Abstract

In recent years, the miracle of China achieving a balance between environmental governance and high economic growth has attracted the attention of many scholars, especially at the production level in various industries. To search for production activities with sustainable development potential and explore their characteristics. This study uses the panel data of 31 provinces in China from 2011 to 2020 to establish a unified analysis framework based on the division criteria of three industries. It takes the three industries' total factor productivity (TFP) as the entry point to study the impact of environmental regulation (ER) on economic growth and its potential mechanisms at the production level. The results show that ER will force the secondary industry to improve TFP but also negatively affect the TFP of the primary and tertiary industries. In addition, ER indirectly affects TFP in the three industries by affecting public environmental concerns and foreign direct investment. This results from the comprehensive effect of production cost effects, compensation effects of innovation, and compensation effects of optimizing resource allocation caused by ER. Moreover, the positive impact of ER on the TFP of the secondary industry is nonlinear. The higher the level of digital economy development, the more significant the positive impact. More importantly, there are regional differences in the impact of ER on the TFP of the primary and secondary industries. This article considers both static and dynamic panels and the results of the two models show consistency.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Since the Industrial Revolution, although significant breakthroughs have been made in the development of human society, the deterioration of the Earth's ecological environment has also reached an unprecedented level. This is mainly reflected in two aspects: firstly, global climate change mainly caused by increased fossil fuel consumption (Anshasy et al., 2014; Khan et al., 2021; Rahman et al., 2022; Sarsa et al., 2021), and secondly, various damages to the natural environment caused by anthropogenic emissions of pollutants, such as marine (Yang et al., 2022; Alam et al., 2021; Dasgupta et al., 2022; Islam et al., 2022) and soil pollution (Shi et al., 2023; Zheng et al., 2023). According to IPCC predictions, the global average temperature is at least 1.5 ℃ higher than the pre-industrial benchmark (Allen et al., 2018). In order to achieve sustainable development of human society, it is necessary to strengthen environmental regulation (ER) to protect the environment. However, with the strengthening of ER, certain production activities will inevitably be negatively affected in the short term (Xie et al., 2023; Liu et al.,2022; Sheng et al., 2022; Qiang et al., 2021). Therefore, it is often necessary to balance environmental protection with economic development. So, are there any production activities that can still promote economic development under high-intensity ER? If so, what type of industry does it belong to, and why is it possible? It is necessary to find these productive activities that have the potential to achieve sustainable development of the economy.

In recent years, countries worldwide have continuously strengthened ER (Li et al., 2022; Perino et al., 2012; Morgan et al., 2023; Depren et al., 2022). The most significant milestones were the 1992 United Nations Framework Convention on Climate Change, the 1997 Kyoto Protocol, and the 2015 Paris Agreement. China has also taken on the burden of reducing pollution and carbon as a world power. In September 2013, China first launched the "Air Pollution Prevention and Control Action Plan" with the "Ten Measures for the Atmosphere", which set a target of reducing the concentration of inhalable particulate matter by 10%. Subsequently, in 2018, the "Three Year Action Plan for Winning the Blue Sky Defense War" and the "Implementation Regulations on Environmental Protection Tax Law" were released to implement environmental protection goals further and improve the environmental regulatory system. However, surprisingly, China has supported an annual economic growth rate of 6.5% with an average annual energy consumption growth rate of 3% over the past decade, and its energy intensity has decreased by 26.2% (See Fig. 1), making it one of the countries with the fastest reduction in energy intensity in the world. This has also led many scholars to study why China can achieve rapid economic development while maintaining high-intensity ER. It includes many aspects, such as the relationship between China's energy consumption and economic growth (Zhang et al., 2011), the impact of coal use on carbon dioxide emissions and economic growth (Kartal et al., 2023), the relationship between China's ER and economic growth (Lu et al., 2022; Ma et al., 2022), the impact of economic growth and energy consumption on environmental degradation in China (Nurgazina et al., 2022), the determinants of China's carrying capacity (Pata et al., 2021), the impact of reducing fossil energy intensity on China's ecological efficiency (Pata et al., 2021), the impact factors of China's carbon emissions (Liu et al., 2022), testing the effectiveness of the Environmental Kuznets Curve (EKC) hypothesis for China (Yılancı et al., 2020), and so on. and further focus on the production level (Ju et al., 2022; Zhang et al., 2018; Li & Tao, 2020; Yuan et al., 2017; Huang et al., 2022).

There is no doubt that studying China's past can be beneficial in identifying productive activities with the potential for sustainable development. However, as far as the existing studies about production-level are concerned, the vast majority of them focus only on a single or a small number of specific industries. Even so far, there are still some industries that have not been studied. Given this, this study provides an idea to provide a unified comparative framework through the division of the three industries (2003) and use the total factor productivity (TFP) of the three industries as an entry point to explore in depth at the production level why China has been able to reconcile environmental protection with rapid economic development, and which industries contribute to this. Therefore, this study aims to search for production activities with the potential for sustainable development through a complete research framework and to analyze why they can achieve development under high-intensity ER and what other characteristics exist.

To sum up, this study uses the data of 31 provinces in the Chinese Mainland from 2011 to 2020, considering both static and dynamic panels, and using two-way fixed effects and system GMM and other models, analyzing the relationship between ER and TFP of the three industries to find production activities with the potential of sustainable development. Furthermore, based on existing literature, analyze the pathways and other characteristics of ER affecting the TFP of the three industries. Therefore, the potential contributions of this paper are: (1) Based on a complete analytical framework, the differences in the impact of ER on the three industries are analyzed, which facilitates the search for production activities with the potential of sustainable development. (2) Based on the connotation of generalized cost in the new institutional economics, the interaction between the production cost effect (PCE), compensation effect of innovation (CEI) and compensation effect of optimizing resource allocation (CEORA) caused by ER is considered, and the mechanism of ER on the TFP of three industries is clarified further. (3) The nonlinear effects of ER on TFP in three industries under the empowering effect of the DE are analyzed. (4) The differences in the effects of ER on the TFP of the three industries in different geographical locations are analyzed, which provides a reference for local governments to formulate policies further. In addition, the novelty of this study is that (1) compared with previous fragmented studies at the production level, all industries are included in the research framework based on the division of the three industries (2) Based on the impact of ER on PEA, a generalized production cost analysis method is provided.

The remainder of this paper is organized as follows. The second part is the literature review; the third part is the study design; the fourth part is the analysis of results, which includes benchmark analysis, mechanism analysis, threshold analysis and heterogeneity analysis; the fifth part is the discussion. The sixth part is the conclusion and recommendation.

2 Literature review and research objectives

The concept of ER was first introduced by Dasgupta (1980), who argued that ER is simply a push–pull effect of government policies (i.e., policies or coercive instruments developed by the government to balance economic development and ecological environment to reduce external diseconomies caused by pollutant emissions). Subsequently, Michael Porter (1990) found that the countries with the most competitive products in the world (Germany, Switzerland, Japan, and the United States) have not only good product quality but also rank high in environmental quality. As a result, Michael Porter came up with the famous "Porter Hypothesis" (1995), which suggests that appropriate ER can lead to more innovative activities. These innovative activities would increase firms' productivity, thus offsetting environmental protection costs and further increasing their profitability in the market (i.e., CEI). In the same year, Panayotou (1993) drew inspiration from the inverted U-shaped curve between per capita income and income inequality defined by Kuznets and proposed the Environmental Kuznets Curve Hypothesis (EKC). EKC indicates an inverted U-shaped relationship between environmental quality and economic development, which pioneered research on coordinating environmental protection and economic development. Subsequently, academic research on ER continued to deepen based on CEI in the Porter hypothesis. Shenggang Ren et al. (2018) combined their previous theoretical studies to classify ER into three categories: mandatory ER, market-based ER, and voluntary ER. In the same period, Peng Wenbin et al. (2017) classified ER into formal and informal ER based on the thinking of new institutional economics. It is precisely based on these studies that the continuous exploration of the connotation of ER enables many scholars to analyze the impact of ER on various production activities. As the research object of this study is China, Table 1 summarizes the relevant research on China.

