Abstract

Genetic algorithms have been established as an alternative to neoclassical optimization for the illustration of economic agents’ behavior. Critics however, doubt they depict the particularities of social evolution, because they fail to describe intentional behavior. The current paper argues that advocates as well as critics of the procedure have overlooked the crucial necessity to distinguish between internal and external selection in the economy and to include both in economic Genetic Algorithms. The paper claims that such a differentiation will allow the model to depict intentional decisions as well as market selection and help to understand the effects of bounded rationality. It illustrates this point with a brief example modeled after the new-versus-new competition between lean-burn engines and catalysts in the 70th.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Starting with Miller (1986), followed by Axelrod (1987), Holland and Miller (1991), and Arifovic (1991) genetic algorithms (GA), originally developed by Holland (1975) as a model of biological evolution, have been established as an alternative description of human behavior in economic contexts (Birchenhall 1995; Dawid 1999). The model has been particularly applied by researchers interested in the evolution of economic systems and the bounded rationality of economic agents. Standard economic optimization theory involves technically very demanding calculations, requiring unrealistically high skills of economic agents (Holland and Miller 1991). Furthermore, when abstaining from the assumption of perfect rationality and information, it becomes obvious that knowledge is distributed across the economy. Technical change and other learning processes have to make use of this distributed knowledge. GA are a means to depict how distributed learning happens (Birchenhall 1995). They can depict the stepwise adaptation to better solutions instead of instant optimization. And they provide a platform to investigate the conditions under which market forces and individual adaptation actually create optimal behavior and under which they do not (Holland and Miller 1991).

Examples of studies in this sense are cobweb models (Arifovic 1994; Dawid and Kopel 1998; Casari 2006), bidding strategies in auctions (Andreoni and Miller 1995; Duffy and Ünver 2008) or trading strategies in stock markets (Matilla-Garcia 2006), the optimization of a production function under stable (Birchenhall et al. 1997) or changing conditions (Geisendorf 2009a), bounded rationality in resource exploitation (Geisendorf 1999, 2001) or the evolution of cooperation in a prisoner’s dilemma (Axelrod 1987; Miller et al. 2002).

GA have also been used in connection with experimental game theory (Arifovic 1996). They are used to reproduce behavior observed in experiments to help understand its underlying mechanisms (Duffy 2000; Casari 2004), carry out simulations over longer time horizons than possible with human test persons (Haruvy et al. 2006) or as a cheaper substitute for costly and time consuming laboratory experiments (Arifovic and Ledyard 2002). In the latter cases, they are usually calibrated using existing experimental findings and then sometimes used to design further experimental settings. Generally, the authors find that such GA produce quite similar results to the lab experiments.

On the other hand, there are critics of the application of GA as economic learning or behavioral models. According to them, the procedure, originally developed by Holland (1975) as a model of genetic adaptation, is not appropriate to depict human behavior. The biological model of continuous non-reflected evolution would lack particularities of human learning like a memory or an explicit incentive to change. But particularly the mechanism of “blind” selection is criticized. Upon closer inspection this criticism is divided into three arguments: (1) GA do not model internal selection (Brenner 1998; Witt 1999). (2) External selection is less relevant or not relevant at all in economic evolution (Brenner 1998; Witt 1999). (3) If the algorithms were to depict internal selection (which some of the models suggest), the information given to the agents would require telepathy (Chattoe 1998).

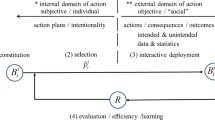

The current paper argues that advocates as well as critics of economic applications of GA have thus far neglected a crucial aspect. In contrast to biological evolution, which is only determined by external selection, economic evolution is driven by internal as well as external selection. Internal selection refers to the cognitive processes of economic agents when deciding about how to develop novelties, like new products or strategies. It also refers to firm-internal discussions or pre-tests, where novelties are analyzed, before being put on the actual market. External or market selection on the other hand refers to the competition such novelties are exposed to on the market and the resulting economic performance, like market shares or profit. Both are obviously related to each other but they are not the same.

In the economy, novelties are designed consciously and given certain characteristics intentionally. This is a huge advantage over the slower evolution of genes (Witt 2004) but it also comes with the risk of misinterpreting external “survival” requirements. Economic agents try to understand and anticipate market requirements but since the discussion on bounded rationality and incomplete information it should be obvious that they only ever do so in an incomplete way. Hence the need to separate internal and external selection in economic GA. Or, in other words, economic GA have to reflect the fact that the reasons for economic success are not necessarily identical with what some economic agents believe to be the reasons.

Thus far, the need to separate internal and external selection and include both into the model in an appropriate way has neither been discussed in economic applications of GA, nor does it seem to have been fully understood by critics of the procedure. Since Vriend (2000) we distinguish between social learning GA and individual learning GA. Social learning refers to the original GA, where each agent is represented by one strategy at a time and the strategies evolve through mutual exchange of information. Social learning GA are usually driven by external selection because the agents receive information about the performance and strategy decomposition of others—some of this information, as can be argued, should only belong to the system (the economy or the market or, in biology, nature) and not be visible for the agents. Individual learning corresponds to Holland’s classifier system, in which an agent has a pool of solutions from which to choose and selects the one to be carried out depending on their former success (Vriend 2000). In individual learning GA, the GA is used to create new strategies out of the ones existing inside each agent’s strategy pool (Holland 1975). These GA thus reflect internal selection.

Although this distinction between individual and social learning would be a good starting point for the discussion of the relevance of internal and external selection, such a debate has not yet taken place. Authors of early economic GA mainly used the social learning variant and generally endowed their agents with external knowledge, without discussing the plausibility of such assumptions.Footnote 1 More recent papers using GA as a substitute for experiments use the individual learning variant, based on internal strategy variations, because in experimental game theory strategies of other participants are usually not visible (Casari 2004; Haruvy et al. 2006). They thereby neglect shared knowledge and information exchange between agents, present in real markets. The dynamics behind social learning GA as well as individual learning GA are claimed to be known from learning literature (Arifovic and Maschek 2006) but there has been no discussion of their relevance for particular economic situations.Footnote 2

Criticism of economic GA or the underlying evolutionary mechanisms dates from the early days of their application and is thus directed at social learning GA (Brenner 1998; Chattoe 1998; Witt 1999). But in their attempt to make a case for intentional decisions, critics of the procedure sometimes reject the relevance of external selection altogether. They concentrate too much on the missing parts of existing economic GA, instead of assessing the potential of the general framework for economic purposes.

