Abstract

Modelling the economics of climate change is daunting. Many existing methodologies from social and physical sciences need to be deployed, and new modelling techniques and ideas still need to be developed. Existing bread-and-butter micro- and macroeconomic tools, such as the expected utility framework, market equilibrium concepts and representative agent assumptions, are far from adequate. Four key issues—along with several others—remain inadequately addressed by economic models of climate change, namely: (1) uncertainty, (2) aggregation, heterogeneity and distributional implications (3) technological change, and most of all, (4) realistic damage functions for the economic impact of the physical consequences of climate change. This paper assesses the main shortcomings of two generations of climate-energy-economic models and proposes that a new wave of models need to be developed to tackle these four challenges. This paper then examines two potential candidate approaches—dynamic stochastic general equilibrium (DSGE) models and agent-based models (ABM). The successful use of agent-based models in other areas, such as in modelling the financial system, housing markets and technological progress suggests its potential applicability to better modelling the economics of climate change.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The consequences of climate change for human welfare are likely to be enormous, and the intellectual challenges presented by the economics of climate change are daunting. As Stern (2007, p. i) observed, the economic analysis of climate change must “be global, deal with long time horizons, have the economics of risk and uncertainty at centre stage, and examine the possibility of major, non-marginal change.”

The response to this gargantuan challenge from economists has included a number of insightful papers that examine many individual aspects of climate impacts and mitigation responses. For example, economists have analysed the regulation of carbon emissions in the presence of uncertainty (Weitzman 1974; Hoel and Karp 2001), consequences of catastrophic outcomes on cost-benefit analysis of climate change (Weitzman 2011; Martin and Pindyck 2014), the effect of climate change on conflict (Hsiang et al. 2011; Cane et al. 2014) and on agriculture (Schlenker et al. 2005; Lobell et al. 2014). There is no doubt that these individual advances have been of great value.

But political and business leaders have also called upon economists to put all the individual pieces together and to provide guidance for action. In response, the starting point has been to build Integrated Assessment Models (IAMs) that attempt to provide a framework for analysing the physical and socio-economic effects of climate change simultaneously. Such models have provided the key tool in the analysis of impacts of climate change since the foundation of the Intergovernmental Panel on Climate Change (IPCC) (Clarke et al. 2009). IAMs are now used in the influential reports produced by the IPCC and by several governments in the economic assessment of climate change policies around the world.

Perhaps because of their policy influence, IAMs have come under increasing criticism (Revesz et al. 2014). This criticism comes not only from philosophers (who tend to object to the aggregation of all physical and social effects of climate change into monetary form) and heterodox economists (who are uncomfortable with the classical nature of such models), but rather from the key users of IAMs, including prominent mainstream economists (Pindyck 2013; Stern 2013; Weitzman 2013). Despite their influence in policy, the outputs of IAMs are now described, not in jest, as being as “close to useless” (Pindyck 2013).

We review several criticisms of current IAMs and consider potential alternative approaches—dynamic stochastic general equilibrium (DSGE) models and agent-based models (ABMs). DSGE models work similarly to standard IAMs. However, unlike existing traditional IAMs, DSGE models explicitly incorporate uncertainty about the future through the introduction of shocks to output, consumption or climate damages. Their primary advantage is that they are (usually) still tractable and can often provide policy makers with straightforward results and comparative statics. For example, a DSGE model introduced by Golosov et al. (2014) provides an elegant analytical solution to the optimal carbon tax problem that only depends on three fundamental parameters. Agent-based models differ more substantially from traditional IAM approaches. ABMs are simulations of the economy based on interactions of a large number of heterogeneous agents according to specified rules that aim to allow more flexible and realistic characterisations of socio-economic systems (Axelrod 1997; Farmer and Foley 2009). ABMs have been more recently successfully used in several areas of economics, including financial markets, technology adoption, lock-in and transfer, business cycles in macroeconomics, labour networks, firm structure and larger scale agent-based macroeconomic models. But they are yet to see a serious application to climate economics.

This paper commences with a brief taxonomy of IAMs (Sect. 2), before providing an overview of the current shortcomings of existing IAMs in Sect. 3. Section 4 argues that a third wave of climate-energy-economic models could help address these weaknesses, and compares the potential of two new modelling approaches: DSGE climate-economy models and ABMs. Section 5 notes that this third wave of modelling has, in fact, recently begun in both areas. It reviews the progress by ABMs and makes some specific recommendations for how these models could be improved. Section 6 concludes with a discussion of how this line of research could be developed in the coming years, so that IAMs can serve as a useful, rather than a “close to useless”, guide to climate change policy in the near future.

2 A Brief History and Taxonomy of IAMs

The creation of IPCC and its 1st Assessment Report spurred the development of the first wave of integrated assessment models, including: CETA (Peck and Teisberg 1992), DICE (Nordhaus 1994); MERGE (Manne et al. 1995); RICE (Nordhaus and Yang 1996); PAGE (Hope et al. 1993) and FUND (Tol 1997). These early models largely used tools and concepts from the classical economic growth literature and were significantly constrained by the availability of data and computational power.

The 3rd Assessment Report of the IPCC helpfully divided IAMs into two broad categories: policy optimization models (POMs) and policy evaluation models (PEMs) (Climate Change 2001). POMs focus on complete cost-benefit analysis of climate change mitigation and optimal policy whereas PEMs look at the cost-effectiveness of achieving a particular mitigation target with a given policy. Since the 1990s the number of IAMs has exploded. In addition to DICE, FUND and PAGE, several new POMs models have been developed, including WITCH (Bosetti et al. 2009, 2008) as well as several dozen PEMs, such as EPPA (Paltsev et al. 2005).

By 2009, models proliferated to such an extent that there was a need to adopt common standards and focus on analysing similar abatement scenarios (Clarke et al. 2009). The 5th Assessment Report of the IPCC Working Group III on climate change mitigation reviewed 31 models for its scenario database (Krey et al. 2014). The report primarily used PEMs, such as GCAM, IMAGE, MESSAGE and AIM and “for most of the Chapter 6 [Assessing Transformation Pathways] IAMs, climate change has no feedback effects on market supply and demand, and most do not include damage functions (Kolstad et al. 2014, p. 247).

However, several governments have relied upon updated POMs, rather than PEMs, in policy making, such as the updated versions of RICE (Nordhaus 2010), DICE2013 (Nordhaus and Sztorc 2013), FUND 3.7 (Anthoff and Tol 2013), and PAGE09 (Hope 2013), employed in the Stern Review. By including a “damage function”, which maps temperature increases to economic damages, POMs allow governments to estimate the social cost of carbon dioxide emissions. The British and American governments have relied on POMs to generate estimates of the social cost of carbon and thus to inform climate change policy (see, for example, Metcalf and Stock (2015) for a discussion of how POMs were used to inform the Environmental Protection Agency’s Clean Power Plan proposed in 2014). For instance, the US Interagency Working Group on Social Cost of Carbon (2010) explains the reliance on POMs as follows: “These models are useful because they combine climate processes, economic growth and feedbacks between the climate and the economy in a single modelling framework. At the same time, they gain this advantage at the expense of a more detailed representation of the underlying climate and economic systems.” The POMs, rather than the PEMs, are the primary focus of this paper.

All IAMs have two core components.

First, in the economic component of many IAMs, a representative agent (either on a regional or global level) solves an inter-temporal optimization problem (the agent may be forward-looking or myopic), deciding how much economic output to consume immediately and how much capital to invest into clean and dirty energy. Output requires capital and energy as inputs and can produce greenhouse gas emissions. Most PEMs use detailed sectoral input-output information to construct general or partial equilibrium models. PEMs used in the IPCC “have the structural detail necessary to explore the nature of energy system or agricultural and land-use transitions” (Clarke et al. 2014, p. 428). This, however, cannot be said for POMs, which aggregate at the regional or global level (Table 2).

