Abstract

Policymakers and authorities in Africa are often concerned about economic growth and stability owing to the long history of socioeconomic problems that have bedeviled the continent for years. However, increasing environmental degradation challenges in recent times beckons for adequate attention considering Africa’s vulnerability to climate change and environmental disasters. Thus, the current study examines the illustrious environmental Kuznets curve (EKC) hypothesis in a sectoral composition framework of fossil resources abundance among leading oil-producing African economies, including Algeria, Nigeria, Angola, and Egypt, using a combination of quantile regression (QR) approach and dynamic ordinary least square (DOLS) for data between 1995 and 2016. Based on the empirical results from the study, three main factors significantly increase environmental pollution through CO2 emissions among the countries, namely: fossil energy consumption, income levels, and the shares of the manufacturing sector in the total gross domestic product (GDP). While income growth exacerbates pollution, the negative impacts of the income square were only significant at the lower and mid quantiles of the understudied periods in the QR estimates. Thus, the EKC hypothesis was not convincingly upheld for the countries as its validity demonstrates significant quantile effects. Furthermore, the tripartite causality nexus among real income, resource rent, and share of the service sector in GDP, which is unobserved in the share of the manufacturing sector, reflect the infamous Dutch disease argument among the resource-dependent countries. Hence, to promote environmental sustainability and address resource dependency toward the actualization of SDGs (1, 8, 12, and 13), the study recommends energy portfolios diversification alongside economic diversification.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Africa is the second-largest continent in the world; the second in rank after Asia in terms of the land area covering an approximate 30.049 million km2 (AfDB, OECD, and UNDP, 2017). Africa is a promising continent with huge potentials when considering two major facts about the continent, namely, the dynamic demographic factors, and the abundant natural resources deposits. A fast-growing youth population characterized the abundant human resources in the continent of Africa. It is estimated that there are about 1.107 billion people in Sub-Saharan Africa alone as of the end of 2019 (WDI 2020). Also, numerous natural resources spreading across the breadth and length of the continents include crude oil, natural gas, gold, copper, uranium, coal, diamonds, iron, livestock, forests, and arable land, among several other resources, as seen in Fig. 1 (African Development Report and AfDB 2007; Gokee 2016; Alao 2007; Aliyu et al. 2018).

Source: Gokee (2016)

A map of Africa showing major tradable natural resources.

Due to these abundant resource deposits, several African countries depend on resource rent, and many have amassed huge fortunes over the years from some of the aforementioned natural resources, especially in the case of the energy-related ones such as oil and gas, which has been popularly described as black gold in the literature (More 2009; Effiong 2010; Adusah-Karikari 2015; Price and Ronck 2018). Also, resource abundance has positioned the continent as virgin land, which many advanced economies and rapidly emerging economies are scrambling for.

Energy production and consumption are essential components of the drivers of the world’s economic activities. Due to the importance of energy consumption in production activities, oil and gas have become very essential among other natural resources in the international market as they help nations meet up with their domestic energy demands. Africa accounts for 7.2% and 7.5% of global proven oil reserves and gas reserves, respectively (British Petroleum BP 2020). Energy production has thus thrived on the ambient of fossil resources in many African countries, especially among the leading oil producers. For instance, electricity production from fossil sources, namely oil, gas, and coal, account for as high as 100% in Libya, and about 99.6%, 91.7%, 81.8%, and 46.8% in other major oil-producing countries, including Algeria, Egypt, Nigeria, and Angola, respectively, as at 2016 (WDI 2020).

However, there are various environmental problems associated with not only the consumption of conventional energy sources like oil and gas but also with their exploitation activities ranging from the release of harmful greenhouse gases (GHGs) like carbon dioxide (CO2), methane (CH4), and nitrous oxide (N2O) among others, to the various damages to natural habitats and biodiversity (IPCC 2021; Jakob and Hilaire 2015; Ugochukwu and Ertel 2008; Zhang et al. 2020). Global carbon emissions have been on the rise, although emissions in Africa are substantially low compared to the rest of the world, especially in Asia and North America. Emissions in Africa grew from about 193.9 in million tons of CO2 to about 1284.5 million tons which represent about 562.45% growth in emissions over the decades between 1965 and 2018 (BP, 2020). This growth can be deemed substantially high despite that the continent only account for about 3.77% of the total estimated 34,007.89 million tons of global CO2 emissions in 2018 (British Petroleum BP 2020).

As such, to avert the preponderance of occurrence of various environmental disasters like prolonged drought, flooding, and global warming, among others, it has been documented that reduction in global emission must be sustained to keep global warming below 1.5 °C and to facilitate the achievement of carbon neutrality in the near future (IPCC 2019, 2021). Although environmental disasters are of global consequences, however, African countries have been said to be more vulnerable (Kula et al. 2013; Herslund et al. 2016; Baarsch et al. 2020). As such, environmental researches are a step in the right direction as they are key to facilitating the right policy directions toward the achievement of SDGs 11 and 13 with the primary focus of ensuring environmental sustainability via collective climate action. Generally, the economic facets of the challenges of resource dependence in rentier states in Africa have received substantial attention in the literature given severe economic challenges in many African countries, however, the environmental dynamics, which hitherto have received less attention should be emphasized considering the enormous dangers and risks from environmental degradation in recent times. This action is also necessary given the level of reported higher vulnerability to climate issues in Africa compared to the rest of the world (Baarsch et al. 2020).

Hence, the current study examines the validity of the EKC hypothesis in a sectoral composition framework for the specific case of the selected leading oil-producing African countries using second-generation panel estimation techniques. To the best of the authors’ knowledge, hitherto, no study has undertaken the EKC analysis within a sectoral composition framework for Africa and especially for the specific case of the group of oil-rich African economies. The majority of extant studies have only addressed the EKC from the perspectives of the energy sector alone while accounting for the income-emission nexus of the Kuznets hypothesis. The current study, therefore, fills the gap in the literature by exploring the question of the EKC validity in an elaborate analysis that accounts for the overlooked impacts of the share of sectoral composition (manufacturing and services sectors) in addition to the dynamics of the energy sector by utilizing selected leading oil-producing economies in Africa. The study further provides insights into both the environmental and economic facets of resources abundance vis-à-vis the validity of the EKC hypothesis among the selected resource-rich countries including Algeria, Nigeria, Angola, and Egypt.

Aside from the introduction in the first section, the remaining aspects of the study have been arranged into other sections starting with the review of literature in EKC perspective in section two, the outlining of the empirical approach and data analysis in section three, and the discussion of results and conclusions with policy matters in section four and section five, respectively.

