Abstract

This paper revisits the dynamic relationship between carbon dioxide (CO2) emissions and income growth for the Middle East and North African (MENA) region. There has been a lively debate about the validity of the environmental Kuznets curve (EKC), which postulates the presence of an inverted U-shaped pattern for pollution levels as income increases. Our study proposes a new approach that models the emissions–income nexus without imposing any prior shape on the EKC. Accordingly, we suggest the implementation of a nonlinear panel threshold regression framework in which the change in the dynamics of environmental quality can be modeled endogenously from the data. The empirical results reveal the presence of a threshold effect in CO2 emissions, as the impact of income changes nonlinearly depending on different energy-related variables. We note the role of the energy fuel mix in mitigating emissions as MENA countries switch to low-carbon sources of energy and renewables.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Middle East and North Africa (MENA) countries face a growing urgency related to sustainable development, and an integrated approach to environmental management and policymaking is critically required. Existing challenges in terms of water scarcity, energy security, and political stability could be exacerbated by the increasing threat of climate change. The United Nations Climate Conference in Marrakech, Morocco, known as COP22, marked the beginning of MENA commitments toward climate action, although considerable efforts are still necessary to foster sustainable development. Several countries have been engaged in structural reforms that diversify the economic base and enhance nonoil growth resilience. The ongoing actions must keep pace with the growing climate fragility risks, as progress is still quite modest. In addition, MENA countries exhibit a great deal of disparity in their energy dependence and income growth.Footnote 1 The divide between rich oil-exporting and poor resource-scarce countries greatly explains the disparate priorities in achieving sustainability and climate resilience. While there is observed progress among the Gulf Cooperation Council (GCC) group, other countries have witnessed limited or no progress. This wide dispersion confirms the need for a relevant empirical strategy to capture the significant heterogeneity in the region. Moreover, the carbon content of energy—which is the amount of carbon emitted as a result of using one unit of energy—relies heavily on oil and gas for both MENA net oil-exporting and oil-importing countries. There is thus room for climate benefits as countries are shifting from fossil fuels toward low-carbon sources of energy and renewables (see, e.g., Bellakhal et al. 2019). Although much still remains to be done, there has been a decreasing trend in recent years with respect to their dependence on traditional energy sources (see Fig. 1).

Oil rents (percentage of GDP) in the MENA countries. Note: Oil rents are the difference between the value of crude oil production at world prices and the total cost of production. Data for oil rents in the MENA countries are only available since 1980. There are no data available for the case of Lebanon. The oil rent plots for Jordan and Morocco are not displayed, as their ratios are very low (below zero) and do not appear here. Source: Data are obtained from the EIA and the World Bank

In this paper, we propose the implementation of a nonlinear panel threshold regression (PTR) framework that is very appealing as it can capture both the heterogeneity and the transition process in the region. We estimate the impact of income growth on air pollutant emissions by taking the moderating effect of energy use into account. Analyzing the role of fossil fuel consumption and how it influences the growth–pollution nexus is key for energy policymaking in the region. One of the main advantages of PTR modeling is that it allows the effect of income on emissions to interact directly with other factors that may influence the environmental quality, such as energy variables.Footnote 2 Therefore, we investigate the change in emissions dynamics with respect to different energy threshold variables, namely, energy use, energy intensity, and energy-related CO2 emissions. The presence of a threshold effect in the pollution–growth nexus has been investigated extensively over the past three decades. The so-called environmental Kuznets curve (EKC) hypothesis suggests the presence of an inverted U-shaped pattern between environmental quality and economic growth. The abundant empirical literature, however, has remained divided and inconclusive about the shape of the relationship between economic activity and environmental performance. Scholars have suggested that some air pollutants follow an N-shaped curve with different turning points (see, e.g., de Bruyn et al. 1998; Torras and Boyce 1998; Lorente and Álvarez-Herranz 2016). Others have reported a monotonically increasing linear relationship between environmental degradation and economic development (Holtz-Eakin and Selden 1995; Fodha and Zaghdoud 2010; Farhani and Ozturk 2015).

From an econometric point of view, possible turning points have usually been captured by introducing quadratic and cubic income variables into the regression analysis in an attempt to determine whether economic development has a nonlinear influence on emissions. For a sample of 12 MENA countries, Arouri et al. (2012) estimated a panel error correction model and found that the long-run coefficients of income and its square satisfy the EKC hypothesis. Air pollutant emissions increase with the income level, stabilize, and then decrease. The reverse result was reported by Baek (2016) for a sample of ASEAN (Association of Southeast Asian Nations) countries. Using the pooled mean group approach of Pesaran et al. (1999), the author revealed that the coefficient of income is negative and that the coefficient of the quadratic term is positive, implying a U-shaped relationship between income and environmental pollution. It is worth noting that incorporating the squared and cubic items allows for possible nonlinearity in the pollution–growth nexus but in a symmetric form relative to the turning point. Pollutant emissions are forced to rise and fall at the same rate. Given the uncertainty about the shape of the pollutant–income nexus, our study suggests that the PTR model should be used so that the dynamics of environmental quality can be modeled properly from the data. This approach enables us to capture the threshold effect better than the standard approach, as the possible presence of turning points is determined endogenously without imposing any prior form on the EKC. Our study covers a sample of 12 MENA countries and measures the impact of income growth on emissions stemming from carbon dioxide (CO2) using annual data over the period 1970–2015.

The rest of the paper proceeds as follows. Section 2 presents a brief overview of the literature and features of the MENA countries. Section 3 describes the empirical strategy and data properties. In Section 4, we discuss our main empirical results. Section 4 concludes the paper and offers some policy implications.