The economic components of many recent IAMs are disaggregated computable general equilibrium (CGE) models that take into account complex country-level trade relationships and inter-sectoral spillovers (Vivid Economics 2013). These dynamic CGE models, such as ICES (Eboli et al. 2010), ENVISAGE (Van der Mensbrugghe 2010), or REMIND (Luderer et al. 2013), model how the economy and climate evolve over time. There are also partial equilibrium models, such as FUND and IMAGE, which are a lot less computationally intensive, as well as recursive dynamic general equilibrium models, such as EPPA and Imaclim-R (Sassi et al. 2010). Like many macroeconomic models, IAMs are usually solved via intertemporal optimization (e.g. FUND), recursive dynamic methods (e.g. IMAGE) or both (e.g. MESSAGE) (Clarke et al. 2009).

Second, in the physical component, emissions accumulate in the atmosphere and translate into an increase in the global temperature. The eventual increase in global temperature due to an increase in emissions—climate sensitivity—is the main object of study in this component. Using climate sensitivity and emission projections, the model spits out a time series of temperature and climate changes.

POMs have a third important component that PEMs lack—the damage function. Increases in temperature might reduce factor productivity or lead to changes in climate that cause damage to capital stock. Estimating the damage function lies at the heart of the analysis of climate change policy. Damage functions aggregate various bottom-up studies of the effects of climate change to estimate how economic damages change as a function of an increase in the concentration of greenhouse gases in the atmosphere and consequent increase in global temperatures. Yet, because of the paucity of data, most POMs use a highly simplified and aggregated damage function (see Table 2 in the Appendix). These parameters are calibrated to other estimates of possible economic damages from temperature increases, but there is ongoing debate about the functional form that is suitable (Moore and Diaz 2015), or even whether this can be captured by a scalar function of the global mean temperature.

Nevertheless, POMs often employ an assumed damage function in calculating whether the total benefits of a particular policy exceed its costs and what an “optimal” (i.e. with highest net benefits) policy looks like. For instance, POMs might seek to explore the impact of taxes or cap-and-trade schemes regulating greenhouse gas emissions on the consumption, production and investment decisions of representative agents, and corresponding emission paths and economic damages 50–100 years into the future. The computational challenge of finding the optimal policy is the main reason why POMs have simpler representations of the economy, climate, and the climate-economy feedback.

3 Main Shortcomings of IAMs

We now briefly summarize the shortcoming of IAMs (Table 1). We first describe the three most important challenges that all IAMs face—uncertainty, aggregation and technological change—before then directly addressing the problems in the damage function that apply specifically to popular POMs. We then examine several additional shortcomings in POMs, particularly the treatment of equilibrium, absence of the financial system, use of standard discounted expected utilitarianism, and potential for improvement in testing and calibration.

3.1 Uncertainty

Climate policy modelling is challenging for many reasons; one of the most serious is the deep uncertainty in both the relevant physical and economic systems. For instance, in a seminal paper, Roe and Baker (2007) show there are inherent scientific uncertainties about climate sensitivity—the eventual increase in global mean temperatures arising from doubling \(\hbox {CO}_{2}\) concentrations in the atmosphere. There is still large uncertainty over the magnitude, and even the sign, of some physical feedback mechanisms in the climate system. Our latest understanding of the climate system cannot rule out a small, but non-negligible, probability of a dramatic (for example \(>\)7 \(^{\circ }\hbox {C}\)) increase in mean temperatures as a result of cumulative carbon dioxide emissions consistent with a best-estimate warming of 2 \(^{\circ }\hbox {C}\) (i.e. roughly 3.67 trillion tonnes of \(\hbox {CO}_{2}\)). Physical scientists have identified a number of tipping points and risks in the climate system (Lenton et al. 2008) that could trigger major economic disruption.Footnote 1

Scientific uncertainties are inevitable and most IAMs try to account for these uncertainties by simulating a range of parameters. But as Pindyck (2013) argues, these uncertainties pose dramatic challenges for IAMs because they often imply a possibility of catastrophic outcomes and irreversible damages. These extreme outcomes may profoundly affect the social cost of carbon (Pindyck 2013; Stern 2013). In fact, since the probability of these “fat-tailed” temperature increases is non-negligible, the calculation of “expected damages” may be entirely inappropriate—yet this is necessary to conduct cost-benefit analysis in POMs (Weitzman 2009, 2011). There are several POMs (e.g. PAGE2002/PAGE09) and extensions of POMs (e.g. Dietz and Stern (2015) for DICE) that attempt to deal with catastrophic outcomes explicitly.

It is crucial to model scientific uncertainty directly, and rather than pretend to know what is likely to happen in 2100 in either the climate or the economic system, be explicit about our ignorance and look for policy interventions that maintain options and that can adapt as more information arise.Footnote 2 For instance, Allen and Frame (2007) argue that any climate policy reliant upon climate sensitivity should be jettisoned for an adaptive, target-based approach.

3.2 Aggregation and Distributional Issues

Analytical tractability of IAMs requires a certain level of aggregation. In POMs, this is usually achieved by assuming that there exists a representative agent: a single household, a firm or a sector. Models still vary enormously in their level of aggregation. Most POMs aggregate at the region level (Table 2). As more data become available, one might expect the level of aggregation in climate models to fall. PEMs tend to disaggregate more than POMs (to the country or sectoral level), but they usually assume that the (benevolent) social planner is able to perfectly implement the most cost-effective mitigation pathway (Kunreuther et al. 2014, p. 178) based on the various representative agents.

Yet the representative agent assumption is rejected strongly by the data. As James Heckman observed: “Inspection of cross-section data reveals that otherwise observationally identical people make different choices, earn different wages, and hold different levels and compositions of asset portfolios. These data reveal the inadequacy of the traditional representative agent paradigm.” (Heckman 2001, p. 684). Kirman (1992) succinctly identifies the main problems with the representative agent assumption. First, as is well known, individual rationality does not imply collective rationality. Second, asymmetric information and agency relationships that underlie much of important economic activity, yet all but disappear under the assumption of a representative agent. Hence, in reality a collection of individuals may react to policy changes very differently to a representative agent. For example, Iyer et al. (2015) show how heterogeneity in the investment risks stemming from a “mosaic” of actors and institutions can have a substantial impact on the cost and geography of climate mitigation within the electricity sector. Third, empirical estimation of policy changes with the representative agent assumption puts us into a predictive straightjacket, forcing us to abandon attempts to explain observed heterogeneity in behaviour.

In a very direct way, using the representative agent shortcut ignores important distributional effects (on income and wealth) and which may create ethical concerns, foster potential social unrest and affect political palatability of policy changes. As the latest IPCC report recognises, “analyses [conducted with IAMs] do not consider distributional effects of policies on different income groups, but instead focus on the effect on total macroeconomic costs” (Kunreuther et al. 2014, p. 178).Footnote 3 Climate change may create conflict among social groups that compete for scarce resources, such as water, and induce large-scale migrations (Stern 2013). Modelling these distributional effects requires us to step outside the representative agent framework. For example, Krussel and Smith (2009) attempt to introduce agent heterogeneity into a climate-economy model using the Bewley-Huggett-Aiyagari consumer heterogeneity framework. This kind of modelling could yield important insights into the likely success of mitigation policies in the future. Who wins and who loses matters enormously to political feasibility, and these effects, including ancillary costs and benefits and the risk of stranded assets from climate policy, have been central to the policy response so far.

3.3 Technological Change

Addressing climate change involves reducing net emissions to zero sometime in the second half of this century. Without radical technological innovation and transformation of the way energy is produced and consumed, such a requirement is unfeasibly expensive. Innovation is required to bring cleaner technologies to the point of being as cheap as or substantially cheaper than dirty technologies. Therefore, understanding how clean innovation occurs is a crucial part of a good economic model of climate change.