Literature review

Socioeconomic and environmental challenges amidst resource abundance: a resource curse and Dutch diseases synopsis

The oil industry in many oil-exporting economies, including those in Africa, has received massive investments over the years, and this has translated into a huge economic fortune (Yates 2006; Ologunde et al. 2020). There are also times when many oil-exporting countries experience booms from a surge in international oil prices due to shocks that trigger a rise in the price level. In a rational thought, it would be expected that huge revenue gains from oil production and other resources should be to the overall economic benefits of the resource-based nations. However, massive returns from resource rents may not necessarily guarantee the expected levels of economic growth and development. Despite the abundant natural and human resources endowments, many of the oil-producing countries on the continent of Africa are still overwhelmed with numerous socioeconomic challenges cutting across almost every facet of life raging from cases of abject poverty to unbearable levels of inequality and acute unemployment (Anyanwu and Erhijakpor 2014; Ayittey 2016; Onifade et al. 2020a; Asongu et al. 2020). There are also incessant cases of political instability and insecurity from prolonged conflict and wars and from insurgencies and terrorism (Tyburski et al. 2020; Kunawotor et al. 2020; Henri 2019).

Environmental degradations have also compounded the numerous socio-economic challenges following the prolonged period of natural resources exploitation and increased fossil resources usage in many resource-dependent African economies. For instance, an oil-rich country like Nigeria has made a huge fortune from oil since its discovery in the Niger Delta region in the 1970s, however, with just very little or no tangible evidence of improvement in the standards of living of the people in this most populous African country of over 200 million people (WDI 2020; Taiwo et al. 2020; Hill 2012; Onifade et al. 2020b). Aside from the health hazards and environmental degradation from oil exploration activities that are predominant in the Niger Delta region of Nigeria, Hill (2012) argued that the oil industry has significantly undermined the development of other sectors in Nigeria. Sandbakken (2006) also observed similar challenges of economic and political drawbacks in rentier states of Libya and Algeria despite the resource abundance. The irony of the matter is that a vast majority of countries though having gained substantial revenues from fossil resources have failed to deliver enough sustainable infrastructures to take care of both socioeconomic and environmental challenges of the populace while also dragging back from diversifying the economy to ensure sustainability in the long run. Thus, making Africa’s vulnerability to climate change and environmental disasters relatively higher (Kula et al. 2013; Baarsch et al. 2020).

This unfortunate situation aligns with the argument of the resource curse theory that posits those nations with natural resources endowments usually experience failure in growth and development indices compared to those that are less endowed. The resource curse theory is often premised on historical antecedents of some common factors like civil wars, corruption, and gross mismanagement of funds that often thrive on weak institutions in many resource-rich countries (Gritsenko and Efimova 2020; Henri 2019; Tyburski et al. 2020; Vahabi 2018; Manzano and Gutiérrez 2019). Frankel (2010) observed that many resource-rich African countries are still underdeveloped compared to countries like Japan and the Asian Tiger countries that have experienced tremendous economic transformations despite having limited resources endowments. Furthermore, following the arguments of Corden (1984) in his Dutch Disease theory, the surge in revenue during the period of a boom in a resource-based economy like times of spike in oil prices in the case of oil-exporting economies may give room for more undesirable economic outcomes unless the economy is developed and well diversified. It has been observed that the prosperity of resource-dependent economies in Africa is undermined by the volatility and shocks in the oil and gas market, as many of these countries are found among the world’s least diversified economies (IEA, 2019). Excess revenue from natural resources export often triggers undue nominal exchange rate appreciation, higher wages, and expansionary fiscal policies that may not be commensurate with the actual size of the economy, thus increasing the rate of economic reliance on the resource sector and compounding other economic challenges like inflationary pressure (Taiwo et al. 2020). While this situation persists, the result is that other economic sectors are often abandoned, thereby buttressing the assertion of Krugman (1987) that excessive reliance on natural resources export could pave way for the crowding out of other important sectors like the manufacturing sector.

In a nutshell, the economic facets of resources abundance have generally dominated the literature over the years, considering that achieving economic growth and stability through macroeconomic policies is the central goal of policymakers and authorities in many African countries. However, the dynamics of environmental challenges have been changing in recent times, therefore, requiring more attention from policymakers and authorities going by the continent’s vulnerability to climate change and environmental disasters (Kula et al. 2013; Herslund et al. 2016; Baarsch et al. 2020).

Empirical literature in the EKC perspective

A review of the empirical literature shows that the environmental Kuznets proposition has often been scrutinized in many economies under various settings right from the origin of the concept of the hypothesis, which is traceable to the study of Kuznets (1955). The fundamental work of Kuznets (1955) focused on the response of inequality in income distribution to trends in economic growth. The Kuznets curve has thereafter been replicated or applied in diverse forms, including its famous application in environmental economics in recent times. Following the demonstration of how income inequality rises or dampens along the growth path in Kuznets’ study, the environmental aspect often focused on the intricacies of pollution-income nexus by providing answers to the question of whether environmental pollution rises or lessens vis-à-vis the trajectory of a nation’s economic growth.

Given the initial stage of a nation’s economic growth path, the EKC conjecture opines that the challenges of pollution and environmental degradation are triggered as income level increases until a point when the positive income-pollution nexus reserves such that further income growth only enhances pollution abatement, as seen in Fig. 2. Hence, the EKC hypothesis demonstrates an inverted ‘U-shape’ income-pollution nexus. Hitherto, the validity of the hypothesis is subject to scrutiny as there is no consensus in the empirical literature. While several empirical studies upheld the EKC’s inverted U-shape income-pollution nexus (Apergis and Ozturk 2015; Sarkodie and Ozturk 2020; Bekun et al. 2021; Apergis and Payne 2009; Alola and Ozturk 2021; Onifade et al. 2021a; Ozturk et al. 2016), many others have failed to uphold the hypothesis or convincingly rejected it (Apergis 2016; Dogan and Ozturk 2017; Pata and Aydin 2020; Sadik-Zada and Loewenstein 2020; Dogan and Inglesi-Lotz 2020; Koc and Bulus 2020).

For African countries, there are also mixed results on the empirical evidence for the EKC hypothesis for extant studies in the literature. El Hédi Arouri et al. (2011) studied a group of the Middle East and North African (MENA) countries in a simple EKC framework that focused solely on the income-pollution nexus with the use of sulfur dioxide proxy for environmental pollution. The result shows that the EKC conjecture is not valid for the region. However, the study fails to take into account other crucial factors that may influence the income-pollution nexus but rather sorely focuses on income. In a different study, Bibi and Jamil (2021) examined the EKC for different regions, including countries in the MENA region and the Sub-Saharan African region. Unlike the study of El Hédi Arouri et al. (2011), they used carbon dioxide as a proxy for pollution by applying the fixed and random effect models in a multivariate setting. Their findings show that the EKC conjecture is valid for the MENA region, thereby contradicting the results from El Hédi Arouri et al. (2011). However, the result of Bibi and Jamil (2021) further shows that the hypothesis does not hold in the case of the Sub-Sahara Africa region.