2 Overview of the literature

For both MENA oil-exporting and importing nations, energy has been a major driver of economic development in the region. The rapid income growth experienced in the last two decades has increased energy needs that are predominantly met by fossil fuels, the main source of the carbon footprint. Although oil-exporting countries traditionally had higher energy consumption than oil-importing countries, Ahmed Qahtan et al. (2021) underscored that there is evidence of catching up and that the energy consumption disparity is narrowing. Aware of their vulnerabilities to global oil market shocks, the recent slump in oil prices has provided an opportunity for several countries to undertake bold steps to reform their energy policy. Nevertheless, there is still much to do to enact the deep changes needed to promote resource efficiency and diversify their economies away from the hydrocarbon sector.

The current challenge for countries in the MENA region is to mitigate environmental degradation through energy conservation policies without jeopardizing economic growth. Using panel cointegration techniques, Mehrara (2007) revealed a strong unidirectional causality from economic growth to energy consumption in 11 oil-exporting countries, where seven MENA countries are included in the sample. According to the author’s findings, fuel price policy reforms are crucial to achieving sustained economic growth without damaging the environment. As there is divergence in energy dependence within the region, different patterns are expected in terms of the impact of income growth on carbon emissions. For instance, Magazzino (2016) studied the case of GCC countries and revealed different causality patterns between energy use and economic growth. The author recommended different policy designs to address climate change concerns. In a more recent study, Magazzino and Cerulli (2019) examined the relationship among CO2 emissions, GDP, and energy in MENA countries by using a responsiveness scores approach. The authors pointed out a significant discrepancy in terms of air pollution, as some GCC countries present a different pattern compared to the average for the MENA region.

The extant empirical literature remains mixed and inconclusive about the temporal patterns of CO2 emissions. For a sample of 12 MENA countries, Arouri et al. (2012) confirmed the validity of the EKC hypothesis for the region as a whole. However, the turning points are very low in some cases and very high in others, hence providing poor evidence in support of the EKC hypothesis. In line with the bulk of the literature, the notion of a turning point in the income level has been approached by Arouri et al. (2012) using linear regression augmented by squared and cubed income variables. Further investigation on the growth–pollution nexus in the MENA region should concentrate on resolving methodological issues and using more appropriate econometric methods to test and identify, in particular, the presence of a turning point in the income level.Footnote 3 More specifically, it is crucial that the moderating effect of energy consumption be accounted for in the design of comprehensive energy policies that allow sustained economic development without damaging the environment. As economic development requires the greater use of energy, the variables related to energy consumption are central when estimating the environmental pollutant and economic growth nexus (see, e.g., Magazzino 2015; Acheampong 2018; Ben Cheikh et al. 2021).Footnote 4 In the last two decades, numerous empirical works have investigated the dynamic relationships between economic growth, environmental pollutants, and energy consumption (see, e.g., Richmond and Kaufman 2006; Ang 2007; Soytas et al. 2007, among the seminal studies in this line of research). In this paper, we fill a gap by considering the interaction between income and energy variables using nonlinear panel data techniques. We estimate the impact of income growth with respect to three energy-related variables: energy use, energy intensity, and energy fuel mix. While MENA countries exhibit a great deal of disparity in terms of energy dependence, investigating the presence of a threshold effect in pollutant emissions with respect to energy consumption will have important implications for energy policymaking in the region.

Furthermore, different sets of variables that are related to the degree of economic and financial development have been tested to determine whether they could entail environmental damage. The extent of trade openness has been one of the most frequently used variables within the EKC framework in recent years, as it is possible that trade flows allow for divergence in production and consumption patterns within a region. Trade openness will increase pollution within a country offering a comparative advantage in dirty production under weaker environmental regulations, unlike countries with restrictive protection laws. The empirical results appear to be inconclusive in this regard, as the role of trade has been found to differ across developed countries and developing countries. For instance, Baek et al. (2009) revealed that trade flows tend to improve the environmental quality in developed countries but that the impact is negative in most developing countries. Further aspects related to globalization have also been considered regarding the pollutant–growth nexus. Recent empirical studies have recognized the important influence of foreign direct investment (FDI) on environmental performance (see, e.g., Shahbaz et al. 2019 for a recent study). As FDI contributes to economic growth, it may lead to an increase in energy consumption and thus increase emissions.Footnote 5

Another possible determinant of environmental performance is the degree of financial development, which has been widely debated in the EKC literature (see, e.g., Tamazian et al. 2009; Shahbaz et al. 2016).Footnote 6 As financial openness and liberalization may contribute to economic growth, they could result in more industrial pollution and degrade environmental quality. At the same time, financial development could support the use of energy-efficient technology and environmentally friendly production, leading to better environmental conditions. It is worth noting that mixed empirical results have been reported in numerous empirical studies, with no significant effect of financial indicators on emissions (see, e.g., Ozturk and Acaravci 2013; Omri et al. 2015). In their comprehensive survey, Shahbaz and Sinha (2019) argued that to avoid the discrepancy present in the literature, econometric specifications should be augmented with institutional and political variables. The authors also suggested that empirical investigations should be conducted using refined data and appropriate econometric techniques. Although conventional models allow for the estimation of the turning point, a more flexible approach is necessary that can determine the shape of the growth–pollution nexus endogenously from the data.

3 Empirical strategy and data

3.1 A panel threshold regression model for CO2 emissions

In their extensive surveys of the EKC literature, Dinda (2004) and Stern (2004) stated that the bulk of empirical studies have considered the following reduced form to model a variety of linkages between environmental quality and economic development:

where the subscript i stands for the cross-sections with 1 ≤ i ≤ N, and t indexes time with 1 ≤ i ≤ N. cit is the CO2 emissions, yit is real GDP per capita, and zit is a vector of other factors that may increase pollutant emissions.Footnote 7 As the variables are transformed into natural logarithms, β1, β2, β3, and β4 can be interpreted as elasticities. These coefficients measure the percentage variation in CO2 emissions with respect to any variation in the real per capita GDP, real per capita GDP squared, real per capita GDP cubed, and other variables.

