Abstract

Determining the share of project cost progress is among the essential issues in the planning phases of financial management and earned value management (EVM). The performance baseline is set up in the planning phase to measure cost deviations during project execution. Then, an estimate at completion (EAC) is forecasted based on the current cost progress. Traditionally, EVM only focuses on the cost performance index (CPI) and does not address other important aspects, such as complexity and risk, which are critical for all organizational stakeholders. In most cases, the cost factor is used to determine the percentage of the project’s financial progress. Despite its superior formulation, EVM forecasts are still influenced by project risks and uncertainties. These factors lead to inconsistency between EAC results obtained through standard formulae. In this study, a framework was developed in which a relatively complete set of criteria has been evaluated and ranked to improve cost progress estimation. Such criteria can be used in the proposed multi-criteria decision-making technique for activities related to peroxide project operations. Expert opinions in several groups have been collected using the group decision-making method. The risk of activities was identified using the Failure Modes and Effects Analysis (FMEA) method. In addition, the rank of activities was determined by the Multi-Objective Optimization based on Ratio Analysis based on G-number theory (G-MOORA) method with an uncertainty approach. Linguistic indicators of importance and necessity in the decision matrix G were fuzzified through triangular numbers. In the next step, these values were normalized to definite numbers, and the cost progress of the project was calculated. The output is a table proposing fixed weights, indicating that adding weighting dimensions changes the calculation of the project cost percentage of progress for well-known activities that can be widely used in construction and installation projects.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Project management knowledge, such as law, medicine, and accounting, relies on experience-based theories resulting from the scientific achievements of operational and academic people, whose achievements are used and the conditions for its scientific progress are provided. Project management knowledge includes proven traditional methods that are widely used in practice. In this regard, new innovative methods are constantly introduced in this field (Fardi et al., 2019). The method of calculating project cost progress is one of the most important issues in management that is continuously growing in the phases of “financial management” and “project control”. In financial management, the projected information is obtained with project progress percentage in different financial periods during the project implementation, called the cost progress percentage. The project progress percentage is determined according to the financial facts and the work done and compared with the relevant programs’ progress percentage. Analyzing the financial percentage of the project and comparing it with the planned is vital for decision-makers because this information can show the project facts with the right or wrong performance (Filippetto et al., 2021).

The main concerns of project managers and stakeholders are to complete the project according to a pre-determined financial plan or to have a slight deviation from the plan. In this respect, integrated and accurate project control depends on the duration and appropriate and correct access to project information. The Project Management Body of Knowledge (PMBOK) is divided into nine areas defining each area’s inputs, techniques, and outputs. Project communication management plays a critical role in project collection, processing, and evaluation. According to this standard, communication management is the sum of the processes required to ensure the production, collection, classification, storage, and distribution of project information (according to the characteristics of each) at a specified time and appropriately (Wu et al., 2021).

A necessary process defined in project communication management is the performance reporting process. This process collects and disseminates the performance information to determine how stakeholders use resources to achieve project goals. This process includes the following topics. First, the project performance reports should contain information about time, cost, and quality, so the technique used to prepare performance reports should include the above items with analysis. Using this analysis allows estimating the remaining time and budget report to reduce the deviations between what actually happens in reality against the budget and time baselines. Revising and optimizing (Terbrack et al., 2021) activity in the project makes the project progress as much as possible. However, if even an activity is done partially, the project progresses as well. The reason is that it is usually impossible to calculate the total tasks of the project and choose a disclosure criterion. Several criteria have been proposed for the activities, such as “risk” and “complexity.” Each activity requires time and budget to complete regardless of the type of task. Some criteria are commonly used to evaluate the progress of projects (Egwim et al., 2021). The percentage of project financial progress is the main project performance indicator in periodic reports. Calculating project progress and comparing it to a pre-determined financial plan (baseline budget) removes many ambiguities and determines the project’s status for project management. There may not be a more important indicator of the project progress percentage to determine the project’s status, based on which the project earned value (Lalmi et al., 2021).

Earned value management (EVM) is a very efficient way to manage the duration and cost of the project (Jafarzadeh-Ghoushchi et al., 2017). Although EVM is designed to control the project cost and duration, this approach focuses on cost management. The explanation is that costs fluctuate and increase the price increase likelihood. As a result, the possibility of project equipment might not be provided. These events can pose serious problems for the project. However, they are not targeted and cover a wide range of industries because of economic sanctions. Studies have considered economic sanctions on target countries (i.e., stupid sanctions), according to which the nature of the restrictions is usually indistinguishable and affects all residents of the target countries (Samee & Pongpeng, 2016). Most projects in EVM have been done in relation to the project cost (Ershadi et al., 2021). Aliverdi et al. (2013) proposed different methods for cost estimation. In those methods, the behavior of time indicators in the value management system has been acquired. However, many researchers have criticized the way they are interpreted. Thus, many efforts have been made to improve duration performance, which eventually led to the emergence of the concept of timing acquired (Lipke, 2006).