Furthermore, Demissew Beyene and Kotosz (2020) carried out an empirical analysis using pooled mean group (PMG) approach to test the EKC among twelve countries from East Africa. Their findings also show that the EKC does not hold among the countries. Their study reveals that the income-emission nexus is negative until a certain level of income where further expansion in growth induces emission levels. Thus, the study produced a bell shape rather than the inverted U-shape for the EKC conjecture. Onifade et al. (2021b) also applied the PMG method in a similar approach to the study of Demissew Beyene and Kotosz (2020), however, not for East African countries but a group of African countries among other OPEC member countries. The results show that both urbanization and renewable energy consumption have no significant effect on pollution levels as proxied by carbon emission while fossil energy consumption does induce pollution levels significantly. Furthermore, the study reveals a U-shape income-emission nexus rather than the invert U-shape nexus, thereby convincingly rejecting the validity of the hypothesis.

On the other hand, some studies have upheld the validity of the EKC in an African setting. Shahbaz et al. (2016) examine the impacts of globalization while exploring the EKC conjecture among selected African countries. The ARDL approach was utilized in the study, and the results show that the EKC conjecture holds in six countries. Also, globalization reduces pollution levels in the country. Similarly, the study of Sarkodie (2018) affirms the validity of the EKC for the case of seventeen (17) selected countries from the continent. The study further pointed out that economic growth, energy use, and agricultural practices constituted a major aspect of environmental pollution in Africa. In addition, the study of Sarkodie and Ozturk (2020) also upholds the EKC in a multivariate analysis of emission data from the Kenyan economy.

However, from an empirical point of view, the validity of the hypothesis may be subject to several issues, including choice of methodologies, the accuracy of model specifications, the sample framework, and the nature or structure of the economies, among other matters. None of the studies has undertaken the EKC analysis within a sectoral composition framework for Africa and especially for the specific case of the oil-rich African economies. The current study, therefore, fills the gap in the literature by exploring the question of the EKC validity in an elaborate analysis that accounts for the overlooked impacts of the share of sectoral composition (manufacturing and services sectors) in addition to the dynamics of the energy sector of selected leading oil-producing economies in Africa. While doing so, it was also ensured that the roles of resources rent were not neglected in the understudied sectoral framework among the selected countries.

Methodology

Data and sample

Resource-rich nations are located across the globe, and several of them are found in Africa. Literarily, almost all African countries can be defined as resource-rich. Besides, in recent times, more countries are discovering resources like oil and gas in commercial quantity, and production has even begun in some while others have several ongoing projects (Graham and Ovadia 2019; IEA 2019). The case of oil and gas was taken for analysis among other resources in the study, considering the crucial roles that these resources play in not only revenue generation for many oil-dependent economies on the continent but also the fact that oil and gas help them to meet up with their growing energy demand. However, not all oil-producing African countries were accommodated in the present study due to constraints in data availability.

Priority was given to four (4) countries among the top five leading oil producers on the continent, including Algeria, Libya, Nigeria, Angola, and Egypt. These countries together are considered a good representative fraction of oil producers on the continent of Africa as they have the highest daily oil and gas production volumes with the largest revenues, and besides, they jointly account for approximately 86.54 and 89.06% of total proved oil and gas reserves in Africa, respectively, as seen in Fig. 3 in the Appendix. Unfortunately, Libya was excluded from the final samples due to the nonavailability of data on sectoral composition. Therefore, the final sample framework covers the case of Algeria, Nigeria, Angola, and Egypt. Related data were drawn from the World Bank development indicator (WDI, 2020) for a panel of the selected countries between 1995 and 2016 to explore the question of the validity of the EKC in a sectoral composition framework that accounts for the share of both manufacturing and services sectors, in addition to the dynamics roles of energy consumption among the countries.

In line with the income levels of the countries, the general baseline model for the study is presented in Eq. (1) to reflect the levels of carbon emissions that are provided as a function of sectoral classification, namely, energy sector, manufacturing sector, and the service sector.

The carbon dioxide emission (\({\mathrm{CO}2}_{it}\)) levels were utilized in measuring environmental quality among the countries, and this variable is provided in metric tons per capita. As for economic performance, rather than utilizing the real gross domestic product values, the real per capita income (\({RI}_{it}\)) levels in the current US$ were utilized in measuring income levels among the countries considering that there are substantial demographic differences in terms of individual country’s population size. The square value of the income level (\({{RI}^{2}}_{it}\)) is factored into the model to validate the EKC assertion as obtainable in the empirical literature (Balsalobre-Lorente et al. 2021; Sadik-Zada and Loewenstein 2020). As for the energy composition among the countries, both energy consumption from fossil sources and corresponding rents from fossil sources were factored into the model. In the case of the former, the amount of energy consumption from fossil resources as a percentage of the total energy consumption (\({FEC}_{it}\)) was utilized, while the sum of natural resources rents (\({NR}_{it}\)) on fossil resources, namely oil rents, natural gas rents, and coal rents were utilized for the latter. As for the manufacturing sector, the sectors’ shares in total GDP, which is based on the total manufacturing value added, (\({MGI}_{it}\)) was utilized, and its values are obtained from the net output of a sector after adding up all outputs and subtracting intermediate inputs. On the other hand, for the service sector, the share of services as a proportion of the GDP (\({SGI}_{it}\)) was utilized. The services sector consists of the value-added in both retail and wholesale trade, real estate services, education, transport, financial services, and health care services, among others. Lastly, considering that the values of both the manufacturing sector and service sector were obtained as a share of the GDP, the log-share of the service sector in GDP was utilized alongside the natural logarithm of the absolute values of the manufacturing sector to avoid collinearity issues. Other variables are also provided in the natural logarithm.

Methodological steps

Cross-sectional dependence (CD), unit root, and cointegration tests

The group of countries in the present study is mainly primary commodities-driven economies. The commodities involved, in this case, oil and gas, are international commodities that are often prone to shocks and diverse degrees of fluctuations. Major periods of fluctuations in the international oil market are often randomly felt among major producers, and they may also create general windfalls in revenue. As such, there is a tendency that the countries may be susceptible to common shocks. Therefore, to begin the empirical analysis, the residual of the sample panel was examined to ascertain whether common shocks affect the error component of the sample by conducting a cross-sectional dependency (CD) test. Failure to conduct such a test may invalidate results and findings from other subsequent analyses due to the possibility of an inappropriate choice of methodological approaches. Hence, following the fundamental study of Pesaran (2007) and Chudik et al. (2016), the CD test has not been sidelined in some contemporary studies, especially while conducting preliminary tests (Koengkan 2018; Bekun et al. 2021; Gyamfi et al. 2021).