According to Eq. (1), several forms of emissions–income relationships are allowed. There will be an inverted U-shaped relationship if the elasticity estimates of CO2 emissions with respect to the income level, income squared, and income cube are expected to be positive (β1 > 0), negative (β2 < 0), and zero (β3 = 0), respectively. This outcome stipulates that in the first stage of economic development, environmental pollution rises as per capita income increases. Pollutant emissions begin to decline beyond a certain turning point, that is, when a threshold level of income is reached. In addition, other studies on the EKC assumption have proposed that some air pollutants follow an N-shaped curve with different turning points (see, e.g., de Bruyn et al. 1998; Torras and Boyce 1998; Lorente and Álvarez-Herranz 2016). As long as the economy is developing, it is possible that some pollutants will be phased out due to technological innovations, while further income growth would raise the emissions of other pollutants when the share of renewables is already filled and the returns on innovative activity are diminishing.Footnote 8 Of course, if β1 > 0 and β2 = β3 = 0, there is a monotonically increasing linear relationship between environmental degradation and economic development (Holtz-Eakin and Selden 1995; Fodha and Zaghdoud 2010; Farhani and Ozturk 2015).Footnote 9

Due to the uncertainty about the shape of the pollutant–income relationship, we suggest modifying the standard model (1) by substituting the quadratic, \( {y}_{it}^2 \), and cubic, \( {y}_{it}^3 \), terms of the income level with a regime-switching dynamic. To do so, we propose implementing a nonlinear panel threshold regression model, as introduced by Hansen (1999). The main advantage of such an approach is that it does not impose any prior assumption on the emissions–income nexus. The PTR framework is very appealing given the possible presence of a threshold effect, and with it, the potential change in the emissions dynamic is captured endogenously and properly from the data. Furthermore, this approach allows the effect of income on emissions to interact directly with other factors that may influence environmental quality, such as energy variables.

Therefore, combining the above standard approach with the PTR framework, our model can be written for a single-threshold model (two regimes) as follows:3

where I(·) is the indicator function, qit is the threshold variable, and γ is the threshold parameter that divides the equation into two regimes with coefficients β1 and β2. If the threshold variable qit is below or above a certain value γ, then income level yit will have a different impact on pollutant emissions cit, represented by β1 ≠ β2. In our applications, the threshold variable, qit, could be one of the factors that would also influence environmental quality and interact directly with income. In our empirical strategy, we consider three different threshold variables: (1) the log-level of energy consumption, euit, measured in kilograms of oil equivalent per capita, which refers to the use of primary energy before transformation into other end-use fuels; (2) the energy intensity, EIit, which is the ratio between energy use and GDP measured at purchasing power parityFootnote 10; and (3) energy-related CO2 emissions, ECit (also called the energy fuel mix), which correspond to the carbon content of the energy consumed in a country, measured as the ratio of carbon dioxide per unit of energy (see, e.g., Baumert et al. 2005).

The advantage of Hansen’s (1999) testing and estimation procedure is that it allows for more flexible modeling and thus the possibility of the existence of multiple thresholds. Then, if the null of the linear model is rejected against a single-threshold specification, the PTR Eq. (2) is extended to a double-threshold model (three regimes) as follows:

where γ1 and γ2 are the thresholds that divide the dynamics of the model into three regimes with γ1 < γ2. The coefficients β1, β2, and β3 are the impacts of the income level on emissions across the different identified states. The same kind of procedure can be applied in general models to determine the number of thresholds.Footnote 11

3.2 Collection and properties of the data

To capture the possible presence of the threshold effect in CO2 emissions, we focus on the case of the MENA region. Our study covers 12 countries for which our key variables are available over the 1970–2015 time period: Algeria, Bahrain, Egypt, Jordan, Kuwait, Lebanon, Morocco, Oman, Qatar, Saudi Arabia, Tunisia, and the United Arab Emirates (UAE). The MENA group represents an interesting empirical case with which to investigate the carbon–growth nexus. First, there is a great deal of variability in terms of income levels in the region: the minimum real GDP per capita is equal to 742.56 USD, while the maximum value is 116,232.75 USD, giving a range equivalent to 115,489.44 USD (see Appendix, Table 7). This is not surprising, as high levels of income are found in rich oil-exporting countries in the region, that is, the Gulf countries, while other MENA countries, such as Egypt, Morocco, and Tunisia, have incomes of less than 3000 USD per capita on average. Furthermore, countries in the MENA region exhibit different patterns with respect to their dependence on oil, as shown in Fig. 1.Footnote 12 Despite the decreasing trend, the oil rents as a percentage of GDP were over 30% in Gulf countries, such as Kuwait, Oman, Qatar, and Saudi Arabia, in 2015. However, Egypt, Jordan, Morocco, and Tunisia have been found to be much less reliant on oil in recent years.Footnote 13 This wide dispersion in terms of income level and energy dependence confirms the need for a nonlinear framework to capture the heterogeneity of income levels in the region.Footnote 14 Finally, it is worth highlighting that there is a general decline in the CO2 content of energy—which is the amount of carbon emitted as a result of using one unit of energy—in most of the MENA countries (see Fig. 5). The possible presence of transitional behavior in pollutant emissions would be properly captured by a threshold panel model.Footnote 15

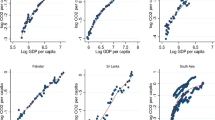

Full details of the definition, sources, and statistical properties of the data are provided in the Appendix (Tables 6 and 7). As discussed above, the existing empirical literature has considered different factors that may also influence environmental quality. To avoid omitted variable bias, four different control variables are included in vector zit: (1) the level of energy consumption measured in kilograms of oil equivalent per capita; (2) trade openness, measured using the sum of exports and imports as a share of GDP; (3) FDI net inflows, as a share of GDP; and (4) financial development, proxied by the total value of domestic credit to the private sector as a share of GDP. In addition, for a visual inspection of the relationship between CO2 and our different explanatory variables, scatterplots are displayed in Fig. 2. As expected, there is a strong positive correlation for the emissions/income and emissions/energy pairs. The link is to some extent weaker for the case of trade openness. However, FDI inflows and financial development appear to be weakly correlated with the level of emissions per capita. This is not surprising, as unclear and ambiguous linkages have been reported in previous studies (see, e.g., Tamazian et al. 2009 for further discussion).

