alpha \), can be used to define a crisp ordering between two fuzzy numbers A and B as \(\left( A\ge B\ \Leftrightarrow \ \mathcal {F} \left( A\right) \ge \mathcal {F}\left( B\right) \right) \).

We illustrate some of the above fuzzy concepts on the adaptive fuzzy number (A.f.n.), introduced by Bodjanova (2005) as an extension of the trapezoidal fuzzy number (Tr.f.n.). The membership function of an A.f.n. \(A=\left[ a_{1},a_{2},a_{3},a_{4}\right] _{k},a_{1}<a_{2}<a_{3}<a_{4},k>0,\) is given by

having the \(\alpha \)-cut \(A_{\alpha }=\left[ a_{1}+\left( a_{2}-a_{1}\right) \alpha ^{\frac{1}{k}},a_{4}-\left( a_{4}-a_{3}\right) \alpha ^{\frac{1}{k}} \right] \) and crisp expected value

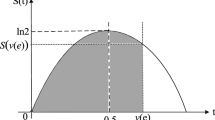

In particular, when \(k=1,\) the A.f.n. (2) becomes the well-known Tr.f.n. denoted by \(\left[ a_{1},a_{2},a_{3},a_{4}\right] \). If \(k\ne 1,\) then the A.f.n. \(\left[ a_{1},a_{2},a_{3},a_{4}\right] _{k}\) is a modification of the Tr.f.n. \(\left[ a_{1},a_{2},a_{3},a_{4}\right] \) in the sense that when \(k>1,\) we obtain a concentration, and when \(0<k<1\), a dilatation of the corresponding Tr.f.n., see Fig. 1. Therefore, one can keep the support and/or the core of the membership function unchanged, and, in the same time, manipulate the parameter k to tune and adjust the shape, which makes the A.f.n. more flexible than the Tr.f.n. Based on this flexibility, the A.f.n. has been used by Appadoo et al. (2008) to decision making problems involving uncertainty. We shall also use such fuzzy numbers in a mean–variance portfolio optimization problem related to an insurance model. The following result will be useful in next section.

Proposition 1

If j is a positive integer and \(A=\left[ a_{1},a_{2},a_{3},a_{4} \right] _{k}\) with \(a_{1}>0\), then

2.2 Fuzzy random variables

Assume that \(\left( \varOmega ,\mathcal {F},\Pr \right) \) is a probability space and let \(\mathcal {B}\) denote the collection of all Borel subsets of \(\mathbb { R}\), while \(\mathcal {S}\) denotes the set of all fuzzy numbers. Several papers developed the concept of fuzzy random variable (f.r.v.) by combining both random and fuzzy uncertainty. On the line of Puri and Ralescu (1986) and Wang and Zhang (1992), we shall use the following definition of a f.r.v.

A fuzzy random variable is a function \(X:\varOmega \rightarrow \mathcal {S}\) such that \(\forall B\in \mathcal {B},\forall \alpha \in [ 0,1] ,\) \(\left\{ \omega \in \varOmega \left| X_{\alpha }\left( \omega \right) \cap B\ne \varnothing \right. \right\} \in \mathcal {F}\), where \( X\left( \omega \right) \) is a f.n. having the \(\alpha \)-cut \(X_{\alpha }\left( \omega \right) =\left[ X_{\alpha }^{L}\left( \omega \right) ,X_{\alpha }^{R}\left( \omega \right) \right] .\) Note that, for fixed \( \alpha \), the extremes of this \(\alpha \)-cut, \(X_{\alpha }^{L},X_{\alpha }^{R}:\varOmega \rightarrow \mathbb {R},\) are themselves random variables; moreover, Wang and Zhang (1992) showed that X is a f.r.v. if and only if \( X_{\alpha }^{L}\) and \(X_{\alpha }^{R}\) are both random variables for any \( \alpha \in \left( 0,1\right] \).

Originally, the expected value of a f.r.v. was defined as a f.n., see, e.g., Puri and Ralescu (1986) (note that, in a complete probability space, the \( \alpha \)-cut of such an expected value becomes \([ \mathbb {E}[ X_{\alpha }^{L}] ,\mathbb {E}[ X_{\alpha }^{R}]] \)). Later on, based on \(X_{\alpha }^{L},X_{\alpha }^{R},\) Liu and Liu (2003) defined a scalar expected value of a f.r.v., which can be written as

Since it facilitates the decision process, a scalar expected value is more convenient for our purpose, hence we shall use this definition in the sequel. Similarly, there are two ways to define the variance of a f.r.v.: as a fuzzy interval and as a scalar value. As in the case of the expected value, we preferred to measure the variance using a scalar value; therefore, to simplify the computations, we chose the definition of Feng et al. (2001), which is also based on the extremes \(X_{\alpha }^{L},X_{\alpha }^{R}\), i.e.,

We shall also use the following definition of the mean chance Ch of the fuzzy random event \(\left\{ X>x\right\} \),

For more details on the definitions of f.r.v.’s, their expected values or variances, and on the Chance operator, see also Sect. 3.2 in Xu and Zhou (2011).

