Abstract

With the widespread implementation of environmental regulations worldwide, their impact on corporate productivity has received increasing attention. Current studies primarily examined the impact of environmental regulations on corporate productivity from the mediating effect of innovation and failed to consider the mediating effect of import behaviour. We scrutinised the relationship between the stringency of environmental regulations and the quality of imported products, and its effects on corporate productivity, in the case of China’s manufacturing corporations. Moreover, we analysed the heterogeneity of these effects from the perspective of ownership and location. The findings show that the increasing stringency of environmental regulations prompts corporations to improve the quality of imported products rather than to transfer polluting industries; thus, it does not pose a threat to the environment of neighbouring countries. Besides, the increasing stringency of environmental regulations also leads to learning effects and improvements in imported product quality, thereby increasing corporate productivity. Finally, the effects of the interaction between environmental regulations and import behaviour on corporate productivity are heterogeneous, as they depend on the type of ownership and corporate location. Therefore, the focus on import behaviour improves the current understanding and contributes a heuristic investigation to the current debate on the relationship between environmental regulations, import behaviour, and corporate productivity.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

For decades, people have been discussing environmental regulation, innovation, and productivity. However, little progress has been made in understanding the impact of environmental regulations on corporate productivity. In particular, environmental regulations profoundly affect import trade (Shang et al., 2021), which may significantly change corporate productivity (Kasahara & Lapham, 2013). The questions about the complex entanglement between environmental regulation, import behaviour, and corporate productivity have received relatively less attention among environmental economists, compared to their prolific analyses of the role of innovation in the relationship between environmental regulations and corporate productivity.

Current studies generally argue that the increasing stringency of environmental regulations can promote corporation innovation (see Lanoie et al., 2011; Rubashkina et al., 2015). However, whether the innovation caused by environmental regulations can improve the productivity of corporations is still unclear. The traditional Porter hypothesis argues that environmental regulations can promote corporation innovation and productivity (Porter & Van der Linde, 1995). Many subsequent studies have confirmed the hypothesis, showing a positive correlation between the stringency of environmental regulations and corporate productivity (see Pan et al., 2017; Ghosal et al., 2019). However, other studies have reached the opposite conclusion that there is a negative correlation between the stringency of environmental regulations and corporate productivity (see Lanoie et al., 2008; Becker, 2011).

Moreover, other studies argue that the relationship between the stringency of environmental regulations and corporate productivity has different effects across industries. Yan Wang and Shen (2016) argue that the effects of environmental regulations on productivity are related to the degree of industrial pollution. Johnstone et al. (2017) argue that the positive correlation becomes negative after a certain threshold of stringency of environmental regulations. However, current studies ignore the mediating effect of import behaviour between environmental regulations and corporate productivity. Environmental regulations can change a country’s factor endowment, which may affect the import behaviour of corporations (Cole & Elliott, 2003), while changes in import behaviour can also affect corporate productivity (Cole, 2004). Therefore, it is necessary to develop the existing environmental regulations theory to understand the mediating effect of import behaviour between environmental regulations and corporate productivity.

To fill this gap, we took the case of China’s manufacturing corporations to study how environmental regulations affect corporate productivity by changing the quality of imported products. Product quality is a non-price feature, depending on how well a product meets consumer preferences (Leffler, 1982). Products produced by green technologies are often favoured as consumers become more environmentally conscious (Arora & Gangopadhyay, 1995). Therefore, we defined the products that are produced by green technologies and are preferred by consumers as “high-quality products”, and the products that are not produced in this way as “low-quality products”.

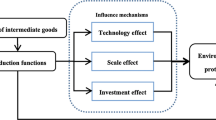

We examined how changes in the stringency of environmental regulations are associated with improved imported product quality. By considering the impact of imported product quality in the production function, we constructed a theoretical framework that includes corporate import behaviour to improve our understanding of the complex relationship between environmental regulations, import behaviour, and corporate productivity. In addition, we also contributed new insights into the impact of environmental regulations on corporate productivity through the intermediary effect of import behaviour. Finally, we reveal the heterogeneity effects of the interaction between environmental regulations and imported product quality, contributing a heuristic investigation to the current debate on the relationship between the three.

We present three arguments that demonstrate the economic and political logic between environmental regulations and corporate productivity from the perspective of import behaviour. First, the increasing stringency of environmental regulations prompts corporations to improve imported product quality, rather than to transfer polluting industries abroad; thus, it does not threaten the environment of neighbouring countries. Second, the increasing stringency of environmental regulations leads to learning effects and improvements in imported product quality, thereby increasing corporate productivity. Third, the effects of the interaction between environmental regulations and import behaviour on corporate productivity are heterogeneous, as they depend on the type of ownership and corporate location.

This paper is structured as follows. Section 2 establishes a theoretical framework to explain the mediating effects of import behaviour between environmental regulations and corporate productivity. Section 3 presents the econometric model and the data. Sections 4 and 5 show the empirical findings and the results of the endogeneity and robustness checks. Section 6 discusses the results. Finally, Sect. 7 presents the main conclusions, arguing how the analysis of the mediating effects of import behaviour can deepen the current understanding of the mechanism of the impact of environmental regulations on corporate productivity.

2 Theoretical framework and hypotheses

Following Chunhua Wang et al. (2018), we described the corporation production function constrained by environmental regulations as follows:

where Y represents the output; A represents the Hicks-neutral technical progress; and K, L, and M represent the inputs of capital, labour, and materials, respectively. To meet the requirements of environmental regulations, corporations need to add some production factors (μ) to reduce pollutant emissions (Chunhua Wang et al., 2018). Consequently, corporate productivity changes from A to (1 − μ)A, implying that the increasing stringency of environmental regulations can reduce corporate productivity.

Moreover, environmental regulations can also promote innovation by changing trade behaviour, which will help improve corporate productivity (Bloom et al., 2015; Peters et al., 2018). The reason is that the increasing stringency of environmental regulations requires corporations to use advanced green technologies. In the absence of green technologies, corporations will try to obtain high-quality products produced by green technologies through imports (Zhu et al., 2014). This import behaviour leads to direct technology transfer and diffusion, improving corporate productivity (Gonchar & Kuznetsov, 2018). Moreover, the impact of environmental regulations on business productivity is also reflected in the complementarity of imported product types (Hamamoto, 2006; Yang et al., 2012). Corporations can also re-integrate and re-innovate production by importing different products, improving productivity (Halpern et al., 2015). Thus, Eq. (1) has been expanded to reflect the link between environmental regulation, import behaviour, and corporate productivity, in the following way:

where I ∈ [0, 1] represents the imported product quality, that is, the degree to which consumers prefer products produced by green technologies, and α represents the coefficient of learning effect, reflecting the ability of corporations to absorb green technologies from imported products (Chen et al., 2017).