The high accuracy of ES has led to the definition of several indicators to measure the duration performance of the project and has made it a suitable complement to value management (Koke & Moehler, 2019). Determining the weight percentage is significant in project management and control, especially in determining cost progress. Defining the project information structure, planning, updating, and reporting the project will be completely affected by the manager’s accuracy in determining the project weight percentages. This issue is especially important in projects where the progress of the project cost is the basis of payment, for instance, in projects whose payment method is unchanged. Given that the resubmission policy causes an immediate decrease in the company’s value, it is reasonable to assume that shareholders, especially small shareholders, believe the disclosure announced by managers (Beladi et al., 2019). Therefore, in such cases, the method for determining the percentage of project cost progress involves many common legal issues of stakeholders and contractors (i.e., consultant, designer, and construction contractor). Some studies have evaluated project progress and project performance based on ISO9001 and EFQM criteria (Zhang et al., 2009). Some other researchers have examined the completion of activities and project progress in terms of time, cost, and organizational learning (Hassanpour et al., 2021; Wi & Jung, 2010). Although in some studies, the project progress has been considered in terms of risk and uncertainty in the implementation of activities and the factors affecting it, there is a deviation in estimating the project’s progress. Therefore, new methods are needed in this field, and most studies on physical progress calculation methods try to reduce the deviation of the calculated progress percentage. Usually, one of the most important criteria for this purpose is the cost criterion, which has a severe deviation. In some studies, equations have been developed assuming data certainty (Anand et al., 2021; Pamucar et al., 2021; Zayed et al., 2008).

In this research, the failure modes and effects analysis (FMEA) method was used to provide a program to predict deviation and its impact on management indicators. FMEA employs a simple step-by-step system structure implemented by industry experts. An important reason for developing this method is its ease and low cost of implementation in various industries. The FMEA method was first introduced in the 1920s, but its widespread use in various industries has increased significantly since the early 1960s. Today, it is widely used in multiple industries, including food, renewable and non-renewable energy, automotive, chemical, medical equipment, and mechanical industries (Akbari et al., 2020; Eroğlu, 2021; Lin et al., 2021; Rahmati et al., 2022). As mentioned, the occurrence of risks and their effects are based on experts’ forecasts. Hence, this process can be considered a possible process.

The FMEA method uses the Risk Preference Quantity (RPN) criterion to rank the identified risks (Dorosti et al., 2020; Hematinia et al., 2020). From Eq. (1), the value of this quantity can be calculated:

In this equation, parameter D indicates the probability of risk detection and identification, O indicates the probability of risk occurrence, and S shows the severity of risk occurrence. Risk priority is determined by the RPN for each risk such that increasing the RPN raises the risk priority, and more important corrective action must be taken against it. The most important disadvantages of this method are the non-interference of weights in determining the importance of indicators of severity, probability of occurrence, and probability of diagnosis. Sometimes RPNs are the same for both risks, but the effects of their risks are different (Liu et al., 2015). Expert opinion is used in this method to determine the number of decision indicators. According to experts, there are always possible features that make the results definitely not the same as the real problems. Therefore, using methods that calculate uncertainty can provide more confidence in the resulting outputs. Another disadvantage of the FMEA method is the incomplete prioritization, which increases the duration and cost of preventive planning (Ghoushchi et al. 2021a, b, c). For these reasons, this method needs new indicators for weighting activities that can help calculate the percentage of more efficient progress by considering uncertainty.

2 Literature review

Project financial management is mostly done by controlling the percentage of cost progress, which is one of the main processes in project financial management. Nevertheless, only a handful of papers have studied the problem from both stakeholder’s and manager’s perspectives. In this section, we review the research literature based on project management and project control.

Zavadskas et al. (2014) proposed a method for estimating project progress with multiple criteria to estimate the project progress percentage by considering the criteria affecting project progress. They presented a new model with a practical approach and compatible with conventional standards in which the criteria of risk, duration, buoyancy, and cost are considered. Finally, each activity has a weight in each criterion, which leads to a change in the percentage of total physical progress.

Ghoushchi et al. (2021a, b, c) provided a new approach to assess and rank HSE risks with inaccurate data. They developed a new approach in three steps to identify some of the disadvantages of the FMEA method. In the first step, risk situations are identified by the FMEA method, and RPN determinants are quantified. In the second step, using the G-BWM method and experts’ opinions, the weight of the desired factors is calculated. Finally, the risk is considered in this approach by G-number theory. The proposed approach in this research was implemented in factories active in copper production. The results indicate the complete prioritization of risks over other methods such as FMEA and fuzzy BWM.

