Abstract

Climate-economic modeling often relies on macroeconomic integrated assessment models (IAMs) that in general try to capture how the combined system reacts to different policies. Irrespective of the specific modeling approach, IAMs suffer from two notable problems. First, although policies and emissions are dependent on individual or institutional behavior, the models are not able to account for the heterogeneity and adaptive behavior of relevant actors. Second, the models unanimously consider mitigation actions as costs instead of investments: an arguable definition, given that all other expenditures are classified as investments. Both are challenging if the long-term development of climate change and the economy shall be analyzed. This paper therefore proposes a dynamic agent-based model, based on the battle of perspectives approach (Janssen [1]; Janssen and de Vries [2]; Geisendorf [3, 4]) that details the consequences of various behavioral assumptions. Furthermore, expenditures for climate protection, e.g., the transition of the energy system to renewables, are regarded as investments in future technologies with promising growth rates and the potential to incite further growth in adjoining sectors (Jaeger et al. [5]). The paper analyzes how a different understanding of climate protection expenditures changes the system’s dynamic and, thus, the basis for climate policy decisions. The paper also demonstrates how erroneous perceptions impact on economic and climate development, underlining the importance to acknowledge heterogeneous beliefs and behavior for the success of climate policy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

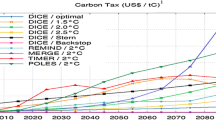

Economic analyses of climate change often apply integrated assessment models (IAMs). These multi-equation computer models attempt to identify and evaluate different climate policy strategies [6–10]. Among the most prominent IAMs, various modeling approaches can be found. CGEs, for example, balance costs and benefits of climate change and its mitigation to determine an optimal path over time [11–15]. Others do not try to optimize but attempt to capture how the system reacts to specific changes [16–30]. In this paper, we propose a modification of the “battle of perspectives” model introduced by Janssen [31] and Janssen and de Vries [32] and updated by Geisendorf [33]. Our aim is to analyze how the perspectives of agents affect chances for growth and climate protection under the assumption that expenditures for climate protection are considered as investments instead of costs. The assumption is based on a report by Jaeger et al. [34]; results from Acemoglu et al. [35], Barker et al. [18], and Barker and Scrieciu [36]; and ideas presented by Fankhauser and Tol [37]. We thereby address two problems that we identified for most of the existing IAMs, irrespective of the modeling approach:

1. IAMs usually understand climate change mitigation actions as costs with a negative effect on production. However, expenses for climate protection, including the transition of the energy system (e.g., new technologies, grids, power plants), have a lifetime much longer than a year and the technological know-how established to develop them represents part of the advance of technological progress. They can thus be understood as investments. Renewable energy and energy saving measures are considered as the main actions to mitigate climate change [38]. With respect to their effects in macroeconomic growth models, these investments should be treated similar to conventional investments, such as road construction, machinery, or a coal-fired power plant: they increase the capital stock, with a positive effect on output. Macroeconomic growth models do not distinguish between different types of investments. They assume that the capital stock, increased through investments, is crucial for economic growth [39, 40]. In turn, to evaluate policy strategies, it is essential to represent the economic effects of abatement strategies completely, including the recognition that green investments both reduce emissions and increase the stock of physical capital, which can lead to higher production [16]. Moreover, investments in the energy transition induce learning by doing (LbD), which can initiate further growth throughout the entire economy [36, 41]. A global climate-economic model, reaching decades into the future, should include this potential. There are noteworthy examples that account for positive effects resulting from mitigation, i.e., induced technological change due to LbD or investments in R & D [3, 42, 43]. However, thus far, only few models explicitly understand expenses in climate change mitigation as investments in a green capital stock (e.g., [34, 44, 45]).

2. In general, IAMs are not able to account for changing preferences or decision dynamics due to the actual behavior of relevant actors [6]. However, worldviews and perspectives regarding the real world’s dynamics are essential elements of the agent’s environmental behavior, such as investments in a green energy transition. Decisions about (green) investments are made by individuals or groups of individuals, i.e., companies, institutions, governments, or households. In order to understand possible obstacles to the decarbonization of the energy system, it is crucial to understand the decision behavior of relevant actors which is characterized by bounded rationality [46]. Due to a limited cognitive capacity [47], people often make decisions based on heuristics or follow routines because they are satisfied even though there are probably better solutions [46]. Such routines and heuristics are mainly influenced by beliefs or worldviews. This is especially true for climate change. People have different beliefs about the seriousness of the problem, and thus, different positions regarding the actions that have to be taken [48–50]. While numerous authors discuss the usefulness of agent-based models in climate economics [51–57] and the approach is considered as an opportunity for integrated assessment modeling since more than 15 years [51], only a few models actually exist. Furthermore, most of them deal with rather specific questions, such as the energy consumption of houses in the UK [58] or land use and farming [1, 2, 59]. Also, the approach to consider different beliefs about climate change when analyzing climate policies is rather rare even though uncertainty plays a key role in the economics of climate change [60]. One exception is Boschetti [61].

Our assumption of climate protecting investments is based on evidence from several studies. Jaeger et al. [34], for example, conclude that a more ambitious CO2 reduction goal of 30%, instead of 20%, by 2020 compared to 1990 would boost European investments from 18 to 22% of gross domestic product (GDP) and also increase the growth rate of the European economy by up to 0.6% per year. They assume that climate protection measures constitute green investments inducing LbD, which in turn spurs economic growth (“virtuous circle”). Barker and Scrieciu [36] argue that stricter emission reduction targets would stimulate both investments in low-carbon alternatives and technological change. Contrary to the conventional view on the economics of climate change, they argue that a transition to a low-carbon economy would not lower production or lead to welfare losses but rather provide macroeconomic benefits. Their results show that world GDP in 2100 could be 3.7% above a baseline scenario with a 550 ppm CO2 level and 6.3% higher with a more stringent 400 ppm CO2 requirement. Barker et al. [18] also assess opportunities for reaching proposed 2020 targets for climate stabilization and suggest that low-carbon investments of 0.7% of GDP annually could be sufficient to achieve the climate targets as well as increase GDP and lower unemployment. The effect of green investments alone (without considering induced technological change) would encompass an increase of world GDP by about 0.9% by 2020, compared to a reference scenario [18]. Finally, a study commissioned by UNEP shows that green investments in renewable energies between 2008 and 2011 were responsible for 1.2% of additional GDP growth in that period [62].

Yet, economies can only profit from this positive relationship between mitigation measures and economic growth if relevant actors actually invest more into climate protection. Investment decisions are strongly influenced by beliefs about future developments. We argue that while conventional IAMs are not integrating adaptive agents, agent-based models are able to account for different beliefs and changing perspectives. Therefore, we adopt the battle of perspectives model to explore what difference it makes if climate protection expenditures are considered as investments instead of costs. Our aim is to analyze how different perspectives of agents affect chances for growth and climate protection under the new assumption of climate protecting investments. The combination of an aggregated climate-economic model with adaptive agents also provides the opportunity to analyze why decision makers sometimes do not follow optimal solution paths proposed by other models.

The remainder of the paper is organized as follows. In Sect. 2, we will give a brief overview of the “ battle of perspectives” model including all equations together with a list of all relevant parameters and starting values. Section 3 presents our arguments to consider climate protection measures as investments instead of costs and outlines the relevant modifications of the reference model. In Sect. 4, we compare simulation runs of the modified model with runs of the reference model in order to analyze the changed system dynamics and we analyze the effect of learning under the new assumption. Section 5 concludes and indicates possible questions for further research.

2 The Battle of Perspectives Model

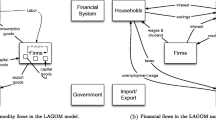

Janssen [31] and Janssen and de Vries [32] propose a multi-agent, climate-economic model based on well-established IAMs, such as that of Nordhaus [24] or Manne et al. [22]. The aim is to account for the possibility of different worldviews and adaptive behavior resulting from interaction and learning. The structure of the original model follows traditional macroeconomic growth models coupled with a climate system. For the purpose of this paper, we use the updated version of the model by Geisendorf [63]. In the following, we provide an overview of the model equations together with a short description. For a more detailed explanation, see Janssen [31], Janssen and de Vries [32], and Geisendorf [33].