There is substantial variation in approaches to modelling innovation across models (Gillingham et al. 2008). Early version of many POMs, such as DICE, FUND and PAGE, in the decreasing-returns spirit of Solow (1956) assumed that technological progress was exogenous, despite the emergence of a huge economics literature on endogenous technological change (Romer 1990; Aghion and Howitt 1992; Pittel 2002; Loschel 2002). This is not surprising: economic models of technological progress often generate increasing returns, which create multiple equilibria and prevent these models from being solvable. Nevertheless, their extensions, such as ENTICE (Popp 2004), FEEM-RICE, Dietz and Stern (2015) and PAGE09, as well as more recent POMs, such as WITCH and REMIND, include endogenous technological change. Most PEMs incorporate some version of endogenous growth, often though learning-by-doing (e.g. MESSAGE) or price-induced change (e.g. EPPA), since the energy sector in these IAMs is usually very carefully modelled (e.g. as in IMAGE or Imaclim-R). But most IAMs, especially POMs, still leave out complex relationships governing the improvement of interdependent technological components.

Innovation is a path-dependent process and if the share of resources devoted to dirty energy research is too great, it may be impossible (i.e. too expensive) to take the economy along a clean-energy path (Acemoglu et al. 2012; Smulders and Di Maria 2012; Aghion et al. 2014a). These possible paths multiply due to complementarities at the research, deployment and adoption stages of innovation (Aghion et al. 2014b). Path dependence and complementarities in technological diffusion and adoption are also currently poorly dealt with in IAMs. In particular, technological improvement is usually modelled using worldwide learning curves (e.g. Imaclim-R & REMIND), which imposes strong assumptions about perfect diffusion and spillovers (Waisman et al. 2012). An even bigger problem is that different technologies have very different rates of improvement, and most existing models fail to employ empirically grounded methods for forecasting the progress of different technologies (Farmer and Lafond 2015).

The latest IPCC report puts the likely (16–84 %) range for loss in consumption in cost-effective mitigation scenarios to be 1.2–4.4 % relative to the baseline by 2100 (stabilizing at 580–650 ppm concentrations) (IPCC 2014, p.17). Models therefore consider it highly unlikely that clean energy infrastructure could cost society less (excluding co-benefits) than the dirty infrastructure in a century. Given the technological and infrastructural changes we have experienced in the last century—making the cost of communication, electricity, computation and data storage almost negligible and their presence ubiquitous—this conclusion seems to us overly pessimistic and warrants more careful investigation.

3.4 Damage Functions

Damage functions are “the most speculative element of the analysis” of the economics of climate change (Pindyck 2013, p. 862). Sadly, it is also one of the most important to determining the social costs of climate change, and hence the aggressiveness (or otherwise) of the optimal economic response. The various problems of modelling uncertainty and distributional considerations in particular come home to roost and exacerbate our ability to develop plausible damage functions. Limitations in our ability to model technological change and innovation also do not help, in that our ability to adapt to climate change and hence reduce the damage is also likely to be a strong function of our ability to develop new technologies. Footnote 4

The damage functions in POMs take a very aggregated form (see Table 2) and are built on meagre empirical evidence. Typically, they model damages in period t as an arbitrary convex function of the increase in global average temperature relative to some benchmark increase (e.g. due to the doubling in \(\hbox {CO}_{2}\) concentration or a fixed increase of \(2^{\circ }\hbox {C}\)). Damages include effects on labour, land productivity and capital stock as well as reduction in biodiversity and natural capital. Since neither tangible nor non-tangible impacts of climate change are easy to estimate, they are typically arbitrarily aggregated, which can lead to misleading projections. For example, in examining seven prominent studies, Burke et al. (2015) demonstrated that incorporating climate uncertainty leads to different point estimates, a much wider range of projected impacts and substantially more negative worst-case scenarios. Adding uncertainty in POMs can lead to finding runs of the model that produce catastrophic outcomes (see, for example, Hope (2013) who finds scenarios under which the net present value of climate damages adds up to 100 years of current world output). Similarly, Butler et al. (2014) find that failing to account for uncertainties associated with climate sensitivity, global participation in abatement and the cost of lower emission energy sources in DICE results in significant underestimations of damage and mitigation costs associated with a doubled \(\hbox {CO}_{2}\) stabilisation goal.

3.5 Other Issues

The four main issues discussed above—uncertainty, aggregation, technological change and the damage function—have an enormous impact on the usefulness of IAMs. Yet, there are other problems that remain to be ironed out. We briefly address an additional set of four important areas for improvement within IAMs, namely: (i) standard behavioural assumptions, including maximising discounted expected utility; (ii) the assumption of equilibrium; (iii) the modelling of money, finance and banking; and (iv) how such models are tested and calibrated. We consider each issue in turn.

First, almost all POMs use the standard discounted expected utility maximisation framework to model the representative agent’s decisions. Economists have long recognized that this elegant analytical framework does not empirically match human behaviour in the presence of risks, even if their probabilities are known (Allais 1953; Rabin 2000). In the context of climate change, these behavioural anomalies have important implications for policy (Brekke and Johansson-Stenman 2008; Gowdy 2008). People feel losses (or income or jobs) far more than gains of equal amount and governments need to take their citizens’ reference-dependence into account (Kahneman and Tversky 1979; Köszegi and Rabin 2006). Climate change policies require agents to make commitments and real people are prone to renege on past promises, even to themselves (O’Donoghue and Rabin 1999). Governments also renege, with potentially serious consequences for environmental policy (Hepburn et al. 2010). IAMs also exclude social preferences, whereby people care directly about fairness, as in Rabin (1993), but such preferences may affect clean energy adoption and climate change negotiations. Similarly, discount rates used in some—certainly not all—IAMs are exponential, without factoring into account the impact of uncertainty and ambiguity that suggests longer-term certainty-equivalent consumption discount rates should be substantially lower (Weitzman 1998, 2001, Hepburn et al. 2009; Farmer et al. 2014; Farmer and Geanakoplos 2009). Indeed, Millner et al. (2013) show that if agents are ambiguity averse, optimal mitigation action would be much stronger. And even if a single well-specified utility function were appropriate, debate continues over the various parameters—including the pure rate of time preference and the elasticity of marginal utility in the standard expected utility framework—that are needed to undertake the analysis (Atkinson et al. 2009; Kolstad et al. 2014, p. 230; Pindyck 2013; Groom et al. 2005; Helgeson 2007; Heal and Millner 2014). This lack of robustness produces a wide range of outcomes sensitive to unknowable parameters, rendering their policy implications uninformative.

Second, most POMs are built around the concept of equilibrium.Footnote 5 CGE models typically assume that capital and labour markets clear, sometimes instantaneously. The transition towards a unique long-run equilibrium outcome happens smoothly and consistently. This varies markedly from empirical observation over the last century, in which economic activity is subject to protracted and unanticipated recessions, long-run unemployment due to hysteresis (Blanchard and Summers 1987), “secular stagnations” (Hansen 1939) as well as misallocation of capital induced by poor institutional and political fundamentals (Harberger 1959). Protracted recessions suggest that economic systems have numerous possible equilibria, or that they may not settle into equilibria at all.Footnote 6 The inherent uncertainties within economic systems (not to mention the climate system) are exacerbated by effects created by increasing returns and complementarities, present in innovation processes relevant to the response to climate change, and may breed multiple equilibria (Diamond 1982; Shleifer 1986; Cooper 1999). Selecting among equilibria means taking into account both the initial conditions of the system and the expectations (Keynesian “animal spirits”) of the agents (Krugman 1991; Matsuyama 1991; Obstfeld 1986; Cole Kehoe 2000; Farmer and Guo 1994). A priori, the equilibrium in these systems is indeterminate and the only selection tool may be activity extrinsic to the model i.e. “sunspots” (Cass and Shell 1983; Woodford 1986; Benhabib and Farmer 1994). Expectations about climate mitigation policy may therefore be self-fulfilling (Aghion et al. 2014b; van der Meijden and Smulders 2014). Ignoring the wide range of economic outcomes by using simple equilibrium models is a dangerous shortcut. For example, the latest IPCC report noted that CGE models might underestimate the effect of extreme weather events, which are picked up by partial equilibrium or bottom-up studies (Arent et al. 2014).