Previous research has focused chiefly on agriculture and industry and has rarely involved the tertiary industry. From the current situation, the impact of ER on green TFP in agriculture and industry is inverted U-shaped, which means that these two industries may have significant sustainable development potential. However, it is undeniable that most of the existing research is insufficient, and even some industries have not been studied. In order to find more production activities with sustainable development potential, it is necessary to locate their industry categories through a large analytical framework initially. This helps to reveal the impact of ER on various production activities on a larger scale, thus providing an essential basis for the government to formulate appropriate policies. Therefore, this study is expected to contribute to coordinating environmental protection and economic development.

3 Research design

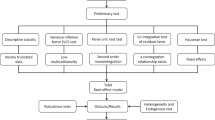

This study investigates the differences in the effects of ER on TFP in three industries by estimating a static panel and a dynamic panel separately through a two-way fixed effects model and a systematic GMM model. This helps to search for production activities with sustainable development potential directly. Then, based on the existing literature and empirical results, analyze how ER indirectly affects TFP in the three industries by influencing public environmental attention (PEA) and foreign direct investment (FDI). In addition, based on the effects of DE development on PEA and FDI, a threshold model is developed to analyze the potential nonlinear effects of ER on the TFP of the three industries under different levels of DE. Finally, the differences in the effects of ER on the TFP of the three industries in different geographical locations are further analyzed.

3.1 Variable selection

3.1.1 Explained variable

The interpreted variable in this study is the TFP of the three industries, measured by the super-efficient SBM-DEA model (Tone, 1997). This model solves the problem of slackness of decision units, avoids the bias caused by direction and angle problems, and can compare the efficiency differences between frontier surfaces in more detail so that the efficiency value can be greater than one, which is more conducive to the subsequent analysis. The input variables selected in this paper use the number of employees and the fixed capital stock of each industry, and the output variables use the gross product of each industry. The fixed capital stock of each industry is calculated using the perpetual inventory method by combining the methods of Xu Xianxiang (2007), Zong Zhenli (2014), and Shan Haojie (2008). Equation (1) shows the super-efficient SBM-DEA model.

where \(\theta^{*}\) is the optimal solution of the model (i.e., the efficiency value); \(i\) represents the input variables; \(r\) represents the output variables; \(t\) represents the year; \(s_{i}^{ - }\) is the slack variables for the inputs; \(s_{r}^{ + }\) is the slack variables for the outputs; \(s.t.\) represents the constraints; \(x_{io}^{t}\) represents the input variables for the \(o\) th decision unit (here, the province) in year \(t\); \(y_{ro}^{t}\) represents the output variables for the \(o\) th decision unit in year \(t\); \(\lambda_{j}^{t}\) is the target parameter to be solved for; and \(\sum {\lambda_{j}^{t} = 1}\) represents the scale variable payoff. The variables required for the calculations and their meanings are shown in Fig. 2. Appendices 1, 2, and 3 provide the TFP trends of three industries in various provinces of China from 2011 to 2020.

3.1.2 Explanatory variable

The explanatory variable in this study is the intensity of ER, which refers to the strength of the government in combating various types of environmental pollution. Most existing literature uses variables such as environmental governance investment and pollution emissions (Guo et al., 2022; Wang et al., 2023) to measure the level of ER. This can to some extent reflect the intensity of ER, but the connotation of ER should not be limited to a specific part. In addition, taking the investment in environmental governance as an example, it depends more on the local economic development level. Thus endogeneity issues will inevitably arise when making econometric estimates.

To avoid the above issues, this study draws on the approach of scholars such as Chen Shiyi (2018) and takes the work reports of provincial and municipal governments as the starting point. Through Python, crawls the vocabulary related to ER and calculates their proportion to reflect the intensity of ER. Because the government work report is an important manifestation of the goals and results of governing society, it can reflect the government's focus and achievements in a certain period in an all-around way. In order to more comprehensively reflect the connotation of ER in this variable, 48 relevant terms have been determined after careful consideration, as shown in Table 2.

To verify the rationality of the variables, the changes in word frequency kernel density between 2012 and 2014 were plotted, as shown in Fig. 3. As shown in the figure, the frequency of words has been increasing yearly, which is highly consistent with China's increasingly strict ER during this period. Therefore, choosing this variable to measure ER is reasonable.

3.1.3 Mechanism variable

The mechanism variables selected in this study are PEA and FDI, measured by the Baidu Index and the proportion of FDI to GDP, respectively. Today, the internet can reflect public attention to various fields. Therefore, the data of search engines can comprehensively reflect the PEA. This study draws inspiration from the approach of Wu Libo et al. (2022), using "environmental pollution" as a search term to collect daily average data and sum it up to obtain annual index data.

3.1.4 Threshold variable

The threshold variable selected in this article is DE. Referring to the approach of Chuanyu Zhao et al. (2023), the development level of DE is measured using the level of internet development and the degree of financial inclusion. The specific indicators are shown in Table 3. Then, the principal component analysis method is used to condense all variables into one variable to represent the level of DE. The inspection results of the principal component analysis method are shown in Table 4.

As shown in Table 4, the KMO value > 0.6, and Bartlett's test rejects the original hypothesis, indicating a correlation between the indicators and is suitable for principal component analysis.

3.1.5 Control variable

By referring to existing literature and combining actual situations, the following control variables were ultimately selected in this study:

-

1.

Advanced level of human capital: Advanced level of human capital refers to the continuous improvement of a person's comprehensive literacy level. This study uses the ratio of the number of people in higher education to the total number of people to measure. There are many advantages to improving people's comprehensive literacy, such as innovation (Fonseca et al., 2019; Hu, 2021; Ma et al., 2019; Mariz-Pérez et al., 2012) and environmental protection (Pata et al., 2023). Generally speaking, having higher comprehensive qualities can enable them to master new skills faster and apply them to the production activities of various industries, thereby effectively improving the TFP of each industry.

-

2.

Level of factor market development: Factor market, i.e., the market of production factors, is one of the main conditions for playing a role in allocating market resources. On the one hand, the better developed the factor market is, the better it is for the industries to procure factors in their production activities and thus effectively maintain the production patterns of each enterprise and avoid losing unnecessary additional adjustment costs (Qiao et al., 2021). Eventually, the TFP of each industry is indirectly improved. This study uses the factor market development score from the China Marketization Index database to measure each province's factor market development level.

-

3.

Level of investment in fixed assets: Investment in fixed assets is the cost of building the items necessary for productive activities. More and better investment in fixed assets improves the production environment of each industry, which in turn increases the TFP of each industry (Liu et al., 2010). This study uses the ratio of fixed asset investment in each industry to GDP to measure each industry's fixed asset investment level.

-

4.

Financial efficiency: Financial efficiency is the efficiency with which funds are transferred from the redundant to the demander of funds. Improving financial efficiency can effectively reduce the cash flow pressure of business operations, which can maintain the survival of enterprises, provide security for their production activities, and ultimately improve the TFP of industries (Liu et al., 2021). This study selects the ratio of bank loans to deposits in each province to measure financial efficiency. The larger the value of this variable, the more efficient the bank's working capital is.

-

5.

Level of technological progress: The impact of technological progress on TFP is self-evident (Si & Wang, 2011). However, technological progress is often difficult to measure, and previous studies usually use R&D inputs to measure technological progress. However, the level of progress from the input perspective to represent the output is more or less inconsistent with reality. Therefore, this paper uses the number of granted invention patents to measure the level of technological progress in each province in the current period. The granted patents indicate that the technology has tended to be complete, while the invention patents are more representative of improving technology levels and technological breakthroughs.

