Abstract

Many studies examined the association between gross domestic production (GDP) and environmental pollution to test the inverted U-shaped environmental Kuznets curve (EKC) hypothesis for varied country groups. Although it has useful implications for achieving a climate–neutral world economy, the exploration of the relationship is yet limited for oil-rich economies. On the other hand, the ambiguity of the available EKC evidence addresses the consideration of other pillars of economic development. Therefore, this paper tests the EKC hypothesis comparatively in the separate non-linear effects of financial and industrial development, as well as the traditional GDP-based economic development, on per capita fossil carbon dioxide (CO2) emissions for the Organization of the Petroleum Exporting Countries (OPEC) bloc. Financial development is proxied by the financial institutions development index, industrial development is measured by per capita industry value-added, and traditional economic development is indicated by per capita GDP. The trade, financial, social, and political dimensions of globalization are also incorporated as control variables in these three models. The paper applies the cross-sectionally augmented autoregressive distributed lag (CS-ARDL) estimator to a dataset from ten OPEC members over the 1980–2019 period. The results clearly contradict the EKC hypothesis and reveal rather a persistent U-shaped pattern for all models in both the short-run and the long-run. In addition, financial globalization is negatively associated and political globalization is positively associated with CO2 emissions. The paper discusses how such oil–rich countries as OPEC may decouple economic growth, financial development, and industrialization trajectories from environmental pollution induced by fossil CO2 emissions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The global emissions of greenhouse gases (GHG) show a persistent growth trend historically without a sign of peaking. According to the estimates of the Emissions Database for Global Atmospheric Research (EDGAR) (Crippa et al., 2021; EDGAR, 2022), the amount of annual GHG emissions caused by anthropogenic activities summed to about 24 gigatons (billion tons) in 1970 but increased steadily over the years (with a few exceptions of 1980–1982, 1992, and 2009) and exceeded 51 gigatons in 2018, with a yearly-average of about 36 gigatons. Over the 1970–2020 period, the use of fossil fuel resources such as coal, oil, and natural gas emitted an average amount of about 26 gigatons of carbon dioxide (CO2) each year which was about 16 gigatons in 1970 and reached 38 gigatons in 2019. Thus, fossil CO2 has persistently remained the key component of GHG emissions with a share close to three–fourths. Although global fossil CO2 emissions fell by 5.14% to about 36 gigatons in 2020 from about 38 gigatons in 2019 due to worldwide coronavirus-related lockdowns, it seems to have reached the pre-pandemic level soon, leaving only a temporary break in global emissions data.

Meanwhile, it is now well-understood that this CO2 emanation caused by fossil fuel use threatens the world ecosystem increasingly in many ways related to global warming and climate change problems (Thio et al., 2022). Thus, identifying the determinants of carbon intensity is crucial to find policy alternatives to reduce carbon emissions. Herein, the link between economic development and environmental degradation has always received great attention from both researchers and policymakers in different countries. Given the close association between human production activities and fossil CO2 emissions, a strong body of the environmental literature has been increasingly examining the drivers of CO2 emissions caused by the use of non-renewable fossil energy resources (coal, oil, and natural gas) for different samples of both individual and groups of countries (AlKhars et al., 2022; Purcel, 2020; Shahbaz & Sinha, 2019). The predominant approach in these studies builds on the well-known environmental Kuznets curve (EKC) hypothesis, which originally predicts an inverted U-shaped relationship between environmental pollution and economic development indicators. Indeed, there is a vast literature on the relationship between carbon-induced environmental pollution and income-indicated economic development since the bell-shaped EKC pattern was first unveiled and coined in the early-1990s (Grossman & Krueger, 1991, 1995; Panayotou, 1993; Stern et al., 1996). According to the EKC hypothesis, economic expansion exacerbates the level of pollution in the early stages of development (the scale effect). This effect occurs because countries mostly prefer increasing production and generating employment opportunities to the improvement of environmental quality at the early development stages. Nevertheless, the strong pollution–production nexus weakens with the structural changes in the relative shares of agricultural, industrial, and service production (the composition effect). In the further stage of economic development, environmental pollution starts decreasing through the increasing adoption of environmentally-friendly technologies and growing societal awareness of environmental concerns (Chen et al., 2020; Lorente & Álvarez-Herranz, 2016).

Studies with the linear approach mostly show that countries’ environmental pollution driven by CO2 emissions is still linked to gross domestic production (GDP) growth, although some quadratic EKC research shows that the link is weakening. The latter argument motivates policy-makers to formulate and implement policy actions for easing the environmental costs of economic development, but they have not been provided with clear evidence. Indeed, as previous literature surveys indicate, the EKC results are inconclusive inherently. The unclearness of evidence is usually attributed to the varied choices of contexts, periods, variables, and methodological procedures. Notwithstanding the sturdy consensus on the measures of environmental degradation by CO2 and/or GHG emissions, there is no stable list of the determinants of environmental pollution as many studies identified miscellaneous factors that affect emissions pollution differently. The EKC literature persistently focuses on the GDP-emissions nexus by also considering various control variables including both economic and non-economic indicators, customized for the characteristics of the covered samples (AlKhars et al., 2022; Al-Mulali et al., 2022; Nahman & Antrobus, 2005; Purcel, 2020; Shahbaz & Sinha, 2019; Sun et al., 2020).

Meanwhile, the probes of the EKC pattern for oil-rich countries provide useful research and policy lessons for international efforts to mitigate global carbon intensity. Regarding this, the Organization of the Petroleum-Exporting Countries (OPEC) bloc, which currently has about 80% of the world’s proven oil reserves and supplies about 40% of the world’s oil demand (OPEC, 2022), is a practical case. The OPEC bloc declared its commitments to not only the stability of global energy markets but also environmental protection (OPEC, 2007) and all OPEC members are signatories to the United Nations Framework Convention on Climate Change (OPEC, 2022). Yet, as a bloc, the OPEC remains lower-ranked compared to not only advanced countries but also developing countries in terms of some environmental performance indicators (EDGAR, 2022; NRGI, 2022; SEDAC, 2022). Over the 1970–2019 period, the 13-country OPEC bloc has about a 4.7% share in total global fossil CO2 emissions. Even though this share seems to be relatively small, their carbon intensity of 8.9 tons of per capita fossil CO2 emissions almost doubled the world average of 4.5 tons during the period (EDGAR, 2022; Crippa et al., 2021). Although the EKC literature on the OsPEC, as individual members (Charfeddine & Khediri, 2016; Mrabet & Alsamara, 2017; Xu et al., 2018) and/or as a bloc (Coskuner et al., 2020; Fakher & Inglesi-Lotz, 2022; Moutinho et al., 2020; Murshed et al., 2020; Saboori et al., 2016; Tarazkar et al., 2021; Yusuf et al., 2020), is expanding recently, the available empirical evidence is yet scant and inconclusive without a consensus on the relationship pattern.

On the other hand, the instability of the existing evidence on the EKC hypothesis has brought out a debate that per capita GDP, albeit its empirical usefulness, may not be the best variable to proxy economic development. Therefore, a recent research strand argues some changes in the structure of the EKC pattern and suggests the consideration of other pillars of economic development such as financial development (Rani et al., 2022a; Ruza & Caro-Carretero, 2022; Shah et al., 2019) and industrial development (Dogan & Inglesi-Lotz, 2020; Lin et al., 2016), as well as some composite socio-economic development indicators (Babu & Datta, 2013; Jena et al., 2022) when testing the EKC hypothesis.

Therefore, addressing both the limited research on oil-rich countries and the overall need for the consideration of other pillars of economic development, this study tests the EKC hypothesis comparatively for the separate effects of financial, industrial, and GDP-based economic development on carbon pollution in the case of OPEC bloc. The study also considers the dimensions of globalization as control variables and analyzes the 1980–2019 period of 10 (Algeria, Republic of Congo, Gabon, Iran, Kuwait, Libya, Nigeria, Saudi Arabia, the United Arab Emirates, and Venezuela) OPEC members. The study will contribute to the directions in the relevant literature in mainly four ways. (i) It provides a comparison of the traditional EKC hypothesis with industry-based and financial EKC patterns. (ii) It tests the EKC patterns in the case of OPEC, which is an experimentally-useful bloc to examine the EKC patterns for oil-rich countries with some common energy/environment policies. (iii) Unlike most studies that focus on trade openness, our study incorporates comprehensively the trade, financial, social, and political components of globalization, that have not been considered separately and simultaneously for the OPEC sample. (iv) The study follows the recent methodological advances and provides both the short-run and long-run results that are robust to cross-sectional dependence, heterogeneity, mixed integration orders, and endogeneity concerns.