2.1 The Economic System

Y(t) | Output |

c × a(t) | Total factor productivity (increasing at a declining rate varying with perspectives) |

S(t) | Scaling factor |

K(t) | Capital stock |

I(t) | Investments |

δ K | Depreciation rate |

γ | Output elasticity |

P(t) | Population (as a proxy for labor) |

E(t) | Emissions |

α | Emission coefficient |

M(t) | Energy transition measured as proportion of fossil energy on whole energy mix |

ε | Individual assumption about autonomous energy transition (varying with perspectives) |

ρM(t) | Autonomous energy transition |

LM(t) | Individual aimed speed of energy transition (based on an agent’s decisions as explained in the following section) |

σ(t) | Energy intensity per output unit |

Based on total factor productivity, capital stock, population, and a scaling factor, the output is calculated. The scaling factor S(t) depicts the relation between damage costs of climate change and cost of its mitigation. Depending on the modeled world, increasing temperatures respectively increasing mitigation measures have more or less negative impacts on production. Here, b i and θ i are the scale and non-linearity of the cost and damage functions, varying with perspectives.Footnote 1 Economic production generates emissions, which reflect the link between the economy and the climate system. Emissions are proportional to output and depend on a logistically declining energy intensity per unit as well as on the transition from fossil fuels to alternative energy sources, all weighed by an emission coefficient of the used fossil fuel.

2.2 The Climate System

pCO2(t) | Atmospheric CO2 concentration (with c i being fractions of carbon emissions with c i = 2 to 5 having different atmospheric lifetimes al i − 1. The multiplier of 0.47 has been introduced by Janssen to translate GT of atmospheric carbon in the original Maier-Reimer/Hasselmann model into atmospheric CO2 concentration) |

ΔQCO2(t) | Radiative forcing |

ΔTp(t) | Potential temperature change |

ΔT(t) | Global mean surface temperature (with β = time lag of 20 years) |

The climate system is based on the carbon cycle by Meier-Reimer and Hasselmann [64]. Emissions increase atmospheric CO2 concentration which in turn negatively affects radiative forcing, defined as the difference between incoming and outgoing radiation energy in a climate system, measured in watts per square meter [65]. Radiative forcing is assumed to influence the global mean surface temperature, calculated in relation to the expected temperature change for a doubling of CO2. As oceans take longer to warm up, the actual temperature increase lags behind by β = 20 years.

2.3 Agents’ Perspectives and Their Decision Rules

The agents represent relevant actors on the international level in an abstract form, all of which have different worldviews offering an explanation of observed climate change and differing objectives for economic growth. To achieve their individual goals, they seek to control investments I(t) and the speed of the green transition LM(t).

2.3.1 Free Market Economists

They aim at economic growth rates of at least 3.2% per year. If such rates do not occur, they increase investments, according to the following decision rule:

Because they believe in a strong resilience of the natural system, they see no need to rush the transition of the energy system, as expressed by a very slow green transition with a 50% reduction of the share of fossil fuels over 1000 years [66]. If damage costs exceed a threshold of 1% of GDP, the green transition gets accelerated moderately (lower bound of 20 years):

2.3.2 Scientifically Informed

They adjust their investments as a function of former investments and changes in economic growth:

They try to avoid a temperature increase of more than 2 °C compared to pre-industrial levels which require a reduction of global CO2 emissions of 50% by 2050 compared to 2000 [67], i.e., an energy transition reducing the share of fossil fuels by 50% every 50 years. If the temperature increases, this transition gets accelerated successivelyFootnote 2:

2.3.3 Environmentalists

Environmentalists invest only to compensate for depreciation (δ K) and aim for the fastest possible green transition, i.e., a 50% reduction of the share of fossil fuels every 20 years:

Besides changes of the behavior within the different worldviews, there is also the possibility that agents may adapt their worldview to the observed modeled world’s dynamics. The higher the deviation between expected and observed temperature development, the higher is the probability that agents may learn from others and adapt their worldviews to one which seems to fit better. This part of the model has been implemented based on a genetic algorithm [68, 69].Footnote 3 The algorithm that the model uses only allows for full imitation, not for a recombination of worldviews or strategies. It is thus not a full genetic algorithm. Learning is depicted as the realization that the own worldview does not correspond with observed facts and a propensity to adopt a more fitting perspective other agents already have.Footnote 4

3 Optimizing Climate Change or Changing the Economy?

3.1 Theoretical Background

Considering the contributions of Jaeger et al. [34], Acemoglu et al. [35], Barker et al. [18], Barker and Scrieciu [36], and Fankhauser and Tol [37], we argue that expenses for climate change mitigation should not be regarded as costs but rather as investments that trigger economic growth. In the short term, a higher growth rate can also be achieved through additional investments in other technologies or sectors; as an example, Jaeger et al. [34] refer to the armament after the Great Depression of 1929 which triggered GDP growth. However, only green investments have also the potential to generate higher growth rates in the long run (i.e., 2050 and beyond), compared to a business-as-usual scenario, because they additionally help avoiding damages caused by climate change. Since investments in climate protection relate to new energy technologies, such investments are also likely to lead to greater technological progress than conventional investments, which as well generates increased economic output [35]. The transition of the energy system also implies efficiency improvements with the potential to save substantial energy costs.

The idea that green investments can lead to economic growth stems from the “Green New Deal.” This stimulus package aimed to overcome the global economic crisis of 2008–2009 while simultaneously addressing an imminent energy and climate crisis through investments in low-carbon energy supply, energy efficiency, transportation, and water infrastructure. The program was developed to channel the economy towards a more sustainable growth path. However, this stimulus package can also lead to crowding out, as all fiscal policies inherit the danger of increasing nominal interest rates that lessen private investments [72–76]. Since we do not distinguish between public and private investments, we account for crowding out in a stylized way. The agents have to allocate their maximally possible investments between conventional and green investments. Depending on their worldview, they prefer either conventional (free market economist) or green investments (environmentalist) or split equally (scientifically informed).

In the model, green investments lead to higher GDP growth through two main effects. First, green investments seek the development of alternative energies and improvements in energy efficiency to transform the economy from a high-carbon to a low-carbon one. For efficiency improvements, the built environment plays a key role. It accounts for the greatest part of the capital stock, so its renewal alone can produce a net increase in the overall capital stock, which in macroeconomic growth models means higher output [34, 77]. Second, green investments induce technological progress [18, 34–36], particularly investments in new technologies such as alternative energies. This rapid technological progress results in higher productivity, allowing for increased production. The LbD effect is not limited to the energy sector but spreads throughout the economy [34]. Such positive spillovers are often not included in climate-economic models [78].

In summary, climate protection relates strongly to the development and implementation of new technologies for the production, distribution, and use of energy. These developments in turn require green investments and can induce technological change. Such changes likely push the economy towards a new and lasting growth path. Especially, renewable energy is, at least in the long run, basically infinite and freely available. Electricity generation with solar power or wind has almost no operating costs and even the nowadays high installation costs will decline in the future, whereas different studies show that prices for fossil energy will increase considerably in the next decades.

3.2 Modeling Green Investments and Learning by Doing—Modifying the Original Model

Our proposed modifications of the battle of perspectives model focus on these arguments, that is, increasing capital stock and LbD through investments in climate change mitigation. The first step is the implementation of green investments additionally to conventional investments. Both conventional and climate change mitigation investments increase the overall capital stock, leading to more economic output. We thus assume two types of capital stock: conventional and green, in line with other research [16, 30]:

The installation of green capital comes at higher costs compared to conventional capital. While agents get one unit of conventional capital for one unit of GDP, this relation is different for green capital (0 ≤ ξ ≤ 1). These costs for green capital differ between the three modeled worlds. In the Environmentalist world, mitigation measures are easy and cheap to implement, whereas in the Free Market Economist world such measures are very costly. Thus, green investments in a Free Market Economist world are less efficient in terms of emission reductions and more costly in terms of green capital accumulation (ξ FME = 0.4, ξ SI = 0.6, ξ E = 0.8). Referring to Arrow [63] and Romer [79], we assume that costs decrease as a side effect of the accumulation of green capital, i.e., the higher the stock of green capital, the lower the costs are.