Equation (2) demonstrates that environmental regulations may affect import behaviour. Due to the increasing stringency of environmental regulations, corporations producing low-quality products through non-green technologies incur higher costs. Therefore, corporations will choose to import, rather than to produce, low-quality products, resulting in the transfer of polluting industries to other countries (Naegele & Zaklan, 2019). However, environmental regulations also prompt corporations to improve production technologies, encouraging them to adopt green technologies by importing high-quality products (Zhu et al., 2014). Therefore, we introduced the first hypothesis as follows:

H1

The increasing stringency of environmental regulations may improve imported product quality.

In addition, changes in import behaviour caused by environmental regulations may also affect corporate productivity. Gutiérrez & Teshima (2018) argue that environmental regulations can change import behaviour, prompting corporations to improve production technologies. The reason is that environmental regulations encourage corporations to reduce pollution by acquiring production technologies from imported high-quality products, through technology spillovers and learning effects (Broda et al., 2017; Huang et al., 2019). Since corporations can meet the requirements of environmental regulations by importing products of different quality, whether environmental regulations can promote the import of high-quality products depends on the ability of corporations to absorb technology from products, and on the cost–benefit balance between different quality products. Therefore, we proposed the second hypothesis as follows:

H2

As the stringency of environmental regulations increases, corporations can improve productivity by importing high-quality products.

The impact of the interaction between environmental regulations and imported products quality on corporate productivity may vary depending on the type of ownership. First, state-owned corporations (SOEs) are more likely to be affected by environmental regulations since they must take an exemplary role in complying with environmental regulations and bear more corporate social responsibility than other corporations (Córdoba‐Pachón et al., 2014). This makes SOEs more inclined than private and foreign corporations to acquire green technologies through imports and, thus, to meet environmental requirements. Second, SOEs often have lower corporate productivity due to the misallocation of production factors (Bajona & Chu, 2010; Girma & Gong, 2008). When the stringency of environmental regulations increases, SOEs are more likely to improve productivity, since they can reduce misallocation through imports more quickly than other corporations. Third, due to their close ties with the government, SOEs are more likely than other corporations to obtain funds to import green technologies, thereby encouraging them to participate more in imports (Megginson, 2017).

Furthermore, the effects of the interaction between environmental regulations and imported products quality on corporate productivity may also vary, due to differences in location. Corporations often differ in innovation, technology absorption, and the adoption of advanced production technologies, due to their different locations (Cai et al., 2002). When the stringency of environmental regulations increases, corporations in developed coastal areas are more likely than other corporations to obtain higher returns from imports, because of their strong capabilities in R&D innovation and technology absorption (Xie et al., 2017; Yasar, 2013). Moreover, location differences can also affect import convenience. Since corporations in developed coastal areas are more involved in trade than those in developing inland areas, when the stringency of environmental regulations increases, the formers are more motivated to reduce pollution and improve productivity through imports (Lanoie et al., 2008). Therefore, we proposed the third hypothesis as follows:

H3

The effects of the interaction between environmental regulations and import behaviour on corporate productivity are heterogeneous, as they depend on the type of ownership and corporate location.

3 Methods

3.1 Model specification

3.1.1 Dependent and independent variables

We selected the logarithm of the total factor productivity (tfp) as the dependent variable to examine how environmental regulations change corporate productivity through the mediating effect of import behaviour. Following Olley & Pakes (1996), we estimated the total factor productivity by combining the production functions with a nonparametric estimation. We first established the regression equation according to the classical Cobb–Douglas function. Then, after deducting the contribution of capital, labour, and intermediate inputs, the rest of the corporation’s output was considered as the total factor productivity.

In addition, we selected the investment in urban environmental facilities (regulation) as one of the independent variables. Strict environmental regulations often trigger investment in environmental facilities to measure the stringency of environmental regulations from the perspective of input (Ren et al., 2018). We standardised this variable to eliminate the influence of the measuring unit.

Moreover, due to increased environmental protection awareness, the public prefers high-quality products produced by green technologies. Therefore, following Khandelwal (2010), we used the difference in product demand (quality) to measure the imported product quality. The reason is that, after controlling other factors affecting product sales, the effect of residual factors can be attributed to product quality (Fan et al., 2015).

Following Hallak & Sivadasan (2013), we set the utility function of a product as follows:

where λgimt and qgimt represent the quality and quantity of the g-th product imported from the m-th exporting country by the i-th corporation in the t-th year, respectively; Ngmt represents the number of corporations that import the g-th product from the m-th exporting country in the t-th year; σ represents the substitution elasticity between products. The price (pgmt) corresponding to the utility function is the following:

Then, we could obtain qgimt in the following way:

where pgimt represents the price of the g-th product imported from the m-th exporting country by the i-th corporation in the t-th year; and Egmt represents the domestic consumption of the g-th product imported from the m-th exporting country in the t-th year.

Then, after applying the logarithm on both sides of Eq. (5), we could obtain the following equation:

where ln pgimt represents the logarithm of the price; εgimt represents the residual, which can measure the quality of the g-th product imported from the m-th exporting country in the t-th year; and Zmt represents the control variable vector.

We selected GDP and the population of each exporting country as the control variables. The GDP can reflect the total economic volume of the importing country, which is closely related to the demand for high-quality products. The population of each exporting country can reflect its market size, which affects the richness of the types of exported products of corporations (Helpman, 1981).

Moreover, since price and demand are mutually causal, following Piveteau & Smagghue (2019), we selected the exchange rate between China and the exporting country as the instrumental variable of price to alleviate endogeneity. The exchange rate between China and the exporting countries directly affects the prices paid by the importing corporations and satisfies the relevant requirements of the instrumental variables. Changes in exchange rates do not directly affect corporation demand, which meets the exogenous requirements of instrumental variables. Finally, we could obtain the residual (εgimt) by estimating Eq. (6) using sample data of China’s manufacturing corporations.

According to Hallak and Sivadasan (2013) and Khandelwal (2010), the relationship between imported product quality and the residual is as follows:

Then, we could obtain ln λgimt according to the residual (εgimt).

The substitution elasticity between products (σ) can reflect the relative quality of the product, and its value is usually between 5 and 10 (Anderson & van Wincoop, 2004; Head & Ries, 2001). Therefore, we set σ as equal to 5.

Since there are many types of products imported each year, we standardised ln λgimt to obtain a standardised quality index (staquality) and then summed it up to obtain the total quality of various products. We set the value of quality of each product (i.e. ln λgit) to vqualitygit. Therefore, the quality of the g-th product imported by the i-th corporation in the t-th year is the following:

where equalitygit represents the standardised quality, and \({\sum }_{it\in \Omega }{vquality}_{it}^{g}\) represents the total value of all product quality.