Scatterplots of key variables with CO2 emissions. Note: CO2 emissions are measured in metric tons per capita; GDP per capita is the gross domestic product based on constant 2010 US dollars divided by the midyear population; energy used is measured in kilograms of oil equivalent per capita; trade openness is measured by the sum of exports and imports as a share of GDP; FDI is foreign direct investment net inflows as a share of GDP; and financial development is proxied by the total value of domestic credit to the private sector as a share of GDP

Finally, we check the proprieties of our panel dataset by performing panel unit root and panel cointegration tests. We use the cross-sectionally augmented IPS (Im et al. 2003) panel unit root tests by Pesaran (2007).Footnote 16 The results indicate that our key variables, namely, CO2 emissions, real GDP per capita, and energy use, are stationary in first differences. The ratio variables, that is, trade openness, FDI inflows, and financial development indicators, are stationary in levels. We also conduct panel cointegration tests using the error-correction-based tests of Westerlund (2007), which suggest that the null assumption of no cointegration cannot be rejected. Therefore, our benchmark nonlinear PTR Eq. (2) is estimated in first differences as follows:

As the series are converted into natural logarithms, our variables can be interpreted in growth terms after taking the first difference. Equation (4) allows the estimation of the nonlinear impact of output growth on carbon emissions with respect to different energy consumption variables as threshold variables, qit = (euit; EIit; ECit).

4 Empirical results

For comparison purposes, we begin our analysis by estimating the linear panel data version of Eq. (1) using first differences as follows:

The above specification is estimated using a fixed-effect estimator.Footnote 17 In fact, the introduction of both squared and cubed income variables has created a multicollinearity problem with no significant effect for the cubic term. To avoid this problem, the linear panel data specification includes only the quadratic, \( {y}_{it}^2 \), term of the income level. In line with the standard approach, the linear specification incorporates the real per capita GDP, the real per capita GDP squared, the real per capita GDP cubed, and a number of control variables as explanatory variables into the regression analysis. As is well known, the estimated EKC would have different temporal patterns. The model is then estimated over three different time periods to check changes in the behavior of emission elasticities with respect to output growth. The estimation results from the linear panel data model over the periods 1970–2015, 1970–1990, and 1990–2015 are displayed in Table 1, Table 2, and Table 3, respectively.

It is clear that income growth has a significant impact on the CO2 emissions in our MENA group. The effect is significantly robust across the different specifications, that is, when different control variables are incorporated into the regression. However, it is worth highlighting that the elasticities of carbon emissions with respect to real GDP per capita differ greatly when comparing the two subperiods 1970–1990 and 1990–2015. As shown in column (1) of Table 2, a 1% increase in income growth increases CO2 emissions by 0.9% in the panel of 12 MENA countries. However, the elasticity is much lower during the period 1990–2015, as emissions increase by only 0.42% using the same specification (see Table 3). We can also note that the coefficients of the squared income variable are only significant over the period 1970–1990. The validity of the EKC hypothesis is rejected for the other periods.

Moreover, the energy use variable is found to be the most significant factor among the control variables influencing the quality of the environment. As expected, the FDI inflows and financial development variables appear not to be determinants of pollutant emissions. The financial sector of the MENA countries is still too weak to contribute to economic growth and environmental conditions (see, e.g., Charfeddine and Kahia 2019). For more accurate estimates of income elasticities, moderator variables that are not statistically significant (at least at the 10% level of significance) are removed when considering the threshold panel model (see, e.g., Demena and Afesorgbor 2020).Footnote 18 The results from the linear panel data models confirm that the specification in column (3)—in which energy use and trade openness are introduced as control variables—has the highest F-statistic, that is, the strongest rejection of the null hypothesis of a zero joint effect.

As the elasticities change across the different time periods, we think that nonlinear panel data would better capture the carbon–income nexus switching behavior. We begin by testing for the presence of the threshold effect using the test procedure of Hansen (1999), which allows us to determine the number of thresholds in the model. We perform the bootstrapping method to obtain the approximations of the F-statistics, and their asymptotic bootstrap p-values are shown in Table 4. The F-statistics contain F1, F2, and F3 to assess the null hypotheses of no, one, and two thresholds, respectively. Tests for the threshold effect are conducted for our three energy threshold variables, namely, energy use, energy intensity, and energy-related emissions: qit = (euit; EIit; ECit).

When testing for the presence of the threshold effect with respect to the level of energy use, Table 4 shows that the p-value associated with F1 leads to the rejection of the null hypothesis of no threshold effect at the 1% significance level. Once the null of no threshold is rejected, the sequential test procedure shows the existence of a single threshold, as the null of one threshold versus two thresholds cannot be rejected. The same dynamic is found when energy intensity is considered a threshold variable. The null of no threshold is strongly rejected, as the p-value is much smaller than the desired significance level. However, the test statistic for a double threshold, F2, is far from statistically significant, having a bootstrap p-value of 0.270. Finally, we check whether the carbon-to-energy ratio would entail a nonlinear mechanism in the growth–emissions nexus. Table 4 indicates that the test for a single threshold, F1, is highly significant, with a bootstrap p-value of 0.006. The test statistic for a double threshold, F2, is also significant, having a bootstrap p-value of 0.013. Finally, the test for a third threshold, F3, reveals that the null assumption of at most two thresholds cannot be rejected with a bootstrap p-value of 0.583. In this case, a PTR model with two threshold levels would be an adequate description of the impact of income growth on emissions with respect to the carbon content of fuels.