The rest of the paper is planned as follows. The next section gives an outlook on some environmental performance trends in OPEC. Section 3 presents the directions in the literature reviewed both theoretically and empirically. Section 4 introduces hypotheses, variables, data, and regression models. After Sect. 5 describes the adopted analysis procedures, Sect. 6 provides the obtained empirical results. Finally, the study concludes with a brief discussion of some implications in the last section.

2 Key environmental trends in OPEC

OPEC is a permanent, intergovernmental organization created by Iran, Iraq, Kuwait, Saudi Arabia, and Venezuela at the Baghdad Conference in 1960 to coordinate and unify petroleum policies among members. These founders were later joined by Libya (1962), the United Arab Emirates-U.A.E. (1967), Algeria (1969), Nigeria (1971), Gabon (1975), Angola (2007), Equatorial Guinea (2017), and the Republic of the Congo (2018) (OPEC, 2022). The OPEC members have different environmental performances with some common trends. For the 1980–2019 average, the OPEC bloc is responsible for about a 5.14% share of the world’s total fossil CO2 emissions. As seen in Table 1, the fossil CO2 emissions in OPEC members are relatively lower than that of top emitters such as China, the United States, and Russia. However, when population size is corrected, most OPEC members, notably U.A.E., Kuwait, and Saudi Arabia, are observed above the world average in terms of carbon intensity measured by per capita fossil CO2 emissions (Table 1). Yearly trends shown in Fig. 1 demonstrate that, notwithstanding some declines over the 1970–1990 period, the OPEC average of carbon intensity also remains higher than that of the world average. Again, some OPEC members such as Algeria, Equatorial Guinea, and Libya have lower scores in terms of 2017 resource governance indicators (Table 2). Likewise, the OPEC average of 2020 environmental performance index (EPI) scores shown in Table 3, is lower than that of the groups of the European Union, the Organization for Economic Co-operation and Development (OECD) countries, group of twenty (G-20), and emerging market economies.

OPEC members declared its commitments to the stability of global energy markets, responsible exploration and extraction of energy for sustainable development, protection of the environment, and the United Nations Framework Convention on Climate Change (OPEC, 2007; OPEC, 2022). Yet, as a bloc, the OPEC group remains lower ranked compared to not only advanced countries but also developing countries in terms of some emissions mitigating and resource governance indicators.

3 Theory and evidence

Kuznets (1955) first observed and hypothesized an inverted U-shaped relationship between economic growth and inequality in the distribution of income. Then, this phenomenon was named the Kuznets curve. Grossman and Krueger (1991, 1995) found a similar pattern in the relationship between economic growth and environmental deterioration. Since its unveiling, the EKC literature has expanded with new studies examining the impact of economic growth on environmental degradation with references to the scale, composition, and technical effects (AlKhars et al., 2022; Lorente & Álvarez-Herranz, 2016; Purcel, 2020; Shahbaz & Sinha, 2019).

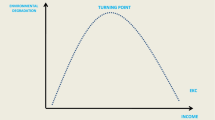

The scale effect indicates that increases in production will scale up environmental pollution because of the increasing demand for energy supplied mostly by non-renewable fossil resources. At this stage, the focus of policymakers is to boost economic growth rather than environmental quality. In this upward trajectory, economic growth is triggered by an overall enhancement of the agricultural, manufacturing, and industrial sectors. The composition effect indicates mixed mechanisms through which the structural changes scale up and down environmental pollution. The structural shift occurs either from agricultural to industrial production or from industrial to service production. If the capital-intensive industrial production pollutes more than labor-intensive agricultural and services production, the environmental pollution increases due to the initial shift in the composition of the economic structure. At this stage, countries also experience some environmentally-friendly developments such as the increasing adoption of energy-saving technologies and societal awareness of environmental concerns. Thus, the turning points are observed within the composition effect phase. The technical effect refers to the downward slope of the EKC. This occurs through the vitalized increases in resource productivity, displacement of polluting technologies by cleaner technologies, investment in the development of environmental technologies, and further shifts from the capital-intensive to knowledge-intensive production structures.

We argue that these three channels may be also true for the effects of financial and industrial development as they tend to follow the economic growth pathways. Therefore, we extend the GDP-based EKC pattern as in Fig. 2.

On the other hand, globalization is a worldwide process of international integration of goods and services markets (trade globalization) and financial markets (financial globalization). Besides these economic dimensions, globalization leads to increases in international tourism, education, and migration activities, which also enhance international communication and information transfers (social globalization). Furthermore, in addition to these socioeconomic aspects, governments may stimulate globalization through more involvement in multilateral treaties and global programs of international organizations (political globalization). As globalization has some channels through which it may both intensify and ease local pollution, its multifaceted environmental consequences are becoming a concern in the environmental literature (Wang et al., 2021; Gaies et al., 2022).

Considering the theoretical grounds, we grouped our literature survey into four groups by the environmental impacts of GDP, financial development, industrialization, and globalization. The literature review is restricted to panel studies that cover developing and emerging countries, especially including OPEC and other fossil-resource-rich countries. Although some studies (e.g., Chang, 2015; Yusuf et al., 2020; Alao et al., 2021; Danmaraya et al., 2021; Mahmood et al., 2021; Padhan et al., 2021; Çakmak & Acar, 2022; Iorember et al., 2022; Ogunsola & Tipoy, 2022) take the energy indicators of environmental degradation addressing the close link between non-renewable energy consumption and environmental pollution, we adopt an effect-based approach and focus on the studies that deal with the environmental pollution concept. Addressing its large share in overall GHG fluxes, studies mostly consider the emission levels of the CO2 pollutant as either total or per capita, as a proxy for environmental pollution. There are also studies, albeit fewer, that take ecological footprint or total GHG emissions, as well as some environmental performance indices from a broader perspective to environmental degradation, for which CO2 emissions yet remain decisive.

3.1 Income-environment nexus: EKC studies

Notwithstanding its critics on both empirical and theoretical grounds (Narayan & Narayan, 2010; Perman & Stern, 2003; Stern, 2004), the EKC literature has been growing with new studies covering different countries and using ever-changing empirical methods. An immense literature has supported the EKC hypothesis. Using the dynamic ordinary least squares (DOLS) and fully modified ordinary least squares (FMOLS) techniques, Charfeddine and Mrabet (2017) show the existence of the EKC pattern in the GDP and ecological footprint relationship for 15 MENA countries and oil-exporting Middle East and North Africa (MENA) countries’ sub-panel over the 1975–2007 period. The fixed-effect and instrumental variable regressions of Hanif and Gago-de-Santos (2017) validate the EKC pattern in a large sample of 86 developing countries over the period 1972–2011. Employing the dynamic seemingly unrelated cointegrating regressions over the 2007–2016 period, Fethi and Rahuma (2019) provide support to the EKC hypothesis for 20 oil-exporting countries. Zafar et al. (2019) adopt continuously updated fully modified and continuously updated bias-corrected approaches to a dataset covering the 1990–2015 period of emerging economies and provide support to the EKC hypothesis. The panel least squares and fixed-effect quantile regression estimations of Akram et al. (2020) find some evidence supporting the EKC pattern for 66 developing countries over the 1990–2014 period. Coskuner et al. (2020) confirm the EKC hypothesis for 12 OPEC countries during 1995–2016 using the FMOLS technique. Le and Ozturk (2020) employ the long-run common correlated effects (CCE), dynamic CCE, and augmented mean group (AMG) estimators for a panel of 47 emerging market and developing economies between 1990 and 2014 and find evidence supporting the EKC hypothesis. The cross-sectionally augmented autoregressive distributed lag (CS-ARDL) estimates of Mensah et al. (2021) give some evidence confirming the EKC pattern for the 1990–2018 period of 26 African economies. Again, the CS-ARDL estimates of Mehmood (2022) over 1990–2017 also reveal that economic growth-CO2 emissions association tends to follow an EKC pattern in South Asian countries.