When economists started to use GA, it has been argued that the models depict evolution in a too biological manner. Brenner (1998) pointed out that the algorithms are missing a memory and an explicit motivation to search for better solutions, and that the mutual exchange of information and the replacement of old by new solutions would not be appropriate for economic purposes. All these four points are true and owed much to the biological origin of the model. But although most economic applications of GA do not discuss whether this constitutes a problem, there is no technical difficulty in altering these features. In fact, some applications have already altered biological features, included missing aspects and discussed their relevance.Footnote 3 The possibilities and consequences of dealing with these issues will therefore not be discussed in the current paper. It should only be noted here that the influence of such changes is sometimes less significant than expected. And where they have a big impact, they raise the question of the correct specification, but that is an obvious problem of all models of bounded rationality. As bounds to rational decisions come in many different forms, the appropriate specification for a particular case has to be chosen with care. The current paper will only discuss this problem as far as the design of different forms of selection is concerned and concentrate upon the necessity to distinguish between internal selection in the minds of people and external selection on markets and the relevance of both for economic evolution.

The remainder of the paper is organized as follows. For those not entirely familiar with GA, Section 2 will start with a brief introduction to the technical details of the procedure. Section 3 will discuss the criticism concerning the lack of internal selection or intentional decisions in GA. It will be shown how this rightful criticism can be answered by a clear distinction between internal selection and market selection. But it will also be argued that critics of GA go too far when rejecting the relevance of external selection for economic evolution. The paper argues that an inclusion of both, internal and market selection, is necessary to illustrate economic evolution (except in cases where they coincide). In Section 4 it will be first described how such an integration of both selective processes can be realized. The second part of Section 4 illustrates this idea with an example modeled after the new-versus-new competition between lean-burn engines and catalysts in the 70th. The paper concludes that although it is unlikely to find a unique description of learning in economics, GA offer a promising way to depict economic evolution in an endogenous way and to investigate the effect of deviations between internal perceptions and external market requirements.

2 Genetic algorithms as models of evolutionary learning

2.1 Some basics

GA have been developed by Holland (1975) as a model of genetic evolution but have quickly been transferred to other areas as search algorithms because they basically constitute an abstraction of a particular kind of search. A number of possible solutions to a given problem is executed in parallel, attributed its resulting fitness (or success) values and then used to develop new and possibly better adapted solutions to the problem. A basic assumption underlying the algorithm is the conjecture that more successful solutions are more likely to provide suitable base material for further research. The procedure choosing the solutions on which new experiments are to be based is called selection. Novel solutions are developed by two operators, crossover and mutation. Crossover combines parts of formerly successful variants and mutation randomly alters parts of an existing variant. There are different kinds of replacement schemes, with which usually the population of all solutions is kept constant. Either the new variants just replace their ancestors or the best of all variants survive (Holland 1975; Arifovic 1994).

When using GA in an economic context, the operators of the algorithm are interpreted as steps of a process of “adaptive learning” (Dawid 1999) or “evolutionary learning” (Arifovic and Maschek 2006). A solution is a product, an output quantity or a market strategy of an economic agent. Fitness, and the resulting selection of solutions to be further developed, depends on the economic environment and the feedback the agents receive from it in the form of profits, market shares or other criteria. If we want to distinguish between internal and external selection, as is proposed here, there might be a difference between objective “survival criteria” (for example, does a firm have enough funds to make it to the next time step?) and subjective assumptions about a good firm strategy. Crossover and mutation translate into developing new ideas by recombining or copying successful old ones, including some mistakes or experiments.

It might be doubted whether these mechanisms, by which genes evolve, are a good description of how novelties are generated in economic contexts. Of course, there are no actual mutations in the sense of informational defects, caused by external influences and transferring knowledge from one product to another does not work in the exact same way as genetic crossover, but interpreted in a general sense, the mechanisms are very universal to the generation of novelty. As Witt (1993) pointed out, although novelties are intrinsically unpredictable, they are constrained by existing variants, because no new ideas (and no artifacts) are entirely unrelated to former variants. Novelties can only be developed as a new recombination of existing knowledge (or of existing materials or components) (ibid.). The main question seems not to be whether crossover is a relevant aspect for innovations. The question is rather how and when it is most likely to happen.Footnote 4

In the following, it will be argued that a bidirectional exchange of information like in biological crossover is unlikely in most economic contexts, but the main feature of the crossover–operator, which is to mix knowledge in a new way, is helpful for a model of economic evolution. The same holds for mutation, which should simply be interpreted as the stochastic influence in experimentation and error-making. Without these mechanisms, it would be hard to depict how novelties are related to former variants and also how they are able to evolve away from them. In fact, the current paper claims that particularly because of these mechanisms—together with selection—GA are able to depict economic evolution in a closed, endogenous way. Other learning models often fail to do so, because the feedback between established knowledge and the kinds of novelties that are able to emerge is missing. Although, obviously, the way in which recombination happens could be modelled differently and the binary structure of GA is not the only (sensible) form to represent knowledge.

To avoid misunderstandings, we will now have a brief look at the technical details of the model, before discussing how internal and external selection could be included and why they should.

2.2 Technical details

GA consist of a number N of binary strings S with n elements si.

Each string is interpreted as a binary number, which is converted into a decimal number. The result can undergo any kind of transformation or renormalization (g) to yield a value xj.Footnote 5

Each xj is a possible solution to a given problem. Now X is the set of all solutions currently executed or known off.Footnote 6

The quality of these solutions is evaluated by f, where f can be a succession of several operations. It can also be time dependent, when the fitness requirements change externally (Geisendorf 2009a), or depend on the currently executed solutions, e.g. when profits change with the number of providers offering the same product in cobb-web models (Arifovic 1994) or other economic environments (Geisendorf 2009a). In this case, fitness changes endogenously.

The fitness evaluation is the starting point for a selection procedure. Generally, such a fitness function can be the basis for either internal or external selection. In a sense, it just constitutes an information basis about the relative performance of the solutions with regard to a specific criterion. The technical difference between internal and external selection and its proper place within an economic GA will be explained later, using an example. For now, just note that the selection can be modeled in different ways. The most known are tournament selection, where two or more solutions are compared and the best one is chosen, or is chosen with a certain probability, and a biased roulette, where each solution x has a probability of being selected in proportion to its relative fitness.

In the basic GA, a number N of solutions are thus selected and combined pair wise. With a certain probability cp they are recombined by crossover. This operator can also be designed to allow for complete imitation. With probability \(1 - \textrm{c}_{\rm p}\) the strategies remain unchanged. There also is a probability mp for each of the si elements of a string to be switched from a 0 to a 1 or vice versa. The newly built strings now replace their “parents” or the best N strings are kept for the next time step.

3 The importance of internal selection and market selection in economic GA

It is no coincidence that GA have been applied far more often as an optimization tool than as a model of human learning. The algorithm has been used for tasks like minimizing cycle times of assembly lines,Footnote 7 oil price predictions,Footnote 8 or cost minimization in supply chains.Footnote 9 About the same time as Holland’s development of GA (Holland 1975) a quite similar procedure, evolutionary strategies, has been developed by German engineers to solve technological construction problems (Rechenberg 1973).