Given that the cross-section dimension (i) in a panel of observations ranges from 1 to N with the time period (t) ranging from 1 to T in Eq. 2, the null hypothesis shows that there is no cross-sectional dependence in the residual as denoted by Cov(\({\mu }_{it}\),\({\mu }_{jt}\)) = 0 against the alternative that portends cross-section dependence (correlation) in residuals given at least a pair of the cross-sections as denoted by Cov(\({\mu }_{it}\),\({\mu }_{jt}\)) ≠ 0.

The estimates from the Lagrange multiplier (LM) approach of Breusch and Pagan (1980) were taken from the OLS operations of Eq. (2), and the corresponding pair-wise correlation of the estimated residuals is represented by ρˆij as seen in Eq. 3. This method is more suitable when the cross-section is relatively small but requires a large T, as is the case with the present study.

From Eqs. 4 and 5, the LM test for CD by Pesaran (2015) that can accommodate slope heterogeneity and cross-sectional issues in a relatively small sample was used. The observed test statistics for the evaluated residuals (\(\upmu\)) are generally assumed to be asymptomatically distributed in a way that CD ~ N(0, 1). The result discussion section presents the outputs of combined CD tests to include both Pesaran (2015) and Pesaran (2007) approaches. The CD tests uphold the existence of CD, and the full details of the results are provided in the result discussion in Sect. 4. Subsequently, to check for the existence of a long-run relationship among the variables, there is a need to adopt a unit root test that accommodates CD limitations. As such, the CIPS panel unit root test of Pesaran (2007) was adopted for the study. This test is an augmented second-generation type of the IPS unit root test of Im et al. (2003). As for the confirmation of the long-run relationship among variables, the Westerlund (2007) cointegration method was utilized in line with the error adjustment mechanism in Eq. 6. This cointegration test is beneficial and more effective for the present study considering that applying other traditional unit root techniques could produce unreliable results when dealing with cross-sectional dependency, as seen in extant studies (Gyamfi et al. 2022; Onifade et al. 2021c).

In Eq. 6, Dt denotes the deterministic arrangement that can be specified to show a model with no deterministic components or a model with an only constant component, or a model with both trend and constant as represented by Dt = (0), Dt = (1), or Dt = (1, t), respectively. On the other hand, the vector of parameters is represented by \({\mathrm{\alpha }}_{t}\). The evaluation of the error correction process (\({\mathrm{\varnothing }}_{i}\)) helps to determine the existence of a long-run relationship among variables based on the group statistics and the panel statistics (Gt, Gα, Pt, and Pα) that is produced.

Long-run coefficient estimations

The long-run estimations were obtained using the QR approach while utilizing the dynamic ordinary least squares (DOLS) technique to provide a comparative analysis and robustness checks. Following the fundamental study of Koenker (2004) and Powell (2016), the QR panel estimation method was utilized as initiated by Koenker and Bassett (1978) in evaluating the long-run coefficients. Equation (7) shows the interactive relationship among the variables in line with what is obtainable in baseline model 1. In Eq. (7), the \({\tau }^{th}\) conditional quantile of the dependent variable (environmental degradation as measured with CO2 emission levels) is represented by \({Q\mathrm{LnCO}2}_{it}(\tau /{\chi }_{it})\), while the vector of the explanatory variables is denoted by \({\chi }_{it}\). Given that (\(\tau\))represents the quantiles for the panel samples of the selected countries i at time t, the slopes of the individual explanatory variables are represented by \(\delta\) while \({\omega }_{it}\) captures the error term for the given vector.

The combined QR and DOLS approach provides certain advantages in the present study. Unlike the conventional OLS approach that shows the nexus between an explained variable and the conditional mean of the explanatory variables alone, the QR approach produces more elaborate results by utilizing the conditional quantiles of the explanatory variables to demonstrate their impacts on the explained variables. In case of the violation of the fundamental normality assumption of the OLS, there is a major pitfall in the conventional approach; however, the QR approach is robust for error distribution, and outliers and it can generate better outcomes when dealing with cross-sectional dependence and heterogeneous effects (Nwaka et al. 2020; Anser et al. 2021). Also, aside from having the advantage of getting an elaborate result from the QR approach, which depends on the median values, the estimates from the DOLS provide alternative or comparative views as the technique utilizes the mean values for estimations. Hence, the combination of the mean and median approaches in the analysis further strengthens the robustness of the estimates. Lastly, the Dumitrescu and Hurlin (2012) granger causality technique was applied to examine the direction of causality among the understudied variables.

Results discussions

A presentation of the descriptive statistics of the sample observations heralds the discussion of the results, as seen in Table 1. From the table, there is a strong significant positive correlation between carbon emissions and income levels as well as fossil energy consumption levels and manufacturing sector but an insignificant negative and positive correlation with natural resources rents and service sector, respectively. These results from the simple correlation are not conclusive but only provide some preliminary clues. Several other factors are to be considered in the analysis to reach a valid conclusion. For instance, there is a cross-sectional dependence issue when considering the estimated results for the CD test in Table 2 as test statistics for the residuals validate the rejection of the null hypothesis of no cross-sectional dependence. Following the affirmation of the CD for the panel sample, the unit root test results and the cointegration outputs were reported in Table 3.

a, b, and c represent the statistical significance of outputs at 1%, 5%, and 10% levels, respectively.

Following the significance of both the group and panel statistics of the Westerlund (2007) long-run test in Table 3, the result confirms that the null hypothesis of the absence of cointegration relationship among the underlaying variables can be rejected. As such, the corresponding long-run coefficients representing the impacts of each of the explanatory variables were obtained and discussed in Table 4 alongside the evidence of causality that is provided in Table 5, accordingly.