The validity of the EKC hypothesis is weakened by the mixed results of some other studies. Applying the moments quantile regression method with fixed-effect to a dataset over the period 1980–2010 for 15 oil-producing countries, Ike et al. (2020) find an EKC pattern only at the median and higher emission countries. Most panel research tends to face the country heterogeneity concern that inhibits the generalization of panel results to individual countries. Narayan and Narayan (2010) test the EKC hypothesis for 43 developing countries over the 1980–2004 period. Their county-level estimates show that for some resource-rich countries, the income elasticity of CO2 emissions is smaller in the long-run than that in the short-run, which they interpret as support for the EKC hypothesis. However, their regional panel estimates reveal that the EKC pattern is confirmed for only the Middle Eastern and South Asian panels. By employing the panel ARDL approach for the 1977–2008 period, Saboori et al. (2016) compare the short-run and long-run income elasticities of ecological footprint and show that the validity of the EKC hypothesis varies with both supporting and rejecting findings for 10 members of OPEC. Using the quantile regression and DOLS approaches for data from 1995 to 2016, Onifade (2022) finds that, in general, income growth leads to increases in environmental pollution but does not exhibit a clear EKC pattern for some oil-producing African economies.

Given the immense literature at the macro level, fewer studies examine sector-wise EKC hypothesis. One of these studies is that of Htike et al. (2021) which employs an ARDL model for a dataset of 86 countries over the 1990–2015 period. They find that electricity and heat production, commercial and public services, and other energy industry own use follow the EKC pattern. Another sectoral study is that of Moutinho et al. (2020), which investigates the EKC hypothesis for seven sectors in OPEC members using panel-corrected standard errors and convergence estimations on a dataset from 1992 to 2015 and provides mixed relationships. Murshed et al. (2020) examine the EKC hypothesis in the case of 12 OPEC members by utilizing data on both the aggregate gross value-added and the service value-added between 1992 and 2015. Their results reveal that although the EKC hypothesis holds in the case of the CO2 effects of gross value-added, the associations in the sectoral levels tend to change that the EKC hypothesis holds only in the context of construction services among the restaurant services, tourism, and transportation services.

Several studies also distinguish between pollutants. One example is that of Alsamara et al. (2018). Covering the 1980–2017 period of the Gulf Cooperation Council region and considering CO2 and sulfur dioxide emissions, they find an EKC pattern between GDP and the emissions of both pollutants. However, their results tend to change over individual countries and the utilized measures. Yusuf et al. (2020) investigate the relationship between GHG emissions and output growth for African OPEC countries using the panel ARDL mean group and pooled mean group estimators for the period 1970–2016. Their findings show a positive impact of economic growth on both CO2 and methane emissions in the long run. But their results confirm the existence of EKC only in the case of the methane emissions model. Using traditional analysis methods for composite indicators of 22 developing countries over the period 1980 to 2008, Babu and Datta (2013) mostly evidence an N-shaped pattern in the link between composite development and environmental degradation indices. Fakher and Inglesi-Lotz (2022) uses a composite environmental index containing the varied dimensions of environmental quality. By applying continuously updated fully modified and bias-corrected techniques to the panel of some OECD countries and OPEC members from 2000 to 2019, they find an inverted N-shaped relationship between the environmental quality index and GDP for the OPEC countries.

Besides, some studies provide clear evidence of the invalidity of the EKC pattern. Using the generalized method of moments (GMM) dynamic panel method, Abid (2016) finds no evidence for the EKC hypothesis by showing a monotonically increasing relationship between GDP and CO2 emissions for a panel of 25 Sub-Saharan African economies over the period 1996–2010. Acar et al. (2018) employ the fixed-effect and GMM techniques for the 1970–2016 period and provide no support for the EKC pattern as they found an inverted N-shaped relationship for the OPEC sample. The estimates of Moutinho et al. (2020) also reject the EKC hypothesis as they evidence a U-shaped relationship for 12 OPEC members from 1992 to 2015. The DOLS and FMOLS estimations of Ansari et al. (2020) do not support the EKC hypothesis for the economic growth–ecological footprint nexus in the case of the Gulf Cooperation Council countries over the period 1991–2017. The results of Ulucak et al. (2020) also indicate that EKC does not hold in the relationship between economic growth and ecological footprint in emerging countries over the period 1974–2016.

3.2 Financial development-environment nexus

The environmental effects of financial development have been also increasingly examined, but mostly in a linear form and/or as a control variable. The GMM estimates of Adams and Klobodu (2018) show that increases in financial development indicators tend to increase CO2 emissions for 26 African countries over the period 1985–2011. The standard least squares estimate of Mahmood et al. (2019) shows that financial development has a positive effect on CO2 emissions for six East Asian countries from 1991 to 2014. By conducting the CCE and AMG estimators for a panel of 47 emerging market and developing economies between 1990 and 2014, Le and Ozturk (2020) find that financial development increases CO2 emissions. Le et al.’s (2020) estimations with Driscoll–Kraay standard errors show that financial inclusion intensifies CO2 emissions in 31-county Asia region during the period 2004–2014. By employing the two-step GMM estimators to large panel data from 66 developing economies over the period 1971–2017, Van Tran (2020) shows that financial development scales up carbon emissions. Using cross-sectionally generalized least square and GMM methods, Yasin et al. (2021) confirm that improving financial development raises CO2 emissions in a group of 59 less-developed countries during 1996–2016. Based on panel regression with Driscoll–Kraay standard errors, Khan et al. (2022) show that financial development increases CO2 emissions and ecological footprint in emerging and growth–leading economies over the 1984–2018 period. The FMOLS estimates of Huang and Guo (2022) for six regional panels from 1995 to 2020 show that financial development and carbon emissions are positively associated in East Asia and the Pacific, Sub-Saharan Africa, and MENA regions. Fakher and Inglesi-Lotz (2022) find that financial development is negatively associated with a composite environmental quality index for OPEC, while the nexus is positive for OECD countries over the period from 2000 to 2019. Using the CS-ARDL methods, Mehmood (2022) shows that financial inclusion leads to increasing CO2 emissions in South Asian countries over the 1990–2017 period. For the environmentally-harmful impacts of financial development, there is a consensus on green finance improvement for environmental sustainability. Green finance refers to targeted financial investments in pro-environmental initiatives (Muganyi et al., 2021). Cao (2022) shows that green finance decreases carbon emissions and increases green economic growth in both the short-run and the long-run based on the CS-ARDL estimates from 2005 to 2018 in the case of the emerging seven (E7) countries. The environmental quality contribution of the green finance is also confirmed by Muganyi et al. (2021) in the case of China.

Some researchers also find a contribution or insignificant effect from developing financial indicators to environmental improvement. The fixed-effects and feasible generalized least squares (FGLS) estimates of Awan et al. (2020) show that financial development tends to reduce CO2 emissions for six MENA countries over the 1971–2015 period. It is clear from the existing evidence that the links between financial development and environmental pollution tend to change over not only the methods but also by regions and samples. This variation may be observed from the DOLS estimation results of Al-Mulali et al. (2016). They find that financial development reduces CO2 emissions for Western Europe and MENA region, while it increases emissions for South Asia, East Asia, and Pacific regions for the 1980–2010 period. The CS-ARDL estimates of Mensah et al. (2021) over the 1990–2018 period explore that financial development is negatively associated with CO2 emissions for the whole panel of 26 African countries and the net-exporters’ sub-panel, while higher financial development increases carbon emissions for the net-importers’ sub-panel. Using DOLS and FMOLS methods, Adebayo et al. (2021) find an insignificant linkage between financial development and CO2 emissions for the 1980–2017 period of Latin American nations.

Only a few studies have adopted the EKC framework in the financial development and environmental pollution linkage. The FMOLS estimates of Shah et al. (2019) show that financial development, as well as income, have a positive relationship with CO2 emissions, while their square terms are negative, which validate the income-based and financial development-based EKC hypothesis for a large sample of 101 countries over the period from 1995 to 2017. The FGLS estimates of Rani et al. (2022a) reveal that financial development has a U-shaped relationship with carbon emissions and economic growth in the case of South Asian countries from 1990 to 2020. Again, by adopting the panel quantile regression approach, Rani et al. (2022b) show a U-shaped association between financial development and carbon emission in the South Asian Association for Regional Cooperation countries over the period 1990–2020. In a panel of developed countries, Ruza and Caro-Carretero (2022) uses fixed-effect estimation and validates the presence of an inverted U-shaped association (the financial EKC pattern) in the methane-financial development nexus for the group of seven (G-7) countries over the period 1990–2019. However, their results show a U-shaped pattern for the GHG and CO2 emissions impacts of financial development, while the ecological footprint is not significantly related to the financial development.