The point is that such algorithms are powerful optimization tools for complex problems. In a certain sense it has been particularly this ability which appealed to economists in search of alternative ways to exemplify human problem solving. Some papers explicitly wanted to investigate the capability of GA to “serve as a behavioral foundation of mainstream economics” (Riechmann 1999, p. 226), or learn rational expectations (Lawrenz 2002). If optimization is the assumed outcome of economic activity, an algorithm performing (near) optimization in a traceable way, would be welcome to illustrate what happens in the black box of mathematical optimization calculus, employed by neoclassical economics. But the fact that GA are able to develop consistently better solutions is no proof that economic agents are able to do so as well. So is it actually possible that a tool with the potential for optimization can depict what is going on in human minds when they solve problems and learn?

It is, if the tool is not necessarily endowed with the ability to optimize. This ability is not an inherent feature of the algorithms. It is related to the selection procedure, implemented in the model, and in particular to the fitness criteria used for selection. It is a common misunderstanding to assume that, as GA are able to optimize, they have to be endowed with an omniscient fitness function. The question of how selection should be designed in economic contexts, to represent human learning, leads to the necessary distinction between internal and external or market selection which has largely been neglected in economic GA. In biology there is only one level of selection, whereas in the economy there are two, because both internal decisions of firms or people developing products and the external reaction of markets to these products play a role in their performance. But neither the distinction between them, nor the relevance of both for economic evolution, has been discussed thoroughly. So what are internal and external selection and how could they be included in economic GA?

3.1 External selection by markets

Let us start with external selection. The system or computer model in which the binary strings are placed “knows” which characteristics work well in the assumed model environment. This is the case for all GA—and also for every other imaginable model of learning or evolution in general. There has to be some “objective” fitness evaluation—objective in the sense of “being implemented in the system”. It does not matter how this evaluation is designed. It may be endogenous and depend on time, the sum of all behaviors in the system, particular relationships between elements of the system or on something else. It is still systemic knowledge, meaning that the calculations to be performed in order to derive the fitness values for each solution are written in the general code of the model. In economic terms, such systemic knowledge leads to results like prices or sales figures, following from consumer demand and market competition, and it leads to the long term success or failure of products or firms. This is something corresponding to external selection through the environment in biology. As the original GA are based on biology, they work with only such external selection. But the social learning GA mostly used at the beginning of economic applications are also based on external selection, which thus looks very much like natural selection and not like individual decision making.

There are several critical points arising from this. First, it has been argued correctly that economic agents are not exposed helplessly to external forces. With the exemption of trial-and-error search, e.g. in the chemical industry, individuals developing new products do not create arbitrary variations of existing ones. They deliberately combine specific materials or elements of other products or strategies (Witt 1997). This intentional aspect of economic evolution is not included in algorithms based on purely external selection. Second, this point is taken even further by some authors to claim that external selection plays a lesser or even no role at all in economic evolution, because the agents are prepared for it and can avoid it.Footnote 10 And third, it has been pointed out by Chattoe (1998) that social learning GA imply that the agents are not only informed about the performance of their competitors, but also able to discern how products or strategies of others are comprised. This requirement is not straightforward in many contexts, which led Chattoe to claim it would be more plausible to assume telepathy right away instead of believing entrepreneurs would disclose their construction secrets to competitors.

Let’s start with this last point and work backwards from there. Social learning GA, which were the first to be used by economists, are based on only one selection criterion, corresponding to external selection in the above described sense. Firms or stock buyers generate more or less profit, resulting from their performance in an external environment (Holland and Miller 1991; Arifovic 1994). It is plausible—although not evident—that such success can be an incentive for others to copy from the winners or to improve one owns strategy. A first problem here is that the real success might not be visible to others. Trained by the tax system, firms are quite good in hiding their actual profits, because they do not only depend on sales figures and prices but also on the less visible costs of developing and producing a good. But second, and more profoundly, the reasons for this success have to be visible in order to imitate them or incorporate parts of them in recombination (Chattoe 1998). So the reasons for success as well as all production secrets would have to be visible for everybody. This is a very strong assumption.Footnote 11 Particularly the information about product compositions is not attainable without difficulty. The neglect of a distinction between internal and market selection in social learning GA might be responsible for their failure to demonstrate, how information that is actually part of external selection can be acquired by the agents.

Nonetheless, that does not mean that social learning and imitation does not take place. Chattoe’s illustrative mockery of the required telepathic abilities is only partly accurate. We know that there is a lot of imitation and knowledge sharing going on in the economy (Schnaars 1994; Mathews 2003). Competitors do not dispense their blueprints, but it is still possible to obtain information about product characteristics. Products can be disassembled and analyzed, patent rights can be purchased and there is industrial spying. Admittedly there are copying restrictions, but that does not mean that knowledge once created is not potentially available to others (Dopfer and Potts 2004). Such barriers to imitation could be respected in economic GA by introducing copying errors or associating crossing-over with search costs (Beckenbach 1999).

The second argument was that external selection is less relevant for economic evolution than internal selection or not relevant at all. Although put forward by some evolutionary economists, it is strongly contested by others.Footnote 12 The current paper sustains the view that external selection still plays an important role in social systems—although obviously not in the form of natural selection.Footnote 13 External selection is the fact that whatever economic agents finally release to market sells better or worse. Firms try to anticipate market requirements, but even if they are very good in doing so their well developed products meet other, equally well prepared products and have to compete with them. Being well informed is thus only a relative advantage, not an absolute one. It is the reason why economic evolution progresses so much faster than the unintentional biological one (Witt 2004) but it would only constitute an advantage for a particular individual if everybody else was stupid. Market selection thus has to be part of economic GA. The misunderstanding is that it has often been mixed up with the process of conscious design of novelties. Market selection happens after novelties have been designed. And what’s more, its relevant fitness criteria do not have to be identical with individual fitness criteria. Researchers concerned with explanations of empirical innovation patterns also recognize the importance of external selection following internal “pre-selection” (Som and Kirner 2009). We will come back to how it can be included in economic GA after discussing internal selection.

3.2 Internal selection

The first mentioned problem some authors have with external selection in economic GA leads to the issue of internal selection. It is argued that evolution in economic systems is driven to a large extent by the intentional development of novelties. Internal selection is used here as a synonym for intentional, deliberate decision making of human agents. Decisions, to be such, require the comparison of different alternatives—otherwise there would be no choice to make—so they are a form of selection between these alternatives.Footnote 14 In the early days of mostly social learning GA, it has been pointed out in papers like Brenner (1998) or Beckenbach (1999) that economic GA do not depict the particularities of social evolution, because they do not model this intentional choice. For most social learning GA this is true. There is no intelligent assessment of market data, no decision whether to innovate or not and no anticipation of market competition. Instead the agents are provided with too much external knowledge, as discussed above.