Third, most IAM do not explicitly model money, finance or banking.Footnote 7 As the recent financial crisis has shown, the financial sector is crucial for understanding cycles of economic activity and hence climate change emissions and mitigation policies. The financial sector can originate bubbles and subsequent defaults (Allen and Gale 2000) and leverage and credit booms lead to deep financial crises (Schularick and Taylor 2012). Financial intermediation has real effects on the economy when firms and banks are capital constrained and the distribution of capital across firms affects the overall level of investment in the economy (Holmstrom and Tirole 1997). While adding the financial sector to IAMs might appear to many modellers to be fairly low down the priority list of necessary improvements, it could, in fact, play a crucial role. Climate policies are increasing the possibility of asset stranding (Carbon Tracker Initiative 2013), which impacts firms’ and banks’ balance sheets. Moreover, many green projects require long-term domestic or international financing, which may not be available in underdeveloped financial sectors.

Fourth, any IAM should be subjected to serious testing and calibration against observed data. Yet many IAMs are rarely re-run to see whether the model under accurate parameter values would have predicted the current state of the economy and climate if it were run starting sometime in the past. This process of checking for historical consistency is known as “back testing”.Footnote 8 Economic IAMs differ from physical climate models that are founded on universally accepted physical laws and are back-tested to make sure they can replicate reality (Ackerman et al. 2009). Weyant (2009) points out several reasons for this, including unavailability of long-run socio-economic time-series, structural changes in the world economy and biases arising from using the same data to estimate structural parameters and make predictions. But perhaps a more fundamental reason is the fact that POMs are designed to compute optimal policies, which are never realised in practice, and therefore never match historical data. Further, when applied to policy analysis, IAMs usually only model differences between a baseline and counterfactual scenarios (such as the change in GDP associated with a carbon tax relative to the baseline scenario where no carbon tax is imposed). In focusing on relative differences, IAMs tend to avoid exposing potentially unrealistic assumptions about modelled baseline and counterfactual scenarios.

4 A New Wave of Models Could Address Some of These Problems

The problems noted above are not entirely specific to climate economic modelling. Similar problems were revealed in modelling approaches within mainstream finance and economic following the 2007-8 crisis and subsequent Great Recession. Challenges in modelling uncertainty and extreme events, path dependence, innovation dynamics and heterogeneity, among others, were central. For instance, following the crisis, former ECB President Jean-Claude Trichet said, “As a policy-maker during the crisis, I found the available models of limited help. In fact, I would go further: in the face of the crisis we felt abandoned by conventional tools”.Footnote 9 New ideas and modelling approaches recently developed in the financial sector may also provide useful insights to climate economic modelling, given the similarities between the challenges (Farmer and Hepburn 2014). It is plausible that a similar new wave of models from the financial sphere could lead to intellectual advances in climate economics.

4.1 Three Future Approaches

What could this new wave look like? There are at least three different approaches to addressing the current problems with IAMs. First, we could return to pared-down representative agent “little models”, and seek to make piecemeal add-ons to these simple model structures to reflect uncertainty and extreme events, innovation and some ex-post patches to attempt to capture heterogeneity. In effect, this is an approach that would look at a collection of separate, partial equilibrium models each of which carries carefully estimated results and important insights. The merits of this approach are that it should be relatively straightforward to observe the different effects in play. These simple and careful models could inform expert opinions on different aspects of climate change policy (Rezai and van der Ploeg 2014; Bretschger and Vinogradova 2014; Golosov et al. 2014; Pindyck 2015). The drawback is that this is unlikely to yield a proper integrated model, and understanding both the relative scale of different effects and their interactions is likely to be difficult or impossible. Our view is that work using “little models”—including both theory and econometric work discussed in Sect. 1 above—will continue to play an extremely important role in identifying effects and dynamics that larger, integrated models should take into account. However, much more than a pared down representative agent framework is required to incorporate the insights from little models into a framework that can provide overall policy advice.

A second approach would be to continue broadly in the current direction, developing more sophisticated IAMs. One approach is to improve current IAMs along the lines we have described in our paper. Take DICE for example: Dietz and Stern (2015) have introduced endogenous growth and catastrophic damages into the DICE model. Recent efforts have also incorporated irreversible climate tipping points into stochastic versions of the DICE model (Lemoine and Traeger 2014; Cai et al. 2015; Lontzek et al. 2015).

An alternative approach has been the development of (analytical) dynamic stochastic computable general equilibrium (DSGE) models of climate change. DSGE models are familiar to macroeconomic forecasters in central banks (Hassler and Krusell 2012). DSGE models can incorporate “new Keynesian” features, such as nominal rigidities, short-run non-neutrality of money and monopolistic competition (Galí 2009). But most importantly, DSGE models take uncertainty seriously. This approach has the merit of building on the existing state of the art in climate economic modelling and continues to represent an “integrated” approach, unlike the pared-down approach above. Indeed, some of the newest climate DSGE models are extension of previous IAMs. For example, building on work by Kelly and Kolstad (1999, 2001), Traeger (2014) modifies DICE by introducing stochasticity, persistent shocks and Bayesian learning into the economic dynamics.

Most current DSGE models are computationally intensive and they currently cannot be used in rich settings with a dozen sectors, fuels and time periods in the same way as CGE models are. However, advances in computing power and numerical algorithms have helped to reduce run times of such models, provided that the additional complexity incorporated in the model does not prevent it from being solved altogether (Cai et al. 2012, 2015). Further, new computational techniques, such as approximate dynamic programming approaches (Powell 2007) are helping incorporate more realistic modelling dynamics, while limiting the traditional increase in model dimensionality and state space size (Webster et al. 2012).

Importantly, DSGE models are (in name, and in nature) general equilibrium models. As such, they are still subject to restrictive assumptions relating to market clearing, optimality and agent representativeness. The current generation of DSGE models may not be flexible enough to incorporate the key insights that are emerging from the theoretical and econometric “little models”. Further, as forward-looking, completely informed utility maximising agents lie at the heart of DSGE models, our criticism relating to the unrealistic nature of agent decision-making processes applies to them. Therefore, DSGE models will represent a useful but not revolutionary improvement on the current IAMs.

A third approach to understanding climate-economy interactions would be to develop an agent-based model (ABM), i.e. “a computerized simulation of a number of decision-makers (agents) and institutions, which interact through prescribed rules” (Farmer and Foley 2009; Bonabeau 2002; Miller and Page 2007; Macal and North 2010). ABMs allow for flexible and realistic characterisations of virtual socio-economic systems, at a cost of greater complexity and requirements for substantial computational power and data to empirically estimate key parameters.Footnote 10 However, as noted above, recent advances in computational power and “big data” make this drawback less and less severe. As we mentioned in the introduction, ABMs have already been applied in a diverse range of different contexts, including conflict dynamics (Lim et al. 2007; Epstein 2002), pandemics (Halloran et al. 2008; Germann et al. 2006; Epstein 2009), urban planning (Brown and Robinson 2006; Ligtenberg et al. 2001; Batty 2009), electricity markets (Weidlich and Veit 2008; Sun and Tesfatsion 2007), emissions trading markets (Zhang et al. 2011), housing markets (Geanakoplos et al. 2012), financial markets, (Thurner et al. 2012; Caccioli et al. 2012; Aymanns and Farmer 2015; Poledna et al. 2014), technology adoption, lock-in and transfer (Frenken et al. 2012; Carrillo-Hermosilla 2006; Ma et al. 2009; Ma and Nakamori 2005; Faber et al. 2010; Schwarz and Ernst 2009; Shafiei et al. 2012), labour networks (Guerrero and Axtell 2013), firm structure (Axtell 1999, 2013), business cycles (Cincotti et al. 2010; Raberto et al. 2012) and larger scale agent-based macroeconomic models (Deissenberg et al. 2008; Dawid et al. 2009).

4.2 A Comparison Between DSGE Models and ABMs

Assume that some coherent integrative modelling framework is required for powerful policy advice. In other words, while important research should proceed using “little models” to develop key theoretical and econometric insights, something beyond a highly-simplified pared-down model is required to combine these individual insights together. Then, it follows that the second and third research pathways are clearly the major options available. It is therefore helpful to directly compare and contrast the advantages and disadvantages of DSGE models and ABMs, to understand where they are complementary and where their differences may generate knowledge as part of a third wave of modelling the economics of climate change.