3.3 Industrial development-environment nexus

Similar to financial development, numerous studies have been increasingly examining the environmental effects of industrialization, but again mostly in a linear form and as a control variable. Studies generally explore the environmental side effect of industrialization. Le et al.’s (2020) estimations based on the Driscoll–Kraay procedure show that industrial enhancement heightens CO2 emissions in 31-county Asia region during the period 2004–2014. The two-step GMM estimate of Van Tran (2020) also shows that industrial development tends to increase carbon emissions in a large panel of developing economies over the 1971–2017 period. Using the FMOLS method, Zafar et al. (2020) conclude that industrialization has a positive impact on CO2 emissions in 46 countries including OPEC countries over the period 1991–2017. Ahmad et al.’s (2022) CS-ARDL estimates covering the 1984–2017 period unveil that financial development raises the ecological footprint in the case of 17 emerging countries. The fixed-effect and robust least squares estimates of Azam et al. (2022) indicate that industrialization leads to increasing CO2 emissions in the case of six OPEC members during the 1975–2018 period. Onifade (2022) uses quantile regression and DOLS techniques for data on the oil-producing African economies between 1995 and 2016 and finds that industrial development tends to be positively associated with environmental pollution. Conducting the FGLS method, Rani et al. (2022a) show that industrialization increases CO2 emissions in South Asian economies from 1990 to 2020. Based on their AMG and CS-ARDL estimates, Mensah et al. (2021) show that industrialization escalates CO2 emissions in the case of African countries. Differently, the CCE mean group estimates of Appiah et al. (2021) reveal an insignificant impact of industrialization on CO2 emissions for the panel of 25 Sub-Saharan African countries over the 1990–2016 period.

One of the few studies that adopt the EKC framework in the industrialization-environmental pollution connection is that of Lin et al. (2016). They disaggregate economic development into agricultural and industrial development and find no evidence of the validity of the EKC hypothesis in African countries. Similar evidence is reached by Dogan and Inglesi-Lotz (2020). They evidence a U-shaped relationship, rather than the EKC pattern, in the industrialization-emissions pollution association for European countries for the period 1980 to 2014. However, there is no study examining the industrialization-environment nexus within the EKC framework for OPEC countries.

3.4 Globalization/openness-environment nexus

The available evidence on the globalization/openness-environment nexus is expanding but, again, lacks a consensus. The DOLS estimations of Al-Mulali et al. (2016) show that trade openness increases CO2 emissions for Sub-Saharan African countries from 1980 through 2010. Mahmood et al. (2019) also find some evidence that trade openness is increasing CO2 emissions in East Asian countries from 1991 to 2014. By employing the DOLS and FMOLS estimators, Ansari et al. (2020) find that increasing globalization is driving the ecological footprint of the Gulf Cooperation Council countries during the period of 1991–2017. Likewise, the GMM estimation of Van Tran (2020) shows that trade openness heightens carbon emissions for developing countries in the period 1971–2017. Le and Ozturk (2020) show that globalization increases CO2 emissions for a large sample of emerging and developing countries by employing CCE and AMG estimators to data spanning from 1990 to 2014. The CS-ARDL estimates of Mehmood (2022) explore a positive association between globalization and CO2 emissions for the 1990–2017 period of some South Asian countries. The FGLS results of Rani et al. (2022a) reveal that globalization increases CO2 in South Asian economies from 1990 to 2020. Gyamfi et al. (2021) use panel OLS and quantile regression and explore that foreign direct investment openness is a significant factor affecting carbon emission but the effects tend to change depending on the considered quantiles for a sample covering both oil-rich and non-oil-rich country groups over the 1990–2016 period. Yet, their OLS estimates and higher quantiles explore a positive association between foreign investment and carbon emissions.

Some studies provide mixed results even a negative nexus between globalization and environmental pollution indicators. Adopting the ARDL approach for a dataset covering the 1960–2009 period, Kohler (2013) shows that trade reduces CO2 emissions for South African countries. Lv and Xu’s (2019) pooled mean group (PMG) estimate shows that trade openness improves the environment in the short-run, but harms in the long-run for 55 middle-income countries from 1992 to 2012. Again, Zafar et al. (2019) find an adverse association between trade openness and CO2 emissions for emerging economies from 1990 to 2015. Applying the FGLS estimators to a dataset from the six MENA countries over the 1971–2015 period, Awan et al. (2020) show that globalization eases carbon intensity. The moments quantile regression results of Ike et al. (2020) over the 1980–2010 period reveal that trade openness is negatively associated with CO2 emissions across quantiles for oil-producing countries including some OPEC members. Le et al.’s (2020) estimations based on a Driscoll–Kraay procedure show that trade openness reduces CO2 emissions in 31-county Asia region during the period 2004–2014. Moutinho et al.’s (2020) panel corrected standard errors and convergence estimations indicate that trade openness reduces CO2 emissions for OPEC countries over the 1992–2015 period. Ulucak et al. (2020) show that financial globalization reduces the ecological footprint in emerging economies over the period 1974–2016. The CS-ARDL estimates of Mensah et al. (2021) unveil that trade openness reduces CO2 emissions in African net exporter countries, while the association is positive for African net importer countries over the 1990–2018 period. The GMM estimates of Wang et al. (2021) show that economic globalization, social globalization, and political globalization improve the environmental performance of 148 countries from 2001 to 2018. Again, Fakher and Inglesi-Lotz (2022) find some evidence that trade openness tends to reduce environmental degradation for OPEC over the period from 2000 to 2019. By employing the PMG/ARDL estimators on panel data spanning from 1990 to 2017, Iorember et al. (2022) find a positive but insignificant effect of trade on environmental degradation for a panel of seven OPEC members from Africa. Based on the nonlinear ARDL estimates for a panel of 17 MENA countries over the 1980–2018 period, Gaies et al. (2022) show that the increasing economic globalization scales up CO2 emissions and the positive effect of trade globalization is stronger than that of financial globalization, whereas the deglobalization has no effect. They further show that financial globalization reduces CO2 emissions for the OPEC members’ sub-panel from the MENA region.

4 Materials

It is noted in the literature survey that linear impacts of income and industrialization indicators on environmental pollution are positive in most studies, implying a trade-off between economic growth/industrialization and environmental quality. This study purposes to test not only the validity of the income-based EKC hypothesis but also to control for its consistency with the industrial and financial EKC patterns for the OPEC sample. The OPEC has 13 members currently. However, Iraq, Angola, and Equatorial Guinea could not be included in the sample due to either missing data or significant outliers in some variables’ series. To exclude the unprecedented pandemic-related breaks in the trends of emissions data, this study’s time coverage ends in 2019. This section is devoted to the construction and modeling of hypotheses and descriptions of variables and datasets.

4.1 Hypotheses

The study’s theoretical setting builds on the EKC hypothesis. Accordingly, the first hypothesis is the original EKC hypothesis as follows:

Hypothesis 1

In OPEC’s economic growth path, environmental pollution initially rises until a certain income level but then starts declining as income continues to increase.

This EKC hypothesis is based on the widely-acknowledged pure economic development, which is driven by income growth. Given the fact that economic development also has financial and industrial development fundamentals, if the EKC hypothesis is confirmed then a similar pattern is expected for the empirical effects of financial development and industrial development on environmental pollution. Therefore, the following hypotheses are proposed.

Hypothesis 2

In OPEC’s financial development path, environmental pollution initially rises until a certain financial development level but then starts declining as financial development continues to increase.

Hypothesis 3

In OPEC’s industrial development path, environmental pollution initially rises until a certain industrial development level but then starts declining as industrial development continues to increase.

4.2 Variables and data

We model the proposed hypotheses in quadratic forms to capture the non-linear EKC patterns. Meanwhile, as outlined in the literature survey, globalization’s varied aspects have significant and different influences on environmental pollution. Therefore, we extend the models by also including the trade, financial, social, and political dimensions of globalization. Following the common approach in the literature, environmental pollution is proxied by per capita CO2 emissions (CEPC), as CO2 is responsible for a considerable deal of global emissions pollution. We took fossil CO2 emissions to better capture the nexus for OPEC countries that are abundant in fossil energy resources. Again, based on most parts of the EKC literature, we represent income-based economic development by per capita gross domestic product (GDPPC).