Urgiles et al. (2020) proposed a technique to improve the control and monitoring of hydropower projects and deal with very complex projects to build hydropower plants, which often face cost increases and delays. Their method is to monitor and control the construction projects of hydropower plants, which allows the periodic calculation of the criteria of physical progress, financial progress, cost forecast, and project completion time. Their proposed method improves efficiency compared to traditional methods. The proposed method makes it possible to simultaneously consider the costs, deadlines, sensitivities, and operational risks of the projects under analysis.

Babar et al. (2017) estimated the cost at completion by risk integration in value management. To this end, they proposed a framework that integrates various key performance indicators into the risk performance index (RPI). They proposed an integrated model using SPI, CPI, and RPI and conducted several case studies to validate it. The results show a better EAC compared to traditional methods. It also provides stakeholders with better monitoring and decision-making tools to measure performance indicators to measure key aspects of the project.

Beigi et al. (2020) evaluated the impact of applying project management knowledge standards on improving the financial success of EPC projects. Also, they examined the impact of project management standards on the financial success of EPC projects. This study aimed to identify the impact of PMBOK standards on improving the financial success of EPC projects. Using previous studies, they prepared a questionnaire and completed the EPC among project experts, identified the factors affecting the financial success of EPC projects, and categorized them according to 10 PMBOK standard areas. Finally, they evaluated the importance of each identified factor in improving the financial success of EPC projects. The results showed that the application of project management knowledge has a significant effect on improving the financial success of EPC projects.

Oliveira (2019) used the EVM model to monitor and control the program and cost performance in protecting the building facade. The proposed model provided satisfactory results for comfortable and effective implementation in the protection of facades. When applying the EVM model, it is necessary to determine the performance capability of short-term tasks with low complexity.

Wang et al. (2009) developed weighting methods for project activities using multiple criteria and calculated fuzzy models of “fuzzy hierarchical analysis process” and “network analysis process”. Also, along with the weights of costs extracted from the project documents, using the TOPSIS method, they calculated the utility distance of each activity with the ideal solution and considered it equal to its weight. The proposed method was implemented in a refinery project (Table 1).

3 Problem description

In project management science, assigning resources to finalize the activities of each project is very important for project experts. Budget, as the most important source of any project, can be completed by the deadline and with the baseline budget with planning and scheduling. This allocation is possible by receiving more detailed information from the current status of the project so that other dimensions are considered important. The common problem in many projects is the disagreements between contractors and stakeholders. Relying on project progress and project cost reports is not recommended when the percentage of project cost progress is not appropriate compared to the facts and activities are entered into the calculations with equal risk, which causes deviations. For example, an activity that can further satisfy stakeholders or affect the project’s credibility, and the project’s complexity, can also influence the project by the variety of resources used and the involvement of several professions.

Another problem that usually occurs in project management is calculating the progress of proposed models. Cost is used as a measure, a criterion whose weight is the cost of each activity divided by the project’s total cost which has a deviation. As a result, the physical progress percentage may also deviate. Thus, this model focuses on improving the percentage of cost-effective progress of the project.

The next problem is to improve the calculated weights of each activity and the opinion of stakeholders and experts. In most studies, this information source is used to collect data, but in any case, the input data has deviations. Entering the data directly definitely causes deviations in the equations and recognizes the weight of activities used to determine the progress percentage. As a result, it is better to use uncertainty models and methods to get a more realistic result.

Our proposed solution to reduce the deviation of project cost progress by adding important and new dimensions while considering the uncertainty in the input data of project experts shows how the difference in results helps the project management.

4 Methodology

A project is composed of several activities. Therefore, project progress estimation requires referring to the activities and their progress and summarizing the project progress. However, the important point is that the weights of project activities are not the same in terms of time and cost. Besides, the weight of each activity is affected by several factors. In the project, the significance coefficient of the affected factors is also different and unique. Due to this issue and the research background on project progress estimation, a multi-criteria decision model is presented in this research. In this method, it is assumed that each activity in a project is part of the project, and this part is a function of several factors. Obviously, the total progress of the project in terms of cost and duration can be obtained from each project activity. The amount of project progress at each stage of project life can be extracted from the total progress of each activity per share. Each activity of the design project is a tool to estimate the impact of the selected dimensions on the cost index. The role of each dimension is essential in the activities and ultimately in the project.