3.2 Research methodology

3.2.1 Baseline regression model

To explore the impact of ER on TFP in three industries, this study uses static and dynamic panels for analysis. On the one hand, production patterns are difficult to change in a short period, and there is path dependence or pattern inertia, such as the adjustment of capital stock. Therefore, the production efficiency of each industry will be influenced by the past in a certain period in the future; on the other hand, certain factors have not only a current impact on production efficiency but also may have a lagged impact. For example, new technologies often play a minor role in the initial input stage. They have to go through a certain period of application improvement before significantly improving each industry's production efficiency. Therefore, it is necessary to consider the dynamic relationship between variables to simulate the actual situation for modeling better. To this end, the following static and dynamic panel models (i.e., using two-way fixed effects estimation and system GMM estimation models (Blundell et al., 1998)) are constructed as shown in Eqs. (2) and (3), respectively.

Further considering the lag effect of new technologies on the dynamic model (controlling the fluctuations caused by technological progress variables lagging for one and two periods), Eq. (3) is converted to Eq. (4).

where \(i\) denotes the time label; \(j\) denotes the province label; \(c\) is the industry label, with values of 1, 2 and 3 corresponding to the primary, secondary and tertiary industries, respectively. \(p\) is the control variable label, with different values (1, 2, 3, 4, and 5) representing different control variables. \(Tfp_{ijc}\) denotes the industry TFP; \(Tfp_{ijc}^{t - 1}\) denotes the industry TFP with one lag; \(Control_{ijp}\) denotes the set of control variables; \(Tp_{ij}^{t - 1}\) and \(Tp_{ij}^{t - 2}\) denote the lagged one-period and \(\beta_{1}\), \(\beta_{2}\), \(\beta_{3}\), \(\beta_{4}\), and \(\beta_{5}\) are all coefficients to be estimated; \(\beta^{\prime}_{p}\) denotes the set of coefficients to be estimated for each control variable; \(\mu_{i}\) and \(\lambda_{j}\) denote time and province fixed effects, respectively; and \(\varepsilon_{ij}\) denotes the random disturbance term.

3.2.2 Threshold model

In order to explore the differences in the impact of ER on the TFP of three industries under different levels of DE, a threshold regression model (Seo et al., 2016) was established, taking into account both static and dynamic panels respectively. The estimation models for the three thresholds are shown in Eqs. (5) and (6). In this section, determine whether there is a threshold based on the threshold test results, then perform threshold regression.

where \(\beta^{\prime\prime}_{1}\), \(\beta^{\prime\prime}_{2}\), \(\beta^{\prime\prime}_{3}\) and \(\beta^{\prime\prime}_{4}\) denote the estimated coefficients of the threshold variables at different regions; \(\gamma_{1}\), \(\gamma_{2}\) and \(\gamma_{3}\) denote different threshold values; \({\text{Dlde}}_{ij}\) denotes the level of digital economic development; and the rest of the symbols are the same as in Eq. (4).

3.3 Sample and data

In this paper, 31 provinces in mainland China from 2011 to 2020 are selected as the research sample, the data used are obtained from various Chinese statistical yearbooks, and a few are obtained through China WIND, EPS and other databases. For the data on fixed asset capital stock, the data on fixed asset investment by industry from 2010 to 2016 are obtained from the China Statistical Yearbook of Fixed Asset Investment 2011–2017. The data for 2013 are missing and found in the China Statistical Yearbook 2014. The data on fixed asset investment by industry in 2017 were obtained from the China Statistical Yearbook 2018. The data on fixed asset investment for 2018–2020 are missing, so the investment data are calculated using the "growth of fixed asset investment by industry by region over the previous year" in the China Statistical Yearbook. The 2021 Statistical Yearbook no longer provides the price index for fixed asset investment, so the consumer price index (CPI) is used instead. The word frequency of ER is obtained from each province and city's local government work reports by summing the total number of words in each province and calculating the percentage. The factor market development scores are obtained from the China Marketization Index database, and the financial inclusion index is obtained from the Digital Finance Center of Peking University. In addition, some missing data are filled by linear interpolation. More importantly, the Jarque Bera statistics of many variables in this study are large, which means that the original hypothesis of the normal distribution is rejected. Therefore, this study takes logarithm or co-multiplication for non-ratio variables, which is significant for stabilizing variance and eliminating nonlinear function forms, thus improving Goodness of fit. The definitions and descriptive statistics for each variable are shown in Table 5.

4 Analysis of result

4.1 Baseline regression analysis

The results of the static panel model (i.e., the model estimated using two-way fixed effects) are presented in Table 6, where items (1), (3), and (5) represent the estimated results of the impact of ER on TFP in the three industries when no fixed effects are added, respectively, and items (2), (4), and (6) represent the estimated results of the impact of ER on TFP in the three industries when fixed effects are added, respectively.

From Table 6, without controlling variables, ER significantly affects TFP in both primary and tertiary industries, except for the secondary industry. After adding the control variables, the coefficients of ER on TFP in the primary industry are significant at the 1% level and −0.05; on TFP in the secondary industry, are significant at the 5% level and 0.016; and on TFP in the tertiary industry are significant at the 1% level and −0.019. This indicates that ER can promote TFP in the secondary sector but also inhibits TFP in the primary and tertiary sectors. In addition, ER has a more significant inhibitory effect on the primary industry than on the tertiary industry. This is different from the subconscious result, which tends to assume that ER has some negative impact on the TFP of the secondary sector, so we consider the dynamic panel scenario immediately afterward.

The results of the dynamic panel model (i.e., the model estimated using the system GMM) are shown in Table 7. This study estimates the \(t\)- statistic instead of the \(z\)-statistic. The \(F\)-test is used instead of the Wald-cardinal test for the overall model fit, which improves the estimation accuracy when the sample is small. Among them, items (1), (4), and (7) represent the estimated results of the impact of ER on the TFP of each industry without adding control variables, respectively; items (2), (5), and (8) represent the estimated results of ER on the TFP of each industry when controlling variables are added, respectively; items (3), (6), and (9) represent the estimated results of the impact of ER on the TFP of each industry after incorporating control variables and the lagging impact of technological progress, respectively. L. and L.2 represent variables with one and two lag periods, respectively.

From Table 7, the second-order autocorrelation test (i.e., AR(2)-test-p) of the difference of the disturbance terms of each model has a p value greater than 0.1, indicating that each model does not reject the original hypothesis of "no second-order autocorrelation of the difference of the disturbance terms," so each model satisfies the autocorrelation test of the disturbance terms of the system GMM model, i.e., the disturbance terms are not autocorrelated. In the over-identification test for instrumental variables (i.e., Hansen-test-p), the p values of all models are more significant than 0.1, indicating that the original hypothesis of "all instrumental variables are valid" is not rejected. Furthermore, the p values are less than 0.25, indicating that all models are not invalidated due to the excessive selection of instrumental variables. So the probability of all models being effective is at least 90%.

More importantly, the first-order lag term of the dependent variable is significant, at least at the 1% level, indicating that considering the inertia of production activities is reasonable. In addition, the estimated coefficients of the bidirectional fixed effects model are generally underestimated, while the absolute value of the estimated coefficients of the system GMM model is significantly greater than that of the bidirectional fixed effects model. Therefore, the rationality of the model was indirectly verified.

Most importantly, the estimation results of dynamic and static panels are consistent. Specifically, all the core explanatory variables are significant, at least at the 5% level, indicating that ER has some impact on TFP in all three industries. Among them, ER positively impacts the TFP of the secondary industry in all models; In contrast, ER negatively impacts the TFP of both the primary and tertiary industries. Furthermore, ER has a more significant negative impact on the primary industry than on the tertiary industry.