Since we understand climate mitigation actions as investments, we adapt the original decision rules for the desired energy transition (LM(t)) as decision rules for the amount of green investments.

3.2.1 Free Market Economists

Since they aim at high economic growth, they observe the current damage costs. If the share of damage costs is higher than 1% of GDP, agents gradually increase investments in green capital at a low rate, starting from zero. Otherwise, the amount of green investments will remain the same.Footnote 5

3.2.2 Scientifically Informed

In order to keep the temperature increase below 2 °C by 2100, the IEA [82] estimates required additional investments in climate change mitigation measures of 2% of GDP p.a. Thus, if temperature increases are less than 0.5 °C, these agents invest 2% of GDP in the energy transition. If temperature goes up further, the amount of green investments increases successively:

3.2.3 Environmentalist

The Environmentalist has an internal representation of the emission path related to an energy transition of minus 50% fossil fuels in the energy mix every 20 years. To determine this reduction path, Environmentalists use calculations of the reference model. Here, an energy transition to 50% reduction of fossil fuels over 20 years (LM(t) = 20) results c.p. via M(t) in a particular emission reduction path. We assume that Environmentalists compare the observed emissions with the calculated emissions related to the desired energy transition according to the reference model (Eq. (3)). If observed emissions exceed the desired emissions by more than 1%, the Environmentalist increases green investments to achieve the desired emission path.

In contrast to the original model, emissions are reduced via the accumulation of green capital:

Investments in emission mitigation are a limiting factor for conventional investments and vice versa. This takes into account the possibility of crowding out in a stylized way. In the extended model, agents must make decisions about two types of investments: green and conventional. First, the agents determine how much they ideally should invest in the green and conventional capital stock. According to the reference model, their maximum investment level depends on a minimum consumption level (I max(t) = Y(t) − C min). If the sum of desired investments exceeds the maximum possible amount, a Free Market Economist cuts green investments first. Because the Environmentalist focuses on green investments, she cuts conventional investments if the desired amount exceeds the maximum possible. The Scientifically Informed, located between the two extreme worldviews, reduces both green and conventional investments in equal parts (50:50).

Since we understand climate change mitigation measures as investments not costs, the new scaling factor consists of the inverse damage function, with the same limiting effect as the original version (Eq. (6)):

A greater rise in temperature increases the damage costs and thus reduces the scaling factor S(t), which is an expected multiplier between zero and one, such that it also reduces economic output (see Fig. 1).

No consensus exists regarding the effect of green capital on the productivity of an economy. Weber et al. [30] assert that there is no difference between a green and a conventional capital stock; Ackermann et al. [16] state that green investments cannot have the same or higher productivity than standard investments, because in this case, the market would have solved climate change problems on its own. Without empirical data, they assume that mitigation investments are half as productive for income as conventional investments are. In contrast, one could argue that investments in climate protection, in addition to having a pure effect on the overall capital stock, influence the productivity of the applied capital stock, particularly if investments focus on new technologies, such as energy-saving advances or renewable energies [83]. Thus, it is possible that the green capital stock has greater productivity than the conventional capital stock, and green investments enhance production not only because of the increase in capital stock but also through the higher productivity that results from LbD [5, 34, 83, 84].

Typical findings indicate that LbD proportionally decreases the unit costs for each increase in production. To maintain the original structure of the "battle of perspectives" model [31], we chose not to implement this cost-reducing effect directly. Instead, referring to Castelnuovo et al. [5], who in turn cite Arrow [63] and Romer [79], we argue that an increasing stock of knowledge leads to greater productivity, which reduces the negative impact on the environment per unit of GDP. This stock of knowledge represents LbD and increases as a side effect of physical capital formation and affects factor productivity in terms of increasing returns to scale of the production function. The idea that increasing returns resulting from the accumulation of knowledge are crucial for long-run growth has a long history [4, 79, 85]. Increasing returns to scale are one way to model endogenous growth on an aggregate level. On the firm level, constant returns to scale can appear, but spillovers would be external to the firm and still lead to increasing returns to scale for the whole economy [86].

For our purpose, we assume that the green capital stock has a different marginal productivity than conventional capital which leads to a new production function:

Since the different worlds behave according to the different worldviews, the advantage of green capital over conventional capital varies between the assumed real-world scenarios. We assume that a Free Market Economist does believe in a lower productivity of green capital. Thus, following Ackermann et al. [16], we set β L to −0.5 in the Free Market Economist world. On the contrary, we assume that Environmentalists have a strong belief in green capital which leads to a β L of 0.07 in the Environmentalist world. The Scientifically Informed agents also believe in a higher productivity of green capital compared to conventional capital but on a more moderate level. Therefore, we set the β L in the Scientifically Informed world according to Castelnuovo et al. [5] to 1/10 of the capital–output elasticity, i.e., β L = 0.03.

3.3 Data

Tables 1 and 2 give an overview of relevant parameters and starting values (partly taken from Geisendorf [33]).

4 Results and Discussion

Besides the three worldviews characterizing the agents and their behavior, there is also the possibility to build different scenarios about the actual dynamics of the “real” world. This allows for analyzing how different groups or individuals of agents behave in different modeled worlds. Agents can thus be placed in a world behaving according to their expectations, i.e., utopia, or in different kinds of dystopias, and the effect of “wrong” worldviews can be analyzed.Footnote 6 In order to analyze how the perspectives of agents affect chances for growth and climate protection under the new assumption of climate protecting investments, we compare simulation runs of the modified model with those of the reference model. The analysis takes place in two steps. First, we are going to discuss results of various simulation runs with non-adapting agents, i.e., with agents that are only able to slightly adjust their decisions but not able to learn. Second, we enable agents to learn from each other in order to analyze how the system’s dynamics change if agents switch their worldviews. This addresses the second issue we identified with respect to most of the existing IAMs, i.e., IAMs are not able to account for changing preferences or decision dynamics due to the actual behavior of relevant actors.

4.1 Non-adapting Agents

4.1.1 A World Working According to the Free Market Economist Worldview

In a first experiment, we ran simulations in which agents representing all three perspectives are placed in a world behaving in accordance to the Free Market Economist’s worldview. On the left-hand side of Fig. 2, the results of the reference model are depicted while the right part shows the results of the modified model including green investments. In both cases, the Free Market Economist agents are able to increase economic output and emissions without heating up the climate. However, the output realized by the Free Market Economists in the modified model is 6% higher than in the reference model. This in turn leads to higher emissions (+8%) compared to the reference model and a greater temperature change (+1%). The world the agents are placed in behaves exactly as the Free Market Economist believes, i.e., a very robust climate system and a high rate of technological progress which help her to achieve this massive GDP growth. Thus, the fact that Free Market Economists invest intensively triggers GDP growth but the high increase is only possible because the dynamics of the modeled world allow such a development. The assumptions about the climate system result in a moderate effect of increasing emissions on temperature change and thus damage costs. This is the reason why the higher emissions in the modified model have only a small effect on temperature change. Free Market Economists in the modified model therefore see no reason to invest in green capital and channel all investments in the conventional capital stock which is assumed to have a higher productivity in this world. In the beginning, they are able to achieve their goal of a 3.2% GDP growth per year. At around year 2050, GDP growth drops below this desired value. In reaction, Free Market Economists in the modified model successively increase conventional investments until the maximally possible proportion of 40% of GDP is reached (cf. Fig. 3, left side).