Then, we further aggregated equalitygit to obtain the total quality of all products imported by the i-th corporation in the t-th year (qualityit) in the following way:

Finally, Table 1 shows the variables used to estimate the imported product quality.

3.1.2 Control variables

We chose to control the impact of several firm-level factors on corporate productivity, including firm size, fixed assets, intangible assets, firm age, corporation liability, and capital intensity, in the following way:

-

Since the input of production factors has a scale effect, the rate of return of large corporations is usually higher than that of small corporations (Garicano et al., 2016). Therefore, we selected the logarithm of the number of employees (labour) as a control variable to measure firm size.

-

Corporations with more fixed assets tend to have more advanced production technologies and equipment, which in turn can improve productivity (Yan Wang & Shen, 2016). Therefore, we selected the logarithm of the fixed assets (fixed) to control their effects on the corporation.

-

Intangible assets, including patents and trademarks, can reflect the capabilities of research and development (R&D) (Bin Xu & Lu, 2009), which in turn can contribute to improving corporate productivity (Cameron et al., 2005). Therefore, we adopted the logarithm of the intangible assets (intangible) as a control variable.

-

Firm age can reflect the stage of the corporation in the life cycle. Corporations at different stages differ in organisational and technical innovation, which can affect corporate productivity (Agarwal & Audretsch, 2001). Therefore, we selected the logarithm of the firm age (age) as a control variable.

-

Due to the higher enthusiasm of workers under debt pressure, the productivity of a corporation with debts tends to be higher (Nickell & Nicolitsas, 1999). Therefore, we adopted the debt to asset ratio (debt) to measure corporation liability.

-

Corporations with a high capital intensity have strong technological upgrading capabilities, which leads to higher technical efficiency and higher productivity (Lall, 1992). Therefore, we used the logarithm of the capital/labour ratio (intensity) to measure capital intensity.

Moreover, we also chose to control the impact of several urban factors on corporate productivity, including urbanisation, urban human capital, urban industrialisation, and the level of urban economic development, in the following way:

-

o

Urbanisation improves urban infrastructure, which contributes to improving corporate productivity (Rizov & Zhang, 2014). Therefore, we selected the urbanisation rate (urban) as a control variable.

-

o

When cities have more college students, corporations are more likely to obtain high-quality human capital, improving corporate productivity (Moretti, 2004). Therefore, we selected the logarithm of the number of college students per 10,000 people (student) to measure urban human capital.

-

o

High industrialisation contributes to agglomeration effects, which help corporations improve productivity (Long & Zhang, 2011). Therefore, we adopted the manufacturing output proportion (industry) to measure urban industrialisation.

-

o

A high level of economic development leads to a well-developed urban infrastructure, which helps corporations improve productivity (Cooke, 2005). Moreover, economically developed cities can attract more corporations and form a complete product supply chain, conducive to improving corporate productivity (Atherton, 2008). Therefore, we used the logarithm of the per capita GDP (pgdp) to measure the level of urban economic development.

3.1.3 Econometric model

The econometric model adopted, which considers the effects of environmental regulations and imported product quality on corporate productivity, is the following:

where i, t, and g represent the i-th corporation, t-th year, and g-th city, respectively; βj (j = 1, 2, 3) and ηk (k = 1, …, 10) represent the coefficients of the independent and control variables, respectively; regu_quality is an interaction term between environmental regulations and imported product quality, which was used to verify the impact of imported product quality on corporate productivity when the stringency of environmental regulations changes. We adopted a centralised interaction term between ln_regulation and quality, since it can avoid the primary masking effect of a single variable (Aiken & West, 1991). Finally, μi represents the time-fixed effect, and εit represents the random error term.

3.2 Data

Since China joined the World Trade Organization in 2001, it has tried to improve the environment by formulating a series of environmental regulations (see Table 2). China has gradually transformed from control-and-command environmental regulations to environmental regulations that combine market-oriented measures and administrative orders (Cheng et al., 2017).

The corporation data come from the China Industrial Enterprise Database (National Bureau of Statistics of China, 2018) and the China Customs Import and Export Database (China General Administration of Customs, 2015); the city data come from the China City Statistical Yearbook (National Bureau of Statistics of China, 2002, 2003, 2004, 2005, 2006, 2007). The manufacturing corporations in the China Industrial Enterprise Database involve 30 categories, such as agricultural and sideline food processing industry, food industry, handicrafts and other manufacturing industry, as well as waste resources recycling and processing industry. As the China Industrial Enterprise Database was missing a large amount of data due to changes in statistical indicators after 2007, we selected the data from 2001 to 2006 based on data availability.

Following Brandt et al. (2012), we matched the abovementioned data. First, we matched the data according to the corporation code and name. Then, we matched the data according to “legal representative name + region”, “region + industry category code + phone number”, and “company establishment year + industry category code + postal code” and deleted the variables with a missing value. Finally, since some importing corporations are not involved in the production, we deleted the corporations with the label “import and export trade” in the corporation name to reduce errors.

Furthermore, following Yu (2015), we matched the China Industrial Corporation Database with the China Customs Import and Export Database according to the “corporation name” and “seven digits after the phone number + postal code”. Then, we use the city code to match the data obtained above with the city data. Finally, we obtained unbalanced panel data containing 293,826 observations from 688 sub-sectors and 83,662 manufacturing corporations from 2001 to 2006. Table 3 presents a summary of all variables.

4 Results

4.1 Regression results

We employed Stata 15 to estimate the abovementioned sample data according to Eq. (10), and the results are shown in Table 4. Model 1 does not control time-fixed effects, while Model 2 controls them.

As shown in Table 4, the coefficients of ln_regulation and quality in Models 1 and 2 are significantly positive; this indicates that the stringency of environmental regulations and imported product quality are significantly positively correlated with corporate productivity. Moreover, the coefficients of regu_quality in both models are significantly positive, indicating that the interaction between environmental regulations and imported product quality is significantly positively correlated with corporate productivity. These results suggest that when the stringency of environmental regulations increases, corporations can improve productivity by increasing imported product quality. Therefore, we have verified the second hypothesis (H2).

4.2 Endogeneity check

There may be endogeneity problems between environmental regulations, imported product quality, and corporate productivity. The reason is that some unobservable variables may affect these variables simultaneously.

First, there are endogeneity problems between environmental regulations and corporate productivity. The increasing stringency of environmental regulations encourages corporations to reduce pollutant emissions through innovation or advanced green technologies, thereby improving productivity (Tang et al., 2017). Moreover, corporations with low productivity emit large quantities of pollutants due to inferior technologies, which leads to a high stringency of environmental regulations. Conversely, corporations with high productivity can reduce pollutant emissions by using green technologies, which results in a low stringency of environmental regulations (Albrizio et al., 2017).