4.2 Mechanism analysis

This section analyzes the impact paths of ER on the TFP of the three industries from two aspects: PEA and FDI.

Specifically, this study first demonstrates the impact of ER on PEA and FDI through empirical analysis in the first stage and then uses theoretical analysis in the second stage to demonstrate how PEA and FDI further affect TFP in the three industries in the context of the actual situation. The empirical results of the mechanism analysis are presented in Table 8. The model is consistent with the baseline regression, except that the explained variables are replaced with PEA and FDI. Items (1) and (2) represent the static panel estimation results of ER on PEA; items (3), (4), and (5) represent the dynamic panel estimation results of ER on PEA. Besides, items (6) and (7) represent the static panel estimation results of the FDI by ER; items (8), (9), and 10) represent the dynamic panel estimation results of the FDI by ER.

From Table 8, in the first stage, all models passed the autocorrelation tests of the nuisance term and over-identification tests of the system GMM. The estimation results show that all models are significantly positive, at least at the 5% level, when PEA is the explained variable, and all models are significantly negative at the 5% level when FDI is the explained variable, except for the static panel model with no control variables. Therefore, the results indicate that ER can increase PEA and reduce FDI in China.

Subsequently, this study will proceed with the second stage of argumentation based on the actual situation. Previous studies have mainly focused on the penalty costs incurred by enterprises in discharging pollutants, making it easy to overlook the negative impact of ER on the primary and tertiary industries. This study is based on the connotation of generalized cost in new institutional economics, incorporating mental cost to comprehensively reveal PCE caused by ER. Firstly, the government's strengthening of ER has increased PEA, which has been proven in the first stage. Therefore, workers will pay more attention to environmental behaviors in production activities (because they will be subject to self-moral constraints or other punishments). Then, these other environmental behaviors will increase the enterprise's cost of production (Because workers consume mental and physical costs in other environmental behaviors). Finally, ER lead to a decrease in the TFP of various industries. However, due to CEI generated by the secondary industry, ER has actually increased the TFP of the secondary industry.

On the other hand, the government has strengthened ER, thus reducing FDI, as demonstrated in the first phase. This is because intense ER has reduced the profitability of pollution-intensive firms that rely on external diseconomies, reducing FDI quickly. However, due to transfer costs, these reduced investments will continue to remain in China. Finally, these stray investments will be placed in under-resourced areas to create more value. So, in addition to PCE, high-strength ER also generates CEORA, which is conducive to improving the TFP of various industries.

Based on the above analysis, this study believes that the results presented by benchmark regression are a comprehensive effect of PCE, CEI, and CEORA. Due to the need for more time to fully generate CEORA, there was only CEI generated by the secondary industry during this period. Therefore, the total compensation effect cannot compensate for PCE for the primary and tertiary industries, making ER's impact on the primary and tertiary industries negative during this period. In contrast, the compensation effect generated by the secondary industry is greater than PCE, making ER' impact on the secondary industry positive during this period.

4.3 Threshold analysis

After analyzing the impact mechanism, this study further considers the potential nonlinear impact of ER on the TFP of various industries. Since the DE can remove information barriers and thus influence PEA and FDI, it is necessary to investigate further whether ER has a nonlinear effect on TFP in the three industries at different levels of DE.

In this section, this study first verifies the impact of DE on PEA and FDI through the model of benchmark regression. Then it uses threshold regression to analyze whether ER has a nonlinear impact on the TFP of the three industries. The estimated results of the impact of DE on the mechanism variables are shown in Table 9. Among them, Items (1), (2), (3), and (4) represent the estimated results of the impact of DE on PEA; Items (5), (6), (7), and (8) represent the estimated results of DE on FDI.

From Table 9, it can be seen that the GMM model of the system has passed the autocorrelation test and over-identification test of the disturbance term. More importantly, the estimated results of all models are significantly positive at the level of at least 5%, indicating that developing DE can increase PEA and FDI. Therefore, considering the impact of DE on mechanism variables, this study continues to analyze the nonlinear impact of ER on the TFP of the three industries. Specifically, we first identify whether there is a threshold when DE is used as a threshold variable and then conduct a threshold regression to analyze the nonlinear effects of ER on TFP in three industries. The recognition results of the threshold are shown in Table 10.

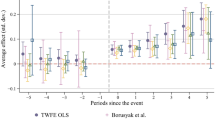

From Table 10, it can be seen that when DE is used as a threshold variable, the impact of ER on the TFP of the primary industry does not have a threshold. In addition, since there is no threshold for the impact of ER on the TFP of the tertiary industry in the dynamic panel, it can be considered that ER has no non-linear impact on the TFP of the primary and tertiary industries. In contrast, the impact of ER on the TFP of the secondary industry has two thresholds at the 10% level. Appendices 4, 5, 6, and 7 provide visualizations of thresholds. Specifically, there are two thresholds when DE is approximately 1 and 2.4. Therefore, the non-linear effects of ER on the TFP of the secondary industry under different levels of DE are analyzed next, and the results are presented in Table 11. Among them, items (1) and (2) represent the estimated results of the static panel, while items (3), (4), and (5) represent the estimated results of the dynamic panel.

From Table 11, it can be seen that when only considering significant estimation results, regardless of whether the control variable is controlled or not, the estimation results of the static panel model before and after each threshold are significantly positive at the level of at least 5%, and the estimation coefficient continuously increases with the appearance of the threshold. Specifically, (1) the estimated coefficient of the item changes from the initial 0.155 to 0.520, and (2) the estimated coefficient of the item changes from the initial 0.122 to 0.247 and then to 0.550. In addition, the estimation results of the dynamic panel model also exhibit the same trend as the static panel. Therefore, developing DE can significantly amplify the positive impact of ER on the TFP of the secondary industry. At the same time, this indirectly confirms the correctness of previous scholars' findings that developing DE can promote economic development (Guo et al., 2023; Myovella et al., 2020). Because developing DE can amplify CEI generated by the secondary industry, thereby ensuring economic development.

4.4 Impact heterogeneity analysis

In addition to human factors, natural factors such as geographical location often potentially impact the development of different regions. Therefore, it is necessary to explore the heterogeneity of the effects of ER on the TFP of the three industries in different regions. The results of the heterogeneity analysis are shown in Table 12. Considering that the sample size of the heterogeneity analysis is too small and the number of provinces size is too close to the length of the time series (i.e., N≈T), it is not appropriate to use either the system GMM or the bias-corrected LSDV method to estimate the dynamic panel at this time, so only the two-way fixed effects model is used in this section to analyze the static panel.

Table 12 shows that the estimated TFP of the primary industry in the eastern region by ER is significantly −0.310 at the 10% level, while the estimated TFP of the primary industry in the central region by ER is significantly 0.382 at the 5% level. However, the estimated TFP of the primary industry in the western region by ER is insignificant. This indicates that ER has a negative impact on the TFP of the primary industry in the eastern region but a positive impact on the TFP of the primary industry in the central region. In addition, the estimated results of ER on the TFP of the secondary industry in all geographical locations are significantly positive at the level of at least 5%, and the magnitude of the estimation coefficient indicates that the western region is greater than the eastern region and ≈ the central region. This indicates that ER can significantly improve the TFP of the secondary industry, and its positive impact on the western region is more significant than that of the central and eastern regions. Finally, the estimated results of ER on the TFP of the tertiary industry in each region are insignificant, which may be related to the small sample size.

5 Discussion

The complete framework of results can be inferred from the above (see Fig. 4). Previous studies have mainly used CEI to explain the shift in the impact of ER on TFP in some industries. This study additionally proposes CEORA and PCE to comprehensively analyze the impact and mechanism of ER on TFP in three industries and further consider the enabling role of DE. It is worth mentioning that this study only uses one stage of empirical analysis in the mechanism analysis section because there are no variables that can reflect the pure value of a single effect (for example, CEORA should have been reflected by investments that cause external diseconomies).