The estimation results of our nonlinear PTR models using different threshold energy variables are reported in Table 5. When considering the log-level of energy use as a threshold variable, the estimation results are obtained from a two-regime (single-threshold) panel threshold model as specified in Eq. (4) with qit = euit. As reported in column (1) of Table 5, the estimated threshold value, \( {\hat{\gamma}}_1=6.8 \), allows the identification of two regimes in the growth–pollution nexus with respect to the extent of energy consumption. The elasticity estimates of carbon emissions given real GDP per capita are clearly different across the two identified states. When the use of energy is below approximately 890 kg of oil equivalent per capita (6.8 in logarithms), CO2 emissions increase by 0.43% given a 1% rise in income per capita. However, the impact is much larger when the threshold level of energy consumption is exceeded, as the income elasticity approaches 0.90%. This outcome confirms the presence of a threshold effect in the relationship between income and environmental degradation. The impact of economic growth on carbon emissions has a nonlinear dependence on the extent of energy consumption. This outcome is very appealing, as higher economic growth does not necessarily mean an increase in energy-intensive activities and therefore higher pollution emissions. Economic growth based on less energy-intensive activities, mainly information-intensive industries and services, would reduce environmental degradation. However, within the high-energy use regime, it is clear that per capita GDP growth has a higher negative impact on the environment. It is also clear that an increase in the income level could be compatible with environmental improvement, especially when the sectoral structure of the economy shifts from energy-intensive industry toward services and knowledge-based technology-intensive activities. In addition, as expected, a visual inspection of Fig. 3 confirms that net oil-exporting countries, such as Bahrain, Qatar, Saudi Arabia, and the UAE, are excessively exploiting fossil fuel to boost their economy, which results in higher carbon emissions.

Energy use and threshold level in the MENA countries. Note: Energy use refers to the use of primary energy before transformation into other end-use fuels. The threshold of energy use corresponds to the estimated threshold value \( {\hat{\gamma}}_1 \) obtained from Eq. (4) with qit = euit

Similarly, the results in column (2) of Table 5 reveal the regime dependence on energy intensity ratio. With less energy per unit of GDP, that is, below the threshold ratio of \( {\hat{\gamma}}_1=6.13 \), the impact of a 1% increase in output growth will raise pollution by 0.32%. However, for the upper regime, that is, when the energy intensity ratio is larger than the threshold level, the income elasticity is equal to 0.82%. As is well known, an economy dominated by heavy industrial production, for instance, is more likely to have higher energy intensity than one where the service sector is dominant, even if the energy efficiencies within the two countries are identical. Our results then confirm the conventional wisdom that between two nations with identical output growth, the one that has higher energy intensity will also have higher carbon emissions. This outcome implies that energy conservation policies that improve energy efficiency can be effective in reducing the rate of pollutant emissions. A shift toward less energy-intensive activities would reduce environmental damage without jeopardizing economic growth. Moreover, countries that import energy-intensive goods, such as Jordan, Lebanon, Morocco, and Tunisia, tend to have a lower energy intensity than those countries that manufacture those same goods for export, such as Algeria, Bahrain, Egypt, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE. It is clear that rich net-oil-exporting countries, namely, Gulf Cooperation Council (GCC) countries, are facing serious challenges to managing and using their natural resources in an environmentally sustainable manner. We point out that most of the MENA countries, including the GCC group, are increasingly using less energy to produce one unit of output. The highest energy intensity ratios are mainly found in Qatar and Bahrain, but a general decline has been observed in recent years (see Fig. 4). The ongoing structural reforms that diversify the economic base in the region are helping to reduce environmental damage. The shift toward less energy-intensive and more technology-intensive industries enhances environmental performance.

Energy intensity and threshold level in the MENA countries. Note: Energy intensity is the ratio between energy use and GDP measured at purchasing power parity. Energy intensity is an indication of how much energy is used to produce one unit of economic output. The threshold of energy intensity corresponds to the estimated threshold value \( {\hat{\gamma}}_1 \) obtained from Eq. (4) with qit = EIit

Finally, we investigate whether the carbon content of fuels leads to nonlinearity in the pollution–income nexus. Coal has the highest carbon content, followed by oil and then natural gas (see, e.g., Baumert et al. 2005). Therefore, for countries with a similar energy intensity but different reliance on coal, oil, and gas, the outcome in terms of emissions would be different.Footnote 19 In line with the threshold tests in Table 4, income elasticities are derived using the double-threshold (three regimes) panel model as follows:

As shown in column (3) of Table 5, the estimated thresholds \( \left({\hat{\gamma}}_1;{\hat{\gamma}}_2\right)=\left(2.28;3.93\right) \) allow three regimes to be distinguished for the carbon–income nexus with respect to energy-related CO2 emissions. The impact of income per capita in the upper regime, that is, when \( {ec}_{it}>{\hat{\gamma}}_2 \), differs greatly from that in the other regimes. When the carbon-to-energy ratio exceeds the threshold level of \( {\hat{\gamma}}_2=3.93 \), the point estimates indicate a unitary elasticity of income. As shown in Table 5, a 1% increase in the output growth leads to a rise in the emission rate of 1.05%. However, for both the lower and intermediate regimes, the elasticities are lower than 0.5%. Our results indicate that climate benefits are possible as countries shift from fossil fuels with higher carbon content, such as coal and oil, toward lower-carbon fuels. The plots displayed in Fig. 5 highlight the decreasing trend in energy-related carbon emissions. Algeria and some Gulf countries have exhibited a significant change in their fuel mix since the 1980s. However, we note that almost all MENA countries remain in the intermediate regime, with air pollution–related to energy being higher than the threshold \( {\hat{\gamma}}_1=2.28 \). Although several MENA countries have been engaged in structural reforms to diversify their economies away from the hydrocarbon sector, further efforts are needed to reduce the carbon content of fuels. In fact, the energy mix in MENA countries relies heavily on natural gas, which is the least carbon intensive of fossil fuels. Therefore, there is little scope for CO2 savings, as coal accounts for a minor share of the fossil fuels in the region. Moreover, some MENA countries have recently become increasingly interested in coal energy, as it is much less costly than gas energy. New coal capacity is currently under construction in Middle Eastern countries, such as Jordan and the UAE, and others plan to add coal plants in the near future (Egypt and Oman). Given the heavy reliance on oil and gas, building new coal plants would worsen the environmental situation. Countries in the region should take further action to protect the climate and conduct the sustainable management of energy use. Switching away from fossil fuels toward low-carbon sources of energy and renewables is crucial for the region to mitigate emissions.

Energy-related emissions and threshold levels in the MENA countries. Note: Energy-related emissions (or the carbon content of fuels) are the ratio of carbon dioxide per unit of energy or the amount of carbon dioxide emitted as a result of using one unit of energy in production. Threshold 1 corresponds to the first estimated threshold value \( {\hat{\gamma}}_1 \) of the carbon content of fuels, and threshold 2 corresponds to the second estimated threshold value \( {\hat{\gamma}}_2 \); both are obtained from Eq. (6) with qit = ECit

5 Concluding remarks and policy discussion

In this study, we aimed to test the presence of the threshold effect in the income–pollution nexus for a sample of 12 countries from the MENA region during the 1970–2015 period. We suggested that a nonlinear panel threshold regression model be adopted, in which a change in the dynamics of environmental pollutants can be modeled properly from the data. As the MENA countries exhibit a great deal of disparity in terms of energy dependence, we estimated the impact of income growth on CO2 emissions with respect to three different threshold variables, namely, energy use, energy intensity, and energy-related emissions. This approach allows the effect of growth on emissions to directly interact with these threshold variables, which may influence environmental performance. Our results indicate the existence of strong regime dependence in the relationship between income and air pollutants. The elasticity of CO2 emissions with respect to income per capita was found to be higher whenever the moderator energy variable exceeded an estimated threshold level. A 1% increase in output growth will raise air pollutant emissions by 0.82% for high levels of energy intensity, while the CO2 emissions per capita are much lower when the amount of energy per unit of GDP is below the threshold value. This result implies that energy conservation policies that improve energy efficiency can be effective in reducing the rate of pollutant emissions. A shift toward less energy-intensive activities can reduce environmental damage without jeopardizing economic growth.

Moreover, our analysis reveals that countries with identical energy intensities but different energy fuel mixes will have different carbon emission patterns. The nonlinear panel threshold model allowed us to identify three regimes of energy-related emissions. In the upper regime, that is, for higher carbon content fuels, we found unitary elasticity of income. Although most of the MENA countries have begun to reduce their carbon-to-energy ratio, they remain in an intermediate regime with an elasticity of approximately 0.50%. Considerable efforts are still needed to reach the lower regime of emissions. Within the latter regime, a 1% increase in income growth generates an increase in environmental pollution of only 0.25%. Accordingly, climate benefits are possible as countries shift from fossil fuels with higher carbon content, such as coal and oil, toward lower-carbon fuels. In fact, coal already accounts for a minor share of the fossil fuels in most MENA countries, and there is then little scope for CO2 savings, as the energy mix in the region relies heavily on oil and gas. Moreover, with the recent increased interest in coal energy from some Middle East countries, environmental conditions could potentially deteriorate in the region. Then, switching away from fossil fuels toward renewables would become the only way for the region to mitigate emissions. Compared with other world regions, the rate of investment in renewable energy in the MENA group remains weak despite these countries’ relatively abundant resources, particularly in solar and wind. The recent empirical literature has emphasized the role of governance and institutional quality in promoting renewable energy investment in the MENA region. Therefore, ongoing structural economic reforms are necessary to strengthen the institutional structure, as these could provide adequate incentives for controlling pollution.

Despite the notable differences between countries in the region, achieving sustainable economic growth without damaging the environment is a common challenge that MENA policymakers must face. An important feature of renewables is that they help to consolidate sustainable development. Energy policies that promote cleaner production practices are beneficial not only to ensure environmental sustainability but also to fulfill the objectives of the Sustainable Development Goals (SDGs). Switching from high-carbon-content fossil fuels to clean energy solutions can act as a major catalyst for the implementation of the 2030 Agenda. In fact, the pace at which the SDGs are being addressed varies across the MENA region, as the countries’ national priorities and specific challenges differ considerably. Some countries have made strong progress on some indicators, such as the GCC group, while others have achieved limited or no progress. Nonetheless, most countries in the region have stagnated or even regressed in regard to environmental goals, including SDG 13 on climate action. Further structural reforms that rationalize inefficient fossil fuel subsidies and tax collection practices are of paramount importance for alleviating the high carbon footprint of this region.

Notes

See Ben Cheikh et al. (2018) for a recent discussion.

Including interactions terms between income and other influencing factors into a cubic polynomial model would increase the possibility of multicollinearity issues (see, e.g., Xie et al. 2020). To avert this problem, income-squared and income-cubed variables are excluded from the nonlinear specification, and regime-switching behavior is introduced instead.