Following Hering & Poncet (2014), we selected the airflow coefficient (flow) of the city where the corporation is located as the instrumental variable to alleviate the endogeneity between environmental regulations and corporate productivity. A slow airflow decelerates the diffusion of contaminants in the air, likely to result in a higher stringency of environmental regulations (Shi & Xu, 2018). Therefore, this variable satisfies the relevant requirements of the instrumental variables. Moreover, the airflow coefficient of a city is determined by meteorological conditions, which are exogenous to corporate productivity. We obtained the airflow coefficient of each city by multiplying the wind speed and the height of the atmospheric boundary layer. We derived the data from the ERA-INTERIM database (https://apps.ecmwf.int/datasets/data/interim-full-daily/levtype=sfc/).

Second, there are endogeneity problems between imported product quality and corporate productivity. On the one hand, corporations can learn advanced green technologies from high-quality, imported products to improve productivity (Augier et al., 2013). On the other hand, corporations with high productivity are more capable of importing high-quality products and absorbing advanced green technologies, than those with low productivity. Therefore, their imported product quality is often higher than that of low-productivity corporations (Halpern et al., 2015).

Following Hummels et al. (2014), we selected the transportation cost (transportation) as the instrumental variable to alleviate the endogeneity between imported product quality and corporate productivity. Since the profits of low-quality products imported by corporations are lower than those of high-quality products, when transportation costs are low, corporations can obtain the same profits by importing more low-quality products. However, when the increase in transportation costs leads to a decline in corporation profits, corporations are more inclined to import high-quality products. Therefore, this variable satisfies the relevant requirements of the instrumental variables. Moreover, the transportation cost, which depends on transportation distance and oil prices, does not directly affect corporate productivity (Hummels et al., 2014), thereby meeting the exogenous requirements of the instrumental variables. We used the product of the distance between China and each exporting country and the oil price to measure transportation costs. We derived the geographic distance data from the GeoDist database (http://www.cepii.fr/CEPII/en/bdd_modele/presentation.asp?id=6).

Finally, we used two-stage ordinary least squares (2SLS) for instrumental variable regression. We set the models as follows:

where i and t represent the i-th corporation and t-th year, respectively; X represents the vector of the control variables in Table 1; Η represents the coefficient of the control variable vector; μi represents the time-fixed effect; εit represents the random error term. Table 4 shows the results of the endogeneity check.

The results in Table 5 demonstrate that the coefficients of ln_regulation and quality in the second-stage regression are significantly positive, entirely consistent with the results in Table 4. Moreover, the Lagrange-Multiplier statistics and the Wald F-value in Models 1 and 2 are significant, indicating that the models passed the under-identification and weak identification, respectively. This means that the instrumental variables we selected are appropriate. These results show that the results in Table 4 are robust; that is, environmental regulations, imported product quality, and the interaction between the two are significantly positively correlated with corporate productivity.

4.3 Robustness checks

To check the robustness of the results, we first selected the utilisation of industrial solid waste (waste) to replace the investment in urban environmental facilities (regulation), as it can reflect the stringency of environmental regulations at the corporation level (Ren et al., 2018). Then, we used its interaction with imported product quality (waste_quality). Model 1 in Table 6 shows the results (please note that Table 6 shows only the results of the core independent variables).

Second, we replaced the total factor productivity (tfp) with the misallocation of production factors (misallocation) as the dependent variable. If there is no misallocation, the productivity of the corporations should be the same, and the utility of production factors can be maximised (Hsieh & Klenow, 2009). Conversely, in case of misallocation of production factors, corporate productivity will be less than optimal. Therefore, misallocation is inversely proportional to corporate productivity; that is, a high misallocation indicates low productivity, and vice versa (Eric Bartelsman et al., 2013). Since the dispersion degree of productivity among corporations can be used to indicate the misallocation (Eric J. Bartelsman & Doms, 2000), following Asker et al. (2014), we used the standardised dispersion degree of productivity to measure the misallocation. Model 2 in Table 6 shows the results.

Third, some corporations are forced to withdraw from the market due to their inability to meet the requirements of environmental regulations. These corporations tend to have lower productivity, which will lead to an underestimation of corporate productivity (Chunhua Wang et al., 2018). Therefore, we deleted 99,870 observations of corporations that exit the market from the sample and used the remaining 64,541 observations to re-estimate Eq. (10). Model 3 in Table 6 shows the results.

Finally, to mitigate the effects of outliers, we removed the values of firm productivity outside the 1% and 99% levels for checking robustness. Model 4 in Table 6 shows the results. We summarise the results of the four robustness checks in Table 8 to save space, where a blank indicates that the variable is not included in the model (the same applies to subsequent tables).

The results in Table 6 show that the coefficients of waste, quality, and waste_quality in Model 1 are significantly positive, which is consistent with the results in Table 4. Besides, the coefficients of ln_regulation, quality, and regu_quality in Model 2 are significantly negative, which is the opposite of the results in Table 4. The coefficients of ln_regulation, quality, and regu_quality in Models 3 and 4 are also consistent with the results in Table 4, which further confirms the robustness of the results. All these results confirm the robustness of the second hypothesis (H2).

5 Additional analysis

5.1 The effects of environmental regulations on imported product quality

We used regulation and quality as independent and dependent variables, respectively, to verify the impact of environmental regulation on imported product quality. Besides, we also chose to control the impact of several factors on imported product quality, including human capital, government subsidies, corporation profit, firm size, firm age, and level of urban economic development, in the following way:

-

Since human capital affects the ability of corporations to absorb new technologies, corporations with more human capital are more likely to gain more benefits from technology spillovers by importing high-quality products (Liu & Buck, 2007). Therefore, these corporations tend to import more high-quality products. Following Helian Xu et al. (2008), we used the average wage (wage) to measure human capital.

-

Since government subsidies can encourage imports, corporations that receive government subsidies have a stronger will and ability to import high-quality products (Qian et al., 2018). Therefore, we used the ratio of government subsidies to gross corporation output (subsidy) to reflect government subsidies.

-

Corporations with high profits are more competitive and are more inclined to import high-quality products to improve productivity and maintain a competitive advantage (Williamson, 1990). Therefore, we selected the profit margin (profit) to reflect the profit level.

-

Large corporations are more capable and willing to achieve scale expansion by importing high-quality products than small corporations (Wagner, 2015). Therefore, we selected the logarithm of employee numbers (labour) to measure firm size.

-

Since corporations in the growth stage of the life cycle have more expansion needs, they will seek to import high-quality products to improve profits and productivity (Majumdar, 1997). Therefore, we adopted the logarithm of the firm age (age) as a control variable.

-

A high level of economic development is conducive to improving urban infrastructure, which facilitates the participation in import trade by corporations (Wilson et al., 2005). Therefore, we selected the logarithm of the per capita GDP (pgdp) to measure the level of urban economic development.