If X is a r.v. and Y a f.n., their product \(Z=XY\) is a f.r.v. defined by \(Z\left( \omega \right) =X\left( \omega \right) Y\). Assuming that the f.n. Y is positive, (1) yields

Further on, denoting by \(F_{X}\) the cumulative distribution function (cdf) of X, these yield the following cdf’s of \(Z_{\alpha }^{L}\) and \( Z_{\alpha }^{R}\)

Similarly, if X has a probability density function (pdf) \(f_{X}\), then \( Z_{\alpha }^{L}\) and \(Z_{\alpha }^{R}\) have the pdf’s

In the next proposition, we give the expected values and variances of \( Z_{\alpha }^{L},Z_{\alpha }^{R}\) and Z. To simplify the formulas, we introduce the following notation

Proposition 2

Let X be a r.v. having pdf \(f_{X},\) Y a positive f.n., and \( Z=XY\). Assuming that all the involved quantities exist and are finite, it holds that

-

(i)

\(\mathbb {E}\left[ Z_{\alpha }^{L}\right] =Y_{\alpha }^{R} \mathbb {E}\left[ X_{-}\right] +Y_{\alpha }^{L}\mathbb {E}\left[ X_{+}\right] \);

-

(ii)

\(\mathbb {E}\left[ Z_{\alpha }^{R}\right] =Y_{\alpha }^{L}\mathbb {E}\left[ X_{-}\right] +Y_{\alpha }^{R}\mathbb {E}\left[ X_{+}\right] \);

-

(iii)

\(\mathbb {E}\left[ Z\right] =\mathbb {E}\left[ X\right] \mathcal {F}\left( Y\right) \);

-

(iv)

\({ Var}\left[ Z_{\alpha }^{L}\right] =\left( Y_{\alpha }^{R}\right) ^{2}Var\left[ X_{-}\right] +\left( Y_{\alpha }^{L}\right) ^{2}Var\left[ X_{+}\right] -2Y_{\alpha }^{L}Y_{\alpha }^{R}K\left[ X\right] \);

-

(iv)

\({ Var}\left[ Z_{\alpha }^{R}\right] =\left( Y_{\alpha }^{L}\right) ^{2}Var\left[ X_{-}\right] +\left( Y_{\alpha }^{R}\right) ^{2}Var\left[ X_{+}\right] -2Y_{\alpha }^{L}Y_{\alpha }^{R}K\left[ X\right] \);

-

(vi)

\({ Var}\left[ Z\right] =\left( Var\left[ X\right] +2K\left[ X\right] \right) \mathcal {F}\left( Y^{2}\right) -2K\left[ X\right] \int _{0}^{1}Y_{ \alpha }^{L}Y_{\alpha }^{R}d\alpha \).

If X and Y are two f.r.v.’s, then an arithmetic operation on them is straightforward defined by \(\left( X*Y\right) \left( \omega \right) =X\left( \omega \right) *Y\left( \omega \right) \), where \(*\in \left\{ +,-,\times ,/\right\} .\) Again, the symbols \(\sum \) and \(\prod \) will also denote the multiple fuzzy form of the corresponding operations on f.r.v.’s.

The following proposition extends Proposition 1 from Ungureanu and Vernic (2015).

Proposition 3

Let \(X_{1},\ldots ,X_{n}\) be r.v.’s and let \(Y_{1},\ldots ,Y_{n}\) be positive f.n.’s, \(n\ge 1\). Then the sum \(S_{n}=\sum _{j=1}^{n}X_{j}Y_{j}\) is a f.r.v. whose \(\alpha -\)cut extremes are given, respectively, by

where \(L_{j}=\left\{ \begin{array}{c} L,\ X_{j}\left( w\right) \ge 0 \\ R,\ X_{j}\left( w\right) <0 \end{array} \right. \) and \(R_{j}=\left\{ \begin{array}{c} R,\ X_{j}\left( w\right) \ge 0 \\ L,\ X_{j}\left( w\right) <0 \end{array} \right. \).

Moreover, if the \(X_{j}\)s are i.i.d. as the generic variable X having finite variance, then it holds that

-

(i)

\(\mathbb {E}\left[ S_{n}\right] =\mathbb {E}\left[ X\right] \sum _{j=1}^{n}\mathcal {F}\left( Y_{j}\right) \);

-

(ii)

\(Var\left[ S_{n}\right] =\sum _{j=1}^{n}\left[ \left( Var\left[ X\right] +2K\left[ X\right] \right) \mathcal {F}\left( Y_{j}^{2}\right) -2K\left[ X \right] \int _{0}^{1}Y_{j,\alpha }^{L}Y_{j,\alpha }^{R}d\alpha \right] \).

3 A fuzzy risk model and its mean chance of ruin

In this section, we recall some probabilistic aspects related to the discrete-time insurance risk model presented in the introduction, then we redefine it in a fuzzy framework and present the associated mean chance of ruin.

3.1 Probabilistic aspects: the probability of ruin

In the classical risk theory, the evolution over time of the reserves of an insurance company is modeled by the risk reserve process \(U\left( t\right) =x+\varPi \left( t\right) -Z\left( t\right) ,t\ge 0\), where x is the initial capital, \(\varPi \left( t\right) \) represents the premium income from time 0 to t, and \(Z\left( t\right) \) the aggregate claim amount up to moment t. In the particular discrete-time model, the time is measured in integers; in this case, denoting by \(\varPi _{n}=\varPi \left( n\right) -\varPi \left( n-1\right) \) all the premiums collected during period n, and, similarly, by \( Z_{n}=Z\left( n\right) -Z\left( n-1\right) \) the amount of all the claims arriving during period n, then the reserve after period n becomes

where \(X_{j}=Z_{j}-\varPi _{j}\) represents the net insurance loss within period j (as defined in the Introduction). Moreover, the process \( \sum _{j=1}^{n}X_{j}\) is called the discrete-time claim surplus process.