See, e.g., Shahbaz and Sinha (2019) for a recent extensive survey of the EKC literature.

See the seminal work by Kraft and Kraft (1978) for an assessment of the linkage within the energy consumption and output nexus.

In line with the pollution haven hypothesis, dirty industries tend to migrate to countries with less stringent environmental standards. In this context, FDI inflows would lead to deteriorating environmental quality in the host country. However, the impact of FDI on environmental quality is still controversial, as it may also result in the increased use of clean energy. Tamazian et al. (2009) reported that FDI helps enterprises to promote technology innovation and adopt new technologies, thus increasing energy efficiency and advancing low-carbon economic growth. In the same vein, Lee (2013) found that FDI has played an important role in reducing the impact of economic growth on CO2 emissions for the G20 economies.

Different indicators of financial development have been used in the literature, such as total credit, domestic credit to the private sector, domestic credit provided by the banking sector, and stock market capitalization. To avoid the multicollinearity issue, Shahbaz et al. (2016) employed principal component analysis (PCA) to construct a financial development index based on banking sector and stock market measures.

Lower-case letters are used here to reflect logarithms.

Lee et al. (2009) showed that an inverted U-shaped EKC is found when using a quadratic specification and an N-shaped curve is found when using a cubic form.

Moreover, the introduction of quadratic and cubic income variables into the empirical specification would entail a multicollinearity issue (see, e.g., Jaunky 2011; Demena and Afesorgbor 2020). For the case of our panel data of 12 MENA countries, the pairwise correlation coefficients are equal to 0.956 and 0.926 for income/income squared and income/income cubed, respectively.

Energy intensity is an indication of how much energy is used to produce one unit of economic output, where a lower ratio indicates less energy used.

See Hansen (1999) for further details on testing and estimation procedure of PTR models.

In our sample of MENA countries, Algeria, Bahrain, Egypt, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE are considered net oil-exporting countries while Jordan, Lebanon, Morocco, and Tunisia are net oil-importing countries.

Oil rent data are not displayed for Jordan and Morocco as the ratios are very low (below zero) and do not appear in Fig. 1.

Using the nonlinear autoregressive distributed lag (NARDL) approach, Shahbaz et al. (2021) found an asymmetric long-term impact on CO2 emissions for the Indian economy. Due to its dependence on fossil fuel-based energy consumption and imported crude oil, the authors pointed out that the prevailing growth pattern in the country is environmentally unsustainable.

For a sample of MENA countries, Magazzino (2019) tested the stationarity and convergence of CO2 emissions series using univariate unit root tests. The author found that the relative per capita CO2 emissions series is stationary in ten countries.

We conduct the Hausman specification test, which suggests a preference for the fixed-effect model, as the null hypothesis of random effects is strongly rejected. The results of the Hausman test are available on request but not reported here due to space constraints.

In line with the general-to-specific approach, it is recommended to start with a general specification that includes all the moderator variables and then reduce to a specific model by systematically removing the nonsignificant variables from the general model one by one until only significant variables remain (see, e.g., Stanley and Doucouliagos 2012).

The energy mix in the MENA countries relies heavily on fossil fuels, particularly oil (45%) and natural gas (47%), with a minor share belonging to coal (5%). Renewables accounted for the remaining 3% in 2015 (see Menichettti et al. 2018).

References

Acheampong AO (2018) Economic growth, CO2 emissions and energy consumption: what causes what and where? Energy Econ 74:677–692

Ahmed Qahtan AS, Xu H, Abdo A (2021) Stochastic convergence of disaggregated energy consumption per capita and its catch-up rate: an independent analysis of MENA net oil-exporting and importing countries. Energy Policy. https://doi.org/10.1016/j.enpol.2021.112151

Ang J (2007) CO2 emissions, energy consumption, and output in France. Energy Policy 35:4772–4778

Arouri MH, Ben Youssef A, M’henni H, Rault C (2012) Energy consumption, economic growth and CO2 emissions in Middle East and north African countries. Energy Policy 45:342–349

Baek J (2016) A new look at the FDI–income–energy–environment nexus: dynamic panel data analysis of ASEAN. Energy Policy 91:22–27

Baek J, Cho Y, Koo WW (2009) The environmental consequences of globalization: a country-specific time-series analysis. Ecol Econ 68:2255–2264

Baumert KA, Herzog T, Pershing J (2005) Navigating the numbers: greenhouse gas data and international climate change policy. WRI report. World Resources Institute, Washington, D.C.

Bellakhal R, Ben Kheder S, Haffoudhi H (2019) Governance and renewable energy investment in MENA countries: how does trade matter? Energy Econ. https://doi.org/10.1016/j.eneco.2019.104541

Ben Cheikh N, Ben Naceur S, Kanaa O, Rault C (2018) Oil prices and GCC stock markets: new evidence from smooth transition models. IMF working paper no. 18/98

Ben Cheikh N, Ben Zaied Y, Chevallier J (2021) On the nonlinear relationship between energy use and CO2 emissions within an EKC framework: evidence from panel smooth transition regression in the MENA region. Res Int Bus Financ. https://doi.org/10.1016/j.ribaf.2020.101331

Charfeddine L, Kahia M (2019) Impact of renewable energy consumption and financial development on CO2 emissions and economic growth in the MENA region: a panel vector autoregressive (PVAR) analysis. Renew Energy 139:198–213

De Bruyn SM, van den Bergh JC, Opschoor JB (1998) Economic growth and emissions: reconsidering the empirical basis of environmental Kuznets curves. Ecol Econ 25(2):161–175

Demena BA, Afesorgbor SK (2020) The effect of FDI on environmental emissions: evidence from a meta-analysis. Energy Policy. https://doi.org/10.1016/j.enpol.2019.111192