The regression results for this period show a negative impact of ER on FDI, which implies that CEORA is not yet fully formed (only when the impact is U-shaped or positive can it reflect the formation of CEORA since the transfer of investment is a process that decreases and then increases). Whereas strengthening ER will undoubtedly boost PEA, which in turn will generate more PCE. Therefore, CEORA in the primary and tertiary industries cannot compensate for PCE in that period (i.e., the impact of ER on TFP is negative). However, the secondary industry is forced to generate CEI through technological innovation due to urgent survival issues, making the secondary industry's CEI plus CEORA greater than PCE (i.e., ER positively affects TFP). In addition, the development of DE promotes both CEORA, CEI and PCE. From the regression results, the promotion effect of DE on CEORA and CEI is significantly greater than that of PCE. This is because the higher the degree of DE development, the greater the positive impact of ER on TFP in the secondary industry. Although in the short term, ER can only enhance the TFP of the secondary industry. However, in the long run, ER undoubtedly can reduce external diseconomies and thus improve the overall TFP of society (as CEORA will continue to increase to the point where it eventually surpasses PCE). On the other hand, the positive impact of ER on the TFP of the primary industry in the eastern region confirms this trend. This is reflected in the fact that the CEORA caused by ER to the primary industry has gradually started to exceed the PCE. (Figs. 5, 6, 7, 8, 9, 10 and 11)

6 Conclusions and recommendations

This study uses the data of 31 provinces in the Chinese Mainland from 2011 to 2020, considering both static and dynamic panels, and using two-way fixed effects and system GMM and other models, analyzing the relationship between ER and TFP of the three industries to find the production activities with the potential of sustainable development. The results indicate that ER positively impacts the TFP of the secondary industry. However, ER also hurt the TFP of the primary and tertiary industries, and the negative impact on the primary industry is more significant than that on the tertiary industry. What is more, this results from the comprehensive effect of PCE, CEI, and CEORA caused by ER. In addition, the higher the level of development of DE, the more significant the positive impact of ER on the TFP of the secondary industry. Most importantly, the impact of ER on the TFP of the primary and secondary industries exhibits significant regional heterogeneity.

The results of this study provide important insights for policymakers to coordinate environmental protection and economic development. From the research results, there is no doubt that the core reason why China has maintained strong ER over the past decade while still achieving rapid economic development is the improvement of TFP in the secondary industry. Furthermore, this also benefits from the development of DE. Therefore, industries in the secondary industry have tremendous potential for sustainable development, and the government should pay more attention to these industries. Specifically, the government should further strengthen the secondary industry's environmental supervision and law enforcement and improve environmental protection regulations and standards. Of course, green transformation must be gradual. Otherwise, it will directly affect the survival of these enterprises. Secondly, the government should continue encouraging enterprises to produce green products, provide environmental services, and promote green technologies and low-carbon equipment. The most important thing is that the government should provide more subsidies and investment for low-carbon and renewable energy industries, as these industries are the focus of future development.

In addition, over the past decade, ER have hurt the TFP of both the primary and tertiary industries due to the compensation effect being smaller than PCE. In order to reverse this situation, it is necessary to reduce cost effects and accelerate the generation of compensation effects. Specifically, ER increase PEA, resulting in additional production costs (including mental and physical costs) for various industries. Therefore, the government and industry leaders must establish a unified green production model and regulate environmental behaviour. This helps to reduce the uncertainty caused by ER and improve the work efficiency of workers. In terms of CEI caused by ER affecting the transfer of FDI, the government should guide investment through targeted support policies. This is beneficial for reducing information asymmetry during investment and accelerating resource allocation optimisation. More importantly, enterprises should fully use the advantages of DE to eliminate information barriers through Digital transformation. Finally, in response to the regional heterogeneity of the impact of ER on the TFP of the three industries, local governments should formulate policies tailored to local conditions instead of blindly following suit. Because natural conditions such as geographical location can lead to potential differences among different regions, it is advisable to find commonalities and explore development paths that are suitable for the local area.

In summary, this study identified the main driving force behind China's green development over the past decade, which directly contributes to adjusting the focus of production activities in the future to achieve a balance between the environment and the economy. However, this study still has some limitations. Firstly, due to data sample limitations, this study did not analyze the potential U-shaped impact of ER on the TFP of the three industries over a long period. From previous literature, the primary and secondary industries are most likely to have this characteristic. Secondly, this study did not explore the spatial spillover effect of ER on the total factor productivity of the three industries. More importantly, this study mainly focuses on China. Therefore, it is recommended to enrich research in this area in the future.

Data availability

The datasets used and/or analyzed during the current study are available from the corresponding author on reasonable request.

Abbreviations

- TFP:

-

Total factor productivity

- ER:

-

Environmental regulation

- PEA:

-

Public environmental attention

- FDI:

-

Foreign direct investment

- DE:

-

The digital economy

- GDP:

-

Gross domestic product

- PCE:

-

The production cost effect

- CEI:

-

The compensation effect of innovation

- CEORA:

-

The compensation effect of optimizing resource allocation

- GMM:

-

Generalized method of moments

- SBM-DEA:

-

Slack based measure-data envelopment analysis

- LSDV:

-

Least squares dummy variable method

References

Alam, M. W., Xu, X., & Ahamed, R. (2021). Protecting the marine and coastal water from land-based sources of pollution in the northern Bay of Bengal: A legal analysis for implementing a national comprehensive act. Environmental Challenges, 4, 100154. https://doi.org/10.1016/j.envc.2021.100154

Allen, M. R., Coninck, H. D., Dube, O. P., Hoegh‐Guldberg, O., & Jacob, D. J. (2018). Technical Summary. In: Global Warming of 1.5°C. An IPCC Special Report on the impacts of global warming of 1.5°C above pre-industrial levels and related global greenhouse gas emission pathways. Technical Summary. pp. 35–39. https://www.ipcc.ch/site/assets/uploads/sites/2/2019/05/SR15_TS_High_Res.pdf.

Anshasy, E. A. A., & Katsaiti, M. (2014). Energy intensity and the energy mix: What works for the environment? Journal of Environmental Management, 136(1), 85–93. https://doi.org/10.1016/j.jenvman.2014.02.001

Blundell, R., & Bond, S. R. (1998). Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics, 87(1), 115–143. https://doi.org/10.1016/S0304-4076(98)00009-8

Cao, Y., Liu, J., Yu, Y., & Wei, G. (2020). Impact of environmental regulation on green growth in China’s manufacturing industry–based on the Malmquist-Luenberger index and the system GMM model. Environmental Science and Pollution Research, 27, 41928–41945. https://doi.org/10.1007/s11356-020-10046-1

Chen, C., Jiang, D., Lan, M., Li, W., & Ye, L. (2022a). Does environmental regulation affect labor investment Efficiency?Evidence from a quasi-natural experiment in China. International Review of Economics and Finance, 80, 82–95. https://doi.org/10.1016/j.iref.2022.02.018

Chen, S., & Chen, D. (2021). Haze pollution, government governance and high-quality economic development. Economic Research, 53(02), 20–34.

Chen, S., & Yao, S. (2021). Evaluation of forestry ecological efficiency: A spatiotemporal empirical study based on China’s provinces. Forests, 12(2), 142–142. https://doi.org/10.3390/f12020142

Chen, X., He, J., & Qiao, L. (2022b). Does environmental regulation affect the export competitiveness of Chinese firms? Journal of Environmental Management, 317, 115199. https://doi.org/10.1016/j.jenvman.2022.115199

Cheng, Z., & Kong, S. (2022). The effect of environmental regulation on green total-factor productivity in China’s industry. Environmental Impact Assessment Review, 94, 106757. https://doi.org/10.1016/j.eiar.2022.106757

Dasgupta. (1980). Environmental regulation and development. World Bank Working Parper.