Real economic agents are both much more sophisticated in their decision making, but also more restricted in their knowledge and abilities, to just copy components of the best performing competitor from every year. They use their knowledge of existing artifacts and technologies and combine it with additional knowledge, e.g. about their target group. Possible alterations or new combinations of product characteristics are tested, first mentally, later possibly in market surveys or technical pre-tests. In some respects, this knowledge is much more sophisticated and comprehensive than nature’s selective “knowledge”. It draws on past experience and includes different aspects and levels of resolution, from the market performance of a whole product, through the technical characteristics of parts of it, to the general tastes of the customers. Such anticipation of required characteristics of novelties is a social particularity. It is the main reason for economic evolution to be so much faster than the “blind” genetic one.

But intentional development of products or strategies does not imply that the agents know all about the external world and have the ability to use all this knowledge in an intelligent way. Internal models about how the world works can be incomplete or plain wrong—depending on the degree of bounded rationality prevailing in the observed economic circumstances. If that is the case the agent’s fitness criteria will not necessarily match external market criteria, which is the reason why we need both. A car producer might assume that hybrid cars are the future of individual transport and invest large sums in their development. That is an intentional and probably intelligent strategy. However, it is possible that he is wrong and it turns out that electric cars from another producer make the race. Both producers used their internal selection criteria to decide what to invest in. In the end, market selection determines who makes profits from his investment. And even after that happened, the agents might differ in their interpretation of how to react to that fact. The first producer might try to catch up and imitate the other one or he might—mistakenly—believe that e-cars have only been more successful because of the better marketing of his competitor and invest in a superior marketing strategy himself.

Although several economic GA applications are concerned with bounded rationality and wrong perceptions (e.g. Arifovic 1994; Janssen and de Vries 1998), only a few, like Georges (2006) or Geisendorf (2001), consider the consequences of such mismatches and the variety of possible assumptions about GA agent’s behavior explicitly. But note that this does not mean that all social learning GA provide their agents with optimization knowledge. Some, like Lawrenz (2002), do, but as just mentioned, others, like Arifovic (1994), explicitly try to depict bounded rational agents resembling the shortsighted producers described by the cobweb model. However, what they generally fall short to do is to explicitly discuss the plausibility of the transition of knowledge related to the performance and strategy of other agents into the decision processes of their competitors.

4 Integrating external and internal selection

4.1 Some basic ideas

Now how do we deal with the necessity to integrate both, internal and external selection in economic GA? There are several ways to achieve this. Individual learning GA might constitute one of them because they do model internal selection processes and are even often calibrated using experimental data, suggesting their empirical validity. The internal comparison of memorized strategies and the sometimes employed hypothetical updating (Arifovic and Maschek 2006)Footnote 15 constitute two important features of human decision processes—a memory and the anticipation of market requirements needed for conscious design—and could be used as a basis for more sophisticated GA. However, individual learning GA have not been devised as an answer to the lack of conscious decision making in economic GA. The conditions in experiments, they are used to reconstruct, are not necessarily similar to those on real markets. This becomes most apparent when authors using them in connection with experimental game theory argue that individuals in game theory do not exchange information, so the GA agents shouldn’t do so either.Footnote 16 The importance of knowledge drawn from other sources than personal experience is thus neglected in these GA and would have to be reintroduced, for example in the form of an external GA written around the individual GA of the agents. In such a structure, memorized knowledge about own experiences could be mixed with the attainable knowledge about the strategies of other market participants.

However, such GA inside a GA would be a rather complex structure and although one might argue that it thereby allows one to depict human learning in more detail, it is questionable whether the model has to be that detailed for economic purposes. The current paper thus proposes a simpler solution in which the basic condition to separate internal and market selection is also fulfilled. This solution is based on a social learning GA.

There already have been some attempts to account for intentionality in social learning GA. The inclusion of a memory, an explicit motivation for change, one directional information transmission and different forms of internal pretests were efforts to liken the algorithms more to cognitive processes (Arifovic 1994; Birchenhall et al. 1997; Geisendorf 2001, 2009a). But although it is evident that the very basic structure of the original GA does not cover the complex procedures going on in human learning and decision making, it is far from obvious how the procedure should be enriched to—ideally—provide a general model of human learning. It has to be noted however, that every possible learning model for economic purposes is faced with the same difficulty. Simple models can at best only grasp the general features of the process and more refined models quickly get to complex and case specific. This discussion will not be extended here. The solution proposed in the following only concentrates on the distinction between internal and external selection since the relevance of a necessary separation of both has not been observed thoroughly by modelers thus far.

Social learning GA have a selection process resembling the one of biological GA. The performance f (see Section 2.2) of all (or in tournament selection of some) individuals is compared and the fitter ones are more likely to be selected for “reproduction” (pxj in Section 2.2). In biology it is appropriate to use just this one level of selection, because the fact that an individual is able to reproduce constitutes its fitness and, at the same time, ensures the transmission of its internal characteristics (i.e. its genes). In the economy, the success of a strategy or product is not that immediately related to an involuntary transmission of its characteristics to future strategies or products of other agents. Still, these other agents will try to copy from successful ones. The model has to include the “objective” fitness criteria of markets.Footnote 17 It then has to cover the subjective beliefs about what represents success and why exactly someone else is believed to have been successful. And it finally has to be defined what information is available for performance assessment and for imitation, because even if success and its reasons have been assessed correctly it may not be possible to copy these successful characteristics, because they are somehow inaccessible.Footnote 18 That sounds complicated and accounts for a lot of real world imitation barriers, but it is relatively easy integrated into economic GA, without raising their complexity by much, and we could still use a social learning GA for it.

The first thing to realize in order to implement internal selection, derived from beliefs about external selection criteria, is that the selection procedure of GA has to represent internal selection. Selection in GA is the staring point for the development of new strategies. So it has to represent the basis on which economic agents decide from whom to copy. Obviously they do so according to their personal criteria—which, as has been elaborated on, might deviate from objective market criteria. After the agents have chosen their role models, the algorithms have to define the agent’s beliefs about the reason for the alleged success. And finally, it has to be delineated to what extent the agents are able to see the details of these characteristics and imitate them accurately.