Long-run coefficients and causality direction

The estimated long-run coefficients from the QR outputs in Table 4 show that there are three main drivers of environmental pollution through carbon emission levels among the countries, namely; fossil energy consumption, manufacturing sector, and income levels. The QR estimates reveal the exacerbating effects of fossil energy consumption on the carbon emission levels among the countries. Fossil energy consumption has strong and positive impacts on emission level and the effects are highly significant and consistent across all the conditional distribution of emission levels from the lower quantiles (\(\tau\) = 0.10 to \(\tau\) = 0.30) to the mid-quantiles (\(\tau\) = 0.40 to \(\tau\) = 0.60) and the upper quantiles (\(\tau\) = 0.70 to \(\tau\) = 0.90). This result is in line with the conclusion from some extant studies that fossil energy is a driver of carbon emission (Shahbaz et al. 2021, 2015; Sarkodie 2018; Sarkodie and Ozturk 2020; Alola et al. 2021; Adedoyin et al. 2021; Gyamfi et al. 2021). Besides, the output of the mean estimations of the DOLS approach gives more credence to the QR results as it reveals that carbon emission levels rise by 0.67% when there is a percent rise in fossil energy consumption level among the countries. Also, there is evidence of a strong two-way causality between fossil energy consumption and carbon emission levels in Table 5, which further corroborates the long-run results. Some studies like Fuinhas et al. (2017) have also demonstrated how primary energy consumption increases environmental pollution for the case of Latin American countries. Interestingly, fossil energy constitutes the main share of total primary energy use among the understudied countries, and the current results are just a reaffirmation of how conventional energy consumption, in particular, can be detrimental to environmental sustainability, as evidenced in extant empirical studies (Koengkan 2018; Adebayo and Rjoub 2021).

As for the impacts of sectoral composition on the pollution level, the results show that the manufacturing sector is the only significant driver of carbon emission level among the countries. The positive and significant impacts of the manufacturing sector on environmental pollution were consistent, as seen across the conditional distribution of the carbon emission level in the QR estimates. This result supports the finding from the study of Sadik-Zada and Loewenstein (2020) concerning the possible deteriorating impacts of the manufacturing sector on environmental quality among countries. The DOLS estimates also reveal that carbon emission level rises by 0.14%, given a percent increase in the share of the manufacturing sector. This shows that energy demands in the manufacturing sector thrive more on conventional energy sources at the detriment of environmental quality, and this is further buttressed by the observed one-way causality link from fossil energy consumption to the share of the manufacturing sector, as seen in Table 5. On the other hand, the observed impacts of the service sector on carbon emission were insignificant across all quantiles in the QR estimates, and the impact was also insignificant in the DOLS outputs. This shows that the service sector is not a major driver of carbon emission levels among the countries as the carbon footprint of the manufacturing sector is the only significant aspect of the share of sectoral composition in the economy.

For income levels and natural resources rent, unlike the impacts of fossil energy consumption that were positive and consistent across all the conditional distribution of carbon emission levels, the impacts of income levels and natural resources rent mixed, and they exhibit significant differences across the quantiles. Insightfully, income levels have strong positive impacts on carbon emission levels, but these impacts are only significant between the lower and mid quantiles (from \(\tau\) = 0.10 to \(\tau\) = 0.40). Likewise, the negative impacts of the income square were only significant at the lower and mid quantiles. This shows that the validity of the EKC hypothesis exhibits significant quantile effects. The implication is that the cushioning impacts of income growth as postulated by the EKC in the case of the selected fossil energy resource-abundant African economies depend largely on the conditional distribution of expansion in income level. Although the validity of the EKC has been upheld for some resource-dependent countries in different empirical studies (Tenaw and Beyene 2021), however, the hypothesis is only observed to be valid at lower and mid quantiles in the present study. The current finding is not in isolation, as it partly supports the conclusion from the study of Sadik-Zada and Loewenstein (2020) and Onifade et al. (2021b) that the EKC conjecture does not hold among fossil abundant countries. Hence it is concluded that income growth will cushion emission levels at lower levels of carbon distribution, but the cushioning impact fizzles away at a higher level thereafter. On the other hand, although natural resources rent has positive impacts on carbon emission levels across all quantiles, however, these impacts were completely insignificant at the lower quantile. Overall, the significance of impacts of resources rents can be said to be weak (only at 10%) in the mid quantile, and they were also marred with inconsistency at the upper quantiles. Hence, in terms of consistency, the impacts of the income levels were more significant and reliable compared to those of natural resources rent. Besides, the DOLS estimate also shows that resource rents themselves are an insignificant driver of carbon emission level, unlike the income aspect where expansion in income levels significantly exacerbates pollution. Thus, findings differed from studies where resources rent significantly increase pollution levels (Hussain et al. 2020; Baloch et al. 2019). This finding is also understandable considering the resource-abundant setting of the panel causality in Table 5, where causality runs from fossil energy consumption and resource rent to real income while income in turn granger causes CO2 emission. The obtained causality flow from energy consumption to the sectoral compositions thus supports the evidence on the link between an increase in energy consumption and rise in sectoral economic growth in the literature like the agricultural sector performance in Pakistan (Khan et al. 2021; Koondhar et al. 2021).

Conclusions

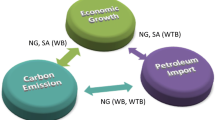

The QR approach was combined with the DOLS technique to explore the impacts of energy components and sectoral composition of the economy on the conditional distribution of environmental degradation as proxied by carbon emission levels among selected fossil energy resource-abundant African economies, including Algeria, Nigeria, Egypt, and Angola between 1995 and 2016. The empirical analysis shows that fossil energy consumption, manufacturing sector, and income levels significantly induce environmental pollution through carbon emission levels among the countries. In addition, the EKC hypothesis was not convincingly validated, but the empirical findings show that the validity of the hypothesis demonstrates a significant quantile effect among the selected African economies. Furthermore, the causality evidence reveals a strong two-way causality between fossil energy consumption and carbon emission levels which further corroborates the strong positive impact of fossil energy consumption on environmental pollution levels among the countries as seen in the long-run estimates. Also, causality runs from fossil energy consumption to income. Rents granger causes real income levels but not the other way round while real income growth in turn granger causes pollution level. Besides, when considering sectoral performances, the real income only granger causes the service sector but has no causality nexus with the manufacturing sector. This is a reflection of the mono-economy structure of dependence on trade and services in the oil and gas industry among the countries, and this may constitute challenges to the actualization of sustainable economic growth in the long term due to the effects of shocks that often create fluctuations and instability in the international oil market.

Policy recommendations

It is recommended that the authorities of the selected countries should put policies measures in place for economic diversification away from resources dependence. Rent from natural resources should be channeled toward developing a strong, vibrant, and greener manufacturing sector to ensure sustainable income growth in the long run toward actualizing SDGs 1 and 8 that focuses on poverty alleviation and wealth creation through sustainable growth. A vibrant real sector stands to provide more advantages in terms of employment creation and income generation. The causality evidence shows that income performance is mostly dependent on resources rent among the countries, and there is a one-way causality from real income level to the service sector, but the reverse is the case for the manufacturing sector as the observed causality flow is rather from the manufacturing sector to the income level. Therefore, the manufacturing sector may not have had the expected benefits from the huge resources rent that has accrued to countries in the panel study over the years.