Decision-making issues are data-based. Therefore, they must have the least ambiguity and uncertainty to make the decision useful and reliable. Many methods such as fuzzy set theory, probability theory, and various decision methods reduce various aspects of ambiguity and uncertainty in decision problems. The problem presented in this study was evaluated using a new method called G numbers using incorrect data based on the concept of importance and necessity and in the form of a regular pair of fuzzy numbers (Ghoushchi & Khazaeili, 2019). Identifying the risks of their occurrence and weighing them is an important task for project managers. For this purpose, the conventional FMEA method is used, despite its weaknesses. The MOORA method was first used by Brauers and Zavadskas (2006) to address the shortcomings of weighting methods in models. Previous decisions such as Preferred Ranking Organization Method for Enrichment Assessment (PROMETHEE), Ideal Solution-Like-Order Priority Technique (TOPSIS), Analytic Hierarchy Process (AHP), and Translate Reality Selection (ELECTRE) are used for this purpose. This method is based on the theory of relative analysis and the reference point method as a suitable method for multi-objective optimization.

The most important features of this method are the facile use of multi-objective optimization, less computation, high stability, and short solution time. In this study, a new approach to prioritize identified risks. It is proposed to eliminate the gap of the FMEA method in two stages: In the first step, the factors are identified by the generalized FMEA method, the risk of peroxide project activities in the petrochemical industry is measured, and three parameters are quantified in the RPN method. In the second step, according to the results from the previous steps, the scores obtained are weighted using the proposed G-MOORA method. The G-number approach also takes into account incorrect risk data and complexity index. This approach is implemented in a plant construction project to produce peroxide in the petrochemical industry.

4.1 Analysis and result

As explained, the proposed method, unlike the traditional, examines the proposed three dimensions for each activity instead of one dimension to estimate the cost progress. In this way, a 4.3% difference means calculating the project progress by giving importance to risk affects the cost of activities and the impact of complexity on the cost of each activity. This complexity increases the calculation accuracy of project cost progress and, ultimately, the accuracy of contractors’ payments. Based on these dimensions, the weight of each activity is calculated for the whole project. During the project implementation, at certain times, information about the progress of project activities from different parts of the project will reach the project control unit and later the financial unit. At this stage, the financial progress is calculated by analyzing the information received. A macro program was designed for the proposed model in VB. In this module, a report on the progress of activities is recorded at each stage. The program automatically calculates the share of each activity of the total project and transmits its information to MS-Project software; then, the software shows the project progress percentage at the time of reporting. In the following, a case study is performed to evaluate the functionality and validation of the presented model.

Figure 3 shows the difference between the percentage of cost progress with the classic method and the innovative method with blue and orange colors. This difference has a simple interpretation: work earned more value than the money spent.

For example, the importance of activities 1–2 is less considering the complexity and risk of the project. Thus, the proposed model suggests 18.9% progress instead of 25% because this activity requires less diverse resources and less complexity and time. The more time and cost is required, the lower the severity and probability. Accordingly, the project value is less than the money spent up to the time of reporting.

5 Proposed model

The proposed model will show how the total value of θ will differ from the value of θ after applying the coefficients by applying the weight of the studied criteria, which will ultimately change the cost progression. According to the above explanations, the research model can be summarized as follows:

\(\theta \): The progress of the whole project at the time of reporting, \(i\): Activity start event, \(j\): End of activity event, \(T_{ij}\): Weight calculated by the proposed method, \({\text{WB}}_{ij}\): The cost weight of each activity based on the total cost of resources consumed by the activity, \({\text{WC}}_{ijc}\): Weight calculated based on activity complexity, \({\text{WR}}_{ijr}\): Calculated weight of activity risk, \({\text{BV}}_{iji}\): The earned financial value of the activity (amount of value earned from the planned budget).

5.1 Calculate financial risk

Risk is the first criteria considered in this method, which tries to evaluate the tasks in a project based on the set parameters in order to gain their weights.

\(R_{ijn}\): The total risk share of each activity ij identified risk factors, \({\text{INR}}_{n}\).: The risk severity of risk factors identified, \({\text{POR}}_{n}\): The risk probability of risk factors identified, \({\text{RPN}}\): The product of the severity of the risk and the probability of the risk occurring between 1 and 25, \({\text{WR}}_{ij}\): The calculated weight of the financial risk of each project activity.

Table 2 shows tt the severity of the risk of achieving the goal, which is important for the organization, is scaled and the average score in the questionnaire is considered by the project expert.

Table 3, the average of the two columns Percentage of probability and Frequency of probability in the questionnaire is recorded by experts The RPN is then calculated by multiplying the scores of the above tables by Eq. (1) (Tables 4, 5, 6, 7, 8).

5.2 Complexity calculation

Complexity of tasks is the second criterion considered in this method that tries to determine the weight of tasks in the project, the same weight that brings the weight of tasks closer to reality.

\({\text{WC}}_{ij}\) The calculated weight of the complexity of each project activity.

To calculate the uncertainty, we perform the following steps:

Step 1 The decision matrix with G-number data is expressed as follows. In this matrix, m and n represent the number of alternatives and the number of criteria, respectively. Also, they indicate the value of the i-th criterion for the j-th option (first component G-numbers) and the necessity of the i-th criterion for the j-th option (the second component of the G-numbers), respectively (Khazaeili et al., 2019).