Table 7 summarises all variables used to verify the effects of environmental regulations on imported product quality.

Finally, the model used to examine the effects of environmental regulations on imported product quality is as follows:

where i, t, and g represent the i-th corporation, t-th year, and g-th city, respectively; β1 represents the coefficient of the environmental regulations; ηk (k = 1, …, 6) represents the coefficient of the k-th control variable; μi represents the time-fixed effect; and εit represents the random error term. We used sample data to estimate Eq. (14); Table 8 shows the results. Similar to regression results, Model 1 does not control time-fixed effects, while Model 2 controls them.

The results in Table 8 show that the coefficients of ln_regulation are significantly positive in Models 1 and 2; this indicates that the increasing stringency of environmental regulations can significantly improve imported product quality. Therefore, when the stringency of environmental regulations increases, corporations will not choose to import low-quality products, thereby preventing the transfer of polluting industries to neighbouring countries. Therefore, we have verified the first hypothesis (H1).

Finally, we used waste to replace regulation, to verify the robustness of the relationship between environmental regulations and imported product quality. Model 1 in Table 9 shows the results. Similarly, we also considered the impact of corporation exits and outliers. Model 2 in Table 9 shows the regression results of deleting the corporations that exit the market. Model 3 shows the regression results of removing the values of the imported product quality outside the 1% and 99% levels.

As shown in Table 9, the coefficient of waste in Model 1 is significantly positive, consistent with Table 8. This also indicates a positive correlation between environmental regulations and imported product quality. Moreover, the coefficients of ln_regulation in Models 2 and 3 are also significantly positive, consistent with Table 8. All these results reaffirm the robustness of the first hypothesis (H1).

5.2 The effect of interaction on heterogeneous corporate productivity

We classified the sample data according to ownership and location to examine the effects of the interaction between environmental regulations and imported product quality on corporate productivity.

We adopted an interaction variable between the SOEs’ dummy variable, environmental regulations, and imported product quality (regu_quality_owner) to explore the difference between the effects of regu_quality on SOEs and on other corporations. Model 1 in Table 10 shows the results.

Similarly, we used an interaction variable between the dummy variable of corporations in developed coastal areas, environmental regulations, and imported product quality (regu_quality_location), to explore the difference between the effects of regu_quality on corporations in developed coastal areas and on corporations in developing inland areas. Model 2 in Table 10 shows the results.

The results in Table 10 show that the coefficient of regu_quality_owner in Model 1 is significantly positive, thus indicating that, with the increasing stringency of environmental regulations, SOEs improve their productivity by increasing imported product quality, more significantly than other corporations. Similarly, the coefficient of regu_quality_location in Model 2 is also significantly positive, thereby suggesting that, with the increasing stringency of environmental regulations, corporations in developed coastal areas improve their productivity by increasing imported product quality, more significantly than those in developing inland areas. Therefore, the effects of the interaction between environmental regulations and import behaviour on corporate productivity are heterogeneous, as they depend on the type of ownership and corporate location. Therefore, we have verified the third hypothesis (H3).

6 Discussion

The increasing stringency of environmental regulations prompts corporations to improve the imported product quality rather than to transfer polluting industries abroad; thus, it does not pose a threat to the environment of neighbouring countries. Our findings indicate that imported product quality will improve as the stringency of environmental regulation increases. The reason is that stringent environmental regulations increase the cost of pollution in production. Therefore, corporations will choose to import rather than to produce, so as to avoid the cost increase caused by environmental regulations. Since improvements in the level of economic development increase the public’s willingness to pay for a high-quality environment, the market often favours high-quality products produced by green technologies (Shao et al., 2018). Therefore, in the face of stringent environmental regulations, corporations seek to meet market demand and increase profits by importing high-quality products (Li et al., 2017). Moreover, since the original investment has been converted into sunk costs, environmental regulations are not a sufficient reason for corporations to transfer production overseas, as long as the costs of implementing environmental regulations do not exceed the sunk costs (Ederington et al., 2005). Therefore, corporations will meet the requirements of environmental regulations by improving imported product quality, rather than by transferring the production process of contaminated products overseas.

The increasing stringency of environmental regulations also leads to learning effects and improvements in imported product quality, thereby increasing corporate productivity. Our findings show that environmental regulations can encourage corporations to import high-quality products and learn advanced green technologies. Therefore, the learning effect caused by imports is an essential path for environmental regulations to affect corporate productivity. Environmental regulations encourage corporations to import high-quality products, triggering technology spillovers caused by imports (Huang et al., 2019). These technology spillovers allow corporations to learn from importing high-quality products to acquire advanced green technologies. Moreover, corporations learn from imports through horizontal knowledge diffusion and vertical technology transfer (Blalock & Veloso, 2007). The former enables corporations to obtain green technologies from imported high-quality products through reverse indirect learning. In contrast, the latter enables corporations to obtain green technologies by directly introducing production lines or technologies compatible with high-quality products (Blalock & Veloso, 2007). Therefore, environmental regulations encourage corporations to learn green technologies in imported high-quality products through horizontal knowledge diffusion and vertical technology transfer, improving corporate productivity.

The effects of the interaction between environmental regulations and imported product quality on corporate productivity are heterogeneous among corporations with different types of ownership. Our findings show that, as the stringency of environmental regulations increases, SOEs improve productivity by increasing imported product quality, more significantly than other corporations. Since they are required to serve as a model in the face of stringent environmental regulations, SOEs will comply better with environmental regulations and will undertake corporate social responsibility (Hofman et al., 2017). This makes SOEs more active than other corporations in pursuing imports to obtain green technologies, and the resulting technological upgrades will also bring productivity improvements. Besides, since SOEs are less productive, their technology spillovers and learning effects caused by imported high-quality products are more significant than for other corporations, thus facilitating productivity improvements (Bajona & Chu, 2010).

Furthermore, the effects of this interaction on corporate productivity are also heterogeneous among corporations in different locations. Our findings show that, with the increasing stringency of environmental regulations, corporations in developed coastal areas improve productivity by increasing imported product quality, more significantly than those in developing inland areas. Due to lower import costs, corporations in developed coastal areas tend to improve productivity by importing high-quality products, as the stringency of environmental regulations increases. Moreover, the impact of imported product quality on productivity is closely related to the ability of corporations to absorb advanced green technologies (Augier et al., 2013). Because of their technical and human advantages, corporations in developed coastal areas are more likely to learn advanced green technologies from imported high-quality products. Consequently, this leads to a more significant increase in productivity than for corporations in developing inland areas.