Dasgupta, S., Sarraf, M., & Wheeler, D. (2022). Plastic waste cleanup priorities to reduce marine pollution: A spatiotemporal analysis for Accra and Lagos with satellite data. The Science of the Total Environment, 839, 156319. https://doi.org/10.1016/j.scitotenv.2022.156319

Depren, Ö., Kartal, M. T., Ayhan, F., & Kılıç Depren, S. (2022). Heterogeneous impact of environmental taxes on environmental quality: Tax domain based evidence from the Nordic countries by nonparametric quantile approaches. Journal of Environmental Management, 329, 117031. https://doi.org/10.1016/j.jenvman.2022.117031

Eriksson, T., Wang, Y., & Luo, N. (2023). Health impacts of two policies regulating So2 air pollution evidence from China. China Economic Review, 78, 101937. https://doi.org/10.1016/j.chieco.2023.101937

Fonseca, T., Faria, P. D., & Lima, F. (2019). Human capital and innovation: The importance of the optimal organizational task structure. Research Policy, 48(3), 616–627. https://doi.org/10.1016/j.respol.2018.10.010

Guo, B., Wang, Y. M., Zhang, H., Liang, C., Feng, Y., & Hu, F. (2023). Impact of the digital economy on high-quality urban economic development: Evidence from Chinese cities. Economic Modelling, 120, 106194. https://doi.org/10.1016/j.econmod.2023.106194

Guo, Q., Hong, J., Rong, J., Ma, H., Lv, M., & Wu, M. (2022). Impact of environmental regulations on high-quality development of energy: From the perspective of provincial differences. Sustainability, 14(18), 11712. https://doi.org/10.3390/su141811712

Han, Z., Han, C., & Yang, C. (2020). Spatial econometric analysis of environmental total factor productivity of ranimal husbandry and its influencing factors in China during 2001–2017. The Science of the Total Environment, 723, 137726. https://doi.org/10.1016/j.scitotenv.2020.137726

He, Y., & Zheng, H. (2023). How does environmental regulation affect industrial structure upgrading? Evidence from prefecture-level cities in China. Journal of Environmental Management, 331, 117267. https://doi.org/10.1016/j.jenvman.2023.117267

Hu, G. (2021). Is knowledge spillover from human capital investment a catalyst for technological innovation? The curious case of fourth industrial revolution in BRICS economies. Technological Forecasting and Social Change, 162, 120327. https://doi.org/10.1016/j.techfore.2020.120327

Huang, K., & Wang, J. (2022). Research on the impact of environmental regulation on total factor energy effect of logistics industry from the perspective of green development. Mathematical Problems in Engineering, 2022, 3793093. https://doi.org/10.1155/2022/3793093

Islam, M. S., Phoungthong, K., Islam, A. R., Ali, M. M., Ismail, Z., Shahid, S., Kabir, M. H., & Idris, A. M. (2022). Sources and management of marine litter pollution along the Bay of Bengal coast of Bangladesh. Marine Pollution Bulletin, 185, 114362. https://doi.org/10.1016/j.marpolbul.2022.114362

Jelinek, M., & Porter, M. E. (1990). The competitive advantage of nations. Administrative Science Quarterly, 37(3), 507–510. https://doi.org/10.2307/2393460

Ju, F., & Ke, M. (2022). The spatial spillover effects of environmental regulation and regional energy efficiency and their interactions under local government competition in China. Sustainability, 14(14), 8753. https://doi.org/10.3390/su14148753

Kartal, M. T., Kılıç Depren, S., Ali, U., & Nurgazina, Z. (2023). Long-run impact of coal usage decline on CO2 emissions and economic growth: Evidence from disaggregated energy consumption perspective for China and India by dynamic ARDL simulations. Energy and Environment. https://doi.org/10.1177/0958305X231152482

Khan, I., Hou, F., Zakari, A., Irfan, M., & Ahmad, M. (2021). Links among energy intensity, non-linear financial development, and environmental sustainability: New evidence from Asia Pacific economic cooperation countries. Journal of Cleaner Production, 330, 129747. https://doi.org/10.1016/j.jclepro.2021.129747

Li, M., Liu, Y., Huang, Y., Wu, L., & Chen, K. (2022b). Impacts of risk perception and environmental regulation on farmers’ sustainable behaviors of agricultural green production in China. Agriculture, 12(6), 831. https://doi.org/10.3390/agriculture12060831

Li, R., & Sun, T. (2020). Research on impact of different environmental regulation tools on energy efficiency in China. Polish Journal of Environmental Studies, 29(6), 4151–4160. https://doi.org/10.15244/pjoes/120520

Li, X., Du, K., Ouyang, X., & Liu, L. (2022a). Does more stringent environmental regulation induce firms’ innovation? Evidence from the 11th Five-year plan in China. Energy Economics, 112, 106110. https://doi.org/10.1016/j.eneco.2022.106110

Li, Z., Meng, N., & Yao, X. (2017). Sustainability performance for China’s transportation industry under the environmental regulation. Journal of Cleaner Production, 142(2), 688–696. https://doi.org/10.1016/j.jclepro.2016.09.041

Lin, B., & Xie, J. (2023). Does environmental regulation promote industrial structure optimization in China? A perspective of technical and capital barriers. Environmental Impact Assessment Review, 98, 106971. https://doi.org/10.1016/j.eiar.2022.106971

Liu, B., Wu, P., & Liu, Y. (2010). Transportation infrastructure and China ’s total factor productivity growth—spatial panel econometric analysis based on provincial data. China ’s Industrial Economy, 03, 54–64. https://doi.org/10.19581/j.cnki.ciejournal.2010.03.005

Liu, C., Cui, L., & Li, C. (2022c). Impact of environmental regulation on the green total factor productivity of dairy farming: Evidence from China. Sustainability, 14(12), 7274. https://doi.org/10.3390/su14127274

Liu, H., Anwar, A., Razzaq, A., & Yang, L. (2022b). The key role of renewable energy consumption, technological innovation and institutional quality in formulating the SDG policies for emerging economies: Evidence from quantile regression. Energy Reports, 8, 11810–11824. https://doi.org/10.1016/j.egyr.2022.08.231

Liu, J., & Ran, M. (2014). Effect of the intensity of environmental regulation on production technology progress in 17 industries: Evidence from China. Polish Journal of Environmental Studies, 23(6), 2071–2081.

Liu, X., & Chen, S. (2022). Has environmental regulation facilitated the green transformation of the marine industry? Marine Policy, 144, 105238. https://doi.org/10.1016/j.marpol.2022.105238

Liu, Y., Liu, C., & Zhou, M. (2021). Does digital inclusive finance promote agricultural production for rural households in China? Research based on the Chinese family database (CFD). China Agricultural Economic Review, 13(2), 475–494. https://doi.org/10.1108/CAER-06-2020-0141

Liu, Y., She, Y., Liu, S., & Lan, H. (2022a). Supply-shock, demand-induced or superposition effect? The impacts of formal and informal environmental regulations on total factor productivity of Chinese agricultural enterprises. Journal of Cleaner Production, 380(2), 135052. https://doi.org/10.1016/j.jclepro.2022.135052

Lu, C., Li, S., Xu, K., & Liu, J. (2022). Coal mine safety accidents, environmental regulation and economic development—An empirical study of pvar based on ten major coal provinces in China. Sustainability, 14(21), 14334. https://doi.org/10.3390/su142114334

Lu, W., Wu, H., & Geng, S. (2021). Heterogeneity and threshold effects of environmental regulation on health expenditure: Considering the mediating role of environmental pollution. Journal of Environmental Management, 297, 113276. https://doi.org/10.1016/j.jenvman.2021.113276