Step 2 Convert the decision matrix G to fuzzy triangular numbers.

Verbal variables Indices of importance and necessity in the decision matrix G are converted to triangular fuzzy numbers using the equation (Egwim et al., 2021; Khazaeili et al., 2019).

Step 3 Normalize the fuzzy decision matrix.

Using formula 7, we normalize the decision matrix and the normalized matrix D is obtained in this step (Khazaeili et al., 2019).

Step 4 Convert fuzzy triangular numbers to definite numbers.

Using the equation formula, 8 fuzzy triangular numbers become definite.

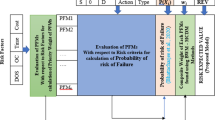

5.3 Diagram/framework step by step

5.4 Describe the model by solving a sample model

Consider the following project, which has 5 tasks (arrows) and event or milestone (circles), and their prerequisite and post-requirement relationships are defined as follows, as well as the cost of each activity on the arrow related to the same activity (Fig. 1).

In Table 9, the hypothetical values of each activity in the project are recorded in relation to each relevant criterion.

\({\text{WB}}_{ij}\): The weight of the cost of each activity based on the sum of the costs of the resources of the activity to the whole project

\({\text{WC}}_{ij}\): Weight calculated based on activity complexity

\({\text{WR}}_{ij}\): Calculated weight of financial risk

To reduce the deviation caused by human error in filling out the questionnaire, then the obtained numbers are entered into uncertainty calculations based on the risk and complexity of activities.

In order to reduce the deviations, in addition to changing the point to 3 points, in the triangular fuzzy numbers, it is also divided into two parts Importance and Necessity (Table 10).

Now, after normalizing the matrices presented in Table 9.

Shown now according to the MOORA approach, the other steps and complete weighting of the approach are in Table 11 (Table 12).

Finally, the risk weight will replace the previous risk weight with uncertainty calculations and enter the next equations (Table 13).

And now the calculations are done for the complexity of the activities (Table 14, 15, 16).

And the obtained weights mentioned in the mathematical model are recorded in Table 17.

According to the model presented in this study Eq. (2), we have:

Calculated percentage of project cost progress before performing the proposed model calculations:

70% progress for project cost progress has been achieved in a classic way and now using calculated weights of risk and complexity with uncertainty of input data by experts, the percentage of cost progress has been improved:

\(\theta \mathrm{\%}=\sum \left[\frac{50}{50}\left(0.1893\right)\right]+\left[\frac{30}{30}\left(0.2271\right)\right]+\left[\frac{40}{50}\left(0.2114\right)\right]+\left[\frac{20}{30}\left(0.1069\right)\right]+[\frac{0}{40}\left(0.2650\right)()\times 100=\mathrm{\%}65.7\)

5.5 Analysis and result

As explained, the proposed method, unlike the traditional examines the proposed three dimensions for each activity instead of one dimension to estimate the cost progress, so the difference of 4.3% means calculating the project progress by giving importance to risk affects the cost of activities as well as the impact of complexity on the cost of each activity, which promotes the calculation of project cost progress and ultimately increases the accuracy of contractors’ payments. Based on these dimensions, the weight of each activity is calculated for the whole project. During the implementation of the project, at certain times, from different parts of the project, information about the progress of project activities will reach the project control unit and later the financial unit. At this stage, the amount of financial progress is calculated by analyzing the information received. A macro program has been designed for the proposed model in VB, in which a report on the progress of activities is recorded at each stage. The program automatically calculates the share of each activity of the total project and transmits its information to MS-Project software; then, the software will show the percentage of project progress at the time of reporting. In the following, a case study is performed to evaluate the functionality and validation of the model presented to the calculations (Fig. 2).

Figure 3 shows the difference between the percentage of cost progress with the classic method and the innovative method with blue and orange colors. This difference has a simple interpretation, which work earned more value with the money spent.

For example, activity 1–2 The importance of this activity is less considering the complexity and risk of the project, so the proposed model of this study suggests 18.9% progress instead of 25% because this activity requires less diverse resources and less complexity and time. The more time and cost is required, the lower the severity and probability, so the value of the project is less than the amount of money spent up to the time of reporting.

6 Case study

This project is to build a peroxide production plant located in the Kurdistan Petrochemical site. Completing the plant’s construction has several management challenges, the most important part of which is cost management. Also, the project can be implemented using project progress reports that monitor the daily status of the project to update budget planning. Using the proposed method, we calculated the value of each activity, taking into account the stated factors. The project progress is calculated after entering this information in the MS-Project software. The results in the output of the software calculations are shown in Fig. 4.