One of the main limitations is the limited data. As the China Industrial Enterprise Database changed statistical indicators after 2007, a large amount of data was missing. We only used data from 2001 to 2006. In addition, another limitation is that we only used the case of China’s manufacturing corporations to examine the relationship between environmental regulations, import behaviour, and corporate productivity. Therefore, we call for more translational studies using the latest data in the future to verify the generality of our conclusions. Moreover, the counterfactual analysis may also be useful in investigating the impact of environmental regulation and imported inputs on productivity (Halpern et al., 2015).

7 Conclusion

With the broad application of environmental regulations globally, a large number of studies have examined the impact of environmental regulations on corporate productivity (Johnstone et al., 2017). However, current studies ignore the mediating effect of import behaviour, which leads to a one-sided understanding of the mechanism of the impact of environmental regulations on corporate productivity. Therefore, it is necessary to develop existing environmental regulations theory to understand the mediating effect of import behaviour. To respond to this gap, we used the case of China’s manufacturing corporations to study how environmental regulations affect corporate productivity by changing imported product quality.

The main contributions of our research can be summarised as follows. First, we examined the mediating effect of import behaviour between environmental regulations and corporate productivity. Second, we constructed a theoretical framework to analyse the relationship between environmental regulations and corporate productivity by considering the influence of imported product quality in the production function. Third, we revealed the heterogeneity effects of the interaction between environmental regulations and imported product quality on corporate productivity through the empirical study of China’s manufacturing corporations.

Our findings demonstrate that the increasing stringency of environmental regulations prompts corporations to improve imported product quality, rather than to transfer polluting industries abroad; thus, it does not pose a threat to the environment of neighbouring countries. Moreover, the increasing stringency of environmental regulations also leads to learning effects and improvements in imported product quality, thereby increasing corporate productivity. Finally, the effects of the interaction between environmental regulations and import behaviour on corporate productivity are heterogeneous, as they depend on the type of ownership and corporate location. With the increasing stringency of environmental regulations, SOEs and other corporations in developed coastal areas improve productivity by increasing imported product quality, more significantly than other corporations.

Our findings have implications for the design of the future environmental regulation policy. First, since environmental regulations do not lead to the transfer of polluting industries abroad, a country can determine the appropriate stringency when formulating environmental regulation policies, without considering pollution transfer. Second, when formulating environmental regulation policies, priority should be given to improving corporate productivity by changing imported product quality. Third, different environmental regulation policies should be formulated according to the differences in ownership and location, to ensure the fairness and effectiveness of environmental regulation policies.

Availability of data and material

The datasets generated during and analysed during the current study are available from the corresponding author on reasonable request.

References

Agarwal, R., & Audretsch, D. B. (2001). Does entry size matter? The impact of the life cycle and technology on firm survival. The Journal of Industrial Economics, 49(1), 21–43.

Aiken, L. S., & West, S. G. (1991). Multiple regression: Testing and interpreting interactions. Sage Publications Inc.

Albrizio, S., Kozluk, T., & Zipperer, V. (2017). Environmental policies and productivity growth: Evidence across industries and firms. Journal of Environmental Economics and Management, 81, 209–226. https://doi.org/10.1016/j.jeem.2016.06.002

Anderson, J. E., & van Wincoop, E. (2004). Trade costs. Journal of Economic Literature, 42(3), 691–751. https://doi.org/10.1257/0022051042177649

Arora, S., & Gangopadhyay, S. (1995). Toward a theoretical model of voluntary overcompliance. Journal of Economic Behavior & Organization, 28(3), 289–309.

Asker, J., Collard-Wexler, A., & Loecker, J. D. (2014). Dynamic inputs and resource (mis)allocation. Journal of Political Economy, 122(5), 1013–1063. https://doi.org/10.1086/677072

Atherton, A. (2008). From “fat pigs” and “red hats” to a “new social stratum”: The changing face of enterprise development policy in China. Journal of Small Business and Enterprise Development, 15(4), 640–655. https://doi.org/10.1108/14626000810917771

Augier, P., Cadot, O., & Dovis, M. (2013). Imports and TFP at the firm level: The role of absorptive capacity. Canadian Journal of Economics, 46(3), 956–981. https://doi.org/10.1111/caje.12034

Bajona, C., & Chu, T. (2010). Reforming state owned enterprises in China: Effects of WTO accession. Review of Economic Dynamics, 13(4), 800–823.

Bartelsman, E. J., & Doms, M. (2000). Understanding productivity: Lessons from longitudinal microdata. Journal of Economic Literature, 38(3), 569–594. https://doi.org/10.1257/jel.38.3.569

Bartelsman, E., Haltiwanger, J., & Scarpetta, S. (2013). Cross-country differences in productivity: The role of allocation and selection. American Economic Review, 103(1), 305–334. https://doi.org/10.1257/aer.103.1.305

Becker, R. A. (2011). Local environmental regulation and plant-level productivity. Ecological Economics, 70(12), 2516–2522.

Blalock, G., & Veloso, F. M. (2007). Imports, productivity growth, and supply chain learning. World Development, 35(7), 1134–1151. https://doi.org/10.1016/j.worlddev.2006.10.009

Bloom, N., Draca, M., & Van Reenen, J. (2015). Trade induced technical change? The impact of Chinese imports on innovation, IT and productivity. The Review of Economic Studies, 83(1), 87–117. https://doi.org/10.1093/restud/rdv039

Brandt, L., Van Biesebroeck, J., & Zhang, Y. (2012). Creative accounting or creative destruction? Firm-level productivity growth in Chinese manufacturing. Journal of Development Economics, 97(2), 339–351. https://doi.org/10.1016/j.jdeveco.2011.02.002

Broda, C., Greenfield, J., & Weinstein, D. E. (2017). From groundnuts to globalization: A structural estimate of trade and growth. Research in Economics, 71(4), 759–783. https://doi.org/10.1016/j.rie.2017.10.001

Cai, F., Wang, D., & Du, Y. (2002). Regional disparity and economic growth in China: The impact of labor market distortions. China Economic Review, 13(2–3), 197–212.

Cameron, G., Proudman, J., & Redding, S. (2005). Technological convergence, R&D, trade and productivity growth. European Economic Review, 49(3), 775–807.

Chen, Z., Zhang, J., & Zheng, W. (2017). Import and innovation: Evidence from Chinese firms. European Economic Review, 94, 205–220.

Cheng, Z., Li, L., & Liu, J. (2017). The emissions reduction effect and technical progress effect of environmental regulation policy tools. Journal of Cleaner Production, 149, 191–205. https://doi.org/10.1016/j.jclepro.2017.02.105

China General Administration of Customs (2015) 'China Customs Import and Export Database' China General Administration of Customs. Beijing. Available at: http://www.resset.cn.