When the discrete-time periods refer to years, the economic environment should also be taken into consideration. In this sense, in this work we considered the investment in a two-asset portfolio as described in the Introduction. Therefore, the present and future values of the insurer’s reserve corresponding to the stochastic discrete-time risk model that includes investments considered over n time periods in the future are, respectively,

where \(Q_{i}=\pi \left( 1+R_{i}\right) +\left( 1-\pi \right) \left( 1+r\right) \) represents the accumulation factor during period i.

The main utility of this model is to illustrate the cash flow of an insurance business in order to evaluate its probability of ruin. Using the present value (8), the finite-time ruin probability by time n is \(\psi (x,n)=\Pr (\min \limits _{1\le k\le n}PV_{k}^{stoch.}<0)\), while the ultimate ruin probability results by letting \(n\rightarrow \infty \). Evaluating the ruin probability is an extremely important issue because, to comply with certain risk reserve regulations, the insurer must hold enough risk reserve in order to meet his future obligations with a high probability. Unfortunately, the ruin probability is difficult to evaluate, which explains the large amount of literature on the subject. The usual probabilistic assumption related to this model is that the net losses are i.i.d. and independent of the return rates. A handy-for-calculation assumption on the return rates is also i.i.d., but unfortunately, not very realistic. This assumption has been surpassed in various ways, often by using extra-assumptions that can limit practical applications. For a review on ruin probabilities, see, e.g., the book by Asmussen and Albrecher (2010).

3.2 The fuzzy risk model

As already mentioned in the introduction, to tackle the fuzziness related to the return rates which influence the allocation of funds between a risk-free bond and a risky stock, we shall now consider the discrete-time insurance risk model (8)–(9) in a fuzzy-probabilistic environment described by the following assumptions:

-

The \(X_{j}\)s are i.i.d. r.v.’s as the generic r.v. X, defined for both positive and negative values (i.e., proper losses and, respectively, proper gains), having pdf \(f_{X}\), finite mean and variance, where \(\mathbb {E}\left[ X\right] <0\) (i.e., in average, we expect to gain);

-

x, r and the number of time periods n under study are deterministic (crisp) values;

-

The accumulation factors \(1+R_{i}\) corresponding to the risky stock are positive fuzzy numbers, hence \(Q_{i}=\pi \left( 1+R_{i}\right) +\left( 1-\pi \right) \left( 1+r\right) \) are also fuzzy numbers.

Starting from the definition of the fuzzy present and future values of a fuzzy amount with fuzzy return rate, we introduce the fuzzy aggregate discounted losses by time n denoted by \(S_{n}=\sum _{j=1}^{n}X_{j}Y_{j},\) where \(Y_{j}=\prod \nolimits _{i=1}^{j}Q_{i}^{-1}\). According to Proposition , \(S_{n}\) is a f.r.v. Then the fuzzy equivalent of the present value (8) is \(PV_{n}=x-S_{n}\). Similarly, the fuzzy equivalent of the future value (9) is \(FV_{n}=x\prod \nolimits _{i=1}^{n}Q_{i}-T_{n},\) where \(T_{n}=\sum \nolimits _{j=1}^{n}X_{j}\prod \nolimits _{i=j+1}^{n}Q_{i}\).

For simplicity, corresponding to the stochastic context assumption that the \( R_{j}\)s are identically distributed, in our fuzzy framework, we take \( R_{j}=R,\) yielding \(Q_{j}=Q\) for all j. Therefore, \(Y_{j}=Q^{-j},\) and hence \(S_{n}=\sum _{j=1}^{n}X_{j}Q^{-j}\), while \(T_{n}= \sum _{j=1}^{n}X_{j}Q^{n-j}\).

Note that being a return rate, R is usually positive, but due to crisis situations, it can also become negative. Therefore, we assume that the support of \(1+R\) is \(\left( 0,\infty \right) ,\) while \(r>0\). Then the support of Q is also \((0,\infty ) ,\) and, from (1 ), for a positive integer j, \([ Q^{j}] _{\alpha }=[( Q_{\alpha }^{L}) ^{j},( Q_{\alpha }^{R}) ^{j}] \) and \( [ Q^{-j}] _{\alpha }=[ ( Q_{\alpha }^{R}) ^{-j},(Q_{\alpha }^{L}) ^{-j}] .\) Applying now the results in Proposition 3, we easily obtain the \(\alpha \)-cut extremes of \( S_{n}\) and of \(T_{n}\) as

Moreover, we also have the following \(\alpha \)-cuts of the present and future values

The following result related to \(FV_{n}\) holds.