7 Conclusion

In this study, an attempt is made to improve financial management, which is an important concern for project managers and stakeholders. To this end, we focus on cost progress, which is an important criterion for calculating the percentage of physical progress. As we know, reports are determining components in project planning because they inform managers of the project status and plan by interpreting deviations and prioritizing tasks based on important issues such as time, cost, risk and complexity in the project. Based on the obtained results, in the case study of “construction of peroxide production plant in Kurdistan Petrochemical Industrial Town”, the percentage of project cost progress with the proposed model is θ% = 44%. In comparison, the project progress percentage without weighting MS-Project cost is 43%. The results show that the budget spent on the “details of engineering” summary task is not adequate, which makes the cost percentage more than θ%. In other words, as much as 1% less attention is paid to risky and complex tasks. In the “procurement” summary task, the cost is reasonable, and thus θ% equals the cost%. In the “construction/installation” summary task, the budget spent is excellent, and tasks with more risk and complexity have more progressed. In other words, the money has been better spent and has been able to reduce risks and more attention to complex tasks. By interpreting the results, managers can now review the impact of the task on the project and plan with prioritizing tasks for the coming weeks based on which tasks are higher in time, cost, risk, and complexity. The results show the proposed method as an innovative method with a high ability to communicate practically with users. Finally, the present study is the first step in obtaining a table that can provide a fixed weight “WCij & WRij” for known activities that are widely used in construction and installation projects.

According to the above Fig. 5, after receiving data from project stakeholders and experts and after performing uncertainty calculations, the results show that the weight of the “details of engineering” summary task was 2% (i.e., the tasks are low cost). Due to the predecessors of “details engineering” tasks the weight value has increased to 29% in risk and 8% in complexity, which eventually reaches 10% in Tij. Meanwhile, the weight of procurement at first it was 80%, then it is 18% in risk and 36% in complexity, and finally in Tij it is about 40%. Overall, although it includes the highest cost of the project, it is simple and has less risk. Also, the weight of “construction/Installation” is 17%, which is 41% in risk, 51% in complexity, and 40% in Tij. In “Pre-Com./Com.” the weight is 2%, which is later increased to 7% with a weight of in risk and 8% in complexity and 10% in Tij. As a result, the weight of the procurement sub-tasks is less risky for the project than for its competitors and less complex. Hence, the model proposed in this study suggests that the weight value of procurement is reduced and that of other activities is increased so that managers can plan better.

Figure 6 shows the final calculation results in the case study of “construction of a peroxide plant in the Kurdistan Petrochemical Industrial Park.” As can be seen, the project progress percentage of the “overall project” with the proposed model (orange) is 44%. In comparison, the project progress percentage without weighting (blue) cost is 43%. Analyzing the results, we conclude that “detail engineering” is not appropriate for the budget spent. The budget is spent on activities with a lower risk value and complexity, and the cost% is more than θ. In “Procurement,” the cost is reasonable. Consequently, θ% is more than the cost because more money was spent on purchasing bids that made the project riskier and more complex. In “Construction/Installation,” the budget spent is excellent, and the work with a higher risk and complexity is more advanced. In other words, money is better spent and reduced risks and paid more attention to complex tasks. In the “Pre-Com./Com.”, the budget was not planned to be spent during the reporting period, and no budget was actually spent. With these results, managers can now prioritize tasks for the coming weeks. The same tasks have higher time, cost, risk, and complexity. The proposed method results show it as an innovative method with a high ability to communicate practically with users. Use another criteria such as: inflation, estimating the dependence of equipment purchase on the engineering phase, resource management and human resource, etc.

The same topics are suggested for further studies, Recommendations for further study include formulating effective criteria on the project and entering their data in the calculations, which results in more coverage of the effective criteria in the project and increases the accuracy of weighting coefficients. In addition, it is suggested to use the results of this study to reduce computational deviations. Finally, experiences of better management with a better understanding of the realities of the project can be used in this approach.

References

Akbari, R., Dabbagh, R., & Ghoushchi, S. (2020). HSE risk prioritization of molybdenum operation process using extended FMEA approach based on Fuzzy BWM and Z-WASPAS. Journal of Intelligent and Fuzzy Systems, 38(4), 5157–5173. https://doi.org/10.3233/JIFS-191749

Aliverdi, R., Naeni, L., & Salehipour, A. (2013). Monitoring project duration and cost in a construction project by applying statistical quality control charts. International Journal of Project Management, 31(3), 411–423. https://doi.org/10.1016/j.ijproman.2012.08.005

Anand, A., Castello, A., & Lecoeuvre, L. (2021). A review and classification of the uncertainties in projects: The way forward. Revue Française De Gestion Industrielle, 35(1), 57–79. https://doi.org/10.53102/2021.35.01.916