The results of the Scientifically Informed agents (thin line) are quite similar to the reference model at first glance. A closer look in the data, however, reveals that economic output in the modified model is almost 11% higher than in the reference model. The reason can be found in Fig. 3 (right side) which depicts the developments of the investment rates and capital stocks (conventional: thin line; green: dashed line) in the modified model. The Scientifically Informed agents accelerate their investments in green capital at around year 2070. The reason is that temperature increase surpasses a certain threshold (here: 1.65 °C) which forces them to expand their climate protection efforts. The different developments of emissions in the modified model result mainly from different assumptions: in the modified model, emissions depend on the green capital stock while emissions in the reference model are related to the speed of the energy transition (LM(t)). Due to the accelerated green investments, Scientifically Informed agents are able to rapidly reduce emissions. At the end, emissions decrease almost to zero. Although the decision rules about the speed of the energy transition (reference model) or the green investments (modified model), respectively, are the same in both models, emission reductions happen more rapidly and abrupt in the modified model. The reason is that green investments have a more direct impact on emissions than the desired speed of the energy transition (LM(t)) in the reference model which is only one influencing factor of the energy transition M(t). In both model versions, these actions help to keep the temperature increase below 2 °C. The results for the Environmentalists are more interesting especially with respect to economic performance. After a period of increasing GDP, the Environmentalists’ performance at the end of the simulation of the modified model is significantly worse compared to the reference model (almost −25%). In both model versions, the Environmentalists assume a very sensitive climate system and aim at a very fast energy transition. To be successful in the modified model, she massively invests in green capital in order to stay on the emission reduction path required to realize an energy transition to 50% renewables within the first 20 years irrespective of whether the transition is necessary or not.Footnote 7 As explained previously, the Free Market Economist world assumes a climate system which is rather robust against emission increases. Moreover, in this world, mitigation measures are less efficient than Environmentalists believe. To cut emissions by 50% within the desired period, huge investments in the green capital stock are necessary, leading to a substantial increase in the entire capital stock (see Fig. 3). After a short period of a mixed investment strategy, this leads to a decrease of the conventional capital stock almost to zero due to depreciation.Footnote 8 Thus, since Environmentalists cut conventional investments first if their combined investments exceed the possible 40% of GDP, all investments are channeled in the green capital stock in the end in order to stay on the required emission reduction path. However, since green capital is less productive in the Free Market Economist world than conventional capital, the increasing capital stock is not sufficient to positively affect economic output.

4.1.2 A World Working According to the Scientifically Informed Worldview

In a second experiment, we ran simulations with Free Market Economists, Scientifically Informed, and Environmentalists all placed in a world behaving according to the Scientifically Informed beliefs. Figure 4 compares the results of the modified model (right) with the reference model (left). The Free Market Economists in the modified model achieve a 7% higher GDP than in the reference model. In both case, they perform best compared to the other perspectives in terms of economic output even though the result is, of course, worse compared to their utopian case, i.e., Free Market Economists in a Free Market Economist world (c.f. Fig. 2). In order to achieve their overall goal of 3.2% GDP growth, they put all their effort on building up the conventional capital stock. The massive increase of conventional capital helps them to boost economic performance. However, since they are now placed in a world with different conditions, i.e., lower rate of technological progress and a more sensitive climate system, the resulting GDP growth turns out to be lower than expected, i.e., as if they were placed in a Free Market Economist world.

As a reaction, they further increase conventional investments leading to an even higher GDP growth which is related to increasing emissions. In the end, emissions in the modified model are higher compared to the reference model (+8.6%) which is mainly due to the higher output in the modified model. The emission reductions in the middle of the simulation stem in both cases from the autonomous energy transition σ(t). Due to the more sensitive climate system, the increasing emissions have a stronger effect on atmospheric CO2 in this world and thus lead to a higher temperature increase (+16.4%).

The Scientifically Informed agent aims at stabilizing the temperature on a level below +2 °C compared to pre-industrial level and in both model versions, she is barely able to achieve this goal. However, in the modified model, the temperature is 10% lower compared to the reference model. Scientifically informed agents start with a green investment rate of 2% of GDP in order to keep the temperature increase at the desired level. In the beginning, this is not enough to build up a green capital stock because depreciation is assumed to be 10%. Emissions even go up due to increasing economic production. In the following, they observe that temperature increase exceeds 1.65 °C in year 2052 which motivates them to increase green investments with an immediate effect on emissions (cf. Fig. 5). In the reference model, the Scientifically Informed agents start with the goal to decarbonize the energy system by 50% every 100 years. In the course of the simulation, they observe higher temperature increases which induce them to intensify their efforts by accelerating the decarbonization. In the end, they are able to reduce emissions close virtually to zero by 2100. In the modified model, emissions are reduced faster and temperature increases a bit less. However, due to the laggardness of the climate system, this advantage is not visible as strongly. At the end, agents in the modified model are successful in keeping temperature increases on an agreeable level, i.e., below 2 °C, while achieving their aim to ensure a continuous GDP growth without any fluctuations which is even higher than in the reference model (+9.7%) due to an increasing green capital stock (cf. Fig. 5). Again, the most noticeable differences between the two simulations occur for the environmentalist agents, especially with respect to economic performance. As explained previously, Environmentalists aim at decarbonizing the energy system as fast as possible. In terms of economic performance, they want to maintain the existing capital stock and, thus, invest in conventional capital only to compensate for depreciation. To achieve their ambitious energy transition goal in the modified model they have to invest in green capital. In the first years, they see no requirement to do so because emissions develop according to their internal representation, i.e., related emission reduction path of a 50% decarbonization of the energy system within 20 years. After a while, however, they observe slight deviations and start to successively increase investments in green capital in order not to miss their ambitious goal. At the of the 2040s, they invest only in green capital because they focus firstly on temperature increase and cut conventional investments in favor of green investments if the temperature development requires additional efforts. Since green capital has a higher productivity than conventional capital in the Scientifically Informed world, green investments have a positive effect on economic performance. The unexpected and unintended GDP growth leads to higher emissions (i.e., rebound effect), which requires even more green investments. Even in the reference model, one can observe an increasing economic output. This is due to population growth and technological progress, which are assumed to be moderate in the Scientifically Informed world. Compared to the other perspectives, the Environmentalist in the reference model performs best in terms of emissions and temperature increase but worst in terms of economic performance. This picture is different for the modified model. In the end, economic performance of the Environmentalists is only slightly lower than that of the Free Market Economists (10%) and clearly higher than that of Scientifically Informed agents (38.6%). The growth enhancing effect of green investments pays off in the modified version.

4.1.3 A World Working According to the Environmentalist Worldview

The effect of outperforming Environmentalists becomes even more visible if all agents are placed in a world behaving according to the Environmentalist worldview. Figure 6 compares the results of simulation runs with only Free Market Economists (thick line), only Environmentalists (thin line), and only Scientifically Informed (dashed line) agents (reference model left; modified model right). Results of both model versions reveal that a focus on economic growth while neglecting climate protection as pursued by the Free Market Economists leads to only short-term benefits in this sensitive environment.

In both model versions, Free Market Economists offer a good start in terms of economic performance, by neglecting the sensitive environment. However, high emissions and high temperature increases have long-lasting consequences, such that Free Market Economists fall behind Environmentalists and Scientifically Informed in the long run (24.4% lower than Environmentalists and 34.4% lower than Scientifically Informed in the reference model). The high initial GDP growth realized by the Free Market Economists causes emissions which have a significant impact on the climate system. The rapid temperature increase has strong negative effects on the economy through the scaling factor, because even small changes in temperature are related to high damage costs in that scenario. The effect of underperforming Free Market Economists is even stronger in the modified model (63.1% lower than Environmentalists and 60.1% lower than Scientifically Informed agents), because they do not benefit from the green investment effects. By trying to avoid the negative economic development, the Free Market Economist in the modified model increases investments in the conventional capital stock right in the beginning which exacerbates the situation (cf. Fig. 7). Although damage costs exceed the pre-defined threshold of 1% of GDP which would motivate them to invest in green capital, Free Market Economists keep back from doing so. This type of agent focuses on economic performance which means that they cut green investments first if economic performance falls behind their goal, i.e., annual GDP growth of 3.2%. Throughout the whole simulation run, GDP growth is below 3.2% or even negative. Consequently, Free Market Economists in the modified model invest all their money in the conventional capital stock. Although they pursue the same objective (annual GDP growth of 3.2%) in the reference model, they at least react to the increasing damage costs by adjusting the desired speed of the energy transition. In the new version, we restricted even such a moderate adjustment by assuming them to react with only more conventional investments to every crisis. If the world is ruled by Environmentalists (dashed line), the rapid emission reductions mitigate the high temperature changes and therefore the negative consequences for the economic system in both model versions. In the modified model, investments in climate protection measures increase the green capital stock and induce LbD. In this world, green investments are assumed to be very efficient and green capital to be very productivity. These two conditions enable such a positive development of economic performance as depicted in Fig. 6 (right).Footnote 9