Cole, M. A. (2004). Trade, the pollution haven hypothesis and the environmental Kuznets curve: Examining the linkages. Ecological Economics, 48(1), 71–81. https://doi.org/10.1016/j.ecolecon.2003.09.007

Cole, M. A., & Elliott, R. J. R. (2003). Do environmental regulations influence trade patterns? Testing old and new trade theories. World Economy, 26(8), 1163–1186.

Cooke, F. (2005). Vocational and enterprise training in China: Policy, practice and prospect. Journal of the Asia Pacific Economy, 10(1), 26–55.

Córdoba-Pachón, J. R., Garde-Sánchez, R., & Rodríguez-Bolívar, M. P. (2014). A systemic view of corporate social responsibility (CSR) in state-owned enterprises (SOEs). Knowledge and Process Management, 21(3), 206–219.

Ederington, J., Levinson, A., & Minier, J. (2005). Footloose and pollution-free. The Review of Economics and Statistics, 87(1), 92–99. https://doi.org/10.1162/0034653053327658

Fan, H., Li, Y. A., & Yeaple, S. R. (2015). Trade liberalization, quality, and export prices. The Review of Economics and Statistics, 97(5), 1033–1051.

Garicano, L., Lelarge, C., & Van Reenen, J. (2016). Firm size distortions and the productivity distribution: Evidence from France. American Economic Review, 106(11), 3439–3479.

Ghosal, V., Stephan, A., & Weiss, J. F. (2019). Decentralized environmental regulations and plant-level productivity. Business Strategy and the Environment. https://doi.org/10.1002/bse.2297

Girma, S., & Gong, Y. (2008). FDI, linkages and the efficiency of state-owned enterprises in China. The Journal of Development Studies, 44(5), 728–749.

Gonchar, K., & Kuznetsov, B. (2018). How import integration changes firms’ decisions to innovate. The Annals of Regional Science, 60(3), 501–528.

Gutiérrez, E., & Teshima, K. (2018). Abatement expenditures, technology choice, and environmental performance: Evidence from firm responses to import competition in Mexico. Journal of Development Economics, 133, 264–274.

Hallak, J. C., & Sivadasan, J. (2013). Product and process productivity: Implications for quality choice and conditional exporter premia. Journal of International Economics, 91(1), 53–67. https://doi.org/10.1016/j.jinteco.2013.05.001

Halpern, L., Koren, M., & Szeidl, A. (2015). Imported inputs and productivity. American Economic Review, 105(12), 3660–3703. https://doi.org/10.1257/aer.20150443

Hamamoto, M. (2006). Environmental regulation and the productivity of Japanese manufacturing industries. Resource and Energy Economics, 28(4), 299–312.

Head, K., & Ries, J. (2001). increasing returns versus national product differentiation as an explanation for the pattern of U.S.-Canada trade. American Economic Review, 91(4), 858–876. https://doi.org/10.1257/aer.91.4.858

Helpman, E. (1981). International trade in the presence of product differentiation, economies of scale and monopolistic competition: A Chamberlin-Heckscher-Ohlin approach. Journal of International Economics, 11(3), 305–340. https://doi.org/10.1016/0022-1996(81)90001-5

Hering, L., & Poncet, S. (2014). Environmental policy and exports: Evidence from Chinese cities. Journal of Environmental Economics and Management, 68(2), 296–318. https://doi.org/10.1016/j.jeem.2014.06.005

Hofman, P. S., Moon, J., & Wu, B. (2017). Corporate social responsibility under authoritarian capitalism: Dynamics and prospects of state-led and society-driven CSR. Business & Society, 56(5), 651–671. https://doi.org/10.1177/0007650315623014

Hsieh, C.-T., & Klenow, P. J. (2009). Misallocation and manufacturing TFP in China and India. The Quarterly Journal of Economics, 124(4), 1403–1448. https://doi.org/10.1162/qjec.2009.124.4.1403

Huang, J., Cai, X., Huang, S., Tian, S., & Lei, H. (2019). Technological factors and total factor productivity in China: Evidence based on a panel threshold model. China Economic Review, 54, 271–285.

Hummels, D., Jørgensen, R., Munch, J., & Xiang, C. (2014). The wage effects of offshoring: Evidence from Danish matched worker-firm data. American Economic Review, 104(6), 1597–1629. https://doi.org/10.1257/aer.104.6.1597

Johnstone, N., Managi, S., Rodríguez, M. C., Haščič, I., Fujii, H., & Souchier, M. (2017). Environmental policy design, innovation and efficiency gains in electricity generation. Energy Economics, 63, 106–115.

Kasahara, H., & Lapham, B. (2013). Productivity and the decision to import and export: Theory and evidence. Journal of International Economics, 89(2), 297–316. https://doi.org/10.1016/j.jinteco.2012.08.005

Khandelwal, A. (2010). The long and short (of) quality ladders. The Review of Economic Studies, 77(4), 1450–1476.

Lall, S. (1992). Technological capabilities and industrialization. World Development, 20(2), 165–186.

Lanoie, P., Laurent-Lucchetti, J., Johnstone, N., & Ambec, S. (2011). Environmental policy, innovation and performance: New insights on the Porter hypothesis. Journal of Economics & Management Strategy, 20(3), 803–842.

Lanoie, P., Patry, M., & Lajeunesse, R. (2008). Environmental regulation and productivity: Testing the porter hypothesis. Journal of Productivity Analysis, 30(2), 121–128.

Leffler, K. B. (1982). Ambiguous changes in product quality. The American Economic Review, 72(5), 956–967.

Li, D., Zheng, M., Cao, C., Chen, X., Ren, S., & Huang, M. (2017). The impact of legitimacy pressure and corporate profitability on green innovation: Evidence from China top 100. Journal of Cleaner Production, 141, 41–49. https://doi.org/10.1016/j.jclepro.2016.08.123

Liu, X., & Buck, T. (2007). Innovation performance and channels for international technology spillovers: Evidence from Chinese high-tech industries. Research Policy, 36(3), 355–366. https://doi.org/10.1016/j.respol.2006.12.003

Long, C., & Zhang, X. (2011). Cluster-based industrialization in China: Financing and performance. Journal of International Economics, 84(1), 112–123.

Majumdar, S. K. (1997). The impact of size and age on firm-level performance: Some evidence from India. Review of Industrial Organization, 12(2), 231–241. https://doi.org/10.1023/A:1007766324749

Megginson, W. L. (2017). Privatization, state capitalism, and state ownership of business in the 21st century. Foundations and Trends in Finance, 11(1–2), 1–153.

Moretti, E. (2004). Workers’ education, spillovers, and productivity: Evidence from plant-level production functions. American Economic Review, 94(3), 656–690.

Naegele, H., & Zaklan, A. (2019). Does the EU ETS cause carbon leakage in European manufacturing? Journal of Environmental Economics and Management, 93, 125–147.