Proposition 4

Under the above assumptions, the expected value and variance of \( FV_{n}\) are given by, respectively,

-

(i)

\(\mathbb {E}\left[ FV_{n}\right] =x\mathcal {F}\left( Q^{n}\right) - \mathbb {E}\left[ X\right] \sum _{j=0}^{n-1}\mathcal {F}\left( Q^{j}\right) ,\)

-

(ii)

\(Var\left[ FV_{n}\right] \!=\! \sum _{j=1}^{n-1}\left[ \left( Var\left[ X\right] +2K\left[ X\right] \right) \mathcal {F}\left( Q^{2j}\right) -2K\left[ X\right] \int _{0}^{1}\left( Q_{\alpha }^{L}Q_{\alpha }^{R}\right) ^{j}d\alpha \!\right] +Var\left[ X\right] .\)

In particular, we shall assume that the risky stock’s accumulation factor \( 1+R\) is the positive A.f.n. \(\left[ a_{1},a_{2},a_{3},a_{4}\right] _{k}\). Then the f.n. \(Q=\pi \left( 1+R\right) +\left( 1-\pi \right) q\), where \( q=\left( 1+r\right) ,\) easily results as \([\tilde{a}_{1},\tilde{a}_{2}, \tilde{a}_{3},\tilde{a}_{4}] _{k}\) with \(\tilde{a}_{i}=\pi a_{i}+\left( 1-\pi \right) q,i=1,2,3,4\). We now introduce some notation needed to evaluate \(\mathbb {E}\left[ FV_{n}\right] \) and \(Var\left[ FV_{n} \right] \) in this particular case. We let

Proposition 5

For \(Q=\pi \left( 1+R\right) +\left( 1-\pi \right) q,\) where \( 1+R=\left[ a_{1},a_{2},a_{3},a_{4}\right] _{k},a_{1}>0,\) with the above notation we have

-

(i)

\(\mathcal {F}\left( Q^{j}\right) =\sum _{u=0}^{j}f_{u,j}\left( \left( a_{i}\right) _{i=1}^{4},k,q\right) \pi ^{u},\)

-

(ii)

\(\int _{0}^{1}\left( Q_{\alpha }^{L}Q_{\alpha }^{R}\right) ^{j}d\alpha =\sum _{u=0}^{2j}g_{u,j}\left( \left( a_{i}\right) _{i=1}^{4},k,q\right) \pi ^{u},\)

where, with \(\left[ x \right] \) denoting the floor function (or integer part) of x,

3.3 Approximate mean chance of ruin

Note that since each X can take positive values representing proper losses, then the f.r.v. \(PV_{n}\) might also be defined for negative values, in which case, for these negative values, the business is considered to be in ruin at time n. Therefore, starting from \(PV_{n}=x-S_{n}\) and the definition (5) of the mean chance Ch, Ungureanu and Vernic (2015) defined the mean chance of ruin of the above discrete-time risk model as follows: related to the risk of ruin at time n, the f.r.v. \( PVm_{n}\) is introduced, defined by the \(\alpha \)-cut \(PVm_{n,\alpha }\left( \omega \right) =[ \min \limits _{1\le k\le n}PV_{k,\alpha }^{L}\left( \omega \right) ,\min \limits _{1\le k\le n}PV_{k,\alpha }^{R}\left( \omega \right) ] \); then \(Ch\left\{ PVm_{n}<0\right\} \) represents the mean chance of ruin after n time periods.

It is not possible in general to find analytic expressions for \(Ch\left\{ PVm_{n}<0\right\} \). Therefore, Ungureanu and Vernic (2015) suggested an algorithm based on simulation to obtain an approximate value of the mean chance of ruin.

4 Fuzzy mean–variance portfolio optimization with a constraint on ruin

In this section, before introducing mean–variance optimization problems for the above fuzzy risk model, we give a very brief overview of the literature on fuzzy portfolio selection.

4.1 A brief literature overview

By combining probability theory with optimization techniques, Markowitz (1952) created the basis of multi-objective optimization models for portfolio selection. To describe the benefit and risk associated with an investment, Markowitz used the expectation and variance of the return, yielding the so-called mean–variance (M–V) approach. However, we shall not enter into details regarding the vast probabilistic literature developed around this model.

Since Markowitz’s model is exclusively probabilistic, fuzzy portfolio selection has been developed as an alternative to tackle the uncertainty in unquantifiable factors such as imperfect, imprecise information (e.g., data) or the knowledge of decision makers (different people have different beliefs about the future performance of various assets).

An overview of the main progress in fuzzy portfolio selection is provided by the book of Fang et al. (2008) or by the survey paper by Wang and Zhu (2002). Both works identify the following approaches: models based on fuzzy decision theory, portfolio selection using possibilistic programming (which includes the center-spread model and models using the necessity measure) and portfolio selection using interval programming (an interval number is a special f.n. whose membership function takes value 1 over the interval, and 0 elsewhere); for details, see also the references therein.

Further on, the above approaches have been extended by capturing additional and alternative decision criteria like: the semivariance (Huang 2008), the skewness (Bhattacharyya et al. 2011), the VaR and TVaR risk measures (Wang et al. 2011; Ning et al. 2012), fuzzy cross-entropy (Qin et al. 2009) etc. Other papers consider more complex computing techniques like genetic algorithms (Bermúdez et al. 2012), fuzzy neural systems (Wong et al. 1992), or hybrid algorithms integrating different such techniques (Li et al. 2009). Most of these works are based on fuzzy variables, while fuzzy random variables are used by Hao and Liu (2009), Li and Xu (2013) etc. We shall also present a M–V optimization problem based on f.r.v.’s, in an insurance context.

For other approaches and more references see also the survey by Huang (2009) or the book by Huang (2010).