While Free Market Economists solely invest in conventional capital in order to increase GDP growth, Environmentalist agents start investing in green capital in order to reduce CO2 emissions. These investments not only increase the green capital stock but also induce LbD and help keeping temperature, and thus, negative economic effects at a low level. A mixed strategy followed by Scientifically Informed agents leads to the best economic performance in the reference model. However, with respect to their climate goals, they are not successful: temperature increases more than 3.5 °C, because they have wrong beliefs about the real world’s dynamics, especially about the sensitivity of the climate system. After starting with the aim to reduce the share of fossil fuels by 50% in 100 years, they soon realize that this will not be fast enough to keep the temperature increase below 2 °C. However, all their efforts to accelerate the decarbonization are not enough to avoid a high temperature increase with significant negative effects on economic performance. In the modified model, the Scientifically Informed agents are more successful. Due to their massive and early investments in green capital, they are able to reduce emissions fast enough to keep temperature increases at a tolerable level. Moreover, since they invest in both green and conventional capital, they produce the highest overall capital accumulation. However, with regard to GDP growth, this is only second best behind the Environmentalist agents. This is due to the fact that, first, Environmentalist agents invest solely in green capital with a significant higher productivity in this world and, second, even a temperature increase of 2 °C is related to sensible damage costs and thus negative impacts on economic performance in the Environmentalist world. Obviously, the Environmentalists in the modified model achieve an unintended win–win situation of keeping temperature at a tolerable level (below 2 °C) while realizing high GDP growth by investing in green capital.

4.2 Adaptive Agents

In the previous section, we compared the results of the modified model with the results of the reference model with only one perspective at a time ruling the world. However, in reality, the world is simultaneously populated by people with different beliefs and assumptions about the real world’s dynamics. In the following, we will therefore discuss simulation runs for various scenarios with heterogeneous groups of adaptive agents. Here, adaptation means not only to adjust investment decisions according to the real world’s development but instead changing the perspective if expectations about the real world’s dynamics are not met. The more the expectations deviate from the observed development, the higher gets the probability that the agents will take over another perspective with a higher explanatory power. This adaptation process is based on a procedure inspired by a genetic algorithm as explained previously. In this part of the analysis, we focus on the differences between non-adaptive and adaptive agents in the modified model to address the effect of adaptive agents under the new assumption of green investments.

4.2.1 Non-adaptive vs. Adaptive Environmentalists in a Free Market Economist World

Figure 8 shows the results of a simulation with only Environmentalists (thin line) and a majority of Environmentalists, placed in a Free Market Economist world (thick line).Footnote 10 The results show that adaptive Environmentalists understand rather fast that their worldview is not the correct one, i.e., the spread of the Environmentalist perspective is reduced step by step (see Fig. 9). However, although the Free Market Economist worldview is the best fitting perspective, a significant number of agents adopt the Scientifically Informed agent’s worldview. The reason is that even this perspective has a higher explanatory power than the Environmentalist worldview. As long as the observed results, i.e., continuous GDP growth and temperature increase below 2 °C, deviate only slightly from the expected results, the Scientifically Informed worldview is still good enough to adopt or keep.

Nevertheless, the composition of the population changes from a majority of Environmentalists to a majority of Free Market Economists. This is also reflected by the results of this simulation. The change of the population leads to an increasing conventional investment rate, because the majority of agents want to achieve GDP growth of 3.2% per year. However, since there is still a substantial number of Scientifically Informed and Environmentalist agents who either want to keep the temperature increase below 2 °C or to achieve the energy transition as fast as possible, there is also investment in green capital. Although agents learn to understand that the climate system is very robust and allows for high economic output, they are not able to exploit the entire potential of this world because the learning process takes time, i.e., GDP stays far behind the possible one for the initially correct worldview, i.e., 21.2% below (cf. Fig. 2). Nevertheless, a mixed population with a majority of Free Market Economists proves to be successful not only in terms of economic performance. The low but still existing green investments by the Scientifically Informed and Environmentalists allow for radical emission reductions with the effect of temperature increases far below 2 °C. Thus, this population is almost able to achieve the positive economic performance of the utopian Free Market Economist situation while mitigating climate change.

4.2.2 Non-adaptive vs. Adaptive Free Market Economists in an Environmentalist World

Figure 10 shows the results for a simulation of only Free Market Economists (thin line) and a majority of adaptive Free Market Economists (thick line), both placed in a world with dynamics according to the Environmentalist worldview.

Compared to the non-adaptive agents, the learning Free Market Economists are able to outperform in all three categories, i.e., GDP growth, emissions, and temperature increase. This is due to the fact that agents realize very fast that their perspective is the wrong one for the Environmentalist world. In the following, most of the agents adopt the correct Environmentalist worldview. Those agents start investing in green capital in order to stay on the desired emission reduction path. The increasing green capital stock has a strong positive effect on output due to the high productivity in this world. Again, compared to the non-adaptive agents, the mixed population is able to enter a win–win situation with high GDP growth and a temperature increase below 2 °C. When Free Market Economists adopt the Environmentalist worldview, they shift their focus from economic growth to climate protection and green investments, which can reduce the negative, long-term consequences for the economy. However, the initial overexploitation of the system in addition with the subsequently required high investments in the energy transition for the reduction of CO2 emissions let this belatedly learning economy falls back behind the correct policy in terms of temperature change (+5.6%) and economic output (−2.9%) (cf. Fig. 6 right). Since there are still Free Market Economists and Scientifically Informed agents among the population, investments in the conventional capital stock are done which are then not available for building up the green capital stock (cf. Fig. 11).

As a result, the energy transition in terms of replacing conventional capital with green capital takes more time. Since agents are placed in a world with a very vulnerable climate system, this has a significant effect on temperature. Moreover, in the Environmentalist world, green capital is assumed to lead to LbD resulting in a higher productivity. If not all the money is invested in green capital, agents fail to make use of the whole potential of green investments. On the contrary, Environmentalists do not focus on economic growth but on emission reduction from the beginning on and thus invest mainly in green capital from the beginning on.

4.2.3 Non-adaptive vs. Adaptive Free Market Economists in a Scientifically Informed World

In the third simulation, we compare only Free Market Economists with a majority of adaptive Free Market Economists, both in a Scientifically Informed world (Fig. 12). Again, the composition of the population changes to a majority of correct worldviews with still a significant number of Free Market Economists and Environmentalists (cf. Fig. 13). Compared to the results of the non-adaptive Free Market Economists (thin line), the mixed population of adaptive agents (thick line) falls behind in terms of economic output (−14.7%).

Although the Free Market Economist worldview is not correct, they are able to significantly increase GDP within the observed period due to massive investments in the conventional capital stock. This is a surprising result since one would assume that Scientifically Informed agents know best the potential of this world since they have the correct assumptions about the modeled world’s dynamics. An obvious explanation is that Scientifically Informed agents do not solely focus on GDP growth but follow a mixed strategy of continuous economic growth and climate change mitigation. But still, a possible conclusion could be that in case of a moderate world according to the Scientifically Informed beliefs, it is not necessary to mitigate climate change. Even a high temperature increase of almost 4 °C allows for a growing economy due to massive investments in conventional capital without taking any climate protection actions. However, as the convergence of the GDP developments of the Free Market Economists (thin line) and the mixed population (thick line) in Fig. 12 already indicates, the damages caused to the climate system will eventually hit back on the economy through high damage costs. As Fig. 13 illustrates, this only happens after our normal observation period. If this property of the simulation would reflect the real situation, this is a critical result. It would mean that a world population which oversteps the boundaries of the climate system would still not be able to understand their mistake by looking at economic output, because this output would, still for a long time, be higher than one for a more sustainable time path.