In all these three steps of the selection and reproduction process there might be deviations from the purely external selection as known from biology. And, as the current paper argues, such a separation in the model is particularly helpful when the effects of different misperceptions should be investigated. Depending on how deep one wants to go into these possibilities to get the wrong idea about how the world works or to be excluded from the relevant information, they have to be built into the model. But note that a three-step deviation from external selection criteria does not necessarily mean there have to be three equations, or series of equations, depicting this divergence. All the algorithms have to encompass are the objective selection criteria at one place and the subjective criteria, together with the availability of the necessary information at another place. After novelties have been developed, using internal criteria, they are applied or put on the market. Now the model has to give some feedback about their performance, like sales figures, profits or market prices, using the criteria of external selection. Only part of the possible external fitness assessment can be used and interpreted for personal decisions. Now let us illustrate these ideas with a modeling example.

4.2 A modeling example

The following model illustrates how market expectations or consumer demands (external selection) may differ from internal criteria of agents developing a novelty (internal selection) and how both can be included in an economic GA. It also highlights the economic consequences of divergences between the two. The example has been adapted from an empirical case in order to illustrate how promising ideas may undergo a successful development process, according to the internal targets of a producer, but meet different criteria on markets. The example is about the development of lean-burn engines for cars and the catalytic converter as an alternative technology to reduce emissions, which ultimately won the competition.

The empirical case has been described in detail by Nill and Tiessen (2005). In short, both technologies aimed to reduce CO, HC and NOx emissions of cars. Lean-burn engines worked with less fuel and thus generated fewer emissions. Catalysts were added after combustion and transformed the exhausts into “harmless” substances like water and CO2 (ibid. 104, 106).Footnote 19 Both technologies tried to meet the standards of the American Clean Air Act of 1970, prescribing severe emission reductions of 90% for 1975 (ibid. 109, 111). Lean-burn technology was able to meet the CO and HC standards, but had difficulties with NOx. Catalysts had more problems with CO and HC and with a combination of all three conversion processes in one. Additionally, the oil price shock of 1973 shortly raised a concern for fuel consumption formerly not present, but on the other hand, reduced the concern for emissions. However, oil companies lobbied against low fuel consumption and Nill and Tiessen (2005, 112) argue that the American public was more likely to accept catalysts than the Japanese developed lean-burn technology. Due to all these aspects the original deadline of the Clean Air Act was postponed several times. For NOx the final deadline was set as late as 1983 and could then be met by three-way catalysts. Altogether, Nill and Tiessen argue, this suspension acted in advantage of catalysts, because although not meeting all standards, lean-burn engines were better equipped for the original deadline. But catalysts became technological standard. It might be added that lean-burn technology has continued to be developed and could be implemented successfully today (Ward 2008).

The following model is based on the general story of the lean-burn engine and uses some of the above mentioned facts. However, note that the model has only been written for illustrative purposes. It does not attempt to reconstruct the whole story or time series and it does not use empirical data. Values for fuel consumption or emissions and dates for legislative or other influences are thus fictitious. The following description shall illustrate the main features of the model. A detailed description of the whole GA is given in the Annex.

We have two types of agents, lean-burn engine and catalyst producers. Due to the different technologies they have different starting positions and development opportunities. Catalyst producers need high fuel consumption and are not concerned with economizing on it. They also start with higher CO and HC emissions. Lean-burn producers start with high NOx emissions. The two types have diverging internal fitness criteria, because lean-burn developers are concerned about fuel and emission reductions whereas catalyst developers only look at emissions. For both types a GA, allowing for imitation and experimentation, represents the way in which new variants are developed. When looking for templates to copy from, both types chose only within their own group and rank former variants according to their internal fitness criteria with a higher probability to imitate successful ones (internal selection).Footnote 20 After development the new variants undergo a technological test and are only kept if they perform better than the former one (election operator).

It is this whole internal selection process that has to be put into the place of evolutionary relevant selection of an economic GA, where “evolutionary relevant” means relevant for the development of new variants. Competition between variants in the external world, which is depicted by the selection operator in biological GA, is a second step in economic GA.Footnote 21

On this second level, there is an external world with its own fitness criteria. The external world represents hypothetical consumers, deciding which car engine to buy (external selection). Their criteria change over time, due to legislation and other concerns. The model runs over 30 time steps. We assume that in the beginning the consumers are interested in the reduction of all three emissions. After the first five time steps the oil price shock raises a concern for fuel efficiency and they weigh it as high as all three emissions together. From period 10 to 15 the oil lobby has convinced the public that low fuel consumption is not important and emissions are the only concern again. However, emissions 1 and 2 (standing for CO and HC) are only half as important as 3 now, reflecting the postponement of the Clean Air Act which catalysts could not meet for these emissions. From period 16 on there is a legislation restricting emissions to −90% of the maximum possible in the model. If an engine can not meet the standard it is not bought at all.

Consumer’s appreciation is translated into economic success in a straightforward way. While both technologies are evaluated by the consumers, the respective cars are bought in proportion to this external fitness. We assume that 1,000 cars are bought in each time step.

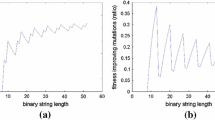

Figure 1 depicts the internal fitness for both types of technologies, Fig. 2 the external appreciation and Fig. 3 the corresponding sales. As particularly Figs. 1 and 2 show, internal success factors need not to coincide with external ones. From their technological point of view both types of agents are quite successful in improving their technologies. However, from a market point of view the perceived internal success does neither need to translate into equally rising appreciation, nor into the same ranking of fitness as in the technological domain. Depending on external requirements – which are often changing over time and, in the example, are subject to influences like the oil crisis or lobbying activity that are hard to foresee for technological innovators—a much more rugged performance appears on the outside. In the model, changing external requirements translate into a period where catalysts get a huge advantage over lean-burn engines, which in the real world template was the period in which a window of opportunity closed for a long time for the lean-burn technology. Additionally, when looking at Fig. 3, we see that even these external assessments cannot be translated 1 to 1 into actual external success. Ultimately it is not absolute appraisal, but the relative performance of different technologies that decides about their market impact. If no product satisfies consumers requirements, they might still buy the best of bad alternatives.Footnote 22

The model is an illustrative example of the effect of deviating internal and external assessments of a novelty. It shows that such disparities can happen, without internal and external criteria being entirely different, or without innovating agents being very badly informed or stupid. Even promising technologies resulting from an intelligent development process can fail due to external selection. So, at the same time as illustrating how an economic GA can be designed to include both selective processes, the empirical background of the example should convince critics of the relevance of external selection in the economy.

5 Conclusions

GA have been established as an alternative to neoclassical optimization for the illustration of the behavior of economic agents. But critics doubt that they are able to depict the particularities of social evolution, because at least social learning GA fail to model intentional behavior and concentrate too much on external selection. The current paper argues that advocates as well as critics of the procedure have overlooked the crucial necessity to distinguish between internal and external selection processes in the economy and to accept the relevance of both.