4.2 A mean–variance two-asset portfolio optimization problem related to the fuzzy risk model

In the following, we consider a M–V portfolio optimization problem related to the fuzzy risk model presented in Sect. 3, in which we aim to determine the proportion \(\pi \) invested in the risky stock subject to a constraint on the mean chance of ruin. We shall use the expected value and variance of the f.r.v. future value \(FV_{n}\) as measures of the investment return and investment risk, respectively. Thus, the classical M–V portfolio model yields the following multi-objective optimization model to be solved for \(\pi \)

where \(\delta _{1}\) is the minimum accepted expected value of \(FV_{n},\) while p is a small value representing our ruin tolerance level (say \(5\,\%\)).

Since the objective of portfolio optimization is either to minimize the risk of the portfolio for a given level of return, or, alternatively, to maximize the expected level of return for a given level of risk, we can reformulate this optimization model as

According to Li and Huang (1996), a portfolio with a relatively high variance can also be relatively safe if its expected value is sufficiently high. Therefore, the above constraints can be replaced with the requirement that the ratio of the expected value and variance of the portfolio should be equal to or greater than a preset level, or, equivalently, with

Clearly, the choice of the parameter \(\delta _{3}\) strongly influences the optimal solution. Related to M–V\(_{3},\)Carlsson et al. (2002) proposed to take \(\delta _{3}=0.005\times A,\) where A is the investor’s risk aversion index (for the average investor in USA, they mentioned the value \(A\simeq \) 2.46), while the scaling factor 0.005 is used to express the expected value and standard deviation as percentages; the higher \(\delta _{3}\) (or A) is, the more risk-averse is the investor.

Note that these optimization models are all nonlinear in \(\pi \). For example, based on the formulas in Proposition 4, M–V\(_{1}\) becomes

where we recall that \(Q=\pi \left( 1+R\right) +\left( 1-\pi \right) q,\) with R a f.n.

If, in particular, the risky stock’s accumulation factor \(1+R\) is the positive A.f.n. \(\left[ a_{1},a_{2},a_{3},a_{4}\right] _{k},\) then, from Proposition 5, the nonlinearity of the optimization models is obvious. For example, in this case, the expected value and variance involved by M–V\(_{1}\) yield, after an easy calculation, the following polynomials in \( \pi \)

Therefore, to solve these optimization problems for \(\pi \), we suggest the following method:

-

1.

First, determine the interval \(\left[ \pi _{1},\pi _{2}\right] ,0\le \pi _{1}\le \pi _{2}\le 1,\) for which the restriction \(Ch\left\{ PVm_{n}<0\right\} \le p\) is satisfied.

-

2.

Then, for M–V\(_{1}\) or M–V\(_{2},\) reduce the solution interval to \( \left[ \pi _{1}^{\prime },\pi _{2}^{\prime }\right] \) based on the restriction \(\mathbb {E}_{\pi }\left[ FV_{n}\right] \ge \delta _{1}\) or \( Var_{\pi }\left[ FV_{n}\right] \le \delta _{2}\), respectively.

-

3.

Finally, decide on the solution by considering the quantity to be minimized or maximized as a function of \(\pi .\)

Note that for the first step, one can use the algorithm described by Ungureanu and Vernic (2015), while, since at Steps 2 and 3 we deal with polynomials, we should study their monotonicity; however, for large n, an alternative way consists of plotting the quantity to be minimized or maximized as a function of \(\pi \) and graphically decide on the solution. Special mathematical software like Matlab and Mathematica can be used to this purpose.

5 Numerical study

We shall now illustrate the above method to solve the optimization problem M–V\(_{1}\) for \(\pi \) when \(1+R\) is a positive A.f.n. More precisely, we fix the distribution of the loss r.v. X as normal \(N\left( -10,10^{2}\right) \) and vary mainly the parameters of the A.f.n. risky stock’s accumulation factor, \(1+R;\) for simplicity, we replace the notation \(\delta _{1}\) with \( \delta \). In the first example, we concentrate on the polynomial aspects of the optimization problem, while in the other examples, we directly present the solution and note how the parameters affect it.

We start by noting that from all our numerical results, the restriction \(Ch\left\{ PVm_{n}<0\right\} \le p\) yields an interval of the form \(\left[ 0,\pi _{2}\right] \), i.e., \(\pi _{1}=0.\)

Example 1

Let us consider the following values of the parameters: \(x=9,q=1.05,1+R=\left[ 0.08,1.07,1.1,1.2\right] \), i.e., a Tr.f.n, while \(n\in \left\{ 3,5,10\right\} \).

When \(n=3\), the polynomials involved in M–V\(_{1}\) are

The expected value polynomial has only one real root and, as it can be seen from Table 1a, it is positive and decreasing for \(\pi \in \left[ 0,1\right] \). This remark enables us in finding the solution \(\left[ 0,\pi _{2}^{\prime }\right] \) corresponding to both restrictions. Moreover, the variance polynomial has no real root, takes only positive values, has one minimum at \( \pi \) =1.134 and decreases on [0,1]. In conclusion, in this case, the solution of M–V\(_{1}\) is given by \(\pi _{2}^{\prime }\),which strongly depends on p and \(\delta \).