Babar, S., Thaheem, M., & Ayub, B. (2017). Estimated cost at completion: Integrating risk into earned value management. Journal of Construction Engineering and Management, 143(3), 04016104. https://doi.org/10.1061/(ASCE)CO.1943-7862.0001245

Beigi, H., Mahpour, A., & Mortaheb, M. (2020). Success breakdown structure: Application to petrochemical projects success assessment. AUT Journal of Civil Engineering, 4(3), 333–348. https://doi.org/10.22060/ajce.2019.16406.5585

Beladi, H., Marjit, S., & Oladi, R. (2019). Inflating profits and industry competitiveness. International Journal of Economic Theory, 15(3), 281–287. https://doi.org/10.1111/ijet.12185

Brauers, W., & Zavadskas, E. (2006). The MOORA method and its application to privatization in a transition economy. Control and Cybernetics, 35, 445–469.

Dorosti, S., Fathi, M., Ghoushchi, S. J., Khakifirooz, M., & Khazaeili, M. (2020). Patient waiting time management through fuzzy based failure mode and effect analysis. Journal of Intelligent & Fuzzy Systems, 38(2), 2069–2208. https://doi.org/10.3233/JIFS-190777

Egwim, C. N., Alaka, H., Toriola-Coker, L. O., Balogun, H., Ajayi, S., & Oseghale, R. (2021). Extraction of underlying factors causing construction projects delay in Nigeria. Journal of Engineering, Design and Technology. https://doi.org/10.1108/JEDT-04-2021-0211

Eroğlu, H. (2021). Multi-criteria decision analysis for wind power plant location selection based on fuzzy AHP and geographic information systems. Environment, Development and Sustainability, 23(12), 18278–18310. https://doi.org/10.1007/s10668-021-01438-5

Ershadi, M., Jefferies, M., Davis, P., & Mojtahedi, M. (2021). Achieving sustainable procurement in construction projects: The pivotal role of a project management office. Construction Economics and Building, 21(1), 45–64. https://doi.org/10.5130/AJCEB.v21i1.7170

Fardi, K., Jafarzadeh-Ghoushchi, S., & Hafezalkotob, A. (2019). An extended robust approach for a cooperative inventory routing problem. Expert Systems with Applications, 116, 310–327. https://doi.org/10.1016/j.eswa.2018.09.002

Filippetto, A., Lima, R., & Barbosa, J. (2021). A risk prediction model for software project management based on similarity analysis of context histories. Information and Software Technology, 131, 106497. https://doi.org/10.1016/j.infsof.2020.106497

Ghoushchi, S. J., Bonab, S. R., Ghiaci, A. M., Haseli, G., Tomaskova, H., & Hajiaghaei-Keshteli, M. (2021a). Landfill site selection for medical waste using an integrated SWARA-WASPAS framework based on spherical fuzzy set. Sustainability, 13(24), 13950. https://doi.org/10.3390/su132413950

Ghoushchi, S. J., Dorosti, S., Khazaeili, M., & Mardani, A. (2021b). Extended approach by using best–worst method on the basis of importance, necessity concept and its application. Applied Intelligence, 4, 1–15. https://doi.org/10.1007/s10489-021-02316-3

Ghoushchi, S. J., Gharibi, K., Osgooei, E., Ab Rahman, M. N., & Khazaeili, M. (2021c). Risk prioritization in failure mode and effects analysis with extended SWARA and MOORA methods based on Z-numbers theory. Informatica, 32(1), 41–67. https://doi.org/10.15388/20-INFOR439

Ghoushchi, S., & Khazaeili, M. (2019). G-Numbers: importance-necessity concept in uncertain environment. International Journal of Management and Fuzzy Systems, 5(1), 27–32. https://doi.org/10.11648/j.ijmfs.20190501.15

Hassanpour, J., Firouzei, Y., & Hajipour, G. (2021). Actual performance analysis of a double shield TBM through sedimentary and low to medium grade metamorphic rocks of Ghomrood water conveyance tunnel project (lots 3 and 4). Bulletin of Engineering Geology and the Environment, 80(2), 1419–1432. https://doi.org/10.1007/s10064-020-01947-z

Hematinia, S., Rezaeyan, S., & Jozi, S. (2020). Environmental risk assessment of urban development projects Tehran 19th District using spatial EFMEA (Case study: The operation of provincial parks). Ustainability, Development & Environment, 1(2), 69–86.