Financial development is a composite concept with varied indicators. In the literature, financial development levels of countries are gauged by different indicators including domestic credit to the private sector, stock market expansion, banking sector performance, as well as financial inclusion and stability measurements (Adams & Klobodu, 2018; Ahmad et al., 2022; Al-Mulali et al., 2016; Chang, 2015). However, these narrowed indicators do not capture sufficiently the complex multidimensional nature of financial development. Addressing this omission, the financial development index initiative of the International Monetary Fund (IMF) provides a cross-country comparable and internationally-harmonized measure of financial development, which is more useful, especially in the panel studies. Thus, by taking the advantage of its multifaceted composite structure and long-period availability, the IMF’s financial development dataset (IMF, 2022) is widely used in the recent literature (e.g., Ahmad et al., 2022; Khan et al., 2022; Ruza & Caro-Carretero, 2022). The IMF’s financial development database provides both the financial markets and financial institutions metrics in terms of their depth (size and liquidity), access (the ability of individuals and enterprises to access financial services), and efficiency (the level of capital market activities and ability of institutions to provide low-cost financial services with sustainable revenues). We use the financial institution development index (FIDI) metric since financial market development indices are zero and stagnated along with significant cross-country outliers in some OPEC members’ time series. Industrial development, by definition, is the enhancement of industrial activities. Hence, we assess industrial development based on the value-added of industrial sectors (mining, manufacturing, and construction), again as per capita (INDPC) to eliminate the population size biases.

Due to its empirical usefulness in terms of measurability and interpretability, the relevant literature mostly considers openness to trade and/or foreign investment to indicate countries’ integration into the world economy. Following recent studies such as Padhan et al. (2021), Awan et al. (2020), Gaies et al. (2022), Mehmood (2022), and Rani et al., (2022a, 2022b), we use the KOF measures of globalization (KOF Swiss Economic Institute, 2022). Yet, like Wang et al. (2021), we take different dimensions of KOF globalization metrics as they cover all aspects of globalization compositely and separately. The recently revised version of the KOF globalization index further distinguishes between de facto and de jure globalization. While de facto globalization measures actual international flows and activities, de jure globalization measures policies and conditions that, in principle, enable, facilitate, and foster flows and activities (Gygli et al., 2019). As suggested by Gygli et al. (2019), we use the new KOF indices that take both de facto and de jure measures into account. This enables us to better capture the impacts of dimensioned globalization. The considered variables are explained briefly in Table 4.

Descriptive statistics of panel series and correlations between variables are reported in Table 5. The overall panel average of CEPC is about 9,785 kg. U.A.E. had the highest (39,452) amount in 1980 and Nigeria had the lowest (508) level in 2009. The GDPPC measure varies considerably among the OPEC members. The overall average GDPPC is 14,572 U.S. dollars, with a maximum value of 107,175 (U.A.E.’s value in 1980) and a minimum of 1,411 (Nigeria’s value in 1984). The mean value of FIDI is 25.930 which reaches a maximum of 58.273 (Iran's value in 2018) and a minimum of 3.631 (the Congo Republic's value in 1994). The mean of INDPC is 8,250 U.S. dollars, ranging from the highest value of 88,339 (U.A.E.’s 1980 value) to the lowest value of 482 (Nigeria’s 2019 value). The sampled OPEC nations are also increasingly integrating into the world economy and international society. The average TRGL is 47.466. It is maximum at 92.273 (U.A.E.’s value in 2012) and minimum at 18.578 (Venezuela’s 1986 value). The mean FINGL is 48.315 that the U.A.E. (83.039 in 2019) and Iran (7.467 in 1986) have the highest and lowest values, respectively. The average SOCGL is 44.654 varying from the minimum of 12.622 (Nigeria’s 1996 value) to a maximum of 77.815 (U.A.E.’s 2019 value), while the mean POLGL is 59.078 that Nigeria (85.934 in 2015) and Congo (35.660 in 1988) were the most and least politically-globalized countries. Standard deviations, which show how the observations spread around the mean, are high enough, enabling the distinction between better and worse performers in the indicators of the variables.

The Pearson correlations of variables show that CEPC is positively and highly (> 0.75) correlated with GDPPC, INDPC, and TRGL, indicating a co-movement of these variables. As expected, GDPPC and INDPC are positively and strongly correlated.

4.3 Regression models

The constructed three hypotheses are tested through separate regression models in a quadratic setting. To eliminate large numbers, all variables are converted into their natural logarithms (symbolized in lower cases), which also enable us to interpret their estimated coefficients as elasticities. After including time-invariant regression constants (α0, β0, θ0) and error terms (ε), the final regression models to be estimated take the following forms in Eqs. 1–3.

In the equations, i and t respectively denote the sampled members of OPEC (i = 1,2,..,10 = N) and years (t = 1980,1981,…, 2019 = T = 40), while the αk, βk, and θk parameters (k = 1,2,..,6) are partial slope coefficients to be estimated. When α1 > 0 and α2 < 0 significantly, the first hypothesis (the original income-based EKC hypothesis) will be supported. Likewise, a significant and positive β1 and significant and negative β2 will confirm the validity of the financial development based-EKC pattern proposed in the second hypothesis. Again, the θ1 > 0 and θ2 < 0 results will validate the industrial development-based EKC pattern suggested by the last hypothesis. In addition, as the dimensions of globalization have different environmental effects, the trgl, fingl, sosgl, and polgl elasticities of cepc may be positive or negative, even insignificant. If the EKC patterns are evidenced, the turning points are calculated through: (–α1)/(2α2) for GDP-based EKC; (–β1)/(2β2) for financial EKC; and (–θ1)/(2θ2) for industrial EKC.

5 Methodology

The empirical strategy proceeds with three sequent steps. We first examine the variables for cross-sectional dependence (CSD) and unit roots, then inspect the constructed models for CSD, homogeneity, and cointegration diagnoses, and finally estimate the models.

Given the interdependence of the OPEC nations, it is highly possible that the panel series contains CSD, which causes unmeasured correlations and common trends across OPEC members. Testing the presence of CSD is a necessity to determine which unit root test should be conducted. Based on the comparison of the number of years (T) and countries (N), several CSD tests are utilized in the literature (De Hoyos & Sarafidis, 2006). As T is larger than N in our case, we conduct the Breusch and Pagan’s (1980) Lagrange multiplier (LM) and Pesaran et al. (2008) bias-adjusted LM tests for both the variables and models. Based on the null hypothesis suggesting that errors (εit residuals) are independent (no CSD) over the period and countries, Breusch–Pagan LM statistic is calculated as in Eq. 4:

The term \({\widehat{\rho }}_{ij}\) is the pairwise correlation of the residuals and computed as in Eq. 5:

where residuals are calculated as \({\varepsilon }_{it}={y}_{it}-{\widehat{\beta }}_{i}{X}_{it}\).

The Breusch–Pagan LM test is valid for fixed N as T → ∞ and biased when the mean of the group residuals is zero and the individual mean is not zero. Under the null hypothesis of no CSD and as a bias-adjusted normal approximation to the Breusch–Pagan LM test, the Pesaran–Ullah–Yamagata bias-adjusted LM test takes the variance and mean of residuals into the calculation as shown in Eq. 6.

where \({\widehat{\mu }}_{Tij}\) and \({\upsilon }_{Tij}\) represent the mean and variance of residuals, respectively.

In the macro-panel cases, which generally involve a few N (such as the OPEC members) with relatively larger T (ranges from 20 to 60 years), the non-stationarity issue must be controlled to select an appropriate estimation strategy (Burdisso & Sangiácomo, 2016). The first-generation panel unit root tests (e.g., Choi, 2001; Im et al., 2003; Levin et al., 2002) that do not consider the CSD, were widely used until a large literature provided sturdy evidence of the CSD for many socio-economic variables. Therefore, recently second-generation panel unit root tests, that account for CSD, have been adopted increasingly to obtain concrete inference of stationarity. Consistently, we apply the cross-sectionally augmented Im–Pesaran–Shin (CIPS) panel unit root test of Pesaran (2007), which is widely carried out in the EKC literature (e.g., Fakher & Inglesi-Lotz, 2022; Htike et al., 2021; Obobisa et al., 2022), as it allows for heterogeneity and CSD.

The CIPS statistics are calculated as a simple average of the country-specific cross-sectionally augmented Dickey–Fuller (CADF) statistics as in Eq. 7. The CADF is specified as in Eq. 8, where \({\overline{Z} }_{t-1}\) and \(\Delta \overline{{Z }_{t-j}}\) denote country averages.