If \(n=5\), as it can be seen from Table 1b, \(\mathbb {E}_{\pi }\left[ FV_{n} \right] \) has a minimum in \(\pi \) =0.824, which belongs to [0,1]. As before, \(Var_{\pi }\left[ FV_{n}\right] \) takes only positive values, but this time has a minimum in \(\pi \) =0.588, which makes the final solution dependent on \(p,\delta \) and possibly on this \(\pi \) =0.588.

For \(n=10\), \(\mathbb {E}_{\pi }\left[ FV_{n}\right] \) has no real root, takes only positive values and has a minimum in \(\pi =0.384\) (see Table 1c). Similarly, \(Var_{\pi }\left[ FV_{n}\right] \) takes only positive values and has one minimum at \(\pi =0.248\), hence the final solution depends on \( p,\delta \) and on this value. For example, taking \(p=5\,\%,\) we obtain \(\pi _{2}\simeq \) 0.16 for which \(\mathbb {E}_{0.16}\left[ FV_{n}\right] =125.790\); if \(\delta \le \) 125.790, then the final solution is 0.16, otherwise, the final solution is the solution in \(\pi \) (smaller than 0.16) of the equation \(\mathbb {E}_{\pi }\left[ FV_{n}\right] =\delta \), and the minimum of \( Var_{\pi }\left[ FV_{n}\right] \) has no influence in this case. However, if we take \(p=8\,\%,\) this gives \(\pi _{2}\simeq \) 0.28; then, noting that \( \mathbb {E}_{0.248}\left[ FV_{n}\right] =122.178\), the final solution depends on the fact if \(\delta \le 122.178,\) in which case it equals \(\pi \) =0.248 (having the global minimum variance); or, if \(\delta >122.178\), the solution of \(\mathbb {E}_{\pi }\left[ FV_{n}\right] =\delta \) (smaller than 0.248) is the final solution.

To conclude, the nonlinearity of our model consists of some polynomials that can be handled without considerable difficulties.

Example 2

Using the same parameters values as in Example 1, i.e., \(x=9,1+R=\left[ 0.08,1.07,1.1,1.2\right] _{k}\), we first varied k and the periods number n for a fixed q=1.05, and obtained the results in Table 2a (see also Fig. 2). Then, for \(k=1,\) we varied both q and n in Table 2b, and, finally, in Table 2c, fixing \(k=1,q=1.05,\) we varied n and \(\delta \) (\(\delta \) varies between \(\min \mathbb {E}\left[ FV_{n}\right] \) and \(\max \mathbb {E}\left[ FV_{n}\right] \)). In all these examples, \( p=5\,\% \), and, Table 2c excepted, the values of \(\delta \) are chosen approximately proportional to n (except for \(n\ge 20\), where we have to take a larger \(\delta \)). In each table, the final optimal solutions are displayed in italics; in Table 2a–b we also present some intermediary solutions.

From Fig. 2 and Table 2a, we note that the optimal fraction to be invested in the risky stock increases with k, which generates the increasing of the crisp expected value of \(1+R\), also displayed in the table (note that the concentration of an A.f.n. by \(n=2\) is often interpreted as the “very” linguistic hedge, while the dilatation by \(n=0.5\) is usually interpreted as the linguistic hedge “more or less”; this corresponds with our numerical results, “very” meaning a higher expected return). From both Table 2a–b and Fig. 2, it can be seen that the optimal \(\pi \) tends to decrease with n, while Table 2b shows that it increases with q. Table 2c shows a significant decrease of \(\pi \) with the increasing of \(\delta ,\) meaning that, for these data, to obtain a larger expected final value with a minimum risk, one should invest less in the risky stock.

The optimal solution as a function of n for the parameters from Table 2a and different values of k

Example 3

In this example, we compare the optimal solutions of M–V\(_{1}\) for two different accumulation factors, \(1+R_{1}=\left[ 0.05,1.05,1.1,1.2\right] \) and \(1+R_{2}=\left[ 0.05,1.06,1.2,1.3\right] \), the second one having a larger crisp expected value, i.e., \(E\left[ 1+R_{1} \right] \) =0.925 and \(E\left[ 1+R_{2}\right] \) =0.978. The other parameters are fixed at \(x=10,q=1.05,p=5\,\%\). As expected, the results in Table 3 (optimal solutions in italics) support the idea that, for the same \(\delta \), a larger expected value of the risky return rate generates a larger fraction invested in the risky stock. Interestingly, it seems that, at least for these data, when n increases, the solutions corresponding to the two different risky returns become closer. As it can be seen from Fig. 2, this result is also supported by the solutions in Example 2.

6 Conclusions

Under various stochastic assumptions, several works studied portfolio optimization problems in the insurance field, which aim of determining the proportion invested in a risky stock that maximizes the expected wealth subject to a solvency constraint usually related to the ruin probability. Following this line, in this paper, we considered a classical discrete-time insurance risk model for which we assumed that the surplus can be invested in both a risk-free bond with constant interest, and in a risky stock with fuzzy return rate. The novelty of our approach consists in replacing the traditional probabilistic return rate assumption with the fuzzy one, and, hence, in reformulating the portfolio optimization problem in a fuzzy framework. The motivation of using fuzzy return rates comes from the fact that fuzziness may impact the asset returns since it is difficult to reflect unquantifiable factors such as the knowledge of experts or the trend of public opinion. In this context, a return rate is often modeled using a fuzzy number, which is a powerful tool to describe the uncertain environment. In particular, the A.f.n. considered in our study generalizes the well-known trapezoidal fuzzy number widely used in the literature to model fuzzy return rates, this A.f.n. having in the same time more flexibility generated by the parameter k which influences its shape (see also the comments from the numerical Example 2).