Ma, G., Lv, D., Luo, Y., & Jiang, T. (2022). Environmental regulation, urban-rural income gap and agricultural green total factor productivity. Sustainability, 14(15), 8995. https://doi.org/10.3390/su14158995

Ma, L., Zhai, X., Zhong, W., & Zhang, Z. (2019). Deploying human capital for innovation: A study of multi-country manufacturing firms. International Journal of Production Economics, 208, 241–253. https://doi.org/10.1016/j.ijpe.2018.12.001

Ma, X. L., & Xu, J. (2022). Impact of environmental regulation on high-quality economic development. Frontiers in Environmental Science, 10, 896892. https://doi.org/10.3389/fenvs.2022.896892

Mariz-Pérez, R. M., Teijeiro-Álvarez, M. M., & García-Álvarez, M. T. (2012). The relevance of human capital as a driver for innovation. Cuadernos De Economía, 35(98), 68–76. https://doi.org/10.1016/S0210-0266(12)70024-9

Morgan, C. L., Pasurka, C., Shadbegian, R. J., Belova, A., & Casey, B. (2023). Estimating the cost of environmental regulations and technological change with limited information. Ecological Economics, 204, 107550. https://doi.org/10.1016/j.ecolecon.2022.107550

Myovella, G., Karacuka, M., & Haucap, J. (2020). Digitalization and economic growth: A comparative analysis of Sub-Saharan Africa and OECD economies. Telecommunications Policy, 44(2), 101856. https://doi.org/10.1016/j.telpol.2019.101856

Nurgazina, Z., Guo, Q., Ali, U., Kartal, M. T., Ullah, A., & Khan, Z. A. (2022). Retesting the influences on CO2 emissions in China: Evidence From dynamic ARDL approach. Frontiers in Environmental Science, 10, 868740. https://doi.org/10.3389/fenvs.2022.868740

Pan, A., Feng, S., Hu, X., & Li, Y. (2021). How environmental regulation affects China’s rare earth export? PLoS ONE, 16, 0250407. https://doi.org/10.1371/journal.pone.0250407

Panayotou, T. (1993). Empirical tests and policy analysis of environmental degradation at different stages of economic development. Pacific and Asian Journal of Energy, 4(1), 5115633.

Pata, U. K., & Caglar, A. E. (2020). Investigating the EKC hypothesis with renewable energy consumption, human capital, globalization and trade openness for China: Evidence from augmented ARDL approach with a structural break. Energy, 216, 119220. https://doi.org/10.1016/j.energy.2020.119220

Pata, U. K., Caglar, A. E., Kartal, M. T., & Depren, S. K. (2023). Evaluation of the role of clean energy technologies, human capital, urbanization, and income on the environmental quality in the United States. Journal of Cleaner Production, 402, 136802. https://doi.org/10.1016/j.jclepro.2023.136802

Pata, U. K., Erdoğan, S. T., & Ozkan, O. (2021). Is reducing fossil fuel intensity important for environmental management and ensuring ecological efficiency in China? Journal of Environmental Management, 329, 117080. https://doi.org/10.1016/j.resourpol.2021.102313

Pata, U. K., & Ertuğrul, H. M. (2023). Do the Kyoto Protocol, geopolitical risks, human capital and natural resources affect the sustainability limit? A new environmental approach based on the LCC hypothesis. Resources Policy, 81, 103352. https://doi.org/10.1016/j.resourpol.2023.103352

Pata, U. K., & Işık, C. (2021). Determinants of the load capacity factor in China: A novel dynamic ARDL approach for ecological footprint accounting. Resources Policy, 74, 102313. https://doi.org/10.1016/j.resourpol.2021.102313

Peng, W., & Lu, J. (2017). Environmental regulation and green innovation policy: Theoretical logic based on externalities. Journal of Social Sciences, 10, 73–83. https://doi.org/10.13644/j.cnki.cn31-1112.2017.10.007

Peng, X. (2020). Strategic interaction of environmental regulation and green productivity growth in China: Green innovation or pollution refuge? The Science of the Total Environment, 732, 139200. https://doi.org/10.1016/j.scitotenv.2020.139200

Perino, G., & Requate, T. (2012). Does more stringent environmental regulation induce or reduce technology adoption? When the rate of technology adoption is inverted u-shaped. Journal of Environmental Economics and Management, 64(3), 456–467. https://doi.org/10.1016/j.jeem.2012.03.001

Porter, M. E., & Linde, C. V. (1995). Toward a new conception of the environment-competitiveness relationship. Journal of Economic Perspectives, 9(4), 97–118. https://doi.org/10.1257/jep.9.4.97

Qiang, O., Wang, T., Ying, D., Li, Z., & Jahanger, A. (2021). The impact of environmental regulations on export trade at provincial level in China: Evidence from panel quantile regression. Environmental Science and Pollution Research, 29, 24098–24111. https://doi.org/10.1007/s11356-021-17676-z

Qiao, S., Shen, T., Zhang, R., & Chen, H. H. (2021). The impact of various factor market distortions and innovation efficiencies on profit sustainable growth: From the view of China’s renewable energy industry. Energy Strategy Reviews, 38, 100746. https://doi.org/10.1016/j.esr.2021.100746

Rahman, M. M., Sultana, N., & Velayutham, E. (2022). Renewable energy, energy intensity and carbon reduction: Experience of large emerging economies. Renewable Energy, 184, 252–265. https://doi.org/10.1016/j.renene.2021.11.068

Ren, S., Li, X., Yuan, B., Li, D., & Chen, X. (2018). The effects of three types of environmental regulation on eco-efficiency: A cross-region analysis in China. Journal of Cleaner Production, 173, 245–255. https://doi.org/10.1016/j.jclepro.2016.08.113

Seo, M. H., & Shin, Y. (2016). Dynamic panels with threshold effect and endogeneity. Journal of Econometrics, 195, 169–186. https://doi.org/10.1016/j.jeconom.2016.03.005

Shah, S. A., Naqvi, S. A., Nasreen, S., & Abbas, N. (2021). Associating drivers of economic development with environmental degradation: Fresh evidence from Western Asia and North African region. Ecological Indicators, 126, 107638. https://doi.org/10.1016/j.ecolind.2021.107638

Shan, H. (2008). Re-estimation of China ’s capital stock K : 1952–2006. Quantitative Economic and Technical Economic Research, 25(10), 17–31.

Sheng, J., Xin, J., & Zhou, W. (2022). The impact of environmental regulations on corporate productivity via import behaviour: The case of China’s manufacturing corporations. Environment, Development and Sustainability, 25, 3671–3697. https://doi.org/10.1007/s10668-022-02193-x

Shi, J., Zhao, D., Ren, F., & Huang, L. (2023). Spatiotemporal variation of soil heavy metals in China: The pollution status and risk assessment. The Science of the Total Environment, 871, 161768. https://doi.org/10.1016/j.scitotenv.2023.161768

Si, W., & Wang, X. (2011). Productivity growth, technical efficiency, and technical change in China’s soybean production. African Journal of Agricultural Research, 6(25), 5606–5613. https://doi.org/10.5897/AJAR11.1080

Sun, Y. (2022). Environmental regulation, agricultural green technology innovation, and agricultural green total factor productivity. Frontiers in Environmental Science, 10, 955954. https://doi.org/10.3389/fenvs.2022.955954

Sun, Y., Ji, J., & Wei, Z. (2022). Can environmental regulation promote the green output bias in China’s mariculture? Environmental Science and Pollution Research, 30, 31116–31129. https://doi.org/10.1007/s11356-022-24349-y

Three industrial division regulations (2003)Gazette of the State Council of the People 's Republic of China, 27, 41–44.