Owing to the environmental damages from fossil energy consumption in terms of rising carbon emission levels among the selected leading oil-producing African countries, it is also recommended that authorities and policymakers come up with workable approaches to ensure energy portfolio diversification plans. Rather than having fossil energy accounting for over 90% of total energy consumption, as is the case for some of the countries, attention has to be paid to the huge environmental benefits that come with renewable energy resources. Fortuitously, the potential for renewable energy resources is estimated to be very high among many African countries, including those in the current analysis. For instance, the annual global horizontal irradiation for solar potential is estimated in the range of 2300 to 2752 kWh/sq.km, while the average wind speed at 100-m height ranges from 7.5 up to as high as 14.1 m/s in a vast majority of African countries (United Nation Environment Program, UNEP 2017). Therefore, these countries can harness their vast renewable potentials by tapping into solar and wind sources as sustainable alternatives to fossil fuels in terms of decarbonization.

Finally, the authorities need to embark on more investments in green manufacturing technologies. This would not only assist in cushioning the pollution effects of manufacturing activities from conventional energy sources via the aggravation of carbon emission levels, but such investments would also help to reduce the undue pressure exerted on the environment by facilitating cleaner ways of exploiting and utilizing natural resources. This will, in turn, also help to enhance biocapacity and ecological footprint reduction among the understudied economies. As such, the resource-abundant African economies can be better positioned toward the actualization of SDGs 12 that emphasizes responsible consumption and production, among other crucial environmental and developmental issues.

Limitations of study and direction for future studies

The current study has focused on the case of the selected four leading oil-producing countries using the carbon emission perspective for environmental degradation. Hence, comparative analysis can be carried out as resource discoveries continue in other countries over time. Furthermore, following the foundation laid in the current study, future studies can also be tailored toward the exploration of the impacts of energy dynamics on environmental degradation while disentangling sectoral components within the specific context of ecological performances and biocapacity among resource-abundant African countries.

Data availability

The data for this present study are sourced from the database of the World Development Indicators (WDI 2020). Available at: https://data.worldbank.org.

References

Adedoyin FF, Ozturk I, Agboola MO, Agboola PO, Bekun FV (2021) The implications of renewable and non-renewable energy generating in Sub-Saharan Africa: the role of economic policy uncertainties. Energy Policy 150:112115

Adebayo TS, & Rjoub H (2021) A new perspective into the impact of renewable and nonrenewable energy consumption on environmental degradation in Argentina: a time–frequency analysis. Environ Sci Pollut Res 1–17

Adusah-Karikari A (2015) Black gold in Ghana: changing livelihoods for women in communities affected by oil production. The Extractive Industries and Society 2(1):24–32

African Development Report, AfDB (2007) Africa’s natural resources: the paradox of plenty. Oxford University Press Inc., New York. Available at: https://www.afdb.org

AfDB, OECD, & UNDP (2017) African economic outlook: global value chains and Africa’s industrialization. Abidjan: African Development Bank. http://www.africaneconomicoutlook.org. Accessed 28 Jan 2021.

Alao, A. (2007). Natural resources and conflict in Africa: the tragedy of endowment (Vol. 29). University Rochester Press.

Aliyu AK, Modu B, Tan CW (2018) A review of renewable energy development in Africa: a focus in South Africa, Egypt and Nigeria. Renew Sustain Energy Rev 81:2502–2518

Alola AA, Ozturk I (2021) Mirroring risk to investment within the EKC hypothesis in the United States. J Environ Manag 293:112890

Alola AA, Adebayo S, Onifade ST (2021) Examining the dynamics of ecological footprint in China with spectral Granger causality and quantile-on-quantile approaches. Int J Sust Dev World. https://doi.org/10.1080/13504509.2021.1990158

Anser, M. K., Adeleye, B. N., Tabash, M. I., & Tiwari, A. K. (2021). Services trade–ICT–tourism nexus in selected Asian countries: new evidence from panel data techniques. Current Issues in Tourism, 1–16.

Anyanwu JC, Erhijakpor AE (2014) Does oil wealth affect democracy in Africa? Afr Dev Rev 26(1):15–37. https://doi.org/10.1111/1467-8268.12061

Apergis N, Payne JE (2009) CO2 emissions, energy usage, and output in Central America. Energy Policy 37(8):3282–3286

Apergis N, Ozturk I (2015) Testing environmental Kuznets curve hypothesis in Asian countries. Ecol Ind 52:16–22

Apergis N (2016) Environmental Kuznets curves: new evidence on both panel and country-level CO2 emissions. Energy Economics 54:263–271

Asongu SA, Uduji JI, Okolo-Obasi EN (2020) Fighting African capital flight: trajectories, dynamics, and tendencies. Financial Innovation 6(1):1–21

Ayittey G. (Ed.). (2016) Africa unchained: the blueprint for Africa’s future. Springer.

Baarsch F, Granadillos JR, Hare W, Knaus M, Krapp M, Schaeffer M, Lotze-Campen H (2020) The impact of climate change on incomes and convergence in Africa. World Development 126:104699

Baloch MA, Mahmood N, Zhang JW (2019) Effect of natural resources, renewable energy and economic development on CO2 emissions in BRICS countries. Sci Total Environ 678:632–638

Balsalobre-Lorente D, Driha OM, Leitão NC, Murshed M (2021) The carbon dioxide neutralizing effect of energy innovation on international tourism in EU-5 countries under the prism of the EKC hypothesis. J Environ Manag 298:113513

Bekun FV, Gyamfi BA, Onifade ST, & Agboola MO (2021) Beyond the environmental Kuznets Curve in E7 economies: accounting for the combined impacts of institutional quality and renewables. J Clean Prod 127924

Bibi F, Jamil M (2021) Testing environment Kuznets curve (EKC) hypothesis in different regions. Environ Sci Pollut Res 28(11):13581–13594

British Petroleum BP (2020) Statistical review of world energy June 2020. Available at: http://www.bp.com/statisticalreview

Chudik A, Mohaddes K, Pesaran MH, & Raissi M (2016) Long-run effects in large heterogeneous panel data models with cross-sectionally correlated errors. Emerald Group Publishing Limited

Corden WM (1984) Booming sector and Dutch disease economics: survey and consolidation. Oxf Econ Pap 36(3):359–380. https://doi.org/10.1093/oxfordjournals.oep.a041643

Demissew Beyene S, Kotosz B (2020) Testing the environmental Kuznets curve hypothesis: an empirical study for East African countries. Int J Environ Stud 77(4):636–654

Dogan E, Ozturk I (2017) The influence of renewable and non-renewable energy consumption and real income on CO2 emissions in the USA: evidence from structural break tests. Environ Sci Pollut Res 24(11):10846–10854