Since in our risk model the net losses are assumed to be i.i.d. r.v.’s, the model consists of a combination of both fuzzy set and probability theory, from where the present and future values become fuzzy random variables. With the purpose to determine the optimal proportion invested in the risky stock, we formulated alternative optimization problems in which we replaced the probabilistic mean and variance with the possibilistic ones. Moreover, we also included a constraint on the mean chance of ruin, corresponding to the probabilistic solvency constraint on the ruin probability. Therefore, based on the concept of f.r.v., we transformed a probabilistic two-asset portfolio optimization insurance problem into a fuzzy one, which can be regarded as a contribution that relies fuzzy portfolio optimization with insurance risk models. Moreover, our approach avoids some restrictive assumptions usually imposed in the stochastic setting.

On the other hand, the model proposed here is a comprehensive and practical one that could be constructed from real data, while the methodology presented is quite general and can be extended to more complex models and portfolio selection problems in hybrid and uncertain environments.

References

Appadoo, S. S., Bhatt, S. K., & Bector, C. R. (2008). Application of possibility theory to investment decisions. Fuzzy Optimization and Decision Making, 7, 35–57.

Asmussen, S., & Albrecher, H. (2010). Ruin probabilities. Singapore: World Scientific Publishing Co.

Azcue, P., & Muler, N. (2009). Optimal investment strategy to minimize the ruin probability of an insurance company under borrowing constraints. Insurance: Mathematics and Economics, 44(1), 26–34.

Bermúdez, J. D., Segura, J. V., & Vercher, E. (2012). A multi-objective genetic algorithm for cardinality constrained fuzzy portfolio selection. Fuzzy Sets and Systems, 188(1), 16–26.

Bhattacharyya, R., Kar, S., & Majumder, D. D. (2011). Fuzzy mean–variance–skewness portfolio selection models by interval analysis. Computers and Mathematics with Applications, 61(1), 126–137.

Bodjanova, S. (2005). Median value and median interval of a fuzzy number. Information Sciences, 172, 73–89.

Carlsson, C., Fuller, R., & Majlender, P. (2002). A possibilistic approach to selecting portfolios with highest utility score. Fuzzy Sets and Systems, 131, 13–21.

Dickson, D. C., & Drekic, S. (2006). Optimal dividends under a ruin probability constraint. Annals of Actuarial Science, 1(2), 291–306.

Fang, Y., Lai, K. K., & Wang, S. (2008). Fuzzy portfolio optimization: theory and methods. Berlin: Springer.

Feng, Y., Hu, L., & Shu, H. (2001). The variance and covariance of fuzzy random variables and their applications. Fuzzy Sets and Systems, 120, 487–497.

Hao, F. F., & Liu, Y. K. (2009). Mean–variance models for portfolio selection with fuzzy random returns. Journal of Applied Mathematics and Computing, 30(1–2), 9–38.

Huang, X. (2008). Mean–semivariance models for fuzzy portfolio selection. Journal of Computational and Applied Mathematics, 217(1), 1–8.

Huang, X. (2009). A review of credibilistic portfolio selection. Fuzzy Optimization and Decision Making, 8(3), 263–281.

Huang, X. (2010). PortFolio analysis: from probabilistic to credibilistic and uncertain approaches. Berlin: Springer.

Li, S. X., & Huang, Z. (1996). Determination of the portfolio selection for a property-liability insurance company. European Journal of Operational Research, 88(2), 257–268.

Li, J., & Xu, J. (2013). Multi-objective portfolio selection model with fuzzy random returns and a compromise approach-based genetic algorithm. Information Sciences, 220, 507–521.

Li, X., Zhang, Y., Wong, H. S., & Qin, Z. (2009). A hybrid intelligent algorithm for portfolio selection problem with fuzzy returns. Journal of Computational and Applied Mathematics, 233(2), 264–278.

Liu, Y., & Liu, B. (2003). Fuzzy random variables: a scalar expected value operator. Fuzzy Optimization and Decision Making, 2, 143–160.

Liu, C. S., & Yang, H. (2004). Optimal investment for an insurer to minimize its probability of ruin. North American Actuarial Journal, 8(2), 11–31.

Markowitz, H. M. (1952). Portfolio selection. The Journal of Finance, 7(1), 77–91.

Ning, Y., Yan, L., & Xie, Y. (2012). Mean–TVaR model for portfolio selection with uncertain returns. Information, 15, 129–137.

Puri, M., & Ralescu, D. (1986). Fuzzy random variables. Journal of Mathematical Analysis and Applications, 114, 409–422.

Qin, Z., Li, X., & Ji, X. (2009). Portfolio selection based on fuzzy cross-entropy. Journal of Computational and Applied Mathematics, 228(1), 139–149.

Tang, Q., & Yuan, Z. (2012). A hybrid estimate for the finite-time ruin probability in a bivariate autoregressive risk model with application to portfolio optimization. North American Actuarial Journal, 16(3), 378–397.

Ungureanu, D., & Vernic, R. (2015). On a fuzzy cash flow model with insurance applications. Decisions in Economics and Finance, 38(1), 39–54.