We structure the comparison along the lines of the shortcomings in the previous section, namely according to their ability to generate improvements in the modelling of (i) uncertainty, (ii) aggregation and distributional issues, (iii) technological change and (iv) the damage function (Table 1). As before, we also briefly address other areas where improvements are possible, including modelling the financial system, realistic agent decision-making, learning and adaptation, assumptions about equilibrium and testing and calibration.

(i) Uncertainty

Both DSGE models and ABMs are able to incorporate uncertainty into agent decision-making processes. Traditional macroeconomic DSGE models tended to emulate how a forward-looking fully rational representative agent forms expectations about a future characterised by stochastic events or outcomes. More recently, Traeger (2015) extended Golosov et al. (2014)’s DSGE model to include (i) a much richer climate model (with standard carbon cycle, radiative forcing, temperature dynamics) as well as Epstein-Zin preferences (see our discussion in Sect. 2). Like Golosov et al. (2014), he also finds that optimal carbon tax is independent of the absolute stock of carbon in the atmosphere (see also Bretschger and Vinogradova 2014). His analytical framework allows him to distinguish between the effects of: (i) the rate of pure time preference (very strong) versus the expected consumption growth rate; (ii) “missing carbon sink” uncertaintyFootnote 11 (under persistent shocks and Bayesian learning) (iii) uncertainty over climate sensitivity (discussed in Sect. 2). This treatment of uncertainty delivers completely new policy implications. Footnote 12 Although the model has exogenous technological change and operates at the world level, there is a lot of promising machinery to build on in the future. Yet, the flexibility of ABMs mean they can more easily incorporate agents that could possess an even greater variety of different decision making processes (Tesfatsion 2002). Agents can also be programmed to learn and adapt using a variety of techniques and learning algorithms.Footnote 13

Given that the economics of climate change will always be plagued by fundamental uncertainty (of climate sensitivity or deep utility parameters), computational techniques can offer some useful approaches to address situations where we lack information. Often we lack appropriate data to calibrate model parameters (such as the pure rate of time preference and elasticity of marginal utility of consumption). In this case, modellers often employ assumptions that are deemed reasonable or appropriate with reference to economic theory. Within the context of the simulation, an ABM approach is able to test the sensitivity of resultant outcomes (such as economic growth and welfare) to such assumptions by running many simulations in which different parameter values are employed. This process is important for robustness testing, and allows modellers to identify which parameters have a greater influence on outcomes than others (Law 2009).

We also often lack understanding about probability distributions underlying key model variables (such as economic damages from large temperature increases). In addition, many economic and climate phenomena are best characterised by heavy-tailed or fat-tailed distributions, which makes taking average or expected values inappropriate (Weitzman 2009).Footnote 14 ABMs do not need to rely on taking expected values because they can be set up to run many repeated simulations where model variables are drawn from particular distributions. This allows the modeller to identify the space (and likelihood) of potential outcomes associated with sampling a given distribution. Further, ABMs can also run various scenarios in which different probability distributions are employed. This technique is particularly useful for characterising (to some extent) the space of potential outcomes associated with unknown probability distributions.

ABMs are less convenient than DSGE models for deriving optimal policies in the face of uncertainty. But ABMs do a good job in scenario analysis in much more complex environments, which is useful when we lack data or information about probability distributions. It is also a valuable technique for addressing situations where we lack foresight about future trajectories of important variables, such as technological progress. The flexibility of ABMs makes them very well suited to accommodate a large number of scenarios relating to future socio-economic outcomes, such as the new ‘Shared Socio-Economic Pathways’, which have been developed for the IPCC (Ebi et al. 2014; O’Neill et al. 2014; Schweizer and O’Neill 2013).Footnote 15 While scenarios are usually determined exogenously and fed into the model, ABMs are also able to undertake a relatively new ‘scenario-discovery’ technique, which instead allows modellers to identify scenarios that emerge endogenously from a set of model simulations. This approach is particularly useful when the choice of scenarios is perceived to be arbitrary or subject to vested interests or values (Gerst et al. 2013a). The ‘scenario-discovery’ method involves applying statistical and data-mining techniques to the large number of model simulations to identify interpretable combinations of model parameters that generate policy-relevant scenarios (Bryant and Lempert 2010). Gerst et al. (2013a) apply the scenario-discovery technique within the context of an evolutionary ABM of economic growth, technological progress and carbon emissions.

(ii) Aggregation and distributional issues

Two dimensions of aggregation are important for the accuracy of IAMs. One is aggregation of physical data, such as temperature changes and precipitation. The other is the aggregation of economic data. As Table 2 in the Appendix shows, the damage function in most POMs aggregates at the world or regional level. The main obstacle to reducing the level of aggregation is the availability of usable data. DGSE models could disaggregate to a regional level or even potentially to the level of a sector within a given country—in a sense, these entities might be considered the “agents” within a typical DSGE. The flexibility of ABMs allows modellers to use data disaggregated at different levels and compare how simulated agent interactions at the micro-level give rise to macro-level outcomes (Epstein 1999). There are often a large number of representative firms in ABMs, with different technologies, balance sheets, business plans and strategies, and so on. This allows economists to characterise the distributional effects of market outcomes and policy changes for different people groups and economic sectors within countries. However, the complexity means that it is relatively difficult to construct such a model at this level of disaggregation for the entire global economy.

In addition to capturing agent heterogeneity, both DSGE models and ABMs are able to model interactions between the agents at their level of aggregation. For example, international trade is a common feature of most modern CGE models already. ABMs tend to simulate these interactions quite explicitly and in a highly detailed manner. Agents can be programmed to interact with each other (often in networks) according to prescribed behavioural decision rules. When one considers the importance of agent interactions within economic systems, aggregating households and firms into single representative agents is not plausible. As Bonabeau (2002) argues “averages will not work”. Further, as macro-level outcomes and dynamics often cannot be deduced from examining the individual micro-entities in isolation (Holland and Miller 1991), the ability of ABMs to capture “emergent phenomena” arising from individuals’ interactions (such as the endogenous formation of market structures and prices, business cycles, product diffusion or the adoption of new technologies), is perhaps one of their most important strengths.

(iii) Technological change

DSGE models and ABMs have the advantage that they can handle more complex technological dynamics than earlier IAMs. While both frameworks allow modellers to incorporate endogenous technological change, path dependence and lock-in effects, ABMs are perhaps more suited to capturing non-linear and interrelated (or networked) aspects of technological improvement and diffusion (Maréchal 2007; Faber et al. 2010; Schwarz and Ernst 2009; Delre et al. 2007; Bonaccorsi and Rossi 2003; Shafiei et al. 2012). Like CGE models, DSGE models of climate change with endogenous technological innovation may be difficult to solve because of the presence of increasing returns and multiple equilibria.

(iv) Damage function

ABMs allow more modular aggregation of various bottom-up studies of the effects of climate change to estimate how economic damages change as a function of an increase in the concentration of greenhouse gases in the atmosphere and consequent increase in global temperatures. For example, a researcher can take carefully estimated partial equilibrium results on effect of increasing temperature on labour productivity or on changes to migration patterns and feed them directly into the ABM. This is much more difficult in DSGE (or CGE) models because with these additional constraints these models may not solve. For example, Traeger (2015) derives the functional form for the damage that is necessary in order to be able to solve his rich model analytically. While these theoretical exercises are interesting, the shape of the damage function should be informed by empirical evidence rather than by the constraints of theoretical elegance. Since ABMs are not constrained by equilibrium, their flexible modular structure can incorporate a lot more piecemeal empirical observations. Hence, ABMs could possibly tackle the problem that is really holding most POMs back: real and credible estimates of economic damages of climate change.

(v) Other issues

Having dealt with the four main issues—uncertainty, aggregation, technological change and the damage function—this part compares the potential of DSGE models and ABMs to address the other key problems, following the structure in Sect. 3.5 above, namely: (i) standard behavioural assumptions, including maximising discounted expected utility; (ii) the assumption of equilibrium; (iii) the modelling of money, finance and banking; and (iv) how such models are tested and calibrated.