Dinda S (2004) Environmental Kuznets curve hypothesis: a survey. Ecol Econ 49:431–455

Farhani S, Ozturk I (2015) Causal relationship between CO2 emissions, real GDP, energy consumption, financial development, trade openness, and urbanization in Tunisia. Environ Sci Pollut Res 22(20):15663–15676

Fodha M, Zaghdoud O (2010) Economic growth and pollutant emissions in Tunisia: an empirical analysis of the environmental Kuznets curve. Energy Policy 38(2):1150–1156

Granger CWJ, Teräsvirta T (1999) A simple nonlinear time series model with misleading linear properties. Econ Lett 62:161–165

Hansen BE (1999) Threshold effects in non-dynamic panels: estimation, testing, and inference. J Econ 93:345–368

Holtz-Eakin D, Selden TM (1995) Stoking the fires? CO2 emissions and economic growth. J Public Econ 57(1):85–101

Im KS, Pesaran H, Shin Y (2003) Testing for unit roots in heterogenous panels. J Econ 115:53–74

Jaunky VC (2011) The CO2 emissions–income nexus: evidence from rich countries. Energy Policy 39:1228–1240

Koop G, Potter SM (2000) Nonlinearity, structural breaks or outliers in economic time series? In: Barnett WA, Hendry DF, Hylleberg S, Teräsvirta T, Tjostheim D, Wurtz AH (eds) Nonlinear econometric modeling in time series analysis. Cambridge University Press, Cambridge

Kraft J, Kraft A (1978) On the relationship between energy and GNP. J Energy Dev 3:401–403

Lee WL (2013) The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy 55:483–489

Lee CC, Chiu YB, Sun CH (2009) Does one size fit all? A reexamination of the environmental Kuznets curve using the dynamic panel data approach. Rev Agric Econ 31(4):751–778

Lorente DB, Álvarez-Herranz A (2016) Economic growth and energy regulation in the environmental Kuznets curve. Environ Sci Pollut Res 23(16):16478–16494

Magazzino C (2015) Economic growth, CO2 emissions, and energy use in Israel. Int J Sustain Dev World Ecol 22(1):89–97. https://doi.org/10.1080/13504509.2014.991365

Magazzino C (2016) The relationship between real GDP, CO2 emissions and energy use in the GCC countries: a time-series approach. Cogent Econ Financ 4(1). https://doi.org/10.1080/23322039.2016.1152729

Magazzino C (2019) Testing the stationarity and convergence of CO2 emissions series in MENA countries. Int J Energy Sect Manag 13(4):977–990

Magazzino C, Cerulli G (2019) The determinants of CO2 emissions in MENA countries: a responsiveness scores approach. Int J Sustain Dev World Ecol 26(6):522–534

Mehrara M (2007) Energy consumption and economic growth: the case of oil exporting countries. Energy Policy 35:2939–2945

Menichettti E, El Gharras A, Duhamel B, Karbuz S (2018) The MENA region in the global energy markets. MENARA working paper no. 21

Omri A, Daly S, Rault C, Chaibi A (2015) Financial development, environmental quality, trade and economic growth: what causes what in MENA countries. Energy Econ 48:242–252

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267

Pesaran H (2007) A simple panel unit root test in the presence of cross-section dependence. J Appl Econ 22:265–312

Pesaran MH, Shin Y, Smith RP (1999) Pooled mean group estimation of dynamic heterogeneous panels. J Am Stat Assoc 94:621–634

Richmond AK, Kaufman RK (2006) Is there a turning point in the relationship between income and energy use and/or carbon emissions? Ecol Econ 56:176–189

Shahbaz M, Sinha A (2019) Environmental Kuznets curve for CO2 emissions: a literature survey. J Econ Stud 46(1):106–168

Shahbaz M, Shahzad JH, Ahmad N, Alam S (2016) Financial development and environmental quality: the way forward. Energy Policy 98:353–364

Shahbaz M, Balsalobre-Lorente D, Sinha A (2019) Foreign direct investment–CO2 emissions nexus in Middle East and North African countries: importance of biomass energy consumption. J Clean Prod 217:603–614

Shahbaz M, Sharma R, Sinha A, Jiao Z (2021) Analyzing nonlinear impact of economic growth drivers on CO2 emissions: designing an SDG framework for India. Energy Policy. https://doi.org/10.1016/j.enpol.2020.111965

Soytas U, Sari R, Ewing T (2007) Energy consumption, income, and carbon emissions in the United States. Ecol Econ 62:482–489

Stanley TD, Doucouliagos H (2012) Meta-regression analysis in economics and business. Routledge, Oxford

Stern DI (2004) The rise and the fall of environmental Kuznets curve. World Dev 32(8):1419–1439

Tamazian A, Chousa JP, Vadlamannati KC (2009) Does higher economic and financial development lead to environmental degradation? Evidence from BRIC countries. Energy Policy 37:246–253

Timmermann A (2000) Moments of Markov switching models. J Econ 96:75–111

Torras M, Boyce JK (1998) Income, inequality, and pollution: a reassessment of the environmental Kuznets curve. Ecol Econ 25(2):147–160

Westerlund J (2007) Testing for error correction in panel data. Ox Bull Econ Stat 69(6):709–774

Xie Q, Wang X, Cong X (2020) How does foreign direct investment affect CO2 emissions in emerging countries? New findings from a nonlinear panel analysis. J Clean Prod. https://doi.org/10.1016/j.jclepro.2019.119422

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Ben Cheikh, N., Ben Zaied, Y. A new look at carbon dioxide emissions in MENA countries. Climatic Change 166, 27 (2021). https://doi.org/10.1007/s10584-021-03126-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10584-021-03126-9