The paper claims that such a differentiation is important for two reasons. First, internal selection is the way to depict conscious decision making in economic learning models, because this mechanism allows us to illustrate the mental models, individual fitness criteria and available information and thus to depict intentionality, as well as bounded rationality of human agents. Second, the distinction is necessary to separate the limited, personal knowledge from the universal “knowledge” of the economic system, which has to be written in the general conditions part of economic GA. Only the latter resembles fitness attributions by natural selection, while the former represents the learning or adaptation process of the agents according to their personal fitness criteria.

It is further argued that the neglect of this distinction in most GA applications and particularly in social learning GA might be responsible for their failure to demonstrate, how information that is actually part of external selection can be acquired by the agents. But the paper also shows how missing aspects of human learning could be—and sometimes have been—included into economic GA and it explains why GA are a valuable tool for the description of economic evolution. Properly defined, GA could depict internal decision making as well as external market selection and depict how discrepancies between the fitness criteria of both processes affect outcomes. This makes them a helpful tool for evolutionary economists, trying to explain bounded rationality and its consequences.

The paper tried to illustrate this point with a brief example modeled after the new-versus-new competition between lean-burn engines and catalysts in the 70th. The example demonstrates how internal and external selection can be included in an economic GA and shows that inconsistencies between the two can have a huge effect on external success, without internal and external criteria being entirely different, or without innovating agents being very badly informed or stupid. So, at the same time as illustrating the importance of a proper distinction between internal and external selection in economic GA, the empirical background of the example should convince critics of the relevance of external selection in the economy.

But the consequences of a distinction between individual and market selection go beyond having to put the right restrictions at the right place of the model. The problem underlying this divergence is the fact that, whereas there is only one type of perfect rationality, there are a multitude of bounds to rational decisions. Agents in neoclassical optimization theory are easy to model, because rationality implies conformity to market requirements. Modeling bounded rationality is less straightforward, because there is no general way in which economic agents are restricted in their knowledge and abilities. However, this difficulty is not a particularity of GA. It affects any model of learning or economic evolution, going deeper than evaluating strategies by some objective fitness or depicting a frequency dependent adoption of novelties. In the current paper it is argued that it is still worth trying to develop such models—particularly on the basis of GA because they offer the opportunity to depict the endogenous generation of novelty.

Finally, it should be noted that the models can be useful, even if there is no unanimous recipe to design them. From a theoretical point of view it is interesting to experiment with different hypothesis and investigate the effects of various assumptions about the agent’s information basis and decision processes (Pyka and Fagiolo 2005). Simulation models like GA are a useful tool for this kind of research and can help identifying the assumptions to which results are not robust. Where that is the case, we know that we have to be particularly careful with hypotheses and ascertain better theoretical and empirical foundations of the learning process.

Notes

An exception is Arifovic (1994) who used both social and individual learning.

In Geisendorf (2001) the effect of a memory, a dissatisfaction-threshold to start action and a one-way exchange of information has been tested for a social learning GA. Arifovic (1994) introduced an election operator to perform pre-tests in a social learning GA before launching new strategies. In Geisendorf (2009a) something similar has been attempted by comparing the long-term performance of standard replacement with a replacement after pre-tests. The paper also tried to adapt the procedure to learning instead of genetic exchange by introducing a one-way information transmission and changed conditions for access to innovative activities. Vriend (2000) introduced a memory by proposing an individual learning GA. Arifovic and Maschek (2006) extended its elements of intentionality by applying Arifovic’s election operator for a hypothetical updating of strategies’ performance. Finally it should be noted that although not depicting all particularities of economic evolution, GA do not depict all particularities of biological evolution either (Burke et al. 1998). The model is simply a very abstract representation of evolutionary processes in general which has to be filled out with domain specific content if needed.

It could, for example, be questioned whether knowledge spillovers just happen as a consequence of some sort of proximity, or by building human capital, as Lo (2008) supports.

Note that it is also possible to decode parts of a string to translate into several numbers (like quantities of production factors) and combine them e.g. by calculating the resulting production costs and/or quantities, as has been done in Geisendorf and Weise (2001) or combine them to represent different products as in Geisendorf (2009a).

Note that this set does not usually include all possible solutions, but just a (small) subset of them. For example, for n = 10 the number off possible solutions is 210 = 1024, but there may be only N = 10 solutions realized at each time step—as in the model presented below.

Kulak et al. (2008)

Fan et al. (2008)

For neoclassical economists, assuming perfect knowledge anyway, all-knowing agents might not pose a problem, but the more detailed description of the search process is likely to raise the question of how this information might be acquired.

Critics of the relevance of external selection sometimes over-interpret it in the sense of economic agents literally dying or having fewer children when their firm goes bankrupt (Brenner 1998). But external market selection only selects for economic “survival”; sometimes only of a particular strategy or product, and not even necessarily of the whole firm.

Critiques of the term argue that it recalls the blind selective processes in biology and is thus not well suited to designate intentional choice (Witt 1999) but ultimately that is just a question of terminology. If we accept the existence of general evolutionary principles, implying that all evolutionary processes take place by the variation of existing variants, in relation to their former relative performance (Stoelhorst 2008; Geisendorf 2009b), it makes sense to keep the general term of selection because some of these processes are not intentional.

Arifovic and Maschek (2006) introduced a procedure of hypothetical updating of strategies, otherwise termed “election operator” (Arifovic 1994). Hypothetical performance refers to the possibility of evaluating the potential success of strategies, currently not in use, but stored in the memory of the agents. The internal GA selects one of the remembered strategies in relation to its actual or hypothetical success.

Note that although it is debatable on what aspects economic survival actually depends in the long run, inside the model, the “world” has explicit criteria.

Coca Cola is probably a good example for the different levels of complication in imitating success. Although it is believed that an imitation of its performance is impossible, because its receipt is not accessible (a plausible reason for imitation impracticalities and a belief fostered by consumers pretending they prefer Coca Cola for its superior taste), blind tests have established that Pepsi Cola actually tastes better. So market success does not depend on what is commonly believed and neither the receipt nor the marketing advantage is easily reproducible.

Note that at the time CO2 was no big concern. From the vantage point of the present the entire appraisal of the two technologies might have been different.

Imitation is performed by the crossover operator and can lead to copying whole strategies of other agents or only parts of them. Apart from arbitrary experiments, no explicit copying errors happen in the model.

As elaborated on above, the information of this external selection may or may not be reflected in the internal criteria. It can be assumed that in most economic contexts it is at best partially available and understood. In the present model internal and external criteria overlap partially.