Along with CSD, slope heterogeneity is another issue that should be checked before the model estimation. Following relevant studies such as that of Mehmood (2022) and Obobisa et al. (2022), we use the Pesaran and Yamagata’s (2008) Delta test to investigate slope homogeneity. The Delta test controls the CSD and produces efficient results even when countries and time dimensions are interrelated. To test the null hypothesis of slope homogeneity, this technique calculates the Delta-tilde and adjusted Delta-tilde statistics. By weighting the cross-sectional dispersion of individual slopes with their relative precision, these statistics are computed through the formula in Eq. 9.

Additionally, to detect the long-run relationship among variables, we employ Westerlund and Edgerton’s (2007) bootstrapped panel cointegration test. The relevant literature uses this technique widely (e.g., Appiah et al., 2021; Fethi & Rahuma, 2019), as it produces efficient results in the existence of CSD and slope heterogeneities. Following the procedure of McCoskey and Kao (1998), the Westerlund–Edgerton LM statistic is computed as in Eq. 10, where \({S}_{it}^{2}\) represents the partial sum of the error terms and \({W}_{i}^{-2}\) is the disturbance term of long-run variance.

The null hypothesis of this bootstrapped LM test is the presence of the cointegration relationship, which is decided based on the critical values generated from the bootstrap simulation.

When there exist cointegration relationships between the first-difference stationary variables, i.e., I(1), the long-run relationships can be estimated. However, when variables are mixed of I(1) and level stationarity, i.e., I(0), cointegration estimates lose efficiency. Concerning this problem, the ARDL approach has an advantage as it makes possible the estimation of the relationships between variables with the mixed structure of I(0) and I(1), by including lags of both the dependent variable and independent variables as regressors in a dynamic heterogeneous form. However, the traditional ARDL approaches such as the Pooled Mean Group ARDL (PMG–ARDL) estimator of Pesaran et al. (1999) are inadequate as they could lead to significant size distortions in the presence of neglected CSD. In this case, as an augmented version of the PMG–ARDL, the Cross-Sectional Augmented ARDL (CS-ARDL) model of Chudik and Pesaran (2015) has recently filled an important methodological gap in the second-generation strand of heterogeneous, mixed, and cross-sectionally dependent panel data analysis.

CS-ARDL procedure estimates the short-run and long-run relationships, as well as error correction terms, and provides several advantages. The first-generation cointegration techniques, such as DOLS and FMOLS may produce biased results in the presence of CSD. The AMG and CCEMG estimators eliminate this bias but they are efficient when all variables follow an I(1) process. In the cases of mixed integration of I(0) and I(1) of variables with slope heterogeneity, the CS-ARDL method is an efficient estimator. Finally, in the weak exogeneity caused by the modeled lagged dependent variable, the CS-ARDL estimator remains efficient. Chudik et al. (2017) argue that including lagged cross-sectional averages in the model helps in the elimination of the endogeneity problem. Consequently, as it handles efficiently the endogeneity, slope heterogeneity, CSD, and mixed order of integration, the CS-ARDL method outperforms the alternative methods. A general CS-ARDL model in an error correction model (ECM) form is as in Eq. 11.

The long-run CS-ARDL coefficients and mean group (MG) estimates are computed through the formulas in Eq. 12.

Considering its addressed advantages, studies in the environmental literature have been increasingly following the CS-ARDL procedure (Cao, 2022; Mehmood, 2022; Mensah et al., 2021; Ogunsola & Tipoy, 2022; Padhan et al., 2021).

6 Empirical results

Results from the CSD tests reported in the upper part of Table 6 confirm that the null hypothesis of no CSD is rejected for the datasets of all variables in both the detrended and trended specifications. The existence of CSD means that the examined variables tend to move together in OPEC. This is expected as OPEC makes some economic decisions affecting the examined variables for the whole bloc. The presence of CSD prompts us to use a second-generation unit root test that takes CSD into consideration. Thus, we conduct the CIPS test and report the results in the lower part of Table 6.

The results from the CIPS test show that panel series of cepc, gdppc, indpc, fingl, socgl, and polgl variables have unit roots but become stationary in their first differences, meaning an I(1) process. However, the fidi and trgl do not contain a unit root at level, I(0), which indicates that the means, variances, and covariances are time-invariant. It is concluded that the analyzed variables are either I(0) or I(1), but not I(2). I(1) variables trend over time and do not return to their previous means. Additionally, any shock to the levels of the I(1) variables will have a permanent effect. Therefore, it is difficult to predict future values of the level of the I(1) variables. Yet, as their first-differences are stationary, the shocks to the growth rates of variables will be temporary and thus cannot cause any permanent effect that helps in predicting the future time path of the variables.

The results from slope homogeneity and CSD inspections, as well as the cointegration tests, for the constructed models are reported in Table 7. The results strongly reject the slope homogeneity and cross-sectional independence hypotheses for all models. Additionally, the results from Westerlund–Edgerton bootstrap LM test reveal cointegration relationships between variables in the models.

Given its addressed efficiencies in fitting the heterogeneous, mixed, and cross-sectionally dependent structure of our panel data and handling endogeneity concerns, we finally implement the CS-ARDL method to estimate the models. The short-run and long-run elasticities of the three models are shown in Table 8. The overall results reveal consistently that the EKC hypothesis is not valid for all the GDP-based, as well as financial and industrial development adoptions in both the short-run and long-run. Rather, as a direct contrast to the EKC hypothesis, we found U-shaped patterns for all models. Furthermore, the magnitudes of the negative elasticities are higher in the short-run than that in the long-run. These findings strongly reject all three hypotheses we constructed based on the EKC framework.

The confirmed U-shaped patterns reveal that per capita fossil CO2 emissions decrease in the lower levels of per capita GDP, financial institutions development index, and per capita industrial value-added. These evidenced patterns indicate that in the earlier steps of economic growth, financial development, and industrial development in the OPEC bloc, the volume of the gross production, financial, and industrial activities are not that much to increase CO2 emanation. This downward pathway, which presents the desired environmental contribution from the overall economic development, may be occurring thanks to the initial spread of the composition and technique effects exceeding the scale effect. However, as per capita GDP keeps growing, financial institutions continue to develop, and industrial production keeps increasing, CO2 emissions start increasing as well, possibly due to the overwhelming scale effect. The turning points at which GDP per capita starts increasing carbon emissions are 4,690 and 4,546 U.S. dollars in the short-run and long-run, respectively. The financial development stops decreasing and starts increasing the carbon emissions when the financial institutions development index reaches 25.659 and 26.374 in the short-run and long-run, respectively. Likewise, the turning points at which per capita industrial value-added begins to increase carbon emissions are 1,588 and 1,632 U.S. dollars in the short-run and long-run, respectively.

In addition, the increased financial globalization tends to reduce carbon emissions but the increased political globalization scales up carbon emissions, while the impacts of trade and social globalization are statistically insignificant.

The evidence on the invalidity of the traditional GDP-based EKC pattern upholds the findings of Abid (2016), Acar et al. (2018), Ansari et al. (2020), and Ulucak et al. (2020). More specifically, like us, Moutinho et al. (2020) found a U-shaped relationship for 12 OPEC members. Nevertheless, our finding does not agree with that of studies including Fethi and Rahuma (2019), Coskuner et al. (2020), and Murshed et al. (2020), which provided support for the EKC hypothesis in different samples of the OPEC.

The confirmed U-shaped pattern in the impacts of financial and industrial development are not directly comparable as there is no study examining these non-linear associations in the case of OPEC members. Yet our results are in line with that of Rani et al., (2022a, 2022b) who found that financial development had a U-shaped relationship with carbon emissions in the cases of some Asian countries. Again, Ruza and Caro-Carretero (2022) found a U-shaped pattern for the GHG and CO2 emissions impacts of financial development for G-7 countries. However, our finding contradicts that of Shah et al. (2019) who validated both the income-based and financial development-based forms of the EKC hypothesis for a large sample of countries. The evidenced U-shaped pattern in the industry-CO2 nexus do not contradict that of Lin et al. (2016) as they found no evidence of the validity of the industrial EKC hypothesis in African countries case. The findings of Dogan and Inglesi-Lotz (2020) also indicated a U-shaped relationship in the industrial development-environmental pollution nexus for European countries.