First, both DSGE models and ABMs offer some promise of a richer and more realistic set of behavioural assumptions. As DSGE models tend to use sector or region-level aggregation, they are not designed to capture individual aspects of behaviour at the household or firm level. However, recent efforts have demonstrated that more realistic agent-behavioural characteristics, such as loss aversion and recursive utility can be incorporated into DSGE models (Gomez 2014; Caldara et al. 2012; Cai et al. 2013). DSGE models also offer some promise in disentagling various dimensions of uncertainty (Traeger 2015), for instance by using recursive, non-expected-utility preferences (Epstein and Zin 1989, 1991).Footnote 16 Another direction has been to model ambiguity—lack of knowledge about the distributions of possible outcomes. ABMs have even more flexibility to adopt agent decision rules that are more consistent with the large body of empirically supported work in psychology, behavioural economics and cognitive science (Roozmand et al. 2011; Zhang and Zhang 2007). Unlike DSGE models, agents can easily be modelled with ‘bounded rationality’, where they employ simple rules to process local information (Arthur 1991). A review and discussion of the comparative strengths and weaknesses of nine different agent decision making frameworks used in agent based simulations of coupled human and natural systems can be found in An (2012).

Second, the concept of equilibrium is a key difference the ABM and DSGE approach. DSGE models start from the assumption that a system returns to equilibrium after suffering shocks of various kinds. In new Keynesian DSGE models, especially in the context of price and wage adjustment, this process is gradual and can involve various types of frictions. In contrast, ABMs explore the economy as a complex adaptive system, where market outcomes can be understood in terms of the dynamic networks of heterogeneous agents (such as households and firms) that interact with each other (Anderson et al. 1988; Beinhocker 2006; Kirman 1997, 2008). Often agents’ interactions will give rise to equilibrium outcomes (Gintis 2007). But sometimes they do not.Footnote 17 If the relevant climate-economy systems do eventually settle into equilibrium, imposing equilibrium assumptions is conceptually costless, and DSGE models have the advantage over ABMs by way of reduced complexity at little or no cost, and also reduced computational demands. But an ABM is required to determine whether this is the case. ABMs allow economists to account for slack resources in the economy, which are critical variables to model to characterise the economic costs and benefits associated with green growth stimulus measures (Hasselmann et al. 2013; Wolf et al. 2013).

Where multiple equilibria exist, ABMs are particularly valuable in identifying how a particular equilibrium is selected, in three respects. Firstly, they allow analysis of how a given equilibrium is attained over the course of a simulation. Since agent behaviours, interactions and other model variables (such as prices) can be recorded at each simulated time-step, ABMs allow economists to trace the paths along which a particular equilibrium unfolds. Similarly to current IAMs, they can also examine how the simulated economy moves from one equilibrium to another (such as the transition from using dirty, carbon-intensive energy to clean energy sources). Secondly, ABMs are able to investigate the sensitivity of given equilibria to changes in model parameters or external shocks and perturbations. This can be very useful when considering how given market conditions may change in response to technological progress, agent preferences or climate shocks, such as extreme weather events. Finally, by running many simulations, ABMs can also be used to characterise relevant probability distributions for specific equilibria (Arthur 2006).

Third, incorporating banking and finance into IAMs would capture important (but often ignored) links between the financial sector, the macro-economy and climate policy outcomes, such as preferential loans and alternative financing mechanisms for clean energy technology development. Prior to the financial crisis of 2008, DSGE models omitted essential aspects of the financial system, such as liquidity. More recent DSGE models are starting to incorporate these elements, and it is conceivable that these new developments could be brought into climate models (see, for example, Del Negro et al. (2011)). Future DSGE climate models could incorporate credit and banking sectors in a similar fashion to Gerali et al. (2010). In contrast, a number of ABM approaches (developed in response to the purported failings of DSGE models after the global financial crisis) have recently demonstrated promise in potentially being able to better capture networked and non-linear aspects of systemic risk within the banking and finance sector. Indeed, post-crisis, a number of ABMs have been developed to examine leverage cycles and financial dynamics (Thurner et al. 2012; Aymanns and Farmer 2015), credit regulation policies (Poledna et al. 2014), endogenous business cycles (Cincotti et al. 2010; Raberto et al. 2012) and macroeconomic policy (Deissenberg et al. 2008; Holcombe et al. 2013; Dawid et al. 2009).

Fourth, DSGE models and ABMs are more amenable to testing and empirical validation than existing IAMs, but it nevertheless remains extremely challenging for both types of models. Calibrating and estimating DSGE models can be a controversial exercise (Faglio and Roventini 2012; Grauwe 2010; Fukač and Pagan 2010; Canova and Sala 2009; Canova 2008). Identification can be particularly difficult within DSGE models as there are often a significant number of non-linearities present in the model’s structural parameters. These identification issues can generate biased estimates, unreliable t-statistics and can even lead investigators to adopt incorrect models (Canova and Sala 2009). Further, in order to allow DSGE models to fit the data, ad-hoc assumptions or ‘frictions’ are applied, such as sticky prices (Grauwe 2010). Misspecification issues within DSGE models are also particularly problematic and they can cause policy analysis to be irrelevant and even erroneous (Faglio and Roventini 2012).

ABMs need to confront different testing and calibration challenges. As ABMs are software programs, they need to be subject to software testing, diagnostic experiments and debugging procedures to ensure that the computer code executes as intended (Gilbert and Terna 2000). As is the case with all software development, it is difficult to be 100 % certain that computer code is completely error-free. There are three main approaches employed to empirically validate ABMs. First, case studies, surveys and econometric findings can be used to calibrate model parameters and agent behavioural assumptions (Janssen and Ostrom 2006). Model developers can also undertake ‘participatory’ agent-based modelling, in which real people directly inform the modellers how they would behave or respond under given conditions or particular circumstances (An 2012). Second, empirical validation can also be achieved by examining whether the model reproduces commonly observed ‘stylised facts’, such as power law distributions of firm sizes, household incomes, exponential and power-law functions of technological progress with respect to time and cumulative production (Nagy et al. 2013), and characteristic degree distributions in networks (Barabasi and Albert 1999). Third, ‘back-testing’ is a further technique for empirical validation. It involves initialising the ABM to a specific point in time, running it forward and comparing the simulated output data to empirical time series of that specific period in history. Back-testing can be a difficult (and often controversial) process as it can require modellers to use the same data to both calibrate and evaluate the model (Weyant 2009). Finally, Monte Carlo experiments, which involve analysing the distribution of outcomes arising from running many (often thousands) of simulations, can also be applied to test the ABM’s variability and sensitivity to parameter vales and initial conditions (Railsback et al. 2006). Monte Carlo simulations and other sampling techniques are already frequently employed in many IAMs (Anderson et al. 2014).

4.3 Summary

The primary suggestion emerging from this review is that a new wave of IAMs could advance climate economics by enabling the incorporation of key insights about deep uncertainty and extreme events, distribution and heterogeneity (and political economy) and innovation and technological progress into an integrative framework that much more seriously addressed the critical questions about the damage function from climate change (Table 1). DSGE models of climate change would represent an improvement on the current IAMs. ABMs represent an emerging modelling tradition with strong successes in adjacent areas but relatively little track record within climate economics (see Sect. 5). They are more flexible and hence likely to be better able to integrate emerging insights from theory and econometrics. Because they impose fewer assumptions (e.g. equilibrium and market clearing) ABMs require more effort to empirically determine appropriate parameter values. However, given the promise of ABMs, it is not surprising that they are beginning to enter the domain of climate economics, and the next section reviews progress to date.

5 The Beginnings of a New Wave of ABIAMs

As we have already mentioned, ABMs already have a good track record outside climate change economics. Furthermore, ABMs have also been employed to model ecological and environmental systems since the 1970s (Grimm 1999). ABMs are also frequently used to model land use (Parker et al. 2003; Matthews et al. 2007), ecosystem management (Bousquet and Page 2004) and have been used to explore climate change related issues (Balbi and Giupponi 2009). This section reviews in more detail the limited experience of using ABMs to model climate-economic interactions, and provides some suggestions for future research directions.