It should be noted that the low values for external fitness in Fig. 2 after the 15th time step result from the fact that the figures depict the average fitness over all producers of each technology. The low value for catalysts thus results from the fact that, in the example, most producers were not able to meet the required standards. Lean-burn engines were first not able to meet the standards at all. However, after more and more of them could meet the standards their sales figures overtook catalysts, although its fitness also rose.

References

Andreoni J, Miller J (1995) Auctions with artificial adaptive agents. Games Econ Behav 10:39–64

Aldrich HE, Hodgson GM, Hull DL, Knudsen T, Mokyr J, Vanberg V (2008) In defence of generalized Darwinism. J Evol Econ 18:577–596

Arifovic J (1991) Learning by genetic algorithms in economic environments. Doctoral dissertation, University of Chicago

Arifovic J (1994) Genetic algorithm learning and the cobweb model. J Econ Control 18:3–28

Arifovic J (1996) The behavior of the exchange rate in the genetic algorithm and experimental economies. J Pol Econ 104:510–541

Arifovic J, Ledyard J (2002) Computer testbeds: the dynamics of groves-ledyard mechanisms. Society for Computational Economics, Computing in Economics and Finance no. 244

Arifovic J, Maschek MK (2006) Revisiting individual evolutionary learning in the cobweb model–an illustration. Comput Econ 28:333–354

Axelrod R (1987) The evolution of strategies in the iterated prisoner’s dilemma. In: Davis L (ed) Genetic algorithms and simulated annealing. Kaufman, Los Altos, pp 32–41

Beckenbach F (1999) Learning by genetic algorithms in economics? In: Brenner T (ed) Computational techniques for modelling learning in economics. Advances in computational economics 11. Kluwer, Dordrecht

Birchenhall C (1995) Modular technical change and genetic algorithms. Comput Econ 8:233–253

Birchenhall C, Kastrinos N, Metcalfe S (1997) Genetic algorithms in evolutionary modelling. J Evol Econ 7:375–393

Brenner T (1998) Can evolutionary algorithms describe learning processes? J Evol Econ 8:271–283

Burke DS, De Jong KA, Grefenstette JJ, Ramsey CL, Wu AS (1998) Putting more genetics into genetic algorithms. Evol Comput 6(4):387–410

Casari M (2004) Can genetic algorithms explain experimental anomalies. Comput Econ 24:257–275

Casari M (2006) Markets in equilibrium with firms out of equilibrium: a simulation study. J Econ Behav Organ 65:261–276

Chattoe E (1998) Just how (Un)realistic are evolutionary algorithms as representations of social processes? J Artif Soc Soc Simul 1. http://www.soc.surrey.ac.uk/JASSS/1/3/2.html

Dawid H (1999) Adaptive learning by genetic algorithms: analytical results and applications to economic models, 2nd revised and extended edition. Springer, Heidelberg

Dawid H, Kopel M (1998) On economic applications of the genetic algorithm: a model of the cobweb type. J Evol Econ 8:297–315

Dopfer K, Potts J (2004) Evolutionary realism: a new ontology for economics. J Econ Methodol 11:195–212

Duffy P (2000) Learning to speculate: experiments with artificial and real agents. J Econ Dyn Control 25:295–319

Duffy P, Ünver MU (2008) Internet auctions with artificial adaptive agents: a study on maket design. J Econ Behav Organ 67:394–417

Fan Y, Liang Q, Wei Y-M (2008) A generalized pattern matching approach for multi-step prediction of crude oil price. Energy Econ 30:889–904

Farahani RZ, Elahipanah M (2008) A genetic algorithm to optimize the total cost and service level for just-in-time distribution in a supply chain. Int J Prod Econ 111:229–243

Foster J (2000) Competitive selection, self-organisation and Joseph A. Schumpeter. J Evol Econ 10:311–328

Geisendorf S (1999) Genetic algorithms in resource economic models—a way to model bounded rationality in resource exploitation? Santa Fe Institute working paper 99–08–058

Geisendorf S (2001) Evolutorische Ökologische Ökonomie. Metropolis, Marburg

Geisendorf S (2009a) The influence of innovation and imitation on economic performance. Econ Issues 14(1):65–94

Geisendorf S (2009b) The economic concept of evolution: self-organization or Universal Darwinism? J Econ Methodol 16:377–391

Geisendorf S, Weise P (2001) Kreativität und Interaktion. Gestalt Theory 23:293–311

Georges C (2006) Learning with misspecification in an artificial currency market. J Econ Behav Organ 60:70–84

Haruvy E, Roth AE, Ünver MU (2006) The dynamics of law clerk matching: an experimental and computational investigation of proposals for reform of the market. J Econ Dyn Control 30:457–486

Hodgson GM, Knudsen T (2006) Why we need a generalized Darwinism, and why generalized Darwinism is not enough. J Econ Behav Organ 61:1–19

Holland JH (1975) Adaptation in natural and artificial systems. University of Michigan Press, Ann Arbor

Holland JH, Miller JH (1991) Artificial adaptive agents in economic theory. Am Econ Rev 81:365–370

Janssen M, de Vries B (1998) The battle of perspectives: a multi-agent model with adaptive responses to climate change. Ecol Econ 26:43–65

Jawahar N, Balaji AN (2009) A genetic algorithm for the two-stage supply chain distribution problem associated with a fixed charge. Eur J Oper Res 194:496–537

Kulak O, Yilmaz I, Gunther H-O (2008) A GA-based solution approach for balancing printed circuit board assembly lines. OR Spectrum 30:469–491

Lawrenz C (2002) Can evolutionary processes result in rational expectations? In: Lehmann-Waffenschmidt M (ed) Perspektiven des Wandels: Evolutorische Ökonomi in der Anwendung. Metropolis, Marburg

Lo ST (2008) Crossover inventions and knowledge diffusion of general purpose technologies: evidence from the electrical technology. NBER Working paper series 14043

Mathews JA (2003) Competitive dynamics and economic learning: an extended resource-based view. Ind Corp Change 12:115–145

Matilla-Garcia M (2006) Are trading rules based on genetic algorithms profitable? Appl Econ Lett 13:123–126

Miller JH (1986) A genetic model of adaptive economic behavior. Working paper, University of Michigan

Miller JH, Carter TB, Rode D (2002) Communication and cooperation. J Econ Behav Organ 47:179–195

Nill J, Tiessen J (2005) Policies, time, and technological competition: lean burn engine versus catalytic converter in Japan and Europe. In: Sartorius C, Zundel S (eds) Time strategies, innovation and environmental policy. Edward Elgar, Cheltenham, pp 102–132

Pyka A, Fagiolo G (2005) Agent-based modelling: a methodology for neo-schumpetarian economics. Discussion Paper Series 272, Institute for Economics, University of Augsburg