Jafarzadeh-Ghoushchi, S., Dorosti, S., & Asgari-Tehrani, S. (2017). Characteristics of the research on value engineering (2000–2015) world review of science. Technology and Sustainable Development, 13(2), 101–116. https://doi.org/10.1504/WRSTSD.2017.084171

Khazaeili, S., Jafarzadeh, S., & Ghoushchi, M. (2019). G-numbers: Importance-necessity concept in uncertain environment. The International Journal of Fuzzy Systems. https://doi.org/10.11648/j.ijmfs.20190501.15

Koke, B., & Moehler, R. (2019). Earned green value management for project management: A systematic review. Journal of Cleaner Production, 230, 180–197. https://doi.org/10.1016/j.jclepro.2019.05.079

Lalmi, A., Fernandes, G., & Souad, S. (2021). A conceptual hybrid project management model for construction projects. Procedia Computer Science, 181, 921–930. https://doi.org/10.1016/j.procs.2021.01.248

Lin, Z., Ayed, H., Bouallegue, B., Tomaskova, H., Jafarzadeh Ghoushchi, S., & Haseli, G. (2021). An integrated mathematical attitude utilizing fully fuzzy bwm and fuzzy waspas for risk evaluation in a SOFC. Mathematics, 9(18), 2328. https://doi.org/10.3390/math9182328

Lipke, W. (2006). Earned schedule leads to improved forecasting (3 ed.). In International conference on project management (ProMAC 2006).

Liu, H. C., You, J. X., Ding, X. F., & Su, Q. (2015). Improving risk evaluation in FMEA with a hybrid multiple criteria decision making method. International Journal of Quality & Reliability Management. https://doi.org/10.1108/IJQRM-10-2013-0169

Oliveira, R. (2019). Monitoring and control of schedule and cost performance in facade conservation. Procedia Structural Integrity, 22, 151–159.

Pamucar, D., Deveci, M., Gokasar, I., & Popovic, M. (2021). Fuzzy Hamacher WASPAS decision-making model for advantage prioritization of sustainable supply chain of electric ferry implementation in public transportation. Environment, Development and Sustainability. https://doi.org/10.1007/s10668-021-01742-0

Rahmati, S., Mahdavi, M. H., Ghoushchi, S. J., Tomaskova, H., & Haseli, G. (2022). Assessment and prioritize risk factors of financial measurement of management control system for production companies using a hybrid Z-SWARA and Z-WASPAS with FMEA method: a meta-analysis. Mathematics, 10(2), 253. https://doi.org/10.3390/math10020253

Samee, K., & Pongpeng, J. (2016). Structural equation model for construction equipment management affecting project and corporate performance. KSCE Journal of Civil Engineering, 20(5), 1642–1656. https://doi.org/10.1007/s12205-015-0717-1

Terbrack, H., Claus, T., & Herrmann, F. (2021). Energy-oriented production planning in industry: A systematic literature review and classification scheme. Sustainability, 13(23), 13317. https://doi.org/10.3390/su132313317

Urgiles, P., Sebastian, M., & Claver, J. (2020). Proposal and application of a methodology to improve the control and monitoring of complex hydroelectric power station construction projects. Applied Sciences, 10(21), 7913. https://doi.org/10.3390/app10217913

Wang, J.-W., Cheng, C.-H., & Huang, K.-C. (2009). Fuzzy hierarchical TOPSIS for supplier selection. Applied Soft Computing, 9(1), 377–386. https://doi.org/10.1016/j.asoc.2008.04.014

Wi, H., & Jung, M. (2010). Modeling and analysis of project performance factors in an extended project-oriented virtual organization (EProVO). Expert Systems with Applications, 37(2), 1143–1151. https://doi.org/10.1016/j.eswa.2009.06.051

Wu, C., Wu, P., Wang, J., Jiang, R., Chen, M., & Wang, X. (2021). Ontological knowledge base for concrete bridge rehabilitation project management. Automation in Construction, 121, 103428. https://doi.org/10.1016/j.autcon.2020.103428

Zavadskas, E. K., Vilutienė, T., Turskis, Z., & Šaparauskas, J. (2014). Multi-criteria analysis of Projects’ performance in construction. Archives of Civil and Mechanical Engineering, 14(1), 114–121. https://doi.org/10.1016/j.acme.2013.07.006

Zayed, T., Amer, M., & Pan, J. (2008). Assessing risk and uncertainty inherent in Chinese highway projects using AHP. International Journal of Project Management, 4, 408–419. https://doi.org/10.1016/j.ijproman.2007.05.012

Zhang, X., Bakis, N., Lukins, T. C., Ibrahim, Y. M., Wu, S., Kagioglou, M., Aouad, G., Kaka, A. P., & Trucco, E. (2009). Automating progress measurement of construction projects. Automation in Construction, 18(3), 294–301. https://doi.org/10.1016/j.autcon.2008.09.004

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Enayati Fatollah, S., Dabbagh, R. & Shahsavar Jalavat, A. An extended approach using failure modes and effects analysis (FMEA) and weighting method for assessment of risk factors in the petrochemical industry. Environ Dev Sustain (2022). https://doi.org/10.1007/s10668-022-02609-8

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10668-022-02609-8