Compared to the results of only Scientifically Informed agents placed in a Scientifically Informed world (cf. Fig. 4), the mixed population (thick line) in Fig. 12) performs considerably better in terms of economic output (+31.5%). The remaining Free Market Economists help to build up the overall capital stock by solely investing in conventional capital whereas Scientifically Informed agents follow a mixed strategy and invest in both green and conventional capital. However, since they do not aim at high economic growth or a fast energy transition, they never invest all the spendable money as the Free Market Economists do. The small group of Environmentalists channels all the money in green investments which leads to faster energy transition than in the run with non-adaptive Scientifically Informed agents in a utopian world. The mixed population in that case thus actually benefits from the small interventions by the two more extreme perspectives, because they help the scientifically informed to increase both kinds of investments over the level they would have chosen on their own (Fig. 14). In the end, the mixed population of adaptive agents shows moderate results for all three variables, i.e., output, emissions, temperature change, and again, a win–win situation.

5 Conclusions

We identified two shortcomings of standard climate-economic integrated assessment models which we tried to address. First, irrespective of the modeling approach, they usually perceive climate protection measures as costs that lead to a loss of production and therefore a loss of welfare. Based on Jaeger et al. [34], we propose that such expenses should be considered as investments instead. These investments have positive growth effects for the economy but at the expense of higher emissions and thus higher temperature increase through rebound effects. Second, most IAMs are not able to account for changing preferences or decision dynamics of relevant actors. In order to address these issues, we have modified the agent-based “battle of perspectives” model initiated by Janssen [31] and Janssen and de Vries [32] and updated by Geisendorf [33] and have integrated propositions from Jaeger et al. [34], Barker and Scrieciu [36], and Barker et al. [18]. Climate protection measures are considered as green investments, which increase the overall capital stock and induce technological progress through learning by doing, triggering economic growth.

We chose the “battle of perspectives” model, because this agent-based, climate-economic model creates awareness for the effect of individual decisions by heterogeneous agents on climate policy. The perception of climate change by relevant actors influences the policy strategy implemented by those actors. Consequently, from a heterogeneous agent perspective, there is no single, optimal strategy. Instead, there are different beliefs and worldviews, competing to explain the observed “reality.” In contrast to conventional IAMs, the model proposed in this paper is able to show how erroneous perceptions impact on economic and climate development. The results of the modified model presented here support this point. First, wrong assumptions about the real world’s development can lead to strong effects, both in terms of climate change and of economic performance. Second, even an adjustment of improper behavior can have long-lasting consequences, in terms of both economic losses and temperature change, because learning after realizing mistakes takes time. Even though the modified model allows for the possibility of a win–win solution through green investments, this solution has no guaranteed outcome. A strategy focusing on climate protection resulting in green investments can unfold its potential only if decision makers understand the actual dynamics of the word, i.e., are able to adapt their measures when the world does not match their predictions. Otherwise, it can even have negative effects if opportunities for economic growth are neglected because of unnecessarily high green investments in case the world is more robust than expected. The same holds true if the real world shows a very sensitive climate system which can only be kept within tolerable limits with massive climate protection measures, i.e., investments in green capital. If relevant actors in policy and economy do not deem such a policy necessary, these investments will not happen with negative consequences not only for the climate but the whole system, including the economy.

Further research based on this model could concentrate on more detailed empirically based representations of the agents’ perceptions and actual behavior. This would offer the opportunity to derive recommendations for policy makers. A thus enhanced model could also be used to test different policies in their effect on an agent’s decisions. Multi-agent models such as the one proposed here offer the unique opportunity to not only calculate “rational” reactions to a policy. It allows analyzing different bounded rational behaviors, linked to the agent types. Ideally, such biases [88–90] from rational responses should be based on empirical foundations. Behavioral economics offers a lot of empirical evidence for existing biases [ibid.]. In this regard, it would also be interesting to follow the idea of Williams [91] that environmental policies should phase in gradually, rather than being immediately implemented at full force. Furthermore, additional research could determine the pace of fossil fuel transition required to achieve the extended economic growth claimed by Jaeger et al. [34]. After determining this pace, studies could investigate what political measures are best able to make agents shift their investments to fit with the real environmental and economic conditions if they do not recognize them on their own.

In the current version of the model, there are two ways of learning. First, moderate behavior adjustments while keeping the perspective and, second, adoption of another perspective with a higher explanatory power. The latter works through learning from others and thus requires the existence of the correct perspective within the population. Further research could implement a third way of learning, which could enable the agents to understand the internal dynamics of the world without the possibility to learn it from others. It could be interesting to enable the agents to check their beliefs about the productivity of different kinds of capital and thus enable them to better understand the growth potential of green investments. However, as has been discussed in the last section, there is a risk that a too growth-oriented policy is more successful in economic terms for many decades than the ultimately sustainable policy. Under such circumstances, neither learning process would help. The solution could then be an information campaign or emission limiting policies, e.g., through taxes. A further specification of the proposed model could help to identify such cases in which economic indicators do not offer a sufficient feedback for learning and analyze the effect of different policies offering an alternative.

Notes

Free Market Economist: b 1 = 0.25, b 2 = 3.5, θ 1 = 0.00166, and θ 2 = 2. Scientifically Informed: b 1 = 0.11, b 2 = 2.9, θ 1 = 0.0011, and θ 2 = 3. Environmentalist: b 1 = 0.05, b 2 = 2.3, θ 1 = 0.0025, and θ 2 = 4, taken from Geisendorf [33].

In case of an acknowledged misfit of the own perspective, adaptation occurs with 80% probability, and the chosen worldview is not necessarily the best or correct one. It is determined by a roulette wheel-like procedure from all other perspectives with a higher likelihood to take a perspective with a relatively good prediction quality at the current stage. The procedure has been calibrated to replicate the speed of learning in Janssen’s model.

Please note that “wrong” here only means “not adapted to the modeled world they are placed in.”

As explained previously, the environmentalists have an internal representation of the emission reduction path related to a 50% reduction of fossil fuels every 20 years. For the calculation, they refer to LM(t) and M(t) in the reference model.

Since the model assumes declining balance depreciation and not linear depreciation, the capital stock can mathematically not become zero although the figure looks as if it does.

Although it is an utopian situation for the Environmentalists, they perform only second best behind the Scientifically Informed agents in terms of economic growth in the reference model. The reason is that Environmentalists do not aim at economic growth, even if it is possible within certain bounds, whereas the Scientifically Informed agents follow a mixed strategy of continuous economic growth and keeping temperature increase below 2 °C.

Since the real world’s development is not the average of several runs but rather a one-shot game, we discuss the results of a typical single run instead of conducting Monte Carlo simulations.

References

Ziervogel, G., Bithell, M., Washingoton, R., & Downing, T. (2005). Agent based social simulation: a method for assessing the impact of seasonal climate forecast applications among smallholder farmers. Agricultural Systems, 83(1), 1–26.

Entwisle, B., Malanson, G., Rindfuss, R. R., & Walsh, S. J. (2008). An agent-based model of household dynamics and land use change. Journal of Land Use Science, 3(1), 73–93.

Goulder, L. H., & Mathai, K. (2000). Optimal CO2 abatement in the presence of induced technological change. Journal of Environmental Economics and Management, 39(1), 1–38. doi:10.1006/jeem.1999.1089.

Fingleton, B., & McCombie, J. S. L. (1998). Increasing returns and economic growth: some evidence for manufacturing from the European Union regions. Oxford Economic Papers, 50, 89–105.

Castelnuovo, E., Galeotti, M., Gambarelli, G., & Vergalli, S. (2005). Learning-by-doing vs. learning by researching in a model of climate change policy analysis. Ecological Economics, 54, 261–276. doi:10.1016/j.ecolecon.2004.12.036.