Despite suggestions over a decade ago that agent-based approaches could be applied to integrated assessment models (Moss et al. 2001), we are only just beginning to see ABM approaches in climate economics. There are three reasons for this. First, agent-based modelling is still a relatively new technique in its application to economics. Well-defined modelling practices and approaches are still being developed, and where guidelines and standards have been proposed, they are often not widely accepted or adhered to (Grimm et al. 2006, 2010; Richiardi et al. 2006; Grimm and Railsback 2012). Second, as noted previously, while ABMs are more amenable to testing, calibration and validation than their CGE counterparts, it can be very difficult and very data intensive. For this reason, Janssen and Ostrom (2006) point out; “most ABM efforts do not go beyond a proof of concept”.Footnote 18 Third, ABM’s flexibility to incorporate multiple agents and complex behaviours and phenomena can make their specification, communication and interpretation extremely difficult. Gerst et al. (2013a) note that such challenges have likely limited the use of ABMs in energy and climate change applications.

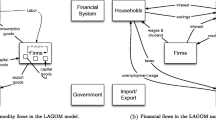

Two agent-based models in particular, ENGAGE (Gerst et al. 2013a, b) and Lagom RegiO (Wolf et al. 2013), which were recently presented in a special issue of Environmental Modelling and Software on “Innovative Approaches to Global Change Modelling”, represent progress towards the successful development of agent-based integrated assessment models (ABIAMs).Footnote 19

Both of these ABIAMs simulate complex interactions between heterogeneous boundedly-rational, adaptive consumers, firms, government and, in the case of Lagom RegiO, a simple financial system. Markets do not necessarily clear; instead price and wages adjust gradually over time. In contrast to traditional approaches, these ABIAMs do not impose strict equilibrium or market clearing assumptions—such outcomes may or may not emerge from the model. This framework allows the model to capture dynamics arising from firms’ capital expansion plans, inventory management decisions and unemployment in the labour market. As noted above, these factors are relevant in modelling investment in clean technology or green growth stimulus measures (Hasselmann et al. 2013; Wolf et al. 2013).

Technology evolves stochastically over time through imitation and mutation. In the ENGAGE model, technological progress is modelled as an endogenous evolutionary and probabilistic process, and the model can simulate many different technological futures. Although the simulated technological development is quite stylised, Gerst et al. (2013a, b) demonstrate the ENGAGE model’s ability to depict different energy technology transitions occurring in response to different implementations of a carbon tax revenue-recycling scheme.

In addition, as future technological progress is one of the most uncertain factors in modelling the economics of climate change, Gerst et al. (2013a) also apply a statistical, data-mining ‘scenario discovery’ method to analyse and classify different technological scenarios emerging from the ENGAGE model parameters.

The models mentioned above are a long way from being complete. For example, ENGAGE entirely ignores population growth and, unlike Lagom RegiO, does not use input-output tables. Moreover, ENGAGE uses only a limited number of representative firms and sectors. While the ENGAGE model has already been used to analyse a variety of policies, the Lagom RegiO model has not yet produced any scenarios. Using the ENGAGE model, Gerst et al. (2013b) find that carbon tax revenues should be used to subsidise clean energy R&D rather than supporting industrial production or rebating households.

6 Conclusion

It should be of great concern when the results of decades of work on climate economics IAMs can be described in a serious peer-reviewed journal as being “close to useless” (Pindyck 2013). Even if this is an overstatement, given the potential seriousness of climate change and the fact that its consequences for human welfare may indeed be staggering, this assessment should be alarming for economists and for policy makers around the globe.

One response would be to attempt to simply ignore the results of IAMs, on the basis that they are not an adequate guide for policy interventions that shift, create or destroy trillions of dollars economic value. Indeed, Pindyck (2015) forcefully argues that complex IAMs should be abandoned in policy making in favour of simple models and expert opinions (see, for example, Rezai and van der Ploeg 2014; Golosov et al. 2014; Bretschger and Vinogradova 2014). However, as Pindyck (2015) acknowledges, experts themselves often rely on IAMs to inform their opinions so their models ought to be as good as possible. But IAMs will continue to be used in policymaking because an integrated framework is required in key decisions of national governments. Even when they are not, IAMs tend to frame political and economic discussions in terms marginal cost benefit analysis (Dietz and Hepburn 2013), rather than system transformation and they set implicit boundaries on what ‘appropriate’ levels of intervention look like—for instance it is because of the results of IAMs (POMs) that policy makers broadly view a carbon price of less than $10/tonne \(\hbox {CO}_{2}\) as too low, and a carbon price of say $200/tonne as too high.

The necessary third wave of climate economic IAMs—including advances in DSGE and ABM climate models—is now underway. This paper has argued that the critical issues that need to be much better addressed in this wave of research are uncertainty, extreme events, technological innovation, impact heterogeneity and political economy. A comparison of ABM and DSGE modelling approaches shows that both have potential to address some or most of those challenges. Sophisticated DSGE models may be able to contribute to our understanding of optimal emission mitigation policies, but given the difficulties of extending them to capture the institutional and geographic structure that is needed, this is likely to be challenging. The effort required to create realistic ABMs is substantial, and much further from the mainstream of economic thinking. Nonetheless we think that if a sufficient effort is mounted, they have a huge potential, particularly for estimating damage functions and exploring mitigation scenarios. Given the promise of ABMs, we briefly explored two recent modelling efforts. While currently the space remains largely open, with much research to be done and numerous challenges to be overcome, we consider that the third wave of IAMs could serve as a genuinely useful and reliable, if less precise and comforting, guide to climate change policy in the near future.

Notes

One perspective is to distinguish between “objective uncertainty”, which may be modelled as probability distributions, and “subjective assumptions”, being both distributions for outcomes that are poorly known (such as damages from higher temperature changes) and welfare parameters (such as the pure rate of time preference) (Baldwin 2015). The advantage of this approach is that the sensitivity of the social cost of carbon and of desirable climate policy (i.e. carbon tax or cap-and-trade) to inherent uncertainty can be made explicit.

Some models use different equity weights to account for disproportionate effect of consumption losses in poorer regions.

Another particularly difficult source of uncertainty to deal with is the extent to which adaptation to climate change is going to reduce mitigation costs. For example, Diaz (2014) argues that with appropriate adaptation the costs of sea-level rise could be reduced by a factor of five. Several POMs have been extended to allow for adaptation (e.g. AD-WITCH and AD-DICE/RICE) and some allow for a mixture of adaptation and mitigation policies (e.g. PAGE09).

The focus on equilibrium has been questioned in other areas of economic modeling, including macroeconomic forecasting (Howitt 2012).

There is no fundamental reason why a complex economic system should simply tend toward a single given, known equilibrium or indeed why a stable equilibrium should even exist. “Chaotic” dynamics can emerge in very simple models of economic growth with rational consumers, decreasing returns to capital and overlapping generations (Benhabib and Day 1981; Day 1982, 1983; Benhabib and Day 1982). The economy is sufficiently complicated and nonlinear that it would be surprising if the attractors of the dynamics were not high-dimensional (Galla and Farmer 2013).

There are minor exceptions. For example, Krussel and Smith (2009) assume that financial markets are incomplete.

It also goes under the names of “hind-casting” or “back-casting”, and is a form of cross-validation.

Speech at the ECB Annual Central Banking Conference, November 2010.

In a sense, although the necessity of estimating so many parameters appears to be a drawback compared to other modelling approaches, this is only because other modelling approaches implicitly assume specific values for such parameters, without empirical estimation.

This is the physical science uncertainty about where around a billion tonnes of anthropogenic carbon disappear from the atmosphere every year i.e. why there is a discrepancy between carbon-uptake models and the field studies (Burgermeister 2007).

“A lower bound of the welfare loss from uncertainty over the climate’s sensitivity to \(\hbox {CO}_{2}\) is 2-3 orders of magnitude higher than the best guess of the welfare loss from uncertainty over the carbon flows. A clear quantitative message from economics to science to shift more attention to the feedback processes on the temperature side” (p. 30).