Tone, K. (1997). A slacks-based measure of efficiency in data envelopment analysis. European Journal of Operational Research, 130(3), 498–509. https://doi.org/10.1016/S0377-2217(99)00407-5

Wang, D., Tarasov, A., & Zhang, H. (2022b). Environmental regulation, innovation capability, and green total factor productivity of the logistics industry. Kybernetes, 52(2), 688–707. https://doi.org/10.1108/K-04-2022-0591

Wang, J., Hu, S., & Zhang, Z. (2023). Does environmental regulation promote eco-innovation performance of manufacturing firms?—Empirical evidence from China. Energies, 16(6), 2899. https://doi.org/10.3390/en16062899

Wang, J., & Zhang, G. (2022). Can environmental regulation improve high-quality economic development in China? The mediating effects of digital economy. Sustainability, 14(19), 12143. https://doi.org/10.3390/su141912143

Wang, Q. H., Zhang, H., & Huang, J. (2022c). Japan’s nuclear wastewater discharge: Marine pollution, transboundary relief and potential implications from a risk management perspective. Ocean and Coastal Management, 228, 106322. https://doi.org/10.1016/j.ocecoaman.2022.106322

Wang, X., Chu, B. Q., Ding, H., & Chiu, A. S. (2022a). Impacts of heterogeneous environmental regulation on green transformation of China’s iron and steel industry: Evidence from dynamic panel threshold regression. Journal of Cleaner Production, 382, 135214. https://doi.org/10.1016/j.jclepro.2022.135214

Wen, H., Wen, C. Y., & Lee, C. (2022). Impact of digitalization and environmental regulation on total factor productivity. Information Economics and Policy, 61, 101007. https://doi.org/10.1016/j.infoecopol.2022.101007

Wu, L., Yang, M., & Sun, K. (2022a). The impact of public environmental attention on corporate and government environmental governance. China Population, Resources and Environment, 32(02), 1–14.

Wu, Q., Li, Y., Wu, Y., Li, F., & Zhong, S. (2022b). The spatial spillover effect of environmental regulation on the total factor productivity of pharmaceutical manufacturing industry in China. Scientific Reports, 12, 11642. https://doi.org/10.1038/s41598-022-15614-8

Xie, B., Yang, C., Song, W., Song, L., & Wang, H. (2023). The impact of environmental regulation on capacity utilization of China’s manufacturing industry: An empirical research based on the sector level. Ecological Indicators, 148, 110085. https://doi.org/10.1016/j.ecolind.2023.110085

Xu, X., Zhou, J., & Shu, Y. Estimation of three industrial capital stock in Chinese provinces. Statistical study, 24(5): 6–13

Xu, H., Wang, Y., Gao, C., & Liu, H. (2021). Road transportation green productivity and its threshold effects from environmental regulation. Environmental Science and Pollution Research, 29, 22637–22650. https://doi.org/10.1007/s11356-021-16833-8

Xu, Y., Li, S., Zhou, X., Shahzad, U., & Zhao, X. (2022). How environmental regulations affect the development of green finance: Recent evidence from polluting firms in China. Renewable Energy, 189, 917–926. https://doi.org/10.1016/j.renene.2022.03.020

Yang, Y., Chen, L., & Xue, L. (2021). Looking for a Chinese solution to global problems: The situation and countermeasures of marine plastic waste and microplastics pollution governance system in China. Chinese Journal of Population, Resources and Environment, 19(4), 352–357. https://doi.org/10.1016/j.cjpre.2022.01.008

Yılancı, V., & Pata, U. K. (2020). Investigating the EKC hypothesis for China: The role of economic complexity on ecological footprint. Environmental Science and Pollution Research, 27, 32683–32694. https://doi.org/10.1007/s11356-020-09434-4

Yin, X., Qi, L., & Zhou, J. (2022). The impact of heterogeneous environmental regulation on high-quality economic development in China: Based on the moderating effect of digital finance. Environmental Science and Pollution Research, 30, 24013–24026. https://doi.org/10.1007/s11356-022-23709-y

Yu, Y., & Zhang, N. (2022). Environmental regulation and innovation: Evidence from China. Global Environmental Change, 76, 102587. https://doi.org/10.1016/j.gloenvcha.2022.102587

Yuan, B., Ren, S., & Chen, X. (2017). Can environmental regulation promote the coordinated development of economy and environment in China’s manufacturing industry?–A panel data analysis of 28 sub-sectors. Journal of Cleaner Production, 149, 11–24. https://doi.org/10.1016/j.jclepro.2017.02.065

Yuan, J., & Zhang, D. (2021). Research on the impact of environmental regulations on industrial green total factor productivity: Perspectives on the changes in the allocation ratio of factors among different industries. Sustainability, 13(23), 12947. https://doi.org/10.3390/su132312947

Zhang, J., Deng, S., Shen, F., Yang, X., Liu, G., Guo, H., Li, Y., Xiao, H., Zhang, Y., Peng, H., Zhang, X., Li, L., & Wang, Y. (2011). Modeling the relationship between energy consumption and economy development in China. Fuel and Energy Abstracts, 36(7), 4227–4234. https://doi.org/10.1016/j.energy.2011.04.021

Zhang, J., Li, H., Xia, B., & Skitmore, M. (2018). Impact of environment regulation on the efficiency of regional construction industry: A 3-stage data envelopment analysis (DEA). Journal of Cleaner Production, 200, 770–780. https://doi.org/10.1016/j.jclepro.2018.07.189

Zhang, J., Pu, S., Philbin, S. P., Li, H., Skitmore, M., & Ballesteros-Pérez, P. (2020). Environmental regulation and green productivity of the construction industry in China. Engineering Sustainability, 174(2), 58–68. https://doi.org/10.1680/jensu.20.00013

Zhang, X., & Wang, D. (2023). Does environmental regulation inhibit enterprise performance? Evidence from listed energy firms in China. The Extractive Industries and Society, 14, 101250. https://doi.org/10.1016/j.exis.2023.101250

Zhao, C., Liu, Z., & Yan, X. (2023). Does the digital economy increase green TFP in cities? International Journal of Environmental Research and Public Health, 20(2), 1442. https://doi.org/10.3390/ijerph20021442

Zheng, F., Guo, X., Tang, M., Zhu, D., Wang, H., Yang, X., & Chen, B. (2023). Variation in pollution status, sources, and risks of soil heavy metals in regions with different levels of urbanization. Science of the Total Environment, 866, 161355. https://doi.org/10.1016/j.scitotenv.2022.161355

Zheng, H., Zhang, L., & Zhao, X. (2022). How does environmental regulation moderate the relationship between foreign direct investment and marine green economy efficiency: An empirical evidence from China’s coastal areas. Ocean and Coastal Management, 219, 106077. https://doi.org/10.1016/j.ocecoaman.2022.106077

Zhou, Z., Liu, W., Wang, H., & Yang, J. (2022). The impact of environmental regulation on agricultural productivity: From the perspective of digital transformation. International Journal of Environmental Research and Public Health, 19(17), 10794. https://doi.org/10.3390/ijerph191710794

Zong, Z., & Liao, Z. (2014). China provincial three industrial capital stock re-estimation : 1978–2011. Journal of Guizhou University of Finance and Economics, 2014(3), 8–16. https://doi.org/10.3969/j.issn.1003-6636.2014.03.002

Acknowledgements

The authors would like to express their sincere gratitude to the editors and reviewers for their suggestions and constructive comments to improve the quality of this article.

Funding

No funding was received for writing this study.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no competing interests.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Appendix 2

Appendix 3

Appendix 4

Appendix 5

Appendix 6

Appendix 7

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Ge, W., Wu, S. & Yang, D. Who are the genuine contributors to economic development under environmental regulation? Evidence from total factor productivity in the three industries. Environ Dev Sustain 26, 22801–22838 (2024). https://doi.org/10.1007/s10668-023-03577-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-023-03577-3