The evidenced environmental contribution of financial globalization agrees with that of Awan et al. (2020), Ulucak et al. (2020), and Gaies et al. (2022) but does not support that of Gyamfi et al. (2021), Rani et al. (2022a), and Mehmood (2022). The positive effect of political globalization does not contradict the findings of Ansari et al. (2020), Le and Ozturk (2020), and Rani et al. (2022a), but is inconsistent with that of Awan et al. (2020) and Wang et al. (2021). The positive but insignificant trade globalization elasticities of carbon emissions are in line with the similar finding of Iorember et al. (2022) for African OPEC members. However, our finding contradicts that of many studies revealing either a significant positive (e.g., Al-Mulali et al., 2016; Mahmood et al., 2019; Van Tran, 2020) or negative (Kohler, 2013; Zafar et al., 2019; Ike et al., 2020; Moutinho et al., 2020) association between trade openness and environmental pollution.

The ECM(–1) result based on the lagged cepc demonstrates the speed of adjustment towards equilibrium and shows that around 70% of disequilibrium is corrected in a year, indicating a moderate convergence to the long-run equilibrium. The disagreements between our findings and that of the previous studies may be explained by the differences in methods, sample, period, and measures. These contradicting results call for more studies which consider different indicators and measures of the varied determinants of environmental pollution, especially in the case of OPEC members.

7 Discussions and conclusion

Economic growth, well-functioning financial systems, industrialization, and globalization promote socio-economic development in many ways but with some environmental side effects. We consistently found that economic growth, financial development, and industrial production had significant non-linear impacts on carbonization-driven environmental pollution in the OPEC bloc. The evidenced convex patterns contradict the concave EKC hypothesis. This evidence indicates that further increases in gross production, financial development, and industrial production are not accompanied by decreases in environmental pollution. As the turning points are low, OPEC members’ economic growth, financial development, and industrial enhancement trajectories threaten their environmental sustainability by increasing fossil carbon emissions. As the environmentally-desired downward paths are related to economically-undesired lower development levels, the inclusive environmental and economic policies should be focused on the upwards paths of the evidenced U-shaped patterns.

The upwards co-movement of GDP and fossil carbon intensity indicates that environmental awareness is lower than the overall economic growth priorities. As they are well-endowed with fossil-fuel resources, the low cost of fossil energy may be encouraging the excessive use of these resources in the production sectors of OPEC members. The richness of fossil resources may be also hindering the formulation and implementation of the initiatives to save energy and promote renewable clean energy transition. Therefore, the awareness and understanding of carbon-induced environmental problems should be conveyed to all economic agents. The integration of overall economic development and environmental sustainability is crucial for OPEC members. Policy-makers in OPEC may be fearing that limiting fossil fuel investments may severely damage their economies as the development of other sectors are also closely interlinked with oil industries. Still, the OPEC members should promote new green enterprises and even compel the existing businesses to adopt new environmental innovations, decarbonization technologies, and environmentally-friendly business models that use fossil resources efficiently and emits responsibly. From the consumption side, carbon taxation may be an efficient policy action, which also needs to be supported by incitements in the production of less-polluting goods and services to make them available cheaply in the markets.

Financial development eases access to low-cost credits for entrepreneurs who start a new business and for business people who expand their existing enterprises. The facilitated investment vitalization enlarges the scale effect and leads to increases in fossil energy use and carbon emissions. Therefore, financial policy-makers in OPEC need to be selective in the allocation of funds that green projects should be prioritized and favored. They may lower the cost of the credits and facilitate access to financial services for enterprises and entrepreneurs endeavoring to involve in green operations. Furthermore, banks and other financial agents may be ranked by the level of green financing and awarded some benefits according to the extent to which they finance green enterprises. A similar ranking and reward system may be an efficient motive for enterprises, as well. All these policy initiatives will increase the importance and awareness of environmental concerns among producers, consumers, investors, and entrepreneurs.

For the evidenced patterns of industrial development, the OPEC members may be specializing in emissions-intensive and oil-led industrial activities. Thus, these countries should adopt and even produce environmentally-friendly industrial products. The diversification of industrial production and energy mix will also improve energy productivity and thus reduce carbon intensity. Overall, an inclusive transition towards green growth, green industrialization, and green finance is needed to decouple the overall three-track economic development from carbonization-induced environmental pollution.

For the environmental pollution impacts of globalization dimensions, we found that increasing financial globalization eased the intensity of fossil CO2 emissions, particularly in the impacts of economic growth and financial development. This means that the growing international flows and activities of foreign direct investment, portfolio investment, and other international financial movements reduce carbon emissions. This finding supports the argument that the financial integration of the developing countries into the world economy creates green spillover transmission between financial markets. Therefore, to reduce the carbon intensity, financial policy-makers should accelerate financial openness by removing restrictions on international investment and capital accounts and by setting more international investment agreements. More specifically, multinational enterprises may transfer some environmental practices from the better performers in other countries, especially in advanced economies with larger environmental capacity. These are important as the findings also imply that increasing financial globalization might lessen the pollution effect of the development of financial institutions.

On the other hand, we found political globalization as a driver of carbon intensity. The positive association between political globalization and CO2 emissions may be explained by the political role and power of OPEC in world politics. In its political relationships with the rest of the world, OPEC’s role is an ‘oil-exporting’ bloc with its dominating power in affecting the world oil price. The global community’s negotiation with OPEC centers around the stability of the world petroleum supply, rather than the responsibility for the production and consumption of fossil resources. The OPEC bloc seems to be uncontrolled by global emissions mitigation initiatives. The political ignorance of environmental pollution may be also hindering the OPEC’s globalizing societies from the embracement of low-carbon environmental quality, as we found an insignificant effect from social globalization. Furthermore, like the other dimensions of globalization, political globalization may also stimulate trade, particularly in the oil industries of OPEC members. This fits why studies mostly consider trade openness as a proxy of overall economic openness. Consistently, we found a positive trade globalization elasticity of CO2 emissions, albeit statistically insignificant. To change the carbonization effect of political globalization, OPEC members should involve in international efforts such as the Kyoto protocol and the Paris agreement, which have motivated and forced many nations to mitigate emissions pollution.

In conclusion, our findings do not support the EKC hypothesis but show that GDP-based, financial, and industrial patterns follow a similar pathway for OPEC. As a research note, further studies may check this consistency for other samples of oil-rich countries. Again, our results may be controlled by future cubic research to unveil different patterns with more turning points. The limitation of our study is that the sample could not include all OPEC members. Since we were interested in OPEC as a single bloc, we did not test the relationships for individual members. Future research may resolve these constraints by studying the individual cases of all OPEC members.

Data availability

The analyzed datasets are available in the [Google-Drive] repository, [https://docs.google.com/spreadsheets/d/1xqVhTbACSVtb_gyC3F2qRTo_xFmnEt4-/edit?usp=sharing&ouid=105583779773111291533&rtpof=true&sd=true] and they, together with any unreported statistics and results, are also available from the authors on request.

References

Abid, M. (2016). Impact of economic, financial, and institutional factors on CO2 emissions: Evidence from sub-Saharan Africa economies. Utilities Policy, 41, 85–94. https://doi.org/10.1016/j.jup.2016.06.009

Acar, Y., Gürdal, T., & Ekeryılmaz, Ş. (2018). Environmental Kuznets curve for CO2 emissions: an analysis for developing, Middle East, OECD and OPEC countries. Environmental & Socio-Economic Studies, 6(4), 48–58. https://doi.org/10.2478/environ-2018-0027

Adams, S., & Klobodu, E. K. M. (2018). Financial development and environmental degradation: Does political regime matter? Journal of Cleaner Production, 197, 1472–1479. https://doi.org/10.1016/j.jclepro.2018.06.252

Adebayo, T. S., Ramzan, M., Iqbal, H. A., Awosusi, A. A., & Akinsola, G. D. (2021). The environmental sustainability effects of financial development and urbanization in Latin American countries. Environmental Science and Pollution Research, 28, 57983–57996. https://doi.org/10.1007/s11356-021-14580-4

Ahmad, M., Ahmed, Z., Yang, X., Hussain, N., & Sinha, A. (2022). Financial development and environmental degradation: Do human capital and institutional quality make a difference? Gondwana Research, 105, 299–310. https://doi.org/10.1016/j.gr.2021.09.012

Akram, R., Chen, F., Khalid, F., Ye, Z., & Majeed, M. T. (2020a). Heterogeneous effects of energy efficiency and renewable energy on carbon emissions: Evidence from developing countries. Journal of Cleaner Production, 247, 119122. https://doi.org/10.1016/j.jclepro.2019.119122