Dogan E, Inglesi-Lotz R (2020) The impact of economic structure to the environmental Kuznets curve (EKC) hypothesis: evidence from European countries. Environ Sci Pollut Res 27(11):12717–12724

Dumitrescu E, Hurlin C (2012) Testing for granger non-causality in heterogeneous panels. Econ Model 29(4):1450–1460. https://doi.org/10.1016/j.econmod.2012.02.014

Effiong J (2010) Oil and gas industry in Nigeria: the paradox of the black gold. An international perspective. Emerald Group Publishing Limited, In Environment and social justice

Frankel JA (2010) The natural resource curse: a survey (No. w15836). National Bureau of Economic Research

Fuinhas JA, Marques AC, Koengkan M (2017) Are renewable energy policies upsetting carbon dioxide emissions? The case of Latin America countries. Environ Sci Pollut Res 24(17):15044–15054

El Hédi Arouri M, Youssef AB, M’Henni H, Rault C (2011) Empirical analysis of the EKC hypothesis for sulfur dioxide emissions in selected Middle East and North African countries. The Journal of Energy and Development 37(1/2):207–226

Gokee CD (2016) Assembling the village in medieval Bambuk: an archaeology of interaction at Diouboye, Senegal. Equinox Publishing Limited. Available at: https://www.equinoxpub.com/home/village-life-land-bambuk-iron-age-economy-diouboye-senegal-cameron-d-gokee/

Graham E, Ovadia JS (2019) Oil exploration and production in Sub-Saharan Africa, 1990-present: trends and developments. The Extractive Industries and Society 6(2):593–609

Gritsenko D, Efimova E (2020) Is there Arctic resource curse? Evidence from the Russian Arctic regions. Resources Policy 65:101547

Gyamfi BA, Onifade ST, Nwani C, & Bekun FV (2021) Accounting for the combined impacts of natural resources rent, income level, and energy consumption on environmental quality of G7 economies: a panel quantile regression approach. Environ Sci Pollut Res 1–13

Gyamfi BA, Bekun FV, Balsalobre-Lorente D, Onifade ST, & Ampomah AB (2022) Beyond the environmental Kuznets curve: do combined impacts of air transport and rail transport matter for environmental sustainability amidst energy use in E7 economies?. Environ Dev Sustain 1–19https://doi.org/10.1007/s10668-021-01944-6

Henri PAO (2019) Natural resources curse: a reality in Africa. Resources Policy 63:101406

Herslund LB, Jalayer F, Jean-Baptiste N, Jørgensen G, Kabisch S, Kombe W, ... & Vedeld T (2016) A multi-dimensional assessment of urban vulnerability to climate change in Sub-Saharan Africa. Nat Hazards 82(2):149–172

Hill JNC (2012) Nigeria since independence. Forever fragile. Palgrave Macmillan, London. https://doi.org/10.1057/9781137292049

Hussain J, Khan A, Zhou K (2020) The impact of natural resource depletion on energy use and CO2 emission in belt & road initiative countries: a cross-country analysis. Energy 199:117409

International Energy Agency, IEA. (2019). Africa Energy Outlook 2019 International Energy Agency, Paris (2019) https://www.iea.org/reports/africa-energy-outlook-2019

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. Journal of Econometrics 115(1):53–74

IPCC (2019) Summary for policymakers. In: Shukla PR, Skea J, Calvo Buendia E, Masson-Delmotte V, Pörtner H-O, Roberts DC, Zhai P, Slade R, Connors S, van Diemen R, Ferrat M, Haughey E, Luz S, Neogi S, Pathak M, Petzold J, Portugal Pereira J,Vyas P, Huntley E, Kissick K, Belkacemi M, Malley J (eds) Climate change and land: an IPCC special report on climate change, desertification, land degradation, sustainable land management, food security, and greenhouse gas fluxes in terrestrial ecosystems. http://www.ipcc.ch/

IPCC, 2021 Summary for policymakers. In: Climate Change 2021: The Physical Science Basis. Contribution of Working Group I to the Sixth Assessment Report of the Intergovernmental Panel on Climate Change [Masson-Delmotte, V., P. Zhai, A. Pirani, S. L. Connors, C. Péan, S. Berger, N. Caud, Y. Chen, L. Goldfarb, M. I. Gomis, M. Huang, K. Leitzell, E. Lonnoy, J.B.R. Matthews, T. K. Maycock, T. Waterfield, O. Yelekçi, R. Yu and B. Zhou (eds.)]. Cambridge University Press. In Press.

Jakob M, Hilaire J (2015) Unburnable fossil-fuel reserves. Nature 517(7533):150–151

Khan, Z. A., Koondhar, M. A., Khan, I., Ali, U., & Tianjun, L. (2021). Dynamic linkage between industrialization, energy consumption, carbon emission, and agricultural products export of Pakistan: an ARDL approach. Environ Sci Pollut Res 1–13.

Koenker R (2004) Quantile regression for longitudinal data. J Multivar Anal 91(1):74–89

Koenker R, Bassett G (1978) Quantile regression. Econometrica 46:33–50

Koengkan M (2018) The decline of environmental degradation by renewable energy consumption in the MERCOSUR countries: an approach with ARDL modeling. Environ Syst Decisions 38(3):415–425

Koondhar MA, Udemba EN, Cheng Y, Khan ZA, Koondhar MA, Batool M, Kong R (2021) Asymmetric causality among carbon emission from agriculture, energy consumption, fertilizer, and cereal food production–a nonlinear analysis for Pakistan. Sustainable Energy Technol Assess 45:101099. https://doi.org/10.1016/j.seta.2021.101099

Kuznets S (1955) Economic growth and income inequality. Am Econ Rev 45(1):1–28

Koc S, Bulus GC (2020) Testing validity of the EKC hypothesis in South Korea: role of renewable energy and trade openness. Environ Sci Pollut Res 27(23):29043–29054

Krugman P (1987) The narrow moving band, the Dutch disease, and the competitive consequences of Mrs. Thatcher: notes on trade in the presence of dynamic scale economies. J Dev Econ 27(1–2):41–55. Available at: https://doi.org/10.1016/0304-3878(87)90005-8.