Rechenberg H (1973) Evolutionsstrategie. Fromann-holzboog Verlag, Stuttgart

Riechmann T (1999) Learning and behavioural stability—an economic interpretation of genetic algorithms. J Evol Econ 9:225–242

Schnaars SP (1994) Managing imitation strategies—how later entrants seize markets form pioneers. The Free Press, New York

Som O, Kirner E (2009) Innovation patterns of non-R&D intensive manufacturing firms: an evolutionary approach to heterogeneity in innovation behaviour. In: 6th Europ meeting on Appl Evol Econ Jena, 21–23 May 2009

Stoelhorst JW (2008) The explanatory logic and ontological commitments of generalized Darwinism. J Econ Methodol 15:343–363

Vriend N (2000) An illustration of the essential difference between individual and social learning, and its consequences for computational analyses. J Econ Dyn Control 24:1–19

Ward MAV (2008) Thirty year quest for lean burn. Design News, 28 April 2008: 16

Witt U (1993) Emergence and dissemination of innovations: some principles of evolutionary economics. In: Daly RH, Chen P (eds) Nonlinear dynamics and evolutionary economics. Oxford University Press, Oxford, pp 91–100

Witt U (1997) Self-organization and economics—what is new? Struct Chang Econ Dyn 8:489–507

Witt U (1999) Bioeconomics as economics from a Darwinian perspective. J Bio-Econ 1:19–34

Witt U (2004) On the proper interpretation of ‘evolution’ in economics and its implications for production theory. J Econ Methodol 11:125–146

Acknowledgements

The paper has much benefited from the comments of two anonymous referees. Particularly one of them detected several mistakes and gave useful advice. I also thank Fank Thesing and Jan Nill for information on the lean-burn modeling example.

Author information

Authors and Affiliations

Corresponding author

Annex

Annex

1.1 Initialization and determination of fuel consumption and emissions

Start with N = 20 strings of string length n = 20 bits.

Each bit can have the value 0 or 1.

N/2 = 10 of them represent agent type 1 (producers of lean-burn technology), N/2 agent type 2 (producers of catalysts). Append a C to the string for agents type 1 and an L for type 2.

For both types interpret bits 1 to 5, 6 to 10, 11 to 15 and 16 to 20 as five bit binary numbers each, the first one standing for fuel consumption, the other three for emissions 1 to 3 (representing CO, HC and NOx). Higher numbers correspond to higher consumption/emission.

- Agents type 1: :

-

With lean-burn technology it is hard to reduce NOx emissions. Therefore initialize the bits for fuel consumption and emissions 1 and 2 randomly and initialize the bits for emission 3 all with 1.

- Agents type 2: :

-

Catalysts for a long time only worked with a high fuel injection and had difficulties to reach the CO and HC targets. Initialize the first 15 bits of the strings with 1, the last 5 bits randomly with 1 or 0.

For t = 20 time steps the following operations are performed repeatedly, where the strings resulting at the end of each time step are taken as initial specifications for the next time step:

Determine the corresponding decimal numbers for all four characteristics.

1.2 External selection

Consumer’s requirements change over time, depending on legislation and external influences like an oil price shock. The importance of emission reduction and fuel consumption thus varies over time.

The external fitness of a variant (a string) is determined as a weighted mean of all four characteristics (fuel consumption and the three emissions).

- For time steps 1 to 5: :

-

All three emissions are equally important. Fuel consumption is not. Add the decimal numbers for all three emissions. Renormalize the possible range (0 to 93) to the range 1 to 0 with highest fitness 1 for lowest total emissions 0.

- For time steps 6 to 10: :

-

Assume an oil price shock, resulting in a temporary requirement of low fuel consumption. Multiply the decimal number for fuel consumption by 1/2, multiply the emission numbers by 1/6 each and add all four numbers. Renormalize the resulting range (0 to 31) to the range 1 to 0 with highest fitness 1 for lowest fuel and emission values.

- For time steps 11 to 15: :

-

The model economy has recovered from the oil price shock and is concentrating on emissions again. Legislation overemphasizes the importance of emission 3 reductions (NOx) over emission 1 and 2 reductions (CO and HC). Multiply the decimal number for emissions 1 and 2 by 1/4, the number for emission 3 by 1/2. Renormalize the resulting range (0 to 31) to the range 1 to 0 with highest fitness 1 for lowest emission values.

- For time steps 16 to 30: :

-

Legislation prescribes emission targets to be met. For each emission type, no emission over 3 is allowed (approximately −90% of maximum emission 31). If the decimal number for one of the three emissions >3, external fitness = 0. Else add the decimal numbers for all three emissions. Renormalize the possible range (0 to 9) to the range 1 to 0 with highest fitness 1 for lowest total emissions 0.

In each time step 1,000 cars are sold. Sales figures for both motor types are proportional to their fitness values. If no cars meet the standard for time steps 16 to 30, no cars are sold.

1.3 Internal selection

- Agents type 1: :

-

Fuel and emission reductions are equally important. Add the decimal numbers for all four characteristics. Renormalize the possible range (0 to 124) to the range 1 to 0 with highest fitness 1 for lowest total values for fuel consumption and emissions.

- Agents type 2: :

-

All three emissions are equally important. Add the decimal numbers for all three emissions. Renormalize the possible range (0 to 93) to the range 1 to 0 with highest fitness 1 for lowest total emissions 0.

1.4 Development of new variants

The agents try to improve their engines.

- Agents type 1: :

-

Look at all the lean-burn producers (marked by an L). Chose other agent as template for variation of characteristics with probability pxj equal to relative internal fitness (roulette wheel selection). With cp = 0.75 randomly cut first or last 1 to n-1 bits of own string and exchange for corresponding parts of other string. Switch each bit with mp = 0.03, if 1 into 0, if 0 into 1.

- Agents type 2: :

-

Look at all the catalyst producers (marked by a C). Chose other agent as template for variation of characteristics with probability pxj equal to relative internal fitness (roulette wheel selection). With cp = 0.75 randomly cut first or last 1 to n-1 bits of own string and exchange for corresponding parts of other string. Switch only the bits 6 to 20 with mp = 0.1, if 1 into 0, if 0 into 1 (bits 1 to 5 remain unchanged, because at the time high fuel consumption was a prerequisite for catalytic conversion and was no concern of catalyst producers).

1.5 Technical pre-tests

Agents type 1 and 2: Each agent compares his old and new strategy according to his internal fitness criteria. Keep old strategy if new one does not reach a higher fitness value. Else take new.

Go back to the beginning of the time-loop and into the next time step until t = 30. Then stop.

Rights and permissions

About this article

Cite this article

Geisendorf, S. Internal selection and market selection in economic Genetic Algorithms. J Evol Econ 21, 817–841 (2011). https://doi.org/10.1007/s00191-010-0193-1

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00191-010-0193-1