For example, Arthur (1991) developed a parameterised learning algorithm to simulate how agents learn to choose among different, discrete actions with initially unknown payoffs. He then calibrated the parameters against learning data measured in human subjects. Epstein (2000) used an ABM to characterise and simulate the evolution of social norms with reference to the inverse relationship between the strength of a norm and the amount of time an agent spends thinking about a particular behaviour. Holland (1975) was the first to develop genetic algorithms, which model learning from a more evolutionary perspective. Using a genetic algorithm approach, Janssen and de Vries (1998) incorporated learning agents into a very simple IAM, and showed that learning can significantly influence outcomes at the aggregate level, especially in environments with imperfect information.

The tails of distributions can be characterized by the tail exponent, which roughly speaking is the absolute value of the power law exponent of the cumulative distribution. For thin tailed distributions the tail exponent is infinite, but for fat-tailed distributions it is finite. Moments higher than the tail exponent do not exist. Thus if the tail exponent is 1.8, the mean exists but the variance does not exist. When moments do not exist, this means that empirical estimates do not converge (but rather increase without bound) in the limit as the number of data points become large. Many meteorological series have tail exponents close to one, meaning that the mean doesn’t exist. (A classic example is flood levels, which is why it is meaningless to discuss an “average flood”. see e.g. Embrechts et al. (1997)).

A remarkable fact from extreme value theory is that there are only three types of extremal distributions, corresponding to fat tails (which are generically power laws), thin tails (such as the normal distribution) and bounded support.

A description of models used in SSPs can be found here: https://secure.iiasa.ac.at/web-apps/ene/SspDb/download/iam_scenario_doc/SSP_Model_Documentation.pdf.

This recursive preference formulation allows the modeler to disentangle the degree of risk aversion from intertemporal substitution enabling us to see more clearly how changes in fundamental parameters of the utility function and in types of uncertainty affect outcomes. For example, Ackerman et al. (2013) find that risk aversion has a remarkably small effect on optimal policy while intertemporal substitution has a large one. Crost and Traeger (2013) show that uncertainty associated with the steepness, rather than level of damages associated with temperature increases is what makes an impact on policy outcomes. Uncertainty about steepness of the damage function can result in a much higher level of optimal mitigation.

For instance, Galla and Farmer (2013) show that in a game-theoretic context where two players must learn their strategies, under some conditions they settle into fixed-point equilibrium as usually assumed in economic theory, but in many other cases there are multiple equilibria, or no stable fixed point equilibria at all. In the latter case their strategies never settle into a steady state, but instead wander around a chaotic attractor, which in some cases is sufficiently high dimensional that the resulting behavior is for most purposes effectively random.

Meaning that the model is a demonstration of the feasibility (but usually not the full realization or implementation) of a particular approach, idea or analytical technique.

References

Acemoglu D, Aghion P, Bursztyn L, Hemous D (2012) The environment and directed technical change. Am Econ Rev 102(1):131–166

Ackerman F, DeCanio SJ, Howarth RB, Sheeran K (2009) Limitations of integrated assessment models of climate change. Clim Change 95(3–4):297–315

Ackerman F, Stanton EA, Bueno R (2013) Epstein–Zin utility in DICE: Is risk aversion irrelevant to climate policy? Environ Resour Econ 56(1):73–84. doi:10.1007/s10640-013-9645-z

Aghion P, Howitt P (1992) A model of growth through creative destruction. Econometrica 60(2):323–351

Aghion P, Dechezleprêtre A, Hemous D, Martin R, Van Reenen J (2014a) Carbon taxes, path dependency and directed technical change: evidence from the auto industry. J Political Econ. http://personal.lse.ac.uk/dechezle/adhmv_jpe_sept21_2014.pdf

Aghion P, Hepburn C, Teytelboym A, Zenghelis D (2014b) Path dependence, innovation, and the economics of climate change. Centre for Climate Change Economics and Policy/Grantham Research Institute on Climate Change and the Environment Policy Paper & Contributing paper to New Climate Economy

Allais M (1953) Le comportement de l’Homme Rationnel Devant Le Risque: Critique Des Postulats et Axiomes de l’Ecole Americaine. Econometrica 21(4):503–546

Allen F, Gale D (2000) Financial contagion. J Polit Econ 108(1):1–33

Allen F, Frame DJ (2007) Call off the quest. Science 318(5850):582–583

An L (2012) Modeling human decisions in coupled human and natural systems: review of agent-based models. Ecol Model 229:25–36

Anderson PW, Arrow KJ, Pines D (eds) (1988) The economy as a complex evolving system. Addison-Wesley, Redwood City

Anderson B, Borgonovo E, Galeotti M, Roson R (2014) Uncertainty in climate change modeling: can global sensitivity analysis be of help? Risk Anal 34(2):271–293. doi:10.1111/risa.12117

Anthoff D, Tol RSJ (2013) The uncertainty about the social cost of carbon: a decomposition analysis using fund. Clim Change 117(3):515–530

Arent DJ, Tol RSJ, Faust E, Hella JP, Kumar S, Strzepek KM, Tóth FL, Yan D (2014) Key economic sectors and services. In: Field CB, Barros VR, Dokken DJ, Mach KJ, Mastrandrea MD, Bilir TE, Chatterjee M, Ebi KL, Estrada YO, Genova RC, Girma B, Kissel ES, Levy AN, MacCracken S, Mastrandrea PR, White LL (eds) Climate change 2014: impacts, adaptation, and vulnerability. Part A: global and sectoral aspects. Contribution of working group II to the fifth assessment report of the intergovernmental panel on climate change. Cambridge University Press, Cambridge, pp 659–708

Arthur WB (1991) Designing economic agents that act like human agents: a behavioral approach to bounded rationality. Am Econ Rev 81(2):353–359

Arthur WB (2006) Out-of-equilibrium economics and agent-based modeling. Handbook of computational economics. Retrieved from http://www.sciencedirect.com/science/article/pii/S1574002105020320

Arthur WB (2013) Complexity economics: a different framework for economic thought. SFI Working Paper 2013-04-012

Axtell R (1999) The emergence of firms in a population of agents: local increasing returns, unstable Nash equilibria, and power law size distributions. Brookings Institution Working Paper

Axtell R (2013) Endogenous firms and their dynamics. Working paper, http://www.acefinmod.com/docs/esrc/axtell-firms.pdf

Axelrod R (1997) The complexity of cooperation: agent-based models of competition and collaboration. Princeton University Press, Princeton

Atkinson G, Dietz S, Helgeson J, Hepburn C, Saelen H (2009) Siblings, not triplets: social preferences for risk, inequality and time in discounting climate change. Econ E-J 2009-14

Aymanns C, Farmer JD (2015) The dynamics of the leverage cycle. J Econ Dyn Control 50:155–179

Balbi S, Giupponi C (2009) Reviewing agent-based modelling of socio-ecosystems: a methodology for the analysis of climate change adaptation and sustainability. Available at SSRN 1457625. http://www.researchgate.net/publication/220141236_Agent-Based_Modelling_of_Socio-Ecosystems_A_Methodology_for_the_Analysis_of_Adaptation_to_Climate_Change/file/72e7e51bd779a1e608.pdf

Baldwin E (2015) Choosing in the dark: incomplete preferences, and climate policy. Mimeo

Barabasi AL, Albert R (1999) Emergence of scaling in random networks. Science 286:509–512

Batty M (2009) Urban modeling. In: International encyclopedia of human geography. Elsevier, Oxford

Beinhocker ED (2006) The origin of wealth: evolution, complexity and the radical remaking of economics. Harvard Business School Press, Boston

Benhabib J, Day RH (1981) Rational choice and erratic behaviour. Rev Econ Stud 48(3):459–471 http://www.jstor.org/stable/2297158

Benhabib J, Day RH (1982) A characterization of erratic dynamics in the overlapping generations model. J Econ Dyn Control 4(1):37–55

Benhabib J, Farmer REA (1994) Indeterminacy and increasing returns. J Econ Theory 63(1):19–41. doi:10.1006/jeth.1994.1031

Blanchard OJ, Summers LH (1987) Hysteresis in unemployment. Eur Econ Rev 31(1–2):288–295