Xu, J., & Zhou, X. (2011). Fuzzy-like multiple objective decision making. Berlin: Springer.

Wang, G., & Zhang, Y. (1992). The theory of fuzzy stochastic processes. Fuzzy Sets and Systems, 51(2), 161–178.

Wang, S., & Zhu, S. (2002). On fuzzy portfolio selection problems. Fuzzy Optimization and Decision Making, 1(4), 361–377.

Wang, B., Wang, S., & Watada, J. (2011). Fuzzy-portfolio-selection models with value-at-risk. IEEE Transactions on Fuzzy Systems, 19(4), 758–769.

Wong, F. S., Wang, P. Z., Goh, T. H., & Quek, B. K. (1992). Fuzzy neural systems for stock selection. Financial Analysts Journal, 48(1), 47–52.

Acknowledgments

The author gratefully acknowledges the two anonymous referees for insightful questions and suggestions that helped to revise and significantly improve the paper.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Proposition 1

(i) We shall use the following formula for \(a,b\ne 0,k>0\) and j a positive integer,

Since A is a positive f.n. and \(j>0\), from (1) we have \(\left[ A^{j}\right] _{\alpha }=\left[ \left( A_{\alpha }^{L}\right) ^{j},\left( A_{\alpha }^{R}\right) ^{j}\right] .\) Then, using the above formula,

from where formula (i) is immediate.

(ii) For \(a,b,c\ne 0,k>0\) and j a positive integer, we obtain the formula

that we shall use into

which easily yields formula (ii). \(\square \)

Proof of Proposition 2

(i) Using the density of \( f_{Z_{\alpha }^{L}}\) from (6), we have

Changing now the variable \(y=x/Y_{\alpha }^{R}\) in the first integral and \( y=x/Y_{\alpha }^{L}\) in the second one, we easily obtain formula (i ). Formula (ii) results in a similar way, while (iii) immediately results by inserting (i) and (ii) into (3) written for Z, and noting that \(\mathbb {E}\left[ X_{-}\right] + \mathbb {E}\left[ X_{+}\right] =\mathbb {E}\left[ X\right] \).

To prove formula (iv), by changing the same variables, we fist evaluate

Therefore, using \(Var\left[ Z_{\alpha }^{L}\right] =\mathbb {E}\left[ \left( Z_{\alpha }^{L}\right) ^{2}\right] -\mathbb {E}^{2}\left[ Z_{\alpha }^{L} \right] ,\) we easily obtain formula (iv), and then (v) in a similar way. Using now (iv), (v) and (4), we obtain

Noting that \(\int _{0}^{1}\left( \left( Y_{\alpha }^{L}\right) ^{2}+\left( Y_{\alpha }^{R}\right) ^{2}\right) d\alpha =\mathcal {F}\left( Y^{2}\right) \) and that

yields formula (vi). \(\square \)

Proof of Proposition 3

The first part of this proposition is proved in Ungureanu and Vernic (2015). For the second part, considering that the \(X_{j}\)s are i.i.d. with generic variable X, formulas (i ) and (ii) immediately result from (iii) and (vi) in Proposition 2 (taking also into consideration the fact that the variance of a sum of independent r.v.’s is the sum of their individual variances). \(\square \)

Proof of Proposition 4

Like in the proof of Proposition 3, the expected value and variance of \(T_{n}\) easily result from ( iii) and (vi) in Proposition 2 as

Inserting (13) and these formulas into

and into

we easily obtain the stated formulas. \(\square \)

Proof of Proposition 5

Note that since \(\tilde{a}_{i}=\pi a_{i}+\left( 1-\pi \right) q\), we have \(\tilde{a}_{2}-\tilde{a}_{1}=\pi \left( a_{2}-a_{1}\right) \) and \(\tilde{a}_{3}-\tilde{a}_{4}=\pi \left( a_{3}-a_{4}\right) \).

(i) Then, from Proposition 1 (i), we obtain

where

Since \(\genfrac(){0.0pt}0{j}{i}\genfrac(){0.0pt}0{j-i}{u-i}=\genfrac(){0.0pt}0{j}{u}\genfrac(){0.0pt}0{u}{i}\), we have

with \(f_{u,j}\left( \left( a_{i}\right) _{i=1}^{4},k,q\right) \) given by ( 14) for \(u\le j\).

(ii) Using (ii) from Proposition 1 and the notation introduced above Proposition 5, we get

In this expression, \(\pi \) appears at the power \(2\left( j-t\right) -l+s+u\) that we renote by \(u^{\prime }\) and, considering only the last sum, we obtain

yielding for the last two sums

where

We now include the sum with index s, i.e.,

with

Inserting this into the above expression of \(\int _{0}^{1}\left( Q_{\alpha }^{L}Q_{\alpha }^{R}\right) ^{j}d\alpha \) yields

where \(g_{u,j}\left( \left( a_{i}\right) _{i=1}^{4},k,q\right) \) is given by (15) for \(u\le 2j\). \(\square \)

Rights and permissions

About this article

Cite this article

Vernic, R. Optimal investment with a constraint on ruin for a fuzzy discrete-time insurance risk model. Fuzzy Optim Decis Making 15, 195–217 (2016). https://doi.org/10.1007/s10700-015-9221-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10700-015-9221-9