Kula N, Haines A, Fryatt R (2013) Reducing vulnerability to climate change in sub-Saharan Africa: the need for better evidence. PLoS medicine 10(1):e1001374

Kunawotor ME, Bokpin GA, & Barnor C (2020) Drivers of income inequality in Africa: does institutional quality matter? African Development Review

Manzano O, Gutiérrez JD (2019) The subnational resource curse: theory and evidence. The Extractive Industries and Society 6(2):261–266

More, C. (2009). Black Gold: Britain and oil in the twentieth century. Bloomsbury Publishing

Nwaka ID, Nwogu MU, Uma KE, Ike GN (2020) Agricultural production and CO2 emissions from two sources in the ECOWAS region: new insights from quantile regression and decomposition analysis. Sci Total Environ 748:141329

Ologunde IA, Kapingura FM, Sibanda K (2020) Sustainable development and crude oil revenue: a case of selected crude oil-producing African countries. Int J Environ Res Public Health 17(18):6799

Onifade ST, Ay A, Asongu S, Bekun FV (2020) Revisiting the trade and unemployment nexus: empirical evidence from the Nigerian economy. Journal of Public Affairs 20(3):e2053

Onifade ST, Çevik S, Erdoğan S, Asongu S, Bekun FV (2020b) An empirical retrospect of the impacts of government expenditures on economic growth: new evidence from the Nigerian economy. Journal of Economic Structures 9(1):1–13

Onifade ST, Erdoğan S, Alagöz M, Bekun FV (2021a). Renewables as a pathway to environmental sustainability targets in the era of trade liberalization: empirical evidence from Turkey and the Caspian countries. Environ Sci Pollut Res 1–12.

Onifade ST, Alola AA, Erdoğan S, Acet H (2021b) Environmental aspect of energy transition and urbanization in the OPEC member states. Environ Sci Pollut Res 28(14):17158–17169

Onifade ST, Gyamfi BA, Ilham H, Bekun FV (2021c) Re-examining the roles of economic globalization on environmental degradation in the E7 economies: are human capital, urbanization, and total natural resources essential components? Resour Policy. https://doi.org/10.1016/j.resourpol.2021.102435

Ozturk I, Al-Mulali U, Saboori B (2016) Investigating the environmental Kuznets curve hypothesis: the role of tourism and ecological footprint. Environ Sci Pollut Res 23(2):1916–1928

Pata UK, Aydin M (2020) Testing the EKC hypothesis for the top six hydropower energy-consuming countries: evidence from Fourier Bootstrap ARDL procedure. J Clean Prod 264:121699

Pesaran MH (2007) A simple panel unit root test in the presence of cross section dependence. J Appl Economet 22(2):265–312

Pesaran MH (2015) Testing weak cross-sectional dependence in large panels. Econom Rev 34(6–10):1089–1117

Price WR, Ronck CL (2018) Gushing about black gold: oil and natural gas tourism in Texas. J Herit Tour 13(5):440–454

Powell D (2016) Quantile regression with nonadditive fixed effects. Quantile Treat Effects 1–28

Sadik-Zada ER, Loewenstein W (2020) Drivers of CO2-emissions in fossil fuel abundant settings:(pooled) mean group and nonparametric panel analyses. Energies 13(15):3956

Sarkodie SA (2018) The invisible hand and EKC hypothesis: what are the drivers of environmental degradation and pollution in Africa? Environ Sci Pollut Res 25(22):21993–22022

Sarkodie SA, Ozturk I (2020) Investigating the environmental Kuznets curve hypothesis in Kenya: a multivariate analysis. Renew Sustain Energy Rev 117:109481

Sandbakken C (2006) The limits to democracy posed by oil rentier states: The cases of Algeria. Nigeria and Libya Democratisation 13(1):135–152

Shahbaz M, Solarin SA, Sbia R, Bibi S (2015) Does energy intensity contribute to CO2 emissions? A trivariate analysis in selected African countries. Ecol Ind 50:215–224

Shahbaz M, Solarin SA, Ozturk I (2016) Environmental Kuznets curve hypothesis and the role of globalization in selected African countries. Ecol Ind 67:623–636

Shahbaz M, Sharma R, Sinha A, Jiao Z (2021) Analyzing nonlinear impact of economic growth drivers on CO2 emissions: designing an SDG framework for India. Energy Policy 148:111965

Taiwo S, Alagöz M, Erdoğan S (2020) Inflation, oil revenue, and monetary policy mix in an oil-dependent economy: empirical insights from the case of Nigeria. Int J Bus 7(2):96–109

Tenaw D, Beyene AD (2021) Environmental sustainability and economic development in sub-Saharan Africa: a modified EKC hypothesis. Renew Sustain Energy Rev 143:110897

Tyburski M, Egan P, Schneider A (2020) Deep determinants of corruption? A subnational analysis of resource curse dynamics in American states. Polit Res Q 73(1):111–125

Ugochukwu CN, Ertel J (2008) Negative impacts of oil exploration on biodiversity management in the Niger De area of Nigeria. Impact Assessment and Project Appraisal 26(2):139–147

United Nation Environment Program, UNEP (2017). Atlas of Africa energy resources. United Nations Environment Programme. PO Box 30552, Nairobi 00100, Kenya

Vahabi M (2018) The resource curse literature as seen through the appropriability lens: a critical survey. Public Choice 175(3):393–428

Westerlund J (2007) Testing for error correction in panel data. Oxford Bull Econ Stat 69:709–748

World Development Indictors (WDI) (2020) https://data.worldbank.org/. Accessed April 2021

Yates D (2006) The scramble for African oil. South African Journal of International Affairs 13(2):11–31

Zhang Z, Zeng Y, Zheng N, Luo L, Xiao H, Xiao H (2020) Fossil fuel-related emissions were the major source of NH3 pollution in urban cities of northern China in the autumn of 2017. Environ Pollut 256:113428

Acknowledgements

The author’s gratitude is extended to Assoc. Prof Savaş Erdoğan, Prof Dr. Mehmet Alagöz, and Prof Bakı Yılmaz of Selçuk University for the constructive comments/criticism toward improving the current draft of this study. The author’s appreciation is also extended to Dr. Cameron Gokee of Appalachian State University, North Carolina, USA, for the support provided concerning Figure 1.

Author information

Authors and Affiliations

Contributions

The author (Stephen Taiwo Onifade) was responsible for the conceptual construction of the study’s idea and handling of the sections in the study, including data gathering, preliminary analysis, simulation, and interpretation of results.

Corresponding author

Ethics declarations

Ethics approval and consent to participate

NA.

Consent for publication

NA.

Competing interests

The author declares no competing interests.

Additional information

Responsible Editor: Eyup Dogan

Publisher's note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Appendix

Appendix

Figure 3

Rights and permissions

About this article

Cite this article

Onifade, S.T. Retrospecting on resource abundance in leading oil-producing African countries: how valid is the environmental Kuznets curve (EKC) hypothesis in a sectoral composition framework?. Environ Sci Pollut Res 29, 52761–52774 (2022). https://doi.org/10.1007/s11356-022-19575-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-022-19575-3

Keywords

- CO2 emissions

- Service and manufacturing sectors

- Resource abundance

- Environmental Kuznets curve

- Sustainable development goals

- Africa