Alao, R. O., Payaslioglu, C., Alhassan, A., & Alola, A. A. (2021). Accounting for carbon dioxide emission effect of energy use, economic growth, and urbanization in the OPEC member states. International Social Science Journal, 72(243), 129–143. https://doi.org/10.1111/issj.12304

AlKhars, M.A., Alwahaishi, S., Fallatah, M.R., & Kayal, A. (2022). A literature review of the Environmental Kuznets Curve in GCC for 2010–2020. Environmental and Sustainability Indicators, 14,100181. https://doi.org/10.1016/j.indic.2022.100181

Al-Mulali, U., Ozturk, I., & Solarin, S. A. (2016). Investigating the environmental Kuznets curve hypothesis in seven regions: The role of renewable energy. Ecological Indicators, 67, 267–282. https://doi.org/10.1016/j.ecolind.2016.02.059

Al-Mulali, U., Gholipour, H. F., & Solarin, S. A. (2022). Investigating the environmental Kuznets curve (EKC) hypothesis: Does government effectiveness matter? Evidence from 170 countries. Environment, Development and Sustainability, 24, 12740–12755. https://doi.org/10.1007/s10668-021-01962-4

Alsamara, M., Mrabet, Z., Saleh, A. S., & Anwar, S. (2018). The environmental Kuznets curve relationship: A case study of the Gulf Cooperation Council region. Environmental Science and Pollution Research, 25, 33183–33195. https://doi.org/10.1007/s11356-018-3161-1

Ansari, M. A., Ahmad, M. R., Siddique, S., & Mansoor, K. (2020). An environment Kuznets curve for ecological footprint: Evidence from GCC countries. Carbon Management, 11(4), 355–368. https://doi.org/10.1080/17583004.2020.1790242

Appiah, M., Li, F., & Korankye, B. (2021). Modeling the linkages among CO2 emission, energy consumption, and industrialization in sub-Saharan African (SSA) countries. Environmental Science and Pollution Research, 28, 38506–38521. https://doi.org/10.1007/s11356-021-12412-z

Awan, A. M., Azam, M., Saeed, I. U., & Bakhtyar, B. (2020). Does globalization and financial sector development affect environmental quality? A panel data investigation for the Middle East and North African countries. Environmental Science and Pollution Research, 27, 45405–45418. https://doi.org/10.1007/s11356-020-10445-4

Azam, M., Rehman, Z. U., & Ibrahim, Y. (2022). Causal nexus in industrialization, urbanization, trade openness, and carbon emissions: Empirical evidence from OPEC economies. Environment, Development and Sustainability, 24, 13990–14010. https://doi.org/10.1007/s10668-021-02019-2

Babu, S. S., & Datta, S. K. (2013). The relevance of environmental Kuznets curve (EKC) in a framework of broad-based environmental degradation and modified measure of growth–a pooled data analysis. International Journal of Sustainable Development & World Ecology, 20(4), 309–316. https://doi.org/10.1080/13504509.2013.795505

Breusch, T. S., & Pagan, A. R. (1980). The Lagrange Multiplier test and its applications to model specification in econometrics. The Review of Economic Studies, 47(1), 239–253. https://doi.org/10.2307/2297111

Burdisso, T., & Sangiácomo, M. (2016). Panel time series: Review of the methodological evolution. The Stata Journal, 16(2), 424–442. https://doi.org/10.1177/1536867X1601600210

Çakmak, E. E., & Acar, S. (2022). The nexus between economic growth, renewable energy and ecological footprint: an empirical evidence from most oil-producing countries. Journal of Cleaner Production, 352, 131548. https://doi.org/10.1016/j.jclepro.2022.131548

Cao, L. (2022). How green finance reduces CO2 emissions for green economic recovery: Empirical evidence from E7 economies. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-022-22365-6

Chang, S. C. (2015). Effects of financial developments and income on energy consumption. International Review of Economics & Finance, 35, 28–44. https://doi.org/10.1016/j.iref.2014.08.011

Charfeddine, L., & Khediri, K. B. (2016). Financial development and environmental quality in UAE: Cointegration with structural breaks. Renewable and Sustainable Energy Reviews, 55, 1322–1335. https://doi.org/10.1016/j.rser.2015.07.059

Charfeddine, L., & Mrabet, Z. (2017). The impact of economic development and social-political factors on ecological footprint: A panel data analysis for 15 MENA countries. Renewable and Sustainable Energy Reviews, 76, 138–154. https://doi.org/10.1016/j.rser.2017.03.031

Chen, T., Gozgor, G., Koo, C. K., & Lau, C. K. M. (2020). Does international cooperation affect CO2 emissions? Evidence from OECD countries. Environmental Science and Pollution Research, 27, 8548–8556. https://doi.org/10.1007/s11356-019-07324-y

Choi, I. (2001). Unit root tests for panel data. Journal of International Money and Finance, 20(2), 249–272. https://doi.org/10.1016/S0261-5606(00)00048-6

Chudik, A., Mohaddes, K., Pesaran, M. H., & Raissi, M. (2017). Is There a debt-threshold effect on output growth? The Review of Economics and Statistics, 99(1), 135–150. https://doi.org/10.1162/REST_a_00593

Chudik, A., & Pesaran, M. H. (2015). Common correlated effects estimation of heterogeneous dynamic panel data models with weakly exogenous regressors. Journal of Econometrics, 188(2), 393–420. https://doi.org/10.1016/j.jeconom.2015.03.007

Coskuner, C., Paskeh, M. K., Olasehinde-Williams, G., & Akadiri, S. S. (2020). Economic and social determinants of carbon emissions: Evidence from organization of petroleum exporting countries. Journal of Public Affairs, 20(3), e2092. https://doi.org/10.1002/pa.2092

Crippa, M., Guizzardi, D., Solazzo, E., Muntean, M., Schaaf, E., Monforti-Ferrario, F., Banja, M., Olivier, J. G. J., Grassi, G., Rossi, S., & Vignati, E. (2021). GHG emissions of all world countries - 2021 report. Publications Office of the European Union. https://doi.org/10.2760/074804

Danmaraya, I. A., Jakada, A. H., Mahmood, S., Ibrahim, B. A., & Ali, A. U. (2021). Heterogeneous effect of oil production on environmental degradation: Panel evidence from OPEC member countries. International Journal of Energy Sector Management, 16(4), 774–793. https://doi.org/10.1108/IJESM-04-2021-0009

De Hoyos, R. E., & Sarafidis, V. (2006). Testing for cross-sectional dependence in panel-data models. The Stata Journal, 6(4), 482–496. https://doi.org/10.1177/1536867X0600600403

Dogan, E., & Inglesi-Lotz, R. (2020). The impact of economic structure to the environmental Kuznets curve (EKC) hypothesis: Evidence from European countries. Environmental Science and Pollution Research, 27, 12717–12724. https://doi.org/10.1007/s11356-020-07878-2

EDGAR-Emissions Database for Global Atmospheric Research. (2022). Emissions data and maps. https://edgar.jrc.ec.europa.eu/

Fakher, H. A., & Inglesi-Lotz, R. (2022). Revisiting environmental Kuznets curve: An investigation of renewable and non-renewable energy consumption role. Environmental Science and Pollution Research, 29, 87583–87601. https://doi.org/10.1007/s11356-022-21776-9

Fethi, S., & Rahuma, A. (2019). The role of eco-innovation on CO2 emission reduction in an extended version of the environmental Kuznets curve: Evidence from the top 20 refined oil exporting countries. Environmental Science and Pollution Research, 26, 30145–30153. https://doi.org/10.1007/s11356-019-05951-z

Gaies, B., Nakhli, M. S., & Sahut, J. M. (2022). What are the effects of economic globalization on CO2 emissions in MENA countries? Economic Modelling, 116, 106022. https://doi.org/10.1016/j.econmod.2022.106022

Grossman, G.M., & Krueger, A.B. (1991). Environmental impacts of the North American free trade agreement. National Bureau of Economic Research Working Paper, No. 3914, Cambridge. http://www.nber.org/papers/w3914.pdf

Grossman, G. M., & Krueger, A. B. (1995). Economic growth and the environment. The Quarterly Journal of Economics, 110(2), 353–377. https://doi.org/10.2307/2118443

Gyamfi, B. A., Bein, M. A., Udemba, E. N., & Bekun, F. V. (2021). Investigating the pollution haven hypothesis in oil and non-oil sub-Saharan Africa countries: Evidence from quantile regression technique. Resources Policy, 73, 102119. https://doi.org/10.1016/j.resourpol.2021.102119