National Bureau of Statistics of China (2018) 'China Industrial Enterprise Database' National Bureau of Statistics of China. 1998–2013. Beijing. Available at: http://162.105.134.150.

National Bureau of Statistics of China. (2002). China City Statistical Yearbook 2002. China Statistics Press.

National Bureau of Statistics of China. (2003). China City Statistical Yearbook 2003. China Statistics Press.

National Bureau of Statistics of China. (2004). China City Statistical Yearbook 2004. China Statistics Press.

National Bureau of Statistics of China. (2005). China City Statistical Yearbook 2005. China Statistics Press.

National Bureau of Statistics of China. (2006). China City Statistical Yearbook 2006. China Statistics Press.

National Bureau of Statistics of China. (2007). China City Statistical Yearbook 2007. China Statistics Press.

Nickell, S., & Nicolitsas, D. (1999). How does financial pressure affect firms? European Economic Review, 43(8), 1435–1456.

Olley, G. S., & Pakes, A. (1996). The dynamics of productivity in the telecommunications equipment industry. Econometrica, 64(6), 1263–1297.

Pan, X., Ai, B., Li, C., Pan, X., & Yan, Y. (2017). Dynamic relationship among environmental regulation, technological innovation and energy efficiency based on large scale provincial panel data in China. Technological Forecasting and Social Change.

Peters, B., Riley, R., Siedschlag, I., Vahter, P., & McQuinn, J. (2018). Internationalisation, innovation and productivity in services: Evidence from Germany, Ireland and the United Kingdom. Review of World Economics, 154(3), 585–615.

Piveteau, P., & Smagghue, G. (2019). Estimating firm product quality using trade data. Journal of International Economics, 118, 217–232. https://doi.org/10.1016/j.jinteco.2019.02.005

Porter, M., & Van der Linde, C. (1995). Green and competitive: Ending the stalemate. Harvard Business Review, 73(5), 120–134.

Qian, G., Liu, B., & Wang, Q. (2018). Government subsidies, state ownership, regulatory infrastructure, and the import of strategic resources: Evidence from China. Multinational Business Review, 26(4), 319–336. https://doi.org/10.1108/MBR-10-2017-0080

Ren, S., Li, X., Yuan, B., Li, D., & Chen, X. (2018). The effects of three types of environmental regulation on eco-efficiency: A cross-region analysis in China. Journal of Cleaner Production, 173, 245–255. https://doi.org/10.1016/j.jclepro.2016.08.113

Rizov, M., & Zhang, X. (2014). Regional disparities and productivity in China: Evidence from manufacturing micro data. Papers in Regional Science, 93(2), 321–339.

Rubashkina, Y., Galeotti, M., & Verdolini, E. (2015). Environmental regulation and competitiveness: Empirical evidence on the Porter Hypothesis from European manufacturing sectors. Energy Policy, 83, 288–300.

Shang, L., Tan, D., Feng, S., & Zhou, W. (2021). Environmental regulation, import trade, and green technology innovation. Environmental Science and Pollution Research. https://doi.org/10.1007/s11356-021-13490-9

Shao, S., Tian, Z., & Fan, M. (2018). Do the rich have stronger willingness to pay for environmental protection? New evidence from a survey in China. World Development, 105, 83–94. https://doi.org/10.1016/j.worlddev.2017.12.033

Shi, X., & Xu, Z. (2018). Environmental regulation and firm exports: Evidence from the eleventh Five-Year Plan in China. Journal of Environmental Economics and Management, 89, 187–200. https://doi.org/10.1016/j.jeem.2018.03.003

Tang, D., Tang, J., Xiao, Z., Ma, T., & Bethel, B. J. (2017). Environmental regulation efficiency and total factor productivity—Effect analysis based on Chinese data from 2003 to 2013. Ecological Indicators, 73, 312–318. https://doi.org/10.1016/j.ecolind.2016.08.040

Wagner, J. (2015). A note on firm age and the margins of imports: First evidence from Germany. Applied Economics Letters, 22(9), 679–682. https://doi.org/10.1080/13504851.2014.967378

Wang, C., Wu, J., & Zhang, B. (2018). Environmental regulation, emissions and productivity: Evidence from Chinese COD-emitting manufacturers. Journal of Environmental Economics and Management, 92, 54–73.

Wang, Y., & Shen, N. (2016). Environmental regulation and environmental productivity: The case of China. Renewable and Sustainable Energy Reviews, 62, 758–766.

Williamson, P. J. (1990). Domestic pricing under import threat. Applied Economics, 22(2), 221–235. https://doi.org/10.1080/00036849000000064

Wilson, J. S., Mann, C. L., & Otsuki, T. (2005). Assessing the benefits of trade facilitation: A global perspective. The World Economy, 28(6), 841–871. https://doi.org/10.1111/j.1467-9701.2005.00709.x

Xie, R.-H., Yuan, Y.-J., & Huang, J.-J. (2017). Different types of environmental regulations and heterogeneous influence on “green” productivity: Evidence from china. Ecological Economics, 132, 104–112.

Xu, B., & Lu, J. (2009). Foreign direct investment, processing trade, and the sophistication of China’s exports. China Economic Review, 20(3), 425–439.

Xu, H., Lai, M., & Qi, P. (2008). Openness, human capital and total factor productivity: Evidence from China. Journal of Chinese Economic and Business Studies, 6(3), 279–289. https://doi.org/10.1080/14765280802283576

Yang, C.-H., Tseng, Y.-H., & Chen, C.-P. (2012). Environmental regulations, induced R&D, and productivity: Evidence from Taiwan’s manufacturing industries. Resource and Energy Economics, 34(4), 514–532.

Yasar, M. (2013). Imported capital input, absorptive capacity, and firm performance: Evidence from firm-level data. Economic Inquiry, 51(1), 88–100.

Yu, M. (2015). Processing trade, tariff reductions and firm productivity: Evidence from Chinese firms. The Economic Journal, 125(585), 943–988. https://doi.org/10.1111/ecoj.12127

Zhu, S., He, C., & Liu, Y. (2014). Going green or going away: Environmental regulation, economic geography and firms’ strategies in China’s pollution-intensive industries. Geoforum, 55, 53–65.

Funding

This study was supported by the National Natural Science Foundation of China (Grant Nos. 72074119 and 71774088), the Social Science Foundation in Jiangsu Province (Grant No. 20GLB003), and the National Social Science Fund of China (Grant No. 18ZDA052).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

We wish to confirm that there are no known conflicts of interest associated with this publication, and there has been no significant financial support for this work that could have influenced its outcome.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Sheng, J., Xin, J. & Zhou, W. The impact of environmental regulations on corporate productivity via import behaviour: the case of China’s manufacturing corporations. Environ Dev Sustain 25, 3671–3697 (2023). https://doi.org/10.1007/s10668-022-02193-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10668-022-02193-x