Ackermann, F., DeCanio, S. J., Howarth, R. B., & Sheeran, K. (2009). Limitations of integrated assessment models of climate change. Climatic Change, 95, 297–315. doi:10.1007/s10584-009-9570-x.

Dowlatabadi, H. (1995). Integrated assessment models of climate change. An incomplete overview. Energy Policy, 23(4/5), 289–296.

Hof, A. F., Hope, C. W., Lowe, J., Mastrandrea, M. D., Meinshausen, M., & van Vuuren, D. P. (2012). The benefits of climate change mitigation in integrated assessment models. The role of the carbon cycle and climate component. Climatic Change, 113, 897–917. doi:10.1007/s10584-011-0363-7.

Parson, E. A., & Fischer-Vanden, K. (1999). Integrated assessment models of global climate change. Annual Review of Energy and the Environment, 22, 589–628.

van Vuuren, D. P., Lowe, J., Stehfest, E., Gohar, L., Hof, A., & Hope, C. (2011). How well do integrated assessment models simulate climate change? Climatic Change, 104, 255–285. doi:10.1007/s10584-009-9764-2.

Bachner, G., Bednar-Friedl, B., Nabernegg, S., & Steininger, K. W. (2015). Maroeconomic evaluation of climate change in Austria: a comparsion across impact fields and total effects. In K. W. Steininger, M. König, B. Bednar-Friedl, L. Kranzl, & F. Prettenthaler (Eds.), Economic evaluation of climate change impacts: development of a cross-sectoral framework and results for Austria (pp. 415–440). Cham: Springer.

Ciscar, J. C., Iglesias, A., Feyen, L., Szabó, L., Van Regemorter, D., Amleung, B., Nicholls, R., Watkiss, P., Christensen, O. B., Dankers, R., Garotte, L., Goodess, C. M., Hunt, A., Moreno, A., Richards, J., & Soria, A. (2011). Physical and economic consequences of climate change in Europe. PNAS, 108(7), 2678–2683.

Aaheim, A., Gopalakrishnan, R., Chaturvedi, R. K., Ravindranath, N. H., Sagadevan, A. D., Sharma, N., & Wei, T. (2011). A macroeconomic analysis of adaptation to climate change impacts on forests in India. Mitigation and Adaptation Strategies for Global Change, 16, 229–245.

Aaheim, A., Amundsen, H., Dokken, T., & Wei, T. (2012). Impacts and adaptation to climate change in European economies. Global Environmental Change, 22(4), 959–968.

Ciscar, J. C., & Dowling, P. (2014). Integrated assessment of climate impacts and adaptation in the energy sector. Energy Economics, 46, 531–538.

Ackermann, F., Stanton, E. A., & Bueno, R. (2013). CRED: a new model of climate and development. Ecological Economics, 85, 166–176. doi:10.1016/j.ecolecon.2011.04.006.

Anthoff, D., & Tol, R. S. J. (2009). The impact of climate change on the balanced growth equivalent: an application of FUND. Environmental and Resource Economics, 43(3), 351–367.

Barker, T., Anger, A., Chewpreecha, U., & Pollitt, H. (2012). A new economics approach to modelling policies to achieve global 2020 targets for climate stabilisation. International Review of Applied Economics, 26(2), 205–221. doi:10.1080/02692171.2011.631901.

Hope, C. W. (2009). How deep should the deep cuts be? Optimal CO2 emissions over time under uncertainty. Climate Policy, 9, 3–8.

Hope, C.W. (2011). The social cost of CO2 from the PAGE09 model. Economics: The Open-Access, Open-Assessment E-Journal, 39 (Special Issue).

Maisonnave, H., Pycroft, J., Saveyn, B., & Ciscar, J. (2012). Does climate policy make the EU economy more resilient to oil price rises? A CGE analysis. Energy Policy, 47, 172–179. doi:10.1016/j.enpol.2012.04.053.

Manne, A.S., Mendelsohn, R., Richels, R.G. (1994). MERGE: a model for evaluating regional and global effects of GHG reduction policies. In: Nakicenovic, N., Nordhaus, W.D., Richels, R., Toth, F.L. (Eds.), Integrative assessment of mitigation, impacts, and adaptation to climate change (pp. 143–172), CP-94-0, IIASA, Laxenburg, Austria.

Manne, R. S., & Richels, R. G. (2006). MERGE: an integrated assessment model for global climate change. In R. Loulou, J.-P. Waaub, & G. Zaccour (Eds.), Energy and environment (pp. 175–189). New York: Springer Science+Business Media.

Nordhaus, W. D. (1994). Managing the global commons: the economics of climate change. Cambridge, MA: MIT Press.

Nordhaus, W. D. (2008). A question of balance weighing the options on global warming policies. New Haven & London: Yale University Press.

Nordhaus, W., & Sztorc, P. (2013). DICE 2013R: introduction and user’s manual (2d ed.). New Haven: Yale University and the National Bureau of Economic Research.

Rotmans, J. (1990). IMAGE: An integrated model to assess the greenhouse effect. Ph.D. thesis, Dordrecht (Netherlands): Kluwer Academic Publishing.

Stern, N. (2007). The economics of climate change: the Stern review. Cambridge: Cambridge University Press.

Wang, K., Wang, C., & Chen, J. (2009). Analysis of the economic impact of different Chinese climate policy options based on a CGE model incorporating endogenous technological change. Energy Policy, 37(8), 2930–2940. doi:10.1016/j.enpol.2009.03.023.

Weber, M., Barth, V., & Hasselmann, K. (2005). A multi-actor dynamic integrated assessment model (MADIAM) of induced technological change and sustainable economic growth. Ecological Economics, 54, 306–327. doi:10.1016/j.ecolecon.2004.12.035.

Janssen, M.A. (1996). Meeting targets: tools to support integrated assessment modelling of global change. PhD Thesis, ISBN 90–9009908-5, University of Maastricht, the Netherlands.

Janssen, M. A., & de Vries, B. (1998). The battle of perspectives: a multi-agent model with adaptive responses to climate change. Ecological Economics, 26, 43–65.

Geisendorf, S. (2016). The impact of personal beliefs on climate change: the “battle of perspectives” revisited. Journal of Evolutionary Economics, 26, 551–580.

Jaeger, C., Paroussos, L., Mangalagiu, D., Kupers, R., Mandel, A., Tàbara, D. (2011). A new growth path for Europe: generating prosperity and jobs in the low-carbon economy. Report for the Federal Ministry for the Environment, Nature Conservation and Nuclear Safety.

Acemoglu, D., Aghion, P., Burzstyn, L., & Hemous, D. (2012). The environment and directed technical change. American Economic Review, 102(1), 131–166. doi:10.1257/aer.102.1.131.

Barker, T., & Scrieciu, S. (2010). Modelling low climate stabilization with E3MG: towards a ‘new economics’ approach to simulating energy-environment-economy system dynamics. Energy Journal, 31, 137–164.

Fankhauser, S., & Tol, R. S. J. (2005). On climate change and economic growth. Resource Energy Economics, 27, 1–17. doi:10.1016/j.reseneeco.2004.03.003.

Von Borgstede, C., Andersson, M., & Johnsson, F. (2013). Public attitudes to climate change and carbon mitigation—implications for energy-associated behaviours. Energy Policy, 57, 182–193. doi:10.1016/j.enpol.2013.01.051.

Harrod, R. F. (1939). An essay in dynamic theory. The Economics Journal, 49(193), 14–33.

Solow, R. M. (1956). A contribution to the theory of economic growth. Quarterly Journal of Economics, 70(1), 65–94.

Kupers, R., Mangalagiu, D. (2010). Climate change policy: positive or negative economic impact? Why? ECF Working Paper, 1/2010.

Gerlagh, R., & van der Zwaan, B. (2003). Gross world product and consumption in a global warming model with endogenous technological change. Resource and Energy Economics, 25, 35–57.

Manne, A., & Richels, R. (2004). The impact of learning-by-doing on the timing and costs of CO2 abatement. Energy Economics, 26, 603–619. doi:10.1016/j.eneco.2004.04.033.

Fischer, C., Toman, M., Withagen, C. (2002). Optimal investment in clean production capacity. Discussion Paper. Resources for the future, 02–38, available at http://www.rff.org.

Rozenberg, J., Vogt-Schilb, A., Hallegatte, S. (2013). How capital-based instruments facilitate the transition toward a low-carbon economy: a tradeoff between optimality and acceptability. World Bank Policy Research, 6609.

Simon, H. A. (1997). Models of bounded rationality. Cambridge and Mass: The MIT Press.

Tversky, A., & Kahneman, D. (1974). Judgement under uncertainty: heuristics and biases. Science, 158(4157), 1124–1131.

Eurobarometer. (2008). Europeans attitudes towards climate change. European Commission, special Eurobarometer, 300.

Eurobarometer. (2009). Europeans attitudes towards climate change. European Commission, special Eurobarometer, 313.

Eurobarometer. (2011). Climate change. European Commission, special Eurobarometer, 372.

Rotmans, J. (1998). Methods for IA: the challenges and opportunities ahead. Environmental Modeling & Assessment, 3, 155–179.

Patt, A., & Siebenhüner, B. (2005). Agent-based modeling and adaptation to climate change. Vierteljahrshefte zur Wirtschaftsforschung, 74, 310–320.

Van den Bergh, J. C. J. M. (2007). Evolutionary thinking in environmental economics. Journal of Evolutionary Economics, 17, 521–549.

Balbi, S., & Giupponi, C. (2010). Agent-based modelling of socio-ecosystems: a methodology for the analysis of climate change adaptation and sustainability. International Journal of Agent Technologies and Systems, 2(4), 17–38.

An, L. (2011). Modeling human decisions in coupled human and natural systems: review of agent-based models. Ecological Modelling, 229, 25–36.

Gsottbauer, E., & van den Bergh, J. C. J. M. (2013). Bounded rationality and social interaction in negotiating a climate agreement. International Environmental Agreements: Politics, Law and Economics, 13(3), 225–249.

Miller, B. W., & Morisette, J. T. (2014). Integrating research tools to support the management of social-ecological systems under climate change. Ecology and Society, 19(3), 41.

Natarajan, S., Padget, J., & Elliott, L. (2011). Modelling UK domestic energy and carbon emissions: an agent-based approach. Energy and Buildings, 43(10), 2602–2612.

Aurbacher, J., Parker, P. S., Calberto Sánchez, G. A., Steinbach, J., Reinmuth, E., Ingwersen, J., & Dabbert, S. (2013). Influence of climate change on short term management of field crops—a modelling approach. Agricultural Systems, 119, 44–57.

Golub, A., Narita, D., & Schmidt, A. G. W. (2014). Uncertainty in integrated assessment models of climate change: alternative analytical approaches. Environmental Modeling and Assessment, 19, 99–109.

Boschetti, F. (2012). A computational model of mental model used to reason about climate change. Environmental Modeling & Assessment, 15(1).

UNEP FSF. (2012). Global trends in renewable energy investment 2012. Frankfurt: Frankfurt School of Finance and Bloomberg New Energy Finance.

Arrow, K. J. (1962). The economic implications of learning by doing. Review on Economic Studies, 29(3), 155–173.

Meier-Reimer, E., & Hasselmann, K. (1987). Transport and storage of CO2 in the ocean—an inorganic ocean-circulation carbon cycle model. Climate Dynamics, 2, 63–90.

IPCC (2013). Climate change 2013: the physical science basis. Working Group I contribution to the IPCC 5th assessment report—changes to the underlying scientific/technical assessment. Unpublished.

Hammitt, J. K., Lempert, R. J., & Schlesinger, M. E. (1992). A sequential-decision strategy for abating climate change. Nature, 357, 315–318.

IPCC (2007). Climate change 2007. Synthesis report. Contribution of Working Groups I, II and III to the fourth assessment report of the Intergovernmental Panel on Climate Change (Core writing team: Pachauri, R.K. and Reisinger, A.), IPCC, Geneva, Switzerland.

Holland, J. H., & Miller, J. H. (1991). Artificial adaptive agents in economic theory. American Economic Review, 81, 365–370.

Geisendorf, S. (2011). Internal selection and market selection in economic genetic algorithms. Journal of Evolutionary Economics, 21(5), 817–841.

Goldberg, D. E. (1989). Genetic algorithms in search, optimization and machine learning. Reading: Addison-Wesley.

Mitchell, M. (1997). An introduction to genetic algorithms (3rd ed.). Cambridge: MIT Press.

Asici, A. A., Aghion, A., & Bünül, Z. (2012). Green new deal: a green way out of the crisis? Environmental Policy & Governance, 22, 295–306. doi:10.1002/eet.1594.

Barbier, E. B. (2010). Global governance: the G20 and a global green new deal. Economics: The Open-Access, Open-Assessment E-Journal, 4(2), 1–35. doi:10.5018/economics-ejournal.ja.2010-2.

Barbier, E. B. (2011). Linking green stimulus, energy efficiency and technological innovation: the need for complementary policies. Berkeley: Conference Paper.

Bowen, A., Fankhauser, S., Stern, N., Zenghelis, D. (2009). An outline of the case for a ‘green’ stimulus. In: Grantham Research Institute on Climate Change and the Environment, Centre for Climate Change Economics and Policy (eds.), Policy Brief February 2009.

Jänicke, M. (2012). “Green growth”: from a growing eco-industry to economic sustainability. Energy Policy, 48, 13–21. doi:10.1016/j.enpol.2012.04.045.

Jochem, E., & Jaeger, C. (2008). Investments for a climate-friendly Germany. Potsdam: BMU http://www.bmu.de/en/service/publications/downloads/details/artikel/investments-for-a-climate-friendly-germany/?tx_ttnews[backPid]=196 (accessed.

Oikonomou, V., Patel, M., & Worrell, E. (2006). Climate policy: bucket or drainer? Energy Policy, 34(18), 3656–3668. doi:10.1016/j.enpol.2005.08.012.

Romer, P. M. (1986). Increasing returns and long-run growth. Journal of Political Economics, 94(5), 1002–1037.

World Bank (2013). Dataset of total final consumption. Available at www.data.worldbank.org (accessed 25.11.2013).

IMF (2013). World economic outlook database, April 2013. Available at http://www.imf.org/external/data.htm (accessed 25.11.2013).

IEA. (2008). Energy technology perspectives. Paris: OECD/IEA.

Hübler, M., Baumstark, L., Leimbach, M., Edenhofer, O., & Bauer, N. (2012). An integrated assessment model with endogenous growth. Ecological Economics, 83, 118–131. doi:10.1016/j.ecolecon.2012.07.014.

Kemfert, C. (2005). Induced technological change in a multi-regional, multi-sectoral, integrated assessment model (WIAGEM): impact assessment of climate policy strategies. Ecological Economics, 54, 293–305. doi:10.1016/j.ecolecon.2004.12.031.

Romer, P. M. (1987). Growth based on increasing returns due to specialization. American Economic Review, 77(2), 56–62.

Ickes, B.W. (1996). Endogenous growth models. Available at: http://econ.la.psu.edu/~bickes/endogrow.pdf (accessed 15.11.2013).

NOAA National Centers for Environmental Information, State of the Climate: Global Analysis for Annual 2015, published online January 2016, retrieved on January 9, 2017 from http://www.ncdc.noaa.gov/sotc/global/201513.

Kahneman, D., Knetsch, J. L., & Thaler, R. H. (1991). Anomalies: the endowment effect, loss aversion, and status quo bias. The Journal of Economic Perspectives, 5(1), 193–206.

Rachlinski, J.J. (2000). The psychology of global climate change. 2000 U.Ill. L. Rev. University of Illinois Law Review, 2000(1).

Thaler, R. (1980). Toward a positive theory of consumer choice. Journal of Economic Behavior and Organization, 1, 39–60.

Williams III, R. C. (2010). Setting the initial time-profile of climate policy. The Economics of Environmental Policy Phase-In. NBER Working Paper Series, 16120.

Acknowledgements